Abstract

This study examines the short and long-run impact of financial development, institutional quality and globalization on economic growth on a sample of 40 Africa countries. It also examines whether the relationships differ across sub-groups of countries namely low-income, lower-middle-income and upper-middle-income over the period 1980–2014. It uses a new technique in macro-econometrics panel estimation to control for dynamic heterogeneity and cross-sectional dependence for an econometric analysis. The findings reveal that the existence of cross-sectional dependence which is non-stationary at their level becomes stationary in their first difference. It also shows the presence of co-integration among the variables showing a long run relationship among the variables. The results from a panel-mean-group model with a correction for common correlated effects show that financial development, institutional quality and globalization have significantly positive effects on long-run economic growth for the entire sample of countries. Further, looking at different income levels the empirical evidence shows that in low-income countries financial development, institutional quality and globalization have a positive impact on long-run economic growth in the entire sample and also in low-income countries. This provides strong evidence that the impact of financial development on economic growth is heterogeneous across income levels. Moreover, the interaction between financial development and institutional quality has a negative and significant effect on economic growth. This implies that either financial development or institutional quality can help boost economic growth.

Access provided by CONRICYT-eBooks. Download chapter PDF

Similar content being viewed by others

Keywords

- Financial development

- Institutional quality

- Globalization

- Economic growth

- Dynamic common correlated effect

1 Introduction

Every country in Africa strives to achieve a higher level of economic growth . Many macroeconomic factors contribute towards the economic growth of a country that have received much attention in literature such as financial development , institutional quality, macroeconomic stability , foreign direct investment (FDI), natural resource endowments and globalization . In the 1980s and 1990s, most African countries undertook significant efforts to expand the depth, efficiency and stability of their financial systems to promote diversification and economic growth so as to manage shocks and enhance macroeconomic stability . However, the efforts that have been made have typically not brought economic growth and macroeconomic stability due to several remaining significant structural challenges, particularly the lack of quality institutions or good governance and financial constraints on the continent.

Several empirical studies have used cross-sectional and panel data analyses to investigate the impact of financial development on economic growth (see, for example , Beck et al. 2000; Cojocaru et al. 2016; Hassan et al. 2011; Khan and Senhadji 2003; King and Levine 1993; Law and Singh 2014; Levine et al. 2000; Levine and Zervos 1998; Lu et al. 2017; Menyah et al. 2014; Samargandi et al. 2015; Valickova et al. 2015; Zhang et al. 2012). Other studies have analyzed the relationship between financial development and economic growth employing time-series analyses (Christopoulos and Tsionas 2004; Demetriades and Hussein 1996; Luintel et al. 2008; Odedokun 1996). Besides financial development , several empirical studies have also investigated the role of institutional quality on economic growth using individual country time-series data and using cross-sectional country data (Acemoglu and Johnson 2005; Acemoglu and Robinson 2013; Bozoki and Richter 2016; Krasniqi and Desai 2016; Rodríguez-Pose 2013; Sarmidi et al. 2014).

Recently , growth literature has combined both financial development and institutional quality to investigate the effect of financial development on economic growth conditional on a country’s institutional quality in the globalized world. The objective of our study is to examine the effect of financial development , institutional quality and globalization on economic growth in the entire sample of 40 African countries and in sub-groups of those countries classified as low-income , lower-middle-income and upper-middle-income countries following the World Bank classification (2015). Based on per capita income,Footnote 1 these 40 countries consist of 19 low-income , 14 lower-middle-income and seven upper-middle-income countries. So far, evidence of such a relationship is mixed and inconclusive. Further, our study also examines whether globalization is a key factor in stimulating institutional quality that generates a conducive environment for technological change and innovation and financial development to enhance economic growth in Africa.

This study also helps fill the following research gaps. First, it uses a new broad-based financial development index. Constructed by the International Monetary Fund (IMF) this index captures both developments in financial institutions, including banks, insurance companies, mutual funds, pension funds and other types of non-bank financial institutions and financial markets, including stock and bond markets (Svirydzenka 2016). Moreover , it uses comprehensive measures of globalization and institutional quality as regressors: the KOF index of globalization index which includes economic globalization , social globalization and political globalization , and the World Bank’s Worldwide Governance Indicators (WGIs) which consist of six different indicators. Second, our study considers country-specific growth responses to financial development , variations in institution quality and their interaction, allowing for parameter heterogeneity and correcting for cross-sectional dependence . Third, the panel dataset covers the period 1980–2014, with a larger number of countries in Africa included over a significantly longer time span than in previous studies. Finally, our analysis complements its main findings for the entire sample of 40 African countries by considering analogous estimates in three sub-groups—low, lower-middle and upper-middle-income countries. To the best of our knowledge, this is the first study to undertake an assessment of how growth is affected in the long-run by financial development , institutional quality and globalization using a non-stationary dynamic panel allowing for parameter heterogeneity and correcting for cross-sectional dependence .

2 Literature Review

2.1 Theoretical Review

Over the past four decades, endogenous growth models have generally been the theoretical basis of studies on the financial development and economic growth nexus. Theoretically, the channels through which financial development affects saving and investment decisions and hence growth have been discussed extensively in literature. In literature the nexus between financial development and economic growth is characterized by optimistic and skeptical approaches.

According to the optimistic approach, efficient financial systems help countries acquire and process information on firms, managers and economic conditions thereby leading to more efficient resource allocations and enhancement of total factor productivity that can stimulate economic growth (Boyd and Prescott 1986; Greenwood and Jovanovic 1990). Second, under better financial systems, the shareholders and creditors monitor firms more effectively and enhance corporate governance which makes savers more willing to finance production and innovations in profitable investments which in turn boost productivity, capital accumulation and economic growth (Bencivenga et al. 1995; Harrison et al. 1999; Stiglitz and Weiss 1983; Sussman 1993). Third , a well-developed financial system mobilizes savings and facilitates efficient allocation of resources (Greenwood et al. 2013; King and Levine 1993). Fourth , financial arrangements play pivotal roles in reducing agency transaction and information costs and enhancing innovation activities and growth (Aghion et al. 2005). Finally , sound financial systems can also contribute to high-return investments through risk-sharing like investments in human capital and research development that accelerate economic growth (Aghion et al. 2009; Bencivenga and Smith 1991; De Gregorio 1996; Devereux and Smith 1994; Galor and Zeira 1993; Greenwood and Jovanovic 1990; Obstfeld 1994; Saint-Paul 1992)

According to the skeptical approach, high systemic risksFootnote 2 can lead to increased economic growth and financial volatility with potential negative impacts on economic growth in the short to long term. Financial sectors may take neglected risky loans, insure risky assets and may be affected by external shocks due to asymmetric information that increase banking instability and are capable of generating systemic financial crises (see, for example, Allen and Carletti 2006; Gai et al. 2008; Gennaioli et al. 2012) and misallocation of natural resources and labor into the fast growing financial sector when ideally those inputs should be used in other sectors. The financial sector attracts more skilled workers while the other real sectors are left behind due to absence of sufficient human resources that can have negative repercussions for growth (Bolton et al. 2016; Philippon 2010; Santomero and Seater 2000). Moreover , deviation from the unique optimal size of the financial sector creates inefficiencies and high costs for the economy (Santomero and Seater 2000), sub-optimal low savings , growth due to financial deregulation (Jappelli and Pagano 1994) and informational overshooting that expands the economy to a new capacity due to financial liberalization which is unknown until it is reached (Zeira 1999). These are some of the main factors that lead financial development to higher systemic risks and then lower economic growth . Therefore, theoretically it is not clear whether financial sector development contributes to economic growth or not particularly in developing countries like those in Africa.

2.2 Empirical Literature

Building on theoretical evidence, there is extensive empirical literature on the role of financial development in economic growth in developing countries . Like in theoretical studies the evidence shows mixed and inconclusive results and differs among countries as per individual characteristics of financial development , institutional quality, globalization , the development stage of the country and country-specific macroeconomic factors.

In finance growth literature, most research has found a positive relationship between financial development and economic growth (Adu et al. 2013; Akinlo and Egbetunde 2010; Christopoulos and Tssionas 2004; Goldsmith 1969; Hassan et al. 2011; Kargbo and Adamu 2009; King and Levine 1993; Levine et al. 2000; Levine and Zervos 1996; Luintel et al. 2008; Odedokun 1996; Rafindadi and Ozturk 2016; Shahbaz and Rahman 2012; Zhang et al. 2012).

Notwithstanding the early empirical evidence , some studies have found a negative relationship between financial development and economic growth (Friedman and Schwartz 2008; Kaminsky and Reinhart 1999; Loayza and Ranciere 2006; Lucas 1988; Rousseau and Wachtel 2011). Kaminsky and Reinhart (1999) suggest a possible negative channel of the effect of financial development on economic growth through triggering financial instability. Loayza and Ranciere (2006) found evidence of the co-existence of a positive relationship between financial intermediation and output in the long run and a negative short-run relationship due to financial instability.

Other related studies have shown that the positive effect of financial deepening weakens over time regardless of the country’s level of development (Beck et al. 2014; Rousseau and Wachtel 2011). Levine et al. (2000) suggest that a larger financial sector increases growth and reduces volatility over the long run while enhancing growth at the cost of higher volatility over short-term horizons.

Further, recent studies document the existence of a certain threshold of financial development beyond which additional deepening generates decreasing returns to economic growth and stability. Using a sample of 87 developed and developing countries , Law and Singh (2014) provide a threshold analysis of the finance-growth link. Their findings reveal that finance is beneficial for growth up to a certain level; beyond the threshold level further development of finance tends to affect growth adversely . Similarly , Arcand et al. (2012), Cecchetti and Kharroubi (2012), Deidda and Fattouh (2002), Huang and Lin (2009), Samargandi et al. (2015) , and Shen and Lee (2006) have also found that the nexus between financial development and economic growth has an inverted U-shape effect where a higher level of financial development tends to slow down economic growth .

Existing empirical evidence on the relationship between financial development and growth shows dependence on the income levels of the countries. De Gregorio and Guidotti (1995) and Huang and Lin (2009) found that the positive effect of financial development on economic growth is much more significant in low-income and middle-income countries than in high-income countries. Calderón and Liu (2003) suggest that financial deepening contributes more to growth in developing countries than in industrial countries. A similar result is found by Masten et al. (2008) who analyzed a sample of European countries. They show a strong and positive effect on economic growth only for countries with intermediate levels of development.

Seven and Coskun (2016) examined whether financial development reduced income inequalities and poverty in 45 emerging countries for the period 1987–2011. They found that although financial development promoted economic growth this did not necessarily benefit low-income emerging countries.

To show the existence of an optimal level of financial development , Ductor and Grechyna (2015) employed the first difference generalized Method of Moment estimator (FD-GMM) in 101 developed and developing countries over the period 1970–2010. They empirically examined the relationship between financial development and real sector output and its effect on economic growth . Their results show that the effect of financial development on economic growth depended on the growth of private credit relative to growth in real output.

Further, financial development also affects growth indirectly through positive spillovers from foreign direct investment (FDI) to stimulate economic growth in a well-functioning financial system . Empirically , Alfaro et al. (2004), Hermes and Lensink (2003), Shahbaz et al. (2013) among many others have shown that financial development encourages FDI inflows and transfer of technology and managerial skills that have positive spillover effects on economic growth . Donaubauer et al. (2016), using gravity-type models show that bilateral FDI increases with better developed financial markets in both the host and source countries which have positive economic growth impacts.

Several works in recent years show that strong legal and institutional frameworks are critical for creating an environment in which the financial sector facilitates economic growth . Al-Yousif (2002) argues that the relationship between financial development and economic growth cannot be generalized across countries because economic policies are country-specific and their success depends on the efficiency of the institutions implementing them. Similarly, Demetriades and Law (2006) extend Arestis and Demetriades (1997) and Demetriades and Andrianova’s (2004) studies on the role of institutions in the financial-growth nexus and using a sample of 72 countries for the period 1978–2000 and employing cross-sectional and panel data estimation find that financial development had a greater effect on growth when the banking system was operating within a sound institutional framework.

Law et al. (2013) using a sample of 85 countries over the period 1980–2008 and employing the threshold estimation technique found that the impact of finance on growth was positive and significant only after a certain threshold level of institutional development had been attained. Specifically, the qualities of formal institutions like control of corruption, rule of law, bureaucratic quality or government effectiveness and the overall institution had a vital role in the finance-growth nexus. As per their results, the effect of finance on growth was non-existent until the optimal level of institution was reached. Similarly , Ng et al. (2016) employed threshold estimation techniques to a cross-section of 85 jurisdictions during the post-crisis period. They found that the impact of stock market liquidity on growth was positive and significant only in jurisdictions where there was a high level of property rights protection but there was mixed evidence in the low to medium degrees of protection. Moreover, using broader governance indicators as threshold variables and instrumental variables the threshold regressions confirmed the main finding of identifying a threshold level above which institutional quality can positively shape the impact of the stock market on economic growth .

In other work , Le et al. (2016) used a panel dataset of 26 countries over the period 1995–2011 to investigate the impact of institutional quality, trade and financial development on economic growth using the dynamic generalized Method of Moments model. They found that better governance and improved institutional quality impacted on financial development in developing economies while economic growth and trade openness were vital determinants of financial depth in developed economies. Therefore, the effect of financial development on economic growth may vary as per the level of the financial indicator itself, institutional quality, income level and other country-specific conditions.

3 Data Description and Methodology

3.1 Data Source and Descriptive Statistics

Our dataset comprises of annual time series data of selected macroeconomics indicators for 40 African countries (see the list of countries in Appendix A, Table 1) on an annual frequency over the period 1980–2014. The number of countries included and the time period of the study were dictated by data availability. All the variables used in the descriptive and econometrics analysis along with their symbols and sources are given in Table 1.

3.1.1 Dependent Variable

The dependent variable is the logarithm of real GDP per capita at chained PPPs (in million 2011 US$) obtained from the Penn World Table (PWT 9.0)

3.1.2 Independent Variables

The Financial Development Index:

To capture the overall size and depth of financial development , most previous empirical studies on financial development have used monetary aggregates (such as M2 and M3 as a ratio of GDP), the ratio of private credit as a ratio of GDP and to a lesser extent the ratio of stock market capitalization to GDP. However, financial development is multidimensional including enhancements in financial institutions and financial markets. Therefore, to investigate the finance-growth relationship more accurately our study uses the financial development index, a new broad-base measure constructed by Sahay et al. (2015) and obtained from IMF. They constructed this index for 183 countries on annual frequency from 1980 to 2014 capturing both financial institutions and financial markets. This index is an improvement over the conventional measures of financial development . Conceptually, it incorporates information on a broader range of financial institutions including banks, insurance companies, pension and mutual funds and financial markets such as the stock and bond markets. For this index, financial development is defined as a combination of depth (size and liquidity of markets), access (ability of individuals and companies to access financial services) and efficiency (institutions’ ability to provide financial services at low costs and with sustainable revenue and the level of activity of capital markets) in both financial institutions and financial markets.

The financial development index ranges from 0 (lowest level of development) to 1 (highest level of development) as do its sub-indices on financial institutions’ development and financial markets’ development.

The Institutional Quality Index:

For a measure of institutional quality our study employs the World Bank’s Worldwide Governance Indicators (WGIs) for all countries over the period 1996–2014. Governance includes both traditions and institutions through which authority is exercised in a country. The WGI indicators have six dimensions of governance—voice and accountability, political stability and absence of violence, government effectiveness, regulatory quality, rule of law and control of corruption.Footnote 3 The data for each variable was normalized to the standard normal distribution with values ranging between −2.5 (lowest quality governance) and 2.5 (highest quality governance).

The Globalization Index:

We used the KOFFootnote 4 index of globalization which was introduced in 2002 (Dreher 2006), its construction details can be found in other studies (Dreher et al. 2008). It was retrieved from the ETH database. The overall index combines economic, social and political dimensions into a measure of total globalization , ranging from 0 to 100, with higher numbers indicating more globalization .

A correlation matrix among the dependent and independent variables and their level of significance is reported in Table 2. The results in column 1 indicate that financial development , globalization and institutional quality variables have positively significant correlations with real gross domestic per capita at the 5 percent level of significance. Similarly, the results in columns 2–5 show that there is a positive and significant correlation between financial development , globalization , institutional quality, human capital and capital formation.

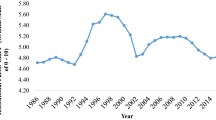

Figure 1 gives information about the overall financial development , financial institutions’ development and financial markets’ development by income groups. As can be seen in the figure, financial institutions’ development is relatively higher than financial markets’ development in all income groups. The overall financial development index and its components on average improve with higher income.

Figure 2 shows a plot of mean values over the sample period regarding indicators of institutional quality for different income levels. In this figure we can see that each of the six institutional quality indicators is the highest in upper-middle-income countries, followed in order by lower-middle-income and low-income countries with one exception: the voice and accountability indicator is on average higher in low-income countries than in lower-middle-income countries.

(Source Author’s calculations based on the WGI dataset obtained from the World Bank—control of corruption, political stability and absence of violence/terrorism, rule of law, government effectiveness, regulatory quality and voice and accountability)

World governance indicators by income group for 40 African countries (1996–2014)

3.2 Theory and Model Specifications

Recently, both endogenous and exogenous growth theories have been used to investigate the determinants of economic growth across countries. Following Mankiw et al. (1992) and Demetriades and Law (2006) we used a Cobb–Douglas production function for the aggregate economy as a theoretical base but this function was augmented with financial development , institutional quality and other control variables. Based on literature and the framework posited by León-Ledesma et al. (2015), Omri et al. (2015), Rahman et al. (2015), and Zerihun (2014), we determined labor-augmenting technology A not only by technological improvements but also by financial development , institutional quality and globalization within the augmented Cobb–Douglas production function .

Theoretically, there are many channels through which financial development , institutional quality, globalization and their interactions can affect economic growth and the level of technology and efficiency. Higher degrees of financial development and institutional quality can encourage accumulation of physical capital , human capital , FDI inflows and transfer of technological knowledge. These factors in turn help improve the level of technology and efficiency thereby promoting economic growth in a country. Globalization also contributes to economic growth by inducing more efficient allocation of internal and external resources and by helping shift technological advancements from developed countries to developing economies with the less-developed countries exploiting innovations of developed countries through learning-by-doing effects. Besides, using both OLS and SYS-GMM on 21 sub-African countries for the period 1980–2010, Effiong (2015) found evidence of threshold effects by the introduction of a linear interaction term between financial development and institutional quality in growth regressions. In his model, financial development contributed positively to growth but only in good policy environments. Various studies (for example, Acemoglu 2006; Acemoglu and Robinson 2008, 2010; Rodrik and Subramanian 2003) have provided new impetus to empirical research by showing that institutions affect the economic growth of individual firms and countries.

To examine the linkage between financial development , institutional quality, globalization and growth we used the production function with constant returns to scale and productivity growth that is purely labor augmenting or ‘Harrod-neutral’ for each country i at time t. This is presented as:

where, \( Y_{it} \) is real gross domestic product (GDP) in country \( i \) (\( i \) = 1, 2, 3, …, 40) at time \( t\,\left( {t = 1,\,2,\,3,\, \ldots ,\,35} \right) \), \( K_{it} \) is capital, including both human and physical capital , \( L_{it} \) is the stock of raw labor and \( A_{it} \) is a labor-augmenting factor measuring the level of technology and efficiency in country \( i \) at time \( t \) in an economy. This equation assumes that \( 0 < \alpha < 1 \), implying decreasing returns to all capital.

In existing literature, the elasticities in the production function are typically estimated under the assumption of country homogeneity and cross-sectional independence which are strong assumptions. We used a flexible framework to estimate the elasticities from a panel of countries allowing for slope heterogeneity and taking into account cross-sectional dependence . There are theoretical and empirical reasons to expect that there will be important heterogeneity and cross-sectional dependence across countries.

Hence, under the assumption of slope heterogeneity across countries the capital stock , raw labor and labor-augmenting technology were assumed to evolve exogenously at rate \( n_{i} \) and \( g_{i} \), and are presented as:

where, \( n_{i} \) is the exogenous labor force growth rate in each country, \( A_{i0} \) is time-invariant country specific technology and \( g_{i} \) is the exogenous rate of technological progress in each country in the panel. Moreover, \( x_{it} \) is a vector of financial development , institutional quality and globalization indices that can affect the level of technology and its efficiency in country i at time t, and \( \theta_{i} \) is a vector of coefficients related to these variables. The term \( \mu_{it} \) represents the error term. The production function in Eq. (1) can be written in a per-worker form such that:

Taking the log transformation of both sides of Eq. (4) yields:

Taking the log of Eq. (3) and then substituting the result into Eq. (5) leads to:

The variable \( x_{it} \) in Eq. (6) shows variations across countries which implies that different countries may converge to different steady states based on their steady state levels of financial development , institutions and globalization .

Plugging-in \( Z_{it} \), representing cross-interaction terms between financial development , institution quality and globalization into Eq. (6) gives the final theoretical specification as:

Rewriting Eq. (7) as a standard panel model specification we get:

where, \( \ln y_{it} \) is the log-transform of real GDP per capita PPP chained 2011 US$, \( \ln k_{it} \) represents log of capital formation per capital, \( X_{it} \) consists of variables representing the degree of financial development , institutional quality and globalization while \( Z_{it} \) represents the cross-interaction term between the variables represented by \( X_{it} \). Moreover, \( \gamma_{t} \, \) and \( \,\eta_{i} \) correspond to the time effect and the unobserved country-specific effect respectively and \( \mu_{it} \) refers to the regression random error term. Finally, the lagged value of the dependent variable is included as a regressor in Eq. (8) to make a dynamic panel model .

In our study in addition to the slope heterogeneity we also take into account the impact of cross-section dependence, both the unobservable and the observable parts of the empirical model. The conventional panel specification assumes that there is slope homogeneity and cross-section independence. That is, all the elasticity and semi-elasticity parameters in Eq. (8) will then be equal across countries (\( \beta_{1i} \, \), \( \beta_{2i} \, \) and \( \beta_{3i} \, \) do not vary by i) and the regression error term will show no systematic patterns of correlation across countries. The slope homogeneity restriction implies that each country with a different level of economic development such as low-income (for example, Ethiopia, Uganda and Tanzania), upper-middle-income (Botswana, Namibia and South Africa) and higher-income (for example, Equatorial Guinea and Seychelles)Footnote 5 countries should have the same parameters in a growth regression. However, this is a strong assumption which is likely to be violated in reality. Moreover, due to strong inter-economy relationships , global technological and financial shocks, co-movements of macroeconomic aggregates and worldwide environmental changes the assumption of cross-section independence is unrealistic and that the covariance of the residual is zero can be easily violated. Westerlund and Edgerton (2008) support this point, ‘When studying long macroeconomic and micro cross country regression cross-sectional dependencies are likely to be the rule rather than the exception, due to the existence of common shocks and unobserved factors .’

3.3 Econometric Methodology

The methodology in our paper follows four steps. First, cross-sectional independence of each variable is tested using the Pesaran (2004) test for N = 40 and T = 35, where N is the cross-section dimension and T is the time dimension. Second, the integration levels of the variables using appropriate panel unit root tests are investigated. That is, in case cross-sectional dependence is rejected, the first-generation panel unit root test by Maddala and Wu (1999) is used . Instead , if there is evidence of cross-sectional dependence we employ the CADF test suggested by Pesaran (2007), a second-generation panel unit root test that controls for cross-sectional dependence . Third, depending on the integration levels of the variables, slope heterogeneity and cross-sectional dependence , both first and second generation panel co-integration tests are used: the Pedroni (1999, 2001, 2004) residual-based test and the Westerlund (2007) error-correction-based test . Finally, given the importance of slope heterogeneity and cross-country dependence in the African context a recently developed model that allows for slope heterogeneity and cross-sectional dependence was also used.

We tried three dynamic panel data estimation techniques that address the issue of non-stationarity—the pooled mean group (PMG) estimators by Pesaran et al. (1999), the mean-group (MG) estimator by Pesaran and Smith (1995) and a PMG estimator with a common correlated effects correction (PMG-CCE)—as suggested in a non-dynamic setting by Pesaran (2006).

The PMG estimator imposes homogeneity on the long-run parameters across individual units (countries in our case) while maintaining heterogeneous short-run dynamics. This estimator yields efficient and consistent estimates when the long-run coefficients are equal across all individual units and when there is no cross-sectional dependence in the panel. Often, however, the hypothesis of long-run slope homogeneity and cross-sectional independence are rejected empirically. The MG estimator relaxes the assumption of long-run slope homogeneity compared to the PMG estimator. The PMG-CCE estimator attempts to correct for cross-sectional dependence by augmenting the regression with cross-section means of the explanatory variables.

3.3.1 Cross-Sectional Dependency Test

In a macroeconomic panel cross-sectional dependence can be introduced because of a finite number of unobservable and/or observed common factors that may have different effects on total factor productivity (TFP) across countries. Such factors include spatial spillovers, aggregate technological shocks, similar national policies intended at raising the level of technology, oil price shocks that influence TFP through their effects on production costs, world financial crises and interaction effects through trade or other networks. Therefore, in a cross-country macroeconomic panel study performing a cross-sectional dependence test is a vital step. That is why of late there has been increasing research interest in characterizing and modeling cross-sectional dependence and its impacts on estimation.

To determine the presence of CD we used the simple test suggested by Pesaran (2004) for all the variables in which the test statistic is based on an average of all pair-wise correlations (for cross-section pairs) of the ordinary least squares (OLS) residuals from the regression of the panel data model:

where, \( y_{it} \) is the dependent variable , (i = 1, …, N), \( N \) is the number of panel members, (t = 1, …, T) is time period and \( x_{it} \) is the vector of observed explanatory variables. \( \hat{\alpha }_{i} \) and \( \hat{\beta }_{i} \) refer to the estimated intercepts and the slope coefficients which can vary across panel members.

The Pesaran (2004) CD-test statistic can generally be expressed as:

where, \( \hat{\rho }_{ij} \) refers to the sample estimate of the pair-wise correlation of the OLS residuals, \( \hat{\mu }_{it} \) and \( \hat{\mu }_{jt} \) associated with Eq. (9).

The null hypothesis for this test is cross-sectional independence and under this the statistics are distributed as standard normal for \( T > 3 \) and a large value (Pesaran 2004). The CD-test statistics from various simulations show robustness to non-stationarity, structural breaks, parameter heterogeneity and above all, they perform well in small samples. This test is applicable both on the variables and on the estimated residuals.

3.3.2 Panel Unit Root Test

Since our dataset covers a long time period (35 years) it is very likely to observe that the macroeconomic variables will follow a unit root process (Nelson and Plosser 1982) Hence, we employed Pesaran’s (2007) second-generation panel unit root test, referred to as cross-sectionally augmented Dickey-Fuller (CADF) test. This test is based on the assumption that the data generating process is:

where, \( \nu_{it} = \rho_{i} \theta_{t} + \mu_{it} \), \( \theta_{t} \) is the common factor and \( \mu_{it} \) is white noise.

The regression model to be estimated for the CADF test is:

where, for each cross-section, a t-statistic is obtained for each of the estimated \( \beta_{i} \). The test statistics for the CIPS test are the mean of these t-statistics. Pesaran (2007) provides the critical values for the CIPS test statistics. In comparison to the first-generation panel unit root tests the CIPS test provides more precise and reliable results in the presence of cross-sectional dependence .

3.3.3 Panel Co-integration Test

The idea of co-integration was first introduced in literature by Engle and Granger (1987). Co-integration means the existence of a long-run relationship among two or more non-stationary variables . The principle of testing for co-integration is to show if the variables in question move together over time so that a short-term sudden shock will be corrected in the long run with the variables in the long run returning to a steady-state linear relationship . Otherwise, if two or more variables are not co-integrated they may wander randomly far away from each other.

Therefore, to determine the existence of a long-run equilibrium relationship among the variables in the panel data two groups of panel co-integration tests have been developed in literature. The first group consists of first generation panel co-integration tests developed by Pedroni (1999, 2001, 2004) which solve the problem of small samples and allow for heterogeneity in the intercepts and slopes across the different members of the panel but these tests ignore cross-sectional dependence in cross-country panel analyses. Pedroni (1999, 2001, 2004) developed seven panel co-integration statistics based on the residuals of the Engle and Granger (1987) co-integrating regression in a panel data model that allows for considerable heterogeneity . Four of these statistics are within-dimension (‘panel’) and the other three statistics are between-dimension (‘group’) test statistics and in all cases the null hypothesis being tested is no co-integration.Footnote 6

The second group of tests is second-generation co-integration tests developed by Westerlund (2007) that take cross-sectional dependence into account. The Westerlund tests consist of four statistics based on the speed that the adjustment parameter in an error-correction model equals zero. Two of these statistics are group mean statistics (Gt and Ga) which investigate co-integration in at least one panel and the other two statistics are panel statistics (Pt and Pa) which investigate co-integration for panel members as a whole. Gt and Pt are computed with the conventional standard error of the parameters of the error correction model whereas Ga and Pa are adjusted for heteroscedasticity and autocorrelations based on two standard errors developed by Newey and West (1994). The null hypothesis tested by all the four tests is the hypothesis of no co-integration.

The second-generation panel co-integration tests have the following advantages. First, they allow for a large degree of heterogeneity both in the long-run co-integration relation and in short-run dynamics and can deal with different integration levels in the variables as long as the dependent variable is not I(0) (Persyn and Westerlund 2008). Second , they take into account cross‐sectionally dependent data among the members of the panel. Third, there is an optional bootstrap procedure developed for the test which is quite robust against cross-sectional dependencies thereby allowing for various forms of heterogeneity . Fourth, the Westerlund panel co-integration tests show both better size accuracy and higher power than the residual-based tests developed by Pedroni . The difference in power arises mainly because the residual-based tests ignore potentially valuable information by imposing a possibly invalid common factor restriction whereas Westerlund avoids the common factor restriction problem.

Hence, we used Westerlund’s (2007) error-correction-based co-integration tests in addition to Pedroni’s (2004) tests to examine the long-run relationship between economic growth , financial development , institutional quality and globalization in African countries.

The Westerlund tests for the absence of co-integration are based on the error-correction model for individual or for panel members as a whole. Consider the error-correction model given as:

where, t = 1, 2 …, T and i = 1, 2, …, N show the time period and cross-sectional index respectively, \( d_{t} \) is a variable that includes any deterministic components and \( x_{it} \) is a variable that includes a set of exogenous variables. We can rewrite Eq. (14) as:

From Eqs. (14) and (15), the deterministic component \( d_{t} \) has three distinct possibilities. The first case is when \( d_{t} = 0 \), in which case Eqs. (14) and (15) have no deterministic term. Second, when \( d_{t} = 1 \), the implication is that Eqs. (14) and (15) have a constant intercept term but no trend. Third, having \( d_{t} = (1,t) \) indicates that Eqs. (14) and (15) have both a constant intercept and a trend. Moreover, \( \phi_{i} \) is the parameter for the error-correction term and determines the speed at which the system corrects back to the long-run equilibrium relationship \( y_{it - 1} - \beta^{\prime}_{i} x_{it} = 0 \) after a sudden shock. Therefore, given that \( \beta_{i} \) is not a zero vector, if the value of \( \phi_{i} < 0 \), then the model is error correcting which implies that \( y_{it} \) and \( x_{it} \) are co-integrated whereas if the value \( \phi_{i} = 0 \) then the model is not error correcting and thus there is no co-integration among the variables. The two group co-integration tests state the null hypothesis of no co-integration as \( H_{0}{:}\phi_{i} = 0 \) for all \( i \) and the alternative hypothesis \( H_{1}{:}\phi_{i} < 0 \) for at least one \( i \). In contrast the panel co-integration tests state the null hypothesis no co-integration as \( H_{0}{:}\phi_{i} = 0 \) for all \( i \) versus the alternative hypothesis of a co-integration presence among the whole panel \( H_{1}{:}\phi_{i} = \phi < 0 \) for all \( i \). In other words, the group mean statistics \( G_{a}\) and \( G_{t} \) are used to test the null hypothesis of no co-integration against the alternative hypothesis of at least one element of panel co-integration and the panel statistics \( P_{a} \) and \( P_{t} \) are used to test the null hypothesis of co-integration against the simultaneous alternative of panel co-integration. Hence, based on the group mean and panel test, rejection of \( H_{0} \) should be taken as evidence of co-integration in at least one of the cross-sectional units or for the whole panel respectively.

3.3.4 Empirical Estimation Technique

The estimation strategy in our study largely follows an extended version of the Pesaran (2006) common correlated effects (CCE) estimator which allows for a heterogeneous coefficient. The CCE estimator has been used in empirical application in Bond and Eberhardt (2013), Eberhardt (2012), LeMay-Boucher and Rommerskirchen (2015), McNabb and LeMay-Boucher (2014) in panel models with strictly exogenous regressors. Pesaran’s (2006) baseline specification given independent explanatory variables and a single common factor is:

where, \( y_{it} \), as used in our paper is the logarithm of real gross domestic per capita for country i at time t and \( x_{it} \) is a vector of regressors. \( f_{t} \) and its coefficient \( \gamma_{i} \) are an unobserved common factor and a heterogeneous loading factor respectively. To account for cross-sectional dependence induced by the unobserved common factor this model is augmented with cross-sectional averages of the dependent variable as well as the regressors, and to account for slope heterogeneity , mean-group regression is used instead of pooled regression.

Nevertheless, Chudik and Pesaran (2015) and Everaert and De Groote (2016) have shown that the CCE estimator is consistent in a non-dynamic panel model only. A dynamic panel model where the lagged dependent variable is added as a regressor to Eq. (16) is given as:

where, the idiosyncratic errors \( \mu_{it} \) are cross-sectionally weakly dependent and the mean of the coefficients of the one-time lag of the dependent is homogenous. The lagged dependent variable in Eq. (17) is no longer strictly exogenous, and hence the coefficient estimates become inconsistent. Chudik et al. (2015) however , show that these estimates become consistent by adding \( \sqrt[3]{T} \) lags of the cross-sectional means. The equation is given as:

where, \( \bar{z}_{t} \) represents a vector of the cross-sectional means of the dependent and independent variables with q time lags of the \( \bar{z} \) vector. Moreover, Chudik and Pesaran (2015) used a ‘half-panel’ jack-knife and recursive mean adjustment to help correct for the small sample bias. Our approach is based on the distributed lag and an error-correction model (ECM) representation of Eq. (18), which can be easily written as:

Equation (19) can be rewritten as:

where, \( \gamma_{i} = \theta_{i} \beta_{i} \).

4 Empirical Analysis

We report the cross-sectional dependence tests based on Pesaran (2004) in this section. Secondly, we also report on the panel unit root for the entire sample as well as sub-groups of countries based on income levels. We used the Pedroni and Westerlund panel co-integration tests to investigate the existence of a long-run relationship among the variables. Finally, this section also gives the estimates from error-correction models.

4.1 Cross-Sectional Dependence Test

The tested cross-sectional dependence results among the variables with the CD test are presented in Table 3 for the entire sample as well as for the different income levels of the countries. The table gives the CD statistics and their p-values, the cross-sectional correlation for each variable, where ρ measures the magnitude of correlation and avg |ρ| indicates the average of such correlation in absolute value in the noted income category. From these statistics, the null hypothesis that there is no cross-sectional dependence can be rejected at the 5 percent significance level for all the variables in all income categories except for institutional quality in the upper-middle-income category and in the full sample of countries.

The results indicate that even after including the regressors that are expected to affect economic growth in each country, the regression disturbance terms among the countries also affect one another. Therefore, the results show that all the countries and countries in each income group examined in this study have highly integrated economies and when a shock occurs in one of them it will also affect the other countries.

4.2 Panel Unit Root Test Allowing for Cross-Sectional Dependence

Since the previous section gives cross-sectional dependency among the variables, Pesaran’s (2007) second-generation panel unit root test was used to investigate the integration levels of the variables. CIPS tests were carried out including an intercept only as well as with an intercept and linear trend in levels and in first differences for all income categories.Footnote 7 As indicated in Table 4, when using the full sample of countries almost all the variables appear non-stationary in levels but after taking the first difference they become stationary under the specifications without trend (constant only) and with trend (constant and trend) at the 1 percent level of significance except for human capital and capital stock per capital.

4.3 Panel Co-integration Test Allowing for Cross-Sectional Dependence

The previous sections show that there is typically cross-section dependence based on the Pesaran (2004) test and the variables appear non-stationary in levels based on Pesaran’s (2007) CIPS test. Following the CD test and panel unit root test , the next step is to check the existence of co-integration among the variables. For this purpose, the results from both the Pedroni (1999, 2001, 2004) and Westerlund (2007) tests , that is, the first and second generation panel co-integration tests respectively are presented in Table 5.

In the case of the entire sample of 40 countries, the results suggest that six out of the seven Pedroni tests (panel and group) reject the null hypothesis of no co-integration, indicating that financial development , institutional quality and globalization have a long-run relationship with economic growth . Similarly, six out of seven Pedroni tests reject the null hypothesis of no co-integration in low-income countries, five out of seven do so regarding lower-middle-income countries and four out of seven do so regarding upper-middle-income countries.

On the other hand, considering the presence of potential cross-sectional dependence across the entire sample of 40 countries and all sub-groups of countries, it is more robust to apply Westerlund’s (2007) panel co-integration tests . Under the presence of cross-sectional dependence , recent papers have shown that the asymptotic p-values without bootstrapping are inefficient and inconsistent as compared to the robust p-values with bootstrapping. The Westerlund tests based on the ECM approach and the robust p-values based on 800 bootstrap replications are reported in Table 5. All four of the Westerlund tests clearly reject the null of no co-integration at the 1 percent level of significance in the entire sample and in all sub-groups of countries. Consequently, the results indicate the presence of a strong co-integration relationship among economic growth , financial development , institutional quality and globalization in the entire sample of countries as well as in each of the three income categories.

4.4 Long and Short Run Estimation Using the Panel Error Correction Model

The results of estimated error correction models with long-run relationships of financial development , institutional quality and globalization indicators on economic growth for the full sample of countries are reported in Table 6. Columns 1 and 2 in Table 6 report the results for the pooled-mean group (Pesaran et al. 1999) and mean-group (Pesaran and Smith 1995) estimated models. Based on the test, presented in Appendix A, Table 2, the calculated Hausman statistic is 1.67 with its p-value 0.644 and is distributed \( \chi^{2} \left( 2 \right) \). Hence, the PMG estimator is preferred to the MG group estimator.Footnote 8

Column 3 gives a PMG model similar to that in column 1 with the difference that the estimates are performed using ordinary least squares (OLS) as advocated by Ditzen (2016), whereas column 1 follows the maximum-likelihood strategy of Pesaran et al. (1999). We refer to the estimates in column 3 as PMG-OLS estimates. The null hypothesis of the absence of weak cross-sectional dependence is rejected in column 3, in which there is no attempt to correct for cross-sectional dependence .

For non-dynamic models with independent explanatory variables in which there is cross-sectional dependency, Pesaran (2006) suggested the correction of MG estimators by augmenting the regression model with cross-sectional means of the explanatory variables which is referred to as the CCE (common correlated effects ) approach. Column 4 modifies the model in column 3 (Table 6) by augmenting it with cross-sectional means of the explanatory variables to correct for common correlated effects with the resulting estimates referred to as PMG-CCE estimates as given in column 4. The CD test is applied with this model also with the result that the hypothesis that there is no weak cross-sectional dependence is rejected, lending credence that this is the most legitimate model among the ones presented in Table 6.

Table 7 presents the PMG-CCE regression results for financial development and its components—financial institutions’ development and financial markets’ development in addition to institutional quality and globalization indices for the entire sample. The results reported in column 1 in Table 7 show that financial development is positively related to economic growth in the long-run and it is statistically significant at the 10 percent level. All else being equal, a 0.1 unit increase in financial development leads to greater economic growth by 15.3 percent, which shows that financial development plays a vital role in increasing economic growth in the long run, a finding that is in line with Beck et al. (2014) and Loayza and Ranciere (2006). Similarly, the estimated results show that in the long-run higher institutional quality and greater globalization have significantly positive impacts on economic growth at the 10 percent significance level. Having 1.1 and 1.7 percent economic growth in the long-run is linked with 1 unit and 0.1 unit increase in the globalization and institutional quality indices respectively.

To examine the role of financial development in economic growth it would be better to consider the simultaneous and separate impact of financial institutions’ development and financial markets’ development across countries and income categories. The results in columns 2 and 3 in Table 7 indicate that greater financial institutions’ development has a positive and significant impact on growth. However, the same cannot be said for greater financial markets’ development. The estimated results indicate that African countries are predominantly financial institution-based economies and financial markets are still very little developed to affect economic growth . This is consistent with the descriptive statistics in Fig. 1. Moreover, in column 4 in Table 7 the interaction between financial development and institutional quality is included in addition to the financial development index and the results show an insignificantly negative impact of financial development on growth being exacerbated by better institutional quality.

The findings reported in Table 8 are similar to the ones in Table 7 with the difference that Table 8 presents the estimates for each of the three sub-groups of countries (low, lower-middle and upper-middle-income ). The results suggest that the three primary explanatory variables (financial development , institutional quality and globalization ) have statistically significant positive effects on economic growth in the low-income countries, while such effects are insignificant in the upper-middle-income countries. The findings for the lower-middle-income countries also show that only financial development had a positive and significant effect on economic growth . Moreover, another interesting finding comes from considering the impact of financial institutions and financial markets separately on economic growth in each of the income groups. The results reveal that financial institutions’ development had significantly positive long-run and short-run effects on economic growth in lower-middle-income countries only and financial markets’ development had no significant effect on growth in any of the income categories.

The results in Table 8 also indicate that when the interaction term between financial development and institutional quality is also included in the regression along with the financial development index, the results indicate that financial development has a negative effect on economic growth and that higher institutional quality aggravates the negative effect of financial development on economic growth in low-income countries. In contrast, in upper-middle-income countries financial development has a positive and significant impact on economic growth while institutional quality adversely affects that positive impact. The empirical findings in Table 8 which show that financial development has positive and significant effects on low and lower-middle-income countries is consistent with Calderón and Liu (2003) and Huang and Lin (2009).

5 Conclusion and Policy Recommendations

This study examined the short and long-run relationships among financial development , institutional quality, globalization and economic growth for 40 African countries and three sub-group panels (low, lower-middle and upper-middle-income panels) over the period 1980–2014. It used a new broad based financial development model generated with the help of a principal component with two sub-components (financial institutions and financial markets), a broad measure of institutional quality having six dimensions of governance and broad coverage of the globalization index comprising economic, social and political globalization variables.

Moreover, it used the recently developed macro-econometrics panel data estimation techniques to address the problems of cross-sectional dependence , variable non-stationarity, dynamics and slope heterogeneity . First, we conducted a cross-sectional dependence test to decide appropriate panel unit root tests and panel co-integration tests . Depending on the CD results appropriate panel unit root tests were conducted in the second step. In the third step, the long run relationship among the variables was tested using the Pedroni and Westerlund co-integration tests. Finally, the dynamic commonly correlated effect estimator which is an extension of the Mean Group Common Correlated Effects estimator developed by Chudik and Pesaran (2015) that allows for the inclusion of lagged dependent variables and weakly exogenous regressors in the panel data modeling was employed.

Our empirical results indicate the existence of cross-sectional dependence among the variables and all variables are integrated at I(1) which is confirmed by the second-generation panel unit root tests. The findings of both Pedroni and Westerlund co-integration tests established that economic growth , financial development , institutional quality and globalization have a long-run relationship. Further, based on the dynamic CCE estimates our empirical results suggest that financial development , institutional quality and the globalization indices have a positive and significant effect on long-run economic growth in the entire sample of countries and also in low-income countries. However, three of these regressors were insignificant in upper-middle-income countries while only financial development had a positive effect on economic growth . Hence, the impact of financial development and institutional quality on economic growth in the globalization world varies across income levels and across countries due to the heterogeneous nature of economic structures, the way countries are integrated into the global economy, institutional set-ups and financial development .

Our study has some specific policy implications. Countries should reform and strengthen their financial sectors to accelerate economic growth . A strong financial sector mainly relaxes credit constraints and provides instruments to withstand adverse shocks. However, financial institutions should be monitored carefully because financial development might also increase the propagation and amplification of shocks. African governments must have strong legal and institutional frameworks to create an environment in which the financial sector stimulates and accelerates economic growth . Moreover, policymakers need to design and implement active development strategies to benefit from FDI flows, technological innovations, efficiency and economies of scale which are components of globalization but also to counteract the negative effects of the immutable forces of globalization on social and political systems.

This study focused more on macro-panel econometrics, hence future researchers can look at country-level studies using a time series analysis or at the firm level for a micro-panel data analysis.

Notes

- 1.

Low-income economies are defined as those with a GNI per capita, calculated using the World Bank Atlas method, of $1025 or less in 2015; lower middle-income economies are those with a GNI per capita between $1026 and $4035; upper middle-income economies are those with a GNI per capita between $4036 and $12,475.

- 2.

Higher systemic risks imply more frequent and/or more severe crises which in turn negatively affect economic growth rates in the short and medium term.

- 3.

Voice and Accountability (VA)—capturing perceptions of the extent to which a country’s citizens can participate in selecting their government, as well as freedom of expression, freedom of association and a free media. Political Stability and Absence of Violence/Terrorism (PV) capture perceptions of the likelihood that the government will be destabilized or overthrown by unconstitutional or violent means, including politically-motivated violence and terrorism. Government effectiveness (GE): Measures the quality of public and civil services, along with their independence from political pressures. Further, it assesses the quality of policy implementation and the reliability of government enforcement about such policies. Regulatory quality (RQ): Assesses the government’s ability to apply sound policies to stimulate private sector development. Rule of law (RL): Captures perceptions concerning the degree of confidence possessed by agents in a society based on the protection of property rights, contract enforcement, police, courts and the possibility of violence. Control of corruption (CC): Evaluates the ability of public power to prevent corruption and the degree of influence on the state wielded by private interest groups.

- 4.

Note: The KOF index is available at: http://globalization.kof.ethz.ch/.

- 5.

Income categories of African countries based on the World Bank’s Development Indicators.

- 6.

Since the seven Pedroni panel co-integration statistics have been extensively discusses in the literature all the procedure will not be discussed in this paper.

- 7.

The CIPS test results for each income category are given in Appendix A.

- 8.

For the PMG estimator, the long coefficients are homogenous but not the short run coefficients.

References

Acemoglu, D. (2006). Modeling Inefficient Institutions. Cambridge, MA: National Bureau of Economic Research.

Acemoglu, D. and S. Johnson (2005). Unbundling Institutions. Journal of Political Economy, 113(5): 949–995.

Acemoglu, D. and J.A. Robinson (2008). Persistence of Power, Elites, and Institutions. The American Economic Review, 98(1): 267–293.

Acemoglu, D. and J.A. Robinson (2010). The Role of Institutions in Growth and Development. World Bank Publications.

Acemoglu, D. and J.A. Robinson (2013). Why Nations Fail: The Origins of Power, Prosperity, and Poverty. Crown Business.

Adu, G., G. Marbuah, and J.T. Mensah (2013). Financial Development and Economic Growth in Ghana: Does the Measure of Financial Development Matter? Review of Development Finance, 3(4): 192–203.

Aghion, P., P. Bacchetta, R. Ranciere, and K. Rogoff (2009). Exchange Rate Volatility and Productivity Growth: The Role of Financial Development. Journal of Monetary Economics, 56(4): 494–513.

Aghion, P., P. Howitt, and D. Mayer-Foulkes (2005). The Effect of Financial Development on Convergence: Theory and Evidence. The Quarterly Journal of Economics, 120(1): 173–222.

Akinlo, A.E. and T. Egbetunde (2010). Financial Development and Economic Growth: The Experience of 10 Sub-Saharan African Countries Revisited. The Review of Finance and Banking, 2(1): 17–28.

Al-Yousif, Y.K. (2002). Financial Development and Economic Growth: Another Look at the Evidence from Developing Countries. Review of Financial Economics, 11(2): 131–150.

Alfaro, L., A. Chanda, S. Kalemli-Ozcan, and S. Sayek (2004). FDI and Economic Growth: The Role of Local Financial Markets. Journal of International Economics, 64(1): 89–112.

Allen, F. and E. Carletti (2006). Credit Risk Transfer and Contagion. Journal of Monetary Economics, 53(1): 89–111.

Arcand, J.L., E. Berkes, and U. Panizza (2012). Too Much Finance? IMF Working Paper WP/12/161.

Arestis, P. and P. Demetriades (1997). Financial Development and Economic Growth: Assessing the Evidence. The Economic Journal, 107(442): 783–799.

Beck, T., H. Degryse, and C. Kneer (2014). Is More Finance Better? Disentangling Intermediation and Size Effects of Financial Systems. Journal of Financial Stability, 10: 50–64.

Beck, T., R. Levine, and N. Loayza (2000). Finance and the Sources of Growth. Journal of Financial Economics, 58(1): 261–300.

Bencivenga, V.R. and B.D. Smith (1991). Financial Intermediation and Endogenous Growth. The Review of Economic Studies, 58(2): 195–209.

Bencivenga, V.R., B.D. Smith, and R.M. Starr (1995). Transactions Costs, Technological Choice, and Endogenous Growth. Journal of Economic Theory, 67(1): 153–177.

Bolton, P., T. Santos, and J.A. Scheinkman (2016). Cream Skimming in Financial Markets. The Journal of Finance, 71(2): 709–736.

Bond, S. and M. Eberhardt (2013). Accounting for Unobserved Heterogeneity in Panel Time Series Models. Universidad de Oxford, Inédito.

Boyd, J.H. and E.C. Prescott (1986). Financial Intermediary-Coalitions. Journal of Economic Theory, 38(2): 211–232.

Bozoki, E. and M. Richter (2016). Entrepreneurship, Institutions and Economic Growth: A Quantitative Study About the Moderating Effects of Institutional Dimensions on the Relationship of Necessity-and Opportunity Motivated Entrepreneurship and Economic Growth. Sweden: Jönköping International Business School, Jönköping University.

Calderón, C. and L. Liu (2003). The Direction of Causality Between Financial Development and Economic Growth. Journal of Development Economics, 72(1): 321–334.

Cecchetti, S.G. and E. Kharroubi (2012). Reassessing the Impact of Finance on Growth. Bank for International Settlement. BIS Working Papers No 381.

Christopoulos, D.K. and E.G. Tsionas (2004). Financial Development and Economic Growth: Evidence from Panel Unit Root and Cointegration Tests. Journal of Development Economics, 73(1): 55–74.

Chudik, A. and M.H. Pesaran (2015). Common Correlated Effects Estimation of Heterogeneous Dynamic Panel Data Models with Weakly Exogenous Regressors. Journal of Econometrics, 188(2): 393–420.

Chudik, A., K. Mohaddes, M.H. Pesaran, and M. Raissi (2015). Long-Run Effects in Large Heterogenous Panel Data Models with Cross-Sectionally Correlated Errors. Cambridge University, UK.

Cojocaru, L., E.M. Falaris, S.D. Hoffman, and J.B. Miller (2016). Financial System Development and Economic Growth in Transition Economies: New Empirical Evidence from the CEE and CIS Countries. Emerging Markets Finance and Trade, 52(1): 223–236.

De Gregorio, J. (1996). Borrowing Constraints, Human Capital Accumulation, and Growth. Journal of Monetary Economics, 37(1): 49–71.

De Gregorio, J. and P.E. Guidotti (1995). Financial Development and Economic Growth. World Development, 23(3): 433–448.

Deidda, L. and B. Fattouh (2002). Non-linearity Between Finance and Growth. Economics Letters, 74(3): 339–345.

Demetriades, P. and S. Andrianova (2004). Finance and Growth: What We Know and What We Need to Know. Financial Development and Economic Growth: 38–65. Springer.

Demetriades, P. and S. Law (2006). Finance, Institutions and Economic Development. International Journal of Finance and Economics, 11(3): 245.

Demetriades, P.O. and K.A. Hussein (1996). Does Financial Development Cause Economic Growth? Time-Series Evidence From 16 Countries. Journal of Development Economics, 51(2): 387–411.

Devereux, M.B. and G.W. Smith (1994). International Risk Sharing and Economic Growth. International Economic Review, 35(3): 535–550.

Ditzen, J. (2016). ‘xtdcce: Estimating Dynamic Common Correlated Effects in Stata’, in United Kingdom Stata Users’ Group Meetings 2016 (No. 08). Stata Users.

Donaubauer, J., E. Neumayer, and P. Nunnenkamp (2016). Financial Market Development in Host and Source Countries and Its Effects on Bilateral FDI. Kiel Working Paper 2029.

Dreher, A. (2006). Does Globalization Affect Growth? Evidence from a New Index of Globalization. Applied Economics, 38(10): 1091–1110.

Dreher, A., Gaston, N. et al. (2008). Measuring Globalization: Gauging its Consequences. New York: Springer.

Ductor, L. and D. Grechyna (2015). Financial Development, Real Sector, and Economic Growth. International Review of Economics & Finance, 37: 393–405.

Eberhardt, M. (2012). Estimating Panel Time-Series Models with Heterogeneous Slopes. Stata Journal, 12(1): 61.

Effiong, E. (2015). Financial Development, Institutions and Economic Growth: Evidence from Sub-Saharan Africa. Department of Economics, University of Uyo.

Engle, R.F. and C.W. Granger (1987). Co-integration and Error Correction: Representation, Estimation, and Testing. Econometrica: Journal of the Econometric Society: 251–276.

Everaert, G. and T. De Groote (2016). Common Correlated Effects Estimation of Dynamic Panels with Cross-Sectional Dependence. Econometric Reviews, 35(3): 428–463.

Friedman, M. and A.J. Schwartz (2008). A Monetary History of the United States, 1867–1960. New Jersey: Princeton University Press.

Gai, P., S. Kapadia, S. Millard, and A. Perez (2008). Financial Innovation, Macroeconomic Stability and Systemic Crises. The Economic Journal, 118(527): 401–426.

Galor, O. and J. Zeira (1993). Income Distribution and Macroeconomics. The Review of Economic Studies, 60(1): 35–52.

Gennaioli, N., A. Shleifer, and R. Vishny (2012). Neglected Risks, Financial Innovation, and Financial Fragility. Journal of Financial Economics, 104(3): 452–468.

Goldsmith, R.W. (1969). Financial Structure and Development. New Haven, CT: Yale University Press.

Greenwood, J. and B. Jovanovic (1990). Financial Development, Growth, and the Distribution of Income. Journal of political Economy, 98: 1076–1107.

Greenwood, J., J.M. Sanchez, and C. Wang (2013). Quantifying the Impact of Financial Development on Economic Development. Review of Economic Dynamics, 16(1): 194–215.

Harrison, P., O. Sussman, and J. Zeira (1999). Finance and Growth: Theory and New Evidence. Handbook of Economic Growth, Chapter 12, Volume 1A, 865–934.

Hassan, M.K., B. Sanchez, and J.S. Yu (2011). Financial Development and Economic Growth: New Evidence from Panel Data. The Quarterly Review of Economics and Finance, 51(1): 88–104.

Hermes, N. and R. Lensink (2003). Foreign Direct Investment, Financial Development and Economic Growth. The Journal of Development Studies, 40(1): 142–163.

Huang, H.C. and S.C. Lin (2009). Non-linear Finance–Growth Nexus. Economics of Transition, 17(3): 439–466.

Jappelli, T. and M. Pagano (1994). Saving, Growth, and Liquidity Constraints. The Quarterly Journal of Economic, 109(1): 83–109. Available at: http://www.jstor.org.proxy.library.ju.se/stable/pdf/2118429.pdf.

Kaminsky, G.L. and C.M. Reinhart (1999). The Twin Crises: The Causes of Banking and Balance-of-Payments Problems. American Economic Review: 473–500.

Kargbo, S.M. and P.A. Adamu (2009). Financial Development and Economic Growth in Sierra Leone. Journal of Monetary Economics Integration, 9(2): 30–61.

Khan, M.S. and A.S. Senhadji (2003). Financial Development and Economic Growth: A Review and New Evidence. Journal of African Economies, 12(suppl 2): ii89–ii110.

King, R.G. and R. Levine (1993). Finance, Entrepreneurship and Growth. Journal of Monetary Economics, 32(3): 513–542.

Krasniqi, B.A. and S. Desai (2016). Institutional Drivers of High-Growth Firms: Country-Level Evidence from 26 Transition Economies. Small Business Economics, 47(4): 1075–1094.

Law, S.H., W. Azman-Saini, and M.H. Ibrahim (2013). Institutional Quality Thresholds and the Finance–Growth Nexus. Journal of Banking & Finance, 37(12): 5373–5381.

Law, S.H. and N. Singh (2014). Does Too Much Finance Harm Economic Growth? Journal of Banking & Finance, 41: 36–44.

Le, T.H., J. Kim, and M. Lee (2016). Institutional Quality, Trade Openness, and Financial Sector Development in Asia: An Empirical Investigation. Emerging Markets Finance and Trade, 52(5): 1047–1059.

LeMay-Boucher, P. and C. Rommerskirchen (2015). An Empirical Investigation Into the Europeanization of Fiscal Policy. Comparative European Politics, 13(4): 450–470.

León-Ledesma, M.A., P. McAdam, and A. Willman (2015). Production Technology Estimates and Balanced Growth. Oxford Bulletin of Economics and Statistics, 77(1): 40–65.

Levine, R., N. Loayza, and T. Beck (2000). Financial Intermediation and Growth: Causality and Causes. Journal of Monetary Economics, 46(1): 31–77.

Levine, R. and S. Zervos (1996). Stock Market Development and Long-Run Growth. World Bank Economic Review, 10(2): 323–339.

Levine, R. and S. Zervos. (1998). Stock Markets, Banks, and Economic Growth. American Economic Review: 537–558.

Loayza, N.V. and R. Ranciere (2006). Financial Development, Financial Fragility, and Growth. Journal of Money, Credit and Banking: 1051–1076.

Lu, X., K. Guo, Z. Dong, and X. Wang (2017). Financial Development and Relationship Evolvement Among Money Supply, Economic Growth and Inflation: A Comparative Study from the US and China. Applied Economics, 49(10): 1032–1045.

Lucas Jr, R.E. (1988). On the Mechanics of Economic Development. Journal of Monetary Economics, 22(1): 3–42.

Luintel, K.B., M. Khan, P. Arestis, and K. Theodoridis (2008). Financial Structure and Economic Growth. Journal of Development Economics, 86(1): 181–200.

Maddala, G.S. and S. Wu (1999). A Comparative Study of Unit Root Tests with Panel Data and a New Simple Test. Oxford Bulletin of Economics and Statistics, 61(S1): 631–652.

Mankiw, N.G., D. Romer, and D.N. Weil (1992). A Contribution to the Empirics of Economic Growth. The Quarterly Journal of Economics, 107(2): 407–437.

Masten, A.B., F. Coricelli, and I. Masten (2008). Non-linear Growth Effects of Financial Development: Does Financial Integration Matter? Journal of International Money and Finance, 27(2): 295–313.

McNabb, K. and P. LeMay-Boucher (2014). Tax Structures, Economic Growth and Development. ICTD Working Paper 22.

Menyah, K., S. Nazlioglu, and Y. Wolde-Rufael (2014). Financial Development, Trade Openness and Economic Growth in African Countries: New Insights from a Panel Causality Approach. Economic Modelling, 37: 386–394.

Neal, T. (2013). Using Panel Co-Integration Methods To Understand Rising Top Income Shares. The Economic Record, 89(284): 83–98.

Nelson, C.R. and C.R. Plosser (1982). Trends and Random Walks in Macroeconmic Time Series: Some Evidence and Implications. Journal of Monetary Economics, 10(2): 139–162.

Newey, W.K. and K.D. West (1994). Automatic Lag Selection in Covariance Matrix Estimation. The Review of Economic Studies, 61(4): 631–653.

Ng, A., M.H. Ibrahim, and A. Mirakhor (2016). Does Trust Contribute to Stock Market Development? Economic Modelling, 52: 239–250.

Obstfeld, M. (1994). Risk-Taking, Global Diversification, and Growth. American Economic Review, 84(5): 1310–1329.

Odedokun, M.O. (1996). Alternative Econometric Approaches for Analysing the Role of the Financial Sector in Economic Growth: Time-Series Evidence from LDCs. Journal of Development Economics, 50(1): 119–146.

Omri, A., S. Daly, C. Rault, and A. Chaibi (2015). Financial Development, Environmental Quality, Trade and Economic Growth: What Causes What in MENA Countries. Energy Economics, 48: 242–252.

Pedroni, P. (1999). Critical Values for Cointegration Tests in Heterogeneous Panels with Multiple Regressors. Oxford Bulletin of Economics and Statistics, 61(s1): 653–670.

Pedroni, P. (2001). ‘Fully Modified OLS for Heterogeneous Cointegrated Panels’, in Nonstationary Panels, Panel Cointegration, and Dynamic Panels, Volume 15. Emerald Group Publishing Limited, Elsevier Science Inc, pp. 93–130.

Pedroni, P. (2004). Panel Cointegration: Asymptotic and Finite Sample Properties of Pooled Time Series Tests with an Application to the PPP Hypothesis. Econometric Theory, 20(03): 597–625.

Persyn, D. and J. Westerlund (2008). Error-Correction-Based Cointegration Tests for Panel Data. Stata Journal, 8(2): 232–241.

Pesaran, M.H. (2004). General Diagnostic Tests for Cross Section Dependence in Panels. Faculty of Economics, Cambridge University.

Pesaran, M.H. (2006). Estimation and Inference in Large Heterogeneous Panels with a Multifactor Error Structure. Econometrica, 74(4): 967–1012.

Pesaran, M.H. (2007). A Simple Panel Unit Root Test in the Presence of Cross-Section Dependence. Journal of Applied Econometrics, 22(2): 265–312.

Pesaran, M.H. (2015). Testing Weak Cross-Sectional Dependence in Large Panels. Econometric Reviews, 34(6–10): 1089–1117.

Pesaran, M.H. and R. Smith (1995). Estimating Long-Run Relationships from Dynamic Heterogeneous Panels. Journal of Econometrics, 68(1): 79–113.

Pesaran, M.H., Y. Shin, and R.P. Smith (1999). Pooled Mean Group Estimation of Dynamic Heterogeneous Panels. Journal of the American Statistical Association, 94(446): 621–634.

Philippon, T. (2010). Financiers Versus Engineers: Should the Financial Sector be Taxed or Subsidized? American Economic Journal: Macroeconomics, 2(3): 158–182.

Rafindadi, A.A. and I. Ozturk (2016). Effects of Financial Development, Economic Growth and Trade on Electricity Consumption: Evidence from Post-Fukushima Japan. Renewable and Sustainable Energy Reviews, 54: 1073–1084.

Rahman, M.M., M. Shahbaz, and A. Farooq (2015). Financial Development, International Trade, and Economic Growth in Australia: New Evidence from Multivariate Framework Analysis. Journal of Asia-Pacific Business, 16(1): 21–43.

Rodríguez-Pose, A. (2013). Do Institutions Matter for Regional Development? Regional Studies, 47(7): 1034–1047.

Rodrik, D. and A. Subramanian (2003). The Primacy of Institutions. Finance and Development, 40(2): 31–34.

Rousseau, P.L. and P. Wachtel (2011). What is Happening to the Impact of Financial Deepening on Economic Growth? Economic Inquiry, 49(1): 276–288.

Sahay, R., C. Martin, N. Papa, B. Adolfo, B. Ran, A. Diana, G. Yuan, K. Annette, N. Lam, S. Christian, S. Katsiaryna, and R. Seyed (2015). Rethinking Financial Deepening: Stability and Growth in Emerging Markets. IMF Staff Discussion Note 15/08. Washington, DC: International Monetary Fund.

Saint-Paul, G. (1992). Technological Choice, Financial Markets and Economic Development. European Economic Review, 36(4): 763–781.

Samargandi, N., J. Fidrmuc, and S. Ghosh (2015). Is the Relationship Between Financial Development and Economic Growth Monotonic? Evidence from a Sample of Middle-Income Countries. World Development, 68: 66–81.

Santomero, A.M. and J.J. Seater (2000). Is there an Optimal Size for the Financial Sector? Journal of Banking & Finance, 24(6): 945–965.

Sarmidi, T., S. Hook Law, and Y. Jafari (2014). Resource Curse: New Evidence on the Role of Institutions. International Economic Journal, 28(1): 191–206.

Seven, U. and Y. Coskun (2016). Does Financial Development Reduce Income Inequality and Poverty? Evidence from Emerging Countries. Emerging Markets Review, 26: 34–63.