Abstract

In many real applications, there exist situations where some independent and decentralized entities will construct a common platform for production processes. A natural and essential problem for the common platform is to allocate the fixed cost or common revenue across these entities in an equitable way. Since there is no powerful central decision maker, each decision-making unit (DMU) might propose an allocation scheme that will favor itself, giving itself a minimal cost and/or a maximal revenue. It is clear that such allocations are egoistic and unacceptable to all DMUs except for the distributing DMU. In this paper, we will address the fixed cost allocation problem in this decentralized environment. For this purpose, we suggest a non-egoistic principle which states that each DMU should propose its allocation proposal in such a way that the maximal cost would be allocated to itself. Further, a preferred allocation scheme should assign each DMU at most its non-egoistic allocation and lead to efficiency scores at least as high as the efficiency scores based on non-egoistic allocations. To this end, we integrate a goal programming method with data envelopment analysis methodology to propose a new model under a set of common weights. The final allocation scheme is determined in such a way that the efficiency scores are maximized for all DMUs through minimizing the total deviation to goal efficiencies. Finally, both a numerical example from prior literature and an empirical study of nine truck fleets are provided to demonstrate the proposed approach.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Fixed cost allocation (FCA) is the problem of determining how a total fixed cost generated from a common platform should be distributed among multiple independent decision-making units (DMUs) in an equitable way (Cook and Kress 1999; Beasley 2003; Lin 2011b; Li et al. 2013, 2018c; Du et al. 2014; Zhu et al. 2017). Since competition is increasingly fierce in modern life, there will be many real managerial applications where some independent and decentralized DMUs will construct a common platform for production processes. This may be due to their constrained capacities and the potential gains from common platforms (Wu et al. 2016; Jouida et al. 2017). In practice, many cases exist in banks, restaurants, supply chains, disaster relief operations, universities, etc. For example, in the last century, the commercial banks in China lacked credit information about their customers and were facing serious credit risks. That led them to cooperate to establish a common credit information sharing system, which improves their risk management and operations. The non-profit organizations in humanitarian operations may participate in joint procurement, which will stretch their limited money further and allow better preparedness and response to disasters. To establish a common platform for all individual DMUs, some fixed costs are inevitable, such as the maintenance expense of a credit information sharing system or the purchasing expense of procuring the total relief supplies. Since all DMUs will enjoy the convenience of the common platform, a natural and essential problem for the common platform is to distribute the total fixed cost across these individual units in a fair way. Additionally, the fixed cost allocation problem is more complex in a decentralized environment where there is no powerful central decision maker (DM) who has the collective goal as a priority and sacrifices individual interests. Lacking a central DM, these decentralized units need to reach a consensus on the allocation plan and we believe that the so-called non-egoistic principle would be of vital importance and significance in distributing a share of fixed costs to a set of independent and competing DMUs.

Theoretically, the allocation scheme should be in line with the causation principle. However, particularly when assigning the total fixed cost, we often have the problem that their causes cannot be determined exactly. Thus, entities mostly use size or activity-related distribution criteria to get a reasonable approximation, which is inherently consistent with the data envelopment analysis (DEA) methodology. DEA, a linear mathematical programming method introduced by Charnes et al. (1978) and further extended by Banker et al. (1984), has proven to be a very useful nonparametric technique to measure the relative efficiency of multiple DMUs that consume multiple inputs to produce multiple outputs. The basic idea behind the DEA methodology is that a convex combination of a set of comparable and homogeneous DMUs is calculated to construct an efficiency frontier. Then each DMU can be projected onto the frontier, and the DMU is evaluated by comparing it to its projection. Since the inception of DEA, this methodology has been applied to many activities in many sectors in many countries (Emrouznejad et al. 2008; Cooper et al. 2011; Emrouznejad and Yang 2018), including universities (Bougnol and Dulá 2006; Yang et al. 2017), hospitals (Butler and Li 2005; Chen et al. 2017), banks (Sherman and Zhu 2006; An et al. 2015; Li et al. 2018a), supply chains (Liang et al. 2006; Lozano and Adenso-Diaz 2017), sport avtivities (Anderson and Sharp 1997; Lei et al. 2015), manufacturing industries (Emrouznejad and Yang 2016a, b), disaster contexts (Yang et al. 2016; Li et al. 2018d), and others. Recently, DEA-based fixed cost allocation approaches have also attracted increasing attention and become a major application area of DEA methodology (Cook and Kress 1999; Beasley 2003; Li et al. 2009, 2013; Lin 2011a, b; Du et al. 2014; Li et al. 2018c; Zhu et al. 2017). There are some significant advantages in developing DEA-based fixed cost allocation approaches, such as multiple attribute decision-making, weights flexibility, and the nonparametric property, and investigating the effect of feasible allocations on efficiency evaluation (Li et al. 2009; Lin and Peng 2011; Si et al. 2013).

In the existing literature, the first attempt to use a DEA-based approach to solve the fixed cost allocation problem was made by Cook and Kress (1999). In that seminal work, two basic principles (efficiency invariance and Pareto-minimality) were used so that the allocation plan will not affect the relative efficiencies and input transfer is impossible without changing the DEA efficiency scores. The Cook and Kress (1999) approach can be used easily to examine whether the given allocation plan satisfies the two principles, but with this approach, it is hard to generate an allocation plan in cases with multiple inputs and multiple outputs. Cook and Zhu (2005) extended the Cook and Kress (1999) method from input orientation to output orientation and proposed a feasible method to generate the final allocation scheme in multi-input–multi-output situations. However, Lin (2011a) argued that the Cook and Zhu (2005) approach will be infeasible when some special constraints are added, and Lin (2011a) modified the constraints to generate the final allocation plan through minimizing the gaps between the largest and smallest allocated cost proportions. Jahanshahloo et al. (2004) showed that the Pareto-minimality principle was also violated in Cook and Kress (1999) and then proposed their approach using a simple formula, but this approach is thought to lack feasibility and acceptability in real applications (Lin 2011b). By guaranteeing the efficiency invariance principle, Lin (2011b) suggested an approach to minimize the deviation from the allocated costs to the proportional costs, while not changing the current input–output scales and relative efficiencies. Mostafaee (2013) allocated the fixed cost in such a way that both efficiency scores and returns-to-scale classifications remain unchanged for all DMUs. The efficiency invariance principle was modeled with a common set of weights by Amirteimoori and Kordrostami (2005), but recently Jahanshahloo et al. (2017) showed that the Amirteimoori and Kordrostami (2005) approach did not necessarily satisfy the efficiency invariance principle. Lin and Chen (2016) allocated a fixed cost allocation approach based on super CCR efficiency and piratical feasibility. Li et al. (2017) proposed a resource allocation and target setting method based on common weights and efficiency invariance principles simultaneously.

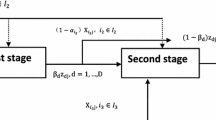

The above studies try to keep the relative efficiency unchanged before and after the fixed cost allocation, while there is another research stream initiated by Beasley (2003), in which the goal is to maximize the average post-allocation efficiency score under a common set of weights. Beasley (2003) obtained a unique allocation plan by solving a series of nonlinear models and the generated allocations will make all DMUs efficient; this finding has also been formally proved by Li et al. (2013) and Si et al. (2013). Although Amirteimoori and Kordrostami (2005) used a numerical example to show the infeasibility of Beasley (2003), recently Jahanshahloo et al. (2017) proved that the Beasley (2003) method is always feasible. Li et al. (2009) considered a special case where the allocated costs are complements of the existing measures and determined the allocation scheme using a super efficiency method. Amirteimoori and Tabar (2010) proposed a fixed resource allocation and target setting approach, which aims to minimize the total deviation and the maximum deviation simultaneously. Li et al. (2013) defined an efficient allocation set upon which all DMUs can be CCR efficient with a common set of weights, and the unique allocation plan was determined by maximizing the satisfaction degree for all DMUs. On the basis of the extended proportional sharing equation, Si et al. (2013) determined the final allocation plan through a minimal total gap between the allocated costs and the algebra average allocations. Hosseinzadeh Lotfi et al. (2013) proposed a resource allocation and target setting model by explicitly assigning a post-allocation efficiency of one to all DMUs, and the unique allocation scheme was determined using the goal programming technique. Khodabakhshi and Aryavash (2014) allocated the fixed cost by considering the merits of the input–output bundle of the DMUs. Du et al. (2014) developed a cross-efficiency iterative procedure to allow DMUs to negotiate with each other until the cross efficiency cannot be increased for any DMU. In one of our recent papers (Li et al. 2018c), we developed a DEA-game cross efficiency method for allocating a total fixed cost, in which each DMU is considered as a player and the characteristic function represents the efficiency increment. Further, we calculated the Shapley value for each DMU and used the associated common weights to determine a unique allocation arrangement. Yu et al. (2016), Zhu et al. (2017) and Li et al. (2018b) extended the fixed cost allocation problem to network situations by considering internal two-stage processes.

In many existing publications, it is also explicitly supposed that there exists a centralized decision maker who can immediately seek the collective goal and sacrifice individual interests, and the allocation scheme would be accordingly determined by maximizing the collective objective functions. For example, Lozano et al. (2004) addressed an output-oriented target setting problem, in which the aggregated outputs across all DMUs were maximized without exceeding the total inputs. Further, Lozano and Villa (2004, 2005) extended the work of Lozano et al. (2004) to more general multiple-input-multiple-output centralized cases with both radial and non-radial models. Also, the work of Lozano and Villa (2004) was extended to the variable returns to scale assumption by Asmild et al. (2009). Fang and Zhang (2008) allocated variable resources to DMUs by maximizing both the total efficiency from centralized decision-making environment and the individual efficiency for each DMU. Hosseinzadeh Lotfi et al. (2010, 2012) addressed the centralized resource allocation problem using enhanced Russell models. Given a capital budget constraint, Lozano et al. (2011) proposed a series of centralized DEA models for individual and collective output target setting, input reallocation and additional input acquisitions. Fang (2013) combined the Lozano and Villa (2004) and Asmild et al. (2009) models to more general cases. Lozano (2014) proposed a slacks-based measure model for fixed cost and common revenue allocation in a centralized environment. Through solving just one linear problem, the Lozano (2014) approach can obtain a unit-invariant and efficiency-invariant allocation plan, where the cost allocated to each DMU is proportional to the weighted sum of its minimal input consumption. Fang (2016) proposed a centralized resource allocation approach based on revenue efficiency, and the allocation plan was determined by maximizing the total output revenue. Ding et al. (2017) addressed the centralized fixed cost allocation problem by considering technology heterogeneity for different DMUs. Similar work can also be seen in Lozano et al. (2009), Fang (2015), Fang and Li (2015), Hatami-Marbini et al. (2015), etc.

Apart from the previous literature, there are also some parametric DEA approaches proposed for fixed input and output allocation. Here the term “parametric” implies that a hyperbolic DEA efficiency frontier is predefined with prior information. Avellar et al. (2007) first allocated a new fixed input among a set of DMUs by considering a spherical frontier. Their equitable allocation plan was determined using a straightforward formula, which can ensure that all DMUs will be efficient or, in other words, be located on the spherically shaped efficiency frontier. Further, Avellar et al. (2010) used a similar model to reallocate an already existing input among these DMUs. Milioni et al. (2011b) further extended the Avellar et al. (2007) approach to not only distribute a new total fixed output but also redistribute an already existing output. Milioni et al. (2011a) considered a different parametric DEA model where the efficiency frontier is characterized by an ellipsoidal form. Besides these approaches, weight restrictions can be incorporated into the ellipsoidal frontier DEA model through varying the eccentricities. Silva and Milioni (2012) presented another method to gain control of the weight restrictions in allocating inputs using a spherical frontier DEA model. With the consideration of dimensional inconsistencies, Guedes et al. (2012) proposed a new adjusted spherical frontier DEA model for input allocation. A very important property related to that method is that the allocation plan is coherent, in the sense that a small data modification would not lead to a huge change in the generated allocation plan. Silva et al. (2017) generalized the previous parametric DEA approaches for fairly allocating a new and fixed output under a centralized environment. Their new model can not only incorporate value judgments, but is also useful under increasing, constant, and decreasing returns to scale properties. All the above parametric DEA models can solve the problem of fairly distributing a fixed input or output very easily if the predefined hyperbolic frontier is acceptable to all DMUs.

In this paper, we will address the DEA-based fixed cost allocation problem taking a decentralized environment into account. That is, we consider situations lacking a powerful central decision maker who can directly seek the collective goal and who sacrifices individual interests. In this scenario, each decentralized DMU might separately propose its own most favorable allocation scheme, which is, in most cases, egoistic and unacceptable to the others. Based on this observation, we suggest a non-egoistic principle, upon which each DMU should give its suggested allocation plan with the restriction that it assigns a cost share to itself no less than that of any other DMU. That is to say, from a decentralized perspective, the DMU must propose an allocation plan that punishes itself the most to guarantee the allocation plan’s acceptability. Otherwise, the allocation plan is unacceptable since it will favor the distributing DMU as compared with the DMUs who are allocated more costs than the distributing DMU. Further, we suggest determining the final allocation scheme in such a way the post-allocation efficiency scores are maximized for all DMUs, yet it assigns each DMU at most its non-egoistic allocation and leads to efficiency scores at least as high as the efficiency scores based on non-egoistic allocations. To this end, a new goal programming DEA model is proposed based on a set of common weights. Finally, the proposed approach is applied to both a numerical example from the previous literature and an empirical application from the real world. To sum up, the contribution of the current paper is threefold: Firstly, we suggest a non-egoistic principle to address these decentralized DMUs. The paper is significant for situations without a powerful central decision maker. Secondly, we proposed a new goal programming model to obtain the optimal allocation plan. The allocation plan is generated on the basis of the non-egoistic principle, and so it is more acceptable and practical. Thirdly, we compare the proposed approach with some selected methods through a numerical example derived from prior literature and we also demonstrate the usefulness and applicability of the proposed approach by applying it to an empirical study in the real world.

The remainder of this paper is organized as follows: in Sect. 2, we propose the mathematical models. Then we apply the proposed method to a numerical example in Sect. 3.1 and an empirical application in Sect. 3.2. Finally, we conclude this paper and provide some perspectives in Sect. 4.

2 Model

In this section, we first provide some preliminary information in Sect. 2.1 and then we introduce and model the non-egoistic principle for fixed cost allocation in Sect. 2.2. The proposed fixed cost allocation model will be presented in Sect. 2.3.

2.1 Preliminary

Consider a set of n independent DMUs, with each consuming m inputs to produce s outputs. Additionally, the input and output vectors of \( DMU_{j} \left( {j = 1, \ldots ,n} \right) \) are denoted as \( X_{j} = \left( {x_{1j} , \ldots ,x_{mj} } \right) \) and \( Y_{j} = \left( {y_{1j} , \ldots ,y_{sj} } \right) \), respectively. To evaluate the performance of \( DMU_{d} \left( {d = 1, \ldots ,n} \right) \), Charnes et al. (1978) proposed the following model (1) to calculate its relative efficiency assuming constant returns to scale (CRS).

In the above model (1), \( \mu_{r} \) and \( w_{i} \) are unknown relative weights attached to the rth output and ith input, respectively. By solving model (1), the evaluated \( DMU_{d} \left( {d = 1, \ldots ,n} \right) \) will choose a set of optimal relative weights to maximize its ratio of aggregated outputs to aggregated inputs while ensuring that the ratio is no more than one for any DMU. Model (1) is nonlinear in a fractional programming form but by inserting \( \tau = {1 \mathord{\left/ {\vphantom {1 {\sum\nolimits_{i = 1}^{m} {w_{i} x_{id} } }}} \right. \kern-0pt} {\sum\nolimits_{i = 1}^{m} {w_{i} x_{id} } }} \), \( \hat{\mu }_{r} = \tau \cdot \mu_{r} \) and \( \hat{w}_{i} = \tau \cdot w_{i} \) into model (1), we have an equivalent linear model (2).

Solving model (2) one time for each \( DMU_{d} \left( {d = 1, \ldots ,n} \right) \) determines a series of n efficiency scores ranging from zero to one. \( DMU_{d} \left( {d = 1, \ldots ,n} \right) \) is identified as DEA-efficient if \( e_{d}^{*} = 1 \), and otherwise inefficient if \( e_{d}^{*} < 1 \).

Now suppose that a total fixed cost R will be completely allocated to the n decentralized DMUs. A natural assumption is that each DMU would be given a proportion \( \lambda_{j} \ge 0 \) of the total cost such that

Clearly, we have \( \sum\nolimits_{j = 1}^{n} {R_{j} } = R,R_{j} \ge 0 \). Without loss of generality, we can consider the allocated cost \( R_{j} \left( {j = 1, \ldots ,n} \right) \) as an additional input and add it to the current input–output bundle (readers can refer to Li et al. (2009) for another case where the allocated cost is combined with existing measures). Thus, the traditional method to calculate the post-allocation efficiency of \( DMU_{d} \left( {d = 1, \ldots ,n} \right) \) can be achieved by solving model (4).

An additional relative weight \( w_{m + 1} > 0 \) was attached to the allocated costs in model (4). Note that model (4) is also a nonlinear fractional programming problem. Let \( t = {1 \mathord{\left/ {\vphantom {1 {\left( {\sum\nolimits_{i = 1}^{m} {w_{i} x_{id} } + w_{m + 1} R_{d} } \right)}}} \right. \kern-0pt} {\left( {\sum\nolimits_{i = 1}^{m} {w_{i} x_{id} } + w_{m + 1} R_{d} } \right)}} \), \( u_{r} = t \cdot \mu_{r} \), \( v_{i} = t \cdot w_{i} \), and \( r_{j} = v_{m + 1} \cdot R_{j} \) so model (4) is changed into the linear version in model (5).

2.2 Non-egoistic principle

Looking at the post-allocation efficiency evaluation in previous Sect. 2.1, we can find that the considered DMU will propose an allocation scheme to maximize its efficiency score without any constraints except for the full coverage requirement. That is to say, any allocation plan is considered as feasible if the total cost is entirely covered by all DMUs. However, this is not the truth in real managerial applications. Consider an extreme case where the considered DMU gives itself with an extremely small cost ε (or even zero) and evenly allocates the remainder of the fixed cost to the remaining DMUs. Then it is possible to find that the considered DMU will be efficient by considering the allocated costs in the efficiency evaluation process. However, this full efficiency is achieved under its most favorable allocation plan, which would not be accepted by other DMUs since such allocation schemes are egoistic. From the decentralized perspective, each DMU can propose a possible allocation plan to maximize its post-allocation efficiency, but the proposed allocation plan should be non-egoistic so that the allocation scheme is acceptable to all DMUs. Based on this idea, here we introduce the non-egoistic principle as follows:

Definition 1

A particular DMUd(d = 1,…, n) is said to propose a non-egoistic allocation scheme if that scheme gives it the maximal cost among all DMUs. The corresponding allocation scheme is said to satisfy the non-egoistic principle for DMUd.

We would emphasize that the non-egoistic principle is focused on the allocation plan instead of relative efficiency. Intuitively, the non-egoistic principle is that the DMUd (d = 1,…, n) divides the total fixed cost R into n parts and all DMUs are required to bear one part, but the other (n − 1) DMUs will choose which parts they will bear before DMUd. If the DMUs are rational, then each DMU will try to choose the minimum cost share and the maximum will be left for DMUd, meaning that it must bear the maximum cost. The non-egoistic principle requires that the distributing DMU who proposes the allocation scheme will pay the maximal cost. Thus the corresponding allocation plan is acceptable to all remaining DMUs (i.e., the set of DMUs other than the distributing DMU), or at least the cost allocated to the distributing DMU is absolutely acceptable by all DMUs. Denote the fixed cost allocated to \( DMU_{j} \left( {j = 1, \ldots ,n} \right) \) as \( R_{j}^{d} \) when \( DMU_{d} \left( {d = 1, \ldots ,n} \right) \) proposes an allocation of the total fixed cost R. Then the non-egoistic principle can be modeled as formula (6) when \( DMU_{d} \left( {d = 1, \ldots ,n} \right) \) is under consideration.

Further, the following model (7) can be used to calculate the post-allocation efficiency for \( DMU_{d} \left( {d = 1, \ldots ,n} \right) \) based on the non-egoistic principle.

Model (7) is just the integration of model (4) with the non-egoistic principle expressed by formula (6). Through model (7), \( DMU_{d} \left( {d = 1, \ldots ,n} \right) \) will determine a set of allocated costs and relative weights to maximize its efficiency score, yet it itself takes the maximal share of the total fixed cost as compared with other DMUs. As with the previous nonlinear models, model (7) can be linearized by inserting \( t = {1 \mathord{\left/ {\vphantom {1 {\left( {\sum\nolimits_{i = 1}^{m} {w_{i} x_{id} } + w_{m + 1} R_{j}^{d} } \right)}}} \right. \kern-0pt} {\left( {\sum\nolimits_{i = 1}^{m} {w_{i} x_{id} } + w_{m + 1} R_{j}^{d} } \right)}} \), \( u_{r} = t \cdot \mu_{r} \), \( v_{i} = t \cdot w_{i} \), and \( r_{j}^{d} = v_{m + 1} \cdot R_{j}^{d} \).

Solving model (8) determines a set of optimal solutions \( \left( {u_{r}^{d*} ,v_{i}^{d*} ,v_{m + 1}^{d*} ,r_{j}^{d*} ,\forall r,i,j} \right) \) when \( DMU_{d} \left( {d = 1, \ldots ,n} \right) \) is under consideration. Further, we can obtain a series of efficiency scores \( \hat{E}_{d}^{*} \left( {d = 1, \ldots ,n} \right) \) along with a set of decentralized non-egoistic allocation schemes \( R_{j}^{d*} = {{r_{j}^{d*} } \mathord{\left/ {\vphantom {{r_{j}^{d*} } {v_{m + 1}^{d*} }}} \right. \kern-0pt} {v_{m + 1}^{d*} }}\left( {d,j = 1, \ldots ,n} \right) \). Note that the efficiency \( \hat{E}_{d}^{*} \left( {d = 1, \ldots ,n} \right) \) and allocation \( R_{j}^{d*} \left( {d,j = 1, \ldots ,n} \right) \) are separately determined from each DMUd’s decentralized perspective, and the allocation plan \( R_{j}^{d*} \left( {d,j = 1, \ldots ,n} \right) \) will maximize DMUd’s efficiency score despite allocating the maximal cost to DMUd. The decentralized allocations are acceptable in the sense that at least each DMU’s own allocated cost \( R_{d}^{d*} \left( {d = 1, \ldots ,n} \right) \) is very acceptable to the other DMUs because each DMU got “last choice” in the allocation plan it itself proposed. Therefore, this allocation is a baseline cost share. Besides this, the efficiency \( \hat{E}_{d}^{*} \) can also be considered as a baseline for each \( DMU_{d} \left( {d = 1, \ldots ,n} \right) \) in generating the optimal allocation plan.

Here we consider a small case derived from Beasley (2003) to show the difference when the non-egoistic principle is considered. Here there are five DMUs that share a common telecommunications cable and three outputs are considered without additional inputs. The dataset is given in Table 1. Assume the total fixed cost is R = 100. By solving model (5) and model (8), the post-allocation efficiency scores can be calculated for each DMU, as shown in the second and eighth column of Table 2.

It can be learned from Table 2 that without considering the non-egoistic principle all DMUs can be separately efficient after bearing their allocated costs. However, DMU2 and DMU4 will be inefficient when the non-egoistic principle is imposed, having efficiency scores of 0.345 and 0.754, respectively. Moreover, the possible allocation plan will be significantly different. Without the non-egoistic principle, each DMU will allocate an extremely small cost amount (0.223, 0.233, 0.208, 0.142, and 0.170) to itself while the costs assigned to the other four DMUs are relatively large. Using the non-egoistic principle, each DMU will allocate the maximal cost amount (31.301, 20.976, 30.007, 22.876, and 26.322) to itself. Clearly, by considering the non-egoistic principle the allocation plan separately proposed by each DMU will be more acceptable as the extreme cases are avoided and the gap among allocated costs for all DMUs is reduced.

Additionally, based on the allocations in Table 2 and corresponding relative weights, we can calculate the cross-evaluated post-allocation efficiency scores, which are listed in Table 3. Using the traditional method without any constraints on the allocation plan, each DMU can maximize its own efficiency to the maximum (one), while the other DMUs are caused to be extremely inefficient. If, however, each DMU proposes a feasible allocation plan on the basis of non-egoistic principle, then very promising efficiency results will be available for all DMUs. Looking at the last five columns of Table 3, we can find that the allocations proposed by each DMU will not only determine an optimal efficiency score for itself but also assign a relative large efficiency score to the other DMUs.

2.3 Proposed DEA model for fixed cost allocation

The goal of each DMU is to bear as little cost as possible. Meanwhile, it will try to raise its relative efficiency as much as possible while taking the allocated costs into account. Further, the non-egoistic allocation \( R_{j}^{j*} \left( {j = 1, \ldots ,n} \right) \) and efficiency score \( \hat{E}_{j}^{*} \left( {j = 1, \ldots ,n} \right) \) obtained in Sect. 2.2 can act as a baseline for each DMU. That is to say, each DMU would like to be allocated a cost less than \( R_{j}^{j*} \left( {j = 1, \ldots ,n} \right) \) and end up with an efficiency score more than \( \hat{E}_{j}^{*} \left( {j = 1, \ldots ,n} \right) \). To generate the final allocation scheme, we propose to maximize the efficiency scores for all DMUs, yet assign each \( DMU_{j} \left( {j = 1, \ldots ,n} \right) \) at most its non-egoistic allocation \( R_{j}^{j*} \) and lead to efficiency scores at least as high as the efficiency scores \( \hat{E}_{j}^{*} \). The above idea is formulated in model (9).

In model (9), the variable \( \alpha_{j} \) represents the efficiency increment of \( DMU_{j} \left( {j = 1, \ldots ,n} \right) \). Through maximizing \( \sum\nolimits_{j = 1}^{n} {\alpha_{j} } \), model (9) aims to maximize the efficiency increment for all DMUs simultaneously. The first constraint reveals the post-allocation efficiency scores, while the second constraint ensures that for each \( DMU_{j} \left( {j = 1, \ldots ,n} \right) \) the post-allocation efficiency score is no less than the baseline \( \hat{E}_{j}^{*} \) and no more than the full efficiency of one. The third constraint ensures the total fixed cost is completely distributed, and the fourth constraint addresses the non-egoistic allocations.

Unfortunately, model (9) cannot be immediately linearized and seems unsolvable. To obtain a linear programming problem from model (9), here we integrate the goal programming (GP) method to propose a new model in a way similar to those of Hosseinzadeh Lotfi et al. (2013) and Hatami-Marbini et al. (2015). Given the known \( \hat{E}_{j}^{*} \left( {j = 1, \ldots ,n} \right) \), maximizing the total efficiency increment \( \sum\nolimits_{j = 1}^{n} {\alpha_{j} } \) is equivalent to maximizing the total post-allocation efficiencies \( \sum\nolimits_{j = 1}^{n} {\left( {\hat{E}_{j}^{*} { + }\alpha_{j} } \right)} \). To maximize the efficiency score \( \frac{{\sum\nolimits_{r = 1}^{s} {\mu_{r} y_{rj} } }}{{\sum\nolimits_{i = 1}^{m} {w_{i} x_{ij} } + w_{m + 1} R_{j} }} \), \( DMU_{j} \left( {j = 1, \ldots ,n} \right) \) must increase its virtual outputs \( \sum\nolimits_{r = 1}^{s} {\mu_{r} y_{rj} } \) in the numerator or decrease its virtual inputs \( \left( {\sum\nolimits_{i = 1}^{m} {w_{i} x_{ij} } + w_{m + 1} R_{j} } \right) \) in the denominator. Based on this observation, we can introduce a series of deviation variables \( \phi_{j}^{ - } \) and \( \phi_{j}^{ + } \), such that the \( DMU_{j} \left( {j = 1, \ldots ,n} \right) \) can reach the efficiency frontier (i.e., the efficiency goal \( \hat{E}_{j}^{*} + \alpha_{j} = 1 \)) by adding \( \phi_{j}^{ + } \) to \( \sum\nolimits_{r = 1}^{s} {\mu_{r} y_{rj} } \) and taking \( \phi_{j}^{ - } \) away from \( \left( {\sum\nolimits_{i = 1}^{m} {w_{i} x_{ij} } + w_{m + 1} R_{j} } \right) \). Clearly, the smaller the deviation to the goal efficiency, the larger the post-allocation efficiency. Then model (9) can be changed into this goal programming (GP) problem:

Model (10) integrates the GP method with DEA methodology to propose a new common weights model. Here the goal is to make all DMUs efficient with an efficiency score of one (the maximal possible efficiency score is one in the DEA framework) and the achievement function is minimizing the total deviation to the goal such that the efficiency scores are maximized for all DMUs. Here an additional constraint \( \sum\nolimits_{j = 1}^{n} {\left( {\sum\nolimits_{i = 1}^{m} {w_{i} x_{ij} } + w_{m + 1} R_{j} } \right)} = 1 \) is introduced to avoid trivial solutions, as the optimal objective function might be extremely small (or even approximate zero) with extremely small solutions of these relative weights. Given the nonnegative deviations \( \phi_{j}^{ + } \) and \( \phi_{j}^{ - } \) in the first constraint, \( \frac{{\sum\nolimits_{r = 1}^{s} {\mu_{r} y_{rj} } }}{{\sum\nolimits_{i = 1}^{m} {w_{i} x_{ij} } + w_{m + 1} R_{j} }} \le 1 \) in the second constraint would be redundant. Further, model (10) can be equivalently converted into model (11) by substituting \( w_{m + 1} R_{j} = r_{j} \left( {j = 1, \ldots ,n} \right) \).

Model (11) can be further simplified by substituting \( \phi_{j}^{ + } + \phi_{j}^{ - } = \phi_{j}^{{}} \left( {j = 1, \ldots ,n} \right) \). As a result, we have the following linear programming model (12), which can be used to determine the final allocation plan.

Clearly, model (10) is always feasible. Through minimizing the total deviation yet still reaching the efficiency frontier as possible, the optimal allocation plan can be determined on the basis of the non-egoistic principle. In other words, the efficiency increment is maximized on the basis of \( \hat{E}_{j}^{*} \left( {j = 1, \ldots ,n} \right) \), which is the private baseline for each decentralized DMU considering the non-egoistic principle. The final allocation plan is determined in such a way that our proposed approach allocates a fixed cost to each \( DMU_{j} \left( {j = 1, \ldots ,n} \right) \) that is at most its non-egoistic allocation and accordingly leads to efficiency scores at least as high as the efficiency score based on the non-egoistic allocations. Supposing the optimal solution to model (12) is \( \left( {\mu_{r}^{*} ,w_{i}^{*} ,w_{m + 1}^{*} ,\phi_{j}^{*} ,r_{j}^{*} ,\forall r,i,j} \right) \), then the optimal allocation plan under the non-egoistic principle is \( R_{j}^{*} = {{r_{j}^{*} } \mathord{\left/ {\vphantom {{r_{j}^{*} } {w_{m + 1}^{*} }}} \right. \kern-0pt} {w_{m + 1}^{*} }}\left( {j = 1, \ldots ,n} \right) \).

3 Illustration applications

In this section, the proposed approach is illustrated with a numerical example derived from Cook and Kress (1999) and an empirical study of nine truck fleets. Also, the results of the numerical example will be compared with some selected approaches in the literature.

3.1 Numerical example

The dataset of the Cook and Kress (1999) case is shown in Table 4; this scenario consists of twelve DMUs with three inputs (m = 3) and two outputs (s = 2). The problem is to distribute a total fixed cost of R = 100 to the twelve DMUs in a fair way.

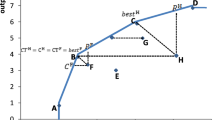

First of all, solving model (2) determines a series of traditional CCR efficiency scores without considering the fixed cost. The efficiency scores are listed in the second column of Table 5, which shows that only five DMUs (4, 5, 8, 9, and 12) are efficient. Further, with the non-egoistic principle, we solve model (8) one time for each DMU to obtain allocations proposed by each DMU separately. The non-egoistic allocations are given in Table 6. Since the non-egoistic principle is imposed to ensure that the allocation plan is acceptable, the distributing DMU will be allocated the greatest cost by its own plan. For example, DMU12 proposes an allocation scheme that assigns a maximal cost of 9.94 to itself, while all other DMUs are required to afford a cost amount less than 9.94. Also, DMU2 proposes an allocation scheme that has multiple maximal costs, as DMU2, DMU4, DMU5, DMU6, and DMU8 are simultaneously allocated the maximal cost 9.72. This situation also applies to DMU1, DMU3, DMU7, DMU10, and DMU11. Additionally, by using the allocated costs in the efficiency evaluation, the DMUs other than DMU4, DMU5, DMU8, DMU9, DMU11, and DMU12 are able to improve their relative performance, as the efficiency scores in the third column of Table 5 are larger than the original CCR efficiencies. Five DMUs (4, 5, 8, 9, and 12) cannot improve their efficiency due to the fact that they already have a full efficiency of one. Since DMU11 is extremely inefficient and with its proposed allocation plan it will be allocated the maximal cost, it has no increment of its efficiency score. It can be concluded that the inefficient DMUs cannot necessarily improve their efficiency scores when the non-egoistic principle is used.

Then we solve model (12) to determine the final allocation plan. At this time, the value of the optimal objective function is 0.024126 > 0, which demonstrates that the efficiency scores of some DMUs will be further improved from the scores based on non-egoistic allocations, but not all DMUs will be simultaneously efficient as the total deviation to the goal efficiency is not zero. The final allocation plan is given in the second column of Table 7 and the post-allocation efficiency is presented in the last column of Table 5. With this plan, six DMUs (1, 2, 3, 7, 10, and 11) will have their efficiency score increased and the rest have their efficiency unchanged at the full efficiency of 1.0000. These results imply that the final allocation plan will favor all DMUs and the generated allocation plan is acceptable to all DMUs.

For the purpose of comparison, the allocations of Cook and Kress (1999), Beasley (2003), Cook and Zhu (2005), Amirteimoori and Kordrostami (2005), Lin (2011b), Hosseinzadeh Lotfi et al. (2013), Li et al. (2013), Du et al. (2014) and Li et al. (2017, 2018c) (denoted as CK, B, CZ, AK, L, HH, LY, DC, LS, and LZ, respectively) are also shown in Table 7.

Looking at all allocated costs, most methods including our proposed approach allocate a positive value to all DMUs. As Cook and Kress (1999) indicated that any allocation plan that exempts some DMUs from all responsibility is unfair and thus will not be accepted by all DMUs. From this perspective, the allocation derived from our proposed method is well designed.

Following a common practice, we then turn our attention to two pairs of DMUs, DMU9 vs. DMU11, DMU10 vs. DMU12, where each pair consumes the same inputs to produce different outputs. It can be learned from Table 7 that some methods allocate very similar or even identical cost to one or both pairs of DMUs, such as the methods of Cook and Kress (1999), Cook and Zhu (2005), Amirteimoori and Kordrostami (2005), Lin (2011b), and Li et al. (2017). Beasley (2003) argued that this near-identical cost allocation is an inherent drawback of approaches emphasizing efficiency-invariance before and after the allocation, but it is not a problem for our proposed approach. Our proposed approach allocates very different costs to the two pairs of DMUs: R9 = 11.4033, R10 = 4.7228, R11 = 0.8787, and R12 = 10.1482.

Note that all methods in Table 7 can be categorized into two groups on the principle of whether the post-allocation efficiencies are maximized or unchanged. Apparently, the Cook and Kress (1999), Cook and Zhu (2005), Amirteimoori and Kordrostami (2005), Lin (2011b), and Li et al. (2017) methods try to keep the efficiency unchanged before and after the fixed cost allocation, while the remaining methods (including our proposed approach) are methods which use efficiency maximization. Although the efficiency-invariance based methods are more likely to have a smaller gap between the maximal and minimal allocated cost (Li et al. 2017), our proposed approach has one of the smallest gaps among these eleven methods, as shown in Table 7. Further, our proposed approach has the smallest allocated cost gap among these efficiency-maximization approaches, as 8.929 compared to 13.530, 16.330, 15.416, 16.680, and 11.508. Therefore, the allocation plan generated from our proposed approach will confront less resistance and would be easier to implement yet still maximize the post-allocation efficiencies through an equitable allocation scheme.

More importantly, our proposed approach is the only one that satisfies the non-egoistic principle. Given the individual non-egoistic allocation for each DMU (9.76, 9.72, 8.95, 11.35, 10.65, 9.22, 8.98, 11.43, 11.50, 10.26, 10.31, and 9.94), all DMUs are willing to bear a lower cost. Otherwise, that DMU will violently disagree with the allocation results and promote its own allocation proposal. For example, Li et al. (2017) allocated a larger cost to DMU3 and DMU12 (9.9731 > 8.95 and 13.3351 > 9.94), so both of these will strongly fight against the allocation plan. Similarly, Li et al. (2018c) allocated more costs than the decentralized non-egoistic allocations to DMU6, DMU8, DMU10, and DMU12. All methods listed in Table 7 except for our new proposed one are found to invalid the non-egoistic principle and thus their generated allocation results are all egoistic to some extent. Since the non-egoistic allocation plan allocates the distributing DMU the maximal cost, which is certainly more than the equivalent sharing, then the resistance to the allocation plan will not be extreme. Among all approaches in Table 7, our approach is the only one that allocates each DMU a cost less than the individual non-egoistic allocations as we explicitly take the non-egoistic principle into account. From this perspective, the proposed approach should be more acceptable.

To sum up, we use Table 8 to describe different conditions that these methods satisfied. Here we consider the following questions: (1) is the efficiency maximized, (2) is the method linear, (3) is the allocated cost positive for each DMU, (4) does the method use a common set of weights, (5) is the allocation plan unique, and lastly, (6) is the non-egoistic principle satisfied. All these conditions are good features for DEA-based fixed cost allocation approaches and are also assumed to be very important in distributing a total fixed cost or input among a set of competing DMUs (Cook and Kress 1999; Beasley 2003; Amirteimoori and Kordrostami 2005; Cook and Zhu 2005; Amirteimoori and Tabar 2010; Lin 2011a, b; Hosseinzadeh Lotfi et al. 2013; Li et al. 2013, 2017, 2018c). We can learn from the results in Table 8 that our proposed approach is the only one that satisfies these six conditions simultaneously. To the best of our knowledge, our new approach presented in this paper is the first and the only one to consider the non-egoistic principle in fixed cost and resource allocation problems.

3.2 Empirical study

In this subsection, we apply the proposed approach to nine truck fleets in China. The nine truck fleets are independent and have different owners (n = 9). Facing with fierce competition, the nine truck fleets are willing to construct a coalition to favor their business activities, but the finance and operations are still controlled separately. In the year 2016, operating that coalition’s common platform led to a total cost of 430 thousand Chinese Yuan (CNY), and the problem is how to distribute the total cost to these decentralized and independent truck fleets. A significant feature of the empirical study is that the nine truck fleets are independent in a decentralized environment, and there is not a central decision maker who can will seek only the collective goal while sacrificing individual goals.

Hereafter each truck fleet is considered as a homogeneous and comparable peer DMU. We select three inputs (m = 3) and three outputs (s = 3) from the operations in 2016. Inputs consist of: (1) Driver hours (x1), which refers to driver’s working efforts by normalizing the number of drivers into paid hours of drivers; (2) Vehicles (x2), referring to the number of vehicles owned by the truck fleet, which is similarly normalized by vehicle capacity. (3) Operation costs other than staff costs (x3), which will include fuel cost, vehicle maintenance costs, etc. The outputs considered are: (1) products delivered (y1), which refers to a standard unit of the amount of products delivered to customers; (2) number of customers (y2), and (3) the driving distance (y3), that is, the total distance traveled to deliver products to customers. The input and output measures are summarized in Table 9 and the detailed data is given in Table 10.

Based on the data in Table 10, we have a series of CCR efficiencies through model (2), as shown in the second column of Table 11. We can learn from Table 11 that three truck fleets are identified as efficient (4, 6, and 9), while the other six truck fleets are inefficient (1, 2, 3, 5, 7 and 8). The smallest efficiency score appears for the fifth vehicle fleet, reaching 0.8500. This finding shows that the nine truck fleets performed relatively well in operations. Further, we proceed to calculate the individual allocation on the basis of the non-egoistic principle. Solving model (8) determines a \( 9 \times 9 \) allocation matrix, as shown in Table 12. Each truck fleet’s proposed allocation plan is a column vector in Table 12 and each truck fleet will try to maximize its own post-allocation efficiency on the condition that it will allocate the maximal cost to itself. For example, the third fleet suggests an allocation R1 = 40.1226, R2 = 35.8552, R3 = 62.3731, R4 = 46.5299, R5 = 39.3643, R6 = 62.3731, R7 = 41.3313, R8 = 39.6774, and R9 = 62.3731 to increase its efficiency score from 0.8794 to 0.9122. Both the non-egoistic allocations presented in the third column of Table 11 and efficiency scores in the fourth column of Table 11 are baselines for all DMUs to determine the final allocation plan.

Further, solving model (12) determines an optimal objective function of 0.065826. This result is associated with the allocation scheme R1 = 31.5442, R2 = 33.9350, R3 = 27.6651, R4 = 77.8923, R5 = 54.3014, R6 = 61.4876, R7 = 57.4743, R8 = 23.8794, and R9 = 61.8208. Considering the allocated costs as an additional input, the relative efficiency for the nine truck fleets would be 0.9429, 0.9260, 1.0000, 1.0000, 0.8672, 1.0000, 1.0000, 1.0000, and 1.0000, respectively. The final allocation and post-allocation efficiency are listed in the last two columns of Table 11. The truck fleets with lower allocated costs are more likely to have more efficiency increments. We can find that three truck fleets (3, 7, and 8) become efficient whereas three other truck fleets (1, 2, and 5) remain inefficient.

To sum up, the numerical example and empirical application illustrate significant features of the proposed approach. The features listed in Table 8 summarize the advantages of the proposed approach. More importantly, this paper suggests the non-egoistic principle as a key component of a scheme to address the fixed cost allocation problem in a decentralized scenario with a set of independent DMUs. On the basis of the non-egoistic principle, the proposed common weights DEA model is of vital significance to allocate a common or shared cost among a set of decentralized and independent DMUs.

4 Conclusions

In many real applications, there are situations where some independent DMUs will construct a common platform for production processes, and thus some common or shared costs will be inevitable. In a decentralized environment, an important problem emerges of how to distribute the total fixed cost to these individual DMUs in an equitable manner. To solve such problems, this paper proposes a new approach based on data envelopment analysis. For this purpose, we first suggest a basic rule called the non-egoistic principle, which is that each DMU will separately propose its allocation scheme in such a way that the considered DMU itself will be allocated the maximal cost among all DMUs. In other words, each DMU splits the cost into shares but takes the least desirable share. Then we modify the post-allocation efficiency evaluation on the basis of the non-egoistic principle. It can be found that not all DMUs will be necessarily efficient after adding the allocated cost to current inputs. Further, we suggest that the final allocation plan should be generated such that the efficiency scores are maximized for all DMUs, yet each DMU receives an allocation no greater than its own non-egoistic allocation and has an efficiency score no less than the one based on that allocation. Then a new goal programming model is proposed to calculate the allocation results. By applying the proposed approach to both a numerical example and an empirical study, the results and analysis show that the proposed approach is useful and has some significant features compared with previous methods.

This paper could be extended in several ways. First, a fairness concern can be explicitly incorporated into the fixed cost allocation problem, and the trade-off and balance between fairness and efficiency criteria might provide valuable insights for managerial implications. Second, similar work can be extended to the problem of resource allocation, target setting, and benefit–cost sharing simultaneously. Third, the non-egoistic principle suggested in this paper can also be used to modify some existing approaches in the literature. For example, one can thus obtain a new cost interval and then use the satisfaction degree method defined in Li et al. (2013) to determine an optimal allocation plan. Finally, an important and significant property in allocating a total and fixed resource is “coherence” (Milioni et al., 2011a, b; Guedes et al. 2012), which implies that the allocation plan must be coherent in the sense that only small changes in results would occur with small uncertainties in the original inputs and outputs. We believe that such a coherence property has great importance in practical applications and should be seriously addressed in future research.

References

Amirteimoori, A., & Kordrostami, S. (2005). Allocating fixed costs and target setting: A DEA-based approach. Applied Mathematics and Computation, 171(1), 136–151.

Amirteimoori, A., & Tabar, M. M. (2010). Resource allocation and target setting in data envelopment analysis. Expert Systems with Applications, 37(4), 3036–3039.

An, Q., Chen, H., Wu, J., & Liang, L. (2015). Measuring slacks-based efficiency for commercial banks in China by using a two-stage DEA model with undesirable output. Annals of Operations Research, 235(1), 13–35.

Anderson, T. R., & Sharp, G. P. (1997). A new measure of baseball batters using DEA. Annals of Operations Research, 73, 141–155.

Asmild, M., Paradi, J. C., & Pastor, J. T. (2009). Centralized resource allocation BCC models. Omega, 37(1), 40–49.

Avellar, J. G., Milioni, A. Z., & Rabello, T. N. (2007). Spherical frontier DEA model based on a constant sum of inputs. Journal of the Operational Research Society, 58(9), 1246–1251.

Avellar, J. G., Milioni, A. Z., Rabello, T. N., & Simão, H. P. (2010). On the redistribution of existing inputs using the spherical frontier DEA model. Pesquisa Operacional, 30(1), 1–14.

Banker, R. D., Charnes, A., & Cooper, W. W. (1984). Some models for estimating technical and scale inefficiencies in data envelopment analysis. Management Science, 30(9), 1078–1092.

Beasley, J. E. (2003). Allocating fixed costs and resources via data envelopment analysis. European Journal of Operational Research, 147(1), 198–216.

Bougnol, M. L., & Dulá, J. H. (2006). Validating DEA as a ranking tool: An application of DEA to assess performance in higher education. Annals of Operations Research, 145(1), 339–365.

Butler, T. W., & Li, L. (2005). The utility of returns to scale in DEA programming: An analysis of Michigan rural hospitals. European Journal of Operational Research, 161(2), 469–477.

Charnes, A., Cooper, W. W., & Rhodes, E. (1978). Measuring the efficiency of decision making units. European Journal of Operational Research, 2(6), 429–444.

Chen, Y., Wang, J., Zhu, J., Sherman, H. D., & Chou, S. Y. (2017). How the Great Recession affects performance: a case of Pennsylvania hospitals using DEA. Annals of Operations Research. https://doi.org/10.1007/s1047.

Cook, W. D., & Kress, M. (1999). Characterizing an equitable allocation of shared costs: A DEA approach. European Journal of Operational Research, 119(3), 652–661.

Cook, W. D., & Zhu, J. (2005). Allocation of shared costs among decision making units: A DEA approach. Computers & Operations Research, 32(8), 2171–2178.

Cooper, W. W., Seiford, L. M., & Zhu, J. (2011). Data envelopment analysis: History, models, and interpretations. In W. W. Cooper, L. M. Seiford, & J. Zhu (Eds.), Handbook on data envelopment analysis (pp. 1–39). US: Springer.

Ding, T., Chen, Y., Wu, H., & Wei, Y. (2017). Centralized fixed cost and resource allocation considering technology heterogeneity: A DEA approach. Annals of Operations Research. https://doi.org/10.1007/s10479-017-2414-6.

Du, J., Cook, W. D., Liang, L., & Zhu, J. (2014). Fixed cost and resource allocation based on DEA cross-efficiency. European Journal of Operational Research, 235(1), 206–214.

Emrouznejad, A., Parker, B. R., & Tavares, G. (2008). Evaluation of research in efficiency and productivity: A survey and analysis of the first 30 years of scholarly literature in DEA. Socio-Economic Planning Sciences, 42(3), 151–157.

Emrouznejad, A., & Yang, G. L. (2016a). A framework for measuring global Malmquist–Luenberger productivity index with CO2 emissions on Chinese manufacturing industries. Energy, 115, 840–856.

Emrouznejad, A., & Yang, G. L. (2016b). CO2 emissions reduction of Chinese light manufacturing industries: A novel RAM-based global Malmquist–Luenberger productivity index. Energy Policy, 96, 397–410.

Emrouznejad, A., & Yang, G. L. (2018). A survey and analysis of the first 40 years of scholarly literature in DEA: 1978–2016. Socio-Economic Planning Sciences, 61, 4–8.

Fang, L. (2013). A generalized DEA model for centralized resource allocation. European Journal of Operational Research, 228(2), 405–412.

Fang, L. (2015). Centralized resource allocation based on efficiency analysis for step-by-step improvement paths. Omega, 51, 24–28.

Fang, L. (2016). Centralized resource allocation DEA models based on revenue efficiency under limited information. Journal of the Operational Research Society, 67(7), 945–952.

Fang, L., & Li, H. (2015). Centralized resource allocation based on the cost–revenue analysis. Computers & Industrial Engineering, 85, 395–401.

Fang, L., & Zhang, C. Q. (2008). Resource allocation based on the DEA model. Journal of the Operational Research Society, 59(8), 1136–1141.

Guedes, E. C. C., Milioni, A. Z., de Avellar, J. V. G., & Silva, R. C. (2012). Adjusted spherical frontier model: allocating input via parametric DEA. Journal of the Operational Research Society, 63(3), 406–417.

Hatami-Marbini, A., Tavana, M., Agrell, P. J., Lotfi, F. H., & Beigi, Z. G. (2015). A common-weights DEA model for centralized resource reduction and target setting. Computers & Industrial Engineering, 79, 195–203.

Hosseinzadeh Lotfi, F., Hatami-Marbini, A., Agrell, P. J., Aghayi, N., & Gholami, K. (2013). Allocating fixed resources and setting targets using a common-weights DEA approach. Computers & Industrial Engineering, 64(2), 631–640.

Hosseinzadeh Lotfi, F., Nematollahi, N., Behzadi, M. H., Mirbolouki, M., & Moghaddas, Z. (2012). Centralized resource allocation with stochastic data. Journal of Computational and Applied Mathematics, 236(7), 1783–1788.

Hosseinzadeh Lotfi, F., Noora, A. A., Jahanshahloo, G. R., Gerami, J., & Mozaffari, M. R. (2010). Centralized resource allocation for enhanced Russell models. Journal of Computational and Applied Mathematics, 235(1), 1–10.

Jahanshahloo, G. R., Lotfi, F. H., Shoja, N., & Sanei, M. (2004). An alternative approach for equitable allocation of shared costs by using DEA. Applied Mathematics and Computation, 153(1), 267–274.

Jahanshahloo, G. R., Sadeghi, J., & Khodabakhshi, M. (2017). Proposing a method for fixed cost allocation using DEA based on the efficiency invariance and common set of weights principles. Mathematical Methods of Operations Research, 85(2), 223–240.

Jouida, S. B., Krichen, S., & Klibi, W. (2017). Coalition-formation problem for sourcing contract design in supply networks. European Journal of Operational Research, 257(2), 539–558.

Khodabakhshi, M., & Aryavash, K. (2014). The fair allocation of common fixed cost or revenue using DEA concept. Annals of Operations Research, 214(1), 187–194.

Lei, X., Li, Y., Xie, Q., & Liang, L. (2015). Measuring Olympics achievements based on a parallel DEA approach. Annals of Operations Research, 226(1), 379–396.

Li, F., Liang, L., Li, Y., & Emrouznejad, A. (2018a). An alternative approach to decompose the potential gains from mergers. Journal of the Operational Research Society. https://doi.org/10.1080/01605682.2017.1409867.

Li, F., Song, J., Dolgui, A., & Liang, L. (2017). Using common weights and efficiency invariance principles for resource allocation and target setting. International Journal of Production Research, 55(17), 4982–4997.

Li, F., Zhu, Q., & Chen, Z. (2018b). Allocating a fixed cost across the decision making units with two-stage network structures. Omega. https://doi.org/10.1016/j.omega.2018.02.009.

Li, F., Zhu, Q., & Liang, L. (2018c). Allocating a fixed cost based on a DEA-game cross efficiency approach. Expert Systems with Applications, 96, 196–207.

Li, F., Zhu, Q., & Zhuang, J. (2018d). Analysis of fire protection efficiency in the United States: A two-stage DEA-based approach. OR Spectrum, 40(1), 23–68.

Li, Y., Yang, M., Chen, Y., Dai, Q., & Liang, L. (2013). Allocating a fixed cost based on data envelopment analysis and satisfaction degree. Omega, 41(1), 55–60.

Li, Y., Yang, F., Liang, L., & Hua, Z. (2009). Allocating the fixed cost as a complement of other cost inputs: A DEA approach. European Journal of Operational Research, 197(1), 389–401.

Liang, L., Yang, F., Cook, W. D., & Zhu, J. (2006). DEA models for supply chain efficiency evaluation. Annals of Operations Research, 145(1), 35–49.

Lin, R. (2011a). Allocating fixed costs or resources and setting targets via data envelopment analysis. Applied Mathematics Computation, 217(13), 6349–6358.

Lin, R. (2011b). Allocating fixed costs and common revenue via data envelopment analysis. Applied Mathematics and Computation, 218(7), 3680–3688.

Lin, R., & Chen, Z. (2016). Fixed input allocation methods based on super CCR efficiency invariance and practical feasibility. Applied Mathematical Modelling, 40(9), 5377–5392.

Lin, R., Peng, Y. Y. (2011). A fixed cost allocation approach with DEA super efficiency invariance. In International conference on electronics, communications and control (ICECC), 2011 (pp. 622–625). IEEE.

Lozano, S. (2014). Nonradial approach to allocating fixed costs and common revenue using centralized DEA. International Journal of Information Technology & Decision Making, 13(01), 29–46.

Lozano, S., & Adenso-Diaz, B. (2017). Network DEA-based biobjective optimization of product flows in a supply chain. Annals of Operations Research. https://doi.org/10.1007/s1047.

Lozano, S., & Villa, G. (2004). Centralized resource allocation using data envelopment analysis. Journal of Productivity Analysis, 22(1), 143–161.

Lozano, S., & Villa, G. (2005). Centralized DEA models with the possibility of downsizing. Journal of the Operational Research Society, 56(4), 357–364.

Lozano, S., Villa, G., & Adenso-Dıaz, B. (2004). Centralised target setting for regional recycling operations using DEA. Omega, 32(2), 101–110.

Lozano, S., Villa, G., & Brännlund, R. (2009). Centralised reallocation of emission permits using DEA. European Journal of Operational Research, 193(3), 752–760.

Lozano, S., Villa, G., & Canca, D. (2011). Application of centralised DEA approach to capital budgeting in Spanish ports. Computers & Industrial Engineering, 60(3), 455–465.

Milioni, A. Z., de Avellar, J. V. G., & Gomes, E. G. (2011a). An ellipsoidal frontier model: Allocating input via parametric DEA. European Journal of Operational Research, 209(2), 113–121.

Milioni, A. Z., de Avellar, J. V. G., Rabello, T. N., & De Freitas, G. M. (2011b). Hyperbolic frontier model: A parametric DEA approach for the distribution of a total fixed output. Journal of the Operational Research Society, 62(6), 1029–1037.

Mostafaee, A. (2013). An equitable method for allocating fixed costs by using data envelopment analysis. Journal of the Operational Research Society, 64(3), 326–335.

Sherman, H. D., & Zhu, J. (2006). Benchmarking with quality-adjusted DEA (Q-DEA) to seek lower-cost high-quality service: Evidence from a US bank application. Annals of Operations Research, 145(1), 301–319.

Si, X., Liang, L., Jia, G., Yang, L., Wu, H., & Li, Y. (2013). Proportional sharing and DEA in allocating the fixed cost. Applied Mathematics and Computation, 219(12), 6580–6590.

Silva, R. C., & Milioni, A. Z. (2012). The adjusted spherical frontier model with weight restrictions. European Journal of Operational Research, 220(3), 729–735.

Silva, R. C., Milioni, A. Z., & Teixeira, J. E. (2017). The general hyperbolic frontier model: Establishing fair output levels via parametric DEA. Journal of the Operational Research Society. https://doi.org/10.1057/s41274-017-0278-4.

Wu, J., Zhu, Q., Cook, W. D., & Zhu, J. (2016). Best cooperative partner selection and input resource reallocation using DEA. Journal of the Operational Research Society, 67(9), 1221–1237.

Yang, G. L., Yang, J. B., Xu, D. L., & Khoveyni, M. (2017). A three-stage hybrid approach for weight assignment in MADM. Omega, 71, 93–105.

Yang, F., Yuan, Q., Du, S., & Liang, L. (2016). Reserving relief supplies for earthquake: a multi-attribute decision making of China Red Cross. Annals of Operations Research, 247(2), 759–785.

Yu, M. M., Chen, L. H., & Hsiao, B. (2016). A fixed cost allocation based on the two-stage network data envelopment approach. Journal of Business Research, 69(5), 1817–1822.

Zhu, W., Zhang, Q., & Wang, H. (2017). Fixed costs and shared resources allocation in two-stage network DEA. Annals of Operations Research. https://doi.org/10.1007/s10479-017-2599-8.

Acknowledgements

The authors would like to thank the editor of Annals of Operations Research and two anonymous referees for their kind work and valuable suggestions. This research was financially supported by the Science Funds for Creative Research Groups of the National Natural Science Foundation of China (No. 71121061), the Fund for International Cooperation and Exchange of the National Natural Science Foundation of China (No. 71110107024), the National Natural Science Foundation of China (Nos. 71271196 and 71671172), the Youth Innovation Promotion Association of Chinese Academy of Sciences (CX2040160004), and the Science Funds for Creative Research Groups of University of Science and Technology of China (No. WK2040160008). This paper was finished when Feng Li was visiting the State University of New York at Buffalo with the financial support from the China Scholarship Council (No. 201606340017), and Qingyuan Zhu was visiting University of Illinois at Urbana-Champaign with financial support from the China Scholarship Council (No. 201606340054).

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Li, F., Zhu, Q. & Liang, L. A new data envelopment analysis based approach for fixed cost allocation. Ann Oper Res 274, 347–372 (2019). https://doi.org/10.1007/s10479-018-2819-x

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-018-2819-x