Abstract

The location affects the competitiveness and market share of a new entry enterprise, especially for a retail enterprise. This study focuses on the competitive location of new chain stores. In this paper, a bi-level model is proposed to formulate the competitive location problem. And the model also considers the pricing game between the new entry enterprise and the existing competitor. The model optimizes the location by maximizing the benefit on the principle of the Nash equilibrium. A heuristic algorithm is proposed to solve the model. Results show the feasibility of the proposed model and provide managerial insights for decision makers to determine an appropriate location.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Facility location problem is a significant problem for a business company, especially for a retail enterprise. When a new retail enterprise with a number of chain stores enters a market, the enterprise will face certain problems, which includes location schemes, competitors, price of substitute goods and so on. The optimization of competitive facility location for chain stores is of great importance to a new retail enterprise. It affects the competitiveness and market share of a new entry enterprise. However the optimization is complex due to the complicated factors. Therefore there is a potential need to study the optimization of competitive facility location for chain stores. For example, KFC and McDonald’s are two main fast food retail enterprises selling alternative products. The entry of these two enterprises in a specific city is not always simultaneously. Sometimes KFC has entered a city with many stores for years but McDonald’s still does not entry the city. So McDonald’s is a new enterprise for the city compared with the KFC. If McDonald’s wants to enter the city to get profits and market share, the locations of stores are of importance. In the case of the KFC and the McDonald’s, the prices of alternative products are the same and cannot be changed in a large selling area (e.g., China). But in the case of other enterprises, the prices of products may vary from different cities. Indeed, there are many Chinese food chain stores enterprises such as Zhengongfu in China have different prices varying from their locations, not one same price within a country. Moreover, even for a large chain store enterprise (such as KFC), it may has different prices in downtown and suburb in an indirect way like discounting. Thus, when a retail enterprise enters a new market, the locations of its stores are not the only factor decision makers need to consider, but also the prices of alternative products.

As we all know, if an enterprise with chain stores wants to enter a new market, it should consider the competitors and demand distribution in the market. In this paper, we combine the classical competitive location model with the principle of Nash equilibrium to optimize the facility location of two enterprises. That means a pricing game is inevitable between the two enterprises, and the pricing game will finally reach a Nash equilibrium (Nash 1951). In this paper, the Nash equilibrium means that both of the competitors are satisfied with the final values of price and the prices of alternative goods will not change any more, considering the other one’s thinking and next action. Note that the pricing game between the new and the existing enterprises proceeds after the specific locations of stores are given.

The pricing process in this paper is a location pricing process. Location pricing is a pricing strategy wherein the same product is offered at different prices across locations, despite the same production costs. For example, seats in a movie theater are priced differently. Front row seats are sold cheap, while the rear seats are comparatively expensive. The movie played (product) is the same for the entire crowd, irrespective of this discrimination. There are no extra costs incurred by the theater owner with respect to seat placements. However, viewer convenience and better visibility determine the price.Footnote 1

The main contributions of this paper to the literature can be summarized as follow. This paper not only focuses on the optimization of competitive location problem for new chain stores but considers the price gaming between two competitive enterprises. Furthermore, a bi-level model is proposed to solve the kind of problem; and the case study shows the feasibility of the model.

This paper is organized as follows: in Sect. 2, related work in the field of competitive facility location problem is presented. Section 3 presents the competitive location problem considering the pricing game. Section 4 provides the mathematical bi-level model and Sect. 5 gives the solving algorithm. In Sect. 6, a case study and sensitivity analysis are presented. Section 7 concludes the paper and provides an outlook on future work.

2 Literature review

Facility location problems deal with the location of facilities in a given space that optimizes a certain objective (Drezner and Hamacher 2002; Francis et al. 1992). Considering the number of competitors, the facility location problem can be divided into competitive and non-competitive location problems. In non-competitive location problems, the decision maker faces a market without competitors or facilities. In reality, competitive facility location problems, however, are more common, which differ from the classical facility problems. Competitive facility location problems take the competition of facilities into account. Thus, the new facility or facilities, which will be located later, need to compete with the facilities existed in the market.

A simple facility location problem is the Weber problem, in which a single facility is to be placed. The objective of the simple facility location problem is to minimize the total distances from a given set of point sites. More complex problems considered in this discipline include the placement of multiple facilities, constraints on the locations of facilities, and more complex optimization criteria (Weiszfeld 1937; Hakimi 1964; Cooper 1963, 1964). In the 1980s, because of the increase of uncertainty in construction cost, demand distribution and travel time, more studies focused on competitive location problems and stochastic location problems instead of location problems with deterministic factors. Weaver and Church (1983), Mirchandani et al. (1985) and Louveaux (1986) set demand and travel time as stochastic variables. Berman and Odoni (1982) and Berman and LeBlanc (1984) concentrated on the location-relocation of mobile facilities on a stochastic network. Larson (1974) first combined facility location problem with queuing theory. Furthermore, Brandeau and Chiu (1990) introduced a general class of single-server network location model considering stochastic queue, which minimize the total time taking the travel time and queuing delay into consideration. Eiselt (1992) discussed the various applications of location models from 1980 to 1990. Brimberg and ReVelle (2000) analysized the problem proposed in Revelle and Laporte (1996), which tried to maximizing the return-on-investment plant location. Aikens (1985) reviewed some of the significant contributions which have been made to the relevant and current state of knowledge. Model formulations and solution approaches, which address the issue vary widely in terms of mathematical and computational complexity. Morris et al. (1988) investigated facility location problems based on operation research and considered the interaction between candidate facilities, not only the interaction between the existing facilities and candidate facilities.

In reality, competitive location problems are more realistic. The study of competitive location problems was first proposed in the work of Hotelling (1929), which studied the location and pricing strategy of two competitors on a finite line, in which customers are uniformly distributed in a liner market and customers choose the closet vendor. The results showed that, given two vendors, both of them will choose to locate at the middle of the beach, called the “main street” effect.

A large number of studies investigated into this field (Eiselt 1993; Eiselt and Laporte 1989, 1996; Eiselt et al. 1993; Friesz et al. 1988; Hakimi 1986; Hamacher and Nickel 1998; Plastria 2001; Slater 1975). Competitive location models were applied to realistic location problems. Bell et al. (1998), Jain and Mahajan (1979) and Nakanishi and Cooper (1974) applied the competitive models to the location of grocery stores. Huff (1964) extended them to furniture and clothing stores. Drezner (2006) and Drezner and Drezner (2002) applied them to shopping malls. Goodchild and Noronha (1987) applied them to the location of gas stations, and Drezner (2011) applied them to hotel industries. Eaton and Lipsey (1975) and Graitson (1982) reviewed the development in competitive location problems. Economides (1986) modified the model in 19 considering equilibrium price between duopoly enterprises. Friesz et al. (1989) proved the existence of a solution to the combined location-equilibrium problem. Serra and ReVelle (1999) extended the Hotelling model to a network and proposed the competitive location pricing problem, where an new entering retail firm seeks optimal location and pricing decisions to compete against the existing firm. In their study, the customers are assumed to make decision based on both transportation cost and purchase cost, and the model is solved by a heuristic algorithm since it is a NP-hard problem. Meanwhile, the shortcoming of this model is that it neglects the response of the existing firm.

Furthermore, some models focus on other components, as a new trend in this field. Drezner and Eiselt (2002) concentrated on the customer characteristics and facility attributes. The facility attributes is also called utility or attractiveness, has been used to measure the attraction a customer feels for a facility. Stochastic customer behavior is used to formulate a two stage model to find the market share (Lu et al. 2010). Customers’ behavior is modeled as a probability distribution according to location, price and waiting time in Pahlavani and Saidi-Mehrabad (2011). The competitive location and pricing problem can be extended to more complex one where the assumptions and factors of real customers are fully considered (Küçükaydın et al. 2012; Wagner et al. 2009; Şahin and Süral 2007). Although the models can yield optimal solutions via mathematical analysis, they are limited in capturing the spatial interactions between participants in the presence of competition (Drezner and Eiselt 2002). So lots of the models were solved by heuristic algorithms such as hybrid tabu search (Serra and ReVelle 1999; Lu et al. 2010; Pahlavani and Saidi-Mehrabad 2011; Küçükaydın et al. 2012).

In terms of the solution space, competitive location problems can be classified in planar continuous space (Plastria 1995, 2002) and discrete space (Current et al. 2002; Daskin 2008). In the former, they seek the location of facilities anywhere from the infinite number of locations in the space, while in the latter, the candidate locations of facilities are assumed to be finite and pre-set.

Although many researchers focused on the competitive location problem, the competitive location problem with pricing game can be further studied, such as considering the price gaming between competitive enterprises and proposing appropriate model to solve the specific problems. In this paper, the proposed bi-level model is formulated based on a discrete space to solve the competitive facility location problem. This paper not only focuses on the optimization of location problem for new chain stores but considers the price gaming between two competitive enterprises. The traffic distance and price of product are considered in the utility function to measure the attraction of facility. In addition, the price is changeable in the proposed model to suit for the price gaming model.

3 Problem description

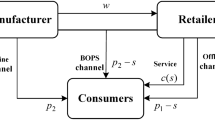

For simplicity and generality, a simple market is given in Fig. 1 to describe the competitive location problem with the pricing game.

In this example, there are 5 communities, which can also be seen as demand points, one competitive store and two candidate stores. A new retail enterprise tries to enter the market by opening chain stores. But one enterprise (e.g., enterprise B) has already existed in the market with one store (e.g., m in Fig. 1). The new enterprise has a number of candidate stores (e.g., a, b in Fig. 1) by the market investigation, which considers the demand, traffic and so on. Note that the final location scheme possibly cannot contain all of the candidate stores because of the budget line. In other words, competitive stores in Fig. 1 represent the existing chain stores of the competitor, where the candidate stores represent feasible locations of the new enterprise’s chain stores after a market investigation. Lines represent the network and the distance of links in this example.

Consumers in the communities consume in stores on the principle of utility. That is, consumers determine which stores to satisfy their demand by a utility function. The utility function is given in Sect. 4, which calculates each store’s utility to each community (refer as demand point). When a new enterprise enters the market, a pricing game is inevitable. Enterprises change the prices of products to adjust the utilities of its stores to demand points. That is, enterprise B is the monopoly enterprise before the new enterprise’s entry, so the new enterprise with alternative products may lower the price of its products to fight for the market share. The existing enterprise (enterprise B) will fight back by decreasing its prices of products. Since the prices of products in different enterprises and the locations of stores vary from each other, the pricing game and location schemes will lead to a different market share for the new and existing enterprises, which will definitely influence their benefits. The pricing game will finally end up with Nash equilibrium, which can be accepted by both sides.

This paper aims to optimize the locations of chain stores and determine the price of products by a process of pricing game between the two enterprises (the new and the existing enterprise).

4 Model formulation

4.1 Assumptions

Throughout this paper, the following assumptions are made for the proposed model as follows:

Assumption 1

The new enterprise can only choose their locations from a number of candidate points, which have been given by a market investigation. In addition, the location, capacity and fixed construction cost of each candidate point are known.

Assumption 2

The demand and location of each demand point in the market are known.

Assumption 3

The two enterprises sell the same product in their chain stores. The differences of the product to customers are the selling price and travel cost. In this paper, we study only one kind of product selling in two enterprises’ stores.

Assumption 4

The same product can have different prices in different cities or different markets, and the same product has the same prices in all locations of the same city or the same market.

4.2 Notations

For simplification, the new entry enterprise is defined as enterprise A, where the existing enterprise is defined as enterprise B. The following notations are defined and used in the mathematical formulation:

I | Set of stores, \(I=I_A \cup I_B \), where \(I_A \) denotes the set of candidate stores of the enterpriseA and \(I_B \) denotes the set of stores of the enterprise B |

J | Set of demand points |

\(p_A \) | Sales price of product in enterprise A |

\(p_B \) | Sales price of product in enterprise B |

\(P_i =\left\{ {_{P_B \hbox {, if }i\in I_B }^{P_A \hbox {, if }i\in I_A } } \right. \) | sales price of product in store \(i, i\in I\) |

\(S_i \) | Maximum supply of store i, \(i\in I_A \) |

\(b_i \) | Construction cost of store i, \(i\in I_A \) |

\(m_j \) | Demand of demand point j, \(j\in J\) |

\(d_{ij} \) | Distance between store i and demand point \(j, i\in I,j\in J\) |

\(u_{ij} \) | Utility of store i to demand point \(j, u_{ij} =e^{a-b\times p_i -c\times d_{ij} }\) |

q | Marginal cost of product |

V | Budget of enterprise A for opening new stores |

\(f_{ij}\) | Probability of demand j choosing store i for consumption |

\(x_i \) | = 1, if the candidate store i is selected to be opened; 0, otherwise, \(i\in I_A \) |

4.3 Model

In location-pricing problem (see more in Sect. 1), the location decision should come before the pricing game. The result of the pricing game (prices of the product in the two enterprises), however, affects the optimization of location decision in turn. Thus, a bi-level model is proposed to solve the competitive location problem in this paper. A simple diagram is given (depicted in Fig. 2) to describe the bi-level model.

4.3.1 The upper-level optimization problem

The upper model aims to maximize the benefit of the new enterprise (enterprise A). Thus, the upper level problem can be formulated as:

subject to

The objective function (1) maximizes the total benefit of enterprise A, where the first part represents sales benefit and the second part defines the total fixed construction cost of stores in a planning horizon. \(p^{A}\) is the price of product in enterprise A’s stores and is given by the lower-level model, presented in Sect. 4.3.2. Note that \(P^{A}\) is deterministic in the upper model but variable in the lower level. \(f_{ij} =\frac{u_{ij} \times x_i }{\sum \limits _{k\in I_A } {u_{kj} \times x_k}}\) defines the probability of consumer j choosing store i for consumption. Constraint (2) ensures that enterprise A can only open a number of stores within the budget. Constraint (3) represents the fact that demand point j can select store i to meet its demand only if store i is selected to be opened by enterprise A. Constraint (4) is the basic constraint of probability. Since \(u_{ij} =e^{a-b\times p_i -c\times d_{ij} }>0\), \(f_{ij} >0\) all the time and this constraint can be omitted. Constraint (5) is a capacity constraint, representing that stores can not only offer service beyond their capacities. Note that the value of \(m_j \times f_{ij}\) is rounded since the demand should be integer. Constraint (6) defines the decision variable.

4.3.2 The lower-level pricing game problem

The lower-level problem is a pricing game problem when the locations of stores are deterministic. Customers choose their stores based on the utility (related to the price of product and distance between stores and consumers) of stores. The utility function (\(u_{ij} =e^{a-b\times p_i -c\times d_{ij} })\) is determined by the price of product and the distance between consumers and stores. Since the locations of stores (\(x_{i}\)) are deterministic, price is the only factor to affect the value of utility. In this model, the pricing game between the two enterprises is seen as static game with complete information. The lower-level model can be formulated as below:

subject to:

The objective function (7) is aimed to minimize the distance of unit benefit (benefit divided by sales volume) of both enterprise A and B, which obeys the principle of Nash equilibrium. Constraint (8) and (9) ensure that the sales price should be higher than the marginal price, which avoids peer cut-throat competition. Constraints (10)–(12) are the same as constraint (3)–(5). Note that in the lower-level model, only \(p_{A}\) and \(p_{B}\) are decision variables, where \(f_{ij}\) is related to price (\(p_{A}\) and \(p_{B})\) and \(x_{i}\) is deterministic.

5 Algorithm

To solve the bi-level model, a heuristic algorithm (Hagan et al. 1996; Yao et al. 2013, 2016; Kennedy 2011; Yu et al. 2015, 2010, 2016; Suykens and Vandewalle 1999; Karaboga and Basturk 2007) is more appropriate. A Tabu Search Algorithm (Glover 1989, 1990; Yu et al. 2011; Yao et al. 2016) is designed in this paper. The method sets an initial price of product and then generates an initial feasible solution, which meets the constraints in the upper-level model. The initial feasible solution represents the scheme of stores’ locations, and this scheme will be the preset of the lower-level model. The lower-level model will then figure out a pair of price for the two enterprises, which is the final solution from the pricing game. This pair of price will be returned to the upper-level model for obtaining the benefit of the new enterprise.

The steps will be repeated until the solution meets the end condition of the algorithm. These steps can be described as below:

Step 1 Set the initial price and generate an initial feasible solution \(x_0\), which meets the upper-level constraints. Then, set the parameters of the Tabu search algorithm. Set \(x_0\) as the optimal solution and the current point. Meanwhile, Empty the Tabu list;

Step 2 The optimal solution is regarded as the preset of the lower-level model. Solve the lower-level model to get a pair of prices which meets Nash equilibrium. If the result meets the end condition of the algorithm, then terminate. Otherwise, go to Step 3;

Step 3 Calculate the objective function according to the Nash equilibrium price from Step 2;

Step 4 Set the current solution from Step 2 as the optimal solution. Generate the neighborhood of the current solution, and then select the candidate solutions;

Step 5 If there is a candidate solution satisfying the amnesty rule, set the optimal candidate solution as the current solution, update the optimal solution and the Tabu list, and then go to step 7. Otherwise, go to Step 6;

Step 6 Select the optimal solution, which has not been banned in the Tabu list, as the current solution and update Tabu table;

Step 7 If the termination rule of the upper-level model is satisfied, then go to Step 2. Otherwise, go to Step 4.

6 Case study

In this section, a case study with a network of communities and stores is designed to illustrate the validity of the model. And the sensitivity analysis on three parameters is performed to make a better location scheme. At last, to test the performance of the proposed model and algorithm, the proposed algorithm is applied on three cases with different scales.

In order to verify the feasibility of the model and the algorithm, a case study is carried out.

Enterprise A is a new enterprise selling sporting goods. To enter the sporting goods market, a number of chain stores will be opened. In the market, however, competitor enterprise B has established a number of chain stores, which has occupied the whole sporting market.

Enterprise A sells the same sporting goods as enterprise B, so a pricing game for the price of the same product is inevitable when A enters the market. This case study shows how enterpriseA figures out the optimal location for its stores through a series of pricing games.

The information about the market and community (refer as demand point) is given. The whole market is divided into 30 communities, and these communities are regarded as 30 demand points. “Appendix 1” shows the demand of each community in a planning horizon.

Enterprise A assumes that the market demand is completely inelastic. In addition, enterprise A also conducts an investigation and finally find out 10 candidate stores (a–j). The network of stores and communities is shown in Fig. 3.

The number on each lines in Fig. 3 represents the distance between two points. Grey points represent 30 communities, where Squares A–D are four stores of the existing enterprise B. Each store has a capacity of 2000. Diamonds a–j are ten candidate stores of enterprise A, which reflects the acquirement after the market investigation (Table 1). The information of the ten candidate stores is listed as follows:

The budget of opening stores is 7000 yuan and the initial sales prices in enterprise A and B are the same. The marginal price in the two enterprises is 40 yuan. Before enterprise A entering the market, the initial sales price in all enterprise B’s stores is 60 yuan.

6.1 Results

To solve the bi-level model in this paper, the parameters of the utility function should be firstly determined. The calibration of the parameters in the utility function is based on the investigation of the National Natural Science Foundation of China project (50278011), named “the Study on the Distribution of Commercial Center and Its Impact on Urban Traffic”. Then we acquired the original values of these parameters (please see “Appendix 2”). According to the results of questionnaires, we use the average value: parameter \(a=100\), price parameter \(b=1.0\), and distance parameter \(c=0.2\). Note that the network is shown in Fig. 3, and it can be seen that the distances between a community and a store are shown on the lines.

In addition, based on the numbers of experiments, the parameters of Tabu Search algorithm are set, where the Tabu length equals to 3, the number of iterations equals to 25 and the size of neighborhood equals to 250. Since the values of most parameters have been given, the model can be solved and the results are presented in Table 2 and Fig. 4.

Through a series of pricing games, four stores are finally selected to be opened. Specific demand-supply pairs are shown in dashed circles. Note that the results are acceptable for both of the two enterprises according to the Nash equilibrium.

To test the effect of the solution method in this paper, 10 times of calculations are conducted and Fig. 5 depicts the convergence of the calculations with different colors. It can be learned that the benefit of the new enterprise increases rapidly from the first to 17th iteration. And then it changes smoothly from the 18th to 22th iteration. Finally, it converges at about 32,000 yuan and hardly changes again. This implies that the solution method used in our paper could solve the competitive-location problem effectively. It shows certain stability and reliability during the calculation.

6.2 Sensitivity analysis

In this section, a sensitivity analysis is conducted by varying the following parameters: (1) the budget of enterprise A; (2) the initial price of enterprise B; and (3) the value of the price parameter in the utility function.

6.2.1 The budget of enterprise A

The budget of opening stores is changeable, and Table 3 tells that higher budget does not mean higher benefits. In fact, when enterprise tries to occupy more market share by opening more stores, enterprise B will decrease its price for resistance, which will definitely reduce the total benefit of A and B. As shown in Table 3, when the budget increases from 8000 to 9000 and 10000 to 12000, the optimal location scheme does not change, resulting from the construction cost of new stores and pricing game with competitor.

6.2.2 The initial price of enterprise B

The market is a perfect monopoly market before A’s entry. This section is aimed to find out the effect of changing initial price of product in the existing enterprise.

As is seen in Table 4, when monopoly price is high, the location scheme and price of A are changeless. The benefits of the two enterprises, however, will decrease if the monopoly price is lower than 55. It can be expected that if the enterprise B sets up a lower price (price barrier), enterprise A will not enter the market because this entry is not profitable. The price barrier by reducing the price will result in both loss of profits, and this behavior possibly violates antitrust laws and regulations.

6.2.3 The value of the price parameter in utility function

The value of the price parameter in utility function means the price sensitivity of customers. Large value of c means that customers feel the price of the product more significant than other factors (e.g., travel distance). According to the results in Fig. 6, the value of price parameter does not affect the optimal location scheme significantly. Location scheme is a, f, h, g all the time. But this value is of importance for enterprises’ prices and benefits. It can be seen, when the value of this parameter increases, the prices of the product will decrease, closing to their marginal price. Since enterprise can only attract more customers by decreasing price of product, customer is the sole victor of this price battle.

6.3 Test of sizes

To evaluate the runtime performance of the heuristic algorithm in this paper, three cases are carried out (with the one in Sect. 6.1), in which the instance sizes vary. As expected, doubling the number of stores and communities approximately doubles the numbers of rows and columns of the demand matrix; in addition, the number of scheme of candidate stores enlarges exponentially. That is, the larger network produces many more schemes due to the increased number of candidate points. Case 1 is extended from the network in Fig. 1 with 5 communities and 3 stores. The case in Sect. 6.1 above with 30 communities and 14 stores is set as the Case 2, and Case 3 contains 30 communities and 17 stores (see “Appendix 3”).

The results of Case 1 and Case 3 are briefly given in Fig. 7, where the results of Case 2 are already illustrated in Fig. 4. In Case 1, the candidate store “a” is finally chosen to open since if “b” is chosen, the existing store “m” will probably monopolize the demand of community “2 and 5”. And store “a” attracts more consumers compared with store “b”. The schemes of Case 2 and Case 3 are similar to each other, probably resulting from the similar locations of candidate stores and existing stores. The schemes, however, are not the same at the top-right area of the networks. The difference between the final results of Case 2 and Case 3 shows the “main street” effect, which means the competitive stores tend to locate together. Overall, the proposed model can be solved with a reasonable solution to provide effective decision support.

7 Conclusions

This paper combines competitive location facility problem with game theory. A bi-level model is proposed to solve competitive location problem considering the price of products. The upper level aims to maximize the benefit of the new enterprise, and the lower level aims to figure out the solution of Nash equilibrium. A utility function is used to define the criterion of customer’s selection. The model was tested and analyzed with a case, and the results show that the model is feasible. Sensitivity analysis is given for decision makers to make a better location scheme.

The model in this paper can be modified to optimize the facility location for more products. We just need to enlarge the set of p and demand matrixes of different products. Furthermore, the model can be extended to diversify the price of the same product. But for a large enterprise, the prices of one product in its stores usually are the same. In this paper, the demand and capacity of supply are fixed. Further study will add dynamic demand into the model. And we only consider the case that new retail enterprise does not have existing stores in this paper. Further study will consider the case where new retail enterprise has existing stores. Meanwhile, the utility function will be diverse with more parameters to make it more realistic.

References

Aikens, C. H. (1985). Facility location models for distribution planning. European Journal of Operational Research, 22(3), 263–279.

Bell, D. R., Ho, T.-H., & Tang, C. S. (1998). Determining where to shop: Fixed and variable costs of shopping. Journal of Marketing Research, 35, 352–369.

Berman, O., & LeBlanc, B. (1984). Location-relocation of mobile facilities on a stochastic network. Transportation Science, 18(4), 315–330.

Berman, O., & Odoni, A. R. (1982). Locating mobile servers on a network with Markovian properties. Networks, 12(1), 73–86.

Brandeau, M. L., & Chiu, S. S. (1990). A unified family of single-server queueing location models. Operations Research, 38(6), 1034–1044.

Brimberg, J., & ReVelle, C. (2000). The maximum return-on-investment plant location problem. Journal of the Operational Research Society, 51(6), 729–735.

Cooper, L. (1963). Location-allocation problems. Operations Research, 11(3), 331–343.

Cooper, L. (1964). Heuristic methods for location-allocation problems. Siam Review, 6(1), 37–53.

Current, J., Daskin, M., & Schilling, D. (2002). Discrete network location models. In Z. Drezner & H. W. Hamacher (Eds.), Facility location: Applications and theory (pp. 81–118). Berlin: Springer.

Daskin, M. S. (2008). What you should know about location modeling. Naval Research Logistics, 55, 283–294.

Drezner, T. (2006). Derived attractiveness of shopping malls. IMA Journal of Management Mathematics, 4, 349–358.

Drezner, T. (2011). Cannibalization in a competitive environment. International Regional Science Review, 34, 306–322.

Drezner, T., & Drezner, Z. (2002). Validating the gravity-based competitive location model using inferred attractiveness. Annals of Operations Research, 11, 227–237.

Drezner, T., & Eiselt, H. A. (2002). Consumers in competitive location models. In Z. Drezner & H. W. Hamacher (Eds.), Facility location: Applications and theory 151–178.

Drezner, Z., & Hamacher, H. (2002). Facility location: Applications and theory. Berlin: Springer.

Eaton, B. C., & Lipsey, R. G. (1975). The principle of minimum differentiation reconsidered: Some new developments in the theory of spatial competition. The Review of Economic Studies, 42(1), 27–49.

Economides, N. (1986). Nash equilibrium in duopoly with products defined by two characteristics. The RAND Journal of Economics, 17(3), 431–439.

Eiselt, H. A. (1992). Location modeling in practice. American Journal of Mathematical and Management Sciences, 12(1), 3–18.

Eiselt, H. A. (1993). Competition in locational models. Studies in Locational Analysis, 5, 129–147.

Eiselt, H. A., & Laporte, G. (1989). Competitive spatial models. European Journal of Operational Research, 39, 231–242.

Eiselt, H. A., & Laporte, G. (1996). Sequential location problems. European Journal of Operational Research, 96, 217–231.

Eiselt, H. A., Laporte, G., & Thisse, J.-F. (1993). Competitive location models: A framework and bibliography. Transportation Science, 27, 44–54.

Francis, R., McGinnis, L., & White, J. (1992). Facility layout and location: An analytical approach. Englewood Cliffs: Prentice Hall.

Friesz, T. L., Miller, T., & Tobin, R. L. (1988). Competitive network facility location models: A survey. Papers of the Regional Science Association, 65, 47–57.

Friesz, T. L., Tobin, R. L., & Miller, T. (1989). Existence theory for spatially competitive network facility location models. Annals of Operations Research, 18(1), 267–276.

Glover, F. (1989). Tabu search—part I. ORSA Journal on Computing, 1(3), 190–206.

Glover, F. (1990). Tabu search—part II. ORSA Journal on Computing, 2(1), 4–32.

Goodchild, M. F., & Noronha, V. T. (1987). Location-allocation and impulsive shopping: The case of gasoline retailing. In A. Ghosh & G. Rushton (Eds.), Spatial analysis and location-allocation models (pp. 121–136). New Jersey: Van Nostrand Reinhold Company.

Graitson, D. (1982). Spatial competition a la Hotelling: A selective survey. The Journal of Industrial Economics, 31(1–2), 11–25.

Hagan, M. T., Demuth, H. B., Beale, M. H., & De Jesús, O. (1996). Neural network design (Vol. 20). Boston: PWS publishing company.

Hakimi, S. L. (1964). Optimum locations of switching centers and the absolute centers and medians of a graph. Operations Research, 12(3), 450–459.

Hakimi, S. L. (1986). p-median theorems for competitive locations. Annals of Operations Research, 6, 77–98.

Hamacher, H. W., & Nickel, S. (1998). Classification of location models. Location Science, 6, 229–242.

Hotelling, H. (1929). Stability in competition. The Economic Journal, 39, 41–57.

Huff, D. L. (1964). Defining and estimating a trade area. Journal of Marketing, 28, 34–38.

Jain, A. K., & Mahajan, V. (1979). Evaluating the competitive environment in retailing using multiplicative competitive interactive models. In J. N. Sheth (Ed.), Research in marketing (Vol. 2, pp. 217–235). Greenwich: JAI Press.

Karaboga, D., & Basturk, B. (2007). A powerful and efficient algorithm for numerical function optimization: Artificial bee colony (ABC) algorithm. Journal of Global Optimization, 39(3), 459–471.

Kennedy, J. (2011). Particle swarm optimization. In Encyclopedia of machine learning.

Küçükaydın, H., Aras, N., & Altınel, İ. K. (2012). A leader-follower game in competitive facility location. Computers & Operations Research, 39(2), 437–448.

Larson, R. C. (1974). A hypercube queuing model for facility location and redistricting in urban emergency services. Computers & Operations Research, 1(1), 67–95.

Louveaux, F. V. (1986). Discrete stochastic location models. Annals of Operations Research, 6(2), 21–34.

Lu, X., Li, J., & Yang, F. (2010). Analyses of location-price game on networks with stochastic customer behavior and its heuristic algorithm. Journal of Systems Science and Complexity, 23(4), 701–714.

Mirchandani, P. B., Oudjit, A., & Wong, R. T. (1985). ‘Multidimensional’extensions and a nested dual approach for the m-median problem. European Journal of Operational Research, 21(1), 121–137.

Morris, J. G., Love, R. F., & Wesolowsky, G. O. (1988). Facilities location: Models and methods. New York: North-Holland Publishing Co.

Nakanishi, M., & Cooper, L. G. (1974). Parameter estimate for multiplicative interactive choice model: Least squares approach. Journal of Marketing Research, 11, 303–311.

Nash, J. (1951). Non-cooperative games. Annals of Mathematics, 54(2), 286–295.

Pahlavani, A., & Saidi-Mehrabad, M. (2011). A competitive facility location model with elastic demand and patronising behaviour sensitive to location, price and waiting time. International Journal of Logistics Systems and Management, 10(3), 293–312.

Plastria, F. (1995). Continuous location problems. In Z. Drezner (Ed.), Facility location : A survey of applications and methods (pp. 225–262). New York: Springer.

Plastria, F. (2001). Static competitive facility location: An overview of optimization approaches. European Journal of Operational Research, 129, 461–470.

Plastria, F. (2002). Continuous covering location problems. In Z. Drezner & H. W. Hamacher (Eds.), Facility location: Applications and theory (pp. 37–79). Berlin: Springer.

ReVelle, C. S., Eiselt, H. A., & Daskin, M. S. (2008). A bibliography for some fundamental problem categories in discrete location science. European Journal of Operational Research, 184, 817–848.

Revelle, C. S., & Laporte, G. (1996). The plant location problem: New models and research prospects. Operations Research, 44(6), 864–874.

Şahin, G., & Süral, H. (2007). A review of hierarchical facility location models. Computers & Operations Research, 34(8), 2310–2331.

Serra, D., & ReVelle, C. (1999). Competitive location and pricing on networks. Geographical Analysis, 31(2), 109–129.

Slater, P. J. (1975). Maximin facility location. Journal of Research of the National Bureau of Standards B, 79, 107–115.

Suárez-Vega, R., Santos-Peñate, D. R., & Dorta-González, D. (2014). Location and quality selection for new facilities on a network market. The Annals of Regional Science, 52(2), 537–560.

Suykens, J. A., & Vandewalle, J. (1999). Least squares support vector machine classifiers. Neural Processing Letters, 9(3), 293–300.

Wagner, M. R., Bhadury, J., & Peng, S. (2009). Risk management in uncapacitated facility location models with random demands. Computers & Operations Research, 36(4), 1002–1011.

Weaver, J. R., & Church, R. L. (1983). Computational procedures for location problems on stochastic networks. Transportation Science, 17(2), 168–180.

Weiszfeld, E. (1937). Sur le point pour lequel la somme des distances de n points donnés est minimum. Tohoku Mathematical Journal, 43(355–386), 2.

Yao, B., Hu, P., Lu, X., Gao, J., & Zhang, M. (2014). Transit network design based on travel time reliability. Transportation Research Part C: Emerging Technologies, 43, 233–248.

Yao, B., Hu, P., Zhang, M., & Wang, S. (2013). Artificial bee colony algorithm with scanning strategy for the periodic vehicle routing problem. Simulation, 89(6), 762–770.

Yao, B., Yu, B., Hu, P., Gao, J., & Zhang, M. (2016). An improved particle swarm optimization for carton heterogeneous vehicle routing problem with a collection depot. Annals of Operations Research, 242(2), 303–320.

Yu, B., Kong, L., Sun, Y., Yao, B., & Gao, Z. (2015). A bi-level programming for bus lane network design. Transportation Research Part C: Emerging Technologies, 55, 310–327.

Yu, B., Song, X., Guan, F., Yang, Z., & Yao, B. (2016). k-Nearest neighbor model for multiple-time-step prediction of short-term traffic condition. Journal of Transportation Engineering, 142(6), 04016018.

Yu, B., Yang, Z. Z., Chen, K., & Yu, B. (2010). Hybrid model for prediction of bus arrival times at next station. Journal of Advanced Transportation, 44(3), 193–204.

Yu, B., Yang, Z., Sun, X., Yao, B., Zeng, Q., & Jeppesen, E. (2011). Parallel genetic algorithm in bus route headway optimization. Applied Soft Computing, 11(8), 5081–5091.

Acknowledgements

This work was supported in National Natural Science Foundation of China 51578112 and 71571026, and the Fundamental Research Funds for the Central Universities DUT16YQ104.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Shan, W., Yan, Q., Chen, C. et al. Optimization of competitive facility location for chain stores. Ann Oper Res 273, 187–205 (2019). https://doi.org/10.1007/s10479-017-2579-z

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-017-2579-z