Abstract

Many firms have recently implemented the buy-online-and-pick-up-in-store (BOPS) strategy on store operations. This paper examines the impact of power structures on the decision of pricing and service level in an omnichannel supply chain with BOPS option. We investigate a two-stage omnichannel supply chain that consists of an online manufacturer and an offline retailer. The manufacturer produces products and adopts an online channel while the retailer sells products on both the traditional and the BOPS channels. Based on game theory analysis, the optimal retail prices in different distribution channels and the retailer’s optimal service quality in an omnichannel supply chain are derived under different power structures. Our results show that the more powerful retailer enjoys a higher profit while the dominant manufacturer may not benefit from its first-move advantage. No dominance among omnichannel supply chain members lead to the highest service level. Our analysis generates managerial insights into the interaction between firms and provides a guide for implementing the BOPS strategy in omnichannel retailing.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

With the rapid development of technology and the growing e-commerce market, omnichannel operations are becoming increasingly popular in the retail industry. The aim of omnichannel operations is to coordinate fragmented service processes and integrate various channels to provide consumers with an interactive and consistent shopping experience. For instance, Tmall.com, one of the largest O2O (online-to-offline) platforms in China, has embraced its new brick-and-mortar shop, Freshhema, which facilitates the integration of online platforms and offline shops.Footnote 1 Both academic researchers and business managers have identified omnichannel retailing as an emerging trend in supply chain management [13].

One of the growing omnichannel retailing fields is the BOPS (buy-online-and-pick-up-in-store) initiative, which blends both the online and offline channels by allowing consumers to place sales online and collect goods in the pointed physical store. For traditional retailers, BOPS channel provides them an opportunity to cross-sell products, which creates store traffic and increases additional revenue [2]. For online manufacturers, BOPS channel enables them to increase order volume and raise brand awareness. With BOPS channel, consumers experience instant gratification and enjoy increased shopping convenience [21]. According to [31] and [26], BOPS is widely deployed by retailers such as Walmart, Uniqlo, Suning Appliance, Target and many more. The emerging trend of the development and adoption of BOPS channel requires consumers to be collect products physically to receive value-added services [10]. For example, the physical store allows consumers to return products immediately and provides them with extensive shelf display and shopping assistance. Empirical researches have also acknowledged that store service is a significant part in optimizing channel profitability [23, 34]. In our study, we assume the value-added service can be provided by the physical retailer for both the offline and the BOPS channels such as the retail showrooms and the personalized explanation of product features. These service offerings allow the supply chain members to be competitive in a growing market.

Furthermore, from the omnichannel supply chain management perspective, channel structure is regarded as one player exerting power on another to either squeeze a fair share of the total revenue or seek compliance to some competitive business practices [3]. For instance, Wal-Mart and Carrefour offer multiple discounts to those picking up orders in stores, including gift cards and dedicated pickup towers. They play a leading role with greater power than upstream online manufacturers. However, in some electronics omnichannel operations, Microsoft and Intel play a leading role in a relatively strong dominant position than their downstream offline players [20]. In other examples, supply chain players could in a balanced market power, where they are participated in vertical Nash competition [32].

Therefore, we propose three classic power structures that are based on the omnichannel supply chain: Manufacturer-Stackelberg (MS), Vertical Nash (VN) and Retailer Stackelberg (RS). With the above formulation, we pursue the following research questions: (1) How to develop pricing policies in an omnichannel context to optimize the players’ profits? (2) How to set a desired service quality to stimulate the omnichannel demand? (3) Given the different power structures, what are the players’ optimal strategies?

To answer these questions, we investigate a two-stage omnichannel supply chain including an online manufacturer and an offline retailer. The manufacturer sells directly to end-consumers through the online platform while the retailer distributes products on both the traditional and the BOPS channels to improve sales performance. This basic two-stage omnichannel model is applicable in the retailing industry in reality, and also it is easy to understand by readers. From game theoretical perspectives, we consider the interactions between the supply chain players and analyze the optimal retail prices, service quality, and profits under different dominance regimes. This work makes some contributions. Although power structure problems were extensively discussed in the operations management area, there are very limited papers that combine the retail service and the omnichannel supply chain with considering power schemes. First, we extend the results of previous research by addressing value-added physical store service quality decisions in omnichannel supply chains. Another contribution is our systematic consideration of optimizing pricing and service quality decisions to improve the performance of individual members and the total omnichannel with different power structures.

The rest of the paper is organized as follows. Section 2 presents the literature review. In Sect. 3, we describe the omnichannel supply chain setting, the demand specification, and the different dominance structures. In Sect. 4, the pricing policies and service quality strategies in an omnichannel supply chain and the effect of power regimes are explored separately. In Sect. 5, some numerical examples are proposed to demonstrate the validity of different models. Section 6 summarizes the findings and shows future research directions.

2 Literature review

Our paper spans two streams of literature: omnichannel supply chain management and effect of power structures on strategies and profits. We provide a summary of the work in each stream and identify the research gap presented in each stream.

With the continuous development of business and e-commerce, omnichannel retailing presents the blowout development trend [30]. Our work is highly related to the following research on omnichannel operation issues. For example, [1] propose a framework for managing and measuring the distribution demand to improve the performance of the omnichannel retailing and introduced metrics for channel efficiency. [9] investigate the impact of different information mechanisms, i.e., information availability and physical/virtual showrooms on the behavior of omnichannel supply chain and consumers’ performance. [30] perform a framework on omnichannel retailing with returns and cancellation, and identify the market conditions that bring benefits to the retailer. Based on the concept of “partitions” to the store inventory, [11] explore two price optimization policies in the presence of cross-channel fulfillment in demand and supply. We complement these studies by considering the impact of power structures on the service quality and equilibrium prices in an omnichannel supply chain.

Among all omnichannel operations, BOPS is the most important method. [7] first study the effect of deploying a BOPS method on both the traditional and online channels. They proposed that instead of increasing online sales, the BOPS project is correlated with a decline in platform sales and an increase in physical store traffic and revenue. Previous studies on BOPS fulfillment can be separated into two streams. The first focus on front-end operations, including the determination of the size of a BOPS service area [15], the Best Performance Frontiers (BPFs) and multi-wave pickup operations for same day BOPS initiative [21] and the identification of whether the BOPS service is always beneficial for enhancing the dual-channel retail’s profits [31]. The second focus on the back-end fulfillment for offering BOPS services, including the pre-orders and consumer returns with BOPS initiative [27], the best replenishment orders to satisfy both online and offline demands [29], and the specification of the optimal set of displays to be converted for platform operations [22]. Further, [8] focus on the effect of the BOPS service on store operations, they consider the allocation of BOPS revenue and how to choose a suitable set of products for BOPS channel. However, most of the above papers consider the centralization decisions under an omnichannel context. We will elaborate, throughout the work, how our model setting differs fundamentally from theirs in both the underlying omnichannel mechanism and the channel structures.

The other relevant literature stream studies the effect of different power structures on channel operations [16]. [26] adopt a game-theory methodology to describe power mechanisms with random and price-dependent demand and studied these demand functions affect the players’ profit. [3] reveal insights on two power regimes influencing firms’ performance in an assembly supply chain, including one assembler and two suppliers. [4] discuss how power mechanisms impact the optimal pricing policies and channel choice of smart phone industry between a bundled and a free distribution channel. [5] demonstrate the influence of power regimes on the retail service under the mix O2O context. The aforementioned paper shows that power imbalance decreases the supply chain’s performance. [19] develop a framework with different power regimes that investigate the vertical and horizontal competitions between the supply chain members. [12, 33] address the channel power system integrated with business decisions. [17] study the influence of power regimes on the pricing policies and production in a decentralized subcontracting assembly supply chain. From different game theoretical perspectives, [20] investigate the impact of consumer value on product selection and pricing strategies. Specifically, we explore how power imbalance affects the operation of decentralization and centralization supply chain with the BOPS channel.

In our analysis, we focus on the case of the retailer and the manufacturer explicitly announcing the BOPS channel and illustrate how the power structure influences equilibrium. In an extension, we consider the implications of the store service quality when consumers choose the BOPS channel.

3 Model description

To better understand the omnichannel pricing mechanism, we develop a game theoretical model and start our analyses with a market consisting of one online manufacturer, one physical retailer, and consumers heterogeneous in their product valuation in different channels. We first describe the omnichannel structure in Subsect. 3.1 and then introduce the demand function and explain its intuitive notion in Subsect. 3.2. Finally, we analyze sequences of events under different possible power structures in Subsect. 3.3.

3.1 Omnichannel structure

We consider an omnichannel system consisting of an upstream online manufacturer (denoted with the subscript m) and a physical retailer (denoted with the subscript r). The manufacturer charges the retailer the wholesale price w and directly sells a single product with the online price \(p_2\). The wholesale price is reasonably assumed to be exogenous and dependent on the long-term contract between the supply chain members, which were ever used by many studies such as [6, 14]. The retailer orders a certain number of products from the upstream manufacturer and resells by the traditional channel with the offline price \(p_1\). To achieve a competitive advantage, the manufacturer also cooperates with the retailer to implement the BOPS channel which leads to consumers purchasing products with online price \(p_2\) and collecting in the designated physical store. Furthermore, the manufacturer chooses to cede BOPS net revenue to increase the retailer’s willingness to cooperate. That implies once the consumer who chooses BOPS channel, the retailer gains \(p_2-w\) from a single product.

In reality, the retailer can attract consumers by providing appropriate service efforts such as personalized consumer experience, more shelf spaces and other order-enhancing activities. It is reasonable to use \(c(s)=\beta s^2/2\) to describe the service cost for the physical store, where \(\beta >0\) is the service cost coefficient, and s refers to the service level. Consequently, consumers could receive service through both the traditional and the BOPS channels. The omnichannel structure is depicted in Fig. 1.

3.2 Demand specification

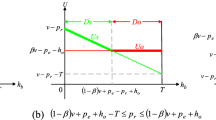

In the omnichannel supply chain framework, each channel’s demand increases in the effective sales price of other channels but decreases in its practical price. Moreover, an improve in the service quality of the physical store can increase not only the traditional channel demand but also the BOPS channel demand. Like many researchers (e.g.,[24, 34]), we also adopt a specific linear demand function. Therefore, the demand for the offline channel and the online channel (\(q_1\) and \(q_2\)), and the demand for the BOPS channel (\(q_b\)), are assumed to be as follows:

where \(p_1-s\), \(p_2\), and \(p_2-s\) are the effective prices of the offline, the online and the BOPS channel, respectively. \(\alpha\) is the demand expansion coefficient of BOPS strategy. The cross-price sensitivity \(\theta\) reflects the degree to which the different channels can substitute for each other. Consequently, \(\theta \in (0,1)\) signifies that the effect of cross-price is less than the effect of ownership price [28]. The above demand functions capture not only the own practice price effect but also the impact of the difference between the own effective price and the competing channel price. Table 1 lists the notations used in this paper.

3.3 Power structure and game sequence

In this subsection, we propose three possible power regimes in the omnichannel context: the offline retailer as a leader, the online manufacturer as a leader and the balanced power. With the channel structures set down, then we explicitly layout the decision sequence of each supply chain participant. Consequently, we present the manufacturer/retailer Stackelberg game to guarantee the omnichannel supply chain dominated by the manufacturer/retailer. Next, we adopt a Nash game to represent omnichannel supply chains with an equal power regime between the members.

-

Retailer Stackelberg (RS) model: under this model, the retailer/manufacturer is the Stackelberg leader/follower. In the first period, the retailer determines the service quality and the offline price. In the second period, given the retailer’s optimal solutions, the manufacturer announces the online price.

-

Vertical Nash (VN) model: under this model, the online manufacturer and the offline retailer have the balanced power and choose the retail prices and the service quality simultaneously.

-

Manufacturer Stackelberg (MS) model:under this model, the manufacturer moves first as the Stackelberg leader. In anticipation of the retailer’s response, the manufacturer designs the online price. Then, given the manufacturer’s optimal decision, the retailer determines the offline price and the service quality.

We use superscripts to index game type and subscripts to index players throughout this article; for instance, \(\pi _m^{RS}(.)\) is the manufacturer’s profit function in the retailer Stackelberg game.

4 Model analysis

In this section, we present four models to characterize the players’ revenue and decisions. First, we dene a completely centralized system. Second, we introduce three models corresponding to dierent power structures, i.e., manufacturer Stackelberg game, vertical Nash game and retailer Stackelberg game. Finally we proceed to calculate the equilibrium decisions from our analysis in several Theorems. Proofs for all theorems are presented in Appendix.

4.1 Centralized system (CS) model

To establish a benchmark case, we consider the centralized system where the supply chain players both belong to one firm. Thus, the firm manager announces the retail prices and the service quality to maximize the firm’s revenue. The profit of the centralized system is maximized as follows:

In Equation (4), the integrated firm’s revenue from the traditional channel is shown in the first term; the second term implies the sales profits from consumers who purchase from both the online and the BOPS channels, and the last term refers to the service cost during the selling period. Solving Equation (4), we can obtain the following theorem.

Theorem 1

In the centralized omnichannel supply chain,

-

(1)

the profit function \(\pi _c^{CS}(p_1,p_2,s)\) of the centralized firm is jointly concave in \(p_1,p_2,s\) under the condition \(\beta >\beta _1 =\dfrac{12 - 16 \theta - \theta ^2 + 5 \theta ^3}{8(2-\theta -\theta ^2)(2+\alpha )}\);

-

(2)

the optimal offline price \(p_1^{CS}\), the optimal online price \(p_2^{CS}\), and the best service level \(s^{CS}\) in the physical store, respectively, are given as follows:

$$\begin{aligned} p_1^{CS} =&\dfrac{2+\theta \alpha }{2(2-\theta -\theta ^2)}+\dfrac{s^{CS}}{2}, \end{aligned}$$(5)$$\begin{aligned} p_2^{CS}=&\dfrac{1+\alpha +\theta }{2(2-\theta -\theta ^2)}+\dfrac{s^{CS}}{4}, \end{aligned}$$(6)and

$$\begin{aligned} s^{CS} =&\dfrac{4[(1-\dfrac{\theta }{2})(2+\alpha \theta )+(1-\dfrac{3\theta }{2})(1+\alpha +\theta )]}{(2-\theta -\theta ^2)[8(2+\alpha )\beta +5\theta -6]}. \end{aligned}$$(7)

In centralized system, it follows from Equations (5) and (6) that the prices for both online and offline channels have a positive relationship with the service level the retailer offers. Intuitively, we find that the rate of change of \(p_1^{CS}\) with regard to the service quality is larger than that of \(p_2^{CS}\). If the integrated firm improves the service quality of the physical store, consumers will shift their demand into the BOPS/traditional channel. In this sense, the integrated firm has a motivation to raise retail prices. Furthermore, we conclude that \(\partial p_2^{CS}/\partial \alpha>\partial p_1^{CS}/\partial \alpha >0\), which indicates that the optimal retail price of the integrated firm is positively related to the BOPS demand expansion coefficient. More specifically, the change of optimal online price with regard to the BOPS demand expansion coefficient is larger than that of the offline price. Namely, the manufacturer’s online price is more sensitive to the BOPS channel expansion coefficient.

In the following, we study a decentralized omnichannel system where the two players individually make their decisions. Our focus is on the derivation of optimal service level and the sales prices of different channels under different power regimes.

4.2 Retailer Stackelberg (RS) model

In this scenario, the retailer moves first as the Stackelberg leader setting the traditional retail price and the service level based on the exogenous wholesale price by maximizing performance. Taking the retailer’s best response into account, the manufacturer settles the online price to maximize its profits. Finally, when the consumer demand is realized, the supply chain players earn their profits.

We examine the manufacturer’s decision problem first. The manufacturer settles the online price to maximize its profits:

Taking the second derivative of the manufacturer’s profit function with respect to \(p_2\), we obtain \(\partial ^2\pi _m^{RS}/\partial p_2^2=(\theta -2)/(2+\alpha )<0\), the manufacturer is concave in \(p_2\). Solving \(\partial \pi _m^{RS}/\partial p_2=0\) gives the manufacturer’s optimal reaction:

In Equation (9), the manufacturer’s online price in the RS model decreases as the service quality of the physical store rises, which means that the higher the degree of service quality, the lower the online price of the product. Therefore, by improving service quality for consumers, the retailer can effectively place retail prices that benefit consumers. In this sense, a higher store service quality lures consumers to shift online purchase to the physical store. Therefore, the manufacturer could announce a lower online price to increase sales volume. In addition, it follows from Equation (9) that the optimal online price \(p_2^{RS}\) decreases with the wholesale price when \(\theta \in (0,2/3)\) and increases when \(\theta \in (2/3, 1)\). Under a higher cross-price sensitivity, the manufacturer has the motivation to drive the wholesale price up to increase sales revenue.

As discussed above, the demands of the traditional and the BOPS channels can be respectively formulated as:

It follows from Equations (10) and (11) that \(\partial q_b^{RS}/\partial s>\partial q_1^{RS}/\partial s>0\), which means that as the sales service level of the physical increases, both the BOPS and the traditional channel demands will rise in the RS model. High service quality of the physical store intuitively attracts more consumers to choose the BOPS/traditional channel. Then, we derive the retailer’s optimal policy in terms of \(q_1^{RS}\) and \(q_b^{RS}\). The retailer’s profit maximization problem can be expressed as:

Therefore, in the presence of a powerful retailer, we can characterize the equilibrium solutions in the following theorem.

Theorem 2

In a retailer Stackelberg omnichannel market,

-

(1)

the profit function \(\pi _r^{RS}\) is jointly concave in \(p_1\) and s when \(\beta >\beta _2=\dfrac{\eta _2^2-8\theta \eta _1}{4(2+\alpha )(2-\theta )\eta _1}\), where \(\eta _1=16-5\theta ^2-8\theta\) and \(\eta _2=8-6\theta -3\theta ^2\);

-

(2)

the retailer’s best offline price \(p_1^{RS}\) and the best service quality \(s^{RS}\) are specified as:

$$\begin{aligned}&p_1^{RS} = \dfrac{8+2\alpha \theta +\eta _2 s^R +(5\theta ^2-10\theta +8)w}{\eta _1}, \end{aligned}$$(13)$$\begin{aligned}&s^{RS} = \dfrac{(4-4\alpha \theta +2\theta )\eta _1+(8+2\alpha \theta )\eta _2+8(2+\theta )(\theta -1)(\eta _1-2\theta )w}{ [4(2+\alpha )(2-\theta )\beta +8\theta ]\eta _1-\eta _2^2}. \end{aligned}$$(14)

Theorem 2 reveals that under the RS game, the product’s offline price increases with the service quality. As the retailer’s service quality improves, more consumers prefer purchasing the product from the physical store, the retailer will raise the retail price. Concerning the service cost, it is easy to understand the retailer’s choice. Besides, Theorem 2 also indicates that the retailer will increase the retail price in anticipation of the manufacturer’s wholesale price increase.

4.3 Vertical Nash (VN) model

In the vertical Nash model, the supply chain members decide simultaneously and the sequence of events is as follows. The retailer settles the offline price and the service quality to maximize its revenue given the manufacturer’s online price, and the manufacturer chooses the online price by anticipating the retailer’s best decision. Consequently, the revenue function of the manufacturer and retailer are given by

The optimal pricing policies and the service level at Nash equilibrium (\(p_1^{VN}\), \(s^{VN}\), and \(p_2^{VN}\)) satisfy

and

Theorem 3 shows that there exists a unique pure strategy Nash equilibrium for this game.

Theorem 3

The equilibrium retail prices of the traditional and online channels in the Nash game then satisfy

Furthermore, at equilibrium, the optimal service quality satisfies

The several suggestions in Theorem 3 are intuitive. When the retailer improves service quality, the manufacturer has the willingness to charge a lower online price to capture sales in both the BOPS and the online channels. In addition, when either player becomes dominant, the retailer’s retail price decreases with the service level when \(\theta \in (0, \sqrt{3} -1)\). A higher cross-price sensitivity leads to a negative cross-effect on traditional sales, the retailer has the incentive to increase offline sales through lower offline retail price. Still, we demonstrate that in the VN game, the increase of the demand expansion coefficient of the BOPS channel induces the retailer to reduce service quality.

4.4 Manufacturer Stackelberg (MS) model

In this model, the manufacturer acts as the decision leader. To stimulate the retailer’s incentive for the BOPS strategy cooperation, the manufacturer moves first and offers the online price, then the retailer responds by simultaneously determining the offline price and service quality to maximize profit. We adopt backward induction to solve the problem. The retailer’s revenue function can be formulated as:

On the right-hand side of Equation (20), the first term is the sales revenue from the traditional channel, the second term shows the sales revenue from consumers who choose the BOPS channel, and the last term is the service cost of the retailer. As to the retailer’s optimal price for the offline channel (\(p_1^{MS})\) and the service quality (\(s^{MS}\)) in the manufacturer Stackelberg model, the following theorem is obtained.

Theorem 4

In a manufacturer Stackelberg omnichannel market,

-

(1)

the profit function \(\pi _r^{MS}\) is jointly concave in \(p_1\) and s when \(\beta >\beta _3=\dfrac{\eta _4^2}{2(2+\alpha )}\), where \(\eta _4 = 1-\dfrac{\theta }{2}\);

-

(2)

the optimal decisions of the retailer are calculated as follows:

$$\begin{aligned}&p_1^{MS}(p_2) =\dfrac{\eta _3+[\eta _4 ^2+(3-3\eta _4 )\eta _3]p_2+(\eta _3\eta _4 -2\eta _4 ^2)w}{2\eta _3-\eta _4 ^2}, \end{aligned}$$(21)$$\begin{aligned}&s^{MS}(p_2) =\dfrac{\eta _4[1+(5-3\eta _4)p_2+(\eta _4 -4)w]}{2\eta _3-\eta _4 ^2}, \end{aligned}$$(22)where \(\eta _3 = (2+\alpha )\beta\).

Theorem 4 reveals that as the value of the manufacturer’s online price increases, the retailer may prefer to increase the offline price and improve the service level of the physical store. Substituting the above results into the manufacturer’s profit function, the manufacturer’s decision problem can be formulated as:

In Equation (23), the first term is the sales revenue from the long-term wholesale contract, the second term is the sales profit from the online channel. From the first-order optimality condition, we can get that the optimal online price of the manufacturer is

Substituting the optimal \(p_2^{MS}\) into Equations (20)–(23), we get the equilibrium pricing and service policies and corresponding profits of the two players under the MS game.

5 Numerical study

Owing to the complexity of the equilibrium retail prices, the optimal service quality and the maximal revenue, it is difficult to summarize analytical comparisons under four models. Therefore, we perform a series of numerical experiments. First, we compare the equilibrium decisions of the four models to investigate the impacts of power structures. Second, we conduct the sensitivity analysis of parameters \(\theta\), \(\alpha\) and \(\beta\), so that we can observe how the demand expansion coefficient of BOPS channel, the price elasticity and service cost factor influence the players’ optimal decisions under different dominance regimes. We conduct numerical experiments to provide managerial implications related to the aforementioned models.

5.1 Comparisons of the results of four models

We consider a case where the manufacturer sells products through the online channel and wholesales products to a retailer, who distributes products on both the traditional and the BOPS channels. Inspired by [24], we use some data in our experiment based on comparisons of previous studies. For instance, the studies set the service cost factor \(\theta = 0.3\) or \(\theta = 0.6\) and \(\beta \in [0.9,1.2]\) to perform [18, 34]. Given these parameters employed in above studies, we set \(\alpha =0.2\) and \(w = 0.4\). The service cost factor is taken values of \(\beta = 0.8\) and \(\beta =1.0\), respectively. Then we observe the optimal decisions and revenue under four scenarios, by changing \(\theta\) in [0.75,0.95] with the step of 0.1. Accordingly, the selected parameters could satisfy the constraints described in Sect. 4 to ensure that this model is appropriate and meaningful.

The experimental results are shown in Tables 2, 3, which demonstrate the three parameters have significant effects on the optimal solutions and profits under four different models. Through the numerical experiments, several intuitions can be deduced as follows.

-

(1)

We compare the optimal retail prices under four scenarios and find \(p_1^{CS}>p_1^{RS}>p_1^{VN}>p_1^{MS}\) and \(p_2^{CS}>p_2^{RS}>p_2^{VN}>p_2^{MS}\). This result indicates that the optimal retail prices in the centralized system (i.e., the CS model) are higher than those in the decentralized system. Moreover, in the decentralized system, the retail prices of three channels are lowest when the manufacturer dominates the market, and the retail prices in the retailer Stackelberg game are the highest. These observations imply that a dominant retailer makes the use of decision-making power in obtaining first-best profits. Simultaneously, consumers are worse off caused by the increase in the effective retail price. However, the dominated manufacturer gives consumers more value for owning the product, which will increase their willingness to pay for the product and reduce their price sensitivity.

-

(2)

We compare the optimal service quality under the different models and obtain \(s^{VN}>s^{MS}>s^{RS}\) and \(s^{VN}>s^{MS}>s^{CS}\). The result shows that the service quality of the physical store is the highest when neither player dominates the omnichannel market. This subsequently leads to consumers obtaining more benefits in a vertical Nash power structure. Our experiment study indicates that both \(s^{RS}>s^{CS}\) and \(s^{RS}<s^{CS}\) can occur.

-

(3)

We observe that the revenue of the total system under various models is described as follows: \(\pi _c^{CS}>\pi _c^{RS}>\pi _c^{VN}>\pi _c^{MS}\). The result shows that the total profit of the omnichannel supply chain achieves the highest in the centralized system, followed by the RS model, the VN model and, finally, the MS model. This means that the total revenue in the centralized model is larger than that in the decentralized models. A power shift to the manufacturer under the long-term exogenous wholesale price contract deteriorates supply chain performance. Following this result, we can explore the impact of power structures on the performance of each individual player.

-

(4)

We examine the profits of the two players under various models and obtain the result \(\pi _r^{RS}>\pi _r^{VN}>\pi _r^{MS}\) and \(\pi _m^{RS}>\pi _m^{MS}>\pi _m^{VN}\). For the three decentralized decision models, the maximal revenue of the retailer in the RS game is the largest. As the retailer’s power increases in the market, its revenue increases for the linear price- and service- sensitive demand. This finding seems to be consistent in the literature [25, 26]. A weak retailer should seek differentiation through a lower product retail price and higher service level. When the wholesale price is exogenous, a dominant retailer would announce a higher retail price. Therefore, the retailer has the motivation to play the leader role in the supply chain. However, this condition is not suitable for the manufacturer. The manufacturer’s profit achieves the highest in the RS model, followed by the MS model. As the manufacturer further gains power and becomes a dominant player, its profit decreases for the exogenous wholesale price constraint.

5.2 Sensitivity analysis of some parameters

First, we change the cross-price sensitivity \(\theta\) and analyze its impact on the optimal decisions and profits in the omnichannel supply chain under four different models. The results are shown in Figs. 2, 3 and 4. The default values of the parameters in Figs. 2, 3 and 4 are set as follows: \(\alpha = 0.2\), \(w = 0.4\), \(\beta =0.8\) and \(\theta \in [0.75,0.95]\).

From Tables 2 and 3 and Figures 2, 3 and 4, we can observe that the cross-price sensitivity has great impact on the players’ optimal decisions and profits under four models. (i) Figures 2 and 3 show that both the online and offline retail prices have positive relationships with the cross-price sensitivity. We find that the equilibrium retail prices increase in the cross-price sensitivity in all power regimes. (ii) Figure 4 shows that the service level of the physical store has negative relationship with the cross-price sensitivity in the centralized system. However, in either the MS or the VN model, the retailer’s service quality increases with the cross-price sensitivity. Besides, the retailer’s service level s is inverted U-shaped in the RS game. (iii) Tables 2 and 3 also reveal that an increase in the sensitivity of cross-price effect results in higher social surplus. Furthermore, when consumers are very sensitive to the channel price difference, the total supply chain can benefit from the centralized system compared with the other three models.

Second, we observe the effect of service cost factor change on the players’ decisions and profits in Figs. 5, 6 and 7. The parameters default values in Figs. 5, 6 and 7 are set as follows: \(\alpha = 0.2\), \(w = 0.4\), \(\theta =0.8\) and \(\beta \in [0.6,1.2]\). Figure 5 shows that the offline retail price \(p_1\) decreases with the service cost factor in the CS and RS scenarios but increases with the service cost factor in the MS and VN models. Besides, the online price \(p_2\) decreases with the service cost factor in the centralized omnichannel but increases with the service cost factor in the decentralized supply chain. Tables 2 and 3 also show that under different power structures, the centralized omnichannel performance and the individual player’s revenue decrease as the service cost factor increases. Intuitively, a higher service cost coefficient decreases consumers’ product evaluation (raising effective price) and therefore undermines the omnichannel supply chain’s competitiveness. As illustrated in Fig. 7, with the increases in the service cost factor, the physical store’s service quality decreases under different models.

Third, we analyze the impact of the BOPS channel demand expansion coefficient \(\alpha\) on the optimal pricing and service solutions, and maximal revenue under different power structures. Table 4 provides visual descriptions of the following results. It is drawn with the parameters \(\theta = 0.8\), \(\beta = 0.8\), \(w=0.4\) and \(\alpha \in [0.1,0.3]\). The coefficient of demand expansion of the BOPS channel was positive and statistically significant in all four models. From Table 4, we can observe the following. (i) Under the four models, as \(\alpha\) decreases, both the retailer’s offline and the manufacturer’s online prices will reduce. Namely, when more and more consumers become accustomed to the existence of the BOPS channel, it is optimal for the players to raise the prices and win demands and profit. (ii) The service level s of the physical store decreases with the BOPS demand expansion coefficient \(\alpha\). The increase of the BOPS channel consumers indicates a higher service cost factor would reduce the physical store’s service quality. (iii) The omnichannel supply chain performance and the individual member’s profits increase with the BOPS demand expansion coefficient \(\alpha\). It is straightforward that a large BOPS channel demand expansion coefficient attracts the retailer to make more orders from the manufacturer. Then the omnichannel supply chain performance finally receives a higher profit than before. The results are consistent with real practice.

6 Conclusions

This study applies the game theory to investigate the price and service decisions in omnichannel supply chains under different power structures. In a two-stage supply chain including one online manufacturer and one offline retailer, the manufacturer produces products and sells directly to consumers, while the offline retailer offers both the traditional and the BOPS channels to end consumers. The retailer with physical store tends to cooperate with the manufacturer to provide BOPS option and improve store service quality to guarantee that consumers could benefit from supply chain cooperation. The above settings in this study represent a more realistic business practice for firms dealing with omnichannel retailing issues. Based on the linear dual-channel demand functions, we segment the markets and derive price- and service-sensitive omnichannel demand functions. By considering the impact of retail service, we develop a centralized model and three decentralized models under different power regimes. To the best of our knowledge, this is the first work to explore the effect of the power structure on service quality and retail prices in the omnichannel supply chain.

Based on extensive numerical studies, we find power structures have a considerable influence on the omnichannel supply chain’s solutions and performance. Moreover, a dominant retailer, together with an exogenous wholesale price, leads to a higher retail price. In decentralized scenarios, a dominant retailer case could lead to optimal omnichannel system performance in our models. In a manufacturer Stackelberg’s omnichannel supply chain, long-term exogenous wholesale price contract and the incentive mechanism for the cooperative retailer to offer BOPS channel will lead to reducing retail prices and the lowest supply chain profits. In a vertical Nash power regime, the supply chain members engage in intense competition, consumers will benefit from the highest service quality. Compared with the decentralized omnichannel system under different power structures, we note that a centralized system is more likely to place higher retail price and lower service quality to maximize its revenue. Both the manufacturer and retailer in decentralized models tend to reap the maximal profit which leads to double marginalization problem.

The preceding analysis provides a variety of managerial implications. Firstly, it shows that the offline retailer would tend to obtain service cost information, meanwhile estimate the demand expansion coefficient of the BOPS channel, to select the desired service level. Besides, the retailer should strengthen channel power when the wholesale price is exogenous. Secondly, the manufacturer can manipulate the online price depending on the retailer’s product decisions. Besides, the interest conflict of individual members and the total system leads to supply chain inefficiency but benefits consumers. Finally, the proposed models for three decentralized systems consider the retail service, and can effectively guide different members to make efficient decisions.

We propose a stylized framework to analyze the effect of power regimes on the profitability for the omnichannel supply chain. However, there remain a number of ways to extend this line of research. First, our model assumes that both the supply chain players have perfect information about service cost. One possible extension of this model would be to consider private service-cost information. Second, we build the model with one retailer and one manufacturer, it would be worthwhile to incorporate a system with more than two supply chain players. Other meaningful extensions include considering the service cooperation between supply chain players. In reality, the manufacturer may adopt policies of service to mitigate channel conflicts and improve the omnichannel supply chain performance.

References

Ailawadi, K. L., & Farris, P. W. (2017). Managing multi-and omni-channel distribution: Metrics and research directions. Journal of Retailing, 93(1), 120–135.

Cao, L., & Li, L. (2015). The impact of cross-channel integration on retailers’ sales growth. Journal of Retailing, 91(2), 198–216.

Chen, L. G., Ding, D., & Ou, J. (2014). Power structure and profitability in assembly supply chains. Production and Operations Management, 23(9), 1599–1616.

Chen, X., & Wang, X. (2015). Free or bundled: Channel selection decisions under different power structures. Omega, 53, 11–20.

Chen, X., Wang, X., & Jiang, X. (2016). The impact of power structure on the retail service supply chain with an o2o mixed channel. Journal of the Operational Research Society, 67(2), 294–301.

Dong, L., & Rudi, N. (2004). Who benefits from transshipment? exogenous vs. endogenous wholesale prices. Management Science, 50(5), 645–657.

Gallino, S., & Moreno, A. (2014). Integration of online and offline channels in retail: The impact of sharing reliable inventory availability information. Management Science, 60(6), 1434–1451.

Gao, F., & Su, X. (2016). Omnichannel retail operations with buy-online-and-pick-up-in-store. Management Science, 63(8), 2478–2492.

Gao, F., & Su, X. (2017). Online and offline information for omnichannel retailing. Manufacturing & Service Operations Management, 19(1), 84–98.

Gao, F., & Su, X. (2018). Omnichannel service operations with online and offline self-order technologies. Management Science, 64(8), 3595–3608.

Harsha, P., Subramanian, S., & Uichanco, J. (2019). Dynamic pricing of omnichannel inventories: Honorable mention-2017 m &som practice-based research competition. Manufacturing & Service Operations Management, 21(1), 47–65.

Hu, Y., Qu, S., Li, G., et al. (2021). Power structure and channel integration strategy for online retailers. European Journal of Operational Research, 294(3), 951–964.

Ishfaq, R., & Raja, U. (2018). Evaluation of order fulfillment options in retail supply chains. Decision Sciences, 49(3), 487–521.

Jiang, Y., Liu, L., & Lim, A. (2020). Optimal pricing decisions for an omni-channel supply chain with retail service. International Transactions in Operational Research, 27(6), 2927–2948.

Jin, M., Li, G., & Cheng, T. (2018). Buy online and pick up in-store: Design of the service area. European Journal of Operational Research, 268(2), 613–623.

Kolay, S., & Shaffer, G. (2013). Contract design with a dominant retailer and a competitive fringe. Management Science, 59(9), 2111–2116.

Li, G., Li, L., Liu, M., et al. (2018). Impact of power structures in a subcontracting assembly system. Annals of Operations Research, 291(1), 475–498.

Li, Q. H., & Li, B. (2016). Dual-channel supply chain equilibrium problems regarding retail services and fairness concerns. Applied Mathematical Modelling, 40(15–16), 7349–7367.

Luo, Z., Chen, X., Chen, J., et al. (2017). Optimal pricing policies for differentiated brands under different supply chain power structures. European Journal of Operational Research, 259(2), 437–451.

Luo, Z., Chen, X., & Kai, M. (2018). The effect of customer value and power structure on retail supply chain product choice and pricing decisions. Omega, 77, 115–126.

MacCarthy, B. L., Zhang, L., & Muyldermans, L. (2019). Best performance frontiers for buy-online-pickup-in-store order fulfilment. International Journal of Production Economics, 211, 251–264.

Mahar, S., Wright, P. D., Bretthauer, K. M., et al. (2014). Optimizing marketer costs and consumer benefits across “clicks’’ and “bricks’’. Journal of the Academy of Marketing Science, 42(6), 619–641.

Ofek, E., Katona, Z., & Sarvary, M. (2011). “bricks and clicks’’: The impact of product returns on the strategies of multichannel retailers. Marketing Science, 30(1), 42–60.

Raju, J. S., Sethuraman, R., & Dhar, S. K. (1995). The introduction and performance of store brands. Management science, 41(6), 957–978.

Sadeghi, R., Taleizadeh, A. A., Chan, F. T., et al. (2018). Coordinating and pricing decisions in two competitive reverse supply chains with different channel structures. International Journal of Production Research, 57(9), 1–25.

Shi, R., Zhang, J., & Ru, J. (2013). Impacts of power structure on supply chains with uncertain demand. Production and Operations Management, 22(5), 1232–1249.

Shi, X., Dong, C., & Cheng, T. (2018). Does the buy-online-and-pick-up-in-store strategy with pre-orders benefit a retailer with the consideration of returns? International Journal of Production Economics, 206, 134–145.

Xu, G., Dan, B., Zhang, X., et al. (2014). Coordinating a dual-channel supply chain with risk-averse under a two-way revenue sharing contract. International Journal of Production Economics, 147, 171–179.

Xu, H., Chu, C., Zhang, J., et al. (2017). Dynamic lot-sizing models for retailers with online channels. International Journal of Production Economics, 183, 171–184.

Zhang, J., Xu, Q., & He, Y. (2018). Omnichannel retail operations with consumer returns and order cancellation. Transportation Research Part E: Logistics and Transportation Review, 118, 308–324.

Zhang, P., He, Y., & Zhao, X. (2019). “Preorder-online, pickup-in-store’’ strategy for a dual-channel retailer. Transportation Research Part E: Logistics and Transportation Review, 122, 27–47.

Zhao, J., Tang, W., & Wei, J. (2012). Pricing decision for substitutable products with retail competition in a fuzzy environment. International Journal of Production Economics, 135(1), 144–153.

Zheng, B., Yang, C., Yang, J., et al. (2017). Dual-channel closed loop supply chains: Forward channel competition, power structures and coordination. International Journal of Production Research, 55(12), 3510–3527.

Zhou, Y. W., Guo, J., & Zhou, W. (2018). Pricing/service strategies for a dual-channel supply chain with free riding and service-cost sharing. International Journal of Production Economics, 196, 198–210.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

On behalf of all authors, the corresponding author states that there is no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Proof of Theorem 1

Substituting \(q_1\), \(q_2\) and \(q_b\) into Equation (4), and after simplification, we have

Taking the first partial derivatives of \(\pi _c^C(p_1,p_2,s)\) with respect to \(p_1\), \(p_2\) and s, we have

respectively. Then, taking the second partial derivatives of \(\pi _c^{CS}(p_1,p_2,s)\) with respect to \(p_1\), \(p_2\) and s, we further have the Hessian matrix of \(\pi _c^{CS}(p_1,p_2,s)\).

With \(\frac{\partial ^2 \pi _c^{CS}(p_1,p_2,s)}{\partial p_1^2} \frac{\partial ^2 \pi _c^{CS}(p_1,p_2,s)}{ \partial p_2^2}-(\frac{\partial ^2 \pi _c^{CS}(p_1,p_2,s)}{\partial p_1 \partial p_2})^2= \frac{4(2-\theta -\theta ^2)}{(2+\alpha )^2}>0\), the Hessian matrix \(\Delta ^2\pi _c^{CS}(p_1,p_2,s)\) is negative definite matrix if \(\Vert \Delta ^2\pi _c^{CS}(p_1,p_2,s)\Vert =\frac{1}{(2+\alpha )^3}[(6-8\theta -\frac{\theta ^2}{2}+\frac{5\theta ^3}{2})-4\beta (2-\theta -\theta ^2) (2+\alpha )]<0\). This implies that \(\pi _c^{CS}(p_1,p_2,s)\) is jointly concave in \(p_1\), \(p_2\) and s if \(\beta >\beta _1 =\frac{12 - 16 \theta - \theta ^2 + 5 \theta ^3}{8(2-\theta -\theta ^2)(2+\alpha )}\).

Next, we solve the optimal selling price of the traditional channel, the sales price of the BOPS channel and the online channel, and the service level from \(\frac{\partial \pi _c^{CS}(p_1,p_2,s)}{\partial p_1}=0\), \(\frac{\partial \pi _c^{CS}(p_1,p_2,s)}{\partial p_2}=0\) and \(\frac{\partial \pi _c^{CS}(p_1,p_2,s)}{\partial s}=0\). Solving \(\frac{\partial \pi _c^{CS}(p_1,p_2,s)}{\partial p_1}=0\) and \(\frac{\partial \pi _c^{CS}(p_1,p_2,s)}{\partial p_2}=0\) yields \(p_1^{CS} = \frac{2+\theta \alpha }{2(2-\theta -\theta ^2)}+\frac{s^C}{2}\), and \(p_2^{CS} =\frac{1+\alpha +\theta }{2(2-\theta -\theta ^2)}+\frac{s^C}{4}\).

Substituting \(p_1^{CS}\) and \(p_2^{CS}\) into \(\pi _c^{CS}(p_1,p_2,s)\), and solving \(\frac{\partial \pi _c^{CS}(p_1,p_2,s)}{\partial s}=0\) yields \(s^{CS} = \frac{4[(1-\frac{\theta }{2})(2+\alpha \theta )+(1-\frac{3\theta }{2})(1+\alpha +\theta )]}{(2-\theta -\theta ^2)[8(2+\alpha )\beta +5\theta -6]}\). Therefore, Theorem 1 can be obtained. \(\square\)

Proof of Theorem 2

Substituting \(q_1^{RS}\) and \(q_b^{RS}\) into \(\pi _r^{RS}\), we obtain

Solving \(\frac{\partial \pi _r^{RS} }{\partial p_1} = 0\) and \(\frac{\partial \pi _r^{RS} }{\partial s} = 0\) yields the retailer’s best response price:

Let \(\eta _1=16-5\theta ^2-8\theta\) and \(\eta _2=8-6\theta -3\theta ^2\), taking the second partial derivatives of \(\pi _r^{RS}(p_1,s)\) with respect to \(p_1\) and s, we further have the Hessian matrix of \(\pi _r^{RS}(p_1,s)\).

\(\Delta ^2\pi _r^{RS}(p_1,s)= \left( \begin{array}{cc} \frac{-\eta _1}{4(2-\theta )(2+\alpha )} &{} \frac{\eta _2}{4(2-\theta )(2+\alpha )} \\ \frac{\eta _2}{4(2-\theta )(2+\alpha )} &{}\frac{-8\theta -4\beta (2-\theta )(2+\alpha )}{4(2-\theta )(2+\alpha )}. \end{array} \right)\) \(\Vert \Delta ^2\pi _r^{RS}(p_1,s)\Vert >0\) if and only if \(\beta >\beta _2=\frac{\eta _2^2-8\theta \eta _1}{4(2+\alpha )(2-\theta )\eta _1}\), the manufacturer’s profit function is strictly concave. Setting \(\frac{\partial \pi _r^{RS}(p_1,s)}{\partial p_1}=0\) and \(\frac{\partial \pi _r^{RS}(p_1,s)}{\partial s}=0\) and solving them simultaneously, we obtain Theorem 2. \(\square\)

Proof of Theorem 3

Taking the first partial derivatives of \(\pi _r^{VN}(p_1,s)\) with respect to \(p_1\) and s, we have

Taking the second partial derivative of \(\pi _r^{VN}(p_1,s)\) with respect to \(p_1\) and s, we obtain that the retailer’s profit function is jointly concave in \(p_1\) and s if and only \(\beta > \beta _3=\frac{(1-\frac{\theta }{2})^2}{2(2+\alpha )}\). At the same time, taking the first partial derivatives of \(\pi _m^{VN}(p_2)\) with respect to \(p_2\), we have

Taking the second derivative of the manufacturer’s profit function with respect to \(p_2\), we obtain \(\partial ^2\pi _m^{RS}/\partial p_2^2=\frac{\theta -2}{2+\alpha }<0\), the manufacturer is concave in \(p_2\). Setting \(\frac{\partial \pi _r^{VN}(p_1,s)}{\partial p_1}=0\), \(\frac{\partial \pi _r^{VN}(p_1,s)}{\partial s}=0\), and \(\frac{\partial \pi _m^{VN}(p_2)}{\partial p_2}=0\), then solving them simultaneously, we obtain Theorem 3. \(\square\)

Proof of Theorem 4

Taking the first partial derivatives of \(\pi _r^{MS}(p_1,s)\) with respect to \(p_1\) and s , we have

Taking the second partial derivatives of \(\pi _r^{MS}(p_1,s)\) with respect to \(p_1\) and s, we further have the Hessian matrix of \(\pi _r^{MS}(p_1,s)\).

\(\Delta ^2\pi _r^{MS}(p_1,s)= \left( \begin{array}{cc} \frac{-2}{2+\alpha } &{} \frac{1-\frac{\theta }{2}}{2+\alpha } \\ \frac{1-\frac{\theta }{2}}{2+\alpha } &{}-\beta \end{array} \right) .\) The retailer’s profit function is strictly concave if and only if \(\Vert \Delta ^2\pi _r^{MS}(p_1,s)\Vert >0\), which means \(\beta > \beta _3=\frac{(1-\frac{\theta }{2})^2}{2(2+\alpha )}\). Setting \(\frac{\partial \pi _r^{MS}(p_1,s)}{\partial p_1}=0\) and \(\frac{\partial \pi _r^{MS}(p_1,s)}{\partial s}=0\) and solving them simultaneously, we obtain Theorem 4. \(\square\)

Rights and permissions

Springer Nature or its licensor holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Jiang, Y., Wu, M. Power structure and pricing in an omnichannel with buy-online-and-pick-up-in-store. Electron Commer Res 24, 1821–1845 (2024). https://doi.org/10.1007/s10660-022-09602-3

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10660-022-09602-3