Abstract

This paper offers an overview of the literature on the economic and financial applications of theory of nonlinear dynamics, especially bifurcation theory. After a short introductory discussion of the first nonlinear dynamic models in social sciences and the economic relevance of the zoo of bifurcations and complicated dynamics that such models can generate, we present an overview of the literature on nonlinear dynamic models in the areas of underdevelopment, environmental poverty traps, the management of common goods, industrial organization and financial markets. The review of the literature is enriched by reflections and ideas for future research.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The term nonlinearity evokes a plethora of complicated dynamics, such as multiple equilibria, cycles or closed orbits, path dependence, complicated structures of the basins of attractions, and global and local bifurcations. In economics and finance, nonlinear dynamics are needed to explain, replicate and provide a rigorous theoretical ground for such important phenomena as business cycles, speculative bubbles and financial crashes.

In an economic system, dynamics often enter by modeling the process of expectations formation, which is what distinguishes economics from the other scientific disciplines. To take a decision, an economic agent needs to form expectations about the consequences of her actions as well as the action of the other economic agents and the state of the economy in the future. Expectations enter in any type of economic models, from macromodels to micromodels, and play a crucial role. A change in the assumption about agents’ expectations and their updating mechanism may impact on results and predictions simulated by the model. Therefore, the design of the expectations formation process is the most critical aspect when developing, or proposing, a new dynamical model. Anticipating the discussion that will follow, let us give only three examples. First, expectations are a working hypothesis in nonlinear growth models that allows them to have multiple growth paths and to provide explanation for the economic underdevelopment. Secondly, relaxing the assumption of perfect-foresight expectations about the rival’s output in oligopoly markets allows for the study of coordination issues among competing firms. Thirdly, heterogeneous expectations are source of instability in financial markets.

Focusing on only a subset of the main issues, the current work reviews the results associated with nonlinear dynamics in social sciences. Following a narrative approach, the discussion of topics, researches and results avoids any form of detail on the construction of the models. Technicalities and methodologies are also avoided, through which the results are obtained. This allows us to reach a broader audience and to focus the attention of the reader on the economic issues. Moreover, it allows us to provide a broader historical and prospective view on the development of nonlinear dynamics in economics and to stress their relevance.

The current paper is addressed to researchers in economics and mathematics that want to appreciate the importance and relevance of nonlinear dynamical systems and bifurcation theory in social sciences. The current work offers a historical prospective as well as an outlook at the open problems in the field of nonlinear economic dynamics. A further aim of this work is to put into perspective the contributions in the current volume of the Journal, which contains the special issue Stability and Bifurcations in Nonlinear Economic Systems.

The structure of the survey is as follows. Section 2 provides a historical overview of nonlinear dynamics in social sciences. Section 3 contains an overview on the dynamic properties, such as local and global indeterminacy, through which underdevelopment/poverty traps arise in standard growth models. The section discusses also underdevelopment and environmental poverty traps in models of bounded rationality where agents follow imitative processes. Section 4 discusses the main contributions related to nonlinearity in industrial organization. Special emphasis is posed on Cournot oligopoly games, on the adjustment mechanism based on adaptive expectations about the rivals’ output and on the evolutionary selection processes adopted to select goods to produce, technology to use, heuristics to follow and so on. Section 5 discusses the importance of nonlinearity in finance, with special emphasis on asset-pricing dynamics and the role of agents’ heterogeneous expectations about future prices. Section 6 concludes and suggests possible directions of research for the future.

2 A historical overview of nonlinear dynamical systems in social sciences

... It may happen that small differences in the initial conditions produce very great ones in the final phenomena. ...

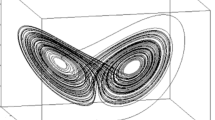

This famous quote of Poincaré is the heart of nonlinear dynamical systems. Simple, completely deterministic models are potentially able to replicate and explain quite complicated real-world phenomena, even those that appear to be unpredictable. In particular, deterministic chaos is one of the main features of nonlinear dynamical systems and it allows for the reconciliation of determinism and unpredictability. In a chaotic dynamic regime, only an infinite (i.e., humanly impossible) precision in the measures of phenomena could permit us to anticipate the future, otherwise even an extremely small error or approximation does not permit to obtain accurate long-run forecasting of the modeled phenomena. This is the property of chaos popularly known as the Butterfly Effect. Deterministic chaos is not the only consequence of nonlinearities. Multiple equilibria and different kinds of attractors (closed orbits, periodic cycles, etc.) are typical of dynamical systems where not every relationship among the variables is linear.

The history of how the assumptions of linearity have been abandoned is different for the various disciplines. One of the first fields where nonlinearities emerged is physics, celestial mechanics in particular, with Newton’s law of gravity. Poincaré proved that by considering particular classes of three-body problems, the outcome (i.e., the relative positions of the three bodies) is basically unpredictable. This is a consequence of the chaotic motion of the three bodies.

In the study of fluid dynamics, nonlinearities are present at least since the formulation of the Navier–Stokes partial differential equations, used also in meteorology forecasting. The famous system of three differential equations numerically studied by Edward Lorenz is based on the Navier–Stokes equations and proved how long-term weather forecasting is not possible. In biology, the introduction of nonlinearities allowed for the explanation of the oscillations in the density of some populations, in particular those in a prey–predator relationship (the Lotka–Volterra differential equations).

Economics is probably the science that showed (and still shows) more resistance to the introduction of nonlinearities into the equations regulating how the economic variables influence each others. We can even say that economists have been (and still are) resistant to the introduction of dynamic modeling tout court. Several standard economic models are static. This is not the place to survey all the efforts made by economists to demonstrate the existence and uniqueness of equilibria of the economic system as a whole (the so-called general equilibrium theory) or of the single markets (partial equilibrium). Even when dynamics cannot be avoided (for instance in growth theory), economists have introduced strong assumptions to guarantee the existence and uniqueness of the stationary equilibrium and of a unique path converging to it (determinacy). In such a way, predictability is saved and coexistence of attractors, complex basins of attraction and chaotic motion are excluded from the picture. An entire section of this work is devoted to discussing the complexity, expressed by local and global indeterminacy, that emerges when such assumptions are challenged for a more general nonlinear context and the related consequences in terms of economic policy analysis.

It is not so strange that nonlinearities entered in economics first through the form of piecewise-linear demand functions, either as a result of the aggregation of linear consumer demand functions (Robinson 1933) or directly in the demand function faced by oligopolists (Palander 1936). The objective was to explain some oscillatory behavior of economic variables (usually prices) or the coexistence of several equilibria. Among the papers using nonlinear relationships between economic variables, the contribution of Richard Goodwin deserves to be cited. Already in the 1950s and 1960s, Goodwin adapted the Lotka–Volterra equations to explain the emergence of endogenous fluctuations for important macroeconomic variables, such as wages, unemployment rate and output. It has been necessary to wait until the 1980s instead to discover the relevance of chaos for economic systems. In this sense, the pioneering contributions are those of Day (1982) and Grandmont and Laroque (1986). Unpredictability associated with chaos undermines, or contradicts, the assumption of perfect-foresight agents and opens the doors to nonlinear dynamic economics.

Nowadays, nonlinear models offer important contributions in almost all the subfields of economic theory. In the next sections, we will focus on the contribution of nonlinear dynamics in industrial organization, finance, environmental economics and macroeconomics. It is worth underlining that both continuous-time and discrete-time dynamical systems are considered in this survey. The systems in continuous time have a long tradition in physics and biology and are considered in economics and finance to describe business cycle models as well as learning processes based on past observations when delays are included. In particular, the delay differential equations offer an analytically tractable modeling framework to describe adjustment processes with memory. On the contrary, discrete-time dynamical systems represent the natural modeling framework to replicate economic and financial processes where agents take decisions at fixed interval of times. The differences between discrete-time and continuous-time dynamical systems are also on the complexity of phenomena that they can explain. We assume that the names of different types of bifurcations are known, and a reader who is not familiar with the terminology is referred to Kuznetsov (2004). In a discrete-time modeling framework, a nonlinear map of dimension one is even able to generate chaos, while in continuous time at least a suitable three-dimensional dynamical system is required to obtain chaotic dynamics. Moreover, some complicated global dynamical properties, such as fractal or even non-connected basins of attractions, can be observed in discrete-time dynamical systems only. These differences reflect also on the numerical techniques which are essential to study dynamical systems (especially global phenomena, i.e., those not related to the behavior of the systems in a neighborhood of an equilibrium). The numerical techniques for continuous-time dynamical systems are often different from the ones used for discrete-time dynamical systems. The reader interested on these aspects can have a look at Kuznetsov (2004) and Bischi et al. (2016) where some analytical and numerical techniques are presented to study local and global bifurcations in both continuous and discrete time. A simple software for beginners equipped with a user-friendly mask, the E&F Chaos software, is described in Diks et al. (2008).

3 Nonlinear growth models and beyond: poverty traps and environmental issues

Multiple equilibria are a striking feature of nonlinear economic systems. These equilibria are classified according to two relevant properties, asymptotic stability and optimality. Asymptotic stability is a mathematical property of an equilibrium revealing that nearby states, or orbits, converge to the equilibrium itself. Optimality is an economic feature and indicates the welfare of the system at an equilibrium. Optimality is typically by Pareto, and it indicates that an equilibrium is optimal when another Pareto-dominant equilibrium does not exist. The discrepancy between optimality and asymptotic stability leads to an important poverty trap phenomenon, when an asymptotically stable equilibrium is not optimal.

A poverty trap is a nonlinear phenomenon well known in economics. It underlines how nonlinearity is essential to get theoretical results consistent with empirical evidences. Indeed, there is a discrepancy between observed persistent differences of the output per worker in very rich and very poor countries and the theoretical predictions of traditional neoclassical growth models that the nations with identical economic structures will converge to the same steady state or balanced growth path.

This example refers to the issue of underdevelopment, which motivated the first studies in nonlinear economic dynamics and still remains a puzzle for economists. Social scientists have developed three different working hypotheses to explain the persistence of different growth paths and at least two of them evoke nonlinear dynamics (see Azariadis 1996 for a critical overview). The first hypothesis, known as the “fundamental view,” does not employ nonlinear dynamics arguments and explains persistent inequality in terms of exogenous elements as innate characteristics or inherently differences among economies in the fundamental aggregate features, i.e., time preferences, technology, demography, market structure or economic policy. In contrast, the second and the third hypotheses use nonlinear arguments to endogenize the mechanisms responsible for differences in the balance growth paths of countries.

The second hypothesis explains persistent inequalities in terms of circumstance positions. According to this theory, also known as the “historical view,” the economic growth follows a nonlinear dynamical system with multiple equilibria. Initial stocks of human and physical capitals and the state of the technology are circumstances that affect the starting point of the growth process. A different initial condition implies a different equilibrium in the long run, which explains the underdevelopment of many economies.

The models based on the historical view can be classified in two groups, depending on whether concavity of production function is assumed or not. In growth models with concave production function, multiple equilibria are obtained through either discontinuous or continuous, piecewise-differentiable dynamical systems. Non-differentiable points or discontinuous points may be originated by technological conditions, e.g., when the aggregate production function is Leontieff. In this case, suboptimal equilibria correspond to technological traps. Multiple equilibria can be obtained without additional assumptions in growth models with non-concave production function. A simple model developed according to the historical-view theory is proposed in Böhm and Kaas (2000), where a (neoclassical) Cobb–Douglas production function is considered showing that differential saving causes complicated dynamics. A variant of this model that accounts for non-concave and non-continuous production functions is analyzed, for example, in Brianzoni et al. (2012), where a discrete-time Solow–Swan growth model with differential saving is considered and the role of variable elasticity of substitution is discussed. The investigation reveals the presence of an unbounded endogenous growth path. In Grassetti et al. (2018), the model is extended further by considering differential savings and the so-called shifted Cobb–Douglas production function. The investigation reveals that the non-concave production function generates a poverty trap. The peril to end up in a poverty trap is represented by nonlinear phenomena generated by the model, such as non-connected basins of attractions and complex dynamics (see, e.g., Naimzada et al. 2013).

The third working hypothesis focuses on the role of expectations within the standard optimal growth theory. Dynamic nonlinear models may lead to phenomena like overtaking and rank reversals and produce multiple attractors. The equilibrium growth paths that converge to the lowest of these attractors, i.e., poverty traps (or development traps), explain asymptotic differences in the standard of living among nations that are similar in both the economic structure and initial conditions. This “multiple equilibrium paths” view is considered in, e.g., Krugman (1991), Matsuyama (1991, 1995), Galí (1994) and Graham and Temple (2006).

An interesting and influential contribution belonging to this last view is the regime-switching model of credit frictions by Kiminori Matsuyama (see Matsuyama 2007). Developed within an overlapping generation framework, it is a macroeconomic model of credit market imperfection. The model suggests how investment-specific technological changes may occur endogenously through the credit channel. The model generates a rich set of dynamic behaviors characterizing the growth paths of the national economies, such as credit traps (or poverty traps), credit collapse, growth miracles, leapfrogging, reversal of fortune and overshooting dynamics. In a context of Pareto-rankable multiple equilibria, an economy is in a credit trap when it converges to a non-Pareto-optimal equilibrium due to frictions in the credit market that affect the macrodynamics. Growth miracles describe situations of a country that succeeds in escaping a poverty trap. Leapfrogging describes situations in which an economy with an initial lower growth rate takes over the growth rate of another economy as time elapses. Opposite is the case described by the phenomenon known as reversal of fortune, while overshooting dynamics show a situation in which the economy is characterized by high growth rates followed by low growth rates. These rich dynamics are generated by a very simple one-dimension discrete-time dynamical system known as the Matsuyama map. A complete characterization of the bifurcation structures observable in this model is provided in Matsuyama et al. (2018).

The discontinuous, or piecewise-differentiable, nature of nonlinear growth models implies that this field of research requires new mathematical methods. Specifically, the recent developments related to the growing mathematical literature on border-collision-bifurcation theory allow researchers to characterize the global dynamics generated by nonlinear economic models and to explain the effects of specific economic policies. For an overview of basic concepts and results in the border-collision-bifurcation theory see, e.g., di Bernardo et al. 2008; Gardini et al. 2019.

Underdevelopment phenomenon is not only related to macroaspects. Another field of research examines the microeconomic reasons why coordination of economic activity may fail and causes persistent poverty. Using a microframework, Accinelli and Sanchez-Carrera (2012) shown how persistent states of underdevelopment or suboptimality can arise in strategic environments in which players are imitative rather than fully rational. In their work, the economy is analyzed as an evolutionary game. In this modeling framework, poverty traps, environmental traps and efficiency traps are self-confirming equilibria in evolutionary stable strategies. These suboptimal outcomes originate from limited information sets, imitative behaviors and bounded rationality that characterize the economic agents. The convergence to suboptimal equilibrium configurations is typical in evolutionary game theory through the adjustment mechanisms such as the replicator dynamics which account for the so-called spiteful behaviors (see, e.g., Hamilton 1970). A suboptimal path in these models is generated after a single deviation from an optimal equilibrium that damages the other agents more than the economic agent that deviates. After this deviation and with a mechanism based on chasing the best-relative performance (and thus mimicking a sort of Darwinian selection in economic behaviors), a poverty trap (which is a Pareto-dominated Nash equilibrium) becomes a stable steady state. The robustness of these results is based on the fact that perfectly rational agents, for instance profit maximizers, are not the best survivals under evolutionary selection (see Schaffer 1989). Avoiding the details, let us point out that replicator dynamics describe a trial-and-error learning processes, or a dynamic selection device for strategies, according to which players find that some strategies perform better than the others, and afterward, the probability to adopt or simply imitate such strategies gradually increases. This change in probabilities may revert the order of preference among available strategies (see again Hofbauer and Sigmund 2003).

Coming back to general equilibrium models of endogenous growth, the stability of suboptimal equilibria in a Pareto sense is not related to underdevelopment of the economic activity only. Nonlinear dynamics are relevant to study environmental issues that affect the development of an economy and may be responsible for multiple balance growth paths. Classical environmental issues tackled by macromodels of endogenous growth regard environmental degradation and depletion of natural resources attributable to economic activity. In case of excessive pollution or overexploitation of renewable and non-renewable natural resources, the peril is to end up trapped in the so-called environmental poverty traps. It occurs when multiple equilibrium growth paths exist and the economy follows a non-Pareto-optimal one, i.e., the equilibrium path with lower income and higher environmental degradation.

Economists began to include environmental externalities in neoclassical economic models of endogenous growth several decades ago, starting the environmental economic literature. Among the early examples, we mention the Green Solow model, recently reconsidered in Brock and Taylor (2010), and the Ramsey–Cass–Koopmans model with environmental pollution (see, e.g., Xepapadeas 2005). A standard approach consists in integrating environmental variables in an endogenous growth framework to study the effect of policy maneuvering to achieve the desirable goal (see, e.g., Fullerton and Kim 2008). An interesting case is analyzed in Maccioni (2018). Their economy features defensive consumption, where agents can substitute depleted environmental goods with private substitute goods. This mechanism of substitution stimulates economic growth through overconsumption and leads to a complete degradation of environmental goods. To avoid such a situation, economic policy strategies are required and need to be studied.

The task, however, is not simple. The normative aspects in general equilibrium models of endogenous growth with environmental externalities present elements of complexity that require advanced nonlinear mathematical techniques. The complexity is mainly related to global and local indeterminacy. Local indeterminacy implies that there will be multiple paths converging to a given steady state. On the other hand, global indeterminacy implies multiple balanced growth paths along which the economy can persistently grow in the long run. The impact of indeterminacy on the effectiveness of economic and environmental policies is relevant. Issues related to local indeterminacy in models of environmental dynamics are discussed (e.g., in Antoci and Sodini 2009). The literature on the effects of global indeterminacy in models of environmental dynamics is rather limited and hampered by the sophisticated bifurcation theory techniques required. Few exceptions are the contributions in Pérez and Ruiz (2007), Antoci et al. (2011b, 2016). Pérez and Ruiz (2007) considered a two-dimensional endogenous growth model with pollution and public abatement activities and shown that global indeterminacy is able to explain why economies with similar fundamentals (preferences, technology and initial capital stock) that choose the same public policies might display different pollution paths. Antoci et al. (2011b) used global analysis techniques to analyze an economic growth model with environmental negative externalities proposed in Wirl (1997). The investigation reveals global indeterminacy, with a locally stable equilibrium, a poverty trap, that coexists with an equilibrium characterized by saddle-node stability. A numerical analysis shows the existence of a limit cycle when the initially locally stable equilibrium loses stability.

The above discussion underlines how advances in bifurcation theory are of fundamental importance to investigate environmental economics. Recent advances in bifurcation theory have allowed to deeper the knowledge on the effects of economic policies and underlined them as possible source of indeterminacy. In this issue of the Journal, Bella and Mattana (2018) used Bogdanov–Takens theorem to study the effect of a fiscal policy in an endogenous growth model with environmental externalities. The Bogdanov–Takens theorem is a mathematical result that allows for a reduction of the dimension of the highly nonlinear original system and to determine the critical regions of the parameter space at which orbits growing in the vicinity of the non-saddle steady state (a possible suboptimal equilibrium) may eventually collide with the saddle steady state via a heteroclinic connection (see Kuznetsov 2004), and therefore escape eventual suboptimal growth paths. Bella and Mattana (2018) contributed to the literature that investigates the role of non-renewable resource depletion on long-run growth and thereby focused on the identification of the economic mechanisms that are able to offset the possible limitations arising from the scarcity of natural resources. To simulate the effects of policy-making on long-run growth, and to achieve a stable equilibrium, this normative approach mainly integrates the environmental variables within an endogenous growth framework, in a context where the existence of a unique long-run equilibrium leaves unexplained a number of puzzling empirical real-world regularities, including the observation of environmental poverty traps. The paper shows that a fiscal policy may induce the onset of two coexisting steady states, one of which characterized by a lower depletion rate and higher income (the virtuous steady state) than the other (the bad steady state). They find that the fiscal policy can create a continuum of equilibria leading toward the virtuous steady state.

The literature on economic growth models in discrete time considering environmental aspects is also relevant. There are mainly overlapping generation (OLG) models able to capture the occurrence of short-run or medium-run nonlinear phenomena and describe the nonlinear interactions between economic activity and environmental dynamics. Examples are the discrete-time overlapping generation models in Zhang (1999) and Naimzada and Sodini (2010) that extend John and Pecchenino (1994) accounting for environmental exploitations and that are able to produce chaotic dynamics. See Caravaggio and Sodini (2018) for a survey on recent contributions.

Environmental economics goes beyond the problems of economic growth. Indeed, the particular feature of natural resources and the strategic interactions among economic agents play a fundamental role in managing an environment. The seminal contribution by Hardin (1968), with the famous slogan or emblematic title the tragedy of the commons, emphasizes strategic aspects and peculiarities characterizing natural resources which, in order to be thoroughly analyzed, require a dedicated theoretical framework that goes beyond the neoclassical growth models. These aspects need to be managed, or at least taken into account or be aware of them, when studying environmental economics. They can be synthesized in a game where multiple, independent players compete for the same natural resources. The impossibility to exclude the competitors leads to overexploitation. Indeed, exploiting as much as possible today is individually rational, because the negative externalities of this behavior will be shared among all agents. This is a classical prisoner dilemma, where there is a Pareto-optimal outcome, but all agents have an incentive to deviate from it and end up in a suboptimal solution (environmental trap) that does not offer any incentive to deviate. Analogy is not accidental, game theory provides an effective and precise language for discussing specific environmental conflicts and is exactly the theoretical framework used to study the problem of overexploitation also not related to natural resources. The contributions related to the possibility of achieving environmental targets are well-known, such as the international agreements on climate actions aiming to reduce greenhouse gases emissions. The strategic sustainability of these agreements, which resemble a prisoner dilemma, are analyzed by the two main streams of research in game theory, cooperative game theory and noncooperative game theory. Cooperative game theory looks at punishment schemes that make the non-complaint strategy non-convenient, while noncooperative game theory studies alternative forms of cooperations or incentive schemes that make compliance a Nash equilibrium strategy (see, e.g., Breton et al. 2010). This fruitful field of research is still active and many open questions need an answer yet, as underlined, for example, in Biancardi and Villani (2014), where it is pointed out that the decision process related to international environmental agreements requires complex relationships (multistage games) which deserves further investigations.

Common groundwater is another famous example of common good that inspired an entire field of research. Emblematic is the problem known in economics as shallow lakes, often formulated as a game where multiple type of players act either using the water in a lake or producing negative externalities that impact on the quality of the water in the lake. This problem inspired a huge quantity of research papers (see, e.g., Mäler et al. 2003 and references therein). The peculiarity of this type of problem is related to the nonlinear dynamics of the lake causing a challenging economic analysis that requires solving non-standard optimal control problems. The recent advances on bifurcation theory and nonlinear dynamical systems are therefore fundamental for the developments of this stream of research, where the lake model can also be viewed as a metaphor for many of the ecological problems that mankind is facing today, so that the technicalities developed and the results obtained for the shallow lake game have a wide applicability.

A recent contribution of Biancardi and Maddalena (2018), included in this issue of the Journal, considers the problem of groundwater management introducing the further aspect of environmental damages due to over-exploitation of the groundwater resource (see Esteban and Albiac 2011), in a model proposed in Rubio and Casino (2001). They contribute to the existing literature by considering heterogeneous farmers that can be classified as cooperators or defectors. In a water conflict, in fact, different groups or individuals can be modeled as players. Each player can make choices unilaterally, and the combined choices of all players together determine the possible outcomes of the conflict. Methodologically speaking, the problem has been analyzed in static form, when each agent is asked to select its strategy once and forever, as well as in dynamic form, when agents revise their strategy over time, computing both open-loop and feedback equilibria. Two regimes or equilibria are observed: the non-cooperation regime, which is characterized by pumping that leads to depletion of the aquifer, and the cooperative regime, which preserves the resource. The investigation reveals that the sustainability of the two regimes depends on the number of cooperators and defectors and that the difference between them is very small. Results like those establish that potential benefits coming from the regulation of the resource are relatively small.

The overexploitation of renewable natural resources such as fisheries is another historical issue that is inherently nonlinear, dynamic and present elements of strategic interaction. Scholars studied different forms of regulations used by management institutions and used models to test alternative solutions. The complexity is related to different aspects. The fish stock dynamics are nonlinear, e.g., logistic. Biological interaction between species of fish needs to be taken into account, e.g., a predator–prey relationship. Overexploitation does not affect the growth rate of a single specie of fish only, but of all the species of the marine ecosystem where the harvested species live. Harvesting a predator may destroy the natural environment, while harvesting a prey reduces predator’s food. These are examples of environmental negative externalities that need to be regulated. Another source of complexity is related to the common good characteristic of fish, which is therefore not immune to overexploitation as documented by empirical fisheries data in McWhinnie (2009). To avoid poverty traps in harvesting fish, many forms of regulation have been proposed. Some of these regulations impose harvesting restrictions, such as constant efforts, individual fishing quotas and taxation, while other regulations limit the kinds of fish to be caught or the regions where exploitation is analyzed (see, e.g., Clark 1990; Fischer and Mirman 1996; Anderson 2002; Bischi and Lamantia 2009; Bischi et al. 2004). The study of the consequences of these regulations requires to analyze nonlinear dynamical models by using bifurcation theory as well as mathematical and numerical techniques often developed ad hoc.

The effectiveness of a regulatory method depends on the compliance rate. This issue does not always have cheap solutions. To overcome the problem, the normative aspect does not always have a strong connotation. Milder regulations are possible and have been adopted to regulate the use of common resources. For example, inspired by an Italian fisheries management experience in the Northern Adriatic Sea, Bischi et al. (2013a, b) considered a fishery in which fishermen are divided into two groups according to the species of fish they are allowed to harvest. Each fisher reconsiders the harvesting decision at fixed and discrete periods of time, while the biological growth rate of the species of fish evolves in continuous time. The combination of discrete-time and continuous-time dynamics in a single model generates a so-called hybrid dynamical system. The numerical analysis of this system reveals that the adaptive self-regulation fishing policy at stake may ensure a virtuous trade-off between profit maximization and resource conservation, driven by cost externalities and market pressure.

The contributions and research topics mentioned so far are only a few of those proposed in the environmental–economic literature. A growing stream of research uses bifurcation theory and nonlinear dynamic techniques to analyze evolutionary models describing self-protection strategy to avoid pollution or issues related to traffic congestion (see Antoci 2009; Antoci and Borghesi 2010), incentive schemes to promote environmentally friendly technology based on financial or insurance instruments (see Antoci et al. 2009, 2011a, 2013), and market incentives to promote harvesting technologies with a lower environmental impact (see Lamantia and Radi 2015).

4 Nonlinear dynamics in oligopoly and monopoly models

The initial and prolonged historical reticence of the literature on economic growth theory toward nonlinear dynamic models is not reflected in industrial organization. Dynamics in industrial organization have been taken into consideration since its earlier and founding contributions. Cournot himself considered a dynamic version of his famous duopoly model by introducing the so-called Cournot adjustment process, that nowadays is known as static expectations of the rival’s output.Footnote 1 The model that Cournot studied is described by a linear map. The unique steady state of this linear model is the Nash equilibrium of a one-shot game; it is globally stable in the case of duopoly, but it may become unstable with more than three firms (see Theocharis 1960).Footnote 2

Multiple equilibria start to emerge as long as the linearity assumption is abandoned. Palander (1936) and Wald (1939) are the first examples of models with multiple Cournot equilibria that arise as a consequence of a piecewise-linear demand function. Besides these pioneering contributions, it is necessary to wait until the 1990s to see a re-discovery of these contributions in the lights of the new tools (analytical and numerical) available for global analysis. A critical revision follows and provides an overview of these results and of the nonlinear configurations for imperfect markets, such as monopolies, duopolies and oligopolies, considered by the literature of industrial organization. Before entering the details, we reiterate that an expectations scheme that deviates from the perfect-foresight hypothesis is one of the ingredients to introduce dynamics in monopoly, duopoly or oligopoly models.

Let us consider the simplest market configuration: monopoly. Only one firm serves the market, trying to maximize the profit. Puu (1995) studied a version of the monopoly model where the inverse demand function is bimodal and the marginal costs are quadratic. Dynamics originate from the bounded rationality of the monopolist, who only partially knows the profit function and adjusts the quantity produced by using the last combinations of price and quantity. The model has multiple equilibria, and chaotic dynamics may occur when the reactivity of the monopolist becomes too large. Similar results have been obtained in Naimzada and Ricchiuti (2008) with constant marginal costs, and in Cavalli et al. (2015) with an isoelastic demand function, where the role of elasticity on stability is investigated as well. Tuinstra (2004) instead investigated the role of a misspecified demand function in a monopolistic setting, finding that complex dynamics may emerge under certain conditions. Recently, dynamic monopolies have also been studied in the models with a continuous-time formulation. Matsumoto and Szidarovszky (2012) proposed a dynamic monopoly formulated in continuous time. They still consider a boundedly rational monopolist adjusting the quantity produced by looking at the marginal profit, but they also take into consideration delays in obtaining and implementing information on output. Bounded rationality and delays are proved to be at the origin of periodic or chaotic dynamics. Extensions of this model are Matsumoto and Szidarovszky (2014a, b, 2015a, b) and Gori et al. (2016), among the others. In this vein is the work of Guerrini et al. (2018) published in this issue. The paper investigates the emergence of limit cycles in a monopoly setting in continuous time with delays and nonlinear (isoelastic) demand function. An approach connecting continuous-time and discrete-time models is proposed in Cavalli and Naimzada (2016), who studied a monopolistic firm that adapt production decisions continuously in time, but on the basis of a discrete, periodic collection of information about the market.

The case of duopoly, where two firms compete in the same market, is also investigated thoroughly. The presence of two competitors makes the things more complicated, and it becomes even more realistic to assume some form of bounded rationality of the firms. In fact, in duopoly (and oligopoly in general) firms do not only have to know the shape of demand and cost functions, but also to anticipate the choices of the competitor to build their profit functions and then maximize them. Economists focus on the expectations or beliefs formed by each duopolist on the choice that the other firm is going to make. Static models of duopoly usually assume, as already stressed, linear demand and cost functions, and consequently linear reaction functions.Footnote 3 These assumptions exclude multiplicity of (Nash) equilibria. Moreover, these models are based on the assumption that firms’ expectations do not induce systematic mistakes (the so-called rational expectations), and this keeps the model static, where firms are able to coordinate to play the unique equilibrium in one shot.

These features are hardly realistic. We have already talked about the dynamic version of the model made up by Cournot, replacing rational expectations with static ones. In a linear world, the only consequence of this alternative assumption consists in proving that the duopoly equilibrium is globally stable. Other adjustment mechanisms or expectations confirming the stability of the Cournot–Nash equilibrium are surveyed in Friedman (1977). Rand (1978) and Dana and Montrucchio (1986) are to our knowledge the first researchers who conjectured and tried to show how complex dynamics may emerge in duopolies where some of the classical assumptions are abandoned. The duopoly model of Puu (1991) is of capital importance in this respect, as it was shown that the linearity of the demand function lacks realistic microfoundations.Footnote 4 By using a standard Cobb–Douglas formulation of the utility function of the representative consumer, the resulting demand function will be hyperbolic and thus nonlinear. The market price depends on the inverse of the total quantity brought to the market by the firms. This demand function is now known as isoelastic demand function. By coupling this kind of nonlinearity in the demand function (leading to nonlinear, unimodal, reaction functions as suggested by Poston and Stewart 1978) and the assumption of static expectations, Puu shown that if the asymmetry in the efficiency (i.e., marginal costs) of the two firms is sufficiently large, the Cournot equilibrium becomes unstable and complex dynamics (periodic or chaotic) arise. Alternatively, unimodal reaction functions are assumed without discussing microfoundations, as it is in Kopel (1996). These models can give rise to multiple equilibria, and there is a branch of the literature dealing with that. In particular, complex dynamics and interesting global phenomena may arise by introducing boundedly rational decision mechanisms or expectations formations schemes.

Bischi et al. (1999) considered the possibility that a firm only partially knows the shape of the profit function, in correspondence with the current couple price-total output. In such a case, firms can decide to increase or decrease their production according to the signal given by the marginal profit. They show that if their reactivity to this signal is too strong, firms may fail to learn the Cournot equilibrium and complex dynamics may arise. Ahmed et al. (2000) extended the results to the case of differentiated products. Bischi et al. (2000) deeply investigated the global phenomena associated with this kind of maps, showing how periodic cycles and chaos naturally arise. Agliari et al. (2006) introduced an adaptive decision mechanism (firms only partially adjust the quantity toward the best reply adopting static expectations) and investigated global bifurcations related to subcritical Neimark–Sacker bifurcations and the appearing of repelling closed invariant curves. Bischi et al. (2007) considered firms that conjecture a linear demand function, when in reality this function is not linear, introducing the so-called Local Monopolistic Approximation (LMA) decision mechanism and show that less information implies more stability when naïve expectations are used. A more recent stream of the literature analyzes the consequences of an asymmetry between firms about their decision mechanism adopted in the absence of complete information. Angelini et al. (2009), Tramontana (2010), Cavalli and Naimzada (2014) and Cavalli et al. (2015) are examples of duopolies where firms are heterogeneous. A typical result of these models is that the equilibrium can be destabilized both via period-doubling and Neimark–Sacker bifurcations, leading to periodic, quasi-periodic and chaotic dynamics. In this special issue, Brianzoni et al. (2018) moved from the heterogeneous duopoly of Tramontana (2010) and transformed it in a continuous-time version, with time delays following a methodology introduced in Matsumoto and Szidarovszky (2014a). They study the role of marginal costs and time delays for the emergence of complex dynamics, highlighting their destabilizing role.

Nonlinear reaction functions may also be derived from alternative assumptions, such as a CES utility function of the consumers (see, e.g., Agliari et al. 2016), or more complicated cost functions, taking into consideration economies or diseconomies of scale, see Furth (1986) and more recently (Tramontana et al. 2009; Dubiel-Teleszyński 2011). In this special issue, Caravaggio and Sodini (2018) considered consumers with CES utility function like Agliari et al. (2016) and introduced in this framework heterogeneous decision mechanisms and product differentiation. They show that under suitable circumstances, the Cournot equilibrium may lose stability with both high and low level of differentiation.

When the number of firms increases, other aspects of oligopolistic markets are investigated and some of them may become further sources of nonlinearity in the dynamical systems. A first element taken into consideration since the beginning of the mathematical studies of industrial organization is the role played by the number of firms operating in the market. In a linear world (i.e., with linear demand and cost functions) and firms endowed with static expectations, Theocharis (1960) proved that with more than three firms, the Cournot–Nash equilibrium becomes unstable, but, as a consequence of the linearity assumptions, if the unique equilibrium is unstable, only diverging trajectories may occur. More interesting out of equilibrium dynamics occur by increasing the number of competitors if we assume a nonlinear demand function (see Ahmed and Agiza 1998; Puu 2008) or nonlinear cost functions (Okuguchi 1970). Some authors have tried to find conditions leading to a more stable equilibrium (i.e., stable also with three or more firms). For example, Fisher (1961) proved that the equilibrium of an oligopoly with more than three firms may be stable when quadratic costs, reflecting the adoption of a decreasing-return to scale technology, are considered. The finding suggests a rule, often true, that technological inefficiency increases stability in oligopoly models with boundedly rational players. Szidarovszky and Okuguchi (1988) demonstrated that even in a linear world, if static expectations are replaced with adaptive expectations, it is possible for the equilibrium to remain stable for any number of firms. Puu (2008) obtained a more stable equilibrium in the case of firms whose production is affected by capacity limits. Other contributions deepen the complex dynamics that may emerge when the Cournot equilibrium of the oligopoly is unstable, and this is the case of Bischi et al. (2007), who consider boundedly rational firms adopting an LMA decision mechanism in a market setting characterized by isoelastic demand function and linear or quadratic costs. Related to these research questions is also the contribution of Cavalli et al. (2018) in this issue. They build an oligopoly where firms, differently from the above-mentioned contributions, adjust production decisions slowly in continuous time. However, the information about others’ output is collected periodically, leading to a discrete-time input into the continuous-time system. Differential equations describing system then have a piecewise-constant argument. The authors investigate the role of the time lag between two consecutive learning activities not limiting the analysis to a local study of the stability of the equilibrium but also performing some global analysis.

All studies discussed above share the assumption that firms are homogeneous, i.e., they are characterized by the same information and degree of rationality. Expectations and decision mechanisms are also the same for all the firms, and so firms may only differ in their marginal costs. Another interesting branch of research on nonlinear oligopolies investigated the role of heterogeneity in the aspects other than marginal cost. Somewhat extreme example here is the contribution of Tramontana et al. (2015), who consider each firm different from the other in a market setting with nonlinear demand function. They show that heterogeneity can even lead to stability of the equilibrium that would otherwise, when firms are homogeneous, be unstable. If firms are allowed to switch from one strategy to another, other nonlinear elements can be added to the system and researchers can perform an analysis from an evolutionary point of view. See Hofbauer and Sigmund (2003) for an overview of strategy-selection mechanisms offered by evolutionary game theory. In fact, the usual assumption in this framework is that firms tend to switch to the strategy that in the past brought a higher profit. What is the dynamic role of this switching? Would only one strategy survive (the Darwinian survival of the fittest) or may several strategies coexist forever? These are the central questions in these evolutionary models of oligopoly. Probably, the first paper studying an evolutionary oligopoly as a nonlinear dynamical system is Droste et al. (2002), where the authors consider two possible behavioral rules (best-reply rule and Nash rule). The switching mechanism they adopt is a version of the so-called replicator equation, a nonlinear equation originally studied in biology (see Taylor and Jonker 1978), but later frequently used also in game theory (see again Hofbauer and Sigmund 2003 and reference therein). The nonlinearity in the switching mechanism is the only nonlinearity of the model in Droste et al. (2002), and it leads to complex dynamics and endogenous fluctuations of quantities produced under different behavioral rules and their relative shares. Similar results considering different decision mechanisms are obtained in Bischi et al. (2015, 2018), Cerboni Baiardi et al. (2015), Cavalli et al. (2015) and Hommes et al. (2018).

In this special issue, Cerboni Baiardi and Naimzada (2018) considered an evolutionary oligopoly with boundedly rational firms and two possible boundedly rational strategies: best reply with static expectations and an imitation of the competitors. As opposed to some previously mentioned papers, in their model, the parameter of intensity of choice, which measures how sensitive firms are to the past profits of strategies, does not necessarily play a destabilizing role. Local and global analyses are performed by the authors, who find complicated dynamic scenarios. The investigation reveals that the Cournot–Nash equilibrium is asymptotically stable, but it can lose stability for certain parameter configurations, while another equilibrium exists which is unstable and corresponds to the Walrasian equilibrium when the implementation cost associated with the best-reply strategy vanishes. This finding is related (and somehow different) to a counterintuitive result in Vega-Redondo (1997), who shows that the Walrasian equilibrium is the only evolutionary stable strategy in an oligopolistic market. This is despite the fact that all firms would be better off at the Cournot–Nash equilibrium. This result is partially confirmed by experiments in Apesteguia et al. (2007) and by a nonlinear evolutionary oligopoly in Radi (2017) where the Walrasian equilibrium results to be asymptotically stable, but coordination problems may destabilize this market-equilibrium configuration and the Cournot–Nash equilibrium may gain stability, at least in Milnor’s sense (see Milnor 1985). Further relevant contributions on this issue are Vriend (2000) and Anufriev and Kopányi (2018).

Evolutionary oligopolies may also refer to different kinds of decisions a firm should make. Diks et al. (2013) and Hommes and Zeppini (2014), for instance, considered oligopolies with firms facing alternative R&D strategies (to innovate or to imitate), while Lamantia and Radi (2015) considered economic agents, such as fishermen, involved in an oligopolistic competition to serve a market that requires to exploit a natural resource. Before entering the oligopolistic competition that determines the level of sold output, these agents choose between two kinds of technologies with different impact on the natural growth of the resource. This vein of research includes also Lamantia and Radi (2018). Considering a forward-looking setup, they show that an evolutionary selection mechanism may lead firms to select suboptimal technology of production, a classical inefficiency trap. In this volume, a similar problem is considered in Lamantia et al. (2018). They study an evolutionary model of oligopoly where firms make quantity and R&D decisions. Different technologies are compared and chosen by the firms, and the emergence of complex dynamics is studied by the authors.

A parallel stream of research investigates similar problems in a Bertrand setting, where firms select the price at which they sell their products instead of quantities. See, e.g., Dubiel-Teleszyński (2010), Fanti et al. (2013) and Ahmed et al. (2015), for remarkable contributions that demonstrate how simple Bertrand models can generate complicated price dynamics.

5 Nonlinearity in financial modeling

The dynamic approach discussed so far does not exhaust its fields of application to economic growth problems, to environmental issues or to describe competition in oligopoly markets. Nonlinear dynamics theory is relevant especially to describe and model market price fluctuations. Price fluctuations of financial assets, houses, other commodities attract attention of almost everyone in society. Most people are just fascinated by historical accounts of famous episodes of bubbles such as tulip mania or dot-com bubble followed by seemingly inevitable crashes. Practitioners are satisfied when market dynamics support their investment strategies and fear that some unexpected event may ruin their fortunes. For academics, these price fluctuations motivate development of theories and policy recommendations, and testing those theories.

The development of economic theories of price movements can also be depicted as a sophisticated trajectory with its own booms and busts. In \(1930\hbox {s}\), \(1940\hbox {s}\) and \(1950\hbox {s}\), the works of Paul Samuelson, Richard Goodwin, John Hicks and others used nonlinear dynamic modeling to explain apparent irregularity and cyclicality in the price movements. However, the development of the theory of rational expectations by John Muth, Robert Lucas, Edward Prescott and others, in 1960s and 1970s has shifted academic attention to the linear world where fluctuations would be explained as a reaction of economic system to a shock, making the origins of fluctuations exogenous. Similar development has happened around the same time in finance, where the works of Eugene Fama, Robert Lucas and others have outlined empirical as well as theoretical foundations of the efficient market hypothesis. Rational bubbles with self-confirmed predictions are, in theory, possible, but forward-looking agents should recognize their explosive or implosive nature and thus effectively stop them before those even start (see, e.g., Diba and Grossman 1987). What looks like a crash for an outsider is a consequence of exogenous preference changes rather than of endogenous system property.

It is fair to say by looking at the papers in the top journals in economics that those rational views dominated economic science during the last decades. However, already starting in the late 1980s, an interest in role of nonlinear modeling and bounded rationality in economics has seen a strong return with a wide range of applications from game theory to macroeconomics. This time, there was also a strong interdisciplinary flavor of the research, which culminated in three Santa Fe Institute volumes “The Economy as an Evolving Complex System” published in 1988, 1997 and 2006 (see Anderson et al. 1988; Arthur et al. 1997; Blume and Durlauf 2005). In recent years, economists produced an abundance of experimental evidence of human decisions supporting bounded rationality and behavioral heterogeneity, and of empirical evidence revealing a lot of discrepancies between real phenomena and predictions of standard linear models of financial markets. Moreover, developments in mathematical theories of nonlinear deterministic and stochastic systems together with advances in computational techniques made theories of nonlinearities in price fluctuations popular again.

It is now almost 20 years since William Brock, one of the pioneers and proponents of use of the nonlinear dynamics methods in economics and finance, has published a stimulating paper “Whither nonlinear?” (see Brock 2000). He concludes the paper saying that:

Even if the speculations given in this article all turn out to be off the mark, it still seems safe to project that as the costs of doing this kind of work continue to fall, the supply curve most likely will drop. Hence, the only way that the quantity of this type of work can fall is for the demand curve to fall further and it is hard to see any forces on the horizon that will push the demand curve down at all, much less further.

Brock’s prediction on the equilibrium quantity of the work using nonlinear methods in economics and finance has definitely been confirmed. It is illustrated by this Journal, for instance, but not only. Two recent reviews in the Handbook of Computational Economics of Dieci and He (2018) and Lux and Zwinkels (2018) list several dozens of financial heterogeneous agent models written in the last two decades that all feature built-in nonlinearity and many of which are investigated using the tools of bifurcation analysis. Cars Hommes’ book Behavioral Rationality and Heterogeneous Expectations in Complex Economic System (see Hommes 2013), is based upon mathematical theory of nonlinear systems and contains many other references.

Reading through the recent literature, we conclude that significant progress in heterogeneous agent modeling has been achieved. In particular, technical and mathematical advances in modeling are apparent in multiple directions and we can list here only some of them with only few examples. These are studies about (a) role of realistic trend-following strategies such as multiple moving-average rules (see Chiarella et al. 2006; He and Li 2012; b) different markets interconnected via diversification strategies of traders that thus become prone to contagion (see Westerhoff 2004; Schmitt and Westerhoff 2014; c) markets with multiple risky assets (see Anufriev et al. 2012; Chiarella et al. 2013); and (d) role of wealth dynamics for equilibrium price discovery (see Chiarella and He 2001; Anufriev and Bottazzi 2010). Built on this variety of models, researchers started to use heterogeneous agent models to study policies for market stabilization (see Westerhoff and Dieci (2006)) who focus on the effects of transaction taxes, and Anufriev and Tuinstra (2013) who analyze the consequences of restrictions on short selling.

Two papers in this special issue that propose new financial models with nonlinearities nicely add to the volume of work surveyed above. In Guerrini et al. (2018), the authors study the price evolution in the market populated by fundamentalists and trend-followers. Trend-followers base their investment decisions on two price changes, the relatively recent one and the one more remote in the past. This dynamics could emerge in the market with a mixture of two groups of trend-followers: those using short moving-average rule, and those using longer moving-average rule. Or, alternatively, this behavior can be observed when trend-followers pay attention to the delayed price pattern in addition to the past trend. This paper thus belongs to the branch (a) listed above that focuses on more realistic trend-following behavior. From the technical point of view, authors look at the dynamics in continuous time (following He and Zheng 2016) and show that the complexities due to the presence of two types of chartists (i.e., two time delays in the dynamical system) can be quite intriguing. In particular, they identify the double-edged effect of different time delays, i.e., a possibility of the system to lose and then regain stability when one of the time delay increases, holding another one at a constant level. The dynamics with limit cycles emerge in the model via Hopf bifurcation.

Dieci et al. (2018) analyzed the model where a number of participants can choose to enter one of the two markets with risky assets or abstain. Thus, this model fits to contributions in the category (b) above that concern endogenous contagion between different financial markets. The model explicitly takes into account feedback between market participation and attractiveness of markets that is due to perceived capital gains and dividend yield. By endogenizing market participation, the authors show that price deviations from the fundamental level can be caused by a low participation resulting in underpricing of assets. On the other hand, the fundamental steady state can also lose stability via Neimark–Sacker bifurcation leading to complicated periodic or quasi-periodic dynamics.

Whereas this issue contains theoretical papers, it is important to emphasize that in parallel to theoretical advances, much work in the past two decades has been done on estimation and validation of the models. One popular strategy here is to judge the model by its ability to reproduce financial empirical regularities (so-called stylized facts). Rigor can be added to this strategy by means of calibrating or estimating the model via matching the characteristics of simulated and real data, such as moments of the return distribution, autocorrelation functions and measures of volatility clustering. Examples of such studies can be found in Gaunersdorfer and Hommes (2007) and Franke and Westerhoff (2016). A prominent study by Franke and Westerhoff (2012) uses this methodology to contest different model specifications and finds that important behavioral characteristics of bounded rationality, such as herding and extrapolating the past successes of the strategies, are crucial to explain price dynamics. Other studies use more standard econometric techniques to estimate parameters in simpler models, see for instance (Boswijk et al. 2007).

In the already cited “Whither nonlinear?” paper, William Brock identifies several directions for the development of “complex systems approaches” and nonlinear analysis. Appreciating success of this work, it might be interesting and worthwhile to make a step back and use our advantage of the hindsight to see whether Brock’s speculations about directions of future research have been supported at the end and to which extent. Did he predict future research directions and successes right? Has the research followed his advice and insight?

Brock envisaged that the use of nonlinear methods, computer power and data analysis will, first of all, bring what can be called a nested approach which would incorporate both heterogeneity with bounded rationality and rational equilibrium theorizing within the same model. This would allow researchers to identify and quantify an amount of full viz-a-viz bounded rational behavior that is necessary to explain the real data. Second, Brock stressed desirability to use economic considerations (benefits vs. costs) to build in a hierarchy of behaviors into the model, from less to more sophisticated. Third, he emphasizes a relevance of different layers of dynamics in real world and a hierarchy in the speed of those dynamics (slow vs. fast, for example). In the financial context, there might be heterogeneous (and local for every agent) relevant information whose amount available can depend on the cost that the agent is willing to pay for it, on this agent’s position in the network of other agents, etc. This information structure would be changing but more slowly than the dynamics of price. On top of this slow informational layer, there can be other, even more slowly changing layers of institutional arrangements about information and economy.

Most of the progress of nonlinear modeling in finance is well in line with the first direction identified by Brock. In most of the models, researchers derive or directly impose some sort of benchmark, fundamental price dynamics that would hold under full rationality of traders, and then are focusing on deviations from this benchmark dynamics. Various measures such as excess kurtosis or excess volatility can be directly observed in the data, and when a model can reproduce them, it is possible to map these phenomena back to the model’s assumptions on individual behavior and/or estimate parameters to identify a degree of bounded rationality necessary to explain the data. The focus on behavioral parameters in parsimonious models is not surprising for an economist. Indeed, acknowledging that every model is based on somewhat unrealistic assumptions, economists are cautious to introduce bounded rationality and want to understand what a deviation from full rationality brings to the model and whether the data can support it. Thus to have an impact on economic profession, it is very desirable to build the models in the settings where bounded rationality can be clearly parameterized and where there are economic motives, such as higher cost, for abandoning more rational behavior. This is essentially the second direction where Brock predicted the work would be concentrated.

To evaluate a success of this path of identification of bounded rationality it is useful to recall some typical channels through which nonlinearity is brought into financial models. The first and most popular channel is via the switching mechanism mapping past performances of different trading strategies into the fractions of their followers. This mechanism has been already present in Brock (1993) and Lux (1995), but became especially popular after publications of the two very influential models of William Brock and Cars Hommes (see Brock and Hommes 1997, 1998), where the switching was modeled via the logit function. In this specification, not only there is a direct connection of switching behavior with an economically relevant variable like the profit, but also a possibility to quantify this switching by relating it with the discrete choice theories. An important parameter which has been since estimated in various models is the intensity of choice describing how sensitive agents are to the past profits. With this approach to modeling nonlinearity, the relative costs of using strategies of different degrees of sophistication can be directly introduced and connected to the switching behavior. This allows estimating the costs of bounded rationality as well as building the hierarchy of the models of different degree of sophistication.

Another way to introduce nonlinearity into the model is via nonlinear functional form of the trend-followers’ demand. Indeed, it is plausible that when the price starts to deviate from fundamental level strongly enough, the trend-followers become less responsive to further price deviations perhaps in a fear of future crash. If this story holds, the demand of trend-followers will be nonlinear. This modeling strategy goes back at least to Chiarella (1992) and is related to Day and Huang (1990) and is used in Guerrini et al. (2018). Finally, the third way in which nonlinearity can be built into the models is when switching between strategies is based not on the profit differences but on some other measure of relative attractiveness of strategies, which can be a function of the price deviation from the fundamental level as in He and Westerhoff (2005) or of past trend and dividend yield as in Dieci et al. (2018). These two modeling strategies may result in a somewhat simpler nonlinear model than when there is a profit-based switching and thus in a cleaner analysis. On the other hand, the models without endogenous profit-based switching could lack an interpretation of assumptions via economic motives of agents’ behavior. Thus, their complicated dynamics, even when fitted to the real data, could not be easily traced back to some behavioral factors that contribute to bounded rationality. In addition, it would not be easy to incorporate the strategies hierarchy via different costs into these models.

On balance, whereas a lot of work has been done in the first direction outlined by Brock, fewer advances were made in the second direction. This can be partly due to a tendency to simplify ways of introducing nonlinearity in the models. Further studies devoted to profit-driven switching would be desirable, as they would contribute to bringing the gap between models of full and bounded rationality and would also allow researcher to build the model with hierarchy of predictions. Similar models have appeared in other contexts. For instance in the game theory literature, the models with different levels of rationality (see Camerer et al. 2004) are often used to explain the experimental outcomes. In these equilibrium models, agents are just assumed to be of different levels of sophistication and do not choose it from the trade-off between benefits and costs. It would be interesting to generalize or adapt those models to the financial context where information may indeed be heterogeneous and its acquisition, and hence use of it strategically, might be costly. This could naturally be built on the rational inattention literature (see, e.g., Matějka and McKay 2015).

Eventually, the question is what motivates traders in making their strategic choices of different expectations, how sensitive they are to the past profits, and which profits they look at. Some interesting theoretical steps in this direction can be found in studies where agents decide the strategy on the basis of future rather than past performances (see Brock et al. 2006), and in studies where agents look at more than only last period profit to choose their strategy (see Hommes et al. 2012). Recent experimental evidence in Anufriev et al. (2016, 2018) suggests that the intensity of choice for switching does not have a uniform value but depends on predictability of profits. Endogenizing it would be another interesting extension of the standard Brock–Hommes model, as also pointed out in Radi and Lamantia (2018). An interesting attempt for this can be found in Chernulich (2018).

What about the third direction identified by Brock that acknowledges a local nature of information that agents often have in the market? We can see here a certain parallel with a new direction of financial networks that has been rapidly developed in the last 10–15 years spurred by the global financial crisis (see the stimulating description in Haldane (2009), and recent overview by Bramoullé et al. (2016)). Whereas we have learned a lot about structure of the financial networks, there is not much work done on incorporating networks into heterogeneous agent models. Two early promising works in this direction are by Alfarano and Milaković (2009) and Panchenko et al. (2013). Panchenko et al. (2013), for instance, shown how the structure of the information network affects the dynamics in the standard Brock–Hommes model. It turns out that realistic network of small world would make system less stable. More work in this direction, studying, for example, consequences of clustering and hubs as well as of endogenous formation of information network would be desirable.

6 Conclusions and possible future directions

The content of this paper is far from providing an all-encompassing overview of the current research on nonlinear economic dynamics. There are many remarkable contributions and strands of research in economics that we did not mention. Nonlinear macromodels discussing monetary policies in a context of bounded rationality and heterogeneous expectations are only one such example (see, e.g., De Grauwe 2011; Agliari et al. 2017 and reference therein). Another area of research regards the distribution of economic activities among economies studied through the so-called new-economic-geography models. These are general equilibrium models that employ adjustment mechanisms, such as replicator dynamics, and are used to describe how the geographic distribution of economic activities responds to economic policies (see, e.g., Commendatore et al. 2014; Agliari et al. 2014).

If a general overview is out of scope, these last remarks aim to stress that the last decade saw the diffusion of contributions that discuss the economic policy implications in nonlinear dynamic frameworks often characterized by bounded rationality. Economic policy analysis in a nonlinear context, involving boundedly rational agents, is a challenge that can attract the attention of the economists and policy makers in the future years. Replicating an economic policy mechanism involves methodological difficulties, since it may introduce constraints in the dynamics of the state variables which reflect in dynamical systems with either non-differentiable points or discontinuities. Therefore, a progress in the economic policy analysis using nonlinear dynamical systems requires progresses on the methodological side as well.

The research on piecewise-smooth dynamical systems and discontinuous dynamical systems represents an active and vibrant area of work that involves many scholars. The loss of smoothness in a dynamic economic model is not tied exclusively to normative aspects. Crespi et al. (2017) discussed problems of ambiguity and uncertainty aversion in game theory and shown how piecewise-smooth dynamical systems arise from oligopoly models when players are uncertainty averse and adopt a worst-case optimization approach to uncertainty. They show that nonlinear phenomena, such as cyclical dynamics, may occur even in an otherwise linear market configuration. Linking these aspects of uncertainty aversions to nonlinearity could also represent a promising area of research, so far virtually unexplored.

Notes

Firms endowed with static expectations assume that the competitor will next period produce the same quantity as in the current one. Under Cournot adjustment process, they play repetitively the best response given these expectations.

The result that more than three firms imply instability in Theocharis (1960) is obtained under the assumptions of static expectations and linear cost function. It is possible to change at least one of these two assumptions so that the dynamical system remains linear but will become stable, converging to the unique Cournot–Nash equilibrium (see, e.g., Fisher 1961).

A reaction function gives the optimal choice of a firm given any possible choice of the competitor. Let us also point out that saying that a reaction function, as well as the inverse demand function, is linear is an abuse of language. In fact, by linear inverse demand function we mean downward sloping, piecewise-linear function with a unique kink point (or point of non differentiability) that originates due to avoidance of negative prices. This kink point in the inverse demand function is reflected in the kink point of the reaction function, which is linear in all other points.

To microfound a demand function means to obtain it as the aggregation of the optimal choices of identical utility maximizing consumers.

References

Accinelli, E., Sanchez-Carrera, E.J.: The evolutionary game of poverty traps. Manch. Sch. 80(4), 381–400 (2012)

Agliari, A., Gardini, L., Puu, T.: Global bifurcations in duopoly when the Cournot point is destabilized via a subcritical Neimark bifurcation. Int. Game Theory Rev. 8(1), 1–20 (2006)

Agliari, A., Commendatore, P., Foroni, I., Kubin, I.: Expectations and industry location: a discrete time dynamical analysis. Decis. Econ. Finance 37(1), 3–26 (2014)

Agliari, A., Naimzada, A.K., Pecora, N.: Nonlinear dynamics of a Cournot duopoly game with differentiated products. Appl. Math. Comput. 281, 1–15 (2016)

Agliari, A., Massaro, D., Pecora, N., Spelta, A.: Inflation targeting, recursive inattentiveness, and heterogeneous beliefs. J. Money Credit Bank. 49(7), 1587–1619 (2017)

Ahmed, E., Agiza, H.N.: Dynamics of a Cournot game with n-competitors. Chaos Solitons Fractals 9(9), 1513–1517 (1998)

Ahmed, E., Agiza, H.N., Hassan, S.Z.: On modifications of Puu’s dynamical duopoly. Chaos Solitons Fractals 11(7), 1025–1028 (2000)

Ahmed, E., Elsadany, A.A., Puu, T.: On Bertrand duopoly game with differentiated goods. Appl. Math. Comput. 251, 169–179 (2015)

Alfarano, S., Milaković, M.: Network structure and N-dependence in agent-based herding models. J. Econ. Dyn. Control 33(1), 78–92 (2009)

Anderson, L.G.: A bioeconomic analysis of marine reserves. Nat. Resour. Model. 15(3), 311–334 (2002)

Anderson, P.W., Arrow, K.J., Pines, D.: The Economy As An Evolving Complex System. Santa Fe Institute Series, CRC press, Taylor & Francis group, ISBN: 9780201156850 (1988)

Angelini, N., Dieci, R., Nardini, F.: Bifurcation analysis of a dynamic duopoly model with heterogeneous costs and behavioural rules. Math. Comput. Simul. 79(10), 3179–3196 (2009)

Antoci, A.: Environmental degradation as engine of undesirable economic growth via self-protection consumption choices. Ecol. Econ. 68(5), 1385–1397 (2009)

Antoci, A., Borghesi, S.: Environmental degradation, self-protection choices and coordination failures in a North–South evolutionary model. J. Econ. Interact. Coord. 5(1), 89–107 (2010)

Antoci, A., Sodini, M.: Indeterminacy, bifurcations and chaos in an overlapping generations model with negative environmental externalities. Chaos Solitons Fractals 42(3), 1439–1450 (2009)

Antoci, A., Dei, R., Galeotti, M.: Financing the adoption of environment preserving technologies via innovative financial instruments: an evolutionary game approach. Nonlinear Anal. Theory Methods Appl. 71(12), e952–e959 (2009)

Antoci, A., Galeotti, M., Radi, D.: Financial tools for the abatement of traffic congestion: a dynamical analysis. Comput. Econ. 38, 389–405 (2011a)

Antoci, A., Galeotti, M., Russu, P.: Poverty trap and global indeterminacy in a growth model with open-access natural resources. J. Econ. Theory 146(2), 569–591 (2011b)

Antoci, A., Borghesi, S., Galeotti, M.: Environmental options and technological innovation: an evolutionary game model. J. Evol. Econ. 23(2), 247–269 (2013)