Abstract

This paper analyses economic dynamics in a context in which the production and consumption choices of economic agents generate environmental degradation. Agents can defend themselves from environmental degradation by increasing the production and consumption of output, which is assumed to be a (perfect) substitute for environmental quality. We consider the cases in which agents can coordinate their actions or not, and we show that if the dynamics is conditioned by negative externalities (so that there is no coordination), then a self-reinforcing mechanism may occur leading to production and consumption levels higher than the socially optimal ones. A complete analysis of the dynamics and of the welfare properties of the stationary states is provided.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Promoting prosperity while protecting the planet is the stated purpose of the strategy of the United Nations (2015) for achieving sustainable development. This goal is particularly challenging because of the complex interactions between economic development and the use of environmental resources. A remarkable example is that production and consumption choices can generate negative externalities on the environment, with a self-reinforcing effect on its quality and endowment, and this can often lead to suboptimal outcomes (Antoci et al. 2012; Antoci and Borghesi 2010, 2012). Indeed, to mitigate the effects of negative externalities, victims are stimulated to react with defensive behaviour, which can generate further negative externalities to other individuals, who are stimulated in turn to react. Suboptimal outcomes can take the form of undesirable growth and overconsumption and can be favoured by the lack of coordination of self-protective agents.

The issue of economic development fuelled by the negative externalities of the development process itself has been explored by a vast literature. Early contributions were proposed by Hirsch (1976) and Hueting (1980), while Bird (1987) classified defensive expenditures according to the type of externality, and Leipert (1989) proposed the first quantification of the impact of defensive expenditures on national income. The first mathematical models were proposed in a static setting by Shogren and Crocker (1991), and in a dynamic setting by Antoci (1996) and Antoci and Bartolini (1999, 2004). Recent contributions have empirically explored this issue in relation to air pollution (Sun et al. 2017), sea pollution (Magnan 2016), water consumption (Dile et al. 2013), biodiversity (Martinet and Blanchard 2009), air conditioning (Davis and Gertler 2015), financial technology (Di Vita 2009) and snow making (Bürki et al. 2007). Recent theoretical analyses have been proposed with regard to soil depletion (Borghesi et al. 2018; Antoci et al. 2015), water depletion (Antoci et al. 2017; Borghesi 2014), biodiversity (Perrings and Halkos 2012), industrialisation (Antoci et al. 2014) and financial technology (Antoci et al. 2012).

The present study adds to the literature with the complete analysis of a dynamic model describing a situation in which a free environmental good gets substituted by private goods, after environmental degradation. We consider the two alternative contexts in which self-interested rational agents coordinate their actions or not. In the model, the welfare of individuals depends on a public environmental good, on the consumption of two private goods and on the effort necessary to produce them. One of the private goods is perceived as a perfect substitute for the environmental good. The process of private production and consumption can reduce the availability of the environmental good, leading individuals to defend themselves by increasing the substitutive private consumption. This gives rise to a self-sustaining mechanism, induced by negative externalities, which can generate overconsumption.

The model proposed is simple but mathematically rigorous. Its simplicity has the advantage to clearly highlight the vicious cycle that may characterise economic dynamics in advanced economies, leading to overproduction and consumption of private output, at the expenses of free-access environmental goods. A distinguishing feature of this study is the comparison between the two contexts in which agents can either coordinate or not their decisions, and the related environmental and welfare implications. The study suggests that the benefits of a greater variety of consumption opportunities can be overcompensated by the consequent depletion of natural resources and degradation of environmental quality, a conclusion supported by recent empirical studies on the negative correlation between income and life satisfaction (Costanza 2014; Kubiszewski 2013).

The paper is organised as follows. Sections 2 and 3 present the model and the basic mathematical results. Section 4 contains the classification of all dynamics, while Sect. 5 discusses the role of altruism towards future generations. Finally, conclusions are drawn in Sect. 6.

2 The model

Let us consider an economy with \(N>1\) individuals, whose welfare depends on the consumption of environmental and private goods. We assume for simplicity that there is a unique environmental good, freely available to all, and two private goods produced in the economy. The private goods differ in that one is viewed by consumers as a perfect substitute for the environmental good.

We assume that each individual solves the following utility maximisation problem:

where the term inside brackets in (1) corresponds to the instantaneous utility function of a representative agent; E is the state variable of the problem and represents the stock of the environmental good; \(\hat{E}\) is the maximum potential value of the stock of E and can be interpreted as the carrying capacity of the environmental good in the economy; \(Y_1\) and \(Y_2\) represent the rate of consumption of the two private goods, the latter being the private good perceived as perfect substitute of the environmental good; c is the marginal rate of substitution in consumption between \(Y_2\) and E; \(l_1\) and \(l_2\) are the control variables of the problem and represent the effort that each individual exerts for producing \(Y_1\) and \(Y_2\) according to functions (2) and (3), respectively; r is the discount rate; and t is time.

Differential equation (4), already considered by Marini and Scaramozzino (1995), describes the evolution of the stock of the environmental good over time, with \(\dot{E}\) corresponding to the derivative of E with respect to t. The parameter \(\hat{E}\) is the maximum potential value of the stock of the environmental good and corresponds to the convergence value of E if production and consumption do not take place in the economy. The term \(\beta \left( l_1+l_2\right) \) measures the deterioration of the environmental good as a function of production and consumption choices of a representative individual in the economy; therefore, \(\beta \left( l_1+l_2\right) N\) represents the aggregate negative impact on E of consumers’ behaviour. On the other hand, the term \(\alpha \left( \hat{E}-E\right) \) describes the regenerative process of the environmental good.

We study two alternative contexts: the one in which individuals are free to choose their production and consumption patterns, without coordination (hereafter \(N\!C\)), and the other in which such choices are made by a policy-maker, who coordinates (hereafter C) the actions of all agents. Namely, when considering the aggregate negative impact on the environmental good, \(\beta (l_1+l_2)N\), the representative individual takes the negative impact of the others, \(\beta (l_1+l_2)(N-1)\), as exogenously given.Footnote 1

To solve optimisation problem (1)–(4), we study the corresponding current-value Hamiltonian function:

where \(\lambda \) is the co-state variable associated with the state variable E and indicates the shadow price of E, and:

The above Hamiltonian does allow for the use of the sufficiency conditions by Mangasarian (1966), for which if the Hamiltonian is (strictly) concave with respect to the control and the state variables, then the first-order conditions are also sufficient for an interior (unique) optimum.

Applying the first-order conditions, we obtain:

together with the following dynamics:

where \(\dot{E}\) and \(\dot{\lambda }\) are, respectively, the time derivatives of E and \(\lambda \).

It is easy to calculate that \(\dfrac{\partial F}{\partial l_1}=\dfrac{\partial F}{\partial l_2}\) is equal to \(\beta \lambda \) in the \(N\!C\) context and to \(\beta \lambda N\) in the C context.

3 Basic mathematical results

3.1 Optimal choice of \(l_1\) and \(l_2\)

The optimal choice of \(l_1\) in the contexts without and with coordination (that is, respectively, \(N\!C\) and C) by condition (7) results (see Fig. 1):

By condition (8), the region of the positive orthant of the plane \(\left( E,\lambda \right) \) where the optimal choice is \(l_2=0\) corresponds to the points that satisfy the inequality:

The previous conditions are satisfied as an equality along the hyperbolae (see Fig. 2):

The latter hyperbola lies in the positive orthant of the plane \(\left( E,\lambda \right) \), below the corresponding hyperbola in the context of no coordination, meaning that, in the economy with coordination, the region in which the optimal choice is \(l_2=0\) is always wider than in the economy without coordination (see Fig. 2).

The optimal choice of effort \(l_2\) by the representative individual for producing and consuming the substitutive good \(Y_2\), in the contexts without and with coordination, is given by (see Fig. 3):

3.2 Analysis of the isocline \(\dot{\lambda }=0\)

We consider first the case of the economy without coordination. It can be checked that \(\dot{\lambda } =0\) holds, in the region in which condition (12) is satisfied (so that the choice is \(l_2=0\)) if and only if:

while in the complementary region (where the choice is \(l_2>0\)) it holds \(\dot{\lambda } =0\) if and only if:

From the above, for \(c(r+\alpha )-\beta >0\), we may observe, at the fixed points of system (9)–(10), a strictly positive rate of consumption \(Y_2\). But this does not happen for \(c(r+\alpha )-\beta \le 0\); indeed, in this case, the isocline lies entirely in the region where the choice is \(l_2=0\).

We now consider the case of the economy with coordination. In the region in which condition (13) is satisfied (so that the choice is \(l_2=0\)), the isocline \(\dot{\lambda } =0\) is given by Eq. (15), while in the complementary region (where the choice is \(l_2>0\)) the same isocline is given by:

Recalling the price interpretation of the co-state variable \(\lambda \), in the economy with coordination, if \(c(r+\alpha )-\beta N\le 0\), then it is not possible to observe a fixed point with (strictly positive) substitutive consumption of the environmental good. Figure 4 shows the isoclines for the economies with and without coordination.

3.3 Analysis of the isocline \(\dot{E}=0\)

We consider first the case of the economy without coordination. It can be checked that, in the region in which condition (12) is satisfied (so that the choice is \(l_2=0\)), \(\dot{E}=0\) holds if and only if:

while in the complementary region (where the choice is \(l_2>0\)), \(\dot{E}=0\) holds if and only if:

which, for \(\beta N\ne \alpha c\), represents the hyperbola:

In the economy with coordination, Eqs. (18) and (19) should be replaced by, respectively:

Equation (22), for \(\beta N\ne \alpha c\), represents the hyperbola:

3.4 Stability analysis

We linearise system (9)–(10) to analyse its local stability properties. The Jacobian matrix of this system is:

It can be checked that the determinant of the Jacobian matrix is always strictly negative in the region where the optimal choice is \(l_2=0\), because it holds \(\frac{\partial l_2}{\partial E}=\frac{\partial l_2}{\partial \lambda } =0\); thus, any fixed point in this region is a saddle point and there exist only two trajectories under system (9)–(10) approaching it.

On the other hand, in the region where \(l_2>0\), it can be checked that the Jacobian matrix is an upper triangular matrix with eigenvalues \(-\alpha +\frac{\beta N}{c}\) and \(r+\alpha -\frac{\beta }{c}\) in the economy without coordination, and eigenvalues \(-\alpha +\frac{\beta N}{c}\) and \(r+\alpha -\frac{\beta N}{c}\) in the economy with coordination.

As seen in the analysis of the isocline \(\dot{\lambda } =0\), a necessary condition for the existence of a fixed point with \(l_2>0\) is that \(r+\alpha -\frac{\beta }{c}>0\) in the economy without coordination and \(r+\alpha -\frac{\beta N}{c}>0\) in the economy with coordination; therefore, a fixed point with \(l_2>0\) is a (hyperbolic) saddle point if and only if it holds \(-\alpha +\frac{\beta N}{c}<0\).

4 Classification of dynamics

4.1 Economy without coordination

We classify the dynamics of system (9)–(10) according to the stability properties described in the previous section. Let us define:

and

where \(E^{*}>E^{**}\) if and only if \(c\alpha -\beta N>0\).

We define two robust casesFootnote 2 according to the sign of the expression \(c\alpha -\beta N\). This expression represents a measure of the net effects on the environmental good of its combined processes of regeneration and depletion. Indeed, \(c\alpha \) is a measure of the regeneration process of E, while \(\beta N\) is a measure of the negative impact of production and consumption on E.

Case (a): \(c\alpha -\beta N>0\).

This condition implies that \(c\left( r+\alpha \right) -\beta >0\), and it determines the following dynamics:

(a.1) If \(\hat{E}\ge E^{*}\), there exists an unique fixed point, which is a saddle, where individuals do not produce nor consume the substitutive private good, that is, \(Y_2=l_2=0\) (see Fig. 5). This case can happen when the carrying capacity of the environmental good \(\hat{E}\) (that is, the maximum potential value that can be reached without production and consumption) is relatively high. Furthermore, whatever the initial value of the environmental good, E(0), individuals can always select the trajectories approaching the fixed point by choosing opportunely the initial value of the shadow price \(\lambda \). As shown in Fig. 5, individuals may initially choose \(Y_2=l_2>0\) but, after a finite period of time, their consumption patterns lead \(Y_2\) to zero.

(a.2) If \(E^{*}>\hat{E}\ge E^{**}\), then there exists a unique fixed point, which is a saddle, where individuals produce and consume a strictly positive quantity of the substitutive good, that is \(Y_2=l_2>0\) (see Fig. 6). The stable manifold of the saddle point can be reached from every initial value of E by choosing the appropriate value of \(\lambda \).

(a.3) If \(E^{**}> \hat{E}\), then system (9)–(10) has no fixed point (see Fig. 7). Then, if the value of \(\hat{E}\) is sufficiently low and the economy can produce a substitute for the environmental good, individuals will follow unsustainable consumption patterns leading to the complete depletion of the environmental good in favour of the substitutive good, so that the system reaches a state where \(Y_2=l_2>0\) and \(E=0\) after a finite period of time.Footnote 3 Conversely, if individuals were not able to produce a substitute for the environmental good (that is, for \(c=0\) so that \(l_2=0\) always holds), there would always exist a fixed point whose stable manifold can be selected from every initial value of E. The complete substitution of an environmental good can happen, for example, in cities located along a polluted river, where individuals choose not to swim and, instead, go to a swimming pool (for more examples, see also Antoci et al. 2008).

Case (b): \(c\alpha -\beta N<0\).

This condition implies that \(E^{*}<E^{**}\), and it holds for a sufficiently large number of individuals in the economy. The possible dynamics are the following:

(b.1) If \(c\left( r+\alpha \right) -\beta \le 0\), then there exists a unique fixed point, which is a saddle, where individuals do not consume the substitutive private good, that is, \(Y_2=l_2=0\) (see Fig. 8). The stable manifold of the saddle point can be reached from every initial value of E by choosing the appropriate value of \(\lambda \).

(b.2) If \(c\left( r+\alpha \right) -\beta >0\) and \(\hat{E}>E^{**}\), then there exists a unique fixed point, which is a saddle, and the configuration of trajectories is analogous to that of case (b.1) (see Fig. 8).

(b.3) If \(c\left( r+\alpha \right) -\beta >0\) and \(E^{**}\ge \hat{E}>E^{*}\), then there exist two fixed points, \((E^s,\lambda ^s)\) and \((E^u,\lambda ^u)\) (see Fig. 9). The former is a saddle, where it results \(Y_2=0\). The latter is a source, where it results \(Y_2>0\); this is a repulsive fixed point; therefore, it cannot be reached if \(E(0)\ne E^u\). Individuals can reach the stable manifold of \((E^s,\lambda ^s)\) if and only if \(E(0)>E^u\), because the trajectory of this stable manifold that lies on the left of \((E^s,\lambda ^s)\) originates from \((E^u,\lambda ^u)\). In such a ’threshold’ regime, the dynamics can lead to opposite results over finite periods of time. Namely, if E(0) is large enough, individuals can reach sustainable consumption patterns where the substitutive good is not consumed (that is, \(Y_2=0\)). Otherwise, for a sufficiently small E(0), the economy may only follow trajectories that are unsustainable, leading to the complete depletion of the environmental good in favour of the substitutive good (that is, \(E=0\) and \(Y_2>0\)).

(b.4) If \(c\left( r+\alpha \right) -\beta >0\) and \(\hat{E}=E^{*}\), then there exists an unique fixed point (where \(Y_2=0\)), which is a saddle under system (9)–(10) restricted to the region in which \(Y_2=0\), while it is a source in the complementary region. This limit case determines trajectories of the ’saddle-node’ type, which are represented in Fig. 10. In such a context, individuals can reach the fixed point only if the initial endowment of environmental good, E(0), is higher than the value of E at the fixed point.

(b.5) If \(c\left( r+\alpha \right) -\beta >0\) and \(E^{*}>\hat{E}\), then there exists no fixed point (see Fig. 11), and the economy can follow unsustainable trajectories leading to the complete depletion of the environmental good in favour of the substitutive good, as described for case (a.3).

4.2 Economy with coordination

In the economy with coordination, we can make a classification analogous to that in the previous subsection by substituting \(E^{*}\) and \(E^{**}\) with, respectively:

and

and by considering the sign of the expression \(c\left( r+\alpha \right) -\beta N\) instead of the expression \(c\left( r+\alpha \right) -\beta \).

A main difference between the two economies with and without coordination is that, in the former case, a necessary condition for the existence of a fixed point with \(Y_2>0\) is that \(c\left( r+\alpha \right) -\beta N>0\), which does not hold if (ceteris paribus) N is large enough. Conversely, in the economy without coordination, the corresponding condition only requires that \(c\left( r+\alpha \right) -\beta >0\).

In addition, recalling that \(N>1\), it also results that \(E_c^{*}<E^{*}\) and \(E_c^{**}<E^{**}\), meaning that the economy with coordination has a lower threshold under which the fixed point with \(Y_2>0\) exists. Then, different consumption patterns may arise in the two economies with the same parameter set. Namely, the economy without coordination may reach a fixed point with \(Y_2>0\), while the economy with coordination may lead to a consumption pattern with \(Y_2=0\) (see Fig. 12). Therefore, a greater quantity and variety of consumption goods may be produced and consumed when individuals do not coordinate their actions, but this result might be the undesirable consequence of their failure to cooperate.

Furthermore, in the economy with coordination, the stable (in the saddle-point sense) fixed point is always characterised by an higher value of E and, consequently, by a lower quantityFootnote 4 of consumptions of private goods, while the opposite assumption holds for the unstable fixed point, when existing. This result implies that the economy with coordination can reach a sustainable consumption pattern from a wider set of initial positions E(0), as it can be checked by recalling the difference between the isoclines \(\dot{\lambda } =0\) in the two economies, and by noting that, in Fig. 12, the isocline \(\dot{E}=0\) in the economy with coordination lies always below the corresponding isocline in that without coordination.

5 Altruism with respect to future generations

In the literature on optimisation models with discounting, the discount rate r can be seen as a measure of altruism. A reduction in the value of r may be interpreted as an increase in altruism of the current generation with respect to the future ones.

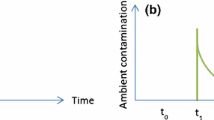

In the present model, varying the parameter r affects only the shape of the isocline \(\dot{\lambda } =0\), in both contexts with and without coordination. Namely, if r decreases (so that agents become more altruistic), then the isocline shifts up. A sufficiently large decrease in r may lead to a change in the system dynamics from the subcases (a.3) and (b.5) to, respectively, the subcases (a.1) and (b.1). In such a case, an increase in altruism can lead some consumption patterns in both economies to change from unsustainable trajectories to sustainable ones, thus favouring the use of the environmental good at the expenses of consumption of costly private goods. This radical change can happen if the economy has, initially, a stable fixed point where \(Y_2>0\), and the increase in altruism leads to its disappearance and to the emergence of a new fixed point where \(Y_2=0\) (see Fig. 13).

Other considerations about altruism can be made from the analysis of the dynamics of the model. Let us recall that in both economies, without and with coordination, if the private substitutive good is not available (that is, for \(c=0\) so that \(l_2=0\) always holds), then there always exists a unique fixed point, which is stable (in the saddle-point sense) and can be reached from every initial value of E.

Furthermore, a ’threshold’ regime, similar to that of case (b.3), can emerge also in the economy with coordination, if the private substitutive good is available. Namely, if E(0) is sufficiently high, individuals may choose the sustainable consumption pattern (in which \(Y_2=0\)), while, if E(0) is sufficiently low, they may choose an unsustainable trajectory, leading to the complete substitution of the environmental good with private goods after a finite period of time (see Fig. 9).

In such a case, individuals may choose the unsustainable trajectory as a consequence of their low altruism. Indeed, if we assume \(r=0\), so that individuals give equal weight to their own welfare and to the welfare of future generations, then the unsustainable optimal trajectory would be Pareto dominated by all paths leading to the fixed point after a finite period of time. Thus, a coordinated economy where individuals are not sufficiently altruist may find optimal to deplete the environmental good in favour of private goods despite the fact that this choice can reduce the quality of life and the choice set of future generations.

6 Conclusion

We proposed a model in which private goods are produced and consumed in a greater quantity and heterogeneity when there is no coordination in the economy. We found that, within our framework, the lack of coordination can stimulate economic growth through overconsumption of a private good, which is viewed as a perfect substitute of a depleted public good. This endogenous spur to economic growth can also result from the lack of altruism of individuals. In both cases, it can be an undesirable process because it can lead to degradation of the public, environmental good.

The study suggests that the depletion of a free-access environmental good can increase the consumers’ need for its private substitutive goods, with a consequent increase in their production and consumption. Thus, the compelled defensive consumption of costly substitutive goods, instead of the free consumption of the (increasingly polluted) environmental good, can be an engine of economic growth. In other words, growth can be driven by the destructive power of overconsumption, a conclusion widely supported by the literature (see among others Antoci 2009; Antoci and Bartolini 2004; Bartolini and Bonatti 2002).

The growth mechanism described here is not necessarily undesirable, although it is based on a process of environmental depletion. Namely, the substitutive consumption compelled by the decreased availability of free goods may generate Pareto improvements, when the endowment of environmental good is too low. Conversely, the substitutive consumption may be undesirable when such endowment is high; then, the welfare of individuals can be higher if no private substitutive good exists. Also, when individuals try to improve their welfare by private (rather than collective) consumption, they may cause a general worsening of their position, as a consequence of a coordination failure.

Notes

This standard procedure (see Romer 1989) is widely used in the literature on positive and negative externalities.

To improve clarity, we omit the analysis of the case for which \(c \alpha -\beta N = 0\), because the resulting dynamics of the system is not robust to uncertainties or perturbations.

In the following, we will refer to the term ’sustainable’ to denote consumption patterns leading to a fixed point in which \(E>0\). Vice versa, we will use the term ’unsustainable’ to denote consumption patterns leading to \(E=0\).

Remember that we measure the quantity of private goods consumed in the economy by the effort that is necessary to produce them, that is, by \((l_1+l_2)N\).

References

Antoci, A.: Negative Externalities and Growth of the Activity Level. Working Paper No. 9308, National Research Group MURST on Nonlinear Dynamics and Applications to Economic and Social Sciences, University of Florence, Italy (1996)

Antoci, A.: Environmental degradation as engine of undesirable economic growth via self-protection consumption choices. Ecol Econ 68(5), 1385–1397 (2009)

Antoci, A., Bartolini, S.: Negative Externalities as the Engine of Growth in an Evolutionary Context. Working Paper No. 83.99, FEEM, Milan (1999)

Antoci, A., Bartolini, S.: Negative externalities and labor input in an evolutionary game. J Environ Dev Econ 9, 1–22 (2004)

Antoci, A., Borghesi, S.: Preserving or escaping? On the welfare effects of environmental self-protective choices. J Socio-Econ 41(2), 248–254 (2012)

Antoci, A., Borghesi, S.: Environmental degradation, self-protection choices and coordination failures in a North–South evolutionary model. J Econ Interact Coord 5(1), 89–107 (2010)

Antoci, A., Borghesi, S., Galeotti, M.: Should we replace the environment? Limits of economic growth in the presence of self-protective choices. Int J Soc Econ 35(4), 283–297 (2008)

Antoci, A., Borghesi, S., Russu, P.: Environmental protection mechanisms and technological dynamics. Econ Model 29(3), 840–847 (2012)

Antoci, A., Borghesi, S., Russu, P., Ticci, E.: Foreign direct investments, environmental externalities and capital segmentation in a rural economy. Ecol Econ 116, 341–353 (2015)

Antoci, A., Borghesi, S., Sodini, M.: Water resource use and competition in an evolutionary model. Water Resour Manag 31(8), 2523–2543 (2017)

Antoci, A., Russu, P., Sordi, S., Ticci, E.: Industrialization and environmental externalities in a Solow-type model. J Econ Dyn Control 47, 211–224 (2014)

Bartolini, S., Bonatti, L.: Environmental and social degradation as the engine of economic growth. Ecol Econ 43(1), 1–16 (2002)

Bird, P.J.: The transferability and depletability of externalities. J Environ Econ Manag 14(1), 54–57 (1987)

Borghesi, S.: Water tradable permits: a review of theoretical and case studies. J Environ Plan Manag 57(9), 1305–1332 (2014)

Borghesi, S., Giovannetti, G., Iannucci, G., Russu, P.: The dynamics of foreign direct investments in land and pollution accumulation. Environ. Resour. Econ. (2018). https://doi.org/10.1007/s10640-018-0263-7

Bürki, R., Abegg, B., Elsasser, H.: Climate change and tourism in the alpine regions of Switzerland. In: Amelung, B., et al. (eds.) Climate change and tourism: assessment and coping strategies. Maastricht, pp. 165–172 (2007)

Costanza, R., et al.: Time to leave GDP behind. Nature 505, 283–285 (2014)

Davis, L.W., Gertler, P.J.: Contribution of air conditioning adoption to future energy use under global warming. Proc. Natl. Acad. Sci. 112(19), 5962–5967 (2015)

Dile, Y.T., Karlberg, L., Temesgen, M., Rockström, J.: The role of water harvesting to achieve sustainable agricultural intensification and resilience against water related shocks in sub-Saharan Africa. Agric. Ecosyst. Environ. 181, 69–79 (2013)

Di Vita, G.: Legal families and environmental protection: is there a causal relationship? J. Policy Model. 31, 694–707 (2009)

Hirsch, F.: Social Limits to Growth. Harvard University Press, Cambridge (1976)

Hueting, R.: New Scarcity and Economic Growth. More Welfare Through Less Production?. North Holland, Amsterdam (1980)

Kubiszewski, I., et al.: Beyond GDP: measuring and achieving global genuine progress. Ecol. Econ. 93, 57–68 (2013)

Leipert, C.: National income and economic growth: the conceptual side of defensive expenditures. J. Econ. Issues 23(3), 843–56 (1989)

Magnan, A.K., et al.: Addressing the risk of maladaptation to climate change. Wiley Interdiscip. Rev. Clim. Change 7(5), 646–665 (2016)

Mangasarian, O.L.: Sufficient conditions for the optimal control of nonlinear systems. SIAM J. Control 4(1), 139–152 (1966)

Marini, G., Scaramozzino, P.: Overlapping generations and environmental control. J. Environ. Econ. Manag. 29, 64–77 (1995)

Martinet, V., Blanchard, F.: Fishery externalities and biodiversity: trade-offs between the viability of shrimp trawling and the conservation of Frigatebirds in French Guiana. Ecol. Econ. 68(12), 2960–2968 (2009)

Perrings, C., Halkos, G.: Who cares about biodiversity? Optimal conservation and transboundary biodiversity externalities. Environ. Resour. Econ. 52(4), 585–608 (2012)

Romer, P.M.: Capital accumulation in the theory of long-run growth. In: Barro, R.J. (ed.) Modern Business Cycle Theory. Basil Blackwell, Oxford (1989)

Shogren, J.F., Crocker, T.D.: Cooperative and noncoperative protection against transferable and filterable externalities. Environ. Resour. Econ. 1, 195–214 (1991)

Sun, C., Kahn, M.E., Zheng, S.: Self-protection investment exacerbates air pollution exposure inequality in urban China. Ecol. Econ. 131, 468–474 (2017)

United Nations: Transforming our world: The 2030 agenda for sustainable development. Resolution adopted by the General Assembly, 25 September 2015 (2015)

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

The author expresses his sincere thanks to Prof. Davide Radi and the two anonymous referees for their precious comments, which contributed to increase the quality of this work.

Rights and permissions

About this article

Cite this article

Fiori Maccioni, A. Environmental depletion, defensive consumption and negative externalities. Decisions Econ Finan 41, 203–218 (2018). https://doi.org/10.1007/s10203-018-0226-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10203-018-0226-z