Abstract

Inspired by Li (2019) who considers one parameter, we propose a novel two-parameter coherent fuzzy number (TPCFN) that can flexibly capture investors’ attitudes (pessimistic, optimistic, or neutral). We define the possibilistic density function, the possibilistic distribution function, the possibilistic mean, and the possibilistic variance of the TPCFN for the first time. Furthermore, we derive the above statistical characteristics with numerical expressions through rigorous mathematical proof. The monotonicity of the possibilistic mean and possibilistic variance are presented by the first-order derivative and illustrated with figures in detail. In addition, we discuss the investors’ attitudes by using different parameter values and their influences on the mean and variance. Then, we construct an equal-weighted model, a mean–variance model, and a regret minimization model with TPCFN, respectively. We carry out a sensitivity analysis to explore the parametric influence on the model’s solution. At the same time, we compare different models with the same parameter values. Finally, we use a numerical example to demonstrate the feasibility and effectiveness of our proposed models. We compare the performance of the three models by five indexes (annual return, Sharpe ratio, beta value, unsystematic risk, and alpha value). The results show that optimistic investors can obtain more gains in the three models. Our minimization model considering the regret factor outperforms the mean–variance model and the equal-weighted portfolio in returns when the parameter values are the same.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

In this part, we introduce the current research works and their limitations. At the same time, we point out the motivation and novelty of this paper. Finally, we introduce the structure of this paper.

The core problem of portfolios is to seek investment returns and diversify investment risks through the scientific allocation of assets. Markowitz (1952) proposed the mean–variance model, which used the mean of the portfolio to measure the return and the variance to measure the risk, establishing the foundation of the modern portfolio theory and opening the prelude to the quantitative evaluation of portfolio performance on the basis of probability theory. Subsequently, many scholars at home and abroad have conducted in-depth and detailed discussions and research on the portfolio problem. Mao (1970) found that variance is limited to measuring investment risk, as treating all extreme returns as unpopular with investors is not objective. He believed that risk should be characterized by a portion of returns lower than the expected return, thus proposing a mean-half variance portfolio model. Subsequently, Knono et al. (1991) used the absolute deviation to measure the risk and constructed the mean-absolute deviation model to reduce the computational burden. Furthermore, Speranza (1993) proposed the mean-semi-absolute deviation model to improve the previous model. Samuelson (1958) introduced high-order moments into the portfolio model for the first time, used the skewness of the return rate to measure the risk, and put forward the mean–variance skewness portfolio model. In recent years, Tong et al. (2010) used the CVaR model, Lai et al. (2022) proposed the MT-CVAR model, and Li et al. (2023) proposed a new tail network enhanced parametric average conditional value at Risk (TNA-PMC) portfolio model to improve the CVaR model for portfolio research. Adcock (2014) studied the mean–variance-skewness combination model with multivariate extended skews-student distribution, then used quadratic programming to find the effective combination on the effective surface. Mehlawat et al. (2018) analyzed the portfolio selection problem from the perspective of considering skewness and kurtosis and including more non-normality information on asset returns.

The uncertainty of the security market includes random uncertainty and fuzzy uncertainty. The above research only focuses on random uncertainty and studies portfolios from the perspective of probability theory. Since the fuzzy set theory and possibilistic theory proposed by Zadeh (1965, 1978) in 1965 provided effective methods to solve the fuzziness problem, many scholars began to add the study of the fuzzy uncertainty of the security market to that of portfolios, and regarded the security returns as fuzzy variables, opening the door of the study of fuzzy portfolios. Carlsson and Fuller (2001) proposed the likelihood expectation and variance of fuzzy numbers and established the fuzzy portfolio model. Li et al. (2010) proposed the concept of skewness of fuzzy variables, and on this basis proposed and analyzed the mean-various-skewness model of fuzzy return portfolio selection. Li and Yi (2019) introduced a new fuzzy portfolio selection model of possibilistic mean-variation-skewness with an adaptive index to obtain the coherence of investors’ expectations and obtain the final asset allocation. In 2021, Pankaj et al. (2021) established a multi-period and multi-objective portfolio optimization model with two coherent triangular fuzzy numbers within the credibility framework, respectively using mean absolute half-deviation and conditional value at risk (CVaR) as risk measures. Gong et al. (2022) discussed the portfolio selection problems in which the uncertainty of future returns and the heterogeneity of investor attitudes towards the stock market (optimistic–pessimistic–neutral) are captured by coherent fuzzy numbers. Mehlawat et al. (2021) studied the multi-objective portfolio optimization problem using coherent fuzzy numbers in a credibilistic environment. Gupta et al. (2020) constructed intuitionistic fuzzy optimistic and pessimistic multi-period portfolio optimization models.

Regret theory plays an important role in investors’ decision-making. Bell (1982), Loomes and Sugden (2015) found that regret would affect investors’ investment behavior. Regret theory mainly studies the comparison between the choices people have made and have not made. If their choices are better than other choices, investors will feel happy; otherwise, they will feel regretful. Moreover, the joy brought by gains is far less than the regret brought by losses. The regret theory has been used to explain some anomalies in finance since it was proposed. Magron and Merli (2015) and Frydman and Camerer (2016) pointed out that regret aversion can explain the “repurchase effect”, that is, investors are unwilling to repurchase stock assets sold at a lower price. Herweg and Müller (2021) studied the relationship between regret theory and salience theory when investors face risky decisions. In addition, regret theory can also explain investors’ irrational behaviors in the investment market. Arisoy and Bali (2018) constructed a measurement method based on regret volatility uncertainty and found that regret aversion would affect the cross-sectional return of stocks. Fioretti (2022) studied the impact of experienced regret and expected regret on investors’ selling decisions in dynamic trading. Ouzan 2020) proposed a rational expectations equilibrium model of stock market collapse with asymmetric information and loss-averse speculators and used this model to prove that short-selling restrictions would intensify the relative upward movement of asset prices. Qin (2020) analyzed the asset pricing model with regret aversion. Xidonas (2017) incorporated future return scenarios into investment decisions and constructs a robust multi-objective portfolio optimization model using the minimax regret value method. Li et al. (2012) studied fuzzy portfolios from the perspective of regret under the framework of credibility theory and proposed the expected regret minimization model, which aims to minimize the distance between the maximum return of investors and the relevant return of each portfolio. Chorus (2008, 2010) established a random regret minimization model based on the regret theory and applied it to the choice of travel routes. Gong et al. (2021) proposed a multi-objective regret portfolio model involving DEA cross-efficiency and higher moments. Baule et al. (2019) expanded Markowitz’s portfolio selection to include investor regret as an additional decision criterion in addition to ultimate wealth.

By reviewing and sorting out the previous literature, we can find that all the researches on fuzzy portfolio use triangular fuzzy numbers, trapezoidal fuzzy numbers, and consistent fuzzy numbers containing one parameter to describe portfolio returns. There is no research on consistent fuzzy numbers with two parameters. In the previous literature, there is no research field concerning the combination of fuzzy numbers with two parameters and behavioral finance. Although the inclusion of an adaptive index takes into account investor psychology by Li and Yi (2019), it does not take into account the fact that the extent to which investors prefer favorable situations and avoid unfavorable ones may be different. In order to flexibly capture investors’ attitudes (pessimistic, optimistic, or neutral), this paper extends the coherent fuzzy number, proposes the generalized coherent fuzzy number with two parameters, and combines the regret theory in behavioral finance to study the fuzzy portfolio problem considering investor psychology. Under the possibilistic measure, a regret minimization portfolio model with the two-parameter coherent fuzzy number is constructed. We compare the literature from nine features including whether we consider the possibilistic mean, the possibilistic variance, the possibilistic density function, the possibilistic distribution function, the form of membership function, the fuzzy environment, the attitude of investors, the two-parameter generalized coherent fuzzy number, and the regret psychology. The novelty of our proposed method is illustrated below.

-

(a)

We innovatively propose a coherent generalized fuzzy number with two parameters \(\alpha\) and \(\beta\) with the ability to describe the pessimistic, neutral, and optimistic attitudes of investors. As far as we know, this has never been done before.

-

(b)

We present the membership degree functions of the coherent trapezoidal fuzzy number and the generalized coherent triangular fuzzy number with two parameters, respectively. We believe this is the first time anyone has given this definition.

-

(c)

We derive the expressions of the possibilistic density function, possibilistic mean, possibilistic variance, and possibilistic distribution function of the coherent trapezoidal fuzzy number with two parameters, and take the coherent triangular fuzzy number as a special form to derive its corresponding expressions. These expressions are also the first innovative derivation.

-

(d)

We use the preference function to describe the regret value and develop a regret minimization portfolio model with the new coherent trapezoidal fuzzy number. We pay attention to the important influence of regret theory on investors’ decision-making and creatively combine the two-parameter coherent fuzzy number and regret theory to build this model.

-

(e)

We construct a new mean–variance model with two-parameter coherent trapezoidal fuzzy numbers. This is also an extension of the traditional Markowitz model. In addition, we construct an equal-weight portfolio model to compare with our proposed model.

-

(f)

We select 20 stocks as examples to verify the feasibility and effectiveness of our proposed model. The results show that our new regret model can obtain higher returns and at the same time well describe investors’ optimism or pessimism.

The remainder of this paper is as follows. Section 2 summarizes the theoretical background of the LR fuzzy numbers, proposes some new definitions of two-parameter coherent fuzzy numbers, and gives derivations for the possibilistic expected value and the possibilistic variance of a new coherent fuzzy number. Section 3 proposes the possibilistic equal-weight, mean–variance model and the regret minimization portfolio model with TPCFN. Section 4 reports details of the empirical results. In Sect. 5, we conclude the research results and remark about future work.

2 Preliminaries

In this part, we recall LR fuzzy numbers and give a new definition of two-parameter coherent fuzzy numbers. At the same time, we give the possibilistic distribution function, possibilistic density function, possibilistic mean, and possibilistic variance of the newly defined fuzzy number. Furthermore, we calculate the numerical expressions of the above statistical characteristics by rigorous mathematical proof. In addition, we also explore the influence of two parameters on the values of mean and variance.

2.1 LR fuzzy numbers

Definition 1

(Dubois and Prade 1983) A fuzzy number \(A\) is called an LR fuzzy number and denoted as \(A = (a_{1} ,a_{2} ,a_{3} ,a_{4} )_{LR}\) if its membership function \(\mu_{A} (x)\) has the following form:

where the functions L and R are called left and right shape functions fulfilling the following conditions:

(1) \(L(x) = L( - x), \, R(x) = R( - x);\)

(2) \(L(0) = R(0) = 1, \, L(1) = R(1) = 0;\)

(3) \(L( \cdot )\) and \(R( \cdot )\) are decreasing functions from \([0,\infty )\) to \([0,1]\).

Case 1: If \(L(t) = R(t) = 1 - t\), then the LR fuzzy number \(\widetilde{A}\) is degenerated to the trapezoidal fuzzy number.

Case 2: If \(L(t) = R(t) = 1 - t, \, a_{2} = a_{3}\), then the LR fuzzy number \(\widetilde{A}\) is degenerated to the triangular fuzzy number and denoted as \(\widetilde{A} = (a_{1} ,a_{2} ,a_{4} )\).

Case 3: If \(L(t) = R(t) = 1 - t, \, a_{2} = a_{3} = a, \, a_{2} - a_{1} = a_{4} - a_{3} = r\), then the LR fuzzy number \(\widetilde{A}\) is called to the symmetric triangular fuzzy number and denoted as \(\widetilde{A} = (a,r)\) or \(\widetilde{A} = (a - r,a,a + r)\).

To help you understand, we give the following three examples: trapezoidal fuzzy numbers (1,2,3,5), triangular fuzzy numbers (1,2,5), and symmetric triangular fuzzy numbers (1,3,5) (Fig. 1).

Definition 2

(Zadeh 1965) For any \(\gamma \in [0,1]\), the \(\gamma -\) level set of a fuzzy number \(\widetilde{A}\) denoted by \([\widetilde{A}]^{\gamma } = \{ x \in X:\mu_{{\widetilde{A}}} (x) \ge \gamma \}\). There exists an increasing function \(\eta_{1} :[0,1] \to x\) and a decreasing function \(\eta_{2} :[0,1] \to x\) such that \([\widetilde{A}]^{\gamma } = \{ \eta_{1} (\gamma ),\eta_{1} (\gamma )\}\) for all \(\gamma \in [0,1]\).

2.2 New definitions of two-parameter coherent fuzzy numbers (TPCFN)

Definition 3

A LR fuzzy number \(\widetilde{A}\) is called a two-parameter coherent LR fuzzy number and denoted as \(\widetilde{A} = (a_{1} ,a_{2} ,a_{3} ,a_{4} ;\alpha ,\beta )_{LR}\) if its membership function \(\mu_{{\widetilde{A}}} (x)\) has the following form:

where \(\alpha\) and \(\beta\) are fixed positive real numbers called adaptive parameters and satisfy \((\alpha - 1)(\beta - 1) \ge 0\). Obviously, if \(\alpha = \beta = 1\), then the coherent LR fuzzy number reduces to the usual LR fuzzy number.

Definition 4

If \(L(t) = R(t) = 1 - t\), then the two-parameter coherent LR fuzzy number \(\widetilde{A}\) degenerates to the two-parameter coherent trapezoidal fuzzy number \(\widetilde{A} = (a_{1} ,a_{2} ,a_{3} ,a_{4} ;\alpha ,\beta )\).

Specially, when \(\alpha = \beta\), we get the same result as Li and Yi (2019). Obviously, if \(\alpha = \beta = 1\), then the two-parameter coherent trapezoidal fuzzy number reduces to the usual trapezoidal fuzzy number which means neutrality of investors. Next, we discuss the relationship between the parameters’ range of the coherent trapezoidal fuzzy number and the investors’ attitude, as well as its membership degree compared with that of the traditional trapezoidal fuzzy number. In addition, for a better presentation, we have listed the results in Table 1.

Case 1: If \(0 < \alpha < 1\) and \(0 < \beta < 1\), the two-parameter coherent trapezoidal fuzzy number assigns relatively smaller membership degrees to unfavorable returns in \([a_{1} , \, a_{2} ]\) and larger membership degrees to favorable returns in \([a_{3} , \, a_{4} ]\) comparing with the corresponding trapezoidal fuzzy number. In view of this fact, \(0 < \alpha < 1,\) and \(0 < \beta < 1\) both can be seen as indications of the optimistic expectation of the investors. Smaller \(\alpha\) and \(\beta\) (\(0 < \alpha , \, \beta < 1\)) mean more optimism for the investors.

Case 2: If \(0 < \alpha < 1\) and \(\beta = {1}\), the two-parameter coherent trapezoidal fuzzy number assigns relatively smaller membership degrees to unfavorable returns in \([a_{1} , \, a_{2} ]\) comparing with the corresponding trapezoidal fuzzy number. It means that investors are optimistic in \([a_{1} , \, a_{2} ]\) and neutral in \([a_{3} , \, a_{4} ]\). Smaller \(\alpha\) (\(0 < \alpha < 1\)) means more optimism for the investors.

Case 3: If \(\alpha = 1\) and \(0 < \beta < 1\), the two-parameter coherent trapezoidal fuzzy number assigns relatively larger membership degrees to favorable returns in \([a_{3} , \, a_{4} ]\) comparing with the corresponding trapezoidal fuzzy number. It means that investors are neutral in \([a_{1} , \, a_{2} ]\) and optimistic in \([a_{3} , \, a_{4} ]\). Smaller \(\beta\) (\(0 < \beta < 1\)) means more optimism for the investors.

Case 4: If \(\alpha = 1\) and \(\beta = {1,}\) the two-parameter coherent trapezoidal fuzzy number reduces to the usual trapezoidal fuzzy number, which represents the neutrality of investors.

Case 5: If \(\alpha = 1\) and \(\beta > 1\), the two-parameter coherent trapezoidal fuzzy number assigns relatively smaller membership degrees to favorable returns in \([a_{3} , \, a_{4} ]\) comparing with the corresponding trapezoidal fuzzy number. It means that investors are neutral in \([a_{1} , \, a_{2} ]\) and pessimistic in \([a_{3} , \, a_{4} ]\). Larger \(\beta\) (\(> 1\)) means more pessimism for the investors.

Case 6: If \(\alpha > 1 \, \) and \(\beta = {1}\), the two-parameter coherent trapezoidal fuzzy number assigns relatively larger membership degrees to unfavorable returns in \([a_{1} , \, a_{2} ]\) comparing with the corresponding trapezoidal fuzzy number. It means that investors are pessimistic in \([a_{1} , \, a_{2} ]\) and neutral in \([a_{3} , \, a_{4} ]\). Larger \(\alpha\) (\(> 1\)) means more pessimism for the investors.

Case 7: If \(\alpha > 1 \, \) and \(\beta > {1}\), the two-parameter coherent trapezoidal fuzzy number assigns relatively larger membership degrees to unfavorable returns in \([a_{1} , \, a_{2} ]\) and smaller membership degrees to favorable returns in \([a_{3} , \, a_{4} ]\) comparing with the corresponding trapezoidal fuzzy number. It means that investors are pessimistic in \([a_{1} , \, a_{2} ]\) and pessimistic in \([a_{3} , \, a_{4} ]\). Larger \(\alpha\) and \(\beta\) (\(> 1\)) mean more pessimism for the investors.

Remark 1

By contrast, Li and Yi (2019) modeled the return of the assets by membership function in the special form:

Although the inclusion of the adaptive index takes into account investor psychology, it does not take into account the fact that the extent to which investors prefer favorable situations and avoid unfavorable ones may be different. In this paper, two parameters \(\alpha , \, \beta\) are introduced and the coherent trapezoidal fuzzy number with two parameters is defined. We consider the situation that investors’ preference for favorable returns is different from their aversion to unfavorable returns. In this respect, Li and Yi (2019) is a special case of our definition.

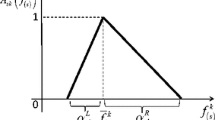

In order to show it more intuitively, we draw the following four types of two-parameter coherent trapezoidal fuzzy numbers with different parameter values, as shown in Fig. 2. The picture on the upper left is the membership function image of (1, 2, 3, 4, 0.5, 0.4), which corresponds to the case that both parameters are less than 1, representing optimistic investors. The upper right figure shows the membership function of (1, 2, 3, 4, 1, 1), where both parameters are equal to 1, which is the traditional trapezoidal fuzzy number, representing the neutral investor. By comparing the two images, we can see that when two parameters are less than 1, the membership degree corresponding to the left width is less than that of the parameters equal to 1, while the membership degree corresponding to the right width is greater than that of the parameters equal to 1. This further suggests that optimistic investors assign more membership degrees to favorable returns. The bottom left and bottom right graphs represent the coherent trapezoidal fuzzy numbers (1, 2, 3, 4, 2, 2) and (1, 2, 3, 4, 2, 2.5) with parameters greater than 1, respectively, and both correspond to pessimistic investors. By comparing them with the figure above, the opposite conclusion can be drawn.

Definition 5

If \(L(t) = R(t) = 1 - t, \, a_{2} = a_{3}\), then the two-parameter coherent trapezoidal fuzzy number is degenerated to the two-parameter coherent triangular fuzzy number and denoted as \(\widetilde{A} = (a_{1} ,a_{2} ,a_{4} ;\alpha ,\beta )\).

Specially, when \(\alpha = \beta\), we get the same result as Pankaj et al. (2021).

2.3 New definitions of possibilistic density function for TPCFN

Li et al. (2015) proposed a possibilistic density function for fuzzy numbers through membership functions to describe their numerical characteristics. Inspired by Li et al. (2015), we obtain the possibilistic density function for TPCFN.

Definition 6

Possibilistic density function for two-parameter coherent LR fuzzy number \(\widetilde{A} = (a_{1} ,a_{2} ,a_{3} ,a_{4} ;\alpha ,\beta )_{LR}\) is.

Specially, when \(\widetilde{A} = (a_{1} ,a_{2} ,a_{3} ,a_{4} ;\alpha ,\beta )\) is a two-parameter coherent trapezoidal fuzzy number, the possibilistic density function is

Furtherly, when \(\alpha = \beta ,\) we get the same result as Li and Yi (2019). When \(\widetilde{A} = (a_{1} ,a_{2} ,a_{4} ;\alpha ,\beta )\) is a two-parameter coherent triangular fuzzy number, the possibilistic density function is

Similar to the probability density function of a random variable, the possibilistic density function of the fuzzy number has the following properties:

-

(1)

\(f(x) \ge 0\);

-

(2)

\(\int_{ - \infty }^{ + \infty } {f(x)dx = 1}\).

Consequently, we define the possibilistic expected mean and the possibilistic variance of the two-parameter coherent fuzzy number respectively, as follows.

2.4 New possibilistic distribution functions of TPCFN

For the convenience of computation, we propose a counterpart of the possibilistic distribution function for the two-parameter coherent trapezoidal fuzzy number \(\widetilde{A} = (a_{1} ,a_{2} ,a_{3} ,a_{4} ;\alpha ,\beta )\).

Definition 7

The possibilistic distribution function \(F(x)\) for the coherent trapezoidal fuzzy number \(\widetilde{A} = (a_{1} ,a_{2} ,a_{3} ,a_{4} ;\alpha ,\beta )\) is defined as.

Furtherly, when \(\alpha = \beta\), we get the same result as Li and Yi (2019). When \(\widetilde{A} = (a_{1} ,a_{2} ,a_{4} ;\alpha ,\beta )\) is a two-parameter coherent triangular fuzzy number, the possibilistic density function is

2.5 New possibilistic means of TPCFN and their proofs

Theorem 1

For a two-parameter coherent trapezoidal fuzzy number \(\widetilde{A} = (a_{1} ,a_{2} ,a_{3} ,a_{4} ;\alpha ,\beta )\) with the possibilistic density function \(f(x)\), the possibilistic mean is:

Proof

By definition of the possibilistic mean, we get.

Specially, when \(\alpha = \beta\), for a two-parameter coherent trapezoidal fuzzy number \(\widetilde{A} = (a_{1} ,a_{2} ,a_{3} ,a_{4} ;\alpha ,\alpha )\),

we get the same result as Li and Yi (2019).

When \(a_{2} = a_{3}\), for a two-parameter coherent triangular fuzzy number \(\widetilde{A} = (a_{1} ,a_{2} ,a_{4} ;\alpha ,\beta )\),

When \(a_{2} = a_{3}\) and \(\alpha = \beta\), for a two-parameter coherent trapezoidal fuzzy number \(\widetilde{A} = (a_{1} ,a_{2} ,a_{4} ;\alpha ,\alpha )\),

Remark 2

When \(\alpha = \beta = 1\), the two-parameter coherent trapezoidal fuzzy number \(\widetilde{A} = (a_{1} ,a_{2} ,a_{3} ,a_{4} ;\alpha ,\beta )\) degenerates into a trapezoidal fuzzy number \(\widetilde{A} = (a_{1} ,a_{2} ,a_{3} ,a_{4} )\), then \(E(\widetilde{A}) = \frac{{a_{1} + 2a_{2} + 2a_{3} + a_{4} }}{6}\), the two-parameter coherent triangular fuzzy number \(\widetilde{A} = (a_{1} ,a_{2} ,a_{4} ;\alpha ,\beta )\) degenerates into the triangular fuzzy number \(\widetilde{A} = (a_{1} ,a_{2} ,a_{4} )\), then \(E(\widetilde{A}) = \frac{{a_{1} + 4a_{2} + a_{4} }}{6}\). Since \(\frac{\alpha }{2(\alpha + 2)} + \frac{1}{\alpha + 2} + \frac{\beta }{2\beta + 1} + \frac{1}{{2\left( {2\beta + 1} \right)}} = 1\), \(E(\widetilde{A})\) is a weighted average of \(a_{1} , \, a_{2} , \, a_{3}\) and \(a_{4}\). We summarize the above results in Table 2.

Next, for the two-parameter trapezoidal fuzzy number \(\widetilde{A} = (a_{1} ,a_{2} ,a_{3} ,a_{4} ;\alpha ,\beta )\), we discuss the effect of different parameter values on the possibilistic mean as follows.

-

(1)

If \(\alpha ,\beta < 1\), then in Eq. (10), the coefficient \(\frac{\alpha }{2(\alpha + 2)} < \frac{1}{6}\) for \(a_{1}\),\(\frac{1}{\alpha + 2} > \frac{1}{3}\) for \(a_{2}\),\(\frac{\beta }{2\beta + 1} < \frac{1}{3}\) for \(a_{3}\),\(\frac{1}{2(\beta + 2)} > \frac{1}{6}\) for \(a_{4}\). That is to say, compared with the usual trapezoidal fuzzy number, less weight is assigned to \(a_{1}\) and \(a_{3}\) while more weight is assigned to \(a_{2}\) and \(a_{4}\) when calculating the expected mean.

-

(2)

If \(\alpha < 1, \, \beta = {1}\), then in Eq. (10), the coefficient \(\frac{\alpha }{2(\alpha + 2)} < \frac{1}{6}\) for \(a_{1}\),\(\frac{1}{\alpha + 2} > \frac{1}{3}\) for \(a_{2}\),\(\frac{\beta }{2\beta + 1} = \frac{1}{3}\) for \(a_{3}\), \(\frac{1}{2(\beta + 2)} = \frac{1}{6}\) for \(a_{4}\). That is to say, compared with the usual trapezoidal fuzzy number, less weight is assigned to \(a_{1}\) while more weight is assigned to \(a_{2}\) when calculating the expected mean.

-

(3)

If \(\alpha = 1, \, \beta < {1}\), then in Eq. (10), the coefficient \(\frac{\alpha }{2(\alpha + 2)} = \frac{1}{6}\) for \(a_{1}\),\(\frac{1}{\alpha + 2} = \frac{1}{3}\) for \(a_{2}\),\(\frac{\beta }{2\beta + 1} < \frac{1}{3}\) for \(a_{3}\), \(\frac{1}{2(\beta + 2)} > \frac{1}{6}\) for \(a_{4}\). That is to say, compared with the usual trapezoidal fuzzy number, less weight is assigned to \(a_{3}\) while more weight is assigned to \(a_{4}\) when calculating the expected mean.

-

(4)

If \(\alpha = 1, \, \beta = {1}\), then in Eq. (10), the coefficient \(\frac{\alpha }{2(\alpha + 2)} = \frac{1}{6}\) for \(a_{1}\),\(\frac{1}{\alpha + 2} = \frac{1}{3}\) for \(a_{2}\),\(\frac{\beta }{2\beta + 1} = \frac{1}{3}\) for \(a_{3}\), \(\frac{1}{2(\beta + 2)} = \frac{1}{6}\) for \(a_{4}\). That is to say, compared with the usual trapezoidal fuzzy number, the trapezoidal fuzzy number with two parameters has the same expected mean.

-

(5)

If \(\alpha = 1, \, \beta > {1}\), then in Eq. (10), the coefficient \(\frac{\alpha }{2(\alpha + 2)} = \frac{1}{6}\) for \(a_{1}\),\(\frac{1}{\alpha + 2} = \frac{1}{3}\) for \(a_{2}\),\(\frac{\beta }{2\beta + 1} > \frac{1}{3}\) for \(a_{3}\), \(\frac{1}{2(\beta + 2)} < \frac{1}{6}\) for \(a_{4}\). That is to say, compared with the usual trapezoidal fuzzy number, more weight is assigned to \(a_{3}\) while less weight is assigned to \(a_{4}\) when calculating the expected mean.

-

(6)

If \(\alpha > 1, \, \beta = {1}\), then in Eq. (10), the coefficient \(\frac{\alpha }{2(\alpha + 2)} > \frac{1}{6}\) for \(a_{1}\),\(\frac{1}{\alpha + 2} < \frac{1}{3}\) for \(a_{2}\), \(\frac{\beta }{2\beta + 1} = \frac{1}{3}\) for \(a_{3}\), \(\frac{1}{2(\beta + 2)} = \frac{1}{6}\) for \(a_{4}\). That is to say, compared with the usual trapezoidal fuzzy number, more weight is assigned to \(a_{1}\) while less weight is assigned to \(a_{2}\) when calculating the expected mean.

-

(7)

If \(\alpha ,\beta > 1\), then in Eq. (10), the coefficient \(\frac{\alpha }{2(\alpha + 2)} > \frac{1}{6}\) for \(a_{1}\),\(\frac{1}{\alpha + 2} < \frac{1}{3}\) for \(a_{2}\), \(\frac{\beta }{2\beta + 1} > \frac{1}{3}\) for \(a_{3}\), \(\frac{1}{2(\beta + 2)} < \frac{1}{6}\) for \(a_{4}\). That is to say, compared with the usual trapezoidal fuzzy number, more weight is assigned to \(a_{1}\) and \(a_{3}\) while less weight is assigned to \(a_{2}\) and \(a_{4}\) when calculating the expected mean.

Remark 3

These facts further indicate that \(\alpha , \, \beta > 1\) represents the pessimistic attitude of investors and \(\alpha , \, \beta < 1\) represents the optimistic attitude of investors, respectively. For an extremely pessimistic investor (\(\alpha , \, \beta \to \infty\)), \(E(\tilde{A}) = \frac{{a_{1} + a_{3} }}{2}\) while for an extremely optimistic investor (\(\alpha , \, \beta \to 0\)), \(E(\tilde{A}) = \frac{{a_{2} + a_{4} }}{2}\). The above discussion results are summarized in Table 3 below.

2.6 New possibilistic variances of TPCFN and their proofs

Theorem 2

For a two-parameter coherent trapezoidal fuzzy number \(\widetilde{A} = (a_{1} ,a_{2} ,a_{3} ,a_{4} ;\alpha ,\beta )\) with the possibilistic density function \(f(x)\), the possibilistic variance is.

where

Proof

By definition of the possibilistic mean, we obtain.

where

when \(\alpha = \beta\), for the two-parameter coherent trapezoidal fuzzy number \(\widetilde{A} = (a_{1} ,a_{2} ,a_{3} ,a_{4} ;\alpha ,\alpha )\),

where

We get the same result as Li and Yi (2019). When \(a_{2} = a_{3}\), for the two-parameter coherent triangular fuzzy number \(\widetilde{A} = (a_{1} ,a_{2} ,a_{4} ;\alpha ,\beta )\),

where

When \(a_{2} = a_{3}\), \(\alpha = \beta\), for the two-parameter coherent triangular fuzzy number \(\widetilde{A} = (a_{1} ,a_{2} ,a_{4} ;\alpha ,\alpha )\),

where

Remark 4

When \(\alpha = \beta = 1\), the two-parameter coherent trapezoidal fuzzy number \(\widetilde{A} = (a_{1} ,a_{2} ,a_{3} ,a_{4} ;\alpha ,\beta )\) degenerates into the trapezoidal fuzzy number \(\widetilde{A} = (a_{1} ,a_{2} ,a_{3} ,a_{4} )\), then.

which is coherent with the results by Li et al. (2015). The two-parameter coherent triangular fuzzy number \(\widetilde{A} = (a_{1} ,a_{2} ,a_{4} ;\alpha ,\beta )\) degenerates into the triangular fuzzy number \(\widetilde{A} = (a_{1} ,a_{2} ,a_{4} )\), then

We summarize the above results in Table 4.

Remark 5

It can be seen that the possibilistic expected mean of a two-parameter coherent trapezoidal fuzzy number can also be obtained by.

And the possibilistic variance of a two-parameter coherent trapezoidal fuzzy number can also be obtained by

Property 1

The derivatives of the variance of the two-parameter coherent trapezoidal fuzzy number with respect to the two parameters are as follows.

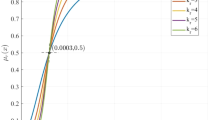

After one parameter is fixed, the images of the variance of the two-parameter coherent trapezoidal fuzzy number changing with the other parameter are as follows:

Remark 6

Figure 3 shows that the mean decreases and the variance increases with the increase of \(\alpha\) when \(\beta\) is fixed, and Fig. 4 shows that the mean and variance decrease with the increase of \(\beta\) when \(\alpha\) is fixed. This is coherent with the theoretical result of Property 1.

Remark 7

Figure 5 shows that when \(\alpha = \beta < 1\), the variance decreases as \(\alpha\) and \(\beta\) increase, when \(\alpha = \beta > 1\), the variance increases as \(\alpha\) and \(\beta\) increase, when \(\alpha = \beta = 1\), the variance is minimized. then we obtain the same result as Li and Yi (2019).

Definition 10

Let \(\widetilde{A}_{i} = (a_{i1} ,a_{i2} ,a_{i3} ,a_{i4} ;\alpha ,\beta )(i = 1, \, 2)\) be the two-parameter coherent trapezoidal fuzzy numbers with parameters \(\alpha\) and \(\beta\),\(x \ge 0\). Then the addition and the scalar multiplication are respectively defined as follows:

-

(1)

\(\tilde{A}_{1} \oplus \tilde{A}_{2} = (a_{11} + a_{21} ,a_{12} + a_{22} ,a_{13} + a_{23} ,a_{14} + a_{24} ;\alpha ,\beta )\);

-

(2)

\(x\tilde{A}_{1} = (xa_{1} ,xa_{2} ,xa_{3} ,xa_{4} ;\alpha ,\beta )\).

Remark 8

It is supposed that short sale is not allowed in this work, so \(x > 0\) for the scalar multiplication. By Eqs. (9) and (13), we can obtain these properties:

-

(1)

\(E(\tilde{A}_{1} \oplus \tilde{A}_{2} ) = E(\tilde{A}_{1} ) + E(\tilde{A}_{2} )\);

-

(2)

\(E(x\tilde{A}_{1} ) = xE(\tilde{A}_{1} )\);

-

(3)

\(V(x\tilde{A}_{1} ) = x^{2} V(\tilde{A}_{1} )\).

In general, \(V(\tilde{A}_{1} \oplus \tilde{A}_{2} ) \ne V(\tilde{A}_{1} ) + V(\tilde{A}_{2} )\), which is analogous to the traditional property of variance on probabilistic random variables in the presence of covariance. For example, two two-parameter coherent trapezoidal fuzzy numbers \(\tilde{A}_{1} = (1,2,3,4;2,2)\) and \(\tilde{A}_{2} = (1,2,3,5;2,2)\). According to Definition 10, we can calculate \(A_{1} \oplus A_{2} = (2,4,6,9;2,2)\). According to Theorem 2, we can calculate \(V(A_{1} \oplus A_{2} ) = {3}{\text{.5267,}}\) \(V(A_{1} ) = 0.7775\) and \(V(A_{2} ) = {0}{\text{.9975}}{.}\) Then \(V(A_{1} ) + V(A_{2} ) = 0.7775 + 0.9975 = 1.7750 \ne V(A_{1} \oplus A_{2} ).\)

3 Model formulation

In this part, the equal-weighted portfolio model, the mean–variance model, and the regret portfolio model with two-parameter coherent trapezoidal fuzzy numbers are proposed. Suppose that an investor wishes to allocate the available wealth among \(n\) assets \(\left( {i = 1, \, 2, \ldots ,n} \right)\). The returns of assets are described by the two-parameter coherent trapezoidal fuzzy numbers. The investor assigns parameters \(\alpha\) and \(\beta\), which indicate his market perception (pessimistic, optimistic, or neutral). Let us suppose that the return of the \(i{\text{ - th}}\) asset is given by the two-parameter coherent trapezoidal fuzzy number \(\xi_{i;\alpha ,\beta } = (a_{i1} ,a_{i2} ,a_{i3} ,a_{i4} ;\alpha ,\beta )\). \(x_{i}\) is the proportion of investment in the \(i{\text{ - th}}\) asset. We define an auxiliary variable \(y_{i}\), which takes the value 1 if the \(i{\text{ - th}}\) asset is included in the portfolio and 0 otherwise. We assume that short selling of assets is not allowed, so \(x_{i} \ge 0\), for each \(i = 1, \, 2, \ldots , \, n\). The portfolio return is modeled by the fuzzy number \(\sum\limits_{i = 1}^{n} {x_{i} \xi_{i;\alpha ,\beta } } = \left( {\sum\limits_{i = 1}^{n} {x_{i} a_{i1} } ,\sum\limits_{i = 1}^{n} {x_{i} a_{i2} } ,\sum\limits_{i = 1}^{n} {x_{i} a_{i3} } ,\sum\limits_{i = 1}^{n} {x_{i} a_{i4} } ;\alpha ,\beta } \right)\). Next, we define the objectives and constraints of the model.

3.1 Objectives

3.1.1 Expected return

The first objective is to maximize the expected return from the portfolio. This is modeled as

3.1.2 Variance

The second objective is to minimize the risk of the portfolio. In our case, this is the variance of the portfolio return. This is modeled as

where \(\rho_{i} { (}i = 1, \, 2, \, 3, \, 4, \, 5)\) are those coefficients in Eq. (13).

3.1.3 Regret value

The third objective is to minimize the regret value of the portfolio. In our case, the preference function (\(E(\xi_{i;\alpha ,\beta } ) - \gamma Var(\xi_{i;\alpha ,\beta } )\)) is used to measure regret value, and the difference of preference function values is minimized,\(\gamma\) is the coefficient of risk aversion. This is modeled as

3.2 Constraints

-

(a)

Total investment constraint.

$$ \, x_{1} + x_{2} + \cdots + x_{n} = 1. $$(34) -

(b)

Upper bound on investment in the \(i{\text{ - th}}\) asset. Suppose the investor sets an upper bound \(u_{i}\) on the proportion of investment in the \(i{\text{ - th}}\) asset. Then

$$ x_{i} y_{i} \le u_{i} {,}\forall \, i = 1,2, \ldots ,n. $$(35) -

(c)

Lower bound on investment in the \(i{\text{ - th}}\) asset. Suppose the investor sets a lower bound \(l_{i}\) on the proportion of investment in the \(i{\text{ - th}}\) asset. Then

$$ x_{i} y_{i} \ge l_{i} {,}\forall \, i = 1,2, \ldots ,n. $$(36) -

(d)

No short selling constraint.

$$ x_{i} \ge 0{,}\forall \, i = 1,2, \ldots ,n. $$(37) -

(e)

Dummy variable constraint. Since \(y_{i}\) is allowed to take values 0 and 1, we subject \(y_{i}\) to the following constraint:

$$ y_{i} \in \left\{ {0, \, 1} \right\}{,}\forall \, i = 1,2, \ldots ,n. $$(38)

3.3 Three portfolio optimization model with two-parameter coherent trapezoidal fuzzy numbers

-

(a)

The equal-weighted portfolio with two-parameter coherent trapezoidal fuzzy number

“Don’t put all your eggs in one basket” is one of the most familiar investment principles. It means that you should invest in a broadly diversified portfolio to spread your risk. Equal-weighted investment is one of the simplest ways to achieve portfolio diversification, which can be mathematically expressed as:

$$ \left\{ \begin{gathered} x_{i} = \frac{1}{N} \hfill \\ {\text{ s}}{\text{.t}}{\text{. Eqs}}{. (34) - (38)}{\text{. }} \hfill \\ \end{gathered} \right. $$(39)where N is the total number of assets in the portfolio. \(x_{i}\) is the proportion of \(i{\text{ - th}}\) assets. For the equal weight investment portfolio problem, it still satisfies the constraints (34)-(38). Specifically, in the equity investment portfolio, \(x_{1} = x_{2} = \cdots = x_{n} = \frac{1}{n} \ge 0, \, y_{i} = 1,x_{1} + x_{2} + \cdots + x_{n} = 1, \, \) therefore, the constraints (34), (37), and (38) are met. And for given appropriate investment upper bound \(u_{i}\) and lower bound \(l_{i}\), it can be achieved \(x_{i} y_{i} \ge l_{i} {,}\forall \, i = 1,2, \ldots ,n.\)\(x_{i} y_{i} \ge l_{i} {,}\forall \, i = 1,2, \ldots ,n.\) So the constraints (35) and (36) are met. This method is very easy to implement. Equal-weighted investment is one of the fastest and most effective ways to diversify investment in the absence of historical asset data. However, equal-weighted investment only considers the allocation of weight in terms of quantity and does not consider the risk of the asset itself. That is to say, no matter the asset with great or minimal risk, the weight assigned under this method is the same, so the risk diversification effect brought by the model is limited.

-

(b)

The mean–variance portfolio with two-parameter coherent trapezoidal fuzzy numbers

As the descriptions of the mean returns and risks of asset returns by the two-parameter coherent trapezoidal fuzzy numbers, the possibilistic expected mean and variance for the two-parameter coherent trapezoidal fuzzy numbers are counterparts of the usual expected mean and variance of asset returns in mean–variance methodology. Therefore, following the mean–variance methodology, in order to obtain an optimized portfolio, the possibilistic expected mean can be maximized given the upper bound of the risk the investor can bear, i.e., the possibilistic variance of the portfolio. Specifically, the possibilistic expected mean–variance model for portfolio selection by the coherent trapezoidal fuzzy numbers can be structured as follows:

$$ \left\{ \begin{gathered} \max Z_{1} = E\left( {\sum\limits_{i = 1}^{n} {x_{i} \xi_{i;\alpha ,\beta } } } \right) \hfill \\ {\text{ s}}{\text{.t}}{. }Var\left( {\sum\limits_{i = 1}^{n} {x_{i} \xi_{i;\alpha ,\beta } } } \right) \le v \hfill \\ {\text{ Eqs}}{. (34) - (38)}{\text{.}} \hfill \\ \end{gathered} \right. $$(40) -

(c)

Regret minimization model with two-parameter coherent trapezoidal fuzzy number

The preference function \((E(\xi_{i;\alpha ,\beta } ) - \gamma V(\xi_{i;\alpha ,\beta } ))\) is used to measure regret value, and the difference of preference function value is minimized, a single objective regret minimization model with two-parameter coherent trapezoidal fuzzy numbers is structured as follows

$$ \left\{ \begin{array}{l} {\text{min }}Z_{2} = \mathop {\max }\limits_{1 \le i \le n} \left( {E(\xi_{i;\alpha ,\beta } ) - \gamma Var(\xi_{i;\alpha ,\beta } )} \right) - \left( {E(\sum\limits_{i = 1}^{n} {x_{i} \xi_{i;\alpha ,\beta } ) - \gamma Var(\sum\limits_{i = 1}^{n} {x_{i} \xi_{i;\alpha ,\beta } )} } } \right) \hfill \\ {\text{ s}}{\text{.t}}{\text{. Eqs}}{. (34) - (38)}{\text{. }} \hfill \\ \end{array} \right. $$(41)

4 Illustrative examples

In this section, we select a numerical example to verify the validity of our proposed model. First, we select 20 stocks as our data and convert the data into two-parameter consistent fuzzy numbers. Secondly, we use software to solve the three models and carry out a sensitivity analysis of the parameters. Finally, we compare the performance of the three models under five indicators.

4.1 Data sources

In this section, in order to verify the validity of the proposed models for portfolio selection by the two-parameter coherent trapezoidal fuzzy numbers, we provide a numerical example of asset allocation in investment portfolios. Specifically, we select 728 trading data of 20 stocks in CSI100 from June 3, 2019 to June 1, 2022. We have provided links to the website for the data here: https://cndata1-csmar-com.webvpn.scut.edu.cn/.

4.2 Model solving

In order to quantify the daily logarithmic return rates of the stocks by the two-parameter coherent trapezoidal fuzzy numbers in the form of \(\xi_{i} = (q_{0.1} ,q_{0.4} ,q_{0.6} ,q_{0.9} ;\alpha ,\beta )\), in which the intervals are specified by the sample quantiles \(q_{\alpha }\) of the history returns by the method of Vercher and Bermudez (2013) and \(\alpha ,\beta > 0\) are the given parameters, two indications of the expectations of the involved investors. Consequently, we can derive the returns of the stocks by the two-parameter coherent trapezoidal fuzzy numbers, listed in Table 5.

Considering the different expectations of the investors, we can use different values for \(\alpha\) and \(\beta\). Note that \(\alpha ,\beta < 1\) means the optimism of the investors, \(\alpha ,\beta = 1\) means neutrality, and \(\alpha ,\beta > 1\) means the pessimism of the investors.

For illustration, we set the following values for two parameters in Table 6. Each parameter is set as 0.5, 1.0, and 1.5. Due to the constraint of \((\alpha - 1)(\beta - 1) \ge 0\), the values that do not meet the conditions are excluded, and there are a total of 7 cases. In addition, we set \(l_{i} = 0, \, u_{i} = 0.9\).

4.2.1 For the equal-weighted model with two-parameter coherent trapezoidal fuzzy numbers

In order to diversify investment risks as much as possible, we set the number of assets in the portfolio N as the total number of shares 20, and regard the logarithmic return rate of assets as a two-parameter coherent trapezoidal fuzzy number, the mean value and variance of the portfolio can be calculated according to the formula of the possibilistic mean and variance of the portfolio, namely Formulae (31) and (32), as shown in Table 7 below.

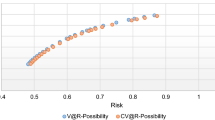

4.2.2 For the mean–variance model with two-parameter coherent trapezoidal fuzzy numbers

We use Matlab to solve Formula (40), gaining the optimal solution of the model, the possibilistic expected mean, and the possibilistic variance. Then we obtain the efficient frontiers by the possibilistic expected mean and the possibilistic variance, as shown in Fig. 6. It can be seen that when one parameter is fixed and the other parameter is smaller, the efficient frontier in Fig. 6 is steeper, such as when \(\alpha = 0.5\) is fixed, the efficient frontier with \(\beta = 0.5\) is steeper than that with \(\beta = 1.0\)(The dark blue line is above the orange line); when \(\beta = 1.0\) is fixed, the efficient frontier with \(\alpha = 0.5\) is steeper than that with \(\alpha = 1.0\) (The orange line is above the purple line), which means that optimistic investors will get a more favorable mean–variance portfolio in the fuzzy framework. Notably, each of these frontiers suggests that investors can earn higher returns by accepting a slightly higher variance.

Table 8 shows the optimal solution of Eq. (40) when the variance upper bound \(v = 2 \times 10^{ - 4}\), including the investment proportion, the expected mean, and the variance. As can be seen from Table 8, when the variance upper bound is \(2 \times 10^{ - 4}\), one parameter is fixed, the mean strictly decreases as the other parameter increases. When \(\alpha = 0.5, \, \beta = 0.5\), the expected mean has the largest value of 0.43%, at this point, 45.18% of the fourth stock is invested and 54.82% of the sixteenth stock is invested. This indicates that when the variance upper bound \(v = 2 \times 10^{ - 4}\), active investors get higher investment returns. When \(\alpha = 0.5, \, \beta = 1.0\) and \(\alpha = 1.0, \, \beta = 0.5\), the obtained optimal expected mean values are 0.35% and 0.25% respectively, which indicates that the increments of the two parameters have different effects on the mean values, and it also implies that the introduction of coherent fuzzy number with two parameters is of practical significance to maximize the return of the portfolio model.

Table 9 shows the optimal solution of Eq. (40) when the variance upper bound \(v = 4 \times 10^{ - 4}\), As can be seen from Table 9, when the variance upper bound is \(4 \times 10^{ - 4}\), one parameter is fixed, the mean strictly decreases as the other parameter increases. When \(\alpha = 0.5, \, \beta = 0.5\), the expected mean has the largest value of 0.77%, at this point, 90.00% of the fourth stock is invested, 1.41% of the seventh stock is invested and 8.59% of the tenth stock is invested. Different from Table 8, when the upper bound of variance changes from \(2 \times 10^{ - 4}\) to \(4 \times 10^{ - 4}\) and the values of parameters \(\alpha\) and \(\beta\) are 1.5, the optimal variance is \(3.5624 \times 10^{ - 4}\), which is less than the given upper bound. At this time, investors are too pessimistic and the obtained expected mean becomes negative.

Table 10 shows the optimal solution of Eq. (40) when the variance upper bound \(v = 6 \times 10^{ - 4}\), As can be seen from Table 10, when the variance upper bound is \(6 \times 10^{ - 4}\), one parameter is fixed, the mean strictly decreases as the other parameter increases. When \(\alpha = 0.5, \, \beta = 0.5\), the expected mean has the largest value of 0.89%, at this point, 10.00% of the seventh stock is invested and 90.00% of the tenth stock is invested. Different from Table 9, when the upper bound of variance changes from \(4 \times 10^{ - 4}\) to \(6 \times 10^{ - 4}\), for these cases \(\alpha = 0.5, \, \beta = 0.5\), \(\alpha = 0.5, \, \beta = 1.0\), \(\alpha = 1.0, \, \beta = 1.0\) and \(\alpha = 1.5, \, \beta = 1.5\) the optimal variances are \(5.8120 \times 10^{ - 4}\),\(4.1626 \times 10^{ - 4}\),\(5.1921 \times 10^{ - 4}\) and \(4.3563 \times 10^{ - 4}\) which are less than the given upper bound. This shows that when the upper bound becomes \(6 \times 10^{ - 4}\), the ability to constrain the model becomes very weak. In addition, when the upper bound of the risk that investors can tolerate becomes larger while the other parameters are unchanged, they can get higher returns. For example, in \(\alpha = 1.0, \, \beta = 0.5\), the mean changed from 0.48% to 0.61%.

From the comparison of Tables 8, 9, 10, it can be seen that although the values of the upper bounds of variance are different, when investors are most optimistic, the expected means reach their maximum values. In addition, we can derive that when one parameter is fixed, as the other parameter increases, the change in the mean becomes smaller. For example, for the case that the upper bound for the possibilistic variance changes from \(v = 2 \times 10^{ - 4}\) to \(v = 4 \times 10^{ - 4}\), when \(\alpha = 1.0\), the increments of the maximized possibilistic expected means of the returns for the cases \(\beta = 0.5, \, \beta = 1.0, \, \beta = 1.5\) are 0.0023, 0.0013, and 0.0006. A similar result can be obtained for the case \(v = 4 \times 10^{ - 4}\) changes to \(v = 6 \times 10^{ - 4}\). This means that when investors bear the same increment of risk, the more pessimistic they are, the less marginal return they will get.

4.2.3 For the regret minimization model with two-parameter coherent trapezoidal fuzzy numbers

In this part, the parameters are still set to the seven cases above, then we use Matlab to solve Eq. (41). Then we get the optimal solution of the model when the risk aversion coefficient is set as 2, 3, and 4 respectively under the conditions of the above seven situations, and obtain the possibilistic expected mean, possibilistic variance, and the optimal value of the objective function. Specific numerical results are shown in Tables 11, 12, and 13. (The actual values of mean, variance, and regret function should be multiplied by 10 to the -4th power.)

As can be seen from Table 11, when the risk aversion coefficient \(\gamma = 2\), parameter \(\alpha\) is fixed, both the optimal expected mean and the optimal variance decrease with the increase of parameter \(\beta\). Similarly, when parameter \(\beta\) is fixed, both the optimal expected mean and the optimal variance decrease with the increase of the parameter \(\alpha\). Coherent with the theoretical results, the variance increases with the increase of the expected mean. When \(\alpha = 0.5, \, \beta = 0.5\), the expected mean of the return rate is the largest, which is 0.89%, and the variance is also the largest, which is \(5.8120 \times 10^{ - 4}\). When \(\alpha = 1.0, \, \beta = 1.0\), the objective function value is the smallest, which is \(2.51 \times 10^{ - 6}\). At this time, the expected mean of the return rate is 0.3%, and the variance is \(5.1921 \times 10^{ - 4}\). As can be seen from the table, the parameter combination that maximizes the mean value will not minimize the value of the objective function, which also indicates that minimizing regret and maximizing return are different goals. When investors are more optimistic, they can get more expected returns, and when investors keep a neutral attitude, they can minimize the regret value.

Table 12 shows the solution results of Eq. (41) when the risk aversion coefficient \(\gamma = 3\). Similar to Tables 11, 12 also shows that when one parameter is fixed, the mean and variance decrease as the other parameter increases. When \(\alpha = 0.5, \, \beta = 0.5\), the mean of return rate is the largest, which is 0.89%, and the variance is also the largest, which is \(5.8120 \times 10^{ - 4}\). When \(\alpha = 1.0, \, \beta = 0.5\), the objective function value is the smallest, which is \(1.13 \times 10^{ - 5}\). At this time, the expected mean is 0.64%, and the variance is \(6.9688 \times 10^{ - 4}\). In this situation, the neutral attitude of the investor does not minimize the value of our regret function, but requires appropriate optimism.

Table 13 presents the solution results of Eq. (41) when the risk aversion coefficient \(\gamma = 4\). Similar to Tables 12, 13 also shows that when one parameter is fixed, the expected mean and variance decrease as the other parameter increases. When \(\alpha = 0.5, \, \beta = 0.5\), the mean of return rate is the largest, which is 0.89%, and the variance is also the largest, which is 5.8120. When \(\alpha = 1.0, \, \beta = 0.5\), the objective function value is the smallest, which is \(1.381 \times 10^{ - 5}\). At this time, the mean is 0.57%, and the variance is \(4.9601 \times 10^{ - 4}\).

From the comparison of the three tables, it can be seen that when the risk aversion coefficient takes different values, it is when the investor’s attitude is the most optimistic that the mean is the largest. In addition, as the risk aversion coefficient increases, the value of the regret function will decrease when the same parameters are taken. For example, when \(\alpha = 0.5, \, \beta = 0.5\), the regret value is \(4.824 \times 10^{ - 5}\) at \(\gamma = 2\), the regret value is \(4.387 \times 10^{ - 5}\) at \(\gamma = 3\), and when the regret value continues to decrease to \(3.950 \times 10^{ - 5}\) at \(\gamma = 4\).

Below, we draw line graphs of the possibilistic mean and variance of the equal-weight model, the mean–variance model, and the regret minimization model under different parameter values. According to Fig. 7, we can see that the mean of the regret minimization model is greater than that of the mean–variance model under the conditions (0.5, 0.5), (0.5, 1.0), (1.0, 0.5), (1.0, 1.0) and (1.5, 1.0). The mean of the equal-weighted portfolio is the smallest in all seven cases. In Fig. 8, in seven cases, the variance of regret minimization is the smallest, which is smaller than the variance of the equal weight model; meanwhile, the variance of the mean–variance model is the largest, which is larger than the variance of the equal weight model.

4.3 Comparative analysis

In order to prove that our proposed models are feasible and effective, we make use of the daily return data of the above 20 stocks, take annual returns, Sharpe ratio, beta value, unsystematic risk, and alpha value as indicators to compare our proposed model with equal-weighted portfolio. The specific data obtained are shown in Table 14. The risk aversion coefficient \(\gamma = 2\) and variance upper bound \(v = 4 \times 10^{ - 4}\). We use the benchmark rate of 2.41% for three-year time deposits as the risk-free rate.

-

(1)

In terms of annual returns, compared with the equal-weighted portfolio, the mean–variance model and regret minimization model have larger annual returns under the same parameter setting. When both parameters are less than 1, the regret minimization model has a higher return than the mean–variance model, which indicates that when investors are optimistic, the regret minimization model is better than the mean–variance model. When both parameters are at least 1, the opposite result is obtained (Fig. 9).

-

(2)

The Sharpe ratio represents that investors can get a few extra rewards for each extra point of risk they take. If it is greater than 1, it means that the fund return rate is higher than the volatility risk. If it is less than 1, it means that the fund operation risk is greater than the rate of return. In this way, the Sharpe ratio can be calculated for each portfolio, namely, the ratio of investment return to excess risk. The higher the ratio, the better the portfolio. In terms of the Sharpe ratio, the value of the regret minimization model is smaller than that of the mean–variance model but larger than that of the equal-weight portfolio under the same parameter setting (Fig. 10).

-

(3)

Beta is a risk index that measures the price movements of individual stocks or stock funds relative to the overall stock market. A higher beta means a stock is more volatile relative to its performance benchmark, and vice versa. When \(\beta = 1\), it means that the returns and risks of the stock are in line with those of the broad index. When \(\beta > 1\), it means that the return and risk of the stock are greater than that of the broad index. Except in the extremely pessimistic case, the beta values of the regret minimization model are larger than those of the mean–variance model and the equal-weight portfolio. This indicates that the regret minimization model has the strongest volatility relative to the market, while the equal-weight model has the weakest volatility relative to the market (Fig. 11).

-

(4)

Unsystematic risk is also called ‘non-market risk’ and ‘diversifiable risk’. It refers to those risks that have nothing to do with fluctuations in financial speculation markets such as stock markets, futures markets, and foreign exchange markets. In terms of unsystematic risk, the equal-weight portfolio has the smallest unsystematic risk, which can also be deduced from its greater dispersion (Fig. 12).

-

(5)

Alpha represents the excess return on the portfolio. As can be seen from the above table, the alpha values of the mean–variance model and the minimization regret model are both greater than that of the equal-weight portfolio, except when investors are in an extremely pessimistic attitude. Under the same parameter setting, the excess return of the regret minimization portfolio model is greater than the corresponding values of the mean–variance model and equal-weight model (Fig. 13).

In addition, when both parameter values are equal to 1, we processed the data in Table 14 to find the corresponding percentages of each index value for three models and obtain Fig. 14. We can see that the regret minimization model has the highest annualized returns and excess returns. At the same time, it also has higher unsystematic risk and volatility.

From the above discussion, it can be seen that the regret minimization model is superior to the mean–variance model to the equal-weight portfolio in terms of obtaining higher returns. If the investor wants to obtain higher returns, the regret minimization model is the best choice for him. In terms of risk aversion, the mean–variance model is better than the regret minimization model. If the investor’s main purpose is to avoid risk, the mean–variance model is the best choice for him.

We have compared our work with some existing ones and listed them in Table 15. Compared with Li’s work in 2019, we explored the investment situation in which the coherent fuzzy number with an adaptive index is used to describe the return, including the case that the parameters are all equal to 0.5, 1.0, and 1.5. At the same time, we also consider the two parameters are not equal, and explore the two parameters on the different impact of investment decisions. This shows that the portfolio model we consider is more universal and practical. Through the above arguments, it can be concluded that the different expectations of investors can be proved by coherent trapezoidal fuzzy numbers when the two parameters are introduced into the fuzzy portfolio selection model. Compared with the coherent trapezoidal fuzzy number with an adaptive index, the coherent trapezoidal fuzzy number with two parameters is generalized, which is an extension of the original case.

5 Conclusion

In this paper, a kind of coherent generalized fuzzy number with two parameters is presented. In particular, the membership degree functions of two-parameter coherent trapezoidal fuzzy numbers and two-parameter coherent triangular fuzzy numbers are proposed. Then we work out the possibilistic mean and the possibilistic variance. To some extent, it is a generalization of the coherent trapezoidal fuzzy number with an adaptive index proposed by Li and Yi (2019) and we remedy the limitation of coherent trapezoidal fuzzy number with an adaptive index, namely, we consider the situation that investors’ preference for favorable returns is different from their aversion to unfavorable returns (when the two parameters have different values). Furtherly, we use the preference function to describe the regret value. Based on the regret theory, we propose a regret minimization portfolio model and a mean–variance model with two-parameter coherent trapezoidal fuzzy numbers. Finally, we use a numerical example to demonstrate the feasibility of our proposed models and compare them with the equal-weighted portfolio. The results show that the regret minimization model outperforms the mean–variance model and the equal-weighted portfolio in obtaining higher returns. In terms of risk aversion, the mean–variance model is better than the regret minimization model.

In future research, on the one hand, we are committed to extending the two-parameter coherent fuzzy number to the two-parameter coherent intuitionistic fuzzy number. We should consider not only the membership degree of the fuzzy number, but also the non-membership degree and hesitation degree of the fuzzy number, so that it can describe the real investment environment more accurately. On the other hand, we intend to combine the two-parameter coherent fuzzy number with the prospect theory to further explore the influence of investment psychology on investment decisions.

Availability of data and materials

The datasets used or analyzed during the current study are available from the corresponding author on reasonable request.

References

Adcock C (2014) Mean-variance-skewness efficient surfaces, stein’s lemma and the multivariate extended skew-student distribution. Eur J Oper Res 234(2):392–401

Arrsoy Y E, Bali T G (2018) Regret in financial decision making under volatility uncertainty. Georgetown McDonough School of Business Research Paper 3195191

Baule R, Korn O, Kuntz LC (2019) Markowitz with regret. J Econ Dyn Control 103:1–24

Bell DE (1982) Regret in decision making under uncertainty. Oper Res 30(5):961–981

Carlsson C, Fuller R (2001) On possibilistic mean value and variances of fuzzy numbers. Turku Centre Comput Sci 122(2):315–326

Chorus CG, Arentze TA, Timmermans HJP (2008) A random regret minimization model of travel choice. Transp Res Part B 42(1):1–18

Chorus CG (2010) A new model of random regret minimization. Eur J Transp Infrastruct Res 10(2):181–196

Dubois D, Prade H (1983) Ranking of fuzzy numbers in the setting of possibilistic theory. Inf Sci 30:183–224

Fioretti M, Vostroknutov A, Coricelli G (2022) Dynamic regret avoidance. Am Econ J Microecon 14(1):70–93

Frydman C, Camerer C (2016) Neural evidence of regret and its implications for investor behavior. Soc Sci Electron Pub 29(11):3108–3139

Gong X, Min L, Yu C (2022) Multi-period portfolio selection under the coherent fuzzy environment with dynamic risk-tolerance and expected-return levels. Appl Soft Comput 114:108104

Gong X, Yu C, Min L, Ge Z (2021) Regret theory-based fuzzy multi-objective portfolio selection model involving DEA cross-efficiency and higher moments. Appl Soft Comput 100:106958

Gupta P, Mehlawat MK, Yadav S, Kumar A (2020) Intuitionistic fuzzy optimistic and pessimistic multi-period portfolio opti-mization models. Soft Comput 24(16):11931–11956. https://doi.org/10.1007/s00500-019-04639-3

Herweg F, Müller D (2021) A comparison of regret theory and salience theory for decisions under risk. J Econ Theory 193:105226. https://doi.org/10.1016/j.jet.2021.105226

Konno H, Yamazaki H (1991) Mean-absolute deviation portfolio optimization model and its applications to Tokyo stock market. Manage Sci 37(5):519–531

Lai ZR, Li C, Wu XT, Guan QL, Fang LD (2022) Multi trend conditional value at risk for portfolio optimization. IEEE Trans Neural Netw Learn Syst. https://doi.org/10.1109/TNNLS.2022.3183891

Li HQ, Yi ZH (2019) Portfolio selection with coherent Investor’s expectations under uncertainty. Expert Syst Appl 133:49–58. https://doi.org/10.1016/j.eswa.2019.05.008

Li MT, Xu QF, Jiang CX, Zhao QN (2023) The role of tail network topological characteristic in portfolio selection: a TNA-PMC model. Int Rev Financ 23(1):37–57. https://doi.org/10.1111/irfi.12379

Li X, Guo S, Yu L (2015) Skewness of fuzzy numbers and its applications in portfolio selection. IEEE Trans Fuzzy Syst 23:2135–2143

Li X, Qin Z, Kar S (2010) Mean-variance-skewness model for portfolio selection with fuzzy returns. Eur J Oper Res 202(1):239–247

Li X, Shou B, Qin Z (2012) An expected regret minimization portfolio selection model. Eur J Oper Res 218(2):484–492. https://doi.org/10.1016/j.ejor.2011.11.015

Loomes GSR (2015) Regret theory: an alternative theory of rational choice under uncertainty. Econ J 125(583):512–532

Magron C, Merli M (2015) Repurchase behavior of Individual Investors, Sophistication and Regret. J Bank Finance 61:15–26

Mao JCT (1970) Models of capital budgeting, E-V VS E-S. J Financ Quant Anal 4(5):657–675

Markowitz HM (1952) Portfolio selection. J Finance 7(1):77–91

Mehlawat MK, Kumar A, Yadav S, Chen W (2018) Data envelopment analysis based fuzzy multi-objective portfolio selection model involving higher moments. Inf Sci 460:128–150

Mehlawat MK, Gupta P, Khan AZ (2021) Multiobjective portfolio optimization using coherent fuzzy numbers in a credibilistic environment. Int J Intell Syst 36(4):1560–1594. https://doi.org/10.1002/int.22352

Ouzan S (2020) Loss aversion and market crashes. Econ Model 1171 92:70–86. https://doi.org/10.1016/j.econmod.2020.06.015

Pankaj G, Mukesh KM, Ahmad ZK (2021) Multi-period portfolio optimization using coherent fuzzy numbers in a credibilistic environment. Expert Syst Appl 176:114135

Qin J (2020) Regret based capital asset pricing model. J Bank Finance 114:105784

Samuelson P (1958) The fundamental approximation theorem of portfolio analysis in terms of means variances and higher moments. Rev Econ Stud 25:65–68

Speranza MG (1993) Linear programming models for portfolio optimization. J Finance 14:107–123

Tong X, Qi L, Wu F, Zhou H (2010) A smoothing method for solving portfolio optimization with CVaR and applications in allocation of generation asset. Appl Math Comput 216(6):1723–1740

Vercher E, Bermudez JD (2013) A possibilistic mean-downside risk-skewness model for efficient portfolio selection. IEEE Trans Fuzzy Syst 21:585–595

Xidonas P, Mavrotas G, Hassapis C (2017) Robust multiobjective portfolio optimization: a minimax regret approach. Eur J Oper Res 262(1):299–305

Zadeh LA (1965) Fuzzy sets. Inf Control 8(3):338–353

Zadeh LA (1978) Fuzzy sets as a basis for a theory of possibilistic. Fuzzy Sets Syst 1(1):3–28. https://doi.org/10.1016/0165-0114(78)90029-5

Acknowledgements

This research was supported by “the National Social Science Foundation Projects of China, No. 21BTJ069”. The authors are highly grateful to the referees and editor in-chief for their very helpful advice and comments.

Funding

This research was supported by “the National Social Science Foundation Projects of China, No. 21BTJ069”.

Author information

Authors and Affiliations

Contributions

XD (First Author): Conceptualization, Software Investigation, Formal Analysis, Methodology and Funding Acquisition; FG (Corresponding Author): Data Curation, Writing Original Draft, Validation, Supervision, Writing Review and Editing.

Corresponding author

Ethics declarations

Conflict of interest

We declare that we have no conflict of interest.

Ethical approval

This article does not contain any studies with human participants or animals performed by any of the authors.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Deng, X., Geng, F. Portfolio model with a novel two-parameter coherent fuzzy number based on regret theory. Soft Comput 27, 17189–17212 (2023). https://doi.org/10.1007/s00500-023-08978-0

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00500-023-08978-0