Abstract

Interval number is a kind of special fuzzy number and the interval approach is a good method to deal with some uncertainty. An interval mean–average absolute deviation model for multiperiod portfolio selection is presented by taking risk control, transaction costs, borrowing constraints, threshold constraints and cardinality constraints into account, which an optimal investment policy can be generated to help investors not only achieve an optimal return, but also have a good risk control. In the proposed model, the return and risk are characterized by the interval mean and interval average absolute deviation of return, respectively. Cardinality constraints limit the number of assets to be held in an efficient portfolio. Threshold constraints limit the amount of capital to be invested in each stock and prevent very small investments in any stock. Based on interval theories, the model is converted to a dynamic optimization problem. Because of the transaction costs, the model is a dynamic optimization problem with path dependence. A forward dynamic programming method is designed to obtain the optimal portfolio strategy. Finally, the comparison analysis of the different desired number is provided by a numerical example to illustrate the efficiency of the proposed approach and the designed algorithm.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

Portfolio selection discusses the problem of how to allocate a certain amount of investor’s wealth among different assets and form a satisfying portfolio. The mean–variance (M–V) model proposed by Markowitz (1952) provides a fundamental basis for modern portfolio selection theory. The main goal of the M–V model is to maximize the expected return for a given level of risk or minimize the risk for a given level of expected return. However, the M–V model is not used extensively to construct large-scale portfolios. Konno and Yamazaki (1991) used the absolute deviation risk function to replace variance to formulate a mean absolute deviation portfolio optimization model. It turns out that the mean absolute deviation model maintains the nice properties of the M–V model and removes most of the main difficulties in solving M–V model. Speranza (1993) proposed a mean semi-absolute deviation portfolio selection model. A mean–average absolute deviation portfolio selection model was proposed by Feinstein and Thapa (1993).

Though probability theory is a major tool used for analyzing uncertainty in finance, it cannot describe the uncertainty completely since there are many other uncertain factors that differ from the random ones found in financial markets. Some other techniques can be applied to handle uncertainty of financial markets. Carlsson and Fullér (2001) introduced the notions of lower and upper possibilistic mean values of a fuzzy number, viewing them as possibility distributions. Carlsson et al. (2002) introduced a possibilistic approach to select portfolios with highest utility score under the assumptions that the returns of assets are trapezoidal fuzzy numbers and short sales are not allowed on all risky assets. León et al. (2002) discussed portfolio selection using fuzzy decision theory. Zhang et al. (2007) proposed the portfolio selection models based on the lower and upper possibilistic means and possibilistic variances of fuzzy numbers. Huang (2008) proposed mean risk curve portfolio selection models. Dubois and Prade (1988) defined an interval-valued expectation of fuzzy numbers, viewing them as consonant random sets. Lai et al. (2002), Giove et al. (2006), Li and Xu (2007), and Zhang et al. (2009) constructed interval programming models of portfolio selection.

Among many improvements proposed to make the Markowitz’s mean–variance portfolio selection model more realistic are limiting the number of assets to be held in an efficient portfolio (cardinality constraints) and also prescribing lower and upper bounds on the fraction of the capital invested in each asset (threshold constraints). These requirements come from real-world practice where the administration of a portfolio made up of a large number of assets is clearly not desirable because of transaction costs, complexity of management, or policy of the asset management companies. Because of its practical relevance, this model (often called cardinality constrained Markowitz model), and some variations have been fairly intensively studied in the last decade. Especially from the computational viewpoint, some researchers proposed exact solution methods, ie., Bienstock (1996) proposed a branch-and-cut algorithm; Bertsimas and Shioda (2009) extended the algorithm of Bienstock (1996) presenting a tailored procedure, based on Lemke’s pivoting algorithm; Li et al. (2006) proposed a convergent Lagrangian method as an exact solution scheme for a problem slightly more general than the LAM (Limited Asset Markowitz) model, and they describe some computational results for problems with at most 30 assets. Another Lagrangian relaxation method was proposed in Shaw et al. (2008) with application to some undisclosed real-life problems with up to 500 assets; Murray and Shek (2012) presented a local relaxation method; Cesarone et al. (2013) propose increasing set algorithm; Cui et al. (2013), and Sun et al. (2013) used the Lagrangian decomposition technique to construct tight convex relaxations to solve the LAM model; Le Thi et al. (2009), Le Thi and Moeini (2014), presented convex functions algorithms (DCA). Since exact solution methods are able to solve only a fraction of practically useful LAM models, many heuristic algorithms have also been proposed, ie., Fernández and Gómez (2007) presented neural networks algorithm; Ruiz-Torrubiano and Suarez (2010) provided solutions to the LAM model using different heuristics, ie., genetic algorithm, simulated annealing and various estimation of distribution algorithms; Anagnostopoulos and Mamanis (2011) proposed multiobjective evolutionary algorithm; Woodside-Oriakhi et al. (2011) examined the application of genetic algorithm, tabu search and simulated annealing for finding the cardinality constrained efficient frontier; Deng et al. (2012) proposed improved particle swarm algorithm. In these studies, it appears that the computational complexity for the solution of the LAM model is much greater than the one required by the classical Markowitz model or by several other of its refinements. Indeed, the standard Markowitz model is a convex quadratic programming problem, while the LAM model is a mixed integer quadratic programming problem that falls into the class of considerably more difficult NP-hard problems.

For those models above, it is assumed that the investment horizon is single period. But, in real world, the portfolio strategies are usually multiperiod, since the investor can reallocate his wealth from time to time. So, it is natural to extend the single-period portfolio selections to multiperiod portfolio selections. Mossin (1968) presented optimal multiperiod portfolio selection policies using dynamic programming approach. Li and Ng (2000) employed the idea of embedding the problem in a tractable auxiliary problem to investigate the mean–variance formulation in multiperiod portfolio selection and obtained the corresponding mean–variance efficient frontier. Zhu et al. (2004) proposed a dynamic mean–variance portfolio selection model with risk control over bankruptcy. Güpinar and Rustem (2007) constructed a multiperiod mean–variance optimization framework for the stochastic aspects of the scenario tree. Çlikyurt and Öekici (2007) introduced several multiperiod portfolio optimization models in stochastic markets using the mean–variance approach. Calafiore (2008) concerned with multiperiod sequential decision problems for financial asset allocation and presented a multiperiod optimization with linear control policies. Yu et al. (2010, 2012), respectively, proposed a dynamic portfolio selection optimization with bankruptcy control for absolute deviation model and maximum absolute deviation. Wu and Li (2012) proposed a non-self-financing portfolio optimization problem under the framework of multiperiod mean–variance with Markov regime switching and a stochastic cash flow. Li and Li (2012) proposed a multiperiod portfolio optimization problem for asset–liability management of an investor who intends to control the probability of bankruptcy before reaching the end of an investment horizon. Considering the linear transaction costs, diversification degree of portfolio and skewness, Zhang et al. (2012, 2014) and Liu et al. (2012, 2013) proposed several multiperiod fuzzy portfolio selection models. Zhang and Zhang (2014) proposed a multiperiod mean absolute deviation fuzzy portfolio selection model with transaction cost, borrowing constraints, threshold constraints and cardinality constraints.

In this paper, we propose an interval mean–average absolute deviation model for multiperiod portfolio selection with risk control where the return of securities is treated as interval numbers. Risk control is crucial to a multiperiod portfolio selection. An integration of risk control and multiperiod portfolio selection is evidently needed. In this note, we propose a model for which an optimal investment policy can be generated to help investors not only achieve an optimal return, but also have a good risk control. This paper is organized as follows. In Sect. 2, the definitions of the interval mean, the interval average absolute deviation, and some properties are, respectively, introduced. In Sect. 3, the borrowing constraints, transaction costs, threshold constraints and cardinality constraints are formulated into the multiperiod portfolio. A new multiperiod portfolio selection model is constructed and a forward dynamic programming method is proposed to solve it in Sect. 4. In Sect. 5, the comparison analysis of differently desired number of assets in the portfolio is given to illustrate the idea of our model and the effectiveness of the designed algorithm. Finally, some conclusions are given in Sect. 6.

2 Preliminaries

In this section, we will briefly review some concepts and results on interval numbers, which we will need in the following sections. Denote the set of all the real number as \(R\). Let \(a\) be an interval number. And \(a\) can be expressed as the following form

where \(a^{L}\) and \(a^{R}\) are the lower bound and the upper bound of interval \(a\), respectively. If \( a^{L}=a^{R}\), then \(a\) is reduced to a real number. The center and width of \(a\) are, respectively, defined as

Then, \(a\) can also be denoted by its center and width as

Definition 1

(Alefeld and Herzberger 1983) Let \(\circ \in \{+,-,\times ,\div \}\) be a binary operation on \(R\). For any given two interval numbers \(a\) and \(b\), the binary operation of them is defined as

where we assume 0 \(\notin b\) in the case of division.

Based on the binary operation above, for any given two interval numbers \(a\) and \(b\), the following relationships hold:

The absolute value of interval \(a\) is defined as

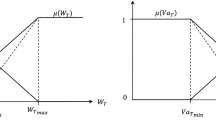

An interval number is a special fuzzy number whose membership function takes the value 1 over the interval and 0 anywhere else.

Definition 2

(Ishibuchi and Tanaka 1990) For any given two interval numbers \(a\) and \(b\), the order relation between them is defined as

If \(a^\mathrm{R} \le b^\mathrm{L}\), the interval inequality relation \(a\le b\) is said to be optimistic satisfactory; if \(a^\mathrm{R} \ge b^\mathrm{L}\), the interval inequality relation \(a\le b\) is said to be pessimistic satisfactory.

Definition 3

Let \(a\) be an interval number with \(a\) \(=\) [\(a^\mathrm{L}\), \(a^\mathrm{R}\)]. Then the crisp mean is defined as

Definition 4

For any two given interval numbers \(a\) with \(a= [a^\mathrm{L}\), \(a^\mathrm{R}\)] and \(b\) with \(b=[b^\mathrm{L}, b^\mathrm{R}]\), the interval average absolute deviation between \(a\) and\( b\) is defined as

Notice that the interval average absolute deviation \(\omega (a\), \(b)\) between \(a\) and \( b\) is defined as the average of \(\overline{M} \left| {a-\overline{M} (a)} \right| \) and \(\overline{M} \left| {b-\overline{M} (b)} \right| \), where \(\overline{M} \left| {a-\overline{M} (a)} \right| \) is the crisp interval mean of the absolute deviations between interval numbers \(a\) and the crisp interval mean \(\overline{M} (a)\), and \(\overline{M} \left| {b-\overline{M} (b)} \right| \) is the crisp interval mean of the absolute deviations between interval numbers \(b\) and the crisp interval mean \(\overline{M} (b)\).

3 The formulation of multiperiod portfolio selection problem

In this section, the problem description and notations used in the following section will be introduced first. The return and risk of multiperiod portfolio are qualified by interval numbers. The cardinality constraints will be presented. Finally, a new multiperiod portfolio selection problem with interval values will be proposed.

3.1 Problem description and notations

Let us consider a multiperiod portfolio selection problem with \(n\) risky assets and a risk-free asset. The return rates of risky assets are denoted as interval values. Assume that an investor joins the market at the beginning of period 1 with initial wealth \( W_{1}\). The investor intends to allocate his/her wealth among the \(n +\)1 assets for making \(T\) periods investment plan. His/her wealth can be reallocated among the \(n +\)1 assets at the beginning of the following \(T\) consecutive time periods. To make it easier to understand the following exposition, all the notations that will be used hereafter are listed as follows:

- \(x_{it }\) :

-

the investment proportion of risky asset \(i\) at period \( t\);

- \(x_{i0 }\) :

-

the initial investment proportion of risky asset \(i\) at period 0;

- \(x_{t }\) :

-

the portfolio at period \( t\), where \(x_{t} = (x_{1t}, x_{2t}, \ldots , x_{nt})\);

- \(x_{ft }\) :

-

the investment proportion of risk-free asset at period \( t\), where \(x_{ft} =1-\sum \nolimits _{i=1}^n {x_{it} } \);

- \(x^{b}_{ft }\) :

-

the lower bound of the investment proportion of risk-free asset at period \( t\), where \( x_{ft \ge } x^{b}_{ft}\);

- \(R_{it}\) :

-

the interval return of risky asset \(i\) at period \( t\);

- \(r_{it }\) :

-

the expected return of \(R_{it, }\) where \( r_{it} = E(R_{it})\)

- \(r_{pt }\) :

-

the return of the portfolio \(x_{t}\) at period \( t\);

- \(r_{Nt }\) :

-

the net return of the portfolio \(x_{t}\) at period \( t\);

- \(r_{bt }\) :

-

the borrowing rate of the risk-free asset at period \( t\);

- \(r_{lt }\) :

-

the lending rate of the risk-free asset at period \( t\);

- \(l_{it}\) :

-

the lower bound constraints of \(x_{it}\);

- \(u_{it}\) :

-

the upper bound constraints of \(x_{it}\);

- \(W_{t }\) :

-

the holding wealth at the beginning of period \( t\);

- \(c_{it }\) :

-

the unit transaction cost of risky asset \(i\) at period \( t\);

- \(K\) :

-

the desired number of assets in the portfolio at period \( t\).

3.2 Interval return and risk for multiperiod portfolio selection

The return, risk, transaction costs, borrowing constraints, threshold constraints and cardinality constraints will be introduced in the following subsections. The return and risk will be quantified by the interval mean value and interval average absolute deviation about the interval return of the asset, respectively. Assume that the whole investment process is self-financing, that is, the investor does not invest the additional capital during the portfolio selection. The return of risky asset, \(R_{it }= [a_{it,} \quad b_{it}]\) (\(i = 1, 2\), \(\ldots \), \(n\); \( t = 1, 2\), \(\ldots \), \(T)\) are interval numbers.

Most of the brokerage houses provide the opportunity to make an acquisition on different assets by borrowing the money from the brokerage. Some researchers studied the borrowing constraints, for example, Sadjadi et al. (2011) proposed the fuzzy portfolio model with different rates for borrowing and lending. Deng and Li (2012) proposed a mean–variance fuzzy portfolio with borrowing constraints. Considering the borrowing constraints, the interval mean value of the portfolio \( x_{t }= (x_{1t}, x_{2t}, \ldots , x_{nt)'}\) at period \(t\) can be expressed as

where \(r_{ft} =\left\{ {\begin{array}{l} r_{lt},\quad \quad 1-\sum \limits _{i=1}^n {x_{it} } \ge 0 \\ r_{bt},\quad \quad 1-\sum \limits _{i=1}^n {x_{it} } \le 0 \\ \end{array}} \right. ,\,\,r_{bt} \ge r_{lt} \). When \(1-\sum \nolimits _{i=1}^n {x_{it} } \ge 0\), it denotes that lending the risk-free asset is allowed. When \(1-\sum \nolimits _{i=1}^n {x_{it} } \le 0\), it denotes that borrowing the risk-free asset is allowed.

The transaction costs which are entailed by buying or selling assets to adjust the existing portfolio are one of the main concerns for portfolio managers. As mentioned by Arnott and Wagner (1990), and Yoshimoto (1996) ignoring the transaction costs may fail to obtain the efficient portfolio. So Gülpinar et al. (2003), and Bertsimas and Pachamanova (2008) incorporated transaction costs into consideration to study the multiperiod portfolio selection problem. In this paper, the transaction costs are assumed V-shaped functions of differences between the \(t\)th period portfolio \(x_{t} = (x_{1t}, x_{2t}, \ldots , x_{nt})\) and the \(t-\)1th period portfolio \(x_{t-1} = (x_{1t-1}, x_{2t-1}, \ldots , x_{nt-1})\). That is to say, the transaction cost for asset \(i\) at period \(t\) is \(c_{it} \left| {x_{it} -x_{it-1} } \right| \). Hence, the total transaction costs of the portfolio \(x_{t}\) = (\(x_{1t}\), \(x_{2t}\), \(\ldots \), \(x_{nt})\) at period\( t\) can be expressed as

Thus, the net return rate of the portfolio \(x_{t}\) at period \(t\) can be denoted as

Then, the crisp form of the holding wealth at the beginning of the period \( t\) can be written as

Solving Eq. (13) recursively, the terminal wealth at the end of period \(T\) can be represented as

Derived from Eq. (9), the interval average absolute deviation of the portfolio \(x_{t}\) can be expressed as

Theorem 1

Let \(R_{it }= [a_{it,} \quad b_{it}]\) be an interval numbers and \(x_{it }^{3}\)0, (\(i = 1, 2, \ldots , n; t = 1, 2, \ldots , T)\), then the interval average absolute deviation of the portfolio \(x_{t}\) can be expressed as

Proof

According to Eq. (4), then

According to Eq. (7), then

From Eqs. (17) and (18), then the Eq. (16) can be turned into

which ends the proof. \(\square \)

To formulate cardinality constraints into the multiperiod portfolio model, zero-one decision variables are added as:

where \(\sum \nolimits _{i=1}^n {z_{it} } \le K\).

3.3 The basic multiperiod portfolio optimization models

Assume that the investor wants to maximize his/her terminal wealth over the whole \(T\) periods investment. The multiperiod portfolio selection problem with risk control and cardinality constraints can be formulated as the following problem:

where constraint (a) denotes the wealth accumulation constraint; constraint (b) states the interval average absolute deviation of the portfolio \(x_{t }\) cannot exceed the given value \( v_{t}\); constraint (c) indicates the investment proportion of risk-free asset at period \( t\) must exceed the given lower bound \( x^{b}_{ft}\); constraint (d) represents the desired number of assets in the portfolio must not exceed the given value \(K\); constraint (e) states threshold constraints of \( x_{it}\).

4 The optimization on the multiperiod portfolio selection model

In Model (20), investors can choose \(v_{t }\) between \(v_{t \min }\) and \(v_{t \max }\). Then \(v_{t \min }\) and \(v_{t \max }\) can be, respectively, obtained as follows:

\(x_{t}^{{\max ^*}}\)(the optimal solution \(x_{t} = (x_{{{\text {1}}t}} ,x_{{{\text {2}}t}} ,\ldots ,x_{{nt}})^\prime )\) can be obtained solving Model (21) by CPLEX. Simultaneously, \(v_{t \mathrm{min}}\) (the biggest of \(\frac{1}{n}\sum \nolimits _{{i = 1}}^{n} {\frac{{b_{{it}} - a_{{it}} }}{2}x_{{it}} }\) ) can also be obtained.

\(x_{t}^{{\max ^*}}\) (the optimal solution \(x_{t} = (x_{{{\text {1}}t}} ,x_{{{\text {2}}t}} ,\ldots ,x_{{nt}})^\prime )\) can be obtained solving the Model (22) by CPLEX. Simultaneously, \(v_{t \mathrm{min}}\) (the smallest of \(\frac{1}{n}\sum \nolimits _{{i = 1}}^{n} {\frac{{b_{{it}} - a_{{it}} }}{2}x_{{it}} }\)) is also obtained. The sub-problem of period t of the Model (20) can be transformed into

In the following section, we provide the detailed procedure of the forward dynamic programming method for finding an optimal solution to the Model (20). The procedure of the algorithm can be showed as follows:

Algorithm The forward dynamic programming method:

Step1. When \(t=1, W_{1}\) and \(x_{0}=(x_{10},\ldots , x_{n0})^{'}\) have been given, the optimal solution of period \(t\) = 1,\( t = {\text {1}},\,x_{1}^{{\max ^*}} = (x_{{11}}^{{\max ^*}} , \ldots ,x_{{n1}}^{{\max ^*}} )^{'}\) can be obtained solving the Model (23) by CPLEX. At the same time, \(W_2^{\max ^*} =W_1^{\max ^*} (1+\sum \nolimits _{i=1}^n {\frac{a_{_{i1} } +b_{_{i1} } }{2}x_{i1}^{\max ^*} } +r_{f1} (1-\sum \nolimits _{i=1}^n {x_{i1}^{\max ^*} } )-\sum \nolimits _{i=1}^n {c_{i1} | {x_{i1}^{\max ^*} -x_{i0}^{\max ^*} }|} )\) can be obtained.

Step2. When \(t=m\) ( \(m\ge \)1 and \(m\in \, \)Z\(^{+})\), \(W_{m+1}^{\max ^*} \) and \( x_{m}^{{\max ^*}} = (x_{{1m}}^{{\max ^*}} , \ldots ,x_{{nm}}^{{\max ^*}} )^{'}\) have been obtained, the optimal solution of period \( t = m + {\text {1}},\,\left( x_{{m + 1}}^{{\max ^*}} = (x_{{m + 1}}^{{\max ^*}} , \ldots ,x_{{nm + 1}}^{{\max ^*}} )^{\prime } \right) \) can be obtained solving the Model (23) by CPLEX. At the same time, \(W_{m+2}^{\max ^*} =W_{m+1}^{\max ^*} (1+\sum \nolimits _{i=1}^n \frac{a_{m+1} +b_{m+1}}{2} x_{im+1}^{\max ^*} +r_{fm+1} (1-\sum \nolimits _{i=1}^n {x_{im+1}^{\max ^*} } )-\sum \nolimits _{i=1}^n c_{im+1} \big | x_{im+1}^{\max ^*} -x_{im}^{\max ^*} \big | )\) can be obtained.

Step3. If \(t=T\), then the maximization of the terminal wealth \(W_{T+1}^{\max } \) can be obtained. Otherwise \(t=m\) + 1, then turn Step 2.

When the number of variables in period \(t\) (\(t=1\),\(\ldots \),\( T)\) is not too big, the global optimal solution of the Model (23) can be obtained by CPLEX. So, the global optimal solution of the Model (20) can also be obtained by the forward dynamic programming method.

5 Numerical example

In this section, a numerical example is given to express the idea of the proposed model. Assume that an investor chooses thirty stocks from Shanghai Stock Exchange for his/her investment. The stocks codes are, respectively, S\(_{1}\),\(\ldots \), S\(_{30}\). He/She intends to make five periods of investment with initial wealth W\(_{1} = 1\) and his wealth can be adjusted at the beginning of each period. We assume that the returns and risk of the thirty stocks at each period are represented as interval numbers. We collect historical data of them from April 2006 to September 2014 and set every three months as a period to handle the historical data. Using the simple estimation method in Vercher et al. (2007) to handle their historical data, the interval distributions of the return rates of assets at each period can be obtained as shown in appendix. Suppose that the transaction costs of assets of the two periods investment take the same value \( c_{it} = 0.003\) (\(i = 1, \ldots ,30; t = 1,\ldots ,5\)), the lower bound of the investment proportion of risk-free asset \(x^{b}_{ft }= -0.5\), the borrowing rate of the risk-free asset \(r_{bt}=0{.}017\), the lending rate of the risk-free asset \( r_{lt}=0.009, t = 1,\ldots \), 5, the lower bound constraints \( l_{it}=0.05\) and upper bound constraints \(u_{it}=0.2\) (\(i= 1\),\(\ldots \),30; \(t = 1\),\(\ldots \),5), the desired number of assets in the portfolio at period \( t K =6\) or 8 (\(t = 1\),\(\ldots \),5). The preset given risk value \(v_{t} =0.001\).

The forward dynamic programming method is used to solve the Model (20). The corresponding results can be obtained as follows.

If \(K=6\), the optimal solution can be obtained as the Table 1.

When \(K =6\), the optimal investment strategy at period 1 is \(x_{11}\) = 0.2, \(x_{131} = 0.2\), \( x_{151} = 0.2\), \( x_{171} = 0.2\), \( x_{261}\) = 0.2, \( x_{281} = 0.2\) and the rest of variables being equal to zero, which means investor should allocate his initial wealth on asset 1, asset 13, asset 15, asset 17, asset 26, asset 28 and on other assets by the proportions of 20, 20, 20, 20, 20, 20 % and the rest of variables be equaling to zero among the thirty stocks, respectively. The optimal investment strategy at period 2, period 3, period 4 and period 5 can be obtained from Table 1. In this case, the available terminal wealth is 1.9387.

If \(K=8\), the optimal solution can be obtained as the Table 2.

When \(K=8\), the available terminal wealth is 2.1156.

To display the influence of \(K\) on the optimal solution of multiperiod portfolio selection, we set its value as 6 and 8, respectively. Then, we use the Model (20) for portfolio decision-making. After using the forward dynamic programming method, the corresponding optimal investment strategies can be obtained as shown in Tables 1 and 2. From Tables 1 and 2, it can be seen that most of assets of the optimal solutions of \(K=6\) and \(K=8\) are same. There are six assets in period 1, i.e., asset 1, asset 13, asset 15, asset 17, asset 26, asset 28; there are six assets in period 2, i.e., asset 1, asset 12, asset 13, asset 15, asset 17, asset 28; there are six assets in period 3, i.e., asset 1, asset 12, asset 13, asset 15, asset 17, asset 28; there are six assets in period 4, i.e., asset 1, asset 12, asset 13, asset 15, asset 17, asset 18; there are six assets in period 5, i.e., asset 1, asset 12, asset 13, asset 15, asset 17, asset 18.

When \(K=1,\ldots ,9\), the optimal terminal wealth can be obtained as shown in Table 3.

In the used data sets, the problems corresponding to \(K\ge 9\) have the same solutions with the \( K=8\). The experiments in this paper correspond to the values of \(K \) in the interval [0, 8]. We note that, as will be seen in Table 3, when the preset the desired number of assets in the portfolio become larger, the terminal wealth also becomes larger, which reflects the influence of the desired number of assets on portfolio selection.

6 Conclusions

In this paper, we discuss a multiperiod portfolio selection problem with interval number, in which the returns, risk of risky assets are characterized by interval numbers rather than single values. We use interval analysis approach to handle the imprecise data in financial markets and propose a multiperiod interval portfolio optimization model. Since the proposed model is an interval programming problem, we use the interval decision-making technique to convert it into a crisp form dynamic optimization with path dependence. A forward dynamic programming method is designed to obtain the optimal portfolio strategy. A numerical example is given to illustrate the application of the proposed model and demonstrate the effectiveness of the designed algorithm for solving our model.

Due to changes of situation in financial markets and investors’ preferences towards risk, most of the applications of multiperiod portfolio optimization involve maximizing the terminal wealth for a given level of risk at period \( t\). In addition, the investors do not only purchase risky assets, but also they can lend or borrow a risk-free asset. How do the investors make a correct multiperiod decision? It will be very important for a real multiperiod portfolio selection problem. So the multiperiod portfolio models based on the interval means and average absolute will be some future directions on the proposed approach in solving real-life problems.

References

Alefeld G, Herzberger J (1983) Introduction to interval computations. Academic Press, New York

Anagnostopoulos KP, Mamanis G (2011) The mean-variance cardinality constrained portfolio optimization problem: an experimental evaluation of five multiobjective evolutionary algorithms. Expert Syst Appl 38:14208–14217

Arnott RD, Wagner WH (1990) The measurement and control of trading costs. Financ Anal J 6:73–80

Bertsimas D, Pachamanova D (2008) Robust multiperiod portfolio management in the presence of transaction costs. Comput Oper Res 35:3–17

Bertsimas D, Shioda R (2009) Algorithms for cardinality-constrained quadratic optimization. Comput Optim Appl 43:1–22

Bienstock D (1996) Computational study of a family of mixed-integer quadratic programming problems. Math Program 74:121–140

Calafiore GC (2008) Multi-period portfolio optimization with linear control policies. Automatica 44(10):2463–2473

Carlsson C, Fullér R (2001) On possibilistic mean value and variance of fuzzy numbers. Fuzzy Sets Syst 122:315–326

Carlsson C, Fulle’r R, Majlender P (2002) A possibilistic approach to selecting portfolios with highest utility score. Fuzzy Sets Syst 131:13–21

Cesarone F, Scozzari A, Tardella F (2013) A new method for mean-variance portfolio optimization with cardinality constraints. Ann Oper Res 205:213–234

Çlikyurt U, Öekici S (2007) Multiperiod portfolio optimization models in stochastic markets using the mean-variance approach. Eur J Oper Res 179(1):186–202

Cui XT, Zheng XJ, Zhu SS, Sun XL (2013) Convex relaxations and MIQCQP reformulations for a class of cardinality-constrained portfolio selection problems. J Glob Optim 56:1409–1423

Deng X, Li RJ (2012) A portfolio selection model with borrowing constraint based on possibility theory. Appl Soft Comput 12:754–758

Deng GF, Lin WT, Lo CC (2012) Markowitz-based portfolio selection with cardinality constraints using improved particle swarm optimization. Expert Syst Appl 39:4558–4566

Dubois D, Prade H (1988) Possibility theory. Plenum Perss, New York

Feinstein CD, Thapa MN (1993) Notes: a reformation of a mean-absolute deviation portfolio optimization. Manag Sci 39:1552–1558

Fernández A, Gómez S (2007) Portfolio selection using neural networks. Comput Oper Res 34:1177–1191

Giove S, Funari S, Nardelli C (2006) An interval portfolio selection problems based on regret function. Eur J Oper Res 170:253–264

Gülpinar N, Rustem B, Settergren R (2003) Multistage stochastic mean-variance portfolio analysis with transaction cost. Innov Financ Econ Netw 3:46–63

Güpinar N, Rustem B (2007) Worst-case robust decisions for multi-period mean-variance portfolio optimization. Eur J Oper Res 183(3):981–1000

Huang X (2008) Risk curve and fuzzy portfolio selection. Comput Math Appl 55:1102–1112

Ishibuchi H, Tanaka H (1990) Multiobjective programming in optimization of the interval objective function. Eur J Oper Res 48:219–225

Konno H, Yamazaki H (1991) Mean-absolute deviation portfolio optimization model and its applications to Tokyo stock market. Manag Sci 37(5):519–531

Lai KK, Wang SY, Xu JP, Zhu SS, Fang Y (2002) A class of linear interval programming problems and its application to portfolio selection. IEEE Trans Fuzzy Syst 10:698–704

Le Thi HA, Moeini M, Dinh TP (2009) Portfolio selection under downside risk measures and cardinality constraints based on DC programming and DCA. Comput Manag Sci 6:459–475

Le Thi HA, Moeini M (2014) Long-short portfolio optimization under cardinality constraints by difference of convex functions algorithm. J Optim Theory Appl 161:199–224

León T, Liem V, Vercher E (2002) Viability of infeasible portfolio selection problems: a fuzzy approach. Eur J Oper Res 139:178–189

Li D, Ng WL (2000) Optimal dynamic portfolio selection: multiperiod mean-variance formulation. Math Finance 10(3):387–406

Li D, Sun X, Wang J (2006) Optimal lot solution to cardinality constrained mean-variance formulation for portfolio selection. Math Finance 16:83–101

Li J, Xu JP (2007) A class of possibilistic portfolio selection model with interval coefficients and its application. Fuzzy Optim Decis Making 6:123–137

Li CJ, Li ZF (2012) Multi-period portfolio optimization for asset-liability management with bankrupt control. Appl Math Comput 218:11196–11208

Liu YJ, Zhang WG, Xu WJ (2012) Fuzzy multi-period portfolio selection optimization models using multiple criteria. Automatica 48:3042–3053

Liu YJ, Zhang WG, Zhang P (2013) A multi-period portfolio selection optimization model by using interval analysis. Econ Model 33:113–119

Markowitz HM (1952) Portfolio selection. J Finance 7:77–91

Mossin J (1968) Optimal multiperiod portfolio policies. J Bus 41:215–229

Murray W, Shek H (2012) A local relaxation method for the cardinality constrained portfolio optimization problem. Comput Optim Appl 53:681–709

Ruiz-Torrubiano R, Suarez A (2010) Hybrid approaches and dimensionality reduction for portfolio selection with cardinality constrains. IEEE Comput Intel Mag 5:92–107

Sadjadi SJ, Seyedhosseini SM, Hassanlou Kh (2011) Fuzzy multi period portfolio selection with different rates for borrowing and Lending. Appl Soft Comput 11:3821–3826

Shaw DX, Liu S, Kopman L (2008) Lagrangian relaxation procedure for cardinality- constrained portfolio optimization. Optim Methods Softw 23:411–420

Speranza MG (1993) Linear programming models for portfolio optimization. J Finance 14:107–123

Sun XL, Zheng XJ, Li D (2013) Recent advances in mathematical programming with semi-continuous variables and cardinality constraint. J Oper Res Soc China 1:55–77

Vercher E, Bermudez J, Segura J (2007) Fuzzy portfolio optimization under downside risk measures. Fuzzy Sets Syst 158:769–782

Woodside-Oriakhi M, Lucas C, Beasley JE (2011) Heuristic algorithms for the cardinality constrained efficient frontier. Eur J Oper Res 213:538–550

Wu HL, Li ZF (2012) Multi-period mean-variance portfolio selection with regime switching and a stochastic cash flow. Insurance: Math Econ 50:371–384

Yoshimoto A (1996) The mean-variance approach to portfolio optimization subject to transaction costs. J Oper Res Soc Japan 39:99–117

Yu M, Takahashi S, Inoue H, Wang SY (2010) Dynamic portfolio optimization with risk control for absolute deviation model. Eur J Oper Res 201(2):349–364

Yu M, Wang SY (2012) Dynamic optimal portfolio with maximum absolute deviation model. J Global Optim 53:363–380

Zhang WG, Wang YL, Chen ZP, Nie ZK (2007) Possibilistic mean-variance models and efficient frontiers for portfolio selection problem. Inf Sci 177:2787–2801

Zhang WG, Zhang XL, Xiao WL (2009) Portfolio selection under possibilistic mean-variance utility and a SMO algorithm. Eur J Oper Res 197:693–700

Zhang WG, Liu YJ, Xu WJ (2012) A possibilistic mean–semivariance–entropy model for multi-period portfolio selection with transaction costs. Eur J Oper Res 222:41–349

Zhang WG, Liu YJ, Xu WJ (2014) A new fuzzy programming approach for multi-period portfolio Optimization with return demand and risk control. Fuzzy Sets Syst 246:107–126

Zhang P, Zhang WG (2014) Multiperiod mean absolute deviation fuzzy portfolio selection model with risk control and cardinality constraints. Fuzzy Sets Syst 255:74–91

Zhu SS, Li D, Wang SY (2004) Risk control over bankruptcy in dynamic portfolio selection: a generalized mean-variance formulation. IEEE Trans Autom Control 49(3):447–457

Acknowledgments

This research was supported by the National Natural Science Foundation of China (nos. 71271161).

Author information

Authors and Affiliations

Corresponding author

Additional information

Communicated by V. Loia.

Appendix

Appendix

The codes of thirty stocks are, respectively, S\(_{1}\) (600000), S\(_{2}\) (600005), S\(_{3}\) (600015), S\(_{4}\) (600016), S\(_{5}\) (600019), S\(_{6}\) (600028), S\(_{7}\) (600030), S\(_{8}\) (600036), S\(_{9}\) (600048), S\(_{10}\) (600050), S\(_{11}\) (600104), S\(_{12}\) (600362), S\(_{13}\) (600519), S\(_{14}\) (600900), S\(_{15}\) (601088), S\(_{16}\) (601111), S\(_{17}\) (601166), S\(_{18}\) (601168), S\(_{19}\) (601318), S\(_{20}\) (601328), S\(_{21}\) (601390), S\(_{22}\) (601398), S\(_{23}\) (601600), S\(_{24}\) (601601), S\(_{25}\) (601628), S\(_{26}\) (601857), S\(_{27}\) (601919), S\(_{28}\) (601939), S\(_{29}\) (601988), S\(_{30}\) (601998). The trapezoidal possibility distributions of the return rates of assets at each period can be obtained as shown in Tables 4, 5, 6, 7, 8.

Rights and permissions

About this article

Cite this article

Zhang, P. An interval mean–average absolute deviation model for multiperiod portfolio selection with risk control and cardinality constraints. Soft Comput 20, 1203–1212 (2016). https://doi.org/10.1007/s00500-014-1583-3

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00500-014-1583-3