Abstract

A dynamic game framework is developed to study market dynamics between two manufacturers/service providers competing on pricing and switching costs. In this game, a portion of consumers may choose to upgrade their products by repurchasing from one of the providers in each period. The switching cost is the one-time costs when consumers “switch” from one provider to another. Switching costs provide consumers an incentive to continue buying from the same firm even if its competitors offer functionally identical but incompatible products. In practice, the switching costs can be increased or decreased by firms through designing products. A mixed logit demand model, which can arbitrarily closely approximate any discrete choice behavior of consumers, is adopted to characterize the dynamic market evolution under stochastically varying consumer preferences. We find that switching costs are usually beneficial to the firm with a dominant market share. Moreover, large switching costs can be detrimental to the firm with a disadvantaged market share, so it wants to decrease switching costs. On the contrary, small switching costs have a negative effect on the demand of the firm with a weak market share but benefit its profit by leading a high price. We implement a simulation study to validate our theoretical results on market dynamics.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In this work, we develop a dynamic game framework to study market dynamics between two manufacturers/service providers (hereafter referred to as firms) competing on pricing and switching costs. The switching cost is the one-time costs associated with consumers who "switch" from one provider to another (Porter 2008). Switching costs provide consumers an incentive to continue buying from the same firm even if its competitors offer functionally identical products (Klemperer 1995). Thus, in a dynamic market, switching costs can bring competing firms a marketing advantage that sometimes is analogous to monopoly power. In the literature, switching costs are widely discussed, and their effect on business strategies and market dynamics are summarized as follows:

-

1.

Influencing market dynamics through switching costs Firms obtain a degree of monopoly power over their consumers through switching costs, which can make the market less competitive and lead to a higher product price (Klemperer 1987a; Wernerfelt 1991). However, switching costs make the current market share an important determinant of future profit but at a trade-off. That is, a firm can either increase its consumer base and create long-term competitiveness by charging low prices or exploit its current consumers by charging high prices. Therefore, the effect of switching costs on a firm’s price may be uncertain in a dynamic market environment (Villas-Boas 2015; Cabral 2016).

-

2.

Guiding consumer behavior using switching costs In a market with switching costs, a firm’s repeat consumers find switching to another provider costly. This lock-in effect limits market liquidity when the firm’s consumers prefer to minimize their immediate costs and cannot anticipate the effect of future switching costs (Zauberman 2003). Thus, switching costs have a significant effect on repeat choice behavior (Weiss and Heide 1993).

-

3.

Creating market entry barrier by switching costs Switching costs provide the existing firm an advantage over later market entrants (Lieberman and Montgomery 1988). Early entrants occupy the market and obtain the first-mover advantage by locking in existing consumers. Late entrants must invest extra resources to attract consumers from the existing firm. However, switching costs may sometimes promote entry. When the existing firm is unwilling to attract new consumers by decreasing prices because of the lock-in effect, late entrants will be motivated to enter the market (Farrell and Shapiro 1988).

-

4.

Interacting between product design and switching costs Selling products that are compatible with those sold by competitors in the same market may allow consumers to switch easily. However, selling incompatible products may create a switching barrier that provides market power and network effect to a firm. The network effect (Katz and Shapiro 1994) brought by switching costs can encourage firms to develop proprietary standards (e.g., lightning interface used on iPhone and iPad, a proprietary interface designed by Apple Inc.). Furthermore, switching costs may lead to firms’ adoption of inferior technologies (Beggs 1989).

To sum up, switching costs play an increasing role in market dynamics. However, the effect of switching costs is oftentimes ambiguous. In revenue management, the lock-in effect enables a firm to have a degree of market power, which leads to inelastic responses to price (Farrell and Shapiro 1988). On this basis, several prior studies suppose that switching costs are always associated with higher profits (e.g., Beggs and Klemperer 1992; Farrell and Klemperer 2007). For example, Apple iPhone locks in consumers successfully with large switching costs through the characteristics of the iOS smartphone operating system and charges high prices to gain more profit. However, previous studies show that switching costs sometimes bring a lower price to consumers empirically (Dubé et al. 2009) and theoretically (Doganoglu 2010; Arie and Grieco 2014). Such a finding makes one wonder if switching costs are becoming a drag on a firm’s profit instead. Apple’s iOS system is taken as an example again. It is incompatible with other operating systems or hardware manufacturers and is not mainstream in the personal computer market, possibly limiting its profitability (Chen and Hitt 2006). The following question then arises: under what circumstances does switching costs become an advantage or a burden for a firm in terms of profitability?

The effect of switching costs on a firm’s profit has not been fully discussed in the literature. To the best of our knowledge, few works argue that switching costs can lead to a lower profit. Klemperer (1987a) pointed out that in a symmetrical market, if consumers who buy intertemporal have preferences changing over time, then the existence of switching cost may reduce the overall profit of a firm. Demirhan et al. (2007) analyzed a market entry problem and proposed that the early entrant’s profit is positively related to the switching cost, whereas the late entrant’s profit is negatively related to the switching cost. Villas-Boas (2015) illustrated that compared with no switching costs, firms can have a lower profit with switching costs, provided that the firms’ forward-looking is not worse than consumers’. The common feature of these works is that they assume a two-period Hotelling model to describe consumer demand and do not consider the effect of the market share on a firm’s profit under switching costs.

To understand the effects of switching costs on market dynamics, including market share and profit, we study a multi-period dynamic Stackelberg game-theoretical model (Steiner 2010) between two decision makers, a leader and a follower, in making decisions sequentially with switching costs. In each period, the two firms innovate and introduce new products. Consumers choose to purchase in one of the two firms, and the switching costs are the one-time costs associated with the switch of the firm. This duopoly is common in practice, such as Boeing and Airbus in the aircraft market, Android and Apple iOS in the smartphone operating system market, and Coca-Cola and Pepsi-Cola in the carbonated drink market.

Consumers learn from experience and interactions with other consumers and build (or lose) trust in brands, leading to changes in their preferences. Empirical studies for non-food goods (Lachaab et al. 2006) and food fast-moving consumer goods (Guhl et al. 2018; Guhl 2019) confirm that the time-varying parameters in consumer utility play an obvious role in revealing consumer brand choices. In particular, Baumgartner et al. (2018) pointed out that the introduction of time-varying brand intercepts and time-varying effects of covariates can improve predictions by 0.5 to 1.75 market share points compared with the model with constant parameters. To study dynamic preference changes, we assume that a consumer’s relative preference toward the follower’s product (against the leader’s product) follows a given probability distribution.

Switching costs are divided into two categories: exogenous and endogenous switching costs (Klemperer 1995). The former are not subject to a firm’s pricing and promotion decisions, whereas the latter are determined by a firm’s action. Prior empirical studies measure exogenous switching costs in online brokerage businesses (Chen and Hitt 2002), internet portal services (Goldfarb 2006), detergent purchases (Osborne 2011), and refrigerated orange juice and margarine markets (Dubé et al. 2010). Nowadays, firms are increasingly adopting endogenous switching cost strategies to respond to competition. Firms’ switching cost strategy is often considered a marketing strategy, such as loyalty reward (bonuses to "old" consumers) or freshman project (bonuses to “new” consumers) (Caminal and Matutes 1990; Chen 1997; Singh et al. 2008; Cosguner et al. 2017). These strategies are essentially price discrimination, which requires a firm to distinguish all consumer categories.

In the high-tech industry, switching cost strategies are often realized by modifying the product design as part of a technological approach. For example, providers of smartphone iOS alter their product technology by designing different user interfaces or incompatible accessories, such as different charging devices or headphones to prevent consumers from switching. Such a switching cost strategy is based on the switching consumers’ purchase history (e.g., psychological factors, usage habits, and learning costs). However, few quantitative studies discuss this type of endogenous switching cost (see Farrell and Klemperer (2007) for an overview).

In this study, switching costs are driven by firms’ product design. We study two scenarios: the switching cost is exogenous and remains unchanged over periods and the switching cost is endogenous that can be changed by the two firms by investing in the product design. In the former scenario, only pricing strategies are considered under switching costs. In the latter, in addition to pricing, the two firms can invest in either increasing or decreasing switching costs by redesigning products that are incompatible or compatible with each other in each period. Although the pricing strategies are short-term decisions that can take effect immediately, the changes for the product design (switching cost investment) require lead time. Therefore, we assume that the switching cost investment occurs in the current period, and the lock-in effect of switching cost occurs in the next period. Such a multi-period game-theoretical model is crucial in investigating the interplay between pricing and switching cost strategies in a dynamic market.

A practical mixed logit model (Aksoy-Pierson et al. 2013; Li et al. 2019), which can arbitrarily closely approximate any discrete choice model (McFadden and Train 2000), is adopted to describe consumer behavior. Discrete choice models are widely used to analyze the market competitions under switching costs, such as the beverage retailing (Dubé et al. 2009; Cosguner et al. 2018), networking equipment service (Chen and Forman 2006; Grzybowski and Liang 2015), and smartphone markets (Park and Koo 2016; Kim et al. 2020). The mixed logit model divides consumers into different segments according to their characteristics, thus overcoming the shortcoming of the independence of irrelevant alternatives (IIA) in the basic logit model (Aksoy-Pierson et al. 2013). In our paper, consumers are divided into three segments according to their previous purchases, and they pay different switching costs for their next purchase. To describe the heterogeneity of consumers in terms of switching costs [e.g., the learning cost varies among consumers (Klemperer 1987b; Nilssen 1992)], we assume that several different types of consumers exist in the market, separated by different perceived switching costs. Based on the mixed logit model, our results can be generalized to other discrete choice models from a theoretical perspective.

We obtain theoretical and numerical results about the effect of switching costs on market share and profitability. First, we show that switching costs can be detrimental to a firm in the market. Specifically, if the switching cost is small, then it can adversely affect the demand of the firm with a small current market share. Second, switching costs can be regarded as the first-mover advantage to maintain the leader’s market share advantage. Third, the market share position determines whether a firm will increase or decrease switching costs. We use dynamic programming to obtain equilibrium strategies. We then adopt forward simulations 5000 times under uncertain market evolution to test our theoretical results and make observations about the market dynamics. We find that larger switching costs can lead to higher profits for the leader, but excessive switching costs can be detrimental to the follower.

The remainder of this paper is organized as follows: Section 2 describes the dynamic game-theoretical model in detail. Sections 3 and 4 provide the results of theoretical analysis and numerical simulations under exogenous and endogenous switching costs, respectively. Section 5 analyzes the case of asymmetric switching cost. Section 6 concludes the study.

2 Dynamic market model with switching costs

2.1 Problem description and consumer demand model

This study examines dynamic pricing and switching cost competition problems in a single market with one leader (firm L) and one follower (firm F). The objective is to maximize their discounted profits over T (finite) periods (numbered by 1, 2,...,T). In each period, the leader and the follower upgrade their products, decide their product pricing, and invest in switching costs (i.e., the endogenous switching cost scenario). Firm L makes decisions prior to firm F. As a leading firm, firm L has the first-mover advantage, and its product is more attractive to consumers than that of firm F in the beginning. However, we assume that the gap in consumers’ cognition of the two products gradually narrows over time.

Such sequential decision-making between firms is common in reality. The leader generally develops new products before the follower, and the follower often determines its strategies by basing on the leader’s strategies. Firms tend to release new products on a regular basis, especially in industries driven by technological innovation. Taking the smartphone market for example, Apple is usually the first to get the most advanced hardware devices from suppliers at each time, and introducing new phones annually is crucial to remain competitiveness for smartphone firms.

The consumers in the market are divided into three segments according to their previous purchases: 1. consumers who last purchased from firm L and are used to firm L’s product (denoted by L), 2. consumers who last purchased from firm F and are used to firm F’s product (denoted by F), and 3. new consumers who have no specific preference for the two firms (denoted by O). In each period, a portion of consumers choose to upgrade/purchase one product from firm L or F (\(\delta _{t}\) denotes the upgrade rate). A consumer who is used to firm L’s or F’s product and purchases a product from the opponent pays a one-time nonnegative switching cost and then gets used to that firm’s product in the next period. The perceived switching costs may vary for consumers. For example, different consumers may have varied levels of acceptance of a new technology or incompatibility in the use habits. For this reason, we assume that there are totally N consumer types in the market, and different types of consumers suffer varying switching costs. New consumers do not pay switching costs when they purchase a firm’s product, but they get used to that firm’s product in the next period. Figure 1 illustrates the market dynamics and problem structure.

In this study, the two firms can either increase or decrease the switching cost in the market through product design, which is unpredictable to consumers. We first assume switching costs as symmetric for the same consumer type (i.e., consumers of type n switching from firm L to F or from firm F to L incur the same switching costs) and then discuss the case of asymmetric switching cost in Sect. 5. Consumers are assumed to be myopic who choose a firm to maximize the current period utility. This assumption is reasonable because consumers cannot predict or know the design of future products before the new products are released. For example, consumers do not know the specifications of the next generation iPhone while making purchasing decisions for the current period. In addition, in order to study the market dynamics of more than two periods, strategic consumers have to be discarded because of the lack of closed-form solutions in the multi-period games. The assumption of myopic consumers is in line with the empirical case and is supported by the literature (e.g., (Demirhan et al. 2007; Dubé et al. 2009; Cabral 2016; Cosguner et al. 2017).)

To model consumer demand, we follow the standard discrete choice framework (Aksoy-Pierson et al. 2013; Li et al. 2019), which can flexibly describe the characteristics of products and consumers. The mathematical notations are summarized in Table 1. In period t, we suppose that consumers who belong to type n and switch providers between firms L and F must pay a nonnegative switching cost \(s_{t}^{n}\). Let \(u_{t}^{i,L}(n)\) and \(u_{t}^{i,F}(n)\) denote the utility of the type n consumer who belongs to segment i (\(i\in \{L, F, O\}\)) and purchases a product from firms L and F, respectively.

where \(r_{t}^{}\) denotes the relative preference of consumers for firm F, \(\alpha _{t}^{L}\) and \(\alpha _{t}^{F}\) denote the non-price attractiveness (factor) from firms L and F, \(\beta _{t}^{L}\) and \(\beta _{t}^{F}\) denote the price sensitivities that are larger than 0, \(p_{t}^{L}\) and \(p_{t}^{F}\) denote the product prices of firms L and F. \({\mathcal {I}}\) denotes the indicator function that is equal to 1 if the condition in bracket holds; otherwise, 0. \(U_{t}^{i,L}(n)\) and \(U_{t}^{i,F}(n)\) denote the observable utility of type n consumers, and \(\varepsilon _{t}^{i,L}\) and \(\varepsilon _{t}^{i,F}\) denote the unobserved noise, which is i.i.d. Type I extreme value distribution. In practice, consumers’ attitudes toward products tend to change over time with uncertainty. To simulate the rapidly changing and uncertain market evolution, we assume that the relative preference \(r_{t}^{}\) follows a Markov chain over periods.

According to the consumer utility Eq. 1, we define the consumer purchase probability of type n consumers who belong to segment i and purchase from firm j, which is derived from the logit model as

2.2 Multi-period competitiveness model

We make the following assumptions to construct our multi-period competitiveness model. When a new period begins, firms L and F observe the current states, including the market shares and switching costs. After both firms evaluate the possible future market states, firm L decides its product price and invests in switching costs (i.e., the endogenous switching cost scenario), followed by firm F. According to their decisions, the current states will transit to other states in the next period. Figure 2 illustrates the sequence of events (i.e., decision flow) in each period.

Formulating the proposed dynamic game model consists of five steps.

-

1.

Planning Horizon: Consider firms that sell products in a finite horizon, and T is the length of the planning horizon, \(t\in \{1, 2,\ldots , T\}\).

-

2.

State: Relative preference of consumers \(r_{t}^{}\), switching cost \(\mathbf{s }_{t}^{} = (s_{t}^{1},s_{t}^{2},\ldots ,s_{t}^{N})\), firm L’s market share \(\omega _{t}^{L}\), and firm F’s market share \(\omega _{t}^{F}\). Denote the state at time t as \({\mathcal {S}}_{t}:=(r_{t}^{}, \mathbf{s }_{t}^{}, \omega _{t}^{L}, \omega _{t}^{F})\).

-

3.

Actions: The actions are pricing in the exogenous switching cost scenario, and pricing and switching cost investment in the endogenous switching cost scenario. \(p_{t}^{j}\) denotes the pricing strategy, and \(I_{t}^{j}\) denotes the switching cost investment strategy of firm \(j \in \{L, F\}\). The switching cost investments can be positive (\(I_{t}^{j}>0\)) or negative (\(I_{t}^{j}<0\)).

-

4.

Transition Rule: A current state transitions to another state at the start of the next period. The transition of the relative preference of consumers \(r_{t}^{}\) follows a Markov chain with probability. For each type n consumer, the transition of the market share of firm j in period \(t+1\) is

$$\begin{aligned} \omega _{t+1}^{j}(n) = \delta _{t}\displaystyle \sum _{i\in \{L, F, O\}}\omega _{t}^{i}(n)P_{t}^{i,j}(n) + (1-\delta _{t})\omega _{t}^{j}(n) \end{aligned}$$(3)where \(\omega _{t}^{j}(n)\) denotes the market share of firm j under type n, \(\omega _{t}^{O}(n)\) denotes the portion of new consumers O under type n that is equal to \(1-\omega _{t}^{L}(n)-\omega _{t}^{F}(n)\), and \(\delta _{t}\) denotes the upgrade rate. The (total) market share of firm j over all types in period t is

$$\begin{aligned} \omega _{t}^{j} = \sum _{n=1}^{N}\omega _{t}^{j}(n) \end{aligned}$$(4)In the endogenous switching cost scenario, the transition of switching costs is determined by the switching cost investments of firms L and F, which is the same as that in (Demirhan et al. 2007),

$$\begin{aligned} s_{t+1}^{n} = \max \{s_{t}^{n} + I_{t}^{L} + I_{t}^{F}, 0\}. \end{aligned}$$(5) -

5.

Reward: The reward in each period is called the current reward. Before obtaining the reward, we define the demand of firm j at period t, which is the sum of the weighted of the purchase probabilities for all three segments of consumers,

$$\begin{aligned} d_{t}^{j} = M\delta _{t}\sum _{n=1}^{N}\sum _{i\in \{L, F, O\}}\omega _{t}^{i}(n)P_{t}^{i,j}(n), \end{aligned}$$(6)where M is the market size. The current reward comprises the total revenue generated from products after subtracting the marginal cost c in the exogenous switching cost scenario,

$$\begin{aligned} R_{t}^{j}({\mathcal {S}}_{t}, p_{t}^{L}, p_{t}^{F}) = (p_{t}^{j} - c)d_{t}^{j}, \quad j\in \{L, F\}. \end{aligned}$$(7)and subtracting the marginal cost c and investment cost \(C(I_{t}^{j})\) in the endogenous switching cost scenario,

$$\begin{aligned} R_{t}^{j}({\mathcal {S}}_{t}, p_{t}^{L}, p_{t}^{F}, I_{t}^{j}) = (p_{t}^{j} - c)d_{t}^{j} - C(I_{t}^{j}), \quad j\in \{L, F\}. \end{aligned}$$(8)We assume that function \(C(I_{t}^{j})\) satisfies convexity and is equal to 0 if \(I_{t}^{j}=0\). The two firms decide their strategies to maximize the total profit \(V_{t}^{j}\) as

$$\begin{aligned} V_{t}^{j} = R_{t}^{j}({\mathcal {S}}_{t}, p_{t}^{L}, p_{t}^{F}, I_{t}^{j}) + E[V_{t+1}^{j*}({\mathcal {S}}_{t+1}|{\mathcal {S}}_{t}, p_{t}^{L}, p_{t}^{F}, I_{t}^{L}, I_{t}^{F})], \end{aligned}$$(9)where \(V_{t+1}^{j*}\) denotes the value function from the next period \(t+1\) to the end T and \(E[V_{t+1}^{j*}] = \Sigma Pr(r_{t+1}^{}|r_{t}^{})V_{t+1}^{j*}\). Recursively, the value function from period t to the end T is obtained under the optimal strategies of firm j, namely \(V_{t}^{j*} = \max _{p_{t}^{j}, I_{t}^{j}}V_{t}^{j}\).

3 Competition with exogenous switching costs

In this section, we consider the exogenous switching costs scenario, that is, the switching costs in the market cannot be controlled by the two firms. We discuss the effect of switching costs on the market shares and profits of the two firms. We also conduct forward simulations to understand the dynamics of the two firms on the basis of the equilibrium prices obtained through backward induction.

3.1 Theoretical results

Switching costs can bring certain monopoly power to firms by restricting the flow of consumers. However, in a competitive market, a firm’s demand and current reward may not be necessarily positively affected by switching costs. Taking the derivative of two firms’ demands with respect to the switching costs of type n consumers, it has

That is, the effect of the switching cost is positive to one firm’s demand and negative to the other’s. As the purchase probabilities in Eq. 2 are between 0 and 1, the current market share \(\omega _{t}^{j}(n)\) of type n consumers is positively related to the sign of the derivative \(\frac{\partial d_{t}^{j}}{\partial s_{t}^{n}}\). The firm with a large current market share is more likely to benefit from switching costs, and conversely, switching costs may negatively affect the firm with a small current market share. In particular, we propose the following:

Proposition 1

For each type of consumer, if the switching cost \(s_{t}^{n}\) is sufficiently small, then the effect of switching costs on demand is positive for the firm with current market share advantage and negative for the firm with current market share disadvantage.

Proof

Without loss of generality, we assume that the leader has a larger current market share than the follower, namely \(\omega _{t}^{L}(n)>\omega _{t}^{F}(n)\). If no switching cost exists in the market, then we have \(P_{t}^{j,j}(n)=P_{t}^{k,j}(n)=P_{t}^{j}(n)\), and

According to the continuity, \(\frac{\partial d_{t}^{L}}{\partial s_{t}^{n}} > 0\) when the switching cost \(s_{t}^{n}\) is sufficiently small. From Eq. 10, \(\frac{\partial d_{t}^{F}}{\partial s_{t}^{n}} < 0\). \(\square \)

Switching costs can be detrimental to a firm in the market because it prevents the firm from expanding its market share. Proposition 1 determines that small switching costs can adversely affect the demand of the firm with a small current market share. When the switching cost increases from 0, a small number of cost-sensitive consumers can be affected, including stop switching behavior, and the demand of the firm with a weak market share begins to decline. At this time, the firm can adjust its price strategy to deal with the loss in demand as the switching cost increases.

We then study the effect of switching costs on firms’ long-term profit. The value function from the next period to the end is closely related to the next-period market shares \(\omega _{t+1}^{L}\) and \(\omega _{t+1}^{F}\). According to the transition rule in Eq. 3, the relationship between the next-period market shares of the two firms and the switching cost is as follows:

Compared with Eq. 10, it has \(\frac{\partial \omega _{t+1}^{j}}{\partial s_{t}^{n}} = \frac{1}{M}\frac{\partial d_{t}^{j}}{\partial s_{t}^{n}}\). Thus, if the effect of the switching cost on a firm’s demand is positive, then the switching cost is also positively related to the next-period market share of this firm and is negatively related to that of the other firm. Basing on the effect of switching costs on a firm’s demand and market share, we establish the relationship between the long-term profit and the switching costs as follows:

Proposition 2

Suppose that the price of each firm is higher than the marginal cost. Let j denote the firm we consider and k denote the other firm. For each type of consumer, if \(\frac{\partial d_{t}^{j}}{\partial s_{t}^{n}}>0\) from the beginning of period t, then \(\frac{\partial V_{t}^{j}}{\partial s_{t}^{n}}>0\) and \(\frac{\partial V_{t}^{k}}{\partial s_{t}^{n}}<0\). If \(\frac{\partial d_{t}^{j}}{\partial s_{t}^{n}}<0\) from the beginning of period t, then \(\frac{\partial V_{t}^{j}}{\partial s_{t}^{n}}<0\).

Proof

We only prove the first part of the theorem, and the proof of the second part is similar. According to the definition of the purchase probabilities in Eq. 2, it has \(P_{t}^{j,j}(n)>P_{t}^{O,j}(n)>P_{t}^{k,j}(n)\), provided that switching cost \(s_{t}^{n}>0\). We define the average purchase probability of all types of consumers belonging to segment i and purchasing from firm j as

which also has \(P_{t}^{j,j}>P_{t}^{O,j}>P_{t}^{k,j}\). Thus, we can rewrite the demand of firm j as \(d_{t}^{j} = M\delta _{t}\sum _{i\in \{L, F, O\}}\omega _{t}^{i}P_{t}^{i,j}\) and claim that \(\frac{\partial d_{t}^{j}}{\partial \omega _{t}^{j}}>0\) and \(\frac{\partial d_{t}^{j}}{\partial \omega _{t}^{k}}<0\).

We first show the relationship between the value function and the next-period market shares. By induction, for the current reward in the last period \(R_{T}^{j}\), it has \(\frac{\partial R_{T}^{j}}{\partial \omega _{T}^{j}}> 0\), and \(\frac{\partial R_{T}^{j}}{\partial \omega _{T}^{k}}<0\) because of \(\frac{\partial d_{T}^{j}}{\partial \omega _{T}^{j}}>0\), \(\frac{\partial d_{T}^{j}}{\partial \omega _{T}^{k}}<0\), and \(p_{t}^{j}> c\). Therefore, for the value function \(V_{T}^{j*}=\max _{p_{T}^{j}, I_{T}^{j}}R_{T}^{j}\) in period T, it also has \(\frac{\partial V_{T}^{j*}}{\partial \omega _{T}^{j}}>0\), and \(\frac{\partial V_{T}^{j*}}{\partial \omega _{T}^{k}}<0\). For period \(T-1\), the profit \(V_{T-1}^{j} = R_{T-1}^{j} + V_{T}^{j*}\) from \(T-1\) to T has

and

Therefore, \(\frac{\partial V_{T-1}^{j*}}{\partial \omega _{T-1}^{j}}> 0\) and \(\frac{\partial V_{T-1}^{j*}}{\partial \omega _{T-1}^{k}}< 0\). We have \(\frac{\partial V_{t}^{j*}}{\partial \omega _{t}^{j}}> 0\) and \(\frac{\partial V_{t}^{j*}}{\partial \omega _{t}^{k}}< 0\) for all period t.

To verify the first conclusion, we still use induction. For the current reward, \(\frac{\partial R_{t}^{j}}{\partial s_{t}^{n}}> 0\) as \(\frac{\partial d_{t}^{j}}{\partial s_{t}^{n}}>0\), whereas \(\frac{\partial R_{t}^{j}}{\partial s_{t}^{n}} < 0\) as \(\frac{\partial d_{t}^{j}}{\partial s_{t}^{n}}<0\) because we assume that \(p_{t}^{j}> c\). Thus, for the value function \(V_{T}^{j^{*}}\) in the last period T, we have \(\frac{\partial V_{T}^{j*}}{\partial s_{T}^{n}}>0\), provided that \(\frac{\partial d_{T}^{j}}{\partial s_{T}^{n}}>0\). Associated with \(\frac{\partial d_{t}^{k}}{\partial s_{t}^{n}}=-\frac{\partial d_{t}^{j}}{\partial s_{t}^{n}}\) from Eq. 10, \(\frac{\partial d_{T}^{k}}{\partial s_{T}^{n}}<0\) and \(\frac{\partial V_{T}^{k*}}{\partial s_{T}^{n}}<0\) are true. For the period \(T-1\), differentiating the profit \(V_{T-1}^{j}\) with respect to the switching cost \(s_{T-1}^{n}\) obtains,

We know that \(\frac{\partial R_{T-1}^{j}}{\partial s_{T-1}^{n}}>0\) and \(\frac{\partial V_{T}^{j*}}{\partial s_{T}^{n}}>0\) if \(\frac{\partial d_{T-1}^{j}}{\partial s_{T-1}^{n}}>0\) and \(\frac{\partial d_{T}^{j}}{\partial s_{T}^{n}}>0\) are true. We obtain \(\frac{\partial \omega _{T}^{j}}{\partial s_{T-1}^{n}}>0\) and \(\frac{\partial \omega _{T}^{k}}{\partial s_{T-1}^{n}}<0\) from Eq. 11. From the first part of the proof, \(\frac{\partial V_{T}^{j*}}{\partial \omega _{T}^{j}}>0\), and \(\frac{\partial V_{T}^{j*}}{\partial \omega _{T}^{k}}<0\). Associated with \(\frac{\partial s_{T}^{n}}{\partial s_{T-1}^{n}}>0\) from the transition rule in Eq. 5, we can claim that \(\frac{\partial V_{T-1}^{j}}{\partial s_{T-1}^{n}}>0\). By analogy, we can obtain \(\frac{\partial V_{t}^{j}}{\partial s_{t}^{n}}>0\) for any period t. Moreover, \(\frac{\partial d_{t}^{j}}{\partial s_{t}^{n}}>0\) means \(\frac{\partial d_{t}^{k}}{\partial s_{t}^{n}}<0\) and \(\frac{\partial \omega _{t+1}^{k}}{\partial s_{t}^{n}}<0\). Through the same analysis as above, we can obtain \(\frac{\partial V_{t}^{k}}{\partial s_{t}^{n}}<0\). \(\square \)

Proposition 2 illustrates that switching costs can negatively affect a firm’s long-term profit. This case happens when the switching cost is negatively related to the firm’s demand or is positively related to the opponent’s. According to Eq. 10, we can assert that the effect of the switching cost on profit is negative to the firm with a weak market share. Conversely, the switching cost can bring additional profits to the firm with a dominant market share. As a result, the leader in the market, which usually has an advantage in technology and market share, benefits more from switching costs, whereas the follower may not be in favor of switching costs. Switching costs can be thus regarded as one of the first-mover advantages.

Below, we discuss the effect of switching costs on the market share under the change of consumer preference. The follower is usually at a disadvantage in terms of consumer preference in the beginning. However, as consumers become more aware of the follower’s product, the consumer preference for the follower relative to the leader changes over time. The increase in the relative preference of consumers plays an important role in reshaping the market shares of the two firms. Nonetheless, in a market with switching costs, we have the following result:

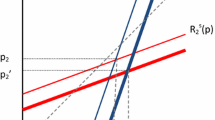

Proposition 3

If the switching cost \(s_{t}^{n}\) in the market is larger than some threshold, then \(\frac{\partial (\frac{\partial \omega _{t+1}^{L}}{\partial r_{t}^{}})}{\partial s_{t}^{n}}>0\), and \(\frac{\partial (\frac{\partial \omega _{t+1}^{F}}{\partial r_{t}^{}})}{\partial s_{t}^{n}}<0\).

Proof

Differentiating the next-period market share \(\omega _{t+1}^{j}\) with respect to the relative preference of consumers \(r_{t}^{}\), we obtain

That is, the relative preference of consumers for the follower is positively related to the follower’s market share and negatively related to the leader’s. Taking the switching cost into consideration, the following is proposed:

From the definitions of purchase probabilities in Eq. 2, \(\frac{\partial P_{t}^{j,k}(n)}{\partial s_{t}^{n}}=P_{t}^{j,k}(n)(P_{t}^{j,k}(n)-1)\le 0\) and \(P_{t}^{j,k}(n)\) tends to 0 as \(s_{t}^{n}\) tends to infinite. Given any price pair \(p_{t}^{L}\) and \(p_{t}^{F}\) of the two firms, some threshold \({\bar{s}}\) exists, such that if \(s_{t}^{n}>{\bar{s}}\), then the switching purchase probabilities satisfy \(P_{t}^{L,F}(n)<\frac{1}{2}\) and \(P_{t}^{F,L}(n)<\frac{1}{2}\). Therefore, \(\frac{\partial (\frac{\partial \omega _{t+1}^{L}}{\partial r_{t}^{}})}{\partial s_{t}^{n}}>0\), and \(\frac{\partial (\frac{\partial \omega _{t+1}^{F}}{\partial r_{t}^{}})}{\partial s_{t}^{n}}<0\). \(\square \)

If the relative preference of consumers for the follower increases, then the follower’s market share in the next period increases, whereas that of the leader’s decreases. Proposition 3 means that as the switching cost increases, the improvement in relative preference of consumers has less influence on the two firms’ market shares. That is, switching costs can help the leader retain consumers and maintain market share as the follower’s product is gradually recognized by consumers. Therefore, switching costs can be seen as the first-mover advantage of the leader.

Proposition 3 also implies that for the leader, switching costs and relative preference of consumers can be considered as complements, while for the follower, they can be considered as substitutes (for the definitions of complements and substitutes, we refer to (Shapley et al. 1962)). In other words, as the relative preference of consumers for the follower increases, the marginal utility of switching costs becomes more significant for the leader and less significant for the follower.

3.2 Numerical simulations

We conduct a case study of a smartphone market to verify the theoretical results and understand the dynamics of both decision makers. Two dominating firms, Apple and Samsung, compete with each other in a single market. For the coefficients of the mixed logit model, we refer to the empirical research of Kim et al. (2020), who sampled 991 Korean smartphone owners between the ages of 20 and 59 and considered five attributes for the standard mixed logit model: brand (Apple or Samsung), screen size (inch), memory (100 GB), user recognition technology (with or without), and price (thousand USD). The estimation results of Kim et al. (2020) are 3.627 (Apple) and 6.571 (Samsung) for brand, 0.097 for screen size, 1.151 for memory, 1.013 for user recognition technology, and \(-6.431\) for price.

We consider an Apple iPhone (5.5-inch screen, 256 GB memory, with user recognition technology) and a Samsung phone (5.8-inch screen, 256 memory, with user recognition technology). The utilities of the type n consumers who switch purchases are

Note that prices \(p_{t}^{\text {iPhone}}\) and \(p_{t}^{\text {Samsung}}\) are in thousands of USD.

For other parameters, the planning horizon consists of 20 time periods, \(t\in \{1,\ldots , 20\}\), the market size is set to \(M=1000\), the marginal cost is set to \(c=200\) USD, and the upgrade rate is set to \(\delta _{t}=0.1\). We assume that in the beginning time epoch \(t=1\), Apple is the market pioneer (the leader) which is more attractive to consumers in the beginning, whereas Samsung (the follower) is less attractive to consumers. That is, the relative preference of consumers in the beginning is \(r_{1}^{}=-3\). Below, we use the leader to represent Apple, and the follower to represent Samsung.

For the initial market shares, we set \(\omega _{1}^{\text {iPhone}} = 0.59\) and \(\omega _{1}^{\text {Samsung}} = 0.27\), which is the average market share of the two smartphone brands in the USA over the past year (StatCounter 2021). In Appendix B, we also use South Korea’s market share data over the past year to analyze the situation where the follower dominates the market share (\(\omega _{1}^{\text {iPhone}} = 0.26\) and \(\omega _{1}^{\text {Samsung}} = 0.64\)). The total market share of the two smartphone brands in these countries (the USA and South Korea) exceeds 85%, which is in line with the duopoly model. In the situation where the follower dominates the market share, all results are similar to the situation where the leader dominates the market share (in the USA), except that the follower is more active in increasing switching costs in early periods (see Appendix B).

We compare the two switching cost cases, namely without exogenous switching costs (\(s_{t}^{n}\equiv 0\)) and with exogenous switching costs (\(s_{t}^{n}\ne 0\)). In the case with exogenous switching costs, we assume that three types of consumers pay switching costs 1, 2, and 3, respectively (\(s_{t}^{1}=1\), \(s_{t}^{2}=2\), and \(s_{t}^{3}=3\)), and these three types of consumers each account for one-third of the market. In the utility equation, each unit change in consumer utility is equivalent to a price change of 155 USD (the price sensitivity is 6.431). Therefore, the largest switching cost (\(s_{t}^{3}=3\)) accounts for 465 USD or up to 38.8% of the price of the smartphone (\(\sim \) 1200 USD for the premium iPhone), which is close to the ratio in empirical studies (e.g., 35.9% in (Park and Koo 2016) and 30% in (Osborne 2011)).

In line with our model assumption, consumers become highly aware of the follower’s product as time passes, and the gap of the consumer preferences between the two brands narrows. Thus, \(r_{t}\) follows a Markov chain over periods. (The transition probability matrix of \(r_{t}\) is shown in Appendix A.) Under this uncertain market evolution, we adopt forward simulation to compare the two firms’ strategic changes on the basis of the equilibrium strategies. The equilibrium strategies are obtained by backward induction of the dynamic game model. We simulate 5000 times for the sake of smoothing the results, and all results are the average of 5000 simulations. For each simulation run, we generate a realization of the dynamic game over the planning horizon. The evolution trend of \(r_{t}\) under 5000 simulations is shown in Fig. 3. The figure shows that \(r_{t}^{}\) has a wide range and can be greater than 0 after the 10th period, which means that the consumer preference for the follower may exceed that for the leader.

Figure 4 shows the trend of market shares, equilibrium price, and profit in each period for the two switching cost cases. The horizontal axis represents the time, and the vertical axis represents the market share/equilibrium price/profit of the two smartphone firms. We draw the following conclusions:

-

The market share position of the two firms reverses because of the improvement of consumers’ relative preference (Fig. 4a and d). However, switching costs protect the leader’s market share advantage to a certain extent, because the switching costs can reduce the effect of consumers’ relative preference on the market share of the two firms (Fig. 4d).

-

The two firms set a higher price with exogenous switching costs. Compared with no exogenous switching costs, the gap between the two firms’ price widens (Fig. 4b and e).

-

Owing to the advantages of market share and consumer performance at the beginning, the leader’s profit increases under exogenous switching costs. Conversely, the follower’s profit decreases under exogenous switching costs (Fig. 4 c and f).

4 Competition with endogenous switching costs

In this section, we consider the dynamic market competition under endogenous switching costs. Different from the exogenous scenario, the switching cost in the market can be changed by the two firms by investing in the product design. In addition to the pricing strategies, the two firms can invest in either increasing (\(I_{t}^{j}>0\)) or decreasing (\(I_{t}^{j}<0\)) the switching cost. For example, they can make their products greatly incompatible or compatible with each other. Although the pricing strategies are short-term decisions that can take effect immediately, the changes for product design (switching cost investment) require lead time. Thus, the two firms decide to invest in switching costs and pay the investment cost in the current period (Eq. 8), and the lock-in effect occurs in the next period (Eq. 9).

Proposition 2 shows how the long-term profit of a firm is influenced by switching cost. Accordingly, Proposition 4 characterizes the switching cost strategy of firms.

Proposition 4

If the switching costs are small or the gap in market shares between the two firms is large, then the firm with market share advantage invests in increasing switching costs, whereas the firm with market share disadvantage takes action to decrease switching costs.

Proof

Without loss of generality, we assume that the leader dominates the market share, namely \(d_{t}^{L}>d_{t}^{F}\). Taking the first-order condition of \(V_{t}^{j}\) on \(I_{t}^{j}\), we obtain \(C'(I_{t}^{j})=\frac{\partial V_{t+1}^{j*}}{\partial s_{t+1}^{n}}\frac{\partial s_{t+1}^{n}}{\partial I_{t}^{j}}\). From Proposition 1 and Eq. 10, we know that if the switching cost \(s_{t}^{n}\) is small or the gap in market shares between the two firms is large, then it has \(\frac{\partial d_{t}^{L}}{\partial s_{t}^{n}}>0\) and \(\frac{\partial d_{t}^{F}}{\partial s_{t}^{n}}<0\). According to Proposition 2, we have \(\frac{\partial V_{t}^{L}}{\partial s_{t}^{n}}>0\) and \(\frac{\partial V_{t}^{F}}{\partial s_{t}^{n}}<0\). Thus, for the value function, \(V_{t}^{j*}=\max _{p_{t}^{j}, I_{t}^{j}}\{V_{t}^{j}\}\), \(\frac{\partial V_{t}^{L*}}{\partial s_{t}^{n}}>0\), and \(\frac{\partial V_{t}^{F*}}{\partial s_{t}^{n}}<0\). Therefore, \(C'(I_{t}^{L})\ge 0\) and \(C'(I_{t}^{F})\le 0\) because \(\frac{\partial s_{t+1}^{n}}{\partial I_{t}^{j}}=1\). Given that the investment cost function C satisfies convexity and is equal to 0 if \(I_{t}^{j}=0\), we have \(I_{t}^{L}\ge 0\) and \(I_{t}^{F}\le 0\). \(\square \)

Proposition 4 shows that firms can adopt the switching cost strategy as a weapon to enhance their market competitiveness. In a duopoly, the firm with a larger market share wants to further increase consumer inertia to maintain its market dominance on the one hand. For example, the firm can make its product greatly incompatible with others or increase the cost of cancellation. On the other hand, the firm with a smaller market share has an incentive to decrease switching costs to enlarge its market scope and can sell greatly compatible products or pay new consumers to switch. The result is similar to that of Katz and Shapiro (1985), who argued that in a single period, firms with good reputations or large networks prefer incompatibility, whereas firms with weak reputations or small networks are in favor of compatibility. By contrast, we confirm the result in multiple periods and further find that although the gap in market shares is small, the result remains valid under small switching costs.

To exhibit the market dynamics with firms’ switching cost investment and the manner in which firms’ switching cost investment changes under uncertain market evolution, we also perform 5000 simulations on the previous smartphone study. We also use the leader to represent Apple and the follower to represent Samsung. All the parameters are the same as those in the exogenous switching cost scenario in Sect. 3.2. In line with the prior works (Demirhan et al. 2007; Xue et al. 2006), we assume that the investment cost \(C(I_{t}^{j})\) is a quadratic function, that is, \(C(I_{t}^{j})=k(I_{t}^{j})^{2}\), where the coefficient of switching cost investment k is equal to 50. The firms’ choice of switching cost investment is set as discrete and bounded, \(I_{t}^{j}\in \{-2, -1, 0, 1, 2\}\). We also compare the two switching cost cases: without initial switching costs (\(s_{1}^{} = 0\)) and with initial switching costs (\(s_{1}^{n} \ne 0\)). In the case of with initial switching costs, we also consider three types of consumers (each accounting for one-third) who pay switching costs 1, 2, and 3, respectively.

-

1.

Market share, equilibrium price, and profit trends in each period.

Figure 5 shows the trend of market shares, equilibrium price, and profit in each period for the two initial switching cost cases. The horizontal axis represents the time, and the vertical axis represents the market share/equilibrium price/profit of the two smartphone firms. We draw the following conclusions:

-

A negative correlation is found between the changes in market share and switching costs. Compared with the exogenous switching cost scenario, the changes in market share are reduced (Fig. 5a and d).

-

Without initial switching costs, investment in switching costs increases the two firms’ prices, whereas with initial switching costs, investment in switching costs decreases the two firms’ prices (Fig. 5b and e).

-

The leader’s profit is positively related to switching costs, and the follower’s profit initially increases and then decreases as the switching costs increase (Figs. 4 and 5c and f).

-

-

2.

Ratio of switching cost investments and switching cost trajectory in each period

Figure 6 shows the ratio of switching cost investments and the trajectory of the largest switching cost (\(s_{1}^{3}\)) in each period for both cases. The horizontal axis represents the time, and the vertical axis represents the changes in switching cost. The colored grid in Fig. 6a–d represents the ratio of decisions made by both firms in 5000 simulations. The darker the color, the higher the probability of switching cost investment. We draw the following conclusions:

-

Without initial switching costs, both firms increase their switching costs to create product differentiation (Fig. 6a and b).

-

With initial switching costs, the follower decreases its switching cost to attract additional consumers, whereas the leader tends to maintain a large switching cost because of its market share advantage (Fig. 6d and e).

-

When the switching cost is small, the switching cost strategy of the two firms will increase the switching cost in the market. Conversely, when the switching cost is large, the switching cost strategy of the two firms will decrease the switching cost in the market (Fig. 6c and f).

-

5 Case of asymmetric switching costs

In this section, we relax the assumption of the symmetric switching costs and discuss the case of asymmetric switching costs, that is, the switching cost paid by consumers switching from firm F to L differs from that when they switch from firm L to F. For simplicity, we assume that there is only one type of consumers in the market (\(N=1\)). Let \(s_{t}^{F,L}\) denote the switching costs when switching from firm F to L and \(s_{t}^{L,F}\) denote the switching costs when switching from firm L to F. Under asymmetric switching costs, the utilities of switching consumers are

Taking the derivative of two firms’ demands with respect to the asymmetric switching costs, we have

Compared with the case of symmetric switching costs, the effect of the asymmetric switching costs on firms’ demand and profit is quite clear. For a firm, the higher the switching costs of its own consumers, the lower the switching costs of the rival’s consumers, the more beneficial it is to its demand and long-term profit.

If a firm can invest in asymmetric switching costs, decreasing the switching costs of the rival’s consumers and increasing the switching costs of its own consumers are natural. However, the performance of investing in these two asymmetric switching costs can vary. According to Eq. 14, we can obtain the following result:

Proposition 5

Suppose the investment costs for the two asymmetric switching costs are the same.

-

1.

If \(\frac{\partial d_{t}^{L}}{\partial s_{t}^{L,F}}>-\frac{\partial d_{t}^{L}}{\partial s_{t}^{F,L}}\), or equivalently \(\frac{\partial d_{t}^{F}}{\partial s_{t}^{F,L}}< -\frac{\partial d_{t}^{F}}{\partial s_{t}^{L,F}}\), then the leader will invest in increasing the switching costs \(s_{t}^{L,F}\) and the follower will invest in decreasing the switching costs \(s_{t}^{L,F}\).

-

2.

If \(\frac{\partial d_{t}^{L}}{\partial s_{t}^{L,F}}<-\frac{\partial d_{t}^{L}}{\partial s_{t}^{F,L}}\), or equivalently \(\frac{\partial d_{t}^{F}}{\partial s_{t}^{F,L}}> -\frac{\partial d_{t}^{F}}{\partial s_{t}^{L,F}}\), then the leader will invest in decreasing the switching costs \(s_{t}^{F,L}\) and the follower will invest in increasing the switching costs \(s_{t}^{F,L}\).

Proof

Suppose that \(\frac{\partial d_{t}^{L}}{\partial s_{t}^{L,F}}>-\frac{\partial d_{t}^{L}}{\partial s_{t}^{F,L}}>0\). For firm L’s next-period market share, it has \(\frac{\partial \omega _{t+1}^{L}}{\partial s_{t}^{L,F}} = \frac{1}{M}\frac{\partial d_{t}^{L}}{\partial s_{t}^{L,F}}\) and \(\frac{\partial \omega _{t+1}^{L}}{\partial s_{t}^{F,L}} = \frac{1}{M}\frac{\partial d_{t}^{L}}{\partial s_{t}^{F,L}}\). Consistent with the proof of Proposition 2, we can obtain \(\frac{\partial V_{t}^{L*}}{\partial s_{t}^{L,F}}>-\frac{\partial V_{t}^{L*}}{\partial s_{t}^{F,L}}\). That is, each unit increase in the switching costs \(s_{t}^{L,F}\) brings more long-term profits than each unit decrease in the switching costs \(s_{t}^{F,L}\). Given that the investment costs for the two asymmetric switching costs are the same, firm L will invest in increasing the switching costs \(s_{t}^{L,F}\) rather than decreasing the switching costs \(s_{t}^{F,L}\). For firm F, we have that \(-\frac{\partial d_{t}^{F}}{\partial s_{t}^{L,F}}>\frac{\partial d_{t}^{F}}{\partial s_{t}^{F,L}}>0\) from Eq. 14. Similarly, we can obtain that \(-\frac{\partial V_{t}^{F*}}{\partial s_{t}^{L,F}}>\frac{\partial V_{t}^{F*}}{\partial s_{t}^{F,L}}\). Therefore, firm F will invest in decreasing the switching costs \(s_{t}^{L,F}\) rather than increasing the switching costs \(s_{t}^{F,L}\).

Similarly, if \(\frac{\partial d_{t}^{L}}{\partial s_{t}^{L,F}}<-\frac{\partial d_{t}^{L}}{\partial s_{t}^{F,L}}\) (or equivalently \(\frac{\partial d_{t}^{F}}{\partial s_{t}^{F,L}}> -\frac{\partial d_{t}^{F}}{\partial s_{t}^{L,F}}\)), then the two firms will invest in the switching costs \(s_{t}^{F,L}\), but in the opposite direction. \(\square \)

Proposition 5 states that a firm’s investment in asymmetric switching costs depends on the effect of the asymmetric switching costs on the firm’s demand. For a firm, if the switching costs of its consumers (i.e., \(s_{t}^{L,F}\) for firm L or \(s_{t}^{F,L}\) for firm F) have a larger effect on its demand than the switching costs of the rival’s consumers (i.e., \(s_{t}^{F,L}\) for firm L or \(s_{t}^{L,F}\) for firm F), then the firm is more willing to invest in increasing the switching costs of its consumers. Conversely, if the switching costs of the rival’s consumers have a larger effect on its demand, then the firm is more willing to invest in decreasing the switching costs of the rival’s consumers. Because the asymmetric switching costs have the opposite effects on the two firms (Eq. 14), they prefer to invest in the same asymmetric switching costs instead of investing in two different asymmetric switching costs separately. Only the investment directions of the two firms are opposite.

6 Conclusion

This study investigates the price and switching cost competition under uncertain market evolution with a leader and a follower as the decision makers. In every period, the two firms make decisions in sequence, and the consumers who purchase from the two firms incur a one-time nonnegative switching cost if they switch from one firm to another. A mixed logit demand model is adopted to describe consumer behavior, which makes our results generalizable to general discrete choice models. To simulate the rapidly changing and uncertain market evolution, we assume that consumers’ relative preference for the follower’s product changes stochastically over time. We obtain theoretical results about the effect of switching costs on market dynamics and conduct forward simulations on the basis of the equilibrium strategies obtained through backward induction.

Switching costs may exert different effects on the demand, market share, and profit of two firms competing in the same market. The current market share is an important factor in determining the effect of switching costs on a firm’s demand and profit. When the switching cost in the market is small, it can be detrimental to the demand of the firm whose current market share is at a disadvantage. Conversely, switching costs can benefit the firm with a dominant current market share. The current market share also plays an important role in a firm’s switching cost investment. The direction of a firm’s switching cost investment is determined by its market share position. Switching costs can be regarded as the first-mover advantage to maintain a firm’s market share advantage, which can reduce the loss of market share caused by the decline of the leader’s market advantage over periods. In addition, switching costs and relative preference of consumers can be seen as complements for the leader and as substitutes for the follower. We also study the asymmetric switching costs, which means that the two switching costs, from the leader to the follower and from the follower to the leader, are different. We find that a firm’s choice of which asymmetric switching cost to invest in depends on the effect of the asymmetric switching costs on the firm’s demand.

Through numerical simulations on the smartphone market, we further find that with the improvement of consumers’ relative preference for the follower, switching costs can narrow the changes in market share and increase the prices of the two firms. The leader’s profit is positively related to switching costs, and the follower’s profit initially increases and then decreases as switching costs increase. For the switching cost investment, both firms increase switching costs under zero initial switching costs. However, under large initial switching costs, the leader has the incentive to increase switching costs, and the follower tends to decrease switching costs.

Switching costs are driven by the two firms’ product design. Consumers are assumed to be not forward-looking because they cannot predict or know the design of future products before the new products are released. In addition to this type of switching costs, firms also can offer loyalty rewards or new consumers’ preferential schemes to consumers, and consumers may consider them in advance when choosing a firm’s product. Accordingly, further research that combines these multiple sources of switching costs with strategic consumers may enhance the explanation regarding switching behavior in the market.

References

Aksoy-Pierson M, Allon G, Federgruen A (2013) Price competition under mixed multinomial logit demand functions. Manage Sci 59(8):1817–1835

Arie G, Grieco PL (2014) Who pays for switching costs? Quant Mark Econ 12(4):379–419

Baumgartner B, Guhl D, Kneib T, Steiner WJ (2018) Flexible estimation of time-varying effects for frequently purchased retail goods: a modeling approach based on household panel data. OR Spectrum 40(4):837–873

Beggs A (1989) A note on switching costs and technology choice. J Indus Econom 37(4):437–440

Beggs A, Klemperer P (1992) Multi-period competition with switching costs. Econom J Econom Soc 60(3):651–666

Cabral L (2016) Dynamic pricing in customer markets with switching costs. Rev Econ Dyn 20:43–62

Caminal R, Matutes C (1990) Endogenous switching costs in a duopoly model. Int J Ind Organ 8(3):353–373

Chen PY, Forman C (2006) Can vendors influence switching costs and compatibility in an environment with open standards? MIS quarterly pp 541–562

Chen PY, Hitt LM (2002) Measuring switching costs and the determinants of customer retention in internet-enabled businesses: A study of the online brokerage industry. Inf Syst Res 13(3):255–274

Chen PY, Hitt LM (2006) Information technology and switching costs. Handbook Econom Inf Syst 1:437–470

Chen Y (1997) Paying customers to switch. J Econom Manag Strategy 6(4):877–897

Cosguner K, Chan TY, Seetharaman P (2017) Behavioral price discrimination in the presence of switching costs. Mark Sci 36(3):426–435

Cosguner K, Chan TY, Seetharaman P (2018) Dynamic pricing in a distribution channel in the presence of switching costs. Manage Sci 64(3):1212–1229

Demirhan D, Jacob VS, Raghunathan S (2007) Strategic it investments: the impact of switching cost and declining it cost. Manage Sci 53(2):208–226

Doganoglu T (2010) Switching costs, experience goods and dynamic price competition. Quant Mark Econ 8(2):167–205

Dubé JP, Hitsch GJ, Rossi PE (2009) Do switching costs make markets less competitive? J Mark Res 46(4):435–445

Dubé JP, Hitsch GJ, Rossi PE (2010) State dependence and alternative explanations for consumer inertia. Rand J Econ 41(3):417–445

Farrell J, Klemperer P (2007) Coordination and lock-in: competition with switching costs and network effects. Handbook indus Org 3:1967–2072

Farrell J, Shapiro C (1988) Dynamic competition with switching costs. RAND J Econom 19(1):123–137

Goldfarb A (2006) State dependence at internet portals. J Econom Manag Strat 15(2):317–352

Grzybowski L, Liang J (2015) Estimating demand for fixed-mobile bundles and switching costs between tariffs. Inf Econ Policy 33:1–10

Guhl D (2019) Addressing endogeneity in aggregate logit models with time-varying parameters for optimal retail-pricing. Eur J Oper Res 277(2):684–698

Guhl D, Baumgartner B, Kneib T, Steiner WJ (2018) Estimating time-varying parameters in brand choice models: A semiparametric approach. Int J Res Mark 35(3):394–414

Katz ML, Shapiro C (1985) Network externalities, competition, and compatibility. Am Econ Rev 75(3):424–440

Katz ML, Shapiro C (1994) Systems competition and network effects. J Econom Perspect 8(2):93–115

Kim J, Lee H, Lee J (2020) Smartphone preferences and brand loyalty: a discrete choice model reflecting the reference point and peer effect. J Retail Consum Serv 52:101907

Klemperer P (1987a) The competitiveness of markets with switching costs. RAND J Econom 18(1):138–150

Klemperer P (1987) Markets with consumer switching costs. Q J Econ 102(2):375–394

Klemperer P (1995) Competition when consumers have switching costs: an overview with applications to industrial organization, macroeconomics, and international trade. Rev Econ Stud 62(4):515–539

Lachaab M, Ansari A, Jedidi K, Trabelsi A (2006) Modeling preference evolution in discrete choice models: a bayesian state-space approach. Quant Mark Econ 4(1):57–81

Li H, Webster S, Mason N, Kempf K (2019) Product-line pricing under discrete mixed multinomial logit demand: Winner-2017 m&som practice-based research competition. Manuf Serv Oper Manag 21(1):14–28

Lieberman MB, Montgomery DB (1988) First-mover advantages. Strat Manag J 9(S1):41–58

McFadden D, Train K (2000) Mixed mnl models for discrete response. J Appl Economet 15(5):447–470

Nilssen T (1992) Two kinds of consumer switching costs. RAND J Econom 23(4):579–589

Osborne M (2011) Consumer learning, switching costs, and heterogeneity: a structural examination. Quant Mark Econ 9(1):25–70

Park Y, Koo Y (2016) An empirical analysis of switching cost in the smartphone market in south korea. Telecommun Policy 40(4):307–318

Porter ME (1980) Competitive Strategy: Techniques for Analyzing Industries and Competitors. Free Press, NewYork

Shapley LS et al (1962) Complements and substitutes in the optimal assignment problem. Naval Res Logist Q 9(1):45–48

Singh SS, Jain DC, Krishnan TV (2008) Research note-customer loyalty programs: are they profitable? Manage Sci 54(6):1205–1211

StatCounter (2021) Mobile vendor market share united states of america. https://gs.statcounter.com/vendor-market-share/mobile/united-states-of-america/#monthly-202012-202111

Steiner WJ (2010) A stackelberg-nash model for new product design. OR Spectrum 32(1):21–48

Villas-Boas JM (2015) A short survey on switching costs and dynamic competition. Int J Res Mark 32(2):219–222

Weiss AM, Heide JB (1993) The nature of organizational search in high technology markets. J Mark Res 30(2):220–233

Wernerfelt B (1991) Brand loyalty and market equilibrium. Mark Sci 10(3):229–245

Xue L, Ray G, Whinston AB (2006) Strategic investment in switching cost: an integrated customer acquisition and retention perspective. Int J Electron Commer 11(1):7–35

Zauberman G (2003) The intertemporal dynamics of consumer lock-in. J Consumer Res 30(3):405–419

Acknowledgements

The authors are grateful to Professor Daniel Guhl, the guest editor and two anonymous referees for their helpful suggestions and comments. This research is supported in part by the Ministry of Science and Technology of Taiwan under grant no. 107-2628-E-002-006-MY3 and 110-2221-E-002-160-MY2.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A. Transition probability matrix of the relative preference

We assume that the relative preference of consumers for the follower \(r_{t}^{}\) can change over periods following Markov chains. The transition of \(t+1\) (the next period) depends on the current \(r_{t}^{}\) with three probabilities: increasing one unit, decreasing one unit, or remaining the same. In our numerical experiment, we set \(r_{t}^{}\) as a discrete variable with an upper bound 3 and a lower bound \(-3\). The transition probability matrix is as follows (Table 2).

Appendix B. Follower dominates the market share

The situations where the follower dominates the market share are shown in Figs. 7, 8, and 9. In the exogenous switching cost scenario (Fig. 7), the results are basically consistent with the situation where the leader dominates the market share. With the improvement of consumers’ relative preference, switching costs still maintain the leader’s market share to a certain extent. Except in early periods, both firms set a higher prices with exogenous switching costs.

In the endogenous switching cost scenario (Figs. 8 and 9), both firms use a low price strategy in early periods. Without initial switching costs, the follower is more active in increasing switching costs in early periods. With initial switching costs, the willingness of the two firms to invest in switching cost drops significantly.

Rights and permissions

About this article

Cite this article

Yang, Y., Wu, CH. Competition and market dynamics in duopoly: the effect of switching costs. OR Spectrum 46, 211–235 (2024). https://doi.org/10.1007/s00291-022-00669-w

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00291-022-00669-w