Abstract

I analyze a dynamic duopoly with an infinite horizon where consumers are uncertain about their potential satisfaction from the products and face switching costs. I derive sufficient conditions for the existence of a Markov Perfect Equilibrium(MPE) where switching takes place each period. I show that when switching costs are sufficiently low, the prices in the steady state are lower than what they would have been when they are absent. This result is in contrast to those found in the literature. In the presence of low switching costs competition can be fiercer.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Switching costs arise when consumers face frictions to change the brand they consume either due to contractual obligations or user-product specific relationships which may be costly to replace or reacquire. The presence of switching costs make consumer preferences state dependent, that is, a consumer who has made previous choices might make significantly different choices than a new customer. Once a consumer buys a particular brand, then in the future, she might find it optimal to keep consuming that product even though there are cheaper or more valuable alternatives available for an unattached consumer.

Moreover, there is an inherent uncertainty about the value of a product or service possibly due to lack of information about its specifications and lack of understanding of the match between the needs of a consumer and characteristics of the product or service. The experiences of others may not fully reveal the value of a product or service to a particular consumer given the variety of needs. In addition, the frictions caused by switching costs suggest that experimenting between brands may not be the optimal. Thus, the uncertainty about benefits coupled with switching costs make it even more difficult for a consumer to make a choice between alternative brands. A typical consumer should not only consider the current benefits which are potentially uncertain but also the possibility of developing a brand-specific relationship which in the future might lead to being stuck with an inferior product.

Examples of industries exhibiting switching cost are plenty. Banking and health care services, computer software and hardware are only few immediate examples. Mobile telephony services presents another perfect example. Once subscribed, each user receives a number and usually sign a long term contract. In the absence of number portability or due to contract termination costs, consumers may face a switching cost. Moreover, consumers cannot be certain about the quality of services offered by the providers available in the market. Thus, once subscribed, a positive experience might keep a user from switching to another cheaper provider, or a bad experience might induce a consumer to consider incurring the switching costs and change the provider.

The goal of the paper is to analyze the role of (low) switching costs on the evolution of market outcomes when switching takes place in equilibrium. I use an experience goods framework to induce equilibrium switching, thus consumers consider switching not only due to cheaper alternatives but also due their experiences.

Before introducing the main features of my model, I would like to briefly summarize the results found in the literature on markets with switching costs. In such markets, firms face two opposing incentives. There is a tension between charging high prices to consumers who are locked in and charging lower prices to the new unattached customers to in order to gain a large share of them to exploit in the future. As a consequence, finite period models lead to an equilibrium where firms charge low prices early on to create large market shares to exploit in the final periods, hence the so-called “bargains-and-then-ripoffs” pattern of prices emerges in equilibrium. In infinite horizon models, on the other hand, coupled with assumptions on consumer expectations (which are justified in equilibrium), papers in the literature suggest that the incentive to exploit current customers are stronger and equilibrium prices in the long run tend to be higher than what they would have been in the absence of switching costs. Thus, the message that has emerged in the literature states that presence of switching costs soften competition.

One important qualitative feature of the equilibrium in infinite horizon models studied in the literature is that there is no switching along the equilibrium path of the industry. This is either due to assumptions of homogeneity of consumers and products, and/or the assumption of prohibitively high switching costs. In a large number of industries, such as mobile telephony, switching between brands is commonplace and churn rates are often the subject of business press. It is therefore important to understand whether the conclusions advocated in the literature are robust when sufficiently low switching costs, which allow equilibrium switching, are considered. I attempt to address this question in this paper. I present a very stylized model with switching costs where there is switching between brands along the equilibrium path of the industry. I then show that, in the long run, firms tend to charge lower prices in a market with low switching costs than a market without them.

I consider a infinite horizon dynamic duopoly model where firms compete by setting prices. The consumer population is formed by two overlapping generations: young and the old. Young consumers are uncertain about the satisfaction they will receive from both brands. These satisfaction levels are only realized after consumption. In addition, individuals initially have different tastes or affinities for the goods, for example due to different exposure to marketing which creates an ex-ante product differentiation between the two brands.

When they are old, on the other hand, consumers are attached to a brand due to their consumption in the beginning of their lives. Hence, they know for certain the level of satisfaction of that brand, while they are still uncertain about the value of the alternative. As they mature, their initial affinities vanish, thus the old do not have particular tastes for brands; the only differentiation is due to their differential information about the value of the available brands.

I derive sufficient conditions for the existence of a Markov Perfect Equilibrium(MPE) in which switching takes place. Consumers always expect that they might switch with a certain probability. In this MPE, a firm with a large market share charges a higher price and hence it is more valuable to have a higher market share. Moreover, if the switching costs are sufficiently low, the prices in the steady state are lower than what they would have been in the absence of switching costs.

This result is opposite to those obtained in the literature. In the presence of low switching costs competition can be fiercer. The underlying reason for this result is the differential impact of switching costs on current and future marginal profits. When switching costs are sufficiently low, a small increase in switching costs results in a higher decrease in future marginal profits than the increase in current marginal profits. This, in turn, leads firms to choose lower prices when switching costs increase infinitesimally. A few policy suggestions emerge. When switching between brands is observed in a market, the outcome could be sufficiently competitive that interventions to reduce switching costs are not warranted. In fact, this might even raise prices.

The paper is organized as follows. In Section 2, I present a brief review of the related literature on switching costs and experience goods. The model is posited in Section 3 and the analysis are presented in Section 4. Section 5 concludes.

2 Related literature

My aim in this paper is to combine two realistic phenomena—uncertainty about satisfaction from a product and switching costs which arise when switching to an alternative—and analyze the evolution of market shares and prices. The focus of the paper is mainly on the effect of switching costs, particularly when they are sufficiently low to allow switching between brands. Here I will briefly summarize results of those papers which are closely related to the present paper. For a full review of the literature see Klemperer (1995) and Farrell and Klemperer (2007)—two excellent surveys on markets with switching costs.

A seminal treatment of switching costs is due to von Weizsäcker (1984) where he introduces a simple model to study the impact of switching costs on competition. He assumes that firms commit to a single price at the first period for forever. Consumers tastes change in time. Being aware of the fact that their taste will change and the presence of switching costs, consumers tend to care less about their own tastes and more about the price differentials which they expect to remain constant. All these effects make consumers more price sensitive since they realize that any choice they make today is probably for a long time, thus the value of the product of low cost supplier is amplified in relation to its alternatives. This leads to lower prices.

In the second half of 1980s, a series of papers by Klemperer have examined the effects of switching cost on the industry outcomes. An important difference of Klemperer’s models to the model of von Weizsäcker is the relaxation of the assumption on firms’ commitment to prices. Klemperer (1987a)Footnote 1 considers a distribution of switching costs in a two period model and show that, under some conditions, firms may sustain the monopoly outcome in equilibrium when competing noncooperatively. He demonstrates the importance of building market share in the early stages to capture potential future profits which leads to fierce competition. However, as market shares are established over time, the equilibrium involves collusive behavior. The effect of switching costs on the profits of the firms are ambiguous due to optimality of different pricing strategies in different stages of the competition. Since prices are unambiguously higher in later stages or in other words established markets, he concludes that it may be presumed that the switching costs are socially undesirable. This would justify interventions, such as the imposition of standards to lower switching costs.

In Klemperer (1987b)—another two period model, some consumers change their tastes from period one to the next. On the other hand, switching costs are constant and uniform across the consumer population. The qualitative nature of the equilibrium is similar to Klemperer (1987a) where firms are able to sustain high prices in the second period. Due to the hefty profits in the second period, first period competition turns out to be quite fierce leading potentially to much lower prices. Farrell and Klemperer (2007) coins the term the “bargains-and-ripoffs” for such pricing patterns. The fact that some consumers change their tastes in time results in some consumers actually switching in equilibrium.

Farrell and Shapiro (1988) develop an overlapping-generations model of an infinitely lived industry with homogenous products and consumers.Footnote 2 Clearly, this type of model is able to address the questions about competition for new uncommitted buyers versus exploiting the locked-in consumers. In a dynamic duopoly model, they show that a firm with locked-in consumers will prefer to serve those, while leaving the new buyers to the entrants. Even though an incumbent firm might profitably exclude its rival, this might not be the optimal strategy. Moreover, they also demonstrate that entry can occur even when it is not socially desirable, because switching costs encourage firms to serve the new customers in the market. An important driver of their results is the homogeneity of products and consumers.

Beggs and Klemperer (1992) study a more sophisticated multiperiod model of duopoly competition. The model, and specially its overlapping generations version in To (1996),Footnote 3 have some similarities to the present model while they differ in certain crucial aspects. Each period, a certain mass of new consumers arrive to the market while the existing consumers survive to the next period with a given probability. The consumers are heterogenous in their tastes and this results in horizontal product differentiation which is modelled á la Hotelling as will be done in this paper. Analysis are performed in the steady state of this birth-and-death process where market size is constant every period. They characterize the Markov-perfect equilibria, where prices depend on the previous market share of the firms.

Their model assumes switching costs to be so high that consumers never expect to switch to the other brand as they make their initial purchase. In equilibrium, this belief is justified and, thus, there is no switching. In fact, this result is common to all the papers reviewed above. An important feature of the model that I study below is the presence of switching in equilibrium. As will be shown later for this to occur switching costs need to be sufficiently low.

In Beggs and Klemperer (1992) and To (1996), steady state price levels are higher than those which would have prevailed in the absence of switching costs, hence they conclude switching costs reduce competition in the market. In my model, I concentrate on low switching costs which maybe more realistic for a wide variety of industries where we do observe switching. Below I show a completely opposite result when compared with the conventional wisdom: Low switching costs for certain products (e.g. experience goods) might enhance competition and drive prices down.

The experience goods part of the model closely follows Villas-Boas (2006) which attempts to uncover the effects of heterogenous consumer experiences on the evolution of market shares and prices. In his model, consumers are not able to know the exact satisfaction they will derive from a product before actually purchasing the product. Once they purchase the product, on the other hand, an informational differentiation arises between the product which a consumer is attached and its alternatives. Depending on the skewness of the distribution of experiences, this maybe advantageous or disadvantageous for a firm. If, for example, most of a firm’s customers have good experiences, i.e. the distribution of the experiences are positively skewed, then that firm may charge higher prices, since its customers will not want to risk a bad experience by switching.

A crucial aspect of Villas-Boas (2006) is that the distribution of experiences must have either negative or positive skewness for there to be any dynamic behavior in equilibrium. Even though, it is very similar to Villas-Boas (2006), in my model consumers have a symmetric distribution of experiences. The asymmetry in my model will arise due to switching costs, and hence there would be a dynamic movement of prices and market shares in equilibrium. Villas-Boas (2006) also addresses the fact that positive experiences with a product might act as barriers to experiment with other brands—emulating switching costs. However, in a pure experience goods model there are switching costs as well as switching benefits. In this paper, in addition to such benefit-cost considerations, there is an explicit cost of switching between brands which we observe for many products.

Some recent papers present results that are similar to the ones I derive below. Viard (2003) presents numerical results based on a fully dynamic version of the model of Klemperer (1987b) and demonstrate that for some parameters of the model steady state prices may decrease with switching costs. Cabral (2008) develops a model of competition with switching costs where preferences of a buyer changes in an i.i.d. fashion from one period to the next. He assumes a rather general distribution for the buyer preferences and concentrate on competition between two firms for a single buyer. This significantly facilitates his analysis as there are only two possible states of the world: the consumer purchases from the same firm or incurs the switching costs and purchase from the rival firm. Cabral (2008) shows that average equilibrium prices decrease in switching costs when these are low and/or when the discount factor is sufficiently high. My model differs from Cabral (2008) in various respects. In my model, consumer tastes are modeled using uniform distributions, however they are not independent across periods. Moreover, my model consists of a continuum of heterogeneous consumers resulting in a continuous state space.

Another recent paper which presents empirical evidence on switching costs resulting in fiercer competition is Dubé et al. (2009). They develop a logit model of differentiated products demand system incorporating switching costs. Solving for the Markov perfect equilibrium prices in a restricted version of their modelFootnote 4 using numerical methods, they demonstrate that for small switching costs average prices in the market decrease with switching costs. They estimate a more general model based on a household panel dataset containing refrigerated orange juice and margarine purchases. The estimated switching costs are on the order of 15 to 19 percent of the purchase prices. Calibrating their model of competition using the estimated parameters, Dubé et al. (2009) show with model simulations that equilibrium prices are lower than those in a market without switching costs for a wide range of parameter values.

3 The model

Before introducing the model, it may be worthwhile to briefly summarize once again the intended goals of the paper. There is an extensive literature on switching costs which suggest that they weaken competition, allowing firms to charge higher prices.Footnote 5 While this conclusion has an intuitive appeal, whether it remains true for all switching costs is not clear. In a dynamic world with switching costs, there are two important incentives for a firm which are inherently contradictory: exploit the consumers who are already locked in or build market share now to exploit them in the future. With high switching costs as assumed in many of the models mentioned above, the incentive to exploit customers now wins out in equilibrium leading to higher prices.

The conventional wisdom that switching costs reduce competition in the long run are curiously based on models where there is no switching along the equilibrium path of the industry. This hypothesis clearly can be rejected in many industries even if one resorts to casual empiricism. We do observe switching between brands. Recent empirical evidence presented in Dubé et al. (2009) refute the conventional wisdom and suggest that switching costs may reduce equilibrium prices—at least for low levels of switching costs. It may be that, indeed, in real life situations the level of switching costs perceived by consumers are sufficiently low allowing them to switch.

Moreover, in most earlier models, there is only one reason a consumer might consider switching: a cheaper alternative.Footnote 6 However, it is not difficult imagine a consumer who is not satisfied with a cheap product to switch to a more expensive alternative. Thus, personal experiences might play an important role in the decision process of a consumer.

The model, I will present below, develops a very stylized framework where consumers may switch between brands for two reasons: bad experiences or cheaper alternatives. I aim to first develop a model where switching between products could be observed in equilibrium, and then characterize the dynamics of prices and market shares as well as their steady state behavior.

I build on the model presented in Villas-Boas (2006) by explicitly introducing a cost of switching between brands. As my results examine the changes in equilibrium as one varies switching costs, they extend the results of Villas-Boas (2006). The model involves two overlapping generations of consumers facing a choice between two brands. I will first describe the consumer preferences and derive demand functions given prices in the next subsection, and then in SubSection 3.2, I will proceed with introducing firms’ characteristics and their pricing problem. In SubSection 3.3, I present a discussion of the modelling choices I make and possible extensions.

3.1 Consumer preferences

As mentioned above, there are two brands in the market. Each period, there are two overlapping generations of consumers, which I will refer to as young and old—for the lack of a better terminology, and they demand one unit of one of the brands. Each generation’s mass is normalized to one for simplicity.

The preferences of the consumers change as they grow older. When young consumers arrive to the market, they are uncertain about the satisfaction they will receive from each brand. This is a crucial aspect of the model. Even though the uncertainty of each consumer is modelled in the same manner, their realizations will differ. Each consumer can realize the level of satisfaction from a brand only after making a purchase.

Before making a purchase, each consumer expects that she will have a satisfaction measured in monetary terms between a lower bound R L and upper bound R H . The consumer population is assumed to form a continuum implying that all the satisfaction levels will be realized by someone. That is, each satisfaction level is realized with probability one. The distribution of consumers along this interval, [R L , R H ], is assumed to be uniform with density f(r) = 1/Δ, and distribution function F(r) = (r − R L )/Δ where Δ = R H − R L . The satisfaction from both brands are independent. I assume that R L is high enough that everyone prefers purchasing one of the brands to staying out of the market.

This is where the experience goods nature of the model is captured and it closely follows Villas-Boas (2006) with one difference: In his model an asymmetric distribution of satisfaction levels is needed to ensure demand functions to evolve as a function of the existing customer bases. As will be seen below, the second period (expected) benefits are now also a function of the switching cost in the present model insuring the dynamic evolution of demands.

Notice that each consumer experiences a different satisfaction; ex-post valuation of the goods are personal. However, before making their choices, consumers have only an idea in the form of a distribution about the possible satisfaction levels that they might observe post purchase. One point to keep in mind is that each consumer only observes their own satisfaction from the brand they have purchased. Their belief about the potential satisfaction they may receive from the alternative remains unchanged.

Young consumers arrive to the market with an affinity towards one of the brands. This affinity is modelled as standard Hotelling horizontal product differentiation with a transport cost normalized to unityFootnote 7 and independent of the later realized satisfaction levels. Consumers also form a continuum in this dimension. This differentiation might be viewed as a consequence of the marketing each consumer may have been subjected to as well as the effect of their social circle.

When consumers become old, they are attached to one of the brands due to their purchasing decision in the previous period and have observed the realization of their satisfaction. Nevertheless, they are still uncertain about the satisfaction level they may experience from the other product. On the other hand, I assume that the product differentiation due to the their initial affinity towards products disappears in the second period.Footnote 8 The model therefore assumes that, consumers will loose their sensitivity to the marketing mix, and evaluate products on the basis of observations and beliefs as they grow mature. Alternatively, one may view this assumption as an extreme way of modelling preferences where the informational differentiation between brands is much stronger that the differentiation due to marketing. Note that the differences between the products are all consumer specific; they are due to personal experiences as well as the observed marketing efforts, effects of one’s social circle.

Consumers can decide to change the brand of their choice when they are old. However, to switch between brands, they must incur a cost, s, which is known when they arrive to the market. This cost is assumed to be uniform (constant) over the population. In addition, it is exogenous, that is, the firms do not control the switching costs. In some markets this is realistic, however in general there is no reason to believe everyone has the same switching cost nor the firms do not affect the switching costs through strategic behavior. If it is any defense, same assumption is made in Farrell and Shapiro (1988), Beggs and Klemperer (1992), Padilla (1995), To (1996) as well as the more recent papers by Viard (2003) and Cabral (2008).

It is useful first to think of the decision problem faced by the older consumers. The young will have to make the same considerations about the second period of their life when they make their first period decision.

Decision of the old

Let us consider a consumer who purchased brand i when young and realized a satisfaction level of r ∈ [R L ,R H ]. If this consumer continues to buy brand i for which she knows her satisfaction level with certainty, the net utility she will receive is \(r - p_i^t\), where \(p_i^t\) denotes the price of brand i in period t. Being still uncertain about the satisfaction level of the other brand, she must consider her expected satisfaction level, \(\bar R\), if she considers switching where \(\bar R= (R_H+R_L)/2\). The net utility she will receive in case of switching to product j is \( \bar R - p_j^t-s\).

This consumer will only switch if she receives a higher net benefit by switching. Formally, she will switch if and only if

or equivalently whenever

Hence switching may occur for two potential reasons:

-

1.

Bad experience with the product, low realized satisfaction,

-

2.

Cheaper alternative.

In most previous models of competition with switching costs, the only reason to switch between brands is the latter, that is consumers only switch due to price differences between brands. This clearly only represents part of the reasoning, and the current model accounts for another important dimension. Consumers may switch to a brand that is more expensive since they expect to receive a higher satisfaction from the alternative. Observe that for very high levels of switching costs, this may be impossible. This is the main assumption adopted in the previous literature. The point of departure in this paper is the assumption that switching costs are sufficiently low that they do not hinder switching between brands.

All the consumers of firm i for whom the switching condition is satisfied will switch to firm j. Let us denote the existing customer base of firm i with \(x_i^t\). Given that the customers of firm i belong to a continuum, all of them will realize one of the possible satisfaction levels. Therefore some of them will be happy to keep buying from i while some of them will prefer switching to the other brand. Then, from the point of view of the firms,

consumers will switch to brand j, while

consumers will remain with brand i. I will denote the total demand faced by firm i from the old generation by \(d_i^o=d^o_{ii} x_i^t+d^o_{ij} x_j^t\).

The expressions (2)–(3) above involve an implicit assumption which will be verified later in equilibrium. It is assumed that, for all reasonable pricesFootnote 9 of firms, there is always a positive mass of consumers who would wish to switch and a positive mass of consumers who would prefer to stay with the brand they already have consumed. Therefore, unlike the previous models of competition with switching costs, it is assumed that the prices chosen by firms leads to switching in both directions. Formally, for this to occur, the equilibrium prices should satisfy

Decision of the young

Upon arrival to the market young consumers have a daunting task due to all the uncertainty they face. They have to form expectations about the second period of their lives. Then, they have to compare their cumulative expected utilities over their lifetime to make a decision. I assume that they discount future with a factor β.

Their preferences for the first period possibilities are rather simple. Since they are uncertain about satisfaction levels from both products they consider the expected satisfaction level. They also take into account their affinity which is modelled in the Hotelling framework with a transportation cost normalized to unity. I assume that firm 1 is located at L 1 = 0 and firm 2 is located at L 2 = 1. Therefore, the net first period benefit a consumer located at α receives from product i is given by

It is the second period that presents a challenging problem. Each consumer is aware of the fact that they will realize a satisfaction level, and depending on this level and prices, they might want to switch. Conditional on their realized satisfaction r, they will have to check the switching condition given in (1) with next period’s (expected) prices. That is, they know that if they buy brand i in the current period and if their realized satisfaction level is such that

they will switch to brand j, and stay with brand i otherwise. Therefore, the net second period expected benefit, \(U_i^{t+1}\), is given by

There will be a customer at \(\tilde \alpha\) who would be indifferent between the two brands. That is

Calculating both expected benefits, and after necessary manipulations, one can show that \(\tilde \alpha\) satisfies

Observe that all the customers to the left of \(\tilde \alpha\) will buy from firm 1 and to the right from firm 2.

Assume for the moment that consumers form expectations of the next period price differences according to

Clearly, \(x_1^{t+1}=\tilde \alpha\) and symmetry requires \(p_1^{t+1}-p_2^{t+1}=0\) whenever \(x_1^{t+1}=\frac{1}{2}\), hence b = − 2a. These expectations should turn out to be correct in equilibrium for them to be sensible. This will be shown to hold later.

Substituting these expectations in (6) and solving for \(\tilde \alpha\) yields

Whenever Δ − 2βs a > 0, this is a regular downward sloping demand function for firm 1 from the younger generation. To guarantee this, it is sufficient that a < 0 in equilibrium. If a turns out to be negative, consumers will expect that a firm with a larger user base will charge a higher price. Under the assumption that everyone buys, firms 2’s demand function from the younger generation will be nothing but \(d_y^2=1-\tilde \alpha\).

Total demand

I assume that the market is covered each periodFootnote 10 which implies that if the customer base of firm 1 is \(x_1^t\), customer base of firm 2 is given by \(x_2^t=1-x_1^t\). From here on, x t will denote the customer base of firm 1. Combining the demands of the old and young consumers, the total demand faced by firm 1 is given by

while the total demand faced by firms 2 is

3.2 Firms

Relative to consumers, firms are rather simple to describe. Both firms have constant marginal costs normalized zero and no fixed costs.Footnote 11 At the beginning of each period they have to announce prices simultaneously and non-cooperatively. The competition has an infinite horizon. For simplicity, I assume that they have the same discount factor as the consumers, β.

Both firms maximize the sum of their discounted per period profits, that is, they select a price path to maximize

3.3 A critical assessment of the model

In this subsection, I would like to discuss some of the modelling choices I have made. Clearly, the model presented so far is very stylized and have quite a few limitations. The strongest assumption is related to the number of products and the number of periods an individual lives. In the model presented above, these two quantities are conveniently equal. This feature removes any incentive on the consumers part to follow experimentation strategies. If there were two products and consumers lived for three periods, consumers could search for the best fitting product in the first two periods and settle on that one in the third period. When switching costs are not too high, such policies could turn out to be optimal. Villas-Boas (2006) argues that the two period lifetime could be seen as consumers changing their tastes completely after two periods. In addition, he suggests that as products and consumer needs constantly evolve, gains from such experimentation would be low. Similar arguments also apply for the model presented above.

As in almost all the papers in the literature, I use linear prices and do not allow for price discrimination between cohorts. Moreover, if firms were able to write long term contracts with consumers, the nature of the competition might change drastically. However, given the personal nature of satisfaction levels, such contracts must be either designed for each person or a menu of incentive compatible contracts have to be offered to avoid switching. Given the variation in the valuation of the products and a positive mass of low valuation consumers, it is not even clear that firms would try to stop consumers from switching.

Price discrimination, on the other hand, is potentially a powerful instrument to extract more surplus from the locked-in consumers while competing aggressively for the new ones. In a standard setting with homogenous consumers and products, the firms will view old and the young generation as simply two separate markets and compete only for the younger generation. This will eliminate the dynamics in the evolution of the market outcome, as no one would be able to switch. However, if firms cannot differentiate between the old customers of their rival and the new generation of consumers, price discrimination will not remove the dynamics in the model I presented above. This is due to the fact that firms actually would prefer loosing their low valuation customers to their competitors. The intuition of this is similar to poaching behavior studied in Fudenberg and Tirole (2000) as well as Gehrig and Stenbacka (2004). I stick with linear pricing and no price discrimination in this paper to be comparable to the previous literature. This allows me to highlight the role played by the level of switching costs and consumer expectations more clearly.

I also do not present a two-period model as customary. The results of a two period model would be qualitatively similar to those of Klemperer (1987b). That is, prices would be low in the first period and high in the second one. In Klemperer’s model, there is also second period switching, as some consumers’ tastes change—they get relocated on the Hotelling line—and some of them find it beneficial to incur the switching costs and buy the alternative brand. Using the approach presented in Klemperer (1987b) would have been another way to induce an equilibrium with switching in a fully dynamic model as demonstrated in Viard (2003). However, in my opinion, the personal experiences story I develop results in a more natural reasoning for switching.

The properties of equilibria in finite period models tell very little about the long run behavior of prices and market shares as they are contaminated by initial conditions and end game effects. The incentives faced by firms in each period are different. A fully dynamic model on the other hand allows me to construct a situation where firms face constantly the opposing incentives to build a customer base or to exploit the current one. Finite period models are silent about at which prices levels these incentives would balanced in the long run.

4 Analysis

The interaction between the firms constitutes a dynamic game. The demand faced by each firm is a function of its customer base, therefore the stage game firms face changes according to the changes in their customer bases. Customer base of firm 1 at time t is a natural state variable. Therefore, I will look for stationary pricing policies as functions of firms’ customer bases, i.e. for stationary markovian strategies. I also require that such policies form a subgame perfect equilibrium. Hence the equilibrium concept adopted here is Markov Perfect Equilibrium (MPE) (see for example, Maskin and Tirole 1987, 2001 as well as Basar and Oldser 1982). In a MPE, given the policy of the opponent, each player solves a dynamic programming problem. Equilibrium is established whenever policies of each player forms best responses to each other.

One can find closed form expressions for equilibrium policies only under very specific functional forms. One such form is obtained, whenever (1) per period payoffs are quadratic in the strategic variables and state as well as concave in own strategies, (2) the state evolves as a linear function of strategies and state. Hence, such games are referred to as Linear Quadratic games. These games possess several well known properties: (a) strategies of both players are affine functions of the state, (b) given these strategies, the discounted sum of profits, the Value Functions, are quadratic in the state variable. The model I have developed in Section 3 falls into this category.

The type of equilibrium I am trying to establish does not exist for all parameter values. In fact for some parameter values, such as very high switching costs, switching in both directions will not occur. In this case, the qualitative nature of equilibrium will be similar to the equilibrium in Beggs and Klemperer (1992) and To (1996). For intermediate switching costs, the problem is even more complicated. If no one wishes to switch when firms charge the same price, a firm could lure a sizeable share of the new and its opponent’s old customers away while keeping all of its own by undercutting its rival sufficiently. Therefore, the main reason for switching will be lower price of one of the brands, which in turn leads to switching only in one direction: from higher priced brand to the lower priced one. This creates a discontinuity in the profit functions of the firms, which complicates the dynamic analysis.

My goal is to derive sufficient conditions which guarantees the existence of a MPE where switching occurs in both directions and the market is shared each period. To this end, I will solve the model assuming the constraint that switching occurs in both directions, namely (4), is not violated. Then, using the equilibrium policies, I will present conditions on the model parameters such that (4) holds and market is shared. Once the existence of the equilibrium pricing policies is established, one can explore further the qualitative properties of the MPE.

Formally, I will assume firms choose symmetric policy functionsFootnote 12 of the form

which justify the assumption on the expected price differences of the form \(p_1^t-p_2^t=a-2ax^t\) given in (7) with k = − a. In this case, the value functions will take the form

The parameters of the policy functions (l,k) and the value functions (n 0,n 1,n 2) as well as the parameter of expectations, a, are to be determined to characterize the equilibrium.

Firm 1, solves the following problem

with

while Firm 2 solves

with

For these maximization problems, usually first order conditions(FOCs) are necessary and sufficient.Footnote 13 Whenever \(p_1(x^t)\) and \(p_2(x^t)\) turn out to be best responses to each other, the value functions will satisfy the equalities given in curly brackets, with the right hand sides evaluated at the optimal policies. This feature makes it possible to calculate the parameters of the value functions as functions of the parameters of the model primitives using the method of undetermined coefficients.

Lemma 1

The policy function parameters which satisfies the FOCs are given by

and the parameters of the value functions consistent with (l*,k*) are given by

where z(a) = Δ − 2 asβ and a* solves g(a) = 0 with g(a) given by

Proof

See Appendix.□

If these policy functions indeed constitute an equilibrium then the state, the stock of old customers of Firm 1, evolves according to the following difference equation:

To insure 0 < x t + 1(x t) < 1, for all x t ∈ [0,1], it is required that

This leads to the condition

which has to hold for both firms to have positive market shares of new consumers each period.

I have earlier assumed implicitly that customers of both firms do switch in equilibrium. This requires equilibrium price policies to result in price differences which lie in a bounded interval. Formally, it is needed that

Manipulating the above inequality, it easy to show that a has to satisfy

to ensure switching for every x t. Observe that a * is endogenous, that is, its value is known only in equilibrium. For there to be switching when both firms charge the same prices, for example in the steady state, it is necessary that Δ > 2s . This actually insures that when the firms charge the same prices, the individual with a realized satisfaction of R L always switches.

Moreover, each firm should prefer producing; this requires V(x) to be non-negative for all x since otherwise a firm could set a price large enough to induce zero demand and obtain zero profit. Furthermore, I require that value functions are increasing in the customer bases. These conditions would hold whenever (n 0,n 1,n 2) are non-negative. Notice also that firms face two-types of demand functions from the young and the old. If the price sensitivity of these demand functions were sufficiently different from each other, a firm might find it profitable to exclude the more sensitive segment and concentrate only on the other where charging high prices would be feasible. Hence, at a given parameter constellation, such deviations, which are not infinitesimal, must be checked.

Thus, in principle, whenever Δ > 2s, it is sufficient to check that the solution of g(a) given in (18) satisfies both (20) and (21); V(x) ≥ 0 and V ′(x) ≥ 0; and firms prefer to serve both segments. Given the nature of g(a), it is a rather difficult task to derive necessary conditions. Nevertheless, it is possible to derive sufficient conditions for which the solution of g(a) will satisfy these conditions. I present one such set of parameters in the next couple of lemmas. This set is derived using very strong conditions, thus the equilibrium I derive exists for a much larger set of parameters.

Lemma 2

There is no root of g(a), given in (18), in the interval \((0, {\overline{a}}_1]\).

Proof

See Appendix.□

Lemma 2 establishes that indeed if there is a root of g(a) satisfying (20) and (21), then it must be negative. Recall that a negative value of a insures that the demand functions of the new generation are well-behaved, i.e. decreasing with price.

Let

and \({\cal D}=\{(\beta,\Delta,s) \mid 0\le \beta \le 1, s\ge 0, \max(\Delta_1,\Delta_2,\Delta_3)\le \Delta \le \Delta_4\}\). When s = 0, \({\cal D}\) is nonempty since for all β, any Δ ∈ [2,7.12] is an element of this set. Notice also that the expressions defining this set vary continuously with the parameters, thus for sufficiently low switching costs, there are always some parameters which belong to \({\cal D}\).

Lemma 3

A sufficient condition for g(a) to have a negative root, which satisfies (20), (21), leads to non-negative \((n_2^*,n_1^*,n_0^*)\) and neither firm deviates from the candidate equilibrium policies, is \({\cal D} \ne \emptyset\) and \((\beta,\Delta,s)\in {\cal D}\).

Proof

See Appendix.□

Lemmas 2 and 3 insure that there is a root of g(a) satisfying (20) and (21) under some conditions, thus establishing region of model parameters for which a MPE exists. Note, once again, that the conditions provided in Lemma 3 are only sufficient conditions, hence MPE indeed exists for a larger set of parameters. The following proposition characterizes the MPE.

Proposition 1

(Existence of Markov Perfect Equilibrium) There is a set of parameters where a symmetric MPE in stationary affine strategies exists. The parameters of the affine policy functions and quadratic value functions are given by Lemma 1. In this equilibrium,

-

1.

The firm with a higher customer base charges a higher price.

-

2.

Each firm charges a price above cost, that is, the parameters of the policy functions, (l*,k*), are both non-negative.

-

3.

Customers bases of both firms converge to the steady state in an oscillatory fashion.

-

4.

Market is shared equally in the steady state.

-

5.

At every period, switching occurs in both directions.

The first four parts of this proposition does not say anything new in addition to what we know about models with switching costs. The only difference with the existing literature, I can claim so far, is the fact that in equilibrium switching between brands indeed occurs. This is mainly due to the experience goods nature of the products; that is, some consumers find it beneficial to switch since they discover the product they have bought is not satisfactory. They are willing to incur the switching costs since they do expect a higher net benefit from the alternative product.

In transition to the steady state, a firm with the higher share of old consumers charges a higher price, as it has more incentives to exploit the locked-in consumers. In turn, a higher percentage of its customers switch as some of them are genuinely displeased about the product and others prefer the cheaper alternative even though they have quite a decent, nevertheless below average, experience with the product. Naturally, a smaller percentage of the young consumers buy from the larger firm, making it the smaller firm next period. Thus, customer bases approach the symmetric steady state in an oscillatory fashion.

It is interesting to note that along the equilibrium path both firms charge positive prices, which in the context of the model corresponds prices above cost. Even a firm with no customer base charges a price above cost. This is due to the nature of the rival it faces, namely, a firm with a large number of locked-in consumers. Since this large user base leads to less aggressive behavior by the larger firm, it makes the firm with no user base also less aggressive.

In the steady state, there is no price differential. Nevertheless, there would be a constant fraction of each firms’ customer bases switching to the other brand. This occurs solely because of bad experiences. In fact, the steady state share of the switching customers of each firm is given by

implying a churn rate as high as 25% when switching costs approach zero. As switching costs grow, naturally the fraction of consumers who switch shrinks. Ultimately, for high switching costs no one would switch, and we would back to the world analyzed in previous models.

It is important to point out that the result on equilibrium switching is in sharp contrast to those found in the literature on industries with switching costs. In most infinite horizon dynamic models, it is assumed that consumers do not expect to switch between brands. Hence, when expectations are rational, there is no switching between brands. In this paper, I started out with expectations which are on the other extreme, that is, consumers always expect to switch albeit with a certain probability. Moreover, I assumed switching costs to be sufficiently low so that they do not hinder switching. And, when expectations are rational, some of them always end up switching in equilibrium.

4.1 Steady state

In this subsection, I will investigate implications of equilibrium switching on the level of steady state prices. In particular, I want to compare them to the price levels which would have prevailed in the absence of switching costs. The message in the literature—see for example Beggs and Klemperer (1992), Klemperer (1995) and Farrell and Klemperer (2007)—loudly and clearly suggest that switching costs tend to increase prices in the long run. However, the previous models arrive at this conclusion by assuming homogeneous products/consumers and/or high enough switching costs that consumers never expect to and never do switch. These are strong assumptions. In many real life situations, consumers do switch and incur switching costs rationally which implies that in some markets switching costs are not prohibitively high. Firms, on the other hand, face the standard trade off between exploiting their existing customers and attracting new unattached consumers to exploit in the future. In equilibrium, these incentives are balanced. However, it is not ex-ante clear at which price level this balance would be reached.

As a brief observation of (9) suggests, in the steady state—i.e. when x t = 1/2, firms’ demands are effected by switching costs only through their impact on the price sensitivity of the demand from the new generation. Furthermore, by charging a lower price now, a firm can shift its future demand upwards. This incentive is likely to push steady state prices down as both firms would wish to enhance their future demand.

Whenever a MPE exists, the steady state prices are given by

where a * is the solution of (18) which satisfies (20) and (21). In the absence of switching costs, s = 0, the prices are given byFootnote 14

Due to the complicated equation determining a * given in (18), it is not possible to derive analytically where p ss lies relative to \(p_{s=0}^{ss}\) in general.

Notice, however, that as switching costs approach zero, the solution of (18) approaches also towards zero, i.e. s →0 implies a * →0 which in turn implies \(p^{ss} \rightarrow p_{s=0}^{ss}\). Therefore, steady state prices are continuous in s around s = 0. One can show that the steady state prices are decreasing in s at s = 0. By continuity of the steady state prices in s, it is thus possible to conclude that the prices in a market with sufficiently low switching costs will be less than those in a market with no switching costs.

Proposition 2

The steady state prices are decreasing in s, at s = 0. Therefore, for all the parameter values that yields an MPE described in Proposition 1, very small switching costs intensify competition.

Proof

See Appendix.□

To prove this proposition, it is sufficient to evaluate the derivative of (22) at s = 0 and a * = 0. However, in order to also identify the underlying mechanism by which an increase in switching costs effects the incentives faced by the firms, I use Monotone Comparative Statics around the steady state equilibrium described in Proposition 1 when s = 0.Footnote 15 For this analysis, I maintain the assumption that parameters are such that a MPE exists.

The derivative of the best response function of firm 1, R(p 2,s), with respect to switching costs can be written asFootnote 16

where \(\Pi_1(p_1,p_2,s)=p_1(d_1^o+d_1^y)+\beta V_1(d_1^y)\). This formulation assumes that in a particular period firm 2 charges p 2 and firm 1 charges its best response to p 2, namely p 1, but they continue from the next period onwards to follow the equilibrium policies which form an MPE. It is clear from (23) that the sign of the change in the best response of firm 1 in response to a change in s is equal to the sign of the numerator in (23) due to concavity of Π 1(p 1,p 2,s), that is

Notice that the numerator of (23) is nothing but the derivative of the FOC of firm 1 with respect to s holding p 1 and p 2 constant. Therefore, (23) provides information on the direction the FOC, as a function p 1, will move in response to a change in s.

In the Appendix, I show that

That is, the FOC of firm 1 around the steady state equilibrium when s = 0 shifts downwards in response to an increase in the switch costs.Footnote 17 This implies that firm 1 is better off by charging a slightly lower price. As a similar downward shift in the first order condition of firm 2 occurs, equilibrium is obtained at lower price levels. Thus, at the steady state, equilibrium prices are decreasing in s when s = 0. For larger switching costs, the change in the current marginal profit is positive. Thus, for much higher levels of switching costs current period effects dominate leading to higher prices.

Furthermore, this analysis also provides the mechanism which brings equilibrium prices down. Around the equilibrium, a slight increase in switching costs has no effect on current marginal profits of the firms. At s = 0, a slight increase in s does not allow firms to act in a more exploitative manner, hence incentives to exploit current consumers does not change. However, given that equilibrium policies imply that a firm with a larger user base can sustain a higher price, firms could benefit from this increase in switching costs next period, when both firms revert to the equilibrium policies associated with the higher level of switching costs. Thus a price increase in the current period decreases the future profits. An increase in the switching costs amplifies this reduction, leading also marginal future profits to decrease. Therefore, for small switching costs, the dominant incentive faced by the firms is to carry over a larger share of consumers to the future and shift their future demand upwards. In a way, one can argue that switching costs act as a curse from the point of the view of the firms. Since they can charge higher prices when they have a larger user base, firms are tempted to charge lower prices to increase their future demand. However, the equilibrium is attained at lower prices as both firms face similar incentives.

This result stands in sharp contrast to the message delivered by the literature on switching costs, which basically suggests that they allow firms to sustain high prices. The basic forces in the present model and other models of switching costs are the same, however their strength changes with the magnitude of switching costs. When switching costs are low, the incentives to attain a large user base to carry on to the future outweighs the incentives to exploit current customers.

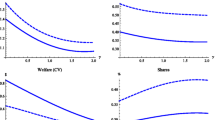

To give a better idea about the general behavior of steady state prices as well as the expectations parameter, a *, as a function of switching costs, I numerically computed these values for some parameters. In particular, I used Δ = 3,5,8, β = 0,0.25,0.5,0.75,0.975. The interval for switching costs then is determined by the constraints that have to be taken into account. In doing this, instead of relying on the sufficient conditions, I have checked the necessary conditions for the existence of an MPE. In all cases, the binding condition is the one which checks for the deviation of firms to just serve the old customers who are less price sensitive. I present the results in Fig 1.

The steady state prices as a function of the switching costs seems to be U-shaped which becomes more accentuated as the discount factor increases. The U-shape of the steady state prices is reminiscent of the first period prices obtained in Klemperer (1987b).Footnote 18 This suggests that when switching costs are low, the nature of competition between firms in the steady state resemble to that of the first period competition in two period models. Furthermore, the shapes suggest that there is a level of switching costs for which the steady state prices are minimized.

The equilibrium value of a * seems to decrease with s, or, in other words grow in absolute value, making the demand from the new generation less elastic. It decreases also with β. Notice that a larger absolute value of a * implies a larger price differential in the future favoring the firm with the larger user base, thus consumers do not always buy bargains being aware of ripoffs later. Given the monotonicity of a *, the non-monotonicity of the steady prices must be due to changes in the relative sizes of incentives to exploit today and exploit tomorrow.

The level of steady state prices as well as the expectation parameter seem to increase with Δ. Young consumers expect less price difference in the future as Δ increases. Furthermore, as Δ increases the old consumers become less price sensitive, but the new ones become more price sensitive. Nevertheless, the set of switching costs for which it is possible to sustain the MPE seems to also grow with Δ.

An important point to note is that the level of steady state prices with switching costs is at most about ten percent less than the price level when there are no switching costs. This implies that the increase in competitive pressure is not too high. However, if the price levels in the absence of switching costs were accepted to be just, there is no reason to believe otherwise for at least low switching costs. In fact, for a relatively wide range of switching costs, any intervention to reduce switching costs might in turn increase prices. Given the fact that the model is rather stylized, it is not easy to jump to conclusions regarding policy. With this note of caution, one robust test helping a policy maker to decide whether to intervene or not is to just look at churn rates. If switching between all the products is observed then switching costs must not be prohibitively high. Then, one may decide in favor of no intervention.

5 Conclusion

I have presented a model of dynamic price competition in an industry with switching costs and experience goods. I have derived sufficient conditions required for the existence of a Markov Perfect Equilibrium when market is shared and covered at all times and consumers always expect and do switch.

In this equilibrium, every period there are some consumers who switch between brands and switching occurs in both directions. This result differentiates the current paper from others that studied industries with switching costs, as in the literature the common result is that there is no switching in equilibrium. This is no surprise, as previous models have considered consumers who do not expect to switch together with prohibitively high switching costs, these expectations turn out to be rational. One problem with the existing models is that it is rather difficult reconcile no switching behavior in equilibrium and high levels of switching observed in many industries. In contrast, I have assumed a consumer population who expect to switch whenever it is beneficial. Given the experience goods nature of the products, some consumers prefer switching when they are not satisfied with their choice and expect a higher value from the alternative. Moreover, I have also considered sufficiently low switching costs which does not hinder switching between brands. Thus, it is again no surprise that switching occurs in equilibrium.

Moreover, the equilibrium pricing policies exhibit interesting features. They prescribe higher prices for a firm with a higher customer base, thus the market shares of the firms, which they carry over from one period to the next, oscillate around the steady state level of one half. These results are all in accord with the literature.

For sufficiently low switching costs, I find that the steady state equilibrium prices are lower than what they would have been in the absence of switching costs. This result stands in sharp contrast with the literature; the common message in the literature is that switching costs soften competition. Even though the steady state prices are above marginal cost levels, they are below the level which would have prevailed in a market without switching costs. Thus, sufficiently low switching costs induce a higher degree of competition in the market.

The fact that the level of switching costs may drastically affect the nature of competition is alarming. Drawing general conclusions such as “switching costs reduce competition” may lead to wrong policy decisions. The model presented above suggest that if there is switching between brands, then it may be that the market is sufficiently competitive. Furthermore, policies aimed at reducing the switching costs might result in higher prices. Therefore, sound policy decisions require empirical studies to identify the environment. The empirical results in Dubé et al. (2009) presents evidence of situations where switching costs may enhance competitiveness of a market.

Notes

Klemperer (1987c) studies entry incentives in the presence of switching costs. He finds that entry may be deterred with very high or very low switching costs while intermediate switching costs might be conducive to entry. Klemperer (1988) shows that entry might reduce welfare when there are switching costs while Klemperer (1989) analyzes price war that might be induced by the presence of switching costs.

Padilla (1995) develops an infinite horizon model of competition between two firms producing a homogenous product sold to homogenous consumers. He derives a MPE in mixed pricing policies which yield to prices exceeding marginal costs. As in Farrell and Shapiro (1988), all the new consumers are served by one firm while older ones keep consuming the brand of their choice when they were young. Thus, again there is no switching in equilibrium.

This model can be viewed as a special case of the model of Cabral (2008).

Such results are obtained under the assumption of homogenous goods and homogenous consumers as well as high enough switching costs such that consumers do not expect to switch between products in the future. See for example, Farrell and Shapiro (1988) and Padilla (1995), or, Beggs and Klemperer (1992) and To (1996).

This normalization is innocent in the present context as will become clear below. It just means that prices, switching costs and satisfaction levels are measured in units of transport costs.

This assumption implies only a single dimension of product differentiation for each type of consumer. Young consumers view the products to be differentiated due to their affinity, while older consumers view them different due to the differential information they possess regarding satisfaction levels.

Reasonable prices here mean prices a firm might choose as a best response to the price of the other firm.

If \(\bar R\) and R L is sufficiently large, indeed this will be the case.

Both of these assumptions are innocent, given the linear utility specification and the fact that entry and exit is not analyzed.

One can start with asymmetric policy functions and indeed show that the resulting equilibrium will be symmetric. It is also possible start with an assumption of symmetry and as long as the result confirms this assumption, the solution methodology remains valid.

I show that the second order conditions are satisfied in the Appendix.

Similar arguments apply for the best response function of firm 2 due to symmetry.

Notice that, this shift is only due to changes in the future marginal profits.

The first period prices in Klemperer (1987b) are in fact quadratic-convex in s.

Recall that whenever \(a^*\in [a_0,0]\), 3z(a *)2 − βΔ a * > 0 is proved in Lemma 2 above.

References

Basar, T., & Oldser, G. (1982). Dynamic noncooperative game theory. New York: Academic Press.

Beggs, A., & Klemperer, P. D. (1992). Multiperiod competition with switching costs. Econometrica, 60, 651–666.

Cabral, L. (2008). Switching costs and price competition. New York University, mimeo.

Dubé, J.-P., Hitsch, G. J., & Rossi, P. E. (2009). Do switching costs make markets less competitive? Journal of Marketing Research, 46, 435–445.

Gehrig, T., & Stenbacka, R. (2004). Differentiation-induced switching costs and poaching. Journal of Economics and Management Strategy, 13, 635–655.

Farrell, J., & Klemperer, P. (2007). Coordination and lock-in: Competition with switching costs and network effects. In M. Armstrong & R. Porter (Eds.), Handbook of industrial organization (Vol. 3). Amsterdam: North Holland Publishing.

Farrell, J., & Shapiro, C. (1988). Dynamic competition with switching costs. Rand Journal of Economics, 19, 123–137.

Fudenberg, D., & Tirole, J. (2000). Customer poaching and brand switching. Rand Journal of Economics, 31, 634–657.

Klemperer, P. D. (1987a). Markets with consumer switching costs. Quarterly Journal of Economics, 102, 375–394.

Klemperer, P. D. (1987b). The competitiveness of markets with switching costs. Rand Journal of Economics, 18, 138–150.

Klemperer, P. D. (1987c). Entry deterrence in markets with consumer switching costs. Economic Journal, 97, 99–117.

Klemperer, P. D. (1988). Welfare effects of entry into markets with switching costs. Journal of Industrial Economics, 37, 159–165.

Klemperer, P. D. (1989). Price wars caused by switching costs. Review of Economic Studies, 56, 405–420.

Klemperer, P. D. (1995). Competition when consumers have switching costs: An overview with applications to industrial organization, macroeconomics, and international trade. Review of Economic Studies, 62, 515–539.

Maskin, E., & Tirole, J. (2001). Markov perfect equilibrium: I. Observable actions. Journal of Economic Theory, 100, 191–219.

Maskin, E., & Tirole, J. (1987). A theory of dynamic oligopoly, III: Cournot competition. European Economics Review, 31, 947–968.

Padilla, A. J. (1995). Revisiting dynamic duopoly with consumer switching costs. Journal of Economic Theory, 67, 520–530.

To, T. (1996). Multi-period competition with switching costs: An overlapping generations formulation. Journal of Industrial Economics, 44, 81–87.

Villas-Boas, J. M. (2006). Dynamic competition with experience goods. Journal of Economics and Management Strategy, 15, 37–66.

Viard, V. B. (2003). Do switching costs make markets more or less competitive?: The case of 800-number portability. Working Paper no. 1773, Stanford Graduate School of Business.

Vives, X. (1999). Oligopoly pricing: Old ideas and new tools. Cambridge and London: MIT Press.

von Weizsäcker, C. C. (1984). The costs of substitution. Econometrica, 52, 1085–116.

Acknowledgements

I would like to thank Volkswagen Stiftung for the generous financial support which made this research possible. All errors are mine.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix

Proof of Lemma 1

Lemma 1

The policy function parameters which satisfies the FOCs are given by

and the parameters of the value functions consistent with (l*,k*) are given by

where z(a) = Δ − 2 asβ and a* solves g(a) = 0 with g(a) is given by

□

Proof

Firms solve the dynamic optimization problems stated in (11) and (12) taking the policy function of their opponent given. Therefore the candidate equilibrium prices of both firms at time period t, given the state is x t, can be found by simply differentiating the right hand side of (11) and (12) with the next state as defined in these problems, and equating the resulting derivatives to zero. This yields

The parameters of the policy functions, (l,k), are simply the constant term and the coefficient of the x t in these expressions. To arrive at the expressions given the lemma, the terms involving n 1 and n 2 have to be eliminated however.

Due to the symmetry of the value functions, it is sufficient to consider the problem faced by one of the firms. Substituting the candidate equilibrium prices in (11), I obtain

There are quadratic functions of x t on both sides of (32). Equating the coefficients of each term provides three equations which I will use to solve for (n 0,n 1,n 2). Furthermore, the price differential has to satisfy \(p_1^*(x^t)-p_2^*(x^t)=a(1-2x^t)\) for the expectations to be fulfilled. Calculating this price differential results in

This implies that a has to satisfy

Let us denote with f i , the equation that collects the difference between the coefficients of the ith power of x t for i = 0,1,2 in (32). That is, f i is the difference between the terms involving (x t)i, on the left and right hand side of (32). The equation involving the squared terms leads to

Equations (33) and (34) can be solved for a and n 2 in terms of the parameters of the model resulting in \(n_2^*\) as given in the lemma. Observe that \(n_2^*\) is nonnegative whenever a * is nonpositive. Substituting \(n_2^*\) in (33) results in the expression given in (29) for g(a) and the equilibrium value of a must be one of the roots of g(a).

By equating the coefficients of x t in (32), one obtains an equation for n 1 in terms of the already determined \(n_2^*\) and a *. This equation looks complicated at first but can be rearranged as

Given f 2 and h are zero, solving this equation for n 1 yields the expression given in the lemma for \(n_1^*\).

Similarly, equating the constants on both sides of (32) leads to an equation which can be simplified to

Given that f 1,f 2 and h are all identically zero, solving the above equation for n 0 yields the expression given in the lemma for \(n_0^*\).

Comparing the coefficient of x t in (30) with (33) implies that k * = − a *. Also substituting \(n_1^*\) and \(n_2^*\) in the constant term in (30) and simplifying yields the expression for l * given in the lemma. □

Proof of Lemma 2

Lemma 2

There is no root of g(a), given in (18), in the interval \((0, {\overline{a}}_1]\).□

Proof

The equilibrium value of a will be one of the four roots of g(a), therefore it will be useful characterize where these root must lie. Observe that there are three values of a which makes g(a) undefined. These are

It is easy to verify that ρ 1 < 0 < ρ 2 < ρ 3 whenever Δ2 ≥ 12βs 2, and ρ 2 < min (ρ 1,ρ 3) whenever Δ2 < 12βs 2. Furthermore, Δ2 + z(a) ≥ 0, whenever a ≤ ρ 3. On the other hand, 3z(a)2 − βΔ 2 a 2 ≥ 0 whenever ρ 1 ≤ a ≤ ρ 2 if Δ2 ≥ 12βs 2, and whenever a ≤ ρ 2 and ρ 1 ≤ a if Δ2 < 12βs 2.

Recall also that

It is also easy to verify that \({\underline{a}}_1>\rho_1\) and \({\overline{a}}_1<\rho_2\) whenever Δ2 ≥ 12βs 2, while \({\underline{a}}_1 < {\overline{a}}_1 < \rho_2 < \min(\rho_1,\rho_3)\) whenever Δ2 < 12βs 2.

Let g 1(a) = g(a) − a. Notice that g 1(a) ≥ 0 for all a such that ρ 1 < a < ρ 2 when Δ2 ≥ 12βs 2, and for all a < ρ 2 when Δ2 < 12βs 2. Therefore for 0 < a < ρ 2, g(a) = g 1(a) + a is strictly positive, and has no roots satisfying g(a) = 0. □

Proof of Lemma 3

Let

and \({\cal D}=\{(\beta,\Delta,s) \mid 0\le \beta \le 1, s\ge 0, \max(\Delta_1,\Delta_2,\Delta_3)\le \Delta \le \Delta_4\}\).

Lemma 3

A sufficient condition for g(a) to have a negative root, which satisfies (20), (21), leads to non-negative \((n_2^*,n_1^*,n_0^*)\) and neither firm deviates from the candidate equilibrium policies, is \({\cal D} \ne \emptyset\) and \((\beta,\Delta,s)\in {\cal D}\).

Proof

The proof will proceed in several steps.

-

1.

There exists a such that g(a) = 0 and \(a\in [max({\underline{a}}_1,{\underline{a}}_2),0]\) and leads to \(n_1^*\ge 0\).

First I will find a particular value a 0, such that \(n_1^*\ge 0\) whenever a ≥ a 0. Then, I will show that g(a 0) ≤ 0 and g(0) ≥ 0, thus there must be a root of g(a) in [a 0,0]. First, notice that \(2 a<-n_2^*+a\), since a 2/Δ < − a/2 whenever \({\underline{a}}_2=-\Delta/2+s<a\) and a 2Δ/2z(a) < − a/2 whenever Δa/z(a) > − 1, thus \(a<-n_2^*\). Therefore,

for all \(\max({\underline{a}}_1,{\underline{a}}_2)\le a \le 0\). Furthermore, it is easy to verify that \(2 s \left( 2 z(a)-\beta a\Delta \right)/(\Delta^{2}+2 \beta \Delta s +2 z(a) )\) is nonnegative and decreasing in a for \(\max({\underline{a}}_1,{\underline{a}}_2)\le a \le 0\). Hence,

Let

Observe that \(\hat n_1\ge 0\), and in turn \(n_1^*\ge 0\), whenever a 0 ≤ a ≤ 0. It is easy to verify that \(a_0\ge {\underline{a}}_1\) as long as Δ> 2s, however, we also need that \({\underline{a}}_2<a\). As long as \({\underline{a}}_2\le a_0\), this condition will be satisfied. Observe that, the denominator of

is positive and the numerator is quadratic-convex function of Δ. Thus, it is positive outside of the roots of the numerator in Δ. The positive root is given by Δ1 above.

I will now proceed to show that there is an a 0 ≤ a ≤ 0 which solves g(a) = 0. Let g 1(a) = g(a) − a. It is easy to confirm that

Note that g 2(a) is decreasing and convex on \([{\underline{a}}_1,0]\) since

and

Therefore, the line going through \(({\underline{a}}_1,g_2({\underline{a}}_1))\) and (0,g 2(0)) is always above g 2(a). That is,

and, hence,

Notice that

Furthermore, evaluating a 0 + g 3(a 0) yields

and given that the denominator is positive, the sign of g 3(a 0) is the opposite of the sign of the term in the brackets. This term is a quadratic-convex function of Δ, hence it is positive outside of its roots. Computing the roots results in one negative root and a positive one given by Δ2, defined above. Thus, for Δ ≥ Δ2, 0 ≥ a 0 + g 3(a 0) ≥ g(a 0), therefore there must be a root of g(a) in [a 0,0]. Moreover, \(n_1^*\) evaluated at this root must be non-negative. Observe that whenever a ≤ 0, \(n_2^*\) is non-negative, and whenever \(n_1^*\) and \(n_2^*\) are non-negative as well as a * non-positive, \(n_0^*\) is non-negative. □

I will now proceed to derive the bounds necessary so that firms do not deviate from the candidate equilibrium policies. The underlying reason why they might want to deviate is the difference in price sensitivities of the demand from older customers and younger customers. For large Δ, old customers become less price sensitive, therefore a firm might find it profitable to charge a price high enough that no young consumers buy from it. While for Δ very small, firms might find it most profitable just to target some of the young consumers. Let us first derive the necessary conditions, so that the latter type deviation is not possible. I will develop the arguments, without loss of generality, by considering a deviation of firm 1 while firm 2 follows the equilibrium policy.

-

2.

Firm 1 cannot deviate to just serve the young consumers.

Recall that the demand faced by firm 1 from the older customers is given by

and is increasing in x t. It is easy to confirm that \(d_1^o\le 0\), whenever

Similarly, the demand from the young consumers is given by

and is positive whenever \(\varrho\le z(a)/\Delta\).

The type of deviation I am considering requires that firm 1 serves no old consumers, i.e. \(d_1^o\le 0\), and serve some of the younger generation, i.e. \(d_1^n\ge 0\). Notice that such a demand configuration is only possible if z(a)/Δ > Δ/2 + s, otherwise there are no prices which support such a configuration. In this case, firm 1 cannot even think of just serving the new customers as a possible deviation. Observe that

is increasing in a. Therefore, if φ(a 0) is positive, then φ(a *) is positive, and hence, firm 1 cannot deviate to serve just the young. Evaluating φ(a 0) yields

where the second inequality follows from s ≤ Δ/2. It could be easily checked that, \(\hat \phi(a_0)>0\), whenever Δ ≥ Δ3, with Δ3 as defined above. Thus, a (very strong) sufficient condition for firm 1 not deviate to a price to just serve the young consumers is Δ ≥ Δ3.

-

3.

Firm 1 cannot deviate to just serve the old consumers.

If the older generation is less price sensitive, firms might find it beneficial to just serve this segment by charging a higher price excluding the younger generation altogether. I will once again presume that firm 2 plays the candidate equilibrium policy, while, firm 1 considers a one period deviation. If firm 1 serves the old customers only, then in the next period it starts game with a zero installed base. Therefore, the deviation profit of firm 1 is simply given by

The value of the future is governed by the same value function since firm 1 returns back to the equilibrium policy next period. The optimal deviation price of firm 1 can be computed via maximizing the deviation profits. First order conditions for this problem implies a deviation price of

where \(p_{{2}}^*=l^*+k^*(1-x^t)\). For this deviation to be possible at all, we need \(d_1^n\le 0\) at \((p_1^d,p_2^*)\) as well as \(d_1^o\ge 0\). Notice that \(d_1^n\le 0\), if \(p_1^d-p_2^*>z(a)/\Delta\), otherwise young will also purchase at the deviation price, implying that firm 1 will have to consider selling to young generation, in which case its optimal action is to follow the equilibrium policy. That is, I will find conditions on Δ such that

First notice that

is increasing in x t, thus ψ(a,x t) is increasing in x t. Hence, \(\psi(a,x^t)\le \psi(a,1)=\hat \psi(a)\). By substituting for l * and rearranging, one can obtain

It could be easily verified that fourth term in the above expression is decreasing with a, while the fifth and sixth terms are increasing. Replacing a with a 0 in the fourth term and with zero in the fifth and sixth term we arrive at

The denominator in \(\bar \psi\) is positive, and the numerator is quadratic-convex function of Δ. Thus, \(\bar \psi \le 0\) in between the two values of Δ which make the numerator zero. One of these roots is negative, the one which could be positive is given by Δ4 defined above.

I will briefly summarize the steps of the proof of the lemma. For Δ ≥ Δ1, \(a_0\ge \max({\underline{a}}_1,{\underline{a}}_2)\) and for Δ ≥ Δ2, g(a 0) ≤ 0, which combined with the fact that g(0) ≥ 0, implies that there is a root of g(a), a *, in [a 0,0] and at this value of a *, \(n_1^*\) is non-negative. A non-positive a * and a non-negative \(n_1^*\) imply that \(n_0^*\) and \(n_2^*\) are also non-negative. There is no price a firm can deviate to such that it only serves the younger generation whenever Δ ≥ Δ3. On the other hand, when a firm selects its optimal price in order to serve just the old, it faces a non-negative demand from younger ones if Δ ≤ Δ4. Thus, it should take into account the demand from the younger ones when selecting its profit maximizing price. But in that case, the best it could do is to follow the equilibrium policy. Combining these conditions leads to the set \({\cal D}\) defined above.

Proof of Proposition 1

Proposition 1

(Existence of Markov Perfect Equilibrium) There is a set of parameters where a symmetric MPE in stationary affine strategies exists. The parameters of the affine policy functions and quadratic value functions are given by Lemma 1. In this equilibrium,

-

1.

The firm with a higher customer base charges a higher price.

-

2.

Each firm charges a price above cost, that is, the parameters of the policy functions, (l*,k*), are both non-negative.

-

3.