Abstract

We directly compare two institutions, a family compact—a parent makes a transfer to her parent in anticipation of a possible future gift from her children—with a pay-as-you-go, public pension system, in a life cycle model with endogenous fertility wherein children are valued both as consumption and investment goods. Absent intragenerational heterogeneity, we show that a benevolent government has no welfare justification for introducing public pensions alongside thriving family compacts since the former is associated with inefficiently low fertility. This result hinges critically on a fiscal externality—the inability of middle age agents to internalize the impact of their fertility decisions on old-age transfers under a public pension system. With homogeneous agents, a strong-enough negative aggregate shock to middle-age incomes destroys all family compacts, and in such a setting, an optimal public pension system cannot enter. This suggests the raison d’être for social security must lie outside of its function as a pension system—specifically its redistributive function which emerges with heterogeneous agents. In a simple modification of our benchmark model—one that allows for idiosyncratic frictions to compact formation such as differences in infertility/mating status—a welfare-enhancing role for a public pension system emerges; such systems may flourish even when family compacts cannot.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

“I’ve always said, and I still think we have to admit, that no matter how much fine reasoning there was about the old-age insurance system and the unemployment insurance prospects—no matter how many people were studying it, or how many committees had ideas on the subject, or how many college professors had written theses on the subject—and there were an awful lot of them—the real roots of the Social Security Act were in the Great Depression of 1929. Nothing else would have bumped the American people into a social security system except something so shocking, so terrifying, as that depression.” (Frances Perkins, U.S. Secretary of Labor, 1962).

1 Introduction

For centuries, before the advent of compulsory, tax-funded social security, financial sustenance of the elderly relied on two sources: their own savings and/or family support. The latter was facilitated by working-age children under an implicit family compact—each young generation pledged to support their parents, just as the parents had supported their own parents in the past. For example, Sundstrom and David (1988) argue that “from colonial times through to the eve of the Civil War, and beyond, American farmers looked to their children as future providers” and that “[i]n exchange for their role in providing old-age security for their parents, the mature offspring of a farm couple expected to receive a portion of the farm family’s wealth...”Footnote 1

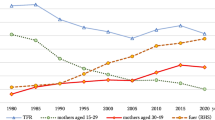

Within family lines, these compacts worked for many generations and helped prevent the immiserization of large segments of the elderly population. By early 1900s, industrialization had become widespread; with it, economy-wide unemployment and long episodes of depressed wages became routine. These eroded the meager savings of many elderly and may have been responsible for the destruction of the aforementioned family compacts. Over time, a belief emerged that the state ought to step in to prevent such old-age economic deprivation and dependency of the elderly, a belief that originated in Europe (Sinn 2004) and had spread to North America by the 1930s (Lindert 2004). Motivated by the early North American experience with social insurance, we ask, is there any rationale for the state to step in if family compacts are thriving? What if the compacts have broken down?

The answers we find have a lot to do with the various roles social security has been called on to play: pension (or old-age support), insurance (e.g., dependent survivor benefits), and income redistribution. These roles, of course, often overlap. Yet, while a social security system may touch on all three roles, its principal identity is (and has always been) intergenerational, its chief function, pension provision to the elderly. To reiterate, in its identity and function as the chief intermediator of intergenerational transfers, social security is unique. We then ask, is this role as a public pension program (henceforth “public pension” or “public pension system,” or PPS for short) sufficient to justify its introduction by the state alongside existing family compacts? If the pension role is not sufficient, what other role might be necessary to justify the state stepping in?

To that end, we study a stylized model of intergenerational transfers, inspired by Cigno (1993, 2006a, b)—a simple, three-period overlapping generations model with no intragenerational heterogeneity and endogenous fertility in which the middle-aged, the decision-makers, value children both as consumption and investment goods. The latter role arises because children provide the means of an endogenously derived family pension system, a family compact (hereafter, FC) in which a middle-aged offspring makes a transfer to her aged parent in anticipation of receiving a possible transfer from each of her own children in the future. A key feature of the Cigno framework we adopt is the absence of intergenerational altruism as motivation for intergenerational solidarity. As a competitor to the FC, we consider a PPS, one that imposes a lump-sum tax on the income of the middle-aged and uses the proceeds to finance a lump-sum pension to the current old. In the aforediscussed setup, we pose the following questions. How does a PPS which has a pure intermediary role measure up in a direct comparison with family compacts? More broadly, is there a sense in which entrusting government with the responsibility for the aging members of society leaves them better off than they could be under their own family compacts? Within the narrow confines of our model, we also enquire: If family compacts perish, can a PPS thrive? Was Frances Perkins (see quote above) right?

In a stationary setting, we derive the optimal family compact, one that is subgame perfect (it dominates the outside option of generational autarky) and maximizes stationary utility. We show, if all agents are identical, a benevolent government has no welfare justification for introducing public pensions in our model economy with actively-thriving family compacts; i.e., both a private FC and an optimal PPS cannot coexist. A “fiscal externality” is at play here: under a PPS, private agents do not internalize the budgetary implications of their fertility decisions. To be clear, a fiscal externality arises in our setup because private agents do not see the connection between the pension they are promised and the number of children they have. Consequently, they have “too few” children and end up with “too low” a public transfer. By way of contrast, the FC faces no such issue. The key point: with identical agents, public pensions cannot compete with family compacts precisely because of this fiscal externality.

Continuing to assume all agents are homogeneous, we go on to show that family compacts may collapse if the income of the middle-aged takes a big, permanent hit. That is, a sufficient condition for family compacts to break down (and be replaced by generational autarky) is a large enough, negative shock to middle-age incomes. Common intuition, as outlined in the Perkins quote, suggests such a setting ought to be ripe for the introduction of a PPS. Interestingly, within the strict confines our model that admits no intragenerational heterogeneity, this turns out not to be the case. We show, if incomes are too depressed to allow for an optimal FC to thrive, they are also too low to permit the introduction of an optimal PPS. (Parenthetically, we show there is a range of incomes in which a PPS would not emerge and yet the FC thrives.) The idea is, once incomes have fallen sufficiently, agents cannot simultaneously afford to have children and honor their parental compact obligations; the same goes for their public pension contributions.

Evidently, a PPS that plays the singular role of pension provision—the only role it can play in our world with homogeneous agents—cannot compete with thriving FCs. How, then, can we rationalize a PPS? Consider the same environment as above except admit some heterogeneity. The latter, in principle, could take many forms. First, consider an idiosyncratic endowment shock (not strong enough to destroy existing compacts) that hits some of the middle-aged but not others. Here, ex ante, all agents would be willing to participate in a public transfer program; conceivably, though, a richer FC may also be able to accommodate this type of agent heterogeneity by making contributions contingent on the middle-aged’s realized income.

Alternatively, one may posit frictions in the compact-creation process or idiosyncratic inability to form compacts—say, through infertility or the failure to successfully mate. In the Cigno framework, these sorts of barriers to compact formation open the door for endogenous separation from the FC. Conceptually, a FC strictly along a single family lineage could stipulate, ex ante, that a childless (ex post) agent, make a transfer to her parent with no expectation of a transfer from her non-existent children—a non-starter in this environment with no altruism. Alternatively, a more comprehensive FC could be defined over extended family lines, requiring ex ante the ex post childbearing middle age to make transfers to all elderly relatives (parents as well as their infertile and unmatched siblings). The problem is then immediate: any such ex ante optimal FC faces a threat of being rejected ex post, once fertility/mating status is revealed. A coalition of middle age agents consisting of those that are fertile/mated could deviate from the existing compact by proposing an alternative, one that makes no provisions for those infertile or single. This constrains the designer of the original compact to restrict transfers to elderly parents only, leaving the elderly infertile/single to support themselves.Footnote 2 A non-discriminating PPS may improve (ex ante) utility even in the presence of a FC. By fiat, a PPS taxes and makes lump-sum transfers to everyone regardless of fertility or matching status. The timing of transfers is key: since the FC transfers are to be made after fertility/mating status is revealed, fertile, matched agents ex post see no benefit of honoring transfers stipulated by a FC to anyone other than their parent.

Interestingly, the issue of identifying a clear rationale for the creation of a public pension was center stage in political deliberations surrounding U.S. President Franklin D. Roosevelt’s (FDR’s) New Deal. FDR’s idea was to de-emphasize the social-insurance aspect of the social security program—contributions and benefits are intentionally not means-tested—and, instead, promote its public pension role. In 1935, the US Congress created a national payroll tax to pay for old-age pensions so as to not rely on funding from general tax revenues. FDR and Social Security administrators took pains to distinguish the US pension system from other welfare programs by portraying the payroll tax not as a form of taxation but instead as a contribution workers made to ensure their own security, an entitlement that people earned through hard work and their own contributions.Footnote 3 In reality, however, as Campbell and Morgan (2005) point out, “there is no one-to-one relationship between contributions and benefits, as the benefits formula is skewed to give higher returns on low-income earners’ contributions, and lower returns on the taxes paid by higher earners.” In short, while FDR opposed a general-revenues funding of PPS (which would have made it overtly redistributive), he favored and sold it to depression-weary Americans as a public pension-like system with contributions, albeit with “redistributive” returns. Within the restricted boundaries of our model economy specifications, our work can offer limited insight into FDR’s strategy: in our theory, a social security system does not garner the same sort of long-run support if implemented as a pension-only system, as long as the traditional forms of old-age security work well. Indeed, embellishments such as survivor benefits and redistributive returns, not integral to the program’s primary function, are needed to make it more acceptable to the general electorate, a point that is evident from our simple extension involving heterogeneous agents.

In sum, our analysis is designed to ask, when and why is a public pension system able to replace a familial pension system run within family lineages? In the absence of heterogeneity, a PPS cannot compete with existing, optimal FCs. If the middle-aged are hit with idiosyncratic income shocks, then again, a suitably modified FC, one that conditions filial transfers on agents’ incomes, could compete with a PPS on an equal footing.

Extending our study to include agent heterogeneity in the form that we do reveals an important but subtle constraint faced by the progenitor of a family compact, an issue originally discussed in Sinn (2004). Consistent with the literature, we assume a family compact can be costlessly instated at any point in time. If true, a compact must then comply with a core-like condition; there can be no sub-coalition within the family compact unit that can break from the compact and form a new compact which is Pareto preferred by all members of that subgroup. This prevents the progenitor from offering a comprehensive compact, one that includes support for elderly family members that do not provide an ingredient critical to its success, namely, children. Introducing of a PPS may then increase agents’ (ex ante) utility, by providing old agent support for those not included in the FC.

Interestingly, if introducing a new compact is not costless, there arises yet another argument in favor of a PPS, one not reliant on agent heterogeneity. The aforementioned discussion on the dissolution of the FC envisions a shock large enough to dissuade agents from making any intertemporal transfers (private or public) towards old age. If, instead, the shock is not that severe, agents may still be amenable to such transfers, just not on the same terms as stipulated by the original FC. If a new FC is costly to install, switching to a PPS may be preferable to agents over complying with the original FC.

We proceed as follows. We start with a selective review of the literature in Section 2. In Section 3, we describe the model environment, population structure, the behavior of economic agents and the stationary private family compacts. In Section 3.3, we characterize the PPS and compare it to the FC. There we find that the introduction of a PPS provides no welfare-enhancing benefits to agents in a steady state if there exists a well-functioning FC. Given this finding, we turn, in Section 3.4, to the question of whether a PPS can prevail when a FC cannot. Both sections lay out a fairly stark conclusion: these family compacts work fairly well, so much so they preclude the introduction of a pay-as-you-go public pension system. As such, a case for a PPS must rest on something beyond a simple pension role. We address this issue in Section 4, where we consider a simple modification of our existing model which allows for risk and heterogeneity across agents. Here, we show a PPS can enhance welfare, even in the presence of a well functioning FC. Along the way, we also provide some support for a hybrid public-private pension system, similar in spirit to that outlined in Cigno (2010). Section 5 concludes; the appendices contains the fine print of the family compacts as well as proofs of major results and discusses some extensions.

2 Literature review

Our work is motivated by the literature on within-family transfers de-linked from altruism, emanating from the seminal contribution contained in Cigno (1993), and enhanced in Rosati (1996), and Cigno (2006a, b). One of our results—if an optimal FC has broken down, an optimal PPS cannot be ushered in if agents are homogeneous—is discussed informally in Cigno (1993): “[if] it has not collapsed already, the family transfer system will then collapse as a result of the introduction of a public pension system.” His argument is as follows: since participation in a PPS is compulsory and since a pension is promised unconditionally (not tied to fertility), the children “will have no choice but to pay the tax,” and “they will then refuse to support the present old, and will have no children.” Of course, without children, the FC collapses, but so too does a PPS. We formalize and generalize these ideas and extend the informal discussion in Cigno (1993): we allow children to be consumption goods thereby preventing the no-children outcome; as such the informal discussion in Cigno (1993) does not carry over.

Our results rely heavily on the presence of the aforediscussed fiscal externality, a term that warrants further elucidation.Footnote 4 For us, the term refers to the assertion that private agents do not internalize the effect of their fertility decisions on the public pension they get, i.e., private fertility decisions have external budgetary consequences. Conceivably, there can arise many other fiscal influences—not all are externalities—relating pensions and fertility. For example, if expected future pension benefits fall but contributions do not, there may arise an income effect, not an externality, that may depress fertility. Alternatively, since parenting takes time away from work and if future pension benefits are understood to be linked to labor income, fertility decisions may get distorted; again, no externality is at play here. Becker (1988) considers the following connection: “A Social Security system that replaces child support of parents with public support raises the net cost of children to parents (not to society), since they are no longer as useful to elderly parents. As a result, a Social Security system tends to reduce the demand for children.” Becker (1988; pg. 4) Clearly, the Beckerian view is that publicly support institutions shape private fertility decisions—no fiscal externality, however, is being implied here. Our focus rests on an angle obverse of Becker: how private fertility decisions may shape public-support institutions, and more importantly, what happens if private fertility decisions are taken without considering their fiscal ramifications. In this sense, our notion of the fiscal externality, by no means unique in the literature (e.g., Demeny 1989), may not have received as much prominence in the analysis of private compacts versus public pensions.

Versions of the fiscal connections that originate in Becker (1988) are also center stage in Prinz (1990), Fenge and Meier (2005), Galasso et al. (2009), and more recently in Fenge and Scheubel (2017). In Prinz (1990), a PPS reduces private willingness to have children because households no longer need children as “investment” goods, an idea similar to Becker (1988). In Prinz’s setup, private agents would not have any children ordinarily, but if a government-run policy of family allowances contingent on fertility is introduced, one that equates the private marginal cost of raising children with the allowance, then a social optimum can be attained. Kolmar (1997) is specific about defining the fiscal externality arising in a public pension system—his IPAYG program—one that delinks pension benefits from prior fertility. In this case, “the future benefits of children are distributed to all individuals of the society whereas the costs of children are borne entirely by the individual family.” Kolmar goes on to identify that this fiscal externality is negative and may possibly weaken if pension payments are made contingent on fertility (via his CPAYG program). This is a variant of the fiscal externality we depend on. Kolmar (1997) does not, however, entertain a direct comparison with family compacts, except perhaps to hint at a possible reinterpretation of his fertility-contingent public pension as “dynastic pensions” in Cigno (1993).

Private family compacts and public pensions are vehicles of intergenerational transfers, both are PAYG, one running along family lines, the other intermediated by the government. And yet, much of the entire literature on public pension systems and their raison d’être—surveyed, for example, in Mulligan and Sala-i-Martin (2004)—focuses on their efficiency and redistributive properties in isolation, but never in a direct comparison with private family compacts. Similarly, there is an established literature on within-family transfers not related to altruism, emanating from the seminal Cigno (1993), and enhanced in Rosati (1996), Cigno (2006a, b), and Cigno and Werding (2007) that largely keeps public pensions out of the spotlight.

This brings us to an important value-added of our analysis: to the best of our knowledge, we are the first to confront an optimal public pension system with an optimal, endogenously derived family compact. van Groezen, Leers and Meijdam (2003), Sinn (2004), Fenge and Meier (2005), and Fenge and Scheubel (2017) do not allow for endogenously derived optimal family compacts. In some of these papers, there is, arguably, a “forced altruism” meaning agents are bound (“by customs or laws”—Sinn, 2004) to leave an exogenously specified transfer to each of their children. Such a requirement simply raises the cost of child rearing and reduces fertility, but has no bearing on the per-child transfer would-be parents can expect to receive when old. As such, all that public pensions do is reduce fertility leaving elderly parents with less overall filial support. In our case, the fiscal externality does more than change the number of children—it also changes the size of the (optimal) transfer, an effect absent in a system with a pre-determined transfer level.

Two additional papers are worthy of note. Leroux and Pestieau (2014) also examine public versus private old-age support in a political-economy model. They consider an environment with exogenously specified norms regarding family transfers; the link between generations is given and agents do not make a choice whether or not to abide by their obligations within the family system. They consider the emergence of public pension systems, due in part to shocks to this family link. Their model, however, sidesteps two important issues which we consider in detail here: (a) how such intergenerational links are formed and (b) why they may break down. The latter is particularly important, since some of these factors that are needed for a thriving private support system (as we show) may also be key building blocks for an optional public support system. In a recent paper, Galasso and Profeta (2010) shed light on the issue of broken FC and the rise of PPS by analyzing the link between the structure of the family—whether characterized by weak or strong family ties—and the emergence of pension systems. In families with weak ties, the adults only provide a pre-specified minimum for the elderly; whereas in strong families, they allocate consumption more evenly among the family members. In their “new regime,” one characterized by industrialization, urbanization, and nuclear families, weak family ties are conducive to the rise of PPSs; yet, if they emerge, pension systems are more generous in societies with strong family ties. Their results are thematically close to ours in that our FC is close to their notion of strong family ties. Notice though, their family ties are really customs or norms, not necessarily optimal.

3 The basic model

Consider an economy populated by cohorts of three-period lived overlapping generations of identical agents who are economically active for the last two periods of their life. Label the periods of life as youth, midddle age, and old-age with youth being economically passive. Let t = 1,2,...,∞ denote time. Each middle age decision-maker (one born at date t − 1) is endowed with w > 0 units of a single, non-storable consumption good; she is endowed with y ≥ 0 units of the good when old. When middle age, she decides how many children, n t , to raise at a contemporaneous cost of ν per child.Footnote 5

To simplify the analysis—for now—we assume that there are no financial assets.Footnote 6 Children, potentially, serve two purposes in this economy. First, following the tradition of Galor and Weil (1996) and de la Croix and Doepke (2003), children provide direct utility to the parent. Second, following Cigno (1993), offspring may be considered akin to investment goods insofar as they provide the means of a family pension system in which the parent, when middle age, passes along a transfer to her parent in anticipation of receiving a possible transfer from each of her children in the future.

Let \(\underline {U}_{t}\) (defined in the section below) denote the agent’s benchmark utility, i.e., what she can achieve on her own without participating in the FC. Within a FC, however, a middle age agent at t faces a family-transfer obligation to transfer α t units of the good to her parents, with the understanding that she receives filial support from each of her children—each will transfer α t+ 1 units of the good to her (a total transfer of α t+ 1 n t ) at date t + 1. Of course, the agent can choose to abide by the obligation or not; if she agrees to, she is, in the language of Cigno (2006a), a “complier,” otherwise, she is a “go-it-aloner.” A FC is, then, an entire sequence of such family-transfer obligations, one for each date. A sequence \(\left \{ \alpha _{t}\right \}_{t = 1}^{\infty } \) represents a family pension system, or family constitution (Cigno 1993) or family compact (FC, hereafter), discussed in detail below. Clearly, for a FC to be operative, it is necessary that each member of each generation obtains at least \(\underline { U}_{t}\) in utility under it.

The lifetime utility of a middle age decision-maker at date t is

where c t (x t ) is the agent’s consumption when middle age (old), and 0 < β ≤ 1 and 𝜃 ≥ 0 are preference parameters. The functions u(⋅) and g(⋅) are increasing and concave and \(\lim \limits _{z\rightarrow 0}\) u ′(z) = ∞. (The time subscript of the decision variables tracks when the agent begins her economic life, i.e., at middle age. Hence, for example, x t represents old-age consumption of an agent born at t − 1 and entered middle age at date t). In contrast to Sinn (2004), it is important to note that the aforediscussed intergenerational transfers are not based on altruism, since a parent’s well-being is not an argument of the agent’s utility function.Footnote 7 We have

Assumption 1

a)u ″′(⋅) > 0∀c,x > 0. b)\(\lim \limits _{n\rightarrow 0}\) g ′(n) = M ≤ ∞ .

Assumption 1 a) is sufficient for our basic argument; u ″′(⋅) > 0 holds for many utility functions used in applied economic analysis; e.g., CES u(c) = c 1−σ/ (1 − σ). It is connected to the notion of prudence, or equivalently, the precautionary motive for saving.

Our approach includes a convenient parameterization of the intensity of utility agents receive from having children, embodied in the parameter 𝜃. As noted in the introduction, the traditional approach to studying family transfer systems does not consider possible warm-glow utility from children. This, however, is problematic and inadequate for our purposes, since one cannot consider replacing a compact with a public pension system without abandoning a component integral to the family compact system—the endogenous fertility decision n t made by participants of the compact. The element 𝜃 g(n t ) of U t in (1) above allows us to consider three alternative cases, the first two include family compacts: children are investment goods only if 𝜃 = 0, and they are investment and consumption goods when 𝜃 > 0 and a thriving family compact exists. A third possibility—children are consumption goods only emerges when 𝜃 > 0 and there is no family compact. By including the possibility that children provide utility in and of themselves (that is, independent of any resource transfers they may provide to their parents) allows us to consider alternatives to the family compact such as a compulsory public pension system, since agents retain an incentive to have children in the absence of the compact. Consequently, in this setting, the economy can continue even if compacts do not.

In anticipation of what will follow in subsequent sections, we make the following assumption regarding the preference parameter 𝜃 and fertility n t .

Assumption 2

An increase in the preference parameter 𝜃 increases steady state n t .

We sidestep laying out the deeper assumptions regarding the model primitives which ensure Assumption 2 holds, in part because these restrictions are not particularly enlightening in their own right. More importantly though, the model and its results would seem untoward if this property did not hold.

At points below, we will consider a competing public pension system. For now, we set aside any such system and focus solely on a FC. At date t, a middle age agent chooses c t and n t , as well as a consumption plan, x t . The agent also decides whether or not to participate in her FC. Given \(\left (\alpha _{t},\alpha _{t + 1}\right ) \in \mathbb {R}_{++}^{2}, \) her problem is to maximize (1) subject to

-

c1

c t + α t + ν n t ≤ w

-

c2

x t ≤ y + α t+ 1 n t

-

c3

c t ≥ 0;x t ≥ 0;n t ≥ 0.

When (c1) and (c2) bind, the choice variable n t satisfies:

The assumption u ″′(⋅) > 0 ensures the marginal cost of an additional child, ν u ′(w − ν n − α), is a convex function of n, for all n > 0. The limiting conditions on u ′(⋅) itself ensures the mapping is convex over a subset, since its derivative, − ν u ″(w − ν n − α) > 0 and u ′(w − ν n − α) →∞ as n → (w − α)/ν. (2) implicitly defines a solution, n t = n(α t ;α t+ 1) which, using (c1) and (c2), define the indirect utility (U t ) the agent obtains under the FC.

If the agent chooses not to abide by the FC, her choice of n t satisfies

Under this option (her outside option), she receives \(\underline {U} _{t}\equiv u\left (w-\nu \underline {n}_{t}\right ) +\beta u\left (y\right ) +\theta g\left (\underline {n}_{t}\right )\), where \(\underline {n}_{t}\) satisfies (3). In this case, c t = w −\(\nu \underline {n}_{t}\) and x t = y. If 𝜃 = 0, then \(\underline {n}_{t}= 0\) (because raising children is costly) and the agent simply consumes her endowment. In that case, \( \underline {U}_{t}=\underline {U}\equiv u\left (w\right ) +\beta u\left (y\right ) \). The importance of assuming y > 0 is apparent here; since u ′(0) →∞, allowing y = 0 precludes non-existence of the FC simply because the outside option is so unappealing. Also, as noted, if 𝜃 = 0, no one has children outside of the FC and the economy ends.

We proceed to derive a FC. The existence or non-existence of a FC relies solely on the view that children are investment goods. Whether they are also viewed as consumption goods is immaterial to the survival of a FC. As such, for expositional clarity, we start by fixing some ideas for the case where 𝜃 = 0.

3.1 Viability of the family compact with children as investment goods only

So far, we have loosely described a family compact as a sequence of transfers, \( \left \{ \alpha _{t}\right \}_{t = 1}^{\infty } \), whose viability requires that, at each date, the utility obtained under it, U t , is at least as great as what she can receive from her outside option, \( \underline {U}_{t}\). This characterization is not entirely complete, since a family member at any generation can take an action, call it \(\widehat {\alpha }_{t}, \) that differs from α t . As such, the compact must also describe the actions of all current and future agents if such deviations do occur at some date. While important, these represent the ‘fine print’ of the compact.Footnote 8 Since they are secondary to our main focus, we relegate them to an appendix – see Appendix F.

We turn to the notion of viability. When 𝜃 = 0, a sequence \(\left \{\alpha _{t}\right \}_{t = 1}^{\infty } \) of transfers is viable (self-enforcing in the language of Cigno 2006a) – the FC is subgame perfect – if

holds for each date t, where n(α t ;α t+ 1) is, mutatis mutandis, the solution to (2). A family compact is not unique. There may be a continuum of sequences \(\left \{ \alpha _{t}\right \}_{t = 1}^{\infty } \) that satisfy (4).

Needless to say, a FC must also ensure each generation procreates, i.e., n(α t ;α t+ 1) > 0∀t. Let A denote the set of (α t ,α t+ 1) consistent with n(α t ;α t+ 1) ≥ 0. For each transfer α t an agent is asked to give to her parent, there is a minimum transfer α min,t+ 1≥ 0 she must anticipate receiving before she is willing to have children, i.e., n(α t ;α min,t+ 1) = 0 for all α t ≥ 0. The smallest of these is defined implicitly by n(0;α min) = 0. More generally, the locus of α min,t+ 1 – call it the mapping γ(α t ) – is increasing in α t . Any feasible α t+ 1 >γ(α t ) is consistent with procreation at date t.

Next, consider the function ϕ(α t ) : (0,w) → (α min,w), defined implicitly as \(V\left (\alpha _{t};\phi \left (\alpha _{t}\right ) \right ) =\underline {U} , \) i.e., given α t , ϕ(⋅) describes the size of the anticipated transfer from the middle age to old at t + 1 that leaves the middle age at t just as well off as the benchmark, \( \underline {U} \). It follows that \(V\left (0;\phi \left (0\right ) \right ) =V\left (0;\alpha _{\min } \right ) =\underline {U}\). The mapping ϕ(α t ) ≥ γ(α t ) for all α t ≥ 0. Figure 1 illustrates, with a convex upward-sloped mapping ϕ(α t ).Footnote 9 For a given α t , any transfer combination (α t ,α t+ 1) with α t+ 1 >ϕ(α t ) generates higher utility than the outside option. This range is shown as the shaded region in Fig. 1. Footnote 10 Let α̲ (\(\overline {\alpha } \)) denote the smallest (largest) fixed point α = ϕ(α) with α < w.

Proposition 1

Let \(\alpha _{1}^{\ast } \in \left (0,\overline {\alpha } \right ] \) be any initial transfer. A subgame perfect sequence of transfers consistent with procreation \(, \left \{ \alpha _{t}^{\ast } \right \}_{t = 1}^{\infty }\) , if it exists, satisfies i) \(\alpha _{t + 1}^{\ast } \geq \phi \left (\alpha _{t}^{\ast } \right ) \geq \gamma \left (\alpha _{t}^{\ast } \right ) \) and ii) \( \alpha _{t}^{\ast } \in \left (0,\overline {\alpha } \right ] .\vspace {-0.08in}\)

Henceforth, we restrict the attention to sequences that satisfy the proposition. An implication of this restriction is that there is no default on the compact in equilibrium. If there was anticipated uncertainty regarding the endowments, the compact would be state contingent; even in that setting, there would be equilibria with no possibility of default.

Consider next, a stationary equilibrium, i.e., α t = α > 0 for t ≥ 1. It is clear that stationary equilibria belong to the set \(\left [ \underline {\alpha } ,\overline {\alpha } \right ] \). These are shown as points along the 450 line inside the shaded region of Fig. 1. Setting aside the welfare of the initial transfer recipients (the old at date t = 1), the best such compact, is the one that maximizes the distance between the curve defined by the mapping ϕ(α t ) (which describes transfers which will leave the agent indifferent between the compact and the no-compact alternative) and 450 (stationary compacts) – where ϕ ′(α) = 1, and solves the following problem: choose α to maximize

Using the envelope theorem, and assuming an interior solution for α, the first-order condition reduces to

which can be rewritten as u ′(c)/β u ′(x) = n. Combine (7) with (2) above to get

Note that this solution is only relevant for the case where 𝜃 = 0. In sum, the best stationary private subgame perfect compact is jointly given by (8)—the number of children—and the size of the transfer, implicitly defined by

following (7). We provide a worked out example of this variation of the model, assuming logarithmic preferences, in Appendix F.1. In his specific context, Cigno (2006a) defines this set—(8) and (9)—to be the set of “renegotiation-proof” family constitutions in a stationary setting.

It bears to emphasize that the decision to abide by the FC or not is endogenous. Since there is no heterogeneity among the children, they will all abide by the FC or none of them will. And, in the steady state, if the parent has the incentive to pass along the transfer, the children will as well. By construction—see (4)—there is no risk of default; either the FC is viable or it is not. Given the lack of uncertainty in family transfers within a FC, there can be no efficiency-enhancing, insurance role for public pensions vis-a-vis the FC.Footnote 11

Having exposited the simpler case of 𝜃 = 0, hereafter, we study the more general case of 𝜃 > 0.

3.2 Viability of the family compact with children as consumption and investment goods

Up to this point, we have discussed the workings of a family compact in a setting where children are viewed solely as investment goods. In such a setting, there is no point to procreation—the economy stops—in the absence of a family compact. This possibility is easily prevented by allowing parents to, additionally, treat children as consumption goods, i.e., by letting 𝜃 > 0. We ask, if 𝜃 > 0, when does a FC cease to be viable? To that end, define:

- Definition 1 :

-

For any y > 0, define \(\hat {n}(y)\) as the value of n such that n β u ′(y) = (𝜃/ν)g ′(n).

- Definition 2 :

-

Define \(\hat {w}(y)\) as the value of w such that \( u^{\prime } \left (w-\nu \hat {n}(y)\right ) =\hat {n}(y)\beta u^{\prime } \left (y\right ) \).

By assumption, the function g(⋅) is increasing and concave, with \(0<\lim \limits _{n\rightarrow 0}g^{\prime } \left (n\right ) \)≤ M ≤ ∞. Since n β u ′(y) is an increasing affine function of n with \(\lim \limits _{n\rightarrow 0}n\beta u^{\prime } \left (y\right ) = 0\) and \(\lim \limits _{n\rightarrow \infty } n\beta u^{\prime } \left (y\right ) =\infty \) , \( \hat {n}(y)>0\) exists and is unique. Also, for any \(\hat {n}(y)\) and y > 0, a unique value for \(\hat {w}(y)>0\) exists if u ′(⋅) satisfies the usual limit conditions, i.e., \( \lim \limits _{c\rightarrow 0}u^{\prime } \left (\cdot \right ) =\infty ,\lim \limits _{c\rightarrow \infty } u^{\prime } \left (\cdot \right ) = 0\).

Intuitively, when faced with lifetime endowment \(\left (\hat {w}(y),y\right ) \) , \( \hat {n}(y)\) is the number of children the agent chooses when the family transfer equals 0. In other words, for a given y, \( \hat {w}(y)\) is the upper bound on first period endowment consistent with children as consumption goods only.

We will assume, provisionally, \( -\nu u^{\prime \prime } \left (\hat {w}(y)-\nu \hat {n}(y)\right ) =\beta u^{\prime } \left (y\right )\), so the marginal cost curve associated with a transfer to the old, u ′(w − ν n − α), is tangent to the marginal benefit curve n β u ′(y + α n) at \(n=\hat {n}(y)\) (and \(w=\hat {w}(y)\), α = 0). A family compact satisfies the first-order conditions:

where (10) holds with equality if α > 0. The term u ′(w − ν n − α) is the marginal cost of an increment in the compact decision α, while n β u ′(y + α n) is its marginal benefit. Likewise for u ′(w − ν n − α) and (𝜃/ν)g ′(n) + (α/ν)β u ′(y + α n) regarding a marginal increment in the number of children, n. Given α, we refer to these as marginal cost (benefit) curves—functions of the fertility decision n; here, it is clear that the FC internalizes the fertility decisions of family members.

Lemma 1

If \(-\nu u^{\prime \prime } \left (\hat {w}(y)-\nu \hat { n}(y)\right ) =\beta u^{\prime } \left (y\right )\) , the only stationary compact supported under the endowment profile \(\left (\hat {w}(y),y\right ) \) is α(y) = 0.

The proof is in Appendix A. If the marginal conditions (10) and (11) both hold with equality (and α > 0), it must be that

prevails. By Definition 1, \( \hat {n}(y)\beta u^{\prime } \left (y\right ) =\left (\theta /\nu \right ) g^{\prime } \left (\hat {n}(y)\right ) \) . Additionally, \(u^{\prime } \left (\hat {w}(y)-\nu \hat {n}(y)\right ) =\hat {n} (y)\beta u^{\prime } \left (y\right ) \) . Together, the two imply: a) given the agents’ decision, \( \hat {n}(y), \) the progenitor of the compact chooses α = 0, and, b) when faced with a zero transfer, the solution to each agent’s child rearing decision is \(n=\hat {n}(y)\).

We are now able to answer the question, when does a FC cease to be viable? The answer is: if w falls to \(\hat {w}(y)\) or below, the family compact is dismantled. Yet, despite the demise of the family compact, the economy continues—parents procreate (have \(\hat {n}(y)\) children) solely to satisfy their consumption needs. Parenthetically, family compacts thrive when \(w>\hat {w}(y)\). Does this continue to obtain if the government introduces a public pension system? Can the two institutions of old-age security coexist?

3.3 Are a FC and a PPS jointly viable?

Can the government, by introducing a stationary PPS alongside an existing optimal FC, improve steady-state welfare? To that end, let (τ t ,b t− 1) summarize a pay-as-you-go public pension system (PPS), where τ t is a lump-sum tax collected at date t from a middle age agent and b t− 1 is a contemporaneous transfer to each old agent. Assuming the government balances its budget at each date, a sequence \( \left \{ \tau _{t},b_{t-1}\right \}_{t = 1}^{\infty } \) of tax-transfers conforms to

for t ≥ 1. We focus our attention on a stationary PPS, τ t = τ∀t, satisfying (13). Assume the government is contemplating introducing such a system alongside an existing, stationary FC. The agent takes the compact transfer α, as well as the PPS elements τ,b as given—they do not see their role in (13)—and solves for the optimal n by

The relevant first-order condition is

yielding the optimal fertility function, n(α; τ, b).

The FC then chooses α taking τ, b as given but internalizes the effect of its choices on n; the FC solves

Using (15), it is easy to see the optimal α in the presence of a PPS satisfies

In Appendix B, we lay out the second-order conditions associated with this optimization problem.Footnote 12

The government internalizes the effect of its choices on the FC (and the agent) and chooses τ (or b) to maximize the welfare of agents. The indirect utility of an agent in a steady state is

where n and α satisfy (15) and (16). The government’s choice of τ satisfies

where, in writing (17), we have used the envelope theorem associated with the choices for n and α. With (16) - i.e., u ′(w − ν n − α − τ) = n β u ′(y + α n + b), this simplifies to

In Appendix B, we show, with the aid of Assumption 2,

Lemma 2

Note that with the budget constraint, b = τ n, Lemma 2 is equivalent to n ′(τ) ≤ 0.

The following proposition is then immediate.

Proposition 2

Introducing a public pension along side a stationary private family compact cannot increase the welfare of agents in a steady state.

Heuristically, an optimally chosen FC lines up the intertemporal trade-off in a desirable way; there is nothing left for the PPS to “correct.” The underlying problem is that private agents view the public tax-transfer scheme as lump sum and fail to internalize the budgetary implications of their fertility decision: they do not see the connection between the pension they are promised and the number of kids they have.Footnote 13 The government’s tax is seen only as an imposition with no salient counterpart.Footnote 14

Just how far does a FC go toward maximizing agents’ welfare, generally? Despite its decentralized decision-making, it turns out quite far, as the following proposition attests.

Proposition 3

Consider a social planner who can reallocate the economy’s resources at each date and chooses consumption allocations c,x and the number of children n,to maximize steady-state utility u(c) + β u(x) + 𝜃 g(n)subject to the resource constraints, c + ν n + Δ ≤ w , x ≤ y + χ , whereΔ,χ represent intergenerational transfers chosen by the planner satisfying the constraint \({N_{t}^{m}}{\Delta } ={N_{t}^{o}}\chi \Leftrightarrow n{\Delta } =\chi \) . The allocations that obtain under an optimally chosen FC solve the social planner’ s problem.

The importance of comparing optimal FCs with optimal PPSs deserves emphasis here. This is where we part ways with van Groezen, Leers and Meijdam (2003), Sinn (2004), Fenge and Meier (2005), and Fenge and Scheubel (2017) who do not allow for endogenously derived family compacts, and therefore cannot make direct comparisons with an optimal PPS.

The above two propositions make clear that in the type of environment we are considering, a public pension system cannot offer agents anything more than what they can achieve on their own through an optimally selected family compact. Therefore, a benevolent government has no welfare justification for introducing PPS in a world with actively thriving family compacts. The upshot is that an optimal FC and a PPS cannot coexist. That said, a natural question to ask is, when might private compacts break down?

3.4 If the FC breaks down, is a PPS viable in its place?

A portion of the Frances Perkins quote from the introduction is worth repeating here: “Nothing else would have bumped the American people into a social security system except something so shocking, so terrifying, as that depression.” This quote could be referring to a widely held notion that the American people were somehow nudged into accepting social security because of an unstated promise by the state to help those hurt by a huge income shock. Our model, as described heretofore, is not suited to explore this line of interpretation—to do so would require us to study a one-time, government-sponsored transfer to the initial old who are hurt by the income shock. Another interpretation of the Perkins quote might be, had the depression not wiped out incomes to the extent it did, a public system could never have been ushered in. Here, we take up two parts of this latter interpretation within the narrow confines our model with homogeneous agents. First, in Proposition 4 below, we show that within the context of the model, absent public pensions, an optimal stationary family compact may fail to attain precisely because of low income (w) when middle age.Footnote 15.

A way to think about this result, in a broader context, is to envision a stationary equilibrium with a family compact in place. At some date, say, T, there is a large, unexpected (and perceived permanent) decrease in w. At that point, middle age agents at T are unable (or unwilling) to make good on the existing family compact, and, based on the perceived longevity of the shock, a new family compact cannot be initiated. From that point onward, the economy would revert to a no-compact benchmark world, until a future shock or change in government policy alters the equilibrium. Second, given the inability to support a new stationary equilibrium with a family compact, it is natural to inquire if an optimal stationary public pension system can be initiated to replace the now-defunct private one. Unfortunately, the condition that ensures the non-existence of a stationary family compact—a low-enough w—also precludes the existence of an optimal stationary public system, as shown in Proposition 4. Connecting it up to the Perkins quote, the gist of this is that, in our model economy, a depression that obliterated incomes and ended familial old-age support would also have prevented a public pension system from emerging.

Proposition 4

Assume a stationary family compact exists for a given endowment profile(w,y) > 0,with \(w>\hat {w}(y)\) where \(\hat {w} (y)\) is defined in Definitions 1-2. Suppose there is an unexpected, permanent negative shock to w. If the shock is large enough: i) the existing family compact will fall apart, and ii) a new stationary family compact, with a smaller, positive transfer to the old, does not attain.

The proof of the proposition follows immediately from Lemma 1.

3.4.1 Some diagrammatic intuition

A stationary family compact will not attain, if, for every transfer α > 0, (10) holds with a strict inequality for any n that satisfies (11). (Intuitively, the marginal cost of passing along a bequest exceeds the marginal benefit). That this is the case whenever w falls below \(\hat {w}(y)\) is shown in Fig. 2.

Figure 2 depicts these marginal cost and benefits conditions as functions of n. The thick, downward curve and upward (convex) curve depict (𝜃/ν)g ′(n) + (α ∗/ν)β u ′(y + α ∗ n) and u ′(w − ν n − α ∗), respectively, while the increasing concave mapping that starts at the origin is n β u ′(y + α ∗ n), for some initial, optimal compact transfer α ∗ > 0. The three curves meet at point A and establish the optimal child decision n ∗ associated with α ∗. Together, (α ∗,n ∗) summarizes the family compact. We also depict the mappings (𝜃/ν)g ′(n), \( u^{\prime } \left (\hat {w}(y)-\nu n\right )\), and n β u ′(y) as dashed curves, each following patterns similar to their counterparts with α ∗ > 0. The three dashed curves meet at point B, where \(n=\hat {n}(y)\). Of particular note is the fact the curve describing the marginal benefit of any transfer α > 0, n β u ′(y + n α), is below the vector n β u ′(y) for all n > 0, as noted in Lemma 1 above. A key component in our analysis is to show we can always find an endowment w which positions the cost curve u ′(w − ν n) above n β u ′(y) for all n.

Consider now an unexpected, permanent negative shock to the first period endowment (leaving y > 0 unchanged), with a new endowment \(w^{\prime } <\hat {w} (y)\). The existing compact breaks down due to the fact that at the new endowment, w ′, the marginal cost in utility terms of the original transfer α ∗ exceeds the marginal benefit, i.e., u ′(w ′− ν n ∗− α ∗) >n ∗ β u ′(y + α ∗ n ∗).Footnote 16

Unfortunately, the new endowment w ′ is such that an alternative optimal family compact, one with a new transfer α ′ > 0, will not attain. The argument follows along the lines outlined in Lemma 1. We depict the new marginal cost curve associated with w ′ as the dotted curve to the left of the dashed curve associated with endowment \(\hat {w}(y)\). Condition (11) is met at a lower child rearing decision n ′, as shown at point C in Fig. 2. But at n ′, the marginal benefit of an infinitesimal transfer (the length of the line segment from the horizontal axis to D) is smaller than the marginal cost C. Initiating any stationary transfer with α ′ > 0 shifts the marginal cost curve even further left of the dotted curve, while the marginal benefit curves both shift to the right of their dashed counterparts. In particular, any curve depicting the marginal benefit of transfer α ′ lies below the curve n β u ′(y); consequently, there is no point n where (10) and (11) hold simultaneously with equality under endowment w ′.

In Appendix D, we account for cases where \(-\nu u^{\prime \prime } \left (\hat {w}(y)-\nu \hat {n}(y)\right ) \neq \beta u^{\prime } \left (y\right ) \). There, we establish that we can find an endowment \(0<\tilde {w} \left (y\right ) <\hat {w}(y)\) and a child decision \(\tilde {n}\left (y\right ) \) such the cost curve is repositioned in such a way as to make

and

hold. This new cost curve \(u^{\prime } \left (\tilde {w}\left (y\right ) -\nu n\left (y\right ) -\alpha \right ) \) lies everywhere above the marginal benefit curve n β u ′(y + α n) for any α > 0. It then follows for any permanent shock to first period endowment w ′ with \(w^{\prime } <\tilde {w}\left (y\right ) \) will nullify the existing compact as well as prevent any new family compact from emerging.

3.4.2 Introducing a public system

We turn next to the public pension system. We enquire if an optimal PPS can be initiated to replace the collapsed private compact. To that end, set α ≡ 0 in (17) above; the optimal public pension then satisfies

where n satisfies

Note that in writing (21), we have used the fact that the future pension transfer is public and taken as given by the agent when deciding on fertility. In short, under a public system, children are no longer investment goods.

Clearly, by construction, when \(w=\hat {w}(y), \) the compact breaks down and hence, it follows from (10) − u ′(c) + β n(τ)u ′(x) < 0. Since n ′(τ) ≤ 0, (20) holds with strict inequality for any τ > 0 whenever \(w<\hat {w}(y), \) similar to the case with private pensions, as shown in Fig. 2. Therefore, optimal τ = 0. Formally,

Proposition 5

Suppose \(w\leq \hat {w}(y)\) . Then an optimal public pension system with τ > 0does not attain.

Essentially, when w falls to \(\hat {w}, \) a middle age agent can no longer make transfers to her parent and have enough remaining resources to consume and raise children of her own. At that point, the middle age agent abandons the investment-utility benefit of the compact in favor of the direct consumption-utility of having children.Footnote 17

Summarizing, we have shown that a publicly funded pension system does not provide additional support if an optimal private family compact is in place—indeed, introducing such a system can even lower welfare in the steady state. A family compact can perform well, but it may break down in the presence of large, permanent shocks to agents’ incomes. While this may seem to provide an ideal time for the introduction of a publicly funded pension system, we find the conditions that prevent families from starting a new, albeit less-generous family compact, also prevents an optimal, public pension system from starting up.

Two important caveats to our discussion must be noted. First, implicitly, we and others envision that a FC can be initiated costlessly at any point in time. Consider, for example, a family compact initiated under a steady-state environment with lifetime endowment profile (w,y), where \(w>\hat {w}\left (y\right ) \). At some date T, there is an unexpected and perceived-to-be-permanent negative shock to w, similar to the kind we described in Proposition 4, but with \(\hat {w}\left (y\right ) <w^{\prime } <w\). Since the endowment, w ′ is above the threshold endowment \(\hat {w}\left (y\right )\), agents are amenable to intergenerational transfers, but not specifically the one directed by the original FC. In such a situation, the new environment would usher in a new compact, one that reflects the new endowment profile, and, as we have stated, this new compact would be preferred to a PPS. We have assumed—in keeping with the literature—that abrogating the original compact and starting anew is costless.Footnote 18 However, if replacing an existing compact with a new one is sufficiently costly, agents, in this circumstance, may certainly prefer a PPS (fiscal externality and all) over continuing the FC under the terms of the original compact. This presumes there is political will to tailor a PPS to the current economic environment, which does happen in practice (for example, during the Great Recession, the US government reduced the rate of employee contributions to Social Security). Additionally, in practice, a government may be able to tap additional sources of revenue outside the PAYG system in times of economic stress, while similar sources are limited or unavailable to a FC.

Our other caveat restricts the applicability or scope of Proposition 5, but also points to the need for “redistributive” elements to be introduced in the PPS. Right at the onset, note that Proposition 5 works off the assumption that all agents within a generation are identical: if any one agent suffers a permanent hit to w, then all do, and therefore if any one abandons the FC, they all do. By way of contrast, consider briefly an otherwise similar environment except the shock to w is unanticipated, idiosyncratic, and uninsurable: a fraction ϕ of the agents see their endowment fall below \(\hat {w}(y), \) the rest do not. All else same, the intuition from Proposition 5 would suggest that a fraction ϕ of middle-aged agents would abandon the FC and deny their parents the transfer, while the remainder would continue to honor existing compacts. Heuristically, one expects that a suitably designed PPS that taxes those whose compacts are thriving and transfers to the parents of those who were abandoned by their children could improve matters.Footnote 19 This is precisely the redistributive element that our formulation of the PPS is missing. Put differently, our sparse analysis with homogeneous agents brings to center stage the exact margin on which the need for “redistributive” elements critically enters PPS design.

4 Agent heterogeneity

Introducing agent heterogeneity of the type described immediately above into our existing model of family compacts is not simple. For one, the modeling must contend with any differences in fertility that arise from differences in agents’ income, accumulated wealth, and family lineage. Second, in the presence of income uncertainty, one can envision a more sophisticated family compact than what has been laid out, one which makes provisions for state-contingent payments to parents.

Both are important, but lie well outside the scope and intent of this study. We can, however, draw insight into how agent heterogeneity considerations may matter by examining a small modification of our existing model which allows us to highlight a fundamental role of a public system suggested immediately above: redistributing income in the presence of agent heterogeneity. At a broad level of generality, we can think of agent heterogeneity and its attending implications for intergenerational transfers along the dimension of ease of compact creation, a friction. This friction could take the form of infertility—the inability to have children who will continue honoring a compact one honored for one’s parents. It could also be interpreted as a matching problem, an inability to find a mate with whom one enters into a child-bearing arrangement. The specifics of the friction are of second-order importance; what is crucial for us is that the environment spurs some individuals to break from the family line and its obligations while others do not. It is here that a PPS can potentially help improve matters.Footnote 20

To pin ideas using a specific friction, consider the possibility that a fraction of the population is born infertile or cannot match with someone of the opposite gender for the purposes of child bearing. This, along with the lack of inter-agent altruism (a hallmark of the Cigno framework), means the FC will only service matched/fertile agents; infertile agents will not pass along a transfer to their parents because they will not get a transfer from anyone in the next generation. Though one could envision a more elaborate FC that requires fertile children to pass on transfers to infertile elderly siblings of their parents, the originator of such a compact faces a very subtle constraint, as mentioned in the previous section: at any point in time, a compact that makes such provisions for the infertile or unmatched can be replaced by one that sidesteps them entirely and provides support only for their parents.

Our presentation is motivated by Cigno et al. (2017) and is kept deliberately stark and stylized to keep the analysis tractable; more elaborate modifications are studied via numerical examples further below in Appendix F.4. In what follows, we lay out a simple framework, which, while removing much generality, allows us to focus on a setting where:

-

(a)

a public pension plays a vital role in improving the lot of the elderly by supplying insurance for infertile agents, and

-

(b)

public subsidies to fertile agents for the rearing of children increases the overall utility of agents (similar to parts of Cigno’s (2010) proposal for pension reform).

Along the way, we also consider the desirability of incorporating a substantive redistributive element into the public pension scheme.

The general terrain we lay out here turns out to be unfavorable to a public pensions system a priori (indeed, if heterogeneity was absent, a public system would not be desirable). Yet, this feature alone takes us beyond the pension-only environment described heretofore, thereby creating a potentially welfare-enhancing role for a publicly supported system. (At the end of this section, we comment briefly on a modification of the existing family compact which, if implemented, may undermine that role, even in this alternative environment).

4.1 Matching, infertility, public pensions, and family compacts

Inspired by Cigno et al. (2017), suppose at each date t, t ≥ 1 there is a cohort of middle age females and of males, of equal size, \( {N_{t}^{m}}\). At the start of her/his middle age, each learns of her/his match/fertility status: a fraction φ, 0 < φ < 1 of the population cohort will be matched with another member of the cohort of the opposite sex, the remainder, 1 − φ are unmatched. Of the fraction that is matched, ξ percent will be fertile and 1 − ξ are infertile. Let π ≡ φ ξ. The number of middle age agents at t (consisting of all females and males), \( N_{t}= 2{N_{t}^{m}}, \) will then consist of \(\pi {N_{t}^{m}}\) fertile couples (a total of \(2\pi {N_{t}^{m}}\) individual agents), π(1 − ξ)/ξ \({N_{t}^{m}}\) infertile couples (total 2π(1 − ξ)/ξ \({N_{t}^{m}}\)) and \(2\left (1-\pi /\xi \right ) {N_{t}^{m}}\) unmatched agents.

Since our focus is not on the joint decision-making of the household per se, we adopt a convention that matching simply gives agents access to child bearing, and that within a match, agents act similar to individual decision-makers rather than as a collective unit.Footnote 21

Parents, when choosing n t , know the procreation odds for their offspring and its consequences for the compact, and incorporate these into their decision-making. Since n is a continuous choice variable, the parent faces no uncertainty regarding the continuation of the compact: specifically, each parent at t knows ex ante that π n t of their children—the fertile ones that are matched—will ex post honor the compact, while the remainder, (1 − π)n t will not.

We continue to assume there are no private saving instruments—only a FC and a PPS may be used. With no private saving instruments, no FC and no PPS, unmatched agents and infertile couples are faced with low levels of consumption when old. Since any agent can be infertile or unmatched, the steady-state ex ante utility of a typical agent can be higher with PPS than without. While a PPS can tap the entire population of middle age agents as a tax base—the FC is restricted to fertile couples only—the PPS also comes with an expanded set of beneficiary recipients. Ultimately, since both the public and private pension systems rely on the population growth rate, we explore, by way of numerical examples, the possibility of using some public funds to support the rearing of children. By earmarking a portion of the tax proceeds obtained from those middle age agents that cannot have children and giving it to those that can, in the form of child-rearing subsidies, the state acts as a conduit for the former in obtaining higher yielding returns (via pensions), which rely on a high rate of procreation in order to be viable—exactly what the subsidies are intended to deliver.

4.1.1 Model setup

Middle age agents learn their match/fertility status prior to making any decisions which are, mutatis mutandis, the same as in the previous section. Of course, for infertile couples and unmatched agents, 𝜃 = 0 and hence n t = 0 and, as noted, with no altruism, they choose to pass nothing along to their parents.

Anticipating what lies ahead, we set up the problem facing these agents in a general way in order to facilitate a smoother discussion of the case with PPS and subsidizing child rearing. We also entertain the possibility of redistributive pension payments. Specifically, the cost of raising children is λ ν n t . The parameter, λ, 0 < λ ≤ 1, captures a public subsidy to child rearing; public subsidies reduce the cost of raising a child by (1 − λ)ν. As previously, τ denotes the tax levied on each middle age person, and b (b ′) be the transfer to the fertile (infertile and unmatched) old.

This variation of the model requires small modifications in the definitions we used earlier

- Definition 1 ′ :

-

For any y > 0, define \(\hat {n}(y)\) as the value of n such that n β u ′(y) = (𝜃/λ ν)g ′(n).

- Definition 2 ′ :

-

Define \(\hat {w}(y)\) as the value of w such that \(u^{\prime } \left (w-\nu \hat {n}(y)\right ) =\pi \hat {n}(y)\beta u^{\prime } \left (y\right ) \).

Given these definitions, we assume as we did above, \( w>\hat {w}(y)\).Footnote 22

4.1.2 The agents’ problems

The basic workings of this variation of the model are similar to what we encountered above. Given the compact parameters (α t ,α t+ 1) and tax/transfers (τ,b), an agent (female or male) in a fertile match chooses n t to maximize

Assuming an interior solution for n t , we have

which, mutatis mutandis, is the same as (2).

Unmatched agents and agents in an infertile marriage, on the other hand, are reduced to consuming their endowment plus/minus the tax or transfer they receive from the government. Their utility is given by

4.1.3 The optimal family compact and public pensions

Using (22), n in a steady state satisfies

Given (23) and the envelope theorem, the progenitor of the family compact sets α such that

which is comparable to (10) with equality.

The government’s plan satisfies the following budget constraint. As noted above, N t denotes the number of middle age agents (female and male) at date t, of which π will turn out to be fertile/matched. Each chooses to have n t children at date t, so N t+ 1 = π n t N t . The government, at date t + 1, levies a tax τ on each of these N t+ 1 agents. It disburses a portion b π N t to those elderly with children and b ′(1 − π)N t to those without; the rest is disbursed as a per-child-rearing subsidy of (1 − λ)ν, to each of the π fertile/matched middle age agents at date t + 1.Footnote 23 We have

Since N t+ 1 = π n t N t , (25) can be rewritten as

and at the steady state,

4.1.4 A basic PPS

We begin with a study of a program sans differences in old age payments, (b ′ = b), and child rearing subsidies (λ = 1). From (26), we have b = π τ n. The government’s objective is to choose τ to maximize

where U f(τ) is a fertile/matched agent’s indirect utility, u(w − α − τ − ν n) + 𝜃 g(n) + β u(y + α π n + π τ n) and n and α satisfy (23) and (24). Similarly, U i,n(τ) is the indirect utility of an infertile or unmatched agent, u(w − τ) + β u(y + π τ n).

Differentiating, we have

where we have incorporated the envelope theorem and (24) in writing (27). The first term in (27) is the net benefit incurred by infertile agents from a marginal increase in the tax rate, τ, holding constant fertility n. The second term, which is negative for any τ > 0, is the indirect utility cost to both fertile and infertile/unmatched agents, which is incurred from raising τ and its negative effect on n (and hence, on public transfers b).

Note, \( \lim \limits _{\tau \rightarrow 0}U^{\prime } \left (\tau \right )=-\left (1-\pi \right ) \left [ u^{\prime } \left (w\right ) -\pi n\beta u^{\prime } \left (y\right ) \right ] \). Since \(n>\hat {n}(y)\) (see Fig. 2), this limit is positive, given the concavity of u(⋅) and the assumption \(w>\hat {w}(y);\) i.e., \( u^{\prime } \left (w\right ) <u^{\prime } \left (\hat {w}(y)-\nu \hat {n}(y)\right ) =\pi \hat {n}(y)\beta u^{\prime } \left (y\right ) <\pi n\beta u^{\prime } \left (y\right ) \). Formally, we have

Proposition 6

Introducing a public pension in an environment with infertility can increase the ex ante welfare of agents in a steady state.

On a close examination of (27) it is clear that the optimal PPS is interior (assuming, of course, the second-order condition holds). It balances the beneficial effect of the tax (and hence the transfer) on infertile agents against the negative impact on fertility and its indirect implications has on the size of the transfer (b = π τ n, i.e., π τ d n/d τ), an effect that impacts all agents, not just the fertile. Additionally, a PPS that is too ambitious could depress fertility so much as to hurt everyone.

Finally, in the previous section, we discussed the possibility a large, unexpected shock could destroy an existing FC and prevent the installation of a new compact (Proposition 4). Despite this, an optimal PPS cannot emerge as a replacement. This result breaks down once we allow for agent heterogeneity, as we show below. Before doing so, we introduce the following definition.

- Definition 3 :

-

For a given w, define n(w) to be the value of n such that u ′(w − ν n) = (𝜃/ν)g ′(n).

Note that for any \(w\leq \hat {w}(y), \) we have (𝜃/ν)g ′(n(w)) ≥ (𝜃/ν)g ′(n(y))) → n(w) ≤ n(y) by the concavity of g(⋅).

Proposition 7

Assume i) \(w\leq \hat {w}(y)\) and ii) β π n(w)u ′(y) > π u ′(w − ν n(w)) + (1 − π)u ′(w) > 0.Introducing a public pension in this environment with matching and fertility heterogeneity can increase the ex ante welfare of agents in a steady state even if family compacts can no longer thrive. Footnote 24

The proof the proposition is in Appendix E. As in the case where there is an active FC, fertile/matched agents bear the net burden of implementing a PPS, while the infertile/unmatched reap the benefit. In the present case, a PPS may emerge despite the fact the shock hits all first period endowments, simply because the infertile/unmatched do not incur the costs of raising children and still prefer a transfer when old. This in turn suggests a PPS may choose to initiate subsidies to childrearing (paid by all middle age agents but chiefly redirecting resources from the infertile/umatched to those fertile and matched) in order to lower the effective cost of raising children and increase the fertility rate, which raises the rate of return of the public system and benefits everyone in old age.

4.2 Discussion

To summarize, in the present setting, the traditional public system cannot be sustained in this economy without the presence of the private system. However, public funds can enhance the family compact by subsidizing the cost of rearing children, hence raising n. The PPS also provides old-age support for those who, through no fault of their own, receive no support from private system. Not surprisingly, the more redistributive the public system is, the greater fertile/matched agents must rely on the family compact, and optimal n rises.

Our analysis of the shut-down of the FC relies on identifying a threshold value \(\hat {w}\left (y\right ) \) such that the optimal compact α ∗ = 0. It is easy to amend the analysis of the setting of this section by postulating that the fertility/match parameter π depends on w, i.e., π(w), and establish a new threshold \(\breve {w}\left (y\right ) \).Footnote 25 If \(\breve {w}\left (y\right ) >\hat {w}\left (y\right )\), then this would mean that the shock to income would not have to be as large as before to disband the FC. Analogously, a condition must be met to insure that introducing the PPS will improve welfare, and that condition will depend on π(w).

Before closing this section, a few additional caveats are in order. While a public pension system is a convenient vehicle by which to provide the kind of insurance we describe here, conceivably, enhanced private systems may provide similar outcomes. First, one could envision a private insurance market where middle age agents—before learning their fertility/match status—enter into binding contracts with a private issuer against the possibility of infertility or not mating. Upon learning their fertility/match status, fertile, matched agents are offered a partial rebate based on the number of children they have (much like the public subsidy to childbearing). The remaining proceeds from sale of the insurance contracts are then passed along to the current old. Future insurance outlays to the old are then financed out of proceeds from the sale of new insurance contracts to the subsequent generation of middle age agents, in much the same (Ponzi) way public pension systems work.

Absent such an insurance market, an enhanced version of the private pension system may be reworked to provide partial insurance to the infertile/unmatched in their old age. As we have described it, the progenitor of our private pension system chooses a stationary sequence of transfers to maximize the steady-state welfare of participants of the private pension system. In what we describe above, a portion of the progenitor’s children will be infertile/unmatched and will opt out of that system, since they themselves will not receive a transfer when they are old. As noted, the progenitor could stipulate the fertile couples to make transfers to their parents (as well as the parent’s infertile/unmarried siblings); however, as we argued above, such a compact could be replaced by one more preferred by fertile/matched middle age agents which does not require any transfers to the infertile and unmarried elderly.

Nevertheless, there is nothing to prevent an enlightened progenitor from stipulating both the fertile and infertile/single middle age agents to make transfers to parents and all elderly relatives.Footnote 26 That raises a philosophical question: where does one draw the line between such a family compact and a bonafide public pension system? One clear advantage the PPS has over the private here is that it can extract, by law, such transfers from all middle age agents, not just fertile/matched ones. It works by “severing the link between persons’ economic status in old age and their fertility behavior...” [Demeny 1989].

5 Conclusion

In this paper, we examine the workings of a family pension system, one where children provide support for their elders in exchange for future pension care from their offspring. This system resembles institutions in place prior to the emergence of support for the elderly through publicly funded pension systems in the late 19th and early 20th centuries. Our results suggest that, in the baseline model with no heterogeneity, family compacts work fairly well, so much so, they preclude the introduction of pay-as-you-go pension system. Moreover, if a large income shock dissolved the family compacts, no benevolent government could usher in a public pension program in their place, unless it brought in redistributive elements. We then go on to show in a simple modification of our benchmark model—one that allows for differences in childbearing status—a welfare-enhancing role for a public pension system emerges; such systems may flourish even when family compacts cannot. This sheds some light on the way US social security was marketed to the American public by President Roosevelt, strictly as a pension program, even though the program itself had strong redistributive intentions right from its inception.

Situations of family dissolution, such as migration, may also lead to nullification of existing compacts. A simple (abstract) way of thinking about this is a situation in which children, for some reason, can no longer identify and make transfers to their own parents (the gift giving equilibria break down, due to lack of memory). Here, of course, forced transfers via PPS may be desirable. Alternatively, as in Hirazawa, Kitaura, and Yakita (2014), there may be redistribution from the childless to those with children as it pertains to contributions for PPS. Such redistribution may end up benefitting those with children. This potential also emerges in our example in Section Appendix F.4.

One final component, not present in the current discussion, is mortality. Fuster, İmrohoroğlu and İmrohoroğlu (2003) for example, stress the importance of mortality when considering the welfare effects of an unfunded social security program in a model with two-side altruism. In our case, the possibility of a child’s death before reaching adulthood creates additional cost for both a family compact and a government-sponsored social security scheme. Within a family compact, this cost is internalized; one can treat it analogous to a decrease in the return to children as an investment good. In a world in which old-age security is provided solely through PPS, and agents view children only as consumption goods, the possibility that a child may die before reaching adulthood has no direct impact on agents’ fertility decisions; indirectly, however, it will affect the size of the available pool of middle age agents from which to tap for contributions to the system, and, hence, the size of the PPS transfer to each old agent. The mortality of agents from mid-age to old has much different ramifications. In a world with only family compacts, the premature death of a parent frees her children from the obligation of the transfer stipulated under the compact. In such a setting, those whose parents died early will choose to have more children than those whose parents survived, thereby creating an endogenous distribution of fertility. By contrast, under a pure PPS, there is no difference in fertility across agents since fertility is no longer tied to a family transfer obligation. Moreover, the public system can exploit the fact that some middle age agents will contribute into the program but not be around to receive any benefits. Precisely how mortality figures into our comparison of these two systems is an avenue worthy of further study.

It would be very interesting to study the political economy of introducing a PAYG public scheme with singular focus on the inaugural date. How would the politics be influenced by the presence or absence of FCs? That is a fascinating issue that is outside the scope of the current paper. A limitation of our analysis is also revealed here: there is no analysis of dynamics inside the FC, we only study the steady state and hence our comparison with a PPS is restricted to steady states, and not along the transition. These are deeper issues worthy of further exploration.

Notes

Clearly, a compact could stipulate that infertile young provide a transfer in exchange for transfers from fertile and infertile young of the next generation. But then, at what point does one draw the line between such a comprehensive FC requiring transfers to all elderly relatives over extended family lines and a PPS?