Abstract

Considering the financial markets and investor’s desire to reallocate wealth among the existing holding assets, in this study, we propose a mean-semi-entropy portfolio adjusting model, in which semi-entropy is employed to measure the downside uncertainty of portfolio. Transaction costs that are induced in the adjusting process are taken into account in model formulation to better trade off between risk and return.The calculation of semi-entropy is simplified by approximately converting it into fitting functions, and numerical analyses demonstrate that a polynomial one is the best approximation after comparing the fitting performance and complexity. To solve the model, the return of risky assets are captured by triangular fuzzy variables. By introducing a risk-averse factor, the proposed mean-semi-entropy portfolio adjusting model is transformed into a deterministic programming program which can be easily solved. Finally, numerical experiments with real data are provided to illustrate the effectiveness of the proposed model and results show that the adjusted portfolio is distributive which is required by investors in practice.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

Modern portfolio selection as one of the classical problems in finance domain is originated from mean-variance model proposed by Markowitz (1952), aiming to obtain an appropriate portfolio by a reasonable trade-off between high return and low risk. Since then, numerical studies based on the mean-variance methodology have been conducted and applied to the reality. In the previous models, the return of a financial asset is characterized as a random variable with corresponding probability distribution and there is a default assumption that the performance of asset markets in the future can be reflected by historical data. The mean is employed to measure the investment return and the variance of the return of a portfolio is applied as a risk measure. Also, semivariance (Markowitz 1993) and semiabsolute deviation (Speranza 1993) was developed to measure real investment risk in financial market.

However, if there is lack of enough data about asset returns to estimate the necessary parameters such as the mean and variance, these probabilistic approaches may be invalid. Further, it is argued that portfolio selection under financial environment often subject to vagueness and ambiguity, and it is more reasonable to capture asset returns with fuzzy variables. In fact, many researches extended Markowitz’s probabilistic mean-variance model to fuzzy environment in different ways, such as Inuiguchi and Tanino (2000); Carlsson et al. (2002); Huang (2007, 2010); Trybuła and Zawisza(2019); Chen et al. (2020); Mehlawat et al. (2020), and among others. Another feasible way to estimate asset returns is given by experts based on their subjective evaluations. Liu and Liu (2002) proposed the credibility theory in which credibility measure is self-dual. and each fuzzy variable is characterized by a credibility distribution in a similar way in probability theory. In addition, Liu (2007) proposed the concept of uncertainty measure and founded uncertainty theory in Liu (2010), in which uncertain programming for solving uncertain optimization problems involving uncertain variables was also introduced. Huang (2011) proposed a mean-risk model for uncertain portfolio selection. Liu and Qin (2012) introduced semiabsolute deviation for downside risk measure and characterized asset returns as asymmetric and uncertain. Li and Qin (2014) presented interval portfolio selection models by capturing the asset returns with interval expected returns as uncertain variables. Li et al. (2020) proposed the calculations of the product of positive L-R fuzzy numbers and its practical application to fuzzy portfolio selection problems. In this paper, credibility measures are employed to describe the fuzzy returns of risk assets and fuzzy semi-entropy is used as a downside risk measure of a portfolio.

Real financial markets are always changeful, which means that the returns of risky assets may change after a period of time and an existing holding portfolio may not be efficient. In addition, investors may be fond of other kinds of investment choice with varied holding capital. Considering this volatility, investors often prefer to periodically adjust their current portfolio during the investment horizon for better investment gains. Common practices includes buying or selling a risk asset, involved with transaction costs, which was suggested as the main concern for portfolio managers by Arnott and Wagner (1990). During the adjusting process, the transaction cost is a V-shaped function of difference between a adjusted portfolio and the existing portfolio, and investor’s buying and selling operation will both incur transaction costs. Many researchers are dedicated to developing portfolio adjusting models for this issue in stochastic environment and fuzzy environment. For example, Fang et al. (2006) proposed a portfolio rebalancing model by considering transaction costs on fuzzy decision theory. Zhang et al. (5) employed credibility measures and presented a portfolio adjusting optimization model. Yu and Lee (2011) studies portfolio rebalancing problem by using multiple criteria. Huang and Ying (2013) characterized returns of risky assets by experts’ evaluations and proposed risk index based models for portfolio adjusting problem. Zhang et al. (2011) further considered portfolio adjusting problems with added assets and transaction costs based on credibility measures. Woodside-Oriakhi et al. (2013) introduced mean-variance portfolio rebalancing model with a stochastic approach and an investment horizon. Besides, investors have other choices for portfolio adjusting in real financial markets, such as lending or borrowing a less risky asset at varied interest rates.

The main contributions of this study are summarized as follows:

-

(1)

This study discusses a portfolio adjusting problem with transaction costs by using uncertainty measures. Asset returns are descried with fuzzy variables in the portfolio adjusting modeling process, with the consideration of the volatility, vagueness and complexity of financial markets.

-

(2)

Semi-entropy is proposed as a downside risk measure to substitute variance or semivariance in traditional studies, and the expected value is employed for investment return measure. The concept of semi-entropy is inspired by the good performance of using entropy and downside risk measures (i.e., semivariance, semideviation) for portfolio selection modeling. Semi-entropy practically focuses the main part of risk (downside) for investors when assembling a optimized portfolio. Numerical analysis methods are employed for the simplifying the calculation of semi-entropy by approximately converting it into several fitting functions and a polynomial one is finally selected after comparing their fitting performance and complexity.

-

(3)

The proposed mean-semi-entropy portfolio adjusting model is transformed into a deterministic programming problem by introducing a useful risk-averse factor.

-

(4)

Experiments with real data are given to illustrate the effectiveness of the proposed model and the obtained results show that the adjusted portfolio is distributive.

The remainder of the paper is organized as follows. Section 2 gives the definition of semi-entropy and some examples, and simplifies the calculation of semi-entropy by approximately converting it into several fitting functions using numerical analysis methods. Section 3 formulates a mean-semi-entropy portfolio adjusting model with transaction costs taken into account, in which the returns of risk assets are characterized as fuzzy variables. Besides, the calculation of the semi-entropy of fuzzy variable is simplified by approximately converting it to a fitting polynomial function using numerical analysis methods. Finally, in Section 4, numerical examples are given to illustrate the effectiveness of the modeling idea. Some concluding remarks are given in Section 5.

2 Semi-Entropy

This section introduces the definition of semi-entropy and the calculation of semi-entropy for several different types of fuzzy variables. The fundamental knowledge about credibility theory can be found in the Appendix.

Definition 1

(Zhou et al. 2016) Suppose that ξ is a continuous fuzzy variable with credibility function ν(x) = Cr{ξ = x} and finite expected value e. Then its semi-entropy is defined as

where \( S(t)=-t\ln t-(1-t)\ln (1-t) \) and

Theorem 1

(Zhou et al. 2016) Let ξ be a continuous fuzzy variable with finite expected value e. Then for any real numbers a ≥ 0 and b, we have

Example 1

Let ξ = (a, b) be an equipossible fuzzy variable with credibility function ν(x) = 0.5 for all x ∈ [a, b] and expected value e = (a + b)/2. Then it has been proved that the semi-entropy is \(((b-a)\ln 2)/2 \).

Example 2

Let ξ = (a, b, c) be a triangular fuzzy variable with credibility function

and its expected value e = (a + 2b + c)/4. Denote ρ = (2b + c − 3a)/8(b − a) and τ = (3c − 2b − a)/8(c − b). Then its semi-entropy is

Especially, if ξ is a symmetric triangular fuzzy variable with b − a = c − b, then its semi-entropy is Sh[ξ] = (b − a)/2.

Considering that the computational complexity when using semi-entropy in (4) as a downside uncertainty measure in practical optimization problems (i.e., portfolio adjusting problem), we approximate it with fitting functions using the numerical analysis methods.

Define \( F(x)=x^{2}\ln x-(1-x)^{2}\ln (1-x) \), 0 ≤ x ≤ 1. The problem is to find a suitable fitting function to approximately substitute F(x). There are several different fitting functions provided by numerical analysis, including Fourier function, Sine function and Polynomial function. The performance of the fitting function is evaluated by some measure indicators, such as sum of squares error (SSE) and R2. SSE and R2 describe how well the fitting function matches the given data set. SSE measures the total deviation of the response values from the fit \( \widehat {y}_{i} \) to the response values yi, and is employed to reflect the influence of random factors and show the difference between the given data set and the fitted function. The following equation describes the SSE

where ωi is the weight for data samples, R2 is a quantitative representation of the fitting level with a value closer to 1 indicating a better fit, which is described by

where \( \overset {-}{y}_{i} \) is the mean value of \( \widehat {y}_{i} \). When the data samples exactly fit on the fitted curve, SSE equals 0 and R2 equals 1, and when some of the data samples are outside of the fitted curve, SSE is greater than 0 and R2 is less than 1.

Additionally, it is usually assumed that the response errors follow a normal distribution, and that extreme values are rare. Still, extreme values called outliers do occur. Outliers have a large influence on the fit because squaring the residuals magnifies the effects of these extreme data points. To minimize the influence of outliers, we fit the polynomial using the method of robust least absolute residuals (RLAR), which finds a curve that minimizes the absolute difference of the residuals, rather than the squared differences by the traditional least Square (LS). Therefore, extreme values have a lesser influence on the fit.

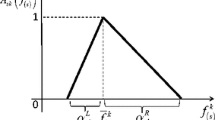

We randomly segment interval [0,1] into 251 parts, and use the curve fitting tool of MatlabR2013a to obtain the approximate functions of F(x). Fitting functions of F(x), including three different fitting types (Fourier, Sine and Polynomial), are then obtained (see Table 1), from which we have three well-performed candidates (with SSE ≤ 1.000e− 3, R2 ≈ 1) marked in bold font. Since we aims to using the semi-entropy for modeling the portfolio adjusting problem, the construction and calculation of the model should be as simple as possible. Selecting fitting functions of Fourier or Sum of Sine forms as the approximation function of F(x) may cause new complexity for further model optimization, thus it is more reasonable and practical to select polynomial 1.518x3 − 2.278x2 + 0.7431x + 8.059e− 3 with acceptable fitting performance (see Fitted Polynomial (1) in Fig. 1).

Let ξ = (a, b, c) be a triangular fuzzy variable with finite expected value e. Denote M(x) = 1.518x3 − 2.278x2 + 0.7431x + 8.059e− 3. Then the semi-entropy of a triangular fuzzy variable ξ = (a, b, c) with finite expected value e can be written as

where ρ = (2b + c − 3a)/8(b − a) and τ = (3c − 2b − a)/8(c − b).

3 Mean-semi-entropy portfolio adjusting with transaction costs

In this section, we consider the problem of finding the optimal portfolio when adjusting the existing portfolio in the presence of transaction costs, and propose a mean-semi-entropy portfolio adjusting model. Suppose that the investor starts with an existing portfolio \(\widehat {\boldsymbol {x}} = (\widehat {x}_{1},\widehat {x}_{2},\cdots ,\widehat {x}_{n})\), where \(\widehat {x}_{i}\) is the current holding of risk asset i, n is the existing number of risk assets owned before. Due to changes of financial markets and capital, the investor decides to adjust his/her portfolio by rebalancing the return and risk. In order to describe conveniently, we use the following notions:

- ξi::

-

future return of i th risky asset as a fuzzy variable, i = 1, ⋯ , n

- \(\widehat {x}_{i}\)::

-

holding proportion of asset i before adjusting

- xi::

-

holding proportion of asset i after adjusting

- \(x_{i}^{+}\)::

-

buying proportion of asset i

- \(x_{i}^{-}\)::

-

selling proportion of asset i

- pi::

-

price of asset i

- \( \widehat {\Upsilon } \)::

-

total number of holding shares before adjusting, a positive integer

- ϒ::

-

desired total number of holding shares after adjusting, which is an positive integer given by the investor

- di::

-

unit transaction cost for buying risky asset i

- si::

-

unit transaction cost for selling risky asset i

- \(\widehat {\mu }\)::

-

the minimum expected investment return.

Obviously, both \(x_{i}^{+}\) and \(x_{i}^{-}\) are non-negative, and di, si > 0 for i = 1, 2, ⋯ , n. After adjusting, the holding proportion xi should satisfy the equation \( x_{i}= \widehat {x}_{i}+x_{i}^{+}-x_{i}^{-}\) with \( x_{i}^{+},x_{i}^{-}\geq 0 \), i = 1, 2, ⋯ , n. For avoiding remarkable fluctuation of portfolio after adjusting, we set bounds on the assets proportion. Let li and μi be the lower and upper bounds of proportion on the i th risky asset after adjusting. Then the constraint can be expressed as li ≤ xi ≤ μi, i = 1, 2, ⋯ , n.

During the adjusting period, for saving cost, the investor should balance between buying an asset and selling it. Thus, the constraint \( x_{i}^{+}x_{i}^{-}=0 \) for i = 1, 2, ⋯ , n should hold. Without loss of generality, we assume that di, si > 0 for i = 1, 2, ⋯ , n. The adjusting cost associated with asset i consists of two parts: buying cost \( d_{i}x_{i}^{+} \) and selling cost \( s_{i}x_{i}^{-} \). Then the total transaction cost incurred by adjusting the existing portfolio is \( {\sum }_{i=1}^{n}(d_{i}x_{i}^{+}+s_{i}x_{i}^{-}) \). After rebalancing and paying the transaction costs, the net return of the portfolio x = (x1, x2, ⋯ , xn) is

For convenient description in the following paper, we denote \( f(\boldsymbol {x},\boldsymbol {\xi })={\sum }_{i=1}^{n}\xi _{i}x_{i} \). Under the Markowitz’s mean-risk principle that the best portfolio can be selected by maximizing the investor’s return at a given expected level or minimizing the risk level with acceptable investment return. In this paper, we employ the expected value of Rp to quantify the investment return and the semi-entropy of Rp to measure the risk. By Theorems 1 and 2, the expected value and semi-entropy of Rp are

and

respectively.

It has been recognized that the future returns and risks of risky assets are difficult to predict accurately. Traditionally, in many early studies, the estimation of the possibility distributions of return rates on risky assets may be easier than the probability distributions. But considering the vagueness and ambiguity in the investment environment and that the investors? subjective opinions are very important in making portfolio decision, it is better to handle the returns and risks of assets using fuzzy approaches. Discussing the portfolio adjusting problem under the assumption that the returns of the assets are fuzzy variables is useful and meaningful. In this paper, we assume that the returns of assets are triangular fuzzy variables in the following discussion.

Suppose that ξi = (ai, bi, ci) (i = 1, 2, ⋯ , n) are all triangular fuzzy variables with finite expected values ei = (ai + 2bi + ci)/4. According to the fuzzy arithmetic operations, \( f(\boldsymbol {x},\boldsymbol {\xi })={\sum }_{i=1}^{n}\xi _{i}x_{i} \) is also a triangular fuzzy number, denoted as

According to Example 2 and Eq. 5, we have

and Sh[f(x, ξ)] =

where

For portfolio selection problems, the wealth flow balance during adjustment must be satisfied (Takano and Gotoh 2014). When we assume that the whole investment process is self-financing, that is, we neither add new fund nor take invested fund out of the existing portfolio. Before adjusting, the investor has wealth \(\widehat {\Upsilon }{\sum }_{i=1}^{n}p_{i}\widehat {x}_{i} \). Therefore, the self-finance condition can be expressed as

Denote \( \varepsilon ={\Upsilon }/\widehat {\Upsilon } \). Since pi > 0 for i = 1, 2, ⋯ , n, then we have the following self-finance constraint

Therefore, the mean-semi-entropy portfolio adjusting model is formulated as

Model (P1) aims to finding the optimal solution \( (\dot {x}_{1}^{+},\cdots ,\dot {x}_{n}^{+},\dot {x}_{1}^{-},\cdots ,\dot {x}_{n}^{-},\)\(\dot {x}_{1},\dot {x}_{2},\cdots ,\dot {x}_{n}) \), which gives a large value for E[Rp] and a small value for Sh[Rp]. Different investors have different levels of risk-aversion, and the higher the risk-aversion level is, the more conservative is the investor. We introduce a scalar parameter λ(λ ≥ 0) as a risk-averse factor to balance the quantity placed on the maximization of E[Rp] and the minimization of Sh[Rp] (equivalently, the maximization of − E[Rp]). The greater the factor λ, the more conservative is the investor. Similar program transformation approach by introducing a risk-averse factor was used in the literatures such as Zhang et al. (2012) and Zhou et al. (2016, 2017). Thus, if \( E[f(\boldsymbol {x},\boldsymbol {\xi })]\leq {\sum }_{i=1}^{n}b_{i}x_{i} \), model (P1) can be converted into a single-objective deterministic programming as

where \( \dot {\rho }={\sum }_{i=1}^{n}(2b_{i}+c_{i}-3a_{i})/8{\sum }_{i=1}^{n}(b_{i}-a_{i}) \) and \( M(\dot {\rho })=1.518\dot {\rho }^{3}-2.278\dot {\rho }^{2} + 0.7431\dot {\rho } + 8.059e^{-3} \). Otherwise, if \( E[f(\boldsymbol {x},\boldsymbol {\xi })]> {\sum }_{i=1}^{n}b_{i}x_{i} \), model (P1) can be transformed into

where \( \dot {\tau }={\sum }_{i=1}^{n}(3c_{i}-2b_{i}-a_{i})/8{\sum }_{i=1}^{n}(c_{i}-b_{i}) \) and \( M(\dot {\tau })=1.518\dot {\tau }^{3}-2.278\dot {\tau }^{2} + 0.7431\dot {\tau } + 8.059e^{-3} \).

4 Numerical examples

In this section, we illustrate our proposed portfolio adjusting model by presenting the following example. Suppose there are ten risky assets with triangular fuzzy returns shown in Table 2, which come from the study (Qin et al. 2014).

Assume that the unit buying cost di = 0.01, selling cost si = 0.02 for i = 1, 2, ⋯ ,10 and \( \varepsilon ={\Upsilon }/\widehat {\Upsilon }=0.95 \) We assume that the holding proportion after adjusting is no more than 0.3 and short selling is not allowed, which means li = 0 and μi = 0.3 for i = 1, 2, ⋯ , 10. Assume that the investor’s current existing portfolio before adjusting is \( \widehat {\boldsymbol {x}}=(0.10,0.10,0.10,0.10,\) 0.10,0.10,0.10,0.10,0.10,0.10). Therefore, with Eq. 6, the expected value of f(x, ξ) is E[f(x, ξ)] = 0.075x1 − 0.25x2 − 0.1x3 + 0.025x4 + 0.225x5 − 0.05x6 + 0.075x7 + 0.2x8 + 0.075x9 + 0.05x10. Moreover, if \(E[f(\boldsymbol {x},\boldsymbol {\xi })] \leq {\sum }_{i=1}^{n}b_{i}x_{i}=0.1x_{1}-0.2x_{2}-0.1x_{3}+0.1x_{4}+0.3x_{5}-0.1x_{6}+0.1x_{7}+0.3x_{8}+0.2x_{9}+0.0x_{10}\), according to Eq. 7, we have \( \dot {\rho }={\sum }_{i=1}^{n}(2b_{i}+c_{i}-3a_{i})/8{\sum }_{i=1}^{n}(b_{i}-a_{i})=0.4720 \), \( M(\dot {\rho })=0.2789 \) and then \( \dot {\rho }-M(\dot {\rho })=0.1931 \). The semi-entropy of f(x, ξ) is Sh[f(x, ξ)] = 0.097x1 + 0.116x2 + 0.077x3 + 0.154x4 + 0.174x5 + 0.058x6 + 0.174x7 + 0.154x8 + 0.174x9 + 0.116x10.

Then, model (P2) can be rewritten as follows

Otherwise, according to Eq. 7, if \(E[f(\boldsymbol {x},\boldsymbol {\xi })] > {\sum }_{i=1}^{n}b_{i}x_{i}=0.1x_{1}-0.2x_{2}-0.1x_{3}+0.1x_{4}+0.3x_{5}-0.1x_{6}+0.1x_{7}+0.3x_{8}+0.2x_{9}\) and \( \dot {\tau }={\sum }_{i=1}^{n}(3c_{i}-2b_{i}-a_{i})/8{\sum }_{i=1}^{n}(c_{i}-b_{i})=0.5361 \). Then we have \( M(\dot {\tau })=-0.0144 \) and the semi-entropy of f(x, ξ) can be represented by Sh[f(x, ξ)] = 0.244x1 + 0.294x2 + 0.194x3 + 0.393x4 + 0.441x5 + 0.143x6 + 0.438x7 + 0.394x8 + 0.444x9 + 0.288x10.

Then, model (P3) can be rewritten as

We solve the above-given models (P4) and (P5) by programming in MatlabR2013a, under the running environment: a Windows 7 platform of personal computer with processor speed 2.4 GHz and memory size 4 GB. The computational results of model (P4) and model (P5) with different risk-averse factors λ are shown in Tables 3 and 4, respectively, in which the last two rows show the expected return values (denoted by E) and corresponding semi-entropy (denoted by SemiH) of the optimal portfolio adjusting strategies. In order to illustrate the effectiveness of using fuzzy semi-entropy as a downside risk measure for the portfolio adjusting problem, we also compare the return frontiers of entropy and variance as risk measures (see Fig. 2), which describes positive relevance between semi-entropy, entropy and variance and illustrates that semi-entropy can be substitutively used to measure the risk of portfolio.

Additionally, we can see from it that the semi-entropy will decrease while the expected return will increase with the growing risk-averse factor λ, that is, the investor becomes more conservative. Further, we can see that the obtained portfolio after adjustment is neither nonconcentrative nor uniformly distributive, which is concordant with Markowitz’s principle of portfolio selection and preferred by the investors.

5 Conclusions

In this paper, we consider a portfolio adjusting problem in the complicated financial markets where randomness and fuzziness coexist. Asset returns are descried with fuzzy variables in the portfolio adjusting modelling process, with the consideration of the fact that financial market is full of volatility, vagueness and complexity. Semi-entropy was proposed in the latest literature as a downside risk measure to substitute variance or semivariance in traditional studies. This study employees fuzzy semi-entropy to efficiently capture the main part of risk (downside) for investors when assembling a optimized portfolio. In order to simplify the calculation of fuzzy semi-entropy, we provide numerical analysis methods to approximately convert fuzzy semi-entropy into several fitting functions, and a polynomial fitting function is selected for the best calculation approximation after comparing the fitting performance and complexity of different fitting functions. Fuzzy expected value and the polynomial approximation of fuzzy semi-entropy are employed to measure the return and risk of the assets, respectively. We present the mean-semi-entropy model for portfolio adjusting with transaction costs. By introducing a risk-aversion factor to balance between the total return and risk, the proposed model is immediately converted into a deterministic programming problem, which can be easily solved by Matlab. Finally, several examples with real data are provided to demonstrate the effectiveness of the portfolio adjusting model, and the obtained computational results show that the optimal portfolio adjusting strategy is distributive that is preferred by investors in practice. Our analyses also reveal that investors’ buying and selling behaviours when adjusting a portfolio are mainly determined by their risk-aversion.

Future studies may be conducted by taking other realistic factors into portfolio adjusting process, such as lending, borrowing and adding more risky assets. Normal distribution for fuzzy returns given by expert’s estimation may also be studied due to the importance of subjective experience by experts in the changeful financial markets. Multi-period portfolio adjusting problem may be another research focus because of its practical requirement for investment.

References

Arnott R D, Wagner W H (1990) The measurement and control of trading costs. Financ Anal J 46(6):73–80

Carlsson C, Fullér R, Majlender P (2002) A possibilistic approach to selecting portfolios with highest utility score. Fuzz Set Syst 131(1):13–21

Chen W, Li SS, Zhang J, Mehlawat MK (2020) A comprehensive model for fuzzy multi-objective portfolio selection based on DEA cross-efficiency model. Soft Comput 24(4):2515–2526

Fang Y, Lai K K, Wang S Y (2006) Portfolio rebalancing model with transaction costs based on fuzzy decision theory. Eur J Oper Res 175(2):879–893

Huang X X (2007) Portfolio selection with fuzzy returns. J Intel Fuzz Syst 18(4):383–390

Huang XX (2010) Portfolio analysis: from probabilistic to credibilistic and uncertain approaches. Springer Science and Business Media

Huang X X (2011) Mean-risk model for uncertain portfolio selection. Fuzz Optim Decis Ma 10(1):71–89

Huang X X, Ying H (2013) Risk index based models for portfolio adjusting problem with returns subject to experts’ evaluations. Econ Model 30:61–66

Inuiguchi M, Tanino T (2000) Portfolio selection under independent possibilistic information. Fuzzy Set Syst 115(1):83–92

Li X, Liu B (2006) A sufficient and necessary condition for credibility measures. Int J Uncertain Fuzz 14 (5):527–535

Li X, Qin Z F (2014) Interval portfolio selection models within the framework of uncertainty theory. Econ Model 41(1):338–344

Li X, Jiang H, Guo S, Ching WK, Yu L (2020) On product of positive L-R fuzzy numbers and its application to multi-period portfolio selection problems. Fuzzy Optim Decis Ma 19(1):53–79

Liu B (2007) A survey of entropy of fuzzy variables. Fuzz Optim Decis Ma 1(1):4–13

Liu B (2010) Uncertainty theory: A branch of mathematics for modeling human uncertainty, 3rd edn. Springer, Berlin

Liu B, Liu Y -K (2002) Expected value of fuzzy variable and fuzzy expected value models. IEEE Trans Fuzz Syst 10(4):445–450

Liu Y, Qin Z (2012) Mean semi-absolute deviation model for uncertain portfolio optimization problem. J Uncertain Syst 6(4):299–307

Markowitz H (1952) Portfolio selection. J Fin 7(1):77–91

Markowitz H (1993) Computation of mean-semivariance efficient sets by the critical line algorithm. Ann Oper Res 45(1):307–317

Mehlawat MK, Gupta P, Kumar A, Yadav S, Aggarwal A (2020) Multi-objective fuzzy portfolio performance evaluation using data envelopment analysis under credibilistic framework. IEEE Trans Fuzzy Syst. https://doi.org/10.1109/TFUZZ.2020.2969406

Qin Z F, Kar S, Zheng H (2014) Uncertain portfolio adjusting model using semiabsolute deviation. Soft Comput 1:1–9

Speranza M G (1993) Linear programming models for portfolio optimization. Finance 14:107–123

Woodside-Oriakhi M, Lucas C, Beasley J E (2013) Portfolio rebalancing with an investment horizon and transaction costs. Omega 41(2):406–420

Takano Y, Gotoh J Y (2014) Multi-period portfolio selection using kernel-based control policy with dimensionality reduction. Expert Syst Appl 41(8):3901–3914

Trybuła J, Zawisza D (2019) Continuous-time portfolio choice under monotone mean-variance preferences-stochastic factor case. Math Oper Res 44(3):966–987

Yu J R, Lee W Y (2011) Portfolio rebalancing model using multiple criteria. Eur J Oper Res 209(2):166–175

Zadeh L A (1978) Fuzzy sets as a basis for a theory of possibility. Fuzzy Set Syst 1:3–28

Zadeh L A, Hayes et al (1979) A theory of approximate reasoning. In: Mathematical frontiers of the social and policy sciences. Westview Press, Boulder, pp 69–129

Zhang X, Zhang W G, Cai R (5) Portfolio adjusting optimization under credibility measures. J Comput Appl Math 234:1458–1465

Zhang W G, Zhang X L, Chen Y X (2011) Portfolio adjusting optimization with added assets and transaction costs based on credibility measures. Insur Math Econ 49:353–360

Zhang WG, Liu YJ, Xu WJ (2012) A possibilistic mean-semivariance-entropy model for multi-period portfolio selection with transaction costs. Eur J Oper Res 222:341–349

Zhou J D, Li X, Pedrycz W (2016) Mean-semi-entropy models of fuzzy portfolio selection. IEEE Trans Fuzzy Syst 24(6):1627–1636

Zhou J D, Li X, Kar S, Zhang G Q, Yu H T (2017) Time consistent fuzzy multi-period rolling portfolio optimization with adaptive risk aversion factor. J Amb Intel Hum Comp 8(5):651–666

Funding

This work was supported by the National Natural Science Foundation of China (Nos. 71722007, 71931001), and the Funds for First-class Discipline Construction in China (No. XK1802-5).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

None.

Conflict of interests

The authors declare that they have no conflict of interest.

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Ethical approval

This article does not contain any studies with human participants performed by any of the authors. This article does not contain any studies with animals performed by any of the authors. This article does not contain any studies with human participants or animals performed by any of the authors.

Informed consent

There is no individual participant included in the study.

Appendix: Preliminaries

Appendix: Preliminaries

Let ξ be a fuzzy variable with membership function μ. For any \( x\ln \Re \), μ(x) which is also called the possibility distribution, represents the possibility that ξ takes values x. For any set B, the possibility measure of \( \xi \ln B \) was defined by Zadeh (1978) as

As the dual part of possibility measure, necessity measure was defined by Zadeh and Hayes et al (1979) as follows

Both of possibility measure and necessity measure have been proved to satisfy the properties of normality, nonnegativity and monotonicity, however, neither of them are self-dual. Since the duality is intuitive and important in both theory and practice, Liu and Liu (2002) defined credibility measure as the average value of possibility measure and necessity measure, which was redefined by Li and Liu (2006) as set function satisfying the normality, monotonicity, duality, and partial maximality axioms

Since Cr{ξ ∈ B} + Cr{ξ ∈ Bc} = 1 for any set B, it is easy to prove that credibility measure is self-dual. The formula is also called the credibility inversion theorem. Its membership function of fuzzy variable ξ is derived from the credibility measure by

The expected value of ξ was defined by Liu and Liu (2002) as

provided that at least one of the two integrals is finite.

Theorem 2

(Liu 2010) Let ξ and η be two fuzzy variables, and a and b two real numbers. Then we have E[aξ + b] = aE[ξ] + b.

Rights and permissions

About this article

Cite this article

Zhou, J., Li, X. Mean-semi-entropy portfolio adjusting model with transaction costs. J. of Data, Inf. and Manag. 2, 121–130 (2020). https://doi.org/10.1007/s42488-020-00032-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s42488-020-00032-0