Abstract

To maximize profit in a competitive market environment, for retailers, it became necessary to optimize preservation, pricing, and marketing strategies together with inventory ordering policies. This study deals with the problem of optimizing price, advertisement frequency, preservation technology (PT) investment and ordering policies simultaneously for non-instantaneous deteriorating items whose deterioration rate can be reduced by investing in PT, while demand depends on both selling price and frequency of advertisement. The supplier allows some credit period to settle the account, and under this policy, three possible cases considered separately. We adopt three-parameter Weibull distribution deterioration and partial backlogs of shortages in a general framework to formulate the model. An iterative algorithm is provided to obtain the optimal solution, then the proposed model is illustrated through numerical examples. The concavity of the total profit function with respect to decision variables shown graphically. Sensitivity analysis has been conducted to investigate the impact of each parameter. PT investment and credit period are beneficial for the retailer, and also can earn more profit through advertisement. Value-added food products, such as bottled fruit juice, soft drinks, packed fruits, bread, cake, processed meat, etc., needs preservation technology and their demand depends on the price as well as marketing. Profit maximization of such items can be studied with the help of new model developed in this paper.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Deteriorating inventory systems are studied extensively in the past few years. In traditional economic order quantity (EOQ) model the deteriorating nature of the items was not considered. But, deterioration is a characteristic of almost all commodities, which means damage, decay, spoilage, loss of utility, vaporization, etc. Nahmias [30], Rafat [33], Goyal and Giri [15], Li et al. [23], Bakker et al. [1], and Janssen et al. [19] time to time provided up to the date literature review on deteriorating inventory problems. Ghare and Schreder [13] proposed an exponential deteriorating inventory model with constant demand. Covert and Philip [5] derived an economic order quantity model for items having two-parameter Weibull distribution deterioration with constant demand, and Philip [32] extended the work of Covert and Philip to the case of three-parameter Weibull distribution. Most of the earlier developed models assumed constant demand, but several factors affect the demand. Selling price and advertisement are the major factors for the demand. Cohen [4], Mukhopadhyay et al. [29], Dye [7], Maihami and Kamalabadi [26] and Mahmoodi [25], considered price-dependent demand and derived joint pricing and replenishment policies for deteriorating inventory systems. Together with price, advertisement also plays a very crucial role in sales. A regular frequency of advertisement through different mediums such as banners, newspaper, magazine, internet, radio, and television significantly increase the demand of the product. Till now, very few researchers studied the effect of advertisement policies on inventory. Kotler [20] first incorporated marketing policies into inventory and derived an optimal marketing policy but not EOQ. Subramanyam and Kumaraswamy [39] further extended the problem of inventory by incorporating demand as a function of price and frequency of advertisement. Also Urban [41], Bhunia and Maiti [3], Goyal and Gunasekaran [16] and Pal et al. [31] studied the impact of pricing and advertisement policies on inventory policies.

Most of the researchers consider that the deterioration rate is exogenous variable, which is not subject to control. But in practice, this phenomenon can be controlled and reduced by procedural changes, cooling storages or specialized types of equipment. When deterioration rate of a product is significantly high, it is possible to reduce the economic losses due to deterioration by investing in PT. Hsu et al. [18] first proposed a model incorporating preservation technology investment to reduce the deterioration. They considered that the reduced deterioration rate is a function of PT investment cost and the resultant deterioration rate is the difference between the original deterioration rate and reduced deterioration rate. After that, Lee and Dye [21], Dye and Hsieh [9], Hsieh and Dye [17] and Mishra [27], etc. studied the effect of preservation technology investment on inventory policies assuming controllable deterioration situation through investing in PT. Zang et al. [43] designed an effective algorithm to address the problem of pricing, preservation technology investment, and inventory control for deteriorating items. Liu et al. [24], Dye and Yang [10], Dye et al. [11] and Zang et al. [44] studied the joint pricing and preservation technology investment strategies. They assumed that the deterioration process starts as soon as the commodities enter into the inventory system. But, some commodities such as fruits, vegetables, processed foodstuffs, etc. does not deteriorate at the beginning stage, they maintain fresh quality for some time duration. This phenomenon of products is known as non-instantaneous-deterioration. Dye [8], Mishra [28], Tsao [40], and Bardhan et al. [2] studied the effect of PT investment on inventory for non-instantaneous deteriorating items. Li et al. [22] presented a model for joint pricing, PT investment for non-instantaneous deteriorating items. Shah et al. [37] derived a model to maximize profit through optimizing price, advertisement frequency and inventory ordering policies.

One of the best practices in businesses is the supplier allows some credit period to the retailer to settle the account. If the retailer can’t settle the account before the given credit period, then the supplier will charge interest at some rate on the remaining amount. This policy is beneficial for both the supplier and retailer. By allowing the credit period, the supplier can increase sales and potential customers by attracting and motivating new customers. The retailer can take advantage of it because it is not always true that the retailer has adequate capital. Also, the retailer can earn interest on sales revenue till settlement. Goyal [14] derived economic order quantity considering permissible delay in payments. Dave [6] considered delay in payments for deteriorating items. Geetha and Uthayakumar [12] proposed a model for non-instantaneous deteriorating items with permissible delay in payments. Shaikh et al. [38] presented an EOQ model with PT, trade credit and partial backlogging for deteriorating items. Yang et al. [42] studied the joint problem of preservation technology investment and trade credit as a dynamic programming problem. Shah et al. [36] developed a joint pricing, PT investment model under two level trade credit financing. Rathore [34] proposed a deteriorating inventory model considering time, price and advertisement dependent demand, with preservation technology investment and trade credit. A brief summary of the literature review is given in Table 1.

Researchers are still studying more and more practical inventory systems to fit into real-world situations, and they are trying to optimize all possible strategies to minimize cost or maximize profit. Recently, Sarkar [35] proposed an EPQ model for better management of defective items in a multistage production system by reworking imperfect items. He developed the model for manufacturing unit wherein imperfect products are inspected in each stage or at the end of the cycle, and they are reworked. So there is no wastage of the products and which helps in minimizing the cost. While in our paper, we have developed the model for perishable products by investing in preservation technology. Which helps in reducing the wastage and that way our profit is maximized.

In our model, we optimize price, advertisement frequency, preservation technology investment, together with inventory ordering policies under trade credit. Till now, no study deals with the optimization of all these major strategies together. But, our study is closely related to Rathore [34]. Our work differs from his work, mainly in five aspects. First, he considered the frequency of advertisement as a continuous variable, while in our model, we considered the frequency of advertisement as a positive integer which is more realistic. Also, we provided an iterative algorithm to obtain the optimal frequency of advertisement. Second, in his model price is not a decision variable, while in our model, price is one of the decision variables. Third, his model is developed for instantaneous deterioration case, while we considered non-instantaneous deterioration which is also applicable for instantaneous deterioration case by fixing no deterioration period zero. Fourth, in his model, shortages are not allowed, while in our model, shortages are allowed and partially backlogged. Fifth, in his model, deterioration cost is constant, while we considered three-parameter Weibull distribution deterioration.

2 Notations

\(C_{O}\) | Ordering cost ($/order). |

\(C\) | Purchase cost ($/unit). |

\(C_{d}\) | Deterioration cost ($/unit). |

\(C_{h}\) | Holding cost ($/unit/unit time). |

\(C_{\text{a}}\) | Advertisement cost ($/advertisement). |

\(C_{s}\) | Lost sale cost ($/unit). |

\(P\) | Selling price ($/unit). |

\(T_{d}\) | Length of time during which there is no deterioration. |

\(T_{1}\) | Time point at which inventory becomes zero. |

\(T\) | Length of inventory order cycle. |

\(M\) | Credit period to settle the account. |

\(I_{c}\) | Rate of interest charged on the remaining amount. |

\(I_{e}\) | Rate of interest earned on sales revenue. |

\(A\) | Frequency of advertisement per cycle. |

\(D\left( {A, P} \right)\) | Demand function. |

\(a, b, m\) | Demand parameters. |

\(\alpha , \beta\) | Deterioration parameters. |

\(I_{1} \left( t \right)\) | Inventory level during \(t \in \left[ {0, T_{d} } \right]\). |

\(I_{2} \left( t \right)\) | Inventory level during \(t \in \left[ {T_{d} ,T_{1} } \right]\). |

\(I_{3} \left( t \right)\) | Inventory level during \(t \in \left[ {T_{1} , T} \right]\). |

\(I_{0}\) | Initial inventory. |

\(\delta\) | Inventory Backlog coefficient. |

\(I_{B}\) | Inventory Backlogged. |

\(\xi\) | Preservation technology investment per unit time. |

\(m\left( \xi \right)\) | Proportion of reduced deterioration rate \(\left( {0 \le m\left( \xi \right) \le 1} \right)\). |

\(k\) | PT investment coefficient. |

\(\xi^{\prime}\) | Maximum PT investment budget. |

\(Q\). | Order quantity per order cycle T. |

\(TP_{i} \left( {A,T_{1} , T, P, \xi } \right)\). | Total profit function for case \(i\), \((i = 1,2,3\)). |

\(\left( {A^{*} ,T_{1}^{*} , T^{*} , P^{*} , \xi^{*} } \right)\) | Optimal solution. |

3 Assumptions

-

The inventory system involves a single non-instantaneous deteriorating item.

-

Demand is a function of selling price and advertisement frequency. We assume the demand function as (described by Kotler [20]) follows:

$$D\left( {A, P} \right) = A^{m} aP^{ - b}$$where \(A ( > 0)\) is the frequency of advertisement, \(P ( > C)\) is the selling price, \(a( > 0)\) is the scaling factor, \(b\left( { \ge 1} \right)\) is the index of price elasticity and \(m\) is the shape parameter, where \(0 \le m < 1\). Since \(\frac{{\partial D\left( {A, P} \right)}}{\partial A} > 0\) and \(\frac{{\partial D\left( {A, P} \right)}}{\partial P} < 0\), the demand function is an increasing function of the advertisement frequency \(\left( A \right)\) and decreasing function of price \(\left( P \right)\), which reflect a real situation.

-

The lifetime \(\left( t \right)\) of the product follows three-parameter Weibull distribution \(f\left( t \right) = \alpha \beta \left( {t - T_{d} } \right)^{\beta - 1} e^{{ - \alpha \left( {t - T_{d} } \right)^{\beta } }}\), where \(\alpha ( > 0)\) is the scale parameter, \(\beta ( > 0)\) is the shape parameter and \(T_{d} \left( { \ge 0} \right)\) (deterioration free life) is the location parameter. The cumulative distribution function is \(F\left( t \right) = \mathop \int \limits_{{T_{d} }}^{t} f\left( t \right)dt = 1 - e^{{ - \varvec{a}\left( {\varvec{t} - T_{d} } \right)^{\beta } }}\), hence the deterioration rate is \(\frac{f\left( t \right)}{1 - F\left( t \right)} = \alpha \beta \left( {t - T_{d} } \right)^{\beta - 1}\).

-

The deterioration rate can be reduced by investing in preservation technology. The proportion of reduced deterioration rate (as in Hsu et al. [18]) is \(m\left( \xi \right) = 1 - e^{ - k \times \xi }\), where, \(k\left( { \ge 0} \right)\) is the simulation coefficient representing the percentage increase in \(m\left( \xi \right)\) per dollar increase in \(\xi\). When \(\xi = 0\), the reduced deterioration rate \(m\left( \xi \right) = 0\), and for \(\xi \to \infty , \lim_{\xi \to \infty } m\left( \xi \right) = 1\). But we set constraint \(0 \le \xi \le \xi^{\prime}\), where, \(\xi^{\prime}\) is the maximum PT investment allowed.

-

Instantaneous replenishment and infinite replenishment rate.

-

Shortages are allowed and partially backlogged. The fraction of unsatisfied demand backlogged is \(D\left( {A,P} \right)e^{{ - \delta \left( {T - t} \right)}}\) for \(t \in \left[ {T_{1} , T} \right],\) where backlogging parameter \(\delta\) is a positive constant and \(\left( {T - t} \right)\) is the waiting time.

-

The supplier will allow some credit period to the retailer, and the retailer must settle the account before placing the next order.

4 Model development

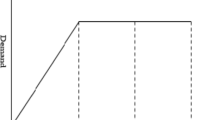

As shown in Fig. 1, initially the inventory system has \(I_{0}\) units. During the time interval \(\left[ {0, T_{d} } \right]\) there will be no deterioration and hence the inventory level decrease in this period due to demand only. During the interval \(\left[ {T_{d} ,T_{1} } \right]\) the inventory level decrease due to demand and as well as deterioration, but in this period the deterioration rate will be reduced by investing in preservation technology. At time \(T_{1}\) the inventory reaches to zero and the demand will be partially backlogged during \(\left[ {T_{1} , T} \right]\). If the supplier allow credit period \(M\) units of the time to settle the account then three cases are possible (1) \(0 \le M \le T_{d}\), (2) \(T_{d} \le M \le T_{1}\) and (3) \(T_{1} \le M \le T\) (See Figs. 2, 3 and 4).

According to the above description, the differential equations representing the inventory status within different time intervals given below.

Using the boundary conditions \(I_{1} \left( 0 \right) = I_{0} , {\text{I}}_{2} \left( {T_{1} } \right) = 0\) and \({\text{I}}_{3} \left( {T_{1} } \right) = 0\), we get the solution of Eqs. (1), (2) and (3) respectively as follows.

Using the condition \(I_{1} \left( {T_{d} } \right) = {\text{I}}_{2} \left( {T_{d} } \right)\)

The maximum amount of demand backlogged per cycle is obtained by putting \(t = T\) in Eq. (6) and considering positive quantity.

Order quantity per cycle:

Purchase cost:

Lost sale cost:

Deterioration cost:

Holding cost:

Total sales revenue:

Preservation technology investment:

Advertisement cost:

Case 1 \(0 \le M \le T_{d}\)

Interest Charged:

Interest earned:

Total profit per unit time:

So, in this case, the objective is to maximize \(Z_{1} = TP_{1} \left( {A,T_{1} , T, P, \xi } \right)\).

When \(M \ge T_{d}\) there are two possibilities either \(T_{d} \le M \le T_{1}\) or \(T_{1} \le M \le T\).

Case 2 \(T_{d} \le M \le T_{1}\)

Interest Charged:

Interest earned:

Total profit per unit time:

So, in this case, the objective is to maximize \(Z_{2} = TP_{2} \left( {A,T_{1} , T, P, \xi } \right)\).

Case 3 \(T_{1} \le M \le T\)

Interest charged: In this case there is no interest charged

Interest earned:

Total profit per unit time:

So, in this case, the objective is to maximize \(Z_{3} = TP_{3} \left( {A,T_{1} , T, P, \xi } \right)\).

The optimal order quantity corresponding to the optimal solution \(\left( {A^{*} ,T_{1}^{*} , T^{*} , P^{*} , \xi^{*} } \right)\) is

5 Solution methodology

For fixed \(T_{1} , T, P,\) and \(\xi\) the second order partial derivative of \(TP_{i} \left( {A,T_{1} , T, P, \xi } \right)\) with respect to \(A\) gives,

where

and \(X_{3} = PI_{e} T_{1} \left( {M - \frac{{T_{1} }}{2}} \right)\)

Because of \(0 \le m < 1, \frac{{\partial^{2} TP_{i} }}{{\partial A^{2} }} < 0\). Therefore, \(TP_{i} \left( {A,T_{1} , T, P, \xi } \right)\) is a concave function of A and hence the problem of finding the global optimal solution of the advertisement frequency (A*), reduces to find the local optimum solution. Concavity of the total profit function, with respect to other decision variables, has been shown graphically by means of numerical examples in concavity section. Since the variable \(A\) is a positive integer, we suggest the following algorithm to find the optimal solution of the proposed inventory system.

Algorithm:

- Step 1 :

-

Assign numerical values to all the parameters in appropriate units.

- Step 2 :

-

Set \(A = 1\).

- Step 3 :

-

Compare \(M\) and \(T_{d}\). If \(M \le T_{d}\) then go to step 4. Otherwise go to step 8.

- Step 4 :

-

Find the optimal solution of \(TP_{1} \left( {T_{1} , T, P, \xi |A} \right)\) subject to the constraints in Eq. (20).

Then obtain the corresponding total profit \(TP_{1} \left( {A,T_{1}^{*} , T^{*} , P^{*} , \xi^{*} } \right)\) and go to next step.

- Step 5 :

-

Set \(A^{\prime} = A + 1\) and repeat step 4 to get \(TP_{1} \left( {A^{\prime},T_{1}^{*} , T^{*} , P^{*} , \xi^{*} } \right)\) and go to next step.

- Step 6 :

-

If \(TP_{1} \left( {A^{\prime},T_{1}^{*} , T^{*} , P^{*} , \xi^{*} } \right) \ge TP_{1} \left( {A,T_{1}^{*} , T^{*} , P^{*} , \xi^{*} } \right)\) then set \(A = A^{'}\) and go to step 4.

Otherwise go to next step.

- Step 7 :

-

Set the optimal solution \(\left( {A^{*} ,T_{1}^{*} , T^{*} , P^{*} , \xi^{*} } \right) = \left( {A,T_{1}^{*} , T^{*} , P^{*} , \xi^{*} } \right)\). Go to step 18.

- Step 8 :

-

Find the optimal solution of \(TP_{2} \left( {T_{1} , T, P, \xi |A} \right)\) subject to the constraints in Eq. (24).

Then obtain the corresponding total profit \(TP_{2} \left( {A,T_{1}^{*} , T^{*} , P^{*} , \xi^{*} } \right)\) and go to next step.

- Step 9 :

-

Set \(A^{\prime} = A + 1\) and repeat step 8 to get \(TP_{2} \left( {A^{\prime},T_{1}^{*} , T^{*} , P^{*} , \xi^{*} } \right)\) and goto next step.

- Step 10 :

-

If \(TP_{2} \left( {A^{\prime},T_{1}^{*} , T^{*} , P^{*} , \xi^{*} } \right) \ge TP_{2} \left( {A,T_{1}^{*} , T^{*} , P^{*} , \xi^{*} } \right)\) then set \(A = A^{'}\) and go to step 8.

Otherwise go to next step.

- Step 11 :

-

Set the optimal solution \(\left( {A^{*} ,T_{1}^{*} , T^{*} , P^{*} , \xi^{*} } \right) = \left( {A,T_{1}^{*} , T^{*} , P^{*} , \xi^{*} } \right)\) and go to next step.

- Step 12 :

-

Set \(A = 1\).

- Step 13 :

-

Find the optimal solution of \(TP_{3} \left( {T_{1} , T, P, \xi |A} \right)\) subject to the constraints in Eq. (28).

Then obtain the corresponding total profit \(TP_{3} \left( {A,T_{1}^{*} , T^{*} , P^{*} , \xi^{*} } \right)\) and go to next step.

- Step 14 :

-

Set \(A^{\prime} = A + 1\) and repeat step 13 to get \(TP_{3} \left( {A^{\prime},T_{1}^{*} , T^{*} , P^{*} , \xi^{*} } \right)\) and go to next step.

- Step 15 :

-

If \(TP_{3} \left( {A^{\prime},T_{1}^{*} , T^{*} , P^{*} , \xi^{*} } \right) \ge TP_{3} \left( {A,T_{1}^{*} , T^{*} , P^{*} , \xi^{*} } \right)\) then set \(A = A^{'}\) and go to step 13.

Otherwise goto next step.

- Step 16 :

-

Set the optimal solution \(\left( {A^{*} ,T_{1}^{*} , T^{*} , P^{*} , \xi^{*} } \right) = \left( {A,T_{1}^{*} , T^{*} , P^{*} , \xi^{*} } \right)\) and go to next step.

- Step 17 :

-

If Max{ \(TP_{2}^{*} , TP_{3}^{*} \} = TP_{2}^{*}\) then the solution obtained in step 11 is the optimal.

If Max{ \(TP_{2}^{*} ,TP_{3}^{*} \} = TP_{3}^{*}\) then the solution obtained in step 16 is the optimal.

- Step 18 :

-

Compute the corresponding optimal order quantity \(Q^{*}\) from Eq. (29). Stop.

While executing the above algorithm, for fixed A, we can obtain the optimal solution which maximizes the total profit function with constraints using software like MATLAB, MATHEMATICA, R, MATHCAD, etc.

For fixed value of the variable \(A\) the necessary and sufficient conditions to maximize the total profit function \(TP_{i} \left( {T_{1} , T, P, \xi |A} \right)\) are as follows:

Provided that the Hessian matrix \(H = \left[ {\begin{array}{*{20}l} {\frac{{\partial^{2} TP_{i} }}{{\partial T_{1}^{2} }}} \hfill & {\frac{{\partial^{2} TP_{i} }}{{\partial T_{1} T}}} \hfill & {\frac{{\partial^{2} TP_{i} }}{{\partial T_{1} P}}} \hfill & {\frac{{\partial^{2} TP_{i} }}{{\partial T_{1} \xi }}} \hfill \\ {\frac{{\partial^{2} TP_{i} }}{{\partial TT_{1} }}} \hfill & {\frac{{\partial^{2} TP_{i} }}{{\partial T^{2} }}} \hfill & {\frac{{\partial^{2} TP_{i} }}{\partial TP}} \hfill & {\frac{{\partial^{2} TP_{i} }}{\partial T\xi }} \hfill \\ {\frac{{\partial^{2} TP_{i} }}{{\partial PT_{1} }}} \hfill & {\frac{{\partial^{2} TP_{i} }}{\partial PT}} \hfill & {\frac{{\partial^{2} TP_{i} }}{{\partial P^{2} }}} \hfill & {\frac{{\partial^{2} TP_{i} }}{\partial P\xi }} \hfill \\ {\frac{{\partial^{2} TP_{i} }}{{\partial \xi T_{1} }}} \hfill & {\frac{{\partial^{2} TP_{i} }}{\partial \xi T}} \hfill & {\frac{{\partial^{2} TP_{i} }}{\partial \xi P}} \hfill & {\frac{{\partial^{2} TP_{i} }}{{\partial \xi^{2} }}} \hfill \\ \end{array} } \right]\) is a negative definite.

6 Numerical examples

In Table 2 consider the parameter values in appropriate units.

While executing the proposed algorithm, for fixed A the solution has been obtained using the DEoptimR package in R. This package uses the differential evolution stochastic algorithm and gives the approximate global optimum solution. The computational results of each example for different values of \(A\) are given in Tables 3, 4 and 5. In Tables 3, 4 and 5, the bold values indicate optimal values for that particular case. The final results are shown in Table 6.

7 Concavity and optimality

For example 2 of the above section, the total profit is plotted against each variable fixing other variables in Fig. 5. From Fig. 5, it is obvious that the total profit function \(TP_{2}\) is concave with respect to each variable. Figures 6, 7 and 8 also reveals that the total profit functions \(TP_{1} , TP_{2}\) and \(TP_{3}\) are concave functions.

Fixing \(A = 4\) in example 2, at the solution \((T_{1}^{*} , T^{*} , P^{*} , \upxi^{*} ) = \left( {0.51493, 0.64856, 20.75582, 85.64372} \right)\) the gradient is \(\left( { - 0.205, 0.125, 0.006, 0.000} \right)\), which is close to zero.

The eigenvalues of \(H\) are \(- 0.0153, - 55.6244, - 270.7990, - 3641.7120\). Therefore, the Hessian matrix is negative definite, and hence the solution is global maximum.

8 Sensitivity analysis

Table 7 reveals that when the supplier allows more credit period \(\left( M \right)\), the retailer earns more profit. The model assumes non-instantaneous deterioration, but it is also applicable for instantaneous deterioration case by taking \(T_{d} = 0\). That is, the instantaneous deterioration case is a particular case of Non-instantaneous deterioration case. Table 7 shows that instantaneous deteriorating items need more PT investment.

Table 8 shows the computational results obtained by increasing each parameter of example 2 by − 50%, − 25%, + 25% and + 50%. Figures 9 and 10 shows how sensitive the total profit with respect to different parameters.

Observations and managerial insights:

-

The total profit is less sensitive with the change in parameters \(\alpha , C_{d} ,\) and \(C_{s}\). An increment in α increase the deterioration rate and increment in \(C_{d}\) increase the total deterioration cost but, PT investment reduce the deterioration rate (number of deteriorating units) significantly, and hence profit is ineffective with the change in α and \(C_{d}\). Hence, retailers are suggested to invest in PT to reduce losses incurring due to deterioration. As the shortage cost \(C_{s}\) increases, our model decreases the shortage period (\(T^{*} - T_{1}^{*}\)) (see Table 8), which reduce lost sales and hence, profit is less effective with the change in \(C_{s}\).

-

Increment in different cost parameters \(C_{h} , C_{o} ,\) and \(C_{a}\) results in a decrement in total profit. In Table 8, increment in holding cost \(\left( {C_{h} } \right)\) decreases the optimal order cycle \(T^{*}\) while increment in ordering cost \((C_{o} )\) increases the optimal order cycle \(\left( {T^{*} } \right)\). Hence, when the holding cost raises, the retailer is suggested to decrease the order cycle, and when the ordering cost rises, the retailer is suggested to increase the order cycle. As the advertisement cost \((C_{a} )\) increase, the frequency of advertisement and total profit decreases. To increase the total profit, the retailer is suggested to increase the frequency of advertisement \(\left( A \right)\) when the advertisement cost \((C_{a} )\) is less.

-

As the value of \(k\) increase, the total profit increases. Since the reduced deterioration rate is \(\left( {1 - m\left( \xi \right)} \right) = e^{ - k \times \xi }\), an increment in \(k\) will reduce the deterioration rate greatly, which results in a less PT investment and more profit. The retailer need to invest more in PT for smaller value of k.

-

The total profit is very sensitive with the change in parameters \(a\) and \(C\). Increased value of the scale parameter \(\left( a \right)\) of the demand function will increase the demand, and hence increase the total profit. As purchase cost \(\left( C \right)\) increase, the optimal value of selling price \(\left( {P^{*} } \right)\) drastically increases. But, increased selling price \(\left( {P^{*} } \right)\) decrease the demand, and hence the total profit is decreasing drastically as \(C\) increases. As the shape parameter of demand \(\left( m \right)\) increase the total profit increases. In Fig. 10, it seems that the profit is less sensitive with the change in the parameter \(\left( m \right)\) this is due to assigning a smaller value to \(m\)\(\left( {m = 0.04} \right)\). The profit will drastically increase for the assignment of higher value to m.

9 Conclusion

In today’s competitive market environment, every business organization wants to optimize all possible strategies to get maximum revenue. Our proposed model is beneficial to the retailers to maximize the total profit by optimizing the pricing, marketing, preservation, and inventory ordering policies. The PT investment reduces faster deteriorations, which is beneficial to businesses based on agricultural products, bakery products, dairy products, and meat and fish products. The retailer earns more profit through credit period. Instantaneous deteriorating items need more PT investment and the profit for the non-instantaneous deteriorating items is more than the profit for instantaneous deteriorating items. When the advertisement cost is less, the retailer can earn more profit through increasing advertisement frequency. This model can be extended to the production order quantity model. Can be further extended for two warehouse problem wherein preservation technology applied in either of the warehouses.

References

Bakker, M., Riezebos, J., Teunter, R.H.: Review of inventory systems with deterioration since 2001. Eur. J. Oper. Res. 221(2), 275–284 (2012)

Bardhan, S., Pal, H., Giri, B.C.: Optimal replenishment policy and preservation technology investment for a non-instantaneous deteriorating item with stock-dependent demand. Oper. Res. 19(2), 347–368 (2019). https://doi.org/10.1007/s12351-017-0302-0

Bhunia, A.K., Maiti, M.: An inventory model for decaying items with selling price, frequency of advertisement and linearly time-dependent demand with shortages. IAPQR Trans. 22, 41–50 (1997)

Cohen, M.A.: Joint pricing and ordering policy for exponentially decaying inventory with known demand. Nav. Res. Logist. Q. 24(2), 257–268 (1977)

Covert, R.P., Philip, G.C.: An EOQ model for items with Weibull distribution deterioration. AIIE Trans. 5(4), 323–326 (1973)

Dave, U.: An EOQ model for deteriorating items subject to permissible delay in payments. Optimization 18(3), 433–437 (1987)

Dye, C.Y.: Joint pricing and ordering policy for a deteriorating inventory with partial backlogging. Omega Int. J. Manag. Sci. 35(2), 184–189 (2007)

Dye, C.Y.: The effect of preservation technology investment on a non-instantaneous deteriorating inventory model. Omega Int. J. Manag. Sci. 41(5), 872–880 (2013)

Dye, C.Y., Hsieh, T.P.: A particle swarm optimization for solving lot-sizing problem with fluctuating demand and preservation technology cost under trade credit. J. Glob. Optim. 55(3), 655–679 (2013)

Dye, C.Y., Yang, C.T.: Optimal dynamic pricing and preservation technology investment for deteriorating products with reference price effects. Omega 62, 52–67 (2016)

Dye, C.Y., Yang, C.T., Wu, C.C.: Joint dynamic pricing and preservation technology investment for an integrated supply chain with reference price effects. J. Oper. Res. Soc. 69(6), 811–824 (2018)

Geetha, K.V., Uthayakumar, R.: Economic design of an inventory policy for non-instantaneous deteriorating items under permissible delay in payments. J. Comput. Appl. Math. 233(10), 2492–2505 (2010)

Ghare, P.N., Schrader, G.F.: A model for exponentially decaying inventories. J. Ind. Eng. 15, 238–243 (1963)

Goyal, S.K.: Economic order quantity under conditions of permissible delay in payments. J. Oper. Res. Soc. 36(4), 335–338 (1985)

Goyal, S.K., Giri, B.C.: Recent trends in modeling of deteriorating inventory. Eur. J. Oper. Res. 134(1), 1–16 (2001)

Goyal, S.K., Gunasekaran, A.: An integrated production-inventory-marketing model for deteriorating items. Comput. Ind. Eng. 28(4), 755–762 (1995)

Hsieh, T.P., Dye, C.Y.: A production–inventory model incorporating the effect of preservation technology investment when demand is fluctuating with time. J. Comput. Appl. Math. 239, 25–36 (2013)

Hsu, P.H., Wee, H.M., Teng, H.M.: Preservation technology investment for deteriorating inventory. Int. J. Prod. Econ. 124(2), 388–394 (2010)

Janssen, L., Claus, T., Sauer, J.: Literature review of deteriorating inventory models by key topics from 2012 to 2015. Int. J. Prod. Econ. 182, 86–112 (2016)

Kotler, P.: Marketing Decision Making: A Model Building Approach. Holt, Rinehart, Winston, New York (1972)

Lee, Y.P., Dye, C.Y.: An inventory model for deteriorating items under stock-dependent demand and controllable deterioration rate. Comput. Ind. Eng. 63(2), 474–482 (2012)

Li, G., He, X., Zhou, J., Wu, H.: Pricing, replenishment and preservation technology investment decisions for non-instantaneous deteriorating items. Omega 84, 114–126 (2019)

Li, R., Lan, H., Mawhinney, J.R.: A review on deteriorating inventory study. J. Serv. Sci. Manag. 3(01), 117 (2010)

Liu, G., Zhang, J., Tang, W.: Joint dynamic pricing and investment strategy for perishable foods with price-quality dependent demand. Ann. Oper. Res. 226(1), 397–416 (2015)

Mahmoodi, A.: Joint pricing and inventory control of duopoly retailers with deteriorating items and linear demand. Comput. Ind. Eng. (2019). https://doi.org/10.1016/j.cie.2019.04.017

Maihami, R., Kamalabadi, I.N.: Joint pricing and inventory control for non-instantaneous deteriorating items with partial backlogging and time and price dependent demand. Int. J. Prod. Econ. 136(1), 116–122 (2012)

Mishra, V.K.: An inventory model of instantaneous deteriorating items with controllable deterioration rate for time dependent demand and holding cost. J. Ind. Eng. Manag. 6(2), 495 (2013)

Mishra, V.K.: Deteriorating inventory model with controllable deterioration rate for time-dependent demand and time-varying holding cost. Yugosl. J. Oper. Res. 24(1), 87–98 (2014)

Mukhopadhyay, S., Mukherjee, R.N., Chaudhuri, K.S.: Joint pricing and ordering policy for a deteriorating inventory. Comput. Ind. Eng. 47(4), 339–349 (2004)

Nahmias, S.: Perishable inventory theory: a review. Oper. Res. 30(4), 680–708 (1982)

Pal, A.K., Bhunia, A.K., Mukherjee, R.N.: A marketing-oriented inventory model with three-component demand rate dependent on displayed stock level (DSL). J. Oper. Res. Soc. 56(1), 113–118 (2005)

Philip, G.C.: A generalized EOQ model for items with Weibull distribution deterioration. AIIE Trans. 6(2), 159–162 (1974)

Raafat, F.: Survey of literature on continuously deteriorating inventory models. J. Oper. Res. Soc. 42(1), 27–37 (1991)

Rathore, H.: A preservation technology model for deteriorating items with advertisement-dependent demand and trade credit. In: Logistics, Supply Chain and Financial Predictive Analytics, pp. 211–220. Springer, Singapore (2019)

Sarkar, B.: Mathematical and analytical approach for the management of defective items in a multi-stage production system. J. Clean. Prod. 218, 896–919 (2019)

Shah, N.H., Shah, D.B., Patel, D.G.: Optimal preservation technology investment, retail price and ordering policies for deteriorating items under trended demand and two level trade credit financing. J. Math. Model. Algorithms Oper. Res. 14(1), 1 (2015)

Shah, N.H., Soni, H.N., Patel, K.A.: Optimizing inventory and marketing policy for non-instantaneous deteriorating items with generalized type deterioration and holding cost rates. Omega Int. J. Manag. Sci. 41(2), 421–430 (2013)

Shaikh, A.A., Panda, G.C., Sahu, S., Das, A.K.: Economic order quantity model for deteriorating item with preservation technology in time dependent demand with partial backlogging and trade credit. Int. J. Logist. Syst. Manag. 32(1), 1–24 (2019)

Subramanyam, E.S., Kumaraswamy, S.: EOQ formula under varying marketing policies and conditions. AIIE Trans. 13(4), 312–314 (1981)

Tsao, Y.C.: Joint location, inventory, and preservation decisions for non-instantaneous deterioration items under delay in payments. Int. J. Syst. Sci. 47(3), 572–585 (2016)

Urban, T.L.: Deterministic inventory models incorporating marketing decisions. Comput. Ind. Eng. 22(1), 85–93 (1992)

Yang, C.T., Dye, C.Y., Ding, J.F.: Optimal dynamic trade credit and preservation technology allocation for a deteriorating inventory model. Comput. Ind. Eng. 87, 356–369 (2015)

Zhang, J.X., Bai, Z.Y., Tang, W.S.: Optimal pricing policy for deteriorating items with preservation technology investment. J. Ind. Manag. Optim. 10(4), 1261–1277 (2014)

Zhang, J., Wei, Q., Zhang, Q., Tang, W.: Pricing, service and preservation technology investments policy for deteriorating items under common resource constraints. Comput. Ind. Eng. 95, 1–9 (2016)

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Rapolu, C.N., Kandpal, D.H. Joint pricing, advertisement, preservation technology investment and inventory policies for non-instantaneous deteriorating items under trade credit. OPSEARCH 57, 274–300 (2020). https://doi.org/10.1007/s12597-019-00427-7

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12597-019-00427-7