Abstract

In this paper we apply wavelet analysis to study the dynamics of long-term movements in wholesale prices for the USA, the UK and France over the period 1791–2012. The application of wavelet analysis to long-term historical price series allows us to detect long waves in prices whose periodization is remarkably similar to those provided in the literature for the pre-World War II period. Moreover, we find evidence on the existence of long waves in prices also after World War II, a period in which long waves are generally difficult to detect because of the positive trend displayed by prices. The comparison between the long wave components extracted through wavelets and the Christiano–Fitzgerald band-pass filter suggests that wavelets provide a reliable and straightforward technique for analyzing long waves dynamics in time series exhibiting quite complex patterns such as historical data.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

After almost a century from its publication Kondratieff’s (1926) research on 50-year long cyclical movements in economic activity remains a fascinating but highly controversial theory. The very presence of long waves is disputed on the basis that available datasets contain too few observations for statistically rigorous testing by means of spectral analysis. In addition, the methodology for identification of long waves in aggregate economic time series is still a largely debated question in the literature on long-run patterns in economic variables. The method initially used for detecting long waves in economic variables, i.e., the decomposition approach,Footnote 1 aimed at isolating major fluctuations in the deviations of a variable around its trend through a combination of detrending procedures and smoothing techniques (Goldstein 1988). However, these methodologies—i.e., moving average smoothing techniques, trend deviation and phase period analysis—can be criticized for adopting ad hoc assumptions, such as the pre-definition of historical phase periods or the specification of a particular form for the secular trend (linear, quadratic, exponential, etc.) in estimating the trend component, but also because statistical artifacts and significant errors in long waves detection can be created by applying arbitrary and inappropriate methods of trend elimination (see Freeman and Louçã 2001; Zarnowitz and Ozyildirim 2002; Metz 2011).

In the light of the above, since the 1980s a wide range of mathematical and statistical tools have been used by researchers: spectral analysis (e.g., Kuczynski 1978; Bossier and Hugé 1981; van Ewijk 1981, 1982; Haustein and Neuwirth 1982; Mosekilde and Rasmussen 1989; Reijnders 1990; Gerster 1992; Metz 1992, 2006; Berry 2006; Diebolt and Doliger 2006, 2008; Korotayev and Tsirel 2010), log-linear trends (Bieshaar and Kleinknecht 1984), correlation analysis (Goldstein 1988; Solomou 1990), best fitting polynomial regression (Taylor 1988), filter design approach (Metz 1992; Metz and Stier 1992; Kriedel 2009), structural time series model (Goldstein 1999), fractional integrated long memory processes (Diebolt 2005), outlier identification and trend breaks within stochastic models (Darné and Diebolt 2004; Metz 2011).Footnote 2 However, these studies have led to contrasting, sometimes contradictory, results on the identification and isolation of long cycles of the Kondratieff-type, so that considerable disagreement still exists about basic issues such as the existence of long waves, their periodization and the countries concerned (see Bosserelle 2001, 2012, 2013).

Among the many existing methods for the empirical detection of long waves, spectral analysis and filter design have represented the dominant approaches. Spectral analysis has been widely applied to long wave analysis because of its ability to simultaneously break down any time series into a set of cyclical components having different frequencies. However, the application of spectral methods to long wave analysis is greatly limited by the requirement of stationarity for the observed time series, the relative shortness of the observation period and the assumption of regularity of long waves.

The similarity between long waves detection and growth cyclesFootnote 3 extraction has favored the rising of the filter design approach for statistical identification of long waves. In the filter design approach, as in spectral analysis, a time series is considered the result of the summation of different frequencies and the task of the filter consists in determining the filter coefficients so as to isolate specific frequencies and to finally show the course of pre-specified frequency components in the time domain. Several approximations of the ideal band-pass filter, commonly used for extracting business cycle components, have been recently developed by Baxter and King (1999) and Christiano and Fitzgerald (2003) which are optimal under different time series representation of the process.Footnote 4

The same goal, which is simultaneous estimation of different cyclical components, may be pursued using wavelet analysis. Spectral and wavelet analysis are similar in that they both consider a time series as the result of the summation of different frequencies each corresponding to a specific frequency band. Thus, in terms of economic interpretation, the two decomposition methods provide the same information content and are very appealing to study economic variables that exhibit a cyclical behavior. However, wavelets may overcome the main problems evidenced by the Fourier transform as all projections of a signal onto the wavelet space are essentially local, rather than global. Unlike spectral methods, wavelets have the ability to detect cyclical components that are spaced irregularly in time and to handle a variety of nonstationary and complex signals.

Wavelet analysis can be used in a straightforward way for the empirical detection of long swings. Indeed, the application of the wavelet transform to annual data allows us to detect a cyclical component whose frequency range is between 32 and 64 years, an average length which is roughly corresponding to that of the long wave cycles identified by Kondratieff in the 1920s. Thus, in this paper we investigate the evolution of long-term wholesale prices for France, the UK and the USA over the period 1791–2012 using wavelet analysis.Footnote 5 The main findings from the application of wavelet multiresolution and energy decomposition to the long series of wholesale prices are twofold: First, there is evidence of long waves in prices not only from the late eighteenth century to the mid-1930s, but also after World War II, with five long waves (4.5 for France) of wholesale prices detected in the three economies over the historical period studied. Second, apart from the trend smooth component, the component corresponding to long waves provides the most significant contribution in terms of the overall variance, especially in comparison with business cycles components.

Furthermore, since the similarities between wavelet and filter design approaches allow a direct comparison of the two methods, we provide a robustness test of our results by comparing them with the corresponding band-pass filtered long wave components derived from two commonly used band-pass filters, Baxter and King (1999) and Christiano and Fitzgerald (2003). We take as a benchmark for comparison the chronologies on long waves in prices provided by early long wave authors on long waves patterns in prices for the pre-WWII period. Our findings indicate that the \(D_{5}\) component extracted using the maximal overlap discrete wavelet transform (MODWT) with the Daubechies’ (1992) LA(8) filter is remarkably similar to long waves detected by the Christiano–Fitzgerald filter and that the timing of both band-pass filters closely resemble the long wave chronologies reported in the literature by historians. Finally, we find that the differences emerging between the two filtered long wave components may be related to the assumed spectral density of the original data in the Christiano–Fitzgerald filter. Thus, we conclude that wavelet analysis can provide a straightforward as well as reliable methodology for detecting and uniquely identifying long wave patterns in historical time series.

The paper is organized as follows: Sects. 2 and 3 introduce the filter design approach with band-pass filtering and wavelet analysis, respectively. The analysis of the data set used is performed in Sect. 4. Section 5 applies the wavelet transform to the wholesale price series for France, the UK and the USA and compares the performance of the long waves detected using the wavelet filter against the corresponding band-pass filtered components isolated through the CF band-pass filter. Section 6 concludes the paper.

2 The filter design approach and band-pass filtering

The extraction of long waves requires the design of band-pass filters from the theory of the spectral analysis whose task is to isolate only the fluctuations within a pre-specified range of periodicities from individual time series. Such band-pass filters can identify the long wave component by filtering out all fluctuations outside the frequency range of interest and are widely employed in business cycle analysis. An ideal frequency-selective filter is one for which the gain is unity over the frequency band of interest (the so-called pass band) and zero over the remaining frequencies (the so-called stop bands), and no phase shift is introduced.Footnote 6 Thus, the ideal band-pass filter for isolating the spectral components of a time series within a particular range of frequencies is a rectangular window in which the transition from the pass band to the stop band occurs at the points corresponding to the cutoff frequencies.Footnote 7

The aim of extracting from a time-series unobserved components within specified frequency bands can be pursued by designing a filter in the frequency domain (see Stier 1989). The filter design approach considers any time series an overlay of many cyclical components of different lengths and frequencies that can be decomposed into different frequency components by using the methodology of spectral analysis.Footnote 8 Spectral analysis provides a frequency domain representation of a signal (or a function) where the same information as the original function is approximated by the sum of periodical functions with fixed frequencies, i.e., sines and cosines. The contribution of each individual frequency to the total variance of the (stationary) time series under consideration can be obtained by estimating the sample spectrum through the application of the Fourier transform.Footnote 9

Since the Fourier transform uses a linear combination of basis functions ranging over \(\pm\) infinity, all projections in Fourier analysis are globals, and thus, a single disturbance affects all frequencies for the entire length of the series. Thus, if the signal is a nonperiodic one, the summation of the periodic functions, sine and cosine, does not accurately represent the signal.Footnote 10 Such a feature restricts the usefulness of the Fourier transform to the analysis of stationary processes, whereas most economic and financial time series display frequency behavior that changes over time, i.e., they are nonstationary (Ramsey and Zhang 1995, 1996).Footnote 11 Hence, in order to accomplish band-pass filtering, one must therefore apply a detrending procedure, but then one is back in the realm of detrending methods along with their problems of arbitrariness in the estimation and elimination of the trend component.Footnote 12

Examples of filtering techniques operating entirely in the frequency domain are the applications of the Stier digital filter to the analysis of long waves (Gerster 1988; Metz 1992) and the frequency domain procedures of Englund et al. (1992) and Hassler et al. (1994). The first method allows filtering the predefined components with multiple band-pass and band-stop filters (Metz 2006), whereas, in the latter case, the periodic components are first computed after applying the Fourier transform to detrended data, then frequencies outside the frequency range of interest are “zeroed,” and finally, the (time domain) filtered series is obtained by computing the inverse Fourier transform. In sum, although spectral analysis is in principle an appropriate methodology for long wave analysis because of its ability to simultaneously estimate the contribution of several cyclical components, in practice its application is greatly limited by the requirement that the series be detrended in order to achieve stationarity.

A solution to the stationarity problems of filtering in the frequency domain is represented by those pass-band filters that are performed in the time domain, but whose desired properties are still formulated in the frequency domain. Well-known examples of time domain filters derived by approximating the frequency domain properties of ideal band-pass filters are the Baxter and King (1999) and Christiano and Fitzgerald (2003) approximate band-pass filtersFootnote 13 which apply two-sided moving averages to time series. These alternative finite sample filters differ for the assumptions about the spectral density of the variables and the symmetry of the weights of the filter. Regarding the first assumption, the approximation by Baxter and King assumes independent and identically distributed variables, whereas Christiano and Fitzgerald assume a random walk. As to the latter, Baxter and King develop an approximate band-pass filter with symmetric weights on leads and lags in order to avoid the filter introducing phase shift in the cycles of filtered series, whereas Christiano and Fitzgerald asymmetric filter has the advantage to avoid losing observations at the beginning and end of the sample.Footnote 14 Finally, the implicit differencing incorporated in both filters results in stationary time series even when the underlying time series is integrated of order one or two.

Although mainly developed in the context of business cycle analysis, these filtering techniques have also been applied for extracting lower frequency components of economic time series because both lower frequency cycles (and trends) and higher frequency components (for example, seasonality and noise) can be filtered out. The Baxter–King filter has been used by Baxter (1994) to study the relationship between real exchange-rate differentials and real interest rates at low frequencies and recently by Kriedel (2009) for the analysis of long waves of economic development with a length between 30 and 50 years in six European countries. Christiano and Fitzgerald (2003) have examined the Phillips curve relationship between unemployment and inflation in the short and the long run, as well as the correlations between low-frequency components of monetary growth and inflation with their own asymmetric band-pass filter. Finally, Metz (2011) has compared the performance of both band-pass filters and the Stier filter by extracting the filtered band-pass components of the pig iron production series with a periodicity range from 20 to 40 years.

3 Wavelet multiresolution analysis

The simultaneous estimation of several cyclical components may be also pursued using wavelet analysis.Footnote 15 Like spectral analysis, wavelet analysis allows to decompose any signal into a set of timescale components, each reflecting the evolution through time of the signal at a particular range of frequencies, and to study the dynamics of each component separately, but with a resolution matched to its scale since the wavelet basis function is dilated (or compressed) according to a scale parameter to extract different frequency information.Footnote 16 A significant benefit of wavelet analysis is that approximations generated by them are robust to small variations. This is in contrast to the situation in time series Fourier analysis where results are often very responsive to small changes in the model. Further, while Fourier analysis is designed to provide efficient estimates of cyclical phenomena, it is at the expense of ignoring nonstationarity. Wavelets provide an analytic structure which can be used to provide relatively efficient estimations of variation by frequency, by time and by scale. In short, the advantages of wavelet analysis are preeminent in the initial analysis of economic and financial data.

Both Fourier and wavelet transforms can be viewed as a rotation in function space to a different domain that for Fourier Transform contains basis functions that are sines and cosines, whereas for the wavelet transform, this new domain contains more complex basis functions called wavelets (see Strang 1993). The basis functions used by the Fourier transform (upper and middle panel) and the wavelet transform (lower panel) are displayed in Fig. 1.

Figure 1 shows how wavelets transform the data into a mathematically equivalent representation by using a basis function that is similar to a sine and cosine function in that it also oscillates around zero, but differs because it is well localized both in the time and the frequency domain. Therefore, wavelet analysis may overcome the main problems evidenced by Fourier analysis since wavelets are compactly supported, as all projections of a signal onto the wavelet space are essentially local, not global, and thus need not be homogeneous over time. Being performed locally, the wavelet transform allows the analysis of series that by their nature, as it is for long historical time series data, is likely to exhibit short-lived transient components like abrupt changes, jumps and volatility clustering, typical of war episodes or crisis episodes. Unlike spectral analysis and related statistical techniques, wavelet analysis considers nonstationarity an intrinsic property of the data rather than a problem to be solved by pre-processing the data. Indeed, much of the usefulness of wavelet analysis has to do with its flexibility to handle a variety of complex and nonstationary signals so that the data need neither be detrended nor corrections for war years are needed.Footnote 17 Hence, with wavelet analysis, we can avoid the practice of studying history by erasing part of the history (Freeman and Louçã 2001).

The wavelet transform maps a function f(t) from its original representation in the time domain into an alternative representation in the timescale domain w(t, j) applying the transformation \(w(t, j) = \psi (\cdot )f(t)\), where t is the time index, j the scale (i.e., a specific frequency band) and \(\psi (\cdot )\) the wavelet filter. There are two basis wavelet filter functions: the father and the mother wavelets, \(\phi\) and \(\psi\), respectively. The first integrates to 1 and reconstructs the smooth and low-frequency parts of a signal, whereas the latter integrates to zero and describes the detailed and high-frequency parts of a signal. The mother wavelet, as said above, plays a role similar to sines and cosines in the Fourier decomposition. It serves as a basis function to construct a set of wavelets, where each element in the wavelet set is obtained by compressing (or dilating) and shifting the mother wavelet, in order to approximate a signal. The functions \(\phi _{j,k}\) and \(\psi _{j,k}\) are the approximating wavelet functions generated from the father and mother wavelets, \(\phi\) and \(\psi\), through scaling and translation as follows

For a discrete signal or function \(f_{1},f_{2},\ldots ,f_{n}\), the wavelet representation of the signal or function \(f\left( t\right)\) in \(L^{2}\left( R\right)\) can be given by

where J is the number of multiresolution components or scales, and k ranges from 1 to the number of coefficients in the specified components. The coefficients \(d_{jk}\) and \(s_{Jk}\) of the wavelet series approximations in (3) are the details and smooth wavelet transform coefficients representing, respectively, the projections of the time series onto the basic functions generated by the chosen family of wavelets, that is

for \(j=1,2,\ldots ,J\). The smooth coefficients \(s_{Jk}\) mainly capture the underlying smooth behavior of the data at the coarsest scale, whereas detail coefficients \(d_{1k},\ldots ,\) \(d_{jk},\ldots ,\) \(d_{Jk}\), representing deviations from the smooth behavior, provide progressively finer scale deviations.Footnote 18

The multiresolution decomposition of the original signal \(f\left( t\right)\) is given by the following expression

where \(S_{J}=\sum \nolimits _{k}{s_{J,k}\phi _{J,k}\left( t\right) }\) and \(D_{j}=\sum \nolimits _{k}{d_{J,k}\psi _{J,k}\left( t\right) }\) with \(j=1,\ldots ,J\). The sequence of terms \(S_{J},D_{J},\ldots ,D_{j},\ldots ,D_{1}\) in (4) represent a set of components that provide representations of the signal at the different resolution levels, from 1 to J. The term \(S_{J}\) represents the smooth long-term component of the signal, and the detail components \(D_{j}\) provide the increments at each individual scale, or resolution, level.

Wavelet multiresolution analysis provides a systematic way of performing band-pass filtering (Proietti 2011). With wavelet multiresolution decomposition analysis, we are able to decompose any individual time series into its different timescale components, each corresponding to a specified frequency band, and then to isolate the stochastic cyclical component of interest. In particular, as the wavelet filter belongs to high-pass filter with passband given by the frequency interval \([1/2^{j+1},1/2^{j}]\) for scales \(1\,<\,j\,<\,J\), inverting the frequency range to produce a period of time, we have that wavelet coefficients associated with scale \(j=2^{j-1}\) are associated with periods \([2^{j},2^{j+1}]\). Thus the application of the discrete wavelet transform (DWT) with a number of levels (scales) \(J=5\) to annual data produces five wavelet details vectors \(D_{1}\), \(D_{2}\), \(D_{3}\), \(D_{4}\) and \(D_{5}\) whose frequency domain interpretation in term of periods is presented in Table 1.Footnote 19

In addition, to decompose a time series into several components each associated with a different resolution level, wavelets allow for an alternative representation of the variability of stochastic processes on a scale-by-scale basis through the energy decomposition analysis. Let E be the total energy of a signal f(t) for \(j=1,\ldots ,J\), we have

where

are the energy of the scaling and wavelet coefficients, respectively. The expression shows that the total signal energy is the sum of the jth level approximation signal and sum of all detail level signals first detail to jth detail. Indeed, since the wavelet transform is an energy-preserving transformation, the sum of the energies of the wavelet and the scaling coefficients is equal to the total energy of the data.Footnote 20 In particular, by performing the energy decomposition analysis, we can decompose the total energy of a series into the energy associated with each scale component so as to detect which frequency components contribute substantially more to the overall energy of the process relative to the others.

4 Dataset: wholesale price series for France, the UK and the USA from late eighteenth century

The presence of long waves has been investigated by early twentieth-century long wave investigators (e.g., van Gelderen 1913; de Wolff 1924; Kondratieff 1926) using price series for three main reasons. First, price data have been largely examined in the literature on long waves because prices have been for a long time the only available economic data and because they were consistently measured (by contrast, output variables have been reconstructed by economic historians relatively recently and only back to mid-nineteenth century). Second, since annual data on the wholesale price index go back to late eighteenth century, they allow us to use the longest possible time span as well as a number of observations higher than any corresponding international dataset on GDP whose data are only available from 1870 onwards only. Third, price series have provided the strongest supporting evidence for the long wave hypothesis.

In what follows, we examine the pattern in the wholesale price index for France, the UK and the USA, the leading economies, respectively, in the eighteenth, nineteenth and twentieth centuries. The raw series are represented by annual observations from 1791 to 2012 of the wholesale price indexes for France (from 1803), the USA and the UK, normalized to 100 for 1914.Footnote 21 All the series show a similar behavior, but very different patterns over time: Between late eighteenth and early twentieth century, the level of prices tends to display a very large amount of variation over time around a trendless or slightly declining trend, with large upward movements during upswings followed by similarly long downward movements during downswings. But after World War II, price level reductions disappear and prices kept increasing also in periods of declines of the level of economic activity as a consequence of a change in the process of price determination (van Duijn 1979; van Ewijk 1982), the effect being the emergence of a strong positive trend since 1930s, but especially in the post-World War II period.

Over the past twenty years, the issue of testing for structural breaks has received great attention in the statistics and econometrics literature.Footnote 22 The occurrence of such one-time structural change in the trend function or in volatility becomes more prominent especially when dealing with secular or long-run movements in macroeconomic time series during which changes in regime may occur as a result of wars, economic crises, changes in institutional arrangements (e.g., international monetary system), etc.

In the classical approach to structural break estimation and testing, such breaks are assumed to take the form of abrupt jumps or irregular changes, rather than smooth transitions, whose effects are displayed instantaneously. Examples of methods testing for the presence of breaks of unknown timing in the data and also estimating their dates are the Quandt likelihood ratio (QLR) test (Andrews et al. 1996), and the sequential procedure suggested by Bai and Perron (1998) for single and multiple structural breaks, respectively.

The approach for detecting and testing the number and location of the structural breakpoints is concerned with investigating whether the null hypothesis of “no structural change” holds in the following linear regression model

where \(y_{t}\) is the dependent variable at time t, \(x_{t}\) the vector of observations of the independent variables with coefficient \(\beta\) and \(u_{t}\) the disturbance at time t. The alternative hypothesis is represented by the assumption that there are m breakpoints so that the vector of regression coefficients varies over time up to \(m+1\) times (there are \(m+1\) segments in which the regression coefficients are constant). The break dates \((T_{1}, \dots , T_{m})\) are simultaneously estimated together with the unknown regression coefficients \((\beta _{1}, \dots , \beta _{m})\), with both breaks and coefficients explicitly treated as unknown. Specifically, the least squares estimates of \(\beta\) and m, \(\hat{\beta }(\hat{T}_{j})\) and \(\hat{T}_{j}\) are obtained by minimizing the residual sum of squares (RSS) of the equation above

where \(S_{T}(T_{j})\) represents the residual sum of squares issued from the estimation of the m regressions.

The dynamic programming algorithm proposed by Bai and Perron (2003) provides an efficient way to determine the optimal partition \((T_{1},\ldots ,T_{m})\) by achieving global minimization of the overall sum of squared residuals over all partitions. Bai and Perron’s suggested OLS procedure consists in first testing for the existence of structural changes (1 break, 2 breaks, etc.) and then, if structural change exists, identifying the number and location of breaks by a sequential procedure where model selection is based on the Bayesian Information Criteria (BIC).Footnote 23 The regressors are modeled by only a constant and a trend, and the sequential test is implemented by setting the maximum number of breaks m equal to 5 and the trimming percentage to 15 % in all cases. The results of the application of Bai-Perron’s test for multiple breakpoints to the wholesale price index of France, the UK and the USA are given in Table 2, where the estimated break dates corresponding to breakpoints are reported along with their confidence intervals. The breakpoint selection procedure, based on the values of the residual sum of squares and Bayesian information criteria (minimum RSS and BIC), identifies three structural breakpoints for each series and four different regimes.Footnote 24

The estimated breakpoints detect sudden and, sometimes, dramatic historical changes, such as World War I and World War II, the Great Depression, oil price shocks and productivity slowdown that have affected economic processes over time. Among all estimated break points, the structural change points occurring before World War I in France and in the 1930s in the UK and the USA are of great interest because they correspond to the trend reversal in the pattern of price series from slightly negative to strongly positive. Indeed, the nonlinear features of all the series are clearly displayed by the two different trend regimes clearly evident before and after these structural breaks.

The results above confirm that complexity and nonlinearities are likely to be intrinsic feature of datasets used in long waves studies as long-term data generally include historical events, such as war episodes, policy changes, technique innovations and crisis periods that are mostly responsible for structural breaks. Moreover, some of the above-mentioned changes can also appear as gradual evolution of long-term trends instead of one-time instantaneous breaks of a constant deterministic or stochastic trend. Such a complex pattern makes the price series suitable for testing the performance of the methodology proposed in this paper for identifying long waves or super cycles, that is wavelet analysis.

5 Wavelet estimation of long waves in prices

Wavelet techniques are one of the most popular and powerful tools for processing complex nonlinear signals.Footnote 25 Compared with other similar basis functions, wavelets possess several uniquely attractive features when dealing with nonlinear series. This result is due to the localization of nonstationary structures. Thus, we apply the maximal overlap discrete wavelet transform (MODWT) to annual observations from 1791 to 2012 of the wholesale price indexes for France, the USA and the UK.Footnote 26 In order to perform a wavelet analysis of a time series, a number of decisions must be made: Which family of wavelet filters to use? What type of wavelet transform to apply? And how boundary conditions at the end of the series are to be handled? There are several families of wavelet filters available, such as Haar (discrete), symmlets and coiflets (symmetric), daublets (asymmetric), differing by the characteristics of the transfer function of the filter and by filter lengths (see Fig. 1). Daubechies (1992) has developed a family of compactly supported wavelet filters of various lengths, the least asymmetric family of wavelet filters (LA), which is particularly useful in wavelet analysis of time series because it allows the most accurate alignment in time between wavelet coefficients at various scales and the original time series. We use the Daubechies least asymmetric (LA) wavelet filter of length \(L=8\) based on eight nonzero coefficients (Daubechies 1992), with reflecting boundary conditions.Footnote 27 The LA(8) is the most widely used filter in economic applications because of its ability to balance the most common desirable characteristic for wavelet basis functions (smoothness, length and (a)symmetry) and is applicable to a wide variety of data types (see Gençay et al. 2010).

5.1 Energy decomposition analysis

The application of the MODWT allows the analysis of the signal energy distribution with respect to different frequency bands and to measure the relative importance of the long wave component as to all other cyclical components, especially business cycle components. Since we are interested in extracting lower frequency components from price series, we need to define which range of cyclical periodicities identify long-term cycles. In the literature, the existence of long-term fluctuations has been primarily recognized using series of commodity prices. Long swings with a characteristic period of 40–60 years and an average length of about 50 years were documented by Kondratieff (1926, 1935, 1992) for several countries (France, Germany, the UK and the USA) using different economic variables (wholesale price index, industrial production, interest rates, foreign trade, etc.).Footnote 28 The frequency domain interpretation of signal components provided in Table 1 indicates that the \(D_{5}\) detail component can provide an estimate of long waves similar to those discovered by Kondratieff in his original studies since its frequency range is between 32 and 64 years and its average cycle length is around 48 years.Footnote 29 Moreover, since no assumption has been made on the underlying nature of the signal and a criterion similar to a locally adaptive bandwidth has been adopted, the wavelet detail component \(D_{5}\) represents a nonparametric estimation of the Kondratieff-type long waves.

That longer cycle frequencies carry most of the energy in wholesale price series, with the small-scale features accounting for a small fraction of the total variability, is a standard result that resemble what Granger (1961) termed as “the typical spectral shape of an economic variable.”Footnote 30 Thus, before applying the MODWT energy decomposition analysis, we remove the \(\hbox {S}_{5}\) long-term component from the price series so as to provide a clear-cut comparison of the relative importance of the different cyclical components present in the price series. The five crystals energy-related bar plots of the wholesale price series for France, the UK and the USA, net of the \(S_{5}\) component, are shown in Fig. 2.

Two main findings emerge from the energy decomposition analysis: First, the residual energy at each scale level tends to decrease with the scale level, and second, most of this energy is concentrated at the detail level corresponding to the long wave component, \(D_{5}\).Footnote 31 In sum, even if the total residual energy is modest, given the dominance of the \(S_{5}\) components, we can conclude that the component corresponding to long waves provides the most significant contribution in terms of overall variance, especially in comparison with classical business cycles cyclical components.

5.2 Long waves detection using wavelet multiresolution analysis

The \(D_{5}\) detail components of the wholesale price index for France, the UK and the USA, \(\hbox {WPI}_{D_{5}}\), are displayed in Fig. 3 along with their corresponding raw series, WPI.Footnote 32 Five long waves in prices are clearly detected between 1790 and 2012 for the UK and the USA, whereas only four and a half long waves are clearly detectable for France because the sample starting in 1803 captures the downswing phase of the first long wave. The periodization is reported in Table 3 with upswings (Phase A) and downswings (Phase B) phases.

The main feature emerging from the visual inspection of long waves prices for all countries is the absence of regularities in terms of length and amplitude of such long wave patterns. Indeed, these long wave patterns in wholesale price indexes are represented as an alternating sequence of historical phases of variable length. Moreover, these long cycle movements in prices are evident not only when the raw series has a slightly negative trend, as it is in the pre-World War II period, but also after World War II when the strong trending behavior of the price level makes such long waves in price indexes hard to be detected. This is an interesting result because in the literature a question highly debated is whether the wave pattern of price index dynamics has changed in the post-World War II period when the wave pattern has ceased to be clearly traced in the price indices as a consequence of the strong positive trend of prices after 1930s. In particular, our results not only confirm the findings of previous researchers (e.g., van Ewijk 1982; Goldstein 1988; Reijnders 1990; Gerster 1992; Berry et al. 1993; Berry 2006), but, at the same time, contrasts other findings, such as Diebolt and Doliger (2007) which had reached the conclusion that there was no Kondratieff type of fluctuations in long price series. Specifically, our results indicate that such a reduction after World War II has occurred for the USA only, where a moderation in amplitude of the waves is evident by looking at the fourth and fifth price waves. Otherwise, for the UK there is no evidence of any reduction in the amplitude of long-term fluctuations in prices in the post-World War II period, whereas in the case of France the evidence shows that a considerable increase in the amplitude of price fluctuations is limited to those long waves taking place in the interwar and post-World War II periods.

Figure 3 also shows that long movements in prices are closely related internationally, especially between the UK and the USA. Long waves in UK and US wholesale prices are highly synchronized throughout the sample period, a finding that is consistent with the historical evidence on prices reported in the empirical literature for the major economies (see Goldstein 1988).Footnote 33 As regards France, although wholesale prices are out-of-phase with the UK and the USA throughout the nineteenth century, they have been moving in phase from the early twentieth century. Such in-phase relationship holds throughout the twentieth century until the US wholesale price index begins moving out-of-phase as to the two European countries.Footnote 34

Finally, another interesting result emerging from this study is about the absence of synchronization of long waves in prices and quantities (mainly GDP) after World War II. Indeed, for the proponents of Kondratieff waves, there would have been a long expansion phase (phase A) from 1945 to 1973 followed by, according to some authors, a long phase of major economic difficulties (phase B), or, according to others, a phase B until the years 1990–2000 and a new phase A since then. Whatever the variant adopted, it is clear that, starting from World War II, there is no correspondence between the paths followed by long waves of production and prices.Footnote 35

Since the results provided in this section arise from applying a new methodology, it is important to examine whether the turning points detected by the \({D}_{5}\) component resemble the periodization of long waves in prices previously reported in the literature.Footnote 36 Table 4 shows countries’ long wave chronologies for wholesale prices as reported in Kondratieff (1935), Burns and Mitchell (1946), Imbert (1959) and Bosserelle (1991), along with the peaks and troughs dates detected by the \(D_{5}\) component.Footnote 37

Despite minor differences, the dates of long wave phases detected by the \(D_{5}\) detail component of the wholesale price index match closely the periodization reported in Table 4. Important deviations are evident only for the first wave of France: The peak at the turn of the nineteenth century and the trough date in the mid-nineteenth century are slightly anticipated by several years . A similar difference also emerges with respect to the trough date in the mid-nineteenth century, for the UK, although there is evidence of a prolonged period of low prices lasting until 1850, the consensus date for the trough of the downswing phase.

All in all, notwithstanding the different periodization at the beginning of the sample for France, and partly the UK, the overall dating scheme provided by wavelet decomposition analysis shows a close correspondence with the chronology provided in the literature on the long waves in prices.

5.3 A comparison with BK and CF band-pass filters

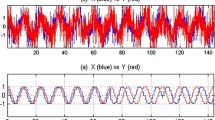

Since wavelet and spectral analysis are filtering approaches that permit to decompose a time series into different components corresponding to pre-specified ranges of periodicities, we can perform a direct comparison of the two methods. In particular, we compare the long waves extracted using the MODWT with the LA(8) Daubechies’ wavelet filter, represented by the \(D_{5}\) component, with the corresponding components extracted using the Baxter and King (1999) and Christiano and Fitzgerald (2003) band-pass filters,Footnote 38 by evaluating how the long waves identified by the various band-pass filtered components accord with the dating schemes reported in Table 4. The \(D_{5}\) component (red line) and the corresponding CF band-pass filtered component for the wholesale price index for France (top), the UK (middle) and the USA (bottom) are plotted in Fig. 4, with gray-shaded areas as in Fig. 3.Footnote 39

A remarkable similarity emerges between the patterns of the long waves detected through the LA(8) wavelet filter and the CF band-pass filter.Footnote 40 With respect to the \(D_{5}\) and CF filtered components, we notice how the amplitude of the filtered cycles and the turning points corresponds quite well since early twentieth century for all the three countries, and also from the late eighteenth to the end of nineteenth century for the USA, and partly the UK. Apart from some rare exceptions, the dating of long wave phases detected by the LA(8) and CF filters closely matches the timing identified by earlier analysts using less formal approaches. Nonetheless, several differences between LA(8) and CF filters are in evidence around mid-nineteenth century for France and the UK, and in the last part of the sample in correspondence of the fifth wave, especially for France and the USA. In the first case, there are differences related to turning points detection, in the latter to the amplitude of the filtered components. Indeed, after detecting the lower turning point of the first long wave for France in the years 1833–1834, the LA(8) wavelet filter detects the upper turning point of the second long wave in 1872, whereas the CF band-pass filter identifies two small extra cycles with peaks in 1852 and 1880 and a trough in 1870. But this is at odd with the chronology based on price index reported in the literature on long waves and reported in Table 3 where the upper turning point of the second wave is dated between 1872 and 1873 (see Kondratieff 1926; Burns and Mitchell 1946; Imbert 1959). As to the UK the main difference refers to the lower turning point of the first long wave that according to the CF filter appears in 1835, while the wavelet-filtered component provides evidence of a prolonged period of low prices lasting until 1850, a date which is in between the consensus dates for the trough of the downswing phase as shown in Table 3. Otherwise, when structural breaks are clearly evident, as it is for the USA also in the pre-World War I period, the filtered components are remarkably similar.

In order to interpret these differences between the filtered components, we must remember that the optimizing criteria adopted by band-pass filter approximations implicitly define the specific class of model for which the approximating filter is optimal. By contrast, the application of the wavelet transform does not require a commitment to any particular class of model. The sub-cycles identified by the CF band-pass filter in the second half of the nineteenth century in the price series for France are consistent with the interpretation that these cycles can be artifacts stemming from implicit differencing, as differencing eliminates all low frequencies when applied to a stationary series (see Metz 2011).Footnote 41

As to the filtered values at the right edge of the price series, the differences emerging between the filtered components do not allow a common interpretation because such differences are not uniform across countries. Since the attenuation of the fluctuations in the components filtered by the MODWT as to the CF is evident for France and the USA, but not for the UK, discriminating between such alternative periodization is difficult because of the absence in the literature of historical chronologies for long waves in price series.Footnote 42

MODWT LA(8) (black lines) and Christiano–Fitzgerald (light gray lines) filtered long wave components of the wholesale price index for France (top), UK (middle) and USA (bottom). Gray-shaded areas (turns) as in Fig. 3

6 Conclusion

In this paper, we propose the application of wavelet analysis to wholesale price series of France, the UK and the USA in order to detect long waves of the type examined by Kondratieff in the 1920s and subsequently by many other authors. A fundamental benefit of wavelet analysis in contrast to Fourier series or splines is that, in general, wavelet analysis is more robust in a messy world than are the other techniques. By a messy world, we mean one in which random occurring sizable shocks distort the dynamical system, the parameterization of approximating models need to be changed over time, and distributions relevant in one time period are not statistically similar in another time period. The prevalence of unit roots is more of a theoretical problem than an empirical one, although all fractional differencing is probably a common phenomenon in economic and financial data.

The comparison with band-pass filters, based on the chronologies for the price series available in the literature, provides interesting information on the potential advantages displayed by wavelet multiresolution decomposition analysis in comparison with classical filtering methods for the analysis of long waves when trend breaks are present in the original data. In particular, since classical filters assume a specific kind of data generating process, whereas no specific assumption on the characteristics of process is required for the application of the wavelet transform, their results are similar to those stemming from wavelet filtering method only when the details of the time series representation are compatible with those assumed by optimal linear approximation. In this sense, the wavelet method seems to be a very promising (model-free) approach to frequency extraction problems, as it allows simultaneous estimation of different unobserved components without making any explicit assumption about the characteristic of the data generating process.

In sum, we believe that wavelet analysis, by allowing researchers to be less committed to a particular class of model, can overcome most of the methodological difficulties faced by previous methods. Moreover, because of its ability to localize the nonstationary structure which depends on time, wavelets are well suited for the analysis of time series resulting from complex, nonlinear processes, as it is the case with the secular movements in price series which exhibit structural changes in the trend function so as to be characterized as a segmented trend process.

Notes

In the classical decomposition approach time series are the sum of different unobserved components: trend, cyclical, seasonal and irregular components.

Growth cycles definition follows from the modern approach to business cycles analysis (Lucas 1977), where business cycles are defined as fluctuations around a (stochastic) trend.

Although designed using frequency domain analysis, these filters are undertaken in the time domain by applying moving averages to time series data.

In this study we do not intend to provide a solution to the problem of the statistical proof of Kondratieff cycles. The statistical identification of long waves is at least problematic given the low number of repeated cycles within the period of observation, i.e., the Kondratieff cycle is too long for the length of the present time series.

The gain and the phase shift of the filter determine the so-called transfer function of a filter which is used to evaluate the properties of a filter.

However, the ideal band-pass filter requires the application of an infinite-order moving average filter to the series of interest, and thus, some kind of approximation is needed in order to be implemented in empirical applications.

The theory of the spectral analysis relies on the spectral representation theorem according to which any time series within a broad class can be decomposed into different frequency components.

The signal can then be analyzed for its frequency content because the Fourier coefficients of the transformed function represent the contribution of each sine and cosine function at each frequency.

In additon, the results of the frequency domain method at all dates are dependent on the sample length (Baxter and King 1999).

Nonstationarity is an intrinsic feature of datasets used in long waves studies since long-term data generally include historical events such as war episodes, policy changes, technique innovations and crisis periods that are likely to be responsible for structural breaks in the form of abrupt changes, jumps and volatility clustering.

Detrending procedures are not neutral with respect to the results relating to the existence of cycles: “the smoothing techniques may create artefacts” (Freeman and Louçã 2001, p. 99).

The exact band-pass filter is a moving average of infinite order, so an approximation is necessary for practical application.

The ideal band-pass filter can be better approximated with longer moving averages. Using a larger number of leads and lags allows for a better approximation of the exact band-pass filter, but makes unusable more observations at the beginning and end of the sample.

Wavelets, their generation and their potential usefulness are discussed in intuitive terms in Ramsey (2010, 2014). A more technical exposition with many examples of the use of wavelets in a variety of fields is provided by Percival and Walden (2000), while an excellent introduction to wavelet analysis along with many interesting economic and financial examples is given in Gençay et al. (2002) and Crowley (2007).

Moreover, the transformation to the frequency domain does not preserve the time information so that it is impossible to determine when a particular event took place, a feature that may be important in the analysis of economic relationships. In other words, it has only frequency resolution but not time resolution.

Corrections for war periods (war data are influenced by pre-war armament booms, war economy and post-war reconstruction booms around World War II and to a lesser extent World War I) are generally applied to original data by interpolating series for the war years (Metz 1992) or a priori elimination of the impact of the war periods (Korotayev and Tsirel 2010) on the assumption that such shocks can be seen as disturbances in the normal structure of data.

Each of the sets of the coefficients \(s_{J},d_{J},d_{J-1},\ldots ,d_{1}\) is called a crystal in wavelet terminology.

They capture oscillations with a period of 2–4, 4–8, 8–16, 16–32 and 32–64 years, respectively.

The variance of the time series is preserved in the variance of the coefficients from the MODWT, i.e., \(\hbox {var}(X_{t}) = \sum _{j=1}^J \hbox{var}(d_{j},t) + \hbox{var}(s_{J},t)\) (see Percival and Mojfeld 1997).

Data from 1791 to 1990 are taken from Lothian and Taylor (1996). As stated in their Appendix (see pp. 505–506), the origin of the wholesale prices series is as follows. For France: 1803–1948, European Historical Statistics (Mitchell 1975, pp. 772–774, table 1) and 1949–1990, various issues of International Financial Statistics (IFS). For the UK: 1791–1939, 1946–1948, Jastram (1977, pp. 32–33, table 2), 1939–1945, Board of Trade, wholesale price index for 1930–1950, as reported in British Historical Statistics (p. 730), table entitled Prices 5, and 1948–1990, IFS, various issues. For the USA 1791–1800, Warren and Pearson (1935, pp. 30–32, table 1), 1800–1976, Jastram (1977, pp. 145–146, table 7), 1976–1990, IFS, various issues. From 1991 to 2012 wholesale price series for the three countries are updated by the authors using various issues of IFS.

The breakpoints are estimated with the R package strucchange (Zeileis et al. 2002). The number of estimated breakpoints according to the values of the RSS and BIC criteria are five and four, respectively. However, on the grounds of sequential tests and also because of the well-known fact that information criteria are often downward biased, we select three breaks (Bai and Perron 2003).

Although wavelets were first introduced in the mid-80s and the real development started in the early 90s, they are considered a relatively new tool in signal processing. Nonetheless, in the last decades, they are becoming increasingly popular, especially in economics and finance applications.

We apply the MOWDT because the DWT has two main drawbacks: (1) the dyadic length requirement (i.e., a sample size divisible by \(2^{J}\)), (2) the wavelet and scaling coefficients are not shift invariant, and, finally, the MODWT produces the same number of wavelet and scaling coefficients at each decomposition level as it does not use downsampling by two.

With reflecting boundary conditions, the original signal is reflected about its end point to produce a series of length 2N which has the same mean and variance as the original signal.

See Bernard et al. (2014) for a discussion of the main theories of long waves proposed in the literature and for some empirical evaluation of the empirical evidence on cycles of different time scales.

Indeed, most economic variables display a spectrum that exhibit a smooth declining shape with considerable power at very low frequencies.

This last result strictly holds for the UK and the USA, whereas in the case of France the level of energy at the \(D_{4}\) level is slightly higher than that at the \(D_{5}\) level.

According to Lewis (1978) Kondratieff price swings, which is declining prices from 1873 to 1895 followed by rising prices from 1895 to 1913, are associated with a change in the terms of trade between agriculture and industry, where agricultural prices fall more up to 1895 and then rise relative to industrial prices.

Indeed, the diverging pattern emerging in the first decade of the new millennium indicates that a phase shift between the price waves of the USA and those of the two European countries could have occurred.

We thank an anonymous referee for suggesting this point.

After Kondratieff (1926) a huge number of long wave chronologies have been proposed by various authors, e.g., Schumpeter (1939), Clark (1944), Burns and Mitchell (1946), Dupriez (1951), Imbert (1959), Mandel (1975), Rostow (1978), van Duijn (1983), among the others, but only a few of them are based on nominal prices.

In Kondratieff the peak of the third long cycle for France is located in 1920 because Kondratieff’s periodization is based upon the movement of gold prices, not nominal prices.

We select the band-pass filtered frequency components in the BK and CF filters so that only fluctuations within the band of 32–64 years are retained in each filtered component.

The BK filter is estimated using a value of leads and lags equal to 12 and padding the original data at both sides to compensate for the loss of data. The filtered components detected using the BK filter (not reported in Fig. 4) are strikingly different from the two other filters, both as to the amplitude of the movements and the timing of the turning points.

These results are fully in line with a-priori expectations about the ability of band-pass filters to extract the cyclical component whose performance are likely to depend on the characteristics of the spectral density of the (unknown) theoretical cyclical component (e.g., Metz 2011). The filters by Baxter and King (1999) and Christiano and Fitzgerald (2003) assume a special type of data generating process, that is independent and identically distributed variables and random walks, respectively. Since a random walk puts more weight on lower frequencies, whereas independent and identically distributed variables weight all frequencies equally, Everts (2006, p.17) conclude that “the filter by Christiano and Fitzgerald approximates the ideal band-pass filter for data sets with low frequencies (long durations) better than the filter by Baxter and King” and that “produces more accurate results for long business cycles than the one by Baxter and King.” On the other hand the filter by Baxter and King approximates the ideal band-pass filter for shorter business cycles with higher accuracy than the filter by Christiano and Fitzgerald which provide a worse performance for cycles with short durations.

As evidenced by Metz (2009, p. 65), “the mechanical use of filters without considering trend breaks may result in spurious impression of the trend and cyclical behavior of time series.”

Filtering methods applied to a finite length time series inevitably suffer from border distortions; this is due to the fact that the values of the transform at the beginning and the end of the time series are always incorrectly computed, in the sense that they involve missing values of the series which are then artificially prescribed. Therefore, at the edges of a series the filtered values are likely to suffer from these boundary effects and have to be interpreted carefully.

References

Andrews DWK, Lee I, Ploberger W (1996) Optimal change-point tests for normal linear regression. J Econom 70:9–38

Bai J (1994) Least squares estimation of a shift in linear processes. J Time Ser Anal 15:453–472

Bai J (1997a) Estimating multiple breaks one at a time. Econom Theory 13:315–352

Bai J (1997b) Estimation of a change point in multiple regression models. Rev Econ Stat 79:551–563

Bai J, Perron P (1998) Estimating and testing linear models with multiple structural changes. Econometrica 66:47–78

Bai J, Perron P (2003) Computation and analysis of multiple structural change models. J Appl Econom 18:1–22

Baxter M (1994) Real exchange rates and real interest differentials: have we missed the business-cycle relationship? J Monet Econ 33:5–37

Baxter M, King R (1999) Measuring business cycles: approximate band-pass filters for economic time series. Rev Econ Stat 81:575–593

Bernard L, Gevorkyan A, Palley T, Semmler W (2014) Time scales and mechanisms of economic cycles: a review of theories of long waves. Rev Keynes Econ 2:87–107

Berry BJL (2006) Recurrent instabilities in K-wave macrohistory. In: Devezas TC (ed) Kondratieff waves, warfare and world security. IOS Press, Amsterdam, pp 22–29

Berry BJL, Kim H, Kim H-M (1993) Are long waves driven by techno-economic transformations? Technol Forecast Soc Change 44:111–135

Bieshaar H, Kleinknecht A (1984) Kondratieff long waves in aggregate output? an econometric test. Konjunkturpolitik 30:279–303

Bosserelle E (1991) Les fluctuations longues de prix de type Kondratieff. Thèse de doctorat nouveau régime en sciences économiques, Université de Reims

Bosserelle E (2001) Le cycle Kondratieff : mythe ou réalité? Futuribles International, numéro 16, LIPS, DATAR, Commissariat Général du Plan

Bosserelle E (2012) La croissance économique dans le long terme: S. Kuznets versus N.D. Kondratiev - Actualité d’une controverse apparue dans l’entre-deux-guerres. Economies et Sociétés, Cahiers de l’ISMEA, série Histoire économique quantitative, AF, 45:1655–1688

Bosserelle E (2013) Les études empiriques menées sur les cycles longs depuis le début des années 1980: Quels enseignements? In: Diemer A, Borodak D, Dozolme S (eds). Heurs et malheurs du capitalisme, Editions Oeconomia, pp 132–154

Bossier F, Hugé P (1981) Une vérification empirique de l’existence de cycles longs á partir de données belges. Cahiers économiques de Bruxelles 90:253–267

Burns AF, Mitchell WC (1946) Cyclical changes in cyclical behavior. In: Burns AF, Mitchell WC (eds) Measuring business cycles. NBER, New York, pp 424–471

Christiano LJ, Fitzgerald TJ (2003) The band pass filter. Int Econ Rev 44(2):435–465

Clark C (1944) The economics of 1960. MacMillan, London

Crowley P (2007) A guide to wavelets for economists. J Econ Surv 21:207–267

Darné O, Diebolt C (2004) Unit roots and infrequent large shocks: new international evidence on output. J Monet Econ 51:1449–1465

Daubechies I (1992) Ten lectures on wavelets. In: CBSM-NSF regional conference series in applied mathematics, vol 61. SIAM, Philadelphia

de Wolff S (1924) Prosperitats-und Depressionsperioden. In: Jensen O (ed) Der Lebendige Marxismus. Thuringer Verlagsanstalt, Jena, pp 13–43

Diebolt C (2005) Long cycles revisited—an essay in econometric history. Economies et Sociétés, série Histoire économique quantitative AF 32:23–47

Diebolt C, Doliger C (2006) Economic cycles under test: a spectral analysis. In: Devezas TC (ed) Kondratieff waves, warfare and world security. IOS Press, Amsterdam, pp 39–47

Diebolt C, Doliger C (2007) Retour sur la périodicité d’une nébuleuse: le cycle économique. Réponse à Eric Bosserelle. Economie Appliquée 50:199–204

Diebolt C, Doliger C (2008) New international evidence on the cyclical behaviour of output: Kuznets swings reconsidered. Quality and quantity. Int J Methodol 42:719–737

Dupriez LH (1951) Des mouvements économiques généraux, Tomes 1 et 2. Edition Nauwelaerts, Louvain

Englund P, Persson T, Svensson L (1992) Swedish business cycles: 1861–1988. J Monet Econ 30:343–371

Erten B, Ocampo JA (2013) Super cycles of commodity prices since the mid nineteenth century. World Dev 44:14–30

Everts M (2006) Band-pass filters. Munich Personal RePec Archive Paper no. 2049

Freeman C, Louçã F (2001) As time goes by: from the industrial revolution to the information revolution. Oxford University Press, Oxford

Gençay R, Selçuk F, Whitcher B (2002) An introduction to wavelets and other filtering methods in finance and economics. San Diego Academic Press, San Diego

Gençay R, Gradojevic N, Selçuk F, Whitcher B (2010) Asymmetry of information flow between volatilities across time scales. Quant Finance 10:895–915

Gerster HJ (1988) Lange Wellen wirtschaftlicher Entwicklung. Lang, Frankfurt

Gerster HJ (1992) Testing long waves in price and volume series from Sixteen Countries. In: Kleinknecht A, Mandel E, Wallerstein I (eds) New findings in long wave research. St Martin’s Press, New York, pp 120–147

Goldstein JS (1988) Long cycles: prosperity and war in the modern age. Yale University Press, New Haven

Goldstein JP (1999) The existence, endogeneity and synchronization of long waves: structural time series model estimates. Rev Radic Polit Econ 31:61–101

Granger WJ (1961) The typical spectral shape of an economic variable. Econometrica 34:150–161

Hassler J, Lundvik P, Persson T, Söderlind P (1994) The Swedish business cycle: stylized facts over 130 years. In: Bergstrom V, Vredin A (eds) Measuring and interpreting business cycles. Clarendon Press, Oxford, pp 11–108

Haustein HD, Neuwirth E (1982) Long waves in world industrial production, energy consumption, innovations, inventions, and patents and their identification by spectral analysis. Technol Forecast Soc Change 22:53–89

Imbert G (1959) Des mouvements de longue durée Kondratieff. Thèse, Aix. La pensée universitaire, 1960

Jacks DS (2013) From boom to bust: a typology of real commodity prices in the long run. NBER, WP no. 18874

Jerrett D, Cuddington JT (2008) Broadening the statistical search for metal price super cycles to steel and related metals. Resour Policy 33:188–195

Kondratieff ND (1926) The major cycles of the conjuncture and the theory of forecast. Economika, Moscow

Kondratieff ND (1935) The long waves in economic life. Rev Econ Stat 17:105–115

Kondratieff ND (1992) Les grands cycles de la conjoncture. Economica, Paris

Korotayev AV, Tsirel SV (2010) A spectral analysis of world GDP dynamics: Kondratieff waves, Kuznets swings, Juglar and Kitchin cycles in global economic development, and the 2008–2009 economic crisis. Struct Dyn 4:3–57

Kriedel N (2009) Long waves of economic development and the diffusion of general-purpose technologies: the case of railway networks. Economies et Sociétés, série Histoire économique quantitative, AF 40:877–900

Kuczynski T (1978) Spectral analysis and cluster analysis as mathematical methods for the periodization of historical processes. Kondratieff cycles—appearance or reality? In: Proceedings of the seventh international economic history congress, vol 2. International Economic History Congress, Edinburgh, pp 79–86

Lewis WA (1978) Growth and fluctuations 1870–1913. George Allen and Unwin, London

Lothian JR, Taylor MP (1996) Real exchange rate behavior: the recent float from the perspective of the past two centuries. J Polit Econ 104:488–509

Lucas RE (1977) Understanding business cycles. Carnegie-Rochester Conf Ser Public Policy 5:7–29

Mandel E (1975) Long waves in the history of capitalism. In: Review NL (ed) Late capitalism. NLB, London, pp 108–146

Metz R (1992) A Re-examination of long waves in aggregate production series. In: Kleinknecht A, Mandel E, Wallerstein I (eds) New findings in long waves research. St. Martin’s Press, New York, pp 80–119

Metz R (2006) Empirical evidence and causation of Kondratieff cycles. In: Devezas TC (ed) Kondratieff waves, warfare and world security. IOS Press, Amsterdam, pp 91–99

Metz R (2009) Comment on Stock markets and business cycle comovement in Germany before world war I: evidence from spectral analysis. J Macroecon 31:58–67

Metz R (2011) Do Kondratieff waves exist? How time series techniques can help to solve the problem. Cliometrica 5:205–238

Metz R, Stier W (1992) Modelling the long wave-phenomena. Hist Soc Res 17:43–62

Mosekilde E, Rasmussen S (1989) Empirical indication of economic long waves in aggregate production. Eur J Oper Res 42:279–293

Percival DB, Mojfeld H (1997) Analysis of subtidal coastal sea level fluctuations using wavelets. J Am Stat Assoc 92:868–880

Percival DB, Walden AT (2000) Wavelet methods for time series analysis. Cambridge University Press, Cambridge

Proietti T (2011) Trend estimation. In: Lovric M (ed) International encyclopedia of statistical science, 1st edn. Springer, Berlin

Ramsey JB (2010) Wavelets. In: Durlauf SN, Blume LE (eds) The new Palgrave dictionary of economics. Palgrave Macmillan, Basingstoke, pp 391–398

Ramsey JB (2014) Functional representation, approximation, bases and wavelets. In: Marco Gallegati, Semmler W (eds) Wavelet applications in economics and finance. Springer, Heidelberg, pp 1–20

Ramsey JB, Zhang Z (1995) The analysis of foreign exchange data using waveform dictionaries. J Empir Finance 4:341–372

Ramsey JB, Zhang Z (1996) The application of waveform dictionaries to stock market index data. In: Kravtsov YA, Kadtke J (eds) Predictability of complex dynamical systems. Springer, Berlin, pp 189–208

Reijnders JPG (1990) Long waves in economic development. Edward Elgar, Aldershot

Rostow WW (1978) The world economy: history and prospect. University of Texas Press, Austin

Schumpeter JA (1939) Business cycles. McGraw-Hill, New York

Solomou S (1990) Phases of economic growth 1850–1973. Kondratieff waves and Kuznets swings. Cambridge University Press, Cambridge

Stier W (1989) Basic concepts and new methods of time series analysis. Hist Soc Res 14:3–24

Strang G (1993) Wavelet transforms versus Fourier transforms. Bull Am Math Soc 28:288–305

Taylor JB (1988) Long waves in six nations: results and speculations from a new methodology. Review 9:373–392

van Duijn JJ (1979) The long wave in economic life. Economist 125:544–576

van Duijn JJ (1983) The long wave in economic life. Allen and Unwin, Boston

van Ewijk C (1981) The long wave–a real phenomenon? Economist 129:324–372

van Ewijk C (1982) A spectral analysis of the Kondratieff cycle. Kyklos 35:468–499

van Gelderen J (1913) Springvloed: Beschouwingen over industrieele ontwikkeling en prijsbeweging (Spring Tides of Industrial Development and Price Movements), De Nieuwe Tijd 18:253–277, 369–384, 445–464

Zarnowitz V, Ozyildirim A (2002) Time Series decomposition and measurement of business cycles. Trends and growth cycles. NBER Working Paper no. 8736, Cambridge

Zeileis A, Leisch F, Hornik H, Kleiber C (2002) strucchange: An R package for testing for structural change in linear regression models. J Stat Softw 7:1–38

Acknowledgments

A preliminary version of the paper has been presented at the 16th Conference of the Association for Heterodox Economics, University of Greenwich, London, Uk, 2–4 July 2014. We thank participant for their useful comments. We would like to thank three anonymous reviewers whose careful reading and valuable comments considerably improved our original text. The responsibility for all remaining errors is, of course, ours.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Gallegati, M., Gallegati, M., Ramsey, J.B. et al. Long waves in prices: new evidence from wavelet analysis. Cliometrica 11, 127–151 (2017). https://doi.org/10.1007/s11698-015-0137-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11698-015-0137-y