Abstract

This paper focus on comparison between three wavelets methodologies to estimate a time–frequency varying parameter. In the discrete case, we oppose the intuitive application of the rolling regression on wavelets frequency bands to the time–frequency rolling window. We compare if we have to use the time rolling window directly on the wavelet’s frequency bands or apply the time–frequency rolling window on the series realizing the wavelet decomposition at each step of the process. A time–frequency varying estimator by continuous wavelets is also considerate in the comparison. Our objective is to show that the time–frequency rolling window and the Continuous estimates are more suitable than the intuitive way. We use in first time simulated data and also the daily returns of AXA and the CAC 40 index from 2005 to 2015 as empirical application. We show that the differences between discrete methods are more important at low-frequencies. Moreover, the continuous time–frequency Betas are closer to the time–frequency windows estimates.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

Measuring the risk is one of the objectives of portfolio manager and analyst. The CAPM of Sharpe [21] provides a simple measure of systematic risk by the Beta parameter. This indicator represents the exposure to the market risk and thus the sensitivity of an equity to market fluctuations. Considering the OLS and CAPM hypotheses, the Beta is constant over time. However, many studies as those of Black et al. [3], Fama and McBeth [9], and Fabozzi and Francis [6] focused on CAPM limits and the instability of its main parameter the Beta. Consequently, an important literature emerges to develop a time-varying estimation of risk such as the rolling window [4, 5, 7, 8].

Moreover, the hypothesis of homogeneity of agents behavior represents an important limit in risk measurement. The tool used to appreciate the risk supposes that all agents share the same investment horizon. Empirically, the market is composed by short-run traders and long-run investors but they still use the same computation and model. In this context, the time–frequency analysis and the wavelets represent a suitable tool to analyze the risk according different investment horizons.

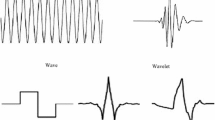

The time–frequency analysis, elaborated by Haar in 1909 and Gabor [10] is an important advance to separate the frequency components of a time series and allows a time representation of it. There are different types of wavelets decompositions: the continuous wavelets transforms (CWT) and the Discrete Wavelets Transforms (MODWT). The discrete wavelets transformation is a practical simplification of CWT because it is based on dyadic scale regrouping the frequencies in bands. High-Frequency Bands are tight and regroup short-run horizon whereas the Low-frequencies bands are larger and related to large investment horizon. In the CWT, the frequencies are separately analyzed so the decomposition consider specific and particular investment horizon. Consequently, the wavelets are suitable to take into consideration the hypothesis of heterogeneous behavior and analyze the time–frequency relationships between variables in finance.

The continuous wavelets are mainly used to appreciate the time–frequency linkages between different variables thanks the wavelets-coherence. Rua and Nunes [19] study the co-movement between several markets with CWT, Bekiros and Marcellino [1] analyze the dynamics of exchanges rate, Vacha and Barunik [22], Bekiros et al. [2]examine the commodities-energy markets linkages.

In the CAPM framework, Gençay et al. [11, 12] study the Beta diversification across different investment horizons by using discrete wavelets decomposition and highlight that the systematic risk is frequencies varying. Mestre and Terraza [17] show that the beta value (of an equity) is strongly volatile but it is differentiated across frequencies. McNevin and Nix [16] study the Beta time–frequency variations by economic sectors using similar approach. They find that the Beta is time–frequency dependent. To highlight this result, they intuitively use the rolling forward regression with a fixed size window associated with discrete wavelets decompositions. This method is equivalent to consider a unique discrete wavelets decomposition of the time series. Conceptually this is contestable because the length of the series is an important parameter to determine the order of wavelet decomposition operated by successive filtering and subsampling. In this case, if we traditionally use the rolling window on discrete Wavelets outputs, the results may be biased. We develop a time–frequency rolling window realizing the wavelets decompositions at each step of the rolling procedure. In this case, the wavelets are used inside the window.

The Continuous wavelets are used in the CAPM framework by Rua and Nunes [20] to analyze the Beta of different countries portfolio. They used the Wavelets coherence to highlight that the importance of systematic risk is time–frequency varying. The risk is higher and stable at long-run than in short-run. Mestre and Terraza [18] use continuous wavelets to develop the time–frequency varying beta estimation. They indicate that the systematic risk can be differentially estimate across time and frequency in order to analyze the greater or lesser robustness of the risk-profile.

The objective of this paper is to compare theses three wavelets methodologies (based on discrete and continuous wavelets) to appreciate the difference between the time–frequency varying betas estimates. In the discrete case, we consider the intuitive association of the wavelets decompositions and the rolling regression and the time–frequency rolling window. In the continuous case, we refer to the methodology developed by Mestre and Terraza [18]. We based our calculations on simulated data characterizing different situations and as an empirical application, we use the daily returns of AXA and the CAC40 index from 2005 to 2015 in order to estimate the Beta of it market line by these three methods.

2 Time–frequency Betas methodologies

In this part, we present briefly the theoretical aspects of wavelets, and the different way to estimate a time–frequency varying parameter in the CAPM framework. We simulate data to illustrate various market situations in order to clearly analyze the Betas differences between these methods.

2.1 Theoretical aspects of wavelets

The wavelets method is a mathematical tool developed to reduce the time or frequency arbitrage imposed by the Fourier transform. There are two types of wavelets decomposition, the continuous transforms and the discrete transform.

The continuous wavelets transform (CWT) is based on a particular function \(\psi (t)\) called wavelet-mother with zero-mean and energy/variance preserving properties.

The wavelet-mother is shifted by \(\tau\) and dilated by s to provide the wavelet family \(\psi_{\tau ,s} \left( t \right)\) (equivalent to the filter).

The wavelets coefficients are calculated by the following equation:

\(\psi^{ *} \left( {\frac{t - \tau }{s}} \right)\) is the complex conjugate of \(\psi_{\tau ,s} \left( t \right)\).

These coefficients represent the values of x(t) at frequency scale s and around the time \(\tau\), consequently we have a time representation of the frequency component of x(t). In this paper the wavelet-mother used is the Morlet wavelet \(\psi_{M} \left( t \right)\):

where \(i^{2} = - 1\) and \(f_{0}\) the non-dimensional frequency equal to 6 in order to have a good balance between time and frequency localization [23].

The previous equations present the continuous wavelets decomposition (CWT) but there is also a Discrete Wavelets Transform (DWT) easiest to implement. The DWT is based on dyadic scale (the length of series N must be a multiple of 2) in order to reduce the computational time. However, in this paper, we use a particular version of DWT called Maximal Overlap Discrete Wavelet Transform (MODWT) having supplementary properties as a better variance analysis without the dyadic constraint.

The MODWT can be viewed as a practical simplification of the CWT by discretizing the parameter \(s {\,\,}{\text{and }}\tau\). The object if is to reduce the frequency step without lose informations about the series, consequently, we consider frequency bands gathering intermediate frequencies of the decomposition. Therefore, there is also an optimal level J indicating the number of frequency bands needed to reconstruct the series named the depth of the MODWT.

The decomposition is realized by a successive filtering of the series and wavelets coefficients with rescaling and subsampling operations. This is called the Cascade Algorithm of Mallat [13,14,15]. On this basis, the MODWT can be assimilated as a band-pass filter composed by a high-pass filter \(\psi \left( t \right)\) called the wavelet-mother and a low-pass Filter \(\phi \left( t \right)\) called the Wavelet-Father. As previous \(\psi_{\tau ,s} \left( t \right)\) and \(\phi_{\tau ,s} \left( t \right)\) are the Wavelet Mother and Father shifted by \(\tau\) and dilated by \(s\).

In the algorithm, the series x(t) is consecutively filtered by \(\psi_{\tau ,s} \left( t \right)\) and \(\phi_{\tau ,s} \left( t \right)\) J times to obtain the details coefficients associated to a particular frequency bands j and the smooth coefficients associated to J level. After the decomposition, we have a frequency repartition of the series on frequency bands \(D_{j}\) for j = 1,….J related to a time horizon (see Appendix Table 5). We can reconstruct the original series by summing up the frequency bands:

The series is a sum of an approximation \(S_{J}\) and the frequency bands \(D_{j}\) with different resolution level j (different investment horizon).

The MODWT provide frequency bands of length N, so it is possible to compute the wavelets variance of each bands as:

where \(\tilde{\varvec{d}}_{{j,{\text{x}}, t}}^{2}\) are the wavelets coefficients at the level j. \(N_{j}\) is the number of coefficients non-affected by boundary (see [11].

In a multivariate framework, by considering another time series \({\text{y}}\left( {\text{t}} \right)\), we can compute the wavelets covariance between the frequency bands of level j of each series such as:

Consequently, an estimator Beta for each frequency bands is written as follow:

The continuous wavelets transform (CWT) can provides a multivariate case by providing tools to compute the correlation between two signal x(t) and y(t) as the wavelet coherence and phase. These tools are a translation of the spectral analysis methods to the wavelets framework. In this case, we define \(SW_{xy} \left( {s,\tau } \right)\) the cross-wavelets transformation and \(|SW_{xy} \left( {s,\tau } \right)|^{2}\) the cross-wavelets power spectrum describing the time–frequency covariance, such as:

\(W_{x} (s,\tau )\) is the wavelets coefficients of x(t) and \(W_{y}^{*} (s,\tau )\) is the complex conjugate of the coefficient \(W_{y} (s,\tau )\) of y(t).

It is also relatively easy to define the wavelet coherence \(WQ\left( {s,\tau } \right)\) as the ratio of the cross-spectrum on the auto-power spectra \(\left| {W_{x} \left( {s,\tau } \right)} \right|^{2} \,\, {\text{and}} \,\, \left| {W_{y} \left( {s,\tau } \right)} \right|^{2}\) describing the wavelets variance of the two series:

G is a time–frequency smoothing operator used to have real values of the coherence [24].

With the cross-transforms by continuous wavelets, we can compute the Phase function \(\varTheta_{x,y} \left( {s,\tau } \right)\) providing supplementary informations on the links between x(t) and y(t) such as the sign of the correlation. If the two series are in phase so they are positively correlated at the opposite if they are out-of-phase the correlation is negative. The phase is the arc-tangent of the real and imaginary part ratio of the cross-wavelets transform:

The coherence formula is similar to a the determination coefficient (R2) so it is possible to find the values of the Beta at each frequency and time. From these tools we develop a time–frequency estimator of the Beta \(\beta_{\tau ,s}\) based on CWTFootnote 1:

For a given s and \(\tau\), \(WQ_{\tau ,s}\) is the wavelets coherence and \(\theta_{\tau ,s}\) a phase parameter equal to 1 if the series are in phase or − 1 if they are out-of-phase.

Contrary to the discrete estimator of Eq. (8) the \(\beta_{\tau ,s}\) estimated by continuous wavelets are time and frequency varying.

2.2 The wavelets in the CAPM framework

Our paper is based on the Capital Asset Pricing Model (CAPM) of Sharpe [21] and its relations between variables called the market line.

\(y_{t} {\text{and }}x_{t}\) are stationary stochastic processes illustrating respectively the assert returns and market returns and \(\varepsilon_{t}\) is a i.i.d (0,\(\sigma_{\varepsilon }\)) process.

The parameter \(\beta\) estimated by OLS is BLUE estimators by hypothesis and represents the systematic risk of the asset.

The CAPM model supposes that the risk estimated by Beta is stable and constant across time and whatever the investment horizon. It does not consider the time evolution (or changings) of systematic risk and the behavioral hypothesis about heterogeneity of agents. To overcome this problem, we use in this paper different wavelets transforms to decompose the series in the time–frequency space and estimate the beta parameter.

The frequency bands of discrete decomposition are sub-chronic for which it is possible to estimate the Beta of the CAPM as show Gençay et al. [11]. However, the Betas estimated on frequency bands are not time-varying. However, it is possible to use rolling window to estimate a parameter at each iteration. Mestre and Terraza [17] apply this method to estimate the beta of French stocks with daily data and highlight that at long-run the beta is higher volatile than in short-run. The frequency dynamic of beta is significantly different than the standard rolling beta estimate without wavelets. This approach is also used by McNevin and Nix [16] with monthly data to analyze the time variations of the Betas by economics sectors. They find that the beta is time and frequency varying and its dynamics are different according sectors. These authors intuitively apply the rolling regression with a fixed window of length L on the frequency bands resulting from a wavelets decomposition based on N observations.

The intuitive combination of the forward regression with rolling window and wavelets decomposition is conceptually contestable because of the parameter estimate is realized on L points (inside the window) whereas the wavelets decompositions are based on N points (total number of observations). In this case, there is not a concordance between the size of the regression and the size of the decomposition. Consequently, the wavelets coefficients are not rescaled and subsampling when the window slides overtime. In practice, it would be conceptually preferable to decompose the series at each step of the regression. Thus, we use the time–frequency rolling window realizing simultaneously the wavelets decompositions of the series and the parameter estimation at each step of the forward regression.

In this paper, we compare different ways to estimate a time–frequency beta with discrete and continuous wavelets. In the discrete case, we use the forward rolling regression with a constant window length equals to L combined with MODWT. In the continuous case, Eq. (12) is used to estimate Betas across time at each frequency.

By this way, we define the following varying Betas:

\(\beta_{r}\) represents the standard rolling Betas estimated without the frequency decomposition.

\(\beta_{F}\) represents the rolling Betas estimated with the intuitive approach. First, we decompose the series with the MODWT and after, in a second, we use the rolling window on the frequency bands. Only one wavelets decomposition (based on N observations) is realized. We estimate N–L time-varying Betas on each frequency bands.

\(\beta_{\text{TF}}\) are the time–frequency rolling Betas estimated with the time–frequency rolling Window. The wavelets decompositions is realized inside the window of length L, so the number used to decompose the series is equal to L and not N in this case. This method estimates N–L time-varying parameter on each band.

\(\beta_{\tau ,s}\) are the time–frequency varying Betas estimated by continuous wavelets. By this way we estimate N Betas at each frequency.

The different estimated betas have not the same nature, \(\beta_{F}\) and \(\beta_{TF}\) are estimated for frequency bands regrouping several frequencies (discrete case) whereas \(\beta_{\tau ,s}\) is estimated for a specific frequency s (continuous case). In order to appreciate the difference between the three methods, we need to realize some adjustments to “discretize’’ the \(\beta_{\tau ,s}\).

First, to simplify the analysis, we consider only the D1, D2 and D6 frequency bands corresponding respectively to short-run investment (2–4 days), medium run (1–2 weeks) and long run (3–6 months) investment horizon. Second, in the continuous case, we compute the frequency mean of the \(\beta_{\tau ,s}\) for the frequencies corresponding to the previous bands (D1, D2 and D6). Third, \(\beta_{F}\) and \(\beta_{TF}\) have not the same length as \(\beta_{\tau ,s}\), consequently, we calculate the rolling mean of \(\beta_{\tau ,s}\) across time (with length equal to L) in order to guarantee the time coherence of the comparison. The “discretize” chronic of \(\beta_{\tau ,s}\) is noted MBc thereafter (for ‘Modified Betas continuous’).

2.3 Comparison of the three methods with simulated data

In order to concretely assess the differences between these three methods, we resort to simulated data corresponding to the variables of Eq. (1) and we estimate the Beta to compare them each other’s. The number of observations N is equal to 2800 with a time step of \(\Delta t = 1\) in each simulation (similar to a daily frequency).

For the 3 simulations, \(x_{t}\) is a sample of a centered AR(1)-GARCH(1,1) process with \(\phi_{1} =\) 0.6 for the AR part, \(u_{1} = 0.7 {\,\, {\text{and}} \,\,} w_{1} = 0.2\) for the GARCH part verifying \(u_{1} + w_{1} < 1\). We fix the market line parameters \(\alpha = 0 {\,\, {\text{and}} \,\,} \beta = 1\) in order to compute the \(y_{t}\) by adding simulated \(\varepsilon_{t}\) to \(x_{t}\). In this case, we simulate different \(\varepsilon_{t}\) to create three cases corresponding to the lesser or greater volatilities of the CAPM errors and so different Beta dynamics.

The first simulation is elaborated with an \(\varepsilon_{t} \sim {\text{i}} . {\text{i}} . {\text{d}} . (0,1)\) and represent the theoretical case.

For simulation 2, \(\varepsilon_{t} \sim {\text{AR}}(1) - {\text{GARCH}}\left( {1,1} \right)\) with \(\phi_{1} = 0.4\) for the AR part and \(u_{1} = 0.3 {\,\, {\text{and}} \,\,} w_{1} = 0.3\) for the GARCH(1,1) part such as \(u_{1} + w_{1} < 1\). In this case, \(\widehat{\sigma }_{\varepsilon } = 1.55\) corresponding to a relatively low volatility.

For simulation 3, \(\varepsilon_{t} \sim {\text{AR}}(1) - {\text{GARCH}}\left( {1,1} \right)\) with \(\phi_{1} = 0.8 {\,\, \,\,}{\text{for the AR part and}} {\,\, \,\,} u_{1} = 0.6 {\,\, \,\,} w_{1} = 0.3\) for the GARCH(1,1) part such as \(u_{1} + w_{1} < 1\). In this case, \(\widetilde{\sigma }_{\varepsilon } = 4.53\) corresponding to a relatively high volatility.

For the 3 cases, we estimate the traditional Beta by OLS, the \(\beta_{r}\) (without wavelets) and finally the \(\beta_{F} , \beta_{TF}\) and the “discretized” \(\beta_{\tau ,s}\) noted MBc.

The OLS estimations for the 3 regressions (Appendix Table 6) indicate that the \(\alpha = 0 {\,\, {\text{and}} \,\,} \beta = 1\). The determination coefficient (R2) are higher for simulations 1 and 2 and lower for simulation 3 in accordance with the simulated \(\varepsilon_{t}\). Simulation 1 is the only one with characteristics of its residuals close to those of an i.i.d. process, while for the other two it is a function of the greater or lesser volatility of \(\varepsilon_{t}\).

Figure 1 illustrates the estimated rolling Betas \(\beta_{r}\) for the three simulations and their volatilities.

These results confirm our expectation related to the construction of the simulations: the mean of the betas is not significantly different from one (the theoretical value) whereas the standard deviation of the betas of simulation 3 is the most important.

In order to apply the intuitive method, we decompose the series with MODWT with the La8 wavelets of Daubechies. We estimate by OLS the Standard Beta on each frequency bands (Appendix Table 7). As previous, the betas are not significantly different from one and the coefficients of determinations are very high except for the simulation 3 which has the most volatile \(\varepsilon_{t}\).

Figure 2 illustrated the differents varying parameters for each simulation (for D1–D2–D6).

The three varying wavelets betas are relatively close to the standard rolling betas at high-frequencies (D1–D2) especially for simulation 1 where the residuals are i.i.d. process. At low-frequencies (D6), the differences are more pronounced. These figures highlight the higher volatility of the Beta in simulation three especially at low-frequencies bands.

Whatever the simulation, we note an increasing gap between \(\beta_{F}\) et \(\beta_{TF}\) as the scale increases: \(\beta_{F}\) et \(\beta_{TF}\) are similar for D1 and D2 but totally different on D6 band and the differences seems more important for the simulation 3. Moreover, the Betas estimated with continuous wavelets are less erratic than the others betas (of discrete case) because of the ‘’discretization’’ used to compare the parameters.

At high-frequencies, the \(\beta_{\tau ,s}\) (noted MBc) share globally the same evolutions than the others betas but at low-frequencies the \(\beta_{\tau ,s}\) dynamic is relatively closer to the \(\beta_{TF}\) compare to the \(\beta_{F}\).

In order to analyse and confirm these observations, we compute in Table 1 the means and the standard deviations of the previous betas chronics.

Regardless of the simulation, we note that the standard deviations are higher on D5–D6 (long-term) compared to D1–D2 (short-term) and some differences appears between \(\beta_{F}\) and \(\beta_{TF}\) at long-run. Low-frequency betas (D5–D6) are more volatile than high-frequency betas (D1–D2), so beta is less stable on low frequencies than on high frequencies and the nature of residuals fosters this volatility. The more the residuals are heteroscedastic the more the betas are volatile over time.

These results confirm the previous graphical observations: the \(\beta_{F}\) is more “smoothed” than \(\beta_{TF}\) and we observe an increasing shift between \(\beta_{F}\) and \(\beta_{TF}\). The \(\beta_{\tau ,s}\) also appear more smooth than the others betas because of the standard deviations are weaker. But this fact is due to the ‘’discretization’’ method used to realize the comparison (aggregation of frequencies and rolling mean).

In order to appreciate the differences between the previous methodologies, we calculate the mean (in absolute value) of the differences between the rolling estimators (Table 2).

We note, in average, that the differences between the two discrete methods (\(\beta_{F}\) and \(\beta_{TF}\)) are more important at low frequency bands (long horizon) whatever the simulation, whereas there are almost no differences between \(\beta_{F}\) and \(\beta_{TF}\) on the high frequencies (D1–D2). Moreover, we notice that the differences are more important for the third simulation. As explained before, the intuitive method does not consider the adequation between the window size/length (260 points) and the number of points used during the decomposition (2800 points). In this case, the intuitive approach supposes a unique wavelet decomposition based on 2800 on and the rolling window of length 260 cuts frequency bands without considerate the rescaled or subsampled coefficients. At the opposite the time–frequency window realize a wavelet transform inside the window (at each iteration) so the window length and the number of points used in the decomposition are equal. In this case, the wavelets coefficients are rescaled according to the window length and the wavelets properties are respected. Thus, the time–frequency window is more preferable than the intuitive way.

These results confirm our hypotheses, higher the volatility of the residuals is greater the gap between \(\beta_{F}\) and \(\beta_{TF}\) is important and increases with the frequency scale.

These observations also concern the differences between \(\beta_{r}\) and \(\beta_{F}\) and those between \(\beta_{r}\) and \(\beta_{TF}\). We see that differences begin to be relatively large from D5 to D6 for simulation 1. For simulation 2, they are wider from D3, while for simulation 3, they are significant on each band.

By analyzing the differences between the continuous betas and the discrete estimations, we note the followings comments:

We observe that the differences between continuous betas and \(\beta_{F}\) increase as the scale increases but there is a break for the D2 band. This result is observed whatever the simulation but it is more pronounced for the third simulation due to the heteroscedastic nature of residuals.

As previously observed the differences between continuous betas and \(\beta_{TF}\) are relatively weaker for D2 band, however, they don’t increase at long-run except for simulation 3. At long-term, we notice that the errors between MBc and \(\beta_{TF}\) are lesser than the differences between MBc and \(\beta_{F}\). So, we confirm our hypothesis: the continuous betas are closer to \(\beta_{TF}\) than to \(\beta_{F}\).

Whatever the simulation, the differences between continuous betas and the standard rolling betas \(\beta_{r}\) are again weaker for the D2 band. For simulations 2, the long-run betas differences are lower than errors for D1, and they are relatively closed to simulation 1. The long-run differences are higher than short-run errors only for simulation 3.

As a partial conclusion, the three wavelets procedures confirm that the beta is more volatile at low frequencies in particular when the residuals are strongly heteroskedastic. Moreover, the three methods are relatively similar at high-frequencies especially the two discrete approaches. The differences observed for the continuous betas are due, in part, to the “discretization” of \(\beta_{\tau ,s}\). At low-frequencies, the differences are more significant particularly between the intuitive approach and the time–frequency window method. At the opposite, the difference between betas estimated by continuous wavelets and by the time–frequency window are the lowest at this frequency. Consequently, we can conclude that the time–frequency window and the continuous method are relatively and conceptually similar because of the two betas chronic share the same tendency (evolutions) even if the errors are important.

These simulations show that it is possible to include frequency volatility in computations by joining regression software and wavelet computations. The use of the time–frequency window instead of the conventional rolling window is an asset to appreciate the stability of the regression parameter over time and frequency scales. Conceptually, the time–frequency window is more suitable than the intuitive approach because of the user does not change his calculations procedure since the discrete wavelet decomposition is realized inside the window at the same time as the regression at each new observation.

However, the simulated data used cannot fully represent the empirical observations of the market line characteristics. They are just a fairly picture of the structures observed for the market line variables and for the residuals resulting from its estimation. It is that why, we empirically apply these methodologies to comfort the previous results.

3 Time–frequency Betas estimation: empirical application

As an empirical application part, we use the daily returns of AXA and the CAC40 index from 2005 to 2015 in order to estimate the Rolling Beta of it market line by the previous methodologies based on discrete and continuous wavelets.

3.1 Static OLS Beta estimates

Previously, we check the stationary of the returns (see Appendix Table 8) and then we estimate the Beta by OLS. The OLS beta is called “Classic Beta’’ because it is non-varying parameter supposed constant over the period. We also discreetly decompose our series with discrete wavelets and we estimate an OLS Beta for each frequency bands. Results are recorded in Table 3. The estimated parameters confirm the nullity of the constant and we note that all Betas and R2 are significantly different to zero.

However according to the tests, the residuals are not a white-noise process, so we suppose that we are in the same case of simulation 2 and 3. Consequently, the Minimal Variance property of BLUE estimator is not respected in our case, so the beta could be instable over time.

3.2 Rolling beta estimates \(\beta_{r} , \beta_{F} ,\beta_{TF}\) and \(\beta_{\tau ,s}\)

We apply the three previous methodologies in order to estimates a time-varying Betas and modelize it instability. Figure 3 illustrates our results. We highlight the Beta volatility around its static estimator and we note a frequency differentiation of the beta dynamics.

We notice that the short-run Beta (D1 and D2 bands) are volatile around 1.51 (OLS Beta) but they are always greater than one so the initial risk-profile is preserved across time only the intensity of the risk is time varying. At the opposite, the long-run betas (D6 band) are more volatile than short-run Betas. Consequently, we note that the initial risk-profile is not the same across time.

We observe again a scale increasing gap between \(\beta_{F}\) and \(\beta_{TF}\). The differences between these Betas increase with the frequency scale (time horizon larger). Moreover, the continuous betas are closer to betas estimated by the time–frequency rolling window because of they share the same dynamics. At high-frequencies (D1–D2 bands), \(\beta_{\tau ,s}\) are not totally similar to \(\beta_{F}\) and \(\beta_{TF}\) but they share globally the same dynamics (similar evolutions). At low-frequencies, \(\beta_{\tau ,s}\) are less volatile and erratic than \(\beta_{F}\) and \(\beta_{TF}\) but the \(\beta_{\tau ,s}\) dynamic is similar to \(\beta_{TF}\).These results are similar to those observed for simulations 2 and 3.

To confirm these observations, we test if the betas differences are significant (or not) and we calculate its mean in absolute value (see Table 4).

We note that the differences between \(\beta_{F}\) and \(\beta_{TF}\) (the two discrete methods) are more important at long-run (low-frequencies bands) whereas there are no significant differences at short-run (high-frequencies). Globally, the differences become relatively important starting the D3 band, these results confirm our previous graphical observations. The estimation gap between \(\beta_{F}\) and \(\beta_{TF}\) increases as the frequency scale increases.

At high-frequencies, the difference between \(\beta_{TF}\) and \(\beta_{\tau .s}\) estimators are 0.11 in average. Similar results are observed for the difference between \(\beta_{F}\) and the continuous betas. But at low-frequencies, the error between \(\beta_{TF}\) and \(\beta_{\tau .s}\) are lesser than differences between \(\beta_{F}\) and \(\beta_{\tau .s}\) (0.25 < 0.45). This result confirms our hypothesis: at high-frequencies the two discrete methods and the continuous wavelets estimations are relatively similar whereas at low-frequencies the differences are more important. The time–frequency window and the continuous wavelets method provide Betas sharing similar dynamics even if significant differences are observed. These differences could be explained, in part, by the adjustments used to compare Betas.

Empirically, the evolution of AXA Betas (\(\beta_{TF}\) and \(\beta_{\tau .s}\)) indicates that the systematic risk increases sharply during crisis period. After the subprime crisis, both the short-run and long-run betas are globally decreasing but their values begin to increase in mid- 2007 with the subprime crisis and rise brutally in autumn 2008 with the financial crisis and the Lehmann Brothers bankruptcy. The Betas reach a peak in mid-2009—early-2010 at the beginning of the global depression. Betas also increase during the European Debt Crisis in 2011–2012 and the Russian Rubles Crisis in summer-2014. We also note that during expansion or recovery periods, the short-run and long-run betas tend to decreasing until the next crisis time. The differences between the long-run and short-run betas are about their values and volatilities. At short-run, Betas are very erratic and change brutally when shocks appear but it quickly reverses to its OLS value. At long-run, the variations are larger but smoother so betas are highly volatile especially during persistent crisis period as 2007–2009 but it slowly reverses in tendency to it OLS value.

Our results are globally consistent with those of Rua and Nunes [20], McNevin and Nix [16] and Mestre and Terraza [17] concerning the beta estimate. The short-run betas are not significantly different to the standard beta but as the scale increases the differences are higher and the time–frequency volatility is also different according to the frequency scales. However, our results are different in more particular aspects. Concerning the MODWT, McNevin and Nix use a 60-months rolling window (5 years) on frequency bands to analyze the beta instability by sectors, whereas, we especially focus our research on the better method to combine the Rolling-Window and the MODWT decompositions. Thus, the time–frequency rolling window appears more suitable at long-run than the intuitive approach. In the continuous case, findings are not fully similar to Rua and Nunes because of we find that the systematic risk is volatile and erratic both for short-run and long-range investment. However, the results comparison is complicated because of the time framework has not the same sense in each paper: they use monthly data whereas we employ daily observations so wavelets coefficients are less erratic in their case.

4 Conclusion

In this paper, we compare different methods to estimate time–frequency varying parameter. We consider two methods based on discrete wavelets transformations and one method based on continuous wavelets.

Our results show that there are no significant differences between the short-run betas of the two discrete methods, but errors increase when the frequency scale increases (from high-frequencies to low-frequencies). In the discrete case, the time–frequency rolling window appear more suitable than the intuitive approach. At short and long-run, the varying betas estimated with continuous wavelets share globally the same dynamics as the betas estimated with the time–frequency window. The comparison is depending to the ‘’discretization ‘’ of the betas estimated with continuous wavelets so errors between these methods are significant, however, results of are consistent each other (same tendency). The estimation with continuous wavelets is more accurate because it considers more frequencies (opposite to a frequency bands) however the computational effort is greater. At the opposite, the Time–Frequency rolling window considerate frequency bands (discrete wavelets) in order to reduce the computational time.

The empirical application with AXA and the CAPM confirms the results observed by simulations. We observe that differences between the two discrete methods are larger in long-run where we note a shift between the betas. The betas estimated with the time–frequency window and those estimated with continuous wavelets have similar evolutions and globally the same tendency. Both the short-run and the long-run betas increase sharply during crisis time. But at long-run the systematic risk is highly volatile so the stock risk-profile changes. At short-run the risk is very erratic but the betas values are still in the same risk-profile.

We conclude, that the three methods have similar results if we consider short-run investment, but, the time–frequency window and the continuous approach provide more relevant and consistent results if we consider long-run investment.

References

Bekiros S, Marcellino M (2013) The multiscale causal dynamics of foreign exchange markets. J Int Money Finance 33:282–305

Bekiros S, Nguyen DK, Uddin GS (2016) On time scale behavior of equity commodity links: implications for portfolio management. J Int Financ Market Inst Money 41:79–121

Black F, Jensen M, Scholes M (1972) The capital asset pricing model: some empirical test; studies in the theory of capital markets. In: Jensen M (ed) Praeger Publishers, New York, pp 79–121

Brooks RD, Faff RW, Lee JHH (1992) The form of time variation of systematic risk: some Australian evidence. Appl Financ Econ 2:191–198

Brooks RD, Faff RW, McKenzie MD (1998) Time-varying Beta risk of Australian industry portfolios: a comparison of modelling techniques. Aust J Manag 23(1):1–22

Fabozzi F, Francis J (1978) Beta as random coefficient. J Financ Quant Anal 13(1):101–116

Faff RW, Lee JHH, Fry TRL (1992) Stationarity of systematic risk: some Australian evidence. J Finance Account 19(2):253–270

Faff RW, Brooks RD (1998) Time-varying risk for Australian industry portfolios, an exploratory analysis. J Bus Finance Account 25(5):721–774

Fama E, MacBeth J (1973) Risk, return, and equilibrium: empirical tests. J Political Econ 81:607–636

Gabor JG (1946) Theory of communication. J Chin Inst Electr Eng 93(3):429–457

Gençay R, Selçuk S, Whitcher B (2003) Systematic risk and timescales. Quant Finance 3(2):108–116

Gençay R, Selçuk S, Whitcher B (2005) Multiscale systematic risk. J Int Money Finance 24:55–70

Mallat S (1989) A theory for multiresolution signal decomposition: the wavelet representation. IEEE Trans Pattern Anal Mach Intell 11(7):674–693

Mallat S (2009) Une exploration des signaux en ondelettes, Ecole polytechnique

Mallat S (2009) Wavelet tour of signal processing: the sparse way. Academic Press, New York

McNevin B, Nix J (2018) The Beta heuristic from a time/frequency perspective: a wavelets analysis of the market risk of sectors. Econ Modell 68:570–585

Mestre R, Terraza M (2018) Time-frequency analysis of CAPM-application to the CAC 40. Manag Glob Trans 16(2):141–157

Mestre R, Terraza M (2018) Time-frequency varying beta estimation-a continuous wavelets approach-. Econ Bull 38(4):1796–1810

Rua A, Nunes L (2009) International comovement of stock market returns: a wavelets analysis’. J Emp Finance 16(4):632–639

Rua A, Nunes L (2012) A wavelet based assessment of market risk: the emerging market case. Q Rev Econ Finance 52:84–92

Sharpe W (1964) Capital asset prices: a theory of market equilibrium under risk. J Finance 19(3):425–442

Vacha L, Barunik J (2012) Co-movement of energy commodities revisited: evidence from wavelets coherence analysis. Energy Econ 34:241–247

Torrence C, Compo GP (1989) A practical guide to wavelet analysis’. Bull Am Meteorol Soc 79(1):61–78

Torrence C, Webster PJ (1999) Interdecadal in the ENSO-monsoon system. J Clim 12:2679–2690

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Mestre, R., Terraza, M. Time–frequency varying estimations: comparison of discrete and continuous wavelets in the market line framework. J BANK FINANC TECHNOL 3, 97–111 (2019). https://doi.org/10.1007/s42786-019-00008-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s42786-019-00008-8