Abstract

As an important way for China to achieve its dual-carbon goal, green finance has become the foundation for promoting high-quality economic development in China. In order to clarify the mechanism of green finance on carbon emissions, this paper puts green finance into the economic model and deduces the relationship between green finance and carbon emission reduction. This paper is based on the panel data of 30 provinces in China (excluding Tibet, Hong Kong, Macao, and Taiwan) from 2008 to 2019, using the individual fixed effect model, dynamical model, mediator model, and SDM model to study the impact of green finance on carbon emissions and its impact path of upgrading of the industrial structure and the development of science and technology based on the measurement of the green finance development index of each province by the entropy method. The findings show that the development of green finance can reduce carbon emission significantly, which can be sustained until at least the third phase and generates spatial spillover effects; regional heterogeneity analysis finds that the development of green finance shows geographical discrepancies: compared with the eastern and western regions, the development of green finance in central region can reduce carbon emissions more significantly; not only can the development of green finance directly reduce carbon emission, but also through the upgrading of industrial structure and technological innovation. The research not only provides a new perspective and supplementary empirical evidence for understanding the carbon emission reduction effect of green finance, but also offers some useful references for green finance to contribute to carbon emission reduction.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Since socialism with Chinese characteristics entered a new era; building a green, low-carbon, and circular development economic system has become one of the tasks to promote high-quality economic development in the face of the contradiction between an increasingly better life for the people and unbalanced and inadequate development. In September 2020, China made a commitment to the world to achieve “carbon peak” and “carbon neutrality”; that is, China’s carbon dioxide emissions will peak in 2030 and achieve carbon neutrality in 2060. However, the time for China to achieve “carbon peak” and “carbon neutrality” is nearly half shorter than that of developed countries (Lin 2022). How to fulfill this commitment to the international community requires China to find new tools to achieve carbon emission reduction.

After the second Industrial Revolution, economic development at the cost of carbon dioxide emissions increased the world’s terrestrial carbon dioxide emissions by more than 250 million tons over the past century. In 2021, the world’s terrestrial CO2 emissions reached 371.24 million tons. Under the background of the increasingly serious problem of carbon emissions, how China achieves “carbon peak” and “carbon neutrality” shows its pursuit of high-quality economic development and its responsibility of a major country. In addition, whether China can achieve “carbon peak” and “carbon neutrality” will significantly affect the global carbon reduction action (Lu et al. 2023). According to the Guidelines on Building a Green Financial System issued by the People’s Bank of China and other seven ministries and commissions in 2016, green finance is defined as economic activities that support environmental improvement, climate change response, and the efficient use of resources. As a new type of finance, the Fifth Plenary Session of the 19th Central Committee of the Communist Party of China proposed to establish and improve the green financial system; guide financial institutions to provide long-term, low-cost funds for green low-carbon projects; and provide long-term stable financing support for achieving “carbon peak” and “carbon neutrality.” In this context, green finance came into being. In order to “promote green and low-carbon economic and social development,” the theoretical model and practical effect of green finance on carbon emission have attracted the attention of scholars (Wang and Wang 2021).

At present, scholars mainly focus on “qualitative research” and “empirical analysis” on the carbon emission reduction effect of green finance. However, in mathematical economic models, there are few theoretical research on carbon emission and green finance (Pan et al. 2021), which limits the development of green finance in the academic field. The impact of green finance on carbon emission reduction and its path is still unclear. Hence, we contend that building a mathematical economic model of green finance and carbon emission merits scholarly deliberation. This is important because there is still significant research space for the economic models of the carbon reduction effects of green finance in the literature. How to build a mathematical economic model of green finance and carbon emission? What is the path of green finance on carbon emission? These problems have certain value in both theory and reality.

Based on the existing literature and related economic models, this paper analyzes the impact of green finance on carbon emission and related mechanisms. Then, it puts forward three hypotheses respectively that the development of green finance can reduce carbon emission and the development of green finance can reduce carbon emission through the upgrading of industrial structure and the development of science and technology. Finally, based on the panel data of 30 provinces in China (excluding Tibet, Hong Kong, Macao, and Taiwan) from 2008 to 2019, the above research hypotheses are tested.

Literature review

At present, academic circles have carried out abundant researches on the carbon emission. Among them, population size, urbanization, industrial structure, science and technology, and opening-up are considered to be the key drivers of carbon emissions. However, when it comes to green finance, scholars have not reached a consensus on the research conclusions of green finance on carbon emissions. Literature on green finance for carbon emission mainly includes two types.

The first type is empirical analysis based on data, which can be divided into three categories according to the results. One view is that green finance contributes to the reduction of carbon emissions: The financial penalty effect and investment inhibition effect of green finance can limit the carbon emission of high-polluting enterprises (Su and Lian 2018; Peng et al. 2022). Green finance has the function of allocating financial resources with double efficiency of economy and environment, guiding funds to flow into green fields, promoting the transformation of clean industrial structure, and realizing the low-carbon transformation of economy (Lei 2022; Zhang et al. 2022). In addition, Chen and Chen (2021) take into account the spatial factor of carbon emissions and find that green finance has a spatial spillover effect, which can reduce carbon emissions of neighboring regions. With the enrichment of empirical data and methods, the first view has been recognized by more scholars. The second strand of literature draws conclusion that green finance has failed to exert the Porter effect. On the one hand, the financing constraints of green finance inhibit the total factor productivity of high-polluting enterprises (Ding et al. 2022) and technological innovation (Lu et al. 2021; Yu et al. 2021), which is not conducive to reduce carbon emissions of high-polluting enterprises. On the other hand, once the existence of externalities leads to the failure of the green finance market, carbon emissions will increase (Krogstrup and Oman 2019). At present, China’s financial system has failed to support green finance to reduce the carbon emission (Chen 2020). The third category is that the green finance has nonlinear effects on carbon emission reduction: The impact of green finance on carbon emission reduction can be divided into three stages, i.e., capital stage, signal stage, and feedback stage, while its effect is manifested in the shift from the “green paradox” to the “forced emission reduction” (Wang et al. 2023). In the threshold effect analysis, the relationship between green finance and carbon emission is dynamic and non-linear (Gan and Voda 2023).

The second type is economic model analysis at the theoretical level, which introduces element of green finance into it. In the DSGE model, Wang et al. (2019) constructed the behaviors of the financial sector and the central bank sector which shows the impact of green credit policies. However, as one of the tools of green finance policy, green credit cannot completely replace green finance policy. In order to further broaden the setting of green finance in the model and make the economic model more universal, Wen et al. (2022a) and Shi and Shi (2022) respectively adopted the intensity index of green finance policy and the ratio of market loan interest rate to green credit interest rate as green finance development, and constructed an economic model of green finance development and high-quality economic development. In order to study the relationship between the impact of green finance on carbon emission reduction in the economic model more directly, Pan et al. (2021) used the interest rate level of the clean sector to represent the broad green finance policy, and Wen et al. (2022b) used the capital of financial institutions to support green development to measure the development degree of green finance, which enriched the current economic model of green finance on carbon emission.

Furthermore, in terms of the path through which green finance affects CO2 emissions, most scholars fail to clarify it. The diverse impact of technological progress on carbon emission intensity has led to varying conclusions regarding the role of technological progress in green finance for carbon emission reduction (Puspanjali et al. 2023; Rasoulinezhad and Taghizadeh-Hesary 2022). For industrial structure, most scholars have confirmed that it can reduce carbon emission intensity (Zhang et al. 2018; Zhu and Zhang 2021).

To sum up, the literature already in existence has provided some groundwork and reference value for the study of green finance and carbon emission. Nevertheless, there are some gaps.

First, in terms of research objects, the existing literature has not reached a consensus on the construction and measurement of green financial system. Most of them use green credit to reflect the development level of green finance. However, this measurement is relatively single and difficult to reveal the comprehensiveness of green finance.

Second, in terms of theoretical analysis, since green finance has not been widely introduced in traditional economic theoretical models, the impact of green finance in economics is very limited only through qualitative research and empirical analysis. At present, the research on the mathematical economic model of the role of green finance in carbon emission reduction is gradually enriched. There is still a large space for research on how to explore the direct impact of green finance on carbon emission and its path in economic models.

Third, in terms of empirical research, due to the interactive relationship between green finance and carbon emissions, there may be serious endogeneity problems in the empirical model, which leads to errors of estimation results in the model (Guo 2022; Yan et al. 2016). In the existing literature, although there are some scholars who use TSLS method to alleviate the endogeneity in the empirical models, few scholars use innovative instrumental variables.

Therefore, the marginal contributions of this paper are as follows: First, the article measures the development of green finance according to the basic connotation of comprehensive green finance development, enriching the existing research on the impact of green finance development on carbon emission. Second, while the existing literature has few researches on the impact of green finance on carbon emission directly and its mechanism in economic models, the article attempts to construct an economic model of green finance and carbon emission, then analyzes the path of green finance on carbon emission based on the economic model. Third, the article seeks some innovative instrument variables of green finance, enriching the solution of endogeneity of the existing literature and further improving the reliability of research conclusions.

The subsequent framework of this investigation is presented in the following manner: the “Mechanism and theoretical hypotheses” section builds a mathematical economic model of green finance and carbon emission, followed by the formulation of theoretical hypotheses. The “Research design” section measures the green finance development index and carbon emissions intensity based on the panel data of 30 provinces in China (excluding Tibet, Hong Kong, Macao, and Taiwan), followed by model construction. This study empirically examines the impact of green finance on carbon emissions intensity in the “Empirical results and analysis” section while also conducting lagged effect test, mediating effect test and spatial effect test to enrich the research findings of this paper. The “Conclusions” section concludes by succinctly outlining the primary discoveries of this research, analyzes limitations and future recommendations, and offers practical policy suggestions.

Mechanism and theoretical hypotheses

In order to investigate the mechanism and the path of green finance on carbon emission, based on the use of CES production function by Deng (2022) and Yan et al. (2016), combined with the application of the Grossman and Helpman endogenous economic growth model by Shi and Shi (2022), this paper has deduces how the green finance affects carbon emission and the path in it.

Final product production sector

This paper assumes that there is a unique final product in the economy whose production process uses green finance inputs and non-green finance inputs. So based on this assumption, we have the final product production function:

where Yc is the total gross output of green finance input sector, Yd is the total gross output of non-green finance input sector. β1 and β2 represent the relative importance of the output of green finance sector in final production, and the relative importance of the output of non-green finance sector in final production respectively. There are β1 > 0, β2 > 0, β1 + β2 = 1, α ≤ 1, and α ≠ 0.

Assuming that the price of the final product is 1, the profit function of the final product is obtained as follows:

Therefore, according to the first-order condition of profit maximization of the final product manufacturer, we can obtain:

Consequently, we can get the relationship between green finance inputs and non-green finance inputs:

Intermediate product production sector

For the intermediate product production sector, combined with Eq. (3), its profit function is:

Among them, we assumed that each unit of green finance input needs to be invested ε units of green finance final product and the cost of R&D and application of new technologies for green finance inputs is k times that of the final products of green finance. The cost of producing one unit of non-green finance input is μ unit of non-green finance final product. It is also assumed that all the capital required by the product production sector comes from financing. In recent years, since the strengthening of environmental supervision by the government, enterprises with high pollution and high energy consumption need to be transformed and upgraded to green and environmental protection enterprises, and traditional production methods also need to be improved to green and environmental protection production. The transformation of these enterprises requires a large investment in science and technology. However, this transformation process carries certain risks. Enterprises may fail to break through technological innovation, leading to the failure of transformation, and the capital invested in the early stage will become a loss. Facing high investment and high-risk investment projects, investors in the traditional financial field will not invest in this field. Therefore, green finance has become an important source of funds for the transformation and upgrading of the enterprises with high pollution and high energy consumption. Green finance provides special capital channels for these enterprises, alleviates the capital shortage of the transformation and upgrading of them, and contributes to the smooth transformation of the enterprises into green and environmental protection enterprises. For enterprises in the field of green finance, financial institutions will give them a lower green lending interest rate rl. On the contrary, for enterprises in the field of non-green finance, the interest rate is r.

According to the first-order condition of profit maximization of the intermediate product production sector, that is, the first-order partial derivative of π with respect to Yc and Yd is 0:

Combining Eq. (6) and Eq. (7), we can obtain:

or

where \(Q=\frac{{\beta }_{1}\mu }{{\beta }_{2}(1+k)\varepsilon },\xi =\frac{r}{{r}_{l}}\) and \(\xi\) represents the development level of green finance.

Green finance and carbon emission

Assuming that the total amount of carbon emission in economic production activities is generated by non-green finance sectors, the carbon emission intensity can be expressed as:

where z represents the carbon emission factor. Combining Eq. (1), Eq. (9), and Eq. (10), we can obtain:

therefore

where \(G=\frac{z{Q}^{\frac{1}{\alpha }}}{{({\beta }_{1}+{\beta }_{2}{Q}^{\frac{\alpha }{\alpha -1}}{\xi }^{\frac{\alpha }{\alpha -1}})}^{\frac{2}{\alpha }}}>0,F={\beta }_{2}{Q}^{\frac{\alpha }{\alpha -1}}{\xi }^{\frac{\alpha }{\alpha -1}}>0\). Thus, the following hypothesis H1 is proposed:

The development of green finance can reduce the carbon emission.

Green finance reduces carbon emission through industrial structure

Firstly, as an emerging field of financial industry, the development of green finance will bring new financial products and supplies to the financial industry, which can affect people’s consumption demand and consumption preference. The supply and demand of new products form new industries and promote industrial structure. The new supply and demand of green finance mainly affect in the financial field, which has less negative impact on the environment and produces less carbon emissions.

Secondly, green finance improves the efficiency of capital allocation. The original funds do not distinguish green finance separately, so that when enterprises borrow funds from financial institutions for transformation and upgrading, the financial institutions will consider the uncertain risks faced by their transformation and upgrading and the low success rate of capital returns, which will hinder the transformation and upgrading process of enterprises with high pollution and high energy consumption. After separated from traditional finance alone, green finance will facilitate the enterprises with high pollution and high energy consumption to borrow funds from financial institutions for transformation. Finally, it will be more convenient for these enterprises to transform and upgrade, promoting the optimization of industrial structure, and reducing the negative environmental effects brought by industrial production.

Combined with Eq. (9), the ratio of non-green financial sectors to green financial sectors can be obtained as follows:

When the development of green finance ξ increases, the ratio S of non-green financial sectors to green financial sectors will decrease. Substituting Eq. (13) into Eq. (11), we obtain:

when S decreases, carbon emission CO2 will decrease. Thus, the following hypothesis H2 is proposed:

The industrial structure transformation driven by green finance can reduce the carbon emission.

Green finance reduces carbon emission through science and technology

Reducing carbon emission cannot be separated from the support of science and technology. After improving the efficiency of capital allocation, green finance makes funds more accurately invested in the field of science and technology, promotes the innovation of production technology of enterprises with high pollution and high energy consumption, and reduces carbon emissions in the production process. Thus, the following hypothesis H3 is proposed:

The technological innovation driven by green finance can reduce the carbon emission.

Figure 1 shows the theoretical framework of this paper.

Research design

Variable selection

Core explanatory variable: green finance development level (GF)

At present, the measurement method of green finance has not reach a consensus in the international community (Khan et al. 2022; Wang et al. 2022). Most of the scholars (Yin et al. 2021; Lee and Lee 2022) used the entropy method to measure the development level of green finance from green credit, green insurance, green securities, green investment, carbon finance, and other elements respectively. According to the definition of green finance by the People’s Bank of China and other departments and the relevant measurement methods, a total of six secondary indicators are selected from the three dimensions of green finance, green credit, green insurance, and green investment to evaluate the development level of green finance. The evaluation system is shown in Table 1.

Figure 2 portrays the development level of green finance in China during the study period. The figure shows that the development level of green finance in China has increased steadily over the sample period. There is significant variations across regions, which exhibits a substantially greater value in the eastern regions than in central and western areas.

Dependent variable: carbon emissions intensity (CI)

According to the existing literature, scholars at home and abroad have not yet reached a consensus on the definition of carbon emission intensity. Some scholars defined carbon emission intensity as carbon productivity from the perspective of single factor, that is, the ratio of GDP to carbon emissions in the same period. Some scholars also put forward the concept of carbon index, which is specifically defined as the carbon emissions per unit of energy consumption. It can be seen that whether based on GDP or energy consumption, the total amount of carbon emissions is a common factor to be considered. Considering the differences in industrial structure, economic development level, and geographical conditions in different provinces, the types of energy consumption are different. Thus, we define carbon emissions intensity as the level of carbon emissions output per unit of GDP. The calculation method is the ratio of carbon emissions and GDP, as shown in formula:

Since the carbon emissions mainly come from the combustion of fossil fuels, we measure the carbon emissions from the combustion of nine major fossil fuels: coal, coke, crude oil, gasoline, kerosene, diesel, liquefied petroleum, and natural gas. The carbon emission coefficients of major fossil combustion are shown in Table 2, and the data are from the China Energy Statistical Yearbook in 2021. Referring to Li (2017), the calculation method to measure China’s inter-provincial carbon emissions is shown in formula:

where EC is the carbon emissions, EK is the consumption of the Kth energy source, TCEK is the standard coal coefficient of the Kth energy, LCVK is the low calorific value of the Kth energy, CCK is the carbon content per unit calorific value of the Kth energy, CORK is the carbon oxidation rate of the Kth energy, and IPCCK is the carbon emission coefficient of the Kth energy.

Based on the above calculations, spatial distribution maps of the carbon emissions intensity index for certain years have been developed to elucidate the present state of carbon emissions intensity in China. As depicted in Fig. 3, we observe an overall downward in China’s carbon emissions intensity, with significant variations across southern and northern areas. Compared with southern region, the carbon emissions intensity is high in the northern region, especially in Ningxia, Shanxi, and Inner Mongolia.

Control variables

Considering that CI is impacted by a variety of things, combined with the existing research of Sun et al. (2023), some control variables are introduced in the paper to reduce the bias caused by omitted variables including urbanization, fiscal expenditure, human capital, and infrastructure. Among them, the urbanization (LNURB) is determined by taking the logarithm of the urban population *100 accounts for the total population; the fiscal expenditure (FIS) is measured by the ratio of fiscal expenditure to GDP; the human capital (LNHC) is determined by taking the logarithm of the number of university students per 100,000 people; and the infrastructure (LNINF) is determined by taking the logarithm of the road area per people.

Mediating variables

Industrial structure

The industrial structure (IS) is determined by the ratio of the output value of the secondary sector to GDP.

Technological innovation

The technological innovation (TI) is determined by the expenditure of technological research per people.

Model construction

Baseline model

In order to test hypothesis H1, the mixed regression model, individual fixed effect model, time fixed effect model, space–time double fixed effect model, and random effect model are constructed, which are used by Nepal et al. (2024) in the study related to green finance. The baseline model is constructed as follows:

Among them, CIit represents the carbon emission intensity of the province i in year t; GFit represents the green finance of the province i in year t; Xit represents the control variables; β1 is the correlation coefficient of the core explanatory variable GF; and λt, μi, and εit are the fixed effect of time, the fixed effect of province, and the random disturbance term, respectively.

Mediation effect model

Statistically, a variable is called a mediator if it has an effect on another one (Baron and Kenny 1986). In order to test hypothesis H2 and H3, drawing on the analysis of the mediation effect by Wen and Ye (2014), mediation effect model is constructed as follows:

where M is the mediation variable. The three steps regarding the investigation of the mediation effect are as follows: First, this study tested whether the estimated coefficient of the core explanatory variable to the explained variable is significant in Formula (17). If β1 is significant, the examination of the mediation effect can be continued. Second, Formula (18) examines whether the estimated coefficients of both the core explanatory variable to mediation variable and mediation variable to explained variable are significant in Formulas (18) and (19). If both φ1 and ζ2 are significant, it reveals that there is the mediation effect. Third, this study examined whether the estimated coefficient of the core explanatory variable to explained variable is significant in Formula (19). If ζ1 is significant, the signs of φ1ζ2 and ζ1 are the same that implies the partial mediation effect exists. If ζ1 is not significant, there is a total mediation effect. If ζ1 is significant, β1 is not significant or the signs of φ1ζ2 and ζ1 are the different; the mediating effect is the masking effect.

Spatial regression model

In order to further investigate whether there is a spatial spillover effect on the impact of green finance on carbon emissions intensity, this paper uses the spatial Durbin model (SDM) for spatial analysis and constructs the SDM model:

Among them, ρ is the spatial influence coefficient of carbon emissions intensity; θ1 is the spatial influence coefficient of green finance; Wij is an n × n dimensional spatial weight matrix. The spatial weight matrix of this paper is setting as:

Figure 4 shows the structure of employed methods in the study.

Data sources and descriptive statistics

This paper uses the panel data of 30 provinces in China (excluding Tibet, Hong Kong, Macao, and Taiwan) from 2008 to 2019 for empirical analysis. For the missing values in some of the data, this paper uses linear interpolation method and trend calculation to fill in the missing values. All data are from the CSMAR databases, Yearbook of China’s insurance, China Statistical Yearbook, and EPS databases. Table 3 shows the descriptive statistics results of the main variables.

Empirical results and analysis

Baseline regression results

This paper constructs the mixed regression model, individual fixed effect model, time fixed effect model, space–time double fixed effect model, and random effect model to assess the impact of green finance on carbon emissions intensity. Columns (1)–(5) of Table 4 show the statistical outcomes of the above models. As observed, all the estimation coefficient of the core explanatory variable GF is significantly negative, indicating that green finance can reduce the carbon emission. Hence, hypothesis H1 is verified. After the F-test, BP test, and Hausman test, the results of the individual fixed effect model are explained in this study. A 1 unit augment in GF reduces CI by 1.467 unit. In order to verify the credibility of the calculation results in this paper, the baseline regression results are further compared with the studies of other scholars. Our findings are similar to those of Ran et al. (2023), although they use the Super-SBM model to measure carbon emissions intensity. Hence, despite the differences in the measurement methods of carbon emissions intensity, the result in this paper is basically consistent with the conclusions of existing researches, which has certain credibility and reference value.

Lagged regression results

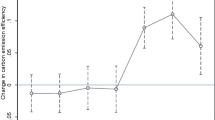

Since it takes a long time for enterprises with high pollution and high energy consumption to use funds from green finance institutions, develop new technologies, change production mode, and finally reduce carbon emissions in production, there may be a lag effect of green finance development on carbon emission reduction. Thus, on the basis of the individual fixed effect model, this paper adopts the green finance variable lagged by one period, two periods, and three periods respectively to test the impact of green finance on carbon emission intensity in the future. Table 5 shows the statistical outcomes of lagged effect model.

As observed, the impacts of one-period, two-period, and three-period lags of green finance on carbon emission intensity are all negative at the significance level of 5%, indicating that lagged effect of green finance on carbon emission reduction is existing, and its inhibitory effect lasts at least until the third period. In order to further verify the reliability of this conclusion, the lagged regression results of this paper are further compared with the research of other scholars. Based on the empirical analysis of China’s provincial panel data from 2011 to 2020, Xu et al. (2023) found that the effect of fintech on carbon emissions reduction also had a lag effect, which lasted at least until the fourth period.

Heterogeneity analysis

In accordance with the regression consequences of the baseline model, the development of green finance can reduce the carbon emission intensity. To move forward a single-step research whether the influence of green finance on carbon emission intensity has regional heterogeneity, this paper divides 30 provinces into eastern, central, and western three sub-sample areas. Similarly, using individual fixed effect model to estimate the regional sample, regression results are exhibited in Table 6.

By comparing the regression coefficients of green finance, it can be found that the influence of green finance on carbon emission intensity has obvious territorial heterogeneity. In the eastern region, the green finance coefficient is negative but not through the significance test, which is contrary to the conclusions of most scholars (Wu et al. 2024). In the eastern region where economic and technological development levels are higher (Huang 2023), most of the industrial enterprises have achieved low-carbon production. Therefore, the carbon emissions reduction effect of green finance is no longer significant. Coefficient of central region of green finance to 10% significance level is negative and shows that the green finance reduces carbon emissions intensity significantly in the central region. A 1 unit augment in GF reduces CI by 6.180 unit in the central region. In the western region, the green finance coefficient is negative but not through the significance test. On one hand, with a relatively weak economy, the western region has many unaware of the importance of green development (Wang et al. 2024). On the other hand, with a slow economic development, western region has not yet reached the economic conditions required for the development of green finance. Firstly, even if green finance in western region is developed and part of the funds are specially invested in enterprises with high pollution and high energy consumption, it is not enough to meet the capital demand of all such enterprises. Secondly, even if the enterprises are supported by green finance, they may not be able to complete the transformation of production and achieve the goal of reducing carbon emission intensity due to the shortage of production factors such as talents and technology.

TSLS regression

Since the possibility of reverse causality or omitted variables, there may be endogeneity problems in the econometric model. Firstly, on one hand, the development of green finance may reduce the carbon emission intensity. On the other hand, the increase of carbon emission intensity may also force the development of green finance. Secondly, there are many factors affecting carbon emission intensity. Some unobservable variables cannot be included in the model, leading to bias in the results of model estimation. In order to solve the potential endogeneity problem between green finance and carbon emission intensity, in addition to using the individual fixed effect model, drawing on existing research, this paper uses the logarithm of per GDP (LNGDP) as instrumental variables to estimate the model. In addition, this paper also uses the logarithm of property insurance premium income (IV1) and one-period lag of green finance (L.GF) as the instrumental variables of green finance development, and adopts the TSLS method (Huang 2023) to solve the potential endogeneity problem between green finance and carbon emission intensity.

The instrumental variables should meet the correlation condition. Firstly, the development of the insurance industry will improve the awareness of the whole society on the insurance concept and other financial concepts. These new concepts will contribute to the development of green finance. Secondly, whether it is green investment or green credit, there will be certain risks in the process of capital allocation. The property insurance can share the risks in the development of green finance. Therefore, property insurance can promote the development of green finance. Thus, “property insurance premium income” meets the correlation condition of instrumental variables.

The instrumental variables should also meet the exogeneity condition. Firstly, property insurance does not provide enterprises with capital, technology, talents, and other production factors, which does not directly affect the carbon emission intensity of enterprises in the production process. Secondly, the development of green finance is to solve the environmental problems that are difficult to be involved in traditional finance. Thus, green finance plays an important role in connecting the two fields. And it is difficult for other tools to replace the bridging role of green finance. Therefore, insurance has no other way to reduce carbon emissions in the traditional financial sector, which means that the “property insurance premium income” meets the exogeneity requirements of instrumental variables.

Table 7 shows the statistical outcomes of TSLS regression. The first-stage regression results shows that instrumental variables have a significant correlation with green finance. The “property insurance premium income,” “one-period lag of green finance,” and “per GDP” have a significantly positive impact on the green finance. At the same time, the CD Wald F-statistic is significantly greater than the critical value of the approved F-value at the 10% bias level. Thus, it significantly rejects the null hypothesis of “weak identification of instrumental variables.” The Anderson LM statistic rejects the null hypothesis of “insufficient identification of instrumental variables” at the 1% significance level. The second-stage regression results show that green finance can reduce carbon emission intensity significantly, which is consistent with the baseline model result above.

Mediating effect analysis

The estimated results of two mediating variables are presented in Table 8. Columns (1) and (2) of Table 8 present the estimated results of the industrial structure as a mediating variable. The direct effect of green finance on carbon emission intensity is − 2.002. The indirect effect of green finance on carbon emission intensity is 0.53(− 0.337* − 1.585). The indirect effect and the direct effect are opposite. And the direct effect is greater than the total effect β1 = − 1.467. Thus, the mediating effect of industrial structure is the masking effect, which accounts for 26.4%. Hence, hypothesis H2 is verified.

Columns (3) and (4) of Table 8 report the estimated results of technological innovation as a mediating variable. The direct effect of green finance on carbon emission intensity is − 1.002. The indirect effect of green finance on carbon emission intensity is − 0.46(2.402* − 0.193). The indirect effect and the direct effect are in the same direction. And the direct effect is smaller than the total effect β1 = − 1.467. Thus, the mediating effect of technological innovation is the partial mediation effect, which accounts for 31.4%. Hence, hypothesis H3 is verified. However, this conclusion is contrary to the findings of Wang and Ma (2022) who used energy efficiency as the variable of technological innovation. This may be because the period of their samples is in the early stage of green finance development and the ambiguity of implementation of the green finance policy leads to the opposite effect.

Spatial effect

In order to determine whether there is a spatial spillover effect on the impact of green finance on carbon emission intensity, a spatial econometric model is further used to conduct a regression analysis of green finance and carbon emission intensity. The Moran’s index and the scatter diagram of the Moran’s index are used to test the spatial autocorrelation of the explained variable carbon emission intensity CI and the core explanatory variable green finance GF. The test results based on the dimensional spatial weight matrix W indicate that the variables meet the requirements of the use of spatial econometric models and can be tested next. The individual fixed spatial Durbin model is selected for regression analysis in this paper. The model estimation results are shown in Table 8 from columns (5) to (8). The main effect, direct effect, indirect effect, and total effect of the impact of green finance on carbon emission intensity are all negative at the significance level of 5%, which is consistent with the conclusions above.

Conclusions

As the intersection of finance and environment, green finance affects the carbon emission intensity of economic and social production activities and promotes the construction of environment-friendly society. Based on CES production function, this paper introduces green finance elements and constructs an economic model of the impact of green finance on carbon emissions and its path. On this basis, this paper proposes that green finance can reduce carbon emission and industrial structure and technological innovation are the paths of it. At the same time, this paper uses the panel data of 30 provinces in China (excluding Tibet, Hong Kong, Macao, and Taiwan) from 2008 to 2019 for the empirical test. The main findings of this paper are as follows: Firstly, the empirical analysis verified the hypothesis that is the green finance can reduce carbon emission, and there is a spatial spillover effect. After the TSLS regression and lag effect analysis, the results are still robust. Secondly, the impact of green finance on carbon emission is spatially heterogeneous. Specifically, the development of green finance in the central region can significantly reduce carbon emission; the development of green finance in the eastern and western regions cannot significantly reduce carbon emission. The difference has a complicated relationship with the level of economic development and regional policies in different regions. Thirdly, from the mediating effect test results, it can be seen that green finance reduces the carbon emission through two paths, i.e., industrial structure and technological innovation, which are masking effect and partial mediation effect respectively in the model. This provides valuable insights for policymakers.

Limitations and future recommendations

It should be noted that the theoretical model and empirical analysis constructed in this paper has certain limitations. For example, in order to simplify the process of model derivation, some assumptions of the theoretical model in this paper are too strong. And the rationality of simply dividing economic production activities into green finance sector and non-green finance sector still needs further exploration. Due to data availability, the data in this paper are only updated up to 2019. The lack of some data makes the empirical analysis results fail to fully reflect the actual situation. How to optimize the theoretical model of the effect of green finance on carbon emission reduction? How to use new data to construct more objective and reasonable carbon emission indicators? These are important contents of the role of green finance in carbon emission reduction in the future.

Policy implications

Based on the above research results, this paper puts forward the following suggestions: First, green finance plays the role of resource allocation. The government can establish green finance incentive mechanisms to encourage the active participation of financial institutions and other market players in green projects and helps enterprises with high pollution and high energy consumption realize transformation through market-based means. We should adhere to the concept that clear waters and green mountains are gold and silver mountains, strengthen the carbon reduction orientation of green finance, give full play to the carbon emission reduction effect of green finance, and achieve “carbon peak” and “carbon neutrality.” Second, at the regional level, we should fully realize the objective conditions that development in our country is unbalanced in different regions. Considering the regional heterogeneity of the carbon emission reduction effect of green finance, the government needs to formulate the development goals of green finance with regional differences, and promote the development of green finance in a focused, phased, and regional manner. For the western region with slow economic development that has not yet reached the level of green finance development, eastern and central regions should provide the support of production factors such as capital, technology, and talents to create a good economic and social foundation for the development of green finance for the western region. Third, green finance can reduce carbon emissions through industrial structure and technological innovation. The government should maximize the guiding effect of green finance in promoting industrial restructure, clarify industrial planning and policies, provide assistance and support for technological upgrading and transformation of enterprises with high pollution and high energy consumption, improve the sustainability of industrial structure, and reduce dependence on traditional industries with high pollution and high energy consumption. In terms of the technological innovation, the government should strengthen the support of green finance for technological progress and broaden the financing channels of technological innovation. Additionally, providing support through subsidies, tax incentives, and low-interest loans for technological innovation projects can help reduce investment risks for micro-enterprises.

Data availability statement

Not applicable.

References

Baron RM, Kenny DA (1986) The moderator-mediator variable distinction in social psychological research: conceptual, strategic, and statistical considerations. J Pers Soc Psychol 51(6):1173–1182

Chen XY (2020) Financial structure, technological innovation and carbon emission: on the development of green financial system. Guangdong Soc Sci 04:41–50

Chen X, Chen Z (2021) Can green finance development reduce carbon emissions? Empirical evidence from 30 Chinese provinces. Sustainability-Basel 13(21):12137

Deng Y (2022) Research on the Impact of Agricultural Green Technology Progress on Carbon Emissions. Tongfang CNKI (Beijing) Technology Co., Ltd. https://doi.org/10.27409/d.cnki.gxbnu.2022.000093

Ding J, Li ZF, Huang JB (2022) Can the green credit policy promote the green innovation in enterprises?—— Based on the perspective of policy effect differentiation. Financ Res 12:55–73

Gan C, Voda M (2023) Can green finance reduce carbon emission intensity? Mechanism and threshold effect. Environ Sci Pollut Res 30:640–653

Guo XY (2022) The influence mechanism and empirical test of green finance in boosting the transformation of low-carbon economy. South Finan 01:52–67

Huang Z (2023) Does green investment reduce carbon emissions? New evidence from partially linear functional-coefficient models. Heliyon 9:e19838

Khan MA, Riaz H, Ahmed M, Saeed A (2022) Does green finance really deliver what is expected? An Empirical Perspective. Borsa Istanb Rev 22(3):586–593

Krogstrup S, Oman W (2019) Macroeconomic and financial policies for climate change mitigation: A review of the literature.

Lee CC, Lee CC (2022) How does green finance affect green total factor productivity? Evidence from, China. Energy Econ 107:105863

Lei XD (2022) Research on the impact of green finance on economic low-carbon transformation and development. Tongfang CNKI (Beijing) Technology Co., Ltd. https://doi.org/10.27623/d.cnki.gzkyu.2022.000687

Li LY (2017) Analysis of inter-provincial total carbon emission efficiency and its influencing factors in China. Dongbei University of Finance and Economics

Lin BQ (2022) High-quality economic growth in China in the process of carbon neutrality. Econ Res 57(01):56–71

Lu J, Yan Y, Wang TX (2021) Research on the micro effect of green credit policy —— based on the perspective of technological innovation and resource reallocation. China’s Ind Econ 01:174–192

Lu H, Xu Y, Wang W, Zhao J, Li G, Tian M (2023) Can China reach the CO2 peak by 2030? A forecast perspective. Environ Sci Pollut Res 30(59):123497–123506

Nepal R, Zhao XM, Liu Y, Dong K (2024) Can green finance strengthen energy resilience? The case of China. Technol Forecast Soc Chang 202:123302

Pan DY, Chen CQ, Michael G (2021) Financial Policy and Economic Low-carbon Transformation —— Research based on the perspective of growth. Financ Res 12:1–19

Peng, Yan W, Elahi E (2022) Does the green credit policy affect the scale of corporate debt financing? Evidence from listed companies in heavy pollution industries in China. Environ Sci Pollut Res 29:755–767

Puspanjali B, Anasuya H, Narayan S (2023) Achieving carbon neutrality target in the emerging economies: role of renewable energy and green technology. Gondwana Res 121:16–32

Ran Q, Liu L, Razzaq A et al (2023) Does green finance improve carbon emission efficiency? Experimental evidence from China. Environ Sci Pollut Res 30:48288–48299

Rasoulinezhad E, Taghizadeh-Hesary F (2022) Role of green finance in improving energy efficiency and renewable energy development. Energ Effi 15:14

Shi DM, Shi XY (2022) Green finance and high-quality economic development: mechanism, characteristics and empirical research. Stat Study 39(01):31–48

Su DW, Lian L (2018) Does green credit affect the investment and financing behavior of heavily polluting enterprises? Financ Res 12:123–137

Sun SY, Wang XY, Gao CY (2023) Can green credit play a carbon emission reduction effect?. China’s Population. Resour Environ 33(08):37–47

Wang J, Ma Y (2022) How does green finance affect CO2 emissions? Heterogeneous and mediation effects analysis. Front Environ Sci 10:931086

Wang X, Wang Y (2021) Green credit policy promotes green innovation research. Manag World 37(06):173–188

Wang Y, Pan DY, Peng Y (2019) Research on green credit incentive Policy based on DSGE model. Financ Res 11:1–18

Wang QJ, Wang HJ, Chang CP (2022) Environmental performance, green finance and green innovation: what’s the long-run relationships among variables? Energ Econ 110:106004

Wang S, Xu J, Zhang W (2023) Research on the impact of green finance on China’s carbon neutralization capacity. Environ Sci Pollut Res 30:108330–108345

Wang LL, Yang XY, Cai QH (2024) Influence mechanism of green finance on regional emission reduction. Heliyon 10(1):e23861

Wen SY, Shi HM, Guo J (2022a) Research on the emission reduction effect of green finance from the perspective of general equilibrium theory: from model construction to empirical test. China Manag Sci 30(12):173–184

Wen WY, Liu H, Wang H (2022b) Green finance, green innovation, and high-quality economic development. Financ Res 08:1–17

Wen ZL, Ye BJ (2014) Mediating effect analysis: methods and model development. Adv Psychol Sci 22(05):731–745

Wu GL, Liu X, Cai YL (2024) The impact of green finance on carbon emission efficiency. Heliyon 10:e23803

Xu J, Chen F, Zhang W, Liu Y, Li T (2023) Analysis of the carbon emission reduction effect of Fintech and the transmission channel of green finance. Financ Res Lett 56:104127

Yan CL, Li T, Lan W (2016) Financial development, innovation, and carbon dioxide emissions. Financ Res 01:14–30

Yin ZM, Sun XQ, Xing MY (2021) Study on the influence of green finance development on green total factor productivity. Stat Decis-Making 37(03):139–144

Yu CH, Wu X, Zhang D, Chen S, Zhao J (2021) Demand for green finance: resolving financing constraints on green innovation in China. Energy Policy 153:112255

Zhang J, Jiang HQ, Liu GY, Zeng WH (2018) A study on the contribution of industrial restructuring to reduction of carbon emissions in China during the five Five-Year Plan periods. J Clean Prod 176:629–635

Zhang W, Zhu Z, Liu X (2022) Can green finance improve carbon emission efficiency? Environ Sci Pollut Res 29:68976–68989

Zhu B, Zhang TL (2021) The impact of cross-region industrial structure optimization on economy, carbon emissions and energy consumption: a case of the Yangtze River Delta. Sci Total Environ 778:146089

Funding

This paper is funded in accordance with the China Association for Science and Technology for the 2022 Graduate Science Popularization Ability Improvement Project (KXYJS2022064) Jiangsu Provincial Postgraduate Practice Innovation Program (KYCX23_1097).

Yizhi Chen thanks the China Association for Science and Technology for the 2022 Graduate Science Popularization Ability Improvement Project (KXYJS2022064) Jiangsu Provincial Postgraduate Practice Innovation Program (KYCX23_1097) for its support.

Author information

Authors and Affiliations

Contributions

Author 1 (first author): Peifeng Jiang. PF contributed to the conceptualization, methodology, design, theoretical model derivation, and data analysis of the study and was a major contributor in writing the manuscript.

Author 2: Chaomin Xu. CX contributed to the investigation, former analysis, data analysis, validation, and writing of the study.

Author 3 (corresponding author): Yizhi Chen. YC contributed to the project administration, supervision, revising, and editing of the study.

All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Ethics statement

No conflict of ethics.

Conceptualization

Under the background of the increasingly serious problem of carbon emissions, how China achieves “carbon peak” and “carbon neutrality” shows its pursuit of high-quality economic development and its responsibility of a major country. In addition, whether China can achieve “carbon peak” and “carbon neutrality” will significantly affect the global carbon reduction action. But there are few theoretical research on carbon emission and green finance. So this paper attempts to construct an economic model of green finance and carbon emission.

Methodology

This paper uses the individual fixed effect model, dynamical model, mediator model, and SDM model to study the impact of green finance on carbon emissions and its impact path of upgrading of the industrial structure and the development of science and technology.

Software

The data processing, modeling analysis, and plotting in this paper were carried out using Excel and Stata.

Consent to participate

Not applicable.

Consent for publication

Not applicable.

Author statement

The manuscript describes original work and is not under consideration by any other journal. All authors have approved the manuscript that is enclosed.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Eyup Dogan

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Jiang, P., Xu, C. & Chen, Y. Can green finance reduce carbon emission? A theoretical analysis and empirical evidence from China. Environ Sci Pollut Res 31, 35396–35411 (2024). https://doi.org/10.1007/s11356-024-33572-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-024-33572-8