Abstract

As a noteworthy initiative of financial supply-side reform to precisely support the green development system, can green finance (GF) help achieve the dual goals of “carbon peaking” and “carbon neutrality”? Using data from China’s provincial panel between 2007 and 2019, this paper measured the green finance index by the entropy method and the carbon emission efficiency (CEE) with carbon emission as the non-desired output by the Super-SBM model. Then, the influence of GF on CEE was empirically investigated by the dynamic panel model and the spatial Durbin model. The findings show that GF can significantly improve CEE and has a positive spillover impact on CEE in provinces with close economic ties; the upgrading of the industrial structure is a key mediator in the transmission of GF to CEE; and regional heterogeneity analysis finds that GF notably improves CEE in eastern, high development levels of economic and GF regions. The research can offer some theoretical and empirical references for green finance to contribute to low-carbon economic growth.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

As industrialization and urbanization continue to advance, human activities and rising energy demand have led to increased carbon emissions, exacerbating a series of climate chain reactions characterized by climate warming (Aslam et al. 2021; Tan et al. 2021; Razzaq et al. 2023). China has pledged to achieve its carbon peak by around 2030 and achieve carbon neutrality by 2060 to actively combat global warming, fully commit to energy saving and resource efficiency, and uphold the Paris Agreement (Irfan et al. 2022; Saqib et al. 2023; Liu et al. 2022a). This target indicates that as China’s environmental carrying capacity is decreasing, the traditional development model of not taking into account environmental costs is now unsustainable, and full attention needs to be paid to total factor carbon productivity, which considers carbon emission as undesired output (Wang and Yi 2022; Hao et al. 2021; Cheng et al. 2022). Given the idea that green development was first explicitly put forward in the 13th Five-Year Plan, which aims at low-carbon development by building a green financial system, developing green trusts, securities, funds, etc. the 19th National Congress report proposed “building a market-oriented green technology innovation system, developing green finance, and growing clean production, clean energy, and energy conservation and environmental protection industries.” The Chinese government is the first market economy in the world to establish a systematic theoretical research framework for green finance policies and measures, but the current in-depth research on green finance policies and measures focuses on qualitative analysis methods, with relatively little empirical evidence, which lags behind the perfect policy system of green finance GF (Lv et al. 2021a, b; Cao et al. 2022). At the stage of the 14th Five-Year Plan, under the ambitious goal of “double carbon,” improving carbon emission efficiency has become a key factor for high-quality economic development, and investigating the value, efficacy, and repeatability of green finance in the conservation of energy and emission control is extremely important from a practical standpoint (Chai et al. 2022).

As an essential measure to support the green development system through financial supply-side reform (Lee and Lee 2022), could GF serve with both objectives of “carbon peak” and “carbon neutrality”? In this research, we measured the GF and carbon emission efficiency (CEE) data and explored the mechanism, heterogeneity, and influence of GF on CEE by using the dynamic panel model and spatial econometric model. The paper aims to offer a theoretical basis and empirical support for GF to benefit the construction of a green and low-carbon economy under the dual carbon target.

The marginal contributions of this paper may be: firstly, it expands the research framework of GF on CEE and explores the mechanism and effect mechanism of GF on CEE; secondly, it distinguishes the heterogeneity of the influence of GF on CEE in cities with diverse geographical locations, economic development levels, and green finance levels, and provides a reference for cities to implement differentiated green finance policies to help green low-carbon development.

Literature review

The theoretic research on GF has progressed relatively slowly, mostly from the perspectives of the implication of GF, the creation and evaluation of the system, and the theoretical exploration of future development (Sachs et al. 2019; Berrou et al. 2019; Migliorelli and Dessertine 2019). Until the last 5 years, as green development has received great attention again, the study on GF has become active, and the relationship between GF and green development has become a core issue in this field (Zhang et al. 2019). “Financing of investments that produce environmental advantages” is the definition of GF. Since its inception, international organizations and national governments have been having extensive discussions about GF, which is a clear indication of its crucial role in policy (Lindenberg 2014). Academic researchers’ interest in the topic has also grown. Zhang et al. (2021a, b) claim that green credit rules reward “high and low” enterprise short-term financing activity while penalizing long-term financing and investment behavior and also help reduce sulfur dioxide and wastewater discharge. More recent empirical studies tend to argue that GF can play a positive role in curbing heavy polluters and improving the ecological environment (Wang and Zhi 2016; Wang et al. 2021a, b; Huang and Chen 2022). Some studies have also explored the connection between economic growth and carbon emission. The results confirm that GF is the best financial strategy to reduce the output of carbon emissions. According to Ren et al. (2020), China’s industry of GF grew quickly, and advancements in the GF index and rising non-fossil energy usage helped to lower carbon intensity.

To reach China’s objective of becoming carbon neutral by 2060, the need for the improvement of CEE is becoming more and more recognized by academics both domestically and internationally. In the previous related studies, the research direction and perspective emphasize primarily three aspects, the definition of CEE, the measurement of CEE, and the influencing factors. Generally, CEE is divided into single-factor CEE and full-factor CEE. The three basic categories used to classify single-factor CEE. One is carbon productivity, which Kaya and Yokobori initially planned to express carbon productivity considering the GDP to CE ratio (Kaya and Yokobori 1997), i.e., the value of GDP generated per unit of CE. Second is the carbon index, which was put up by Mielnik and Goldemberg (1999) to evaluate CEE in terms of the proportion of overall energy use to overall CE, i.e., the CE for each unit of energy consumed. The third component is carbon intensity, or CE per unit of GDP growth (Ang 1999). Because single-factor efficiency can only represent how energy and economic efficiency are related, ignoring the consideration of the effect of other factors like capital, labor, and technology on the significance of economic growth (Lv et al. 2021a, b), total factor productivity takes into account the situation of multiple inputs (Zhao et al. 2022a, b; Wang et al. 2021a, b), and the calculation results are more scientific and reasonable than single-factor efficiency, scholars began to use the stochastic frontier analysis (SFA model) of parametric method and the non-parametric method of data envelopment analysis (DEA model) to mainly measure the total factor carbon efficiency to conduct research. In previous studies, it is generally agreed that openness to the outside world, government intervention, enterprise ownership structure, technological progress, and enterprise size have favorable effects on CEE; economic size, energy consumption structure and industrial structure, urbanization rate, and endowment structure have greater negative effects on CEE (Sun and Huang 2020; Yu and Zhang 2021).

To sum up, the literature already in existence has provided some groundwork for the study of GF and CEE, but there are still some gaps: firstly, scholars focus more on theoretical studies related to green finance, and there are relatively few empirical studies; secondly, there are studies related to the association between GF and green development, but the influence of GF on the overall performance of carbon emission is neglected. Therefore, using data from China’s provincial panel between 2007 and 2019, this paper measured the green finance index by the entropy method and the CEE with carbon emission as the non-desired output by the Super-SBM model.

Theoretical analysis and research hypothesis

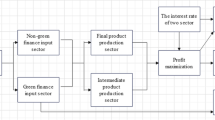

The direct influence of GF on CEE

China’s economy has transitioned from fast growth to high-quality development; green finance has received increasing attention to find an effective power source during the economic transformation. Zhou et al. (2020) discovered that green financing can result in a situation where both economic growth and the environment benefit. They did this by using global principal component analysis to build a GF development index. According to Soundarrajan and Vivek (2016), GF is an essential component of the low-carbon green economy. It is a market-based loan or investment project that evaluates risks in light of environmental impact or uses environmental incentives while making business choices. It thus connects finance, environmental improvement, and economic growth. Iqbal et al. (2021) argue that to control global warming, the transition to green energy requires a lot of GF. Green finance could aid in lowering the environmental pollution. Among the intellectual studies on the influence of GF on the output of carbon emission, some researchers have pointed out that financial development could lower the output of carbon emission through paths such as encouraging business technology innovation and raising awareness of nature conservation (Zhang et al. 2021a, b). Using data from different countries, Boutabba (2014) found that financial deepening suppressed the output of carbon emissions. Xiu et al. (2015) argued that financial regulation initiatives help to encourage saving and lowering pollutants under industrial development constraints. Increases in the use of renewable power, real exchange rate, and financial deepening all result in a drop in carbon pollution, according to Dogan and Seker (2016), while increases in the use of non-renewable energy increase the amount of pollution. Ren et al. (2020) investigated the improvement of the growing index of GF and the utilization of non-fossil power. Shen et al. (2021) investigated that green inputs showed a negative relationship with carbon dioxide emissions. Chen and Chen (2021) investigated that after the introduction of the GF policy, the interest-bearing corporate debt investment and corporate gearing of heavy polluters were significantly reduced, the corresponding financing cost became larger, and the new incoming investment was significantly reduced. When the investment is restrained, highly polluted companies will have less capacity to produce, and energy consumption and pollutant emission will be reduced at the same time.

According to the constraint theory, green investment as a special fund for pollution control has special characteristics and cannot be invested in production and operation (Ren et al. 2022a, b). Under the condition that the existing capital and labor factors remain unchanged, early on in the creation of GF, green investment is low, and enterprises need more energy consumption for regional economic growth to maximize short-term profits, which results in an energy rebound effect and leads to the rise in the output of carbon emission. In line with the scale effect theory, with the improvement of GF, the scale of green investment expands, the production process of green enterprises becomes more and more perfect under the effective control of R&D cost, and the energy utilization efficiency is significantly improved, which can effectively lower the output of carbon emission in the production process. The findings of the current study suggest that the advancement of GF will be beneficial to enhance the performance of carbon pollution on the whole. Thus, the following hypotheses are proposed:

-

H1: GF improves the CEE.

Mechanisms of GF’s impact on CEE

With the release of green bonds and trusts, GF has created a new avenue for financial investment in green sectors, such as those that conserve energy and protect the environment (Falcone 2020). The gray correlation approach is used by Wang and Wang (2021) to empirically investigate the association between GF and upgrading of the industrialization in China. The goal of green finance is to assist environmentally friendly initiatives financially, advance technical advancement, and foster environmentally friendly and sustainable economic growth. For China’s “three high” excess industries, the investment environment risk will further increase the investment environment cost of enterprises, strengthen the government investment environment constraints, and curb the financing of high energy-consuming enterprises; green finance will use the effect of government investment environment penalties and corporate financing environment, inhibiting influence to encourage the green transformation of the economy so that the unit energy consumption intensity significantly decreased, the productivity of the unit resource consumption corresponding to increase (Qi and Qi 2020; Du et al. 2022). Green finance promotes the green and ecological life and consumption of residents, influences the activities of enterprises by using the requirements of green consumption at the end and market-based economic incentives, forces the optimization and upgrading of front-end industries, increases the efficient supply of green and ecological goods, and improves the efficiency of energy consumption (Sun and Chen 2022). Green financial capital is tilted toward growth and innovative industries, and market players are guided by social expectations to spontaneously encourage improving and modernizing industrial structures, which in turn promotes green development. Gu et al. (2021) established the VAR model, super efficiency DEA, and the Tobit regression model. Empirical examination shows that GF is quite effective at encouraging industrial modernization and transformation.

Green finance itself belongs to the service industry; firstly, its development improves its gross product and thus increases the proportion of the three industries; secondly, it promotes the migration of production factors to more efficient sectors and encourages the modernization of industrial infrastructure, and the three industries develop to contribute to a high degree of economic efficiency, low consumption, and less pollution; it makes the allocation of financial resources more effective and encourages the rationalization of industrial structure and thus improves the efficiency of various resource factors such as energy. It makes the allocation of financial resources more effective, advocates the rationalization of industrial structure and thus enhances the application efficiency of various resource factors such as energy, promotes economic and social development, and has a favorable impact on carbon emission performance (Wang et al. 2019). Accordingly, we suggest the following scenario:

-

H2: GF improves the CEE by promoting industrial structure upgrading.

Study design

Model construction

Using the aforementioned theoretical study and research premise as a foundation, we may investigate how GF affects CEE. This paper constructs a dynamic panel model as follows:

In Eq. 1, \(i\) denotes city, \(t\) indicates year, CEE denotes carbon emission efficiency, green denotes green finance, X denotes control variable, and \(\varepsilon\) denotes random disturbance term.

In addition, utilizing the previous mechanism of action study, in addition to the above-mentioned direct effects, to prove that GF increases CEE by optimizing industrial structure, this paper draws on Wu et al. (2021) to test the mediating effect and constructs the following equation in three steps:

Equations 1, 2, and 3 constitute the mediating model. \(indup\) represents the mediating variable, and if \({\varphi }_{1}\) and ϑ2 are significant simultaneously, then there is a mediating effect φ1 × ϑ2 on the impact of GF on CEE.

GF and CEE in one region may also affect neighboring or more interlinked locations by spatial spillover effects. By using the research conducted by Le Sage and Pace (2009), with this essay, the spatial Durbin model is chosen and set up as follows:

where ρ depicts the lagged regression coefficient of explained variables, θ depicts the lagged regression coefficient of explained variables;\(\gamma\) represents the time-fixed effect;\(u\) depicts the individual fixed effect; and W is the economic spatial weight matrix, which preferably able to capture the level of economic asymmetry among areas.

Variable measures and descriptions

Explanatory variables

Carbon emission efficiency (CEE).

Utilizing the findings of Ge et al. (2022) and Meng et al. (2022), the essay constructs a measurement system of CEE based on the Super-SBM model, using DEA Solver Pro 5.0 software, as shown in Table 1. Among them, following Ren and Wu (2022), the capital stock is used to compute the capital, using 2006 as the starting point and the “perpetual inventory method.” Following Wu et al. (2020), for labor force indicators, the total number of employed persons in the three industries in the current year is selected for measurement. The expected output is the gross domestic product (GDP) of each province and region, and the real GDP of each region is deflated by taking 2006 as the base period to account for price changes. The non-desired output factor is the output of carbon emission of each province, and the output of carbon emission from fossil fuel consumption in 30 provinces in mainland China is measured by the approach outlined in the IPCC Guidelines for National Greenhouse Gas Inventories from 2006 (Hao et al. 2023).

Explanatory variables

Green finance (green)

In this study, as shown in Table 2, according to the data obtained, five categories of financial services using the entropy value method can calculate the index of GF.

Mediating variables

Industrial structure upgrading (indup)

China’s economy has developed to this stage, and industrial development shows a significant increase in the development rate of the tertiary industry. Referring to Liu et al. (2021), industrial structure upgrading is quantified using the ratio of the tertiary industry’s value added to the secondary industry’s value added.

Control variables

Considering that CEE is impacted by a variety of things, following Xiao and Liu (2022), Liu et al. (2022a, b), and Ren et al. (2022a, b), some control variables are introduced in the paper to reduce the bias caused by omitted variables. Among them, the logarithm of per capita GDP is applicable to determine the amount of economic growth (lnpgdp); the degree of foreign openness (lnfdi) is determined by taking the logarithm of foreign direct investment; and government intervention (gov) is the government’s share of GDP as measured by spending.

Data sources and descriptive statistics

The primary sources of the original data are the China Statistical Yearbook, China Energy Statistical Yearbook, and historical statistical yearbooks of the provinces, autonomous areas, and municipalities directly under the central government. Among them, the data of green financial index measurement are from the annual statistical reports of the banking industry in the past years, Wind and CSMAR databases. Table 3 displays the descriptive statistics for the primary variables.

Empirical results and analysis

Baseline regression results

This essay first uses a dynamic panel model to assess the influence of GF on CEE. Columns (1) and (2) of Table 4 show, correspondingly, the statistical outcomes of the OLS model without and with control variables utilizing dynamic lagged variables. Columns (3) and (4) show the empirical results of the system GMM model. The CEE regression coefficients for the lag period may be shown to be both statistically notable and favorable at the 1% level, indicating that the CEE during the present time is significantly influenced by the value of the previous period, which has a strong cumulative circularity, which also indicates that the estimation of dynamic panel model is reasonable. All of the GF’s coefficients on CEE are significant and positive, and thus hypothesis 1 is valid. Unlike the first-order autocorrelation statistics, the p-value of the second-order autocorrelation statistics is greater than 0.1. Therefore, the original hypothesis of “no autocorrelation of the disturbance term” is accepted; and the Hansen statistic is not significant, which indicates that the selected instrumental variables are valid and there is no over-identification. Our findings are similar to those of Zhao et al. (2022a, b), Lu et al. (2022), and Sharif et al. (2022). GF, through green loans and securities, broadens the financing options available to businesses engaged in energy conservation and environmental safeguarding to support their development (Meo and Abd Karim 2022; Sun et al. 2022). For the “three high” industries, their environmental protection business risks will increase the cost of corporate financing, increase the investment and financing constraints, and curb the input of high energy-consuming SMEs (Soundarrajan and Vivek 2016; Xiong and Sun 2022). Green finance accelerates the green transformation through the financing penalty effect and investment disincentive effect, which is also conducive to the enhancement of CEE.

Analysis of the intermediary effect

Theoretical studies suggest that green finance enhances carbon performance through industrial structure effects. To determine if this mechanism is reliable, we employ the mediating effect model. In Table 5, we can see that GF positively influences industrial structure improvement and that both green financing and industrial structure improvement positively impact CEE, which means that GF can improve CEE by promoting industrial upgrading; thus, hypothesis 2 is valid. Green finance itself belongs to the service sector and its development has increased its gross product and thus the share of the three sectors. Green finance facilitates the migration of factors of production to more efficient sectors and encourages the modernization of industrial infrastructure (Gu et al. 2021; Sun et al. 2022). It makes the allocation of financial resources more efficient, encourages industrial structure upgrading, and has a favorable impact on carbon emission efficiency (Wang et al. 2019).

Analysis of spatial spillover effects

In this essay, utilizing the research done by Xu et al. (2022), we use the economic spatial weight matrix and discuss the spatial clustering status of the model explanatory and explanatory variables through the global Moran index. The outcomes are displayed in Table 6. In the table, it is apparent that the observed values of GF and CEE are positive in the observation period of 2007–2019 (except for 2018), which indicates that the observed values have a considerable positive spatial connection between the two.

Within this essay, we shall choose a spatial econometric model that is appropriate for this paper and evaluate its reliability. The study uses the approach described by Le Sage and Pace (2009) to test whether there is spatial autocorrelation, the spatial autoregressive model passes the LM statistic and its robust form. Secondly, the Wald test is used to compare the applicability of the SDM. The results of the aforementioned experiments are presented in Table 7, and it is clear that the SDM is the best model.

The spatial Durbin model’s regression outcomes are displayed in Table 8, from which we can see that the main utility coefficients of GF are all beneficial and notable at the 1% level, indicating that GF has been shown to considerably improve regional carbon efficiency, which again verifies hypothesis 1. Additionally, the coefficient of W × green is substantial and positive, demonstrating that GF has a favorable geographical spillover impact, which not only improves local CEE but also significantly contributes to the economic. The coefficient of W × green is also significant.

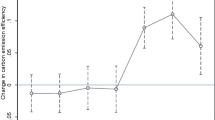

Heterogeneity analysis

Although it is clear that GF and CEE are strongly correlated on a global scale and may differ significantly depending on the region’s geography, level of economic development, and intensity of GF policies, the regression results of GF heterogeneity on CEE are displayed in Table 9. Firstly, to examine how GF affects local CEE, the data are split into eastern and central-western samples. It is evident that GF considerably improves CEE at the 5% level in eastern provinces, but not in the central-west. The possible reason is that the capital market in the eastern region has been more mature through its long-term development, which is more likely to attract scarce financial resources to the east and has profoundly influenced the economic growth and capital pattern of the country; the Midwest areas are also developing their economies based on energy consumption, but the development level of GF lags behind that of the east and central regions, so a mature financial market has not yet been formed, and it cannot have a notable influence on the progress of regional CEE. The development of GF in the Midwest areas is also founded on energy consumption.

To further clarify the influence of GF on regional CEE at different development stages, the total sample was divided into two smaller samples of high and low economic development levels following the median GDP per capita and then divided into two smaller samples of high and low GF levels following the median GF index, and regression analysis was conducted separately. The regression analysis shows that the effect of GF on CEE is positive in areas with a high economic level and high GF level, but not notable in areas with a low economic level and low GF level. One explanation could be that the economy is still in its infancy, and the high speed of development must consume huge energy resources and form huge carbon emission, so the environmental performance decreases; when the development reaches a certain amount of living level, citizens and government departments will increasingly focus on environmental health and seek green development, and government departments will focus on pollution control and promote carbon emission reduction. It is also in line with the “Environmental Kuznets Curve” (EKC) effect, which has been widely studied (An et al. 2021). The application of GF will push for improved industrial structure, improve the efficiency of factor allocation, and control carbon emission while economic development (Xiong and Sun 2022).

Robustness tests

Robustness tests for samples that may cause interference are excluded

In this paper, 30 provinces and cities in mainland China are selected as the sample, among which Guangdong, Zhejiang, Jiangsu, and Shandong provinces are among the more developed provinces with the top four GDPs in the 30 provinces. Because of their rapid economic development, extensive capital markets, large financial market volume, and active financial activities, which may obstruct the study for this work, the specimens of these four provinces are firstly excluded from this paper, and the results of the re-run regression are shown in Table 10, and the main variables’ signals and importance match those in the earlier paper, which proves the robustness of the results.

Excluding the first-year data robustness test

The time frame of this paper is 2007–2019; the 2008 global economic crisis prompted the Chinese government to modify the extent and scope of financial reform, focusing on prudential supervision of the financial system on the macro level, tightening the credit risk audit of banks, tightening the risk management and internal control of commercial banks, and changing the capital and financial markets compared to 2008. To avoid the possible disturbance of data before 2008, the paper excludes the sample data from 2007 and adjusts the data before estimating the parameters again. Table 11 again proves the robustness of the empirical results, and the sign and significance of the main variables remain the same as above.

Main conclusions and policy recommendations

Using Chinese provincial panel data from 2007 to 2019, this paper measured the GF index using the entropy method and carbon emission efficiency with carbon emission as non-expected output using the Super-SBM method, explored the influence of GF on CEE using the dynamic panel model and spatial Durbin model with full consideration of the mechanism of the variables’ effects, and reached the following research conclusions: first, GF significantly improves CEE; second, the modernization of the industrial structure is a key mediator in the transmission of GF to CEE; third, GF significantly reduces CEE in eastern regions, high economic development level, and large cities with strong GF policies, while it does not significantly affect CEE in the Midwest, low economic development level, and low level of green finance policy support. Fourth, GF has a notable positive spatial spillover impact on the CEE of provinces with close economic ties. The findings of this paper expand the mechanism of the impact of GF on CEE, and the following are the policy ramifications.

First, the orderly guidance of GF helps low-carbon economic growth. In the process of promoting the construction of GF, the flow of financial resources and capital into new enterprises must be increased comparatively. In the eastern region, we should promote the optimization of industrial structure, attract green capital to support technological innovation in the energy field, strengthen the construction of energy networks, and improve energy utilization efficiency by various means such as reducing losses caused by energy transmission over long distances; in the Midwest regions, we could further accept the industrial migration from the eastern development regions, empower China’s traditional resource factors with data factors, activate economic potential, optimize the industrial structure, and improve the utilization efficiency of various resource factors. In the Midwest regions, we should further accept the industrial migration from the eastern development regions, empower China’s traditional resource elements with data elements, activate economic potential, optimize the industrial structure, improve the efficiency of various resource elements, and achieve green development.

Second, we should reduce government intervention in the financial market and incorporate green GDP into the government performance appraisal to prevent the detrimental effects of government “bottom-up competition” on regional CEE, break the path dependence created by traditional high energy-consumption industries and “zombie firms,” strengthen the performance management of both energy efficiency and ecological sustainability, increase and rationalize the use of local government spending on preventing pollution and pollution prevention, and stimulate local governments to promote green and ecological economic development. Similarly, they are required to set “green technology thresholds for environmental protection” and strict energy-saving access when introducing foreign investment in construction projects to tighten the construction of high-pollution, high-energy-consumption projects from the root.

Third, we should strengthen exchanges and cooperation. Green finance can become an essential tool to enhance the CEE and can better support sustainable economic development. China has a relatively mature green financial policy system, which should strengthen inter-regional exchanges and cooperation. Regions with rich practical experience in the field of GF should play a leading role in actively promoting GF policies so that they can be gradually promoted and implemented nationwide to better cope with global environmental pressure.

Data availability

Not applicable.

References

Alam MM, Murad MW, Noman AHM, Ozturk I (2016) Relationships among carbon emissions, economic growth, energy consumption and population growth: testing environmental Kuznets curve hypothesis for Brazil, China, India and Indonesia. Ecol Ind 70:466–479

An H, Razzaq A, Haseeb M, Mihardjo LW (2021) The role of technology innovation and people’s connectivity in testing environmental Kuznets curve and pollution heaven hypotheses across the belt and road host countries: new evidence from method of moments quantile regression. Environ Sci Pollut Res 28(5):5254–5270

Ang BW (1999) Is the energy intensity a less useful indicator than the carbon factor in the study of climate change? Energy Policy 27(15):943–946

Aslam B, Hu J, Shahab S, Ahmad A, Saleem M, Shah SSA, ..., & Hassan M (2021) The nexus of industrialization, GDP per capita and CO2 emission in China. Environ Technol Innov 23:101674

Berrou R, Dessertine P, Migliorelli M (2019) An overview of green finance. The rise of green finance in Europe: opportunities and challenges for issuers, investors and marketplaces, pp 3–29. https://doi.org/10.1007/978-3-030-22510-0_1

Boutabba MA (2014) The impact of financial development, income, energy and trade on carbon emissions: evidence from the Indian economy. Econ Model 40:33–41

Cao J, Law SH, Samad ARBA, Mohamad WNBW, Wang J, Yang X (2022) Effect of financial development and technological innovation on green growth—analysis based on spatial Durbin model. J Clean Prod 365:132865

Cao L (2022) How green finance reduces CO2 emissions for green economic recovery: empirical evidence from E7 economies. Environ Sci Pollut Res 30:3307–3320. https://doi.org/10.1007/s11356-022-22365-6

Chai J, Wu H, Hao Y (2022) Planned economic growth and controlled energy demand: how do regional growth targets affect energy consumption in China? Technol Forecast Soc Chang 185:122068

Charfeddine L, Khediri KB (2016) Financial development and environmental quality in UAE: cointegration with structural breaks. Renew Sustain Energy Rev 55:1322–1335

Chen X, Chen Z (2021) Can green finance development reduce carbon emissions? Empirical evidence from 30 Chinese provinces. Sustainability 13(21):12137

Cheng H, Liu X, Xu Z (2022) Impact of carbon emission trading market on regional urbanization: an empirical study based on a difference-in-differences model. Econ Anal Lett 1:15–21

Dogan E, Seker F (2016) The influence of real output, renewable and non-renewable energy, trade and financial development on carbon emissions in the top renewable energy countries. Renew Sustain Energy Rev 60:1074–1085

Du L, Jiang H, Adebayo TS, Awosusi AA, Razzaq A (2022) Asymmetric effects of high-tech industry and renewable energy on consumption-based carbon emissions in MINT countries. Renew Energy 196:1269–1280

Falcone PM (2020) Environmental regulation and green investments: the role of green finance. Int J Green Econ 14(2):159–173

Ge W, Xu Y, Liu G, Shen B, Su X, Liu L, ..., Ran Q (2022) Exploring the impact of the DE on CEE under factor misallocation constraints: new insights from China. Front Environ Sci 10:953070. https://doi.org/10.3389/FENVS.2022.953070

Gu B, Chen F, Zhang K (2021) The policy effect of green finance in promoting industrial transformation and upgrading efficiency in China: analysis from the perspective of government regulation and public environmental demands. Environ Sci Pollut Res 28(34):47474–47491

Hao Y, Ba N, Ren S, Wu H (2021) How does international technology spillover affect China’s carbon emissions? A new perspective through intellectual property protection. Sustain Prod Consump 25:577–590

Hao X, Li Y, Ren S, Wu H, Hao Y (2023) The role of digitalization on green economic growth: does industrial structure optimization and green innovation matter? J Environ Manage 325:116504

Huang Y, Chen C (2022) The spatial spillover and threshold effect of green finance on environmental quality: evidence from China. Environ Sci Pollut Res 29(12):17487–17498

Iqbal S, Taghizadeh-Hesary F, Mohsin M, Iqbal W (2021) Assessing the role of the green finance index in environmental pollution reduction. Stud Appl Econ 39(3)

Irfan M, Razzaq A, Sharif A, Yang X (2022) Influence mechanism between green finance and green innovation: exploring regional policy intervention effects in China. Technol Forecast Soc Chang 182:121882

Kaya Y, Yokobori K (1997) ‘Global environment, energy, and economic development’ held at the United Nations University, Tokyo, 25–27 October 1993

Le Sage J, Pace RK (2009) Introduction to spatial econometrics. Chapman and Hall/CRC Taylorfrancis, New York, Heidelberg. https://doi.org/10.1201/9781420064254

Lee CC, Lee CC (2022) How does green finance affect green total factor productivity? Evidence from China. Energy Econ 107:105863

Lindenberg N (2014) Definition of green finance. German Development Institute/Deutsches Institut für Entwicklungspolitik (DIE). DIE mimeo, 2014 https://papers.ssrn.com/sol3/papers.cfm. Available on 2/3/2023

Liu L, Yang X, Meng Y, Ran Q, Liu Z (2021) Does the construction of national eco-industrial demonstration parks improve green total factor productivity? Evidence from prefecture-level cities in China. Sustainability 14(1):26

Liu F, Feng J, Zhai G, Razzaq A (2022a) Influence of fiscal decentralization and renewable energy investment on ecological sustainability in EU: what is the moderating role of institutional governance? Renew Energy 200:1265–1274

Liu H, Lei H, Zhou Y (2022b) How does green trade affect the environment? Evidence from China. J Econ Anal 1:1–19

Lu Q, Farooq MU, Ma X, Iram R (2022) Assessing the combining role of public-private investment as a green finance and renewable energy in carbon neutrality target. Renewable Energy 196:1357–1365

Lv C, Bian B, Lee CC, He Z (2021a) Regional gap and the trend of green finance development in China. Energy Econ 102:105476

Lv Y, Liu J, Cheng J, Andreoni V (2021b) The persistent and transient total factor CE performance and its economic determinants: evidence from China’s province-level panel data. J Clean Prod 316:128198

Meng Y, Liu L, Xu Z, Gong W, Yan G (2022) Research on the heterogeneity of green biased technology progress in Chinese industries—decomposition index analysis based on the slacks-based measure integrating (SBM). J Econ Anal 1:17–34

Meo MS, Abd Karim MZ (2022) The role of green finance in reducing CO2 emissions: an empirical analysis. Borsa Istanbul Rev 22(1):169–178

Mielnik O, Goldemberg J (1999) Communication the evolution of the “carbonization index” in developing countries. Energy Policy 27(5):307–308

Migliorelli M, Dessertine P (2019) The rise of green finance in Europe. Opportunities and challenges for issuers, investors and marketplaces. Palgrave Macmillan, Cham, p 2

Qi R, Qi L (2020) Can synergy effect exist between green finance and industrial structure upgrade in China? Open J Soc Sci 8(08):215

Razzaq A, Sharif A, Afshan S, Li CJ (2023) Do climate technologies and recycling asymmetrically mitigate consumption-based carbon emissions in the United States? New insights from Quantile ARDL. Technol Forecast Soc Chang 186:122138

Ren S, Wu H (2022) Path to green development: the role environmental regulation and labor skill premium on green total factor energy efficiency. Green Finance 4(4):387–410

Ren X, Shao Q, Zhong R (2020) Nexus between green finance, non-fossil energy use, and carbon intensity: empirical evidence from China based on a vector error correction model. J Clean Prod 277:122844

Ren S, Hao Y, Wu H (2022a) How does green investment affect environmental pollution? Evidence from China. Environ Resource Econ 81(1):25–51

Ren S, Liu Z, Zhanbayev R, Du M (2022b) Does the internet development put pressure on energy-saving potential for environmental sustainability? Evidence from China. J Econ Anal 1:50–65

Sachs JD, Woo WT, Yoshino N, Taghizadeh-Hesary F (2019) Why is green finance important? ADBI Working Paper Series, No. 917. Asian Development Bank Institute (ADBI). https://doi.org/10.2139/ssrn.3327149

Salahuddin M, Gow J, Ozturk I (2015) Is the long-run relationship between economic growth, electricity consumption, carbon dioxide emissions and financial development in Gulf Cooperation Council Countries robust? Renew Sustain Energy Rev 51:317–326

Saqib N, Ozturk I, Usman M, Sharif A, Razzaq A (2023) Pollution haven or halo? How European countries leverage FDI, energy, and human capital to alleviate their ecological footprint. Gondwana Res 116:136–148. https://doi.org/10.1016/j.gr.2022.12.018

Shahbaz M, Solarin SA, Mahmood H, Arouri M (2013) Does financial development reduce CO2 emissions in Malaysian economy? A time series analysis. Econ Model 35:145–152

Sharif A, Saqib N, Dong K, Khan SAR (2022) Nexus between green technology innovation, green financing, and CO2 emissions in the G7 countries: the moderating role of social globalisation. Sustain Dev. https://doi.org/10.1002/sd.2360

Shen Y, Su ZW, Malik MY, Umar M, Khan Z, Khan M (2021) Does green investment, financial development and natural resources rent limit carbon emissions? A provincial panel analysis of China. Sci Total Environ 755:142538

Soundarrajan P, Vivek N (2016) Green finance for sustainable green economic growth in India. Agric Econ 62(1):35–44

Sun H, Chen F (2022) The impact of green finance on China’s regional energy consumption structure based on system GMM. Resour Policy 76:102588

Sun W, Huang C (2020) How does urbanization affect CEE? Evidence from China. J Clean Prod 272:122828

Sun Y, Guan W, Cao Y, Bao Q (2022) Role of green finance policy in renewable energy deployment for carbon neutrality: evidence from China. Renew Energy 197:643–653

Tan R, Xu M, Sun C (2021) The impacts of energy reallocation on economic output and CO2 emissions in China. Energy Econ 94:105062

Wang X, Wang Q (2021) Research on the impact of green finance on the upgrading of China’s regional industrial structure from the perspective of sustainable development. Resour Policy 74:102436

Wang Y, Zhi Q (2016) The role of green finance in environmental protection: two aspects of market mechanism and policies. Energy Proc 104:311–316

Wang K, Wu M, Sun Y, Shi X, Sun A, Zhang P (2019) Resource abundance, industrial structure, and regional carbon emissions efficiency in China. Resour Policy 60:203–214

Wang S, Wang X, Tang Y (2020) Drivers of carbon emission transfer in China—an analysis of international trade from 2004 to 2011. Sci Total Environ 709:135924

Wang S, Chen S, Zhang H (2021a) Effect of income and energy efficiency on natural capital demand. Environ Sci Pollut Res 28(33):45402–45413

Wang Y, Zhao N, Lei X, Long R (2021b) Green finance innovation and regional green development. Sustainability 13(15):8230

Wang S, Yi X (2022) Can the financial industry ‘anchor’ carbon emission reductions? —the mediating and moderating effects of the technology market. Energy Environ 0958305X211061810. https://doi.org/10.1177/0958305X211061

Wu H, Hao Y, Ren S (2020) How do environmental regulation and environmental decentralization affect green total factor energy efficiency: evidence from China. Energy Econ 91:104880

Wu H, Hao Y, Ren S, Yang X, Xie G (2021) Does internet development improve green total factor energy efficiency? Evidence from China. Energy Policy 153:112247

Xiao H, Liu J (2022) The impact of digital economy development on local fiscal revenue efficiency. Econ Anal Letters 1:1–7

Xiong Q, Sun D (2022) Influence analysis of green finance development impact on carbon emissions: an exploratory study based on fsQCA. Environ Sci Pollut Res 1–12. https://doi.org/10.1007/s11356-021-18351-z

Xiu J, Liu HY, Zang XQ (2015) The Industrial growth and prediction under the background of green credit and energy saving and emission reduction[J]. Mod Econ Sci 37(3):55–62

Xu C, Liu Y, Fu T (2022) Spatial-temporal evolution and driving factors of grey water footprint efficiency in the Yangtze River Economic Belt. Sci Total Environ 844:156930. https://doi.org/10.1016/j.scitotenv.2022.156930

Yu Y, Zhang N (2021) Low-carbon city pilot and CEE: quasi-experimental evidence from China. Energy Econ 96:105125

Zhang D, Zhang Z, Managi S (2019) A bibliometric analysis on green finance: current status, development, and future directions. Financ Res Lett 29:425–430

Zhang S, Wu Z, Wang Y, Hao Y (2021a) Fostering green development with green finance: an empirical study on the environmental effect of green credit policy in China. J Environ Manage 296:113159

Zhang W, Hong M, Li J, Li F (2021b) An examination of green credit promoting carbon dioxide emissions reduction: a provincial panel analysis of China. Sustainability 13(13):7148

Zhao S, Tian W, Dagestani AA (2022b) How do R&D factors affect total factor productivity: based on stochastic frontier analysis method. Econ Anal Lett 1:28–34

Zhao J, Taghizadeh-Hesary F, Dong K, Dong X (2022) How green growth affects carbon emissions in China: the role of green finance. Econ Res-Ekonomska Istraživanja 1–22. https://doi.org/10.1080/1331677X.2022.2095522

Zhou X, Tang X, Zhang R (2020) Impact of green finance on economic development and environmental quality: a study based on provincial panel data from China. Environ Sci Pollut Res 27(16):19915–19932

Funding

This work received financial support from the National Natural Science Foundation of China (71463057), the Special Research Project on Science and Technology Innovation Strategy of Xinjiang Uygur Autonomous Region (2021B04001-4), the graduate research and innovation project of Xinjiang University (XJ2021G014, XJ2021G013, XJ2020G020), and the special project of the School of Business and Economics, Shanghai Business School “Research on the Impact of Digital Economy on High-Quality Economic Development” (SWJJ-GYZX-2021–06). The usual disclaimer applies.

Author information

Authors and Affiliations

Contributions

Lu Liu: conceptualization, project administration, writing—review and editing, and writing—original draft, software, visualization, formal analysis. Qiying Ran: writing—original draft, writing—review and editing, formal analysis, funding acquisition, and supervision. Yuxin Meng: formal analysis, methodology, data curation, writing—review and editing, and validation. Xiaodong Yang: writing—review and editing. Asif Razzaq: writing—review and editing and validation.

Corresponding author

Ethics declarations

Ethics approval and consent to participate

Not applicable.

Consent for publication

Not applicable.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Nicholas Apergis

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Ran, Q., Liu, L., Razzaq, A. et al. Does green finance improve carbon emission efficiency? Experimental evidence from China. Environ Sci Pollut Res 30, 48288–48299 (2023). https://doi.org/10.1007/s11356-023-25571-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-023-25571-y