Abstract

In the crucial phase of high-quality economic growth, green finance is essential for directing capital to green industries and optimizing the quality of economic growth. Academics in China have paid a great deal of attention to green finance because it is a crucial government policy for advancing the development of an ecological civilization. This document examines the Chinese State Council’s implementation of the Guidance on Building a Green Financial System as a quasi-natural experiment. It determines, using the double difference method and panel data from 283 prefecture-level cities in China between 2011 and 2020, if green financial reform policies can enhance carbon emission efficiency and its mechanisms. The study reveals that green finance reform policies considerably improve the carbon efficiency of cities, albeit with a significant time lag and an annual increase in net effect. In addition, the mechanism analysis revealed that green financial policies primarily improve carbon emission efficiency by decreasing the intensity of energy consumption, enhancing technological innovation, and optimizing industrial structure. Therefore, expanding the size of the reform pilot zone and increasing incentives and guidance for green financial institutions will aid the transition of cities to a low-carbon economy.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

The deteriorating environmental pollution and climate catastrophes resulting from accelerated economic development have posed a grave threat to human survival and development (Nordhaus 1994). The increase in monetary aggregates and economic growth is typically driven by high fossil energy consumption, which results in excessive CO2 emissions (Ren et al. 2022). These emissions are a significant contributor to global warming, which negatively impacts human survival and sustainability. Modern economic growth theories have enabled economists to conduct extensive research on sustainable development and the path to optimal exploitation and use of available natural resources (Bovenberg and Smulders 1995; Heal 1974; Stiglitz 1974). The International Energy Agency (IEA) reported that energy-related CO2 emissions increased by 6% to 36.3 billion tons in 2021, a fact that compelled many nations to commit to net-zero emissions and carbon neutrality in order to combat future global warming. China is under pressure to minimize its carbon emissions due to its high population and energy consumption. China’s carbon emissions in 2021 were 11.9 billion tons, or 33% of the global total, making China the country with the highest percentage of carbon emissions. China has developed a series of environmental policies to achieve its goals, such as carbon emission trading policies and low-carbon city pilot policies, which have reduced regional carbon emission and improved carbon production efficiency (Dong et al. 2022; Zhang et al. 2022a). In 2020, China pledged to “strive to peak CO2 emissions by 2030 and achieve carbon neutrality by 2060” at the 75th session of the U.N. General Assembly.

It is difficult for a country to simultaneously achieve economic growth and carbon reduction, as the solution is either enhanced carbon emission efficiency or successful transformation and upgrading of energy-intensive industries. This requires financial sector investment and pertinent industrial policies. As the environmental problem worsens, the demand for capital from industries to reduce carbon emissions and enhance carbon efficiency increases, and it has become a global concern. Micro-enterprises in China’s industrial production sector are constrained by external financing as a result of multiple restrictions imposed by diverse environmental and industrial policies.

The modern economy is centered on the financial sector, which influences the allocation of production resources and the circulation of social capital. Green finance can therefore provide the capital necessary to reduce carbon emissions in high-carbon industries and scale up production in low-carbon industries (Lv et al. 2021; Madaleno et al. 2022). The majority of the current investment and financing in China’s green industry consists of government funds and green financial capital. With the former’s limited role in reducing carbon emissions, the latter can provide long-term assistance (Ren et al. 2020). With the announcement of carbon neutrality and carbon emission targets by the Chinese government, climate investment and financing have become a vital component of China’s green finance. China’s green loans increased by 3.86 trillion yuan in 2021, with 67% invested in initiatives with direct and indirect carbon emission reduction benefits, and a significant portion of financial sector funds flowing to low-carbon environmental industries. However, externalities, imperfectly competitive markets, and information asymmetries may cause financial market failures in which the supply of relevant green investments does not meet the demand for green assets (Jeucken 2010). Government-led green finance policies are crucial for addressing market failures in the financial sector. The Chinese government has introduced a series of green finance policies that provide detailed regulations on the investment of the green finance market, green credit lending standards, and disclosure of corporate environmental information. In 2016, seven ministries, including the People’s Bank of China and the Ministry of Finance of China, issued the Guidance on Building a Green Financial System (hereinafter referred to as guidance) for developing green credit with a number of supporting measures to promote and support green investment and financing. China became the first economy in the world to establish a relatively comprehensive green finance policy system with the publication of these guidelines. In order for China to accomplish its carbon emission reduction goals, it is of vital practical importance to investigate the impact of the guidance on carbon emission efficiency.

In order to remedy financial market failures, government-led green finance policies are indispensable. The Chinese government has enacted a number of green finance policies to provide specific regulations on the investment of the green finance market, green credit lending standards, and corporate environmental information disclosure. In 2016, seven ministries, including the People’s Bank of China and the Ministry of Finance of China, issued the Guidance on Building a Green Financial System (hereinafter referred to as guidance) for developing green credit with a variety of supporting measures to encourage and support green investment and financing. China became the first nation in the world to implement a relatively comprehensive green finance policy system with the publication of these guidelines. In order for China to reach its carbon emission reduction goals, it is of the utmost significance to investigate the impact of the guidance on carbon emission efficiency.

Policy background

China’s green financial policy has three fundamental components. First, credit penalties such as loan suspension and moratorium are imposed on projects or businesses that violate environmental protection and energy conservation and emission reduction laws and regulations. Second, adopt appropriate credit policies and instruments to support environmental protection and energy conservation initiatives and businesses. Third, use credit instruments to guide and supervise debtors in the prevention of environmental risks, thereby reducing credit risk. The evolution of green finance policy has occurred in three stages: the exploratory phase, the credit-control phase for two two high and one leftover project, and the standardization phase.

Firstly, in 1995–2006, the nascent exploration stage. The construction of China’s green financial system began in 1995 when the People’s Bank of China issued the Circular on Issues Related to the Implementation of Credit Policy and the Strengthening of Environmental Protection, which required the financial sector to consider pollution prevention and ecological, environmental protection as one of the conditions for bank lending, which was the germ of China’s green financial system. For a long time after that, green finance remained mainly at the conceptual level. In 2004, China’s National Development and Reform Commission and three other departments jointly issued the Notice on Issues Related to Further Strengthening the Coordination of Industrial Policies and Credit Policies to Control Credit Risks. Banking and financial institutions follow the notice involved in the enterprise as the basis for implementing national industrial policy and credit policy, optimizing credit investment. In 2005, the State Council issued the Decision on Implementing the Scientific Outlook on Development and Strengthening Environmental Protection, which stipulates that credit will be stopped for enterprises not complying with the national industrial policy and environmental protection standards. The document’s release means that China is starting to explore green financial approaches.

Secondly, in 2007–2011, the credit-control phase of two high and one leftover project. This phase of credit policy is mainly to guide the two high-industry energy saving and emission reduction and excess capacity industries to eliminate backward production capacity. Specifically, in 2007, the State Environmental Protection Administration and three other departments jointly issued the Opinions on Implementing Environmental Protection Policies and Regulations to Prevent Credit Risks to control credit for enterprises that do not comply with industrial policies and environmental violations, and require commercial banks to make ecological compliance one of the necessary conditions for loan approval. The introduction of the opinion marks the green credit as an economic tool to enter the main battlefield of pollution reduction. In July and November 2007, the China Banking Regulatory Commission issued the Notice on Preventing and Controlling the Risk of Loans to Highly Polluting Industries and the Guidance on Crediting for Energy Conservation and Emission Reduction, requiring banking financial institutions to control the access conditions for the two high projects strictly and to classify and manage borrowing projects according to their degree of environmental impact. In May 2010, the CBRC issued Opinions on Further Improving Financial Services to Support Energy Conservation, Emission Reduction, and Elimination of Backward Production Capacity, requiring banking financial institutions to strictly control irregular loans while increasing practical credit support for qualified projects, strengthening credit management, and exploring long-term mechanisms to support energy conservation, emission reduction, and elimination of backward production capacity.

Thirdly, from 2012 to the present, the standardized development stage. The tendency of green credit policy at this stage shows a greater emphasis on credit support for energy-saving and environmental protection projects. In contrast, the construction of green credit-related systems has become more complete, and the guidelines for green credit work have been improved and deepened. In February 2012, the CBRC issued the Green Credit Guidelines, which provide detailed regulations on the organization and management, policies and systems, capacity building, process management, internal control management, information disclosure, and supervision and inspection of the implementation of green credit by banking financial institutions. In February 2013, the CBRC issued Opinions on Green Credit Work, requiring banking financial institutions to conduct targeted environmental and social risk screening and further explore specific ways to incorporate the effectiveness of green credit implementation into the supervisory ratings of institutions. In response to the inconsistent implementation of green credit standards among banks, in January 2013, the CBRC began implementing the Green Credit Statistical System, which specifies statistical indicators for credit to enterprises with significant risks and statistical indicators for energy-saving and emission reduction capabilities, among others. In December 2013, the Ministry of Environmental Protection and four other departments jointly issued the Evaluation Measures for the Use of Enterprise Environmental Information (for Trial Implementation), requiring environmental protection departments and financial institutions to promote the evaluation of enterprise ecological credit. In June 2014, the CBRC issued the Key Evaluation Indicators of Green Credit Implementation, which specifies the critical evaluation indicators of banks’ implementation of green credit in seven aspects and requires banks to conduct self-evaluation of their implementation of green glory. In January 2015, the CBRC and the NDRC jointly issued the Energy Efficiency Credit Guidelines, which regulate the critical service areas and key projects of energy efficiency credit business and other aspects. In 2016, the People’s Bank of China and seven other departments jointly issued the Guiding Opinions. This policy proposed several supporting measures to encourage and support green investment and financing, marking China as the first economy in the world to have established a relatively complete green finance policy system. Given this, it is reasonable to consider the implementation of the 2016 Guidance policy as a quasi-natural experiment in green finance policy and to explore its socioeconomic impact.

Literature review and theoretical analysis

Literature review

The first branch of literature is the study of the impact of green finance on the transition to a low-carbon economy. Some scholars have suggested that green finance can facilitate the low-carbon economic transition and green economy development (Fan et al. 2021; Hong and Kacperczyk 2009; Zhang et al. 2021). Traditional environmental economics assumes that governmental environmental policies and financial support can help companies to complete the green and low-carbon transition and reduce regional pollution and energy consumption (Greenstone 2002; Greenstone and Hanna 2014; Nelson et al. 1993). However, government finance has limitations in combating environmental problems, and many countries cannot meet the enormous financial needs of green industries and green industrial projects (Muganyi et al. 2021). Therefore, it is crucial to play the role of resource allocation and guidance of the financial sector. Green finance can promote the development of a green economy and provide financial support for capacity optimization and green transformation of enterprises (Taghizadeh-Hesary and Yoshino 2019). Another part of scholars believes that green finance may not significantly accelerate the development of a low-carbon economy. Green finance is still in its infancy, and the traditional fossil fuel industry model has a huge cost advantage over the new green low-carbon production model, which dramatically suppresses the development of innovative green technologies (Wang et al. 2020), which makes the positive impact of green finance on green technological innovation and low-carbon economic transformation insignificant. At the same time, the disorderly expansion of green financial capital will instead negatively influence commercial banks to borrow from green and low-carbon producers, indirectly hindering the development of new energy industries (He et al. 2019).

The second branch focuses on the study of the impact of green finance on carbon emission efficiency. The first research perspective proposes that green finance can significantly improve regional carbon emission efficiency. The development of green finance can drive direct financing channels and indirect financing channels to inhibit the expansion of high-pollution and high-emission enterprises while effectively directing financial resources from heavy pollution and high energy-consuming industries to green and environmental initiatives, and the differentiated allocation of financial resources can promote the growth and development of green and low-carbon enterprises and environmental and low-carbon projects (Geddes et al. 2018; Zhao et al. 2022). In turn, it promotes reducing carbon emissions and improving carbon efficiency in the region (Meo and Abd Karim 2022; Pang et al. 2022). Another research view is that the effect of green finance on carbon efficiency has limitations and requires the regulation of green finance policies to play a positive role. In the process of low-carbon economy transition, once the market price fails to reflect the social cost of carbon emissions, the existence of externalities will lead to market failure, making carbon emission level increasing, triggering the greenhouse effect and a series of natural disasters (Krogstrup and Oman 2019), and carbon emission efficiency cannot be improved. Some studies have pointed out that the green finance business implemented by commercial banks cannot alleviate the problem of financing discrimination, and private enterprises still face more severe financing constraints compared to state-owned enterprises, which dramatically limits private enterprises’ green and low-carbon technology innovation and clean production equipment transformation (Yu et al. 2021). Relying solely on financial institutions to spontaneously execute green finance operations cannot avoid market failure, and financial institutions themselves will choose to invest in higher energy-consuming and high-polluting industries with higher returns due to market failure. A complete green financial system requires a high equilibrium level on both the supply and demand sides. Achieving this equilibrium requires the supervision and support of green monetary policies (Owen et al. 2018). Usually, government departments guide and supervise banks, securities, insurance, and other financial institutions to execute green finance business by issuing green finance policies (Sun et al. 2022). Green finance policies put forward some policy requirements with guidance and principles in terms of organizational management, policy and system construction, capacity building, investment and financing process management, internal control management and information disclosure, supervision, and management, etc., to guide financial institutions to carry out green finance business in an orderly manner in all aspects. Therefore, some studies have pointed out that green finance policies led by the government can strengthen the function of differentiated resource allocation of green finance and encourage more financial institutions and economic agents to participate in the process of carbon emission reduction actively (Luo et al. 2021), thus, strengthening the positive impact of green finance in enhancing carbon emission efficiency (Zhang et al. 2022a).

Through combing the above literature, we find that among the existing studies, the literature of empirical studies on the carbon emission reduction effects of green finance policies is relatively small and does not form a unified view, which requires more in-depth analysis and assessment of the environmental impact of green finance policies implemented in each region. Based on this, this paper considers the policy of the State Council’s Guidance on Building a Green Financial System implemented in China in 2016 as a comprehensive green financial policy and empirically analyzes the effect of this policy on regional carbon emission efficiency using a double difference model, which is a valuable addition to the existing literature and is the first marginal contribution of this paper. The second marginal contribution is to define the policy treatment and control groups of green finance and green credit policies implemented nationwide using regional energy consumption intensity and interest expenditure of energy-intensive industries. It provides new research ideas to analyze the policy effects of the one-size-fits-all policy empirically.

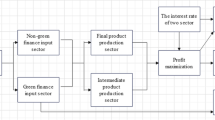

Analysis of mechanisms

Green finance policy mainly supports the green environmental protection industry and gives full play to its role from the policy level. Unlike traditional financial policies that influence economic development, it develops mechanisms or systems on green standards, environmental information disclosure, risk compensation, and green capital loan management to expand access to financing for green and low-carbon projects. It provides financing preferences for low-carbon environmental enterprises in credit, interest rates, and capital access, assisting them in realizing green technology innovation and transforming to low-carbon production to improve regional carbon emission efficiency. The specific mechanism of action is as follows.

Firstly, green financial policies enhance regional carbon efficiency by promoting technological innovation. At the enterprise level, technological innovation is a critical factor in the efficiency of carbon emissions. On the one hand, green finance policies prompt financial institutions to provide substantial financial resources to low-carbon environmental projects (Jones 2015), and increased external financing effectively raises the level of green technology R&D inputs and innovation output of enterprises (Zhang et al. 2022). Moreover, these policies alleviate interest expenses on debt for low-carbon environmental companies, allowing more fund investment in innovative R&D projects within the company (Hu et al. 2021). On the other hand, green finance policies adopt financing penalties for high energy-consuming and high-polluting enterprises. Consequently, some energy-intensive industries are forced to improve their green technology innovation capabilities to circumvent the restrictions set by these policies. As technological progress is characterized by significant path dependence, when companies improve their green technological innovation capabilities, their carbon productivity also increases.

Secondly, green financial policies enhance regional carbon efficiency by promoting the transformation and upgrading of regional industrial structures. From the perspective of industrial structure, it significantly affects regional carbon emission efficiency, and its improvement effectively reduces the total amount of regional carbon emissions and improves efficiency (Zhou et al. 2012). Green finance policy aims to guide financial institutions to utilize structural monetary policy tools further, provide low-cost financing for projects with significant carbon emission reduction benefits, and allocate financial resources with a differentiated approach to different industries. The policy directs financial institutions to provide low-interest loans to companies in the three critical areas of clean energy, energy conservation and emission reduction, and carbon emission reduction technologies while raising interest rates on loans to companies in energy-intensive industries. The industrial sector’s green and low-carbon transition requires more significant funding and prolonged time to use the funds. Therefore, green financial policies strengthen the differentiated allocation of financial resources to support green industries in the sector, such as energy-efficient equipment manufacturing, advanced environmental protection equipment manufacturing, and resource recycling equipment manufacturing, to obtain financial support.

Meanwhile, the backward production enterprises with high energy consumption and low efficiency will gradually withdraw from the original sector and resort to other industries due to increased financing constraints. Rigorous regulation of green finance policies will encourage social capital to flow to tertiary sector industries such as services. In this process, the industrial structure is gradually adjusted to capital-intensive high-end manufacturing and low-carbon environmental protection manufacturing; the proportion of output value of secondary industry decreases while the output value of tertiary industry increases, and the efficiency of regional carbon emission improves significantly.

Thirdly, green finance policies improve carbon efficiency by reducing regional energy consumption. Green financial policies introduce mechanisms of environmental information disclosure and green financial information sharing, which strengthen the regulation of carbon emissions in regions and can effectively reduce regional energy consumption intensity (Lee et al. 2022). Cities are highly dependent on energy consumption, regulated by green finance policies, and are pressured to transform their economic structure. Some local energy-intensive enterprises choose to reduce their production or withdraw from the local market, leading to a decrease in the scale of energy-intensive industries and energy consumption intensity in cities (Hou et al. 2022). In addition, consumers voluntarily choose low-carbon lifestyles under the influence of green financial policies, accelerating the decline of urban energy consumption from the demand side. Ultimately, the decrease in the scale of urban energy consumption under the influence of green finance policies leads to optimized industrial production and improved carbon efficiency (Auffhammer et al. 2017).

Model design and variable description

Model design

We employed the double difference method (DID) to identify the causal effects between financial policies and the carbon efficiency of Chinese cities. The DID estimation method helped us to effectively assess the difference in carbon emission efficiency between cities severely and slightly impacted by the policy when the guidance was implemented. We set the following empirical DID model based on previous literature (Gehrsitz 2017; Lee et al. 2022):

where i represents the city and t represents the time (this article is the year). CEEit shows the carbon emissions efficiency of the i city in the t year. postt is the dummy variable before and after the policy, the value is 0 after the green finance policy was fully implemented; otherwise, the value is 1. The guidance is a comprehensive policy for all regions of China and does not apply to the grouping criteria of the traditional DID model. Referring to other literature (Vig 2013), we set cities more susceptible to green finance policies as the treatment group and those less sensitive to policies as the control group. In general, determining the treatment and control groups based on the magnitude of the policy impact can address the sample self-selection issue to some extent and ensure the homogeneity of the policy impact. In this paper, we divided the treatment and control groups according to the values of urban energy consumption per unit of GDP because green financial policies have the most substantial impact on regions with dense energy-consuming industries as the result of higher energy consumption and carbon emissions where there is a thick and uneven distribution of high-energy-consuming industries. We calculated the energy consumption per unit GDP of cities and divided the sample cities into three groups from high to low according to the magnitude of the values. The cities in the top one-third of energy consumption per unit of GDP were set as the treatment group, which included the regions that received the most significant policy shocks. The cities in the last one-third were designated as the control group, which included the least affected areas by the policy. treatiis the dummy variable that divides the treatment and control groups, treati = 1denotes the treatment group, and treati = 0represents the control group. treati × postt is the interaction term of two dummy variables, the core double difference variable. β1is the coefficient we focused on, and if the coefficient is significantly positive, it indicates that green finance policies improve carbon efficiency. \({X}_{it}^{\prime }\) is a matrix of control variables at the prefecture level, including the level of economic development, financial development, science and technology input, fiscal expenditure, human capital, and urbanization. λtand uirepresent the fixed effect of time and city that does not change with time and cities. εit is a random error term.

Variable definition and data description

Explained variables

Explained variable in this paper is carbon emissions efficiency (CEE). According to previous studies (Emrouznejad et al. 2008; Emrouznejad and Yang 2018), we adopted a data envelopment analysis (DEA) approach to measure CEE, where the input variables were capital, labor, and energy for each prefecture-level city; the expected output was real GDP; and the unintended output was CO2 emissions. In this paper, we used the number of employed people to measure the city’s labor force and the fixed capital stock to measure its capital. The fixed capital stock was calculated by the perpetual inventory method with the base period set in 2011, referring to the relevant literature (Yan et al. 2020). The data on CO2 emissions, employment, fixed asset investment, raw urban GDP, and energy consumption selected for this paper were obtained from China Urban Statistical Yearbook and China Urban Construction Statistical Yearbook.

Core explanatory variable

The core explanatory variables in this paper are treati × postt, which is given a value of 1 when the city is in the treatment group and the sample time is in 2016 and later, and 0 otherwise. The guidance is a comprehensive policy for all regions of China and does not apply to the grouping criteria of the traditional DID model. We refer to other literature (Vig 2013) and set cities more susceptible to green finance policies as the treatment group and cities less sensitive to policies as the control group. In general, determining the treatment and control groups according to the magnitude of policy impact can solve the sample self-selection problem to a certain extent and ensure the homogeneity of policy impact. Since regions with dense energy-consuming industries have more energy consumption and carbon emissions, and the regional distribution of energy-consuming industries is uneven, green finance policies have the most substantial impact on regions with dense energy-consuming industries, and we divide the treatment and control groups according to the value of urban energy consumption per unit of GDP. Drawing on the literature on the evaluation of the effects of “one-size-fits-all” policies (Xiao et al. 2023), we divide the sample cities into three groups according to the size of their energy consumption per unit of GDP before the implementation of the policy (2013–2015), with the top one-third of cities in terms of energy consumption per unit of GDP were set as the treatment group, which contained areas that received the most significant policy shocks, and the cities in the bottom third were selected as the control group, which included sites that received the most miniature policy shocks.

Control variable

Drawing on previous studies (Du et al. 2020; Sun et al. 2020; Zhang et al. 2022b), we selected six city-level control variables to mitigate the omitted variable problem. (1) Economic development (pgdp): we used per capita GDP to measure regional economic development as it reflects urban residents’ income and consumption level. The pgdp influences regional carbon emissions as higher income and consumption lead to higher energy consumption (Jia et al. 2021). (2) Financial development (financial): we used the sum of deposits and loans from financial institutions as a share of GDP to measure the level of financial development, which has a significant impact on urban economic growth and affects carbon emission efficiency (Jalil and Feridun 2011). This indicator represents the city’s financial development scale, and the larger the value, the larger the scale of financial development. (3) Technology expenditure (te): we used the ratio of government S&T spending to GDP to measure the level of S&T investment. Government investment firmly guides investment in science and technology in a region, where the level of such investment indirectly influences the efficiency of urban carbon emissions by affecting technological innovation. (4) Fiscal expenditure (fiscal): we used government fiscal spending as a share of GDP to measure the level of fiscal spending. Its impact on regional economic growth rates and development patterns ultimately affects carbon emissions. (5) Human capital (hc): we used the number of students in higher education per 10,000 people in a city to measure the level of human capital as it reflects the level of education and human capital in a region. The higher the level, the higher the possibility of improving carbon efficiency through channels of action such as knowledge spillover, imitation, and innovation. (6) Urbanization rate (urban): we used the ratio of urban residents to the total population of prefecture-level cities to measure the urbanization rate, which affects the development of agriculture and industry and the efficiency of carbon emissions. The higher the value, the higher the urbanization level of the city.

Mechanism variable

Technological innovation level (patent): Invention patents are generally considered to be a key determinant of substantive regional innovation, and we use green invention patents filed per 10,000 people in cities and invention patents filed per 10,000 people as proxy variables for regional technological innovation, denoted as patent1 and patent2, respectively.

Industrial structure (industry). We use the ratio of the output value of the secondary sector to GDP and the ratio of the tertiary sector to the secondary drive to characterize the change in industrial structure, denoted as industry1 and industry2, respectively.

Energy consumption level (energy). We use energy consumption per unit of GDP as a proxy variable for the level of energy consumption in cities, denoted as energy. The specific calculation is as follows: we convert the electricity, heat, natural gas, and LPG consumed by the prefecture-level city into standard coal and divide it by the deflated GDP, and this indicator reflects the energy consumption intensity of the city.

Data description

We used 283 prefectural-level cities in China from 2011 to 2020 as our research sample, excluding those without necessary data. Among them, the raw data used to calculate the carbon emission efficiency of cities have been elaborated in the section describing the explanatory variables, and the control variables are obtained from the China City Statistical Yearbook of each year. Among the mechanism variables, the city patent data selected in this paper are obtained from the CNRDS database and the China Intellectual Property Database, and the raw data for the total output value of each industry and the calculation of city energy consumption are obtained from the China City Statistical Yearbook. Individual missing data were filled in by linear interpolation. The descriptive statistics of each variable are shown in Table 1.

Empirical analysis

Benchmark regre2ssion analysis

Column (4) in Table 2 shows the results of the baseline regression and columns (1)–(3) serve as comparison data. We focused on the coefficients of the interaction term treat×post. The coefficients of the interaction terms in columns (1)–(4) are significantly positive at the level of 1%, indicating that cities influenced by green finance policies experienced a significant increase in carbon emission efficiency after the implementation of green finance policies compared with cities less affected by the guidelines. The coefficient of the interaction term in column (4) is 0.069, indicating that the carbon efficiency of cities susceptible to the policies increased by 6.9% compared with cities insusceptible. The baseline regression results revealed that green finance policies could effectively improve urban carbon efficiency and promote low-carbon economic transformation, consistent with Lin et al. (2023) and Wan et al. (2022). The reason for this positive impact of implementing green financial policies is that green financial policies promote the development of green finance, and encourage financial institutions, governments, enterprises, and other stakeholders to participate in the construction of green financial system actively, the difference in green financial resource allocation leads to the rapid development of green environmental protection enterprises and green low-carbon projects, and the investment and financing penalties imposed by green financial policies on high pollution and high energy-consuming industries make these industries seek technological transformation and technological research and development to improve carbon production efficiency to avoid policy restrictions, and finally realize the Porter hypothesis.

Robustness test

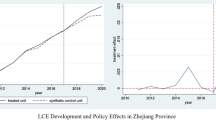

Parallel trend test

The basic premise of adopting the DID is to satisfy the parallel trend hypothesis (Kahn et al. 2015). We employed the event analysis method to investigate the differences between the treatment and control groups before implementing the 2016 Guideline. The estimation equation is as follows:

where in GFPs = treati × after0 + s, after is the dummy variable of the year, s is the difference between the year and 2016. We set the base period as 2016. Figure 1 visualizes the results of the parallel trend test for the sample when the explanatory variable is carbon emission efficiency. It can be inferred that βs is insignificantly negative at the 10% level before the implementation of the green finance policy, indicating that no significant difference existed between the carbon emission efficiency of the treatment and control groups before the policy implementation. The sample data are consistent with the parallel trend hypothesis. After the performance of the policy, βs is significantly positive at the 1% level, which indicates that the implementation of green finance policies improves the carbon efficiency of cities in the treatment group and that the effect is persistent.

Substitution of explanatory variables

Some research uses carbon productivity to measure carbon emission efficiency (Zhang et al. 2018), calculated by dividing real GDP by CO2 emissions. This paper uses carbon productivity as an explanatory variable, and the regression results are presented in columns (1) and (2) of Table 3. The impact coefficients of the core explanatory variables treat × post are 4.8805 and 4.7138, respectively, both of which are significantly positive at the 1% level, indicating that implementing green finance policies can effectively improve city carbon productivity.

Sample selection

Excluding municipalities

Under the direct jurisdiction of the Central People’s Government, municipal cities have larger built-up areas and residential populations than prefecture-level cities. They assume essential roles in the country’s political, economic, scientific, cultural, and transportation (Zhang et al. 2022a). To verify the robustness of the regression results, we excluded the observations on the four municipal cities in the sample here, and the regression results are shown in column (1) of Table 4. The coefficient of the interaction term treat × post in column (1) is significantly positive at the 1% level, with a slight decrease in the magnitude of the value compared with Table 2 column (4).

Sample time selection

To further identify the sensitivity of green finance policies to time changes, we regressed the subsample on the year of policy implementation and the 3 years before and after the policy implementation, and the results are shown in column (2) of Table 4. The coefficient of the interaction term x in column (2) is significantly positive at the 1% level, and the magnitude of the value shows no significant alteration compared with Table 2 column (4). Through the regression results, the green finance policy continues to significantly improve the efficiency of urban carbon emissions once the interval of the sample observation time is shortened.

Excluding the effect of extreme values

To prevent extreme values of some variables from interfering with regression results, we winsorized the numerical continuous-type variables included in the baseline regression model based on the 1% level, and the regressed results are shown in column (3) of Table 4. Similarly, the coefficient of the interaction term is significantly positive at the 1% level, consistent with the baseline regression results.

Excluding other policy interference

The policy we examined was the guidance issued by the Chinese government in 2016, while relevant departments introduced other green finance policies during the policy shock period. Therefore, it is a necessity for us to exclude the interference of other policies of the same type as the cross-implementation of multiple policies may interfere with the DID model estimation results, the Green Financial Reform and Innovation Pilot Zone Policy by the People’s Bank of China in 2017 established five provinces (autonomous regions), namely, Zhejiang, Jiangxi, Guangdong, Guizhou, and Xinjiang, as pilot areas, and Gansu Province in 2019, to develop green low-carbon industries and promote a green economy. We should exclude the interference of this policy as it contained massive homogeneous policy contents and objectives with the guidance we studied. We added the dummy variable of green financial reform and innovation pilot zone policy to the baseline regression equation, and the regression results are presented in column (4) of Table 4. The coefficients of the core explanatory variables are significantly positive at the 1% level, and the magnitude is generally consistent with the results of the benchmark regression.

In addition to green finance policies, there are other environmental policies that potentially impact urban carbon emissions. During our selected sample period, the “low-carbon pilot city” was an actual environmental pilot policy that focused on promoting the development of a low-carbon economy in pilot cities. To control the effect of the low-carbon city pilot policy, we included a dummy variable for this policy in the baseline regression equation, and the regression results are displayed in column (5) of Table 4, where the coefficient of the interaction term treat × post is significantly positive at the 1% level. The regression results controlling both green financial reform and innovation pilot zone policy and the low carbon city pilot policy are shown in column (6) of Table 4, and the coefficient of the interaction term treat × postis significantly positive at the 1% level. The results in these three columns indicate that the regression results are consistent with the baseline result after controlling for the effects of green financial policies and related environmental policies.

Placebo test

Although the green financial reform and innovation pilot zone policy and the low carbon city pilot policy were controlled in the previous regressions, omitted variables remained. To enhance the reliability of the causal identification results of the DID model in the baseline regression, we referred to last literature (Liu et al. 2022; Zhang et al. 2022a) and applied a placebo test for the sample data of the baseline regression. This was accomplished by randomly generating treatment groups and re-estimating the baseline model after 500 random samples. If the change in urban carbon emission efficiency was undoubtedly a result of the guidance, the coefficient of the interaction term treat × post generated by random sampling should be insignificant. Figure 2 plots the distribution of the estimated coefficients of the interaction term treat × post after random sampling. As seen from Fig. 2, the coefficients of the spurious interaction terms are mainly concentrated around 0 and are not statistically significant. Based on the results of the placebo test, we excluded other factors from interfering with the research findings.

Analysis of mechanisms

From the previous benchmark regression analysis, we concluded that the green finance policies implemented by the Chinese government in 2016 significantly improved the carbon emission efficiency of cities. According to our previous theoretical analysis on how green financial policies influence urban carbon emission efficiency through three channels: technological innovation, industrial transformation and upgrading, and energy consumption reduction, we conducted empirical tests on the three channels in the following model as Eq. (3).

where MV is the mechanism variable, including three proxy variables for technological innovation, industrial structure, and energy consumption. The control variables in the mechanism test section are consistent with the baseline regression.

Technological innovation

Green finance policies can directly limit urban carbon emissions through policy regulation and improve the carbon efficiency of cities by promoting technological innovation. As patents are the core determinant of substantive innovation in a region, we used green invention patents per 10,000 applicants and invention patents per 10,000 applicants as proxy variables for regional technological innovation, and the regression results were shown in columns (1) and (2) in Table 5, respectively. The results show that whether the technological innovation capacity is measured by the number of green invention patents or the number of invention patents, the coefficient of the interaction term is significantly positive, which indicates that the green finance policy implemented in 2016 has improved the technological innovation capacity of the city. Therefore, green financial policies can improve carbon efficiency by promoting technological innovation. From the estimation results, the green finance policy pushes the implementing region to enhance technological innovation output and realize the Porter’s hypothesis, improving carbon emission efficiency.

Industrial restructuring

Implementing green finance policies increases capital investment in policy-supported industries while discouraging investment and financing in heavily polluting, energy-intensive industries. Green finance policies influence the development of different sectors by adjusting capital allocation, which is usually reflected in the alteration of industry output. We used the ratio of the secondary sector to GDP and the percentage of the output value of the tertiary sector to the secondary industry to demonstrate the changes in industrial structure. The test results are shown in columns (3) and (4) of Table 5. The explanatory variable in column (3) is the ratio of secondary industry output to GDP, and the coefficient of the interaction term is significantly negative at the 5% level, indicating that green finance policies reduce the share of secondary industry output, eliminating inefficient industrial enterprises and retaining those with production efficiency. The explanatory variable in column (4) is the ratio of the output value of the tertiary industry to the secondary sector. The coefficient is significantly positive at the 5% level, indicating that the green finance policy has promoted the development of the tertiary industry. The regional economy has gradually shifted from industry to the service sector, a reasonable industrial restructuring to reduce carbon emissions. Overall, green finance policies discourage the secondary drive and eliminate energy-intensive and inefficient industrial production sectors while promoting the tertiary sector and ultimately enhancing carbon efficiency by restructuring industries.

Reduce energy consumption

Green finance policies can reduce regional energy consumption levels and force producers and the energy sector to improve carbon efficiency. We used energy consumption per unit of GDP as the explanatory variable, and the results are shown in column (5) of Table 5. The coefficient of the interaction term in column (5) is significantly negative at the 1% level, which indicates that green finance policies significantly reduce conventional energy consumption and urge the energy sector and energy-intensive industries to improve their carbon efficiency under limited emission scenarios. After the implementation of the green finance policy in China, both the intensity of regulation of regional carbon emissions by financial institutions and government departments and the public concern about carbon emissions will rise, and industries with high energy consumption and increased emissions will be forced to transform into green and low-carbon production or reduce carbon emissions. The green finance policy motivates industries with high energy consumption and high emissions to optimize their production processes and minimize inefficient energy consumption behaviors, ultimately optimizing the regional energy consumption structure, reducing the intensity of traditional energy consumption, and thus improving carbon emission efficiency.

Analysis of differences in green policy effects

In 2012, the former China Banking Regulatory Commission (CBRC) issued the Green Credit Guidelines, which was the first time that China’s financial regulator sets out precise requirements for banks’ green credit efforts, and the policy stipulated that banking financial institutions should regularly conduct comprehensive assessments of green credit and set out policy-binding green credit management practices. In this paper, we further assess the impact of the Green Credit Guidelines on the carbon efficiency of prefecture-level municipalities and compare and analyze its policy impact on carbon efficiency with the 2016 Guidelines. Here, we use a DID model to assess the policy effects of the Green Credit Guidelines. To complete the DID estimation, we use panel data of prefecture-level cities from 2006 to 2019 for the empirical study. Among them, the explanatory variable is the carbon emission efficiency of prefecture-level cities, and the data treatment is consistent with the benchmark regression. The core explanatory variable is the interaction term of the city group dummy variable treat and the time dummy variable post. We use the ratio of interest expenditure on high energy-consuming industries to interest expenditure on industrial industries in each Chinese province as a criterion to identify cities in the treatment group and cities in the control group. The data on interest expenditure on high energy-consuming industries and interest expenditure on industrial industries are obtained from the statistical yearbooks of each province and city. This indicator represents the credit scale of high energy-consuming ambitions in each region, and the larger the value of this indicator, the more likely it is to be affected by the policy of the Green Credit Guidelines. Therefore, we divide the sample into three equal parts according to the credit ratio of high energy-consuming industries in the first 3 years of the policy implementation year, with the group with the highest value being the treatment group and the group with the lowest value being the control group, and eliminate the sample with the value in the middle, with the treatment group post taking the value of 1 and the control group taking the value of 0. Other control variables are consistent with the baseline regression. Table 6, reports the estimated results of the impact of the Green Credit Guidelines on urban carbon efficiency. Columns (1) and (2) show the estimation results for the panel data of prefecture-level cities from 2006 to 2019, with estimated coefficients treat × post of 0.0085 and 0.0075, respectively, failing the 10% significance test. Considering that the sample time is too long and may underestimate the policy effect, we re-estimate through the sub-sample data from 2009 to 2015. Columns (3) and (4) show the results treat × post of the subsample estimation, where the estimated coefficients have significantly higher values but still do not pass the 10% significance test. The above estimation results indicate that the Green Credit Guidelines implemented in 2012 did not significantly improve the carbon efficiency of cities. Regarding policy content, the Green Credit Guidelines regulate the review of green credit, strengthen the loan restrictions for high pollution and high energy-consuming industries, and may not provide enough support for green environmental projects. In contrast, the Guideline implemented in 2016 expands the supply of green finance based on the policy purpose of building a green financial system, promotes innovation in green financial institutions and mechanisms, and invests more financial resources in the field of green and low-carbon development, which in turn improves carbon emission efficiency. By comparing the implementation content and implementation effects of the two green finance policies, we find that the guidance can substantially improve the carbon emission efficiency of cities. At the same time, the Green Credit Guidelines do not play a positive role in enhancing carbon emission efficiency.

Conclusion

Based on the Chinese State Council’s policy of establishing pilot green financial reform and innovation zones in some provinces as a quasi-natural experiment, this paper examines the effect of pilot green financial policies on multi-city carbon emission efficiency using the double difference method. It is found that, first, the green finance policy significantly enhances the carbon emission efficiency of pilot prefecture-level cities relative to non-pilot prefecture-level cities with a lag, where the policy effect is not significant in the period of policy implementation but continues to show effect in later years. Parallel trend tests and a series of robustness tests prove that the inferred policy effects are consistent and robust under the assumptions of the empirical model. Second, regarding the mechanism of action, green financial policies are designed to improve urban carbon emission efficiency by promoting technological innovation, accelerating industrial restructuring, and reducing energy consumption improvements. Third, by comparing the effects of the two green financial policies in 2012 and 2016, we find that the 2016 Guidelines can substantially improve urban carbon emission efficiency, while the 2012 Green Credit Guidelines did not play a positive role in enhancing carbon emission efficiency.

The findings in this paper provide policy insights for deepening the development of green finance and accelerating the transition to a green and low-carbon economy. Based on these findings, this paper proposes the following policy recommendations: First, the scale of green financial reform and innovation pilot zones needs to be expanded. At the present stage, green financial reform policies can significantly exert an inhibiting effect on CO2 emission intensity and the inhibiting effect strengthens year by year. Therefore, the scale of green financial reform and innovation pilot zones should be actively expanded, and the pilot experience should be gradually extended to the whole country. Secondly, under the policy incentives and guidance, financial institutions should conscientiously implement and enforce the green finance policy. Considering the economic and environmental benefits of the projects, the government should strictly limit the investment of credit funds to the “two high” enterprises and increase the support for environmental protection investment projects and actively give credit support. Meanwhile, the government should improve the information disclosure function of green finance to alleviate the information asymmetry of green technology innovation and guide social capital to flow into green technology innovation projects. Third, a series of actions should be implemented by the government, including building a regional financial development pattern, establishing an inter-regional green financial information sharing mechanism, strengthen communication and coordination in policy implementation and execution, giving full play to the spillover effect of green financial reform policies, and promoting low-carbon economic transformation. Fourth, a low-carbon industrial system should be established to create high-end manufacturing industries. In the mechanism test, we found that the green financial policy inhibits the development of secondary industries. China’s energy structure has a large share of coal, and heavy industry accounts for a large percentage of the total economy. The central government should formulate policy details according to the country’s actual situation to minimize the negative impact of green financial policies on the real economy. Governments at all levels should make joint efforts to build low-carbon industrial chains and green industrial projects while promoting the development of high-end manufacturing industries. Policymakers also need to explore synergistic development paths for low-carbon development and economic growth based on regional factor endowments and use green financial services to help backward production capacity achieve technological upgrading and green transformation.

Data availability

The datasets used and/or analyzed during the current study are available from the corresponding author on reasonable request.

References

Auffhammer M, Sun W, Wu J, Zheng S (2017) The decomposition and dynamics of industrial carbon dioxide emissions for 287 Chinese cities in 1998–2009. Environ Econ Sustain 71–94

Bovenberg AL, Smulders S (1995) Environmental quality and pollution-augmenting technological change in a two-sector endogenous growth model. J Public Econ 57:369–391

Dong Z, Xia C, Fang K, Zhang W (2022) Effect of the carbon emissions trading policy on the co-benefits of carbon emissions reduction and air pollution control. Energy Policy 165:112998

Du K, Yu Y, Li J (2020) Does international trade promote CO2 emission performance? An empirical analysis based on a partially linear functional-coefficient panel data model. Energy Econ 92:104983

Emrouznejad A, Yang GL (2018) A survey and analysis of the first 40 years of scholarly literature in DEA: 1978–2016. Socio Econ Plan Sci 61:4–8

Emrouznejad A, Parker BR, Tavares G (2008) Evaluation of research in efficiency and productivity: a survey and analysis of the first 30 years of scholarly literature in DEA. Socio Econ Plan Sci 42:151–157

Fan H, Peng Y, Wang H, Xu Z (2021) Greening through finance? J Dev Econ 152:102683

Geddes A, Schmidt TS, Steffen B (2018) The multiple roles of state investment banks in low-carbon energy finance: an analysis of Australia, the U.K. and Germany. Energy Policy 115:158–170

Gehrsitz M (2017) The effect of low emission zones on air pollution and infant health. J Environ Econ Manag 83:121–144

Greenstone M (2002) The impacts of environmental regulations on industrial activity: evidence from the 1970 and 1977 clean air act amendments and the census of manufactures. J Polit Econ 110:1175–1219

Greenstone M, Hanna R (2014) Environmental regulations, air and water pollution, and infant mortality in India. Am Econ Rev 104:3038–3072

He L, Liu R, Zhong Z, Wang D, Xia Y (2019) Can green financial development promote renewable energy investment efficiency? A consideration of bank credit. Renew Energy 143:974–984

Heal DG (1974) The optimal depletion of exhaustible resources. Rev Econ Stud 41:3–28

Hong H, Kacperczyk M (2009) The price of sin: the effects of social norms on markets. J Financ Econ 93:15–36

Hou H, Chen M, Zhang M (2022) Study on high energy-consuming industrial agglomeration, green finance, and carbon emission. Environ Sci Pollut Res 1–21

Hu J, Yan S, Han J (2021) Research on implied carbon emission efficiency of China’s industrial sector–an empirical analysis based on three-stage DEA model and non competitive I.O. model. Statistical Research 38:30–43

Jalil A, Feridun M (2011) The impact of growth, energy and financial development on the environment in China: a cointegration analysis. Energy Econ 33:284–291

Jeucken M (2010) Sustainable finance and banking: The financial sector and the future of the planet. Sustainable finance and banking: the financial sector and the future of the planet

Jia R, Shao S, Yang L (2021) High-speed rail and CO2 emissions in urban China: a spatial difference-in-differences approach. Energy Econ 99:105271

Jones AW (2015) Perceived barriers and policy solutions in clean energy infrastructure investment. J Clean Prod 104:297–304

Kahn ME, Li P, Zhao D (2015) Water pollution progress at borders: the role of changes in China’s political promotion incentives. Am Econ J Econ Pol 7(4):223–242

Krogstrup S, Oman W (2019) Macroeconomic and financial policies for climate change mitigation: A review of the literature

Lee CC, Chang YF, Wang EZ (2022) Crossing the rivers by feeling the stones: the effect of China's green credit policy on manufacturing firms’ carbon emission intensity. Energy Econ 116:106413

Lin M, Zeng H, Zeng X, Mohsin M, Raza SM (2023) Assessing green financing with emission reduction and green economic recovery in emerging economies. Environ Sci Pollut Res 30(14):39803

Liu X, Li Y, Chen X, Liu J (2022) Evaluation of low carbon city pilot policy effect on carbon abatement in China: an empirical evidence based on time-varying DID model. Cities 123:103582

Luo S, Yu S, Zhou G (2021) Does green credit improve the core competence of commercial banks? Based on quasi-natural experiments in China. Energy Econ 100:105335

Lv C, Bian B, Lee CC, He Z (2021) Regional gap and the trend of green finance development in China. Energy Econ 102:105476

Madaleno M, Dogan E, Taskin D (2022) A step forward on sustainability: the nexus of environmental responsibility, green technology, clean energy and green finance. Energy Econ 109:105945

Meo MS, Abd Karim MZ (2022) The role of green finance in reducing CO2 emissions: an empirical analysis. Borsa Istanbul Rev 22:169–178

Muganyi T, Yan L, Sun H-P (2021) Green finance, fintech and environmental protection: evidence from China. Environ Sci Ecotechnol 7:100107

Nelson RA, Tietenberg T, Donihue MR (1993) Differential environmental regulation: effects on electric utility capital turnover and emissions. Rev Econ Stat 368–373

Nordhaus WD (1994) Managing the global commons: the economics of climate change. MIT press Cambridge, MA

Owen R, Brennan G, Lyon F (2018) Enabling investment for the transition to a low carbon economy: government policy to finance early stage green innovation. Curr Opin Environ Sustain 31:137–145

Pang L, Zhu MN, Yu H (2022) Is green finance really a blessing for green technology and carbon efficiency? Energy Econ 114:106272

Ren X, Shao Q, Zhong R (2020) Nexus between green finance, non-fossil energy use, and carbon intensity: empirical evidence from China based on a vector error correction model. J Clean Prod 277:122844

Ren X, Tong Z, Sun X, Yan C (2022) Dynamic impacts of energy consumption on economic growth in China: evidence from a non-parametric panel data model. Energy Econ 107:105855

Stiglitz J (1974) Growth with exhaustible natural resources: efficient and optimal growth paths. Rev Econ Stud 41:123–137

Sun X, Yan S, Liu T, Wu J (2020) High-speed rail development and urban environmental efficiency in China: a city-level examination. Transp Res Part D: Transp Environ 86:102456

Sun Y, Guan W, Cao Y, Bao Q (2022) Role of green finance policy in renewable energy deployment for carbon neutrality: evidence from China. Renew Energy 197:643–653

Taghizadeh-Hesary F, Yoshino N (2019) The way to induce private participation in green finance and investment. Financ Res Lett 31:98–103

Vig V (2013) Access to collateral and corporate debt structure: evidence from a natural experiment. J Financ 68:881–928

Wan QL, Qian JN, Baghirli A, Aghayev A (2022) Green finance and carbon reduction: Implications for green recovery. Econ Anal Policy 76:901–913

Wang X, Han L, Huang X (2020) Bank competition, concentration and EU SME cost of debt. Int Rev Financ Anal 71:101534

Xiao TS, Dong QC, Zhang MA, Xu JB (2023) Competition policy and enterprises’labor income share——quasi-natural experiment based on the China’s Anti-Monopoly Law. China Industr Econ 04:117–135

Yan Y, Zhang X, Zhang J, Li K (2020) Emissions trading system (ETS) implementation and its collaborative governance effects on air pollution: the China story. Energy Policy 138:111282

Yu C-H, Wu X, Zhang D, Chen S, Zhao J (2021) Demand for green finance: resolving financing constraints on green innovation in China. Energy Policy 153:112255

Zhang L, Xiong L, Cheng B, Yu C (2018) How does foreign trade influence China’s carbon productivity? Based on panel spatial lag model analysis. Struct Chang Econ Dyn 47:171–179

Zhang D, Mohsin M, Rasheed AK, Chang Y, Taghizadeh-Hesary F (2021) Public spending and green economic growth in BRI region: mediating role of green finance. Energy Policy 153:112256

Zhang H, Feng C, Zhou X (2022a) Going carbon-neutral in China: does the low-carbon city pilot policy improve carbon emission efficiency? Sustain Prod Consump 33:312–329

Zhang Q, Fang K, Chen J, Liu H, Liu P (2022b) The role of sectoral coverage in emission abatement costs: evidence from marginal cost savings. Environ Res Lett 17:045002

Zhang A, Wang S, Liu B (2022) How to control air pollution with economic means? Exploration of China's green finance policy. J Clean Prod 353:131664

Zhao J, Taghizadeh-Hesary F, Dong K, Dong X (2023) How green growth affects carbon emissions in China: the role of green finance. Econ Research-Ekonomska Istraživanja 36(1):2090–2111

Zhou P, Ang BW, Wang H (2012) Energy and CO2 emission performance in electricity generation: a non-radial directional distance function approach. Eur J Oper Res 221:625–635

Funding

This research was supported by the 2023 Gansu Provincial Department of Education College Teachers’ Innovation Fund Project (No. 2023A-281) from China and, Reaearch Platform Open Subject of Chongqing Technology and Business University (grant number: KFJJ2022039) and the Chongqing Graduate Student Research and Innovation Program 2023 (grant munber: CYB23263). The authors also extend great gratitude to the anonymous reviewers and editors for their helpful review and critical comments.

Author information

Authors and Affiliations

Contributions

Zhonghao Lei conceptualized and done analysis of the paper. Dongmei Wang read the paper and made necessary corrections prior to submission. All authors read and approved the final paper.

Corresponding author

Ethics declarations

Ethical approval and consent to participate

Not applicable.

Consent for publication

Not applicable.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Nicholas Apergis

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Lei, ., Wang, D. The impact of green financial policies on carbon emission efficiency: empirical evidence from China. Environ Sci Pollut Res 30, 89521–89534 (2023). https://doi.org/10.1007/s11356-023-28699-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-023-28699-z