Abstract

This article discusses the influence and mechanism of green finance on carbon emission efficiency. Based on the panel data of 27 provinces and municipality in China from 2008 to 2017, the slack-based model of unexpected output is used to measure the efficiency of carbon emissions. On this basis, the Tobit model is used to empirically study the impact and mechanism of green finance on the efficiency of carbon emissions. The consequences exhibit that (1) China’s carbon emission efficiency is not high and generally presents a gradient decreasing characteristic of east, middle, and west. (2) Overall, green finance plays a considerable role in improving carbon emission efficiency; by region and group, there are significant differences in the influence of green finance on carbon emission efficiency. (3) The study found that green finance promotes the efficiency of carbon emission through technological progress and industrial structure upgrading. This study provides empirical evidence and policy enlightenment for the realization of carbon peaking and carbon neutrality goals and the evolution of green finance.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

For quite some time, China’s economic growth at the expense of the environment and the negative impact on the climate are also increasing. According to the climate change data released by the World Bank, China’s carbon emissions and their share have been rising from 1990 to 2014, especially since the beginning of the twenty-first century. Although the rising rate has slowed down since 2014, carbon dioxide emissions have remained at a high level. According to the relevant data disclosed by the World Bank, in 2018, China’s carbon dioxide emissions reached 10.3 billion tons. Under the background of global warming, changing the energy consumption structure, developing new energy, and developing low-carbon economy have become a significant path for China to achieve sustainable evolution. With the proposal of the carbon peaking and carbon neutrality goals, China urgently needs scientific and technical innovation and industrial reform to promote carbon emission efficiency and achieve economic development while taking into account the environment. Ning et al. (2021) pointed out that for the sake of achieving the dual mandate of China’s sustained economic growth and further reducing carbon emissions, improving carbon emission efficiency is the crux to resolve the issue.

Academic circles have carried out abundant researches on the efficiency of carbon emission. Hu et al. (2021a, b) believe that carbon emission efficiency is to obtain more output with the same or less carbon emissions under the interaction of multiple input factors. The academic research on carbon emission efficiency mainly focuses on two aspects: One is the measurement and analysis of carbon emissions efficiency. Yu et al. (2015) calculated and analyzed carbon emission efficiency of China based on stochastic frontier method (SFA). Meng et al. (2016) and Zhang et al. (2016) applied DEA model to count carbon emission efficiency and pointed out that carbon emission efficiency has obvious regional differences. Wang et al. (2019a, b) found through empirical analysis that China’s carbon emission efficiency exhibits a spacial framework of “east, middle, and west” gradually decreasing, while “south, middle, and north” symmetrically distributed. The second is to explore the affecting elements of carbon emission efficiency. The specific influencing factors include technology (He et al. 2021), natural resource richness (Wang et al. 2019a, b), and urbanization (Sun and Huang 2020). In addition, Yu and Zhang (2021) found through empirical research that LCCP policy can improve carbon emission efficiency. In the process of improving carbon emission efficiency, a lot of financial support is needed. Relevant studies have pointed out that China needs a total investment of 127,240 billion yuan to achieve the 2 ℃ scenario and 174,380 billion yuan to achieve the 1.5 ℃ scenario. For the sake of completing the goal of deep decarbonization, relevant investment and financing mechanisms and capital guarantee need to be improvedFootnote 1. Some scholars have studied the relationship between finance and carbon emission efficiency. Li et al. (2018) found that there is a positive “U” relationship between financial correlation, financial deepening, and carbon emission efficiency, while direct financing is not conducive to the improvement of carbon emission efficiency, and the level of R & D technology can promote the improvement of carbon emission efficiency.

Although, finance can help achieve green, low-carbon, and high-quality evolution. However, because the green high-tech industry has the features of considerable risk, considerable return, and long return cycle, the financial resources flowing into the green high-tech industry are limited. The proposal of green finance improves the deficiency of foregone finance. The implementation of green finance focuses on the diversion of investment from the field of heavy pollution and high energy consumption to the field of saving energy and protecting environment. Green finance promotes more financial resources to flow into green projects and green industries. To some extent, the realization of low-carbon economy is affected by the development of green finance. Most studies show that green finance can decrease carbon emissions and promote environmental quality (Ren et al. 2020). However, looking at the relevant research of scholars, most scholars pay close attention to the relationship between green finance and carbon emission, and the study of green finance and carbon emission efficiency is relatively lacking. Compared with carbon emission index, carbon emission efficiency is a more comprehensive measurement index including economic development factors. The simple carbon emission index separates it from the economy and energy, while the carbon emission efficiency integrates a variety of input factors. In addition to the carbon emission index, it also takes into account the economic output. Hu et al. (2021a, b) pointed out that the carbon emission efficiency is closely related to the development of low-carbon economy. Therefore, studying the relationship between green finance and carbon emission efficiency is of great significance for the development of low-carbon economy and further realizing the carbon peaking and carbon neutrality goals. From this perspective, this article explores the influence and mechanism of green finance on carbon emission efficiency; it comes up with policy recommendations for the realization of China’s carbon peaking and carbon neutrality goals and green finance development.

The marginal contributions of this paper are as follows: First, although a large number of literatures have analyzed the impact of green finance on carbon emissions, few literatures pay attention to the impact of green finance on carbon emission efficiency. Therefore, the work of this paper enriches the existing research. Second, it attempts to analyze the path of green finance on carbon emission efficiency, which provides an analytical framework for further promoting green finance and how to promote the development of low-carbon economy.

Mechanism analysis

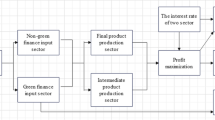

The implementation and evolution of green finance are able to afford strong support for the development of low-carbon economy. Green finance is also called environmental finance or sustainable finance. From the microlevel, green finance takes environmental protection industry as the key object of support and provides corresponding preferential treatment in capital access, credit, interest rate, and maturity (Taghizadeh-Hesary and Yoshino 2019). In 2016, China promulgated the guidance on establishing the system of green financial, which pointed out that the green financial support environment, climate change, and resource saving and efficient utilization of economic activity. Green finance will affect carbon emission efficiency through financing function, resource allocation function, and promoting innovation (Fig. 1).

First, green finance affects carbon emission efficiency through financing function. On the one hand, green enterprises can issue stocks, bonds, and other forms of direct financing through listing to fully mobilize social capital. Meanwhile, the evolution of green securities can drive green investment, improve the green operation ability of enterprises, and facilitate the further evolution of clean industry. On the other hand, green enterprises or green projects can be indirectly financed through bank loans. Relevant data show that from 2010 to 2020, China’s green credit balance showed an upward trend, especially since 2012, the green credit balance has increased significantlyFootnote 2. According to relevant statistics, in 2020, the balance of loans for infrastructure green upgrading, clean energy conservation, energy industry, and environmental protection industry accounted for the highest, accounting for 85.99%Footnote 3. The implementation of Green Credit provides strong maintenance for the evolution of clean industry.

Secondly, green finance will affect carbon emission efficiency through resource allocation effect. From the microlevel, green finance provides more financial resources for the green low-carbon industry and creates a more relaxed financing condition for the green low-carbon industry. Green finance reduces the financing cost of green environmental protection enterprises, guides more financial resources to green low-carbon enterprises, and promotes the further development of green low-carbon enterprises. Green finance has strong pertinence; especially, green high-tech enterprises have the characteristics of high risk and high income; green finance makes financial resources flow to such enterprises. In particular, green finance integrates the characteristics of traditional finance and can achieve the purpose of dispersing risks through the binding and combination of plenty of green financial products, so as to afford a basis for the stable evolution of green low-carbon enterprises. For another, Ding (2019) and Chen et al. (2019) pointed out that the implementation of green credit policy will inhibit the credit scale of heavily polluting enterprises. The inclination of financial resources in circulation to green and low-carbon will also strengthen the credit constraints of heavily polluting enterprises. In order to obtain financial resources, heavily polluting enterprises must carry out innovation and transformation, so as to further reduce their own pollution level.

Finally, green finance will affect carbon emission efficiency by promoting innovation. Under the guidance of relevant policies of green finance, green finance makes more financial resources flow to green low-carbon enterprises. A large number of research consequences exhibit that under the guidance of green finance policy, the green innovation ability of firms will be further improved (Yu et al. 2021; Wang and Wang 2021b; Hu et al. 2021a, b). At the same time, the green innovation of enterprises will reduce the financing constraints of enterprises and more financial resources will flow into enterprises. The interaction between the two will further enhance the green innovation capability of firms, reduce the pollution level of enterprises, and improve the business performance of enterprises. On the other hand, green finance strengthens the financing constraints faced by heavy polluting enterprises, and its financing difficulty is stronger than before. In order to obtain more financial resources, heavy polluting enterprises must pay attention to the development of green low-carbon products and green low-carbon technologies, so as to reduce their negative impact on the environment. Liu et al. (2020) point out that under the influence of green finance-related policies, heavily polluting enterprises will strengthen innovation output and improve their innovation efficiency. Hu et al. (2021a, b) found that under the external restrictions of green finance–related policies, heavy polluting enterprises will be forced to make green innovation.

Methods and data

Model construction

Since the carbon emission efficiency value is between 0 and 1, the Tobit model is selected to test the relationship between the efficiency of carbon emission and green finance, and the benchmark regression model is constructed as follows:

where i stands for region; t stands for time; CEE stands for carbon emission efficiency, GF represents green finance; X represents control variable group, including regional openness, urbanization rate, regional economic development level, and other control variables; ε is a random perturbation term.

Data source and sample selection

Explained variable

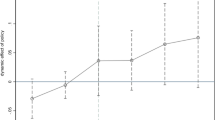

Carbon emission efficiency (CEE). The input variables selected in this paper are labor force, capital, and energy. The expected output is GDP, and the unexpected output is carbon dioxide emissions, so as to calculate the carbon emission efficiency (Fig. 2). To be specific, labor force refers to the number of employed persons in each province at the end of the year. Capital stock refers to the practice of Zhang et al. (2004). Taking 2005 as the base period to calculate the capital stock from 2008 to 2017, the GDP is calculated based on the year 2005. The labor data comes from provincial statistical yearbooks, the original data of capital stock, the original data of energy consumption, and GDP come from EPS macroeconomic database. CO2 data comes from CEADs database.

Considering the actual situation, this paper selects the SBM undesirable model proposed by Tone (2002) to calculate the efficiency of carbon emission. The SBM undesirable model is described in formula (2).

where \({\rho }^{*}\) is the efficiency value; m, s1, and s2 are the number of inputting, desirable output, and unexpected output factors, respectively; s = (s−, sg, sb) stands for the relaxation of input, desirable output, and unexpected output, respectively; x, yg, and yb are input, expected output, and unexpected output, respectively; X, Yg, and Yb are matrices composed of input, expected output, and unexpected output, respectively; λ is the weight vector. Objective function \({\rho }^{*}\) is about S−, Sg, Sb strictly monotonically decreasing and between 0 and 1. The higher the \({\rho }^{*}\), the more efficient the production cell. When \({\rho }^{*}\) = 1, the production unit is completely effective.

Core explanatory variables

Green finance (GF). The article constructs a green finance evaluation index system including 9 three-level indicators from five aspects: green securities, green credit, green investment, green insurance, and carbon finance (see Table 1).

This paper selects the relevant data of 27 Chinese provinces (excluding Guangxi, Hainan, Xinjiang, Xizang, Hong Kong, Macao, and Taiwan) from 2008 to 2017 as the research sample. In terms of specific indicators and green credit, this article selects the new bank loans of regional listed environmental protection enterprises in that year to denote the green credit balance. The new bank loan data is from CSMAR database, and the loan balance of financial institutions is from China Financial Yearbook; interest expense data for energy-intensive industries and total interest expense data for industrial industries are obtained from EPS database. In terms of green securities, the data comes from the rest database. According to the green insurance index, China began to implement environmental liability insurance in 2013, lacking relevant statistical material, and agriculture is the industry most affected by the natural environment. Consequently, this article uses the agricultural insurance size and loss quotiety to approximately reflect the development of green insurance, and relevant data is from the China Insurance Yearbook over the years. In terms of green investment, the data on the proportion of environmental protection investment comes from the China Environmental Statistics Yearbook. The expenditure data on energy conservation and environmental protection comes from EPS database. In terms of carbon finance, referring to the research of Li and Dong (2018), this article uses the ratio of the loan balance of a regional financial institution to carbon emissions to calculate it. The source of loan balance is China Financial Yearbook, and the data of carbon dioxide comes from CEADs.

This article uses entropy method to calculate the development level of green finance. The calculation steps are as follows:

-

(1)

Dimensionless processing of data:

$${\mathrm{Positive indicators}: X}_{ij}=(\frac{{x}_{ij}-\mathrm{min}{x}_{ij}}{\mathrm{max}{x}_{ij}-\mathrm{min}{x}_{ij}})$$(3)$${\mathrm{Retrograde index}: X}_{ij}=(\frac{\mathrm{max}{x}_{ij}-{x}_{ij}}{\mathrm{max}{x}_{ij}-\mathrm{min}{x}_{ij}})$$(4) -

(2)

Calculate the ratio of the ith scheme under item j to this index:

$${Y}_{ij}=\frac{{X}_{ij}}{\sum_{i=1}^{n}{X}_{ij}}$$(5) -

(3)

Calculate the index information entropy:

$${E}_{j}=-\frac{1}{\mathrm{ln}(n)}\sum\nolimits_{i=1}^{n}{Y}_{ij}\times \mathrm{ln}({Y}_{ij})$$(6) -

(4)

The information entropy redundancy is calculated:

$${D}_{j}=1-{E}_{j}$$(7) -

(5)

Calculation of index weight:

$${W}_{j}=\frac{{D}_{j}}{\sum_{j=1}^{m}{D}_{j}}$$(8) -

(6)

Calculate the comprehensive evaluation level:

$${S}_{i}=\sum\nolimits_{j=1}^{m}{W}_{j}\times {X}_{ij}$$(9)

Mediating variables

-

(1)

Technological progress (Tech). In this article, technological advancement is measured by the number of patents granted per 100,000 people.

-

(2)

Upgrading of industrial structure (GIS). Industrial structure upgrading is measured by industrial structure upgrading index, which is calculated by the following formula:

$$GIS=\sum\nolimits_{j=1}^{3}{y}_{j}\times j, 1\le GIS\le 3$$(10)

where \({y}_{j}\) stands for the ratio of the j industry in the GDP (j = 1, 2, 3). The larger the GIS number, the more advanced the industrial structure is.

Other control variables

This article selects the control variable as shown below. (1) Regional openness (OPEN): Regional openness is measured by the proportion of regional entire import and export to regional GDP. The data of entire export and import and regional GDP are from the China Economic Network database. (2) Urbanization rate (URB): Selecting the proportion of urban population to measure the data source for EPS database. (3) Financial expenditure level (FEL): Using the proportion of fiscal expenditure to GDP to represent the level of fiscal spending. The data comes from EPS database. (4) Regional economic evolution level (RED): Per capita GDP is used to indicate the degree of regional economic evolution, which is derived from the Database of China Economic Network. (5) Industrial agglomeration level (IA): It is measured by the ratio of regional industrial output value to national industrial output value. Data were obtained from EPS database.

Descriptive statistics are made on the samples in this paper (see Table 2).

Empirical results and analysis

Calculation results of carbon emission efficiency

This article selects unexpected output SBM model to calculate the carbon emission efficiency of 27 provinces and municipality in China from 2008 to 2017. Due to limited space, 2008, 2011, 2014, and 2017 were selected as representative years for analysis. The carbon emission efficiencies of provinces and cities in 2008, 2011, 2014, and 2017 are shown in Table 3.

As can be seen from Table 3, China’s carbon emission efficiency from 2008 to 2017 was in a state of low efficiency. From the results of 2008, 2011, 2014, and 2017, China’s carbon emission efficiency has not been effectively improved. The results of Table 3 show that China’s carbon emission efficiency is still at a low level. The temporal evolution characteristics of China’s carbon emission efficiency were studied (see Fig. 3). As can be seen from Fig. 3, the average carbon emission efficiency of China showed a downward trend from 2008 to 2016 and began to show an increasing trend after 2016. By region, the average carbon emission efficiency in eastern China showed a downward trend from 2008 to 2016, and an obvious growth trend after 2016. The average carbon emission efficiency in central and western China showed a downward trend from 2008 to 2017, and the carbon emission efficiency did not improve effectively. The reason is that the eastern region is economically developed and has a strong awareness of environmental protection. In recent years, with China’s attention to environmental issues, the eastern region has gradually begun to pay attention to environmental issues in the process of development. However, the development focus of the central and western regions is mainly economy, so the carbon emission efficiency has not been improved. Overall, China’s carbon emission efficiency is not high, and further measures should be taken to improve it.

The spatial distribution characteristics of carbon emission efficiency were further investigated. ArcGIS10.2 software was used to draw spatial distribution maps for comparative analysis of the spatial evolution characteristics of carbon emission efficiency in 2008, 2011, 2014, and 2017 (see Fig. 4). The darker the color, the higher the carbon emission efficiency. The results of Fig. 4 show that, on the whole, the spatial pattern of carbon emission efficiency is relatively stable, with a gradient decreasing from east to west. Carbon emission efficiency in eastern China is relatively high. On the one hand, the eastern region has relatively developed economy, complete infrastructure, and low energy consumption demand. On the other hand, the awareness of environmental protection in eastern China is stronger than that in western China. People’s demand for green consumption will force industries to carry out green production and reduce carbon emissions to a certain extent. Compared with the eastern region, the development of the central region needs to coordinate the relationship between economy and environment. The carbon emission efficiency of the western region is relatively low. On the one hand, the economy of the western region is relatively backward, and the development process is dominated by economy. On the other hand, in the process of undertaking industrial transfer, the western region may have undertaken some energy-intensive industries to increase the carbon emission level, so the carbon emission efficiency of the western region is relatively low.

Benchmark model regression

Firstly, the method of gradually increasing control variables is adopted. The consequences are revealed in Table 4. Regression consequences reveal that in the process of gradually increasing control variables, the coefficient of green finance is positive and passes the conspicuousness test; it shows that green finance can prominently improve carbon emission efficiency.

The regression results were further analyzed, in terms of control variables, regional openness can motivate the enhancement of carbon emission efficiency. To some extent, regional opening-up level is higher, the higher the level of foreign trade. Foreign trade is instrumental in the optimization and upgrading of local industries, the introduction of new technologies, and increasing carbon emission efficiency. Urbanization rate is not instrumental in the improvement of carbon emission efficiency. Wang and Cheng (2020) found that diverse levels of urbanization development have different influences on carbon emission efficiency. At the present stage, the improvement of China’s urbanization level means that more people flow into cities, economic activities increase, and its energy consumption demand increases sharply. Therefore, the urbanization level has an inverse relationship with carbon emission efficiency. The level of fiscal expenditure has a negative impact on carbon emission efficiency. This may be because fiscal spending has focused less on environmental protection and more on infrastructure such as education and health care. From 2008 to 2017, although the total national environmental protection expenditure continued to rise, its proportion in fiscal expenditure fluctuated around 2.5%Footnote 4, that is, the level of environmental protection expenditure needs to be further improved. There is a positive relationship between territorial economic development level and carbon emission efficiency. Above all, the more developed the regional economy, the more sound the local infrastructure, the industrial structure tends to be reasonable. The more likely it is to use high and new technology in local production to reduce the degree of environmental pollution. For another, the more advanced the regional economy, the stronger the people environmental protection consciousness is, which inhibits carbon emissions to a certain extent. Industrial agglomeration level has a negative correlation with carbon emission efficiency. The higher the industrial agglomeration level is, the agglomeration degree and scale of enterprises will significantly increase, and their pollution emissions will also increase, which to some extent inhibits the improvement of carbon emission efficiency.

Heterogeneity analysis

Study results by region

In accordance with the regression consequences of the benchmark model, the development of green finance can promote the improvement of carbon emission efficiency. To move forward a single-step research whether the influence of green finance on carbon emission efficiency has regional heterogeneity, this paper divides 27 provinces and municipalities into eastern, central, and western three sub-sample areas. Similarly, using Tobit model to estimate the regional sample, regression results is exhibited in Table 5.

By comparing the regression coefficients of green finance, it can be found that the influence of green finance on carbon emission efficiency has obvious territorial heterogeneity. Coefficient of eastern and central parts of green finance to 1% significance level is positive and shows that the eastern region and central region of the green financial development for carbon emissions significantly raise efficiency; the regression results are consistent with the sample; the green financial resources make more cash flow to the green industry, promote the development of green industry, reduce carbon emissions, and improve the efficiency of carbon emission. In the western region, the green financial coefficient is positive but not through the significance test. Compared with the east, the central region and the western region economic development is relatively backward, environmental awareness is relatively weak, green financial resource inflows will priority to economic development, while ignoring the environmental problems, therefore green financial did not significantly improve efficiency of carbon emissions. In addition, by comparing the regression coefficient of green finance, it can be found that green finance plays a higher role in improving carbon emission efficiency in the eastern region than in the central region. Compared with the central region, the economic level of the eastern region is higher, and the development of green finance can better improve carbon emission efficiency.

Empirical analysis based on grouping of green finance level and carbon emission efficiency level

The level of carbon emission efficiency and the development degree of green finance may affect the influence of green finance on carbon emission efficiency. Therefore, further research is carried out, referring to Xing (2015), this article first on the efficiency of each province of carbon emissions in 2008–2017 average is calculated, then calculates the mean value of all provinces, and takes the mean value of all provinces as the basis for sample division, the group above the mean value is the high efficiency group. Otherwise, it is the low efficiency group, so as to discuss the influence of green finance on carbon emission efficiency at different efficiency levels. Secondly, it studies the influence of different levels of green finance on carbon emission efficiency is studied with the same method as above. The divided samples are regressed. The regression consequences are demonstrated in Table 6.

The consequences of Table 6 exhibit that the influence of green finance on carbon emission efficiency shows obvious heterogeneity due to the different evolution degrees of green finance and the disparate level of carbon emission efficiency. Columns (1) and (2) indicate that green finance plays an obvious role in promoting carbon emission efficiency at different levels at the 1% level. The development of green finance can promote regional clean technology innovation, guide more financial resources to flow to green projects, and promote industrial green transformation. Column (3) shows the impact of low green finance development level on carbon emission efficiency. When the development level of green finance is low, it cannot promote the improvement of carbon emission efficiency. Column (4) indicates that high green finance level has a significant promoting effect on carbon emission efficiency at 5% level. When the development of green finance is relatively high, more financial resources can flow to the field of environmental protection, promote the development of green industry, and improve the efficiency of carbon emission.

Mechanism analysis

Green finance, technological progress, and carbon emission efficiency

Zhang (2016) pointed out that technology and capital are the two core elements of low-carbon economy. Most studies believe that technological progress can improve carbon emission efficiency (Xie et al. 2021; He et al. 2021). Hao et al. (2021) studied the effect of technological innovation on environmental pollution in Asian developing countries based on the theoretical framework of strip and EKC. The research results show that technological advancement has the effect of carbon emission reduction. Technological progress will have an impact on carbon emission efficiency. In the first instance, technological advancement is a process of continuous development and improvement of technology and new technology replacing old technology. Technological progress can accelerate the advancement of green and low-carbon technology, boost the development of low pollution energy, make the existing energy consumption structure better, and decrease carbon emissions. In the second place, technological advancement can accelerate the improvement of enterprise productivity, decrease the cost of enterprises, and increase the economic benefits of enterprises. However, technological progress needs a lot of money. The innovation and R&D of firms are inseparable from the support of funds. Green finance provides support for R&D funds for technological progress. Green finance guides financial resources to the domain of environmentally sustainable and energy efficient, drives private capital to invest in green industries, and stimulates enterprises to carry out R&D and innovation. Meanwhile, green finance reduces the risk of project investment through the risk management function, so that high tech can get sustainable financial support. Zhu et al. (2021) found through empirical analysis that green finance can accelerate technological innovation.

In this regard, the correlation between green finance, technological progress and carbon emission efficiency is further studied. The regression consequences are demonstrated in Table 7. Column (1) shows that green finance can boost carbon emission efficiency. Column (2) shows that the implement of green finance is able to boost technological progress. Column (4) shows the green finance after joining technology progress effect on the efficiency of carbon emissions. Green finance still has a remarkable improvement on the efficiency of carbon emission. Compare column 1 (1) and (4) of Table 7 with the consequences, after joining technological advancement variables, the influence coefficient of green finance on carbon emission efficiency is reduced by 0.373. It shows that technological progress is the mechanism of green finance to improve carbon emission efficiency.

Green finance, optimization, and upgrading of industrial structure and carbon emission efficiency

The optimization and upgrading of industrial structure can effectively reduce carbon emissions, which has been confirmed in most studies (Zhang et al. 2018; Wu et al. 2021; Zhu and Zhang 2021). From the meso-level, the promotion and optimization of industrial construction refer to the entire improvement of technology, production efficiency, and product quality of major enterprises in an industry. In the first place, the upgrading of industrial construction means that the cost of enterprises is relatively reduced and their economic benefits will be improved. In the next place, the optimization of industrial construction means that enterprises can produce with more advanced technology, and the pollution caused by their production is reduced. Combining the two effects, the promotion of industrial construction will improve the efficiency of carbon emission.

As a matter of fact, green finance is able to optimize the industrial construction and further improve the efficiency of carbon emissions. Jiang et al. (2020) pointed out that green finance affects carbon emissions through the optimal allocation effect of financial resources, the improvement effect of technological innovation tendency, and the signal transmission effect. On this basis, Zhang et al. (2021) studied the correlativity between green credit and carbon emission. The research consequences reveal that green credit is able to facilitate carbon emission reduction, and green credit will decrease carbon emissions by means of facilitating industrial construction upgrading and technological advancement. In the first place, green finance can realize the green transformation of industry by promoting technological progress. Green finance is able to encourage firms to proceed with green innovation and realize technological progress. Green finance can force “two high” firms to proceed with green low-carbon technology innovation and realize the transformation of “two high” enterprises. At the same time, the “green” tendency information conveyed by the green financial policy, green credit, and green security market also makes nongovernmental capital invest more in environmentally friendly industries, which will promote the sustainable transformation of various industries. In the next place, green finance is able to realize the further evolution of the industry proceed with the scale effect, and the industrial upgrading will produce the market scale effect. The two promote each other and finally realize the industrial upgrading. Wang and Wang (2021a) and Gu et al. (2021) empirically analyze the actual influence of green finance on industrial structure optimization. The results show that the development of green finance is conducive to industrial structure optimization.

In this regard, further study on the relationship between green finance, industrial construction upgrading, and the efficiency of carbon emission in needed. The regression consequences are exhibited in Table 7. Column (1) reveals that green finance is able to significantly promote carbon emission efficiency. Column (3) shows that green finance is able to facilitate the upgrading of industrial construction. Column (5) shows the impact of green finance on the efficiency of carbon emission after adding industrial construction upgrading. Green finance still has a remarkable improvement on the efficiency of carbon emission. Comparing the results of column (1) and column (5), it can be found that after adding the variable of industrial construction upgrading, the influence coefficient of green finance on carbon emission efficiency is reduced by 0.474, indicating that industrial construction upgrading is the mechanism for green finance to improve carbon emission efficiency.

Robustness test

In the first place, the method of changing the model was used to test. OLS, RE, and FE models are used to test successively. The consequences are exhibited in columns (1), (2), and (3) of Table 8. Adopting the method of gradually increasing the control variables, the consequences are exhibited in Table 3. In particular, considering the endogeneity of the model, this article draws on the practices of Zhang and Chen (2017), takes the current carbon emission efficiency as explained variable, and makes a regression analysis with the value of green finance and control variables lagging by one period. The regression consequences are shown in Table 8, column 4, the endogeneity examine consequences are no difference with the benchmark test consequences, it shows that the conclusions of this article are robust.

On the basis of the consequences in Table 8, green finance is able to elevate carbon emission efficiency, which shows that green finance has strong robustness to improve carbon emission efficiency.

Conclusions and policy recommendations

Based on the panel data of 27 provinces and municipalities in China from 2008 to 2017, this article empirically researches the influence and mechanism of green finance on the efficiency of carbon emission. The consequences exhibit the following. (1) China’s carbon emission efficiency level is not high. The carbon emission efficiency presents obvious heterogeneity. By regions, the carbon emission efficiency of the eastern area was larger than that of the central area and larger than that of the western area. (2) By studying the relationship between green finance and carbon emission efficiency, it is found that from the national level, green finance can memorably promote carbon emission efficiency. In terms of regions, the development of green finance is able to facilitate the promotion of carbon emission efficiency in the eastern and central areas, and the influence of green finance on carbon emission efficiency is not observable in the western area. From the perspective of grouping based on the evolution level of carbon emission efficiency, green finance can improve the efficiency of carbon emission at different levels. Grouping based on the evolution level of green finance, high-level green finance is beneficial to the promotion of carbon emission efficiency, while low-level green finance has no remarkable impact on carbon emission efficiency. (3) It is found that green finance is able to affect carbon emission efficiency through technological progress and industrial structure upgrading. Accordingly, this article comes up with the following suggestions.

In the first place, vigorously develop green finance. The research consequences reveal that at the national level, green finance can significantly promote carbon emission efficiency. The grouping research results show that high-level green finance is able to facilitate the improvement of carbon emission efficiency. For this reason, promoting the development of green finance is still an important theme at this stage. To vigorously develop green finance, first of all, we should perfect the juristic and statutory system of green finance. We should perfect the green finance laws and regulations system, establish a multi-level and multi-dimensional green finance evaluation standard system, formulate a unified green finance quantitative standard, comprehensively estimate the evolution degree of green finance, improve the green finance performance evaluation system, establish an incentive mechanism, and guide financial resources to green and low-carbon projects. In the second place, we should continue to perfect the green financial market. First, develop the direct financing market of green finance, encourage green low-carbon enterprises to go public, finance through the capital market, and guide angel investment in green low-carbon enterprises. Second, improve the indirect financing market of green finance, innovate and study green credit products, establish professional carbon banks, and improve the financial support efficiency of green low-carbon enterprises. Third, improve the guarantee, risk assessment, and supervision system of green financial market. In the end, actively explore carbon financial products and improve the carbon information disclosure system. Explore and innovate carbon financial products; innovate carbon bonds and carbon funds; actively innovate carbon financial products by using digital technology, Internet technology, and Internet technology; set up a national joint and unified carbon financial product exchanging platform; and fully realize the function of market orientation. Simultaneously, improve the carbon information disclosure system. We should formulate carbon information disclosure standards; clarify the legal responsibilities of all parties in carbon information disclosure; establish a supervision system for carbon information disclosure; form a tripartite joint force of government, society, and enterprises to promote carbon information disclosure; and ensure the quality of carbon information disclosure.

Second, we should vigorously encourage technological innovation and promote technological progress. The results show that green finance can improve the efficiency of carbon emission through technological advance. Technological advance is able to improve firm production efficiency, reduce enterprise costs, improve enterprise green technology R&D level, and reduce environmental pollution. In this regard, the government should formulate relevant policies to encourage firms to proceed with technical innovation, especially green and clean technology, thereby decreasing the pollution emissions generated in enterprise production.

Third, we should continue to improve the industrial structure. The results exhibit that green finance is able to promote carbon emission efficiency by means of industrial construction upgrading. Therefore, we need to improve industrial evolution to achieve sustainable transformation and decrease carbon emissions. First of all, the government needs to enact a catalog of green industries, guide enterprises to carry out green transformation, promote green industrial development, drive the modulation of industrial construction, and facilitate the majorization and promotion of industrial construction. Meanwhile, the government should introduce relevant policies to promote private capital investment in green industry projects. Secondly, we should increase investment in research and development, increase investment in related industries, promote industrial innovation, actively cultivate high-tech industries and emerging industries of strategic importance, promote industrial sustainable transformation, and facilitate the degree of energy preservation, emission decrease, and clean technology. Finally, cultivate consumers’ awareness of green consumption, force high contamination and high-energy-consuming firms to proceed with green innovation, and reduce their pollution level.

Data availability

All data generated or analyzed during this study are included in this article. What’s more, the data and materials used in this paper are available from the corresponding author on reasonable request.

Notes

Project comprehensive report preparation team (2020). Comprehensive report on China’s long-term low-carbon development strategy and transformation path. China Population, Resources and Environment. 30:1–25.

The data comes from CSMAR database.

Writing Group of China Green Finance Progress Report (2021). Analysis of green loan business in China. China finance. pp:48–50.

The data comes from EPS database.

References

Chen X, Shi Y, Song X (2019) Green credit constraints, commercial credit and corporate environmental governance. Studies of International Finance (12):13–22

Ding J (2019) Green credit policy, credit resource allocation and enterprise strategic response. Econ Rev (04):62–75

Taghizadeh-Hesary F, Yoshino N (2019) The way to induce private participation in green finance and investment. Financ Res Lett 31:98–103

Gu B, Chen F, Zhang K (2021) The policy effect of green finance in promoting industrial transformation and upgrading efficiency in China: analysis from the perspective of government regulation and public environmental demands. Environ Sci Pollut Res Int 28:47474–47491

Hao W, Rasul F, Bhatti Z et al (2021) A technological innovation and economic progress enhancement: an assessment of sustainable economic and environmental management. Environ Sci Pollut Res 28:1–13

He A, Xue Q, Zhao R et al (2021) Renewable energy technological innovation, market forces, and carbon emission efficiency. Sci Total Environ 796:148908

Hu G, Wang X, Wang Y (2021a) Can the green credit policy stimulate green innovation in heavily polluting enterprises? Evidence from a quasi-natural experiment in China. Energy Economics 98:105134

Hu J, Yan S, Han J (2021b) Research on implied carbon emission efficiency of China’s industrial sector – an empirical analysis based on three-stage DEA model and non competitive I-O model. Statistical Research 38:30–43

Jiang H, Wang W, Wang L et al (2020) Research on carbon emission reduction effect of China’s Green Financial Development – taking green credit and green venture capital as an example. Finance Forum. 25:39-48+80

Li D, Xu H, Zhang S (2018) Financial development, technological innovation and carbon emission efficiency: theoretical and empirical research. Inquiry into Economic Issues (02):169–174

Li L, Dong B (2018) Research on the development level and influencing factors of regional carbon finance. Econ Manag 32:60–65

Liu Q, Wang W, Chen H (2020) Research on the impact of the implementation of green credit guidelines on the innovation performance of heavily polluting enterprises. Sci Res Manag 41:100–112

Meng F, Su B, Thomson E et al (2016) Measuring China’s regional energy and carbon emission efficiency with DEA models: a survey. Appl Energy 183:1–21

Ning L, Zheng W, Zeng L (2021) Evaluation of China’s provincial carbon emission efficiency and analysis of influencing factors from 2007 to 2016 – two-stage analysis based on super efficiency SBM Tobit model. Acta Scientiarum Naturalium Universitatis Pekinensis 57:181–188

Ren X, Shao Q, Zhong R (2020) Nexus between green finance, non-fossil energy use, and carbon intensity: Empirical evidence from China based on a vector error correction model. J Clean Prod 277

Sun W, Huang C (2020) How does urbanization affect carbon emission efficiency? Evidence from China. J Clean Prod 272:122828

Tone K (2002) A slacks-based measure of super-efficiency in data envelopment analysis[J]. Eur J Oper Res 143:32–41

Wang G, Deng X, Wang J et al (2019a) Carbon emission efficiency in China: a spatial panel data analysis. China Econ Rev 56:101313

Wang K, Wu M, Sun Y et al (2019b) Resource abundance, industrial structure, and regional carbon emissions efficiency in China. Resour Policy 60:203–214

Wang X, Cheng Yu (2020) Research on the impact mechanism of urbanization on carbon emission efficiency – an empirical analysis based on the panel data of 118 countries around the world. World Regional Studies 29:503–511

Wang X, Wang Q (2021a) Research on the impact of green finance on the upgrading of China’s regional industrial structure from the perspective of sustainable development. Resources Policy, 74

Wang X, Wang Y (2021b) Research on green credit policy promoting green innovation. Manage World 37:173–188+11

Writing Group of China Green Finance Progress Report (2021) Analysis of green loan business in China. China finance, pp 48–50

Wu L, Sun L, Qi P, et al. (2021) Energy endowment, industrial structure upgrading, and CO2 emissions in China: revisiting resource curse in the context of carbon emissions. Resources Policy, 74

Xie Z, Wu R, Wang S (2021) How technological progress affects the carbon emission efficiency? Evidence from national panel quantile regression. J Clean Prod 307:127133

Xing Y (2015) Research on the dynamic relationship between economic growth, energy consumption and credit extension -- an empirical analysis of provincial panel based on carbon emission intensity grouping. J Financ Res (12):17–31

Yu CH, Wu X, Zhang D et al (2021) Demand for green finance: resolving financing constraints on green innovation in China. Energy Policy 153:112255

Yu D, Zhang X, Liu W (2015) Carbon emission efficiency analysis based on stochastic frontier analysis. China Popul Resour Environ 25:21–24

Yu Y, Zhang N (2021) Low-carbon city pilot and carbon emission efficiency: quasi-experimental evidence from China. Energy Economics 96:105125

Zhang C, Chen H (2017) Product market competition, property right nature and internal control quality. Accounting Research (05):75–82 + 97

Zhang J, Jiang H, Liu G et al (2018) A study on the contribution of industrial restructuring to reduction of carbon emissions in China during the five Five-Year Plan periods. J Clean Prod 176:629–635

Zhang J, Wu G, Zhang J (2004) Estimation of China’s inter provincial physical capital stock: 1952–2000. Econ Res J (10):35–44

Zhang W, Hong M, Li J et al (2021) An examination of green credit promoting carbon dioxide emissions reduction: a provincial panel analysis of China. Sustainability 13:7148–7148

Zhang X (2016) Current situation, problems and countermeasures of financing for low-carbon economic construction in China. J Graduate School Chinese Acad Soc Sci (06):58–63

Zhang Y, Hao J, Song J (2016) The CO2 emission efficiency, reduction potential and spatial clustering in China’s industry: evidence from the regional level. Appl Energy 174:213–223

Zhu B, Zhang T (2021) The impact of cross-region industrial structure optimization on economy, carbon emissions and energy consumption: a case of the Yangtze River Delta. Sci Total Environ 778:146089–146089

Zhu X, Huang Y, Zhu S, Huang H (2021) Technological innovation and spatial differences of China’s polluting industries under the influence of green finance. Scientia Geographica Sinica 41:777–787

Funding

This research was supported by the key project of the National Social Science Foundation of China—“Research on policy framework and innovation path of green finance to promote the realization of carbon neutrality goal” (Grant No. 21AZD113).

Author information

Authors and Affiliations

Contributions

Wei Zhang: conceptualization and validation; Zhangrong Zhu: methodology, visualization, and writing—original draft; Xuemeng Liu: software, data curation, formal analysis; Jing Cheng: formal analysis.

Corresponding author

Ethics declarations

Ethical approval

Not applicable.

Consent to participate

Not applicable.

Consent for publication

Not applicable.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Roula Inglesi-Lotz

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Zhang, W., Zhu, Z., Liu, X. et al. Can green finance improve carbon emission efficiency?. Environ Sci Pollut Res 29, 68976–68989 (2022). https://doi.org/10.1007/s11356-022-20670-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-022-20670-8