Abstract

This study investigates the relationships among renewable energies (RE), carbon dioxide (CO2) emissions, foreign direct investment (FDI), foreign and non-foreign patents (FP, NFP), and trade (TR) for the case of Tunisia using time series data spanning the period 1980–2017. The autoregressive distributed lags (ARDL) model approach of Pesaran et al. (J Appl Econ 16:289–326, 2001) and the causality of Granger are employed to explore the dynamic association between the underlined variables. The results from the long-run elasticities show that FDI and TR have negative and statistically significant impacts on RE, while NFP has a positive and statistically significant effect on the consumption of RE. Both FP and CO2 emission variables are insignificant in the long run. In the short run, there are no Granger causal links between RE and patents (FP and NFP), but we have one-way causality running from CO2 emissions to patents (FP and NFP). In the long run, there are bidirectional causalities between RE, NFP, and TR. The Tunisian authorities must impose more stringent environmental standards to attract foreign investments that are more respectful of the environment, and import and export cleaner. It is also necessary to encourage R&D and innovation which appear to be beneficial for the environment.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Tunisia’s development program is based on ensuring environmental sustainability and stable growth. In COP21 (21st yearly session of the Conference of the Parties held in Paris, France, 30 November–12 December 2015), the government suggested minimizing greenhouse gas (GHG) emissions in all sectors to reduce the country’s carbon intensity by 41% in 2030, relative to the 2010 baseline year. The energy sector intending to decrease its carbon impact by 46% by 2030, in comparison to 2010, will require a particular focus on mitigation efforts. The sustained energy transition under the project will significantly enhance the achievement of this aim. It will also blaze a trail for further decarburization in the long term, to continue with the electrification of many energy uses, as well as a sustained transition from fossil fuels to renewable sources of electricity generation. The energy sector policies in Tunisia contain significant end-use effectiveness actions to control demand growth (World Bank 2019).

In 2001, Tunisia’s status changed from an energy-exporting country to that of an importer. It made the right decision to develop numerous programs for the production of renewable energy and energy efficiency. Its goal is to become less dependent on energy imports and the volatility of oil and gas prices. For more than 20 years, Tunisia has developed a policy of energy conservation and promotion of renewable energies with a specific energy regulation framework. On January 22, 2003, it ratified the Kyoto Protocol even though, as a developing country, it is not bound by any reduction in GHG emissions under this protocol. The expansion of renewable energies is essential to meet the challenges and signals the dynamics of the electricity sector in Tunisia, especially towards significant private involvement. The integration of more profitable renewable energy sources will decrease the sensitivity of the Tunisian electricity and gas company (STEG) to international oil prices, thus helping to improve the financial performance of the electricity sector in general and to reduce the pressure on public finances. Electricity prices will remain stable over time and reduce the demands for rate increases that will influence consumers. Tunisia’s renewable energy program marks Tunisia’s evolution towards a broader electricity market, with the private sector gaining a significant share of the production sector (World Bank 2019).

According to the report of the UNESCO Institute for Statistics (2016), global spending on research and development (R&D) reached a record of 1000.7 billion US$ and indicates that only a very little number of countries concentrate 80% of these expenses. South Korea devotes 4.3% of its gross domestic product (GDP) to R&D, followed by Japan (3.6%). Tunisia spends about 0.6% of its GDP and has 1803 researchers per million inhabitants. In Tunisia, R&D investments are split between the government (50%), companies (19%), and universities (31%). Like several studies (Katila 2000; Wurlod and Noailly 2018; Ben Youssef 2020), as a proxy for R&D efforts, we use patent applications. This enables us to measure innovation externalities. We will distinguish between foreign patents that are filed by foreigners and non-foreign patents that are filled by residents. The former, i.e., foreign patents, can be considered as a good proxy for R&D externalities.

To the extent of our knowledge, no study on Tunisia has been notified investigating the relationships between patents (either foreign or non-foreign) and renewable energy consumption. This paper studies the relationships between carbon dioxide (CO2) emissions, renewable energy (RE) consumption, foreign direct investments (FDI), foreign patents (FP), non-foreign patents (NFP), and trade (TR) in Tunisia by considering data ranging from 1980 to 2017. The autoregressive distributed lags (ARDL) approach and the causality of Granger are employed to explore the dynamic association between the underlined variables.

This paper is organized as follows. “Literature review” presents an overview of the literature review. Data will be discussed in “Data and descriptive statistics.” “Methodology and results” is concerned with empirical findings. “Conclusion” summarizes the paper and presents some recommendations.

Literature review

Our work is related to the literature dealing with environmental R&D and innovation (Scott 2005; Poyago-Theotoky 2007; Ben Youssef 2011; Yamazaki et al. 2012; Giuliani et al. 2016; Jeong et al. 2017; Costa-Campi et al. 2017). Ang (2009) defines the determinants of CO2 emissions in China over the period 1953–2006. Empirical findings show a negative link between CO2 emissions and technology transfer. Besides, CO2 emissions can increase by higher trade openness, elevated income, and expanded energy use. Rahmouni et al. (2011) investigate the link between the attitude of exportation and the innovation tendency in Tunisian companies. Empirical results show that companies that manage nationally and internationally innovate better and use foreign sources of knowledge. Also, they find that internal efforts of R&D and cooperative agreements are necessary for innovation. Moreover, external knowledge sources have a fundamental role because companies can profit from them to achieve an important innovation proclivity. By using Japanese data, Inoue et al. (2013) investigate the determinants that promote environmental technological innovation, by concentrating on ISO 14001. These authors examine how the expertise level of ISO 14001 influences environmental R&D costs that upgrade environmental technological innovation. The results show that the maturity level of ISO 14001 is a significant element inducing the investment in environmental R&D. Ghisetti and Pontoni (2015) study the determinants of environmental innovation. To this end, they evaluate empirically the efficiency of two factors: R&D and policy. The results indicate that only some categories of policy can influence environmental innovation, especially rigor regulation. Ben Youssef and Zaccour (2014) highlight that a higher per-unit subsidy is given to inventive research when the free R&D spillover is sufficiently high. Nevertheless, absorptive research is encouraged to strengthen R&D externalities, when the free R&D spillover is low enough and the marginal damage cost of pollution is sufficiently high. Bretschger et al. (2017) discussed the consequences of knowledge dissemination on economic growth and the costs of environmental policy. Knowledge dissemination relies on availability and absorption capacity. The dissemination of knowledge contributes to the greening of economies, by stimulating the efficiency of clean, carbon-intensive activities. Knowledge dissemination reduces expenditures on climate policy. Dissemination of knowledge reduces global climate policy expenditures in emerging countries (China) by about 90% and in developed ones (Europe and the USA) by 20%, based on the interchangeability of different forms of knowledge. Ben Youssef (2020) uses annual data about the USA during the period 1980–2016. Long-run ARDL elasticities show that NFP increases carbon emissions, but FP reduces it. Both NFP and FP have a positive impact on RE and GDP.

Also, this research is concerned with the literature on renewable energy and pollution. In general, previous empirical analyses highlighted renewable energy’s role in mitigating pollution levels and enhancing economic expansion. For this reason, this topic has attracted several academic researchers. Apergis et al. (2010) study the connection between economic growth, CO2 emissions, renewable energy consumption, and nuclear energy consumption in 19 developed and developing countries by using annual data ranging from 1984 to 2007. Long-run estimates revealed a negative and statistically significant impact of nuclear energy use on CO2 emissions and a positive and statistically significant effect of renewable energy use on emissions. Besides, Fatima et al. (2020) assess the implications of renewable energy and rising incomes on the quality of the environment. Empirical results indicate that a rise in income moderates the ratio between renewable energy use and CO2 emissions. Higher-income increases the share of non-renewable energy in the total energy mix, which causes environmental damage. Also, Doğan et al. (2020) examine the impact of renewable energy consumption, economic progress, population growth, and economic complexity on CO2 emissions, in 28 OECD countries during the period 1990–2014. Results show that renewable energy and economic complexity contribute to the reduction of CO2 emissions.

Besides, energy (renewable and non-renewable) use and international trade have attracted several researchers. Various studies revealed that international trade is an important topic that could have a critical influence on the environmental situation and in the use of energy. Grossman and Krueger (1991) and Copeland and Taylor (2004) highlighted three environmental effects that could result from trade liberalization: the scale effect, the structural effect, and the technical effect. Kukla-Gryz (2009) examines how international exchange and economic expansion influence the level of air pollution. The findings indicate that in the developing economies, world trade and revenue per capita imply changes in the pattern of economic activity and thus higher levels of air pollution. Ben Jebli and Ben Youssef (2015) study the interaction between per capita CO2 emissions, GDP, consumption of renewable and non-renewable energy, and international trade (exports or imports) in Tunisia by considering data ranging from 1980 to 2009. Long-run estimates indicate that there is a positive effect of trade and non-renewable energy on CO2 emissions, while renewable energy has a small and negative effect on CO2 emissions for the model with exports. Dogan and Deger (2016) investigate the relationships between economic growth, overall energy use, and globalization in BRIC (Brazil, Russia, India, China) countries. They find a unidirectional causality running from globalization and overall energy use to economic growth. However, there is no causality between globalization and energy consumption. Bashir et al. (2020) use a sample of 29 OECD economies during the period 1990–2015. They investigate the impact of three export diversification measures (intensive margin, extensive margin, and export product diversification) on carbon and energy intensity. Results show that the three export diversification indicators contribute to decreasing energy intensity and could be applied as a policy instrument to ameliorate energy efficiency and environmental sustainability. Also, Shahzad et al. (2021a) examine the effect of extensive margin, intensive margin, and export product diversification on the demand for energy in emerging countries using a sample of 10 newly industries countries and annual panel data ranging from 1971 to 2014. Findings indicate that these three indicators contribute to decreasing total energy demand. Also, urbanization, economic growth, and natural resources raise energy consumption. Shahzad et al. (2021b) study the impacts of extensive margin, intensive margins, and export diversification on the use of renewable energy in G-7 and E-7 countries. The outcomes indicate that, in both advanced and emerging countries, product diversification strategies act positively on the demand for renewable energy.

The present study tries to investigate the interactions that may exist between CO2 emissions, renewable energy consumption, foreign direct investment, foreign and non-foreign patents, and international trade for the case of Tunisia using the ARDL bounds test to cointegration and Granger causality. We aim to evaluate particularly the role of patents (foreign and non-foreign) in the expansion of renewable energy and environmental quality when renewable energy is a dependent variable. Also, the short and long-run directions of causalities between variables are discussed.

Data and descriptive statistics

Tunisia’s annual data for the period 1980–2017 are acquired from different databases. Used variables are CO2 emissions measured in kilotons (kt); foreign and non-foreign patents are measured as the number of patentsFootnote 1; foreign direct investments are net inflows measured as a percentage (%) of GDP; trade of goods and services is measured as a % of GDP; renewable energy consumption is measured in quadrillion Btu then converted to Btu value. Data on CO2 emissions are collected from World Data Atlas (2020); renewable energy consumption data are collected from the US Energy Information Administration (2020); and the rest of the variables are obtained from the World Bank (2020). Time series are limited to the year 2017 due to their availability. Eviews 10.0 software is used for all estimates.

The empirical analysis starts by studying some descriptive statistics before the log-transformation of variables. The descriptive statistics of the chosen time series are provided in Table 1. These statistics are computed to assess the tendency of the variables under consideration.

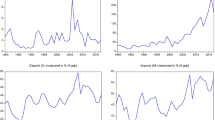

Figure 1 reports the graphical representations of CO2 emissions, renewable energy consumption, foreign and non-foreign patents, foreign direct investment, and trade over the period 1980–2017 for the case of Tunisia. Table 1 reports some descriptive statistics of the analysis variables under investigation. According to these statistical data and plots, the tendency of CO2 emissions is increasing continuously over the period. The number of foreign patents was unstable over time. Its evolution recorded some falls until 2002, and from 2003, it rises permanently until 2011, and then it decreases again. The maximum number of foreign patents was equal to 543 in 2011, while the minimum was equal to 58 in 2002. The non-foreign patents increased slowly across time and recorded some slights fluctuations. The highest number of patents was in 2016, while the lowest number was equal to 12 in 1984. The evolution of the FDI rate across time is characterized by important dynamic fluctuations. The biggest peak was in 2006 with a share of 9.42%. Renewable energy consumption was almost steady with nearly the same values from 1980 to 2004. However, from 2014 to 2017, its evolution showed a continuous rise. Trade was unsteady over the considered period with a rising trend. The minimum reached a share of 67.48% in 1986, and the maximum share was equal to 114.35% in 2008.

Methodology and results

The objective of this article consists of investigating the interaction among the consumption of renewable energy, FDI, CO2 emissions, number of patents (foreign and non-foreign), and trade for the case of Tunisia and during the period 1980–2017. The empirical part employs the ARDL boundary method and the tests of Granger causality to check for the association that may occur between the analysis variables in the short and long run. The modeling of the analysis explains renewable energy consumption (dependent) in the function of the other factors taken as explanatory variables in our model.

The following model will be developed as follows:

To explore the long-run relationships between the variables, the log-linear equation between variables can be expressed as follows:

where t, α0, and ε designate the time, the constant, and the white noise term, respectively; αi, i = 1, …, 4 designate the long-term elasticity of renewable energy variable with respect to each corresponding explanatory variable.

The empirical study requires the examination of long-run cointegration between the variables when renewable energy is dependent on the other variables. The ARDL bounds test to cointegration will be considered in this case. This approach is practically based on the bounds recommended by Pesaran et al. (2001). This test uses the joint significance of the Fisher statistic test (Wald test) to verify the long-term relationship among time series data. Several advantages are recorded from this technique of estimation against the other methods. First, time series could be either integrated of order zero (I(0)), of order one (I(1)), or fractionally (both of them). Secondly, the short- and long-run estimated coefficients can be considered in the same model. Thirdly, with a small sample, the results are more efficient. For our case, the number of observations is equal to 38 which implies that our sample is small.

Before studying the cointegration, the integration order should be examined for each time series data. To do that, two-unit root tests are employed which are the augmented Dickey-Fuller (ADF, 1979) and Phillips and Perron (P-P, 1988). All these tests are estimated for three cases which are: (i) intercept; (ii) intercept and trend; (iii) no intercept and trend. The findings from these statistics are reported in Table 2 and indicate that, for both tests, all our variables are stationary after the first’s difference, meaning that they are integrated of order one, at the 1% significance level.

Our study follows the same empirical procedure considered by Ben Jebli and Ben Youssef (2015) for the case of Tunisia. As we have mentioned before, we will use the ARDL technique previously recommended by Pesaran and Pesaran (1997), Pesaran and Smith (1998), Pesaran and Shin (1999), and finally developed by Pesaran et al. (2001). The representation of our ARDL model is given by the following equation:

where Δ, ε, and q indicate the first difference, the error term, and the number of lags selected, respectively. To proceed with the modeling of the ARDL technique for cointegration developed by Pesaran et al. (2001), it is necessary to think about estimating the optimal number of lags. The corresponding number of lags will be properly estimated based on the selection criteria which is mainly the Akaike Information Criterion (AIC). The detection of a long-run association using the ARDL method consists of testing the joint significance of the long-run coefficients. This test is inspired by the Wald test which is based on the Fisher statistic. The null hypothesis of this test suggests that all coefficients are jointly null (α7 = α8 = α9 = α10 = α11 = α12 = 0), meaning that there is no long-run interaction among the variables. The alternative hypothesis assumes that there is a long-run relationship between the variables (α7 ≠ α8 ≠ α9 ≠ α10 ≠ α11 ≠ α12 ≠ 0). There are two bounds critical values that Pesaran et al. (2001) proposed to check for cointegration. The first bounds is a lower critical value denoted by C(0) and the second bounds is an upper critical value denoted by C(1). The estimated value of the Fisher statistic will then be compared to the two limits critical values. Thus, there are three cases to discuss: (i) if the estimated Fisher statistic value is higher than the upper critical value, then there is a cointegration; (ii) if the estimated Fisher statistic value is less than the lower critical value, so there is no cointegration; and (iii) if the calculated value of the Fisher statistic is between the two critical bounds values, then we cannot conclude and the significance of the error correction term (ECT) is required to check for a long-run relationship between the variables. The validity of the estimated results will be verified using diagnostic tests (normality, residual heteroskedasticity, and serial correlation tests).

The results of the ARDL bounds for cointegration are presented in Table 3 and show that the computed Fisher statistic is above the upper critical value signifying the presence of a long-run cointegration among the variables when renewable energy is endogenous. Also, the diagnostic tests are verified and revealed that our computed results are validated. Thus, there is no problem of serial correlation or residual heteroscedasticity, and the normality of residuals is proved.

The estimated coefficients of the long-run elasticities are reported in Table 4. If renewable energy is dependent, all explanatory variables are statistically significant except for CO2 emissions and foreign patents. A 1% increase in foreign direct investment will reduce renewable energy consumption by 0.30% at the 5% significance level, and a 1% increase in trade leads to a decrease in renewable energy consumption by 2.17% with a significance level of 1%. These results can be explained by the pollution haven hypothesis: developed nations manufacture low-polluting products in their countries and transfer their polluting factories to developing areas where environmental regulations are low. Our first result is not consistent with that of Fan and Hao (2020) who show that foreign direct investment positively affects renewable energy consumption in China. However, our second result is following that of Mohamed et al. (2019) showing that trade openness reduces renewable energy consumption in France.

A 1% increase in non-foreign patents will raise renewable energy consumption by approximately 1.28% for a significance level of 1%. Thus, innovation and R&D help to use renewable energy production processes in Tunisia. This constitutes an interesting result as no previous study has evaluated the long-run impact of innovation or R&D on renewable energy consumption in Tunisia. This finding is similar to that of Ben Youssef (2020) who shows that resident patents result in higher consumption of renewable energy in the USA. The long-run impact of foreign patents on renewable energy consumption is not statistically significant, which is in contradiction with the work of Ben Youssef (2020) on the USA.

The long-term steadiness parameters have been verified using some efficient and powerful techniques such as the cumulative sum (CUSUM) and the cumulative sum of squares (CUSUM of squares) statistics established by Brown et al. (1975). The results from these statistical tests are presented in Fig. 2 indicating that the estimated coefficients are stable given that the graphical illustrations fall within the critical bounds at the 5% significance level.

Determining the optimal lag number is necessary before studying Granger causality. This step consists of estimating a suitable number of lags to launch the vector autoregressive (VAR) model. The determination of the optimal lag is based on various selection criteria: the Akaike information criteria (AIC), the Schwarz information criteria (SIC), Hannan-Quinn (HQ), Log-likelihood (LogL), Log-likelihood ratio (LR), final prediction error (FPE). The results from Table 5 indicate that all criteria choose an optimal lag equal to 1 except the Log-likelihood criterium. Thus, we consider a model VAR (1), and the discussion of the Granger causality approach can be treated.

The causality between the analysis variables can be investigated using Engle and Granger (1987) approach. This technique can be executed in two steps. The first one consists of the estimation of the long-run equation (Eq. (2)) to recover the residuals. The second step involves the estimation of the short-run equilibrium. We use the pairwise Granger causality tests to check for the short-run causality between the variables based on the Fisher statistic. The long-run interaction between time series can be established using the meaning of the lagged error correction term (ECTt−1). The representation of the vector error correction model (VECM) is given as follows:

where Δ represents the operator of the first difference; p is the VAR lag length; ECTt−1 denotes the lagged ECT associated with every equation; τj shows the velocity of adjustment from the short- to the long-run equilibrium; ζjt represents the residual termFootnote 2.

Granger causality findings are presented in Table 6 for the short- and long-run associations. The lagged ECT is statistically significant and negative for (4), (8), and (9) indicating that there is a long-run relationship between renewable energy consumption, non-foreign patents, and international trade. More precisely, there are long-run bidirectional causalities between RE, NFP, and trade. This result is different from that of Ben Jebli and Ben Youssef (2015) showing a long-run unidirectional causality running from exports to renewable energy consumption for the case of Tunisia. However, it is in line with the result of Sadorsky (2012) who found long-run bidirectional causality between trade (exports or imports) and energy consumption for the panel of 7 South American countries considered.

In the short run, we have one-way causality running from CO2 emissions to foreign and non-foreign patents. This result is different from that of Ben Youssef (2020) who found no short-run interaction of carbon emissions with resident and non-resident patents in the case of the USA. Besides, we have a short-run causality running from non-foreign patents to foreign patents and foreign direct investments. This means that investments in R&D and innovation in Tunisia help domestic firms to benefit, even in the short-term, from foreign innovations while attracting foreign investments.

Conclusion

The present paper tries to investigate the interdependence between renewable energy consumption, CO2 emissions, foreign direct investments, foreign and non-foreign patents, and trade in Tunisia, using time series data during the period 1980–2017. The cointegration between the variables has been established by employing the ARDL bounds method for cointegration. The long-term coefficients have been estimated and the short and long-run interactions between the variables have been investigated using Granger causality tests. We find many interesting results.

Empirical findings mentioned that increasing the share of trade and foreign direct investments will decrease the consumption of renewable energy. Moreover, we have a one-way long-run causality running from FDI to RE consumption, and long-run bidirectional causality between renewable energy consumption and international trade. These results could be explained by environmental regulations, at the level of texts or the level of application, less strict compared to other countries such as the European Union, which attracts polluting foreign direct investments, production, consumption, import, and export of relatively polluting products.

In the long run, non-foreign patents have a positive impact on renewable energy consumption, which could be beneficial for the environment and combat climate change. Moreover, we have long-run bidirectional causality between renewable consumption and non-foreign patent use. This means that encouraging innovation and R&D can have good effects on the development of renewable energy projects ending in more renewable energy consumption and less environmental pollution.

Foreign patent use do not seem to have any long-run impact on renewable energy consumption in Tunisia, whereas a one-way long-run causality running from foreign patents to renewable energy consumption is detected. This may be because, at present, foreign patents are neutral concerning renewable energy consumption as they can be either more or less polluting. However, encouraging the use of cleaner foreign innovations may have a beneficial impact on renewable energy consumption in Tunisia.

Given our econometric results, we recommend that the Tunisian authorities should set up stronger environmental standards to attract foreign direct investments that are less polluting. This will incite foreign investors to use renewable energy, and even to invest in renewable energy projects to benefit from the renewable energy potential of Tunisia, in particular, that of solar energy. International trade will encourage the use of renewable energy as it becomes inciting to produce, consume, export, and import less polluting goods.

Data availability

The datasets used during the current study are available from the corresponding or first author on reasonable request.

Notes

For the FP value of the year 1982, we take the mean of the 2 years 1981 and 1983.

The robustness of the VECM model is checked using residuals Portmanteau tests for autocorrelations. The results from the test revealed no problem of autocorrelation. The result is available upon request.

References

Ang JB (2009) CO2 emissions, research and technology transfer in China. Ecol Econ 68(10):2658–2665

Apergis N, Payne JE, Menyah K, Wolde-Rufael Y (2010) On the causal dynamics between emissions, nuclear energy, renewable energy, and economic growth. Ecol Econ 69(11):2255–2260

Bashir MA, Sheng B, Doğan B, Sarwar S, Shahzad U (2020) Export product diversification and energy efficiency: Empirical evidence from OECD countries. Struct Chang Econ Dyn 55:232–243

Ben Jebli M, Ben Youssef S (2015) The environmental Kuznets curve, economic growth, renewable and non-renewable energy, and trade in Tunisia. Renew Sust Energ Rev 47:173–185

Ben Youssef S (2011) Transboundary pollution and absorptive capacity. Environ Model Assess 16(2):205–211

Ben Youssef S (2020) Non-resident and resident patents, renewable and fossil energy, pollution, and economic growth in the USA. Environ Sci Pollut Res 27:40795–40810

Ben Youssef S, Zaccour G (2014) Absorptive capacity, R&D spillovers, emissions taxes and R&D subsidies. Strateg Behav Environ 4(1):41–58

Bretschger L, Lechthaler F, Rausch S, Zhang L (2017) Knowledge diffusion, endogenous growth, and the costs of global climate policy. Eur Econ Rev 93:47–72

Brown RL, Durbin J, Evans JM (1975) Techniques for testing the constancy of regression relations over time. J R Stat Soc Ser B 37:149–163

Copeland BR, Taylor MS (2004) Trade, growth, and the environment. J Econ Lit 42(3):7–71

Costa-Campi MT, García-Quevedo J, Martínez-Ros E (2017) What are the determinants of investment in environmental R&D? Energy Policy 104(C):455–465

Dickey DA, Fuller WA (1979) Distribution of the estimators for autoregressive time series with a unit root. J Am Stat Assoc 74:427–431

Dogan B, Deger O (2016) How globalization and economic growth affect energy consumption: panel data analysis in the sample of Brazil, Russia, India, China countries. Int J Energy Econ Policy 6(4):806–813

Doğan B, Driha O, Lorente D, Shahzad U (2020) The mitigating effects of economic complexity and renewable energy on carbon emissions in developed countries. Sustain Dev 1:1–12

Energy Information Administration (2020) International energy outlook. Accessed at: www.eia.gov/forecasts/aeo

Engle RF, Granger CWJ (1987) Co-integration and error correction: representation, estimation, and testing. Econometrica 55:251–276

Fan W, Hao Y (2020) An empirical research on the relationship amongst renewable energy consumption, economic growth and foreign direct investment in China. Renew Energy 146:598–609

Fatima T, Shahzad U, Cui L (2020) Renewable and nonrenewable energy consumption, trade and CO2 emissions in high emitter countries: does the income level matter? J Environ Plan Manag 0(0):1–25

Ghisetti C, Pontoni F (2015) Investigating policy and R&D effects on environmental innovation: a meta-analysis. Ecol Econ 118:57–66

Giuliani E, Martinelli A, Rabellotti R (2016) Is co-invention expediting technological catch up? A study of collaboration between emerging country firms and EU inventors. World Dev 77:192–205

Grossman GM, Krueger AB (1991) Environmental impacts of a North American free trade agreement. NBER Working Paper No. 3914

Inoue E, Arimura TH, Nakano M (2013) A new insight into environmental innovation: does the maturity of environmental management systems matter? Ecol Econ 94:156–163

Jeong H, Moon JJ, Shin J (2017) The determinants of MNEs’ environmental R&D and the role of stakeholder pressure. Acad Manag Proc 2017(1):11708

Katila R (2000) Using patent data to measure innovation performance. Int J Bus Perform Manag 2:180–193

Kukla-Gryz A (2009) Economic growth, international trade and air pollution: a decomposition analysis. Ecol Econ 68(5):1329–1339

Mohamed H, Ben Jebli M, Ben Youssef S (2019) Renewable and fossil energy, terrorism, economic growth, and trade: evidence from France. Renew Energy 139:459–467

Pesaran MH, Pesaran B (1997) Working with Microfit 4.0: interactive econometric analysis. Oxford University Press, Oxford

Pesaran MH, Shin Y (1999) An autoregressive distributed lag modelling approach to cointegration analysis. In: Strom S (ed) Chapter 11, Econometrics and Economic Theory in the 20th Century: The Ragnar Frisch Centennial Symposium. Cambridge University Press, Cambridge

Pesaran MH, Smith RP (1998) Structural analysis of cointegrating VARs. J Econ Surv 12:471–505

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J Appl Econ 16:289–326

Phillips PCB, Perron P (1988) Testing for a unit root in time series regression. Biometrika 75(2):335–346

Poyago-Theotoky JA (2007) The organization of R&D and environmental policy. J Econ Behav Organ 62(1):63–75

Rahmouni M, Yildizoglu M, Ayadi M (2011) Export behaviour and propensity to innovate in a developing country: the case of Tunisia (halshs-00608239; Working Papers). HAL. https://ideas.repec.org/p/hal/wpaper/halshs-00608239.html

Sadorsky P (2012) Energy consumption, output and trade in South America. Energy Econ 34:476–488

Scott JT (2005) Corporate social responsibility and environmental research and development. Struct Chang Econ Dyn 16(3):313–331

Shahzad U, Doğan B, Sinha A, Fareed Z (2021a) Does export product diversification help to reduce energy demand: exploring the contextual evidences from the newly industrialized countries. Energy 214:118881

Shahzad U, Lv Y, Doğan B, Xia W (2021b) Unveiling the heterogeneous impacts of export product diversification on renewable energy consumption: new evidence from G-7 and E-7 countries. Renew Energy 164:1457–1470

UNESCO Institute for Statistics (2016) How much does your country invest in R&D. Accessed at: http://uis.unesco.org/apps/visualisations/research-and-development-spending/#!lang=fr

World Bank (2019) Energy sector improvement project (P168273). Report No: PAD3220. Accessed at: http://documents1.worldbank.org/curated/en/296941561687292260/pdf/Tunisia-Energy-Sector-Improvement-Project.pdf

World Bank (2020) World Development Indicators. Accessed at: http://datatopics.worldbank.org/world-development-indicators/

World Data Atlas (2020) Data and statistics. Accessed at: https://knoema.com/atlas/Tunisia

Wurlod JD, Noailly J (2018) The impact of green innovation on energy intensity: an empirical analysis for 14 industrial sectors in OECD countries. Energy Econ 71:47–61

Yamazaki K, Capatina A, Bouzaabia R, Koçoğlu İ (2012) Cross-cultural issues related to open innovation in high-tech companies from Japan, Romania, Tunisia and Turkey. Rev Int Comp Manag 13:561–573

Author information

Authors and Affiliations

Contributions

Sana Ghorbal: introduction, literature review, concept-building, data. Mehdi Ben Jebli: methods, analysis, and supervision. Slim BenYoussef: literature review, editing, discussion, conclusion, and implications.

Corresponding author

Ethics declarations

Ethics approval

Not applicable

Consent to participate

Not applicable

Consent for publication

Not applicable

Competing interests

The authors declare no competing interests.

Additional information

Responsible editor: Roula Inglesi-Lotz

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Ghorbal, S., Ben Jebli, M. & Ben Youssef, S. Exploring the role of renewable energy and foreign and non-foreign patents on mitigating emissions: evidence for Tunisian economy. Environ Sci Pollut Res 28, 36018–36028 (2021). https://doi.org/10.1007/s11356-021-13108-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-021-13108-0

Keywords

- Carbon dioxide emissions

- Renewable energy

- Foreign patents

- Non-foreign patents

- Foreign direct investment

- Tunisia