Abstract

The main objective of this paper is to estimate the impact of foreign research and development (R&D) spillovers on pollution and renewable energy consumption (RE). We choose as proxies for R&D and for foreign R&D spillovers, resident patents (RP) and non-resident patents (NRP), respectively. We use annual data for the USA spanning the period 1980–2016. We show the presence of a long-run relationship between NRP, RP, RE, fossil energy consumption (FE), net energy imports (NEI), gross domestic product (GDP), and carbon dioxide (CO2) emissions. There are long-run unidirectional Granger causalities running from all considered variables to economic growth. There are short-run unidirectional causalities running from NEI to all considered variables except RP and GDP, from GDP to RP and RE, from FE to RE, and from carbon emissions to RE. By using the autoregressive distributed lag approach, several long-run elasticities are evaluated. In particular, RP increases carbon emissions, whereas NRP reduces it. Both RP and NRP have a positive impact on RE and GDP. RP and NRP seem to be complementary activities, and RE reduces NEI. Therefore, the US authorities should encourage the use of NRP because of their beneficial effect on pollution, home innovation, renewable energy consumption, and economic growth.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

The USA is considered as one of the largest carbon dioxide (CO2) emitters in the world. Indeed, in 2018, China accounted for approximately 27.52% of global CO2 emissions, and the USA, India, and Russia Federation accounted for 14.81, 7.26, and 4.68%, respectively.Footnote 1 Also, the USA is considered one of the leading countries in research and development (R&D) and innovation. Indeed, the top countries by gross research and development expenditure in 2019, based on purchasing power parity calculations, are the USA, China, Japan, and Germany, which have invested about 581, 519, 193, and 123 billion US $, respectively.Footnote 2 Since renewable energy production is an activity that impacts pollution while being relying on innovation, studying the interplay between these interesting variables could be of great interest particularly in the case of the USA.

Recognizing the important role that renewable energy can play in reducing greenhouse gas emissions, by enabling a reduction in fossil fuels use, the USA have decided several incentives for renewable energy and energy efficiency. The American Congress has voted several major energy laws that encourage energy efficiency and renewable energy research, development, demonstration, and deployment (RDD&D) programs. The Department of Energy is in charge of most incentive programs in efficiency and renewable energy comprising technology transfers and grants to states (Congressional Research Service 2019). The Department of Agriculture is in charge of programs related to agriculture, such as bio-fuels and assistance to rural communities supporting high energy costs, grants, and loans for agricultural producers and rural businesses to help them achieve energy efficiency and renewable energy use. The Department of the Treasury established several incentives, such as tax credits, that could be used for activities, such as efficient-energy home improvements or business investments, in energy efficiency and renewable energy.

These top decisions brought encouraging results as the share of renewable energy in the energy mix has considerably increased. Indeed, the consumption of bio-fuels and other non-hydroelectric renewable energy sources has more than doubled from 2000 to 2018, with an expected continuous increase through 2050 (Energy Information Administration 2019). In 2018, the energy mix in the USA is comprised of petroleum (36%), natural gas (31%), coal (13%), renewable energy (11%), and nuclear electric power (8%). Renewable energy consumption is divided into biomass (45%), hydroelectric (25%), wind (21%), solar (6%), and geothermal (2%), and it accounts for about 17% of electricity generation.

In addition, dealing with renewable energy and environmental protection cannot be well addressed without taking into account R&D and innovation efforts. In this respect, the OECD/Eurostat (2018) manual is a worthy international resource which benefits of inputs from the World Bank, the United Nations Educational, Scientific and Cultural Organization (UNESCO), and several regional development banks, that are engaged to support investments in innovation for sustainable development goals. The 2018 manual edition is concerned by worldwide economies, independently of their level of economic development. It is committed to pursue improving measurement systems for a better capture of the main features of science, technology, and innovation.

Patent applications could be a good proxy for R&D or innovation efforts. Indeed, several studies recommend, or have used, patents as a proxy for innovative activity (Katila 2000; ACS et al. 2002; Wurlod and Noailly 2018; World Bank 2019). Patent applications give exclusive rights for an invention, a product, or process that offers a new way of doing something or provides a new technical solution to a problem. A patent protects the owner’s invention for a limited period of time, in general for 20 years (World Bank 2019). Using patents as a proxy allows us to measure R&D efforts in absorption capacity or to measure the externalities of innovations. Indeed, we will distinguish between resident patents (RP) which are filed by residents of the considered country and non-resident patents (NRP) which are filed by foreigners. The latter, i.e., NRP, can be considered as a good proxy for absorptive capacity.

The importance of granting fundamental rights for new inventions has been recognized in the United States since the adoption of its Constitution.Footnote 3 The US patents are guided by the Patent Act (35 U.S. Code) and the United States Patent and Trademark Office (USPTO). The US law provides patentees with rights to impede others benefiting freely from the invention. For instance, utility patents have duration of 20 years beginning at the date of filing.

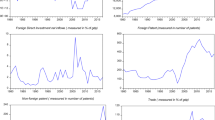

As a result, from 1980 to 2016, the number of resident patents has passed from 59,391 to 295,327 (World Bank 2019), i.e., an increase of 397.26% in 36 years, denoting the remarkable R&D efforts made by the USA. Interestingly, for the same period, the number of non-resident patents has considerably increased passing from 42,231 to 310,244, representing a 634.60% increase. Figure 1 shows that these increases were almost continuous and very important proving that making its own innovations does not necessarily prevent from benefiting from abroad innovations. For the other considered variables in our study, the global trend is upward. However, we remark a similar graph for net energy imports, fossil energy consumption, and carbon dioxide emissions, as they show a decreasing tendency from year 2007. Since 2012, renewable energy consumption has increased almost continuously. With the exception of some years like 2009, economic growth was continuous and remarkably significant.

To the best of our knowledge, no empirical research has been reported on the impact of foreign R&D spillovers on pollution or renewable energy consumption. The main objective of this paper is to evaluate the impact of foreign R&D spillovers on CO2 emissions and renewable energy consumption (RE). As proxies for R&D and foreign R&D spillovers, we choose resident patents and non-resident patents, respectively. Other interesting variables are also included as fossil energy consumption (FE), net energy imports (NEI), and gross domestic product (GDP). Annual data for the USA spanning the period 1980–2016 are used. The autoregressive distributed lag (ARDL) approach is adopted for evaluating long-run elasticities, the Johansen and Juselius (1990) cointegration test is used for assessing the long-run cointegration between all considered variables, and the vector error correction model (VECM) approach is used for detecting short- and long-run causalities.

Our paper has the following structure: the “Literature review” section, the “Data and econometric analysis” section, and the “Conclusion” section with policy recommendations.

Literature review

Our review of the literature can be divided into studies that relate to innovation, R&D and absorptive capacity, those that relate to patents, and those that relate to renewable and non-renewable energy consumption and carbon emissions.

Innovation, R&D, and absorptive capacity

The literature review on innovation, R&D, and research spillovers is very rich. Some authors have addressed this theme theoretically (D’Aspremont and Jacquemin 1988, 1990; Kamien and Zang 2000; Wiethaus 2005). Cohen and Levinthal (1989) pioneered the absorptive capacity’s notion in the literature of R&D. They have shown empirically that the investment in R&D improves the company’s ability to identify, and then assimilate, and use knowledge of the environment. Hammerschmidt (2009) proposed the following two types of R&D: original (or inventive) R&D creating new knowledge and absorptive R&D enabling a firm to benefit from the original research conducted by others. She concluded that, when the spillover parameter is greater, firms improve their absorptive capacity by more investments in R&D.

By using a panel of countries and R&D spending data, Goñi and Maloney (2014) show that, on average, poor countries do much less R&D as a share of GDP than wealthy countries. They find that the rates of return follow an inverted U shape because they increase with the distance to the border and then decrease, becoming potentially negative for the poorest countries. These results are consistent with the importance of factors complementary to R&D, such as education and the quality of scientific infrastructure, which become increasingly weak with the distance from the border and whose absence can erase the catch-up effect. They point out that, despite the expected low returns of China and India, their explosive growth in R&D investments can be justified by the importation of complementary factors in the form of multinational companies which carry out most of the patentable research in these countries. Chung and Lee (2015) use data from South Korea and show that a learning process involving foreign technology, and particularly know-how tacit knowledge, happens before firms can proceed to in-house R&D and innovations. Giuliani et al. (2016) analyze Brazil, India, and China cross-border inventions with the European Union. They conclude that these inventions represent an opportunity for companies in these emerging economies to accelerate their technological progress. Ahuja and Novelli (2017) use the existing literature on R&D overinvestment to prove the need for further scientific studies on this interesting but still blank subject.

Ho et al. (2018) use a panel of 74 countries and data during 1970–2010 to show that the main channel through which political democratization reinforces the role of banking and stock markets in financing innovation is the state’s increase in openness and competitiveness in the recruitment of executive leaders. Grabiszewski and Minor (2019) show that the increase in counterintelligence measures may have the searched effect of increasing national R&D and reducing economic espionage by foreigners. Nevertheless, it is possible to get the opposite result. Goel and Nelson (2020) use data concerning 135 countries to show that sole proprietorships and firms performing R&D activities were more expected to introduce innovations, while firms located in island countries were less expected to do so. It appears that the size and vintage of the companies did not have a significant influence on innovation.

Milliman and Prince (1989) is one of the early studies in the environmental R&D topic. They showed that emissions taxes and auctioned permits are more incentive for technological change. Other researches have followed (e.g. Jung et al. 1996; Farzin and Kort 2000; Fischer and Newell 2008). Ben Youssef (2011) and Ben Youssef and Zaccour (2014) were the first to use the notion of absorptive capacity in environmental R&D. Ben Youssef (2011) showed that absorptive research’s investment enables non-cooperating countries to better internalize transboundary pollution. Ben Youssef and Zaccour (2014) showed that when the free spillover is high enough, a greater per-unit subsidy is given for inventive research; however, when it is sufficiently low and the marginal damage cost of pollution is high enough, absorptive research is supported to strengthen R&D spillovers.

Patents

Several researchers have been interested in patenting. Bravo-Ortega et al. (2016) show that the stock of patents of a country affects significantly its current and future patents’ production and that there are significant spillovers from the stock of knowledge of the rest of the world. A significant proportion of firms face negative international spillovers. However, more productive firms benefit from positive spillovers. Positive spillovers from the same geographic region and potentially negative from the rest of the world are also detected. They also find that technology transfer is larger for creation of new products than for the improvement of existing ones. These authors propose public policy interventions in developing countries to help finance private R&D investments for bringing positive spillovers. Wurlod and Noailly (2018) evaluate the impact of green innovation on energy intensity by considering 17 OECD (Organization for Economic Co-operation and Development) countries and 14 industrial sectors during the period 1975–2005. A stock of green patents for each industrial sector is elaborated. They show that green innovation has declined energy intensity in most sectors and that the magnitude of this effect is greater in more recent years.

Cheng et al. (2019) use the panel ordinary least square and panel quantile regression methods with data on the BRIICS countries (Brazil, Russia Federation, India, Indonesia, China, South Africa) spanning the period 2000–2013. They show that the impacts of the considered variables on CO2 emissions are not homogeneous across quantiles. It is shown that renewable energy reduces carbon emissions, and the highest effect is reached at the 95th quantile. Environmental patents increase CO2 emissions significantly at the 95th quantile. They recommend for BRIICS countries to adopt policies that encourage the creation of new environmental patents and speed up their dissemination. Sweet and Eterovic (2019) use data from a sample of 70 countries during the period 1965–2009 and find that stronger patent systems have insignificant impact on the growth of productivity for both developing and developed countries. Their results are in accordance with the absorptive capacity theory suggesting that it is the ability to adapt and replicate existing innovations that induce productivity’s growth.

Some of these researches concern the USA. Youn et al. (2015) use US patent data from 1790 to 2010 and characterize invention as a combinatorial process. They show that the combinatorial process of innovation highlights an invariant rate of “exploitation,” i.e., improvements of existing technological combinations, and “exploration,” i.e., the creation of new technological combinations. They also show that despite the very low rate of introduction of new technologies, the latter generate an almost infinite space of technological configurations. Lin and Lincoln (2017) use confidential microdata from the US Census and several different estimate procedures to establish that, when US firms export, improving intellectual property rights affects the access to new varieties of products coming from technologically advanced countries. Johnson et al. (2019) use more than 350,000 US citations of patents and a multivariate regression to find that physical distance is becoming less meaningful for impacting spillovers in the energy sector. However, this spillover effect differs from one energy subsector to another.

Energy and CO2 emissions

Many studies have addressed the issue of renewable and non-renewable energy consumption and their impact on carbon emissions (Ang 2007; Belloumi 2009; Ozturk and Acaravci 2010; Apergis and Payne 2011; Sadorsky 2012; Ozcan 2013; Al-Mulali et al. 2014; Shahbaz et al. 2014; Ito 2017; Chandio et al. 2019). Ben Jebli and Ben Youssef (2015) highlight the existence of short-run unidirectional causality running from imports, exports, GDP, carbon emissions, and non-renewable energy consumption to renewable energy consumption, for the case of Tunisia. Inglesi-Lotz and Dogan (2018) estimate the determinants of CO2 emissions for the ten biggest electricity generators in Sub-Saharan Africa by means of panel techniques robust to cross-dependence. They establish that increasing renewable energy consumption reduces pollution, while the opposite result is obtained for non-renewable energy. Ben Jebli et al. (2020) study the relationships between renewable energy consumption, industrial value added, service value added, economic growth, and carbon emissions by considering a panel of 102 countries. They show that renewable energy consumption decreases CO2 emissions in all countries, except the lower-middle income countries.

Other studies have been concerned by the USA. Payne (2009) uses US annual data between 1949 and 2006 and shows the absence of Granger causality between economic growth and renewable or non-renewable energy consumption, supporting the neutrality hypothesis. Bowden and Payne (2009) use US annual data covering 1949–2006 and come to the conclusion that the relationship between energy consumption and economic growth is not homogeneous and depends on the considered sectors. In particular, primary energy consumption in the industrial sector Granger-causes economic growth. Soytas et al. (2007) show the absence of long-run causality running from GDP to carbon emissions in the USA. However, there is a long-run causality running from energy consumption to carbon emissions. Menyah and Wolde-Rufael (2010) use US data for the period 1960–2007 and show the absence of causality running from renewable energy consumption to CO2 emissions because renewable energy consumption was not sufficiently important in the US energy mix.

Dogan and Turkekul (2016) use data on the USA for the period 1960–2010 to invalidate the environmental Kuznets curve (EKC) hypothesis. In the long run, energy consumption and urbanization increase carbon emissions, while trade reduces it. Granger causality tests show the presence of bidirectional causalities between CO2 emissions and the three variables GDP, energy consumption, and urbanization, and between GDP and the two variables urbanization and trade openness. Dogan and Ozturk (2017) use US annual data from 1980 to 2014. Their long-run ARDL estimates confirm that the EKC hypothesis is not verified and that an increase in non-renewable energy consumption increases carbon emissions, whereas renewable energy reduces CO2 emissions. Shahbaz et al. (2017) examine the environmental Kuznets curve hypothesis for the US by considering annual data between 1960 and 2016. The relationship between economic growth and carbon emissions is shown to be inverted U-shaped and even N-shaped. Biomass energy consumption, exports, imports, and trade openness reduce CO2 emissions. There is bidirectional Granger causality between carbon emissions and biomass energy consumption, and GDP Granger causes carbon emissions.

Our literature review highlights the need for econometric studies linking foreign R&D externalities to polluting emissions and the consumption of renewable energy. Several other interesting questions related to the empirical relationships between R&D, foreign R&D externalities, the consumption of renewable energy, and net energy imports are also worth examining and will be assessed in this study.

Data and econometric analysis

Data and stationary tests

Our annual data collected on the United States go from 1980 to 2016 and include the following variables: (a) resident patent applications (RP, rp); (b) non-resident patent applications (NRP, nrp) are from applicants outside the USA; (c) gross domestic product (GDP, y) in constant 2010 US $; (d) net energy imports (NEI, nei), measured in oil equivalents, are in 1000 barrels per day (bbl/d) and are estimated as energy use less production; (e) renewable electricity (RE, re) net generation is measured in billion kilowatt hours (kwh); (f) fossil energy consumption (FE, fe), measured in Quad Btu, comprises coal, natural gas, petroleum, and other liquids; and (g) carbon dioxide emissions (CO2, e), in million metric tons (MM tons), comprise emissions coming from the consumption of petroleum, natural gas, coal, and natural gas flaring.

All data are obtained from the World Bank (2019) except those about renewable energy, fossil energy, and carbon emissions, which are obtained from the US Energy Information Administration (2019). We were limited by the availability of data, and it was not possible to use monthly or quarterly data. Data are expressed in natural logarithmic form before conducting the econometric analysis. All computations are done with Eviews 10 software.

Our econometric study begins by testing the stationary of our variables. The following two tests are considered: augmented Dickey and Fuller (1979) and Phillips and Perron (1988) unit root tests. For both tests, the three cases of intercept, intercept and trend, and no intercept and trend are considered and they come to the same conclusions. However, only the case of intercept and trend is provided in Table 1. It is shown that all our considered variables are not stationary at level but they become stationary after first difference. Therefore, we can conclude that all our considered variables are integrated of order one, i.e., are I (1).

Cointegration and long-run elasticities

This study tries to evaluate some interesting elasticities between variables. However, considering all our seven variables in the same model does not provide statistically significant results because of, among other things, the high correlation between some considered variables. For this reason, models 1–10 are considered and estimated:

Where ci are the constant terms; αi, βi, γi, and λi represent the elasticity of the dependent variable with respect to the corresponding independent variable; εit are the residual terms.

For each equation, long-run cointegration between variables and long-run elasticities are determined by using the autoregressive distributed lag approach developed by Pesaran and Pesaran (1997), Pesaran and Smith (1998), and Pesaran et al. (2001). This ARDL technique has several advantages with respect to other cointegration techniques because it can provide good estimate results even with small samples, and endogeneity problems are avoided. It has been used in several papers like Dogan (2016), Shahbaz et al. (2017), and Chandio et al. (2019). When Zt is the dependent variable and Xit, i = 1, …k are the independent variables, the ARDL equation can be written as:

Where the first differences and the error terms are denoted by Δ and εt, respectively. The numbers of lags are denoted by pj, j = 0, 1, …, k, and the estimated coefficients are c, δji, θj. The optimal number of lags could be chosen by using the Akaike information criterion (AIC). According to Pesaran et al. (2001), we compare the estimated Fisher-statistics (F) of the Wald’s test to the following two critical values: when it is higher than the upper value I(1), there is cointegration between variables; when it is weaker than the lower value I(0), there is no cointegration; lastly, when the Fisher statistics is between I(0) and I(1), this test is inconclusive. For the robustness of our results, we check for normality, heteroskedasticity, and serial correlation of residues. Table 2 gives the results of our cointegration analysis showing that for each considered Eqs. (1)–(10), there is long-run cointegration between the considered variables.

In Table 3, long-run elasticities are established and most of them are statistically significant. Because the number of elasticities is very high (31, without the constants), only some of them will be discussed. Increasing non-resident patents reduces carbon dioxide emissions in the long-run in the USA. This shows the presence of an important green absorptive capacity as foreign research and development efforts, i.e., R&D externalities, are significant in the USA and serve to reduce pollution and protect the environment. This constitutes an interesting finding as, to the best of our knowledge, no preceding empirical study has evaluated the impact of foreign R&D investments on home pollution. More interestingly, increasing resident patents increases carbon emissions in the USA. This shows that the foreign technologies used in the USA are cleaner than those developed in this country perhaps because there are insufficient incentives for research in cleaner technologies. This result is similar to that of Cheng et al. (2019) who found that environmental patents increase CO2 emissions significantly at the 95th quantile for the BRIICS countries. As expected, the increase in net imports in energy, which are comprised mainly by fossil energy, increases carbon emissions. The long-run impact of renewable energy use on emissions is negative but not statistically significant because the proportion of renewable energy used with respect to fossil energy is still weak in the USA. Indeed, in 1990 and 2015, the percentage of renewable energy consumption with respect to total final energy consumption was 4.175 and 8.717, respectively (World Bank 2019). Our result is in accordance with those of Dogan and Ozturk (2017) and Shahbaz et al. (2017) studies on the USA and that of Ben Jebli et al. (2020) study on a panel of 102 countries showing that renewable energy consumption reduces carbon missions.

Three models are used to express the long-run impact on renewable energy consumption (models 2–4) because it was econometrically impossible to take some exogenous variables, like NRP and RP, in the same model. Both non-resident and resident patents contribute to increase renewable energy consumption in the USA. This constitutes an interesting result not reached before by the literature. However, the increase in CO2 emissions or in fossil energy consumption seems to reduce renewable energy consumption denoting the fact that RE and FE are still substitute goods in the USA. This result is in accordance with that reached by Ito (2017) study on a panel of 42 developing countries. Interestingly, the increase in net energy imports increases renewable energy consumption. This expresses the long-run interest of the USA about its energy security and the heavy fossil energy bill it has to pay when its net fossil energy imports are increased. Again, this is a new and worth considering result.

Models 5–7 consider economic growth as dependent variable. As expected, both NRP and RP have a positive long-run impact on GDP. Thus, administrative facilities should be provided to use non-resident patents, and both administrative facilities and R&D subsidies should be provided for resident patents use. Both renewable and fossil energy consumptions increase economic growth. These results are similar to those achieved by Dogan (2016) and Pao and Fu (2013) studies on Turkey and Brazil, respectively, and showing that non-renewable energy and renewable energy consumption, respectively, increase economic growth in the long-run. However, net energy imports reduce economic growth because of their heavy bill. Since more carbon emissions means more fossil energy consumption, economic growth is boosted by the former.

In model 8, we learn that non-resident patents have a long-run positive impact on resident patents. Thus, foreign R&D spillovers encourage home innovation and patenting in the USA. This constitutes a new and interesting result not reached before by the literature for the USA case or anywhere. In the long-run, an increase in net energy imports increases resident patents because this pushes the USA to more R&D efforts for energy efficiency and renewable energy use. Economic growth enables to get the necessary money for R&D investments and thus increases resident patents.

Model 9 shows that an increase in resident patents increases the ability of firms to use the innovations developed abroad and thus increases their used non-resident patents. An increase in net energy imports incites the USA to more R&D efforts for energy efficiency and renewable energy use, and this seems to decrease the used non- resident patents.

In the long-run, non-resident patents’ increase may imply more fossil energy use and thus more net energy imports. Despite this, non-resident patents ends to be less polluting as shown by model 1 because they induce less polluting technologies use. As expected, an increase in renewable energy consumption reduces net energy imports, and the contrary occurs with an increase in fossil energy consumption.

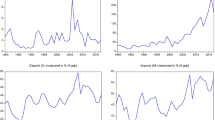

The stability of our long-run estimated coefficients is verified by using the cumulative sum (CUSUM) and the cumulative sum of squares (CUSUM of squares) statistics developed by Brown et al. (1975). When the graphs for these statistics are within the critical limits of 5%, we can assume that the estimated coefficients of a given regression are stable. The results of these statistical tests are shown graphically in Figs. 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, indicating that the statistics are well within the critical values at the 5% level of significance. Thus, all the estimated long-term coefficients of our ARDL regressions are stable.

Granger causality

It is worth considering knowing the causalities between our variables, and their directions by following the Engle and Granger (1987) procedure. For this purpose, and since all our variables are integrated of order one, i.e., are I(1), we will use the vector error correction model. When a given model comprises k variables Xi, i = 1, …k,to construct its VECM representation, we have to take at each time one variable as dependent and the other variables become independent giving an error correction model (ECM) representation. Suppose Xm, m = 1, …, k is the dependent variable, then the ECM representation of our model is:

Where Δ denotes the first difference operator; q designates the vector autoregressive (VAR) lag length; ECTt − 1 is the lagged error correction term; τm designates the adjustment speed from the short to the long-run equilibrium; υm, t denotes the residual term.

A precondition for running the VECM model is that variables are cointegrated in the long-run. We will follow the following three steps. First, we determine the optimal lag length by running the standard vector autoregressive model with a maximum lag equal to two, and by using the following several criteria: Hannan-Quinn (HQ) information criterion, log likelihood (LogL), log likelihood ratio (LR), final prediction error (FPE), Akaike information criterion, and Schwarz information criterion (SIC). Table 4 shows that the optimal lag to be considered is one.

For the second step, we use the Johansen and Juselius (1990) cointegration test to prove the existence of a long-run cointegration between our variables. Table 5 gives the results for the intercept and no trend case for the trace statistic. It shows that there are four cointegrating equations at the 5% significance level. We obtain the same conclusion with the Max-eigenvalue test. Thus, we conclude that there is a long-run relationship between our variables and we can run the VECM model.

For each equation related to the dependent variable Xm, in system Eq. (12), the Wald test (Fisher statistics) is used on the estimated parameters ψm, j, i to prove the existence of a short-run causality running from the variable Xj to Xm. When the estimated parameter τm is negative and significant (t Student), we conclude to the existence of a long-run causality running from all the independent variables to Xm. The robustness of the VECM is checked by the Portmanteau autocorrelation test for residuals. For instance, there is no residual autocorrelation up to lag 3 as the Q-statistic is equal to 118.145 with a probability of rejecting the null hypothesis of 0.91, and the adjusted Q-statistic is equal to 126.464 with a probability of 0.787. Our short and long-run causalities are reported in Table 6.

Table 6 shows that only the error correction term of the economic growth equation is negative and statistically significant, meaning the presence of a long-run unidirectional causality running from all considered variables to economic growth. This confirms our long-term elasticities established in the “Cointegration and long-run elasticities” section for Eqs. (5), (6), and (7), to say that non-resident patents, resident patents, renewable energy consumption, fossil energy consumption, and carbon emissions have a positive unidirectional long-run causality on economic growth. However, net energy imports have a negative unidirectional long-run causality on economic growth. Our results are contrary to those of Dogan and Turkekul (2016) and Shahbaz et al. (2017) who found a long-run unidirectional causality running from economic growth to energy or biomass energy consumption, respectively, in the USA. Moreover, Chandio et al. (2019) established short-run bidirectional causality between industrial oil consumption and economic growth for the case of Pakistan.

There are short-run unidirectional causalities running from net energy imports to fossil energy consumption and to carbon emissions. Indeed, more imports of energy imply more fossil energy consumption and its corresponding emission of pollution. We find a short-run unidirectional causality running from net energy imports to non-resident patents. When NEI are reduced because of several reasons including an increase in fossil fuel prices or military conflicts, there is an increase in non-resident patents use for more energy efficiency or cleaner energy processes. This may be explained by the lower cost of fossil energy imported from the Middle East compared to the cost of fossil energy produced in the USA. Again, this is a worth considering result not addressed before by the literature. A short-run unidirectional causality running from NEI to renewable energy consumption exists because the high bill of fossil energy imports incites the USA to consume alternative energies like renewable energy.

There is a short-run unidirectional causality running from economic growth to renewable energy consumption because growth needs more energy and renewable energy. This result is similar to that reached by Menyah and Wolde-Rufael (2010) for the USA. We find a short-run unidirectional causality running from economic growth to resident patents use because economic growth enables to get the necessary funds for making R&D. Finally, a unidirectional causality running from fossil energy to renewable energy is found and explains the substitutability between these two energy sources even in the short-run. This result differs from that reached by Apergis and Payne (2012) study on a panel of 80 countries showing the presence of short-run bidirectional causality between renewable and non-renewable energy consumption, and from that reached by Dogan (2016) study on Turkey showing the absence of short-run causality between renewable and non-renewable energy consumption.

Conclusion

This research evaluates the relationships between non-resident patents, resident patents, renewable energy consumption, fossil energy consumption, net energy imports, carbon emissions, and economic growth. It uses annual data on the USA covering the period 1980–2016. To evaluate long-run elasticities, 10 models have been estimated with the autoregressive distributed lag approach. Our variables are shown to be cointegrated in the long-run, and a unique vector error correction model has been considered for Granger causality analysis. Several obtained results are interesting and have not been achieved before in literature.

An increase in non-resident patents reduces CO2 emissions in the long-run in the USA. This denotes the existence of an important green absorptive capacity as foreign research and development efforts, i.e., R&D externalities, are significant in the USA and promote pollution reduction and environment protection. This is an interesting finding because, to the best of our knowledge, no previous econometric study has evaluated the impact of foreign R&D externalities on home pollution. More curious, an increase in resident patents led to an increase in carbon emissions in the USA. This shows that the foreign technologies used in the United States are cleaner than those developed in that country, perhaps because the incentives for research in cleaner technologies are insufficient. There are short-term unidirectional causalities ranging from net energy imports to fossil fuel consumption and to carbon emissions. Indeed, the increase in net energy imports implies a greater consumption of fossil energy and its corresponding pollution emissions. That is why we find that, in the long-run, NEI increase carbon emissions. The long-term impact of the use of renewable energies on emissions is negative but not statistically significant because the proportion of the used renewable energy, compared with fossil fuels, is still low in the USA.

Non-resident and resident patents are increasing the consumption of renewable energy in the United States. This is an interesting result that the literature has not achieved before. In addition, a unidirectional causality ranging from fossil energy to renewable energy is found, and the long-run impact of increasing FE is to reduce RE. This indicates that renewable energy and fossil energy are still substitutes in the USA, even in the short-run. Interestingly, a short-run unidirectional causality running from NEI to renewable energy consumption exists, and in the long-run, the increase in net energy imports increases the consumption of renewable energy. This expresses the long-term interest of the United States in its energy security and the hefty fossil fuel bill that it has to pay when its net imports of fossil energy increase, inciting the USA to consume alternative energies like renewable energy. Again, this is a new and interesting result to consider.

We show that all our considered variables have a long-run unidirectional causality on economic growth. However, there is a short-term unidirectional causality ranging from economic growth to renewable energy consumption because growth needs more energy and renewable energy, and to resident patents because growth enables to get the required funds for doing R&D. As expected, both NRP and RP have a long-term positive impact on economic growth. Thus, administrative facilities should be provided for the use of non-resident patents, and administrative facilities and R&D grants should be provided for the creation and use of resident patents. While the consumption of renewable and fossil energy increase economic growth, net energy imports reduce economic growth due to their high cost.

We learn that non-resident patents have a positive long-term impact on resident patents. Therefore, spillovers from foreign R&D encourage domestic innovation and patenting in the United States. This constitutes a new and interesting result that has not been reported before in literature. In the long run, an increase in net energy imports increases residents patents, as it pushes the United States into more R&D efforts for energy efficiency and use of renewable energy. On the other hand, an increase in resident patents increases the capacity of companies to use innovations developed abroad, and therefore increases their used non-resident patents. We find a short-term unidirectional causality ranging from net energy imports to non-resident patents, and we show that NEI reduce NRP in the long-run. Indeed, when NEI are reduced for a number of reasons, including higher fossil fuel prices or military conflicts, there is an increase in the use of non-resident patents for cleaner energy processes or more energy efficiency. This can be explained by the lower cost of fossil fuels coming from the Middle East compared to those produced in the United States. Again, this is a result to consider that has not been addressed before in literature.

The huge number of obtained results led to several policy recommendations. Our main recommendations are the following: (a) the USA should encourage companies to benefit from foreign R&D spillovers through non-resident patents use. This can be done by facilitating administrative formalities. This will reduce carbon emissions, increase the consumption of renewable energy, boost R&D through more resident patents use, and increase economic growth; (b) the USA should encourage R&D, and particularly R&D in cleaner technologies, and the use of resident patents should be made more accessible and less costly. This will induce more use of non-resident patents and renewable energy, and more economic growth; (c) encouraging renewable energy use by the appropriate economic instruments like subsidies or pollution taxation induces less fossil fuel imports and increases economic growth. Ultimately, global warming could be combated when renewable energy becomes more important in the US energy mix.

References

Acs ZJ, Anselin L, Varga A (2002) Patents and innovation counts as measures of regional production of new knowledge. Res Policy 31:1069–1085

Ahuja G, Novelli E (2017) Activity overinvestment: the case of R&D. J Manag 43:2456–2468

Al-Mulali U, Fereidouni HG, Lee JYM (2014) Electricity consumption from renewable and non-renewable sources and economic growth: evidence from Latin American countries. Renew Sustain Energy Rev 30:290–298

Ang JB (2007) CO2 emissions, energy consumption, and output in France. Energy Policy 35:4772–4778

Apergis N, Payne JE (2011) The renewable energy consumption–growth nexus in Central America. Appl Energy 88:343–347

Apergis N, Payne JE (2012) Renewable and non-renewable energy consumption growth nexus: evidence from a panel error correction model. Energy Econ 34:733–738

Belloumi M (2009) Energy consumption and GDP in Tunisia: cointegration and causality analysis. Energy Policy 37:2745–2753

Ben Jebli M, Ben Youssef S (2015) The environmental Kuznets curve, economic growth, renewable and non-renewable energy, and trade in Tunisia. Renew Sust Energ Rev 47:173–185

Ben Jebli M, Farhani S, Guesmi K (2020) Renewable energy, CO2 emissions and value added: empirical evidence from countries with different income levels. Struct Chang Econ Dyn 53:402–410. https://doi.org/10.1016/j.strueco.2019.12.009

Ben Youssef S (2011) Transboundary pollution and absorptive capacity. Environ Model Assess 16:205–211

Ben Youssef S, Zaccour G (2014) Absorptive capacity, R&D spillovers, emissions taxes and R&D subsidies. Strateg Behav Environ 4:41–58

Bowden N, Payne JE (2009) The causal relationship between US energy consumption and real output: a disaggregated analysis. J Policy Model 31:180–188

Bravo-Ortega C, Cusolito AP, Lederman D (2016) Faraway or nearby? Domestic and international spillovers in patenting and product innovation. World Bank Group, Latin America and the Caribbean Region, Office of the Chief Economist. Policy research working paper 7828

Brown RL, Durbin J, Evans JM (1975) Techniques for testing the constancy of regression relations over time. J R Stat Soc Ser B 37:149–163

Chandio AA, Rauf A, Jiang Y, Ozturk I, Ahmad F (2019) Cointegration and causality analysis of dynamic linkage between industrial energy consumption and economic growth in Pakistan. Sustainability 11:4546

Cheng C, Ren X, Wang Z, Yan C (2019) Heterogeneous impacts of renewable energy and environmental patents on CO2 emission—evidence from the BRIICS. Sci Total Environ 668:1328–1338

Chung MY, Lee K (2015) How absorptive capacity is formed in a latecomer economy: different roles of foreign patent and know-how licensing in Korea. World Dev 66:678–694

Cohen WM, Levinthal DA (1989) Innovation and learning: the two faces of R&D. Econ J 99:569–596

Congressional Research Service (2019) Renewable energy and energy efficiency incentives: a summary of federal programs. CRS Report 40913. Accessed at: https://crsreports.congress.gov

D’Aspremont C, Jacquemin A (1988) Cooperative and noncooperative R&D in duopoly with spillovers. Am Econ Rev 78:1133–1137

D’Aspremont C, Jacquemin A (1990) Cooperative and noncooperative R&D in duopoly with spillovers: erratum. Am Econ Rev 80:641–642

Dickey DA, Fuller WA (1979) Distribution of the estimators for autoregressive time series with a unit root. J Am Stat Assoc 74:427–431

Dogan E (2016) Analyzing the linkage between renewable and non-renewable energy consumption and economic growth by considering structural break in time-series data. Renew Energy 99:1126–1136

Dogan E, Ozturk I (2017) The influence of renewable and non-renewable energy consumption and real income on CO2 emissions in the USA: evidence from structural break tests. Environ Sci Pollut Res 24:10846–10854

Dogan E, Turkekul B (2016) CO2 emissions, real output, energy consumption, trade, urbanization and financial development: testing the EKC hypothesis for the USA. Environ Sci Pollut Res 23:1203–1213

Energy Information Administration (2019) International energy outlook. Accessed at: www.eia.gov/forecasts/aeo

Engle RF, Granger CWJ (1987) Co-integration and error correction: representation, estimation, and testing. Econometrica 55:251–276

Farzin YH, Kort PM (2000) Pollution abatement investment when environmental regulation is uncertain. J Public Econ Theory 2:183–212

Fischer C, Newell RG (2008) Environmental and technology policies for climate mitigation. J Environ Econ Manag 55:142–162

Giuliani E, Martinelli A, Rabellotti R (2016) Is co-invention expediting technological catch up? A study of collaboration between emerging country firms and EU inventors. World Dev 77:192–205

Goel RK, Nelson MA (2020) How do firms use innovations to hedge against economic and political uncertainty? Evidence from a large sample of nations. J Technol Transf. https://doi.org/10.1007/s10961-019-09773-6

Goñi E, Maloney WF (2014) Why don’t poor countries do R&D? The World Bank development research group: macroeconomics and growth team. Policy research working paper 6811

Grabiszewski K, Minor D (2019) Economic espionage. Def Peace Econ 30:269–277

Hammerschmidt A (2009) No pain, no gain: an R&D model with endogenous absorptive capacity. J Inst Theor Econ 165:418–437

Ho CH, Huang S, Shi H, Wu J (2018) Financial deepening and innovation: the role of political institutions. World Dev 109:1–13

Inglesi-Lotz R, Dogan E (2018) The role of renewable versus non-renewable energy to the level of CO2 emissions: a panel analysis of sub-Saharan Africa's big 10 electricity generators. Renew Energy 123:36–43

Ito K (2017) CO2 emissions, renewable and non-renewable energy consumption, and economic growth: evidence from panel data for developing countries. Int Econ 151:1–6

Johansen S, Juselius K (1990) Maximum likelihood estimation and inference on cointegration—with applications to the demand for money. Oxf Bull Econ Stat 52:169–210

Johnson DKN, Lybecker KMA, Moore J (2019) Sure, but who has the energy? The importance of location for knowledge transfer in the energy sector. Energy Econ 80:582–588

Jung C, Krutilla K, Boyd R (1996) Incentives for advanced pollution abatement technology at the industry level: an evaluation of policy alternatives. J Environ Econ Manag 30:95–111

Kamien MI, Zang I (2000) Meet me halfway: research joint ventures and absorptive capacity. Int J Ind Organ 18:995–1012

Katila R (2000) Using patent data to measure innovation performance. Int J Bus Perform Manag 2:180–193

Lin JX, Lincoln WF (2017) Pirate's treasure. J Int Econ 109:235–245

Menyah K, Wolde-Rufael Y (2010) CO2 emissions, nuclear energy, renewable energy and economic growth in the US. Energy Policy 38:2911–2915

Milliman SR, Prince R (1989) Firm incentives to promote technological change in pollution control. J Environ Econ Manag 17:247–265

OECD/Eurostat (2018) Oslo manual 2018: guidelines for collecting, reporting and using data on innovation. In: The measurement of scientific, technological and innovation activities, 4th edn. OECD Publishing, Paris/Eurostat. https://doi.org/10.1787/9789264304604-en

Ozcan B (2013) The nexus between carbon emissions, energy consumption and economic growth in Middle East countries: a panel data analysis. Energy Policy 62:1138–1147

Ozturk I, Acaravci A (2010) The causal relationship between energy consumption and GDP in Albania, Bulgaria, Hungary, and Romania: evidence from ARDL bound testing approach. Appl Energy 87:1938–1943

Pao HT, Fu HC (2013) Renewable energy, non-renewable energy and economic growth in Brazil. Renew Sust Energ Rev 25:381–392

Payne JE (2009) On the dynamics of energy consumption and output in the US. Appl Energy 86:575–577

Pesaran MH, Pesaran B (1997) Working with Microfit 4.0: interactive econometric analysis. Oxford University Press, Oxford

Pesaran MH, Smith RP (1998) Structural analysis of cointegrating VARs. J Econ Surv 12:471–505

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J Appl Econ 16:289–326

Phillips PCB, Perron P (1988) Testing for a unit root in time series regressions. Biometrika 75:335–346

Sadorsky P (2012) Energy consumption, output and trade in South America. Energy Econ 34:476–488

Shahbaz M, Khraief N, Uddin GS, Ozturk I (2014) Environmental Kuznets curve in an open economy: a bounds testing and causality analysis for Tunisia. Renew Sust Energ Rev 34:325–336

Shahbaz M, Solarin SA, Hammoudeh S, Shahzad SJH (2017) Bounds testing approach to analyzing the environment Kuznets curve hypothesis with structural beaks: the role of biomass energy consumption in the United States. Energy Econ 68:548–565

Soytas U, Sari R, Ewing BT (2007) Energy consumption, income, and carbon emissions in the United States. Ecol Econ 62:482–489

Sweet C, Eterovic D (2019) Do patent rights matter? 40 years of innovation, complexity and productivity. World Dev 115:78–93

Wiethaus L (2005) Absorptive capacity and connectedness: why competing firms also adopt identical R&D approaches. Int J Ind Organ 23:467–481

World Bank (2019) World development indicators. Accessed at: http://www.worldbank.org/data/onlinedatabases/onlinedatabases.html

Wurlod JD, Noailly J (2018) The impact of green innovation on energy intensity: an empirical analysis for 14 industrial sectors in OECD countries. Energy Econ 71:47–61

Youn H, Strumsky D, Bettencourt LMA, Lobo J (2015) Invention as a combinatorial process: evidence from US patents. J R Soc Interface 12:20150272

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible Editor: Eyup Dogan

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Highlights

- There is a short-run unidirectional causality running from NEI to RE.

- In the long-run, RP increases carbon emissions, whereas NRP reduces it.

- In the long-run, both RP and NRP have a positive impact on RE and GDP.

- RE reduces NEI in the long-run.

Rights and permissions

About this article

Cite this article

Ben Youssef, S. Non-resident and resident patents, renewable and fossil energy, pollution, and economic growth in the USA. Environ Sci Pollut Res 27, 40795–40810 (2020). https://doi.org/10.1007/s11356-020-10047-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-020-10047-0

Keywords

- Non-resident patents

- Resident patents

- Renewable energy consumption

- Carbon dioxide emissions

- Economic growth