Abstract

The impact of the investment in absorptive capacity on transboundary pollution is studied by considering two countries, each of them regulating a firm. Firms can invest in inventive research and in absorptive research to lower their pollution intensity. The absorptive research enables a firm to capture part of the inventive research made by the other one. We show that by means of adequate emission taxes, original and absorptive research and development (R&D) subsidies, regulators can reach the non-cooperative social optimum. Interestingly, we show that the investment in absorptive research enables non-cooperating regulators to better internalize transboundary pollution. The higher is the learning parameter of absorption, the greater is the proportion of transboundary pollution internalized. Therefore, it is recommended for the international community to make the patent laws more flexible and enabling learning from the research made by others more interesting. Moreover, the investment in absorptive R&D may lead to multiple equilibria necessitating non-cooperating countries to coordinate on an equilibrium, which constitutes an incentive for them to cooperate.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The ozone layer depletion and global warming are examples of damages engendered by transfrontier pollution and are caused by the total emissions of gases such as the carbon dioxide. Transboundary pollution is therefore a negative externality between countries which usually does not lead non-cooperating countries to the Pareto-optimality. Nevertheless, some authors showed that non-cooperating governments can reach the first best under some conditions (Hoel [11], Zagonari [20]). By developing a static two-country, two-good general equilibrium model, Takarada [19] investigated the welfare effects of the transfer of pollution abatement technology when cross-border pollution exists. He derived and interpreted the conditions under which technology transfer enriches the donor and the recipient. While the tax competition literature showed that tax rates are set too low in the non-cooperative Nash equilibrium with respect to the cooperative one, Bjorvatn and Schjelderup [5] showed that international spillovers from public goods reduce tax competition. Ben Youssef [1] showed that free research and development (R&D) spillovers and the competition of firms on the common market help non-cooperating countries to better internalize transfrontier pollution.

This paper differs from the existing literature by the fact that we study transborder pollution using a model where firms can invest in absorptive research to capture part of the inventive research developed by others.

Cohen and Levinthal [7] were the first to introduce the idea of absorptive capacity in the cost reduction R&D literature. Contrary to D'Aspremont and Jacquemin [8, 9] and Kamien et al. [13], where R&D spillovers are assumed exogenous and cost free, Cohen and Levinthal [7] showed that the investment in R&D develops the firm's ability to identify, assimilate, and exploit knowledge from the environment. Poyago-Theotoky [18] showed that, when spillovers of information are endogenized, non-cooperative firms never disclose any of their information, whereas they will always fully share their information when they cooperate in R&D. Kamien and Zang [14] modeled a firm's effective R&D level that reflects how both its R&D approach (firm specific or general) and R&D level influence its absorptive capacity. Leahy and Neary [15] specified a general model of the absorptive capacity process and showed that costly absorption both raises the effectiveness of own R&D and lowers the effective spillover coefficient. This weakens the case for encouraging research joint ventures, even if there is complete information sharing between firms. Milliou [17] showed that the lack of full appropriability can lead to an increase in R&D investments. Hammerschmidt [10] distinguished between two types of R&D: inventive (or original) R&D that generates new knowledge and absorptive R&D that allows a firm to benefit from the inventive R&D conducted by others. She found that firms will invest more in R&D to strengthen absorptive capacity when the spillover parameter is higher.

Ben Youssef and Zaccour [2] were the first to integrate into the same model absorptive R&D and pollution control. They have compared the socially optimal levels of original and absorptive research, and the socially optimal subsidies for both types of R&D.

The present model differs from that of Ben Youssef and Zaccour [2] by considering that there is transboundary pollution and, for simplicity, there are no free R&D spillovers between firms which furthermore operate in separate markets.

We consider a three-stage game consisting of two identical regulator-firm hierarchies. Each firm produces one good sold on the domestic market and can invest in original research which directly reduces its emission/output ratio. It can also invest in absorptive research enabling it to benefit from the original research made by the foreign one. A part of the pollution of firm i is exported to country j. Since each firm constitutes a monopoly polluting the (domestic) environment, it is regulated. In this paper, regulators behave non-cooperatively and each of them aims at maximizing his social welfare function to reach the non-cooperative social optimum. In the first stage, each regulator announces a tax per unit of pollution to induce the socially optimal level of pollution and production, a subsidy per unit of inventive research to induce the socially optimal level of inventive research, and a subsidy per unit of absorptive research to induce the socially optimal level of absorptive capacity. In the second stage, each firm invests in R&D, and in the third one, they offer their production to the domestic market.

Interestingly, we show that the investment in absorptive research enables non-cooperating regulators to better internalize transboundary pollution. The higher is the ability to absorb, the greater is the proportion of transboundary pollution internalized. This constitutes an important result of this paper, which is due to the second stage of investment in research. Indeed, transboundary pollution, which is a negative externality between countries, has been mostly studied by static models which showed that transboundary pollution is completely not internalized by non-cooperating countries when the damage function is, as in our model, separable with respect to the pollution remaining at home and the one received from other countries (Mansouri and Ben Youssef [16]). Nevertheless, Ben Youssef [1] showed that free R&D spillovers and the competition of firms on a common market help non-cooperating countries to better internalize transboundary pollution.

In addition, the investment in absorptive R&D may lead to a multiplicity of subgame perfect Nash equilibria necessitating non-cooperating countries to coordinate on an equilibrium, which constitutes an incentive for them to cooperate. Therefore, all the transboundary pollution will be internalized and the first best outcome may be reached.

We also prove that regulators can reach the non-cooperative social optimum by means of the three regulatory instruments which are a per-unit emission tax, a per-unit original research subsidy and a per-unit absorptive research subsidy.

The paper is structured as follows. Section 2 presents the model, in Section 3 we study the reaction of firms, in Section 4 we derive the socially optimal regulatory instruments, and in Section 5 we conclude. An Appendix contains some proofs.

2 The Model

We consider a symmetric model consisting of two countries and two firms. Firm i, located in country i, is a regional monopoly and produces good i in quantity q i sold on the domestic market having the following inverse demand function \( {p_i} = a - b{q_i}, a,b > 0 \) . One reason for the market structure used in this study is that the markets of the industries engaged in large investments in R&D are usually oligopolistic. Also, we suppose that markets are separated for simplicity.Footnote 1

The production process generates pollution and firms can invest in R&D in order to lower their fixed emission/output ratio. We distinguish between inventive or original research, denoted by \( x_i^o \), which directly reduces the emission ratio and costs \( {k^o}{\left( {x_i^o} \right)^2}, {k^o} > 0 \), and absorptive research, denoted by \( x_i^a \), which enables a firm to capture part of the original research made by the other one, and costs \( {k^a}{\left( {x_i^a} \right)^2}, {k^a} > 0. \) For simplicity, we suppose that there are no free R&D spillovers between firms.

The effective R&D level of firm i is:

where l > 0 is a learning or absorptive parameter. Since the firm cannot get as research externality more than the original research developed by the foreign one, we need to have \( 0 \leqslant lx_i^a \leqslant 1 \).

By normalizing the emission per unit of production to one without innovation, the emission/output ratio of firm i is:

Therefore, the pollution of firm i is \( {E_i} = \left( {1 - x_i^o - lx_i^ax_j^o} \right){q_i} \).

Since firm i is a regional monopoly that pollutes the domestic environment, it is regulated. Each regulator behaves non-cooperatively and maximizes his own social welfare function by using three regulatory instrumentsFootnote 2: an emission tax per unit of pollution t i to induce the non-cooperative socially optimal levels of production and pollution, a subsidy per unit of original R&D level \( r_i^o \) and a subsidy per unit of absorptive R&D level \( r_i^a \) to induce the non-cooperative socially optimal levels of effective R&D and emission/output ratio. Therefore, each regulator chooses the non-cooperative socially optimal per-unit emission tax and per-unit R&D subsidies in the first stage given that the reaction of his firm which is it chooses its optimal levels of R&D and production in the second and third stages, respectively. By backward calculations up to the beginning of the game, we determine the subgame perfect Nash equilibrium of this three-stage game.

If we denote the marginal cost of production by θ > 0, the profit of firm i is \( {\Pi_i} = {p_i}\left( {{q_i}} \right){q_i} - \theta {q_i} - {k^o}x_i^{o2} - {k^a}x_i^{a2} \), and its profit net of taxes and subsidies is \( {V_i} = {\Pi_i} - {t_i}{E_i} + r_i^ox_i^o + r_i^ax_i^a \).

Conjecture

We conjecture that\( \mathop {{\lim }}\limits_{{k^o},{k^a} \to + \infty } {x^o} = \mathop {{\lim }}\limits_{{k^o},{k^a} \to + \infty } {x^a} = 0 \).

This conjecture is logical because when the investment cost parameters are very high, it is socially optimal to not invest in R&D.

There are also negative externalities between countries through transborder pollution. Damages caused to country i are \( {D_i} = \alpha {E_i} + \gamma {E_j} \), where α > 0 is the marginal damage of the domestic pollution, and γ > 0 is the marginal damage of the foreign pollution.Footnote 3

The consumer surplus in country i engendered by the consumption of q i is \( C{S_i} = \int_0^{{q_i}} {{p_i}(u)du} - {p_i}\left( {{q_i}} \right){q_i} = \frac{b}{2}q_i^2 \).

The social welfare of a country is equal to the consumer surplus, minus damages and subsidies, plus taxes and the net profit of the domestic firm, and is equal, after simplifications, to:

Notice that taxes and subsidies do not appear in the social welfare function because the tax diminished from the firm's profit is added to the consumer welfare, and the subsidies added to the firm's profit are diminished from the consumer welfare.

3 Firms Behavior

Given the per-unit emission tax and the per-unit R&D subsidies announced by the regulator in the first stage, the firm reacts by choosing its optimal research and production levels in the second and third stages, respectively. By backward induction, the firm maximizes in the third stage its net profit with respect to its production, then, in the second stage, it maximizes its net profit with respect to its R&D levels.

The first order condition of firm i third stage is:

The resolution of (2) gives:

Therefore, the symmetric optimal production level for each firm is:

The first order conditions of firm i second stage areFootnote 4:

and

At the equilibrium, (5) and (6) are simplified by using (2), and the symmetric solutions are given by the following equations systemFootnote 5:

and

where \( q^* \) is given by (4).

4 The Non-Cooperative Socially Optimal Emission Tax and R&D Subsidies

In the first stage, each regulator i maximizes his social welfare, given by (1), with respect to t i , \( r_i^o, \) and \( r_i^a \) which are the choice variables. However, computations may be not easy to do if the regulator looks directly for the optimal per-unit emission tax and per-unit R&D subsidies. Thus, rather than this direct method, the regulator maximizes, respectively in the third and second stages, his social welfare with respect to the production quantity and the R&D levels which become the new choice variables. Then, by equalizing the socially optimal quantities obtained to those chosen by his firm, he determines the socially optimal per-unit emission tax and per-unit R&D subsidies. In fact, the model is resolved as if it was a two-stage one.

Expression (1) can be written as:

Expression (9) shows that, when regulator i chooses his optimal production level in the third stage, then transboundary pollution is completely not internalized since the parameter γ is eliminated by derivation. This is general for static models with a damage function linear with respect to the total pollution, or a separable one with respect to the pollution remaining at home and the one received from other countries.Footnote 6 However, when he chooses his optimal level of inventive research in the second stage, transboundary pollution is partially internalized when the learning parameter is non-nil (l ≠ 0). The higher the absorptive parameter is, the greater proportion of the negative transboundary externality is internalized.

A part of this transboundary pollution is internalized when a country chooses its level of original research because this choice, in the case of a positive learning parameter, affects the emission ratio and, therefore, the pollution of the firm of the other country which, in turn, affects the foreign pollution received.

As it is commonly known, if countries fully cooperate by maximizing the sum of their social welfare functions, then transboundary pollution is completely internalized and the first best may be reached.

The first order condition of regulator i third stage is:

The resolution of (10) gives:

Therefore, the symmetric socially optimal production level for each regulator is:

A sufficient condition for the above production quantities to be positive is:

Thus, the maximum willingness to pay for the good must be higher than its marginal cost of production plus its marginal domestic damage cost.

The first order conditions of regulator i second stage areFootnote 7:

and

At the equilibrium, system (14)–(15) is simplified by using (10), and the symmetric solutions are given by the following equations:

and

By using the expression of \( \hat{q} \) given by (12), (16) and (17) become:

and

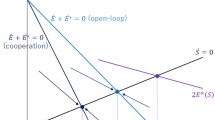

The non-linear equations system (18)–(19), confirms the fact that when the learning parameter is nil (l = 0), transboundary pollution is completely not internalized since γ disappears from (18)–(19). The higher l is, the greater proportion of transboundary pollution is internalized. Thus, we can state the following proposition:

Proposition 1

The investment in absorptive research enables non-cooperating countries to better internalize transboundary pollution. The higher is the ability to absorb, the greater is the proportion of transboundary pollution internalized.

The above result suggests that relaxing patent laws, which can ameliorate the learning ability of firms, may improve the social welfare. However, Cheng and Tao [6] considered a model without transboundary pollution, and have found (in their Proposition 5) that patent enforcement may increase the consumer's welfare.

The resolution of the non-linear equations system (18)–(19) gives the symmetric socially optimal R&D levels denoted by \( {\hat{x}^o} \) and \( {\hat{x}^a} \). Unfortunately, we are not able to get the explicit solutions.

Proposition 2

When\( {k^o} \)and\( {k^a} \)are sufficiently high, there are at least one and at most five couples of real solutions\( {\hat{x}^o} > 0 \)and\( {\hat{x}^a} > 0 \)that solve the non-linear equations system given by (18) and (19).

Proof

See the Appendix.

The above proposition shows the possibility of multiple symmetric equilibria. In this case, non-cooperating regulators have to coordinate on an equilibrium, which constitutes an incentive for them to fully cooperate. Therefore, the possibility to invest in absorptive research may give incentives to cooperate. This result is similar to that found by Mansouri and Ben Youssef [16] who showed that the lack of information of non-cooperating regulators about the cost of production of their respective firms leads to an infinity of equilibria, which may necessitate the coordination on equilibrium.

The socially desired level of absorptive research is strictly positive when the learning parameter is non-nil. Thus, investing in absorption is socially desired. If firms are tempted to under-invest, then subsidies can be used so that they reach the socially desired level.

Condition (13) and the conjecture guarantee that the socially optimal levels of research, production, and pollution are strictly positive, and that \( 0\; < \,l{\hat{x}^a} \leqslant 1 \), when \( {k^o} \) and \( {k^a} \) are high enough.

Since the emission tax and the R&D subsidies are set to incite firms to reach the socially optimal production and research levels which are \( \hat{q} \), \( {\hat{x}^o}, \) and \( {\hat{x}^a} \), then Eqs. (4), (7), and (8) give the optimal emission tax and R&D subsidies:

and

Proposition 3

By using the three regulatory instruments, which are a per-unit emission tax, a per-unit original research subsidy, and a per-unit absorptive research subsidy, regulators can push their firms to implement the non-cooperative socially optimal levels of production and R&D.

The above result is close to what have obtained Benchekroun and Long [3] in a different (dynamic) setup with no investment in R&D. Indeed, they showed that there exists a time-independent tax rule that guides polluting oligopolists to achieve the socially optimum production path. Moreover, Benchekroun and Long [4] showed that there exists a continuum of time-independent tax rules that guide the monopolist to achieve the socially optimum production path.

By using the conjecture, (12) and (20), we obtain:

Thus, when the marginal damage of pollution is sufficiently low, each regulator actually subsidizes pollution (or production) to deal with the monopoly distortion.

and

By using (23) and (24) in (21) and (22), we get:

Proposition 4

When the investment-cost parameters are sufficiently high, the per-unit R&D subsidy for inventive research is higher than the one for absorptive research.

Therefore, when \( {k^o} \) and \( {k^a} \) are high enough, the subsidy for original research is always positive. The investment in absorptive research is socially desired. However, a greater subsidy is given to inventive research. This result is similar to a finding of Jin and Troege [12] who have used a model where firms do not pollute and have showed that, for the society and consumers, the marginal value of innovation expenditure is always higher than that of imitation. Nevertheless, when α is high enough, this result contradicts with that of Ben Youssef and Zaccour [2] who showed that the subsidy for original research can be lower than the one for absorption. We think that this difference is due to the fact that firms operate in separate markets in the present paper.

5 Conclusion

In this paper, we develop a non-cooperative three-stage game played by two regulator-firm hierarchies in presence of transborder pollution. Firms have the possibility to invest in original and in absorptive research to reduce their pollution intensity.

We show that the investment in absorptive research enables non-cooperating countries to better internalize transboundary pollution. The higher the learning parameter of absorptive capacity is, the higher the proportion of transboundary pollution internalized is. Therefore, it is recommended for the international community to make the patent laws less strict and enabling learning from the research made by others more attractive.

Interestingly, the learning ability of firms may lead to multiple subgame perfect Nash equilibria necessitating the coordination on an equilibrium, which constitutes an incentive for non-cooperating countries to fully cooperate. Consequently, transboundary pollution will be completely internalized and the first best outcome may be reached.

Moreover, countries can implement their non-cooperative socially optimal levels of production and research by using three regulatory instruments which are a per-unit emission tax, a per-unit subsidy for inventive research and a per-unit subsidy for absorptive research.

Notes

If we suppose that firms compete on the same common market, then the impact on transboundary pollution of both the competition of firms on the common market and the investment in absorptive capacity are mixed. To clearly highlight the impact of the investment in absorptive research, which is the main contribution of this paper, we should consider the case of separate markets. Since Ben Youssef [1] has shown that opening markets to international trade better internalizes transboundary pollution, we have chosen to not study the case of an integrated market in the present paper.

These three instruments are necessary in this model. Indeed, even if the non-cooperative socially optimal level of pollution can be implemented by only one instrument, such as pollution permits, there is no incentive for firms to implement the socially optimal levels of production and R&D. Thus, the non-cooperative optimal social welfare level cannot be realized.

Notice that, even when α and γ are different, the model still remains symmetric because these parameters are the same for the two countries. This damage function can explain a pure transfrontier pollution problem when α = d(1-c) and γ = dc, where 0 < c < 1 is the proportion of pollution of firm j exported to country i. It can also explain an international environmental problem, when α = γ, because damages in one country become a function of the whole pollution.

The second-order conditions are verified in the Appendix when \( {k^o} \) and \( {k^a} \) are sufficiently high.

We look for the symmetric equilibria because the model is symmetric and computations are easier. As it will be explained in the following section, the backward resolution of the game is stopped at the second stage. That is why we have the right to look for the symmetric equilibria at this second stage.

If damages are not linear, nor separable, then transboundary pollution is partially non-internalized.

The second-order conditions are verified in the Appendix when \( {k^o} \) and \( {k^a} \) are high enough.

References

Ben Youssef, S. (2009). Transboundary pollution, R&D spillovers and international trade. The Annals of Regional Science, 43, 235–250.

Ben Youssef, S., & Zaccour G. (2009). Absorptive capacity, R&D spillovers, emissions taxes and R&D subsidies, HEC Montréal: Les Cahiers du GERAD No. G-2009-41, MPRA Paper No. 16984.

Benchekroun, H., & Long, N. V. (1998). Efficiency inducing taxation for polluting oligopolists. Journal of Public Economics, 70, 325–342.

Benchekroun, H., & Long, N. V. (2002). On the multiplicity of efficiency-inducing tax rules. Economics Letters, 76, 331–336.

Bjorvatn, K., & Schjelderup, G. (2002). Tax competition and international public goods. International Tax and Public Finance, 9, 111–120.

Cheng, L. K., & Tao, Z. (1999). The impact of public policies on innovation and imitation: the role of R&D technology in growth models. International Economic Review, 40, 187–207.

Cohen, W. M., & Levinthal, D. A. (1989). Innovation and learning: the two faces of R&D. The Economic Journal, 99, 569–596.

D’Aspremont, C., & Jacquemin, A. (1988). Cooperative and noncooperative R&D in duopoly with spillovers. The American Economic Review, 78, 1133–1137.

D’Aspremont, C., & Jacquemin, A. (1990). Cooperative and noncooperative R&D in duopoly with spillovers: erratum. The American Economic Review, 80, 641–642.

Hammerschmidt, A. (2009). No pain, no gain: an R&D model with endogenous absorptive capacity. Journal of Institutional and Theoretical Economics, 165, 418–437.

Hoel, M. (1997). Coordination of environmental policy for transboundary environmental problems? Journal of Public Economics, 66, 199–224.

Jin, J. Y., & Troege, M. (2006). R&D competition and endogenous spillovers. The Manchester School, 74, 40–51.

Kamien, M. I., Muller, E., & Zang, I. (1992). Research joint ventures and R&D cartels. The American Economic Review, 82, 1293–1306.

Kamien, M. I., & Zang, I. (2000). Meet me halfway: research joint ventures and absorptive capacity. International Journal of Industrial Organization, 18, 995–1012.

Leahy, D., & Neary, J. P. (2007). Absorptive capacity, R&D spillovers, and public policy. International Journal of Industrial Organization, 25, 1089–1108.

Mansouri, F., & Ben Youssef, S. (2000). Regulation and coordination of international environmental externalities with incomplete information and costly public funds. Journal of Public Economic Theory, 2, 365–388.

Milliou, C. (2009). Endogenous protection of R&D investments. Canadian Journal of Economics, 42, 184–205.

Poyago-Theotoky, J. (1999). A note on endogenous spillovers in a non-tournament R&D duopoly. Review of Industrial Organization, 15, 253–262.

Takarada, Y. (2005). Transboundary pollution and the welfare effects of technology transfer. Journal of Economics, 85, 251–275.

Zagonari, F. (1998). International pollution problems: unilateral initiatives by environmental groups in one country. Journal of Environmental Economics and Management, 36, 46–69.

Author information

Authors and Affiliations

Corresponding author

Additional information

I would like to thank Georges Zaccour for fruitful discussions and two anonymous referees for their useful comments.

Appendix

Appendix

1.1 Second Order Conditions of the Firms Second Stage

Consider the Hessian matrix:

By using the first order conditions given by (5) and (6), we can determine the second derivatives constituting matrix H V which can be written as:

where g i , i = 1, 2, 3, are polynomial functions in t and \( {x^o} \) (symmetric case).

Since \( \mathop {{\lim }}\limits_{{k^o},{k^a} \to + \infty \,} \,{x^o} \) and \( \mathop {{\lim }}\limits_{{k^o},{k^a} \to + \infty \,} \,t \) are finite numbers, then \( {g_i} \) take finite values when \( {k^o} \) and \( {k^a} \) tend to \( + \infty \).

Therefore, when \( {k^o} \) and \( {k^a} \) are sufficiently high:

-

a.

\( \frac{{{d^2}{V_i}}}{{dx_i^{o2}}} < 0 \) and \( \frac{{{d^2}{V_i}}}{{dx_i^{a2}}} < 0 \),

-

b.

\( \det {H_V} = \left( {{g_1} - 2{k^o}} \right)\left( {{g_3} - 2{k^a}} \right) - g_2^2 > 0 \).

Thus, we have a maximum when \( {k^o} \) and \( {k^a} \) are high enough.

1.2 Second Order Conditions of the Regulators Second Stage

Consider the Hessian matrix:

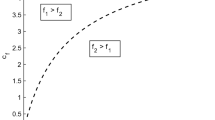

By using the first order conditions given by (14) and (15), we can determine the second derivatives constituting matrix \( {H_S} \) which can be written as:

where \( {f_i} \), i = 1, 2, 3, are polynomial functions in \( x^o \) and \( x^a \) (symmetric case).

Since \( \mathop {{\lim }}\limits_{{k^o},{k^a} \to + \infty } {x^o} = \mathop {{\lim }}\limits_{{k^o},{k^a} \to + \infty } {x^a} = 0 \), then \( {f_i} \) take finite values when \( {k^o} \) and \( {k^a} \) tend to \( + \infty \).

Therefore, when \( {k^o} \) and \( {k^a} \) are high enough:

-

a.

\( \frac{{{d^2}{S_i}}}{{dx_i^{o2}}} < 0 \) and \( \frac{{{d^2}{S_i}}}{{dx_i^{a2}}} < 0 \),

-

b.

\( \det {H_S} = \left( {{f_1} - 2{k^o}} \right)\left( {{f_3} - 2{k^a}} \right) - f_2^2 > 0 \).

Thus, we have a maximum when \( {k^o} \) and \( {k^a} \) are high enough.

1.3 Proof of Proposition 2

From (19), we deduce:

Expression (18) is equivalent to:

By using (25) in (26), and then multiplying by \( {\left( {2b{k^a} - {\alpha^2}{l^2}x^{o2}} \right)^2} \), we get a polynomial function of degree 5 in \( x^o \): \( B\left( {x^o} \right) = 0 \). The constant term of B is \( 4{b^2}\alpha \left( {a - \theta - \alpha } \right){k^{a2}} \)>0 and the coefficient of \( x^{o5} \) is \( - 2b{\alpha^4}{l^4}{k^o} \)<0.

We have B(0) > 0 and \( \mathop {{\lim }}\limits_{x^o \to + \infty } B\left( {x^o} \right) = - \infty \), then \( B(x^o) \) admits at least one and at most five real and positive roots \( \hat{x}^o > 0 \). Since \( \hat{x}^o > 0 \), from expression (25) and condition (13), we have \( \hat{x}^a > 0 \) when \( {k^o} \) and \( {k^a} \) are high enough.

Rights and permissions

About this article

Cite this article

Ben Youssef, S. Transboundary Pollution and Absorptive Capacity. Environ Model Assess 16, 205–211 (2011). https://doi.org/10.1007/s10666-010-9237-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10666-010-9237-z