Abstract

We explore the relationship between carbon dioxide (CO2) emissions, fossil fuels energy consumption (FE), home patents (HP), foreign patents (FP), foreign direct investment (FDI), and Gross Domestic Product (GDP) in South Korea over the period 1980–2018 by employing the autoregressive distributed lag (ARDL) approach. Results reveal that FE, HP, and GDP have positive impacts on CO2 emissions, while FP have a negative impact. Furthermore, FE and FP act positively on GDP, whereas HP and CO2 emissions act negatively on it. In addition, HP, FDI, and GDP have positive effects on FP, and FE harms FP. Granger causality findings reveal that in the long run there will be two-way causality between CO2 emissions, GDP, HP, and FE, while, in the short run, there is one-way causality running from HP, FE, and FP to GDP; from FP to HP; from HP and FP to FE, and from HP and FP to CO2 emissions. Since foreign patents enhance environmental quality and boost economic growth, the South Korean government should encourage the use of foreign patents and promote clean technology home patents.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In 2019, Korea was the 11th highest economy in the world and the seventh-highest exporter of goods. Firms compete in the export market due to innovation induced by patents, and research and development (R&D) expenditures. Indeed, Korea is considered one of the leading countries in research and development, and innovation. It was the world's second-highest country in terms of the ratio of expenditures in R&D to gross domestic product, accounting for 4.36% in 2012 (Ministry of Science 2013). However, South Korea is one of the largest energy consumers in the world, holding ninth place internationally (International Energy Agency, 2019). More than 87% of energy consumption comes from fossil fuels, with oil and coal representing 73% of the national energy mix (Korea Energy Economics Institute, 2019; Korea Electric Power Corporation, 2018). At the same time, South Korea held seventh place in the world in contributing to carbon dioxide emissions in 2017, which accelerated global warming (International Energy Agency, 2019). The increase in carbon dioxide emissions has worsened the global climate, with large-scale impacts on human and natural systems. The examination of the interaction among carbon dioxide (CO2) emissions, gross domestic product (GDP), foreign direct investment (FDI), home patents (HP), foreign patents (FP), and fossil fuel (FE) consumption may have considerable interest in the case of South Korea.

South Korea’s energy consumption is increasing as industrialization and urbanization increase. Thus, the government has worked to achieve energy efficiency and sustainable development. At the international level, Korea signed and ratified the Paris agreement, which seeks to limit the temperature increase to 1.5 °C. The Republic of Korea participated in this movement. To this end, it defined its national goal for 2030 by reducing Greenhouse Gas (GHG) emissions and strives to realize it. It was the first Asian country to initiate a national emissions trading system (United Nations Framework Convention on Climate Change, 2017). Besides, in 2015, South Korea inserted its Emissions Trading System (K-ETS) to treat GHG emissions by employing the market mechanism. K-ETS covers 69% of GHG emissions. Moreover, since 2009 the Korean government has decided to set an objective, which is the creation of green growth engines through technological change and industrial transformation. Some green technologies were dedicated to energy generation technologies, and others were devoted to efficiency improvement. Thus, technology has been considered crucial for accomplishing the green growth strategy objective.

Technologies can play a fundamental role in reducing carbon dioxide emissions. Therefore, the South Korean government pays much attention to the field of research and development, especially technologies that can be commercialized immediately. Under the budget allocation and adjustment plan of 2018, important investments were realized in the basic techniques comprising artificial intelligence. The aim is to double the number of small and medium-sized enterprises (SMEs'), and R&D funding, and increase venture funds considerably to achieve USD 4.2 billion in 2022, from USD 2.7 billion in 2016. To this end, the government will subsidize the wages for some employees to encourage firms. In South Korea, applied research is very well developed, but there is a lack of cutting-edge basic research. Despite the big number of patents registered by Korean firms, the patent commercialization rate remains low.

Korean intellectual property organization (KIPO) and 17 provincial governments initiated the provincial IP Policy Council in 2013 to examine strategies and processes of operation of IP between the national and regional governments. KIPO encourages the entry and improvement of SMEs in the international market. KIPO has supported 1,659 SMEs since the commencement of the program in 2010. In 2018, 205 firms were identified and several penetrated the international market even without previous experience.

Patent applications have been used as a proxy for innovation in a comparatively large number of studies (Balsalobre-Lorente et al., 2018; Herrerias et al., 2016). Research revealed that innovation activity leads to a decrease in environmental pollution as well as energy use. In South Korea, from 1980 to 2018, the number of home patents increased from 1241 to 162,561 (World Bank 2022). This can be explained by the important R&D efforts made by South Korea. During the same period, the number of foreign patents grew from 3829 to 47,431. Therefore, South Korea does not only benefit from its local innovations but also foreign innovations. According to the World Intellectual Property Organisation (2021), South Korea is the 4th in patent applications used after China, the USA, and Japan.Footnote 1 It is also the world leader in patents and industrial designs by origin due to its strong innovation system. Despite the importance of technological change for Korea, no study on Korea has yet focused on the relationship between fossil fuels, CO2 emissions, and patents.

Technological development and innovation can play a prominent role in energy and environmental economics. It can reduce CO2 emissions and other Greenhouse Gases (Alvarez-Herranz et al., 2017). Theoretically, the relationship between energy technologies, innovation, and CO2 emissions has started to be investigated in recent years. However, the empirical finding has remained somewhat meager. Moreover, the relationship between fossil fuel, innovation, R&D, and CO2 emissions has not been studied. Most of the current studies have examined the impact of R&D expenditures on the energy sector and economic growth, but few have focused on the impact of innovation on total emissions (Hille and Lambernd, 2020). To our knowledge, no research has been reported on South Korea examining the impact of innovation on fossil fuels and CO2 emissions. According to the Ministry of Science (2013), South Korea is considered one of the leading countries in innovation. At the same time, it holds seventh place in contributing to carbon dioxide emissions in the world in 2017 (International Energy Agency, 2019). To this end, this study contributes to discovering the underlying links between fossil fuel energy consumption, carbon dioxide emissions, foreign direct investment, patents, and gross domestic product, by considering annual data about South Korea ranging from 1980 to 2018. The autoregressive distributed lag (ARDL) approach is adopted to evaluate long-run elasticities, and the vector error correction model (VECM) approach is used to detect short- and long-run causalities.

The remainder of this paper is structured as follows. The literature review is provided in Sect. 2, and data are presented in Sect. 3. The empirical results are discussed in Sect. 4, and Sect. 5 summarizes policy implications.

2 Literature review

Our review of the literature is divided into three major strands. Firstly, we investigate the relationship between CO2 emissions, fossil fuels, and GDP. Secondly, we explore innovation and absorptive capacity, and lastly, we review prior studies on patents.

The relationship between CO2 emissions and fossil fuels has been the subject of numerous amounts of studies (Magazzino, 2016; Amri, 2017; Dogan and Ozturk, 2017; Magazzino and Cerulli, 2019; Jin et al., 2020; Khan et al., 2020; Ben Youssef, 2020). The findings affirmed that energy consumption and economic growth increased the release of CO2. By using the autoregressive distributed lag (ARDL), Amri (2017), Dogan and Ozturk (2017), Khan et al. (2020), and Ben Youssef (2020) highlighted the positive effect of non-renewable energy on CO2 emissions in Algeria, the USA, Pakistan, respectively. They indicated that an increase in the rate of non-renewable energy per capita led to an increase in CO2 emissions per capita in the short run and the long run as well. Amri (2017) confirmed the existence of the environmental Kuznets curve (EKC) hypothesis, contrary to Dogan and Ozturk (2017) who invalidated the EKC hypothesis. Similarly, Jin et al. (2020) surveyed 71 sample apartment units located in Seoul (South Korea) from May 2017 to April 2018. They revealed that energy consumption increases carbon emissions.

Researchers used different approaches to examine GDP's impact on carbon emissions. Magazzino (2016) in his research in the South Caucasus countries and Turkey over the period 1992–2013 employed the ARDL approach, and Magazzino and Cerulli (2019) research in the Middle East and North Africa (MENA) countries during the period 1971–2013 used responsiveness scores approach. The findings of both studies revealed that real GDP and GDP per capita have a positive impact on carbon emissions.

In South Korea, emissions from energy have increased considerably, surpassing the Organization for Economic Cooperation and Development (OECD) countries' emissions standards defined since 1990 (Oh et al., 2010). Korea needs to establish climate change strategies that take into account the particular influences related to the rise in CO2 emissions in various sectors. According to Song et al. (2015), most new-build developers opt for a geothermal heat pump due to its long life and low cost at the present electricity tariff. Fossil fuel is the source of generation of electric power that ground-source heat pumps use. For Timilsina et al. (2011), when sectors or countries only use the policy of carbon tax, they will not encourage biofuels even when the tax rates are higher. The policy of carbon tax and biofuel subsidy will promote market permeation of biofuels, even though it will engender a higher loss in economic output at the international level. Thus, financing biofuels subsidies by the carbon tax revenue will notably boost using biofuels.

Innovation and absorptive capacity have been well studied. Some studies have addressed the impact of innovation on CO2 emissions. Chen et al. (2019) used a panel quantile regression in five OECD countries and data spanning from 1996 to 2018. They revealed that innovation could enhance environmental quality. Dauda et al. (2021) used data from 1980 to 2018 in some selected African nations. They showed that innovation reduces CO2 release. In addition, they revealed unidirectional causality running from innovation to carbon emissions.

By using a panel technique in 62 countries during the period 2003 to 2018, Zhao et al. (2021) showed the existence of a positive connection between innovation and CO2 released. Besides, they found a causality running from innovation to CO2 emissions.

Cohen and Levinthal (1990) highlighted that absorptive capacity started first for firms and can absorb new technologies and new methods adopted by other firms. Then this concept was developed on the macro-economic scale. The effects of changes and combinations of openness, industrial structure, and innovation on income per capita growth have been studied by Castellacci and Natera (2015) in 18 countries of Latin America between 1970 and 2010 and by Latif et al. (2018) for BRICS between 2000 and 2014. Findings from Castellacci and Natera (2015) show that the combination of policies that countries adopt to catch up changes the growth trajectories. Besides, there is a big relationship between the policy strategy adopted and growth performance. Economies that mix the imitation and innovation policies proved a rate of growth superior to those that adopt only the imitation policy. Savin and Egetokun (2016) used a model of innovation networks with the endogenous absorptive capacity to complete the idea of strategic R&D alliances. Knowledge and R&D investment allocation affect absorptive capacity that leads to a partner selection. In small industries with restricted involuntary spillovers and abounding voluntary ones, some network strategies payoff. This special finding is guided by endogenous absorptive capacity. Grabiszewski and Minor (2019) show that the increase in counterintelligence measures may bring the search effect of increasing national R&D and reducing economic espionage by foreigners. Goel and Nelson (2020) used data from 135 countries to show that sole proprietorships and firms performing R&D activities were more expected to introduce innovations, while firms located in island countries were less expected to do so. It seems then that the size and vintage of the companies did not have a significant influence on innovation.

With regard to patents, literature on foreign patents indicated a significant increase in research. Hu and Jaffe (2003) utilized patent citations as an indicator of the flow of acquaintance to investigate the knowledge spread models from Japan and the USA to Korea and Taiwan. Results show that probably Korean patents refer to Japanese patents more than US patents, whereas Taiwanese innovators learn from both. Furthermore, Korea and Taiwan rely on comparatively new technology. According to Branstetter and Kwon (2018), the exchange rate has a significant and positive impact on R&D spending. South Korean exporting companies producing goods similar to Japanese ones had more sensitivity to exchange rate changes than exporting companies whose goods were less similar to Japanese products because of the appreciated value of the Japanese yen. There is a link between cause and effect between R&D expenditure and external demand. Jung and Imm (2002) utilized the national patent data of Korea, Taiwan, and the USA from 1988 to 1998 to study the patent issuance rate of Taiwan and Korea. The Taiwanese rate of granting US patents has steadily risen, while there is a fluctuation in the Korean one.

Ben Youssef (2020) estimated the effect of non-domestic research and development (R&D) spillovers on pollution and renewable energy consumption for the USA over the period 1980 to 2016 using the autoregressive distributed lag approach. He found that foreign patents used in the USA are cleaner than resident technologies. An increase in non-resident patents reduces CO2 emissions in the long run in the USA.

As regards the home patents, Hille and Lambernd (2020) studied the relationship between technological change and corresponding energy intensities in South Korea from 2002 to 2017. They note that the technical impact induced by revenues, trade openness, public environmental spending, and innovation decreases the overall energy intensity. The technical impact decreases the intensity of oil and electricity usage and raises the intensity of renewable energy consumption. Coal consumption decreases are due to higher public spending, innovations, and trade openness. Reducing the consumption of natural gas seems difficult to realize. Few studies have empirically examined the relationship between patents, fossil fuels, and CO2 emissions. The case of Korea provides an excellent opportunity to examine this relationship. In our study, we chose home and foreign patents as proxies for domestic innovation and absorptive capacity, respectively.

3 Data and models

The data required for the present study are drawn from the WORLD DATA ATLAS (2022) and the World Bank (2022) and cover the period 1980 to 2018. It involves fossil fuels energy consumption (FE) measured in percentage of total energy use; carbon dioxide (CO2) emissions measured in kilotons; foreign direct investment (FDI) measured in percentage of GDP; gross domestic product (GDP) measured in constant 2010 USD; home patents (HP) and foreign patents (FP) measured in the number of patents. Data on fossil fuels are collected from Energy Information Administration (Energy Information Administration, 2022), and all other variables are from the World Bank (World Bank, 2022). The time series is limited to the year 2018 due to its availability.

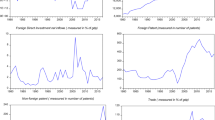

The descriptive statistics of the selected time series are displayed in Table 1. We examined them before the logarithmic transformation of the variables. Some descriptive estimates (mean, maximum, minimum) were made to assess the tendency of CO2 emissions, foreign direct investment, gross domestic product, foreign patents, home patents, and fossil fuel energy consumption in South Korea from 1980 to 2018. The curves of our selected variables are plotted in Fig. 1. According to these statistics data and plots, the tendency of foreign direct investment is not stable over time; it rises and then falls. It reached a peak in 2000, 2004, 2008, and 2013, and then it dropped from 2013 to 2015. The highest value of the foreign direct investment was 2.15% of GDP in 1999. Regarding the CO2 emissions plot, its trend is upward with a little decrease in 1998. Gross domestic product is steady over time with almost the same scale of growth. The trends of home patents and foreign patents are upward with some fluctuations. A continued decrease was observed in the fossil fuels energy consumption plot.

In this study, we aim to investigate the relationship between CO2 emissions, foreign direct investment, gross domestic product, foreign patents, home patents, and fossil fuel energy consumption.

The following model will be developed:

The log-linear equation to examine the long-run relationship between variables is given as follows:

where t, α0, and ε represent the time, the constant, and the white noise stochastic disturbance term, respectively. The coefficients α1, α2, α3, α4, and α5 are the long-run elasticities corresponding to each explanatory variable.

4 Empirical results and discussion

4.1 Unit root outcomes

Unit root tests (Augmented Dickey and Fuller (Dickey and Fuller, 1979) and Phillips and Perron (1988) were employed to investigate the stationarity of the variables. The order of integration was measured to test whether the variables are integrated of order zero (I (0)) or order one (I (1)). Such tests are considered at the level and after the first difference for all variables in question. The null hypothesis in both tests is the existence of a unit root, whereas its alternative hypothesis is the stationary nature of the variables. The unit root tests were carried out in the intercept, trend, and intercept, and none cases. The ADF and P-P unit root test outcomes (Table 2) show a non-stationary condition for all variables at the level, but after the first difference, they become stationary at the 1% significance level. Therefore, the ARDL cointegration method for lag was employed (Table 3).

4.2 Cointegration and diagnostic tests

The ARDL co-integration approach is employed in this paper for its benefits over other econometric methods like Pesaran and Pesaran (1997), Pesaran and Smith (1998). This approach was applied by Pesaran et al. (2001). It offers additional benefits relating to sample size, degree of stationary integration, endogeneity, and coefficient estimates. This approach is appropriate for the small sample and provides good results. Moreover, time series can be integrated at I (0) or I (1), or a combination of both. This technique resolves the endogeneity problem. It has also been applied in various works like Chandio et al. (2019), Ben Youssef (2020), and Ghorbal et al. (2022). The ARDL equation is presented as follows:

where ∆, ε, and q indicate the first difference operator, the error term, and the number of lags, respectively.

The results from the ARDL cointegration are displayed in Table 3. The calculated Fisher statistic and the critical value are compared.

The diagnostic tests prove that there is no heteroscedasticity and no residual autocorrelation. They also indicate that residues are well normally distributed in models where carbon emissions, foreign patents, and economic growth are dependent variables.

4.3 Long-run elasticity test

Long-term elasticities are performed using the ARDL model representation. The long-run equilibrium relationship between estimated variables using the ARDL method is reported in Table 4.

Carbon dioxide emissions as the dependent variable; an increase in GDP triggers the CO2 emissions release in South Korea in the long term. This can be explained as follows. Factories in South Korea, which use a lot of fossil fuels, contribute greatly to economic growth. This result complies with studies of Bakhsh et al. (2017) in Pakistan, Muhammad (2019) in MENA, and Munir et al. (2020) in the ASEAN-5 countries.

It has been shown that a positive variation in foreign patents decreases CO2 emissions in Korea in the long term. Foreign patents improve environmental quality. South Korea is a developed country; although it uses fossil fuels in its local production, foreign patents should be clean and use green sources. This result is consistent with the study of Ben Youssef (2020) in the case of the USA as well as Adebayo et al. (2022) for Sweden.

However, a positive shift in home patents contributes to environmental degradation in Korea in the long term. This highlights that foreign technologies employed in South Korea are more environmentally friendly than domestic technologies, which could be due to a lack of stimulus for green technologies use. This outcome is in line with Ben Youssef (2020) in the case of the USA, Cheng et al. (2019) for the BRICS countries, and Demir et al. (2020) for Turkey. Fossil fuels act to increase CO2 emissions. This result is expected as fossil energies always cause environmental quality deterioration.

Gross domestic product (GDP) is the dependent variable; home patents act negatively on the gross domestic product. This may be because the production of patents is expensive in South Korea, which leads to a negative impact on economic growth. In developed countries like South Korea, patents are more expensive, which explains the negative relationship between GDP and national patents. This result is different from that of Bayarcelik and Taşel (2012) who found that the long-run relationship between GDP and patents is positive, but the short-run relationship is negative.

Fossil fuels contribute to raising GDP. As mentioned earlier, the South Korean economy is highly dependent on fossil energy use.

Foreign patents contribute to economic expansion. The importation of FP would bring to the country new technologies and new ideas, which helps to improve the South Korean economy.

Foreign patents as the dependent variable; GDP acts positively on FP. South Korea is a developed country that encourages the importation of foreign patents to achieve its economic development. This is because a developed country (with a high GDP) can buy more foreign patents and vice versa.

FE has a negative impact on FP. This means that FP do not depend on using FE. As mentioned before, FP imported by South Korea must not be based on fossil fuel consumption.

This can have a relationship with energy efficiency. South Korea is a developed country, so energy efficiency is very important to it. To this end, this country can oblige foreign researchers to use advanced energy technologies, processes, and standards in their patents.

HP act positively on FP. This result is in line with Cai et al. (2020) who found that the demand for foreign patents in China is linked to its technological innovation capacity and is significantly affected by the Chinese patent system reform.

FDI acts positively on FP: foreign direct investment will bring to the country new technologies and new ideas, so it will enhance the importation of FP. FDI is an important factor in South Korea's innovation index.

To test the stable nature of the calculated coefficients in the short and long term, the cumulative sum (CUSUM) and squared CUSUM techniques of Brown et al. (1975) are applied. According to this test, the estimated coefficients of regression are stable when the plot of these statistics is inside the critical 5% significance level.

The representations of dependent variables, such as CO2 emissions, GDP, and foreign patents indicate that the computed short- and long-run elasticities are well within the critical bounds. Therefore, the short- and long-run elasticities of these regressions are stable. The graphs are presented in Figs. 2, 3, and 4.

4.4 ECT and Granger causality test

In order to examine the direction of the short- and long-run causal relationship between variables, the technique of Engle and Granger (1987) was employed. It aims to study the short- and long-term associations between CO2 emissions, foreign direct investment, gross domestic product, foreign patents, home patents, and fossil fuels energy consumption in two steps. The short-term impact among the variables is investigated through the use of the VEC Granger causality test. This test assesses the causality among the variables to test whether (i) the causality runs in only one direction, and thus causality is unidirectional; or (ii) the causality runs in two directions, and thus causality is bidirectional; or (iii) the causality does not run in any direction. Long-term causality is evaluated by the significance of the error correction term for every cointegration equation: if the ECT is statistically significant, a long-term causality exists from all independent variables to the dependent one. During the first step, the long-term coefficients are evaluated and the residuals are recovered, whereas the short-term adjustment terms are evaluated during the second step. The short-term relationship among the examined variables is investigated through VEC Granger causality, and its significance is evaluated using the Fisher statistic. The significance of the long-term interdependence among the variables is measured by applying the t-student statistic. Before that, we need to determine the optimal lag length. We execute the unrestricted VAR model to verify the number of lags, essentially centered on the AIC criterion (Table 5).

With max lag 2, the optimal number of the lag length in the examination of the model is equal to 2. The vector error correction model is given as follows:

where ∆ is the first difference operator; q denotes the VAR lag length; ECTt−1 designates the lagged ECT for each equation; Υ denotes the adjustment speed from the short-run equilibrium to the long-run equilibrium, and ζt represents the residual term.

The results from the short- and long-run Granger causalities interdependencies between variables are presented in Table 6. ECT−1 of CO2 emissions, GDP, HP, and FE are significant, negative, and between − 1 and 0, which indicates the existence of long-run bidirectional causalities between CO2 emissions, GDP, HP, and FE. Moreover, results show the existence of unidirectional short-run causality running from HP, FE, and FP to GDP; from FP to HP; from HP and FP to FE, and from HP and FP to CO2 emissions. Adedoyin et al. (2020), Emir and Bekun (2019) in Romania; Balsalobre-Lorente et al. (2018) study on EU-5 countries also show the existence of unidirectional causality running from FE to GDP.

5 Conclusion

This empirical study explored the connection between carbon dioxide emissions, fossil fuel energy consumption, home patents, foreign patents, foreign direct investment, and gross domestic product in South Korea over the period 1980 to 2018 by employing the ARDL bounds testing approach to cointegration and the Granger causality approach.

Our long-run estimates show that foreign patents have a beneficial impact on both economic growth and the environment. This can be explained by the severe South Korean environmental legislation that attracts only relatively less polluting foreign technologies and more efficiency in fossil energy use leading to more competitive products. Interestingly, home patents and foreign patents seem to be complementary activities in South Korea. Therefore, South Korea should continue to encourage R&D and innovation through appropriate taxes and subsidies. Moreover, it should continue attracting foreign direct investments because of their positive impact on foreign patents ending to more economic growth and a cleaner environment.

In addition, increasing home patents contribute to environmental degradation despite the strong investment of South Korea in R&D and environmental public initiatives. Indeed, there is a tremendous increase in R&D expenditures; they grew by 355% between 2002 and 2017 (Hille and Lambernd, 2020). We recommend that commitment to home patents be coupled with a green growth strategy. Moreover, home patents act negatively on gross domestic product because they are costly. Therefore, policymakers should encourage innovation in sustainable and green activities by encouraging the use of green foreign patents and imposing taxes on polluting home patents.

References

Adebayo, T. S., Oladipupo, S. D., Kirikkaleli, D., & Adeshola, I. (2022). Asymmetric nexus between technological innovation and environmental degradation in Sweden: An aggregated and disaggregated analysis. Environmental Science and Pollution Research, 29(24), 36547–36564.

Adedoyin, F. F., Bekun, F. V., Driha, O. M., Balsalobre-Lorente, D. (2020). The effects of air transportation, energy, ICT, and FDI on economic growth in the industry 4.0 era: Evidence from the United States. Technological Forecasting and Social Change, 160(C). https://ideas.repec.org/a/eee/tefoso/v160y2020ics0040162520311239.html.

Alvarez-Herranz, A., Balsalobre-Lorente, D., Shahbaz, M., & Cantos, J. M. (2017). Energy innovation and renewable energy consumption in the correction of air pollution levels. Energy Policy, 105(6), 386–397.

Amri, F. (2017). Carbon dioxide emissions, output, and energy consumption categories in Algeria. Environmental Science and Pollution Research, 24, 14567–14578.

Bakhsh, K., Rose, S., Ali, M. F., Ahmad, N., & Shahbaz, M. (2017). Economic growth, CO2 emissions, renewable waste and FDI relation in Pakistan: New evidence from 3SLS. Journal of Environmental Management, 196, 627–632.

Balsalobre-Lorente, D., Shahbaz, M., Roubaud, D., & Farhani, S. (2018). How economic growth, renewable electricity, and natural resources contribute to CO2 emissions? Energy Policy, 113, 356–367.

Bayarcelik, E., & Taşel, F. (2012). Research and development: Source of economic growth. Procedia Social and Behavioral Sciences, 58, 744–753.

Ben Youssef, S. (2020). Non-resident and resident patents, renewable and fossil energy, pollution, and economic growth in the USA. Environmental Science and Pollution Research International. https://doi.org/10.1007/s11356-020-10047-0

Branstetter, L. G., & Kwon, N. (2018). South Korea’s transition from imitator to innovator: The role of external demand shocks. Journal of the Japanese and International Economies, 49, 28–42.

Brown, R. L., Durbin, J., & Evans, J. M. (1975). Techniques for testing the constancy of regression relations over time. Journal of the Royal Statistical Society, Series B, 37, 149–163.

Cai, H. H., Sarpong, D., Tang, X., & Zhao, G. (2020). Foreign patents surge and technology spillovers in China (1985–2009): Evidence from the patent and trade markets. Technological Forecasting and Social Change, 151, 119784.

Castellacci, F., & Natera, J. M. (2015). Innovation, absorptive capacity, and growth heterogeneity: Development paths in Latin America 1970–2010. Structural Change and Economic Dynamics, 37, 27–42.

Chandio, A. A., Rauf, A., Jiang, Y., Ozturk, I., & Ahmad, F. (2019). Cointegration and causality analysis of dynamic linkage between industrial energy consumption and economic growth in Pakistan. Sustainability, 11, 4546.

Chen, Y., Wang, Z., & Zhong, Z. (2019). CO2 emissions, economic growth, renewable and non-renewable energy production and foreign trade in China. Renewable Energy, 131, 208–216.

Cheng, C., Ren, X., Wang, Z., & Yan, C. (2019). Heterogeneous impacts of renewable energy and environmental patents on CO2 emission—Evidence from the BRICS. Science of the Total Environment, 668, 1328–1338.

Cohen, W. M., & Levinthal, D. A. (1990). Absorptive capacity: A new perspective on learning and innovation. Administrative Science Quarterly, 35(1), 128–152. https://doi.org/10.2307/2393553

Dauda, L., Long, X., Mensah, C. N., Salman, M., Boamah, K. B., Ampon-Wireko, S., & Kofi Dogbe, C. S. (2021). Innovation, trade openness and CO2 emissions in selected countries in Africa. Journal of Cleaner Production, 281, 125143. https://doi.org/10.1016/j.jclepro.2020.125143

Demir, C., Cergibozan, R., & Ari, A. (2020). Environmental dimension of innovation: Time series evidence from Turkey. Environment, Development and Sustainability, 22(3), 2497–2516.

Dickey, D. A., & Fuller, W. A. (1979). Distribution of the estimators for autoregressive time series with a unit root. Journal of the American Statistical Association, 74, 427–431.

Dogan, E., & Ozturk, I. (2017). The influence of renewable and non-renewable energy consumption and real income on CO2 emissions in the USA: Evidence from structural break tests. Environmental Science and Pollution Research, 24, 10846–10854.

Emir, F., & Bekun, F. V. (2019). Energy intensity, carbon emissions, renewable energy, and economic growth nexus: New insights from Romania. Energy & Environment., 30(3), 427–443.

Energy Information Administration. (2022). International Energy Outlook. Accessed at: www.eia.gov/forecasts/aeo

Engle, R. F., & Granger, C. W. J. (1987). Co-integration and error correction: Representation, estimation, and testing. Econometrica, 55, 251–276.

Ghorbal, S., Farhani, S., & Youssef, S. B. (2022). Do renewable energy and national patents impact the environmental sustainability of Tunisia? Environmental Science and Pollution Research, 29(17), 25248–25262. https://doi.org/10.1007/s11356-021-17628-7

Goel, R. K., & Nelson, M. A. (2020). How do firms use innovations to hedge against economic and political uncertainty? Evidence from a large sample of nations. The Journal of Technology Transfer., 46, 407–430.

Grabiszewski, K., & Minor, D. (2019). Economic espionage. Defence and Peace Economics, 30, 269–277.

Herrerias, M. J., Cuadros, A., & Luo, D. (2016). Foreign versus indigenous innovation and energy intensity: Further research across Chinese regions. Applied Energy, 162, 1374–1384. https://doi.org/10.1016/j.apenergy.2015.01.042

Hille, E., & Lambernd, B. (2020). The role of innovation in reducing South Korea’s energy intensity: Regional-data evidence on various energy carriers. Journal of Environmental Management, 262, 110293.

Hu, A. G. Z., & Jaffe, A. B. (2003). Patent citations and international knowledge flow: The cases of Korea and Taiwan. International Journal of Industrial Organization, 21(6), 849–880.

International Energy Agency, (2019). Global energy and CO2 Status Report; the latest trends in energy and emissions in 2018. Accessed at: www.iea.org.

Jin, H.-S., Lee, S.-J., Kim, Y.-J., Ha, S.-Y., Kim, S.-I., & Song, S.-Y. (2020). Estimation of energy use and CO2 emission intensities by end-use in South Korean apartment units based on in situ measurements. Energy and Buildings, 207, 109603.

Jung, S., & Imm, K.-Y. (2002). the patent activities of Korea and Taiwan: A comparative case study of patent statistics. World Patent Information, 24(4), 303–311.

Korea Energy Economics Institute, (2019). Yearbooks of Regional Energy Statistics. http://www.keei.re.kr/main.nsf/index_en.html. (Accessed 10 August 2019)

Korea Electric Power Corporation, 2018. KEPCO annual report 2018. Accessed at: http://home.kepco.co.kr/kepco/main.do.

Khan, N. H., Ju, Y., Danish, H., Latif, Z., & Khan, K. (2020). Nexus between carbon emission, financial development, and access to electricity: Incorporating the role of natural resources and population growth. Journal of Public Affairs. https://doi.org/10.1002/pa.2131

Latif, Z., Mengke, Y., Danish, A., Latif, S., Ximei, L., Pathan, Z. H., Salam, S., & Jianqiu, Z. (2018). The dynamics of ICT, foreign direct investment, globalization and economic growth: Panel estimation robust to heterogeneity and cross-sectional dependence. Telematics and Informatics, 35(2), 318–328.

Magazzino, C. (2016). Economic growth, CO2 emissions, and energy use in the South Caucasus and Turkey: A PVAR analyses. International Energy Journal, 16(4), 153–162.

Magazzino, C., & Cerulli, G. (2019). The Determinants of CO2 emissions in MENA countries: A responsiveness scores approach. International Journal of Sustainable Development and World Ecology, 26(6), 522–534.

Ministry of science, 2013. ICT and future planning. Accessed at: https://pitchbook.com/profiles/limited-partner/179186-59#commitments

Muhammad, B. (2019). Energy consumption, CO2 emissions and economic growth in developed, emerging and Middle East and North Africa countries. Energy, 179, 232–245.

Munir, Q., Lean, H. H., & Smyth, R. (2020). CO2 emissions, energy consumption and economic growth in the ASEAN-5 countries: A crosssectional dependence approach. Energy Economics, 85, 104571.

Oh, I., Wehrmeyer, W., & Mulugetta, Y. (2010). Decomposition analysis and mitigation strategies of CO2 emissions from energy consumption in South Korea. Energy Policy, 38(1), 364–377.

Pesaran, M. H., & Pesaran, B. (1997). Working with Microfit 4.0: Interactive Econometric Analysis. Oxford: Oxford University Press.

Pesaran, M. H., Shin, Y., & Smith, R. J. (2001). Bounds testing approaches to the analysis of level relationships. Journal of Applied Econometrics, 16, 289–326.

Pesaran, M. H., & Smith, R. P. (1998). Structural analysis of cointegrating VARs. Journal of Economic Survey, 12, 471–505.

Phillips, P. C. B., & Perron, P. (1988). Testing for a unit root in time series regression. Biometrika, 75(2), 335–346.

Savin, I., & Egetokun, A. (2016). Emergence of innovation networks from R&D cooperation with endogenous Absorptive capacity. Journal of Economic Dynamics and Control, 64, 82–103.

Song, J., Song, S. J., Oh, S.-D., & Yoo, Y. (2015). Evaluation of potential fossil fuel conservation by the renewable heat obligation in Korea. Renewable Energy, 79, 140–149.

Timilsina, G. R., Csordás, S., & Mevel, S. (2011). When does a carbon tax on fossil fuels stimulate biofuels? Ecological Economics, 70(12), 2400–2415.

United nations framework convention on climate change (2017). Second biennial update report of the Republic of Korea. Accessed at: https://unfccc.int/.

World intellectual property organization. (2021). Accessed at: https://www.wipo.int/edocs/infogdocs/en/ipfactsandfigures/

World Bank, (2022). World development indicators. Accessed at: http://datatopics.worldbank.org/world-development-indicators/.

WORLD DATA ATLAS (2022). Data and statistics—knoema.com. Accessed at: https://knoema.com/atlas/South-Korea.

Zhao, J., Shahbaz, M., Dong, X., & Dong, K. (2021). How does financial risk affect global CO2 emissions? The role of technological innovation. Technological Forecasting and Social Change, 168, 120751.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Ghorbal, S., Soltani, L. & Ben Youssef, S. Patents, fossil fuels, foreign direct investment, and carbon dioxide emissions in South Korea. Environ Dev Sustain 26, 109–125 (2024). https://doi.org/10.1007/s10668-022-02770-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10668-022-02770-0