Abstract

With the rapid development of green consumption demand, more and more consumers choose to purchase green products. Incorporating consumers’ environmental awareness into a green supply chain, this paper studies the decisions and coordination of the green supply chain under the retailer’s reciprocal preference. The decentralized models with and without reciprocity are constructed and analyzed with consideration of product green degree and pricing. Then, the cost-sharing joint commission contract is proposed to realize Pareto improvement. Finally, propositions and conclusions are verified by numerical simulation. The results indicate that improving consumers’ environmental awareness is favorable to the profit of the whole supply chain and environment. Besides, within the reasonable range of retailer’s reciprocal preference, higher value of the retailer’s reciprocal preference is conductive to the better realization of environmental protection and the improvement of the economic welfare of the whole society. The cost-sharing contract exerts a positive effect in improving the environmental and economic performance in the green supply chain (GSC). The paper provides a theoretical foundation for the design of cooperative contracts in the GSC, especially the GSC with retailer’s reciprocal preference.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

With the aggravation of the global greenhouse effect, it is urgently necessary to achieve the emissions reduction targets (Lotfi et al. 2020). Consumer’s increasing preference for green products is the primary incentive for enterprises to reduce carbon emissions (Mehrjerdi and Lotfi 2019; Banik et al. 2020). In recent years, a growing body of literature shows that consumer’s awareness and preference of green products will affect their consume behavior and market demand (Aslani and Heydari 2019; Mehrbakhsh and Ghezavati 2020). As enterprises in the green supply chain (GSC) face a particular market demand, consumers tend to have low-carbon preferences (Xu et al. 2018; Tang et al. 2020). Faced with the double pressure of governmental controls on carbon emission and demand growth for green products, the core enterprises in the GSC take green transformation strategies, such as adopting advanced energy-saving and emission-reduction production technology, encouraging cooperators to participate in energy conservation and emission reduction, and stimulating consumer-facing retailers to strengthen the propaganda low-carbon products (Lotfi et al. 2017a, b). These strategies will lead to an increase in operating costs more or less and even a reduction in supply chain performance. Therefore, it is of great significance for enterprises to take consumers’ environmental preference into account when making operational decisions.

The psychology of decision-makers is still a key issue in supply chain coordination. At present, a large number of research is based on the low-carbon supply chain, most of which assume that decision-makers are rational economic men (Xiao et al. 2020). However, a growing number of researches suggest that this assumption is at odds with reality. They propose the theories of finite rationality and illustrate that people have social preferences. A prime difference of finite rationality hypothesis model from rational hypothesis model is that decision-makers with social preferences target the maximum utility functions which include cooperators’ profits and their profits, rather than just maximizing their profits. Reciprocal preference is one of the most critical social preferences, which is defined as an attitude of the decision-maker to “repay the kindness of others, revenge on the spite of others” (Fehr and Gächter 2000). In practice, many firms reward partners who are kind to them, even if they cannot foresee whether reciprocal behavior between firms will improve economic benefits. Enterprises’ reciprocal preferences impact not only their own decisions but also cooperators’ decisions in the GSC. For example, companies in a reciprocal social network tend to adopt kinder strategies, and any company adopting kind strategy can increase the efficiency of the whole supply chain (Xia et al. 2018). Furthermore, to reflect the realistic conditions truer, Xia et al. (2018) assume that the retailer has a reciprocal preference. In practice, it is usually the core enterprises in the GSC, namely manufacturers, that play leading roles in reducing carbon emissions. For instance, Huawei Technologies Co., Ltd., has cooperated with suppliers in energy conservation and emission reduction innovation, and actively participated in relevant industry organization activities and the formulation of relevant standards to build a GSC in an all-round way. This company has achieved a carbon emission reduction of about 450,000 t by 2018. Similarly, Dell works closely with Chinese suppliers to help them meet strict international standards in environmental protection and enhance competitiveness in the international environment. And it ranked second in the 2017 CITI index of green supply chain released by the Institute of Public and Environmental Affairs (IPE). However, the dominant manufacturer tends to decide the most self-interest way, such as deliberately improve the wholesale price or share the less environmental cost, which is not conducive to the long-term development of the GSC (Zhao et al. 2016). Therefore, the manufacturer needs to consider the reciprocity preference of retailers so that the retailer can better serve manufacturer’s green transformation strategies. In this paper, we focus on a GSC in which the retailer wholesales green products from a manufacturer to meet consumers’ demand for low-carbon products. More specifically, we focus on four issues: (1) How do players determine the optimal price of green products and emission abatement level in a GSC considering reciprocal preference? (2) How does consumers’ environmental awareness influence management decisions in a GSC? Can green products provide more value-add for the GSC system? (3) How does retailer’s reciprocal behavior affect environment, members’ decision-makings, and their profits? (4) Can the channel profits realize Pareto improvement under the cost-sharing contract? Can a cost-sharing contract improve the environmental and economic performance in the GSC?

Motivated by the above issues, several analytical models are proposed under the framework of the Stackelberg game to obtain the optimal equilibrium in the GSC. Based on these equilibrium results, decision-makers can develop specific computer programs and introduce them to management information systems, then use mass data stored in the information system to predict model parameters, so as to realize the optimal pricing and emission-reduction scheme. For this purpose, we first develop two decentralized models based on whether the retailer has reciprocal preference. Then, we introduce the cost-sharing contract to investigate whether contracts can realize the Pareto improvement with and without the retailer’s reciprocal preference. The backward induction method and the Kuhn-Tucker condition (KT condition) are used to solve the decision variables in our models. Our results lead to the creation of new operation and management perspectives for the decision-making and contract design in the GSC. The results show that both the emission abatement level and the profits of retailer and manufacturer increase with the consumer’s environmental preference; thus, improving consumer environmental preference is beneficial to the construction of energy-saving society. In addition, we obtain a reasonable range of retailer’s reciprocal preference. The results show that the higher value of the retailer’s reciprocal preference can lead to improvement in environmental protection and economic welfare of the whole society within this reasonable range. Besides, the manufacturer can make more profit when the retailer is kind to him, while both the manufacturer and entire GSC would make less profit when the retailer takes a hostile attitude. Furthermore, we discuss the cost-sharing contract, especially focus on exploring how this contract affects optimal decisions and whether it can realize Pareto improvement. Interestingly, we find that the channel profits can realize Pareto improvement under certain conditions regardless of the presence of the retailer’s reciprocal preference.

The remainder of the paper is organized as follows. The “Literature review” section presents the relevant literature. “The models” section introduces the problem description and assumptions, besides elaborating the basic models’ formulation and solution. Subsequently, “The models” section introduces the contract mechanism to explore whether cost-sharing contract can improve the performance of GSC or achieve Pareto improvement. The “Numerical analysis” section presents some numerical examples to analyze the equilibrium in “The models” section by several numerical examples. The “Conclusions” section summarizes conclusions of our work as well as proposes further research work direction of the related research.

Literature review

In this section, the most relevant topics and research (including three aspects) are presented that will help to continue the discussion. Table 1 lists part of the literature, which is the highly relevant to our research and shows our contributions.

Consumer environmental preference

The first stream of literature studies consumer environmental preference in the supply chain. Chen et al. (2014) analyze the influence of consumer environmental preference on their purchase decisions, and conclude that the low-carbon awareness, wage levels, cultural diversity, and geographical position are influential in the consumer’s purchase intentions. Wang et al. (2017) show that increasing consumer environmental preference makes them pay more attention to the carbon performance of products and even would like to shell out more money for green products. Hence, consumer environmental preference exerts influence on consumer’s purchase intentions, which will affect enterprises’ decision-making in turn. There are a couple of studies similar to that of Wang et al. (2017) as they all illustrate the effects of consumer environmental preference on the supply chain based on the demand of emission abatement level (see for example Ghosh and Shah 2012; Du et al. 2016; Zhao et al. 2016; Cui et al. 2017; Du et al. 2017). Ghosh and Shah (2012) investigate the influences of different power structures on pricing and emission-reduction decision. Du et al. (2016) present the effects of emissions and environmental preference on the production decisions in the carbon cap-and-trade system. Zhao et al. (2016) construct a remanufacturing model considering low-carbon preference to achieve harmonious development of economy. Cui et al. (2017) study the selection model of remanufacturing quality and introduce a demand function of remanufactured products generated by environmental preference. The results show that the optimal decision relates to consumer environmental preference. In the findings of Du et al. (2017), the environmental performance of products in the low-carbon supply chain is studied, and price discount sharing is designed to achieve Pareto improvement. The above-cited work uses a similar linear demand function dependent on retail price and emission abatement level. However, we consider a GSC where both retailer’s reciprocal preference and consumer environmental preference affect the channel decisions, rather than disregarding reciprocity as the existing literature does.

Reciprocal preference in the supply chain

The previous literatures related to the reciprocal preference mainly involved two aspects. One aspect conducts various surveys and experimental games to prove that reciprocity exists and has a significant effect on human behavior. For instance, Fehr and Gächter (2000) show that individuals with reciprocal preferences are willing to make the material sacrifice to reward others who are kind to them and punish those who are not. The model of reciprocity can explain games such as the gift exchange game (Fehr et al. 1993), ultimatum game (Camerer and Thaler 1995), trust game (Camerer 2003), and mini-ultimatum game (Falk et al. 2003), while the widely studied fairness-based models cannot. Fehr et al. (1993) find that the employer will reciprocate with a generous remuneration package, and the employer expects reciprocity in return for a generous wage offer in the gift exchange game. Camerer and Thaler (1995) illustrate that responders continually reject low offers and always sanction defectors for unfair behavior, which is manifested as negative reciprocity in the ultimatum game. In Camerer (2003), there is a positive reciprocal relationship between the investor and the trustor in the absence of a formal contract or a perfect contract. The other aspect focuses on constructing various reciprocity models and putting reciprocal preference into the study of the supply chain. Many existing papers have proved that some social preference behaviors, especially fairness concerns (Chen et al. 2018; Liu et al. 2018), can affect supply chain’s performances. Many contracts related to fairness concerns in these literatures have been proved to be able to achieve channel profits’ Pareto improvement, while it is difficult to implement these contracts effectively in reality. Although the above works are not about reciprocity, they have an important reference value to this paper. A prime difference between the fairness-based model and the reciprocity-based model is that in the fairness-based model, the follower only punishes others if they are possible to reduce such unfairness. While in the reciprocity-based model, decision-makers reward or punish others based on their perceived kindness or spite (Du et al. 2014). In practice, large-scale automobile manufacturers with reciprocal preferences for suppliers, such as Toyota and GM, are not only committed to profit-maximization but also concerned about the profit of upstream suppliers. Therefore, a few scholars introduce reciprocal preference into the supply chain decision-making and further explore the performances of the supply chain (Du et al. 2014; Xia et al. 2018; Yan et al. 2017). Du et al. (2014) study the effects of reciprocal preferences on players’ optimal decision-making by using the modeling quantitative analysis method. Xia et al. (2018) investigate a two-level low-carbon supply chain in the trading scheme considering reciprocity theory. Yan et al. (2017) propose the allocation game framework model under reciprocity. In our paper, the similar reciprocity theory and different contract design to study the optimal pricing and emission abatement problem in the GSC.

Cost-sharing contract in the supply chain

Revenue-sharing and cost-sharing have been widely studied in related literature (Wang and Shin 2015) to encourage supply chain coordination. There are many papers similar to that of Wang and Shin (2015) because they all consider the cost-sharing contract in the non-green supply chain (see for example Cavusoglu et al. 2008; Chao et al. 2009; Frisk et al. 2010; Panda 2013). Cavusoglu et al. (2008) assume that cost-sharing may realize optimal social benefits even in the presence of information asymmetry. Chao et al. (2009) present that cost-sharing contract could raise the quality of the non-green product. Frisk et al. (2010) propose an allocation method in a collaborative forest transportation to achieve a balanced distribution of profits among participants. Compared with the revenue sharing contract, the cost-sharing contract proposed in Panda (2013) can effectively coordinate the two-level supply chain. Panda (2013) presents a cost-sharing contract that can effectively coordinate the two-level supply chain, while the revenue-sharing contract cannot. With the widespread application of cost-sharing in reality, more and more academics start to study cost-sharing contracts in the field of the GSC. Faced with the low-carbon demand in the GSC, the retailers have the motivation to encourage manufacturers to take steps to reduce carbon emission and protect the environment (Jaber et al. 2013). The manufacturers make unique infinitely divisible green products and engage in emission reduction by adopting green technology, which could not only bring economic benefits and enhance enterprises’ competitiveness but also increase investment costs (Xu et al. 2016). In the work of Wang et al. (2017), the cost-sharing contract is regarded as an effective coordinated mechanism under low-carbon behavior. We refer the reader to Ghosh and Shah (2015) for a recent review of practically implemented cost-sharing contract. The authors develop two cost-sharing models to compare and analyze performances of the supply chain. A similar cost-sharing contract enables us to research the influence of cost-sharing on the optimal decisions in the GSC considering the retailer’s reciprocal preference.

The models

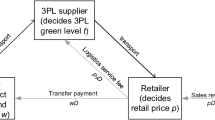

The paper focuses on a GSC considering reciprocity and cost-sharing contract. We consider a make-to-order production system in which the downstream retailer wholesales green products from an upstream manufacturer to satisfy environmentally friendly market demand. The inventory is not taken into account, and the information between supply chain members is assumed to be completely symmetric. Table 2 shows the notations that are used in the subsequent models. Figure 1 depicts the corresponding strategies of the five models proposed in this paper.

Based on practical considerations, we give the following three assumptions.

Assumption 1

-

The improvement of emission abatement level of low-carbon products affects the market demand function. As in the work of Tang et al. (2020), the manufacturer has a quadratic abatement cost function, which is a convex and increasing function with emission abatement level. So the manufacturer’s cost function of investing emission abatement is expressed as βθ2, where β denotes the difficulty level of carbon emission abatement, and θ denotes emission abatement level of the manufacturer. In the actual situation, the cost of emission abatement is diseconomies of scale for green technology (Mehrbakhsh and Ghezavati 2020), which means huge losses of profits. Therefore, we have to ensure that the difficulty level of emission abatement is high enough to reduce the loss of profits. Following Xiao et al. (2020), we give the assumption of e2 < 4bβ to keep the existence of optimal solutions, besides, the values of total market potential a and the investment coefficient of emission abatement β are far higher than other parameters in this paper.

Assumption 2

-

The green supply chain faces the oligopoly market of single low-carbon product, and each member is risk-neutral. The manufacturer strengthens reduction efforts of carbon emission by adopting various green measures, such as using green raw materials and applying clean manufacturing technology, to meet consumer demand for green products. The unique manufacturer is directly exposed to the pressure of emission reduction, and the emission abatement level of manufacturer immediately affects the carbon emissions. According to Xu et al. (2018), we assume that the manufacturer bears the whole emission abatement cost without cooperative contracts, and retailer’s carbon emissions are neglected. Given that cost-sharing contract plays a critical role in encouraging the manufacturer to participate in the green channel (Ghosh and Shah 2015; Yang and Chen 2018), we assume that the retailer determines a ratio of sharing emission abatement cost, namely ϕ. Under the cost-sharing contract, the retailer’s abatement cost is ϕβθ2, and the manufacturer’s abatement cost is (1 − ϕ)βθ2, where 0 < ϕ < 1.

Assumption 3

-

Consumers have low-carbon preferences and the market demand is related to retail price and emission abatement level. Demand function is linearly correlated with emission abatement level and negatively linearly related to the retail price. Following Xia et al. (2018), the demand function is characterized as D = a − bp + eθ, where a is the total market potential, b is the price elasticity of demand, and e denotes consumer’s environmental preference and the extent to which demand responds to changes in the emission abatement level. The higher e is, the more willing consumers are to buy low-carbon products and the more insensitive demand function is to the retail price.

Case 0: Benchmark model

In this scenario, the retailer and manufacturer under the centralized decision-making are considered as a centralized system. This is an ideal model that is practically impossible to implement, as all the participants are committed to maximizing their profits. However, the achieved result by this model can serve as a benchmark for the following decentralized models. We index this case by superscript B. The whole supply chain’s objective function with constraints is:

By Eq. (1), we can derive the Hessian matrix of \( {\pi}_{\mathrm{sc}}^C \) with respect to pC and θC:

In real-life, bβ is much bigger than e, then we can derive that H1 is negative definite; thus, the GSC’s profit function is jointly concavity for the above decision variables. Therefore, the optimal solutions for Eq. (1) exist. Next, we can derive this optimal solution with the Kuhn-Tucker condition (KT condition), and the optimal decisions can be derived from equating the first derivatives concerning pB and θB to zero. The optimal solutions and profit of GSC are \( {p}^{B\ast }=\frac{c{e}^2-2 a\beta -2 bc\beta}{e^2-4 b\beta} \), \( {\theta}^{B\ast }=\frac{\left(-a+ bc\right)e}{e^2-4 b\beta},{\pi}_{\mathrm{sc}}^{B\ast }=\frac{{\left(a- bc\right)}^2\beta }{-{e}^2+4 b\beta}. \)

Case 1: Decentralized model without the retailer’s reciprocal preference

In this case, the retailer has no reciprocal preference. Both the retailer and manufacturer are completely rational and in pursuit of the maximum profits (Lotfi et al. 2017a). Supposing the manufacturer is the leader and bears all emission abatement cost, we solve the optimal decisions by the backward induction method.

The sequence of events in the following decentralized games is in the first stage; the manufacturer makes decisions of the emission abatement level (θ) and wholesale price (w). In the second stage, the retailer determines the retail price (p) based on the manufacturer’s decisions in the first stage. Then, the market demand and the profits of each member are realized. Figure 2a depicts the decision process.

We propose a Stackelberg game model to study the management decisions with no reciprocal preference, which lays a foundation for the research later in this section. We index case 1 by superscript N. The objective functions of each player are stated as follows:

The optimal solutions can be obtained by backward induction method. Firstly, we can derive the retailer’s optimal response function from the first-order condition for pN∗ = (a + bw + eθ)/2b. Then, the manufacturer maximizes its profit based on pN∗. Substituting pN∗ into Eq. (2). The Hessian matrix with respect to w and θ is:

According to the “Case 0: Benchmark model” section, we derive e2 < 8bβ, so H2 Hessian matrix is negative definite. Then we can derive the optimal decisions of the manufacturer by equating the first derivatives concerning wN and θN to zero. The equilibrium solutions of decision variables in case 1 are \( {p}^{N\ast }=\frac{c{e}^2-6 a\beta -2 bc\beta}{e^2-8 b\beta} \), \( {w}^{N\ast }=\frac{-c{e}^2+4 a\beta +4 bc\beta}{-{e}^2+8 b\beta} \), and \( {\theta}^{N\ast }=\frac{\left(-a+ bc\right)e}{e^2-8 b\beta} \). The players’ optimal profits are \( {\pi}_m^{N\ast }=\frac{{\left(a- bc\right)}^2\beta }{-{e}^2+8 b\beta} \) and \( {\pi}_r^{N\ast }=\frac{4b{\left( a\beta - bc\beta \right)}^2}{{\left({e}^2-8 b\beta \right)}^2} \). The entire profit of the GSC is \( {\pi}_{\mathrm{sc}}^{N\ast }=\frac{{\left(a- bc\right)}^2\beta \left(-{e}^2+12 b\beta \right)}{{\left({e}^2-8 b\beta \right)}^2}. \)

Proposition 1

The optimal decisions (pN∗, wN∗ and θN∗) and the optimal profits (\( {\uppi}_{\mathrm{m}}^{\mathrm{N}\ast },{\uppi}_{\mathrm{r}}^{\mathrm{N}\ast } \) and \( {\uppi}_{\mathrm{sc}}^{\mathrm{N}\ast } \)) are increasing with the consumer environmental preference (e).

We can derive these relationships from the algebraic calculation of the corresponding first-order conditions. Proposition 1 implies that consumers’ environmental preference pushes the manufacturer to increase emission-reduction efforts. Intriguingly, the retail price, wholesale price, and emission-reduction level increase with consumer environmental preference. Consumer’s low-carbon awareness affects demand as well as the profits of channel members. Both the retailer’s and manufacturer’s profits increase with the consumer’s environmental preference, so the GSC’s profit also increases. Thus, improving consumer environmental preference is favorable to the construction of resource service–oriented and environmentally friendly society. How to improve consumers’ awareness of protecting the environment will be a major challenge facing the national environmental administrations.

Case 2: Decentralized model with the retailer’s reciprocal preference

The theory of self-interest is often proved to be contradictory in human’s decision-making process. To deal with these contradictions, economists have tried to reconstruct utility functions that can explain human’s behavior. Frequently studied fairness concerns are defined over outcomes, while the reciprocity highlights both outcomes and human beliefs about the individual intentions or types of people they deal with (Loch and Wu 2008).

If the retailer in the GSC has the reciprocal preference, then the retailer takes the manufacturer’s profit into his/her utility and aims to maximize the utility function. The retailer’s utility function is expressed as Ur = πr + γr ∗ πm, where γr is the retailer’s reciprocal preference parameter, and it denotes the retailer’s extent of reciprocity to the manufacturer. The range of values of γr is −1 to 1 and does not include 0. Especially, γr = 0 means that the retailer has no reciprocal preference, which is similar to the model in case 1. Importantly, if 0 < γr ≤ 1, the retailer has positive reciprocity behavior and is kind to the manufacturer. A higher γr implies a greater reciprocal preference of the retailer for the manufacturer’s profit. On the contrary, −1 ≤ γr < 0 indicates that the retailer has negative reciprocity behavior and shows hostility to the manufacturer, and a higher γr implies a smaller reciprocal preference of the retailer for the manufacturer’s profit. Besides, the manufacturer who has no reciprocal preference aims to maximize the profit function. We index this case by superscript Y. The player’s objective functions are:

We substitute the best retailer’s response function pY∗ = (a + bw + eθ + b(c − w)γr)/2b into Eq. (4). The Hessian matrix with respect to wY and θY is:

e2 < 8bβ(1 − γr) is assumed to ensure that this model has an optimal solution. Then the optimal decisions of the manufacturer can be derived by equating the first derivatives concerning wY and θY to zero. The equilibrium solutions of decision variables in case 2 are \( {p}^{Y\ast }=\frac{-6 a\beta +c\left({e}^2-2 b\beta \right)+2\left(3a+ bc\right)\beta {\gamma}_r}{e^2-8 b\beta +8 b\beta {\gamma}_r} \), \( {w}^{Y\ast }=c-\frac{4\left( ae- bce\right)\beta }{e\left({e}^2-8 b\beta +8 b\beta {\gamma}_r\right)} \), \( {\theta}^{Y\ast }=-\frac{ae- bce}{e^2-8 b\beta +8 b\beta {\gamma}_r} \). The optimal profits are \( {\pi}_m^{Y\ast }=-\frac{{\left(a- bc\right)}^2\beta }{e^2-8 b\beta +8 b\beta {\gamma}_r} \), \( {\pi}_r^{Y\ast }=\frac{4b{\left(a- bc\right)}^2{\beta}^2\left(-1+{\gamma}_r\right)\left(-1+3{\gamma}_r\right)}{{\left({e}^2-8 b\beta +8 b\beta {\gamma}_r\right)}^2} \) and \( {\pi}_{sc}^{Y\ast }=\frac{{\left(a- bc\right)}^2\beta \left(-{e}^2+12 b\beta -24 b\beta {\gamma}_r+12 b\beta {\gamma}_r^2\right)}{{\left({e}^2-8 b\beta +8 b\beta {\gamma}_r\right)}^2} \).

Theorem 1

The reasonable range of the retailer’s reciprocal preference is \( {\Omega}_r^Y=\left\{{\gamma}_r|-1\le {\gamma}_r<0\ \mathrm{and}\ 0<{\gamma}_r\le 1/3\ \right\} \).

We derive \( {\Omega}_r^Y \) from the inequality pY − wY = [2(a − bc)β(−1 + 3γr)]/[e2 − 8bβ + 8bβγr] ≥ 0. The manufacturer is the market leader and is in a competitive position, the minimum for the retailer to participate in the cooperation with the manufacturer is to profit from it.

The manufacturer is the market leader and in a competitive position. As a follower, the retailer hopes to profit from cooperating with the manufacturer. The reasonable range of the retailer’s reciprocal preference (\( {\Omega}_r^Y \)) is a mutually beneficial area for the manufacturer and retailer to maintain stability. The following propositions in case 2 are based on this reasonable range.

Proposition 2

In case 2, the optimal decisions (pY∗, wY∗ and θY∗) and the optimal profits (\( {\uppi}_{\mathrm{m}}^{\mathrm{Y}\ast },{\uppi}_{\mathrm{r}}^{\mathrm{Y}\ast } \) and \( {\uppi}_{\mathrm{sc}}^{\mathrm{Y}\ast } \)) are increasing with the consumer’s environmental preference (e).

This relationship can be derived from the algebraic calculation of the first-order partial conditions. Interestingly, the relationship is similar to that of proposition 1. Proposition 2 means that the consumers’ low-carbon conscious make them prefer to afford additional payment for green products, regardless of whether the retailer has reciprocal preference. If consumers are more green-minded, greater emission abatement could affect market demand. Meanwhile, emission abatement level, members’ profit, and GSC’s profit tend to rise with consumers’ environmental preference.

Proposition 3

The optimal decisions (pY∗, wY∗ and θY∗), manufacturer’s profit (\( {\pi}_m^{Y\ast } \)) and GSC’s profit (\( {\pi}_{sc}^{Y\ast } \)) are increasing with the retailer’s reciprocal preference parameter (γr).

Proposition 3 means that within the reasonable range of the retailer’s reciprocal preference (\( {\Omega}_r^Y \)), the retailer’s reciprocal preference can be an effective incentive for the manufacturer to do more to reduce carbon emissions. Interestingly, the retail price, wholesale price, and emission abatement level increase with the retailer’s reciprocal preference. To encourage the manufacturer to make efforts to enhance emission abatement level, the retailer needs to show more kindness to him. This means that the manufacturer’s profit has a greater impact on the retailer’s utility. The retailer’s reciprocal concern not only affects the low-carbon market demand but also affects manufacturer’s profit and GSC’s profit. More specifically, the profits of manufacturer and GSC increase with retailer’s reciprocal preference. Therefore, the increasing reciprocal concern of the retailer is beneficial to the GSC within the reasonable range (\( {\Omega}_r^Y \)). The realization of environmental protection and the improvement of economic welfare of the whole society would benefit greatly by the high-value retailer reciprocal preference. In particular, the closer γr is to the maximum value of 1/3, the larger the optimal decisions and GSC’s profit will be in case 2.

Proposition 4

Within the reasonable range of retailer’s reciprocal preference (\( {\Omega}_r^Y \)), the comparison results of optimal decisions in case 1 and case 2 are:

-

(i)

if γr < 0, we have \( {\theta}^{Y\ast }<{\theta}^{N\ast },{w}^{Y\ast }<{w}^{N\ast },{p}^{Y\ast }<{p}^{N\ast },{\pi}_m^{Y\ast }<{\pi}_m^{N\ast },{\pi}_r^{Y\ast }>{\pi}_r^{N\ast },{\pi}_{\mathrm{sc}}^{Y\ast }<{\pi}_{\mathrm{sc}}^{N\ast } \);

-

(ii)

if 0 < γr ≤ 1/3, we have \( {\theta}^{Y\ast }>{\theta}^{N\ast },{w}^{Y\ast }>{w}^{N\ast },{p}^{Y\ast }>{p}^{N\ast },{\pi}_m^{Y\ast }>{\pi}_m^{N\ast },{\pi}_r^{Y\ast }<{\pi}_r^{N\ast },{\pi}_{\mathrm{sc}}^{Y\ast }>{\pi}_{\mathrm{sc}}^{N\ast } \).

Proposition 4 means that the retailer would make the manufacturer more profitable if the retailer is kind to the manufacturer (0 < γr ≤ 1/3). By contrast, if the retailer is mean to the manufacturer (−1 ≤ γr < 0), the manufacturer and GSC would gain less profit. Especially, when the retailer shows positive reciprocal concern to the cooperator, he/she is willing to sacrifice own interest to improve the manufacturer’s profit, which can also enhance the entire GSC’s profit. Hence, as a leader, the manufacturer tends to collaborate with a retailer who has a positive reciprocal preference.

Proposition 5

Within the reasonable range of retailer’s reciprocal preference (\( {\Omega}_r^Y \)), the optimal emission abatement level and GSC’s profit in the benchmark are greater than those in the decentralized cases (case 1 and case 2), that is: \( {\pi}_{\mathrm{sc}}^{B\ast }>{\pi}_{\mathrm{sc}}^{Y\ast },{\pi}_{\mathrm{sc}}^{B\ast }>{\pi}_{\mathrm{sc}}^{N\ast },{\theta}^{B\ast }>{\theta}^{Y\ast },{\theta}^{B\ast }>{\theta}^{N\ast } \).

Proposition 5 indicates that the centralized model is an ideal case, as both emission abatement level and GSC’s profit in such a case are larger than those of the other two decentralized cases. This also explains why this paper uses centralized model as a benchmark to help us characterize equilibrium decisions. However, in reality, enterprises do not make decisions based on the goal of maximizing the profit of the entire GSC. The differences of enterprises’ goals lead to an inability to reach the ideal state in the benchmark, namely, supply chain maladjustment. Although it cannot achieve the optimal decisions of the centralized case, enterprises can adopt effective cooperative contracts, which will be a promising way to approach it infinitely. Therefore, next, we will introduce the contract mechanism to further explore whether cost-sharing contract can improve performance of the GSC or achieve Pareto improvement in the above decentralized models.

Case 3: Cost-sharing contract without the retailer’s reciprocal preference

The above cases illustrate the GSC’s performance with and without retailer’s reciprocal preference. In this section, we will introduce the contract mechanism to explore whether cost-sharing contract can improve performance of GSC or achieve Pareto improvement in the decentralized models. According to Xu et al. (2016), the cost-sharing contract can coordinate the supply chain with environment-concerned consumers and plays a significant role in encouraging the manufacturer to participate in the green channel. Therefore, we propose a cost-sharing contract in the GSC where the retailer shares investment cost of emission abatement. Contract analysis is important in this section. More importantly, we need to determine whether the retailer benefits from this cost-sharing contract. The following models reflect the collaborative development of low-carbon products. Figure 2b describes the decision process with the cost-sharing contract. The sequence of the game to understand the cost-sharing contract:

-

Step 1:

The retailer sets a cost-sharing ratio (ϕ), then the retailer’s abatement cost and manufacturer’s abatement cost can be obtained as ϕβθ2 and (1 − ϕ)βθ2, respectively.

-

Step 2:

The manufacturer determines the emission abatement level (θ) and wholesale price (w) based on the new abatement cost functions in Step 1.

-

Step 3:

Finally, the retailer decides the retail price (p) based on the emission abatement level and wholesale price in STEP-2.

Under the above game sequence, the optimal decisions in two cases can be derived.

In this case, players are completely rational and pursue maximum profits. We index this case by superscript NS. The objective functions of each player can be described as follows:

By substituting the best retailer’s response pNS∗ = (a + bwNS + eθNS + b(c − wNS)γr)/2b into Eq. (6), the Hessian matrix with respect to wNS and θNS can be expressed as:

We assume 3e2 − 16bβ < 0 to ensure the existence of optimal solutions. By first-order conditions, the optimal solutions can be derived as \( {p}^{\mathrm{NS}\ast }=\frac{3a{e}^2+9 bc{e}^2-48 ab\beta -16{b}^2 c\beta}{12b{e}^2-64{b}^2\beta } \) , \( {w}^{\mathrm{NS}\ast }=\frac{a\left({e}^2-16 b\beta \right)+ bc\left(5{e}^2-16 b\beta \right)}{6b{e}^2-32{b}^2\beta } \) , \( {\theta}^{\mathrm{NS}\ast }=\frac{2\left(a- bc\right)e}{-3{e}^2+16 b\beta} \). Then, we substitute above optimal solutions to Eq. (7). Since \( {d}^2{\pi}_r^{\mathrm{NS}}/\mathrm{d}{\phi}^2=\frac{8b{\left(a- bc\right)}^2{e}^2{\beta}^2\left(-5{e}^2+16 b\beta \left(1+2\phi \right)\right)}{-{\left({e}^2+8 b\beta \left(-1+\phi \right)\right)}^4}<0 \), the optimal cost-sharing ratio exists. We derive \( {\phi}^{\mathrm{NS}\ast }=\frac{e^2}{16 b\beta} \) by the first-order condition.

Substituting the optimal decisions into Eq. (6) and Eq. (7), we can derive the optimal profits \( {\pi}_m^{\mathrm{NS}\ast }=\frac{{\left(a- bc\right)}^2\left(-{e}^2+16 b\beta \right)}{8b\left(-3{e}^2+16 b\beta \right)} \), \( {\pi}_r^{\mathrm{NS}\ast }=\frac{{\left(a- bc\right)}^2\left({e}^2+16 b\beta \right)}{16b\left(-3{e}^2+16 b\beta \right)} \) and \( {\pi}_{\mathrm{sc}}^{\mathrm{NS}\ast }=\frac{{\left(a- bc\right)}^2\left(-{e}^2+48 b\beta \right)}{16b\left(-3{e}^2+16 b\beta \right)} \).

Proposition 6

The optimal decisions (pNS∗, wNS∗, θNS∗ and ϕNS∗) and the optimal profits (\( {\pi}_m^{NS\ast },{\pi}_r^{NS\ast } \) and \( {\pi}_{sc}^{NS\ast } \)) increase with consumer environmental preference (e).

The above relationships can be derived from the algebraic calculation of the first-order partial conditions. Interestingly, the relationship in proposition 6 is similar to that of proposition 1 and proposition 2. This means consumers’ strong low-carbon preference consciousness can also be beneficial to environmental protection and supply chain interests even considering the cost-sharing contract.

Proposition 7

The optimal decision variables and profits in case 3 are greater than those in case 1, thus \( {\theta}^{NS\ast }>{\theta}^{N\ast },{w}^{NS\ast }>{w}^{N\ast },{p}^{NS\ast }>{p}^{N\ast },{\pi}_m^{NS\ast }>{\pi}_m^{N\ast },{\pi}_r^{NS\ast }>{\pi}_r^{N\ast },{\pi}_{sc}^{NS\ast }>{\pi}_{sc}^{N\ast } \); the optimal emission abatement level and GSC’s profit in the benchmark are greater than those in the case 3, thus \( {\theta}^{NS\ast }<{\theta}^{B\ast },{\pi}_{sc}^{NS\ast }<{\pi}_{SC}^{B\ast } \).

Proposition 7 demonstrates the cost-sharing contract makes for higher emission abatement level than the decentralized channel of case 1; that is, the cost-sharing contract can promote environmental protection. Interestingly, both the retailer and manufacturer in case 3 make higher profits than those of the decentralized GSC in case 1. The manufacturer benefits from the abatement cost-sharing of the retailer. The main reason is that the manufacturer can improve the greening level when the abatement costs are lowered. Importantly, the retailer though bears a portion of the abatement costs makes a higher profit than that of the decentralized channel in case 1, which helps explain why the retailer enters into this cost-sharing contract. More importantly, sharing responsibility for reducing emission with manufacturer can improve profits for each participant and the entire GSC, which indicates that both of them can achieve Pareto improvement through the cost-sharing contract without considering retailer’s reciprocal preference. The above results serve as reminders to managers and policymakers to establish reasonable incentives for the GSC.

Case 4: Cost-sharing contract with the retailer’s reciprocal preference

To further explore whether members can achieve Pareto improvement through the cost-sharing contract, we focus on a cost-sharing contract with the retailer’s reciprocal preference. We first illustrate the necessary and sufficient conditions for Pareto improvement in a GSC considering the retailer’s reciprocal preference. Next, we investigate how a cost-sharing contract that realizes Pareto improvement affects GSC’s performances. The retailer aims to maximize the utility function, while the manufacturer pursues the maximum profit. We index this case by superscript YS. The player’s objective functions are:

By substituting the best retailer’s response pYS∗ = (a + bwYS + eθYS + b(c − wYS)γr)/2b into Eq. (8), the optimal emission abatement level and wholesale price can be solved. The Hessian matrix with respect to wYS and θYS is:

Under the assumption of e2 < 8bβ(1 − ϕ)(1 − γr), the Hessian matrix is negative definite; thus the decentralized model has the optimal solutions. We derive the optimal retail price and emission abatement level by equaling the first derivatives concerning to 0. Then, we substitute the optimal decision above to Eq. (9). The retailer’s utility function \( {U}_r^{\mathrm{YS}} \) is concave in ϕ if the second-order condition \( {d}^2{U}_r^{\mathrm{YS}}/\mathrm{d}{\phi}^2=5{e}^2-16 b\beta \left(1+2\phi \right)+32 b\beta \left(-1+\phi \right){\gamma}_r<0 \) is satisfied. The optimal cost-sharing ratio ϕYS∗ can be derived from setting the first-order condition equal to 0. Especially, we can get the necessary condition 3e2 < 16bβ, which ensures the existence of the optimal decisions, by substituting the optimal cost-sharing proportion ϕYS∗ into e2 < 8bβ(1 − ϕ)(1 − γr) and \( {d}^2{U}_r^{\mathrm{YS}}/\mathrm{d}{\phi}^2<0 \), the optimal solutions in this case can be calculated as: \( {w}^{\mathrm{YS}\ast }=\frac{a\left({e}^2-16 b\beta \right)+ bc\left(5{e}^2-16 b\beta \right)+2 bc\left(-3{e}^2+16 b\beta \right){\gamma}_r}{2b\left(-3{e}^2+16 b\beta \right)\left(-1+{\gamma}_r\right)} \), \( {\theta}^{\mathrm{YS}\ast }=\frac{2\left(a- bc\right)e}{-3{e}^2+16 b\beta} \), \( {\phi}^{\mathrm{YS}\ast }=\frac{-{e}^2+16 b\beta {\gamma}_r}{16 b\beta \left(-1+{\gamma}_r\right)} \) and \( {p}^{\mathrm{YS}\ast }=\frac{3a{e}^2+9 bc{e}^2-48 ab\beta -16{b}^2 c\beta}{12b{e}^2-64{b}^2\beta } \).

Next, substituting the optimal decisions into Eq. (8) and Eq. (9), the optimal profits are derived as: \( {\pi}_m^{\mathrm{YS}\ast }=\frac{{\left(a- bc\right)}^2\left({e}^2-16 b\beta \right)}{8b\left(-3{e}^2+16 b\beta \right)\left(-1+{\gamma}_r\right)} \), \( {\pi}_r^{\mathrm{YS}\ast }=\frac{{\left(a- bc\right)}^2\left({e}^2+16 b\beta +\left({e}^2-48 b\beta \right){\gamma}_r\right)}{-16b\left(-3{e}^2+16 b\beta \right)\left(-1+{\gamma}_r\right)} \) and \( {\pi}_{\mathrm{sc}}^{\mathrm{YS}\ast }=\frac{{\left(a- bc\right)}^2\left(-{e}^2+48 b\beta \right)}{16b\left(-3{e}^2+16 b\beta \right)} \).

More interestingly, by solving inequalities pYS∗ − wYS∗ ≥ 0, and 0 < ϕYS∗ < 1, the reasonable range of the retailer’s reciprocity can be derived as: \( {\Omega}_r^{YS}=\left\{{\gamma}_r|-1\le {\gamma}_r<0\ \mathrm{and}\ 0<{\gamma}_r<{e}^2/16 b\beta \right\} \). This reasonable range (\( {\Omega}_r^{\mathrm{YS}} \)) is a mutually beneficial area for manufacturer and retailer to maintain stability. The following propositions in case 4 are based on this reasonable range.

Proposition 8

In the decentralized channel under cost-sharing contract, the optimal decisions ((pYS∗, wYS∗, θYS∗ and ϕYS∗) and the optimal profits (\( {\pi}_m^{YS\ast },{\pi}_r^{YS\ast } \) and \( {\pi}_{sc}^{YS\ast } \)) are increasing with the consumer’s environmental preference (e).

The optimal decisions and profits increase with consumer environmental preference, which means that consumer’s environmental awareness affects not only demand but also profits. Thus, under the cost-sharing contract, enhancing consumer’s environmental awareness is favorable to the establishment of an energy-saving and environment-protective society.

Proposition 9

The optimal cost-sharing ratio (ϕYS∗) and retailer’s profit (\( {\pi}_r^{YS\ast } \)) decrease with the retailer’s reciprocal preference parameter (γr); the optimal wholesale price (wYS∗) and the manufacturer’s profit (\( {\pi}_m^{YS\ast } \)) increase with the retailer’s reciprocal preference parameter (γr).

Proposition 9 implies that the manufacturer will improve wholesale price if the cooperator (the retailer) treats him/her more kinder or less mean. Higher wholesale price can bring the manufacturer more profit. Interestingly, the cost-sharing ratio (ϕYS∗) decreases with retailer’s reciprocal preference parameter (γr). This indicates the retailer shares less cost of emission abatement if retailer has stronger reciprocal preference. More interestingly, the retail price, emission abatement level, and GSC’s profit are equal in case 3 and case 4, that is: \( {\pi}_{\mathrm{sc}}^{\mathrm{NS}\ast }={\pi}_{\mathrm{sc}}^{\mathrm{YS}\ast } \), θYS∗ = θNS∗ and pYS∗ = pNS∗. The retailer’s reciprocal preference (γr) affects the wholesale price and cost-sharing ratio. Signing the cost-sharing contract contributes to achieve redistribution of the supply chain profit between the manufacturer and retailer.

Proposition 10

Within the reasonable range of retailer’s reciprocity (\( {\Omega}_r^{YS} \)), the optimal decision variables and profits in case 4 are greater than those in case 2, that is: θYS∗ > θY∗, wYS∗ > wY∗, pYS∗ > pY∗, \( {\pi}_m^{YS\ast }>{\pi}_m^{Y\ast } \), \( {\pi}_r^{YS\ast }>{\pi}_r^{Y\ast } \),\( {\pi}_{sc}^{YS\ast }>{\pi}_{sc}^{Y\ast } \).

Proposition 10 indicates that within a reasonable range (\( {\Omega}_r^{\mathrm{YS}} \)), both the retailer and the manufacturer make more profits in case 4 than those in case 2. Interestingly, the emission abatement level is also greater in case 4, which implies that the cost-sharing contract is conducive to realizing Pareto improvement of channel profits and improving the manufacturer’s environmental protection efforts. The above results will contribute to the coordination theory of the GSC with reciprocity preference.

Numerical analysis

In this section, we comprehensively analyze the equilibrium in “The models” section by several numerical examples. We mainly concentrate on the influences of the retailer’s reciprocal preference and consumer environmental preference on the optimal decisions and profits.

Influence of retailer’s reciprocal preference

According to the related conditions and literature, we provide some parameter values related to the current study, as shown in Table 3.

We can derive the reasonable range of retailer’s reciprocity: {γr| − 1 ≤ γr < 0, 0 < γr < 0.2}. The equilibrium solutions and profits in different cases are obtained and shown in Table 4.

Based on our theoretical results in “The models” section and the numerical results in Table 4, we draw the following insights: (1) compared with other decentralized models, both emission abatement level and GSC’s profit are the highest, while the retail price is the lowest in the centralized model, which illustrates that the centralized decision-making is able to improve the GSC’s efficiency; (2) in case 2 and case 4, the profit of retailer decreases with γr, the profit of manufacturer and wholesale price decrease with γr. This can be explained by the fact that with a greater γr, the retailer is more kind to the manufacturer and prefers to sacrifice self-profit to realize the growth of GSC’s profit. Meanwhile, increasing the wholesale price can result in a higher manufacturer profit, indicating that the Pareto improvement of channel profit can be realized through cost-sharing contract. However, in case 4, γr has no significant effect on the emission abatement level, GSC’s profit, and retail price, which shows that the cost-sharing contract can realize profits Pareto only by affecting wholesale price and cost-sharing ratio; (3) in case 4, the manufacturer’s profit shows an increasing trend when the retailer is kinder to the manufacturer. Interestingly, the profit of the GSC is constant. This is because reciprocal preferences only work between enterprises within the GSC, and the change of the retailer’s reciprocity preference value does not affect the GSC’s profit when the supply chain is a system; (4) the cost-sharing contract plays an active role in improving the environmental and economic performance in the GSC. For each value of retailer’s reciprocal preference, the players’ profits and the emission abatement level in the models of using cost-sharing contract (in case 3 and case 4) are higher than those of the models without using cost-sharing contract (in case 1 and case 2), which means that the contract is able to realize the profit’s Pareto improvement, as well as environmental protection and economic growth of the whole society.

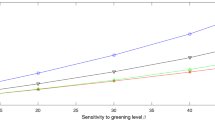

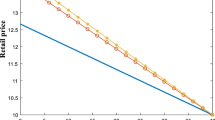

Influence of consumer environmental preference

In this part, we focus on interpreting the impacts of consumer environmental preference on optimal decisions and profits. Similar to the “Influence of retailer’s reciprocal preference” section, the parameters are set to a = 1500, b = 20, c = 10, and β = 100. Importantly, we derive the value range of consumer’s environmental level (e) from the conditions: γr < e2/16bβ and 3e2 − 16bβ < 0. According to the above conditions, we find that the value range of e is related to the value of γr. Therefore, we illustrate the influence of the consumer environmental preference in the cases of positive retailer’s reciprocal preference (i.e., γr = 0.2) and negative retailer’s reciprocal preference (i.e., γr = − 0.2) respectively. The changes of the optimal decisions and profits are shown in Figs. 3, 4, 5, 6, 7, and 8 (by Matlab 2010). Here, the value of e approximately varies from 80 to 103 if γr = 0.2, while the value of e almost varies from 0 to 103 when γr = − 0.2. The numerical example of parameters is shown in the Table 5.

As shown in Figs. 3, 4, 5, 6, 7, and 8, consumer’s environmental preference (e) positively impacts optimal decisions and profits regardless of whether the retailer’s positive or negative reciprocal preference is considered. The higher the e, the more likely consumers are to buy green products. Then the manufacturer increases emission-reduction efforts to produce consumer-oriented products (refer to Fig. 5), which means greater costs of investing carbon emission abatement. To make up for the loss of profit caused by the increase in environmental cost, the manufacturer raises the wholesale price (refer to Fig. 4), and the retailer accordingly increases the retail price (refer to Fig. 3).

In addition, we find that the members’ profits and GSC’s profit are increased with e (refer to Figs. 6, 7, and 8). Therefore, the manufacturer and environmental regulators should devote themselves to improve consumers’ low-carbon concerns to ensure that the players’ in the GSC make more profits. Interestingly, the curves of the optimal retail price, emission abatement level, and GSC’s profit in case 3 and case 4 coincide completely. This means that the retail price, emission abatement level, and GSC’s profit are out of the effect of retailer’s reciprocal preference parameter (γr). The retailer’s reciprocal preference (γr) affects the wholesale price and cost-sharing ratio. Signing the cost-sharing contract contributes to achieve redistribution of the supply chain profit between the manufacturer and retailer.

Conclusions

Reciprocal preference has a profound influence on the policymakers and managers. In this paper, we attempt to integrate the consumers’ environmental preference in the channel members’ decision-making with and without the retailer’s reciprocal preference. We present a centralized model to characterize pricing and emission-reduction decisions, as well as four decentralized cases in which retailer’s reciprocal preference and cost-sharing contract are selectively considered.

The key conclusions and management implications of this paper are highlighted as follows: (1) The higher consumers’ environmental awareness makes them prefer to pay for low-carbon products. The emission abatement level, channel profits, and GSC’s profit tend to increase with consumer’s environmental preference. Green products provide more value-add for the GSC system. Therefore, improving consumer environmental awareness is favorable to the construction of resource-saving society. The government should strengthen civic awareness of protecting environment. Meanwhile, the enterprises need to enhance the propaganda of low-carbon products. (2) In this paper, reciprocal behavior is further divided into two types: reciprocation for a friendly act (positive reciprocity) and revenge for a hostile one (negative reciprocity). When the retailer shows positive reciprocal concern to the cooperator, he/she is willing to sacrifice his/her own interest to improve the manufacturer’s and the GSC’s interest. Thus, the retailer with reciprocal preference is trying to ensure that the cooperator (the manufacturer) can make profit. In addition, within the reasonable range of retailer’s reciprocal preference, higher value of the retailer’s reciprocal preference is conducive to the better realization of environmental protection and the improvement of the economic welfare of the whole society. (3) Regardless of whether the retailer’s reciprocal preference is considered, the channel profits can realize Pareto improvement under certain conditions using the cost-sharing contract. Thus, the cost-sharing contract plays an active role in improving the environmental and economic performance in the GSC. These conclusions provide a theoretical basis on cooperation contract for companies committed to reducing carbon emissions in the GSC when the retailer has a reciprocal preference.

Although this research provides useful insights, there are some limitations to this study. Firstly, only a two-stage supply chain structure without competitive relationship is considered. However, the actual supply chain structure is more complicated; it is necessary to develop models among competing retailers or manufacturers. Secondly, the current research is based on the assumption that each member has symmetrical information. Given that players’ information is usually asymmetric in practice, it would be of value to investigate the GSC with incomplete asymmetric information for getting more convincing results. Furthermore, we will be looking at perfecting our research by introducing random demand that has wider applicability.

Data availability

All data generated or analyzed during this study are included in this article.

References

Aslani A, Heydari J (2019) Transshipment contract for coordination of a green dual-channel supply chain under channel disruption. J Clean Prod 223:596–609

Banik A, Taqi HM, Ali SM, Ahmed S, Kabir G (2020) Critical success factors for implementing green supply chain management in the electronics industry: an emerging economy case. Int J Logist. https://doi.org/10.1080/13675567.2020.1839029

Camerer CF (2003) Behavioral game theory: plausible formal models that predict accurately. Behav Brain Sci 26:157–158

Camerer C, Thaler RH (1995) Anomalies: ultimatums, dictators and manners. J Econ Perspect 9:209–219

Cavusoglu H, Cavusoglu H, Zhang J (2008) Security patch management: share the burden or share the damage? Manag Sci 54:657–670

Chao GH, Iravani SMR, Savaskan RC (2009) Quality improvement incentives and product recall cost sharing contracts. Manag Sci 55:1122–1138

Chen H, Long R, Niu W, Feng Q, Yang R (2014) How does individual low-carbon consumption behavior occur? – An analysis based on attitude process. Appl Energy 116:376–386

Chen J, Zhou YW, Zhong Y (2018) A pricing/ordering model for a dyadic supply chain with buyback guarantee financing and fairness concerns. Int J Prod Res 55:1–18

Cui L, Wu KJ, Tseng ML (2017) Selecting a remanufacturing quality strategy based on consumer preferences. J Clean Prod 161:S0959652617304912

Du S, Hu L, Song M (2016) Production optimization considering environmental performance and preference in the cap-and-trade system. J Clean Prod 112:1600–1607

Du S, Hu L, Wang L (2017) Low-carbon supply policies and supply chain performance with carbon concerned demand. Ann Oper Res 255:569–590

Du S, Nie T, Chu C, Yugang Y (2014) Reciprocal supply chain with intention. Eur J Oper Res 239:389–402

Falk A, Fehr E, Fischbagher U (2003) On the nature of fair behavior. Econ Inq 41:20–26

Fehr E, Gächter S (2000) Fairness and retaliation: the economics of reciprocity. J Econ Perspect 14:159–181

Fehr E, Kirchsteiger G, Riedl A (1993) Does fairness prevent market clearing? An experimental investigation. Q J Econ 108:437–459

Frisk M, Göthe-Lundgren M, Jörnsten K, Rönnqvistab M (2010) Cost allocation in collaborative forest transportation. Eur J Oper Res 205:448–458

Ghosh D, Shah J (2012) A comparative analysis of greening policies across supply chain structures. Int J Prod Econ 135:568–583

Ghosh D, Shah J (2015) Supply chain analysis under green sensitive consumer demand and cost sharing contract. Int J Prod Econ 164:319–329

Jaber MY, Glock CH, El Saadany AMA (2013) Supply chain coordination with emissions reduction incentives. Int J Prod Res 51:69–82

Liu W, Wang S, Zhu DL, Wang D, Shen X (2018) Order allocation of logistics service supply chain with fairness concern and demand updating: model analysis and empirical examination. Ann Oper Res 268:1–37

Loch CH, Wu Y (2008) Social preferences and supply chain performance: an experimental study. Manag Sci 54:1835–1849

Lotfi R, Mehrjerdi YZ, Mardani N (2017a) A multi-objective and multi-product advertising billboard location model with attraction factor mathematical modeling and solutions. Int J Appl Logist 7(1):64–86

Lotfi R, Yadegari Z, Hosseini SH, Khameneh AH, Tirkolaee EB, Weber GW (2017b) A robust time-cost-quality-energy-environment trade-off with resource-constrained in project management: a case study for a bridge construction project. J Ind Manag Optim 13(5):0

Lotfi R, Mehrjerdi YZ, Pishvaee MS, Sadeghieh A, Weber GW (2020) A robust optimization model for sustainable and resilient closed-loop supply chain network design considering conditional value at risk. Numer Algebra. https://doi.org/10.3934/naco.2020023

Mehrbakhsh S, Ghezavati V (2020) Mathematical modeling for green supply chain considering product recovery capacity and uncertainty for demand. Environ Sci Pollut Res 27:44378–44395. https://doi.org/10.1007/s11356-020-10331-z

Mehrjerdi YZ, Lotfi R (2019) Development of a mathematical model for sustainable closed-loop supply chain with efficiency and resilience systematic framework. Int J Supply Oper Manag 6(4):360–388

Panda S (2013) Coordinating two-echelon supply chains under stock and price dependent demandent demand rate. Asia-Pac J Oper Res 30:20

Tang S, Wang W, Zhou G (2020) Remanufacturing in a competitive market: a closed-loop supply chain in a Stackelberg game framework. Expert Syst Appl 161:113655. https://doi.org/10.1016/j.eswa.2020.113655

Wang J, Shin H (2015) The impact of contracts and competition on upstream innovation in a supply chain. Prod Oper Manag 24:134–146

Wang L, Song H, Wang Y (2017) Pricing and service decisions of complementary products in a dual-channel supply chain. Comput Ind Eng 105:223–233

Wang C, Wang W, Huang R (2017) Supply chain enterprise operations and government carbon tax decisions considering carbon emissions. J Clean Prod 152:271–280

Xia L, Guo T, Qin J, Yue X, Zhu N (2018) Carbon emission reduction and pricing policies of a supply chain considering reciprocal preferences in cap-and-trade system. Ann Oper Res:1–27

Xiao Q, Chen L, Xie M, Wang C (2020) Optimal contract design in sustainable supply chain: Interactive impacts of fairness concern and overconfidence. J Oper Res Soc:1–20. https://doi.org/10.1080/01605682.2020.1727784

Xu X, He P, Xu H, Zhang Q (2016) Supply chain coordination with green technology under cap-and-trade regulation. Int J Prod Econ 183

Xu L, Wang C, Zhao J (2018) Decision and coordination in the dual-channel supply chain considering cap-and-trade regulation. J Clean Prod 197:551–561

Yan Z, Li J, Gou Q (2017) An allocation game model with reciprocal behavior and its applications in supply chain pricing decisions. Ann Oper Res 258:1–22

Yang H, Chen W (2018) Retailer-driven carbon emission abatement with consumer environmental awareness and carbon tax: Revenue-Sharing versus Cost-Sharing. Omega 78:179–191

Zhao S, Zhu Q, Li C (2016) A decision-making model for remanufacturers: considering both consumers’ environmental preference and the government subsidy policy. Resour Conserv Recycl 128:S0921344916301689

Acknowledgements

Here, we give sincere appreciation to the anonymous editors as well as reviewers for the suggestions and comments.

Funding

This work is supported by the Graduate Innovation Fund of Shanghai University of Finance and Economics under Grant No.CXJJ-2018-404.

Author information

Authors and Affiliations

Contributions

YM constructed the models and was a major contributor in writing the manuscript. GXM participated in the conceptualization, methodology, formal analysis, and data curation of this paper. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Ethics approval and consent to participate

Not applicable.

Consent for publication

Not applicable.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Eyup Dogan

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Highlights

• Both environmental preference and retailer’s reciprocal preference are considered.

• Retailer’s positive reciprocity is good for environment and supply chain.

• Channel profits can realize Pareto improvement by cost-sharing contract.

• Green products provide more value-add for the GSC system.

Rights and permissions

About this article

Cite this article

Yang, M., Gong, Xm. Optimal decisions and Pareto improvement for green supply chain considering reciprocity and cost-sharing contract. Environ Sci Pollut Res 28, 29859–29874 (2021). https://doi.org/10.1007/s11356-021-12752-w

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-021-12752-w