Abstract

Regarding a two-echelon supply chain consisting of a logistics service integrator (LSI) and several functional logistics service providers (FLSPs), this paper establishes a two-stage order allocation model considering demand updating and the FLSPs’ fairness preferences. This model is a multi-objective programming model, whose goal is to maximize profits of the LSI and the total utility of FLSPs. The ideal point method is used to obtain the optimal solution. In the numerical example, the impacts of FLSPs’ behavioral parameters and demand update parameters on the order allocation in the social services network are discussed. Besides, multi-methodological method is used to verify the theoretical perspectives through an empirical study of Tianjin SND Logistics Company. Our study obtains a few important conclusions. For example, when demand of the second stage is updated, there is an optimal updating time maximizing the supply chain performance. Increased demand of the second stage results in greater supply chain performance. When the demand during the second stage decreases, the bigger the difference of the fairness preference coefficients among FLSPs, the greater the LSI’s profits and the lower the FLSPs’ total utility will be. However, the difference of the fairness preference coefficients among FLSPs has little influence on the LSI’s profits and total utility of the FLSPs, when the demand during the second stage increases.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

Social network refers to the stable relationship formed by social individual member’s interaction, and focuses on the interaction and contact between people, and social interaction will influence people’s social behavior (Borgatti and Everett 1997; Gómez et al. 2008; Perry-Smith and Mannucci 2015). Social network theory has been widely applied in the enterprise field since the 1990s (Valente 1996; Choi and Sethi 2010; Brashears and Gladstone 2016), and various social cooperation networks have emerged. In logistics service outsourcing, the logistics service integrator (LSI) and functional logistics service providers (FLSPs) form the logistics service supply chain, in which the LSI integrates service capabilities from multiple FLSPs to provide integrated logistics services for customers (such as manufacturing companies) (Liu et al. 2011). In general, there are usually multiple FLSPs for one LSI. After obtaining customer demand, the LSI assigns the orders to many FLSPs according to the demand, and finally the FLSPs provide complete logistics service capabilities to finish the logistics service, thus forming a network of logistics service supply chain. Logistics service supply chain is a typical social cooperation network. For example, YTO Express of Tianjin, a branch of YTO Express in north China, integrates 42 FLSPs in Tianjin, which provides service capabilities such as warehousing, transportation and other human handling to help YTO Express of Tianjin finish customer’s logistics service demand from all the 31 provinces and autonomous regions in China (Liu et al. 2015a). During the cooperation of the LSI and FLSPs, the LSI’s rational allocation of orders is one of the important decisions in supply chain network management (Mallik and Harker 2004). When faced with multiple FLSPs, the LSI knowing how to allocate the orders rationally is a key to ensuring long-term stability of supply chain operations.

However, from the view of practice, service orders allocation decisions are often faced with updated service needs in the service supply chain network (Fisher and Raman 1996; Wang et al. 2015). Allocating the orders with demand update seems much more difficult. On the one hand, changes in the total number of allocated orders will result in the order being re-allocated, causing changes in order allocation results. On the other hand, the second order allocation will result in a quantity difference from the first allocation. Due to the FLSPs’ fairness preference behavior, the difference in order allocation will directly affect the FLSPs’ utility function, thereby affecting the decision-making of the FLSPs. FLSP’s unfair preferences exist in practice (Güth et al. 1982; Camerer 2003; Charness and Rabin 2002; Andreoni and Miller 2002). The allocation process after demand updating must take fairness factor into account. Therefore, two key factors must be considered in order allocation: demand updating and FLSPs’ fairness preferences. Without considering these two factors, LSIs are affected. For example, during China’s online shopping market promotion on November 11, 2011, e-commerce transactions of Taobao in China reached 3.36 billion Yuan (Ram, 2011). Nationwide outlets of China’s YTO Express Logistics Company solely collected a total of 2.67 million parcels. The data is constantly updated annually. On November 11, 2015, e-commerce transactions of Taobao in China has grown to 91.217 billion Yuan, and YTO Express Logistics Company received a total of 53.28 million parcels, which had to be delivered to customers across 31 provinces by their service FLSPs within 3–5 days (Sun 2015). The surge in demand was completely beyond the expectations of YTO Express in October, and YTO Express Logistics Company’s lack of order allocation rules with demand updating made service order allocation unfair for different FLSPs and resulted the FLSPs preparing too much or too little service capability. Problems such as a logistics “warehouse explosion,” delay of distribution, cargo damage were caused (Zhang and Xiao 2011; Xia 2015; Sun 2015). Some FLSPs even dropped out of collaboration with YTO Express Logistics Company after the selling season. Therefore, YTO Express Logistics Company is under great pressure during promotional period every year and urgently needs to solve the order allocation problem under demand updating. The similar problems also occurred in China’s SND logistics company. SND provides logistics services for companies such as Procter & Gamble and Siemens by integrating its own capabilities and the capabilities of other FLSPs, such as Tianjin SMF Logistics Co., Ltd., which formed a networked service supply chain. In the logistics service network, when the demand is updated, SND will re-assign the customer orders, and the FLSPs will adjust their existing cooperation strategies based on the fairness of the order allocation by SND. Some FLSPs will even directly quit the cooperation with SND. For example, in September 2015, when the demand of SND’s customer Procter & Gamble was updated, SND re-allocated the Tianjin to Taicang City orders based on the demand. Tianjin Jiangxin Antai Company, one of SND’s FLSPs, felt a serious injustice about the allocation, finally directly gave up the orders, and announced the suspension of cooperation with the SND. Clearly, in the case of demand update, the decision-making of the order allocation needs to be made more scientific and rational by LSIs.

From theoretical perspective, research on supply chain order allocation has been proposed very early. As for the methods for solving the order allocation problem, the common methods are linear programming (Ghodsypour and O’brien 1998), nonlinear programming (Benton 1991) and mixed-integer programming (Ghodsypour and O’brien 2001). But these models of order allocation have deficiencies in two aspects. On the one hand, traditional supply chain management is usually based on the rational economic man assumption, without considering the influence of the behavior on the order allocation. Only Liu et al. (2015a) took into account the behavior factors in a multi-period order allocation model of a two-echelon logistics service supply chain, and introduced the fairness preference function to the model. But demand update was not considered in Liu et al. (2015a). On the other hand, previous studies on the order allocation of supply chains haven’t considered the environment of demand update. Therefore, we will investigate the effect of fairness preference on the order allocation based on demand update, and discuss the influence rules of increased demand and decreased demand.

This paper is expanded from Liu et al. (2015a) and Eppen and Iyer (1997a, b). Different from Liu et al. (2015a), we studied order allocation in service supply chain with demand update and analyzed the impacts of the lead time and the cost parameter of demand update on supply chain coordination. Different from Eppen and Iyer (1997a, b), from the view of practice, we considered the influence of the FLSP’s fairness preference coefficient on the order allocation, based on which we constructed the FLSP’s utility function. We adopted the multi-methodological method to solve the problem (Choi et al. 2015), established a two-stage order allocation model from a theoretical perspective, and conducted an empirical study of Tianjin SND Logistics Company to analyze the influences of demand update and fairness preference on the order allocation and verify the theoretical conclusions. The following problems are studied:

-

What impacts will the FLSPs’ behavior of fairness preference have on their total utility, the LSI’s profit and the total performance of the supply chain under demand update on the basis of Liu et al. (2015a)? Will the rules be significantly different from those of Liu et al. (2015a)?

-

After updating the demand, is there any significant difference of order allocation rules in a supply chain in two cases of increased demand and decreased demand? What impact will the two cases have on the total performance of a supply chain?

-

Is there optimal time for demand update? Will the parameters of demand update, such as cost update coefficient, affect the total performance of the supply chain?

In this paper, we established a multi-objective order allocation decision model, whose goal is to maximize profits of the LSI and the total utility of the FLSPs. Then we solved the model and conducted a series of numerical analysis, then discussed the impacts of FLSPs’ behavioral parameters and demand update parameters on the order allocation. Besides, multi-methodological methods are used in this paper, verifying the theoretical perspectives through an empirical study of Tianjin SND Logistics Company. This paper makes contribution in two aspects. On the one hand, we introduced inequity aversion function into the service supply chain order allocation problem, and explored the interaction effects of demand update and fairness preference behavior on task assignment. On the other hand, some important conclusions in this paper have very good guidance on the task allocation decisions for LSIs. For example, the LSI should select optimal time to update the demand for greater supply chain performance. In addition, fairness preferences of the FLSPs will have different influences on supply chain performance under increased demand and under decreased demand, so the LSI should select different order allocation strategies.

The remainder of the paper is organized as follows: Sect. 2 is a literature review regarding order allocation, fairness preference and demand update. Section 3 is model building and assumptions. Section 4 establishes an order allocation model of a two-echelon logistics service supply chain considering the FLSP’s fairness preference with demand update, and it shows the solving method of the model. Section 5 is numerical simulation; the effect of different behavioral parameters and related demand updating parameters on the order allocation results is analyzed. Section 6 presents an empirical case of Tianjin SND Logistics Company. The main conclusions and future research will be given in Sect. 7.

2 Literature review

Our research is mainly concerned with the order allocation of a two-echelon logistics service supply chain considering the FLSP’s fairness preference with demand update. Thus, the literature review is mainly related to fairness preference theory and fairness preference function, supply chain order allocation, and supply chain coordination with demand update. Our research aims will be proposed after summarizing the literature and its deficiencies.

2.1 Inequity behavior and fairness preference function

Fairness centers on how people are treated by others, especially the requirement that they be treated alike, in the absence of significant differences between them, so fairness behavior is closely related to social network theory (Judd et al. 2011; Choi and Messinger 2016). Social network theory, a new research paradigm of sociology, originates from the 1930s and matures in the 1970s (Freeman 1978). Social network refers to the stable relationship formed by social individual member’s interaction, and focuses on the interaction and contact between people, and social interaction will influence people’s social behavior (Borgatti and Everett 1997; Gómez et al. 2008; Perry-Smith and Mannucci 2015). Social network theory has been widely applied in the enterprise field since the 1990s (Valente 1996; Choi and Sethi 2010; Brashears and Gladstone 2016). Logistics service supply chain network contains logistics services integrators and logistics service providers, which refer to the traditional functional logistics enterprise, such as transportation enterprise, storage enterprise, etc. Their businesses are often limited to a particular region due to single and standard service function. Finally, the providers are integrated by logistics service integrator as suppliers in the construction of national and even global service network (Liu and Wang 2015; Christopher 2016). Therefore, logistics service supply chain is a typical social cooperation network. In the logistics service supply chain, there are close relationship and interaction between the LSI and FLSPs, so fairness and behavior problem is also one of the important issues in logistics service supply chain management (Tate 1996; Bottani and Rizzi 2006; Wang et al. 2016).

Enterprises sometimes may act contrary to their self-interests, which is an unnatural phenomenon in the cooperation of the supply chain. Therefore, behavior operations have been a branch of operations management in recent years. In general, the utility function is usually used to analyze and describe the behavior and underlying motivation of the enterprise decision-making in the operations theory (Larsen et al. 1999; Choi et al. 2015). For the discussion of equity behavior, a series of easily used equity preference utility functions has been put forward, stemming from the simplification of form and feasibility of handling since the 1990s. Rabin (1993) proposed a creative way to formalize the first reciprocity model based on motivation equity of equity preference theory, in which an equilibrium model of equity preference is obtained by building a good function and a reciprocity function. On the basis of Rabin (1993), Fehr and Schmidt (1999) proposed adverse inequality and an unequal favorable utility function according to human selfishness and an attempt to keep equity with other members of the group, which was used in other operations literature, such as Liu et al. (2015a). Bolton and Ockenfels (2000) proposed an equity preference utility function based on equality, reciprocity, and competition, which shows that comparisons are not just pairwise among supply chain members; instead, some members will judge the equity according to the ratio between their own income and the average income of the entire group. Behavior operations research, especially Camerer (2003), introduced behavioral factors into the analysis of agent utility, which corrected the traditional utility functions. Falk and Fischbacher (2006) used psychology to extend equity preference to the game between the participants, combining equity preference and experimental economics to establish and analyze a theoretical model. Different from the goodwill and malicious metric function in Rabin (1993), they quantified the degree of goodwill and malicious degrees by income differences among members. These previous studies made equity preference theory mature, but research in which preference theory is applied to the supply chain order allocation is rarely done. Only Liu et al. (2015a) used the fairness preference function proposed in Fehr and Schmidt (1999). Fairness preference utility function is the most common type of function; therefore, this paper will also draw on the modeling process based on the theory of fairness preference utility function proposed in Fehr and Schmidt (1999) with an attempt to explain the influence of behavioral factors on the supply chain order allocations.

2.2 Supply chain order allocation

Research on order allocation is one of the hot spots in the field of supply chain management. However, scholars are mainly involved in the order allocation among multi-suppliers and multi-cycles under limited production capacity or limited service capacity, most of which concentrate on the order allocation of manufacturing products (Basnet and Leung 2005; Demirtas and Üstün 2008; Zhang et al. 2016). Most research models are constructed using multi-objective programming, such as the the objective integer programming model and the 0–1 integer programming model. In the complicated models, a hybrid algorithm based on a combination of genetic algorithms (GAs) and heuristic rules is also a commonly used method (Che and Wang 2008). In recent years, some scholars have considered a more complex environment, taking order allocation together with other factors, such as supplier selection, inventory and BOM information into consideration, which has gradually become an important trend of research. For example, some scholars use the Analytic Hierarchy Process (AHP) to select vendors, allocating the orders by building multi-period dynamic integer programming models according to the result of selection (Mafakheri et al. 2011). Analytic network process (ANP) is also used for supplier evaluation, according to which orders are allocated by establishing fuzzy multi-objective linear programming models (Lin 2012). In the research on order allocation, the manufacturing sequence, manufacturing time and other factors are considered combined with BOM information, resulting in the establishment of a non-linear, dynamic, multi-objective integer programming model, which can be solved by genetic algorithms (GAs) (Che and Wang 2008). A dynamic random integer programming model is designed in some studies of order allocation when considering inventory factors, which can be solved by a heuristic algorithm (Zhou et al. 2011).

With the rise of supply chain services in recent years, more and more scholars have begun to explore the order allocation problems in service supply chains, most of which relates to supply chain logistics services. In the field of logistics and supply chain services, the complexity of the order allocation environment is considered in some studies, such as the distribution of environmental emergency (Liu et al. 2011) and the mass customization service environment (Liu et al. 2013); behavioral factors have been considered in other studies, such as the order allocation research considering prospect theory (Liu et al. 2014) and order allocation study considering inequity averse behavior (Liu et al. 2015a). However, these studies do not take into account the updated demand environment, nor do they combine the updated demand environment and inequity averse behavior.

In addition to the field of logistics and supply chain services, some scholars have explored the order allocation problem in the supply chain, in which service characteristics are added. For example, Wei et al. (2013) studied the issue of a supplier allocating fixed service capacity to two retailers, and found that the retailers’ strategies in the game won’t be affected by the supplier’s allocation rules. Eruguz et al. (2014) explored the optimal reorder intervals R and order-up-to levels S in the service supply chain with commitments situation, in which a sequential optimization procedure is used to solve the problem.

2.3 Supply chain coordination research considering demand updating

In order to be responsive to changes in the market, demand information collection and consumer preferences are critical, some scholars such Choi and Sethi (2010) reviewed the information updating systematically from supply and demand aspects respectively. Existing literature on demand update can be divided into two types according to the source of demand formation: one is based on the observed market demand signal information (Gurnani and Tang 1999; Zhang et al. 2013); the other is based on actual observed demand (Bradford and Sugrue 1990; Eppen and Iyer 1997a, b; Tsay 1999; Milner and Rosenblatt 2002). Eppen and Iyer (1997a, b) is most similar to this paper. They studied a two-stage model with two opportunities to meet the demand, in which orders are played at the beginning of the first phase, and the demand will be updated according to the actual observed market demand after the initial realization of demand in order to re-correct the orders in the second stage to meet the market demand.

From the content of the supply chain coordination with demand update, related research mainly includes two fields: One is the retailer updating the demand to optimize ordering policy; the other is supply chain coordination with demand update. In the study of ordering strategies, the single selling season of fashion products with two replenishment opportunities was the first to be researched (Bradford and Sugrue 1990; Eppen and Iyer 1997a, b). From the supply chain perspective, research on two replenishment opportunities began earlier with Gurnani and Tang (1999), who studied retailers using observed demand information based on market signals to update the demand and optimize a two-stage ordering decision problem under uncertain demand. Subsequently, many scholars extended the problem to more complex cases and explored the second order problem in many cases, such as retailers being allowed to purchase goods in external markets (Sethi et al. 2004), service level constraints (Sethi et al. 2007), and a number of products (Miltenburg and Pong 2007a, b). In the supply chain coordination, there are also many scholars such as Tsay (1999), Donohue (2000), and Milner and Rosenblatt (2002) who conducted research on demand update and pointed out that supplier and retailer conducting a proper contract can improve the supply chain’s profit when the market demand can be predicted. Chen et al. (2006) studied the pricing and inventory joint decision-making problems with demand update and random demand, and finally designed a buy-back contract to share the market risk. Liu et al. (2015b) studied the two-stage batch ordering strategy of logistics service capacity with demand update. From the above two aspects of the literature, the existing literature on demand update mainly studies newspapers and magazines, DVDs, food, medicines and other perishable goods, and only regards the price or lead time and order quantities as a decision variable. However, the research on logistics service demand order allocation strategies is rare.

2.4 Summary of literature review

As can be seen from the above review of the literature, the independent research on supply chain order allocation, inequity behavior and fairness preference function, and supply chain coordination considering demand updating are relatively abundant. Although there are some studies combining the supply chain order allocation and behavioral factors or demand update, the combination of the three studies hasn’t yet emerged, namely, the study of supply chain logistics services order allocation models with demand update considering FLSP’s fairness preference. Therefore, to combine the dual characteristics of FLSP’s fairness preferences and demand update, the integrated allocation strategy of logistics service will be the focus of this study. This paper is expanded from Liu et al. (2015a) and Eppen and Iyer (1997a, b). Different from Liu et al. (2015a), we studied order allocation in service supply chains with demand update and analyzed the impacts of the lead time and the cost parameter of demand update on the supply chain coordination. Different from Eppen and Iyer (1997a, b), we considered the influence of FLSP’s fairness preference coefficient on the order allocation from reality, and constructed FLSP’s utility function based on the fairness preference coefficient. This paper establishes a two-stage order allocation model considering FLSP’s fairness preference with demand update, and discusses the impacts of FLSP’s behavioral parameters and demand update parameters on the order allocation.

3 Problem description and model assumptions

In this section, the problem and basic assumptions are described in detail. Notations used in model building are listed as well. In Sect. 3.1, both the problems and the decision process of order allocation are described. In Sect. 3.2, important assumptions and notations in our model are listed specifically.

3.1 Problem description and the decision process

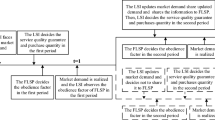

Suppose a logistics service supply chain consisting of an LSI and n FLSPs that cooperate with each other. The model assumes that some of the logistics service capability needed by customers comes from the LSI itself, the rest comes from its FLSPs. There are two stages of the customer’s demands, and the specific sequence of events is as follows:

In the first stage, the LSI and the FLSPs distribute the profits and the costs with revenue-sharing contracts, with the sharing ratio set by the LSI. The LSI predicts market demand and shares information with the FLSPs, and then allocates the orders initially according to the original market forecast in order to better respond to fluctuations in demand caused by demand update. Taking into account the requirements of equitable distribution, the order allocation result is open to the each FLSP, namely that the FLSPs know the number of orders assigned to each other. The FLSPs’ satisfaction and feelings of equity about the LSI are generated based on the result of order allocation. Finally, the customer’s demand is finished at the end of the first stage.

In the second stage, the customer’s demand will change on the basis of the demand of the first stage. The LSI updates the demand information before achievement of the customer’s demand of the second stage, with a lead time t. Meanwhile, the FLSPs adjust the quoted price of the current phase based on the degree of satisfaction with the allocation result in the first stage. Finally, the LSI allocates orders and supply chain members get their own profits after the customers’ demand achievement of the second stage.

3.2 Model assumptions

Except for those presumptions, other related assumptions are given as follows:

Assumption 1

Assuming an LSI and n FLSPs have a long-term cooperation. The LSI receives customers’ orders and finishes some of the orders with its own logistics service capability and allocate the others to various functional logistics service FLSPs. In order to achieve fairness, the result of the order allocation is open, and the allocation results can be known by all FLSPs. With demand uncertainty considered, the demands are assumed to be random variables following normal distribution \(N(\mu , \sigma ^{2})\) (Zhang et al. 2013; Liu et al. 2015a).

Assumption 2

Due to the market volatility, the market demand still meets a normal distribution after the demand update in the second stage, and the distribution parameters are concerned with the update time t. Based on the method of Cheng (2012), the updated demand distribution is assumed that \(\left( {X|\xi } \right) \sim N\left( {\mu \left( \xi \right) ,\upsilon ^{2}} \right) \), in which \(\xi \) is an estimate of the demand according to the collected demand information at a lead time of t before the second stage. The expectation of the updated demand is \(\mu (\xi )=\frac{\sigma ^{2}\mu +\tau ^{2}(t)\xi }{\sigma ^{2}+\tau ^{2}(t)}\), variance is \(\upsilon ^{2}(t)=\frac{1}{\sigma ^{-2}+\tau ^{-2}(t)}\). In which, \(\tau \left( t \right) \) is the demand forecasting accuracy, and \(\tau \left( t \right) =\gamma e^{bt}\), \(\gamma >0\). The details of proof process are listed in Appendix.

Assumption 3

The LSI and the FLSPs are supposed to distribute the profits and the costs with revenue-sharing contracts in both stages and the profit distribution coefficient of the FLSP i is set as (\(1-r_{i}\)) (Giannoccaro and Pontrandolfo 2009). \(r_{i}\) is the profits distribution coefficient of the LSI.

Assumption 4

To guarantee fairness of the order allocation, the LSI does not allow the FLSPs to form alliances or conspiracy relationship (Huang et al. 2013). In the order allocation, each FLSP maximizes its own utility with fairness concern, which is true in the actual logistics service provider market. For instance, Baogong Logistics Company, one of the largest LSI in China, integrates more than 500 storage companies, more than 1200 highway transportation companies, and over 500 manual loading and unloading companies into its chain and then delivers the integrated logistics services to its customers, such as Procter & Gamble, Philips and etc. (Liu et al. 2014). Therefore, there is full of competition among the numerous FLSPs when Baogong Logistics Company allocates its orders to its FLSPs. Baogong Logistics Company requests its FLSPs involved in the order allocations signing self-discipline agreement to avoid forming an alliance relationship with each other. Otherwise, the FLSPs will be eliminated from the order allocation because of their violation of self-discipline agreement.

All the related symbols are explained in Table 1.

4 Model building

4.1 The decision model in the first stage

An order allocation model of a logistics service supply chain considering fairness preference will be set up in this section. It is a multi-objective programming model, and the objective functions and constraint conditions of the model are as follows:

(1) The objective function 1: Maximization of the LSI’s profit

Set \(\lambda \) as the LSI’s unit income to provide logistics capacity. \(c_{i,1} \) is unit quoted price of the FLSP i in the first stage. K represents the profit rate of the LSI’s own service capability, and \(\Delta \) is the order allocated to the LSI’s own capacity. The LSI’s profit of logistics services in the first stage can be expressed as \(\mathop {\sum }\limits _{i=1}^n {r_i \left( {\lambda -c_{i,1} } \right) } x_{i,{1}} \). Thus we get objective function 1 as follows, which maximizes the LSI’s profit in the first stage:

(2) The objective function 2: Maximization of FLSPs’ overall utility

In this paper, this fairness preference function is introduced into the measurement of the FLSPs’ utility. First, \(d_{i,T} \) is set as the original order allocation utility of FLSP i in period T. According to Liu et al. (2011), \(d_{i,T} \) is expressed as follows,

where the available range of logistics capacity for FLSP i is \([\theta _i^- ,\theta _i^+ ]\) and \(d_{i,0}\) is the initial utility of FLSP i when the order volume of FLSP i is equal to \(\theta _i^- \). \(\theta _i^+ ,\theta _i^- \) and \(d_{i,0}\) can all be obtained by investigation when the LSI conducts the order allocation. Second, \(\upsilon _{i,T} \) is set as the AOAU of FLSP i in the Tth period.

On the basis of the \(d_{i,T} \), with inequity aversion function (Liu et al. 2015a), we introduce the utility function \(v_{i,T} \), which represents the utility due to the fairness preference of FLSP i, which is shown in Eq. (3).

where \(x_{i,T} \) denotes FLSP j’s allocated order volume in the Tth period. \(\alpha _i \) and \(\beta _i \) represent the fairness preference coefficient at a disadvantageous or advantageous situation respectively, which can be obtained by the questionnaire to the FLSPs set by the LSI or behavioral experimental approach. These methods have been discussed in supply chain order allocation models considering fairness preference (Cui et al. 2007; Ho and Su 2009; Katok and Pavlov 2013; Ho et al. 2014; Choi and Messinger 2016). \(A_{i,T} \) denotes the utility decrease of FLSP i in the Tth period at a disadvantageous situation and \(B_{i,T} \) denotes the utility decrease of FLSP i in the Tth period at a disadvantageous situation. According to the formula (3), the inequity feeling of FLSP i in the Tth period is \(\rho _{i,T} \), \(\rho _{i,T} =\frac{A_{i,T} +B_{i,T} }{d_{i,T} }\).

-

Structure of each FLSP’s total utility function

The comprehensive order allocation utility (COAU) of FLSPs is divided into two parts. The first part comes from the profit of the FLSP, namely, \(\frac{\left( {1-r_i } \right) \left( {\lambda -c_{i,1} } \right) x_{i,1} -c^{{\prime }}_{i,1} x_{i,1} }{\lambda x_{i,1} }\). Its denominator is income from FLSP i providing logistics service capacity and its numerator is the net profit of FLSP i. The second part comes from the order volume, namely, \(v_{i,1}\). Then, the weight of each part is set as \(w_{i1} \) and \(w_{i2} \), respectively, and \(w_{i1} +w_{i2} =1\). Thus, the COAU of FLSPi in the Tth period is \(w_{i1} \frac{\left( {1-r_i } \right) \left( {\lambda -c_{i,1} } \right) x_{i,1} -c^{{\prime }}_{i,1} x_{i,1} }{\lambda x_{i,1} }+w_{i2} v_{i1} \). FLSPs’ utility function varies from 0 to 1 after the standardization process, which is different from the general utility function in previous researches.

-

Total utility function of all FLSPs

Assume the weight of the FLSP i is \(e_i ,\mathop {\sum }\limits _{i=1}^n {e_i } =1\), and we can get the second objective function which maximizes the utility function of all FLSPs in the first phase:

(3) The constraints of the model

There are three constraints in this model: (1) the LSI should have adequate capacity to meet the customers’ demand; (2) The allocation results should be profitable for the LSI; (3) The allocation results should meet the participation constraint.

First, the LSI should have adequate capacity to meet the customers’ demand. With demand uncertainty and \(R\sim N(\mu ,\sigma ^2 )\) considered, an opportunity constraint \(\Pr ob(\mathop {\sum }\nolimits _{i=1}^n {x_i} \ge R)=\alpha \) is set and \(\alpha \)represents the probability of meeting customers’ demand. For example, when \(\alpha =95\%\), the total capacity of FLSPs can meet 95% of the customers’ demand at least. According to Liu et al. (2011), the uncertain demand constraints can be transformed and the transformed constraint is \(\mathop {\sum }\nolimits _{i=1}^n {x_i +\Delta =\mu +\Phi ^{-1}} \left( \alpha \right) \sigma \) .

Second, the allocation results should be profitable for the ith FLSP. The ith FLSP’s profit of unit logistics service capacity in the first stage is \(\left( {1-r_i } \right) \left( {\lambda -c_{i,1} } \right) x_{i,1} -c^{{\prime }}_{i,1} x_{i,1} \). And then it must satisfy \(\left( {1-r_i } \right) \left( {\lambda -c_{i,1} } \right) x_{i,1} -c^{{\prime }}_{i,1} x_{i,1} >0\).

Finally, the allocation results should meet the equity constraint. The participation condition of order allocation for an FLSP is to ensure that its inequity feeling is lower than its patience limit, which means \(\rho _{i,1} <k_i \). Therefore, the order allocation model in the first stage is as follows:

In Eq. (7), the first constraint represents that the LSI’s order price should be greater than the FLSP’s unit service cost; the second constraint is that all FLSPs’ capability should meet the demand of customer orders; the third constraint means that the inequity feeling of each FLSP in the first phase should be below the limit; the fourth constraint shows the tasks assigned to each FLSP are not negative; the fifth constraint is an equation constraint, which indicates the sum of the weight of each FLSP’s utility is 1; the sixth constraint denotes that customers’ requirements will be lower than all FLSPs’ total capability; the seventh constraint shows that the LSI’s own service capability must be in a certain range; finally, the eighth constraint represents the range of the unit profit rate of the LSI’s own capability.

4.2 The model in the second stage

After the implementation of customer demand in the first phase, the customers’ demand will change on the basis of customer demand in the first stage. Then the LSI will decide the optimal time to update demand information, at the same time the FLSPs will adjust the effort of the current phase according to the satisfaction with the result of the order allocation in the first stage, resulting in affecting the unit quoted price of the FLSP. Finally, LSI allocates the orders to all FLSPs.

4.2.1 The process of Bayesian updating

According to the assumptions, the average demand before demand update is unknown, while the variance is known. The average and variance after demand update are all unknown, but updated demand still meets the normal distribution and the distribution parameters are related to information and the lead time of the demand update (Pratt et al. 1995). During the demand update process, we observe the current demand information of average and variance firstly, and then decide the average and variance on the basis of the lead time of demand update. The longer the lead time, the less accurate the prediction, and the less the prediction cost will be. According to the Assumption 2, the expectation of the updated demand is \(\mu (\xi )=\frac{\sigma ^{2}\mu +\tau ^{2}(t)\xi }{\sigma ^{2}+\tau ^{2}(t)}\), variance is \(\upsilon ^{2}(t)=\frac{1}{\sigma ^{-2}+\tau ^{-2}(t)}\). \(\xi \) is an estimate of the demand according to the demand information collected during lead time before the second stage. We define \(\xi >\mu \) as increased demand, namely the estimate of the demand is higher than the average demand before the second stage. Also, \(\xi <\mu \) is defined as decreased demand, namely the estimate of the demand is smaller than the average demand before the second stage. The \(\tau \left( t \right) \) represents the prediction accuracy and keep a logarithmic relationship with the update time: \(\tau \left( t \right) =\zeta e^{\beta t}\). Therefore, taking Iyer and Bergen (1997) as a reference, we assume that the price proposed by the FLSPs after updating the demand is associated with forecasting accuracy and fairness preference in the first stage, namely, the more accurate the prediction and the fairness preference in the first stage, the higher the quoted price. So we set \(c_{i,2} =c_{i,1} \left( {1+\frac{1}{\tau \left( t \right) }} \right) \left( {1+\rho _{i,1} } \right) \). For the LSI, updating the demand will also produce the update cost, which is proportional to the update time t and cost coefficient of the demand update, namely \(C_{\mathrm{g}}\), then the updated cost for the LSI will be \(\frac{C_g }{\gamma \tau \left( t \right) }\). \(\frac{C_g }{\gamma }\) represents the cost of demand update when the lead time of demand update t close to zero.

4.2.2 Model objectives and constraints

(1) Objective function 1: maximization of the LSI’s profit

In the second stage, the FLSPs will adjust the quoted price of the current phase according to the satisfaction with the result of the order allocation in the first stage. After the demand update, the LSI will allocate the orders according to the new demand distribution. Therefore, the profit of the LSI and FLSP i is \(r_i \left[ {\left( {\lambda -c_{i,2} } \right) x_{i,2} -\frac{C_g }{\tau \left( t \right) }} \right] +K\lambda \Delta \), where the first part is the revenue gained by cooperation, the second part is the demand update cost, and the third part is the profit from LSI’s own capacity. The resulting objective function 1 is as follows, which maximizes the profits of the second phase:

(2) Objective function 2: maximization of the FLSPs’ total utility

Similar to the first phase, the FLSPs’ total utility consists of two parts. The first part comes from the profits of the FLSPs. The second part comes from the order volume related to fairness preference. Its denominator is income from FLSP i providing logistics service capacity and its numerator is the net profit of FLSP i. The second part comes from the order volume. Then the ith FLSP’s profit utility is \(\frac{\left[ {\left( {\lambda -c_{i,2} } \right) x_{i,2} -\frac{C_g }{\tau \left( t \right) }} \right] \left( {1-r_i } \right) -c^{{\prime }}_{i,2} x_{i,2} }{\lambda x_{i,2} }\). The final order allocation utility of FLSP i due to fairness preference is \(v_{i,2} \). Therefore, the total utility of FLSP i in the second stage can be represented as:

The total utility of all FLSPs is shown as Eq. (9).

(3) The constraints of the model

Similar to the first stage model, there are three important constraints for the model in the second stage, namely that the FLSPs’ capabilities must satisfy the constraints of the customer’s demand, the FLSPs gain positive revenues and the requirement of the FLSPs’ fairness constraints. In particular, \(\left( {1-r_i } \right) \left[ {\left( {\lambda -c_{i,2} } \right) x_{i,2} -\frac{C_g }{\tau \left( t \right) }} \right] -c^{{\prime }}_{i,2} x_{i,2} >0\) represents the profits of the FLSP i is positive; \(\mathop {\sum }\nolimits _{i=1}^n {x_{i,2} } +\Delta =\mu \left( {e_t } \right) +\Phi ^{-1}\left( \alpha \right) \sigma \) denotes that the orders allocated to all FLSPs should meet the demand of customer order; \(\rho _{i,2} <k_i \) shows that the tasks assigned to each FLSP are not negative.

Therefore, the order allocation model in the second phase is as follows.

\(Z_{1,2} \) represents the profit maximization of the LSI in the second stage, and \(Z_{2,2} \) is the overall utility maximization of the FLSPs. In equation (12), the first constraint represents that the LSI’s order price should be greater than the FLSP’s unit service cost; the second constraint is that the orders allocated to all FLSPs should meet the demand of customer orders; the third constraint shows that the tasks assigned to each FLSP are not negative; the fourth constraint means that the feelings of fairness preference of each FLSP in the first phase should be below the limit; the fifth constraint is an equation constraint, which indicates the sum of the weight of each FLSP’s utility is 1; the sixth constraint denotes that customers’ requirements will be lower than all FLSPs’ total capability; the seventh constraint shows that LSI’s own service capability must be in a certain range; finally, the eighth constraint represents the range of the unit profit rate of the LSI’s own capability. We need to note that, as the market demand changes, demand of the second stage may increase or decrease compared with the first stage.

4.3 Model solution

Earlier researches often solve the two-stage ordering models by dynamic programming method, namely getting the optimal value by reverse solving (Zheng et al. 2015). Demand update is based on the predicted demand update information before the first-stage ordering instance, rather than the actual observed market signals after the first-stage ordering opportunity (Gurnani and Tang 1999; Donohue 2000; Song et al. 2014). In this way, the first stage ordering decision will depend on the ‘observed’ market signals during the interval, which are unknown when the first-stage ordering strategy is made. This traditional model- building and solution methodology actually is based on the forecasted market signals, rather than observed market signals during the interval (Liu et al. 2015b). In this paper, we aim to study the logistics service capacity ordering strategy with actual ‘observed’ demand update signals. In addition, in reality, with the development of information technology, the enterprises’ capability of information collection has improved greatly. As a result, the buyer tends to adopt actual observed demand update information rather than predicted demand update information in its demand update process to increase the efficiency and accuracy of demand update (Liu et al. 2015b). For example, TAOBAO will update the sales amount every month based on that of the last month instead of the predicted demand update information. Thus, we do not build a traditional nested dynamic programming model based on backward induction; rather, we follow the decision sequence and establish a two-stage ordering model based on decision sequence.

Besides, in this paper, the LSI makes decisions about the order allocation in both the first stage and the second stage according to time, namely, the customer’s demand achieved after the order allocation of the demand in the first stage. The customer’s demand in the second stage changes on the basis of the demand in the first stage, and the FLSPs will adjust their efforts in the second stage according to the fairness preference in the first stage, resulting in affecting the unit logistics capacity of the FLSPs. The LSI updates the demand based on the above and makes the second allocation. Hence, we would like to study the observed market demand signals and explore the logistics supply chain order allocation in this case. Similar to Eppen and Iyer (1997a, b), a sequential solution should be used in this paper when solving the two-stage model. First solve the first model, and then take it into the second model. Because these are multi-objective programming models, the multi-objective programming problem-solving idea transforms the multi-objective problem into a single objective problem; therefore, the ideal point method can be used to solve the above two models.

Step 1: Because there are two objective functions for the two models in this paper, we might as well set the objective function for \(\hbox {Z}_{1}\) and \(\hbox {Z}_{2}\) for simplicity. Solve the optimal value \(Z_1^{*} \) of the \(\hbox {Z}_{1}\) without considering the other objective function \(\hbox {Z}_{2}\); at the same time solve the optimal value \(Z_2^{*} \) of the \(\hbox {Z}_{2}\) without considering the other objective function \(\hbox {Z}_{1}\). Therefore, the combination of the optimal solution \(Z^{*}=(Z_1^{*}, Z_2^{*})\), which is the ideal point.

Step 2: the normalization of the objective function. Because \(\hbox {Z}_{1}\) and \(\hbox {Z}_{2}\) are not in the same dimension therefore, we must normalize them.

Step 3: construct the evaluation function. Because the ideal point is generally difficult to achieve, we can seek the closest point \(Z^{*}\) as an approximation, and the evaluation function is constructed as follows:

In formula (11), \(\delta \) is the weight of the two objective functions after the normalization .

Step 4: minimization of the \(\varphi [Z(x)]\), namely,

The constraints of the two models are shown as formula (7) and formula (12), respectively.

Because \(\varphi [Z(x)]\) is the combination of the LSI’s profit goal and the FLSPs’ total utility goal, \(\varphi [Z(x)]\) can be viewed as the total performance of the supply chain (TP).

5 Numerical analysis

This section verifies the validity of the model through numerical analysis, explores the influence of related parameters on the overall supply chain performance, and further puts forward effective suggestions for supply chain optimization. The numerical analysis is conducted on a PC with 2.4 GHz dual core processor, 2 GB memory and Windows 7 system. We programed and simulated numerical results using Matlab R2008 software. In Sect. 5.1, basic values of the numerical analysis will be given, and the data setting is completely the same as in Liu et al. (2015a). In Sect. 5.2, the influences of the fairness preference on the total performance of the supply chain, the LSI’s profit and the total utility of FLSPs will be shown. In Sect. 5.3, the influences of the cost parameters on the total performance of the supply chain, the LSI’s profit and the total utility of the FLSPs will be shown. In Sect. 5.4, the two cases of increased and decreased demand will be discussed, and the influence of the demand on total performance of the supply chain, the LSI’s profit and the total utility of the FLSPs will be analyzed.

5.1 Basic data

Arbitrary parameter settings and numerical results to demonstrate the model validity and applicability are not acceptable. As we discussed the research motivation in the introduction, in order to compare the research results of Liu et al. (2015a) which do not consider the factor of demand updating, we will use the same data setting as Liu et al. (2015a) in numerical analysis. Suppose that there were three FLSPs, \(\hbox {A}_1 \), \(\hbox {A}_2 \) and \(\hbox {A}_3\), providing logistics service to LSI B, and LSI B would assign orders to all the FLSPs. It is assumed that the transport capacity demanded by B follows normal distribution \(\hbox {N}(100,4)\ (\alpha =95\% )\), which can be obtained by market observation. Unit logistics service capacity income \(\lambda =60\). Weight \({\updelta }\) equals 0.5 which can be obtained through expert scoring and analytic hierarchy process. \(K=0.8\). Take the simulation data of Cheng (2012) as a reference, set \(\gamma =1,b=0.2\). The transport capacities of \(\hbox {A}_1 \), \(\hbox {A}_2 \) and \(\hbox {A}_3 \) are shown in Table 2.

\(k_i\) is obtained by a survey measure of patience in terms of a question that asks respondents to indicate their general impatience (Vischer et al. 2013). The accurate question is that “If your company participates the order allocation, what’s your tolerance of unfair?” Answers are coded on a 10-point scale, with “0” referring to “very impatient” and “10” referring to “very patient”. For example, if the respondents answer is 6, which means his patience is 6/10, that is 0.6. \(\alpha _i \) and \(\beta _i \) can be obtained by questionnaire survey set by the LSI or behavioral experimental approach, which has been discussed in supply chain order allocation model with fairness concern (Cui et al. 2007; Ho and Su 2009; Katok and Pavlov 2013; Ho et al. 2014; Choi and Messinger 2016). \(d_i^0\) could be obtained when the utility functions is tested with scaling judgments (Cross 1982; Fisman et al. 2007).

The order allocation result in the first stage is calculated using the Matlab software:

\(Z_{1,2} ^{*}=4058.0,Z_{2,2} ^{*}=0.387.\) Take the \(x_{i,1} \) into the model of the second stage, and we can get the total performance of the supply chain is 0.773.

5.2 The influence of estimate market demand \(\xi \) on the order allocation after demand updating

When studying the influence of estimate market demand on the result of the order allocation, we set \(\alpha _i =0.3,\beta _i =0.2\), Cg=500. When \(\xi >\mu \), we set \(\xi =120,\xi =130,\xi =140\); when \(\xi <\mu \), we set \(\xi =80,\xi =85,\xi =90\). The influence of \(\xi \) on the result of the order allocation is shown in Figs. 1, 2, 3, 4, 5 and 6.

From Figs. 1 and 2, we can find that when \(\xi >\mu \), the total performance of the supply chain is greater than that when \(\xi <\mu \), which suggests that increased demand will result in greater total performance of the supply chain. No matter \(\xi >\mu \) or \(\xi <\mu \), total performance of the supply chain first increases and then stabilizes with the increase of the lead time of demand update, so there exists an optimal updating time. Less lead time requires a higher flexible ability for enterprises, resulting in more costs. When the lead time increases to a certain value, updating demand won’t produce much value, and therefore supply chain performance is no longer of great change. In addition, when the lead time of the demand update is certain, the higher the average market demand is, the greater the total performance of the supply chain will be.

We can get from Figs. 3 and 4 that when \(\xi >\mu \), the profit of the LSI is greater than that when \(\xi <\mu \), which suggests that increasing demand will lead to increased profit of the LSI. Profit of the LSI first increases and eventually stabilizes with the lead time of the demand update, so there exits an optimal updating time, which is consistent with Figs. 1 and 2. In addition, from Fig. 3, when \(\xi <\mu \), the bigger the estimate market demand \(\xi \) is, the greater the profit of the LSI will be, as demand will have direct influence on the profit of the LSI. However from Fig. 4, we can find when \(\xi >\mu \), the estimate market demand \(\xi \) has little impacts on the profit of the LSI, because when the demand decreases, profit of the LSI is so little that small change of demand won’t cause influence on profit of the LSI.

We can get from Figs. 5 and 6 that when \(\xi >\mu \), utility of the FLSPs is greater than that when \(\xi <\mu \), which suggests that increasing demand will lead to increased utility of the FLSPs. Simultaneously, utility of the FLSPs first increases and eventually stabilizes with the lead time of the demand update, which indicates an optimal updating time. It can be seen from Fig. 5 that when \(\xi <\mu \), the estimate market demand \(\xi \) has little impacts on the total utility of the FLSPs., because the LSI will decrease the orders allocated to itself when faced with decreased demand in order to keep its FLSPs’ satisfaction. But from Fig. 6, we can find that when \(\xi >\mu \), total utility of FLSPs increases with the estimate market demand before updating the demand. This is because the LSI will reallocate the new increased market demand fairly to his FLSPs for their satisfaction.

5.3 The influence of fairness preference on the order allocation

When studying the influence of FLSPs’ fairness preference on the result of the order allocation, we set Cg=500, and then discuss the effects in three following cases when \({\upxi }=120\) and \({\upxi }=80\).

Scenario 1: \(\alpha _1 =\alpha _2 =\alpha _3 =0.3,\beta _1 =\beta _2 =\beta _3 =0.2\),

Scenario 2: \(\alpha _1 =0.28,\beta _1 =0.18;\alpha _2 =0.3,\beta _2 =0.2;\alpha _3 =0.32,\beta _3 =0.22\)

Scenario 3: \(\alpha _1 =0.2,\beta _1 =0.1;\alpha _2 =0.3,\beta _2 =0.2;\alpha _3 =0.4,\beta _3 =0.3\)

Scenario 1 represents fairness preference of the three FLSPs are the same. Scenario 2 shows small difference among the fairness preference of the three FLSPs. Scenario 3 shows big difference among the fairness preference of the three FLSPs. The consequence is shown in Figs. 7, 8, 9, 10, 11 and 12.

We can get from Figs. 7 and 8 that total performance of the supply chain first increases eventually stabilizes with the lead time of the demand update, which is consistent with Fig. 1. From Fig. 7, we can get that the lower the difference of fairness preference among the FLSPs is, the greater the total performance of the supply chain will be. Because different fairness preferences of the FLSPs makes the final order allocation result depend on the fairness factor and weakens the effect of the profit. Thus it’s better to select FLSPs without much difference in the fairness preference for the improvement of the total supply chain performance. However from Fig. 8, we can obtain that when the lead time is certain, the difference of fairness preference among the FLSPs has less influence on the total supply chain performance when \(\xi >\mu \) than \(\xi <\mu \). This is because when the demand increases, the LSI’s profits will have a larger proportion in the total performance, thus reduce the FLSP ’s fair effects on total performance.

We can get from Figs. 9 and 10 that the profit of the LSI first increases and eventually stabilizes with the lead time of the demand update, which is consistent to the conclusion in Figs. 3 and 4. It can be seen from Fig. 9 that when \(\xi <\mu \), the lower the difference of fairness preference among the FLSPs is, the greater the profit of the LSI will be. This is because the LSI hopes that their FLSPs have varying degrees about fairness preference, thus improving the flexibility and reducing the difficulty of the order allocation. However when \(\xi >\mu \), the difference of fairness preference among the FLSPs will have little impacts on the profit of the LSI.

We can get from Figs. 11 and 12 that utility of the FLSPs first increases and eventually stabilizes with the lead time of the demand update, which is consistent to the conclusion in Figs. 5 and 6. When \(\xi <\mu \), the bigger the difference of fairness preferences among the FLSPs is, the lower the utility of the FLSPs will be. As the difference of fairness preferences will cause the final order allocation to mainly depend on fairness factor, and the profit utility will decrease, and so does the total utility. But when \(\xi >\mu \), the difference of fairness preference among the FLSPs will have little impacts on the total utility of the FLSPs. This is because when the demand increases, profit utility is so large that the utility difference of fairness preference would not be so obvious.

5.4 The influence of cost coefficient of the demand update on the order allocation

When studying the influence of FLSPs’ fairness preference on the result of the order allocation, we set \(\alpha _1 =\alpha _2 =\alpha _3 =0.3,\beta _1 =\beta _2 =\beta _3 =0.2\), and then discuss the effects in three cases of Cg=300, Cg=400 and Cg=500 when \({\xi }=120\) and \({\xi }=80\). The consequences are shown in Figs. 13, 14, 15, 16, 17 and 18.

As is shown in Figs. 13 and 14, when \(\xi >\mu \), total performance of the supply chain first increases and eventually stabilizes with the lead time of the demand update. We can know from Fig. 13 that when the lead time of the demand update is certain, \(C_g \) has little impacts on the total performance of supply chain. This is because total performance of supply chain depends on the overall effect of the two functions of the LSI and FLSPs, and the results brought by the functions of the LSI and FLSPs are offset when \(\xi <\mu \), thus the total performance of supply chain won’t change. It can be seen from Fig. 14 that \(C_g \) also has little impacts on the total performance of supply chain. Because when faced with increased demand, the cost of demand update has little influence on the profit of LSI and the total utility of the FLSPs, resulting in little impact on the total performance of supply chain.

As can be seen from Figs. 15 and 16, when \(\xi >\mu \), the profit of the LSI first increases and eventually stabilizes with the lead time of the demand update, which is consistent with the conclusion of Figs. 3 and 4. Besides, we can see from Fig. 15 that when \(\xi <\mu \), the bigger the cost coefficient of the demand update is, the greater the profit of the LSI will be, which is consistent with the expected results. However, from Fig. 16, we can obtain that when \(\xi >\mu \), the cost coefficient of the demand update has little impacts on the profit of the LSI, as the increased market demand will bring significant growth of profit for the LSI, resulting in negligible reduction of profit for the LSI caused by the increased cost coefficient of the demand update.

As can be seen from Figs. 17 and 18, utility of the FLSPs first increases and eventually stabilizes with the lead time of the demand update. It can be seen from Fig. 17 that when \(\xi <\mu \), the bigger \(C_g \) is, the greater the total utility of the FLSPs. Because the larger the demand cost, the more accurate the update will be, leading to increased FLSPs’ profit utility, which results in increased total utility of FLSPs. In addition, from Fig. 18, we can get that when \(\xi >\mu , C_g \) has little impacts on the total utility of the FLSPs. This is because the current profit is so large that demand cost only accounts for a small proportion, and will not produce large fluctuations.

5.5 Discussion

From the above numerical analysis, we can find the estimate of the demand before the second stage, fairness preference coefficient of the FLSPs and the cost coefficient of demand update will have influence on the total performance of supply chain, profit of the LSI and the total utility of the FLSPs. The impact relationships are shown in Table 3.

In addition, there is an optimal updating time for the LSI, the FLSPs and the supply chain. When faced with decreased demand, the higher the estimate of the demand before the second stage is, the greater the profit of the LSI will be, but the total utility of FLSPs won’t change. However when faced with increased demand, the higher the estimate of the demand before the second stage is, the greater total utility of FLSPs will be, but profit of the LSI won’t change.

6 Model application: a case examination from Tianjin SND Logistics Company

In this section, we will use the case of Tianjin SND Logistics Company to analyze and verify the conclusions put forward by the above models.

According to the theory of social network, social network refers to the relatively stable relationship system formed by interaction among social members. Social network is concerned with the interaction and connection between people. Therefore, social interaction will affect people’s social behavior, in which Tianjin SND Logistics Company can be taken for an example. Tianjin SND Logistics Company, a professional FLSP and LSI, was founded in June 2007 and now has more than 500 staff and 30 branch offices covering main metropolises in China. It is also one of the top 10 logistics companies in Tianjin. Currently, SND has more than 210 FLSPs, which are providers of SND. SND currently has incorporated 2000 trucks of capacity and more than 160,000 square meters of warehouses, in addition, SND also owns more than 30 vehicles as its own capacity. By integrating the service capacity of these FLSPs, SND has successfully established widespread business relations and a cooperation network with more than 20 multi-national manufacturing enterprises, such as Procter & Gamble, Siemens, and Delphi, and is able to provide personalized services according to clients’ requirements.

In the networked supply chain structure, SND must take full account of various social behaviors, such as fairness preference behavior of the upstream FLSPs, in satisfying the customer’s demand. For example, SND provides logistics services for Procter & Gamble, Siemens, Carrefour, Mars and Kimberly-Clark through the integration of Tianjin SMF Logistics Co., Ltd., Beijing XKST Logistics Co., Ltd., Tianjin HONGWU Logistics Co., Ltd., Tianjin CQY Cargo Transport Co., Ltd. and other 10 providers, thus forming a network of social service supply chain, which are shown in Fig. 19. In this social service network, when the demand changed, SND will re-assign order tasks to the upper six FLSPs according to the demand of downstream client, such as Procter & Gamble. The six FLSPs will adjust their existing pricing strategy based on the fairness of the allocation, which will affect the final task allocation results and the overall supply chain performance. So the demand update of downstream customer in the supply chain and the fairness preference behavior of upstream FLSPs in the supply chain will affect the final order allocation results and supply chain performance.

With demand updating, SND allocates the customers’ orders reasonably taking into account the FLSPs’ behavior of fairness preference. And the typical practice is as follows.

Firstly, the demand of SND’s customers often varies with time. Especially on the New Year’s Day, National Day and other major festivals, customer demand changed greatly, hence the demand needs to be updated. Managers of SND said that “If the update time is early enough, SND’s FLSPs can prepare the service capability well, but the poor update accuracy will also produce extra costs. When the update time is too late, the FLSPs of SND will lack enough service capability stock, which will result in reduced ability to respond to market changes for SND. Therefore, SND must consider the influence of update on data accuracy and flexibility of the FLPS’s when selecting an optimal update time”. In addition, according to our survey, the total performance is better in peak season than in off-season no matter for SND or its FLSPs. Turnover of SND’s two FLSPs are listed in Table 4 when they are in response to sudden increase customer demand of Procter & Gamble in May 2015. It can be seen from Table 4 that in the case of a surge in demand (such as in May 2015 and June 2015), logistics business turnover brought to SND by Procter & Gamble also showed rapid growth trend. Table 4 also shows the growth of the logistics business of two providers of SND. The first FLSP—the logistics business of Tianjin HONGWU Logistics Ltd. shows a growing trend; the second FLSP—the logistics business of Tianjin CQY Cargo Transport Co., Ltd. also appears a growing trend. However, the growing speed of HONGWU Logistics is less than that of CQY Cargo Transport.

Therefore, this case can verify the conclusions from Figs. 1, 2, 3,, 4, 5 and 6, namely that the total performance of supply chain will be better when \(\xi >\mu \) than \(\xi <\mu \), thus increased demand will lead to increased profit of LSI and total utility of FLSPs, resulting in increased total performance of supply chain.

Secondly, according to our research, difficulty of updating demand information is different for SND’s customers. It’s much difficult to update the demand for some customers, while easier for others. Generally, SND will update the demand information one month in advance before the peak season (such as New Year’s Day, the National Day), then it collects customer’s demand information to predict demand and share the information with FLSPs. In the peak season, increased demand will produce obvious rising supply chain performance, having masked the impact of demand updating cost to a certain extent. In the off-season, due to the small volume of business, the cost of updating information will have more obvious impact on profit of the LSI, so SND does not cost that much in terms of information update, only update information simply. Therefore, this case can verify the conclusions from Figs. 1, 2, 3, 4, 5, and 6, namely that the lower the cost coefficient of update demand, the greater the profit of the LSI will be when \(\xi <\mu \); while \(\xi >\mu \), cost coefficient of update demand has little influence on profit of the LSI.

Thirdly, fairness will be required by the SND’s provider in the process of order allocation, and fairness, impartiality, openness must be guaranteed by SND. SND will also choose similar FLSPs without much difference of fairness preferences to increase provider’s utility according to the requirements of providers. Meanwhile, SND designed a corresponding order allocation process, but also various providers can learn assignment progress and results from allocation process. Generally, when SND allocates orders to its FLSPs, cooperation with the FLPSs in the next stage will be affected if the order allocation is unfair, and some FLSPs may quit the cooperation with SND. Especially in the off-season, this phenomenon will be more obvious, while in the peak season, the rising demand will reduce the effect to the overall performance largely, so this phenomenon is not expressively so prominent. Thus, for the entire supply chain performance, it is most conducive for long-term cooperation to select FLSPs with similar degree of fairness preferences. Therefore, this case can verify the conclusions from Figs. 7, 8, 9, 10, 11 and 12, namely that the lower the difference of fairness preference among the FLSPs, the greater the total performance of supply chain will be. When \(\xi <\mu \), the difference of fairness preference coefficient will reduce the total utility of the FLSPs, while when \(\xi >\mu \), the difference of fairness preference coefficient has little influence on total performance of supply chain.

7 Conclusions and management insights

In this paper, a two-stage order allocation model considering FLSPs’ fairness preferences with demand update was established, and Matlab R2008 numerical simulations were performed to study the impacts of increasing and decreasing demand, lead time of the updated demand information, the FLSPs’ feelings of inequity and the cost coefficients of the demand update on the coordination of the logistics service supply chain. Muti-methodological method is used in this paper, studying the problem by modeling analysis and empirical study. Our study obtained some important conclusions and management implications. Main conclusions will be shown in Sect. 7.1. Implications for managers and researchers are displayed in Sect. 7.2. Future research directions are provided in the end of Sect. 7.2.

7.1 Main conclusions

There are three main conclusions. Firstly, in the logistics service network, demand update and fairness preference will affect the order allocation strategy and cooperative behavior of the network members. When the demand is updated, the fairness preference behavior of the FLSPs will affect their total utility and thus influence their cooperation strategy such as quotation strategy towards the LSI, which will affect the order allocation strategy of the LSI and the overall performance of the supply chain. This finding improves the existing social network theory from behavioral perspective.

Secondly, total performance of supply chain first increases and eventually stabilizes with the lead time of the demand update, so there is an optimal updating time. Cost coefficient of demand update has little influence on the total performance of supply chain.

Thirdly, there are different rules under increased demand and decreased demand. When demand is increased, the higher the estimation of the demand before the second stage is, the greater the total utility of FLSPs will be, but the profit of the LSI won’t change. Difference of fairness preferences among the FLSPs has less influence on total performance of supply chain, the profit of the LSI and the total utility of the FLSPs compared with that under decreased demand. When demand is decreased, estimation of the demand before the second stage has a positive correlation with the total performance of supply chain and the profit of the LSI, but the total utility of FLSPs won’t change.

7.2 Insights for manager and researcher

From a manager’s point of view, this article has a number of management insights on LSIs and FLSPs. For the LSI, first, the increase of market demand is beneficial to its own profit, therefore, from the perspective of long-term cooperation, the LSI’s efforts should be to improve the accuracy of demand forecasting and reduce demand update costs. Second, if the LSI is concerned with overall performance of the supply chain, it should select FLSPs with similar degree about fairness preference and the order allocation must be equitable to reduce the loss aversion of the FLSPs’ fairness preferences. Third, the LSI should choose an optimal lead time t of the demand information update; bigger or smaller t will be both unfitted. For the FLSPs, FLSPs should establish certain coordination (such as income compensation) with LSIs or to establish a certain FLSP alliance to try to reduce their sensitivity degree of inequity. At the same time, FLSPs and LSIs should unite and establish a reasonable income allocation mechanism to minimize the impact of fluctuations in demand, which is conducive to making the supply chain system achieve higher profits and increase the overall utility of the FLSPs.

From a researcher’s point of view, this paper has a theoretical inspiration in two main aspects. On the one hand, this article analyzed and studied the actual decision problems from the perspective of behavioral operations management and introduced the fairness preference function to the order allocation problems of the service supply chain. Because the fairness preference exists in a wide variety of problems, this factor can be applied to the allocation problems in other areas of the supply chain. On the other hand, the modeling of this paper considered the demand update factor and introduced the concept of prediction accuracy, and built the order allocation model of the second stage according to a decision-making sequence based on the observed information update. These modeling ideas can be used for other similar research on demand update as a reference.

This paper still has some drawbacks. For example, the demand information update considered in this paper is based on actual collection of demands, rather than the traditional modeling mode of predicted-updating information, so subsequent researchers can refer to the modeling idea of this paper and can also compare the differences between two ways of demand updating between the allocation results and finally show comparative advantages and disadvantages of the two methods of updating. In addition, this paper has not discussed the scenario of capacity combination, in future studies, researchers can try to establish the order allocation considering the FLSPs’ capacity match combined with the prospect theory based on Liu et al. (2014) to investigate order allocation with demand update.

References

Andreoni, J., & Miller, J. (2002). Giving according to GARP: An experimental test of the consistency of preferences for altruism. Econometrica, 70(2), 737–753.

Basnet, C., & Leung, J. M. (2005). Inventory lot-sizing with supplier selection. Computers & Operations Research, 32(1), 1–14.

Benton, W. C. (1991). Quantity discount decisions under conditions of multiple items, multiple suppliers and resource limitations. The International Journal of Production Research, 29(10), 1953–1961.

Bolton, G. E., & Ockenfels, A. (2000). ERC: A theory of equity, reciprocity, and competition. American Economic Review, 90(1), 166–193.

Borgatti, S. P., & Everett, M. G. (1997). Network analysis of 2-mode data. Social Networks, 19(3), 243–269.

Bottani, E., & Rizzi, A. (2006). A fuzzy TOPSIS methodology to support outsourcing of logistics services. Supply Chain Management: An International Journal, 11(4), 294–308.

Bradford, J. W., & Sugrue, P. K. (1990). A Bayesian approach to the two-period style-goods inventory problem with single replenishment and heterogeneous Poisson demands. Journal of Operations Research Society, 41(3), 211–218.

Brashears, M. E., & Gladstone, E. (2016). Error correction mechanisms in social networks can reduce accuracy and encourage innovation. Social Networks, 44, 22–35.

Camerer, C. (2003). Behavioral game theory: Experiments in strategic interaction. Princeton: Princeton University Press.

Charness, G., & Rabin, M. (2002). Understanding social preferences with simple tests. Quarterly Journal of Economics, 117(3), 817–869.

Che, Z. H., & Wang, H. S. (2008). Supplier selection and supply quantity allocation of common and non-common parts with multiple criteria under multiple products. Computers & Industrial Engineering, 55(1), 110–133.

Chen, H., Chen, J., & Chen, Y. F. (2006). A coordination mechanism for a supply chain with demand information updating. International Journal of Production Economics, 103(1), 347–361.

Cheng, Q. (2012). Supply chain coordination based on Bayesian demand forecast updating and cvar models. Hangzhou: Zhejiang University of Technology. (In Chinese) .

Choi, T. M., Cheng, T. C. E., & Zhao, X. (2015). Multi-methodological research in operations management. Production and Operations Management, 25(3), 379–389.

Choi, T.-M., Li, D., & Yan, H. (2004). Optimal single ordering policy with multiple delivery modes and Bayesian information updates. Computers & Operations Research, 31, 1965–1984.

Choi, T. M., & Sethi, S. (2010). Innovative quick response programs: A review. International Journal of Production Economics, 127(1), 1–12.

Choi, S., & Messinger, P. R. (2016). The role of fairness in competitive supply chain relationships: An experimental study. European Journal of Operational Research, 251(3), 798–813.

Christopher, M. (2016). Logistics & supply chain management. London: Pearson Higher Ed.

Cross, D. V. (1982). On judgments of magnitudes. In B. Wegener (Ed.), Social attitudes and psychological measurement. Hillsdale, NJ: Lawrence Erlbaum.

Cui, T. H., Raju, J. S., & Zhang, Z. J. (2007). Fairness and channel coordination. Management Science, 53(8), 1303–1314.

Demirtas, E. A., & Üstün, Ö. (2008). An integrated multiobjective decision making process for supplier selection and order allocation. Omega, 36(1), 76–90.

Donohue, K. L. (2000). Efficient supply contracts for fashion goods with forecast updating and two production modes. Management Science, 46(11), 1397–1411.

Eppen, G. D., & Iyer, A. V. (1997a). Backup agreements in fashion buying the value of upstream flexibility. Management Science, 43(11), 1469–1484.

Eppen, G. D., & Iyer, A. V. (1997b). Improved fashion buying with Bayesian updates. Operations Research, 45(6), 805–819.

Eruguz, A. S., Jemai, Z., Sahin, E., et al. (2014). Optimising reorder intervals and order-up-to levels in guaranteed service supply chains. International Journal of Production Research, 52(1), 149–164.

Falk, A., & Fischbacher, U. (2006). A theory of reciprocity. Games and Economic Behavior, 54(2), 293–315.

Fehr, E., & Schmidt, K. M. (1999). A theory of fairness, competition, and cooperation. Quarterly journal of Economics, 114(3), 817–868.

Fisher, M., & Raman, A. (1996). Reducing the cost of demand uncertainty through accurate response to early sales. Operations Research, 44(1), 87–99.

Fisman, R., Kariv, S., & Markovits, D. (2007). Individual preferences for giving. The American Economic Review, 97, 1858–1876.

Freeman, L. C. (1978). Centrality in social networks conceptual clarification. Social Networks, 1(3), 215–239.

Ghodsypour, S. H., & O’brien, C. (1998). A decision support system for supplier selection using an integrated analytic hierarchy process and linear programming. International Journal of Production Economics, 56(1), 199–212.

Ghodsypour, S. H., & O’brien, C. (2001). The total cost of logistics in supplier selection, under conditions of multiple sourcing, multiple criteria and capacity constraint. International Journal of Production Economics, 73(1), 15–27.

Giannoccaro, I., & Pontrandolfo, P. (2009). Negotiation of the revenue sharing contract: An agent-based systems approach. International Journal of Production Economics, 122(2), 558–566.

Gómez, D., González-Arangüena, E., Manuel, C., Owen, G., Del Pozo, M., & Saboyá, M. (2008). The cohesiveness of subgroups in social networks: A view from game theory. Annals of Operations Research, 158(1), 33–46.

Gurnani, H., & Tang, C. S. (1999). Note: Optimal ordering decisions with uncertain cost and demand forecast updating. Management Science, 45(10), 1456–1462.