Abstract

In addition to green product design, this paper introduces green logistics into a green supply chain, and studies the supply chain system composed of a manufacturer producing green products, a 3PL supplier and a retailer from the perspective of fairness. Through the construction of the game models, this paper studies the pricing, green decision-making and the supply chain members’ profits, and discusses the impact of the retailer’s fairness concern on the decision-making and performance of members. Finally, in order to improve supply chain performance under fairness concern, two contracts are designed: 3PL green cost sharing contract and combination contract. It is found that the retailer with fairness concern sets lower retail price, the manufacturer chooses lower product greenness and wholesale price, and 3PL green level is not related to fairness concern. The retailer’s fairness concern is not conducive to the manufacturer, the 3PL supplier and the whole supply chain, but beneficial to the retailer. In addition, both these two contracts improve the performance of the supply chain and get more environmental benefits. Compared with the 3PL green cost sharing contract, the combination contract plays a more significant role in making more profit for the 3PL supplier and more utility for the retailer.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

With the rapid economic development, resources are overconsumed. Ecological destruction is everywhere. Increasing environmental problems not only threaten human life and health, but also restrict the further development of economy and society. These have aroused the attention of the international community to the environment. The sustainable development of enterprises plays an important role in promoting the benign development of the ecological environment. In order to reduce the threat of enterprises to the environment and promote the sustainable development of enterprise economy, countries around the world have issued a series of laws and regulations on environmental protection to motivate and force enterprises to assume social responsibilities and fulfill environmental management obligations. For example, as a large resource-consuming country, China once achieved economic development at the expense of the environment. After realizing the problem, it has successively introduced a variety of environmental protection measures, such as the “Cleaner Production Promotion Law of the People’s Republic of China” and “Provisions on Cleaner Production Audit Procedures for Key Enterprises”. In addition to attracting the national attention, environmental protection issues have also gradually entered the vision of the general public. People pay more attention to the negative impact brought by enterprise activities on the environment. Consumers constantly enhance the awareness of environmental protection and gradually establish the concept of green consumption. As a result, there is a stronger demand for green products and green services.

In order to reduce the negative impact of enterprise operation on the environment, achieve sustainable development and meet regulatory requirements and customer expectations, the implementation of green supply chain is very necessary. Enterprises need to take sustainable measures such as improving product greenness and carrying out green logistics activities to meet the green needs of consumers and market requirements. In this way, the enterprises can be recognized by the public and gain benefits. So, they can survive and obtain the ability of long-term development. Take logistics as an example. Logistics activities are accompanied by serious negative environmental impacts. According to the “World Economic Forum—Supply Chain Low-carbon Report” released in 2009, the annual greenhouse gas emissions from the global transportation industry account for about 5.5% of the greenhouse gas emissions from human activities. Therefore, the adoption of environmental strategy by third-party logistics enterprises is of great significance to social and environmental problems. Third party logistics (3PL) refers to a business model in which logistics services are provided by a third party other than the logistics supplier and demander. For third-party logistics enterprises, improving the green level of logistics services can not only improves consumer satisfaction and enhance the loyalty to products and brands, but also stimulate the market demand for products. And the logistics demand of third-party logistics enterprises also increases. This is conducive to the improvement of enterprise performance and helps enterprises to remain invincible in the complex and volatile market environment. Thus, the green supply chain with the participation of green logistics is a powerful guarantee and the best choice for enterprises to enhance competitiveness and take into account sustainable development.

In the actual decision-making activities of supply chain management, decision-makers will not only pay attention to economic interests, but also measure utility from the perspective of fairness, and even sacrifice their own economic interests to punish each other. Adhikari and Bisi [1] pointed out that cooperation between supply chain members ends because of unfair pricing strategies and profit distribution. For example, in 2011, due to IKEA’s long-term price pressure, more than a dozen OEM manufacturers in China, including Endurance Wood, which had been OEM for IKEA for many years, realized that IKEA’s pricing was unfair, cancelled the supply contract with IKEA. Therefore, in order to ensure the stability of the supply chain and the sustainability of performance, decision makers should also consider the fairness concerns of supply chain members when paying attention to the environmental factors of products and logistics.

Based on the above analysis, this paper integrates green logistics into the green supply chain, studies the supply chain pricing, green decision-making and performance from the perspective of fairness, and discusses the contract design under fairness concern. The contents are as follows:

-

1.

Identify the green indicators of the supply chain.

-

2.

Study the influencing factors of market demand and the influence of parameters in market demand on the decision-making and performance of supply chain members.

-

3.

This paper studies the pricing, green decision and profits of green supply chain members when the retailer is concerned about fairness, and analyzes the impact of fairness concern.

-

4.

This paper studies how to improve the green level of logistics under the retailer’s fairness concern.

-

5.

In view of the impact of fairness concern on supply chain, contracts are studied to further improve supply chain performance and promote supply chain members’ cooperation.

This paper studies the three-echelon supply chain composed of a single manufacturer, a single 3PL supplier and a single retailer, considers the influence of product greenness and green logistics on market demand, and uses game theory to construct four models: the basic model without fairness concern, the model with the retailer’s fairness concern, the model under 3PL green cost sharing contract and the model under combination contract. Through these models, the pricing and green decision-making of supply chain members in different situations are obtained. It is found that the 3PL green level is irrelevant to whether the retailer has fairness concern. Meanwhile, the existence of the retailer’s fairness concern is not conducive to the manufacturer, the 3PL supplier and the whole supply chain, but beneficial to the retailer. And the stronger the degree of fairness concern, the better for the retailer. The study also noted that the increase in the retailer’s profit under fairness concern comes from the reduction in the manufacturer’s wholesale price. In order to improve the efficiency of the supply chain under the retailer’s fairness concern, a 3PL green cost sharing contract is designed, and the range of cost sharing proportion to achieve performance improvement is given. Based on this contract, a combination contract is further designed and the effective range of transfer payment is studied. Both these two contracts improve the performance of the whole supply chain and its members.

The second part of this paper is literature review. The third part is the contributions of this study. The fourth part describes the supply chain problem studied in this paper, including the business, interaction and decision between the members of the chain, as well as assumptions. The fifth part is notations. The sixth part is the models, the equilibrium results and analysis. The seventh part is the numerical analysis of these models. And the last part is the conclusion and future work.

2 Literature review

The relevant literature mainly includes three aspects: green supply chain, supply chain with 3PL participation and fairness concern in supply chain.

2.1 Green supply chain

Green supply chain has gradually become a solution to sustainable management of enterprises. Scholars have also studied green supply chain from various perspectives. As for green supply chain coordination, Ghosh and Shah [2] studied the green supply chain coordination under cost sharing contract. Zhang and Liu [3] studied the three-level supply chain coordination by building revenue sharing mechanism, asymmetric Nash negotiation mechanism and Shapley value coordination mechanism. As for the pricing decision of products in green supply chain, Li and Zhu et al. [4] studied the pricing strategy of the green supply chain in the centralized and decentralized situations, and found that the retail price under decentralized decision was lower than that under centralized decision. As for carbon emissions in green supply chain, Xu and He et al. [5] studied the production and emission reduction decision-making of the supply chain that produce to order under cap-and-trade regulation. Zhao and Neighbour [6] analyzed the manufacturer’s choice of carbon emission strategy based on game theory. In addition, green supply chain also has research in specific fields. Adhikari and Bisi [1] took a green apparel supply chain as the research object, and discussed the problems such as contract, bargaining and fairness among members. The above studies are all supply chains without the participation of logistics. The study object of this paper is the green supply chain with the participation of green logistics. There are two green indicators: product greenness and green level of logistics services.

2.2 Supply chain with 3PL participation

In recent years, the academic circles have examined the services provided by 3PL suppliers from different angles and studied the supply chain with 3PL participation. Wu and Mu et al. [7] focused on the supply chain with a distributor and a 3PL supplier, where the 3PL supplier provided logistics services such as transportation and inventory and focused on improving the logistics service level. The paper surveyed the effect of different dominant rights on the supply chain, and designed contracts to achieve channel coordination and win–win situation. Yu and Xiao [8] studied a three-level supply chain composed of a fresh produce supplier, a 3PL supplier and a retailer. They focused on the cold chain service level of 3PL enterprises that affected the quality and quantity loss of agricultural products. They also examined the influence of channel dominance on the decision-making and performance. Giri and Sarker [9] focused on 3PL service cost in the environment of uncertain demand. They studied the impact of production disruption on the supply chain including 3PL, and designed buyback and revenue sharing contracts to coordinate the supply chain. Zhang and Fan et al. [10] studied the supply chain that included a manufacturer, a 3PL supplier and a retailer. The 3PL supplier provided not only logistics services, but also financing services. The paper studied the optimal decision-making of members in the supply chain under the 3PL financing service mode when capital-constrained objects are different. Fu and Ke et al. [11] considered the platform supply chain. The paper explored 3PL equity financing strategies and investigated the relationship between performance and cost allocation of members. The above literatures considered 3PL services from the non-environmental perspective, while this paper considers the environmental awareness of consumers and focuses on 3PL green services from the perspective of environment.

Jamali and Rasti-Barzoki [12] focused on the environmental sustainability with 3PL services. They assumed that the supply chain has two manufacturers, a 3PL supplier and a retailer, and revealed the impact of three competitive structures on sustainability and profit of the supply chain. Lee [13] studied the same supply chain, but the study focused on the decisions and profits of members under five distribution channels. The above two studies considered the sustainability decision-making of 3PL suppliers, and the conclusions obtained have important implications for supply chain management. However, they studied the supply chain from the perspective of profit maximization under the assumption that decision makers are completely rational. This paper considers fairness concern and examines the impact of fairness concern on the supply chain by establishing utility models and profit models of other supply chain members.

2.3 Fairness concern in supply chain

The introduction of fairness theory into supply chain research is in line with the actual situation of decision maker’s psychological preferences in supply chain. In terms of research content, many scholars have studied the supply chain coordination with fairness concern in mind. Cui and Raju et al. [14] studied the decentralized supply chain when decision makers had fairness concerns. They pointed out that manufacturer can coordinate the supply chain through wholesale price contract. Pavlov and katok [15] established models based on fairness and bounded rationality. According to their research, when fairness is private information, the supply chain cannot achieve coordination. Katok and Pavlov [16] further studied the supply chain channel coordination. They found that the incomplete information of the retailer’s inequality aversion can best explain the supplier’s behavior. Zhou and Bao et al. [17] introduced fairness into the low-carbon supply chain. They pointed out that the retailer’s fairness concern will change the coordination of the supply chain under certain circumstances. Ho and Su et al. [18] conducted a study of the supply chain composed of one supplier and two retailers. They investigated the issue of coordinating supply chain with wholesale price contract under different types of fairness concern.

In addition, some scholars have studied the impact of fairness concern on decision-making. Du and Wei [19] considered a supply chain consisting of one manufacturer and two retailers. They surveyed the effect of the retailer’s peer-regarding fairness on the decision-making and performance. Ma and Li et al. [20] studied the pricing of closed-loop supply chain members under fairness concern.

In existing studies, there are two types of fairness concern. One is distributional fairness concern, the other is peer-induced fairness concern. Many papers have studied distributional fairness concern. For instance, Li and Guan et al. [21] discussed the response of supply chain members to the retailer’s distributional fairness concern based on different green products. They pointed out that the retailer with concern about fairness set higher retail price and made less profit than its competitors. Xu and Yu [22] analyzed the influence of vertical distributional fairness on service and revenue sharing strategies in a dual channel supply chain, and concluded that fairness concern had a great impact on the decision-making and performance. In addition, some studies have focused on peer-induced fairness concern, such as Du and Wei [19] mentioned above. The above studies were two-level supply chains, while this paper studies the three-level green supply chain in which 3PL participates. Similar to Li and Guan [21], Xu and Yu [22], distributional fairness are considered. Unlike them, this paper explores the contract design under fairness concern.

3 Research gap and contributions of this study

As mentioned above, many scholars focus on the design of green products in the research on green supply chain, and green indicator is mainly reflected in the product greenness. However, this paper includes green logistics in the green supply chain and considers the impact of green logistics on market demand. Green indicators include 3PL green level. Although Jamali and Rasti-Barzoki [12], Lee [13] considered the emission reduction decisions of 3PL, these studies did not study supply chain decisions from the perspective of fairness concern. This paper considers the retailer’s fairness concern with the manufacturer’s profit as the reference point, and studies the supply chain cooperation under the retailer’s fairness concern. Therefore, the work of this paper is to put green products, green logistics, fairness and contract design under an analytical framework. Based on game theory, this paper studies the green supply chain decision-making and contract design with the introduction of green logistics under fairness concern. Here, some of the literature is given in Table 1 to distinguish the work of this paper.

4 Problem description and assumptions

The supply chain studied in this paper consists of a manufacturer, a 3PL supplier and a retailer. The manufacturer develops and produces a green product and influences the actual market demand by controlling the product greenness. The 3PL supplier provides logistics services to distribute green products from the manufacturer to the retailer. The retailer is responsible for the sale of the product and pays service fees to the 3PL supplier. In the supply chain decision system, the manufacturer is the leader, the 3PL supplier is the secondary leader, and the retailer is the follower. There is a Stackelberg game relationship among them. The manufacturer, as the dominant player, first decides the product greenness θ, the unit wholesale price w, and shares this information with the retailer and the 3PL supplier. Then the 3PL supplier makes a decision on the 3PL green level t. Finally, the retailer determines the unit retail price p of the green product based on all the information of other members. The operation process of the three-level supply chain is shown below (Fig. 1).

Assumption 1

The market demand of the green product is not only related to the product greenness and price, but also affected by the 3PL green level. Similar to Jamali and Rasti-Barzoki [12], Lee [13], Wang and Ren [23], the demand function related to product price and green is established on the basis of traditional linear form. And the green indicators include product greenness and 3PL green level. It is assumed that the market demand function of the green product is \(D = \alpha - \beta p + \lambda \theta + \eta t\), where α is the potential market demand for the green product, β indicates the sensitivity of consumers to the retail price, λ expresses consumers’ green preference and θ is product greenness, which has a positive impact on the market demand.

Because of the improvement of consumer environmental awareness and the focus of green logistics, the green behavior of the 3PL supplier in providing logistics services affects the product demand. Therefore, the 3PL green level is positively related to the product demand, and the higher the 3PL green level, the higher the market demand for the product. At the same time, because the revenue of the 3PL supplier is related to the logistics quantity, the 3PL supplier have an interest incentive to invest in green logistics to improve the green level. η is the sensitivity coefficient of market demand to 3PL green level, and the greater the value, the greater the market demand brought by 3PL green level. Compared with the product greenness and 3PL green level, consumers are more sensitive to product price, i.e., \(\beta > \lambda\), \(\beta > \eta\). In addition, it is assumed that the market demand is positive without considering the influence of product greenness and green logistics on demand, i.e., \(\alpha - \beta p > 0\).

Assumption 2

It is assumed that the manufacturer produces a development-intensive green product (DIGP), which means that the cost of green investment for the manufacturer is related to the product greenness and has nothing to do with the volume of production. It is supposed that the manufacturer’s green investment cost function is \(I(\theta ) = \frac{{h\theta^{2} }}{2}\), where h is the manufacturer’s green investment cost coefficient. This assumption is consistent with existing literature studies such as Wang and Hou [24], Lin and Chen [25]. Obviously, \(I^{^{\prime}} (\theta ) > 0\), in which it indicates that the manufacturer’s green investment cost is a strictly increasing function of the product greenness θ. It shows that the higher the green level of the product, the higher the green cost that the manufacturer needs to invest. \(I^{^{\prime\prime}} (\theta ) > 0\) means that the green investment cost will increase faster and faster with the increase of product greenness, which is in line with the actual situation.

Assumption 3

Suppose that the 3PL green cost is independent of the transportation volume. And it is a quadratic function of the green level, i.e., \(C(t) = \frac{{ft^{2} }}{2}\). The square form reflects the increasing characteristics of the marginal green logistics cost of the 3PL supplier, where the green investment cost coefficient of the 3PL supplier is positive, i.e., \(f > 0\). When the 3PL green level is zero, the logistics green investment cost is zero. When the green level is high, it will be more difficult to further improve it. It will cost more.

Assumption 4

In order to ensure that the manufacturer, the 3PL supplier and the retailer can make profits by joining the supply chain, the relationship between price and cost must be met: (1) \(w > c_{m}\). It indicates that the unit wholesale price of the green product is greater than the unit production cost; (2) \(p_{3} > c_{3}\). It means that the logistics service price is greater than the cost, otherwise the 3PL supplier is not necessary to join the supply chain; (3) \(p > w + p_{3}\). It represents that the sales price of the product is greater than the cost paid by the retailer (the sum of the wholesale price of the product and the logistics service price). Thus, it can be deduced that \(p > c_{m} + p_{3}\).

Assumption 5

Without loss of generality, it is supposed that the manufacturer’s green investment cost coefficient is greater than the sensitivity coefficient of market demand to product greenness, i.e., \(h > \lambda\).

Assumption 6

Assuming that members in the supply chain are risk-neutral. The retailer who considers fairness concern makes decisions based on utility maximization, while other rational members take profit maximization as their decision-making basis.

Assumption 7

Assuming that the information is completely symmetric, all parameters involved in the model are known and transparent to all supply chain members.

5 Notations

The notations and their description in this paper are shown in Table 2.

6 Model development

In contrast to the supply chain with fairness concern, this paper first constructs a game model where the manufacturer, the 3PL supplier and the retailer have no fairness concern, and analyzes the optimal decision and profits of supply chain members. Secondly, the retailer’s fairness concern model is constructed to explore the changes of supply chain pricing and green decision-making under the behavior of fairness concern, and analyzes how the retailer’s fairness concern affects the performance of the supply chain members and systems. Finally, two contract models are constructed to improve the performance of the supply chain under the retailer’s fairness concern. It provides some reference for the decision-making of supply chain node enterprises under the green background.

6.1 Basic model without fairness concern (model 1)

In the Stackelberg game model, neither the manufacturer, the 3PL supplier nor the retailer have fairness concern. As fully rational economic men, they make decentralized decisions with the goal of maximizing their own economic interests, and do not care whether the overall profit distribution of the supply chain is fair or not. The profit functions of the manufacturer, the 3PL supplier and the retailer in the supply chain are as follows:

In Eq. (1), the first item of the manufacturer’s profit is sales revenue, the second item is production cost, and the third item is the manufacturer’s green investment cost. In Eq. (2), each item of the 3PL supplier’s profit is: revenue, cost from providing logistics services and 3PL green investment cost. In Eq. (3), the items of the retailer’s profit are: the retailer’s sales revenue, procurement cost and logistics cost borne by the retailer. The equilibrium solution of the model is solved by backward induction. According to the market demand, under the premise of given product greenness, wholesale price and 3PL green level, the retailer acting as a follower in the supply chain system makes the optimal retail price decision. Secondly, the decision of the optimal 3PL green level is studied. Meanwhile, the product greenness and wholesale price have been determined. Finally, the manufacturer’s decision on product greenness and wholesale price is studied.

Proposition 1

-

i.

When the condition \(\beta h > \frac{{\lambda^{2} }}{4}\) is met, the manufacturer’s optimal product greenness θ*, the optimal wholesale price w*, the optimal 3PL green level t*, and the retailer’s optimal retail price p* are as follows:

$$\begin{aligned} \theta^{*} & = \frac{{\left( {2f\left( {\alpha - \left( {c_{m} + p_{3} } \right)\beta } \right) + \eta^{2} \left( {p_{3} - c_{3} } \right)} \right)\lambda }}{{2\left( {4\beta h - \lambda^{2} } \right)f}}, \\ w^{*} & = \frac{{\left( {2f\left( {\alpha + \left( {c_{m} - p_{3} } \right)\beta } \right) + \eta^{2} \left( {p_{3} - c_{3} } \right)} \right)h - f\lambda^{2} c_{m} }}{{\left( {4\beta h - \lambda^{2} } \right)f}}, \\ t^{*} & = \frac{{\left( {p_{3} - c_{3} } \right)\eta }}{2f}, \\ p^{*} & = \frac{{2f\left( {3\alpha h + \left( {\beta h - \lambda^{2} } \right)\left( {c_{m} + p_{3} } \right)} \right) + 3h\eta^{2} \left( {p_{3} - c_{3} } \right)}}{{2f\left( {4\beta h - \lambda^{2} } \right)}}. \\ \end{aligned}$$ -

ii.

All supply chain members’ profits and the relationship between the manufacturer’s profit and the retailer’s profit are as follows:

$$\begin{aligned} & \pi_{m}^{*} = \frac{{\left( {2f\left( {\alpha - \left( {c_{m} + p_{3} } \right)\beta } \right) + \eta^{2} \left( {p_{3} - c_{3} } \right)} \right)^{2} h}}{{8f^{2} \left( {4\beta h - \lambda^{2} } \right)}}, \\ & \pi_{3}^{*} = \frac{{\left( {8\alpha \beta fh - 8fh\left( {c_{m} + p_{3} } \right)\beta^{2} + \eta^{2} \lambda^{2} \left( {p_{3} - c_{3} } \right)} \right)\left( {p_{3} - c_{3} } \right)}}{{8f\left( {4\beta h - \lambda^{2} } \right)}}, \\ & \pi_{r}^{*} = \frac{{\beta h^{2} \left( {2\alpha f - 2f\left( {c_{m} + p_{3} } \right)\beta + \eta^{2} \left( {p_{3} - c_{3} } \right)} \right)^{2} }}{{4f^{2} \left( {4\beta h - \lambda^{2} } \right)^{2} }}, \\ & \pi_{m}^{*} > \pi_{r}^{*} . \\ \end{aligned}$$

Proof

Firstly, the first-order and the second-order derivative of the retailer’s profit w.r.t. p are obtained:

Obviously, \(- 2\beta < 0\). It shows that the retailer’s profit function is strictly concave w.r.t. p. From \(\frac{{d\pi_{r} }}{dp} = 0\), the optimal response function of retail price can be obtained:

Substitute p into (2). Then, the first-order and second-order derivative of π3 w.r.t. t are respectively:

Clearly, \(- f < 0\).Therefore, the 3PL supplier’s profit function is strictly concave w.r.t. t. From the first-order condition, i.e., \(\frac{{d\pi_{3} }}{dt} = 0\), the optimal response function of 3PL green level can be obtained:

Substitute p and t into (1), and the Hessian matrix of the manufacturer’s profit function can be obtained:

where \(- h < 0\). When \(\beta h > \frac{{\lambda^{2} }}{4}\), the Hessian matrix Hm is negative definite. The manufacturer’s profit function is strictly concave w.r.t. θ and w. From the first-order conditions, i.e.,

θ* and w* can be obtained. The optimal response function of 3PL green level is also t*. Substitute θ*, w* and t* into p, and p* can be obtained. By substituting θ*, w*, t* and p* into Eqs. (1) - (3), the members’ maximum profits can be obtained.

Since \(h > \lambda\) and \(\beta > \lambda\), the relationship between πm and πr is as follows:

□

Corollary 1

\(\frac{{\partial \theta^{*} }}{\partial \beta } < 0\), \(\frac{{\partial w^{*} }}{\partial \beta } < 0\), \(\frac{{\partial t^{*} }}{\partial \beta } = 0\), \(\frac{{\partial p^{*} }}{\partial \beta } < 0\), \(\frac{{\partial \pi_{m}^{*} }}{\partial \beta } < 0\), \(\frac{{\partial \pi_{3}^{*} }}{\partial \beta } < 0\), \(\frac{{\partial \pi_{r}^{*} }}{\partial \beta } < 0\).

Proof

Since \(\alpha - \beta p > 0\) and \(p > c_{m} + p_{3},\) we have \(\alpha - \left( {c_{m} + p_{3} } \right)\beta > 0\), i.e.,\(\alpha > \left( {c_{m} + p_{3} } \right)\beta\). Then, \(4\alpha h > 4\beta h\left( {c_{m} + p_{3} } \right)\). Moreover, since \(4\beta h > \lambda^{2}\), we can obtain \(4\beta h\left( {c_{m} + p_{3} } \right) > \lambda^{2} \left( {c_{m} + p_{3} } \right)\). Hence,\(4\alpha h > \lambda^{2} \left( {c_{m} + p_{3} } \right)\). In addition, \(p_{3} - c_{3} > 0\), we have \(f\left( {c_{m} + p_{3} } \right)\lambda^{2} - 4fh\alpha - 2h\eta^{2} \left( {p_{3} - c_{3} } \right) < 0\). Therefore,

From \(\beta > \lambda\) and \(h > \lambda\), \(\left( {2h\beta - \lambda^{2} } \right)\left( {c_{m} + p_{3} } \right) > 0\) can be obtained. Therefore,

Moreover, since \(\alpha > \left( {c_{m} + p_{3} } \right)\beta\), \(\beta > \lambda\) and \(h > \lambda\), we have

Thus,

Corollary 1 shows that the more sensitive consumers are to the retail price, the smaller the market demand is, and the manufacturer will sacrifice the product greenness to provide relatively low-price products to meet consumer demand. The decrease in profit due to the reduced wholesale price is greater than the increased profit caused by the reduced green investment, the manufacturer’s profit decreases. The retailer sales products at lower retail price and makes lower profit. 3PL green level has nothing to do with the consumer response to price, and the 3PL supplier’s investment in green logistics remains unchanged. Thus, the declining market demand leads to the reduction of the 3PL supplier’s profit. It can be seen that the higher the sensitivity of consumers to the price, the negative impact will be exerted on the promotion and use of green products, which is not conducive to the expansion of green products’ market share and harms the interests of node enterprises in the supply chain. Therefore, enterprises should understand consumers’ attitude towards retail price through market research, and actively guide consumers’ attention to the quality and environmental advantages of the product in the publicity and promotion of the green product, so as to weaken the negative effect of consumers’ price sensitivity on the supply chain.□

Corollary 2

\(\frac{{\partial \theta^{*} }}{\partial \lambda } > 0\), \(\frac{{\partial w^{*} }}{\partial \lambda } > 0\), \(\frac{{\partial t^{*} }}{\partial \lambda } = 0\), \(\frac{{\partial p^{*} }}{\partial \lambda } > 0\), \(\frac{{\partial \pi_{m}^{*} }}{\partial \lambda } > 0\), \(\frac{{\partial \pi_{3}^{*} }}{\partial \lambda } > 0\), \(\frac{{\partial \pi_{r}^{*} }}{\partial \lambda } > 0\).

Proof

Since \(\alpha - \left( {c_{m} + p_{3} } \right)\beta > 0\), \(p_{3} - c_{3} > 0\) and \(4\beta h > \lambda^{2}\), we have,

Corollary 2 shows that except for 3PL green level, the equilibrium results of the decision variables and the profits of all parties are positively correlated with consumers’ green preference for products. When the market demand is more sensitive to the product greenness, the manufacturer will increase the product greenness to increase profit. The increase of product greenness, in turn, increases the green investment cost of the product, which makes the manufacturer set a higher wholesale price. The increase of the manufacturer’s profit is mainly because the increase of revenue brought by the expansion of demand and higher wholesale price is greater than the increase of green cost brought by the improvement of product greenness. Meanwhile, the green investment and green level of the 3PL supplier remain unchanged. Due to the expanded market demand, the 3PL supplier’s profit increases. The retailer raises retail price in response to higher wholesale prices. In addition, the profits of all supply chain members are positively correlated with λ, which reveals consumers’ green consciousness will increase the revenue of the supply chain. Therefore, decision makers in the supply chain should take effective measures to actively carry out green marketing, improve consumption awareness of green demand and enable more consumers to establish the concept of green consumption.□

Corollary 3

\(\frac{{\partial \theta^{*} }}{\partial \eta } > 0\), \(\frac{{\partial w^{*} }}{\partial \eta } > 0\), \(\frac{{\partial t^{*} }}{\partial \eta } > 0\), \(\frac{{\partial p^{*} }}{\partial \eta } > 0\), \(\frac{{\partial \pi_{m}^{*} }}{\partial \eta } > 0\), \(\frac{{\partial \pi_{3}^{*} }}{\partial \eta } > 0\), \(\frac{{\partial \pi_{r}^{*} }}{\partial \eta } > 0\).

Proof

Since \(p_{3} - c_{3} > 0\) and \(4\beta h > \lambda^{2}\), we can obtain,

Moreover,\(\alpha - \left( {c_{m} + p_{3} } \right)\beta > 0\), and hence,

□

Corollary 3 shows that the greater the sensitivity coefficient η of market demand to the green level, the greater the market demand for products, which motivates the 3PL supplier to increase green logistics investment to improve the green level. From \(\frac{{\partial t^{*} }}{\partial \eta } = \frac{{p_{3} - c_{3} }}{2f}\), it can be concluded that the 3PL green level increases at a constant rate with the increase of η. As the revenue from the increased demand exceeds the increased cost of 3PL green investment, the 3PL supplier gains increased profit. The expanded demand makes the manufacturer have stronger economic ability to improve the product greenness. In addition, the manufacturer raises wholesale price to ensure the increase of revenue. Correspondingly, the retailer increases retail price. The dual effects of demand and retail price lead to an increase in retailer’s profit. It can be seen that the increase of consumers’ sensitivity to 3PL green level will simultaneously improve the benefits of all members. Therefore, considering the promoting effect of 3PL green level on market demand, enterprises should be encouraged to increase the research and application of new green logistics technologies, which will help the implementation of green supply chain. As a representative enterprise of China’s logistics, SF Express actively practices the concept of green development, adheres to the combination of enterprise operation with green development, and is committed to the development and application of sustainable packaging products. In 2018, the terminal recycling packaging “Feng box” developed by SF Express realized the reuse of green packaging based on the monitoring and allocation system.

6.2 Model with the retailer’s fairness concern (model 2)

This paper uses the inequality aversion model (F-S model) of Fehr and Schmidt [26] to describe fairness concern. Based on the income gap, the model focuses on the fairness of the distribution outcomes. When one’s own income is lower than others, he will exhibit an aversion against disadvantageous inequality. When one’s own income is higher than others, he will exhibit an aversion against advantageous inequality. In general, more attention is paid to disadvantageous inequality.

The retailer serves as an inferior follower in the supply chain system, and it is easy to trigger its fairness psychology, which affects the decision-making and profit distribution of the supply chain members. According to Proposition 1, we have \(\pi_{m}^{*} > \pi_{r}^{*}\), so this paper considers the retailer’s aversion against disadvantageous inequality. In the model, the retailer with fairness concern pursues the maximization of utility, and its utility function depends on its own and the manufacturer’s profit. Similar to Pu and Jin [27], taking the manufacturer’s profit as the reference point, the retailer’s utility function when considering fairness concern is:

where

k is the retailer’s fairness concern coefficient, i.e., the retailer’s aversion coefficient to disadvantageous inequality, which reflects the degree of fairness concern. Neither the manufacturer nor the 3PL supplier takes fairness concern into consideration, and their decision goal is to maximize their own profits. The manufacturer’s profit function is shown above, and the 3PL supplier’s profit function is:

Proposition 2

-

i.

When the retailer has fairness concern, if the condition \(4\beta h > \frac{{\left( {k + 1} \right)\lambda^{2} }}{2k + 1}\) is met, the manufacturer’s optimal product greenness θ**, the optimal wholesale price w**, the optimal 3PL green level t**, and the retailer’s optimal retail price p** are respectively as follows:

$$\begin{aligned} \theta^{**} & = \frac{{\lambda \left( {k + 1} \right)\left( {2f\left( {\alpha - \left( {p_{3} + c_{m} } \right)\beta } \right) + \eta^{2} \left( {p_{3} - c_{3} } \right)} \right)}}{{2\left( {4h\beta \left( {2k + 1} \right) - \lambda^{2} \left( {k + 1} \right)} \right)f}}, \\ w^{**} & = \frac{{\left( {2f\left( {\alpha + k\left( {\alpha + \left( {3c_{m} - p_{3} } \right)\beta } \right) + \beta \left( {c_{m} - p_{3} } \right)} \right) + \eta^{2} \left( {k + 1} \right)\left( {p_{3} - c_{3} } \right)} \right)h - f\lambda^{2} c_{m} \left( {k + 1} \right)}}{{\left( {4h\beta \left( {2k + 1} \right) - \lambda^{2} \left( {k + 1} \right)} \right)f}}, \\ t^{**} & = \frac{{\left( {p_{3} - c_{3} } \right)\eta }}{2f}, \\ p^{**} & = \frac{{h\left( {2k + 1} \right)\left( {2f\left( {3\alpha + \beta \left( {c_{m} + p_{3} } \right)} \right) + 3\eta^{2} \left( {p_{3} - c_{3} } \right)} \right) - 2f\lambda^{2} \left( {k + 1} \right)\left( {p_{3} + c_{m} } \right)}}{{2\left( {4h\beta \left( {2k + 1} \right) - \lambda^{2} \left( {k + 1} \right)} \right)f}}. \\ \end{aligned}$$ -

ii.

When the retailer has fairness concern, the profits of all members and the utility of the retailer are as follows:

$$\begin{aligned} \pi_{m}^{**} & = \frac{{h\left( {k + 1} \right)\left( {2f\left( {\left( {p_{3} + c_{m} } \right)\beta - \alpha } \right) - \eta^{2} \left( {p_{3} - c_{3} } \right)} \right)^{2} }}{{8\left( {4h\beta \left( {2k + 1} \right) - \lambda^{2} \left( {k + 1} \right)} \right)f^{2} }}, \\ \pi_{3}^{**} & = \frac{{\left( {8hf\beta \left( {2k + 1} \right)\left( {\alpha - \left( {p_{3} + c_{m} } \right)\beta } \right) + \eta^{2} \lambda^{2} \left( {k + 1} \right)\left( {p_{3} - c_{3} } \right)} \right)\left( {p_{3} - c_{3} } \right)}}{{8\left( {4h\beta \left( {2k + 1} \right) - \lambda^{2} \left( {k + 1} \right)} \right)f}}, \\ \pi_{r}^{**} & = \frac{{h^{2} \beta \left( {4k + 1} \right)\left( {2k + 1} \right)\left( {2f\left( {\left( {p_{3} + c_{m} } \right)\beta - \alpha } \right) - \eta^{2} \left( {p_{3} - c_{3} } \right)} \right)^{2} }}{{4f^{2} \left( {4h\beta \left( {2k + 1} \right) - \lambda^{2} \left( {k + 1} \right)} \right)^{2} }}, \\ U_{r}^{**} & = \frac{{h\left( {k + 1} \right)\left( {2f\left( {\left( {p_{3} + c_{m} } \right)\beta - \alpha } \right) - \eta^{2} \left( {p_{3} - c_{3} } \right)} \right)^{2} \left( {2h\beta \left( {2k + 1} \right)^{2} + k\lambda^{2} \left( {k + 1} \right)} \right)}}{{8f^{2} \left( {4h\beta \left( {2k + 1} \right) - \lambda^{2} \left( {k + 1} \right)} \right)^{2} }}. \\ \end{aligned}$$

Proof

The optimal retail price p** for maximizing the retailer’s utility satisfies the following first-order and second-order conditions:

□

It shows that the retailer’s utility function is strictly concave w.r.t. p, so the optimal response function of retail price can be obtained:

Substitute p into (7). Then, the first-order and second-order derivative of π3 w.r.t. t can be obtained:

Obviously, \(- f < 0\), so the 3PL supplier’s profit function is strictly concave w.r.t. t. Solving \(\frac{{d\pi_{3} }}{dt} = 0\) for t gives the optimal response function of 3PL green level, i.e.,

Substitute p and t into (6). The Hessian matrix of the manufacturer’s profit function can be obtained:

where \(- h < 0\). When the condition \(4\beta h > \frac{{\left( {k + 1} \right)\lambda^{2} }}{2k + 1}\) is met,

The Hessian matrix Hm is negative definite. Therefore, the manufacturer’s profit function is strictly concave w.r.t. θ and w. From the first-order conditions, i.e.,

θ** and w** can be obtained. As above, the optimal response function of 3PL green level is also t**. Then, p** can be obtained by substituting θ**, w** and t** into p.

Continue to substitute θ**, w**, t** and p** into Eqs. (4)–(7) to obtain the maximum profit of all members and the maximum utility of the retailer.

Corollary 4

\(\frac{{\partial D^{**} }}{\partial k} < 0\), \(\frac{{\partial \theta^{**} }}{\partial k} < 0\), \(\frac{{\partial w^{**} }}{\partial k} < 0\), \(\frac{{\partial t^{**} }}{\partial k} = 0\), \(\frac{{\partial p^{**} }}{\partial k} < 0\), \(\frac{{\partial \pi_{m}^{**} }}{\partial k} < 0\), \(\frac{{\partial \pi_{3}^{**} }}{\partial k} < 0\), \(\frac{{\partial \pi_{r}^{**} }}{\partial k} > 0\).

Proof

Since \(\alpha > \left( {c_{m} + p_{3} } \right)\beta\) and \(p_{3} - c_{3} > 0\), we have,

Since \(4\beta h > \frac{{\left( {k + 1} \right)\lambda^{2} }}{2k + 1}\), we have

Moreover, \(h > \lambda\), \(\beta > \lambda\), obviously, \(4h\beta \left( {2k + 1} \right) - \left( {5k + 2} \right)\lambda^{2} > 0\), and hence,

□

Corollary 4 indicates that the market demand, the manufacturer’s product greenness, the wholesale price and the retail price decrease with the increase of the retailer’s fairness concern coefficient, while the 3PL green level is not related to the retailer’s fairness concern coefficient. The retailer attaches importance to fairness, expects to stimulate demand and compete for market share by lowering retail price. In consideration of the retailers’ perception of fairness, when the manufacturer makes pricing decisions, if the retailer’s fairness concern is enhanced, the manufacturer takes the initiative to make concessions and lower the wholesale price to encourage the retailer who has concern about fairness. At the same time, the manufacturer reduces the product greenness to achieve the purpose of cost reduction, which reduces the damage to the manufacturer’s own profit under the retailer’s fairness concern. In addition, the decrease of greenness and retail price both affect the promotion and market demand for green products, and the reduction of market demand caused by the decline of product greenness exceeds the increase of demand caused by the reduction of retail price. This shows that the retailer’s price reduction is not large enough, resulting in no increase in market demand.

According to Corollary 4, the profits of the manufacturer and the 3PL supplier decrease with the increase of the retailer’s fairness concern, while the profit of the retailer increases. The declining wholesale price and the shrinking market reduce the profit of the manufacturer. As the 3PL green level has nothing to do with the retailer’s fairness concern coefficient, the investment in green logistics services remains unchanged. But the market demand decreases. Finally, the profit of the 3PL supplier decreases.

Corollary 5

\(D^{**} < D^{*}\), \(\theta^{**} < \theta^{*}\), \(w^{{*{*}}} < w^{*}\), \(t^{{*{*}}} = t^{*}\), \(p^{{*{*}}} < p^{*}\), \(\pi_{m}^{{*{*}}} < \pi_{m}^{*}\), \(\pi_{3}^{{*{*}}} < \pi_{3}^{*}\), \(\pi_{r}^{{*{*}}} > \pi_{r}^{*}\).

Proof

Since \(\alpha > \left( {c_{m} + p_{3} } \right)\beta\) and \(p_{3} - c_{3} > 0\), we have,

Since \(\beta h > \frac{{\lambda^{2} }}{4}\), we have

Moreover, \(h > \lambda\), \(\beta > \lambda\), obviously, \(4h\beta - 3\lambda^{2} > 0\), and hence,

□

Compared with the retailer having no fairness concern, the retailer with fairness concern reduces the retail price in the manufacturer-led green supply chain. The manufacturer chooses lower product greenness and wholesale price when making decisions, but the 3PL green level does not change, which indicates once again that whether the retailer is concerned about fairness has no impact on the 3PL green level. In addition, the profits of both the manufacturer and the 3PL supplier are smaller than those of the basic model, but the profit of the retailer is larger than that of the basic model. This shows that the retailer’s fairness concern benefits the retailer itself, but harms the green production manufacturer and the 3PL supplier, which hinds the further implementation of enterprise green strategy. It is not conducive to the development of green products.

From the previous analysis, it can be seen that when the retailer has fairness concern, the retail price, wholesale price and market demand fall, while the retailer’s profit rise, which reflects that the effect of reducing the wholesale price exceeds the effect of reducing the retail price and market demand. It shows that the increase of the retailer’s profit under fairness concern is mainly due to the decline of the manufacturer’s wholesale price.

6.3 Model under 3PL green cost sharing contract (model 3)

The retailer’s fairness concern hurts both the manufacturer and the 3PL supplier. Therefore, the manufacturer should take active measures to reach cooperation with the 3PL supplier to mitigate the harm. In reality, green activities have high investment and high risk. Many enterprises are small in scale and lack of funds. Such enterprises often have low enthusiasm for developing green technology, and it is difficult for them to make a large amount of green investment. Therefore, as the leader of the supply chain, it is necessary for the manufacturer to share the investment cost of the 3PL supplier’s green activities, share resources and promote cooperation, so as to mobilize the 3PL supplier’s enthusiasm for green investment and encourage it to improve the level of green logistics. Such cooperation not only improves the income of supply chain members, but also takes into account the sustainable development of supply chain.

Under the 3PL green cost sharing contract, it can be assumed that the proportion of green logistics investment cost borne by the 3PL supplier is ϕ, then the manufacturer shares \(1 - \phi\) of green logistics cost. In this case, the utility function of the retailer and the profit functions of other members in the supply chain are:

Proposition 3

Under the 3PL green cost sharing contract, when the condition \(4\beta h > \frac{{\left( {k + 1} \right)\lambda^{2} }}{2k + 1}\) is met, the manufacturer’s optimal product greenness θ***, the optimal wholesale price w***, the optimal 3PL green level t***, and the retailer’s optimal retail price p*** are as follows:

Proof

The optimal retail price p*** for maximizing the retailer’s utility satisfies the following first-order and second-order conditions:

It shows that the retailer’s utility function is strictly concave w.r.t. p, so the optimal response function of retail price can be obtained:

Substitute p into (9). Then, the first-order and second-order derivative of π3 w.r.t. t can be obtained:

Obviously, \(- \phi f < 0\), so the 3PL supplier’s profit function is strictly concave w.r.t. t. Solving \(\frac{{d\pi_{3} }}{dt} = 0\) for t gives the optimal response function of 3PL green level, i.e.,

Substitute p and t into (8). The Hessian matrix of the manufacturer’s profit function can be obtained:

where \(- h < 0\). When the condition \(4\beta h > \frac{{\left( {k + 1} \right)\lambda^{2} }}{2k + 1}\) is met,

The Hessian matrix Hm is negative definite. Therefore, the manufacturer’s profit function is strictly concave w.r.t. θ and w. From the first-order conditions, i.e.,

θ*** and w*** can be obtained. As above, the optimal response function of 3PL green level is also t***. Then, substitute θ***, w*** and t*** into p, p*** can be obtained.□

Corollary 6

\(\frac{{\partial D^{***} }}{\partial \phi } < 0\), \(\frac{{\partial \theta^{***} }}{\partial \phi } < 0\), \(\frac{{\partial w^{{*{**}}} }}{\partial \phi } < 0\), \(\frac{{\partial t^{{*{**}}} }}{\partial \phi } < 0\), \(\frac{{\partial p^{{*{**}}} }}{\partial \phi } < 0\), \(\frac{{\partial \pi_{3}^{{*{**}}} }}{\partial \phi } < 0\), \(\frac{{\partial \pi_{r}^{{*{**}}} }}{\partial \phi } < 0\).

Proof

Since \(p_{3} - c_{3} > 0\) and \(4\beta h > \frac{{\left( {k + 1} \right)\lambda^{2} }}{2k + 1}\), we have,

Moreover, \(\alpha > \left( {c_{m} + p_{3} } \right)\beta\) and \(2f\phi \left( {\beta \left( {p_{3} + c_{m} } \right) - \alpha } \right) - \eta^{2} \left( {p_{3} - c_{3} } \right) < 0\), and hence,

In the manufacturer-led green supply chain, the proportion of green logistics cost borne by the 3PL supplier negatively affect its green level under the contract, that is, the green level is bound to decline with the increase of ϕ. The manufacturer further lowers the wholesale price to make up for lost demand, and reduces the greenness to make up for lost profits. Naturally, as ϕ increases, the retail price also decreases to increase demand. From Corollary 6, the profits of the 3PL supplier and the retailer are negatively correlated with ϕ, which indicates that the more green investment the 3PL supplier undertakes, the more unfavorable it is to the 3PL supplier and the retailer. However, the relationship between ϕ and the manufacturer’s profit is not simple. When ϕ falls in different ranges, its impact on the manufacturer’s profit varies. We explain in detail how ϕ affects the manufacturer’s profit in the numerical analysis section.□

Corollary 7

\(D^{***} \ge D^{**}\), \(\theta^{***} \ge \theta^{**}\), \(w^{{*{**}}} \ge w^{**}\), \(t^{{*{**}}} \ge t^{**}\), \(p^{{*{**}}} \ge p^{**}\).

Proof

Since \({1} - \phi \ge 0\), \(p_{3} - c_{3} > 0\), and \(4\beta h > \frac{{\left( {k + 1} \right)\lambda^{2} }}{2k + 1}\), we have,

Corollary 7 shows that when the 3PL green cost sharing contract is introduced into the supply chain, the manufacturer will correspondingly set a higher wholesale price and improve the product greenness to attract consumers, while the 3PL supplier will improve the green level of logistics due to the reduction of green costs, and the retailer will increase the retail price. In addition, the consumer demand under the contract will rise because the increased demand from product greenness and 3PL green level exceeds the reduced demand from the increase of retail price.□

Corollary 8

-

i.

\(\pi_{3}^{{*{**}}} \ge \pi_{3}^{{**}}\), \(\pi_{r}^{{**{*}}} \ge \pi_{r}^{{**}}\).

-

ii.

When the condition \(1 \ge \phi \ge \frac{{\left( {p_{3} - c_{3} } \right)\left( {4f\beta h\left( {2k + 1} \right) - \left( {k + 1} \right)\left( {f\lambda^{2} + h\eta^{2} } \right)} \right)}}{{h\left( {k + 1} \right)\left( {4f\left( {\alpha - \beta \left( {c_{m} + p_{3} } \right)} \right) + \eta^{2} \left( {p_{3} - c_{3} } \right)} \right)}}\) is met, \(\pi_{m}^{***} \ge \pi_{m}^{**}\).

iii. When \(\phi = \frac{{2\left( {p_{3} - c_{3} } \right)\left( {4f\beta h\left( {2k + 1} \right) - \left( {k + 1} \right)\left( {f\lambda^{2} + h\eta^{2} } \right)} \right)}}{{f\left( {4\beta h\left( {kp_{3} - c_{3} \left( {2k + 1} \right)} \right) - \left( {k + 1} \right)\left( {4h \left( {\beta c_{m} - \alpha } \right) + \lambda^{2} \left( {p_{3} - c_{3} } \right)} \right)} \right)}}\),

the manufacturer gains the maximum profit and minimizes the impact of the retailer’s fairness concern on itself.

Proof

-

i.

It is easy to get that:

$$\begin{aligned} \pi_{3}^{***} - \pi_{3}^{**} & = \frac{{\left( {p_{3} - c_{3} } \right)^{2} \left( {1 - \phi } \right)\left( {k + 1} \right)\lambda^{2} \eta^{2} }}{{8\phi f\left( {4h\beta \left( {2k + 1} \right) - \lambda^{2} \left( {k + 1} \right)} \right)}} \ge 0, \\ \pi_{r}^{***} - \pi_{r}^{**} & = \frac{{\beta \eta^{2} h^{2} \left( {4f\phi \left( {\alpha - \beta \left( {c_{m} + p_{3} } \right)} \right) + \eta^{2} \left( {\phi + 1} \right)\left( {p_{3} - c_{3} } \right)} \right)\left( {p_{3} - c_{3} } \right)\left( {2k + 1} \right)\left( {4k + 1} \right)\left( {1 - \phi } \right)}}{{4\phi^{2} f^{2} \left( {4h\beta \left( {2k + 1} \right) - \lambda^{2} \left( {k + 1} \right)} \right)^{2} }} \ge 0. \\ \end{aligned}$$ -

ii.

When \(\pi_{m}^{***} - \pi_{m}^{**} = \frac{{\eta^{2} \left( {p_{3} - c_{3} } \right)\left( {1 - \phi } \right)\left( {h\left( {4f\left( {\left( {k + 1} \right)\left( {\alpha - \beta \left( {c_{m} + p_{3} } \right)} \right)\phi - \beta \left( {2k + 1} \right)\left( {p_{3} - c_{3} } \right)} \right) + \eta^{2} \left( {\phi + 1} \right)\left( {k + 1} \right)\left( {p_{3} - c_{3} } \right)} \right) + f\lambda^{2} \left( {k + 1} \right)\left( {p_{3} - c_{3} } \right)} \right)}}{{8\phi^{2} f^{2} \left( {4h\beta \left( {2k + 1} \right) - \lambda^{2} \left( {k + 1} \right)} \right)}} \ge 0\), we have \(h\left( {4f\left( {\left( {k + 1} \right)\left( {\alpha - \beta \left( {c_{m} + p_{3} } \right)} \right)\phi - \beta \left( {2k + 1} \right)\left( {p_{3} - c_{3} } \right)} \right) + \eta^{2} \left( {\phi + 1} \right)\left( {k + 1} \right)\left( {p_{3} - c_{3} } \right)} \right) + f\lambda^{2} \left( {k + 1} \right)\left( {p_{3} - c_{3} } \right) \ge 0\). Therefore, we get \(1 \ge \phi \ge \frac{{\left( {p_{3} - c_{3} } \right)\left( {4f\beta h\left( {2k + 1} \right) - \left( {k + 1} \right)\left( {f\lambda^{2} + h\eta^{2} } \right)} \right)}}{{h\left( {k + 1} \right)\left( {4f\left( {\alpha - \beta \left( {c_{m} + p_{3} } \right)} \right) + \eta^{2} \left( {p_{3} - c_{3} } \right)} \right)}}\).

-

iii.

Let \(g\left( \phi \right) = \pi_{m}^{***} - \pi_{m}^{**}\) and \(\phi_{1} = \frac{{\left( {p_{3} - c_{3} } \right)\left( {4f\beta h\left( {2k + 1} \right) - \left( {k + 1} \right)\left( {f\lambda^{2} + h\eta^{2} } \right)} \right)}}{{h\left( {k + 1} \right)\left( {4f\left( {\alpha - \beta \left( {c_{m} + p_{3} } \right)} \right) + \eta^{2} \left( {p_{3} - c_{3} } \right)} \right)}}\). we have \(g\left( {\phi_{1} } \right) = 0\) and \(g\left( 1 \right) = 0\). According to Rolle’s theorem, when \(\phi \in \left( {\phi_{1} ,1} \right)\), there exists at least a \(\phi_{2}\) that makes \(g^{\prime } \left( {\phi_{2} } \right) = 0\) true. Moreover, it can be obtained that the function \(g\left( \phi \right)\) has only one stationary point from \(g^{\prime } \left( \phi \right) = 0\). Therefore, \(\phi_{2}\) is unique and \(\phi_{2} = \frac{{2\left( {p_{3} - c_{3} } \right)\left( {4f\beta h\left( {2k + 1} \right) - \left( {k + 1} \right)\left( {f\lambda^{2} + h\eta^{2} } \right)} \right)}}{{f\left( {4\beta h\left( {kp_{3} - c_{3} \left( {2k + 1} \right)} \right) - \left( {k + 1} \right)\left( {4h \left( {\beta c_{m} - \alpha } \right) + \lambda^{2} \left( {p_{3} - c_{3} } \right)} \right)} \right)}}\). According to ii, when \(\phi \in \left( {\phi_{1} ,1} \right)\), \(g\left( \phi \right) > 0\). Then \(g\left( {\phi_{2} } \right) > 0\). Thus, \(\phi_{2}\) is the maximum point of the function \(g\left( \phi \right)\), and is also the maximum point of \(\pi_{m}^{***} \left( \phi \right)\).□

3PL green cost sharing contract results in improved performance for all supply chain members. Therefore, reasonable interest coordination and incentive mechanism should be established to maintain and develop the cooperative relationship between nodes enterprises in the supply chain. According to Corollary 8, no matter what value ϕ is taken, the 3PL supplier and the retailer gain more profits than they would without cooperation, while the manufacturer gains more profit only within a certain range of the sharing proportion. Corollary 8 ii indicates that the manufacturer, as a rational person, must improve its own profit to protect its interests, that is, \(\pi_{m}^{***} \ge \pi_{m}^{**}\) must be achieved, so that the cooperation between the manufacturer and 3PL supplier can be realized. Thus, the range of ϕ in Corollary 7 can be obtained.

6.4 Model under combination contract (model 4)

Based on the 3PL green cost sharing contract, this paper designs a combination contract composed of 3PL green cost sharing and fixed fee, which can also improve the performance of supply chain under the retailer’s fairness concern. For the green level of products and logistics activities, the combination contract can achieve the same level as the 3PL green cost sharing contract. More importantly, according to the benefits of both parties after the manufacturer shares 3PL green cost, the combination contract can adjust the size of the transfer payment to take into account the interests of the follower 3PL supplier, thus ensuring the cooperation between members in the supply chain and contributing to the stable and healthy development of the supply chain. In this contract, the manufacturer will pay a fixed fee to the 3PL supplier in addition to sharing the 3PL green cost in the proportion of \(1 - \phi\). Suppose the fixed fee paid by the manufacturer is A, then the manufacturer’s profit function is:

s.t. \(\pi_{m} \ge \pi_{m}^{**}\).

The 3PL supplier’s profit function is:

s.t. \(\pi_{3} \ge \pi_{3}^{***}\).

The retailer’s profit and utility expressions are the same as Eqs. (10) and (11). Use backward induction to obtain the equilibrium solution of the model.

Proposition 4

Under the combination contract, when the condition \(4\beta h > \frac{{\left( {k + 1} \right)\lambda^{2} }}{2k + 1}\) is met, the manufacturer’s optimal product greenness θ****, the optimal wholesale price w****, the optimal 3PL green level t****, and the retailer’s optimal retail price p**** are as follows:

Compared with 3PL green cost sharing contract, the equilibrium solution of all decision variables and the retailer’s profit do not change under the combination contract, but the retailer’s utility increases by K*A. The 3PL supplier draws the surplus A from the manufacturer, effectively enhancing the strength of its own profit growth, but the manufacturer’s profit decreases.

Compared with the fairness concern model, the product greenness, wholesale price, 3PL green level and retail price under the combination contract are higher. The utility and profit of the retailer increase as well as profits of other members in the supply chain. Although the manufacturer both shares the 3PL green cost and pay a fixed fee, a higher wholesale price and increased demand are enough to ensure that the manufacturer earns more profit. The contract is feasible.

The manufacturer’s profit must be at least the same as that in the fairness concern model before the manufacturer can accept the combination contract. When \(A = {0}\), the manufacturer’s profit is \(\pi_{m}^{****} = \pi_{m}^{***}\), and the range of ϕ is the same as that in the green cost sharing model. When A reaches the maximum value, the 3PL supplier gets all the surplus from the manufacturer, and the manufacturer’s profit is \(\pi_{m}^{****} = \pi_{m}^{**}\). Because the manufacturer’s profit depends on the proportion of 3PL green cost sharing, the maximum value of A is related to the value of ϕ when \(\pi_{m}^{***}\) achieves the maximum value.

Therefore, the maximum value of A is: \(A_{\max } = \pi_{m}^{***} - \pi_{m}^{**} = \frac{{\left( {1 - \phi } \right)\left( {p_{3} - c_{3} } \right)\eta^{2} \left( {B_{1} \left( {f\lambda^{2} + \eta^{2} h\left( {\phi + 1} \right)} \right) - 4fh\left( {\phi B_{2} + \beta B_{3} } \right)} \right)}}{{8\phi^{2} f^{2} \left( {4\beta h\left( {2k + 1} \right) - \lambda^{2} \left( {k + 1} \right)} \right)}},\)where \(\phi = \frac{{2\left( {p_{3} - c_{3} } \right)\left( {4f\beta h\left( {2k + 1} \right) - \left( {k + 1} \right)\left( {f\lambda^{2} + h\eta^{2} } \right)} \right)}}{{f\left( {4\beta h\left( {kp_{3} - c_{3} \left( {2k + 1} \right)} \right) - \left( {k + 1} \right)\left( {4h \left( {\beta c_{m} - \alpha } \right) + \lambda^{2} \left( {p_{3} - c_{3} } \right)} \right)} \right)}},\) \(B_{1} = \left( {k + 1} \right)\left( {p_{3} - c_{3} } \right)\), \(B_{2} = \left( {k + 1} \right)\left( {\beta c_{m} + \beta p_{3} - \alpha } \right)\), \(B_{3} = \left( {2k + 1} \right)\left( {p_{3} - c_{3} } \right)\).

Therefore, \(A \in [0,A_{\max } ]\). In actual enterprise operation, A is often set less than Amax, otherwise the manufacturer has no incentive to cooperate. Within the scope of A, the final size of A depends on the bargaining power of the manufacturer and the 3PL supplier.

7 Numerical analysis

The equilibrium strategy given through the above analysis is relatively complex in form. In order to intuitively grasp the conclusion of the study and find some unknown laws, similar to Du and Du [28], Pu and Zhuge [29], Ma and Zhang [30], this paper uses the numerical analysis method. The parameters are taken as follows: α = 1200, β = 2, λ = 1.2, η = 0.9, h = 6, f = 2, cm = 60, c3 = 20, p3 = 50.

7.1 Comparison and analysis of the optimal values

This section uses a numerical example to compare the optimal greenness, wholesale price, retail price, 3PL green level, maximum profits and utility under different models. In addition to the values of the parameters as shown above, let k = 0.3 and ϕ = 0.2, and the results are shown in Table 3.

As can be seen from Table 3, the greenness, prices, profits of the manufacturer and the 3PL supplier, and total profit of the supply chain under retailer’s fairness concern are all lower than those without fairness. The 3PL green level is not affected by the retailer’s fairness concern, while the retailer benefits from its own fairness concern. Compared with the fairness concern model, the 3PL green cost sharing contract can further improve the product greenness, the green level of logistics and product pricing, and correspondingly improve the benefits of supply chain members. The optimal values of all decision variables under the combination contract are the same as those under the 3PL green cost sharing contract, but the profit of the 3PL supplier is significantly improved. In addition, the retailer’s utility reaches the highest under the combination contract, followed by the 3PL green cost sharing contract, and reaches the lowest under the fairness concern model. The whole supply chain earns more profit under both contracts than that under the fairness concern model. Based on the above results, it can be concluded that both contracts further improve the economic and environmental benefits of the supply chain.

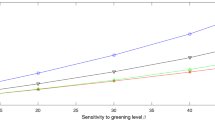

7.2 The effect of the retailer’s fairness concern on profits and utility

Firstly, this paper analyzes the impact of the retailer’s fairness concern on the retailer’s utility, members’ profits and the total profit of green supply chain. According to Fig. 2, when the retailer has fairness concern and the fairness concern coefficient k gradually increases, the profits of the manufacturer and the 3PL supplier gradually decrease, while the retailer’s profit and utility gradually increase. This is consistent with Corollary 4. In addition, the total profit of the supply chain decreases gradually because the reduced profits of the manufacturer and the 3PL supplier exceed the increased profit of the retailer. It can be seen that the stronger the retailer’s fairness concern, the better it is for itself and the worse it is for other members and the entire supply chain. Therefore, the retailer can benefit the whole supply chain system by reducing the concern about fairness as much as possible. However, as an economic man, the retailer is self-interested and hard to restrain self-interest behavior. Therefore, it is necessary to minimize or even eliminate the influence of the retailer’s fairness concern through close cooperation between the manufacturer and the 3PL supplier.

From the data in Fig. 2, it can be found that the retailer’s fairness concern has a significant impact on its own and the manufacturer’s profit. Although the 3PL supplier’ profit showed a downward trend, it decreased slowly. According to Corollary 4, the 3PL green level is not affected by the retailer’s fairness concern, so it can be deduced that although market demand decreases with the increase of the retailer’s fairness concern, the decrease is small.

Secondly, this paper makes a comparative analysis of the profits between models of whether the retailer has fairness concern. According to Fig. 2, compared with the profits without fairness concern under the assumption of fully rational economic man, for any fairness concern coefficient k, the profits of the manufacturer and the 3PL supplier and the total profit of supply chain under fairness concern are always low. Thus, the retailer’s fairness concern is good for itself, but bad for the manufacturer, the 3PL supplier and the overall performance of the supply chain.

7.3 The effect of the 3PL green cost sharing contract on profits and utility

In this sub-section, the effect of ϕ on profits and the retailer’s utility are analyzed numerically, and Corollary 7 is also verified. The values of the parameters remain the same. In addition, set k = 0.3.

Under the retailer’s fairness concern, when the manufacturer and the 3PL supplier reach cooperation, if the proportion ϕ of green logistics cost borne by the 3PL supplier falls into a certain range, the profit of each member in the supply chain and the retailer’s utility are greater than the decentralized decision-making. As can be seen from Fig. 3, when the proportion ϕ is quite low, the manufacturer’s profit improves with the increase of ϕ. If the manufacturer earns less profit than the decentralized decision, it will not accept the contract. When ϕ exceeds a certain threshold (0.0702), the manufacturer earns a higher profit than the decentralized decision and accepts the contract. When ϕ reaches a certain value (0.1312), the 3PL green cost sharing contract brings the largest profit to the manufacturer. However, when ϕ continues to increase, the manufacturer’s performance decreases, but it is always higher than the decentralized case. In addition, the greater the proportion ϕ, the lower the 3PL supplier’s profit will be, which is consistent with the conclusion of Corollary 6. Therefore, the proportion ϕ of green logistics cost shared by the 3PL supplier should be reduced, and the manufacturer’s sharing proportion 1−ϕ will increase correspondingly. According to Fig. 3, the retailer’s profit and utility will decrease with the increase of ϕ, but always higher than the decentralized decision-making. Therefore, as long as the manufacturer shares the 3PL green cost, it is beneficial to the retailer and the 3PL supplier. Accordingly, when ϕ is in a certain range, the overall profit of the supply chain is greater than the non-cooperative decision-making in model 2. And the effect of ϕ on the whole supply chain is similar to that of ϕ on the manufacturer. In short, the 3PL green cost sharing contract benefits the entire supply chain and all members. Therefore, to improve the supply chain performance and promote the long-term development of the supply chain, we need to actively seek cooperation among members. In particular, the manufacturer should give full play to its dominant advantages, coordinate the interests of each node enterprise in the supply chain, establish a long-term and stable supply chain partnership, and improve the total benefits of the whole supply chain.

Figure 3 shows that under the 3PL green cost sharing contract, the 3PL supplier’s profit is improved, but the improvement is relatively small. In combination with Fig. 4, the 3PL green level under the 3PL green cost sharing contract is superior to that under the non-cooperation situation. It can be found that the greatest significance of 3PL green cost sharing contract for the 3PL supplier is the improvement of green logistics level. Therefore, if the 3PL supplier not only wants to improve the green level of logistics, but also enhance the strength of profit increase, the combination contract is a better choice.

7.4 The effect of the combination contract on profits

The retailer’s profit increase under the combination contract has nothing to do with fee A. Therefore, this part focuses on the analysis of the increase in profits of the manufacturer and the 3PL supplier, and selects three situations to discuss the relationship between their profit increase and fee A. Let \(\Delta \pi_{m} = \pi_{m}^{****} - \pi_{m}^{**}\), \(\Delta \pi_{3} = \pi_{3}^{****} - \pi_{3}^{**}\). Based on the parameter setting in this paper, \(A_{\max } = {1914}{\text{.0489}}\) can be obtained. The specific range of A varies with the value of ϕ, but A does not exceed Amax. In Fig. 5a, when ϕ = 0.0702, A can only be 0. In this case, the profits of the manufacturer and the retailer under the combination contract and fairness concern model are the same respectively. In Fig. 5b, when ϕ = 0.3, \(1111.1521 \ge A \ge 0\). In Fig. 5c, when ϕ = 0.1312, \({1914}{\text{.0489}} \ge A \ge 0\). In (b) and (c), the profits of the manufacturer and the retailer can be improved within the corresponding range of A. The third scenario in Fig. 5 is used as an example to illustrate the increase in profits under the combination contract and reasonable range of fee A.

Compared with the fairness concern model, when \(A = {0}\), the 3PL supplier’s profit increases by 7.5387 and the manufacturer’s profit increases by 1914.0489 under the combination contract. When \(A = {1914}{\text{.0489}}\), the manufacturer’s profit increment is 0, and the 3PL supplier extracts all of the manufacturer’s surplus. When \(A > {1914}{\text{.0489}}\), the manufacturer’s profit decreases, and the manufacturer rejects the contract to protect its own interests. Therefore, when \({1914}{\text{.0489}} \ge A \ge 0\), the manufacturer and 3PL supplier can increase their profits simultaneously. The contract is implementable.

7.5 The effect of fairness concern coefficient and fixed fee on retailer’s utility improvement between two contracts

Let \(\Delta U_{r} = U_{r}^{****} - U_{r}^{***}\). As shown in Fig. 6, the retailer’s utility under the combination contract is usually higher than that under the 3PL green cost sharing contract. The retailer takes the manufacturer’s profit as the reference point of fairness concern. Under the combination contract, the manufacturer pays fees to the 3PL supplier and thus reduces its own profit, which will inevitably lead to the increase of the retailer’s utility. The retailer’s utility gap between two contracts is based on fairness concern coefficient k and fixed fee A. The gap is greatest when k and A are both their maxima. \(\Delta U_{r}\) increases as k and A increase. When the retailer pays more attention to fairness and the manufacturer transfers more to the 3PL supplier, gap in the retailer’s utility between the two contracts will widen. We know that the retailer’s profit is the same in both contracts, so the combination contract makes more sense in terms of the retailer’s utility.

8 Conclusions and future work

The supply chain studied in this paper consists of a manufacturer, a 3PL supplier and a retailer. This paper introduces green logistics into the green supply chain, takes the product greenness and 3PL green level as the influencing factors of market demand. Using game theory, this paper constructs the optimal decision-making model of each member in the supply chain according to whether the retailer has fairness concern, studies pricing and green strategy, and discusses the impact of price sensitivity coefficient, consumers’ green preference and the retailer’s fairness concern on the decision-making and performance of supply chain members. Finally, the supply chain cooperation under the retailer’s fairness concern is studied.

8.1 Main conclusions

-

1.

The retailer’s fairness concern is not conducive to the manufacturer, the 3PL supplier and the whole supply chain, but beneficial to the retailer. And the stronger the degree of fairness concern, the more beneficial to the retailer. The main reason for the increase of the retailer’s profit under fairness concern is the decline of the manufacturer’s wholesale price.

-

2.

In order to improve the performance of supply chain under fairness concern, this paper designs 3PL green cost sharing contract and combination contract. Compared with the non-cooperative case under the retailer’s fairness concern, both these two contracts improve the performance of the whole supply chain and its members. The environment also benefits from both contracts with more environmentally friendly products and logistics activities.

-

3.

The 3PL green cost sharing contract improves the profits of the retailer and the 3PL supplier. For the manufacturer, only when 3PL green cost sharing proportion is within a certain range given in this paper, the manufacturer will share the 3PL green cost, and the contract can be realized.

-

4.

The combination contract makes more sense for the 3PL supplier. The 3PL supplier improves the green level of logistics, and gains more profit than otherwise by redistributing the profit increment of the contract parties with a fixed fee within a given range.

-

5.

Compared with the 3PL green cost sharing contract, the retailer’s utility under the combination contract increases, and the amount of increase is positively correlated with the degree of fairness concern and fixed fee.

-

6.

Both the wholesale price and retail price are negatively correlated with the retailer’s fairness concern and 3PL green cost sharing proportion.

-

7.

Product greenness increases with the increase of greenness sensitivity coefficient and green logistics sensitivity coefficient, and decreases with the increase of price sensitivity coefficient, the degree of fairness concern and 3PL green cost sharing proportion.

-

8.

3PL green level has nothing to do with consumers’ reaction to price, their preference for green products and retailer’s fairness concern. It has a positive correlation with consumers’ sensitivity to green logistics, and a negative correlation with 3PL green cost sharing proportion.

8.2 Future work

First of all, only green products are considered in this paper. In the future, non-green products can be added to the analysis environment of this paper together with green products, that is, the decision of two manufacturers to sell heterogeneous products is considered. Secondly, this paper only considers the retailer’s fairness concern. Next, the impact of the 3PL supplier’s fairness concern on supply chain decision-making and performance can be explored. Finally, this paper proposes two improved contracts under the retailer’s fairness concern. Other contracts that can improve the performance can be studied later.

Availability of data and materials

The data used to support the findings of this study are included within the article.

References

Adhikari A, Bisi A (2020) Collaboration, bargaining, and fairness concern for a green apparel supply chain: an emerging economy perspective. Transp Res E-Log 135:101863. https://doi.org/10.1016/j.tre.2020.101863

Ghosh D, Shah J (2015) Supply chain analysis under green sensitive consumer demand and cost sharing contract. Int J Prod Econ 164:319–329. https://doi.org/10.1016/j.ijpe.2014.11.005

Zhang CT, Liu LP (2013) Research on coordination mechanism in three-level green supply chain under non-cooperative game. Appl Math Model 37(5):3369–3379. https://doi.org/10.1016/j.apm.2012.08.006

Li B, Zhu MY, Jiang YS, Li ZH (2016) Pricing policies of a competitive dual-channel green supply chain. J Clean Prod 112:2029–2042. https://doi.org/10.1016/j.jclepro.2015.05.017

Xu XP, He P, Xu H, Zhang QP (2017) Supply chain coordination with green technology under cap-and-trade regulation. Int J Prod Econ 183:433–442. https://doi.org/10.1016/j.ijpe.2016.08.029

Zhao R, Neighbour G, Han JJ, McGuire M, Deutz P (2012) Using game theory to describe strategy selection for environmental risk and carbon emissions reduction in the green supply chain. J Loss Prevent Proc 25(6):927–936. https://doi.org/10.1016/j.jlp.2012.05.004

Wu Q, Mu YP, Feng Y (2015) Coordinating contracts for fresh product outsourcing logistics channels with power structures. Int J Prod Econ 160:94–105. https://doi.org/10.1016/j.ijpe.2014.10.007

Yu YL, Xiao TJ (2017) Pricing and cold-chain service level decisions in a fresh agri-products supply chain with logistics outsourcing. Comput Ind Eng 111:56–66. https://doi.org/10.1016/j.cie.2017.07.001

Giri BC, Sarker BR (2017) Improving performance by coordinating a supply chain with third party logistics outsourcing under production disruption. Comput Ind Eng 103:168–177. https://doi.org/10.1016/j.cie.2016.11.022

Zhang C, Fan LW, Tian YX (2020) Optimal operational strategies of capital-constrained supply chain with logistics service and price dependent demand under 3PL financing service. Soft Comput 24(4):2793–2806. https://doi.org/10.1007/s00500-019-04560-9

Fu H, Ke GY, Lian ZT, Zhang LM (2021) 3PL firm’s equity financing for technology innovation in a platform supply chain. Transp Res E-Log 147:102239. https://doi.org/10.1016/j.tre.2021.102239

Jamali MB, Rasti-Barzoki M (2019) A game theoretic approach to investigate the effects of third-party logistics in a sustainable supply chain by reducing delivery time and carbon emissions. J Clean Prod 235:636–652. https://doi.org/10.1016/j.jclepro.2019.06.348