Abstract

The scholars of environmental economics have attempted the investigation of the impact of foreign direct investment-growth nexus, but they have missed the essential role played by technological innovation and financial development regarding the environmental costs. The notable economic growth and the consequent speedy process of urbanization in BRICS countries have brought about colossal escalation of energy needs leading to environmental degradation. The present study endeavors to explore the effect of foreign direct investment, technological innovation, and financial development on carbon emissions in BRICS member countries, with data from 1990 to 2017. The results verify a strong cross-sectional dependence within the panel countries. The Augmented Mean Group (AMG) estimator shows that foreign direct investment, technological innovation, and financial development in the BRICS countries possess a negative and statistically significant long-run association with CO2 emissions, while economic growth, trade openness, urbanization, and energy use are found to contribute statistically significant and positive with carbon emissions. The current study chose to employ the Dumitrescu and Hurlin panel causality test for examining the direction of causality. Findings reveal a bidirectional long-run causality running among financial development, economic growth, trade openness, urbanization, energy use, and CO2 emissions; on the contrary, unidirectional causality is found between foreign direct investment and carbon emissions. Consequently, for the BRICS member countries, the development of industries, financial institutions, and development of technological innovation are required to attract quality foreign direct investment. Moreover, urbanization contributes enormously to environmental degradation and necessitates urgent policy responses in these countries.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Out of the major research domains in the field of environmental economics, climate change has attracted considerable attention from researchers throughout the globe because of its association and likely threats to sustainable development (Destek and Sarkodie 2019), the consequential ever-increasing industrialization, and the ensuing urbanization, which, in the past few decades, have caused dramatic changes in the world (Dong et al. 2018b). This phenomenon is highly relevant to a group of states called BRICS that includes Brazil, Russia, India, China, and South Africa. The BRICS economies, by virtue of their rapid industrialization, have experienced remarkable economic growth which is evident from their GDP that reached the promising level of 2187 US$ in 2010 and grew at the rate of 6.5% annually since 1985 (Dong et al. 2017; Azevedo et al. 2018; World Bank 2018; Danish and Wang 2019). The developing economies look upon the BRICS states as role models and a source of guidance and inspiration for economic growth (Danish et al. 2018). Goldman (2003) studies that the BRICS states have the capacity to challenge the economic monopoly of the G6 in the coming few decades. This will be evident in the next 5–6 years when these economies will surpass half of the economic stature of G6 by 2025. It is highly probable that these states will transform themselves by dint of economic growth, state-of-the-art technological advancement, strict pursuance of environment-friendly guidelines, and economic structural transformation from pollution intensive industrial phase to a highly advanced information exchange service centers (Destek and Sarkodie 2019). However, all that rapid advancement has and will not come without consequences. All these economic achievements have brought with them mammoth issues especially relating to environment, for instance, carbon emissions (Dong et al. 2017).

Foreign direct investment (FDI) denotes the transmission of technology, management skills, and knowledge from developed economies to underdeveloped economies (Doytch and Narayan 2016). FDI has been described as a trusted way for developing domestic production capabilities of an economy, increasing their investments through new finances and accessing innovative technologies (Xu et al. 2018). The FDI can be attracted through financial development and energy use, which, in turn, can stimulate economic development and encourage research-oriented activities for enhancing economic efficiency (Ziaei 2015). Concerning the analysis of possible association between sustainable development and FDI, three major hypotheses are dominant: FDI Halo Hypothesis, Pollution Havens Hypothesis, and Environmental Kuznets Curve (EKC). The FDI Halo Hypothesis suggests that FDI is likely to exercise positive environmental spillover impact as FDI usually brings superior technologies from the developed economies to the underdeveloped countries (Balsalobre-Lorente et al. 2019). Pollution Havens Hypothesis forwards that multinational corporations and trans-boundary plants serve as disseminators of advanced technology from advanced states to the less advanced countries encompassing the environmental sector and the consequent impact and improvement in environmental performance (Bakirtas and Cetin 2017). There has been an extensive advocacy by international monetary organizations advising the developing economies to bring reforms for attracting foreign investment for their economic development. The theoretical evidence of how GDP can boost economic development goes back to neoclassical growth models. The recent models have forwarded that technological advancement, produced through FDI, can yield instant as well as durable economic benefits (Hsiao and Hsiao 2006). It is widely believed that a country with a competent and stable financial sector has the potential to ensure improvement in investment procedure, financial risk mitigation, capital accumulation, and so forth thereby attracting higher degree of FDI, which, in turn, improves technological innovation (TI) and allows the retention of natural environment. The financial development plays a pivotal role in the allocation of financial resources for the purpose of valuable ventures and mobilization of savings, which improve domestic production and bring about economic development. Many scholars have forwarded the idea that when the financial sector develops in a country, it can invite FDI as well as state-of-the-art technology that is friendly to environment (Birdsall and Wheeler 1993; Frankel and Rose 2002). Hence, it can be safely maintained that the financial sector expansion drastically affects energy consumption (Sadorsky 2011; Islam et al. 2013), which consequently impacts the degree of CO2 emissions (Tamazian et al. 2009; Alam et al. 2012).

Today’s world faces a huge challenge in balancing the environmental sustainability, on one hand, and countries desire for economic prosperity, on the other hand. To address the challenge of keeping the economic growth without risking their environmental pollution, countries in the world have introduced various policies to address climate change and minimize CO2 emissions (Akadiri Saint et al. 2019a). In this respect, the economic growth model of BRICS countries has extraordinarily inspired the emerging economies. The BRICS countries have received this attention due to the rapid rise of their influence in the global economic development, which is also changing the global environmental governance pattern. The BRICS member countries are the most polluting countries in the world; resultantly, they emit biggest quantity of CO2 emissions. Two of the BRICS members, China and India, are under immense pressure to control their respective CO2 emissions because of their status as the main contributing sources for newly added carbon emissions. In the meantime, China and India are also under pressure to boost industrialization and subsequent urbanization in order to address poverty alleviation (Wang et al. 2018). China, being a BRICS member, is globally the biggest consumer of energy and consequently biggest CO2 emitter (Birol 2016). On account of their limited resources, the developing economies find it difficult to invest in the environmental protection that comes at huge costs (Zhang 2011; Chang 2015; Seetanah et al. 2019). This situation strongly calls for a thorough investigation to assess how financial development and TI operate in developing countries and discover their impact on environment. The study may be helpful in formulating a broad consensus on feasible policies to address the issue of carbon emissions and minimize depletion of ozone layer and global warming (Alam et al. 2012).

Based on the abovementioned brief literature and taking into consideration the existing studies, the current study aims to examine the association between CO2 emissions and its determinants: namely FDI, financial development, technological innovation, and economic growth in BRICS states. The current study obtains panel data of BRICS states from 1990 to 2017. To our best knowledge, the current study will be pioneering, illuminating, and an addition to the existing literature highlighting the association of TI and FDI with CO2 emissions. The current study drastically differs from a recent study conducted by Danish and Wang (2019) on BRICS Countries, where they investigated the association of natural resources and CO2 emissions. The present study will add to the existing literature in the domain of FDI, technological innovation, financial development, and carbon emissions using the case of BRICS states. The study has highlighted the validity of EKC measuring the association of economic growth and carbon emissions.

The present study is of huge importance because it carries significant guidelines for future following the fourth assessment report of Intergovernmental Panel on Climate Change (IPPC), which maintains that the global atmospheric temperature must not increase beyond 2 °C. The environmental experts have identified a number of affordable alternative energy technologies for keeping the environment at such temperature (IPCC 2007, 2014; Tol 2007). The current study chose the case of BRICS countries owing to the fact that the BRICS member states are considered to be prone to the climatic changes and that in case of rise in global temperature, the coastal areas of these BRICS Countries are likely to face extreme weather conditions for instance floods, shortage of drinkable water, and even droughts. Majority of researchers have underscored the role of economic growth and climate change in emerging economies. The existing literature presents a contradiction, in theoretical and empirical dimensions, on the association between the variables under the study. The current study appears to differ in great deal from the studies carried out previously in the same domain. This difference ranges from time-range and methodology to the selection of variables. Majority of researchers prefer employing diverse range of proxies for financial development (Tamazian et al. 2009; Al-mulali et al. 2015); however, no study has ever used financial development index (FI) for BRICS countries, which comprises wide-ranging factors for measurement. The present study fills the said research gap by employing a single and comprehensive FI for BRICS countries and discover the actual role played by FI and TI across these countries.

This paper is presented in the following way: The second part gives a succinct, systemic review of the existing body of literature; the third section discusses research methodology, data collection, and estimation procedure followed by the section that covers results and findings, while the last part submits conclusions and recommendations.

Review of literature

Out of a host of most significant issues dominating the domain of environmental economics is the investigation of linkage between financial development and environmental degradation. The studies on the said association have come up with mixed findings. Some have portrayed a positive association between these variables, some have brought neutral results, while the rest have found a negative association. This paper endeavors to explore the work of previous scholars on the main variables for setting the stage for the main theme.

FDI and carbon emissions

The central theme of the current study is focused on exploring the association between FDI and environment. Keeping in view the growing importance of BRICS states and the growth of FDI inflow there, which is likely to rise in the next few years, the study underlines the environmental costs of such gigantic FDI inflow within that region (Goldman 2003; Zeng et al. 2017; Dong et al. 2017; Azevedo et al. 2018; Danish and Wang 2019). The theories on FDI inform about contradictory effects of FDI on environment from being positive, neutral to negative. The FDI impact on environment can be determined through the degree of dominance of the transmission channels. These conflicting views are evident through three types of hypotheses: the pollution haven hypothesis, the pollution halo hypothesis, and the scale effects hypothesis (Pao and Tsai 2010). The findings of various studies carried out in different states and regions inform that FDI can exert varied impacts on environment. For example, the studies conducted by Pao and Tsai (2010) on BRICS states, Al-mulali and Binti Che Sab (2012) on GCC states, Pazienza (2015) on OECD states, and Zhang and Zhou (2016), Liu et al. (2017) and Xing et al. (2017) on China have found that FDI can improve the quality of environment.

In contrast, the studies carried out by He (2006) and Ren et al. (2014) in Chinese, Hitam and Borhan (2012) and Lau et al. (2014) on Malaysian, Solarin et al. (2017) on Ghanaian, Tang (2015) on Vietnamese context, Paramati et al. (2016) on 20 emerging states, Sbia et al. (2014) on Middle East region, Abdouli and Hammami (2017) on MENA, Shahbaz et al. (2015) on a wide variety of countries based on their income status, and a recent study by Shahbaz et al. (2018) using the case of France have concluded that FDI is one of the leading causes triggering environmental degradation. At the same time, some studies have come up with the findings which do not support either the positive or the negative implications of FDI and concluded insignificant results, for example, the study by Kivyiro and Arminen (2014) on some countries of sub-Saharan region. Unpredictably, the studies that used a number of BRICS states as their cases also submitted contrasting findings (Zeng et al. 2017; Dong et al. 2017; Azevedo et al. 2018; Danish and Wang 2019). However, all these studies excluded the essential variables of financial development and growth, which can offer better findings when employed along with FDI. The present investigators intend to include financial development in a wide-ranging manner. Keeping in view the colossal degree of FDI along with economic and financial growth in BRICS states, the current study aims to explore the combined effect of all these variables on environment. In order to execute that, we intend to employ several empirical approaches, which are elaborated in the following section.

TI and CO2 emissions

The concept of technological change is credited to Schumpeter (1942) as quoted by Fields (2004) who presented the theory that a superior technological invention is incorporated into an existing market through three phases: invention, innovation, and diffusion. In his opinion, the process of research and development (R&D) is employed to execute the invention and innovation phases while the diffusion phase is executed when individuals or organizations adopt that TI in order to exploit it. The composite effect of these three phases is called the process of technological change. Owing to the internalization of technology employed as a variable into the model of market-functioning, the latest growth theory is referred to as “endogenous” growth theory. Experts believe that technological change is of vital importance in explaining major issues affecting the environment, which addresses larger picture with respect to time and scale and include climate change (Weitzman 1997; IPCC 2007). A wide range of arguments have been forwarded to recognize the actual magnitude of technological changes, which help in decreasing environmental pollution including changes in the fuel mix, employment of highly energy efficient production technologies, and installation of end-of-pipe technology which is regarded as the most significant among all. Regarding the investigation of climate change, which relates to energy and environment, the most significant theoretical assumptions address the nature and rate of technology change (Yeh and Rubin 2012). Likewise, some researchers contend that reduction in CO2 emissions may be brought about through investment in R&D and technology change (Jones 2005). Others argue that if the society accepts these increased costs in order to decrease the degree of carbon emissions through technological development, it can surely help resolve the key issue of climate change (Newell and Pizer 2008). A study carried out by Sohag et al. (2015) found economic development and trade openness to increase the degree of energy consumption, while TI was found to augment energy efficiency as well as decrease energy consumption, therefore eventually cause reduction in CO2 emissions. Conversely, a number of studies have submitted opposing findings about TI and environment. In this respect, the study by Parry (2003) endeavored to investigate the role of TI or the optimal pollution control (Pigouvian) welfare in reducing CO2 emissions. It concluded that the welfare gains from optimal pollution control were larger in comparison with the welfare gains obtained from TIs. However, Smulders and de Nooij (2003) found that induced innovation could alleviate the per capita income decline but, because of the energy conservation policies, it could not completely counterbalance its impact.

Financial development and carbon emissions

The current tendency of research in the domain of environmental economics has focused largely on the investigation of linkage between financial development and environment. The fundamental factor for the achievement of economic growth is the role played by developed financial sectors. Many scholars believe that the developed financial markets can motivate the pace of the economic development if these markets can invite FDI and seek higher investment in R&D (Frankel and Romer 1999) thereby influencing the dynamics of environment. In the same way, scholars also believe that financial growth can produce eco-friendly technological advancement, which aims at keeping the environment least polluted, manufacturing eco-friendly products resulting in the rise of developmental sustainability at national, regional, and global levels (Birdsall and Wheeler 1993; Frankel and Rose 2002). The financial development may be blamed for causing rise in CO2 emissions on account of its encouragement for production activities. In this regard, the growth in financial sector is considered to carry direct effect on the consumption of energy (Sadorsky 2011; Islam et al. 2013), and thus, it can affect the pattern of CO2 emissions (Tamazian et al. 2009). On the same footing, a number of scholars have claimed that the growth in financial sector is capable to reduce the cost of borrowing, provide greater investment opportunities (Shahbaz et al. 2012), and boost the energy sector effectiveness, which, in turn, is highly likely to decrease CO2 emissions (Tamazian et al. 2009; Tamazian and Bhaskara Rao 2010). Scholars also believe that all government sectors can get benefit from financial growth, which can finance development projects leading to TI (King and Levine 1993), which, in turn, result in significant reduction of CO2 emissions by employing efficient energy utilization (Kumbarouglu et al. 2008).

Financial development, according to Tamazian and Bhaskara Rao (2010), markedly influences in changing CO2 emissions. However, a Turkish study by Ozturk and Acaravci (2013) found CO2 emissions not to produce any significant impact from financial development. A recent investigation by Uddin et al. (2017) using the Kuwaiti case found financial development to impact negatively on environment. Surprisingly, there is an opposite research direction that has come up with findings suggesting insignificant association between financial development and degradation of environment. Such a direction includes Turkish study by Ozturk and Acaravci (2013), Middle Eastern and North African (MENA) study by Omri et al. (2015), study on GCC states by Bekhet et al. (2017), Emeriti study by Charfeddine and Ben Khediri (2016), and a European study by Coban and Topcu (2013) reporting either insignificant or mixed findings.

The above-discussed brief review of literature clearly signifies that no investigation has ever been carried out to associate the variables that the present study proposes employing the case of BRICS countries. Resultantly, the findings of the current study are likely to add insights to the existing literature addressing the association of TI and CO2 emissions for BRICS countries, which may be replicated using similar cases in future. The present study is also likely to offer addition to literature about the role of financial development and significance of economic development in affecting environment. It can offer assistance in identifying the role played by efficient energy consumption in order to check CO2 emissions. The above discussion on the theoretical perspective of how FDI, TI, and financial development affect CO2 emission guides us on the path to develop following hypotheses:

-

Hypothesis a: There exists of a negative relationship between FDI and CO2 emissions in BRICS countries.

-

Hypothesis b: There exists of a negative relationship between TI and CO2 emissions in BRICS countries.

-

Hypothesis c: There exists of a negative relationship between FI and CO2 emissions in BRICS countries.

-

Hypothesis d: The existence of the environmental Kuznets curve (EKC) hypothesis in BRICS countries.

Data, methodology, and model specification

In order to analyze empirically, we employ panel data set for BRICS countries 1990–2017 acquired from the World Development Indicators (WDI) (World Bank 2018). Our dependent variable is CO2 emissions per capita (metric tons), and independent variables are foreign direct investment (net inflows of GDP %), financial development (index), and patent applications as a proxy for technological innovation (TI). Our control variables include GDP, trade openness, urban population, and energy consumption. Table 1 shows the description of variables. The variable of TI is measured as the number of patent applications in accordance with the guidelines supplied by Alam and Murad (2020) and Madsen et al. (2010). According to Levine (2005), two major elements make up the financial sector of an economy: Financial institutions comprising banking, mortgage, and insurance firms, which serve as financial intermediaries, and financial market consisting of capital market and other derivative markets. As there are four broad measures each for financial institution and financial market, for instance, financial depth, financial efficiency, financial stability, and financial access. This study uses the FI, which measures financial development of each category (Shoaib et al. 2020). In financial terms, private credit to GDP serves as the proxy of financial depth. Net interest margin acts as a proxy of financial efficiency of economies. Z-score is employed to measure the stability of the financial system. Stock market capitalization to GDP variable measures the total value of shares of all the listed stock market companies to the total GDP. It acts as the proxy of financial depth in financial markets. Stock market turnover ratio implies the ratio between total shares traded during a financial year and the average market capitalization in the economy. It is the proxy of financial efficiency in financial markets. Most of the recent studies employ various proxies for financial development. For instance, stock market value addition, bank asset, and capital account liberalization were employed by Tamazian and Rao (2009) and Tamazian et al. (2009). While, percentage of domestic credit to the private sector was employed by Shahbaz et al. (2013a, b, c) and Al-mulali et al. (2015). The study by Abbasi and Riaz (2016) employed a combination of proxies: total credit as a percentage of GDP and stock market capitalization and the market traded turn-over measured as a percentage of GDP (Khan et al. 2017). We believe that this is the first work that employs FI index for BRICS countries, which consists wide-ranging measurement factors. The variable of urbanization has been incorporated in the proposed model because at the early stage of urbanization, the goods that consume more electricity are known to increase energy demand (Danish and Wang 2018). The process of urbanization can be stimulated by speedy development in economy, which can bring multidimensional structural changes throughout the economy, eventually resulting in affecting energy consumption (Danish et al. 2018). The studies by Islam et al. (2013) and Danish and Wang (2018) enlighten that urbanization, because of the movement and settlement of large numbers, supports economic activities; therefore, it intensifies the use of energy.

Econometric methods

Specification of model

The formal version of the proposed model may be composed in the following way:

Shahbaz et al. (2012) recommend that if the series of variables are transformed into natural logarithm, they can provide reliable and consistent results. Following Shahbaz et al. (2013a), taking log for variables, the estimation model for current study may now be composed in the following way:

In the above Eq. (1), CO2 shows carbon dioxide emissions per capita, FDI indicates foreign direct investment, and FDI2 is the square of FDI implying that FDI > 0 and FDI2 < 0 directed U-shaped between FDI. Similarly, GDP is the proxy for economic growth; GDP2 is square of GDP shows a non-linear association between CO2 emissions and income. FI is a financial development index, TI is proxy for technological innovation, TOP is trade openness, ENR is for energy use, and URPOP depicts urbanization. i and t illustrate the number of states and time span chosen for study, respectively. Since the studies that employ panel data use both dimensions: time series and cross-sectional, and the fact that the estimation methodologies based on panel data are efficient in controlling endogeneity, heteroscedasticity, serial correlation, and multicollinearity (Baltagi 2013), we use panel data analysis techniques for improved results.

Econometric procedures

CD tests

The detection of cross-sectional dependence (CD) serves as the primary step of panel data empirical analysis, which should be determined before the panel unit root tests are carried out (Rauf et al. 2018; Dong et al. 2019; Shuai et al. 2019). CD aims to remove the means in the correlation computation. The null hypothesis presumes the presence of cross-sectional independence in the panel, while the presence of CD illustrates the rejection of null hypothesis (Rauf et al. 2018). Breusch-Pagan Lagrange multiplier (LM) test might be inconsistent, so the bias-adjusted LM test (Pesaran et al. 2008) is used to explore the existence of CD in the panel series, which can be shown in the following way:

where \( {{\hat{\rho}}^2}_{ij} \) shows the residual pairwise correlation sample estimate, estimated by using a simple linear regression equation. The above-described models are asymptotically distributed as standard normal if the null hypothesis considers Tij → ∞ and N → ∞.

Panel unit root tests

It is of vital importance to identify the order of the integration for each variable because the cointegration tests necessitate that all the variables must be integrated into order one; therefore, the panel unit root test should be carried out to accomplish this objective (Al-mulali et al. 2015). The recent literature suggests numerous panel root tests, which have been broadly bifurcated: The first group includes first generation tests for example LLC (Levin Lin Chu), Breitung, and Hadri penal unit root tests. They are all derived from diverse cross-sectional properties and depend on a common unit root process. The second group includes second-generation tests: IPS (IMPesaran Shin), Fisher ADF, and Fisher PP unit root tests. They control the homogeneity problem. Since the BRICS member countries possess wide-ranging economic structures and diverse CO2 emissions levels and there exists CD across the panel countries, the current study chooses the second generation of unit root test and opts to apply a few, such as the Pesaran cross-sectionally Augmented Dickey-Fuller (CADF) and the Pesaran cross-sectionally Augmented Im, Pesaran, and Shin (CIPS) (Pesaran 2007).

Westerlund panel cointegration test

The study uses Westerlund (2005) and Kao (1999) owing to the presence of CD in panel. The test establishes a model with panel specific-AR test statistic and the same-AR test statistic, which can be estimated with the following equation, respectively (Wang and Dong 2019):

where \( {\hat{E}}_{it}^2={\sum}_{j=1}^t{\hat{e}}_{ij},{\hat{R}}_i={\sum}_{t=1}^T{\hat{e}}_{it}^2 \), and \( {\hat{e}}_{it}^2 \)are the residuals from the panel regression model, while VR shows the group means variance-ratio statistic.

Panel long-run parameters estimation methods

A number of studies have suggested that if there is presence of long-run cointegrating associations of the time series, the estimation of long-run parameters should be carried out in the second phase. The key approach that we have employed in this study is fully modified OLS (FMOLS) for the reason that it uses the Newey-West to correct the autocorrelation of the error term Uit. Nonetheless, if the lagged and lead variables are chosen in the proposed models to control the errors of autocorrelation on the error term Uit, we can choose Dynamic OLS (DOLS). The mathematical expression for the panel FMOLS estimator given by Pedroni (1996, 2001) can be explained as given below:

where \( {\hat{\beta}}_{\mathrm{FMOLS},\mathrm{n}} \) is the FMOLS estimator applied to applied to country n and the associated t-statistic can be written in the following manner:

However, since the FMOLS and DOLS estimators ignore the CD in the panel, they are likely to supply contradictory estimation. Therefore, the current study also employs Augmented Mean Group (AMG) estimator developed by Eberhardt and Bond (2009), for the estimation of the long-run parameter. The AMG estimator considers CD by including the common dynamic effect parameter, which can be estimated by a two-stage method, which may be written in the following way:

-

AMG − Stage 1

-

AMG − Stage 2

where Δ illustrates the first difference operator; xit and yit indicates observables; βi indicates the country-specific estimators of coefficients; ft indicates the unobserved common factor with the heterogeneous factor; δi indicates the coefficient of the time dummies and referred to as the common dynamic process; \( \hat{\beta} \)AMG indicates the mean group estimator for AMG; αi indicates the intercept, while εit illustrates the error term.

Panel causality test

If there exists cointegration in panel data, the direction of causality should be evaluated. In view of the presence of CD among panels, the Dumitrescu and Hurlin (D-H) panel causality test was chosen to identify the direction of causality among variables of interests in the developing economies. This test is derived from individual Wald statistics of assuming non-causality averaged across the cross-sectional units and may be described mathematically through the following equation:

where y and x stand for observables; λiJ symbolizes the autoregressive parameters, while βij symbolizes regression coefficient estimates, and they are supposed to differ across cross-sections. The null hypothesis is: there exists no causal association for any subgroup; while the alternative hypothesis is: there exists a causal connection for at least one subgroup of the panel. The above-stated hypothesis can be tested through an average Wald statistic in the following way:

where Wi, T indicates the individual Wald statistic for each cross-section unit.

Results and discussion

Descriptive statistics of variables and correlation results

Table 2 displays the summary statistics of the selected variables, whereas Table 3 describes the correlations among variables. The results reveal that the largest and smallest mean value of CO2 emissions is (2.45) for Russia and (0.64) for Brazil. On the basis of mean GD p values, Russia is the richest (27.84) and South Africa is the poorest country (26.44). Besides, out of the BRICS countries, China has the highest mean value for FDI (3.48), while India possesses minimum mean value. Regarding the TI mean value, South Africa possesses highest mean value (5.23), while Russia possesses the lowest (4.50). CO2 emissions are highly associated with energy consumption (56%), urban population (50%), TOP (45%), FI (33%), TI (18%), GDP (15%), and FDI (4%). We checked the multicollinearity through variance inflation factor (VIF) technique shown in Table 4. As a general rule, below 10 VIF value of a variable suggests absence of multicollinearity problem. The results exhibit that the VIF value is less than 10, so the issue of multicollinearity is no more applicable.

The analysis of panel data estimation suggests that currently CD appears to be the center of scholarly attention in the domain of environmental economics. The numerous tests we conducted reveal that ignoring the CD would render the results unreliable (Ahmad and Zhao 2018; Dong et al. 2018a, b). Table 5 displays the results of the Breusch-Pagan LM and the Bias adjusted LM tests. The two statistics show the rejection of cross-sectional independence and confirmation of the presence of CD. This clearly suggests that if there arises a shock in one of the sample countries, it can spread out to other countries.

Table 6 exhibits the results of CIPS and CADF unit root tests, applied for two cases (a) at the level form (b) at first difference form (Δ). The results of the unit root tests confirm that all the selected variables are stationary at first difference form.

For providing the cointegration analysis, we use Kao (1999) test of no cointegration between a group of variables (see Table 7). It may be noticeably observed that all the tests unanimously reject the null hypothesis of no cointegration following the Kao (1999) approach. Thus, it can be concluded that there exists cointegration association in the study variables. This particular finding yields huge significance and supplies a strong support in favor of the variables that possess a long run association. It is of vital importance to supply additional cointegration testing, which can prove the robustness for CD.

In this respect, Westerlund (2005) is believed to be one of the highly reliable tests with the null hypothesis being no cointegration for all panels. Displayed through Table 8, the results of Westerlund test recommend that on the basis of the critical values generating from bootstrapped robust, there are three out of four tests, which reject the null hypothesis. These findings further confirm a long-run association among variables on the basis of cointegration (see Tables 9 and 10).

Results of panel long-run parameters estimation methods

Table 9 shows the long-run parameters of the estimation for FMOLS and AMG estimators. The two estimation methodologies offer comparable results. Nevertheless, the absolute value of the coefficients of FDI estimated by FMOLS are far smaller in comparison to those offered by AMG estimation, while that of lnGDP in FMOLS is significantly larger in comparison with that offered by AMG estimation. This suggests that there may be overestimation or underestimation of parameters because of the existence of CD. As a result, the AMG estimator is employed as the benchmark estimation method.

The AMG estimator suggests that the coefficient of FDI on CO2 emissions is negatively significant at 1% level. The decrease in CO2 emissions is 7.3% due to 1% increase in FDI. The negative coefficient of FDI supports the pollution halo hypothesis. These finding aligns with the studies by Pao and Tsai (2010) on BRICS states, Al-Mulali and Tang (2013) on GCC states, Pazienza (2015) on OECD states, and Zhang and Zhou (2016), Xing et al. (2017), and Liu et al. (2017) on China that have concluded that FDI develops the quality of environment. FDI inflowing is a major factor in assisting to expand environmental and advanced technological skills and TI in production. Conversely, the developing economies can serve as “pollution havens” for global polluting industries. Developed countries have strict pollution regulations, so it is likely that industrial pollution may be transferred to developing states. The long-run findings reveal that technological development possesses a negative association with pollution. Technological innovation can reduce CO2 emissions by 2% at 5% level of significant. The production process is the key component of economic development and causes more environmental corrosion. The development in technological stature has a positive and healthy effect on environment through its role in the reduction of pollution; however, this beneficial effect is at its initial stages, where it demands some time to furnish satisfactory outcomes. The effect of FI, in due course, is also friendly to environment and stands significant at 5% level since a rise in a one percentage of FI will decrease 6.7% in CO2 emissions. The current study results align with previous studies conducted by Tamazian et al. (2009) and Tamazian and Bhaskara Rao (2010) who incorporated the variable of financial development in their models and concluded that financial development has the potential to reduce environmental pollution. This may be observed that the impact of economic growth on CO2 emissions is positive. The coefficient of GDP is highly significant and carries a positive sign, which raises in conjunction with the rise in carbon emissions. Therefore, the economic growth causes increase in CO2 emissions in the developing countries. The study outcomes also suggest the conclusion that the developing states must focus on two core interlinked issues: economic growth and environment. The 1% rise in GDP (lnGDP) can contribute to 8.1% rise in carbon emissions. These study findings align with previous studies by Shahbaz et al. (2013c) and Shahbaz et al. (2018). The study also submits that the coefficient of GDP2 (lnGDP2) is negative and highly significant. The findings of the BRICS states case study reveal that the greater the economic growth is, the higher the carbon emissions will be, and that the EKC hypothesis problem can be supported. The likely explanation to this dilemma can be that the developing countries may have obtained their income levels later than their development stage. Generally, the level of income and social development in a country is reflected through GDP.

The rise in CO2 emissions was 11% due to 1% rise in the use of energy (lnENR) (Akadiri Saint et al. 2019c). It implies that the use of environment-friendly energy is highly desirable since it contributes more towards carbon emissions. The effect of TOP on carbon emissions is positive and significant. Concerning the effect of urbanization (lnURPOP) on CO2 emissions, the results show a positively significant association between urbanization and CO2 emissions. The effect of urbanization can be explained through the notion that during the early phase of urbanization, electronic commodities are purchased in large numbers, the city transportation system is expanded, and increased number of financial institutions are established. All these pursuits increase energy consumption, which, in turn, increase the CO2 emissions levels (Akadiri Saint et al. 2019d; Akadiri Saint et al. 2019b; Saint Akadiri et al. 2020).

Fixed effects model and DOLS estimations offered the same results, which were almost identical to those obtained by AMG and FMOLS though with different coefficients values in these methods. Therefore, it can be maintained that the findings of this study are robust. Table 10 reports that the results of the estimation using the interaction term (FDI*lnTI) have positive and significant impact in all estimations included. This aligns with the results from estimations shown in Table 9. The finding reveals that elevated degree of technological development in the host country can cause higher capability of the host country to absorb any potential spillovers from FDI.

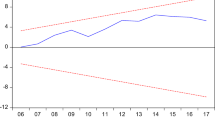

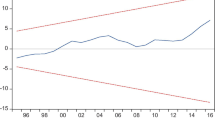

We investigate the causal analysis among study variables by using the D-H causality estimation method. Table 11 and Fig. 1 display the findings showing a unidirectional causality between FDI and carbon emissions. Moreover, bidirectional causal association exists among lnCO2, lnTI, lnGDP, FI, TOP, lnURPOP, and lnENR. The results point out that the majority of the variables have two-way causality.

Conclusions and policy recommendations

The key current study objective is to evaluate the impact of FDI, technological innovation and financial development on CO2 emissions using the case of BRICS states from 1990 to 2017. Considering the CD that may exist within cross countries, the current study employs a series of econometric techniques, which results confirm the CD in panel countries. According to AMG and FMOLS results, the influence of FDI, TI, and financial development are negative and significant on carbon emissions. However, the impact of GDP, TOP, urbanization, and energy use are positively significant on carbon emissions. The estimated results reveal an inverted U-shaped relationship between GDP and CO2 emissions. The application of DOLS and fixed effects model yield results, which are almost same than those obtained by FMOLS and AMG though with different coefficients values in these methods. Furthermore, a unidirectional causality between FDI and carbon emissions is found. Furthermore, bidirectional causal association exists between GDP, financial development, TI, TOP, urbanization, energy use, and carbon emissions.

The study results indicate that economic growth increases environmental degradation. This study finding verifies empirically the EKC existence for the BRICS countries (Bakirtas and Cetin 2017; Balsalobre-Lorente et al. 2019). We find that FDI helps to attain lower CO2 emissions, thus validating the pollution halo hypothesis (Shahbaz et al. 2019; Balsalobre-Lorente et al. 2019). This implies that FDI inflows in conjunction with green technological transfer and improved labor and environmental management methods are highly likely to assist the BRICS states in achieving the sustainable development goals. Financial development is likely to perform a decisive role for environmental disclosure in BRICS countries. Our study also reflects the impact of urbanization and energy use on the CO2 emissions. The empirical results of the current study offer suggestions for promoting more efficient system of urban transportation, environment-friendly architecture, and more sustainable energy use in urbanized localities (Akadiri Saint et al. 2019d; Sarkodie and Strezov 2019; Balsalobre-Lorente et al. 2019).

Finally, the present study submits some policy implications for BRICS countries. Above all, it offers an understanding of the estimated dynamic associations among the variables that can offer assistance to the BRICS states in their endeavors to advance FDI, financial development, economic growth, urbanization, and technological progress for achieving the goal of reduction in CO2 emissions. For instance, technological progress and efficient energy use can improve the overall environmental health of the BRICS member states. Financial growth can improve the quality of environment through larger investments in state-of-the-art and environment-friendly technologies; therefore, the governments should pay attention towards investments in environment-friendly technologies. We firmly believe that policies highlighting financial openness and liberalization for attracting elevated degrees of R&D associated FDI can reduce the degradation of environment. The governments must introduce regulations aimed at seeking guarantees from the foreign investment companies regarding implementation of green and environment-friendly technologies. Concerning energy consumption, the energy development programs must be transformed from non-renewable to renewable energy. Furthermore, the energy policies that aim at boosting the production and use of renewable energy will leave a positive and sustainable effect on economic growth. Thus, the actions aimed at controlling CO2 emissions and policy recommendations ought to be shaped differently keeping in view the degree of CO2 emissions in a particular country.

While the current study has used FDI inflows, the future researchers may study the role of international trade and technological innovation in assessing pollution levels employing both EKC and the pollution haven hypothesis. This would help in understanding the determinants shaping the EKC.

References

Abbasi F, Riaz K (2016) CO2 emissions and financial development in an emerging economy: an augmented VAR approach. Energy Policy 90:102–114. https://doi.org/10.1016/j.enpol.2015.12.017

Abdouli M, Hammami S (2017) Investigating the causality links between environmental quality, foreign direct investment and economic growth in MENA countries. Int Bus Rev 26:264–278. https://doi.org/10.1016/j.ibusrev.2016.07.004

Ahmad M, Zhao Z-Y (2018) Empirics on linkages among industrialization, urbanization, energy consumption, CO2 emissions and economic growth: a heterogeneous panel study of China. Environ Sci Pollut Res 25:30617–30632

Akadiri Saint S, Alkawfi MM, Uğural S, Akadiri AC (2019a) Towards achieving environmental sustainability target in Italy. The role of energy, real income and globalization. Sci Total Environ 671:1293–1301. https://doi.org/10.1016/j.scitotenv.2019.03.448

Akadiri Saint S, Alola AA, Akadiri AC (2019b) The role of globalization, real income, tourism in environmental sustainability target. Evidence from Turkey. Sci Total Environ 687:423–432. https://doi.org/10.1016/j.scitotenv.2019.06.139

Akadiri Saint S, Bekun FV, Sarkodie SA (2019c) Contemporaneous interaction between energy consumption, economic growth and environmental sustainability in South Africa: what drives what? Sci Total Environ 686:468–475. https://doi.org/10.1016/j.scitotenv.2019.05.421

Akadiri Saint S, Lasisi TT, Uzuner G, Akadiri AC (2019d) Examining the impact of globalization in the environmental Kuznets curve hypothesis: the case of tourist destination states. Environ Sci Pollut Res 26:12605–12615. https://doi.org/10.1007/s11356-019-04722-0

Alam MM, Murad MW (2020) The impacts of economic growth, trade openness and technological progress on renewable energy use in organization for economic co-operation and development countries. Renew Energy 145:382–390. https://doi.org/10.1016/j.renene.2019.06.054

Alam MJ, Begum IA, Buysse J, Van Huylenbroeck G (2012) Energy consumption, carbon emissions and economic growth nexus in Bangladesh: cointegration and dynamic causality analysis. Energy Policy 45:217–225. https://doi.org/10.1016/j.enpol.2012.02.022

Al-mulali U, Binti Che Sab CN (2012) The impact of energy consumption and CO2 emission on the economic and financial development in 19 selected countries. Renew Sust Energ Rev 16:4365–4369. https://doi.org/10.1016/j.rser.2012.05.017

Al-Mulali U, Tang CF (2013) Investigating the validity of pollution haven hypothesis in the gulf cooperation council (GCC) countries. Energy Policy 60:813–819

Al-mulali U, Tang CF, Ozturk I (2015) Does financial development reduce environmental degradation? Evidence from a panel study of 129 countries. Environ Sci Pollut Res 22:14891–14900. https://doi.org/10.1007/s11356-015-4726-x

Azevedo VG, Sartori S, Campos LMS (2018) CO2 emissions: a quantitative analysis among the BRICS nations. Renew Sust Energ Rev 81:107–115

Bakirtas I, Cetin MA (2017) Revisiting the environmental Kuznets curve and pollution haven hypotheses: MIKTA sample. Environ Sci Pollut Res 24:18273–18283. https://doi.org/10.1007/s11356-017-9462-y

Balsalobre-Lorente D, Gokmenoglu KK, Taspinar N, Cantos-Cantos JM (2019) An approach to the pollution haven and pollution halo hypotheses in MINT countries. Environ Sci Pollut Res 26:23010–23026. https://doi.org/10.1007/s11356-019-05446-x

Baltagi BH (2013) Econometric analysis of panel data, 5th edn. Wiley, Chichester

Bekhet HA, Matar A, Yasmin T (2017) CO2 emissions, energy consumption, economic growth, and financial development in GCC countries: dynamic simultaneous equation models. Renew Sust Energ Rev 70:117–132. https://doi.org/10.1016/j.rser.2016.11.089

Birdsall N, Wheeler D (1993) Trade policy and industrial pollution in Latin America: where are the pollution havens? J Environ Dev 2:137–149

Birol F (2016) Energy efficiency market report 2016. Int Energy Agency, Abu Dhabi

Chang S-C (2015) Effects of financial developments and income on energy consumption. Int Rev Econ Financ 35:28–44. https://doi.org/10.1016/j.iref.2014.08.011

Charfeddine L, Ben Khediri K (2016) Financial development and environmental quality in UAE: cointegration with structural breaks. Renew Sust Energ Rev 55:1322–1335

Coban S, Topcu M (2013) The nexus between financial development and energy consumption in the EU: a dynamic panel data analysis. Energy Econ 39:81–88. https://doi.org/10.1016/j.eneco.2013.04.001

Danish, Wang Z (2018) Dynamic relationship between tourism, economic growth, and environmental quality. J Sustain Tour 26:1928–1943. https://doi.org/10.1080/09669582.2018.1526293

Danish, Wang Z (2019) Does biomass energy consumption help to control environmental pollution? Evidence from BRICS countries. Sci Total Environ 670:1075–1083. https://doi.org/10.1016/j.scitotenv.2019.03.268

Danish, Wang B, Wang Z (2018) Imported technology and CO2 emission in China: collecting evidence through bound testing and VECM approach. Renew Sust Energ Rev 82:4204–4214. https://doi.org/10.1016/j.rser.2017.11.002

Destek MA, Sarkodie SA (2019) Investigation of environmental Kuznets curve for ecological footprint: the role of energy and financial development. Sci Total Environ 650:2483–2489. https://doi.org/10.1016/j.scitotenv.2018.10.017

Dong K, Sun R, Hochman G (2017) Do natural gas and renewable energy consumption lead to less CO2 emission? Empirical evidence from a panel of BRICS countries. Energy 141:1466–1478. https://doi.org/10.1016/j.energy.2017.11.092

Dong K, Hochman G, Zhang Y et al (2018a) CO 2 emissions, economic and population growth, and renewable energy: empirical evidence across regions. Energy Econ 75:180–192. https://doi.org/10.1016/j.eneco.2018.08.017

Dong K, Sun R, Li H, Liao H (2018b) Does natural gas consumption mitigate CO2 emissions: testing the environmental Kuznets curve hypothesis for 14 Asia-Pacific countries. Renew Sust Energ Rev 94:419–429

Dong K, Jiang H, Sun R, Dong X (2019) Driving forces and mitigation potential of global CO2 emissions from 1980 through 2030: evidence from countries with different income levels. Sci Total Environ 649:335–343. https://doi.org/10.1016/j.scitotenv.2018.08.326

Doytch N, Narayan S (2016) Does FDI influence renewable energy consumption? An analysis of sectoral FDI impact on renewable and non-renewable industrial energy consumption. Energy Econ 54:291–301

Eberhardt M, Bond S (2009) Cross-section dependence in nonstationary panel models: a novel estimator. Soc Res (New York)

Fields G (2004) Territories of profit: communications, capitalist development, and the innovative enterprises of GF Swift and Dell Computer. Stanford University Press, Palo Alto

Frankel JA, Romer D (1999) Does trade cause growth? Am Econ Rev 89:379–399. https://doi.org/10.1257/aer.89.3.379

Frankel J, Rose A (2002) An estimate of the effect of common currencies on trade and income. Q J Econ 117:437–466. https://doi.org/10.1162/003355302753650292

Goldman S (2003) Dreaming with Brics: the path to 2050. Global economics paper no. 99

He J (2006) Pollution haven hypothesis and environmental impacts of foreign direct investment: the case of industrial emission of sulfur dioxide (SO2) in Chinese provinces. Ecol Econ 60:228–245. https://doi.org/10.1016/j.ecolecon.2005.12.008

Hitam MB, Borhan HB (2012) FDI, growth and the environment: impact on quality of life in Malaysia. Procedia Soc Behav Sci 50:333–342. https://doi.org/10.1016/j.sbspro.2012.08.038

Hsiao FST, Hsiao MCW (2006) FDI, exports, and GDP in East and Southeast Asia-panel data versus time-series causality analyses. J Asian Econ 17:1082–1106. https://doi.org/10.1016/j.asieco.2006.09.011

IPCC (2007) The physical science basis: summary for policymakers. Contribution of working group I to the fourth assessment report of the intergovernmental panel. Cambridge University Press, Cambridge

IPCC (2014) Climate change 2014: synthesis report. Contribution of working groups I, II and III to the fifth assessment report of the intergovernmental panel on climate change [Core writing team, Pachauri RK, Meyer LA (eds.)]. Geneva, Switzerland

Islam F, Shahbaz M, Ahmed AU, Alam MM (2013) Financial development and energy consumption nexus in Malaysia: a multivariate time series analysis. Econ Model 30:435–441. https://doi.org/10.1016/j.econmod.2012.09.033

Jones CI (2005) Growth and ideas. In: Handbook of economic growth. Elsevier, Amsterdam, pp 1063–1111

Kao C (1999) Spurious regression and residual-based tests for cointegration in panel data. J Econ 90:1–44. https://doi.org/10.1016/S0304-4076(98)00023-2

Khan MTI, Yaseen MR, Ali Q (2017) Dynamic relationship between financial development, energy consumption, trade and greenhouse gas: comparison of upper middle income countries from Asia, Europe, Africa and America. J Clean Prod 161:567–580. https://doi.org/10.1016/j.jclepro.2017.05.129

King RG, Levine R (1993) Finance and growth: Schumpeter might be right. Q J Econ 108:717–737. https://doi.org/10.2307/2118406

Kivyiro P, Arminen H (2014) Carbon dioxide emissions, energy consumption, economic growth, and foreign direct investment: causality analysis for Sub-Saharan Africa. Energy 74:595–606. https://doi.org/10.1016/j.energy.2014.07.025

Kumbarouglu G, Karali N, Arikan Y (2008) CO2, GDP and RET: an aggregate economic equilibrium analysis for Turkey. Energy Policy 36:2694–2708

Lau LS, Choong CK, Eng YK (2014) Investigation of the environmental Kuznets curve for carbon emissions in Malaysia: DO foreign direct investment and trade matter? Energy Policy 68:490–497. https://doi.org/10.1016/j.enpol.2014.01.002

Levine R (2005) Finance and growth: theory and evidence. In: Handbook of Economic Growth. Elsevier, Amsterdam, pp 865–934

Liu Y, Hao Y, Gao Y (2017) The environmental consequences of domestic and foreign investment: evidence from China. Energy Policy 108:271–280. https://doi.org/10.1016/j.enpol.2017.05.055

Madsen JB, Ang JB, Banerjee R (2010) Four centuries of British economic growth: the roles of technology and population. J Econ Growth 15:263–290

Newell RG, Pizer WA (2008) Indexed regulation. J Environ Econ Manag 56:221–233. https://doi.org/10.1016/j.jeem.2008.07.001

Omri A, Daly S, Rault C, Chaibi A (2015) Financial development, environmental quality, trade and economic growth: what causes what in MENA countries. Energy Econ 48:242–252

Ozturk I, Acaravci A (2013) The long-run and causal analysis of energy, growth, openness and financial development on carbon emissions in Turkey. Energy Econ 36:262–267. https://doi.org/10.1016/j.eneco.2012.08.025

Pao HT, Tsai CM (2010) CO2 emissions, energy consumption and economic growth in BRIC countries. Energy Policy 38:7850–7860. https://doi.org/10.1016/j.enpol.2010.08.045

Paramati SR, Ummalla M, Apergis N (2016) The effect of foreign direct investment and stock market growth on clean energy use across a panel of emerging market economies. Energy Econ 56:29–41. https://doi.org/10.1016/j.eneco.2016.02.008

Parry IWH (2003) On the implications of technological innovation for environmental policy. Environ Dev Econ 8(1):57–76

Pazienza P (2015) The environmental impact of the FDI inflow in the transport sector of OECD countries and policy implications. Int Adv Econ Res 21:105–116. https://doi.org/10.1007/s11294-014-9511-y

Pedroni P (1996) Fully modified OLS for heterogeneous cointegrated panels and the case of purchasing power parity. Manuscript. Dep Econ Indiana Univ, Bloomington, pp 1–45

Pedroni P (2001) Fully modified OLS for heterogeneous cointegrated panels. In: Nonstationary panels, panel cointegration, and dynamic panels, vol 15. Emerald Group Publishing Limited SV, Bingley, pp 93–130

Pesaran MH (2007) A simple panel unit root test in the presence of cross-section dependence. J Appl Econ 22:265–312. https://doi.org/10.1002/jae.951

Pesaran MH, Ullah A, Yamagata T (2008) A bias-adjusted LM test of error cross-section independence. Econ J 11:105–127. https://doi.org/10.1111/j.1368-423X.2007.00227.x

Rauf A, Liu X, Amin W, Ozturk I, Rehman OU, Hafeez M (2018) Testing EKC hypothesis with energy and sustainable development challenges: a fresh evidence from belt and road initiative economies. Environ Sci Pollut Res 25:32066–32080

Ren S, Yuan B, Ma X, Chen X (2014) International trade, FDI (foreign direct investment) and embodied CO2 emissions: a case study of Chinas industrial sectors. China Econ Rev 28:123–134. https://doi.org/10.1016/j.chieco.2014.01.003

Sadorsky P (2011) Financial development and energy consumption in Central and Eastern European frontier economies. Energy Policy 39:999–1006. https://doi.org/10.1016/j.enpol.2010.11.034

Saint Akadiri S, Adewale Alola A, Olasehinde-Williams G, Udom Etokakpan M (2020) The role of electricity consumption, globalization and economic growth in carbon dioxide emissions and its implications for environmental sustainability targets. Sci Total Environ 708. https://doi.org/10.1016/j.scitotenv.2019.134653

Sarkodie SA, Strezov V (2019) Effect of foreign direct investments, economic development and energy consumption on greenhouse gas emissions in developing countries. Sci Total Environ 646:862–871. https://doi.org/10.1016/j.scitotenv.2018.07.365

Sbia R, Shahbaz M, Hamdi H (2014) A contribution of foreign direct investment, clean energy, trade openness, carbon emissions and economic growth to energy demand in UAE. Econ Model 36:191–197. https://doi.org/10.1016/j.econmod.2013.09.047

Schumpeter J (1942) Creative destruction. Capit Soc Democr 825:82–85

Seetanah B, Sannassee RV, Fauzel S et al (2019) Impact of economic and financial development on environmental degradation: evidence from small island developing states (SIDS). Emerg Mark Financ Trade 55:308–322. https://doi.org/10.1080/1540496X.2018.1519696

Shahbaz M, Lean HH, Shabbir MS (2012) Environmental Kuznets curve hypothesis in Pakistan: cointegration and Granger causality. Renew Sust Energ Rev 16:2947–2953. https://doi.org/10.1016/j.rser.2012.02.015

Shahbaz M, Hye QMA, Tiwari AK, Leito NC (2013a) Economic growth, energy consumption, financial development, international trade and CO2 emissions in Indonesia. Renew Sust Energ Rev 25:109–121. https://doi.org/10.1016/j.rser.2013.04.009

Shahbaz M, Khan S, Tahir MI (2013b) The dynamic links between energy consumption, economic growth, financial development and trade in China: fresh evidence from multivariate framework analysis. Energy Econ 40:8–21. https://doi.org/10.1016/j.eneco.2013.06.006

Shahbaz M, Kumar Tiwari A, Nasir M (2013c) The effects of financial development, economic growth, coal consumption and trade openness on CO 2 emissions in South Africa. Energy Policy 61:1452–1459. https://doi.org/10.1016/j.enpol.2013.07.006

Shahbaz M, Nasreen S, Abbas F, Anis O (2015) Does foreign direct investment impede environmental quality in high-, middle-, and low-income countries? Energy Econ 51:275–287. https://doi.org/10.1016/j.eneco.2015.06.014

Shahbaz M, Nasir MA, Roubaud D (2018) Environmental degradation in France: the effects of FDI, financial development, and energy innovations. Energy Econ 74:843–857. https://doi.org/10.1016/j.eneco.2018.07.020

Shahbaz M, Balsalobre-Lorente D, Sinha A (2019) Foreign direct investment–CO 2 emissions nexus in Middle East and North African countries: importance of biomass energy consumption. J Clean Prod 217:603–614. https://doi.org/10.1016/j.jclepro.2019.01.282

Shoaib HM, Rafique MZ, Nadeem AM, Huang S (2020) Impact of financial development on CO2 emissions : a comparative analysis of developing countries (D 8) and developed countries (G 8). Environ Sci Pollut Res:1–15. https://doi.org/10.1007/s11356-019-06680-z

Shuai C, Chen X, Wu Y, Zhang Y, Tan Y (2019) A three-step strategy for decoupling economic growth from carbon emission: empirical evidences from 133 countries. Sci Total Environ 646:524–543. https://doi.org/10.1016/j.scitotenv.2018.07.045

Smulders S, de Nooij M (2003) The impact of the energy conservation on technology and economic growth. Resour Energy Econ 25:59–79. https://doi.org/10.1016/S0928-7655(02)00017-9

Sohag K, Begum RA, Syed Abdullah SM, Jaafar M (2015) Dynamics of energy use, technological innovation, economic growth and trade openness in Malaysia. Energy 90:1497–1507. https://doi.org/10.1016/j.energy.2015.06.101

Solarin SA, Al-Mulali U, Musah I, Ozturk I (2017) Investigating the pollution haven hypothesis in Ghana: an empirical investigation. Energy 124:706–719. https://doi.org/10.1016/j.energy.2017.02.089

Tamazian A, Bhaskara Rao B (2010) Do economic, financial and institutional developments matter for environmental degradation? Evidence from transitional economies. Energy Econ 32:137–145

Tamazian A, Rao BB (2009) Do economic, financial and institutional developments matter for environmental degradation? Evidence from transitional economies. Econ Econom Res Inst 32:137–145

Tamazian A, Chousa JP, Vadlamannati KC (2009) Does higher economic and financial development lead to environmental degradation: evidence from BRIC countries. Energy Policy 37:246–253. https://doi.org/10.1016/j.enpol.2008.08.025

Tang J (2015) Testing the pollution haven effect: does the type of FDI matter? Environ Resour Econ 60:549–578. https://doi.org/10.1007/s10640-014-9779-7

Tol RSJ (2007) Europe’s long-term climate target: a critical evaluation. Energy Policy 35:424–432. https://doi.org/10.1016/j.enpol.2005.12.003

Uddin GA, Salahuddin M, Alam K, Gow J (2017) Ecological footprint and real income: panel data evidence from the 27 highest emitting countries. Ecol Indic 77:166–175. https://doi.org/10.1016/j.ecolind.2017.01.003

Wang J, Dong K (2019) What drives environmental degradation? Evidence from 14 Sub-Saharan African countries. Sci Total Environ 656:165–173. https://doi.org/10.1016/j.scitotenv.2018.11.354

Wang Q, Su M, Li R (2018) Toward to economic growth without emission growth: the role of urbanization and industrialization in China and India. J Clean Prod 205:499–511. https://doi.org/10.1016/j.jclepro.2018.09.034

Weitzman ML (1997) Sustainability and technical progress. Scand J Econ 99:1–13. https://doi.org/10.1111/1467-9442.00043

Westerlund J (2005) New simple tests for panel cointegration. Aust Econ Rev 24:297–316. https://doi.org/10.1080/07474930500243019

World Bank (2018) World development indicators 2018. In: Washington, DC Dev. Data Group, World Bank

Xing T, Jiang Q, Ma X (2017) To facilitate or curb? The role of financial development in China’s carbon emissions reduction process: a novel approach. Int J Environ Res Public Health 14. https://doi.org/10.3390/ijerph14101222

Xu Z, Baloch MA, Danish et al (2018) Nexus between financial development and CO2 emissions in Saudi Arabia: analyzing the role of globalization. Environ Sci Pollut Res 25:28378–28390. https://doi.org/10.1007/s11356-018-2876-3

Yeh S, Rubin ES (2012) A review of uncertainties in technology experience curves. Energy Econ 34:762–771. https://doi.org/10.1016/j.eneco.2011.11.006

Zeng S, Liu Y, Liu C, Nan X (2017) A review of renewable energy investment in the BRICS countries: history, models, problems and solutions. Renew Sust Energ Rev 74:860–872. https://doi.org/10.1016/j.rser.2017.03.016

Zhang Y-J (2011) The impact of financial development on carbon emissions: an empirical analysis in China. Energy Policy 39:2197–2203. https://doi.org/10.1016/j.enpol.2011.02.026

Zhang C, Zhou X (2016) Does foreign direct investment lead to lower CO2 emissions? Evidence from a regional analysis in China. Renew Sust Energ Rev 58:943–951

Ziaei SM (2015) Effects of financial development indicators on energy consumption and CO2 emission of European, East Asian and Oceania countries. Renew Sust Energ Rev 42:752–759. https://doi.org/10.1016/j.rser.2014.10.085

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible Editor: Eyup Dogan

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Rights and permissions

About this article

Cite this article

Rafique, M.Z., Li, Y., Larik, A.R. et al. The effects of FDI, technological innovation, and financial development on CO2 emissions: evidence from the BRICS countries. Environ Sci Pollut Res 27, 23899–23913 (2020). https://doi.org/10.1007/s11356-020-08715-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-020-08715-2