Abstract

The nexus of foreign direct investment and economic growth has been extensively investigated by the researchers of environmental economics; however, few studies have been conducted to find the impact of financial development and technological innovation in the backdrop of the environment. In the G8 countries (UK, USA, Canada, Germany, France, Italy Russia, Japan), the rapid increase in urbanization resulting from their speedy economic growth has brought about a huge increase in energy consumption that is in turn responsible for contemporary environmental degradation. This research intends to find the impact of technological innovation, financial development, foreign direct investment, energy use, and urbanization on carbon emission in G8 member countries, based on data from 1990 to 2019. The findings present strong cross-sectional dependence within the panel countries. According to the FMLOS estimator, a statistically significant long-run and negative association with CO2 has been found between foreign direct investment, financial development, and technological innovation in G8 countries. A long-run bidirectional causality has been found among economic growth, financial development, urbanization, trade openness, CO2 emission, and energy use; antithetically there is unidirectional causality between carbon emission and foreign direct investment. A quality foreign direct investment is the present demand for the development of industries, technological innovation, and financial development for G8 countries. Furthermore, urbanization plays a major role in environmental degradation, and more improved policies are needed for these countries.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

For the last few years, climate change and environmental economics have been widely studied and discussed by the researchers throughout the world. This is because environmental economics and climate change can help or hinder sustainable development that can threaten the economic monopoly of G8 nations in few decades (Destek and Sarkodie 2019). In the past few decades, increasing urbanization and industrialization have caused harmful environmental changes (Mehmood 2020a, b, 2021a, b; Mehmood and Tariq 2020). Similar situation exists in France, Italy, Russia, the USA, the UK, and Canada, where remarkable economic growth has been found in the last decades due to rapid industrialization. This has caused the GDP at 56766 US$ level in 2010 (Dong et al. 2018a). This economic growth is the aspiration of developing economies that look upon the G8 countries as a source of guidance and inspiration (Chang 2014).

Along with developed nations, developing countries have also set up information exchange service centers for structural development in economy. Advancement has been made in all aspects related to technology, the art of economy, and environmental-friendly guidelines (Destek and Sarkodie 2019). All these development and advancement will not occur without any climatic effects. This massive economic development brings serious environmental issues like carbon emission (Tariq et al. 2017; Mehmood 2020a, 2020b, 2021a, 2021b; Mehmood and Tariq 2020). The transformation of management skill, technology, and information from developed countries to underdeveloped countries is done by foreign direct investment (FDI)(Doytch and Narayan 2016). FDI is the tool to increase the domestic production of emerging economies. Access to new technologies and finance also increase the investment rate (Xu et al. 2018). A clear relation between FDI, financial development, and energy use of a country has been found that alternatively increases the economic growth (Mahdi Ziaei 2015). Three prominent hypotheses are present in the analysis of the association between FDI and sustainable development: pollution havens hypothesis, environmental Kuznets curve (EKC), and halo hypothesis. Halo hypothesis of FDI in the context of environment puts positive impact as it brings advanced technologies to developing countries from developed states (Balsalobre-Lorente et al. 2019). International monetary organizations play an important role in the economic development of developing countries by guiding them to bring FDI.

Growth model gives theoretical evidence of how economic growth is increased by GDP. Recent model resulted that the technological advancement produced by FDI gives double and long-lasting economic benefits (Hsiao and Hsiao 2006). A state with a strong financial sector has a profitable procedure for investment. FDI is more attracted by capital accumulation, mitigation, and financial risk that improve the technological improvement. The mobilization of saving and valuable venture can be done by the proper allocation of financial resources, and this can be done by the stable financial development that increases domestic production and leads toward economic development. So, expansion of financial sector dramatically increases energy consumption (Sadorsky 2011), which cause more CO2 emissions (Tamazian and Rao 2009).

To maintain environmental sustainability is the biggest challenges of the world (Mariam; Mehmood 2021c; Tariq et al. 2021). Many policies have been made to cope with this situation in which policy-makers are trying to minimize the risk of environmental pollution and CO2 emission caused by economic development (Akadiri et al. 2019c). Therefore, it is a need to formulate feasible policies to minimize carbon emission and depletion of the ozone layer. (Jahangir Alam et al. 2012).

Through existing studies and the above-mentioned research, this research intends to find the link between CO2 emission and its factors: economic growth, FDI, technological innovation, and financial development in G8 states. From 1990 to 2019, panel data of G8 countries has been used. This study will be an addition to the existing body of literature that presents the link between CO2, IT, and FDI by focusing on the aspect of financial development, FDI, carbon emission, and technological innovation by using the case of G8 countries. EKC linkage with carbon emission and economic growth will also be measured in this study.

According to the Intergovernmental Panel for assessment report on Climate Change (IPPC), atmospheric temperature of the globe must not go beyond 2° C. To maintain this standard temperature, many energy technologies have been suggested by the environmental experts (IPCC 2014). G8 countries are majorly responsible in raising the global temperature and causing unusual weather conditions in their coastal areas such as shortage of drinkable water and floods (Rafique et al. 2020). Moreover, technological advancement, FDI, has been increased consistently in these countries because rapid increase in economic growth becomes the key regulator of CO2 emission. The demand in energy consumption also increased in these developed countries that directly effect on FDI and technological development. The objectives are specifically exploring the impact of financial development, technological innovation, and foreign direct investment on carbon emission with respect to Canada, France, Germany, Italy, Japan, and the USA, because these countries are the big importer and exporter of the goods. They invest a big portion of budge in the formation of new technologies to satisfy the need of their population. So it puts a great responsibility on these states to work on quality foreign direct investment that is less harmful to environment.

There is a disagreement found in empirical and theoretical dimensions in the linkage among the variables under the study in the existing literature. This study tries to give different results from the previous studies in the same dimension. The difference lies in methodology and time range in choosing variables. Previous studies applied various ranges of proxies for financial development (Tamazian et al. 2009); however, for G8 countries, financial development index (FI) has not been used. Present study has tried to fill the gap by using FI for G8 countries and discover the impact of FI and technological innovation (TI) in these states.

After the “Introduction” section, second part which is the “Review of the literature” section consists of literature review followed by research methodology in the “Data, methodology, and model specification” section; the fourth part which is the “Results and discussion” section deals with the estimation procedure, finding, and results, while the conclusion and recommendations are presented in the “Conclusion and policy recommendations” section.

Review of the literature

This study is significant as it shows the linkage between environmental degradation and financial development along with other variables. The related literature of some recent studies is presented as follows:

FDI and carbon emissions

The association between environment and FDI is the central theme of this study. FDI theory gives its association with the environment in neutral, positive, and negative impacts. The scale effects hypothesis, the pollution halo hypothesis, and the pollution haven hypothesis give conflicting evidence regarding this theory (Pao et al. 2010). Different studies give different results of FDI impact on the environment as its impact on the environment varies in different states and regions. For instance, (Pao et al. 2010) for BRICS forOECD states study of (Pazienza 2015) , determine that environmental quality has been improved by FDI.

Many researches have been conducted to find the effects of FDI on the environment and its varied effects. Shahbaz et al. (2018) presented FDI as the main cause of environmental degradation in the context of France. The study on the sub-Saharan region by Kivyiro and Arminen (2014) gives entirely different results, where FDI impact is not positive or negative and gives a significant impression. All these researches did not add the important variable of financial growth and development with FDI that gives batherfindings. This study seeks to examine the close relation between economic, financial development, and FDI in G8 states and the linked effects of all these variables on the climate.

Technological innovation and CO2 emissions

The technological change concept is given by Schumpeter (1942); in the recent market, the modern technological invention is not supported, and dissemination in three aspects, innovation, diffusion, and invention, is the theory presented by Schumpeter. Invention and innovations are proceeding by research and development in the phase of the diffusion process arebeingcontrolled by technological innovation by the organization or individuals to use it. Technological change occurs by the combined impact of these three phases. Technological change has played a vital role while explaining the aspects that put a negative effect on the environment. This covers a big picture with time and environmental change (Weitzman 1997). There are a lot of discussions done to find the vastness of technological change. With the help of this environmental pollution decreased. Fuel mix change, technologies with high efficiency, and end-of-pipe installation changes are also included in this study. Climate change investigation that is related to environment and energy use, important theories work by taking into accountthe nature and amount of change in technology (Yeh and Rubin 2012).Co2 emission decreases with the rise in research and development (R&D) and technology change (Jones 2005). At the same time, there is an argument regarding the decrease in CO2 emission; then it should help to cope with environmental issues (Newell et al. 2008). Increase in transboundary trade and economic growth make a rise in energy consumption. TI eventually reduce CO2 emission presented by Sohag et al. (2015). Inversely other studies give opposite findings regarding the environment and TI. Explored the role of TI in ideal pollution control to decreasing Co2 emission. He stated that TI is more effective in pollution control than any other welfare.

Carbon emission and financial development

The present focus of the study is the aspect of environmental economics that found the linkage between the environment and financial development. Groomed financial sector played a major role in achieving the targets of economic growth. By inviting FDI, the developed financial market creates a rise in economic growth; this is done by large investment in R&D (Hsiao and Hsiao 2006). Some scholars believe that eco-friendly technological advancement can be created by financial growth. It seeks least polluted environment by giving eco-friendly goods and leads toward developmental sustainability at regional, national, and global levels (Birdsall and Wheeler 1993). Sometimes the reason for CO2 emission is considered because of financial development growth of production activities. In the same manner, energy consumption is increased by the direct effect of financial development (Sadorsky 2011). Alternatively, it changes the amount of CO2 emission (Tamazian and Rao 2009). In the same vein, many researchers claim that development in the financial sector can double the investment options and minimize the rate of borrowing with boost in energy (Tamazian and Rao 2009). Scholars have believed that financial growth provides more benefits to government sectors than IT projects related to financial development progressed (King and Levine 1993), which leads toward the prominent CO2 emission reduction by using dynamic energy utilization (Tang 2015).

Financial development is prominently affected by a change in CO2 emission (Tamazian and Bhaskara Rao 2010). There is insignificant relation found between environmental degradation and financial development that takes a different research direction from the previous one. The above literature review states that using these variables in the case of G8 countries has never been conducted. The results shed light on existing literature, explaining the relation between CO2 emission and TI for G8 countries. The present study also focuses on the significance and role of economic development and financial development in impacting the environment along with the exploration of the role of energy consumption in CO2 emission. All the theoretical discussion of the role of TI, FDI, and financial development in affecting CO2 emission helped in formulating these hypotheses:

-

Hypothesis a: G8 countries may have negative relation between CO2 emission and FDI.

-

Hypothesis b: G8 countries have negative relation between CO2 emission and technological innovations the hypothesis c: G8 countries have negative relation between CO2 emission and domestic credit.

-

Hypothesis d: G8 countries also have an environmental Kuznets curve (EKC).

Udemba (2020) presented Carbon Brief Profile report by Timperley (2019) that shows China is at third place after the USA and India that emit greenhouse gases. India accepted and responds positivity to Paris agreement in decreasing its emission to increase positive environmental conditions. A task is presented before in both developing and developed countries to stop the world average climate situation to well below 2 °C and to bring it to a minimum of 1.5 °C and above pre-industrial levels. Both nonlinear autoregressive distributed lag (NARDL) and linear autoregressive distributed lag (ARDL) were used by the Edmund Ntom Udemba. He dropped NARDL in later stages because of its inability to maintain cointegration in the analysis. Remaining analysis was based on diagnostic test, Granger causality with linear ARDL. One side transition passing from foreign direct investment, agriculture, population to ecological foot print, and energy use has shown by Granger causality test.

Adebayo et al. (2021) step forward by utilizing consumption-based carbon emissions (CO2) as environmental degradation proxy for Chile. In this research, novel nonlinear ARDL technique for Chile from 1990 to 2018 has been used. The research employed ADF and KSS (nonlinear) tests to check the data series to stationary level. Asymmetric ARDL and symmetric approaches are used to find long-run and cointegration linkages. Results found that technological innovation is ineffective in decreasing consumption-based carbon emissions, which intimate that Chile’s technological innovation is not directed toward manufacturing green technology.

Udemba’s (2021) research on Chile shows that this country is among the top rating in reducing carbon emission. This country moved from highly insufficient to insufficient and still doing efforts for conforming the region of 2 °C in controlling climate change by carbon emission reduction. The author has used the asymmetric and nonlinear methods to investigate the positive and negative impacts of selected variables. Important variables of this study are institutional quality, economic growth (GDP per capita), fossil fuels, foreign direct investment, and renewable energy consumption. The findings are the negative and positive shocks to economic growth, renewable energy, and institutional quality which impacted negatively and favorably on Chile’s environment by promotion and reduction of emission.

Udemba et al. (2021) in this research intend to explore the implication of CO2 with the reference of energy intensity on Indian economic growth. To investigate the nexus between environmental degradation, the variables used are economic growth in a carbon income function, energy use, and openness to trade. This study on Indian economy shows significant negative relation between economic growth, trade openness, and CO2 emission. Modified Wald test of Toda Yamamoto with autoregressive distributed lag (ARDL) with annual time series were applied from 1975 to 2017. Also unidirectional relation between energy utilization and GDP was observed under corroborated causality analysis.

Data, methodology, and model specification

In the empirical analysis panel data of (1990-2019) have been used from world development Indicators (WDI 2019). CO2 emission per capita (metric tons) is the dependent variable, and patent application as a proxy for technological innovation (TI), financial development (index), and foreign direct investment (net inflows of GDP%) are the dependent variables. Trade openness, GDP, urban population, and energy consumption are controlled variables. The description of variables has been shown in Table 1. Mortgage, banking, and insurance firms work as financial institutions and financial intermediaries that present the capital market. Financial efficiency, financial depth, and financial stability are the measure of the financial market. All these categories of financial development were measured in this study. The proxy for the financial efficiency of economies is the net interest margin. The total share of all the stock companies is measured by the GDP capitalized variables to the total GDP. In the financial market, it substitutes for financial debt. Past studies have employed substitutes for financial development. It is first time that FI index is used for G8 states, which covers big range parameters. With urbanization at the first stage, it is said to be an increase in energy required (Danish and Wang 2018). Rapid development in the economy stimulates urbanization that comes up with multidimensional structural change, in due course impacting energy consumption (Danish and Wang 2019).

Econometric methods

Specification of model

The model is presented in the following way:

Transformed natural logarithm of variable gives well-founded results stated by Shahbaz et al. (2012). This study calculated the model now presented in the following way in which Shahbaz et al. (2013) took log for variables.

In Equation (1), foreign direct investment is presented as FDI, carbon dioxide emission as CO2, and the square of FDI as FDI2 using as FDI> 0 and FDI2 <0 directed U-shaped between FDI. Financial development index is FI, technological innovation proxy is Tl, trade openness is TOP, energy use is ENR, and depicts urbanization is URPOP; i and t illustrate and explain the time and states taken for the research. Both dimensions were used in panel data studies: cross-sectional and time series, panel data estimation, and methodology. Controlling of endogeneity, serial correlation, heteroscedasticity, and multicollinearity are controlled by panel data methodologies (Islam et al. 2013); analysis is based on panel data techniques.

Econometric procedures

CD tests

Empirical analysis panel data is the primary step to explore the cross-sectional dependence (CD) that is found before the panel unit root test (Dong et al. 2018b). Correlation computation means have been removed by CD. The cross-sectional panel presumes its presence in the null hypothesis, while null hypothesis rejection was found in CD (Rauf et al. 2018). It can be shown in this way:

Panel unit root tests

For all the variables, it is important to find integrational pattern because all the variables integrated into order necessitate by cointegrated test. This can be done by panel unit root test (Ozturk and Al-Mulali2015). Many panel root tests have been found in the literature. LLC (Levin Lin Chu) is an example of a first-generation test. Diverse cross-sectional properties give all these, and unit root process is used. The second-generation test lies in the second group that includes Fisher ADF, IPS (Zeng et al. 2017), and Fisher PP unit root tests. Homogeneity problems are controlled by these tests. There is a mega economic structure and varying CO2 emission levels, and panel countries have CD in G8 countries. Two tests like Pesaran cross-sectional and unit root-second generation test have been used in this study. In addition, Pesaran cross-sectionally augmented Im, Pesaran, and Shin (CIPS) have also been used (Pesaran 2007).

Westerlund panel cointegration test

The presence of CD in the panel is exhibited by Westerlund and Edgerton (2007), in this study. The panel specific AR-established test is shown in the following way (Danish and Wang 2019).

Panel long-run parameters estimation methods

The fully modified ordinary least square approach of this study (FMOLS) because the error term Uit autocorrelation is corrected by using Newey-west. In the model, lead and lagged variables are selected to manage the error of autocorrelation on the error term Uit, which we apply (DOLS).The mathematical form of the FMOLS and DOLS can be presented as:

Here n is the country on which FMOLS is applied where γ̂FMOLS works as estimator.

Associated t-statistic and n is written in the following manners.

Eberhardt and Bond developed the augmented mean group (FMOLS) long-run parameter estimated by this. CD is considered a common dynamic.

Result and discussion

According to the World Bank, G8 countries are facing a high level of CO2emissions. For example, the USA’s CO2 emission is 6.5 billion metric tons, 15.09 for Canada, 14.8 is for Russia, 5.1 billion metric tons for the USA, and 351.5 for the UK. Based on GDP, the USA (20.81) is the richest among G8 group. In G8 countries, the USA has the highest value of FDI. Energy consumption is highly associated with CO2 emission.

In environmental economics, mostly scholars pay attention to CD; this is suggested by the panel data analysis. The results become unreliable by ignoring CD that is revealed by all the tests we have conducted (Ahmad and Zhao 2018). In Table 1, cross-sectional dependence, rejection, and presence of confirmation of CD are statistically explained (LM test). This illustrates that the increase in one country directly impacts another country.

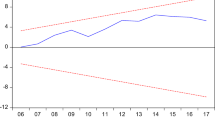

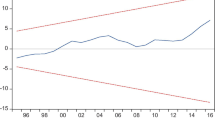

Table 2 shows the result of the CADF and CIPS unit root test, which is used for two reasons, namely: (a) at the level form and (b) first difference form. In the findings, all the variables are stationary at first difference.

Westerlund test has been used for giving an analysis of cointegration between variables. It is observed in Table 3 that the null hypothesis is rejected by the tests unanimously of no cointegration. The conclusion of the study gives association in cointegration among variables. This result gives huge importance and promotes the variables that have an association in long run. The robustness of CD can be proved by additional cointegration testing.

In the account of the null hypothesis, Westerlund is considered one of the highly responsible tests for no cointegration in all panels. This test rejects the null hypothesis of no co-integration.

Results of panel long-run parameters estimation methods

FMOLS estimator presents long-run parameters in Table 4. Comparable results have been shown in two estimation methodologies. FMOLS estimated coefficient value of FDI is smaller. In FMOLS the lnGDP value is larger. CO2 emission decrease is 2.3% with the 1% increase in lnF. CD existence has an impact on the parameters of the estimation; some of it is overestimation or underestimation.

According to the FMOLS estimator, CO2 emission is negatively significant because of the coefficient of FDI at 1% level. If FDI is increases by 1%, CO2 emission decreases by 2.3%. Pollution halo hypothesis is supported by this finding. These results align with the studies by Al-mulali and Foon Tang (2013), Pazienza (2015), and Zeng et al. (2017). The environmental air quality is improved by the FDI in China. Environmental change and technological advancement and production in TI are caused by the FDI. World polluting industries are considered to be the developing countries and also called “pollution haven.” Strong pollution-controlled regulations have been made by developed countries, and probably developing countries are receiving this pollution. CO2 emission is reduced by 2% by technological innovation at 5% level of significance. Environmental degradation is caused by the production activities that are the base for economic development. When the developed technological process plays a role in pollution reduction, then it is considered a positive activity with respect to environment. The impact of FDI is also positive to the environment and has 5% significant level since 6.7% CO2 emission is decreased by the rise of 1% in FDI. These results align with the study of (Tamazian et al. 2009; Tamazian and Bhaskara Rao 2010) financial development variable incorporated with that in model and resulted environmental pollution reduced by the financial development. Also, CO2 emission has positive impact on economic development. That is the way in developing countries CO2 emission has increased by economic growth.

G8 member countries are also working on to control and manage their CO2 emissions rate. These results align with Shahbaz et al. (2013) and Sinha and Shahbaz (2018). The coefficient of GDP2 (lnGDP2) is significant and negative in this study. The results of G8 states present that CO2 emission increases with the increase in economic growth, and we can accept the EKC hypothesis problem. Generally, GDP reflects the social development and level of income. The increase in CO2 emission was 11% because of 1% increase in the use of energy (lnENR).

Carbon emissions have positive and significant impact on POP. A significant and positive relation has been found between urbanization and CO2. There is found a positive and significant relation between CO2 and urbanization. The impact of urbanization can be seen at the early stage of urbanization where electronic commodities increase in large number and transportation system becomes huge that establishes a number of financial institutions. Energy consumption increases by all these activities that inversely give rise to CO2 emission (Akadiri et al. 2019b).

DOLS estimation also presents the same results as FMOLS with different coefficient values. Results of this estimation suggested that (FDI*lnTI) interaction term impacts significantly on all estimation. Table 5 is showing the results of causality test by Dumitrescu and Hurlin (2012); it is evident that there exists bi-directional causality between energy use and CO2 emissions. Financial development and foreign direct investment are causing more environmental pollution. One directional causal affect is found between GDP, technological innovations, population growth, and CO2 emissions.

Conclusion and policy recommendations

This research intends to explore the effects of FDI, financial development, and technology on CO2 emission using the case of G8 countries from 1990 to 2019. By taking CD that is present in cross countries, series of econometric techniques have been used in this study that shows panel countries have CD. Carbon emissions have significant and negative impact on FDI, financial development, and TI, which resulted by FMOLS. Inverted U-shaped relation has been found between CO2 emission and square of GDP. The results of DOLS are same as obtained by FMOLS with varying coefficient values. Between FDI and carbon emission, unidirectional causality has been found in the results. Causal association of bidirectional is present between TI, financial development, GDP, TOP, energy use, urbanization, and carbon emissions.

Environmental degradation increases by economic growth and it isverifies in G8 countries with the existance of EKC. This explores that CO2 emission decrease by FDI; thus, pollution halo hypothesis is validated. For G8 countries, financial development plays a conclusive role in environmental betray. The observational results of this research tell to forward a more effective system to architecture a friendly environment, transportation in urban areas, and sustainable energy use in urbanized areas (Akadiri et al. 2019a).

For the great eight countries, there are some policies suggested at the end of this study. Overall this study gives an understanding of the calculated linked dimension of variables that gives help to G8 countries in their attempts to FDI, economic growth, urbanization, financial development, and technological process for reducing CO2 emission. Great eight counties’ environmental health can be improved by efficient energy use and advancement in technologies. Huge investments in environmentally friendly technologies can improve the quality of climate. Therefore, environmentally friendly technologies should be invested more than any other. We resolutely believe that financial openness related to government policies and FDI-associated R&D can decrease the demotion of the environment. There must be a striking pattern of policies related to environmentally friendly technologies that have been given to the foreign investment organizations before inviting them. While considering energy consumption, development can be done where all programs can be transferred to renewable energy from non-renewable energy. Production that can be increased by the policies related to energy use with renewable energy can put a sustainable and positive effect on economic growth.

This study has used FDI inflow; the role of technological innovation evaluating pollution measures by using EKC and pollution haven hypothesis and international trade may be the area of study for future work.

Data availability

Not required

References

Adebayo TS, Udemba EN, Ahmed Z, Kirikkaleli D (2021) Determinants of consumption-based carbon emissions in Chile: an application of non-linear ARDL. Environ Sci Pollut Res 28:43908–43922. https://doi.org/10.1007/S11356-021-13830-9

Ahmad M, Zhao ZY (2018) Empirics on linkages among industrialization, urbanization, energy consumption, CO2 emissions and economic growth: a heterogeneous panel study of China. Environ Sci Pollut Res 25:30617–30632. https://doi.org/10.1007/s11356-018-3054-3

Akadiri SS, Alkawfi MM, Uğural S, Akadiri AC (2019a) Towards achieving environmental sustainability target in Italy. The role of energy, real income and globalization. Sci Total Environ. https://doi.org/10.1016/j.scitotenv.2019.03.448

Akadiri SS, Alola AA, Akadiri AC (2019b) The role of globalization, real income, tourism in environmental sustainability target. Evidence from Turkey. Sci Total Environ 687:423–432. https://doi.org/10.1016/j.scitotenv.2019.06.139

Akadiri SS, Lasisi TT, Uzuner G, Akadiri AC (2019c) Examining the impact of globalization in the environmental Kuznets curve hypothesis: the case of tourist destination states. Environ Sci Pollut Res 26:12605–12615. https://doi.org/10.1007/s11356-019-04722-0

Al-mulali U, Foon Tang C (2013) Investigating the validity of pollution haven hypothesis in the gulf cooperation council (GCC) countries. Energy Policy 60:813–819. https://doi.org/10.1016/j.enpol.2013.05.055

Balsalobre-Lorente D, Gokmenoglu KK, Taspinar N, Cantos-Cantos JM (2019) An approach to the pollution haven and pollution halo hypotheses in MINT countries. Environ Sci Pollut Res 26:23010–23026. https://doi.org/10.1007/s11356-019-05446-x

Birdsall N, Wheeler D (1993) Trade policy and industrial pollution in Latin America: where are the pollution havens? J Environ Dev 2:137–149. https://doi.org/10.1177/107049659300200107

Chang SC (2014) Effects of financial developments and income on energy consumption. Int Rev Econ Financ 35:28–44. https://doi.org/10.1016/j.iref.2014.08.011

Danish, Wang Z (2018) Dynamic relationship between tourism, economic growth, and environmental quality. J Sustain Tour 26:1928–1943. https://doi.org/10.1080/09669582.2018.1526293

Danish, Wang Z (2019) Does biomass energy consumption help to control environmental pollution? Evidence from BRICS countries. Sci Total Environ 670:1075–1083. https://doi.org/10.1016/j.scitotenv.2019.03.268

Destek MA, Sarkodie SA (2019) Investigation of environmental Kuznets curve for ecological footprint: the role of energy and financial development. Sci Total Environ 650:2483–2489. https://doi.org/10.1016/j.scitotenv.2018.10.017

Dong K, Hochman G, Zhang Y, Sun R, Li H, Liao H (2018a) CO2 emissions, economic and population growth, and renewable energy: empirical evidence across regions. Energy Econ 75:180–192. https://doi.org/10.1016/j.eneco.2018.08.017

Dong K, Sun R, Li H, Liao H (2018b) Does natural gas consumption mitigate CO2 emissions: testing the environmental Kuznets curve hypothesis for 14 Asia-Pacific countries. Renew Sustain Energy Rev.

Doytch N, Narayan S (2016) Does FDI influence renewable energy consumption? An analysis of sectoral FDI impact on renewable and non-renewable industrial energy consumption. Energy Econ 54:291–301. https://doi.org/10.1016/j.eneco.2015.12.010

Dumitrescu EI, Hurlin C (2012) Testing for Granger non-causality in heterogeneous panels. Econ Model 29:1450–1460. https://doi.org/10.1016/j.econmod.2012.02.014

Hsiao FST, Hsiao MCW (2006) FDI, exports, and GDP in East and Southeast Asia-Panel data versus time-series causality analyses. J Asian Econ 17:1082–1106. https://doi.org/10.1016/j.asieco.2006.09.011

IPCC (2014) Climate Change 2014: Synthesis Report. Contribution of Working Groups I, II and III to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change

Islam F, Shahbaz M, Ahmed AU, Alam MM (2013) Financial development and energy consumption nexus in Malaysia: a multivariate time series analysis. Econ Model 30:435–441. https://doi.org/10.1016/j.econmod.2012.09.033

Jahangir Alam M, Ara Begum I, Buysse J, Van Huylenbroeck G (2012) Energy consumption, carbon emissions and economic growth nexus in Bangladesh: cointegration and dynamic causality analysis. Energy Policy 45:217–225. https://doi.org/10.1016/j.enpol.2012.02.022

Jones CI (2005) Growth and Ideas

King RG, Levine R (1993) Finance and growth: Schumpeter might be right. Q J Econ 108:717–737. https://doi.org/10.2307/2118406

Kivyiro P, Arminen H (2014) Carbon dioxide emissions, energy consumption, economic growth, and foreign direct investment: causality analysis for Sub-Saharan Africa. Energy. 74:595–606. https://doi.org/10.1016/j.energy.2014.07.025

Mahdi Ziaei S (2015) Effects of financial development indicators on energy consumption and CO2 emission of European, East Asian and Oceania countries. Renew Sustain Energy Rev.

Mehmood U (2020a)Globalization-driven CO2 emissions in Singapore: an application of ARDL approach. Environ Sci Pollut Res 28:11317–11322. https://doi.org/10.1007/s11356-020-11368-w

Mehmood U (2020b) Does the modifying role of institutional quality remains homogeneous in GDP-CO 2 emission nexus ? New evidence from ARDL approach. Environ Sci Pollut Res

Mehmood U (2021a)Renewable-nonrenewable energy: institutional quality and environment nexus in South Asian countries. Environ Sci Pollut Res 28:26529–26536. https://doi.org/10.1007/s11356-021-12554-0

Mehmood U (2021b) The interactional role of globalization in tourism-CO 2 nexus in South Asian countries

Mehmood U (2021c) Air pollution and hospitalization in megacities : empirical evidence from Pakistan

Mehmood U, Tariq S (2020) Globalization and CO2 emissions nexus: evidence from the EKC hypothesis in South Asian countries. Environ Sci Pollut Res 27:1–13. https://doi.org/10.1007/s11356-020-09774-1

Newell RG, Pizer WA, Newell R, Pizer W (2008) Indexed regulation. J Environ Econ Manag 56:221–233

Ozturk I, Al-Mulali U (2015) Investigating the validity of the environmental Kuznets curve hypothesis in Cambodia. Ecol Indic 57:324–330. https://doi.org/10.1016/j.ecolind.2015.05.018

Pao H-T, Tsai C-M, Pao H-T, Tsai C-M(2010) CO2 emissions, energy consumption and economic growth in BRIC countries. Energy Policy 38:7850–7860

Pazienza P (2015) The environmental impact of the FDI inflow in the transport sector of OECD countries and policy implications. Int Adv Econ Res 21:105–116. https://doi.org/10.1007/s11294-014-9511-y

Pesaran MH (2007) A simple panel unit root test in the presence of cross-section dependence. J Appl Econ 22:265–312. https://doi.org/10.1002/jae.951

Rafique MZ, Li Y, Larik AR, Monaheng MP (2020) The effects of FDI, technological innovation, and financial development on CO2 emissions: evidence from the BRICS countries. Environ Sci Pollut Res 27:23899–23913. https://doi.org/10.1007/S11356-020-08715-2

Rauf A, Liu X, Amin W, Ozturk I, Rehman OU, Hafeez M (2018) Testing EKC hypothesis with energy and sustainable development challenges: a fresh evidence from belt and road initiative economies. Environ Sci Pollut Res 25:32066–32080. https://doi.org/10.1007/s11356-018-3052-5

Sadorsky P (2011) Financial development and energy consumption in Central and Eastern European frontier economies. Energy Policy 39:999–1006. https://doi.org/10.1016/j.enpol.2010.11.034

Schumpeter (1942) Encyclopedia of Creativity, Invention, Innovation and Entrepreneurship

Shahbaz M, Lean HH, Shabbir MS (2012) Environmental Kuznets curve hypothesis in Pakistan: cointegration and Granger causality. Renew Sust Energ Rev 16:2947–2953. https://doi.org/10.1016/J.RSER.2012.02.015

Shahbaz M, Ozturk I, Afza T, Ali A (2013) Revisiting the environmental Kuznets curve in a Global Economy. MPRA Pap

Shahbaz M, Nasir MA, Roubaud D (2018) Environmental degradation in France: the effects of FDI, financial development, and energy innovations. Energy Econ 74:843–857. https://doi.org/10.1016/j.eneco.2018.07.020

Sinha A, Shahbaz M (2018) Estimation of environmental Kuznets curve for CO2 emission: role of renewable energy generation in India. Renew Energy 119:703–711. https://doi.org/10.1016/j.renene.2017.12.058

Sohag K, Begum RA, Syed Abdullah SM, Jaafar M (2015) Dynamics of energy use, technological innovation, economic growth and trade openness in Malaysia. Energy. 90:1497–1507. https://doi.org/10.1016/j.energy.2015.06.101

Tamazian A, Bhaskara Rao B (2010) Do economic, financial and institutional developments matter for environmental degradation? Evidence from transitional economies. Energy Econ 32:137–145. https://doi.org/10.1016/j.eneco.2009.04.004

Tamazian A, Rao BB (2009) Do economic, financial and institutional developments matter for environmental degradation? Evidence from Transitional Economies. Econ Econ Res Inst

Tamazian A, Chousa JP, Vadlamannati KC (2009) Does higher economic and financial development lead to environmental degradation: evidence from BRIC countries. Energy Policy 37:246–253. https://doi.org/10.1016/j.enpol.2008.08.025

Tang J (2015) Testing the pollution haven effect: does the type of FDI matter? Environ Resour Econ 60:549–578. https://doi.org/10.1007/s10640-014-9779-7

Tariq S, Ul-Haq Z, Imran A et al (2017) CO2 emissions from Pakistan and India and their relationship with economic variables. Appl Ecol Environ Res. https://doi.org/10.15666/aeer/1504_13011312

Tariq S, Nawaz H, Mehmood U (2021) Journa l Pre of. Turkish National Committee for Air Pollution Research and Control

Timperley J (2019) The carbon brief profile: India. https://www.carbonbrief.org/the-carbon-brief-profile-india

Udemba EN (2020) Mediation of foreign direct investment and agriculture towards ecological footprint: a shift from single perspective to a more inclusive perspective for India. Environ Sci Pollut Res 27:26817–26834. https://doi.org/10.1007/S11356-020-09024-4

Udemba EN (2021) Mitigating environmental degradation with institutional quality and foreign direct investment (FDI): new evidence from asymmetric approach. Environ Sci Pollut Res 2021:1–15. https://doi.org/10.1007/S11356-021-13805-W

Udemba EN, Güngör H, Bekun FV, Kirikkaleli D (2021) Economic performance of India amidst high CO2 emissions. Sustain Prod Consum 27:52–60. https://doi.org/10.1016/J.SPC.2020.10.024

WDI (2019) World Development Indicators 2019. The World Bank

Weitzman ML (1997) Sustainability and Technical Progress

Westerlund J, Edgerton DL (2007) A panel bootstrap cointegration test. Econ Lett 97:185–190. https://doi.org/10.1016/j.econlet.2007.03.003

Xu Z, Baloch MA, Danish et al (2018) Nexus between financial development and CO2 emissions in Saudi Arabia: analyzing the role of globalization. Environ Sci Pollut Res 25:28378–28390. https://doi.org/10.1007/s11356-018-2876-3

Yeh S, Rubin ES (2012) A review of uncertainties in technology experience curves. Energy Econ 34:762–771. https://doi.org/10.1016/j.eneco.2011.11.006

Zeng S, Liu Y, Liu C, Nan X (2017) A review of renewable energy investment in the BRICS countries: history, models, problems and solutions. Renew Sustain Energy Rev.

Author information

Authors and Affiliations

Contributions

Aysha Abid wrote the paper. Usman Mehmood conducted analysis; Salman Tariq and Zia Ul Haq supervised the work

Corresponding author

Ethics declarations

Ethics approval

Not required

Consent to participate

All authors participate in this research.

Consent for publication

Not applicable

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Roula Inglesi-Lotz

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Abid, A., Mehmood, U., Tariq, S. et al. The effect of technological innovation, FDI, and financial development on CO2 emission: evidence from the G8 countries. Environ Sci Pollut Res 29, 11654–11662 (2022). https://doi.org/10.1007/s11356-021-15993-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-021-15993-x