Abstract

The objective of this paper is to explore the nexus of innovation–environment and economic growth in the context of the Indian economy. To achieve the study objective, we explored the role of technological innovation, FDI, trade openness, energy use, and economic growth toward carbon emissions. Using the data of 1985–2017, the study employed ARDL bound testing and vector error correction model (VECM) methods to capture the effects of technological innovation, trade openness, FDI, energy use, and economic growth on CO2 emissions. Empirical estimation has confirmed the existence of long-run cointegration. Similarly, in the long run, it is found that trade openness, energy use, and economic growth positively reinforce CO2 emissions. In contrast, technological innovation and FDI negatively reinforce CO2 emissions in the long run. Furthermore, VECM indicates that the relationship among innovation, trade openness, and energy use is bidirectional in the long run. Whereas, unidirectional relation has been found that is coming from GDP to carbon emissions, FDI, innovation, trade, and energy use. In the short run, unidirectional link found which is coming from FDI, innovation, and energy use to carbon emission. However, the association between emissions and trade openness is bidirectional. The conclusions put forward policy implications that innovation is a way to reduce environmental degradation.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Over the past few decades, India’s economy has grown at a fast pace and remained back to China. But the recent figures have shown that Indian economy has outperformed and crossed China in the annual growth rate. The recent data has shown that annual rate of increase in patent registration has grown more than 10% over a year. So, currently, India is the fastest growing economy in the world with respect to its economic and innovation growth. During the last twenty years, the main forces behind India’s rapid economic growth were exports and foreign direct investment. A large number of scholars worldwide believe that economic growth is at the cost of greenhouse gas emissions (Balsalobre-Lorente et al. 2018; Cai et al. 2018; Heidari et al. 2015; Wang et al. 2016). Increased use of fossil fuels affects environmental quality which results in climate change. As a result, climate change adversely affects crop yields in agro-based economies. Therefore, the ambition of governments worldwide is to reduce greenhouse gas emissions without compromising economic growth.

Scientists have reached a consensus on climate warming. The issue of climate change and carbon emissions has also attracted the attention of the general public. The research in the area of energy economics shows that a large number of studies have been used to unfold the linkage of greenhouse gas emissions and economic growth (Balsalobre-Lorente et al. 2018; Heidari et al. 2015). Most of previous research has highlighted that economic growth significantly relates to carbon emissions. But, the question arises, whether carbon emissions are the only way to attain economic growth? The answer would be probably no. To this end, Zameer et al. (2019) highlighted innovations as an engine of economic growth. Technological innovations on the one end improve economic growth, whereas on the other hand, they improve energy efficiency which, as a result, improves environmental quality by declining carbon emissions. Similarly, this factor is highly significant and need attention of the experts in exploring the determinants of carbon emissions. The high level of technological innovation can enable the country to produce more output with lower level of energy consumption. In addition, technological advancement is pivotal to adopt renewable energy to fulfill country energy demands. Schmandt and Wilson (2018) highlighted that lately much interest has been paid to examine the role of new and innovative technologies in high-tech industries, but now technology is important at every stage of economic activity to pervade modern economic life. Technological advancements have made life easy and it has improved the performance of every industry. Technology has also changed the modes of transportation.

In the context of technological advancement, the economic growth in India has raised a question about the impact of technological innovation on environmental degradation. It has been an issue of debate that whether EKC exists said context for India. Fan and Hossain (2018) incorporated the role of innovation and measured its role toward economic growth using ARDL approach. Their findings have shown that the impact of innovation on economic growth is insignificant in the context of India. However, this evidence is not enough to believe that how and to what extent innovation can contribute toward environment. Furthermore, Antweiler et al. (2001) noted that economic growth achieved via capital accumulation results in environmental degradation. They further emphasized for the need of technological advancement in attaining low carbon economic growth. The endogenous growth theory also indicates that technological progress improves the capability of a nation to replace the polluting resources with environmentally friendly resources. Such as, country can shift traditional energy production resources to renewable energy resources to cope with environmental challenges.

Furthermore, innovations and technological advancements can improve energy usage to a lower level which will lead to less environmental degradation (Fernández et al. 2018). The aforementioned background raises a question, whether a developing nation like India may reduce carbon emissions and achieve sustainable economic growth via technological advancement? Because India is at the stage of industrialization and urbanization, energy demand and consumption are inelastic. Although, a great deal of efforts has been made to study the relationship among energy emissions and economic growth, the role of technological innovations is ignored. Therefore, it is necessary to study innovations–growth–environment nexus. Therefore, this study contributes in existing energy economics literature by three folds: (i) innovations–emissions nexus is investigated by considering role of foreign direct investment and trade openness in carbon emissions function for Indian economy. (ii) ADF and PP unit root tests are applied to examine stationarity properties of the variables and robustness is tested by applying Kim and Perron’s (2009) unit root test accommodating single unknown structural break in the data. (iii) The bounds testing approach is applied to test the existence of cointegration between carbon emissions and its determinants by considering role of structural breaks in the series. The causal relationship between the variables is examined by applying VECM Granger causality approach.

Literature review

We divide literature review into three parts following the scope of our study: (i) innovations–emissions; (ii) FDI–emissions nexus and nexus between trade openness and emissions.

Innovations–emissions nexus

Reduction in greenhouse gas emissions and sustainability of economic growth are key objectives of countries worldwide. In doing so, it is necessary to take initiatives for the transition of economic activities from high-polluting resource consumption to low-polluting resources based upon innovative technologies (Fernández et al. 2018). For example, Antweiler et al. (2001) have indicated that economic growth triggered by capital accumulation can reinforce environmental pollution, whereas economic growth achieved via technological progress would result in reducing environmental pollution. Erdoðan et al. (2019) also highlighted that economic growth without technology may cause increased carbon emission in the country. The endogenous growth theory supports the argument of significant impact of technological progress on economic growth and environmental pollution. This theory considers that technological progress improves the capability of a nation to replace the polluting resources with other environment friendly resources. Moreover, Cheng et al. (2018) found that technical progress significantly influences carbon intensity among provinces in China. Due to the important role of technical progress, they believe that upgradation and optimization of industrial structure are conducive to reduce carbon emissions in the country. Zameer et al. (2020) indicated the role of green innovations for cleaner production in China. Álvarez-Herránz et al. (2017) highlighted the importance of energy innovations for the improvement of environmental quality. They used 28 OECD countries data to study the how R&D in energy technology can improve environmental quality. Recently, Yasmeen et al. (2020) decomposed the factors affecting carbon emissions and found the traditional way of economic development is the main cause of carbon emissions. Dauda et al. (2019) used panel data of 18 developed and developing economies. They used FMOLS and DOLS and come up with similar thoughts that technological advancement plays a significant role in pollution reduction. The study by Chen and Lei (2018) stated that non-renewable energy use increases carbon emissions and create severe environmental challenges. Erdoǧan et al. (2019) also have similar beliefs that energy consumptions may cause environmental issues in the countries worldwide. Churchill et al. (2019) studied the role of R&D intensity towards carbon emissions using non-parametric panel data model for the period of 1870–2014 for G7 countries and found that the linkage between R&D and carbon emissions varies over the passage of time. Ganda (2019) noted that renewable energy use and country spending on research and development have inverse relation with carbon emissions in context of OECD countries. It is also shown that collectively higher energy consumption would result in higher environmental degradation in OECD countries. In contrast, a study employed data of 15 countries from Europe along with the USA and China and run linear regression using OLS and found that innovation and technology improvement can improve energy leading to less environmental degradation (Fernández et al. 2018). Tam et al. (2019) studied the environmental laws in ten OECD countries till 2014 and emphasized on the importance of environmental regulations related to energy consumption for improving environmental quality by reducing carbon emissions.

Furthermore, Adeel Farooq et al. (2018) tried to determine the role of green field investments on environmental performance in nine Asian developing economies for the year of 2003–2014. The study used Yale University environmental regulations index as a proxy of country environmental performance. Fixed and random effect estimating techniques along with robust least square method was employed to estimate empirical findings. Their results have validated that green field investment significantly improves environmental performance. Long et al. (2018) examined the impact of innovations on carbon emissions in China using data for the period of 1997–2014. They used first-stage and second-stage least square regression and found that innovations negatively impact carbon emissions and improves environmental quality. Yii and Geetha (2017) used VECM and TYDL Granger causality technique to estimate the relationship among technological innovation and CO2 emissions in Malaysia. Based upon the data from 1971 to 2013, they reported that technological innovation negatively influences CO2 emissions in Malaysia. Yusuf et al. (2018) employed the Kuznets Curve framework to study the long-run relationship of technological innovation with carbon emissions in Indonesia. They used FMOLS and DOLS upon the data of 1980–2017. Their empirical analysis found that in the long run technological innovation and carbon emission have significant negative relationship in Indonesia. Wang et al. (2018) used spatial econometric model on data ranging from 2000 to 2014 of Chinese provinces and noted that technological advancements in energy sector can play a vital role in reducing CO2 emissions in China. Similarly, Fernández et al. (2018) used linear regression OLS on panel data of fifteen European economies along with the USA and China and indicated that R&D spending is not only pivotal for economic growth, but also driver of sustainable economic development where economic growth can be reconciled with lower environmental degradation. Yu and Du (2019) employed extended STIRPAT model and unveiled that China’s focus on introducing innovation plays a significant and positive role in emission reduction. On the contrary, Fan and Hossain (2018) used ARDL bound test approach and Toda-Yamamoto Granger causality technique to estimate the impact of technological advancement on carbon emissions in China and India based upon data from year 1974 to 2016. Their results have shown that technological advancement has insignificant influence on CO2 emissions.

FDI–emissions nexus

An assessment of previous research reveals that even though research has explored the linkage between FDI and CO2 emissions, most of this research has been focused on developed countries. The research on exploring the linkage between FDI and carbon emissions in context of developing countries especially for India (one of the larger attracter of FDI) is relatively small (Peng et al. 2016; C. Zhang and Zhou 2016). A significant inflow of FDI in India may influence environmental quality due to increase in production activities. Keeping this in mind, exploring the impact of FDI on CO2 emissions in context of India has become a critical issue. The global research on the linkage of FDI and CO2 emissions has given mixed empirical findings (Shahbaz et al. 2015). For example, Merican et al. (2007) explored the impact of foreign direct investment on carbon emissions in Thailand, Malaysia, Singapore, Indonesia, and the Philippines using ARDL technique. Their empirical results show that FDI has positive impact on carbon emissions in context of Thailand, Malaysia, and the Philippines. However, for Indonesia, FDI improves environmental quality and no effect is noted for Singapore. Furthermore, Blanco et al. (2013) examined how foreign direct investment in different sectors influences carbon emissions in 18 Latin American countries. They employed Granger causality test using panel data of 1980–2007 and found that foreign direct investment in pollution-intensive industries results in significant increase in carbon emissions. Salahuddin et al. (2018) used data of Kuwait from 1980 to 2013 to explore the impact of FDI on carbon emissions. They used ARDL technique along with VECM Granger causality test. Their findings have suggested that FDI has stimulated carbon emissions in Kuwait. Bakhsh et al. (2017) used data of 1980–2014 and employed a 3SLS model and found that FDI has a significant and negative impact on carbon emissions in Pakistan.

Furthermore, Hille et al. (2019) explored the impact of FDI on air pollutions in Korea. They utilized province-level data of 16 provinces from year 2000 to 2011. Simultaneous equations model using 3SLS estimator was employed. Their empirical findings indicate that FDI stimulates regional economic growth and reduces air pollution. Jiang et al. (2018) employed the city-level data in 2014 of 150 Chinese cities to explore the role of FDI inflows on air pollution. They have considered spatial spillovers and used spatial econometric models. Their findings have suggested that FDI has inverse relationship with air pollution, i.e., FDI improves environmental quality by reducing air pollution which validates the presence of pollution halo hypothesis. Liu et al. (2017) utilized the panel data of 112 Chinese cities from 2002 to 2015 to explore the environmental consequences of FDI. They used first difference GMM and orthogonal deviation GMM method to estimate the results. Their findings indicate that FDI has negative effect on environmental degradation in context of Chinese cities. Another study by Liu et al. (2018) also found that FDI inflows do not necessarily lead to environmental pollution. Paramati et al. (2016) employed the data of 20 emerging economies for the period of 1991–2012 to explore the linkage between FDI and clean energy usage. They used Durbin–Hausman test to check panel cointegration and heterogeneous panel non-causality tests is used to check the direction of causality. Their results suggested a positive association between FDI and clean energy usage which further improves environmental quality. Causality test show unidirectional causality exists among FDI and clean energy usage. Ansari et al. (2019) used panel data from 1994–2014 of 29 economies; they created sub-panels based upon homogenous properties of countries. They employed FMOLS and found that foreign direct investment reduces environmental degradation by lowering carbon emissions in Southeast Asian countries in panel, whereas the impact of FDI on rest of the countries in panel is insignificant.

On the contrary, Aydemir and Zeren (2017) employed the 1970–2010 data of 10 nations of G-20 countries. Using Durbin Hausmann panel cointegration method, they found mixed empirical findings. Their results show that for France, USA, and Argentina, pollution halo hypothesis is valid, whereas for the rest of the countries in panel pollution haven hypothesis is confirmed. Shahbaz et al. (2018) studied the relationship of FDI and environmental degradation in case of France. They used the data from 1955 to 2016 and employed bounds testing approach of McNown et al. (2018) to test cointegration. Their findings have shown that FDI impedes environmental quality by increasing carbon emissions. A recent study by Shahbaz et al. (2019) explored the relationship between FDI and carbon emissions in context of MENA region. By employing the data from 1990 to 2015 and using generalized method of moments (GMM), they indicate the presence of inverted U-shaped relationship between FDI and carbon emissions, i.e., initially carbon emission rise and at the later stages of development, emissions decrease with rise in FDI. Similar positive association among FDI and CO2 emission is indicated in the study of Koçak and Şarkgüneşi (2018). Solarin et al. (2017) studied the pollution haven hypothesis in Ghana; their study validated the pollution haven hypothesis and indicated that FDI, GDP, trade, and financial development has positive association with CO2 emissions. Rana and Sharma (2019) employed Indian data from 1982 to 2013 and used dynamic multivariate Toda-Yamamoto (TY) method to estimate empirical results. They found that FDI stimulate economic growth at the cost of environmental degradation. Their results confirmed the existence of PHH (Pollution Haven Hypothesis) and EKC (Environmental Kuznets Curve).

Trade–emissions nexus

Over the past few decades, the substantial changes in social and economic development around the globe have caused a significant damage to natural environment. For example, Munir and Ameer (2018) believe that these damages to environment are due to the increased pressure of free trade on natural resources. However, the previous research has contrary views on how trade effects natural environment. For instance, the pioneer study of Stern et al. (1996) suggested that trade has neutral effect on environmental degradation. Whereas, Stretesky and Lynch (2009) employed fixed effect regression technique and used data of 169 countries for the period of 1989–2003, to examine the relationship between carbon emissions and exports. They measured how exports of these countries to the world and to the USA affect carbon emissions. Their results show that positive correlation exists between carbon emissions and exports only to the USA. Similarly, Shahzad et al. (2017) used data of 1971–2011 and employed ARDL approach and Granger causality test in the context of Pakistan and reported that 1% rise in trade will increase CO2 emissions by 0.247%. They found unidirectional causality exists among trade openness and carbon emissions. Erdoğan et al. (2019) explored the role of natural gas consumption. Shahbaz et al. (2019) used data of 105 developed and developing countries to explore how trade affects environmental quality. They used panel cointegration approaches of Pedroni (1999) and Westerlund (2007) along with panel VECM causality. Their panel cointegration analysis indicate that trade impedes environmental quality by increasing carbon emissions. The panel VECM causality results indicate the feedback effect between trade and CO2 emissions at global level. Moreover, trade openness Granger causes CO2 emissions in low-income and high-income countries. In contrast, Shahbaz et al. (2013) employed ARDL and ECM method and used data of South Africa from year 1965 to 2008 and reported that trade openness improves environmental quality if techniques effect dominates scale effect keeping other things constant. Ling et al. (2015) also used ARDL approach and found that trade openness improves environmental quality for Malaysian economy. Hasanov et al. (2017) utilized PDOLS, PFMOLS, and PMG methods to study the impact of trade on carbon emissions in context of oil exporting countries. They found that imports and exports have insignificant effects on territory-based CO2 emissions. Mahmood et al. (2019) employed ARDL approach and used data 1971–2014 to study the asymmetric effects of trade on CO2 emissions in Tunisia, and reported that trade effects on CO2 emissions asymmetrically but insignificantly.

Moreover, Bento and Moutinho (2016) utilized Italy data for the period of 1960–2011; they used ARDL along with Granger causality approach and found that trade Granger causes carbon emissions, i.e., trade-led emissions hypothesis. Wang and Ang (2018) employed index decomposition analysis using global data to examine the impact of international trade on CO2 emissions and found that growing the trade volume worldwide increases global carbon emissions. Lv and Xu (2019) investigated the effect of trade openness on environmental quality by using data for 55 middle income countries using pooled mean group (PMG) approach. Their results indicated that trade openness improves environmental quality but in the long run, trade openness is harmful for environment. Salahuddin et al. (2019) studied the nexus of globalization and environment. Theoretical analysis by Mazumdar et al. (2019) also confirmed the nexus of trade and environment. They highlighted that trade has adverse effect on environmental quality. Even though it is widely discussed that non-renewable energy consumption gives upward rise to carbon emissions. The recent study of Karasoy and Akçay (2019) validated the said argument that non-renewable energy consumption and trade both create severe environmental challenges due to increase in carbon emissions. Omri et al. (2019) used Johansen cointegration test along with DOLS and FMOLS to explore environmental sustainability determinants in case of Saudi Arabia; based upon their findings, they suggested that FDI, GDP, and trade negatively contribute environmental quality. Zhang et al. (2017) used 1971–2013 data of ten newly industrialized economies and examined the linkage between trade and carbon emissions using panel OLS, FMOLS, DOLS, and panel VECM causality. Their results have provided support for the existence of EKC hypothesis and highlighted that trade openness negatively and significantly effects CO2 emissions. Rana and Sharma (2019) used dynamic multivariate Toda-Yamamoto method upon India data of 1982–2013 and highlighted that India’s imports mainly consist of pollution-intensive goods which is creating severe environmental challenges through the increase in carbon emissions.

Methodology and data

Methodology

To explore the nexus of innovation–environment and growth, the long-run relationships between carbon emissions, technological innovation, economic growth, foreign direct investment, energy use, and trade openness have been designed. The relationship in linear form can be expressed as follows.

In Eq. (1), CO2 refers to carbon emissions, INN is technological innovation, EG is economic growth, FDI is foreign direct investment, TROP is trade openness, and ENG is energy consumption. Since the study is exploring the role of innovation, growth, FDI, energy consumption, and trade openness on carbon emissions, β1, β2, β3, β4, β5 can be positive or negative indicating how an increase or decrease in the concerned variables will influence carbon emissions. In order to estimate the long-run and short-run effects of technological innovation, economic growth, foreign direct investment, energy consumption, and trade openness on carbon emissions, this study used the autoregressive distributed lag model (ARDL) proposed by Pesaran et al. (2001). The ARDL model has many advantages over traditional cointegration models. First, its main advantage over traditional cointegration techniques is that the regression term both I(0) and I(1) can be tested and estimated. Secondly, it can effectively correct the endogenous problem of explanatory variables; thirdly, it has ability to estimate the short-term dynamic and long-term cointegration relationship between variables simultaneously. Ahmad et al. (2017) and Yasmeen et al. (2019) argued that the bound testing approach of Pesaran et al. (2001) is only useful when sample size is large; in contrast, if the sample size of the study is small then the bound testing approach of Pesaran et al. (2001) can lead to biased and spurious results. Beliefs of Erdoğan et al. (2020) are also similar for using ARDL approach. To deal with this problem, Narayan (2005) introduced a mechanism that is useful even form small sample size. As the sample size being used in this study is small, therefore Narayan (2005) method has been followed. In order to employ ARDL bound testing approach, the ECMs has been estimated. The mathematical representation ECMs models are presented as follows.

In Eq. (3), Δ is the difference term, n is the number of lag periods and α0 is the constant term. β1 − β5 are the coefficients of the corresponding variables and are used as error correction dynamics in the model. εt is the error correction term; it indicates white noise error-term in the model. The symbol δ1 − δ5 is representing the long-run cointegration relationship. The model ARDL that is being employed is based upon the Wald F-statistic value that represents the long-run cointegration with null hypothesis of no-cointegration as H0: δ1=δ2=δ3=δ4=δ5=0. And, the alternative hypothesis H1: δ1#δ2#δ3#δ4#δ5#0. Similarly, the preceding mechanism can be used to explain the rest of the Eqs. (2–7) to show the long-run relationship of the variables.

Once the long-run cointegration established and confirmed through F-statistic, the next step of the modeling would be the estimation of short-run coefficients; similarly, to estimate the short-run associations of the variables, the following short-run models were employed.

Equation (8) is the mathematical representation of short-run model; in the short-run equation, ECT is the error correction mechanism and the coefficient of an error correction term is represented by η1 in the equation. The error correction term (ECT) basically shows that if there is any disturbance, how much time the system will take for reaching back to its equilibrium path in the long term? Similarly, the preceding mechanism can be used to explain the rest of the equations (Eqs. 8–13). And also, the same pattern can be utilized to explain ECT for rest of the short-run equations (Eqs. 9–13). The method of Brown et al. (1975) is utilized to check the stability of short-run and long-run coefficients. As Brown et al. (1975), method shows CUSUM and CUSUMSQ can be used to check the stability of coefficients; the study also checked the stability of coefficients using CUSUM and CUSUMSQ.

Data and variables

The data used for analysis covers the period from 1985–2017. Innovation was measured using the sum of patent applications by the residents and patent applications by nonresidents. Economic growth is measured using GDP per capita (constant 2010 US$). Foreign direct investment is used as FDI net inflows (% of GDP). Trade openness has been taken as a summation of imports of goods and services (% of GDP) and exports of goods and services (% of GDP). The data of growth, innovation, trade, and FDI is taken from highly reliable database of World Bank (World Development Indicators). CO2 emissions have been taken as a proxy of environmental degradation. The data for CO2 emissions has been gathered from the database of Carbon Dioxide Information Analysis Center, Oak Ridge National Laboratory, and the US Department of Energy. Prior to employing the model, all the variables were transformed into their natural logarithms.

Empirical findings

Unit root testing

Although the application of ARDL model does not require all the variables to be single ordered stationary, it must be confirmed prior to the application of ARDL bound testing approach that none of the variable is second order stationary. This is because the critical values of F-statistics depend on the I(0) or I (1) characteristics of time series in ARDL model. Thus, to confirm the stationary characteristics of time series, the study employed Augmented Dickey-Fuller and Phillips-Perron unit root test. The summary of results from each test is shown in Table 1.

The results from unit root testing from both tests (i.e., ADF and PP) confirm that LnCO2, LnINN, LnTROP, LnFDI, and LnEG are stationary at I(0) and I(1). Similarly, it satisfies the precondition of ARDL model that all the variable must be stationary at I(0), I(1), or mix of these. Although ARDL model can be employed to check the f and long-run relation among the variables, the time series data may contain structural breaks, and therefore, it is required to employ structural breaks unit root test along with the simple unit root test. Thus, to check the structural breaks in the data, we employed Kim and Perron (2009) structural breaks unit root test. Results from structural breaks unit root test are represented in Table 2.

Application of ARDL model

As it is discussed in the previous part, the cointegration using ARDL method is based on F-statistic. The ARDL model estimate long-run cointegration with null hypothesis of no-cointegration as H0: δ1=δ2=δ3=δ4=δ5=0. And the alternative hypothesis H1: δ1#δ2#δ3#δ4#δ5#0. The study of Pesaran et al. (2001) reported a pair of critical values at different levels of significance: one with a hypothetically assumed that variables are I(0) and the other assuming variables as I(1). If the F-statistic value is higher than the critical value, the null hypothesis indicating no-cointegration will be rejected, and there is a long-run cointegration among the variables. If the value of F-statistic is below the critical value of lower bound, then null hypothesis of no-cointegration cannot be rejected which means there is no cointegration relationship among the variables. If the value of F-statistic is in-between the lower and upper bound, the results would be inconclusive. Moreover, Banerjee et al. (1998) suggest that error correction term (ECT) can be used to establish the cointegration relationship. Accordingly, if the coefficient of ECT is negative and significant, it indicates that there is a significant relationship in the long-run.

As the first step of ARDL estimation is lag selection criteria, the number of observations in this study are 33 observations (1985–2017), previous studies show that AIC lag selection criteria is appropriate for small sample size. Similarly, keeping in view the small sample size, the study also used the AIC lag selection criteria. The results from lag selection are presented in Table 3. Following the appropriate lag selection, the F-statistic has been calculated. F-statistic is shown in Table 4.

The F-statistic results from bound testing are presented in Table 4. Results show that calculated F-statistic value is 5.156148 which is higher than the critical value of upper bound at 1% level of significance. Therefore, the null hypothesis of no-cointegration is rejected indicating that there is a long-run cointegration among CO2 emissions, innovation, economic growth, foreign direct investment, energy consumption, and trade openness.

To further ensure the long-run cointegration among the target variables, we used another cointegration technique, i.e., Johansen cointegration technique. In spite of the limitations of this technique, it is widely used. The core purpose of employing this technique over here is to further confirm the cointegration relation. The results from Johansen cointegration technique are presented in Table 5.

Once F-statistic confirmed the long-run cointegration through both of the techniques, the long-run estimation from ARDL model can be used for interpretation. Similarly, the F-statistic and Johansen cointegration results have confirmed the cointegration among CO2 emissions, innovation, economic growth, foreign direct investment, energy consumption, and trade openness in the context of India. Therefore, the long-run results from ARDL bound testing are being used for interpretation. Table 6 shows the results estimated through ARDL bound testing approach under AIC lag selection criteria. The relationship between FDI and CO2 emission is significant at 5% level. The coefficient is negative which is indicating that higher the FDI will result in lower the CO2 emissions. Based upon the coefficient, it can be said that in the context of India, 1% increase in FDI will result in 0.03% decrease in CO2 emissions. Even though it is a very small effect, the negative coefficient tells that somehow the foreign direct investment may result in decreasing CO2 emissions in India. The relationship between EG and CO2 emissions is significant at 1% level and coefficient is positive. Results indicate that 1% change in economic growth will outcome in 0.60% growth in CO2 emissions. These show that rapid economic growth of India has brought huge increase in CO2 emissions which have worsened the environment of India and its surrounding countries. It shows that India has not reached the EKC turning point of income level, and thus economic growth is resulting in huge CO2 emissions which are creating environmental degradation. Moreover, the relationship between innovation and CO2 emission is significant at 5% level. The coefficient is negative which is indicating that higher the rate of innovation will result in lower the CO2 emissions. Based upon the coefficient, it can be said that in the context of India, 1% increase in innovation level will result in 0.13% decrease in CO2 emissions. Even though, it is a small effect, in the long run, it provides a guiding significance for concerned authorities. Furthermore, the results from the effects of trade openness on CO2 emissions are significant at 5% level and the coefficient is also positive similar to economic growth. It shows that about 1% increase in trade is resulting 0.11% growth in CO2 emissions. It can be stated that India is achieving more trade and economic growth at the cost of environmental degradation. Finally, the results from the effects of energy consumption on CO2 emissions are significant at 1% level and the coefficient is also positive similar to economic growth and trade openness. It shows that about 1% increase in energy consumption is resulting 2.06% growth in CO2 emissions. It can be stated that the main culprit behind increasing CO2 emissions in India is energy consumption. India is achieving more trade and economic growth at the cost of environmental degradation. This study also uses iterative GMM and FMOLS methods for robust analysis. These two techniques cover the issue of endogeneity problem among the variables (Dogan and Seker 2016; Fei et al. 2011; Sinha et al. 2019). Table 7 represents the results of Iterative GMM and FMOLS methods.

Once the long-run coefficients of cointegration equation has been estimated, the next step is to measure error correction term (ECT). In this study, an ARDL-based error correction model is estimated to study the short-run dynamic adjustment relation of explanatory variables with CO2 emissions as it can be seen in Eq. (7).

In the short-run model, Eq. (7), ECTt − i represents error correction term and η1 is used for its coefficient. When the equilibrium relationship among the variables deviates from its long-run equilibrium path, the ECT is basically the adjusted time that model will take to reach back to its equilibrium state in the long run. The error correction model employing ARDL approach is used to measure the short-run dynamic relationship among CO2 emissions, innovation, foreign direct investment, trade openness, and economic growth. The results are shown in Table 6. The influence of foreign direct investment on CO2 emissions is insignificant in the short run, which shows that the foreign investment in India is coming to those sectors that are not harmful for the environment in the short run. The relationship of economic growth and CO2 emissions is also negative in the short run, and insignificant. The short-run coefficient of the influence of economic growth on CO2 emissions is smaller and negative as compare with the long-run coefficient that is positive, which shows that India is trying to reduce the impact of economic growth on CO2 emissions through effective policies in the short run. It can be seen that the coefficient of innovation on CO2 emissions is negative, but insignificant. Even though results are insignificant in the short-run, the negative coefficient indicates that innovation is beneficial to deal with environmental pollution via decreasing CO2 emissions. Thus, attracting more foreign direct investment and boosting innovation can trigger India toward low carbon economy. Trade openness also has negative impact on CO2 emissions, and it is significant at 1% level. However, the short-run coefficient is opposite to the long-run coefficient, indicating that India is trying to reduce the impact of trade openness on CO2 emissions through effective policies in the short run. In context of energy consumption variable, the similar trend has been seen in short run and long run. It is worth mentioning that coefficient of error correction term (ECT) is negative and significant at 1% level. A negative coefficient of error correction term (ECT) indicates the viability to achieve long-term equilibrium. The coefficient of ECT shows the rate of adjustment back to long-run equilibrium path. Based upon the estimations, it can be said that when economy fluctuates from its equilibrium path, CO2 emissions can return to a long-run equilibrium. The ECT coefficient 0.51 shows that 51% adjustments occur during a year.

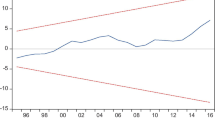

Once the model has been developed and coefficients have been estimated, it is highly significant to check the appropriateness and stability of the model. To this end, to check the overall fitting of the model, we used RESET test, LM test, Breusch-Pagan-Godfrey, R2, adjusted R2, F-statistic, and Durban Watson test. The values R2 and adjusted R2 closer to 1 and significant F-statistic represent the overall fitting of the model is appropriate. The Durban Watson statistics also indicate that model is correctly specified. To determine the serial correlation in estimated model, we employed Breauch-Godfrey LM test. The insignificant results of Breauch-Godfrey LM test have confirmed that there is no serial correlation. Null results of Jarque-Bera test confirm the normality. Finally, Breusch-Pagan-Godfrey heteroscedasticity null is no heteroscedasticity. Overall, it can be stated that model is appropriately specified and the results can be used for policy formulation. To check the stability of the coefficients, we employed CUSUM and CUSUMSQ introduced by Brown et al. (1975).

The stability of the coefficients was investigated using CUSUM and CUSUMSQ. The null hypothesis of the graph model is correctly specified and parameters are stable. And the alternative hypotheses used to represent parameters are not stable. The null hypothesis was designed using mechanism of Brown et al. (1975) which states that if graph remains within the bounds at 5% significant level then model can be said as correctly specified and coefficients are stable. On the other hand, if the graph does not remain within the bounds at 5% significant level, it can be stated that coefficients are not stable. Figures 1 and 2 represent the CUSUM and CUSUMSQ respectively for the estimated model. It can be seen that graph remains within the bounds at 5% significant level which further confirms stability of the coefficients and the reliability of the estimates.

Δ indicates the first difference; *, **, and *** indicate the significant level at 10%, 5%, and 1% respectively; t values are mentioned in brackets, and p values are mentioned in parenthesis

VECM test results are represented in Table 8 which indicates the result of long-run and short-run causality. First, we discuss the long-run causality relation among the variables and later we will discuss the short-run results. As we can notice, the feedback relationship exists between emissions and FDI. The relationship between carbon emissions and innovation is bidirectional. It means that carbon emissions Granger causes innovation and in return innovation also Granger causes emissions at 1 percent significance level. Similarly, the bidirectional relationship found between carbon emissions and trade openness. It implies that both affect each other in the long-run causality sense. Our results indicate a feedback link between carbon emissions and energy use. The similar relationship found between FDI and innovation for India. The association between FDI and trade openness is also bidirectional. FDI Granger causes energy consumption and in response, energy use also Granger causes FDI in the long run. The relationship among innovation, trade openness, and energy use is bidirectional at 1 and 5% significance level. A unidirectional relationship found is coming from GDP to emissions, FDI, innovation, trade, and energy use.

In the short run, the unidirectional link was found which is coming from FDI, innovation, and energy use to carbon emission at 5% significance level. However, the relationship between emissions and trade openness is bidirectional. FDI Granger causes trade openness and this type of relationship is unidirectional. Similarly, innovation effects economic growth in the Granger sense, but economic growth Granger causes trade openness at 1% significance level. The results indicate that unidirectional association is coming from trade openness to innovation. The bidirectional link exists between innovation and energy use.

Discussion

The impact of technological innovation on CO2 emission is found to be negative. Our results are consistent with the study of Fernández et al. (2018), which has indicated that economic growth achieved through technological progress would result in reducing environmental pollution. The endogenous growth theory supports the argument, as the theory considers that technological progress improves the capability of a nation to replace the polluting resources with other environmentally friendly resources. Moreover, Cheng et al. (2018) also found similar thoughts and indicated that technical progress significantly influences carbon intensity among provinces in China. Due to the important role of technical progress, it can be believed that upgradation and optimization of industrial structure is conducive to reduce carbon emissions in the country. Zameer et al. (2020) indicated the role of green innovations for cleaner production in China which is conducive to upgrade industrial structure. Álvarez-Herránz et al. (2017) also indicate the role of innovations and highlighted the importance of energy innovations for the improvement of environmental quality. Furthermore, Dauda et al. (2019) also found that technological advancement plays a significant role in pollution reduction. Our results are also in line with the studies of Fernández et al. (2018), Long et al. (2018), Shahbaz et al. (2020), and Wang and Ang (2018). However, our results are different from the study of Fan and Hossain (2018) which shows that technological advancement has insignificant influence on CO2 emissions.

The global research on the linkage of FDI and CO2 emissions has given mixed empirical findings (Shahbaz et al. 2015). In addition, in the studies of Peng et al. (2016) and Zhang and Zhou (2016), most of the research related to FDI has been focused on developed countries and the research on exploring the linkage between FDI and carbon emissions in context of developing countries especially for India (one of the larger attracter of FDI) is relatively small. Similarly, our study extends the scholarly research and fills the said research gap. The assessment in this paper has indicated that foreign direct investment has a significant impact on carbon emission in India. Our results are in line with the previous studies of Blanco et al. (2013) and Salahuddin et al. (2018) which indicated that FDI stimulates the carbon emissions. Our results are also similar to the study of Bakhsh et al. (2017) that has shown that FDI has significant negative impact on carbon emissions in Pakistan. Our results are in contrast with the study of Merican et al. (2007) which found that there is no impact of foreign direct investment on carbon emission in the context of Singapore. Our results are also contrary with the study of Hille et al. (2019) which explored the impact of FDI on air pollutions in Korea and found that FDI stimulates regional economic growth and reduces air pollution.

The results further showed that economic growth stimulates CO2 emissions in India. Our results are consistent with the recent studies of Chen et al. (2019) and Yasmeen et al. (2020). This shows that rapid economic growth of India has brought huge increase in CO2 emissions which has worsened the environment of India and its surrounding countries. It shows that India has not reached the EKC turning point of income level, and thus economic growth is resulting in huge CO2 emission, which is creating environmental degradation. Finally, the results from the effects of trade openness on CO2 emissions are also significantly positive similar to economic growth. Our results are similar to the studies of Munir and Ameer (2018), Shahzad et al. (2017), and Stretesky and Lynch (2009) that show carbon emissions and trade have positive relationship. However, our results are contrary to the study of Shahbaz et al. (2013) which indicates that trade openness improves environmental quality.

Conclusion and policy implications

The study employed ARDL technique to explore the nexus of innovation–environment and growth in India. The long-run and short-run estimations of the results have indicated that technological innovation has significant negative impact on CO2 emissions. It shows that for India, increasing the level of technological advancement is conducive for reducing CO2 emissions. Furthermore, the impact of foreign direct investment on CO2 emissions is significant in in the long run. These significant results of the effects of foreign direct investment on CO2 emission in the long run give some guiding significance. Similarly, the negative coefficients tell that to some extent the foreign direct investment may results in decreasing CO2 emissions in India. Moreover, the relationship between economic growth and CO2 emissions is significant and coefficient is positive. This shows that rapid economic growth of India has brought huge increase in CO2 emissions which have worsened the environment of India and its surrounding countries. It shows that India has not reached the EKC turning point of income level, and thus economic growth is resulting in huge CO2 emission, which is creating environmental degradation.

Further interrogation of empirical findings shows that the short-run coefficient is lower and negative compared with the long-run coefficient which means that current economic growth has lowered the emissions level. Thus, it can be concluded that India’s current economic growth is better for the environment compared with the economic growth in the past. Moreover, the results from the effects of trade openness on CO2 emissions were significant with positive coefficient. It can be concluded that India is achieving more trade and economic growth at the cost of environmental degradation in the long run. Finally, the results from the effects of energy consumption on CO2 emissions are significant and positive similar to economic growth and trade openness. The effect is highest compared with other factors; therefore, it can be concluded that the main reason behind increasing CO2 emissions in India is energy consumption. Moreover, India is achieving more trade and economic growth at the cost of environmental degradation.

Based on the results of the study, certain policy implications emerge. In order to devise a policy framework, the policymakers first target the energy consumption pattern, as this is the primary driver of economic growth. The government should consider a phase-wise transition of fossil fuel-based energy solutions to renewable energy solutions, and in this pursuit, the policymakers should target the households in the first phase, and the industrial sector in the second phase. In the first phase, the households can be provided with the renewable energy solutions at a pro-rata discounted rate, based on the income level of that particular household. This particular initiative by the government might lead to incurring of losses, which might be recovered in the second stage. In this stage, the industrial sector will be provided with renewable energy solutions, which will be priced comparatively higher than those of the households. The pro-rata rate of the solutions will be based on the level of environmental degradation caused by those industries, or firms, in specific. For acquiring these solutions, the availability of credit will be ascertained by the financial institutions, and rate of interest on the credit will also depend on the carbon footprint of the firm. This mechanism will act as a sin tax for fossil fuel-based solutions, and this will gradually encourage the firms to use renewable energy solutions.

While these initiatives will be put in place, it should be remembered that it might not be possible for the existing renewable energy infrastructure to cater to the demand for renewable energy, as the fossil fuel solutions will be replaced gradually. In such a situation, the capability for R&D in the nation might be utilized for the development of renewable energy solutions, so that those can be deployed across the nation. Until these endogenous solutions are in place, the policymakers should rely on the trade route and FDI for technology transfer. These initiatives should be complementary to the policy initiatives carried out in the first two phases. Following the FDI route, the government should ponder upon the technological developments carried out by the international firms, so that those can be used in the manufacturing processes in India. Moreover, the international firms already operating in India should be asked to contribute towards the initiative to promote renewable energy solutions. Though in this process, firms might incur some short-term losses owing to the higher implementation and replacement costs, it might provide them with a long-term sustainable solution. In order to sustain this solution, the government should restrict the trade route for importing polluting technologies. Also, gradual development of endogenous R&D-based renewable energy solutions might prove to be a viable replacement for the crude oil import. Majorly the crude oil import in India has an impact on economic growth and environmental quality, and the import substitution for crude oil might encourage the firms to choose renewable energy solutions. Thereby, FDI and trade route might be able to complement the policy decisions.

In order to bring a legislative dimension in the policy framework, government might necessitate the enforcement of environmental regulations for bringing down the level of environmental degradation. Along with these legislations, the government should also monitor the level of energy efficiency maintained by the industries, and replicate the best practices across the nation. While recommending this initiative, it should also be remembered that the laws and legislations might provide the desired output, when the primary policy framework is in the place. Lastly, the government should encourage trade in services, as the carbon footprint of this industry is comparatively lower than that of the manufacturing sector.

References

Adeel Farooq MR, Bakar A, Aznin N, Raji O, Jimoh (2018) Green field investment and environmental performance: a case of selected nine developing countries of Asia. Environ Prog Sustain Energy 37(3):1085–1092

Ahmad N, Du L, Lu J, Wang J, Li H-Z, Hashmi MZ (2017) Modelling the CO2 emissions and economic growth in Croatia: is there any environmental Kuznets curve? Energy 123:164–172

Álvarez-Herránz A, Balsalobre D, Cantos JM, Shahbaz M (2017) Energy innovations-GHG emissions nexus: fresh empirical evidence from OECD countries. Energy Policy 101:90–100

Ansari MA, Khan NA, Ganaie AA (2019) Does foreign direct investment impede environmental quality in Asian countries? A panel data analysis. OPEC Energy Rev

Antweiler W, Copeland BR, Taylor MS (2001) Is free trade good for the environment? Am Econ Rev 91(4):877–908

Aydemir O, Zeren F (2017) The impact of foreign direct investment on CO2 emission: evidence from selected G-20 countries. In: Handbook of research on global enterprise operations and opportunities. IGI Global, pp 81–92

Bakhsh K, Rose S, Ali MF, Ahmad N, Shahbaz M (2017) Economic growth, CO2 emissions, renewable waste and FDI relation in Pakistan: new evidences from 3SLS. J Environ Manag 196:627–632

Balsalobre-Lorente D, Shahbaz M, Roubaud D, Farhani S (2018) How economic growth, renewable electricity and natural resources contribute to CO2 emissions? Energy Policy 113:356–367

Banerjee A, Dolado J, Mestre R (1998) Error-correction mechanism tests for cointegration in a single-equation framework. J Time Ser Anal 19(3):267–283

Bento JPC, Moutinho V (2016) CO2 emissions, non-renewable and renewable electricity production, economic growth, and international trade in Italy. Renew Sust Energ Rev 55:142–155

Blanco L, Gonzalez F, Ruiz I (2013) The impact of FDI on CO2 emissions in Latin America. Oxf Dev Stud 41(1):104–121

Brown RL, Durbin J, Evans JM (1975) Techniques for testing the constancy of regression relationships over time. J R Stat Soc Ser B Methodol 37(2):149–163

Cai Y, Sam CY, Chang T (2018) Nexus between clean energy consumption, economic growth and CO2 emissions. J Clean Prod 182:1001–1011

Chen W, Lei Y (2018) The impacts of renewable energy and technological innovation on environment-energy-growth nexus: new evidence from a panel quantile regression. Renew Energy 123:1–14

Chen Y, Wang Z, Zhong Z (2019) CO2 emissions, economic growth, renewable and non-renewable energy production and foreign trade in China. Renew Energy 131:208–216

Cheng Z, Li L, Liu J (2018) Industrial structure, technical progress and carbon intensity in China’s provinces. Renew Sust Energ Rev 81:2935–2946

Churchill SA, Inekwe J, Smyth R, Zhang X (2019) R&D intensity and carbon emissions in the G7: 1870–2014. Energy Econ 80:30–37

Dauda L, Long X, Mensah CN, Salman M (2019) The effects of economic growth and innovation on CO 2 emissions in different regions. Environ Sci Pollut Res 26(15):15028–15038

Dogan E, Seker F (2016) The influence of real output, renewable and non-renewable energy, trade and financial development on carbon emissions in the top renewable energy countries. Renew Sust Energ Rev 60:1074–1085

Erdoðan S, Yýldýrým DÇ, Gedikli A (2019) Investigation of causality analysis between economic growth and CO2 emissions: the case of BRICS–T countries. Int J Energy Econ Policy 9(6):430–438

Erdoğan S, Gedikli A, Kırca M (2019) A note on time-varying causality between natural gas consumption and economic growth in Turkey. Res Policy 64:101504

Erdoǧan S, Gedikli A, Yılmaz AD, Haider A, Zafar MW (2019) Investigation of energy consumption–economic growth nexus: a note on MENA sample. Energy Rep 5:1281–1292

Erdoğan S, Çevik Eİ, Gedikli A (2020) Relationship between oil price volatility and military expenditures in GCC countries. Environ Sci Pollut Res:1–13

Fan H, Hossain MI (2018) Technological innovation, trade openness, CO2 emission and economic growth: comparative analysis between China and India. Int J Energy Econ Policy 8(6):240

Fei L, Dong S, Xue L, Liang Q, Yang W (2011) Energy consumption-economic growth relationship and carbon dioxide emissions in China. Energy Policy 39(2):568–574

Fernández YF, López MF, Blanco BO (2018) Innovation for sustainability: the impact of R&D spending on CO2 emissions. J Clean Prod 172:3459–3467

Ganda F (2019) The impact of innovation and technology investments on carbon emissions in selected organisation for economic Co-operation and development countries. J Clean Prod 217:469–483

Hasanov F, Bulut C, Suleymanov E (2017) Review of energy-growth nexus: a panel analysis for ten Eurasian oil exporting countries. Renew Sust Energ Rev 73:369–386

Heidari H, Katircioğlu ST, Saeidpour L (2015) Economic growth, CO2 emissions, and energy consumption in the five ASEAN countries. Int J Electr Power Energy Syst 64:785–791

Hille E, Shahbaz M, Moosa I (2019) The impact of FDI on regional air pollution in the Republic of Korea: a way ahead to achieve the green growth strategy? Energy Econ 81:308–326

Jiang L, Zhou H-F, Bai L, Zhou P (2018) Does foreign direct investment drive environmental degradation in China? An empirical study based on air quality index from a spatial perspective. J Clean Prod 176:864–872

Karasoy A, Akçay S (2019) Effects of renewable energy consumption and trade on environmental pollution: the Turkish case. Management of Environmental Quality: An International Journal 30(2):437–455

Kim D, Perron P (2009) Assessing the relative power of structural break tests using a framework based on the approximate Bahadur slope. J Econ 149(1):26–51

Koçak E, Şarkgüneşi A (2018) The impact of foreign direct investment on CO2 emissions in Turkey: new evidence from cointegration and bootstrap causality analysis. Environ Sci Pollut Res 25(1):790–804

Ling CH, Ahmed K, Muhamad RB, Shahbaz M (2015) Decomposing the trade-environment nexus for Malaysia: what do the technique, scale, composition, and comparative advantage effect indicate? Environ Sci Pollut Res 22(24):20131–20142

Liu Y, Hao Y, Gao Y (2017) The environmental consequences of domestic and foreign investment: evidence from China. Energy Policy 108:271–280

Liu Q, Wang S, Zhang W, Zhan D, Li J (2018) Does foreign direct investment affect environmental pollution in China’s cities? A spatial econometric perspective. Sci Total Environ 613:521–529

Long X, Luo Y, Wu C, Zhang J (2018) The influencing factors of CO 2 emission intensity of Chinese agriculture from 1997 to 2014. Environ Sci Pollut Res 25(13):13093–13101

Lv Z, Xu T (2019) Trade openness, urbanization and CO2 emissions: dynamic panel data analysis of middle-income countries. J Int Trade Econ Dev 28(3):317–330

Mahmood H, Maalel N, Zarrad O (2019) Trade openness and CO2 emissions: evidence from Tunisia. Sustainability 11(12):3295

Mazumdar D, Bhattacharjee M, Chowdhury JR (2019) Trade and environment nexus: a theoretical appraisal. In: Handbook of research on economic and political implications of green trading and energy use. IGI Global, pp 1–17

McNown R, Sam CY, Goh SK (2018) Bootstrapping the autoregressive distributed lag test for cointegration. Appl Econ 50(13):1509–1521

Merican Y, Yusop Z, Noor ZM, Hook LS (2007) Foreign direct investment and the pollution in five ASEAN nations. Int J Econo Manage 1(2):245–261

Munir K, Ameer A (2018) Effect of economic growth, trade openness, urbanization, and technology on environment of Asian emerging economies. Management of Environmental Quality: An International Journal 29(6):1123–1134

Narayan PK (2005) The saving and investment nexus for China: evidence from cointegration tests. Appl Econ 37(17):1979–1990

Omri A, Euchi J, Hasaballah AH, Al-Tit A (2019) Determinants of environmental sustainability: evidence from Saudi Arabia. Sci Total Environ 657:1592–1601

Paramati SR, Ummalla M, Apergis N (2016) The effect of foreign direct investment and stock market growth on clean energy use across a panel of emerging market economies. Energy Econ 56:29–41

Pedroni P (1999) Critical values for cointegration tests in heterogeneous panels with multiple regressors. Oxf Bull Econ Stat 61(S1):653–670

Peng H, Tan X, Li Y, Hu L (2016) Economic growth, foreign direct investment and CO2 emissions in China: a panel Granger causality analysis. Sustainability 8(3):233

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J Appl Econ 16(3):289–326

Rana R, Sharma M (2019) Dynamic causality testing for EKC hypothesis, pollution haven hypothesis and international trade in India. J Int Trade Econ Dev 28(3):348–364

Salahuddin M, Alam K, Ozturk I, Sohag K (2018) The effects of electricity consumption, economic growth, financial development and foreign direct investment on CO2 emissions in Kuwait. Renew Sust Energ Rev 81:2002–2010

Salahuddin M, Gow J, Ali MI, Hossain MR, Al-Azami KS, Akbar D, Gedikli A (2019) Urbanization-globalization-CO2 emissions nexus revisited: empirical evidence from South Africa. Heliyon 5(6):e01974

Schmandt J, Wilson R (2018) Growth policy in the age of high technology, vol 46. Routledge

Shahbaz M, Tiwari AK, Nasir M (2013) The effects of financial development, economic growth, coal consumption and trade openness on CO2 emissions in South Africa. Energy Policy 61:1452–1459

Shahbaz M, Nasreen S, Abbas F, Anis O (2015) Does foreign direct investment impede environmental quality in high-, middle-, and low-income countries? Energy Econ 51:275–287

Shahbaz M, Nasir MA, Roubaud D (2018) Environmental degradation in France: the effects of FDI, financial development, and energy innovations. Energy Econ 74:843–857

Shahbaz M, Balsalobre-Lorente D, Sinha A (2019) Foreign direct investment–CO2 emissions nexus in Middle East and North African countries: importance of biomass energy consumption. J Clean Prod 217:603–614

Shahbaz M, Raghutla C, Song M, Zameer H, Jiao Z (2020) Public-private partnerships investment in energy as new determinant of CO2 emissions: the role of technological innovations in China. Energy Econ 104664

Shahzad SJH, Kumar RR, Zakaria M, Hurr M (2017) Carbon emission, energy consumption, trade openness and financial development in Pakistan: a revisit. Renew Sust Energ Rev 70:185–192

Sinha A, Shahbaz M, Balsalobre D (2019) Data selection and environmental Kuznets curve models-environmental Kuznets curve models, data choice, data sources, missing data, balanced and unbalanced panels. In: Environmental Kuznets Curve (EKC). Elsevier, pp 65–83

Solarin SA, Al-Mulali U, Musah I, Ozturk I (2017) Investigating the pollution haven hypothesis in Ghana: an empirical investigation. Energy 124:706–719

Stern DI, Common MS, Barbier EB (1996) Economic growth and environmental degradation: the environmental Kuznets curve and sustainable development. World Dev 24(7):1151–1160

Stretesky PB, Lynch MJ (2009) A cross-national study of the association between per capita carbon dioxide emissions and exports to the United States. Soc Sci Res 38(1):239–250

Tam VW, Le KN, Tran CN, Illankoon ICS (2019) A review on international ecological legislation on energy consumption: greenhouse gas emission management. International Journal of Construction Management:1–12

Wang H, Ang B (2018) Assessing the role of international trade in global CO2 emissions: an index decomposition analysis approach. Appl Energy 218:146–158

Wang S, Li Q, Fang C, Zhou C (2016) The relationship between economic growth, energy consumption, and CO2 emissions: empirical evidence from China. Sci Total Environ 542:360–371

Wang B, Sun Y, Wang Z (2018) Agglomeration effect of CO2 emissions and emissions reduction effect of technology: A spatial econometric perspective based on China’s province-level data. Journal of Cleaner Production 204:96–106

Westerlund J (2007) A panel CUSUM test of the null of cointegration. Oxf Bull Econ Stat 67(2):231–262

Yasmeen H, Wang Y, Zameer H, Solangi YA (2019) Does oil price volatility influence real sector growth? Empirical evidence from Pakistan. Energy Rep 5:688–703

Yasmeen H, Wang Y, Zameer H, Solangi YA (2020) Decomposing factors affecting CO2 emissions in Pakistan: insights from LMDI decomposition approach. Environ Sci Pollut Res 27(3):3113–3123

Yii K-J, Geetha C (2017) The nexus between technology innovation and CO2 emissions in Malaysia: evidence from Granger causality test. Energy Procedia 105:3118–3124

Yu Y, Du Y (2019) Impact of technological innovation on CO2 emissions and emissions trend prediction on ‘New Normal’economy in China. Atmospheric Pollut Res 10(1):152–161

Yusuf M, Sabara Z, Wekke IS (2018) Role of innovation in testing environment kuznets curve: a case of indonesian economy. Int J Energy Econ Policy 9(1):276–281

Zameer H, Wang Y, Yasmeen H (2019) Transformation of firm innovation activities into brand effect. Mark Intell Plan 37(2):226–240

Zameer H, Wang Y, Yasmeen H (2020) Reinforcing green competitive advantage through green production, creativity and green brand image: implications for cleaner production in China. J Clean Prod 247:119119

Zhang C, Zhou X (2016) Does foreign direct investment lead to lower CO2 emissions? Evidence from a regional analysis in China. Renew Sust Energ Rev 58:943–951

Zhang S, Liu X, Bae J (2017) Does trade openness affect CO 2 emissions: evidence from ten newly industrialized countries? Environ Sci Pollut Res 24(21):17616–17625

Funding

This work was received funding from the College of Economics and Management, Nanjing University of Aeronautics and Astronautics, and is supported by the Young Teachers Research Supporting fund Project number (1009-56SYAH19058).

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible editor: Nicholas Apergis

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Zameer, H., Yasmeen, H., Zafar, M.W. et al. Analyzing the association between innovation, economic growth, and environment: divulging the importance of FDI and trade openness in India. Environ Sci Pollut Res 27, 29539–29553 (2020). https://doi.org/10.1007/s11356-020-09112-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-020-09112-5