Abstract

This paper studies comparative static effects in a portfolio selection problem when the investor has mean-variance preferences. Since the security market is complex, there exists the situation where security returns are given by experts’ estimates when they cannot be reflected by historical data. This paper discusses the problem in such a situation. Based on uncertainty theory, the paper first establishes an uncertain mean-variance utility model, in which security returns and background asset returns are uncertain variables and subject to normal uncertainty distributions. Then, the effects of changes in mean and standard deviation of uncertain background asset on capital allocation are discussed. Furthermore, the influence of initial proportion in background asset on portfolio investment decisions is analyzed when investors have quadratic mean-variance utility function. Finally, the economic analysis illustration of investment strategy is presented.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

Mean-variance utility framework is an important method for rational portfolio investment choice under risk. The mean-variance utility decision criterion hypothesizes that an investor’s optimal choice is made by ranking alternatives through a preference function defined over the first and second moments of random payoff. Since the studies of Tobin (1958) and Chipman (1973), this decision-making framework has received prominent attention and been widely applied in theoretical and empirical research. The mean-variance utility framework is impressive because of its simplicity and ease of handling.

In recent years, a large number of research results have been presented based on mean-variance utility framework. For example, Lajeri-Chaherli (2003) solves a portfolio problem with a risk free asset and a risky asset by using the partial derivatives of mean-variance utility. However, these research only considers the risks of financial assets themselves. When investors make portfolio investment in financial assets, they often face additional sources of risk, such as exogenous and unhedged risks brought by labor income, health and real estate. These sources of risk are often referred to as background risks and the sources background assets. Therefore, some research based on mean-variance utility with background risk is done. For example, Eichner and Wagener (2003) study the influence of standard deviation increase in a mean-zero background risk on an investor’s willingness to take risk when the investor adopts mean-variance utility framework. Eichner and Wagener (2009) analyze the comparative static effects in a generic, quasi-linear decision problem with endogenous risk and background risk in the mean-variance utility model. Beaud and Willinger (2014) recently show that more than 80% of investors actually reduce the risky investment when being exposed to background risk. Guo et al. (2018) study the comparative static effects of dependent background risk on the banking firm’s risk-taking in the mean-variance utility model. Extensive research indicates that the presence of background risk has a great impact on the optimal portfolio selection decision.

The papers mentioned above treat the security returns as random variables and adopt probability theory as the tool. It is usually assumed that investors have sufficient historical data and the future situation of the security returns can be reflected by the information in the past. However, it cannot always be true. Since security market is complex, it is found that sometimes historical data cannot predict future security returns effectively. Investors must rely on experienced and knowledgeable experts to predict security returns. Therefore, many researchers believe that another method should be found to solve the problem of portfolio selection. With the introduction of fuzzy set theory, researchers have tried employing this methodology to manage portfolio and have produced important achievements. However, it has been found later that paradoxes would occur if we use fuzzy theory to handle humans’ imprecise estimations Liu (2012). In order to better quantitatively describe the subjective imprecision, Liu (2007) proposes an uncertainty theory. With the development of uncertainty theory, applications of uncertainty theory have been widely studied. In the area of portfolio selection, an uncertain portfolio selection theory is initiated by Huang (2010). Afterwards, great progress has been made in this field. For example, Huang (2011) proposes a risk curve model for uncertain portfolio selection. Huang (2012) studies the uncertain mean-variance and mean-semivariance selection models. Later, Qin et al. (2016) propose uncertain mean-semiabsolute deviation adjusting models for portfolio adjusting problem. And Li et al. (2019) study the uncertain dynamic project portfolio selection problem with divisibility. A review on uncertain portfolio selection can be found in paper Huang (2017). In addition, Yao and Ji (2014) first apply uncertainty theory to study the properties of an uncertain expected utility function and apply it to uncertain portfolio solution. However, the literature mentioned above studies uncertain portfolio selection problems which only consider the risk of financial assets and do not consider the background risk. In view of this, Huang and Di (2016) study the uncertain mean-chance portfolio selection model with background risk. Based on the results of Huang and Di (2016), Zhai and Bai (2018) propose an uncertain mean-risk curve model with background risk. Yet scholars haven’t studied the portfolio selection with background risk within the uncertain mean-variance utility framework based on uncertainty theory. Motivated by this, this paper will discuss some properties of the uncertain mean-variance utility model with background risk.

For most portfolio activities, it is usually assumed that investors are risk averse. In this paper, we also assume that investors are risk averse. We will conduct a comprehensive analysis of portfolio selection decision responding to the change of background risk under the mean-variance utility framework. Our contribution is threefold: Firstly, a new mean-variance utility model with background risk is proposed using the uncertainty theory. Secondly, the effects of changes in mean and standard deviation of uncertain background asset on capital allocation are discussed. Finally, the influence of initial proportion in background asset on portfolio investment decisions under quadratic mean-variance utility function is discussed. These contributions can provide good advice to investors who are sensitive to changes of background asset and initial proportions of background asset when making decisions.

This paper proceeds as follows. Section 2 reviews some basic knowledge about uncertainty theory. Section 3 develops a portfolio model with background risk under uncertain mean-variance utility. In Sect. 4, we characterize comparative static effects of changes in mean and standard deviation of uncertain background asset and initial proportion in background asset on optimal risk taking. In Sect. 5, we conduct an economic analysis illustration. Finally, we conclude the results in Sect. 6.

2 Preliminaries

This section introduces some fundamental concepts and properties in uncertainty theory which will be used in the paper.

Definition 1

Let \(\text{ L }\) be a \(\sigma \)-algebra over a nonempty set \(\Gamma \). Each element \(\Lambda \in \text{ L }\) is called an event. A set function \(\text{ M } \{\Lambda \}: \text{ L }\rightarrow [0,1]\) is called an uncertain measure if it satisfies the following axioms (Liu 2007):

-

(i)

(Normality Axiom) \(\text{ M } \{\Gamma \}=1.\)

-

(ii)

(Duality Axiom) \(\text{ M } \{\Lambda \}+\text{ M } \{\Lambda ^c\}=1.\)

-

(iii)

(Subadditivity Axiom) For every countable sequence of events \(\{\Lambda _i\}\),

$$\begin{aligned} \text{ M }\displaystyle \left\{ \bigcup \limits _{i=1}^{\infty }\Lambda _i\right\} \le \sum \limits _{i=1}^{\infty } \text{ M }\{\Lambda _i\}. \end{aligned}$$In order to provide the operational law, Liu (2009) defines the product uncertain measure on the product \(\sigma \)-algebra \(\text{ L }\), called product axiom.

-

(iv)

(Product Axiom) Let \((\Gamma _k, \text{ L}_k, \text{ M}_k)\) be uncertainty spaces for \(k=1, 2, \cdots \). The product uncertain measure \(\text{ M }\) is an uncertain measure satisfying

$$\begin{aligned} \displaystyle \text{ M }\left\{ \prod \limits _{k=1}^{\infty }\Lambda _k\right\} =\bigwedge \limits _{k=1}^{\infty }\text{ M}_k \{\Lambda _k\}, \end{aligned}$$where \(\Lambda _k\) are arbitrarily chosen events from \( \text{ L}_k\) for \(k=1, 2, \ldots \), respectively.

Definition 2

(Liu 2007) An uncertain variable \(\xi \) is a function from an uncertainty space \((\Gamma , \text{ L }, \text{ M})\) to the set of real numbers such that for any Borel set of B of real numbers, the set

is an event.

An uncertain variable is characterized by an uncertainty distribution function. The uncertainty distribution \(\Phi : \mathfrak {R}\rightarrow [0,1]\) of an uncertain variable \(\xi \) is defined as \(\Phi (t)= \text{ M }\{\xi \le t\},\,\, t\in \mathfrak {R}.\) If an uncertainty distribution \(\Phi (t)\) has inverse function, we call it the inverse uncertainty distribution of \(\xi .\)

An uncertain variable \(\xi \) is called normal if it has an uncertainty distribution

In this paper, we denote it by \({\mathcal {N}}(e, \sigma )\), where e and \(\sigma \) are real numbers and \(\sigma >0\).

The operational law is given by Liu (2010) as follows:

Theorem 1

(Liu 2010) Let \(\xi _1, \xi _2, \cdots , \xi _n\) be independent uncertain variables whose inverse uncertainty distributions exist and are \(\Phi ^{-1}_1, \Phi ^{-1}_2,\cdots , \Phi ^{-1}_n,\) respectively. Let \(f(t_1,t_2,\cdots ,t_n)\) be continuous and strictly increasing with respect to \(t_1,t_2,\cdots ,t_n.\) Then

is an uncertain variable with inverse uncertainty distribution

As the average value of an uncertain variable in the sense of uncertain measure, expected value can represent the size of the uncertain variable.

Definition 3

(Liu 2007) Let \(\xi \) be an uncertain variable. Then the expected value of \(\xi \) is defined as

provided that at least one of the two integrals is finite.

Theorem 2

(Liu 2010) Let \(\xi \) be an uncertain variable whose inverse uncertainty distribution \(\Phi ^{-1}\) exists. Then

As another important feature for an uncertain variable, variance is defined as follows:

Definition 4

(Liu 2007) Let \(\xi \) be an uncertain variable with finite expected value e. Then the variance of \(\xi \) is defined by

Theorem 3

(Yao 2015) Let \(\xi \) be an uncertain variable with inverse uncertainty distribution \(\Phi ^{-1}\) and finite expected value e. Then

3 The uncertain mean-variance utility model

An investor’s investment preference for stocks is represented by two-parameter utility function

where \(\sigma _{y}\) and \(\mu _{y}\) denote the standard deviation and the expected value of uncertain final return y, respectively. We assume that the utility function \(U(\sigma _{y}, \mu _{y})\) is at least twice continuously differentiable, increasing with \(\mu _{y}\) and decreasing with \(\sigma _{y}\) (risk aversion), and makes strictly convex indifference curves in the \((\sigma _{y}, \mu _{y})\)-space. Here we represent partial derivatives by subscripts, and the following properties are satisfied for all \((\sigma _{y}, \mu _{y})\in R_{+}\times R:\)

We denote by

the marginal rate of substitution between \(\sigma _{y}\) and \(\mu _{y}\), which measures the slope of \((\sigma _{y}, \mu _{y})\) indifference curves. As shown by Ormiston and Schlee (2001), the slope of \((\sigma _{y}, \mu _{y})\) indifference curves with respect to \(\mu _{y}\) determines whether absolute risk aversion increases or decreases. Meyer (1987) and Lajeri-Chaherli (2003) show that the marginal rate of substitution is decreasing in mean, i.e. \(m_{\mu }(\sigma _{y}, \mu _{y})<0\) if and only if investor’s preferences reflect decreasing absolute risk aversion (DARA).

In this paper, we consider that an investor’s initial wealth is composed of financial assets and background asset. The investment proportion of financial assets is w, and the investment proportion of background asset is \(1-w\). Let \(\xi \) and \(r_{f}\) denote the returns of the risky asset and risk free asset, respectively, z denote return of the background asset, which is independent of the return of the risky asset. Then the final return y of the decision maker is given by

where x and \(1-x\) denote the capital amounts to be invested in the risk free asset and the risky asset, respectively.

For the given formula (9), when both the return of risky asset \(\xi \) and background asset z follow normal uncertainty distributions, i.e., \(\xi \sim {\mathcal {N}}(\mu _{\xi },\sigma _{\xi })\) and \(z\sim {\mathcal {N}}(\mu _{z},\sigma _{z})\), respectively, according to Theorem 1, the inverse uncertainty distribution function of the final return y is

According to Theorem 2, the expected value of final return can be obtained as follows:

Similarly, according to Theorem 3, the variance of final return can be obtained as follows:

Therefore,

Thus, if the investor wants to maximize his/her utility consisting of mean and standard deviation, a portfolio decision model is established as follows:

The optimal investment proportion \(x^{*}\) is determined by the first-order condition

where

The second-order condition for a maximum is satisfied with

Note that the investor in our paper is risk averse, which means he/she is not willing to hold risky assets without risk premium, \(\mu _{\xi }-r_{f}\). Therefore, we get that \(\mu _{\xi }-r_{f}>0\).

4 Comparative statics

Comparative statics is the comparison of two different economic outcomes, before and after a change in some underlying exogenous parameters. Comparative statics for decision problems has long attracted the attention of economists. In this section, we characterize the comparative static effects of changes in distribution parameters of background asset and initial proportion in background asset on investment decisions.

4.1 Changes in the uncertain background risk

Proposition 1

When returns of risky asset and background asset are independent and both follow normal uncertainty distributions, an individual will decrease x of the risk free asset upon an increase in \(\mu _{z}\) if and only if \(m_{\mu }<0\).

Proof

Be aware of the marginal rate of substitution (8), then the first-order condition (13) can be rewritten as

Implicit differentiation of (15) with respect to \(\mu _{z}\) yields

From formulas (7) and (14), we know \(U_{\mu }>0\), \(\phi _{x}(x)<0\). Since \(\sigma _{\xi }>0\), we get \(\frac{\partial x}{\partial \mu _{z}}\) is negative if and only if \(m_{\mu }(\sigma _{y}, \mu _{y})<0\) for all \((\sigma _{y}, \mu _{y})\). \(\square \)

Proposition 2

When returns of risky asset and background asset are independent and both follow normal uncertainty distributions, an individual will increase x of the risk free asset upon an increase in \(\sigma _{z}\) if and only if \(m_{\sigma }>0\).

Proof

By the marginal rate of substitution (8), the first-order condition (13) can be rewritten as the equation (15). Implicit differentiation of (15) with respect to \(\sigma _{z}\) yields

which is positive if and only if \(m_{\sigma }(\sigma _{y}, \mu _{y})>0\) for all \((\sigma _{y}, \mu _{y})\). \(\square \)

These propositions reveal the investors’ investment decisions to changes in the background risk, that is, investors will increase the risky asset proportion when the mean of the background asset increases if and only if their preference manifests as DARA (i.e., \(m_{\mu }(\sigma _{y}, \mu _{y})<0\)) or investors will reduce the risky asset proportion when the standard deviation of the background asset increases if and only if their preference is \(m_{\sigma }(\sigma _{y}, \mu _{y})>0\).

4.2 Changes in parameters and proportion of background asset when the uncertain mean-variance utility function is quadratic

To illustrate the Propositions 1 and 2 , we give a specific example of the utility function. We apply the following utility function which is due to Saha (1997):

The monotonicity and concavity properties (7) require \(\theta >1\) and \(\gamma >1\). For simplicity, we suppose that the mean-variance utility function is

From \(m(\sigma _{y}, \mu _{y})=\frac{\sigma _{y}}{\mu _{y}}\), we obtain

because investors will always require that \(\mu _{y}\) is greater than 0 when they make investment in real life. Then, we derive the following corollary,

Corollary 1

Suppose returns of risky asset and background asset are independent and both follow normal uncertainty distributions. If the investor’s mean-variance utility function is \(\mu _{y}^{2}-\sigma _{y}^{2},\) then

-

(i)

the increase in mean of background asset will decrease the investment in risk free asset, i.e., \(\frac{\partial x}{\partial \mu _{z}}<0\);

-

(ii)

the increase in standard deviation of background asset will increase the investment in risk free asset, i.e., \(\frac{\partial x}{\partial \sigma _{z}}>0\).

Based on the given utility function, the objective function of final return can be written as

Taking the first derivative with respect to x yields

Taking the second derivative with respect to x yields

Letting the first-order condition be zero and solving for x gives

and the second-order condition is less than zero, we get

Taking the derivative with respect to \(\mu _{z}\) yields

Since \(0<w<1\) and \(r_{f}-\mu _{\xi }<0\) and \((r_{f}-\mu _{\xi })^{2}-\sigma _{\xi }^{2}<0\), we get \(\frac{\partial x}{\partial \mu _{z}}<0\). Taking the derivative with respect to \(\sigma _{z}\) yields

From the formulas (23) and (24), we can deduce the relationship between \(\frac{\partial x}{\partial \mu _{z}}\) and w, and the relationship between \(\frac{\partial x}{\partial \sigma _{z}}\) and w, respectively.

Proposition 3

Suppose returns of risky asset and background asset are independent and both follow normal uncertainty distributions. If the investor’s mean-variance utility function is \(\mu _{y}^{2}-\sigma _{y}^{2},\) then

-

(i)

the risk free asset proportion of an increase in \(\mu _{z}\) with respect to w is positive, i.e., \(\frac{\partial x}{\partial \mu _{z}}\) is increasing about w;

-

(ii)

the risk free asset proportion of an increase in \(\sigma _{z}\) with respect to w is negative, i.e., \(\frac{\partial x}{\partial \sigma _{z}}\) is decreasing about w.

Proof

When the decision maker’s uncertain mean-variance utility function is \(\mu _{y}^{2}-\sigma _{y}^{2}\), we can obtain formulas (23) and (24).

-

(i)

In formula (23), let \(k_{1}=\frac{(r_{f}-\mu _{\xi })}{(r_{f}-\mu _{\xi })^{2}-\sigma _{\xi }^{2}}\), then

$$\begin{aligned} \frac{\partial x}{\partial \mu _{z}}=f(w)=-k_{1}\frac{1}{w}+k_{1}. \end{aligned}$$(25)Since \(k_{1}>0\), we get that f(w) is increasing about w. That is, when \(w_{1}<w_{2}\),

$$\begin{aligned} \frac{\partial x}{\partial \mu _{z}}(w_{1})<\frac{\partial x}{\partial \mu _{z}}(w_{2})<0. \end{aligned}$$(26) -

(ii)

In formula (24), let \(k_{2}=\frac{\sigma _{\xi }}{(r_{f}-\mu _{\xi })^{2}-\sigma _{\xi }^{2}}\), then

$$\begin{aligned} \frac{\partial x}{\partial \sigma _{z}}=g(w)=-k_{2}\frac{1}{w}+k_{2}. \end{aligned}$$(27)Since \(k_{2}<0\), we get that g(w) is decreasing about w. That is, when \(w_{1}<w_{2}\),

$$\begin{aligned} \frac{\partial x}{\partial \sigma _{z}}(w_{1})>\frac{\partial x}{\partial \sigma _{z}}(w_{2})>0. \end{aligned}$$(28)

\(\square \)

5 Illustration

In this section, we analyze the impact of changes in distribution parameters of background asset and initial capital proportion in background asset on the optimal investment decisions when mean-variance utility is quadratic function. For the purpose of economic analysis, we need characteristics of the risky and risk free assets and background asset. We follow a recent study of Xue et al. (2019), who have addressed issues related to portfolio selection with background risk. From the data in the paper (Xue et al. 2019), we select six stocks whose returns are given in Table 1. In order to consider all the six stocks, we set up an equally weighted portfolio and obtain the risky asset’s inputs as \(\mu _{\xi }=0.16\) and \(\sigma _{\xi }=0.19\). For the risk free asset, we suppose an annual interest rate is 0.03. For the characteristics of the background risk, different from the assumptions in most previous literatures, the mean \(\mu _{z}\) in this paper is not equal to 0, which means that the optimal portfolio also depends on the mean of background asset. According to the experts’ estimations, it can be obtained that background asset has normal uncertainty distribution, i.e., \(z\sim {\mathcal {N}}(0.015,0.01)\) by referring to the method (Liu 2010). In order to determine the optimal portfolio, we suppose \(w=0.7\) and \(w=0.8\), respectively, which means that 70 or 80 percent of investors’ wealth is invested in financial assets. According to formula (22), the optimal solution is obtained and shown in Table 2 when \(U(\sigma _{y}, \mu _{y})=\mu _{y}^{2}-\sigma _{y}^{2}\).

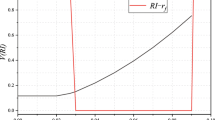

First, we study the effect of change in mean of background asset \(\mu _{z}\) on the investment decisions. Please be aware that the optimal portfolio solution also depends on w, the initial proportion in background asset. We change the initial proportion in background asset from \(w=0.7\) to \(w=0.8\), which reflects the investors’ preference to risky asset. We plot the optimal solutions with respect to different values of \(\mu _{z}\) with \(w=0.7\) and \(w=0.8\), respectively and show them in Fig. 1. In addition, we calculate the optimal target values of the programming problem with different values of \(\mu _{z}\) and w, and show them in Fig. 2.

From Fig. 1, we can see that the optimal risk free investment proportion x is a decreasing function of the mean value \(\mu _{z}\) of the background asset. Moreover, when the initial proportion in background asset changes, it does not affect the monotonicity of the investment proportion, but it changes the decreasing speed of the investment proportion in risk free asset. That is, with the increase of the mean of background asset, the rate of decline of the optimal risk free investment proportion with large w value is slower than that with small w value. From Fig. 2, we can get that the optimal target value increases with the increase of the mean of the background asset.

Next, we study the effect of change in standard deviation of background asset \(\sigma _{z}\) and initial proportion in background asset on the investment decisions. We calculate the optimal solution of x with different values of \(\sigma _{z}\) and w and show them in Fig. 3. In addition, we calculate the optimal target values with different values of \(\sigma _{z}\) and w and show them in Fig. 4.

From Fig. 3, we observe that the optimal risk free investment proportion x is an increasing function of the standard deviation of background asset \(\sigma _{z}\). Furthermore, we can see that the rate of increase of the optimal risk free investment proportion x with large w value is slower than that with small w value. For example, when the standard deviation of background asset of an investor increases, he or she will reduce the investment risk by increasing the proportion of capital in risk free assets. At the same time, the investor with big initial capital proportion in background asset is slower to increase the proportion of risk free assets than the investor with small initial capital proportion in background asset. From Fig. 4, we can get that the optimal target value decreases with the increase of the standard deviation of the background asset.

In summary, considering the change of background asset can reflect investors’ actual investment status more truly and has a great impact on investors’ investment strategy. For investors considering background assets such as labor income or health status, when the investors’ expectation of labor income increases or their health is expected to be better, they will be more willing to increase the proportion of risky assets. When there are risk increase of labor income or health, they will reduce the proportion of risky assets in order to avoid risks. This is consistent with the intuitive behavior of most investors. In addition, the size of the initial proportion of background assets reflects the importance of background risk to the investors’ decisions in response to one unit change in the mean or standard deviation of background asset. Compared with having smaller initial proportion of background asset \(1-w\), when the initial proportion of background asset \(1-w\) is bigger, investors allocate extra less capital to the risk free asset when both increasing one unit of mean of the background asset and invest extra more capital in the risk free asset when both increasing one unit of standard deviation of the background asset. These investment strategies provide good advice to investors who are sensitive to changes of background asset and initial proportions of background asset.

6 Conclusions

In real life, investors’ background risk affects their investment decisions in financial securities. In addition, due to the complexity or the lack of historical data in the economic and social environment, the background asset return and security returns cannot always be reflected by historical data and should be evaluated by experts sometimes. This paper explores the investors’ decisions in portfolio management with background risk under the uncertain mean-variance utility framework in such a situation where returns of securities and background asset are estimated by experts. In this paper, we regard security returns and background asset returns as uncertain variables which are subject to normal uncertainty distributions and consider an investor who wants to maximize his/her utility function of terminal returns. We obtain the explicit solution of optimal strategy for quadratic mean-variance utility function. Then we discuss the effect of changes in distribution parameters of background asset on capital allocation, and find that the optimal risk free investment proportion x is respectively the decreasing function of the mean \(\mu _{z}\) of background risk and the increasing function of the standard deviation \(\sigma _{z}\) of background risk. In addition, we analyze the influence of initial proportion in background asset on portfolio investment decisions and get that the change of optimal risk free investment proportion x to the change of mean of background asset increases with w value and the change of optimal risk free investment proportion x to the change of standard deviation of background asset decreases with w value. These results can provide good advice to investors who are sensitive to changes of background asset and initial proportions of background asset to make decisions.

References

Beaud, M., & Willinger, M. (2014). Are people risk vulnerable? Management Science, 61(3), 624–636.

Chipman, J. S. (1973). The ordering of portfolios in terms of mean and variance. The Review of Economic Studies, 40(2), 167–190.

Eichner, T., & Wagener, A. (2003). Variance vulnerability, background risks, and mean-variance preferences. The Geneva Papers on Risk and Insurance Theory, 28(2), 173–184.

Eichner, T., & Wagener, A. (2009). Multiple risks and mean-variance preferences. Operations Research, 57(5), 1142–1154.

Guo, X., Wagener, A., Wong, W. K., & Zhu, L. (2018). The two-moment decision model with additive risks. Risk Management, 20(1), 77–94.

Huang, X. (2010). Portfolio analysis: From probabilistic to credibilistic and uncertain approaches. Berlin: Springer.

Huang, X. (2011). Mean-risk model for uncertain portfolio selection. Fuzzy Optimization and Decision Making, 10(1), 71–89.

Huang, X. (2012). Mean-variance models for portfolio selection subject to experts’ estimations. Expert Systems with Applications, 39(5), 5887–5893.

Huang, X. (2017). A review of uncertain portfolio selection. Journal of Intelligent & Fuzzy Systems, 32(6), 4453–4465.

Huang, X., & Di, H. (2016). Uncertain portfolio selection with background risk. Applied Mathematics and Computation, 276, 284–296.

Lajeri-Chaherli, F. (2003). Partial derivatives, comparative risk behavior and concavity of utility functions. Mathematical Social Sciences, 46(1), 81–99.

Li, X., Wang, Y., Yan, Q., & Zhao, X. (2019). Uncertain mean-variance model for dynamic project portfolio selection problem with divisibility. Fuzzy Optimization and Decision Making, 18(1), 37–56.

Liu, B. (2007). Uncertainty theory. Berlin: Springer.

Liu, B. (2009). Some research problems in uncertainty theory. Journal of Uncertain Systems, 3(1), 3–10.

Liu, B. (2010). Uncertaint theory: A branch of mathematics for modeling human uncertainty. Berlin: Springer.

Liu, B. (2012). Why is there a need for uncertainty theory? Journal of Uncertain Systems, 6(1), 3–10.

Meyer, J., et al. (1987). Two-moment decision models and expected utility maximization. American Economic Review, 77(3), 421–430.

Ormiston, M. B., & Schlee, E. E. (2001). Mean-variance preferences and investor behaviour. The Economic Journal, 111(474), 849–861.

Qin, Z., Kar, S., & Zheng, H. (2016). Uncertain portfolio adjusting model using semiabsolute deviation. Soft Computing, 20(2), 717–725.

Saha, A. (1997). Risk preference estimation in the nonlinear mean standard deviation approach. Economic Inquiry, 35(4), 770–782.

Tobin, J. (1958). Liquidity preference as behavior towards risk. The Review of Economic Studies, 25(2), 65–86.

Xue, L., Di, H., Zhao, X., & Zhang, Z. (2019). Uncertain portfolio selection with mental accounts and realistic constraints. Journal of Computational and Applied Mathematics, 346, 42–52.

Yao, K. (2015). A formula to calculate the variance of uncertain variable. Soft Computing, 19(10), 2947–2953.

Yao, K., & Ji, X. (2014). Uncertain decision making and its application to portfolio selection problem. International Journal of Uncertainty, Fuzziness and Knowledge-Based Systems, 22(01), 113–123.

Zhai, J., & Bai, M. (2018). Mean-risk model for uncertain portfolio selection with background risk. Journal of Computational and Applied Mathematics, 330, 59–69.

Acknowledgements

This work is supported by National Social Science Foundation of China No. 17BGL052, USTBNTUT Joint Research Program No. TW201709 and Fundamental Research Funds for the Central Universities No. FRF-MP-20-12.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Huang, X., Jiang, G. Portfolio management with background risk under uncertain mean-variance utility. Fuzzy Optim Decis Making 20, 315–330 (2021). https://doi.org/10.1007/s10700-020-09345-6

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10700-020-09345-6