Abstract

In this paper, we discuss a multi-period portfolio selection problem when security returns are given by experts’ estimations. By considering the security returns as uncertain variables, we propose a multi-period mean–semivariance portfolio optimization model with real-world constraints, in which transaction costs, cardinality and bounding constraints are considered. Furthermore, we provide an equivalent deterministic form of mean–semivariance model under the assumption that the security returns are zigzag uncertain variables. After that, a modified imperialist competitive algorithm is developed to solve the corresponding optimization problem. Finally, a numerical example is given to illustrate the effectiveness of the proposed model and the corresponding algorithm.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

Portfolio selection discusses the problem of how to allocate a certain amount of investor’s wealth among different assets and from a satisfying portfolio. The mean–variance (M–V) model formulated by Markowitz (1952) lays the basis for single-period portfolio selection. It combines probability theory with optimization techniques to model the investment behavior with some uncertainties. Quantifying investment return as the mean of returns, and investment risk as the variance from the mean, Markowitz formulated his models mathematically in two ways: minimizing variance for a given expected value, or maximizing expected value for a given variance. Since then, variance is widely used as a risk measure, and the mean–variance models are well investigated such as Yoshimoto (1996), Best and Hlouskova (2000), Liu et al. (2003), Corazza and Favaretto (2007), etc. However, as pointed out by Grootveld and Hallerbach (1999), the distinguished drawback is that variance treats high returns as equally undesirable as low returns because high returns will also contribute to the extreme of variance. In particular, when probability distributions of security returns are asymmetric, variance becomes a deficient measure of investment risk because it may have a potential danger to sacrifice too much expected return in eliminating both low and high return extremes. To overcome this disadvantage, semivariance was proposed to replace variance in portfolio selection. Semivariance only measures the variability of returns below the mean and gauges no variability of returns above the mean and thus better matches investors’ intuition of risk than the variance. Afterward, several researchers have employed the semivariance as risk measure to study portfolio selection problems in random environment, such as Markowitz (1959, 1993), Hogan and Warren (1974), Choobineh and Branting (1986), Ballestero (2005).

Note that all the models mentioned above are single-period portfolio selection models, which provide an one-off decision at the beginning of the investment period and suggest to hold it until the end of the investment period. But, in the real world, investors often adjust their wealth from time to time by taking into consideration the volatile market conditions. Thus, a lot of work has been done to extend portfolio selection from single-period case to multi-period case by using different approaches. Mossin (1968) presented an optimal multi-period portfolio polices by using dynamic programming approach. Dantzig and Infanger (1993) demonstrated how multi-period portfolio optimization problems can be efficiently solved as multistage stochastic linear programs. Li and Ng (2000) presented a multi-period mean–variance model and derived an analytical optimal solution. Zhu et al. (2004) developed a generalized mean–variance multi-period portfolio model incorporating bankruptcy. Wei and Ye (2007) developed a multi-period mean–variance model for portfolio selection under bankruptcy risk control. Geyer et al. (2009) used stochastic linear programming approach to study the multi-period portfolio optimization. Yan and Li (2009) proposed a class of multi-period semivariance portfolio selection with a four-factor futures price model. Brieca and Kerstens (2009) presented a general approach for multi-horizon mean–variance portfolio analysis. Fu et al. (2010) considered a continuous-time mean–variance model with borrowing constraint in portfolio selection. Zeng et al. (2013) studied a multi-period investment-consumption problem with state-dependent utility functions and uncertain time-horizon in a regime-switching market. Sun et al. (2016) developed a minimax model for a multi-period portfolio selection problem. Yao et al. (2016) studied multi-period mean–variance portfolio selection with stochastic interest rate and uncontrollable liability.

All the above literature assumes that the security returns are random variables with probability distributions. As we know, a premise of applying probability theory is that the obtained probability distribution is close enough to the true frequency. That is to say, we should have enough samples to estimate probability distributions of the security returns. However, in real financial markets, there are situations where people have none or not enough historical data. Thus, in such situations, the predictions of the security returns have to rely on experts’ estimations rather than historical data. With the widely use of fuzzy set theory, more and more researchers have studied fuzzy portfolio selection problems, see, for example, Carlsson et al. (2002), Abiyev and Menekay (2007), Zhang et al. (2009), Chen (2015), Zhang (2016), Liu et al. (2016a), Chen et al. (2016), Mehlawat (2016), Wang et al. (2017). These researches broadened the way to handle portfolio selection problems with returns given by experts’ estimations. However, deeper researches find that paradoxes will appear when fuzzy variable is used to describe the security returns (see Liu 2012). To better deal with this subjective uncertainty, an uncertainty theory was founded by Liu (2007) in 2007 and refined by Liu (2010) in 2010. By using uncertainty theory, no counterintuitive results occur. So far, the uncertainty theory has been used to handle many optimization problems, such as the shortest path (Gao 2011), single-period inventory (Qin and Kar 2013), facility location-allocation (Wen et al. 2014), and option pricing (Shen and Yao 2016; Sun et al. 2017). In particular, some researchers have applied the uncertainty theory for portfolio selection problems. In an early study, Huang (2012) proposed a risk index model for uncertain portfolio selection. Li and Qin (2014) formulated a mean-semiabsolute deviation model for portfolio selection under assumption that security returns are uncertain interval variables. Zhang et al. (2015) proposed two uncertain portfolio selection models, that is, an expected-variance-chance model and a chance-expected-variance model. Qin et al. (2016) formulated an uncertain portfolio rebalancing model with transaction costs by using semiabsolute deviation to measure the portfolio risk. Chen et al. (2017a) proposed two uncertain diversified mean–semivariance models for portfolio selection. Chen et al. (2017b) formulated an uncertain multi-objective mean–variance–skewness–kurtosis portfolio optimization model. Recently, Zhai and Bai (2018) presented an uncertain mean-risk model with background risk for portfolio selection. Chen et al. (2018) proposed an uncertain portfolio selection model under consideration of the skewness, transaction costs, cardinality and minimum transaction lots constraints. Apart from the above-mentioned studies, there exist few studies on multi-period uncertain portfolio selection problems. Huang and Qiao (2012) developed a multi-period uncertain mean-risk index model. Li et al. (2018) proposed an uncertain multi-period portfolio selection model, in which transaction cost and bankruptcy of investor are considered.

Imperialist competitive algorithm (ICA) is a new population-based meta-heuristic algorithm proposed by Atashpaz-Gargari and Lucas (2007) in 2007. This novel optimization method was developed based on a socio-politically motivated strategy. The ICA uses an initial population that consists of colonies and imperialists that are assigned to several empires. The empires then compete with each other, which cause the weak empires to collapse and the powerful empires to dominate and overtake their colonies. The ICA has shown potential superiority to other well-known optimization methods; for example, Atashpaz-Gargari and Lucas (2007) showed the ICA has potential superiority to other well-known optimization techniques, such as the genetic algorithm (GA) and particle swarm optimization (PSO) in terms of its convergence rate and global optima achievement; Towsyfyan et al. (2013) also demonstrated that ICA has considerable improvement over GA in finding the optimum solution in less computational time with the same population size and iterations; Niknam et al. (2011) mixed ICA with a K-means algorithm to show its advantages over GA, PSO, ant colony optimization (ACO), simulated annealing (SA), Tabu search (TS), and honeybee mating optimization (HBMO) algorithms. Therefore, ICA has aroused much interest and has been successfully used in different fields, such as traveling salesman (Xu et al. 2014), job-shop scheduling (Zandieha et al. 2017), economic load dispatch (Morshed and Asgharpour 2014), feature selection (MousaviRad et al. 2012), distribution network design (Ghorbani and Akbari Jokar 2016) problems. A comprehensive survey of ICA is presented in the studies of Hosseini and Al Khaled (2014), Sharafi et al. (2016).

Though there are some researches about portfolio selection problems under the framework of uncertainty theory, most of them are mainly focused on single-period portfolio selections. To the best of the author’s knowledge, there is few research on constructing multi-period uncertain portfolio selection model by using semivariance as risk measurement under the real-world constraints, and then solving the corresponding model by ICA algorithm. Therefore, the purpose of this paper is to present a multi-period mean–semivariance model for uncertain portfolio selection with real-world constraints and to develop an efficient heuristic approach based on ICA algorithm for solving proposed model. Our contributions can be summarized under two aspects as follows: (1) We formulate a new multi-period mean–semivariance portfolio optimization model including transaction costs, cardinality and bounding constraints, in which the security returns are the uncertain variables whose values are obtained from experts’ evaluations rather than historical data. (2) Considering the complexity of the proposed model, we design a MICA algorithm for the solution, in which the GA’s crossover and mutation operators are integrated into the ICA by introducing a new type of country called ‘independent’ country, and a dynamic switching revolution strategy is also proposed.

The rest of the paper is organized as follows. In Sect. 2, we review some basic concepts and results of the uncertainty theory. In Sect. 3, we present a multi-period mean–semivariance model for uncertain portfolio selection and then give an equivalent of the model when security returns are zigzag uncertain variables. In Sect. 4, we design a MICA algorithm to solve the proposed model. After that, an example is given to illustrate the effectiveness of the proposed model and algorithm in Sect. 5. Finally, we present conclusions and future research directions in Sect. 6.

2 Preliminaries

Uncertainty theory is developed based on the following four axioms.

Definition 1

(Liu 2007) Let \(\Gamma \) be a nonempty set and \(\mathcal{{L}}\) be a \(\sigma \)-algebra on \(\Gamma \). A set function \(\mathcal{{M}}\) is called an uncertain measure if it satisfies the following axioms:

Axiom 1: (Normality) \({\mathcal{{M}}}\{ \Gamma \}=1\);

Axiom 2: (Duality) \({\mathcal{{M}}} \{\Lambda \}\) +\(\mathcal{{M}}\)\( \{\Lambda ^{\mathrm{c}}\}\)=1 for any event \(\Lambda \in \mathcal{{L}}\);

Axiom 3: (Subadditivity) For every sequence \(\{\Lambda _{\mathrm{i}}\}\in \mathcal{{L}}\), we have

Moreover, a product axiom was given by Liu (2009) for the operation of uncertain variables.

Axiom 4: (Product) Let \((\Gamma _{k},\mathcal {L}_{k},\mathcal{{M}}_{k})\) be the uncertainty spaces for \(k=1,2,\ldots \). Now, the product uncertain measure \(\mathcal{{M}} \) is an uncertain measure satisfying

where \(\Lambda _{k}\) are arbitrarily chosen events from \(\mathcal {L}_k\) for \(k=1,2,\ldots \), respectively.

Definition 2

(Liu 2007) Let \(\varGamma \) be a nonempty set, \(\mathcal {L}\) the \(\sigma -\)algebra over \(\varGamma \), and \(\mathcal{{M}}\) be an uncertain measure. Then, the triplet \((\varGamma , \mathcal {L}, \mathcal{{M}})\) is said to be an uncertainty space.

Definition 3

(Liu 2007) Let (\(\Gamma , \mathcal {L}, \mathcal{{M}}\)) be an uncertainty space. An uncertain variable \(\xi \) is a measurable function from \(\Gamma \) to a set of real numbers; that is, for any Borel set B of real numbers, the set

defines an event.

Definition 4

(Liu 2007) The uncertainty distribution \(\Phi :R\rightarrow [0,1]\) of an uncertain variable \(\xi \) is defined by

An uncertainty distribution \(\Phi \) is called regular if it has an inverse function \(\Phi ^{-1}\). In this case, the inverse function \(\Phi ^{-1}\) is called an inverse uncertainty distribution.

Definition 5

(Liu 2007) The uncertain variables \(\xi _1,\xi _2,\ldots ,\xi _n\) are said to be independent if

for Borel sets \(B_1,B_2,\ldots ,B_n\) of real numbers.

Theorem 1

(Liu 2007) Let \(\xi _1, \xi _2, \ldots , \xi _n\) be the independent uncertain variables with regular uncertainty distributions \(\Phi _1, \Phi _2, \ldots , \Phi _\mathrm{n}\), respectively. If \(f(x_1, x_2, \ldots , x_n)\) is strictly increasing with respect to \(x_1, x_2, \ldots , x_m\) and strictly decreasing with respect to \(x_{m+1}, x_{m+2}, \ldots , x_n\) then \(\xi =f(\xi _1, \xi _2, \ldots , \xi _n)\) is an uncertain variable with an inverse uncertainty distribution

Definition 6

(Liu 2007) Let \(\xi \) be an uncertain variable; then the expected value of \(\xi \) is given by

provided that at least one of the two integrals is finite.

Since the uncertain variables operate mainly in the form of inverse uncertainty distributions, Liu (2010) presented the following formulas to calculate the expected value of an uncertain variable via inverse uncertainty distributions.

Definition 7

(Liu 2007) Let \(\xi \) be an uncertain variable with finite expected value e. Then, the variance of \(\xi \) is, respectively, given by

Theorem 2

(Liu 2010) Let \(\xi \) and \(\eta \) be independent uncertain variables. Then, for any real numbers a and b we have

3 The multi-period uncertain portfolio optimization model

As discussed earlier, in many situations, historical data are insufficient for the estimation of security returns. In such cases, we have to rely on the domain experts’ subjective evaluations for estimating the security returns. In this section, by regarding security returns as the uncertain variables, we will propose a multi-period mean–semivariance model for portfolio selection with real-world constraints.

3.1 Mathematical modeling

Assume that an investor allocates his initial wealth \(W_0\) among the n securities at the beginning of period 1, and obtain the terminal wealth at the end of period T. The investor could readjust his wealth at the every beginning of the following \(T-1\) consecutive time periods. For the better understanding of our paper, we first introduce all the notations that will be used in the following sections. For \(i=1,2,\ldots ,n\), and \(t=1,2,\ldots ,T\), we let

\(r_{t,i}\) | The uncertain return rate of ith security at period t; |

\(r_\mathrm{f}\) | The risk-free interest rate; |

\(d_{t,i}\) | The transaction cost on security i at period t; |

\(W_t\) | The available wealth at the end of period t; |

\(\varDelta W_t\) | The increment wealth between the period t and \(t-1\); |

\(\varepsilon _{t,i}\) | The minimum proportion allocated to security i at period t, if security i is held; |

\(\delta _{t,i}\) | The maximum proportion allocated to security i at period t, if security i is held; |

\(m_t\) | The number of securities that investors wish to hold in the portfolio at period t, |

1 \(\le m_t \le \)n; | |

\(z_{t,i}\) | The binary variable, \(z_{t,i}\in \{0,1\}\). If security i is included in the portfolio at period t, |

\(z_{t,i}=1\), and \(z_{t,i}=0\) otherwise. |

Transaction cost is an important factor for an investor to take into consideration in portfolio selection. It is not trivial enough to be neglected, and the optimal portfolio depends on the total costs of transaction. Similar to the researches in Chen (2015); Chen et al. (2016) and others, we assume that the transaction cost is a V-shaped function of the differences between portfolio \(x_t\) at period t and the portfolio \(x_{t-1}\) at period \(t-1\). Hence, the total transaction cost of the portfolio \(x_t\) at period t can be represented by

Thus, the net return rate of the portfolio \(x_t\) at period \(t(t=1,2,\ldots ,T)\) after paying transaction costs is obtained as

Furthermore, the wealth at the end of period \(t+1\) can be expressed as

Solving Eq. (8), recursively, the terminal wealth obtained at the end of period T can be expressed by

Besides the transaction costs, investors commonly face other real-world constraints such as cardinality and bounding constraints. The cardinality constraint imposes a limit on the number of assets in the portfolio either to simplify the management of the portfolio or to reduce transaction costs. The bounding constraint restricts the proportion of each asset in the portfolio to lie between the lower and upper bounds in order to avoid very small (or large) and unrealistic holdings. Specifically, a minimum \(\varepsilon _{t,i}\) and a maximum \(\delta _{t,i}\) for each asset i at period t are given, and we impose that either \(x_{t,i}=0\) or \(\varepsilon _{t,i}\le x_{t,i}\le \delta _{t,i}\). In addition, the cardinality constraints about the portfolio at period t can be expressed by

where \(z_{t,i}\in \{0, 1\}\) is a binary variable that controls whether asset i at period t should be selected in the portfolio or not.

Taking above facts into consideration, we assume that the investor wants to maximize his/her terminal wealth over the T period. At the same time, the cumulative investment risk of the portfolios must be smaller than the given maximum risk tolerance level. Thus, the multi-period uncertain portfolio selection problem with real-world constraints can be formulated as the follows:

where \(\sigma \) is the preset maximum risk tolerance level.

In the model (11), variance is used as risk measure. However, as discussed in introduction section, we know that when return distributions of securities are asymmetric, using variance as risk measure leads to an unsatisfactory prediction of portfolio behavior. Thus, some researchers began to employ semivariance as an alternative risk measure to qualify the risk of portfolio, see, for example, Markowitz (1959), Liu and Zhang (2015). Especially, Huang (2012) introduced a new easier-to-use risk measure for single-period portfolio selection, where risk-free interest rate is set as a base target and any portfolio returns below the risk-free interest rate are regarded as losses. In this paper, the semivariance of the return rate on the portfolio at period t can be defined as follows:

Definition 8

Let \(W_0\) be the initial wealth, and \(r_\mathrm{f}\) the risk-free interest rate. Then, the semivariance of the return rate on the portfolio at period t is defined as

where

Now, we assume that the investor adopts semivariance as risk measure. Then, the multi-period mean–semivariance model for uncertain portfolio selection can be formulated as follows:

3.2 Equivalent of the proposed model

In order to solve the proposed model (13), we need to convert it into its equivalent. Before giving the crisp form, we first give a theorem for calculating the semivariance.

Theorem 3

Let \(\xi \) be an uncertain variable with continuous uncertainty distribution \(\Phi \) whose inverse function \(\Phi ^{-1}(\alpha )\) exists and is unique for each \(\alpha \in (0,1)\), and semivariance defined as

Then

where \(\Phi ^{-1}(\beta )= W_0 \cdot r_\mathrm{f}\).

Proof

According to Definitions 6 and 8, we have

\(\square \)

The theorem is proved.

In the following section, we will convert the proposed model (13) into its equivalent. With the same consideration as Chen et al. (2018) and Qin et al. (2016), we assume that the returns of security \(r_{t,i}\) are zigzag uncertain variables for all \(i=1,2,\ldots , n\) and \(t=1,2,\ldots , T\), denoted by \(r_{t,i}=\mathcal {Z}({a_{t,i},b_{t,i},c_{t,i}})\) whose uncertainty distribution can be described by

where \(a_{t,i}<b_{t,i}<c_{t,i}\).

Furthermore, the inverse uncertainty distributions of zigzag uncertain variables \(r_{t,i}(i=1,2,\ldots ,n;\quad t=1,2,\ldots ,T)\) are

Then, from Eq. (3), we have

According to the results in Liu (2007), the sum of two independent zigzag uncertain variables \(\xi _{1}=\mathcal {Z}(a_{1}, b_{1}, c_{1})\) and \(\xi _{2}=\mathcal {Z}(a_{2}, b_{2}, c_{2})\) is also zigzag uncertain variable \(\mathcal {Z}(a_{1}+a_{2}, b_{1}+b_{2}, c_{1}+c_{2})\), i.e., \( \mathcal {Z}(a_{1}, b_{1}, c_{1})+\mathcal {Z}(a_{2}, b_{2}, c_{2})=\mathcal {Z}(a_{1}+a_{2}, b_{1}+b_{2}, c_{1}+c_{2}).\) In addition, the product of a zigzag uncertain variable \(\mathcal {Z}(a, b, c)\) and a real number \(k>0\) is also a zigzag uncertain variable \(\mathcal {Z}(ka, kb, kc)\), i.e., \( k\cdot \mathcal {Z}(a, b, c)=\mathcal {Z}(ka, kb, kc)\).

Therefore, for any real numbers \(x_{t,i} \ge 0\)\((i=1,2,\ldots ,n; t=1,2,\ldots ,T)\), the total uncertain return at period t is still a zigzag uncertain variable with the following form:

Thus, we easily obtain the expected total return at period t as follows,

Furthermore, according to Eq. (9), we can obtain the final expected wealth at the end of period T as follows:

Moreover, for the zigzag uncertain variables \(r_{t,i}=\mathcal {Z}({a_{t,i},b_{t,i},c_{t,i}})\), according to Eqs. (14) and (15), we have following results.

-

(i)

If \(\beta < 0.5\), then

$$\begin{aligned} \begin{aligned} \hbox {SV}(r_{t,i})&=\int _0^\beta (\Phi ^{-1}(\alpha )-W_0\cdot r_\mathrm{f})^2 \mathrm{d}\alpha \\&=\int _0^{\beta }[(1-2\alpha )a_{t,i}+2\alpha b_{t,i}-W_0\cdot r_\mathrm{f}]^2\mathrm{d}\alpha \\&=\int _0^{\beta }[(2b_{t,i}-2a_{t,i})^2\alpha ^2+2(2b_{t,i}-2a_{t,i})(a_{t,i}\\&-W_0\cdot r_\mathrm{f})\alpha +(a_{t,i}-W_0\cdot r_\mathrm{f})^2]\mathrm{d}\alpha \\&=\frac{1}{3}\bigg [4(b_{t,i}-a_{t,i})^2\beta ^3+6(b_{t,i}-a_{t,i})(a_{t,i}-W_0\cdot r_\mathrm{f})\beta ^2\\&+3(a_{t,i}-W_0\cdot r_\mathrm{f})^2\beta \bigg ] \end{aligned} \end{aligned}$$(20) -

(ii)

If \(\beta \ge 0.5\), then

$$\begin{aligned} \begin{aligned} \hbox {SV}(r_{t,i})&=\int _0^\beta (\Phi ^{-1}(\alpha )-W_0\cdot r_\mathrm{f})^2 \mathrm{d}\alpha \\&=\int _0^{0.5}[(1-2\alpha )a+2\alpha b-W_0\cdot r_\mathrm{f}]^2\mathrm{d}\alpha \\&+\int _{0.5}^{\beta }[(2-2\alpha )b+(2\alpha -1)c-W_0\cdot r_\mathrm{f}]^2\mathrm{d}\alpha \\&=\frac{4}{3}(c_{t,i}-b_{t,i})^2\beta ^3+2(c_{t,i}-b_{t,i})(2b_{t,i}\\&-c_{t,i}-W_0\cdot r_\mathrm{f})\beta ^2+(2b_{t,i}-c_{t,i}-W_0\cdot r_\mathrm{f})^2\beta \\&-\frac{1}{6}[(c_{t,i}-b_{t,i})^2+3(c_{t,i}-b_{t,i})(2b_{t,i}\\&-_{t,i}c-W_0\cdot r_\mathrm{f})+3(2b_{t,i}-c_{t,i}-W_0\cdot r_\mathrm{f})^2] \end{aligned} \end{aligned}$$(21)

Furthermore, the semivariance about the return rate of the portfolio at period t can be expressed by

-

(i)

If \(\beta < 0.5\), then

$$\begin{aligned} \begin{aligned} \hbox {SV}(W_{t})&= \frac{1}{3}\bigg [4(b_{t,i}W_{t-1}-a_{t,i}W_{t-1})^2\beta _t^3\\&-6(a_{t,i}W_{t-1}-b_{t,i}W_{t-1})(a_{t,i}W_{t-1}-W_0\cdot r_\mathrm{f})\beta _t^2\\&+3(a_{t,i}W_{t-1}-W_0\cdot r_\mathrm{f})^2\beta _t\bigg ].\\ \end{aligned} \end{aligned}$$(22) -

(ii)

If \(\beta \ge 0.5\), then

$$\begin{aligned} \begin{aligned} \hbox {SV}(W_{t})&=\bigg \{ \frac{4}{3}(c_{t,i}W_{t-1}-b_{t,i}W_{t-1})^2\beta _t^3+2(c_{t,i}W_{t-1}\\&-b_{t,i}W_{t-1})(2b_{t,i}W_{t-1}-c_{t,i}W_{t-1}-W_0\cdot r_\mathrm{f})\beta _t^2\\&+(2b_{t,i}W_{t-1}-c_{t,i}W_{t-1}-W_0\cdot r_\mathrm{f})^2\beta _t\\&+\frac{1}{6}\big [(a_{t,i}W_{t-1})^2+a_{t,i}b_{t,i}W^2_{t-1}+6b_{t,i}W_{t-1}W_0\cdot r_\mathrm{f}\\&-3(a_{t,i}W_{t-1}+c_{t,i}W_{t-1})W_0\cdot r_\mathrm{f}\\&-(c_{t,i}W_{t-1})^2+5b_{t,i}c_{t,i}W^2_{t-1}-6b_{t,i}^2\big ]\bigg \}. \\ \end{aligned} \end{aligned}$$(23)

Based on the above analysis, the uncertain multi-period portfolio selection model (13) can be transformed into the following optimization problem:

-

(i)

If \(\beta < 0.5\), the model (13) equals

$$\begin{aligned} \begin{aligned} \max&\quad W_0\prod _{t=1}^\mathrm{T}\bigg [1+\sum _{i=1}^n\big (\frac{1}{4}(a_{t,i}+2b_{t,i} +c_{t,i})x_{t,i}\\&-d_{t,i}|x_{t,i}-x_{(t-1),i}|\big )\bigg ]\\ \mathrm {s.t.}&\quad \sum _{t=1}^\mathrm{T} \frac{1}{3}\bigg [4(b_{t,i}W_{t-1}-a_{t,i}W_{t-1})^2\beta _t^3\\&-6(a_{t,i}W_{t-1}-b_{t,i}W_{t-1})(a_{t,i}W_{t-1}-W_0\cdot r_\mathrm{f})\beta _t^2\\&\quad +3(a_{t,i}W_{t-1}-W_0\cdot r_\mathrm{f})^2\beta _t\bigg ]\le \sigma ,\\&\quad \sum _{i=1}^n x_{t,i}=1, \\&\quad \sum _{i=1}^n z_{t,i}=m_t, \\&\quad \varepsilon _{t,i}z_{t,i}\le x_{t,i} \le \delta _{t,i}z_{t,i},\\&\quad z_{t,i}\in \{0,1\}, \\&\quad x_{t,i} \ge 0, \\&\quad i=1,2,\ldots , n;\quad t=1,2,\ldots ,T. \end{aligned} \end{aligned}$$(24) -

(ii)

If \(\beta \ge 0.5\), the model (11) equals

$$\begin{aligned} \begin{aligned} \max&\quad W_0\prod _{t=1}^\mathrm{T}\bigg [1+\sum _{i=1}^n\big (\frac{1}{4}(a_{t,i} +2b_{t,i}+c_{t,i})x_{t,i}\\&-d_{t,i}|x_{t,i}-x_{(t-1),i}|\big )\bigg ]\\ \mathrm {s.t.}&\quad \sum _{t=1}^\mathrm{T}\bigg \{ \frac{4}{3}(c_{t,i}W_{t-1}-b_{t,i}W_{t-1})^2\beta _t^3+2(c_{t,i}W_{t-1}\\&-b_{t,i}W_{t-1})(2b_{t,i}W_{t-1}-c_{t,i}W_{t-1}-W_0\cdot r_\mathrm{f})\beta _t^2\\&\quad +(2b_{t,i}W_{t-1}-c_{t,i}W_{t-1}-W_0\cdot r_\mathrm{f})^2\beta _t\\&+\frac{1}{6}\big [(a_{t,i}W_{t-1})^2+a_{t,i}b_{t,i}W^2_{t-1}+6b_{t,i}W_{t-1}W_0\cdot r_\mathrm{f}\\&\quad -3(a_{t,i}W_{t-1}+c_{t,i}W_{t-1})W_0\cdot r_\mathrm{f}-(c_{t,i}W_{t-1})^2\\&+5b_{t,i}c_{t,i}W^2_{t-1}-6b_{t,i}^2\big ]\bigg \} \le \sigma ,\\&\quad \sum _{i=1}^n x_{t,i}=1, \\&\quad \sum _{i=1}^n z_{t,i}=m_t, \\&\quad \varepsilon _{t,i}z_{t,i}\le x_{t,i} \le \delta _{t,i}z_{t,i},\\&\quad z_{t,i}\in \{0,1\},\\&\quad x_{t,i} \ge 0, \\&\quad i=1,2,\ldots , n;\quad t=1,2,\ldots ,T. \end{aligned} \end{aligned}$$(25)

4 Hybrid of imperialist competitive and genetic algorithm

The proposed models (24) and (25) are classified as a mixed integer nonlinear programming model necessitating the use of efficient heuristic algorithms to find the solution. In this paper, we propose a modified imperialist competitive algorithm (MICA) for the solution. In the following, basic ICA is first reviewed and then, MICA algorithm to solve the proposed models is presented.

4.1 Basic ICA

Imperialist competitive algorithm (ICA) (Atashpaz-Gargari and Lucas 2007) is an evolutionary meta-heuristic algorithm that mimics socio-political imperialist competition to search for a global optimal solution. It is a population-based algorithm in which every element of the population is called a country. Each country denotes an encoded solution to the problem. The better countries are chosen to become the imperialists. The other countries are divided among the imperialists as colonies. The whole set of an imperialist and its colonies is called an empire. After seizing the colonies, the imperialists try to penetrate into their colonies by making them similar to themselves. Then, the imperialists compete with each other to seize more colonies and gain more power. This process makes some imperialists more powerful and some weaker. The weak empires eventually collapse. An overview of the main steps of the ICA is presented next.

4.1.1 Initialization

Similar to other population-based meta-heuristic algorithms, ICA also begins with a randomly generated population which contains \(N_\mathrm{pop}\) initial solutions. In ICA, each individual is called a ‘country.’ For an \(N_\mathrm{var}\)-dimensional optimization problem, a country is a \(1*N_\mathrm{var}\) array whose elements are randomly generated in the allowable range of the corresponding parameters as:

The power of country is inversely proportional to the value of the cost function. The country with smaller cost has greater power. Thus, the cost of each country is evaluated with the cost function f at variables \((p_1, p_2,\ldots , p_{N_\mathrm{var}})\) as the follows:

In the initialization step, we need to generate an initial population with the size of \(N_\mathrm{pop}\). Next, we have to select \(N_\mathrm{imp}\) of the most powerful countries to construct the empires. The remaining \(N_\mathrm{col} (N_\mathrm{col}=N_\mathrm{pop}-N_\mathrm{imp})\) will be the colonies such that each colony belongs to an empire. So, an empire consists of an imperialist and set of colonies.

To form the initial empires, the colonies are divided among the imperialist countries according to the power of the imperialists. The normalized fitness of each imperialist is determined by,

where \(c_n\) and \(C_n\) are the cost and normalized cost of nth imperialist, respectively. An imperialist with larger cost (i.e., a weaker imperialist country) has smaller normalized cost. When the normalized costs of all imperialists are gathered, the normalized power of each imperialist can be evaluated as follows:

The initial colonies are distributed among empires based on their power; therefore, the initial number of colonies for nth empire can be defined as follows:

where \(NC_n\) is the number of initial colonies possessed by the nth imperialist, \(N_\mathrm{col}\) is the total number of colonies in the initial population, and round is a function that gives the nearest integer of a fractional number.

4.1.2 Assimilation process

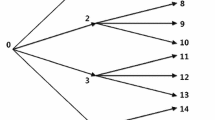

After forming initial empires, the colonies in each empire start to improve their power by moving toward their relevant imperialist. This process is known as the assimilation process, illustrated in Fig. 1.

As shown in Fig. 1, the colony moves x distance along with d direction toward its imperialist. The moving distance x is a random number generated by random distribution within interval \([0, \beta *d]\). The value of \(\beta \) falls between 1 and 2. Setting \(\beta > 1\) causes the colony to move toward the imperialist direction. Meanwhile, a random amount of deviation (the \(\theta \) in Fig. 1) is added to the movement direction, to enhance the exploration ability of the algorithm. The \(\theta \) is defined as follows:

where \(\varphi \) is an arbitrary parameter, where a larger value will facilitate a global search and a smaller value will encourage a local search. Setting \(\varphi \) to \(\pi /4\) (radian) could be a good choice.

4.1.3 Revolution operator

Similar to the mutation process in GA, ICA allows a sudden change in socio-political characteristic of a country, known as revolution. During revolution, the positions of some countries suddenly change which facilitate diversification. The revolution rate decides the percentage of countries inside an empire which will randomly change. This process avoids the algorithm to converge to local optimal solution in the early iterations. The revolution operator must be precisely determined since a very high value of it decreases the intensification power of algorithm while a very low value of it decreases diversification.

4.1.4 Exchanging the position of a colony and an imperialist

After assimilation and revolution processes, it is possible that a colony reaches a position with lower cost than its imperialist. If there exists any colony with lower cost, then the position of this colony exchanges with the position of its imperialist. The algorithm then continues with imperialist in a new position, and new imperialist attempts to assimilate its colonies.

4.1.5 Total power of an empire

The power of an empire is computed based on the power of its imperialist and a fraction of the power of its colonies.

where \(TC_n\) is the total cost of nth empire, and \(\xi \) is a positive number between 0 and 1, usually close to zero. A small value of \(\xi \) emphasizes a greater influence of imperialist power in determining the total power of empire, while a large value of \(\xi \) indicates the influence of the mean power of colonies in determining the total power of the empire. And all the empires except the most powerful one will collapse and all colonies will be under the control of this unique empire.

4.1.6 Imperialist competition

Any empire that is unable to gain power will finally be eliminated, and more powerful empires will seize their colonies. In an iteration of the algorithm, a set of the weakest empires are considered and the more powerful empires try to conquer colonies from the weakest empires. The competition for colonies is based on the power of empires. In fact the more powerful an empire is, the better chance it has to win the competition for taking a colony. To model this competition, first the probability of every empire for winning the competition is calculated based on the normalized total cost of every empire. Normalized total cost of an empire is given by

where \(TC_n\) is the total cost of nth empire and \(NTC_n\) is the normalized total cost of corresponding nth empire. After calculating the normalized cost (power) of every empire, the probability with which each empire might win the competition for conquering colonies is given by

In the imperialist competition step, if the weakest imperialist loses all of its colonies, then this imperialist is collapsed. A collapsed imperialist is possessed by other imperialists as a colony.

4.1.7 Convergence

After a certain amount of iterations, there will be only one empire left, as that empire is the most powerful empire among the other empires. The other empires have collapsed during imperialistic competition. Also, the colonies in the most powerful empire will have the same position and same fitness as the imperialist. The program will terminate when the number of imperialist, \(N_\mathrm{imp}=1\) or the maximum number of iterations has reached.

4.2 The proposed MICA algorithm

4.2.1 Fitness function

The fitness function is a factor for measuring the quality of a solution. In an optimization problem, fitness is often determined by the value of its objective function. Thus, for the maximization problems, the individual with higher fitness will have more chance to generate offspring. In this paper, we take the objective functions of the models (24) and (25) as the fitness functions.

In addition, we know that, in the basic ICA, the power of country is inversely proportional to the value of the cost function. So, for the proposed MIC algorithm, the cost function is defined as the reciprocal of the fitness function:

where fit(country) refers to the fitness of the country.

4.2.2 Hybrid ICA-GA

ICA has attracted much attention and wide applications for solving optimization problems; however, this algorithm is easily to be trapped into a local optimum. Thus, inspired by the ideas in Mehdinejad et al. (2016), in this paper, a new type of country called ‘independent’ country is introduced, and the GA’s crossover and mutation operators are applied for these independent countries. The independent countries are anti-imperialism and are in competition with imperialist countries. Independent countries’ aim is to free the colonies from the empires and let them join independent countries to cause the collapse of all empires.

More specifically, in the initial population, \(N_\mathrm{imp}\) of the most powerful countries from initial countries \(N_\mathrm{pop}\) are selected to be imperialists, \(N_\mathrm{ind}\) of the most powerful countries from remaining countries \((N_\mathrm{pop}-N_\mathrm{imp})\) are selected to be independent countries, and the remaining \(N_\mathrm{col}\) (\(N_\mathrm{col}=N_\mathrm{pop}-N_\mathrm{imp}-N_\mathrm{ind}\)) countries form the colonies. Then, in each iteration, three operators of GA are added as follows:

-

(1)

Mutation Operator. In the evolutionary progress of ICA, population diversity may be lost and premature convergence always happens. Here, we design a new mutation strategy to perform mutation operator. Specifically, a new independent country \(Ind'_{i}\) is produced according to the following equation:

$$\begin{aligned}&\quad \hbox {Ind}'_{i}=\hbox {Ind}_{i}+\varphi _{i}\times \hbox {rand}(N_\mathrm{var},N_\mathrm{var})\times (\hbox {Cou}_\mathrm{best}-\hbox {Ind}_i), \end{aligned}$$(36)$$\begin{aligned}&\quad \varphi _{i}=1- \frac{\hbox {fit}(\hbox {Ind}_i)}{\sum ^{N_\mathrm{pop}}_{i=1} \hbox {fit}(\hbox {cou}_i)}, \end{aligned}$$(37)where \(\hbox {Ind}_{i}\) refers to the ith independent country, \(\hbox {rand}(N_\mathrm{var},N_\mathrm{var})\) is a \(N_\mathrm{var}\times N_\mathrm{var}\) matrix, whose elements are random numbers between 0 and 1. \(\hbox {Cou}_\mathrm{best}\) refers to the country with the best fitness, and \(\varphi _{i}\) is the mutation probability of ith independent country. \(\hbox {fit}(\hbox {Ind}_i)\) refers to the fitness of the ith independent country. The countries with greater fitness have less probability to mutation. It should be noted that, after mutation operator, if the new country is not better than old one, we let \(\hbox {Ind}'_{i}=\hbox {Ind}_{i}\).

-

(2)

Crossover Operator. This paper adopts the single-point crossover operation method. In single-point crossover, one crossover position k is selected uniformly at random in the interval \([1,2,\ldots ,N_\mathrm{var}]\), and then the variables exchanged between the ‘independent countries’ in this point. Thus, two new independent countries are produced.

-

(3)

Selection Operator. We select some of the best countries with the size of \(N_\mathrm{imp}\) from the new countries including imperialists, independent countries and colonies to be new imperialists, and the rest of the countries are to be the new colonies.

4.2.3 Dynamic switching revolution strategy

Like many meta-heuristic methods, parameters selection has great effects on the algorithm performance. Revolution operator is the counterpart of mutation in GA. A large value of revolution rate reinforces the exploration, while a small value of it may encourage exploitation. Hosseini and Al Khaled (2014) showed that the value of revolution rate is highly dependent on the magnitude of solution spaces, and the value of 0.2 could be an appropriate choice in general. Besides, Sadeghi et al. (2016) suggested that 0.1 is the better set for revolution rate. However, for any generalized algorithm, we know that more global search should be done at the beginning as it will tend to explore the search space better and when enough exploration has been done, the process should move on to local search that is exploitation. Thus, in this paper, dynamic switching revolution strategy is employed to make the algorithm more reliable in exploring and exploiting the search space. The revolution operator is performed as follows:

where \(\hbox {fit}(\hbox {col}_i)\) is the fitness for the ith colony, \(\hbox {cou}_\mathrm{best}\) is the country with the best fitness, \(\hbox {rand}\, [0, N_\mathrm{var}]\) is a random number between 0 and \(N_\mathrm{var}\).

From Eq. (38), we can see that the bigger the fitness value, the smaller the probability of performing revolution operation. Moreover, the revolution rate is also associated with the dimension of the optimization problem. As the dimension \(N_\mathrm{var}\) increases, the probability of performing revolution operation also increases.

4.2.4 Constraint satisfaction

We use hybrid representation to define a portfolio, in which two vectors are defined as following forms:

Here, \(z_{t,i}\) is a binary vector that specifies whether a particular asset participate in the portfolio at period t, where \(z_{t,i}\in \{0,1\}(i=1,2,\dots ,n;\quad t=1,2,\dots ,T)\). \(x_{t,i}\) is a real-valued vector used to compute the investment proportions of the budget invested on the portfolio at period t, where \(x_{t,i}\in [0,1](i=1,2,\dots ,n;\quad t=1,2,\dots ,T)\).

Similar to the studies in Chang et al. (2000), Liu et al. (2016b), Mishra et al. (2014), we performed the following operators to find the portfolio x associated with the above encoding. First, if the number of assets in the portfolio at each period (i.e., the number of 1’s in \(z_{t}\)) exceeds the maximum allowed number m, we deleted (by changing its value from 1 to 0 in \(z_t\)) those assets with the \((n-m)\) smallest weights in \(x_t\). In this way, we can keep the portfolio at each period satisfy the cardinality constraints.

To meet the budget constraint, we perform the following normalization operation

Since the normalize investment proportion may not satisfy the bound constraints, the following three cases are discussed.

Case 1: If both lower and upper constraints are present, then the investment proportions are computed by

Case2: If the investment proportion has to be adjusted only for the lower constraint, and there is no restriction on the upper limit, then the adjusted investment proportions are computed as:

Case 3: If the investment proportion has to be adjusted for the upper constraint, and there is no restriction on the lower limit, then the adjusted investment proportions are calculated by

4.2.5 Stop criteria

We consider two stopping criteria. The program will terminate when the number of imperialist \(N_\mathrm{imp}=1\) or the maximum number of iterations has reached.

The pseudo-code about the MICA algorithm is showed in Algorithm 1.

5 Numerical example

In this section, we give a numerical example to illustrate the applications of the proposed models and demonstrate the validity of the designed algorithm. In this example, the investor intends to make four consecutive periods investment among the 10 securities with initial wealth 10,000 RMB. In addition, we assume that security returns cannot be well reflected by the historical data and are given by experts’ evaluations. Here, the return rates are characterized by zigzag uncertain variables \(r_{t,i}~(i=1,2,\ldots ,10;~t=1,2,3,4)\), which are shown in Table 1.

In this example, we assume that the initial portfolio at the beginning of period is \(x_{0, i}=0.1\) for \(i=1,2,\ldots , 10\). The risk-free interest rate is 0.02. The transaction costs of securities at the four periods are set as \(d_{t,i}=0.0015~(i=1,2,\ldots ,10;~t=1,2,3,4)\). The maximum number of securities held in the portfolio in each period is \(m_t=5 ~(t=1,2,3,4)\). The lower bound constraint \(\varepsilon _{t,i}=0.1\), and upper bound constraint \(\delta _{t,i}=0.6\) for all \(i=1,2,\ldots ,10\) and \(t=1,2,3,4\).

The parameters of the MICA algorithm are set as follows: the numbers of countries \(N_\mathrm{pop}\), imperialists \(N_\mathrm{imp}\), independent countries \(N_\mathrm{ind}\), and colonies \(N_\mathrm{col}\) are set to 30, 10, 10, and 10, respectively. In addition, assimilation coefficient \(\beta \) and crossover rate \(p_c\) are set to 0.6 and 0.5, respectively. The maximum generation number is 200.

Using the proposed algorithm, we can obtain some investment strategies by varying the risk tolerate parameter \(\sigma \). The results are listed in Table 2. We find that the investor will adopt different investment strategies at different investment periods. For example, when \(\sigma =1600\) RMB, the investor adopts the following strategies. At the beginning of period 1, the investor needs to assign his initial wealth among securities 2, 6, 7, 9 and 10 by the investment proportions of 0.331, 0.168, 0.146, 0.095 and 0.260, respectively. At the beginning of period 2, the investor needs to adjust his wealth again. After adjustment, he holds securities 1, 3, 4, 8 and 10 by the investment proportions of 0.245, 0.182, 0.316, 0.009 and 0.247, respectively. Finally, at the beginning of period 4, the investor constructs a portfolio among securities 1, 4, 6, 7 and 10 by the investment proportions of 0.221, 0.286, 0.144, 0.126 and 0.223, respectively. In this case, the crisp value of terminal wealth is 16,966.6278 RMB. In addition, Table 2 also indicates that the terminal wealth increases along with the increasement of the risk tolerate value \(\sigma \). For instance, when \(\sigma =1800\) the best terminal wealth is achieved, while \(\sigma =1500\) leads to the lowest terminal wealth.

To demonstrate the effects of the cardinality constraint on the portfolio selection, given \(m _t=5\) and \(6~(t=1,2,3,4)\), the histograms for the optimal portfolio strategies are depicted in Fig. 2. From Fig. 2, it is clear that with the changes of the \(m_t\), the investors adopt different investment strategies. For example, when \(m_t=5\), securities 1, 6 and 10 are included in the portfolio at period of 4. Nevertheless, when \(m_t=6\), these securities are not selected at the same period. Moreover, taking the security 6 as a example, we can see that when \(m_t=5\), it is selected to invest just at periods 1 and 4 by the investment proportions of 0.168 and 0.144, respectively. However, when \(m_t=6\), the investor holds this security at each period by the investment proportions of 0.114, 0.132, 0.121 and 0.1, respectively.

Furthermore, given \(\sigma =1600\), \(r_\mathrm{f} =0.02\), and \(m_t=5\), Table 3 is presented to demonstrate the effect of transaction costs on portfolio selection. It can be seen from Table 3 that when the transaction cost rate increases, the investor gains less expected incremental wealth.

Similarly, Table 4 demonstrates how the risk-free interest rates \(r_\mathrm{f}\) affect the portfolio selection. It can be seen that the obtained terminal wealth as well as the corresponding risk increase at the same time along with the increasing of the \(r_\mathrm{f}\) value. For instance, when \(r_\mathrm{f}=0.01\), the terminal wealth is 14,705.8295 at end of period 4, and the cumulative semivariance SV is 899.1219, while \(r_\mathrm{f}=0.03\), the corresponding values are 18,280.9852 and 1471.7799, respectively.

Finally, to demonstrate the effectiveness of our designed algorithm, we compare it with the basic ICA and GA by varying the generation numbers. The parameters of the above two algorithms are the same as the proposed MICA. The detailed comparative results are shown in Table 5. It should be noted that Different 1 refers to the difference between the objective values of MICA and ICA, and Different 2 refers to the difference between the objective values of MICA and GA. It can be seen that the objective values obtained by our proposed algorithm are larger than those by the basic ICA and GA algorithms. In addition, we also calculate the maximum deviation of objective for the proposed model with respect to different generations. The maximum deviation generated by the MICA algorithm is smaller than the one generated by the other algorithms. Besides, the convergence characteristic of different algorithms is shown in Fig. 3. It is obvious that the proposed MICA can quickly converge to a better solution much faster than the other algorithms. All these results show that the proposed MICA algorithm has a better performance and is more efficient in finding optimal portfolios.

6 Conclusion

Since the security market is so complex, sometimes security returns have to be predicted by experts’ evaluations rather than historical data. This paper discusses a multi-period portfolio selection problem with returns given by experts’ evaluations. By using uncertainty theory, we propose a multi-period mean–semivariance portfolio model with real-world constraints, in which transaction costs, cardinality and bounding constraints are considered simultaneously. We further convert the proposed optimization model into a crisp mathematical programming under the assumption that the security returns are zigzag uncertain variables. After that, we design a MICA algorithm to solve the corresponding optimization model. Finally, a numerical example is given to illustrate the ideas of the proposed model and the validity of the designed algorithm. The experimental results demonstrate that real-world constraints have a great impact on the optimal investment strategy, and the designed MICA algorithm is effective for solving the proposed model.

Finally, for future researches three areas are proposed: first adding other real-world constraints such as minimum transaction lots and bankruptcy in the investment horizon, second changing the proposed model to a multi-period multi-objective one and third comparing other heuristic algorithms with the designed algorithm.

References

Abiyev RH, Menekay M (2007) Fuzzy portfolio selection using genetic algorithm. Soft Comput 11:1157–1163

Atashpaz-Gargari E, Lucas C (2007) Imperialist competitive algorithm: an algorithm for optimization inspired by imperialistic competition. IEEE Congress on evolutionary computation, pp 4661–4667

Ballestero E (2005) Mean–semivariance efficient frontier: a downside risk model for portfolio selection. Appl Math Finance 12:1–15

Best MJ, Hlouskova J (2000) The efficient frontier for bounded assets. Math Method Oper Res 52:195–212

Brieca W, Kerstens K (2009) Multi-horizon Markowitz portfolio performance appraisals: a general approach. Omega 37:50–62

Carlsson C, Fullér R, Majlender P (2002) A possibilistic approach to selecting portfolios with highest utility score. Fuzzy Set Syst 131:13–21

Chang TJ, Meade N, Beasley JE et al (2000) Heuristics for cardinality constrained portfolio optimisation. Comput Oper Res 27:1271–1302

Chen W (2015) Artificial bee colony algorithm for constrained possibilistic portfolio optimization problem. Phys A 429:125–139

Chen W, Wang Y, Mehlawat MK (2016) A hybrid FA–SA algorithm for fuzzy portfolio selection with transaction costs. Ann Oper Res. https://doi.org/10.1007/s10479-016-2365-3

Chen L, Peng J, Zhang B, Rosyida I (2017a) Diversified models for portfolio selection based on uncertain semivariance. Int J Syst Sci 48:637–648

Chen W, Wang Y, Zhang J, Lu S (2017b) Uncertain portfolio selection with high-order moments. J Intell Fuzzy Syst. https://doi.org/10.3233/JIFS-17369

Chen W, Wang Y, Gupta P, Mehlawat MK (2018) A novel hybrid heuristic algorithm for a new uncertain mean–variance–skewness portfolio selection model with real constraints. Appl Intell. https://doi.org/10.1007/s10489-017-1124-8

Choobineh F, Branting D (1986) A simple approximation for semivariance. Eur J Oper Res 27:364–370

Corazza M, Favaretto D (2007) On the existence of solutions to the quadratic mixed integer mean–variance portfolio selection problem. Eur J Oper Res 176:1947–1960

Dantzig GB, Infanger G (1993) Multi-stage stochastic linear programs for portfolio optimization. Ann Oper Res 45:59–76

Fu C, Lari-Lavassani A, Li X (2010) Dynamic mean–variance portfolio selection with borrowing constraint. Eur J Oper Res 200:312–319

Gao Y (2011) Shortest path problem with uncertain arc lengths. Comput Math Appl 62:2591–2600

Geyer A, Hanke M, Weissensteiner A (2009) A stochastic programming approach for multi-period portfolio optimization. Comput Manag Sci 6:187–208

Ghorbani A, Akbari Jokar MR (2016) A hybrid imperialist competitive-simulated annealing algorithm for a multisource multi-product location-routing-inventory problem. Comput Ind Eng 101:116–127

Grootveld H, Hallerbach W (1999) Variance vs downside risk: Is there really that much difference? Eur J Oper Res 114:304–319

Hogan W, Warren J (1974) Toward the development of an equilibrium capital market model based on semi-variance. J Financ Quant Anal 9:1–11

Hosseini S, Al Khaled A (2014) A survey on the imperialist competitive algorithm metaheuristic: implementation in engineering domain and directions for future research. Appl Soft Comput 24:1078–1094

Huang XX (2012) A risk index model for portfolio selection with returns subject to experts’ estimations. Fuzzy Optim Decis Mak 11:451–463

Huang XX, Qiao L (2012) A risk index model for multi-period uncertain portfolio selection. Inf Sci 217:108–116

Li D, Ng WL (2000) Optimal dynamic portfolio selection: multi-period mean–variance formulation. Math Finance 10:387–406

Li X, Qin Z (2014) Interval portfolio selection models within the framework of uncertainty theory. Econ Model 41:338–344

Li B, Zhu Y, Sun Y, Aw G, Teo KL (2018) Multi-period portfolio selection problem under uncertain environment with bankruptcy constraint. Appl Math Model 56:539–550

Liu BD (2007) Uncertainty theory, 2nd edn. Springer, Berlin

Liu BD (2009) Some research problems in uncertainty theory. J Uncertain Syst 1:3–10

Liu BD (2010) Uncertainty theory: a branch of mathematics for modeling human uncertainty. Springer, Berlin

Liu BD (2012) Why is there a need for uncertainty theory? J Uncertain Syst 6:3–10

Liu YJ, Zhang WG (2015) A multi-period fuzzy portfolio optimization model with minimum transaction lots. Eur J Oper Res 242:933–941

Liu S, Wang S, Qiu W (2003) A mean–variance–skewness model for portfolio selection with transaction costs. Int J Syst Sci 34:255–262

Liu YJ, Zhang WG, Zhao XJ (2016a) Fuzzy multi-period portfolio selection model with discounted transaction costs. Soft Comput. https://doi.org/10.1007/s00500-016-2325-5

Liu YJ, Zhang WG, Wang JB (2016b) Multi-period cardinality constrained portfolio selection models with interval coefficients. Ann Oper Res 244:1–25

Markowitz H (1952) Portfolio selection. J Finance 7:77–91

Markowitz H (1959) Portfolio selection: efficient diversification of investments. Wiley, New York

Markowitz H (1993) Computation of mean–semivariance efficient sets by the critical line algorithm. Ann Oper Res 45:307–317

Mehdinejad M, Mohammadi-Ivatloo B, Dadashzadeh-Bonab R, Zare K (2016) Solution of optimal reactive power dispatch of power systems using hybrid particle swarm optimization and imperialist competitive algorithms. Int J Elec Power 83:104–116

Mehlawat MK (2016) Credibilistic mean-entropy models for multi-period portfolio selection with multi-choice aspiration levels. Inf Sci 345:9–26

Mishra SK, Panda G, Majhi R (2014) A comparative performance assessment of a set of multiobjective algorithms for constrained portfolio assets selection. Swarm Evol Comput 16:38–51

Morshed MJ, Asgharpour A (2014) Hybrid imperialist competitive-sequential quadratic programming (HIC-SQP) algorithm for solving economic load dispatch with incorporating stochastic wind power: a comparative study on heuristic optimization techniques. Energ Convers Manag 84:30–40

Mossin J (1968) Optimal multi-period portfolio polices. J Bus 41:215–229

MousaviRad SJ, Tab AF, Mollazade K (2012) Application of imperialist competitive algorithm for feature selection: a case study on bulk rice classification. Int J Comput Appl 40:41–48

Niknam T, Taherian Fard E, Pourjafarian N, Rousta A (2011) An efficient hybrid algorithm based on modified imperialist competitive algorithm and K-means for data clustering. Eng Appl Artif Intell 24:306–317

Qin ZF, Kar S (2013) Single-period inventory problem under uncertain environment. Appl Math Comput 219:9630–9638

Qin Z, Kar S, Zheng H (2016) Uncertain portfolio adjusting model using semiabsolute deviation. Soft Comput 20:717–725

Sadeghi J, Mousavi SM, Niaki STA (2016) Optimizing an inventory model with fuzzy demand, backordering, and discount using a hybrid imperialist competitive algorithm. Appl Math Model 40:7318–7335

Sharafi Y, Khanesar MA, Teshnehlab M (2016) COOA: competitive optimization algorithm. Swarm Evol Comput 30:39–63

Shen Y, Yao K (2016) A mean-reverting currency model in an uncertain environment. Soft Comput 20:4131

Sun Y, Aw G, Teo KL, Zhu Y, Wang X (2016) Multi-period portfolio optimization under probabilistic risk measure. Financ Res Lett 18:60–66

Sun Y, Yao K, Dong J (2017) Asian option pricing problems of uncertain mean-reverting stock model. Soft Comput. https://doi.org/10.1007/s00500-017-2524-8

Towsyfyan H, Adnani-Salehi SA, Ghayyem M, Mosaedi F (2013) The comparison of imperialist competitive algorithm applied and genetic algorithm for machining allocation of Clutch assembly. Int J Eng 26:1485

Wang B, Li Y, Watada J (2017) Multi-period portfolio selection with dynamic risk/expected-return level under fuzzy random uncertainty. Inf Sci 385–386:1–18

Wei SZ, Ye ZX (2007) Multi-period optimization portfolio with bankruptcy control in stochastic market. Appl Math Comput 186:414–425

Wen M, Qin Z, Kang R (2014) The \(\alpha \)-cost minimization model for capacitated facility location–allocation problem with uncertain demands. Fuzzy Optim Decis Mak 13:345–356

Xu S, Wang Y, Huang A (2014) Application of imperialist competitive algorithm on solving the traveling salesman problem. Algorithms 7:229–242

Yan W, Li SR (2009) A class of multi-period semi-variance portfolio selection with a four-factor futures price model. J Appl Math Comput 29:19–34

Yao H, Li Z, Li D (2016) Multi-period mean–variance portfolio selection with stochastic interest rate and uncontrollable liability. Eur J Oper Res 252:837–851

Yoshimoto A (1996) The mean–variance approach to portfolio optimization subject to transaction costs. J Oper Res Soc Jpn 39:99–117

Zandieha M, Khatamib AR, Rahmatiba SHA (2017) Flexible job shop scheduling under condition-based maintenance: improved version of imperialist competitive algorithm. Appl Soft Comput 58:449–464

Zeng Y, Wu HL, Lai YZ (2013) Optimal investment and consumption strategies with state-dependent utility functions and uncertain time-horizon. Econ Model 33:462–470

Zhai J, Bai M (2018) Mean-risk model for uncertain portfolio selection with background risk. J Comput Appl Math 330:59–69

Zhang P (2016) An interval mean-average absolute deviation model for multiperiod portfolio selection with risk control and cardinality constraints. Soft Comput 20:1203–1212

Zhang WG, Xiao WL, Wang YL (2009) A fuzzy portfolio selection method based on possibilistic mean and variance. Soft Comput 13:627

Zhang B, Peng J, Li S (2015) Uncertain programming models for portfolio selection with uncertain returns. Int J Syst Sci 46:2510–2519

Zhu SX, Li D, Wang SY (2004) Risk control over bankruptcy in dynamic portfolio selection: a generalized mean–variance formulation. IEEE Trans Autom Control 49:447–457

Acknowledgements

This research was supported by the National Natural Science Foundation of China (Nos. 71720107002 and 71601132), the Beijing Municipal Education Commission Foundation of China (Nos. KM201810038001 and SM201810038006) and the Special Research Funds from the Quantitative Finance Research Center of School of Information, Capital University of Economics and Business.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare no conflict of interest.

Human and animal rights

This article does not contain any studies with human participants or animals performed by any of the authors.

Additional information

Communicated by V. Loia.

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Chen, W., Li, D., Lu, S. et al. Multi-period mean–semivariance portfolio optimization based on uncertain measure. Soft Comput 23, 6231–6247 (2019). https://doi.org/10.1007/s00500-018-3281-z

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00500-018-3281-z