Abstract

Recently, traditional manufacturing industries have faced two serious gaps and problems in line with effective product-line sales forecasting methods to balance the negative impacts on the performance of the subjective experience, including (1) arbitrary judgment, such as growth rate of expectancy, manager’s experiences, and historical sales data, may cause inaccurately predictive results and severe negative effects, and (2) sales forecasting is a key priority and challenge in the context of considerable product lines that have different properties and need specific models for supporting decision analytics. This study is motivated to propose an advanced hybrid model to utilize the advantages of variation for methods of fuzzy time series (FTS), exponential smoothing (ES), moving average (MA), and regression analysis (RA). To analyze the four product lines—stably growing product (SGP), declining product (DP), irregularly growing product (IGP), and special sales product (SSP)—this study is based on empirical sales data from a leading traditional manufacturer to accurately identify the high potentials of decisive key factors and objectively evaluate the model. Two evaluation standards—the mean absolute percentage error (MAPE) and root mean square error (RMSE), a parameter sensitivity analysis, and comparative analysis—are measured. After implementing the data from the case study, four key reports were conclusively identified. (1) Purely for the RMSE, the best one (10.32) is the ES method in the SGP line. (2) In the DP line, the better one is the RA(2) method, with a relatively low MAPE of 17.78% and RMSE of 26.46. (3) The FTS method is the best choice (MAPE 12.41% and RMSE 18.98) for the IGP line. (4) For the SSP line, the better one (MAPE 24.05 and RMSE 29.34) is the MA method. According to the above reports, although the proposed hybrid model has a general performance for the SSP line, it still has a superior predictor when compared to manager subjective prediction. Interestingly, the proposed model is rarely used, has a new trial with an innovative solution for the traditional manufacturer, and thus realizes applicable values. The study concludes with acceptable and satisfactory results and yields seven important findings and three managerial implications that significantly contribute to decision-making reference for complete sales-production planning for interested parties. Thus, this study benefits and values a conventional industry upgrade from novel application techniques.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

This section initially describes the study issue related to research background and research question, research motivation, and the significance and purposes of the study addressed and highlighted.

1.1 Research background and research question

First, highlighting a decision-making practice in sales forecasting for concerns of various industries from big data profits is an interesting and important practical topic for the main purpose of supporting sustainable business management under a circular economy (Wen et al., 2023) in traditional industries manufacturing for the achievement of better business operating performance and engineering applicable values. Next, traditional industries manufacture general products for daily life, which can supply domestic demand and are even exported to foreign countries, play important roles in steady economic growth with the purposes of a circular economy and free from waste, particularly for committing to the environmental, social, and governance (ESG) policy for a circular economy and for sustainability of both efficient use and protection of environmental resources (Yu et al., 2023), and benefit employees in Taiwan. Interestingly, it will face an unintended consequence if enterprises neglect ESG importance within their sustainable business management in the world (Yu et al., 2023); thus, it is obvious that the issue of sustainable business management under the circular economy is very important for the continuous development of enterprises, and in particular, the sustainable performance of the enterprise’s ESG has become a benchmark indicator to measure the environmental and social obligation responsibility of enterprises. Successively, when we turn back to reviewing traditional industries for actual operating conditions, customer demand might not always be practical or cost-oriented but rather might consist of the pursuit of high-quality and creative merchandise. Thus, the context of customer demand is continually changing, and smaller companies or those with fewer products might be unable to cope with the changing environment. Observing traditional domestic industries reveals a few companies with long histories or larger scales that insist on producing and selling a variety of product lines. However, they always meet with a serious problem of operating performance, such as inventory management and excessive waste (Nozari et al., 2023; Teerasoponpong & Sopadang, 2022). Lack of production capacity can lead to loss of orders, poor inventory, and other operational problems. Heizer and Render (2011) pointed out that customers are more likely to stop buying their goods whenever a company encounters a shortage of goods. In contrast, in cases of manufacturing too many products, there are inventory problems (Feng & Shanthikumar, 2022) but fewer problems of capacity. Given the above heavy dilemma problems faced for sales and production issues, it has emerged to guide effective decision-making in practice from the key priority of benefiting from the use of AI-based machine learning techniques (Gupta et al., 2022; Jiang et al., 2022; Yazici et al., 2022) on enhancing innovative knowledge management to offer sustainable products that traditional industries manufacture. However, it has a research gap because no researchers focus on studying the AI-based machine learning techniques to match up specific characteristics of different product lines from the limited literature review; thus, it should be first bridged. A key research question is hereby triggered with how to solve such an adverse condition to develop an effective forecasting mechanism to employ optimal alternative methods for making a pair with different product lines in the traditional manufacturing industry for further pursuing the realization of sustainable development under the background of the circular economy (Wan et al., 2023).

1.2 Research motivation

Furthermore, response capability is likely to become a decisive key factor for the customer. Response capability helps a company match the competition, except for production quantity. In order to deliver the product on time, the company must have sufficient quantities of inventory as well as meet each customer's order requirement on time. Production volume and storage space are so limited that how to balance sales, production quantities, and reaction capacity is a key point in sales forecasts. To increase profits, manufacturers should maintain the correct mix of the correct product lines at the correct time relevant to market demands based on sales forecasting strategies. Practically speaking, manufacturers can base sales forecasts for product lines on the personal and subjective experiences of a manager. This approach depends heavily on individual opinion, historical sales data, and the expectancy of future growth rates, which might cause inaccurate results that result in negative effects. For these reasons, sales forecasting is a key priority and an interesting challenge for sustainable inventory management in particular, because various product lines have different specific properties and backgrounds that need different forecasting models that can be applied in various application fields (Fang & Chen, 2022; Golmohammadi & Radnia, 2016; Jiang & Dai, 2015; Kamaraj et al., 2015; Lu et al., 2015; van Donselaar et al., 2016; Wang et al., 2022; Yuan et al., 2015). Forecasting models can have a significant effect on product lines. Thus, the research gap with the key research question to model a suitable and effective sales forecasting tool and effectively identify the decisive key factors based on characteristics for various product lines applied in the traditional manufacturing industry is required to be filled and is particularly of concern. To bridge the research gap and question, this research is motivated by the search for optimal alternative methods for machine learning to pursue an effective decision-making methodology to highlight integrating AI into processing decision-making mechanisms for supporting the achievement of better sustainable business management from the perspectives of industry-engineering applications highlighted in this study. That is, the study aims at providing a reasonable justification of technique for addressing and adding academic values to strengthen the novelty of traditional industry application.

1.3 Significance and purposes of the study

Lastly, this study thus proposes a hybrid model to build four key techniques and use their advantages to support the manufacture of the correct quantity of products by predicting the quantity of sales accurately. The study further organizes fuzzy time series (FTS) models (Chan et al., 2015; Efendi et al., 2015; Yang et al., 2022), exponential smoothing (ES) methods (Sadeghi, 2015; Udenio et al., 2022; Yang et al., 2015), moving average (MA) methods (Lin et al., 2023; Marshall et al., 2017), and regression analysis (RA) models (Fumo & Biswas, 2015; Tang et al., 2023; Thrane, 2016) to help manufacturers lower total stock costs and improve sales performance. To evaluate model performance through objective analysis, this study collects practical sales data from a leading traditional manufacturer in Taiwan for various product lines. The product lines are varied based on specific characteristics, such as long-term or periodic, to select representative products from various categories. In particular, there is no better model applicable to a variety of product lines. Thus, it is a key significance of the study to achieve a crucial strategy for finding out a better model for different product lines. Meanwhile, this study has the following four significant objectives: (1) Construct four models to predict and determine the related conditions of sales quantity in manufacturing and their decisive factors. (2) Estimate the effect of the four models by comparing the artificial-subjective approach and the technical-objective approach. (3) Identify the problems of sales forecasting, make recommendations, and propose improvements to provide more-precise sales quantity data for back-end production units. (4) Provide empirical results as a reference for near-range purposes in supporting business sales forecasting decision-making and in key interests of the remote target of addressing sustainable business management under the circular economy in order to achieve the core goal of further protecting the Earth due to the limited resources.

Importantly and interestingly, it is worth mentioning that the base of concepts and ideas of this study is emphasized on structurally modeling the scientific-technical research based on machine learning techniques with the advantages for an industrial application in the traditional manufacturer. Thus, from the well-established literature on the related research for the FTS method (Cagcag Yolcu et al., 2020), for the ES method (Gallina et al., 2021; Jayant et al., 2021), for the MA method (Hanggara, 2021), and for the RA method (Zheng et al., 2023), for the time series prediction of good manufacturing industry applications, this study provides the equivalent research or works of intellectuals to build a citadel for well designing the learning architecture of the proposed hybrid model, which can justify the adaptability and applicability of the proposed methods employed. Moreover, regarding the applicability of the proposed hybrid model, it is basically acceptable to the generally traditional manufacturing industry for identifying sales forecasting, but it is inapplicable that the sales quantity has outbreaking and slumping situations, and it will be a challengeable issue for the black swan effect, such as in the COVID-19 case. Furthermore, the proposed hybrid model is rarely used, and a new trial with an innovative solution for the traditional manufacturer is conducted after reviewing the related literature and thus realizing applicable values for academic research purposes. Thus, this study benefits and values a conventional industry for the technical upgrade of prediction models from novel application techniques, with a significant contribution of industry application for interested parties.

The remainder of the paper is presented as follows: Sect. 2 reviews sales forecasting literature and four models for quantitative analysis. The proposed model is described in Sect. 3 by using an empirical case to compare its errors under two useful criteria. Section 4 displays comparison, verification, and related comparative studies. Section 5 explores the study findings and management implications, and introduces discussions and limitations. Finally, Sect. 6 concludes and defines the future direction.

2 Related studies

This section summarizes the work related to sales forecasting and its applications, including FTS, ES, MA, and RA.

2.1 Sales forecasting and its applications

Prediction (or forecasting) information is important for helping policymakers (or decision-makers) make appropriate decisions and can be found in a variety of applications (Fang & Chen, 2022; Gokulachandran & Mohandas, 2015; Sarkheyli et al., 2015; Wu et al., 2013; Zeroudi & Fontaine, 2015). Accurate forecasting results can provide more useful and truer information for proper reactions against encountered problems; however, each of the constructed methods has its pros and cons that derive from some of the data’s characteristics. Thus, effective methods for modeling and identifying related activities are a top-priority concern for academicians and practitioners. Concerning previous forecasting research, many researchers used various models or methods to predict, with the aim of addressing and analyzing relevant problems in various fields of applications. For example, Yu and Huarng (2008) and Yang et al. (2022) indicated that FTS is suitable for applicable forecasting in a variety of fields. Their research model combined neural networks (NNs) with FTS to build a binary model for predicting stock market indices; experimental results showed that this model was better at prediction accuracy than other models. Wang and Hsu (2008) used FTS to model and predict tourism demand and analyze tourism data for 1991–2001, and their findings showed that this model is suitable for short-term forecasts in the tourism industry. Udenio et al. (2022) used the ES method to forecast and control the bullwhip effect problem. Liu et al. (2010) used the ES method to predict the development trend of water environmental safety in Zhejiang. Thomassey (2010) conducted a study of the current practice of the garment industry, which is characterized by short-cycle and seasonal product problems. He uses FTS, NNs, and other data mining methods to build predictive models that enable the supply chain to react faster to market changes and reduce the impact of addressing the bullwhip effect. Moraes et al. (2013) studied the electricity demand forecast and used fuzzy theories as the basis for this application. They found it was more accurate when given a small amount of input. Aladag et al. (2014) presented an advanced predictive model for high-order seasonal FTS by integrating the model with the NNs; they also applied this approach to Turkey's international tourism needs and found that the experience of this proposed model was better than that of a normal seasonal FTS for a tourism service system. Carpio et al. (2014) used a multi-variable ES and dynamic factor model applied to the hourly electricity price analysis, and they showed the advantages of its multi-variant version and introduced the performance of the model through applications in previous markets, such as Omel, Powernext, and Nord Pool. Jónsson et al. (2014) incorporated the seasonal and dynamic nature of real-time prices into the ES methodology for predicting real-time electricity markets, and subsequent empirical surveys of the Nord pool, imitating practical forecasts for the 4-year period of 2008–2011, proved that the proposed approach was superior to several common benchmarks. Marshall et al. (2017) applied time-series momentum and moving averages (MAs) to trading rules, and their experimental findings showed that the MA rule often gives early signals that lead to meaningful returns. Zhang et al. (2014) used a seasonal autoregressive integrated MA model to forecast the mortality of road traffic injuries in China and had significant results. Fumo and Biswas (2015) performed RA to predict residential energy consumption, and when compared to other methods, it showed promising results due to its reasonable accuracy and relatively simple implementation. Thrane (2016) employed a logistic RA to examine how certain independent variables explained a tendency to choose package travel rather than independent travel. Yang et al. (2015) combined an extensive ES model of knowledge-based precise time series decomposition approaches to forecast global horizontal irradiance; the results showed that their proposed method performs as a persistence model. Wang et al. (2016) used an intuitive FTS forecast model on admission to the University of Alabama and the Taiwan Stock Exchange capitalized weighted stock index. Yolcu and Lam (2017) presented an integrated, powerful model (C-R-FTSM) to evaluate the outliers and analytical predictive performance of the methods used. Overall, Table 1 lists the above-mentioned studies related to forecasting issues in chronological order.

According to Yang et al. (2022), Udenio et al. (2022), Lin et al. (2023), and Tang et al. (2023), FTS, ES, MA, and RA not only have a noted and distinguished role but also have received widespread attention in recent years due to the invention of the national space design. (Ramos & Oliveira, 2016; Ramos et al., 2015), which delivers a satisfactory performance in many studies. Although a variety of composite models (or hybrid models) of these methods are further proposed for use in a wide variety of application fields, the models still provide a basic theoretical form and structure, providing advantages for numerous studies. Moreover, based on a limited literature review, these models are less applied in the sales forecasting of the traditional manufacturing industry in Taiwan than in other application contexts. Based on these reasons, this study thus combines these methods with knowledge-based prediction modeling and identification models to improve prediction accuracy and efficiency for sales forecasting issues in the traditional manufacturing industry.

Furthermore, it is a hot issue to address and evaluate the ESG sustainable performance to save resource efficiency and avoid waste for industrial companies worldwide (Yu et al., 2023) due to the increasingly serious problem of global warming, particularly for the traditional manufacturing industry; thus, the main objective is highlighted on matching the program of sales and production by effective sales forecasting models and achieving the reduction of waste free from overproduction, over-inventory, oversupply, and over-material and over-labor in this study.

2.2 Fuzzy time series

In applied time series analysis, observing trends in data, such as seasonal cycles, increasing, and decreasing, can help to assess events and then choose the most appropriate model. In the modeling process of time series, various time-series modeling analyses can be combined into a composite model in a more effective framework. The three basic, well-known forms of this approach are auto regressive moving average (ARMA; Huang, 2015), auto regressive integrated moving average (ARIMA; Wei et al., 2016), and seasonal auto regressive integrated moving average (SARIMA; Zhang et al., 2014). Due to errors or obstacles in data collection, time delays, and the interaction effects of these models, the researchers used only single numerical parameters for measurement; however, doing so might incur the danger of overfitting. Accordingly, Jain et al. (2012) provided a data dredging approach through a fuzzy concept to extract relevant data from the reduction of a massive amount of time-series data in a stock market, which can help investors decide when to buy and sell their products. The authors’ experimental results indicated satisfactory progress. Thus, this research focuses on the FTS model to solve the above errors, obstacles, and real-life sales forecasting problems encountered. Zadeh (1965) proposed a fuzzy set theory that uses mathematical models to describe the vague information provided, which should be represented by the probability distribution. Zadeh (1996) further introduced possibility theory as a part of the modeling of fuzzy information that can be expressed in natural language. Fuzzy set theory can help imitate human thinking processes, specifically by extending each element from binary logic to multivariate logic. Yager et al. (1987) used fuzzy set concepts to express the definition of fuzzy set characteristics as follows: Let X be the universal set. A is a fuzzy set, and x is the generic element of X. \({\varvec{\mu}}{\varvec{A}}\left({\varvec{x}}\right)\) calls the membership function of group A, and \({\varvec{\mu}}{\varvec{A}}\left({\varvec{x}}\right)\) assigns the value between 0 and 1. The definitions are defined as Eqs. (1) and (2).

Zadeh (1965) used membership functions to introduce the characteristics of fuzzy sets. Fuzzy sets of data can be quantified, analyzed, and accurately processed through the membership function, and the value between 0 and 1 represents the fuzzy membership degree. The membership function is divided into two main types: a discrete membership function (DMF) and a continuous membership function (CMF). DMF directly gives a member a grade for each member in a finite fuzzy set, whereas CMF uses different forms of functions to describe fuzzy sets. Membership functions include triangular, trapezoidal, and Gaussian functions. Determining the appropriate member function is often one of the most important factors in practical examples of fuzzy theory; it is mostly demonstrated by experience or statistical methods.

In a further application analysis for FTS, Arora and Saini (2013) suggested that FTS applied fuzzy logic to time series analysis processes to solve fuzzy issues of data provided in the real world. Chen (2014) further adopted a new high-order FTS method to address nonlinearity and complexity issues, predicting good performance for the Taiwan Stock Index and the University of Alabama student enrollment record. The definition of FTS is as follows:

Let {X(t)}\(\in\) R, t = 1, 2, …, n} be a time series. U is its domain. Since U is an orderly partition set, the linguistic variable of {Pi; i = 1, 2, …, r,\(\bigcup\nolimits_{i = 1}^{r} {P_{i} }\) = U} is corresponded to {Li; i = 1, 2, …, r} if there has {Li; i = 1, 2, …, r} corresponding to F(t) of X(t); then, F(t) is called as a FTS on X(t) (t = 1, 2, …, n). Given the above description of theory, F(t) is called a linguistic variable. The membership function of F(t) is {\({{\varvec{\mu}}}_{1}\)(X(t)), \({{\varvec{\mu}}}_{2}\)(X(t)), …, \({{\varvec{\mu}}}_{{\varvec{r}}}\)(X(t))}, 0 ≤ \({{\varvec{\mu}}}_{{\varvec{i}}}\)(t) ≤ 1, and i = 1, 2, …, r. This definition is used to define the set on FTS of {F(t)} as Eq. (3).

In this equation, \({{\varvec{\mu}}}_{1}\): R → [0, 1], \(\sum\nolimits_{i = 1}^{r} {}\) \({{\varvec{\mu}}}_{{\varvec{i}}}\)(X(t)) = 1, for each t = 1, 2, …, n.

Based on Egrioglu (2014) and Song and Chissom (1993), the FTS models are detailed as follows.

-

(1)

p-th order on fuzzy auto-regressive method: For a notation FAR(p), it is generalized as an autoregressive FTS method for order p, and the formation is defined as Eq. (4). Equation (4) shows that R refers to a relationship of fuzzy set among \({\varvec{F}}\left({\varvec{t}}\right)\), \({\varvec{F}}\left({\varvec{t}}-1\right)\), \({\varvec{F}}\left({\varvec{t}}-2\right)\), …, and \({\varvec{F}}\left({\varvec{t}}-{\varvec{p}}\right)\).

$$ {\varvec{F}}\left( {\varvec{t}} \right) = {\varvec{F}}\left( {{\varvec{t}} - 1} \right) \cdot {\varvec{F}}\left( {{\varvec{t}} - 2} \right) \cdot \cdots \cdot {\varvec{F}}\left( {{\varvec{t}} - {\varvec{p}}} \right) \cdot {\varvec{R}} $$(4) -

(2)

First order of fuzzy auto-regressive method: In a particular case, the notation FAR(1) indicates an autoregressive FTS method of first order when p = 1, and the equation is defined as Eq. (5). Afterwards, R has a relationship of fuzzy set between \({\varvec{F}}\left({\varvec{t}}\right)\) and \({\varvec{F}}\left({\varvec{t}}-1\right)\).

$$ {\varvec{F}}\left( {\varvec{t}} \right) = {\varvec{F}}\left( {{\varvec{t}} - 1} \right) \cdot {\varvec{R}}. $$(5)

2.3 Exponential smoothing

Exponential smoothing was suggested by Brown (1956) in the statistical literature. ES is suitable for forecasting issues, such as sales forecasting for both individual and multiple items. That is, it is also appropriate for forecasting time series data with or without seasonal patterns or trends. In particular, the ES method has better effectiveness when the data values to describe the time series are changed slowly because it can assign larger weights to more recent data. This method is intuitional, computable, and resilient; thus, it benefits from the advantages of requiring less data storage property, assigning more weight to recent observations, and having the easier-to-change responsiveness of a forecast that the decision-maker desires for the parameter alpha (\({\alpha }\)). Given these merits, it is widely applied in various domains, such as the electricity industry (Carpio et al., 2014; Jónsson et al., 2014) and the shoe manufacturing industry (Singh et al., 2015). However, this method still has a significant lack (or disadvantage) of statistical theory and does not contain explainable exogenous variables. Based on the study of Brown (1956, 1960), the ES model is usually classified into the following two different types:

-

(1)

Simple ES: It calculates the difference between the actual and forecast values of the previous year and the preceding year and adds the result to the expected value of the prior year. Higher smooth constant weights mean that recent data is more important; conversely, lower smooth regular weights mean that historical data is more important. Simple ES is defined as Eq. (6). For example, if \({{\varvec{A}}}_{{\varvec{t}}-1}\) is 585, \({{\varvec{F}}}_{{\varvec{t}}-1}\) is 472, and \(\boldsymbol{\alpha }\) is set with a suitable value of 0.9, then the forecasting value for \({{\varvec{F}}}_{{\varvec{t}}}\) is rounded to 574.

$$ {\varvec{F}}_{{\varvec{t}}} = {\varvec{F}}_{{{\varvec{t}} - 1}} + {\varvec{\alpha}}\left( {{\varvec{A}}_{{{\varvec{t}} - 1}} - {\varvec{F}}_{{{\varvec{t}} - 1}} } \right) $$(6)where \({{\varvec{F}}}_{{\varvec{t}}}\) refers to the forecasting data of the ES model in the period t, \({{\varvec{A}}}_{{\varvec{t}}-1}\) refers to the actual sales value for period \({\varvec{t}}-1\), and \(\boldsymbol{\alpha }\) is the value of smooth constant between 0 and 1.

-

(2)

Trend-adjusted ES method: Use a simple ES method to reach the predicted value, and then use the second ES value to reach the final predictable value. This approach could lead us to a major trend shift. Equations (7) and (8) of trend-adjusted ES are expressed as follows:

$$ {\varvec{F}}_{{\varvec{t}}} = {\varvec{\alpha}}\left( {{\varvec{A}}_{{{\varvec{t}} - 1}} } \right) + \left( {1 - {\varvec{\alpha}}} \right)\left( {{\varvec{F}}_{{{\varvec{t}} - 1}} + {\varvec{T}}_{{{\varvec{t}} - 1}} } \right), $$(7)$$ {\varvec{T}}_{{\varvec{t}}} = {\varvec{\beta}}\left( {{\varvec{F}}_{{\varvec{t}}} - {\varvec{F}}_{{{\varvec{t}} - 1}} } \right) + \left( {1 - {\varvec{\beta}}} \right){\varvec{T}}_{{{\varvec{t}} - 1}} , $$(8)where \({{\varvec{F}}}_{{\varvec{t}}}\) refers to the forecasting data of the ES model in the period t; \({{\varvec{T}}}_{{\varvec{t}}}\) refers to the trend-adjusted data of the ES method in the period t; \({{\varvec{A}}}_{{\varvec{t}}}\) is an actual demand in the period t; \(\boldsymbol{\alpha }\) is a value of smooth constant; \({\varvec{\beta}}\) refers to a trend constant, and values of both \(\boldsymbol{\alpha }\) and \({\varvec{\beta}}\) are between 0 and 1.

2.4 Moving average

Granville (1976) pointed out that MA is the use of recent actual data to predict data for the next period, which can help companies predict demand for products or production capacity. In statistical applications, the MA method is also suitable for sales forecasting issues used in the shoe industry (Singh and Borah 2014) and in fresh food sales (Lee et al., 2012). The MA method is simply divided into two modes: simple MA and weighted MA. First, in its simplest form, this method is properly used with time-series data in a calculation to analyze the actual given data by computing a series of averages of different subsets with equal weights, each containing a certain number of items for the full dataset, and these average data can show a short-term fluctuation and reflect a long-term trend. This approach is called simple MA; in particular, the weight of each element for simple MA should be equal. Second, for weighted MA, the points of this approach are that each period of historical data used to forecast future demand should be set up with different weights, with n viewed as a periodically changing value. The changing variables are not important if they are away from the target period; thus, the weight is low. For the MA method, the generalized equation in the form of generic weights is formatted as Eq. (9).

where \({{\varvec{F}}}_{{\varvec{t}}}\) refers to the predicted value for the next period; n refers to the periods number of MA model; \({{\varvec{A}}}_{{\varvec{t}}-1}\) refers to the actual value from the previous period; \({{\varvec{A}}}_{{\varvec{t}}-2}\), \({{\varvec{A}}}_{{\varvec{t}}-3}\), and \({{\varvec{A}}}_{{\varvec{t}}-{\varvec{n}}}\) refer to the real value for the first two periods, the first three periods, and until the previous n periods, respectively; \({{\varvec{w}}}_{1}\) refers to the weight for the actual value of sales quantity during the period \({\varvec{t}}-1\); \({{\varvec{w}}}_{2}\) refers to the weight for the actual value of sales quantity during the period \({\varvec{t}}-2\), etc.; \({{\varvec{w}}}_{{\varvec{n}}}\) refers to the weight for the actual value of sales quantity during the period \({\varvec{t}}-{\varvec{n}}\); and \({{\varvec{w}}}_{1}+{{\varvec{w}}}_{2}+\cdots +{{\varvec{w}}}_{{\varvec{n}}}\) is a total of 1.

Concerning the MA method, some characteristics are defined for sales forecasting topics. (1) The fewer the data periods, the greater the responsiveness for the decision-maker (e.g., sales and production managers setting appropriate weights). (2) As an analytical tool, the MA method can be used quickly and easily to identify a current uptrend or downtrend change for smoothing out the volatility of the sales or production quantity in a given dataset. (3) Measure the effects of different timeframes in short and long terms. The longer the timeframes, the smoother the simple MA; in other words, a shorter-term MA is more volatile than a longer-term MA for sales and production quantities.

2.5 Regression analysis

Regression analysis uses statistical theory to construct and explore the forms of these relationships between variables and is used in equations to prove the effect between each variable and the product formula. Allen and Fildes (2001) and Scott (2012) found sufficient evidence to suggest that RA often provides useful predictions for data analysis and modeling. Thus, this RA method is also widely applied, with many practical usages and research studies, and is used for forecasting or prediction, as in the automobile industry (Sharma & Sinha, 2012) and grocery store sales (Morphet, 1991). This approach has the following two main types of RA: (1) According to the difference between the independent variables, there are two RA classifications: simple RA and multiple RA. Simple RA has only one independent variable; conversely, multiple RA has more than two independent variables. (2) Based on the relationship between the dependent variables and the independent variables, the RA model can be divided into linear and non-linear methods.

As Schneider et al. (2010) described, a linear RA model means that one or more independent variables and dependent variables are based on the variability and linearity of the independent variable in order to predict the average trend development of the dependent variable. Particularly, the linear regression prediction model is always used for sales prediction, as is frequently shown in previous studies (Palia & Roussos, 2004; Rogers, 1992). In the study of practical problems, the dependent variable of multiple linear regressions is often affected by several important factors. Assume that X refers to an independent variable and Y is a dependent variable. X and Y have existed in a linear relationship. Specifically, the details of generalized multiple linear regression models can be referenced in Uyanık and Güler (2013) and are defined as in Eq. (10).

where \({{\varvec{b}}}_{0}\) refers to a constant, and \({{\varvec{b}}}_{1}\), \({{\varvec{b}}}_{2}\), …, \({{\varvec{b}}}_{{\varvec{k}}}\) are the coefficients of regression.

The RA method to analyze data can help production managers forecast future demands to support sufficient sales quantities in operations management and provide new insights to move the production plans toward a more profitable solution. Some advantages associated with the high performance of the RA method used by academicians and practitioners as a forecasting model are as follows: (1) The method can provide an efficient forecast. (2) Using a suitable slope for an RA model can increase forecasting accuracy because there is less variability in the forecasting processes. (3) The model lends an objective and scientific view to measuring the relative correlation of one or more independent variables to the dependent values. (4) It has the ability to determine outliers. However, disadvantages of the RA method can include (Osborne & Waters, 2002): (1) It needs typical assumptions, such as no error measurement and linear independence with the independent variables; and (2) the performance of the RA method is highly dependent upon the form of how the data are used in the data-generating process.

3 The proposed model

This section introduces the concepts and algorithms for the proposed model with the introduction of an empirical case study.

3.1 Concepts of the proposed hybrid model with an empirical case study

Concerning the relevant research on creative forecasting from key technical tools for the interests of better sustainable business management in traditional manufacturing industries, although there are many approaches to sales forecasting for various products, no existing model is suitable for every product because of differences between product lines. The authors have experienced the effects of losses in traditional manufacturing industries when sales forecasting is wrong. Moreover, the authors’ work in traditional industries triggered an empirical case study. The research object is a large-scale manufacturing company (hereafter referred to as L-Company) with four manufacturing product lines: a stably growing product (SGP), a declining product (DP), an irregularly growing product (IGP), and a special sales product (SSP) from big data application analytics. The company manufactures and sells an enormous number of stock-keeping unit (SKU) products and plans to produce similar make-to-stock (MTS) products. In a detailed estimation in 2008–2012, a review of the total inventory of products sold by L-Company in Taiwan found approximately 500, 90, 1200, and 220 products belonged to SGP, DP, IGP, and SSP, respectively. The company is also a leading one in Taiwan’s traditional industry. How L-Company estimates its sales rates is based on subjective predictions. Administrators use historical sales data and expected sales growth rates (SGRs) to forecast the sales rate for the next year. Such subjective experiences and prediction standards might be changed frequently and dramatically by a manager; such negative activity would affect production plans provided by the back-end production unit severely and persistently. The activity might cause a significant reduction in operating performance and increases in sales and inventory costs due to subjective forecasting results being different from actual demand quantities. This research benefits objective and smart technologies for sales forecasting: (1) It facilitates sales quantity forecasting based on the characteristics of product lines more accurately and then arranges production plans more appropriately to avoid creating excessive inventory quantities; and (2) it helps production supply to avoid delays and enhances the competitive advantage of L-Company for a good decisional support model.

Given these reasons, this study develops a hybrid sales forecasting model for each type of product line in an empirical case study using L-Company and collects the sales data as an experimental dataset to use for calculation and decision analysis. The processes of modeling the proposed model are divided into three phases, as follows: (1) Three procedures are conducted in the following three steps: (a) Choose the research items of products; (b) catalogize the four product lines by type according to product property; and (c) organize and collect the data on sales quantity for each product line. (2) Build FTS, ES, MA, and RA in the proposed model for sales forecasting, defining and training the various parameters of each model. (3) Calculate the performance of each proposed method and compare the four empirical results with actual and predicted values from the subjective forecasting of managers. Figure 1 describes the flow chart of the proposed hybrid model.

3.2 Implementing algorithms for the proposed hybrid model using the L-Company case

The computational processes of the proposed hybrid model comprise the seven steps for L-Company as follows: (Note: For ease of presentation, the empirical results are unified and described in the next section.)

Step 1: Select the research item from the products.

Initially, this study selects historical sales data on the products from L-Company to conduct modeling and identify processes. The experimental dataset was collected as monthly data in 2008–2012.

Step 2: Classify products by their line types.

Categorize the product item based on product properties, such as trends in sales quantity and frequency of sales. One alternative means of determining the stage of the sales cycle for product lines is based on the SGR method because the SGR approach shows a high relationship to product sales cycles (Harrell & Taylor, 1981). This method helps this study judge, based on changes in SGR, the stage of the sales cycle of the products being analyzed. SGR is used to divide the stages of product life cycles based on the annual growth rate in sales quantity. The four types of product lines for L-Company are classified by SGR (Harrell & Taylor, 1981) as follows:

-

(1)

SGP line: It is identified as the SGP line, which meets the definition of the continuous growth type life cycle for the products in the last 5 years. This type of product line is a popular group applicable to writing, painting, and designing. Practically speaking, the SGP line can be applicable to the surface of a variety of materials for a wide range of uses and for having a specific property with steady demand for sales quantity when SGR is greater than 10%. The company needs an effective production plan to produce a product line that meets growing sales quantities continuously. Forecasting sales demand for this line accurately is important and attracts much attention at L-Company.

-

(2)

DP line: Art painting materials belong primarily to the DP line and are often bought by schoolchildren. Their sales quantity and sales profit present a declining trend in which SGR is less than 0%, with a prolonged recession in 2008–2012. This product line has the following characteristics: First, such products exist on the market as long as they are spread and standardized. Second, there are many competitors selling the same types of alternatives. Third, consumer demand for the product line has changed, and this change is characterized as time-descending. Although there are promotional activities for the product line, the line generates insufficient sales. Concerning management implications, the DP line should not be overstocked. Therefore, to prevent an accumulation of potential inventory and losses, L-Company clearly must control the inventory level rigorously and appropriately based on correct sales forecasting models.

-

(3)

IGP line: According to expert opinion in the manufacturing field, an IGP line has problems with a certain irregularity of pattern rules and unsteady sales. On the one hand, an IGP line can be a growing trend, and when no similar type of product is competing in the market, the product can become a potential mainstream product with a massive quantity of sales. On the other hand, the IGP line can enter a decline for unknown reasons. Specifically, a product line is considered an IGP when its SGR is between 0 and 10%. Thus, if this study can analyze the sales logic of this product line or identify the potential reasons for and growth method of its irregular rules, this product line can be converted from a potential product to a major, popular product that will achieve better profits for L-Company. This situation motivates the research.

-

(4)

SSP line: Experts from the manufacturing company have indicated that the SSP line (SGR is always lower than 10%) is primarily coordinated with a property of specific activities on particular days, such as the beginning of the school season or a particular exhibition with a significant sales quantity. An experienced business will address group demand for semester activities with suitable product sets for enhancing sales quantity. It is an interesting process for L-Company to make an accurate prediction for this product line.

Step 3: Gather and organize the data describing the sales quantities of products.

Select a representative product from each of the different types of products based on two criteria: the SGR (Harrell & Taylor, 1981) and the property of specific activities on particular days, based on a consensus reached by three professional experts at L-Company, and then collect the historical sales data for the product. There is an existing drift, non-linear relationship, and uncertainty for the given data; thus, it is a key point to do sales forecasting by using similar fuzzy data dredging (Jain et al., 2012). To address these problems, this study preprocesses the data based on the following two sub-steps: (1) Implement and evaluate the adjustment according to the best intervals of data, and (2) generate corresponding datasets. The preprocessed data applied to the related fuzzy models can greatly improve forecasting accuracy (Bang & Lee, 2008). This study preprocesses the data based on the experts’ recommendations before conducting each technique of the proposed model. Any abnormal, special features caused by specific unit events, such as an increase in expected price that is contingent on anticipated price changes for oil and electricity, i.e., anything that might generate pseudo-needs or fictitious demands that could cause unusual or inaccurate sales information for that period, should be removed or adjusted in this preprocessing stage before being used in this study. Furthermore, testing for autocorrelation (also known as serial correlation) (Sun et al., 2018) for the given linear RA method and other models used is a common and necessary task for researchers because the accuracy of the forecast method used depends upon the right selection of explanatory variables. An autocorrelation test is a mathematical representation of the degree of similarity between observations that acts as a function of identifying the time lag to find repeating patterns over the forecasting horizon in the experimental time intervals. The test for detecting the presence of first-order auto-correlation is to apply the statistic of Durbin Watson (DW) for a measure of autocorrelation in the residuals from an RA method or other model. The test value of the DW statistic should be between 0 and 4. The DW statistic is thus run to test the autocorrelation problem of the data used in this study; testing results of 1.01, 1.32, 1.47, and 2.08 for these data of the four representative products are obtained, respectively. Field (2013) suggested that a definite concern about autocorrelation should exist when the test values of DW are less than 1 or greater than 3. Thus, there appears to be no autocorrelation problem of concern based on the testing results of the four given experimental samples.

Step 4: Model sales forecasting methods.

This step selects four representative products for the four corresponding product lines based on the suggestions of experts at L-Company. Accordingly, we model the four sales forecasting methods (FTS, ES, MA, and RA methods) with the four representative products.

Step 5: Build forecasting models.

This step first introduces building the FTS method to model and analyze the empirical case data collected from L-Company because the type of fuzzified data can yield better results for the numerical values of the data used. Accordingly, the constructs of the other three models are used to determine suitable methods for various types of representative products. First, in the building process, a recognition of the order in FTS analysis is useful to handle the variables associated with data trends and to build a mathematical method to show the real world. In general, the existence of an increasing or decreasing trend shows that the raw data can be processed with different actions. The calculative processes for the FTS model are divided into seven sub-steps, as follows: (1) Build the domains for fuzzy sets and subsequently fuzzify their data. (2) Employ the principle of a hypothetical test to judge whether the data is fuzzy; otherwise, return to sub-step (1). Afterwards, execute the difference conversion of the given data; otherwise, proceed to the next step. (3) Identify the order of the FTS method. (4) Compute fuzzy relationships by matrix. (5) Choose the best FTS method. (6) Apply the FTS method to make a forecast. (7) Defuzzify the data to obtain the experimental results. Second, in the ES building process, based on Eqs. (6) and (7), various smoothing constants (α) between 0 and 1 are adjusted to model better results for different product lines. Third, in using the MA method, various numbers of moving-period times are measured based on Eq. (9) to obtain the predicted value for the next period. Finally, in the RA building process, the key task is initially based on the experts’ recommendations to identify the decisive key factors influencing sales quantity and then calculate the forecasting results based on Eq. (10).

Step 6: Generate forecasting values.

In fact, the data from the sales quantities of the product lines have an interval value at L-Company; thus, this step fuzzifies data with the same interval value into the same fuzzy sets. There are two advantages to this approach. The first is that it could decrease the data complexity; the second is that the processed data could be supplied as the input values for each forecasting method. Accordingly, this step generates the forecasting results to further verify the empirical results of the proposed model. Additionally, based on the other models modeled in previous steps, their forecasting results are accordingly calculated and created. For brevity, the empirical results will be uniformly presented in the next section.

Step 7: Make a comparison of empirical results and deal with an error analysis.

To assess the performance of the proposed model, the step compares the predicted value with the actual value, both of which are based on a mean absolute percentage error (MAPE) (Zhang et al., 2023a), which prevents the proportion of inaccuracy caused by large differences in product sales quantity. However, error analysis with only one percentage indicator for MAPE is not sufficient to verify a forecasting model. Thus, the root mean square error (RMSE) (Zhang et al., 2023a) should be employed when the forecasting value is critical and the unit price is high. Additionally, this approach can convert error values to a percentage of the actual values. The greater the MAPE and RMSE, the poorer the performance of the method in terms of the size of the error for the forecast horizon required. The equations of MAPE and RMSE are defined as Eqs. (11) and (12), respectively.

where \(x(k) - x^{\prime}(k) = \varepsilon_{k}\), \(x(k)\) refers to an actual value, \(x^{\prime}(k)\) refers to an estimated value, \(\varepsilon_{k}\) refers to the difference of the above two values, and M is sample size. The calculation yields a perfect performance measure for the predicted results if their values of both the MAPE and RMSE achieve 0% and 0, respectively.

4 Experimental results and comparisons

This section shows the verification of the case study for four product-line datasets and summarizes the experiments, comparable methods with internal and external comparisons of four product lines by using the FTS, ES, MA, and RA methods, and the Wilcoxon signed-rank test to model and identify related sales forecasting for the experimental time periods during 2008–2012.

4.1 Empirical study results using the four product lines

The verification of an empirical study for L-Company on the four product lines and using the proposed model is described in bullet points, and in particular, a parameter sensitivity analysis to core parameters is needed to make more validation for the experimental results of mathematical time series models. For brevity, the main experimental results with tables and figures, and their illustrations are listed as follows:

4.1.1 For the SGP line

-

(1)

FTS method: In the FTS building process of time series forecasting, there is the minimum value of 360, the maximum value of 3204, interval values from 10 to 200, and fuzzy auto-similarity examined from 1 to 15 periods for the parameter sensitivity analysis of periods in order to find out the best empirical results in the SGP line. Interestingly, parameter sensitivity analysis (Ganaie et al., 2023; Singhal et al., 2023) is specifically a vital necessity for measuring mathematical models constructed with solving a real-life problem, and the detailed parameters of sensitivity analysis can determine a broad set of predictions to see how different values affect the mathematical method outputs under a given set of data in a time series model. Table 2 lists the experimental results by the FTS method with different periods, and from Table 2, it is shown that the best similarity of fuzzy is found behind 1 period having 20 intervals; at the same time, the best similarity is 0.9527 using the FAR(1) adaptive value. Accordingly, the determination method of order number was 1; thus, the predicted result of the FTS model for the SGP line was MAPE = 7.768% and RMSE = 10.342. From the results of the evaluation indicators, this study provides the meaningful fact that it is acceptable and has a good reason for benefiting the rationality of the proposed hybrid model.

-

(2)

ES method: In the ES building process, the smoothing constant α is an important parameter. In accordance with the SGP line, this step conducts a parameter sensitivity analysis and adjusts the smoothing constant α from 0.1 to 0.9 to see how this detailed parameter affects the forecasting outputs of the mathematical ES model. Table 3 shows the experimental results of this ES method with different values of the core parameter α. Consequently, the prediction results have a lowest value of 7.692% in terms of the MAPE when the α value is 0.8 and a lowest RMSE value of 10.323 when the α value is equal to 0.9. From Table 3, it is understandable that the MAPE and RMSE show a good performance for sales prediction of the ES method in the SGP line.

-

(3)

MA method: In the average of the volume of sales in the previous period, the MA method is used as the predicted value for the next period. The MA method, similar to the previous building process, also runs a parameter sensitivity analysis of periods for a mathematical model. Table 4 lists the experimental results for the MA method with different time periods in 2–4 periods. From Table 4, it is shown that the moving-period number increases with both the MAPE and RMSE values, and the comparison results of MAPE 7.682% and RMSE 10.455 for this method show two moving periods with better performance than that of the other periods; importantly, the empirical results also show a clear performance advantage of the MA method.

-

(4)

RA method: In the RA building process, the most important work is to identify decisive key factors that significantly affect sales quantity. In an interview with three experts at L-Company, three core factors were noted as follows: (a) Seasons are divided into two types: peak (the first and third seasons) and low (the second and fourth seasons). The peak season means before and after the beginning of the school season, and sales quantity will increase; in other words, sales quantity will decrease in the other seasons. (b) The price is a vital factor affecting sales quantity distinctively. The price will increase with the cost of the SGP line. However, when the price is increasing, retailers might decrease the purchase quantity and charge customers higher prices, resulting in a decrease in sales quantity during this increase period. (c) The frequency of product exposure increases when there are promotional events (such as TV ads or exhibitions). Promotions will attract the attention of customers and encourage them to purchase the product. However, from the sales records of L-Company, there were no promotional activities for the SGP line in 2008–2012. Thus, the promotion factor could be removed from the RA method for the SGP line. Table 5 lists the partial RA data. Tables 6, 7 and 8 list the experimental results after conducting the RA method sequentially. Table 8 shows that season and price have significance levels of 0.1 and 0.001, respectively; thus, the RA equation is constructed for the SGP line below, and its calculated error value from 2008 to 2012 has the values of MAPE 31.203% and RMSE 45.690. From Table 8, it is clear that both the factors of season and price have a significant impact on influencing sales quantity, particularly the core factor of price. However, only from the MAPE of 31.203%, the forecasting result seems to have just a general mediocre performance.

$$ {\varvec{Y}} = - {2}0,{314}.00{5} - {156}.{896}{\varvec{X}}_{1} + {2},{85}0.{187}{\varvec{X}}_{2} \left( {{\varvec{X}}_{1} :{\text{ Season factor and }}{\varvec{X}}_{2} :{\text{ Price factor}}} \right). $$

After implementing the above four methods for the SGP line, this study just selected Fig. 2 to show its curve details between the actual and predicted values by a MAPE of 31.203% when using the RA method for the SGP line. From Fig. 2, it is clear that the two curves seem to not be quite suitable in some graphs for the SGP line due to its relatively high MAPE of 31.203%; however, it is acceptable if the RA method is compared to manager subjective (MS) prediction.

This study omits some complicated content, such as figures and tables, and uses text to narrate the following three types of product lines for brevity. The comparative studies after conducting parameter sensitivity analyses are distinctly summarized for convenience and ease of interpretation in the next subsection.

4.1.2 For the DP line

-

(1)

FTS method: Similarly, the minimum value of 4 and the maximum value of 3124 were determined. Several intervals from 10 to 200 and behind 1–15 periods were identified for a parameter sensitivity analysis of periods in the FTS modeling process. Table 9 lists the fuzzy similarity of behind periods with different values for the DP line by the FTS method. From Table 9, the empirical results show the best similarity of fuzzy sets remains behind 1 period with 30 intervals; its best similarity is 0.9772; and the order number of determinations still indicates 1. Subsequently, the empirical results of the FTS model using an adaptive FAR(1) have values of MAPE 27.037% and RMSE 58.169. From the above empirical results, it is clear that MAPE 27.037% and RMSE 58.169 seem to have less than the ideal performance expected for the FTS method.

-

(2)

ES method: Subsequently, the experimental results in the building process of the ES method are also run with a parameter sensitivity analysis of key α. Table 10 shows the experimental results of different values for parameter α (adjusted from 0.1 to 0.9) in this ES method for the DP line. It is indicated that when the smoothing constant α value is 0.9, it has the lowest values of MAPE 22.948% and RMSE 34.294. Figure 3 shows information on the curve details between the actual and predicted values for achieving a MAPE of 22.948% for the DP line by the ES method. Likewise, it seems that a general effect is identified for MAPE 22.948% for the ES method.

-

(3)

MA model: Moreover, the experimental results for running the moving average from different 2–4 periods with a parameter sensitivity analysis are conducted from the building process of the MA model. Table 11 lists the analytical results of MAPE in the MA method for the sensitivity analysis from two periods to four periods for the DP line. It is shown that the number of moving periods increases with both the MAPE and RMSE values. This information in the DP line is similar to that in the SGP line. The MA method also shows that two-periods have better performance and effective models than do other periods. The method has a slightly higher MAPE of 31.893% and an RMSE of 48.670. When compared to all the previous results, the MAPE of 31.893% seems to specifically disappoint the MA method; however, it is also acceptable when compared to the MS method.

-

(4)

RA model: With the coefficient results of the regression analysis method, the RA mathematical equation of the DP line is defined as RA(1). After the experiment, Table 12 shows the experimental result on regression coefficients using the RA method for the data of the DP line. From Table 12, it is clear that only the promotion factor has a significant level of 0.01 for influencing the consequence of the sales quantity of the DP line.

$$\begin{aligned} &{\text{RA}}\left( {1} \right):{\varvec{Y}} = { 266}.{112 } + { 35}.{271}{\varvec{X}}_{1} + \, 0.{78}0{\varvec{X}}_{2} + { 577}.{16}0{\varvec{X}}_{3} \big({\varvec{X}}_{1} \\ &\quad :{\text{ Season factor}},{\varvec{X}}_{2} :{\text{ Price factor}},{\text{ and }}{\varvec{X}}_{3} :{\text{ Promotion factor}} \big).\end{aligned} $$

Surprisingly, an ultra-high error rate of MAPE 644.000% and RMSE 1813.704 is achieved for the above equation; thus, this equation should be reconsidered and reconstructed. Based on the professional knowledge of experts from L-Company, this model should consider the enrollment number of elementary school students for the past 5 years (i.e., 2008–2012) as a decisive key factor; the RA equation is then reformatted as RA(2) below. Table 13 shows the error results with the enrollment number of elementary school students in 2008–2012 for the DP line by using the RA(2) method. This refined equation yields a significantly lower average MAPE of 17.780% than the MAPE of 644.000%. Similarly, the RMSE value is significantly reduced from 1,813.704 to 26.457. This refined result clearly shows that the DP line is affected significantly by the enrollment numbers at elementary schools. Thus, this decisive key factor of enrollment numbers at elementary schools is found and identified in this study. Moreover, it is an impressive feature that the error rate has a lower 1.07% for the data in 2008 for the DP line when using the RA method from Table 13.

4.1.3 For the IGP line

-

(1)

FTS method: The IGP line has a large range, with a minimum value of 181,136 and a maximum value of 727,093. Similarly, a larger interval from 1000 to 10,000 with behind 1–15 periods of a parameter sensitivity analysis is defined for implementing a time series model. Table 14 lists the fuzzy similarity of different values on behind periods for the IGP line by the FTS method. The best similarity for fuzzy sets has 1 period and 5000 intervals, and the value of 0.8981 is determined as the best similarity. The order number for determinations remains 1. Thus, the analytical results for the FTS model by the FAR(1) adaptive value are a low value of MAPE 12.412% and RMSE 18.980. From both the testing results of MAPE 12.412% and RMSE 18.980, it is determined that the FTS method can be used as the prediction model for the IGP line.

-

(2)

ES method: Similarly, the analytical results of this ES method in the IGP line are executed with a parameter sensitivity analysis of the core parameter α. Table 15 shows the experimental results of different α values in this method for the IGP line. It is shown that when the adjusted constant α value achieves 0.9, it has a lowest value of MAPE 13.429% and RMSE 19.469; importantly, this outcome is an acceptable bottom line for a prediction model based on the expert opinions in the case study.

-

(3)

MA method: Moreover, given the 2–4 moving periods for a parameter sensitivity analysis, the experiment is run. Table 16 lists the analytical results of the MA method with different values from two periods to four periods in terms of the MAPE for the IGP line. The empirical results of the MA method still show better performance in the two moving periods, with MAPE 13.974% and RMSE 19.777. Importantly, it was found that the values of MAPE and RMSE are greater when the number of moving periods is greater. Figure 4 shows information on the curve details between the actual and predicted values by a MAPE of 13.974% for the IGP line using the MA method. From the above evidence-based results in prediction, it is also an acceptable outcome for the MA method in the IGP line.

-

(4)

RA method: The RA equation for the IGP line is also constructed below, and the calculated error results in 2008–2012 are MAPE 18.220% and RMSE 22.638. Importantly, although the IGP line has the property of having no certain rule and can vary dramatically up or down in sales quantity, its error rate between the actual value and the predicted value is controlled within less than 20% in this study. Thus, the piloted curve of the predicted values from the RA equation still has some degree of approaching the centerline to indicate the middle of the actual values in this representative product of the IGP line. Table 17 presents the experimental results on regression coefficients for the RA method using the data from the IGP line. It is also very clear that only the promotion factor from Table 17 has a significant level of 0.01, which means that this factor is a critical variable for influencing the sales quantity of the consequent result Y in the IGP line.

4.1.4 For the SSP line

For promotional purposes, L-Company chooses new items that can be expected to receive much attention or existing items that were always used by customers and assembles them as an on-sale item package.

-

(1)

FTS method: Similarly, the minimum and maximum values of 1016 and 5076 for the SSP line are defined. The behind 1–15 periods with 10–200 intervals with a parameter sensitivity analysis are handled in building the FTS model. Table 18 lists the fuzzy similarity of different values on behind periods for the SSP line by the FTS method. From Table 18, it is clear that the best similarity for fuzzy sets is set behind 3 periods; twenty intervals are classified into 202 types of items, and the best similarity has a value of 0.8994. The empirical results of the FTS method for the FAR(3) adaptive value achieve an error value of MAPE 36.211% and RMSE 53.520. From the above results, both the values of MAPE 36.211% and RMSE 53.520 have a higher error rate, and that seems to be a relatively unacceptable outcome when compared to the previous three product lines for the FTS method.

-

(2)

ES method: The empirical results for this model with a parameter sensitivity analysis of key values for parameter α were run and obtained. Table 19 shows the experimental results of different α values in this ES method for the SSP line. It is shown that when the adjusted α value is 0.3, the lowest MAPE and RMSE values reach 34.076% and 43.947, respectively, in accordance with the SSP line by the ES model. Similarly, from the lowest values of both MAPE 34.076% and RMSE 43.947, it is also not a good result when compared to the previous three product lines for the ES method.

-

(3)

MA method: For this SSP line, the MA method with a parameter sensitivity analysis of different periods for a mathematical model is run. Table 20 lists the analytical results from two periods to six periods in terms of MAPE in the MA method for the SSP line. Interestingly, using the MA model, we find that when the moving periods decrease, the MAPE and RMSE values increase. This phenomenon is converse to other product lines. In the given 2–6 periods, this study provides empirical results that have the lowest MAPE of 24.047% and RMSE of 29.342 in the four moving periods. This method performs better and more effectively than do other moving periods. Only for the SSP line does the MA method have less error when compared to the other three methods. This result seems to imply that the MA method is more suitable for application in this product line.

-

(4)

RA method: The same three key factors from experts are used. Consequently, the values of MAPE 32.485% and RMSE 39.953 in 2008–2012 are obtained from the RA method, and its regression equation is expressed as follows: Table 21 shows the regression coefficient results of the experiment using the RA method for the data from the SSP line. From Table 21, it is clear that both the price and promotion factors have a significant level of 0.01 for significantly influencing the consequence of sales quantity in the SSP line.

$$ {\varvec{Y}} = { 2},{385}.{918 } + { 77}.{945}{\varvec{X}}_{1} {-} \, 0.{3}0{5}{\varvec{X}}_{2} + { 1},{195}.{599}{\varvec{X}}_{3} \left( {{\varvec{X}}_{1} :{\text{ Season factor}},{\varvec{X}}_{2} :{\text{ Price factor}},{\text{ and }}{\varvec{X}}_{3} :{\text{ Promotion factor}}} \right). $$

4.2 Comparable studies

This subsection describes aggregate MAPE and RMSE for internal comparison (i.e., the component comparison inside the proposed model) and external comparison (i.e., the proposed model and MS method) of the four product lines by the proposed model from the above empirical results with the main tables and figures of the study. This part discusses the significance of each independent variable for sales quantity forecasting.

4.2.1 Comparisons of MAPE and RMSE

In order to further compare the performance of subjective artificial and objective machine methods, this study discusses L-Company performance forecasts of MS (i.e., manager subjects) for four product lines. Table 22 lists the summary of the error rates in terms of MAPE and RMSE for internal and external comparisons of the four types of product lines by the proposed model and an additional MS method from the empirical results.

Table 22 shows that the five key points determined for the details of internal and external comparison results of the MAPE and RMSE are slightly small for MAPE and RMSE, respectively. These details are identified from the empirical results and conclusively described as follows: (1) In the SGP line, performance differences for the first three methods, i.e., 7.68, 7.69, and 7.77% vs. 10.32, 10.3%, and 10.46%. The ranking order of model components for the proposed hybrid model in terms of the MAPE performance has been defined as MA → ES → FTS → RA(1) → MS, and in terms of the RMSE performance, it is ranked as ES → FTS →MA → RA(1) → MS. The independent factors include season and price. (2) Interestingly, the ES method has the best original performance in the DP line for both MAPE and RMSE. In particular, the RA method has an extra unsatisfied result (MAPE 644.00% and RMSE 1813.70) based on the three factors season, promotion, and price; however, the RA method yields a significant result of MAPE 17.78% and RMSE 26.46 when a decisive key factor of the enrollment number of elementary schools is considered in the regression equation. Similarly, the ranking order in terms of the MAPE performance becomes RA(2) → ES → FTS → MA → MS → RA(1), and in terms of the RMSE, it becomes RA(2) → ES → MA → FTS → MS → RA(1). (3) Importantly, in a specific characteristic of the IGP line, the FTS model has the best prediction performance for both the MAPE and RMSE performances. The ranking order in terms of both the MAPE and RMSE performances shows the same: FTS → ES → MA → RA(1) → MS. Notably, the proposed model performs well in the IGP line (Table 22), and the independent factors are season, promotion, and price. (4) More interestingly, the MA method has a lower error rate for MAPE and RMSE than do the other three models in the SSP line. The ranking order for both the MAPE and RMSE performances is also the same: MA → RA(1) → ES → FTS → MS, and its independent factors also include season, promotion, and price. (5) In the MS method of artificial forecasting of external comparison, the error rate of the subjective analysis was higher than that of the proposed model (Table 22). All types of technological sales forecasting models in this study were more accurate than any subjective method. For the MS worst performance, a reasonable explanation is provided; the manager in the empirical L-Company case has the difficult responsibility of controlling an extensive variety of 2010 SKU products. Thus, it is clear that, in the empirical case, the company needs a more intelligent method to process the sales forecasting work effectively and efficiently. Interestingly, this information also implies that if L-Company can use the proposed model as an intelligent sales forecasting tool instead of using a traditional forecasting method, it can benefit from correct and accurate sales forecasting to decrease operating costs and provide a completely effective production plan for downstream production units.

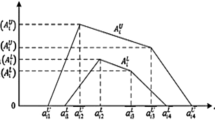

Moreover, to provide complete information in relation to internal and external comparison results in graphic format, Figs. 5, 6, 7 and 8 show their curve details of actual and predicted values for the four product lines by the four techniques of the proposed method with the MS method, respectively. Clearly, these comparison curves support the empirical results from Table 22. The MS method has the worst performance.

4.2.2 Effect of independent variables

To identify key factors for the three variables further, Table 23 highlights the significance of each independent variable on sales forecasting by using the RA method for the four product lines. Table 23 shows that this study characterizes the following four directions according to the achieved RA equation: (1) For the SGP line, the key factor price practically shows a significant relationship to the sales quantity from the analysis in Table 23. In particular, this SGP product is defined as an increasing-demand product with a high market share rate. Thus, this useful information implies that the expected higher prices might have a higher sales quantity due to consumers’ psychological expectations, with panic behavior for downstream customers. A reasonable explanation is that when wholesalers, dealers, sellers, or even retailers worry about the expected increasing cost of goods purchased, they might move to make larger purchases to stock in advance. Therefore, it is an interesting and special case that this type of product will have some influence and attraction on the consumer market. Specifically, the experts also support this thought-provoking phenomenon in interviews. (2) Practically speaking, although many of the same types of competitive products in the manufacturing industry might exist, only promotional factors can affect and improve the sales quantity of the DP line. In particular, the SGP product does not actually need a promotional activity to promote sales quantity in the empirical L-Company because it has good sales in practice (please see Table 5). (3) Similar to the DP line, only the factor of promotion significantly affects the sales quantity of the IGP line. This type of product has great potential to experience increased sales volume from improved marketing capabilities. Moreover, this information implies that if L-Company makes a promotional activity and introduces a new product, the volumes of sales will specifically increase. (4) For the SSP line, the main factors include promotion and price. Most product sets are derived from a combination of marketing activity and special sales, such as at the product exhibition of the World Trade Center in Taipei, Taiwan. Thus, when these types of products go on sale, the sales quantities will increase statistically and significantly.

4.3 Wilcoxon signed-rank test

A Wilcoxon signed-rank is a test of a non-parametric statistical hypothesis that can identify the difference in values between two related samples and assess whether population averages differ when groups are not necessarily distributed properly (Wilcoxon, 1945). Thus, the study adopts and extends it to evaluate MAPE and RMSE further for the proposed model. In Wilcoxon statistics, the values 1, 0, and − 1 indicate that the first method outperformed, performed equally to, or underperformed the other methods, respectively, for addressing a two-tailed test method at a ± 5% level of significance. Tables 24 and 25 simply summarize the internal comparison results of the Wilcoxon test under the MAPE and RMSE of the proposed model for the four product lines, respectively. Tables 24 and 25 show the related results of both the used models and the product lines in alphabetical order. Interestingly, the test results show that the best model is the ES method and the worst model is the RA method under both the MAPE and RMSE criteria. Conclusively, the ranking order of prediction performance from Table 24 and 25 is ES → MA → FTS → RA in this study.

5 Findings and discussions

This section includes related findings, discussions, research contributions, and research limitations from the above experimental results.

5.1 Findings and management implications

The study yields seven findings for academicians and practitioners from the empirical results of internal comparisons, as follows:

-

(1)

The MA method works well for the SGP line on the MAPE criterion and the SSP line on both the MAPE and RMSE criteria, according to the empirical results (Table 22).

-

(2)

The DP line performed well with the ES model on both the MAPE and RMSE criteria; nevertheless, if decisive key factors are identified and considered in the modeling process, the RA method has the best forecasting results (Table 22).

-

(3)

For the IGP line, the FTS method has better forecasting performance than the other proposed models on both the MAPE and RMSE criteria in cases of the unpredictability of sales data and unknown factors (Table 13).

-

(4)

Empirical results prove that the ES model has the most accurate forecasting model, and the RA method is the worst (Tables 24 and 25).

-

(5)

In using the MA model, the number of moving periods had a positive correlation with the MAPE and RMSE values for the SGP, DP, and IGP lines; however, for the SSP line, the number of moving periods had negative effects on the MAPE and RMSE values.

-

(6)

This study further proves that the most decisive key factor for the DP line when using the RA method is the student enrollment numbers in elementary school because of the low rate of birth in Taiwan (Table 13). The meaningful information can provide relevant types of products as a helpful reference for decision-making in sales and production planning for L-Company.

-

(7)

Although Table 23 shows that the factor price is an important variable in this empirical case, different types of product lines lead to different pricing performance for decision-making. First, if the products dominate the market or sell well, retailers are willing to agree to a higher purchase price in the future; on the contrary, when the expected price increases, retailers remain willing to order more products to increase sales quantity. Second, the market gives a lot of attention to the same competitive products, and customers have many choices to choose from. A price decrease will attract customers to buy the product and thus generate increased sales.