Abstract

The remarkable increases in life expectancy observed over the last decades have posed a major challenge to pension funds and annuity providers because of the related systematic longevity risk. This article proposes a variable payout life annuity where benefits have to follow the observed mortality and the interest rates obtained. This scheme is effective and efficient for annuity providers, who always have a fund that matches exactly the undertaken commitments to annuitants. On the other hand, potential reductions in the benefit payments can be felt by annuitants more bearable than those that include a safety loading. Specifically, the concept of observed survival probabilities is introduced and applied to: (a) translate a demographic change into the related financial adjustment; (b) decompose a demographic change into two effects, one stemming from the survival probability observations and the other from life table updates; (c) show that the financial compensation mechanism should run for single cohorts to avoid creating inequalities for older and smaller cohorts.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

Over the last few decades, remarkable increases in life expectancy have been experienced worldwide, particularly in most industrialized countries. In Europe, for example, life expectancy at birth has increased, on average for both males and females, by around 10 years between 1960 and 2015 (European Commission 2017), that is, an increase in just over two months per annum, on average, over the last 55 years. Although the debate on whether there is a natural biological limit to longevity is still open (Oeppen and Vaupel 2002; Christensen et al. 2009; Vaupel 2010), such a historical trend does not seem to be slowing down. Indeed, the last projections provided by the European Committee show a further increase in life expectancy at birth for Europe as a whole, for both males (7.8 years) and females (6.6 years), from 2016 to 2070. The same pattern is projected for life expectancy at 65, which is expected to increase by roughly 5 years for both males and females (European Commission 2017). Note that such a projected increase depends on the underlying assumptions which, generally, do not assume that the reduction in mortality would continue at the same pace in the long run (European Commission 2017; Debonneuil et al. 2018) and, therefore, the gains in life expectancy could prove to have been underestimated.

Such a phenomenon, albeit a desirable one for individuals, seriously affects annuity providers and pension funds: the longer an individual lives, the longer is the payment phase duration, and the larger is the capital required to cover the liability (see, among many others, Blake and Burrows (2001), Brown et al. (2001), Hari et al. (2008)). Consider, for example, the case of Italy, where for a male aged 65 the age at death was 77.93 years in 1965, whereas fifty years later, in 2014, it had become 84.01 years (European Commission 2017), undergoing an increase of about 1.2 years per decade. Under the assumption of a real interest rate equal to \(2\%\), the expected present value of a whole life annuity of 1 per year payable in arrears for an Italian 65-year-old male would have increased from 10.49 in 1965 to 14.87 in 2014, that is an increase of roughly \(42\%\). This means that to finance a life annuity for an Italian male aged 65 the annuity provider would have needed \(42\%\) more capital in 2014 than in 1965.

Therefore, the empirical evidence of longer life expectancies, which entails the risk of underestimating the financial coverage for annuities and pensions, poses a challenge on how annuity providers and pension funds should address the longevity risk, namely the risk that an individual or a group of individuals will live a longer life than expected (see Bravo and de Freitas (2018), Börger (2010), Coughlan et al. (2007), and also Deng et al. (2012), Donnelly et al. (2013), MacMinn et al. (2006), Visco (2006)). Note that part of the literature uses the term longevity risk to refer to any uncertainty in future development of mortality, regardless of whether it leads to longer or shorter life expectancies than expected lifetime (see Barrieu et al. (2012), Brown et al. (2001), Dus et al. (2005), Hari et al. (2008), Pitacco (2004)), whereas other authors use the term mortality risk to refer to “\(\dots \) the risk of underestimating mortality improvements\(\dots \)”, p. 339, Blake and Burrows (2001).

However, the importance of the longevity risk lies in its very nature. Indeed, it constitutes a systematic risk because it affects all individuals in the same way, hence affecting the whole annuity provider portfolio and cannot be reduced by increasing the insurance portfolio size. Hence, it is a ‘non-pooling’ risk (Börger 2010; Visco 2006; Olivieri 2001).

A very extensive literature is available on this topic in the actuarial framework. A very sound classification of the main research patterns as well as a comprehensive review of the scholarly literature is provided by Milevsky (2013), which also analyzes in detail the specific role of annuities in the ‘optimal’ retirement portfolio. An exhaustive survey on the main current developments in longevity-risk modeling or on some important potential developments for longevity-risk management from a financial perspective can be found in Barrieu et al. (2012), Pitacco (2013). Furthermore, Bernhardt and Donnelly (2018) provide an extremely up-to-date report on the state of art on this topic.

In the large framework of the literature on this topic, the issue of sharing longevity risk between the annuity provider and annuitants has been analyzed by many authors. This is not such a new concept as can be seen in Ogborn and Wallas (1955), which suggested a profit-participation scheme for deferred annuities. In more recent literature, the risk sharing group self-annuitization mechanism is studied in Piggott et al. (2005) and Qiao and Sherris (2013), whereas the mechanism for linking the annuity benefits to the mortality that is actually experienced, the so-called mortality-indexed annuities, is considered in Richter and Weber (2011). Furthermore, an extensive literature refers to the pooled annuity funds proposed by Stamos (2008), which focused on optimization problems within such pools. Related to this topic, the authors in Donnelly et al. (2013) focused on the stability of income streams in these schemes and compared them with mortality-linked funds, and successively in Donnelly et al. (2014) they introduced a new type of pooled annuity funds, referred to as annuity overlay funds, which is actuarially fair at each instant and where participants can leave the fund before death without any financial penalty and have individual investment freedom. In this regard, the more recent paper of Bräutigam et al. (2017) considers the annuity overlay funds, where the individual annuity is proportional to the initial wealth invested and the corresponding mortality rate, and compares them with the equitable income tontines of Milevsky and Salisbury (2016). This latter is related to the very interesting research stream that reconsiders the eighteenth-century scheme of tontine annuities and proposes related arrangements for annuities, Sabin (2010), Milevsky (2015), Milevsky and Salisbury (2015), and also Weinert and Gründl (2016), which examines how the policyholders can partially invest their retirement wealth in tontines to supplement the existing pension products, or Chen et al. (2019), which presents a new retirement product, called tonuity, deriving from the combination between a tontine at early retirement ages and an annuity at a predetermined later age.

Other participating annuity designs have also been investigated: for example, Luthy et al. (2001) proposed the adaptive algorithmic annuities, Denuit et al. (2011, 2015) considered indexing annuity payments to a reference population in longevity-indexed life annuities, or to the length of the deferment period in longevity-contingent life annuities; and Maurer et al. (2013) dealt with so-called variable investment-linked deferred annuities (VILDAs).

The present paper, in the author’s view, is strictly related to the above-mentioned research line. It derives from the original idea proposed in Angrisani and Di Palo (2006), and from its subsequent development in Di Palo (2016), where the authors modeled a new scheme for revaluing life annuities thereby immunizing the longevity risk in an effective and efficient way. Basically, this scheme considers life annuities, whose benefit payments are paid in arrears and are financially revalued, with the demographic changes being compensated for by means of financial revaluation. Unlike the other papers in the literature, this scheme has proved to be effective and efficient in dealing with the longevity risk.

Therefore, the proposed scheme could be introduced in the actuarial practice for two main reasons. Firstly, note that in this model the interest rate, which is actually returned on the benefits, makes the balance between the fund and the reserve when longevity changes have taken into account. Hence, in the point of view of the insurer, the management of these products avoids the risk of default as a result of the systematic re-balance between the fund and the reserve. Secondly, this rate can act favorably or unfavorably on the revaluation of the benefit payments if the observed mortality is higher or lower than that expected, respectively. Thus, the possible positive compensations on benefits, or also the comparison with life annuity benefits including a safety loading for longevity risk, could disarm the little attractive feeling to this product, likely due to the fact that the systematic longevity risk is borne by the group of annuitants and no minimum warrantees are provided. In this regard, note that products such as unit-linked annuities have gained a considerable share of the market even though the investment risk is not borne by the insurer but by the policyholder. In comparison with possible adjustments reflecting the investment experience, the impact of annual mortality adjustments is relatively modest as, for example, reported by the Teachers Insurance and Annuity Association (TIAA), one of the most important life insurance companies in the USA, which introduced variable annuities where payments reflected the actual mortality experienced (Piggott et al. 2005).

The theoretical core of our paper is presented in Sects. 2 and 3. The former defines the concepts of observed, estimated, and evaluated survival probabilities and derives the related definitions of life expectancy, which are necessary for modeling the life annuity revaluing scheme under demographic compensation (LADeC). The latter briefly describes the LADeC model in the case of a unique homogeneous cohort, as in Angrisani and Di Palo (2006) and Di Palo (2016), thus extending the model to the cases of a unique cohort or more cohorts of individuals who pay varying lump sums and who are all the same age when they join the scheme (as could be the case for pension annuities). Section 4 contains the basic theorem on the effectiveness and efficiency (TEE) of the LADeC scheme, whereas Sect. 5 provides an illustrative numerical application of the LADeC model.

2 The structure of the observed, estimated and evaluated probabilities of survivorship

In light of Angrisani and Di Palo (2006), the definitions of observed, estimated, and evaluated survival probabilities for individuals belonging to a fixed generation are herein introduced.

Let sequence \(\{0, 1, 2, 3\dots \}\) be the time line, where the unitary time increment is equal to one year. Here and throughout the paper, for each \(h\in \mathbb {N}\), we refer to year \(h+1\) as the year beginning in h and ending in \(h+1\), including \(h+1\), i.e., \((h, h+1]\).

Let us consider a group of individuals aged \(x_0\), but not yet \(x_0+1\), at 0, referred to as collectivity or cohort 1. Furthermore, the following assumptions are set:

-

(a)

Cohort 1 is a closed group;

-

(b)

Death is the only cause of exit from the group;

-

(c)

A limiting attainable age exists, although its possible outcome is not known in advance, namely \({\overline{h}}\in N\) exists such that there is at least one individual still alive at age \(x_0+{\overline{h}}\), whereas no-one is alive at age \(x_0+{\overline{h}}+1\).

Furthermore, the set of individuals in cohort 1 alive at time h and aged \(x_0+h\) is denoted by \(N_{x_0+h}\), with \(h \in \mathbb {N}\), and their number, namely the cardinality of set \(N_{x_0+h}\), is denoted by \(|N_{x_0+h}|\). Therefore, by assumptions (a–c), cohort 1 is identified by the sequence of sets \(\{N_{x_0+h}\}\) such that \(N_{x_0+h}\supseteq N_{x_0+h+1}\), where \(\{N_{x_0+{h}}\}\ne \emptyset \) with \(h\le {\overline{h}}\) and \(\{N_{x_0+{h}}\}=\emptyset \) otherwise.

2.1 Observed and estimated survival probabilities

All the following definitions are provided for each \(h\in \mathbb {N}\) and with specific reference to cohort 1. Hence, for ease of notation, we do not specify the cohort index.

Definition 1

The one-year observed probability that an individual aged \(x_0+h\) survives to at least age \(x_0+h+1\) is denoted by \({\overline{p}}_{x_0+h}\) and is defined as

Note that this value is known only at the end of year \(h+1\). At any time \(m<h+1\), the survival probability for one year at age \(x_0+h\) can only be estimated according to a fixed life table available at time m and will be denoted by \( {\tilde{p}}_{x_0+h}^m\). Since the value of the one-year survival probability depends on evaluation time m, the following definition is provided.

Definition 2

The one-year probability that an individual aged \(x_0+h\) survives to at least age \(x_0+h+1\) evaluated at time m is denoted by \(p_{x_0+h}^m\) and is defined as

The previous definitions can be extended to the case of a k year survivorship.

Definition 3

The observed k-year probability that an individual aged \(x_0+h\) survives to at least age \(x_0+h+k\) is denoted by \(_k{\overline{p}}_{x_0+h}\) and is defined as

Note that \(_0{\overline{p}}_{x_0+h}=1\), \(_1{\overline{p}}_{x_0+h}={\overline{p}}_{x_0+h}\), and

we also have

As for the one-year case, \(_k{\overline{p}}_{x_0+h}\) is known only starting from time \(m=h+k\). At any time m such that \(h<m<h+k\), the k-year survival probability at age \(x_0+h\) is partially observed, for the number of years between h and m and estimated for the remaining years. Differently, at any time m such that \(m\le h\), the k-year survival probability at age \(x_0+h\) is totally estimated according to a fixed life table available at m. Therefore, the following definition is provided.

Definition 4

The k-year probability that an individual aged \(x_0+h\) survives to at least age \(x_0+h+k\) evaluated at time m is denoted by \(_kp_{x_0+h}^m\) and is defined as

By means of Definition 4, the definition of the (curtate) life expectancy at age \(x_0+h\) evaluated at m can be set: it is the number of whole years that a cohort 1 individual aged \(x_0+h\), according to the evaluation at time m, can expect to live.

Definition 5

The (curtate) life expectancy for an individual aged \(x_0+h\) evaluated at time m is denoted by \(e_{x_0+h}^{m}\) and is defined by

Consistently with the adopted notation, \({\tilde{e}}_{x_0+h}^m\) denotes the (curtate) life expectancy at age \(x_0+h\) estimated at m, given by

By means of Definition 4, it easy to verify that

For example, if \(h=0\) and \(m=1\)

and hence

3 Revaluing life annuities under demographic compensation

In this section, following Angrisani and Di Palo (2006) and Di Palo (2016), the LADeC scheme is briefly reviewed in the case of a unique homogeneous cohort. Hence, this scheme is extended to the cases of: (a) a unique cohort of individuals paying varying lump sums when they join the scheme; and (b) multiple cohorts of individuals who all have all the same age and pay varying lump sums when they join the scheme.

Throughout the paper, it is assumed that: the expected present value of life annuities is at a zero interest rate, so that the annuity divisor coincides with the life expectancy value; and also that the reserves allocated for covering benefits earn an annually compounded risk-free interest rate.

3.1 The case of a unique homogeneous cohort

Let us consider that all individuals belong to the same cohort, referred to as cohort 1, and assume that all conditions set in Sect. 2 are satisfied. In addition, it is assumed that each individual in cohort 1 pays the same lump sum, \(M^0\), to buy a whole life annual annuity whose benefits are payable in arrears.

The following notation is used for the model:

-

\(R^{h+1}\) is the benefit payment actually paid to a cohort 1 individual alive at the end of year \(h+1\);

-

\(V^{h}\) is the individual reserve available at h, namely at the beginning of year \(h+1\);

-

\(r^{h+1}\) is the rate of interest to be returned on the reserve in year \(h+1\);

-

\(e^{h+1}_{x_0+h}\) is the life expectancy for an individual aged \(x_0+h\) evaluated at \(h+1\).

The annuity benefit paid at \(h+1\) is given by

Note that formula (4) does not hold if \({e^{h+1}_{x_0+h}}=0\), that is starting from \({\overline{h}}+1\) when \({\overline{p}}_{x_0+{\overline{h}}}\) is the first observed null value. In any case, starting from \({\overline{h}}+1\) no individual in cohort 1 is still alive, and no annuity benefit has to be paid, that is \(R^{h+1}=0\) for \(h\ge {\overline{h}}\). For the detailed description of the mechanism to achieve (4), refer to Angrisani and Di Palo (2006).

Note that

where \({\tilde{e}}^{h}_{x_0+h}\) is the life expectancy at age \(x_0+h\) estimated according to the life table available at h. The recursive formula for the benefit payments is obtained by means of (5) and (4), and it is

Life annuities, whose benefit payments are expressed by (6), are referred to as LADeC, that is life annuities under demographic compensation. Their basic feature is that annuity benefits have to be revalued on a yearly basis either by the observed change in the life expectancy and by the realized interest rate, both of them known a posteriori.

With reference to formula (6), the following definitions are set.

Definition 6

The demographic correction factor for the benefit payment to individuals aged \(x_0+h\) at time \(h+1\) is denoted by \(cd_{x_0+h}^{h+1}\) and is defined as

Under the assumption of non-negative interest rates, it follows that the individual in cohort 1 receives a yearly annuity benefit increase if \(cd_{x_0+h}^{h+1}>1\), namely if his/her life expectancy is evaluated, at the end of the year, to be shorter than the estimated value, based on the life table used at the beginning of the year. On the contrary, if his/her life expectancy, evaluated at the end of the year, is longer than that estimated at the beginning of the year, the cohort 1 individual has to bear a benefit decrease deriving from the change between the estimated and the evaluated values. Clearly, if no change occurs, no demographic correction is applied to the annuity payment.

By means of (3), it is easy to verify that

that is the demographic correction factor includes the effects of a twofold change, the first one stemming from the shift in survival probability from estimated to observed, and the second one from the possible updating of survival probabilities estimated at the beginning and at the end of the year. Of course, if the same life table is used, then

where the reader can identify the definition of the Mortality Experience Adjustment, provided in Piggott et al. (2005), which can therefore be considered as a particular case of the more general definition of the demographic correction factor.

Definition 7

The demographic correction rate of the benefit payment to individuals aged \(x_0+h\) at time \(h+1\) is denoted by \({d^{h+1}_{x_0+h}}\) and is defined as

From Definition 7, it follows that

namely the demographic correction rate is equal to the relative change in life expectancy, at the beginning and at the end of the year, with respect to its value at the end of the year, in opposite sign. This means that a systematic longevity, involving an increase in life expectancy, can be rendered as a negative demographic correction rate, which decreases the revaluation of the benefit payment for the year considered.

If no change in life tables occurs at the end of the year, then we have

Definition 8

The interest rate under the demographic compensation for the benefit payment to individuals aged \(x_0+h\) at time \(h+1\) is denoted by \(r^{h+1}_{x_0+h}\) and is defined as the value so that

In first approximation, we have

Using Definition 7, the LADeC benefit payment can be written in recursive terms as

which is a homogeneous linear difference equation of the first order, with variable coefficients. With the initial value calculated at the beginning of the contract, \(R^0\), being fixed, there exists a unique solution given by

Following Angrisani and Di Palo (2006), the LADeC scheme is proved to be an effective and efficient strategy to tackle longevity risk; in this regard, to aid the reader, the theorem on the effectiveness and efficiency (TEE) is recalled hereinafter.

For each \(h=0,1,\dots {\overline{h}}-1\), let us denote by

-

\(\mathcal {R}^h\) the total expenditure for annuity benefits actually paid out to the cohort 1 individuals alive at time h, i.e., \(\mathcal {R}^h=|N_{x_0+h}|R^{h}\), with \(h\ge 1\);

-

\(\mathcal {M}^h\) the total fund after the benefit payments at time h ;

-

\(\mathcal {V}^h\) the total reserve allocated for the cohort 1 individuals alive at time h, i.e., \(\mathcal {V}^h=|N_{x_0+h}|V^h=|N_{x_0+h}|R^{h}{\tilde{e}}^{h}_{x_0+h}=\mathcal {R}^h {\tilde{e}}^{h}_{x_0+h}\).

Theorem 1

(on effectiveness and efficiency) In the LADeC scheme, where benefit payments are given by (6), the annuity provider is able to meet its obligations at every expiry date, namely it is

Proof

See Appendix. \(\square \)

3.2 The case of a unique cohort with varying lump sums

In this subsection, the LADeC scheme is extended to the case of a unique cohort whose individuals pay varying initial lump sums to join the scheme.

To this aim, we consider cohort 1, satisfying the assumptions indicated in Sect. 2, and hence constituted by \(n^0=|N_{x_0}|\) individuals alive at time 0.

Let us assume that each individual in cohort 1 can be identified with natural number j, with \(j=1,2,\ldots n^0\), and hence is referred to as the j-th annuitant. Hence, a one-to-one correspondence between the set of individuals, \(N_{x_0}\), and the subset of the natural numbers from 1 to \(n^0\) is established at time 0, that is set \(N_{x_0}\) is identified with the subset of the first \(n^0\) natural numbers. Because of this correspondence, throughout the paper, we refer to \(N_{x_0}\) as the set of the natural numbers identifying the individuals alive at 0. In addition, the one-to-one correspondence, established at 0, is assumed to be also preserved at the subsequent dates \(h=1,2,\dots {\overline{h}}\), namely each individual in cohort 1 alive at h remains identified by the same natural number fixed at time 0. This means that set \(N_{x_0+h}\) is the subset of \(N_{x_0}\), whose elements are the natural numbers corresponding to the cohort 1 individuals still alive at time h.

Furthermore, it is assumed that at time 0 the j-th annuitant pays an initial amount, denoted by \(M^0_j\), to join the scheme, and to receive in return annuity benefit \({R}^0_j\) paid in arrears, that is

where \({\tilde{e}}^0_{x_0}\) is the life expectancy at age \(x_0\) estimated at 0. This means that at time 0 the LADeC scheme is actuarially fair as the individual lump sum paid equals the individual reserve, thus

At the end of the first year, that is at \(h=1\), and at the end of any other year \(h+1\), the annuity payment has to be adjusted for the survival probability updates and the actual return on the reserve, as established in the LADEC scheme. In addition, the amounts paid by annuitants, who have died during year \(h+1\), are assumed to be redistributed to those who are still alive in parts that are proportional to their own initial pay-in amount. Hence, the individual fund that is obtained at time \(h+1\), before the payment of the annuity benefit, denoted by \(\hat{{\hat{M}}}^{h+1}_j\), is given by

where \(\mathcal {M}^h\) denotes the total fund at h, namely \(\mathcal {M}^h=\sum _{j\in N_{x_0+h}}M^h_j\), and \(\mathcal {M}^h|_{L(h+1)}\) denotes the total fund at h restricted for the only individuals alive at \(h+1\), namely \(\mathcal {M}^h|_{L(h+1)}=\sum _{j\in N_{x_0+h+1}}M^h_j\). The annuity benefit to be certainly paid to the annuitants alive at \(h+1\) is given by

We show that the annuity benefit calculated with (8) can be expressed in recursive terms using the definition of the observed survival probability. Indeed, if we consider average values

we can easily show that

Therefore, it follows that

and the annuity benefit certainly paid to the annuitants alive at \(h+1\) is given by

By means of (3), it follows that

It is easy to verify that if the annuity benefit is calculated according to (10), or equivalently to (11), then the individual fund, after the benefit payment, equals the individual reserve, namely

Therefore, using (12) and Definition (6), the annuity benefit, in recursive form, is given by

Hence, we find out that the annuity benefit is equal to that considered in the previous case, see (6), further adjusted by factor \(\frac{{\overline{M}}^h}{{\overline{M}}^h|_{L(h+1)}}\) stemming from the inheritance due to yearly deaths in cohort 1 in year \(h+1\). Therefore, the following definition is provided.

Definition 9

The inheritance correction factor to the benefit payment at time \(h+1\) is denoted by \(ch^{h+1}\) and is defined as

Note that if the deaths observed in year \(h+1\) are related to individuals who held funds that were, on average, larger than the average value of the total fund at h, then it is \(ch^{h+1}>1\), otherwise the factor of the inheritance correction is lower or equal to one. Clearly, if all annuitants have paid the same initial lump sum, then it is \(ch^{h+1}=1\), and formula (6) results in being a particular case of (13).

By Definition 9, the annuity benefit can be expressed in recursive terms as

namely the annuity benefit to be paid at the end of year \(h+1\) is equal to the annuity benefit paid at the end of year h, doubly adjusted for the demographic and inheritance correction factors and revalued by the yearly interest rate. Note that both correction factors are specific for the fixed cohort, and that

that is the overall correction can be split into the product of two factors, the first one exclusively depending on the life tables adopted, and the second one strictly related to the observed evolution of the capitals held by participants.

The TEE of the LADeC scheme also holds in the case considered in this subsection. However, firstly we extend the LADeC scheme to the more general case of multiple cohorts, and then we prove that the TEE holds in both the cases considered.

3.3 The case of multiple cohorts

In this subsection, the LADeC scheme is extended to the case of more cohorts of annuitants enter the scheme at the same fixed initial age but at subsequent times and with varying initial lump sums.

As in previous subsections, cohort 1 is the cohort of individuals aged \(x_0\) who join the scheme at time 0. Let us assume that each other cohort of individuals aged \(x_0\), referred to as cohort k, with \(k=2,3,\dots \), join the scheme at the later times of \(h=k-1\). To specify the cohort, index k is added to the upper left side of the variable’s name.

For individuals in each cohort k, the annuity benefit is calculated according to rule (14) set in the LADeC scheme, namely

where function \(f(h,k)=(h-k)+1\) provides the number of years passed in the scheme up to h for individuals in cohort k. If \(f(h,k)<0\), set \(^kN_{x_0+f(h,k)}^h\) is assumed to be empty, that is cohort k has not yet joined the scheme at time h.

If formula (15) is applied, then the effectiveness and the efficiency of the LADeC scheme are preserved since the additive property holds for the calculation of both the fund and the reserve. However, even though the application of correction factors specific for each cohort is a feasible strategy, our aim is to establish whether an adjustment factor, common for all cohorts, can be determined so that the effectiveness and efficiency of the LADeC scheme could be preserved, and, at the same time, annuity benefits for individuals could be improved. We show that such a common adjustment factor, even though it preserves the effectiveness and efficiency, is not fair because it favors younger and larger cohorts at the expense of older and smaller cohorts.

In order to determine this factor, the principle of the capital redistribution for all individuals, belonging to any cohorts and who die in the year considered, is applied, as for example in Piggott et al. (2005) and Qiao and Sherris (2013). Hence, analogously to what has been proposed in the previous subsection, the annuity benefit to be certainly paid to an individual in cohort k alive at \(h+1\) is given by

where \(\mathcal {M}^h\) is the total fund at h, namely

and \(\mathcal {M}^h|_{L(h+1)}\) is the total funds at h for the annuitants alive at \(h+1\), namely

Ratio \(A^{h+1}=\)\(\frac{\mathcal {M}^h}{\mathcal {M}^h|_{L(h+1)}}\) is the total correction factor to be applied to the individual fund before the benefit payment, as a result of the inheritance in year \(h+1\).

Referring to the average values of the capital, it is easy to show that the reciprocal of \(A^{h+1}\) is given by

with \({^kw^{h}}=\frac{|^kN^{h}_{x_0+f(h,k)}|}{\sum _{k}{|^kN^{h}_{x_0+f(h,k)}|}}\), and \(\sum _{k}{^kw^{h}}=1\). Quantity \(\sum _{k}{^k{\overline{p}}_{x_0+f(h,k)}}{^kw^{h}}\) is the weighted average of the observed survival probabilities with non-negative weights \({^kw^{h}}\), each of them equal to the weight that each cohort has over the total group of annuitants. Clearly, if only one cohort participates in the LADeC scheme, then the reciprocal of the total correction factor coincides with that defined in (9).

It follows that the annuity benefit to be certainly paid to a cohort k individual alive at \(h+1\) is given by

Using property (2), the annuity benefit is given by

Since \({^kM^h_j}={^kR^{h}_j}{{\tilde{e}}^{h}_{x_0+f(h,k)}}={^kV^h_j}\) and by means of both Definition 9, the (total) inheritance correction factor here extended to the whole of cohorts in the LADeC scheme, and Definition 6, the demographic correction factor, the benefit payment can also be expressed in recursive terms as

where, in comparison with (15), there is a further factor, \(\frac{^k{\overline{p}}_{x_0+f(h,k)}}{\sum _{k}{^k{\overline{p}}_{x_0+f(h,k)}}{^kw^{h}}}\), that expresses the weight of cohort k over all cohorts, in terms of observed survival probabilities.

Remark 1

When the pooling among cohorts is considered, that is \(A^{h+1}\) is used as the (total) fund correction factor, then the individual benefit payment is constrained to follow the observed trend in survival probabilities specific for the cohort considered, see relationship (18). This implies that the correction to the individual benefit payments for older cohorts will be lower than that applied to those for younger cohorts.

Remark 2

It should be noted that

which is the linear convex combination of the inheritance correction factors for each cohort. This means that cohorts with higher capitals, that is the younger and larger ones, contribute more to the weighted average than do cohorts with low weights, that is the older and smaller ones.

4 The theorem on the effectiveness and efficiency of the LADeC scheme

The TEE of the LADeC scheme holds in the general case of multiple cohorts of individuals who join the scheme at the same initial age at subsequent times and contribute with varying initial lump sums.

For ease of reading, the notations used throughout the paper are as follows. For each cohort \(k=1, 2 ,\ldots \), and for each time \(h=0,1,\dots \)

-

1.

\({^kN_{x_0+f(h,k)}^h}\) denotes the set of the cohort k annuitants alive at time h, and aged \(x_0+f(h,k)\), with \(f(h,k)=(h-k)+1\); if \(f(h,k)<0\), set \(^kN_{x_0+f(h,k)}^h\) is assumed to be empty, that is cohort k has not yet joined the scheme at time h;

-

2.

\({^kn^h}\) denotes the number of annuitants in cohort k who are alive at time h and aged \(x_0+f(h,k)\), namely the cardinality of set \({^kN_{x_0+f(h,k)}^h}\);

-

3.

depending on cohort k, at time h there are observed probabilities of survival if and only if \(h\ge k\); if so, their number is f(h, k), and it is \({^kn^h}=({^kn^{h-1}}){^k{\overline{p}}_{x_0+f(h-1,k)}}\);

-

4.

\(^k\mathcal {M}^h\), \(^k\mathcal {R}^h\), and \(^k\mathcal {V}^h\) denote the total fund, the total expenditure, and the total reserve allocated for the cohort k annuitants, whereas \(\mathcal {M}^h\), \(\mathcal {R}^h\), and \(\mathcal {V}^h\) denote the total fund, the total expenditure, and the total reserve, respectively, namely

$$\begin{aligned} \mathcal {M}^h= & {} \sum _{k} {^k\mathcal {M}^h}= \sum _{k}\left( \sum _{j\in {^kN_{x_0+f(h,k)}^h}}{^kM^h_j}\right) ,\nonumber \\ \mathcal {R}^h= & {} \sum _{k} {^k\mathcal {R}^h} =\sum _{k}\left( \sum _{j\in {^kN_{x_0+f(h,k)}^h} }{^kR^h_j}\right) ,\\ \mathcal {V}^h= & {} \sum _{k}{^k\mathcal {V}^h}=\sum _{k}\left( \sum _{j\in {^kN_{x_0+f(h,k)}^h}}{^kV^h_j}\right) .\nonumber \end{aligned}$$(19)Since \({^kV^h_j}={^kR^h_j}{\tilde{e}}^{h}_{x_0+f(h,k)}\) for each \(j\in \!{^kN_{x_0+f(h,k)}^h}\), then it also follows that

$$\begin{aligned} \begin{aligned} \mathcal {V}^h&=\sum _{k}\left( \sum _{j\in {^kN_{x_0+f(h,k)}^h}}{^kR^h_j}\right) {\tilde{e}}^{h}_{x_0+f(h,k)}\\&=\sum _{k}{^k\mathcal {R}^h}{\tilde{e}}^{h}_{x_0+f(h,k)}. \end{aligned} \end{aligned}$$

Theorem 2

In the LADeC scheme, where the benefit payments are given by (16), the annuity provider is able to meet its obligations at every expiry date, namely

Proof

At time 0, the theorem is banally satisfied by the actuarial fairness principle.

At time h, with \(h\ge 1\), the total fund held by the annuity provider after the payment of the annuity benefits can be written as

The total expenditure for annuity benefits, given by (19), can be expressed by means of the annuity benefit formula in the LADeC scheme, see (16), as

with \(A^{h}=\)\( \frac{\mathcal {M}^{h-1}}{\mathcal {M}^{h-1}|_{L(h)}}\). Note that:

-

(a)

divisor \(1+{\tilde{e}}^{h}_{x_0+f(h,k)}\) depends on time h and cohort k and not on the single j-th annuitant; and

-

(b)

\(\sum _{j\in {^kN_{x_0+f(h,k)}^h}} {^kM^{h-1}_j}={^k\mathcal {M}^{h-1}|_{L(h)}}\).

Set \({^kx^h={\frac{^k\mathcal {M}^{h-1}|_{L(h)}}{1+{\tilde{e}}^{h}_{x_0+f(h,k)}}}}\); it follows that

and substituting (21) in (20), at the denominator, by means of algebraic calculation, it follows that

Since

it follows that

that is the total fund, after the payment of the annuity benefits, is equal to the total expenditure times the weighted average of the life expectancies estimated at h at ages \(x_0+f(h,k)\), with weights \({^kx^h}\). Using (21), then it follows that

and hence the thesis. \(\square \)

Remark 3

Note that in the LADeC scheme, the fund evolution does not depend on the trend observed in survival probabilities. Indeed, from (23), it follows that

where we find out the weighted average of terms \((1-\frac{1}{1+{\tilde{e}}^{h}_{x_0+f(h,k)}})\) with non-negative weights \({^k\!\mathcal {M}^{h-1}|\!_{L(h)}}\).

5 Numerical illustration

In this section, to illustrate the proved theory, a numerical example is provided to show the effectiveness and efficiency of the LADeC scheme. The obvious choice is to parallel the fund, and the related annuity benefits, from the LADeC scheme with those from a conventional life annuity whose benefits are revalued annually at the same interest rate.

To perform the simulation, the following choices were made.

The mortality rates in EUROPOP2013 (European Population Projections, base year 2013) for Italy—male population, main scenario, see Eurostat (data downloaded 2016) (2016), were chosen as the mortality basis for the life annuity contracts. They were selected because the tables contain information on mortality rates until 2080 and the underlying assumptions account for future increases in life expectancy. The set of these life tables on calendar years \(z=2013, 2014,\dots 2080\) is used for valuing the estimated survival probabilities.

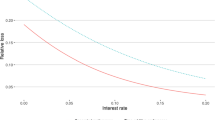

In order to simulate trends in the observed survival probabilities, we considered four different scenarios where the mortality rates, provided by the EUROPOP2013 life tables, for each calendar year \(z=2013, 2014,\dots 2080\), are adjusted by a factor \(1-\alpha \), with \(\alpha =0,+\,0.10, +\,0.20, -\,0.40\), respectively, for the first projected 25 years, and \(\alpha =0, +\,0.02, +\,0.04, -\,0.08\) for the remaining years. Adjusted mortality rates that were negative or greater than one are replaced with the original values provided by the tables. The effects of the adopted adjustments on mortality rates are illustrated in Fig. 1, where the estimated survival function and the observed survival functions in the four scenarios considered are shown at different calendar years.

All simulations in the four scenarios assume:

-

1.

The first cohort joins the scheme at the beginning of year 2014, which corresponds to time \(t=0\); hence, the table life for year 2013 is used to perform the initial calculation of the annuity benefit;

-

2.

The initial age is \(x_0=65\), and the maximum age attainable is 110; these values are set for all cohorts participating in the scheme;

-

3.

All cohorts start with the same number of individuals which is set to 10,000. This choice was made to reduce variations in the benefit payments at older ages;

-

4.

The interest rate is \(r=2\) percent per annum, equal to the average interest rate of Treasury Securities in Italy in year 2013, see MEF Dipartimento del Tesoro (2018). Even though the assumption of a constant risk-free rate of interest can be criticized as being unrealistic, it has no relevance for the purpose of illustrating our theory.

Under the adopted assumptions, the result of the TEE is illustrated showing the evolution of the fund in the three cases considered in the previous sections:

-

(a)

One cohort of individuals with the same initial lump sum, which is chosen to be equal to 400 money units;

-

(b)

One cohort of individuals with different initial lump sums; these values are chosen from a normal distribution with a mean of 400 and a standard deviation of 200, in money units;

-

(c)

Two cohorts of individuals entering the scheme at \(t=0\) and \(t=1\), respectively, and paying different starting lump sums. For both cohorts, these values are outcomes from a normal distribution with the first cohort having a mean of 400 and a standard deviation of 200, in money units, and the second cohort having a mean of 450 and a standard deviation of 250, in money units.

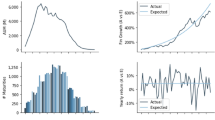

As proved in the TEE, the fund never falls below the zero level in the LADeC scheme in all cases considered (see the upper left box for cases a and b, respectively, in Figs. 2 and 3, and the star line for case c in Fig. 4).

Conversely, in the conventional life annuity scheme, the fund goes into default in the case of assumed improvements in mortality rates in the first three scenarios, whereas it overcapitalizes in the case of worsening mortality rates in Scenario 4 (see the lower left box for cases a and b, respectively, in Figs. 2, 3, and Fig. 4 for case c).

In addition, to illustrate the impact of the demographic compensation on annuity benefits to individuals in the LADeC scheme, the mean values of the simulated outcomes, at each age in the four scenarios taken into account, are shown and compared with those of a conventional re-valuable life annuity. In the LADeC scheme, versus a fund that is always sustainable, the benefit payments are negatively adjusted to take into account the gained improvement in mortality rates in the first three scenarios, whereas they are positively adjusted in the fourth scenario (see the upper right box for cases a and b, respectively, in Figs. 2 and 3, and the boxes related at each scenario for case c in Fig. 5). Compare these with the benefit payments revalued at the fixed interest rate of \(2\%\) in the conventional annuity, against a non-sustainable fund in the first three scenarios or an overcapitalized fund in the fourth scenario (see the right lower box for cases a, b, respectively, in Figs. 2, 3, Fig. 5 for case c).

In Fig. 5, benefit payments are shown for all the four scenarios and the two cohorts considered in the cases of a demographic compensation working for: (a) a single cohort; and (b) for pooling cohorts. As proved by (18), the demographic compensation among pooling cohorts acts favorably for younger and larger cohorts, namely cohort 2 in our simulation, at the expense of older and smaller cohorts, namely cohort 1 in our simulation.

6 Conclusions

This paper has dealt with the problem of designing life annuities with the aim of providing an effective and efficient strategy to tackle the longevity risk. Indeed, although the improvement in life expectancy is a desirable process, influenced by socioeconomic, biological, and environmental developments, the low but persistent increase in life expectancy, which is the longevity phenomenon, gives rise to the longevity risk, that is the risk borne by annuity providers and pension funds when an individual or a group lives longer than expected.

In the framework of a large and authoritative literature on this topic, the basic idea to link annuity benefits to actual longevity has already been considered by many authors, who have designed attractive new arrangements for life annuities. This paper has extended and generalized the LADeC scheme, as proposed by Angrisani and Di Palo (2006) and Di Palo (2016), to the case of multiple cohorts. It can be suggested that this new annuity model can provide a concrete hedge against longevity risk for annuity providers and pension funds since was proved to be effective and efficient. Indeed, as the result of the TEE, it was found that at each time recurrence of the life annuity contract the annuity provider holds a fund that exactly matches its commitments, namely the reserve allocated for the future benefit payments. On the other hand, under the LADeC scheme, benefit payments are constrained to follow the observed trends in survival probabilities, and hence in life expectancy: they decrease or increase according to possible falls or rises in mortality rates, thus compensating for possible deficits suffered by the annuity provider or sharing possible profits earned by the annuity provider. Hence, from the point of view of the annuitants, this product could appear less attractive because of the possible decrease in future benefit payments. However, this aspect can be cushioned if the LADeC annuity benefits are compared to those of products that include a safety loading.

In addition, the paper has shown that the strategy for pooling among several cohorts is not a feasible one in terms of intergenerational fairness. Indeed, the LADeC scheme proved to provide more favorable benefits for younger or larger cohorts to the disadvantage of older and smaller cohorts.

References

Angrisani M, Di Palo C (2006) Strategies for managing longevity risk in retirement plans. In: 28th International congress of actuaries. ICA, Paris vol 28

Barrieu P, Bensusan H, El Karoui N, Hillairet C, Loisel S, Ravanelli C, Salhi Y (2012) Understanding, modelling and managing longevity risk: key issues and main challenges. Scand Actuar J 3:203–231

Bernhardt T, Donnelly C (2018) Pension decumulation strategies a state-of-the-art report. Obtained from https://risk-insight-lab.com/ 15(08)

Blake D, Burrows W (2001) Survivor bonds: helping to hedge mortality risk. J Risk Insur 68:339–348

Börger M (2010) Deterministic shock vs. stochastic value-at-risk—an analysis of the Solvency II standard model approach to longevity risk. Blätter der DGVFM 31(2):225–259

Bräutigam M, Guillén M, Nielsen JP (2017) Facing up to longevity with old actuarial methods: a comparison of pooled funds and income tontines. Geneva Pap Risk Insur Issues Pract 42(3):406–422

Bravo JM, de Freitas NEM (2018) Valuation of longevity-linked life annuities. Insur Math Econ 78:212–229

Brown JR, Mitchell OS, Poterba JM, Warshawsky MJ (2001) The role of annuity markets in financing retirement. MIT Press, Cambridge

Chen A, Hieber P, Klein JK (2019) Tonuity: a novel individual-oriented retirement plan. ASTIN Bull J IAA 49:5–30

Christensen K, Doblhammer G, Rau R, Vaupel JW (2009) Ageing populations: the challenges ahead. The Lancet 374(9696):1196–1208

Coughlan G, Epstein D, Ong A, Sinha A, Hevia-Portocarrero J, Gingrich E, Khalaf-Allah M, Joseph P (2007) Lifemetrics: a toolkit for measuring and managing longevity and mortality risks. Technical document, Life metrics. JP Morgan

Debonneuil E, Loisel S, Planchet F (2018) Do actuaries believe in longevity deceleration? Insur Math Econ 78:325–338

Deng Y, Brockett PL, MacMinn RD (2012) Longevity/mortality risk modeling and securities pricing. J Risk Insur 79(3):697–721

Denuit M, Haberman S, Renshaw A (2011) Longevity-indexed life annuities. N Am Actuar J 15(1):97–111

Denuit M, Haberman S, Renshaw AE (2015) Longevity-contingent deferred life annuities. J Pension Econ Finance 14(3):315–327

Di Palo C (2016) A strategy for managing the longevity risk. In: Proceedings of the XVI Iberian Italian conference on financial and actuarial mathematics, Paestum Italy

Donnelly C, Guillén M, Nielsen JP (2013) Exchanging uncertain mortality for a cost. Insur Math Econ 52(1):65–76

Donnelly C, Guillén M, Nielsen JP (2014) Bringing cost transparency to the life annuity market. Insur Math Econ 56:14–27

Dus I, Maurer R, Mitchell OS (2005) Betting on death and capital markets in retirement: a shortfall risk analysis of life annuities. Technical reports. National Bureau of Economic Research

European Commission (2017) The 2018 ageing report: underlying assumptions and projection methodologies. Institutional paper 065, Economic and Financial Affairs. https://ec.europa.eu/info/sites/info/files/economy-finance/ip065_en.pdf

Eurostat (data downloaded 2016) Europop2013: European population projections 2013-based. Technical reports. Available at http://www.humanmortality.de, http://ec.europa.eu/eurostat/web/population-demography-migration-projections/population-projections-data

Hari N, De Waegenaere A, Melenberg B, Nijman TE (2008) Longevity risk in portfolios of pension annuities. Insur Math Econ 42(2):505–519

Luthy H, Keller P, Binswangen K, Gmur B (2001) Adaptive algorithmic annuities. Bull Swiss Assoc Actuar 2:123–38

MacMinn R, Brockett P, Blake D (2006) Longevity risk and capital markets. J Risk Insur 73(4):551–557

Maurer R, Mitchell OS, Rogalla R, Kartashov V (2013) Lifecycle portfolio choice with systematic longevity risk and variable investment—linked deferred annuities. J Risk Insur 80(3):649–676

MEF Dipartimento del Tesoro (2018) Average yield of government securities at issuance

Milevsky MA (2013) Life annuities: an optimal product for retirement income. Research Foundation Institute, Charlottesville

Milevsky MA (2015) King William’s Tontine: why the retirement annuity of the future should resemble its past. Cambridge University Press, Cambridge

Milevsky MA, Salisbury TS (2015) Optimal retirement income tontines. Insur Math Econ 64:91–105

Milevsky MA, Salisbury TS (2016) Equitable retirement income tontines: mixing cohorts without discriminating. ASTIN Bull J IAA 46(3):571–604

Oeppen J, Vaupel JW (2002) Broken limits to life expectancy. Science 296(5570):1029–1031. https://doi.org/10.1126/science.1069675

Ogborn M, Wallas G (1955) Deferred annuities with participation in profits. J Inst Actuar 81(3):261–299

Olivieri A (2001) Uncertainty in mortality projections: an actuarial perspective. Insur Math Econ 29(2):231–245

Piggott J, Valdez EA, Detzel B (2005) The simple analytics of a pooled annuity fund. J Risk Insur 72(3):497–520

Pitacco E (2004) Survival models in a dynamic context: a survey. Insur Math Econ 35(2):279–298

Pitacco E (2013) Biometric risk transfers in life annuities and pension products: a survey. Technical reports, CEPAR working paper 2013/25, 2013. Available at http://www.cepar.edu.u

Qiao C, Sherris M (2013) Managing systematic mortality risk with group self-pooling and annuitization schemes. J Risk Insur 80(4):949–974

Richter A, Weber F (2011) Mortality-indexed annuities managing longevity risk via product design. N Am Actuar J 15(2):212–236

Sabin MJ (2010) Fair tontine annuity. Available at SSRN 1579932

Stamos MZ (2008) Optimal consumption and portfolio choice for pooled annuity funds. Insur Math Econ 43(1):56–68

Vaupel JW (2010) Biodemography of human ageing. Nature 464(7288):536

Visco I (2006) Longevity risk and financial markets. In: Balling M, Gnan E, Lierman F (eds) Money, finance and demography: the consequences of ageing. SUERF colloquium, Vienna

Weinert JH, Gründl H (2016) The modern tontine: an innovative instrument for longevity risk management in an aging society. ICIR working paper series No 22/2016

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The author declares that she has no conflict of interest.

Ethical approval

This article does not contain any studies with human participants or animals performed by any of the authors.

Additional information

Communicated by Philippe de Peretti.

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

In this appendix, the proof of the TEE is provided in the case of a unique cohort of annuitants homogeneous in their features, as in Angrisani and Di Palo (2006).

Proof

The proof uses the principle of the finite induction.

Firstly, we prove that at time \(h=1\), the thesis is true. Indeed, at time 1, the annuity provider, after having paid out the annuity benefits to all individuals alive in 1, has a total fund, \(\mathcal {M}^1\), given by

where \(M^0\) is the initial lump sum paid at the beginning of the contract such that \(M^0=V^0=R^0{\tilde{e}}^0_{x_0}\). Hence, by (4), it follows that

Using (3) in (26), it is obtained

namely the total fund at 1 equals the total reserve at 1, and the thesis is true.

Secondly, we prove that if \(\mathcal {M}^{h}=\mathcal {V}^{h}\), then \(\mathcal {M}^{h+1}=\mathcal {V}^{h+1}\). At time \(h+1\), after having paid out the life annuity payments, the total fund of the annuity provider, \(\mathcal {M}^{h+1}\), is given by

As it is \(\mathcal {M}^{h}=\mathcal {V}^{h}\), and being \(\mathcal {V}^{h}=|N_{x_0+h}|{V}^{h}\), it follows that

Therefore, for the finite induction principle it follows that \(\mathcal {M}^h=\mathcal {V}^h\) for each \(h\in \mathbb {N}\), and hence for \(h=0,1,\dots ,{\overline{h}}+1\).

\(\square \)

Rights and permissions

About this article

Cite this article

Di Palo, C. Tackling longevity risk by means of financial compensation. Soft Comput 24, 8583–8597 (2020). https://doi.org/10.1007/s00500-019-04433-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00500-019-04433-1