Abstract

Most of the portfolio optimization problems are devoted to either stochastic model or fuzzy one. However, practical portfolio selection problems often involve the mixture of the stochastic returns with fuzzy information. In this paper, we propose a new mean variance random credibilitic portfolio selection problem with different convex transaction costs, i.e., linear function, non-smooth convex function, smooth convex function. In this proposed model, we assume that the returns of assets obey the trapezoidal-type credibilitic distributions, and the risks obey the stochastic distributions. Based on the random credibilitic theories, these models are transformed into crisp convex programming problems. To find the optimal solution, we, respectively, present a pivoting algorithm, a branch-and-bound algorithm, and a sequence quadratic programming algorithm to solve these models. Furthermore, we offer numerical experiments of different forms of convex transaction costs to illustrate the effectiveness of the proposed model and approach.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

The traditional mean variance method, which was proposed by Markowitz (1952), is the foundation of the modern portfolio theory. After that, a number of methods were proposed to find efficient portfolio such as Gao and Li (2013), Macedo et al. (2017), Al Janabi et al. (2017), Liagkouras and Metaxiotis (2017)and so on. The basic assumption for using portfolio model within a probabilistic framework is that the situation of financial markets in future can be correctly reflected by security data in the past. If there are not enough data for the practical problem, these models will be invalid. Because of lack of data in an emerging financial market, the parameters or probability distributions of random returns are difficult to be accurately estimated.

However, these quantities can be provided by the experts based on their past information and subjective belief. In other words, security returns may be considered as fuzzy variables instead of random variables when there is lack of data. The fuzzy set is a powerful tool used to describe an uncertain financial environment where not only the financial markets but also the investment decision-makers are subject to vagueness, ambiguity or fuzziness. Possibility theory has been proposed in Zadeh (1978), where fuzzy variables are associated with possibility distributions. Recently, a number of researchers have investigated fuzzy portfolio selection problem, such as Zhang et al. (2009), Qin et al. (2009), Zhang and Zhang (2014), and Kar et al. (2018). But the possibility measure is not self-dual. Credibility theory has been newly proposed in Liu (2002a). As the average of a possibility measure and a necessity measure, the credibility measure is self-dual. In this respect, the credibility measure shares some properties with the probability measure. Recently, a number of researchers have investigated credibilitic portfolio selection problem, such as Zhang et al. (2010), Mehlawat and Gupta (2014), Jalota et al. (2017), and Deng et al. (2018).

Actually, the investors may encounter uncertainty of both randomness and fuzziness simultaneously when handling the practical portfolio selection problem. Random and credibilitic optimization models provide useful methods for investors to handle uncertainty. For example, the probability distributions of security returns may be partially known. Therefore, the uncertain parameters may be estimated by experts on the basis of available data, which implies that security returns may be characterized by random credibilitic variables. Random credibilitic variable was a recently introduced variable by Liu (2002b) to describe a random fuzzy phenomenon. After that, several authors have also applied random credibilitic variable to model portfolio optimization, such as Hasuike et al. (2009), Huang (2007a, b), Liu et al. (2011), Qin (2017),Wang et al. (2017), Dutta et al. (2018).

To the best of the author’s knowledge, at present, there is little research in modeling and solving random credibilitic portfolio selection problem with different convex transaction costs. This stimulates the authors to employ the latest development of mathematics on uncertainty theory to study the portfolio selection problem in random credibilitic environment. The contribution of this work is as follows. We propose a new mean variance random credibilitic portfolio selection model with different convex transaction costs. Using the random credibilitic decision-making approach, the proposed model is transformed into a crisp convex programming problem. Three algorithms are designed to obtain the optimal portfolio strategy.

The rest of the paper is organized as follows. In Sect. 2, necessary knowledge about credibilitic variable, random credibilitic variable, and some properties will be briefly introduced. In Sect. 3, we propose a new mean variance random credibilitic portfolio selection model with three types of convex transaction costs functions, i.e., linear function, non-smooth convex function, and smooth function. Using the random credibilitic theory, the proposed model is turned into a crisp convex programming problem. A novel pivoting algorithm, a branch-and-bound algorithm, and a sequence quadratic programming are proposed to solve the proposed models with different convex transaction costs in Sect. 4. Numerical examples are presented in Sect. 5 to help understanding the modeling idea and the designed algorithm. Finally, some conclusions are given in Sect. 6.

2 Preliminaries

Some definitions, which are needed in the following section, will be introduced herein.

Definition 1

(Liu (2002a)). Let Θ be a nonempty set and P the power set of Θ. A set function Cr on P is called credibility measure if it satisfies:

-

(1)

(Normality) Cr{Θ} = 1;

-

(2)

(Monotonicity) Cr{A} ≤ Cr{B} whenever A ⊂ B;

-

(3)

(Self-duality) Cr{A} + Cr{Ac} = 1 for any A∈P;

-

(4)

(Maximality) \( Cr\{ \cup_{i} A_{i} \} = \sup_{i} Cr\{ A_{i} \} \) for any sequence {Ai} ⊂ P with \( \sup_{i} Cr\{ A_{i} \} < 0.5 \). The triplet (Θ, P, Cr) is called a credibility space.

Let ξ be a fuzzy variable with membership function μ. For any x∈ ℜ, μ (x) represents the possibility that ξ takes value x. Hence, it is also called the possibility distribution. For any set B, the possibility measure and necessity measure of ξ ∈ B were, respectively, defined by Zadeh (1978) as

It is proved that both possibility measure and necessity measure satisfy the properties of normality, nonnegativity, and monotonicity. However, neither of them is self-dual. Since the self-duality is intuitive and important in real problems, Liu (2002a, b) defined a credibility measure as the average of possibility measure and necessity measure

where Cr is self-dual measure and satisfies \( Cr\left\{ {\xi \le r} \right\} + Cr\left\{ {\xi \ge r} \right\} \, = \, 1 \).

Definition 2

(Liu (2002a)). Let ξ be a credibilitic variable. Then, the expected value is defined as

Based on Definition 2, Liu (2002a) deduced the following two theorems.

Theorem 1

(Liu (2002a)). Let ξ be a credibilitic variable with finite expected value. Then, for any real numbers λ and μ, it holds that

Theorem 2

(Liu (2002a)) Let ξ and η be independent credibilitic variables with finite expected values. Then, for any real numbers λ and μ, it holds that

A popular credibilitic number is the trapezoidal credibilitic number ξ = (a, b, α, β) with membership function μξ(x) in the following form

where α and β are positive numbers, i.e., α, β > 0.

From Eq. (3), the credibility of the event {ξ ≤ r} is as follows:

Theorem 3

Let ξ be a the trapezoidal credibilitic number ξ = (a, b, α, β) with membership function μ ξ (x). Then,

Proof

Because the credibility measure is self-dual measure, according to Eq. (8), we can obtain the following:

According to Definition 2, we can obtain as follows:

Thus, the proof of Theorem 3 is ended.

Until now, there are many studies of portfolio selection problems whose future returns are assumed to be random variables or fuzzy numbers. However, since few studies of them are treated as random credibilitic variables, we introduce a random credibilitic variables defined by Liu (2002b) as follows.

Definition 3

(Liu (2002b)). A random credibilitic variable is a function ξ from a credibility space(Θ, Cr(Θ), Cr) to collection of random variables R. An n-dimensional random credibilitic vector ξ = (ξ1, ξ2,…, ξn) is an n-tuple of random credibilitic variables ξ1, ξ2,…, ξn.

That is, a random credibilitic variable is a fuzzy set defined on a universal set of random variables. Furthermore, the following random credibilitic definition is introduced.

Definition 4

(Liu (2002b)). Let ξ1, ξ2,…, ξn be random credibilitic variables, and f: Rn → R be a continuous function. Then, ξ = f (ξ1, ξ2,…, ξn) is a random credibilitic variable on the product credibility space(Θ, Cr(Θ), Cr), defined as

for all(θ1, θ2,…, θn) ∈Θ.

From these definitions, the following theorem is derived.

Theorem 4

(Liu (2002b)). Let ξibe random credibilitic variables with membership functions μi, i = 1, 2,…, n, respectively, and f: Rn → R be a continuous function. Then, ξ = f (ξ1, ξ2,…, ξn) is a random credibilitic variable whose membership function is

for all η∈ R, where R = {f (η1, η2,…, ηn)| ηi∈Ri, i = 1, 2,…, n}.

Definition 5

Let ξ be a random credibilitic variable with finite mean value e. Then, the variance of ξ is defined by

3 The random fuzzy portfolio selection model

Assume that there are n risky assets in financial market for trading. An investor wants to allocate his/her wealth among n assets. Then, an optimal portfolio should be the one with minimized variance for the given expected return level. Suppose that the return rates of the n risky assets at each period are denoted as trapezoidal credibilitic variables. Let w be the portfolio, where w = (w1,w2,…,wn)′; \( \widetilde{{R_{i} }} \) be the random credibilitic return of risky asset i; rp be the excepted return rate of the portfolio w; σ2 be the variance of the portfolio w, where σ2 = (σij)n×n, σij = Cov(Ri,Rj); c(w) be the transaction cost of the portfolio w; rN be the net return rate of the portfolio w.

3.1 Return, risk, and transaction costs constraints

In this section, we employ the credibilitic mean value to measure the return of portfolio. The risk on the return rate of portfolio is quantified by the random variance. The return rate of security i, \( \widetilde{{R_{i} }} \) = (ai,bi,αi, βi), is trapezoidal random credibilitic variable for all i = 1,…,n.

The credibilitic value of the portfolio w = (w1, w2, …, wn)′ can be expressed as

Let \( \widetilde{{R_{i} }} \) be trapezoidal credibilitic variable for all i = 1,…,n, \( \widetilde{{R_{i} }} \) = (ai,bi,αi, βi). The mean value of the portfolio w = (w1, w2, …, wn)′ can be expressed as

Transaction cost is one of the main concerns for portfolio managers. Arnott and Wagner (1990) and Yoshimoto (1996) found that ignoring transaction costs would result in an inefficient portfolio. Bertsimas and Pachamanova (2008), Gülpınar et al. (2003), and Zhang (2016, 2017) incorporated transaction cost into the multiperiod portfolio selection problem. In this paper, the transaction cost for asset i can be expressed as ci(wi). Hence, the total transaction costs of the portfolio w = (w1, w2,…, wn)′ can be represented as C(w)

The net return rate of the portfolio w can be denoted as

The variance of the portfolio w can be expressed as

where w = (w1, w2, …, wn)′, σ2 = (σij)n×n, σij = Cov(Ri,Rj).

The capital constraint of risky assets is

3.2 The basic multiperiod portfolio optimization models

Let \( \widetilde{{R_{i} }} \) be expressed with a fuzzy set and r0 be a minimum target value of the total future profit. We formally introduce the following mean–variance model:

where constraint (a) denotes that the return of the portfolio is not less than the preset value r0; constraint (b) indicates that the proportion of risk assets sums to one; and constraint (c) states the nonnegative constraints of wi.

Model (18) is a fuzzy optimization problem. Let \( \widetilde{{R_{i} }} \) = (ai,bi,αi, βi). Using the random credibilitic theory, the proposed Model (18) can be turned into as

If the covariance matrix σ2 is semi-definite, and C(w1,w2,…,wn) is linear function, Model (19) is a convex quadratic programming problem, which can be solved by Algorithm 1. If the covariance matrix σ2 is semi-definite, and C(w) is non-smooth or smooth convex function, Model (19) is a convex programming problem, which can be solved by Algorithm 2 or Algorithm 3.

4 Solution algorithm

In this section, the smallest and biggest value of r0 can be obtained. Several methods will be proposed to solve the problems with the different transaction costs.

4.1 The smallest and biggest value of r 0

In Model (19), investors can choose r0 between \( r_{0}^{ \hbox{min} } \) and \( r_{0}^{\hbox{max} } \). \( r_{0}^{ \hbox{min} } \) and \( r_{0}^{\hbox{max} } \) can be, respectively, obtained as follows:

The investor considers to maximize the expected return of the portfolio

w* (the optimal solution w = (w1, w2,…, wn)′) can be obtained solving Model (20) by the following algorithms. The biggest of objective (\( r_{N}^{\hbox{max} } = \sum\limits_{i = 1}^{n} {\left( {\frac{{a_{i} + b_{i} }}{2} + \frac{{\beta_{i} - \alpha_{i} }}{4}} \right)} w_{i}^{*} - \sum\limits_{i = 1}^{n} {c_{i} (w_{i}^{*} )} \)) can be obtained, i.e., \( r_{0}^{ \hbox{max} } = r_{N}^{ \hbox{max} } \).

The smallest value of the \( r_{0}^{ \hbox{min} } \) can be obtained as follows:

w* (the optimal solution w = (w1, w2,…, wn)′) can be obtained solving Model (21) by Algorithm 1. Simultaneously, \( r_{N}^{ \hbox{min} } \) (the smallest of \( r_{N}^{\hbox{min} } = \sum\limits_{i = 1}^{n} {\left( {\frac{{a_{i} + b_{i} }}{2} + \frac{{\beta_{i} - \alpha_{i} }}{4}} \right)} w_{i}^{*} - \sum\limits_{i = 1}^{n} {c_{i} (w_{i}^{*} )} \)) is obtained, i.e., \( r_{0}^{ \hbox{min} } = r_{N}^{ \hbox{min} } \).

4.2 Several methods for the problems with different transaction costs

In this section, we will present several methods for the random credibilitic mean variance portfolio selection models with different types of transaction costs, i.e., linear function, non-smooth convex functions, and smooth functions

4.2.1 The transaction cost is linear function

In Model (19), let the transaction costs be linear functions, i.e., ci(wi) = kiwi, and Model (19) can be obtained as follows:

Let μ1 and μ2 be the Lagrange multiplier. The KKT conditions for Model (22) are as follows:

where the KKT conditions of Model (22) are a system of equalities where all the expressions are linear equalities or inequalities except for complementarity conditions, and there are n + 2 variables and 2n + 4 linear equalities or inequalities in Eq. (23).

Algorithm 1. The pivoting algorithm for Eq. (23).

Step 1 Construct initial table.

Let w 3 i 0, i = 1,2,…,n, μ 31 0, μ 32 0 be the initial basic inequality. The initial basic solution is x0 = (0,…,0,0,0)′. The initial basic vector is ei, i = 1, 2,…, n + 2, which is the ith row of the identity matrix of order n + 2. Other equalities and inequalities of Eq. (23) and their coefficient vectors are non-basic gi.

Let \( d_{i} = \frac{{a_{i} + b_{i} }}{2} + \frac{{\beta_{i} - \alpha_{i} }}{4} - k_{i} \), \( q = (0, \ldots ,0,r_{0} ,1)' \); \( g_{i} = (\sigma_{i1} ,\sigma_{i2} , \ldots ,\sigma_{in} , - d_{i} ,1) \), i = 1,2,…,n; \( g_{n + 1} = (d_{1} , \ldots ,d_{n} ,0,0) \); \( g_{n + 2} = (1, \ldots ,1,0,0) \)

The deviation with respect to x0 is Δ = gx0 − q. Thus, we have an initial table as shown in Table 1.

Step 2 Preprocessing.

Let I3 be the index set of equalities, i.e., I3 = {n + 2}, I4 be the index set of inequalities, i.e., I4 = {1,2,…,n,n + 1}. Select a non-basic vector gn+2 to enter the basis, and the basic vector e1 leaves the basis. Select a non-basic vector g1 to enter the basis, and the basic vector en+2 leaves the basis. Then, carry out two pivoting on the positive elements 1. Then, delete the column of gn+2 and the row of en+2. The calculating process is as follows:

According to Eq. (24), we can obtain Eq. (25).

Substituted Eq. (25) into Eq. (24), we can get Eq. (26).

Using the same method, we obtain the following pivoting operation: gn+2 ↔ e1.

Step 3 Main iterations.

-

(1)

If all of the deviations of non-basic vectors are nonnegative, the current basic solution is a solution to Eq. (23).

-

(2)

Otherwise, select a non-basic vector gr with negative deviation to enter the basis. If there is no positive element in the row of entering vector that is corresponding to the basic inequality, Eq. (23) has no solution. If there is the biggest positive element grs in the row of entering vector, the basic vector of the sth column corresponding to grs leaves the basis. Then, carry out a pivoting operation: gr↔es. After that, return to Step 3. (1).

4.2.2 The transaction cost is non-smooth convex functions

Let the transaction costs be non-smooth convex functions; the random credibilitic portfolio selection model is:

Model (27) is a non-smooth convex quadratic programming problem.

If ci(wi) is a non-smooth convex function, \( \sum\nolimits_{i = 1}^{n} {\left( {\frac{{a_{i} + b_{i} }}{2} + \frac{{\beta_{i} - \alpha_{i} }}{4}} \right)w_{i} } - \sum\nolimits_{i = 1}^{n} {c_{i} (w_{i} )} \) is concave function. So, Model (27) is a non-smooth convex programming problem. We propose a branch-and-bound method and a pivoting algorithm to solve Model (27). Let the function of OB be ci(wi) = kiwi, where ki = ci(ui)/ui. When ci(wi) is substituted by kixi, Model (27) can be turned into as follows:

Theorem 5

Let w0be the optimal solution of Model (28). Then, w0is the feasible solution of Model (27).

Proof

If x0 is the optimal solution of Model (28), we can get the following equation:

Because ci(wi) is a non-smooth convex function, we can obtain the following equation:

According to Eq. (29) and Eq. (30), we can get

So, w 0 i is the feasible solution of Model (27).

Thus, the proof of Theorem 5 is ended.

Theorem 6

Let w0and g(w0), respectively, be the optimal solution and the optimal objective function value of Model (28), w*and f(w*), respectively, be the optimal solution and the optimal objective function value of Model (27), f(w0) be the objective function value of the feasible solution w0of Model (27). Then,

Proof

According to Theorem 5, we can obtain that w0 is the feasible solution of Model (27). Because w* is the optimal solution of Model (27), we can get that

According to Fig. 1, we can obtain that

According to Eq. (33), we can obtain that

According to Eq. (34), we can obtain that w* is the feasible solution of Model (28), i.e.,

Because the objective functions of Model (27) and Model (28) are same, we can get that

According to Eqs. (32), (35), and (36), we can obtain that

Thus, the proof of Theorem 6 is ended.

From Eq. (36), we can obtain that there are upper and lower bounds on the optimal objective function value of Model (28).

Definition 6

Let w0 be the optimal solution of Model (28), and

Then, w0 is almost the optimal solution of Model (27).

If there is an optimal solution of Model (28) w0, which cannot satisfy Eq. (37), then let

Model (27) can be turned into the following two models:

and

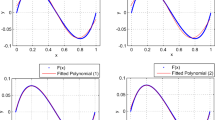

Let cs(ws) be substituted by two piecewise linear function. The function of cs(xs) can be denoted as in Fig. 2.

In Fig. 2, the linear OA is ks1 (ws1), in which the slope of OA is cs(us/2)/(us/2), and the linear AB is ks2(ws2), in which the slope of AB is ks2 = (cs(as) − cs(as/2))/(as/2).

Model (28) can be turned into the two following models:

Definition 7

Let w1 and w2 be, respectively, the optimal solution of Model (43) and Model (44). If \( \sum\limits_{i = 1}^{n} {\left( {k_{i} w_{i}^{1} - c_{i} (w_{i}^{1} )} \right)} \le \varepsilon \) or \( \sum\limits_{i = 1}^{n} {\left( {k_{i} w_{i}^{2} - c_{i} (w_{i}^{2} )} \right)} \le \varepsilon \), then x1 or x2 is the optimal solution of Model (27).

Algorithm 2. The branch-and-bound algorithm for Model (27)

Step 1 Let k = 0, l 0 i = 0, \( u_{i}^{0} = u_{i} ,w_{i}^{0} = \{ w_{i} |l_{i}^{0} \le w_{i} \le u_{i}^{0} \} . \)

Step 2 Let k j i (wi) be the approximate linear function of ci(wi). We can obtain the optimal solution of the following model by Algorithm 1.

where the optimal solution of Model (45) is Wj = (w j1 ,…,w j n ).

Step 3 If \( \sum\limits_{i = 1}^{n} {(k_{i}^{j} (w_{i}^{j} ) - c_{i} (w_{i}^{j} ))} \le \varepsilon \), \( W^{j} = \left( {w_{1}^{j} , \ldots ,w_{n}^{j} } \right) \) is the optimal solution of Model (27). Otherwise, \( k_{s}^{j} \left( {w_{s}^{j} } \right) - c_{s}^{j} \left( {w_{s}^{j} } \right) = \hbox{max} \{ k_{i}^{j} \left( {w_{i}^{j} } \right) - c_{i}^{j} \left( {w_{i}^{j} } \right)|i = 1, \ldots ,n\} \), \( W^{j + 1} = \{ l_{s}^{j} \le w_{s} \le (u_{s}^{j} + l_{s}^{j)} )/2,w \in W^{j} |w_{i} \ne w_{s} \} \), \( W^{j + 2} = \{ (u_{s}^{j} + l_{s}^{j)} )/2 \le w_{s} \le u_{s}^{j} ,x \in X^{j} |w_{i} \ne w_{s} \} \), turn Step 2.

4.2.3 The transaction cost is smooth convex functions

Let the transaction costs be smooth convex functions. The function can be denoted as in Fig. 3.

The random credibilitic portfolio selection with smooth convex transaction costs is as follows:

If ci(xi) is a convex function, \( \sum\nolimits_{i = 1}^{n} {[r_{i} w_{i} - c_{i} (w_{i} )]} \) is a concave function. So, Model (46) is a smooth convex programming problem.

Algorithm 3. A sequence quadratic programming algorithm for Model (46)

We propose a sequence quadratic programming and a pivoting algorithm to solve Model (46).

Step 1 Let w0 = (1/n, …, 1/n)T, ci(wi) be approximated as gi(wi) = ci(w 0 i ) + ci′ (w 0 i )(wi − w 0 i ). The subproblem of Model (46) can be obtained as follows:

The optimal solution of Model (47) w* can be obtained by Algorithm 1. Let w1 = w*.

Step 2 Let ci(wi) be approximated as gi(wi) = ci(w k i ) + ci′ (w k i )(wi − w k i ). The subproblem of Model (46) can be obtained as follows:

The optimal solution of Model (48) w*can be obtained by Algorithm 1. Let wk+1 = w*.

Step 3 If \( \left| {w^{k + 1} - w^{k} } \right| \le \varepsilon ,\;\varepsilon = 10^{ - 6} ,\;w^{k + 1} \) is the optimal solution of Model (46). Otherwise, let wk: = wk+1. Turn to Step 2.

5 Numerical examples

In this section, three numerical examples are given to express the idea of the proposed model. Assume that an investor chooses twenty stocks from Shanghai Stock Exchange for his investment. The stocks codes are, respectively, S1 (600036), S2 (600002), S3 (600060), S4 (600362), S5 (600519), S6 (601111), S7 (601318), S8 (600900), S9 (600887), S10 (600690), S11 (6000970), S12 (600000), S13 (600009), S14 (600019), S15 (600029), S16 (600104), S17 (600315), S18 (600518), S19 (600570), and S20 (600880). He/she assumes that the returns and risk of the twenty stocks at each period are represented as trapezoidal fuzzy numbers. We collect historical data of them from April 2006 to June 2018 and set every three months as a period to handle the historical data. By using the simple estimation method in Vercher et al. (2007) to handle their historical data, the trapezoidal possibility distributions of the return rates of assets can be obtained as shown in Table 2. We use the above algorithms to obtain the optimal solution of Model (19) with the three types transaction costs. (1) When the transaction cost is linear function, we assumed that ci(wi) = 0.003wi. (2) When the transaction cost is non-smooth convex function, we assumed that \( c_{i} (w_{i} ) = \left\{ {\begin{array}{*{20}l} {0.003w_{i} ,0 \le w_{i} \le 0.5} \hfill \\ {0.004w_{i} - 0.0005,0.5 \le w_{i} \le 1} \hfill \\ \end{array} } \right. \).

(3) When the transaction cost is smooth convex function, we assumed that \( c_{i} (w_{i} ) = 0.003w_{i}^{2} + 0.003w_{i} \).

The trapezoidal possibility distributions \( \widetilde{{R_{i} }} \) = (ai,bi,αi, βi) can be obtained as shown in Table 2.

The covariance matrix σ2 = (σij)n×n can be obtained as follows:

As illustrations, the following numerical examples are given to show the effectiveness of the proposed model and the algorithms. The algorithm was programmed by C++ language and run on a personal computer with Pentium Dual CPU, 4 GHz, and 8 GB RAM.

(1) When the transaction cost is linear function, we assumed that the coefficients of transaction costs are generated same for all assets, i.e., ci(wi) = 0.003wi. By using the pivoting algorithm to solve Model (20) and Model (21), we can, respectively, obtain r max0 = 0.179025, r min0 = 0.0964.

By using the pivoting algorithm to solve Model (22), the computational results are summarized in Table 2.

If r0 = 0.1, 0.12, 0.13, the optimal solution will be obtained as Table 3.

When r0 = 0.1, the optimal investment strategy at period 1 is w1 = 0.1207, w3 = 0.6370, w6 = 0.1018, w9 = 0.0984, w12 = 0.0004, w19 = 0.0324, w20 = 0.0093 and being the rest of variables equal to zero, which means investor should allocate his initial wealth on asset 1, asset 3, asset 6, asset 9, asset 12, asset 19, asset 20 and otherwise asset by the proportions of 12.07%, 63.7%, 10.18%, 9.84%, 0.04%, 3.24%, 0.93% and being the rest of variables equal to zero among the twenty stocks, respectively. From Table 3, it can be seen that the investment proportion of asset 8 will increase when the minimum target value of the total future profit r0 increases.

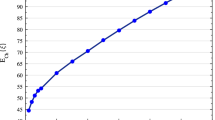

If r0 = 0.0964, 0.1, 0.105, 0.01,…, 0.17, 0.175, 0.179025, the variance and expected return will be obtained as given in Table 4.

In Table 4, it can be seen that the standard deviation will increase when the net expected return increases.

(2) When the transaction cost is non-smooth convex function, we assumed that

\( c_{i} (w_{i} ) = \left\{ {\begin{array}{*{20}l} {0.003w_{i} ,0 \le w_{i} \le 0.5} \hfill \\ {0.004w_{i} - 0.0005,0.5 \le w_{i} \le 1} \hfill \\ \end{array} } \right. \). By using Algorithm 2 to solve Model (20) and Model (21), we can, respectively, obtain r max0 = 0.178525, r min0 = 0.096203.

By using Algorithm 2 to solve Model (27), the computational results are summarized in Table 2.

If r0 = 0.1, 0.12, 0.13, the optimal solution will be obtained as given in Table 5.

From Table 5, it can be seen that the investment proportion of asset 8 will increase when the minimum target value of the total future profit r0 increases.

If r0 = 0.096203, 0.1, 0.105, 0.01,…, 0.17, 0.175, 0.178525, the variance and expected return will be obtained as given in Table 6.

In Table 6, it can be seen that the standard deviation will increase when the net expected return increases.

(3) When the transaction cost is smooth convex function, we assumed that \( c_{i} (w_{i} ) = 0.003w_{i}^{2} + 0.003w_{i} \). By using Algorithm 3 to solve Model (20) and Model (21), we can, respectively, obtain

By using Algorithm 3 to solve Model (16), the corresponding results can be obtained as follows.

If r0 = 0.1, 0.12, 0.13, the optimal solution will be obtained as given in Table 7.

From Table 7, it can be seen that the investment proportion of asset 8 will increase when the minimum target value of the total future profit r0 increases.

If r0 = 0.094818, 0.1, 0.105, 0.01,…, 0.175, 0.1760250, the variance and expected return will be obtained as given in Table 8.

In Table 8, it can be seen that the standard deviation will increase when the net expected return increases.

The computational results for these three types of transaction costs are summarized in Tables 3, 5, and 7. In general, the optimal strategies under different transaction costs are different. The change of the transaction cost has great influence on the strategy making.

In the general type of convex transaction cost function ci(wi) contains three types, i.e., linear function, non-smooth convex function, and smooth convex function. The above three types of transaction costs can be used to describe the practical situation for the transaction cost precisely.

6 Conclusions

A random credibilitic portfolio optimization model with different convex transaction costs is proposed, which can be deduced into any specific form by investors’ estimation and practical situation. We present three algorithms especially for solving the different convex transaction costs function form of portfolio selection problem. Moreover, we define three general types of transaction cost and describe the practical situation for the transaction cost precisely. The computational experiments show that different types of transaction cost have great influence on strategy making.

References

Al Janabi MAM, Hernandez JA, Berger T, Nguyen DK (2017) Multivariate dependence and portfolio optimization algorithms under illiquid market scenarios. Eur J Oper Res 259:1121–1131

Arnott RD, Wagner WH (1990) The measurement and control of trading costs. Financ Anal J 6:73–80

Bertsimas D, Pachamanova D (2008) Robust multiperiod portfolio management in the presence of transaction costs. Comput Oper Res 35:3–17

Deng X, Zhao J, Li Z (2018) Sensitivity analysis of the fuzzy mean-entropy portfolio model with transaction costs based on credibility theory. Int J Fuzzy Syst 20(1):209–218

Dutta S, Biswal MP, Acharya S, Mishraa R (2018) Fuzzy stochastic price scenario based portfolio selection and its application to BSE using genetic algorithm. Appl Soft Comput 62:867–891

Gao J, Li D (2013) Optimal cardinality constrained portfolio selection. Oper Res 61(3):745–761

Gülpınar N, Rustem B, Settergren R (2003) Multistage stochastic mean-variance portfolio analysis with transaction cost. Innov Financ Econ Netw 3:46–63

Hasuike T, Katagiri H, Ishii H (2009) Portfolio selection problems with random fuzzy variable returns. Fuzzy Sets Syst 160:2579–2596

Huang X (2007a) Two new models for portfolio selection with stochastic returns taking fuzzy information. Eur J Oper Res 180:396–405

Huang X (2007b) A new perspective for optimal portfolio selection with random fuzzy returns. Inf Sci 177:5404–5414

Jalota H, Thakur M, Mittalb G (2017) A credibilistic decision support system for portfolio optimization. Appl Soft Comput 59:512–528

Kar MB, Kar S, Guo S, Li X, Majumder S (2018) A new bi-objective fuzzy portfolio selection model and its solution through evolutionary algorithms. Soft Comput. https://doi.org/10.1007/s00500-018-3094-0

Liagkouras K, Metaxiotis K (2017) A new efficiently encoded multiobjective algorithm for the solution of the cardinality constrained portfolio optimization problem. Ann Oper Res. https://doi.org/10.1007/s10479-016-2377-z

Liu B (2002a) Theory and practice of uncertain programming. Physica Verlag, Heidelberg

Liu B (2002b) Random fuzzy dependent-chance programming and its hybrid intelligent algorithm. Inf Sci 141:259–271

Liu Y, Tang W, Li X (2011) Random fuzzy shock models and bivariate random fuzzy exponential distribution. Appl Math Model 35:2408–2418

Macedo LL, Godinho P, Alves MJ (2017) Mean-semivariance portfolio optimization with multiobjective evolutionary algorithms and technical analysis rules. Expert Syst Appl 79:33–43

Markowitz H (1952) Portfolio selection. J Financ 7(1):77–91

Mehlawat MK, Gupta P (2014) Fuzzy chance-constrained multiobjective portfolio selection model. IEEE Trans Fuzzy Syst 22(3):653–671

Qin Z (2017) Random fuzzy mean-absolute deviation models for portfolio optimization problem with hybrid uncertainty. Appl Soft Comput 56:597–603

Qin Z, Li X, Ji X (2009) Portfolio selection based on fuzzy cross-entropy. J Comput Appl Math 228:139–149

Vercher E, Bermudez J, Segura J (2007) Fuzzy portfolio optimization under downside risk measures. Fuzzy Sets Syst 158:769–782

Wang B, Li Y, Watada J (2017) Multi-period portfolio selection with dynamic risk/expected return level under fuzzy random uncertainty. Inf Sci 385–386:1–18

Yoshimoto A (1996) The mean–variance approach to portfolio optimization subject to transaction costs. J Oper Res Soc Japan 39:99–117

Zadeh LA (1978) Fuzzy sets as a basis for a theory of possibility. Fuzzy Sets Syst 1:3–28

Zhang P (2016) An interval mean-average absolute deviation model for multiperiod portfolio selection with risk control and cardinality constraints. Soft Comput 15(1):63–76

Zhang P (2017) Multiperiod mean semi- absolute deviation interval portfolio selection with entropy constraints. J Ind Manag Optim 13(3):1169–1187

Zhang P, Zhang W (2014) Multiperiod mean absolute deviation fuzzy portfolio selection model with risk control and cardinality constraints. Fuzzy Sets Syst 255:74–91

Zhang W, Zhang X, Xiao W (2009) Portfolio selection under possibilistic mean–variance utility and a SMO algorithm. Eur J Oper Res 197:693–700

Zhang X, Zhang W, Xu W, Xiao W (2010) Possibilistic approaches to portfolio selection problem with general transaction costs and a CLPSO algorithm. Comput Econ 36:191–200

Acknowledgements

This research was supported by the National Natural Science Foundation of China (Nos. 71271161).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

Peng Zhang declares that he/she has no conflict of interest.

Ethical approval

This article does not contain any studies with human participants performed by any of the authors.

Informed consent

Informed consent was obtained from all individual participants included in the study.

Additional information

Communicated by V. Loia.

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Zhang, P. Random credibilitic portfolio selection problem with different convex transaction costs. Soft Comput 23, 13309–13320 (2019). https://doi.org/10.1007/s00500-019-03873-z

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00500-019-03873-z