Abstract

This paper proposes the fuzzy mean-entropy portfolio models with transaction costs based on credibility theory. In the paper, entropy is used as the measurement of risk. Furthermore, sensitivity analysis is discussed for objective function coefficients and constraint coefficients on the right sides in our proposed models. In addition, two numerical examples are given to illustrate the effectiveness of our proposed models and the practicability of sensitivity analysis. More importantly, the obtained results also show that when certain coefficient changes in some value range, we still can obtain the unchanged optimal solutions or unchanged objective function values. Compared with Huang (IEEE Trans Fuzzy Syst 16:1096–1101, 18; Fuzzy Optim Decis Mak 10:71–89, 19), our paper not only proposes the mean-entropy models, but also does research work on sensitivity analysis about objective function coefficients and constraint coefficients in depth in maximizing return model and minimizing risk model. Our results can provide more choices for investors in the practical financial market.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

The mean–variance methodology for the portfolio selection problem, proposed originally by Markowitz [1,2,3], played a critical role in the development of modern finance theory. It combines probability with optimization technique to model the behavior investment. The fundamental principle of the mean–variance model is to use the expected return of the portfolio as the investment return and to use the variance of the return of the portfolio as the investment risk. As we know, the traditional Markowitz’s mean–variance models are optimal models by minimizing risk or maximizing return with some constraints. Most of the existing portfolio selection models are based on probability theory. The mean–variance portfolio selection problem has been studied by many researchers including Best et al. [4], Merton [5], Pang [6], Perold [7] and Sharpe [8]. These portfolio models are solved by traditional optimal algorithm (see active set algorithm in [9]) and intelligent algorithm (evolutionary algorithms in [10]).

In the practical financial market, many non-probabilistic factors affect the financial market such that the risky asset’s uncertainty is more embodied in the fuzzy uncertainty. Fuzzy uncertainty is more important than the probabilistic uncertainty. Liu [11] presented the credibility theory based on the axiomatic system of fuzzy number. Based on the credibility theory, many researchers investigated fuzzy means and variances into portfolio model. The concept of fuzzy entropy was defined by Liu [11] for measuring the uncertainty of fuzzy variables. Liu [12] presented a deep theoretical study and discussion on credibility theory by some basic concepts and fundamental theorems. Liu [13] also proposed a chance constrained programming model and designed a genetic algorithm to solve the model. Much research work has been obtained when the return rate is regarded as fuzzy number by Amiri [14], Bhattacharyya [15], Dastkhan [16], etc.

At the same time, we also note that risk is also can be measured by entropy. Philippatos [17] pointed out that entropy is more general than variance as an efficient measure of risk because entropy is free from reliance on symmetric probability distributions and can be computed from non-metric data. Huang [18, 19] studied the mean-entropy models for fuzzy portfolio selection and mean-risk models for uncertain portfolio models. Mukesh [20] presented credibilistic mean-entropy models for multi-period portfolio selection with multi-choice aspiration levels. And a real-world empirical application with dataset from an Indian stock market is presented to demonstrate effectiveness of the proposed models. Zhou [21] presented a mean–variance hybrid-entropy model for portfolio selection with fuzzy returns. Finally, the corresponding results show that the proposed models generally perform better than the traditional portfolio selection models.

In the past, many researchers studied fuzzy portfolio selection models with all kinds of complex constraints. Zhang [22] and Sadjadi [23] considered more complex portfolio models with borrowing and lending and transaction costs. Li [24] did some research work on entropy of credibility distributions for fuzzy variables, which was the basis of fuzzy entropy. Liu [25] studied portfolio selection problem with interval-valued returns in which the risk was measured by absolute deviation. Liu [26] also studied a fuzzy portfolio optimization model. Qin [27] considered fuzzy cross-entropy in portfolio selection. Zhou [28] studied a portfolio optimization model based on information entropy with fuzzy time series, both entropy-based models outperform the traditional ones and the fuzzy time series forecasting model also help to further improve the actual performance. Yue [29] studied a new fuzzy multi-objective and higher-order moment portfolio selection model for diversified portfolios, and a new effective multi-objective evolutionary algorithm was designed. Chen [30] did some research work on the hybrid FA-SA algorithm for fuzzy portfolios selection with transaction costs.

As we know, the portfolio model is an optimization model actually. Sensitivity analysis plays an important role in the optimization method. In optimization method, the stability of the optimal solution is studied by using sensitivity analysis to do research on original data inaccuracy and change. Many researchers paid a little attention to the sensitivity analysis about portfolio model. In this paper, the expected return of the portfolio is used as the investment return and the fuzzy entropy of the return of the portfolio is used as the investment risk. We also note that the transaction cost is an important factor in portfolio investment. Thus, the fuzzy mean-entropy model with transaction costs is proposed when the return rates are triangular fuzzy numbers. At the same time, the sensitivity analysis is discussed for the objective function and constraint on coefficients in detail.

The other part of this paper is organized as follows. In Sect. 2, we introduce credibility theory and some basic definitions. In Sect. 3, we propose a mean-entropy model with transaction costs when the returns are triangular fuzzy numbers. In Sect. 4, we use two numerical portfolio examples to demonstrate the effectiveness of our proposed models and the practicability of sensitivity analysis. Furthermore, we investigate sensitivity analysis with right-hand sides of constraints or objective coefficients. In Sect. 5, a brief summary of this paper is given. Finally, scope for future study is presented in Sect. 6.

2 Credibility, Expected Value and Entropy

The concept of fuzzy set was initiated by Zadeh [31] with membership function in 1965. In order to measure a fuzzy set, Zadeh [32] proposed the concept of possibility measure in 1978. Although possibility measure has been widely used, it does not obey the law of truth conservation and is inconsistent with the law of excluded middle and the law of contradiction. The main reason is that possibility measure has no self-duality property. However, a self-dual measure is absolutely needed both in theory and in practice [11].

Liu [11] defined credibility measure with self-dual with strict mathematical basis. The crucial point of credibility theory is self-dual. When the credibility value of a fuzzy event achieves 1, the fuzzy event will surely happen. Therefore, we adopt credibility as the measure of occurrence chance of a fuzzy event in this paper.

Definition 2.1

[11] Let \(\xi\) be a fuzzy variable with membership function \(\mu\) and real number \(x\). Then for any set \(A\) of \(R\), the credibility of a fuzzy event \(\xi \in A\) is defined as

This above formula is also known as the credibility inversion theorem. Conversely, if \(\xi\) is a fuzzy variable, then its membership function is derived from the credibility measure by

Definition 2.2

[11] Let \(\xi\) be a fuzzy variable; then, its expected value is defined by

Provided that at least one of the above two integrals is finite.

Definition 2.3

[11] Let \(\xi\) be a continuous fuzzy variable; then, its entropy is defined by

where \(S(t) = - t\ln t - (1 - t)\ln (1 - t)\).

Fuzzy entropy is used to measure the uncertainty associated with each fuzzy variable. If \(\xi\) has continuous membership function \(\mu\), then we have \({\text{Cr}}\left\{ {\xi = x} \right\} = \frac{\mu (x)}{2}\) for any \(x \in R\). In this case, it is easy to prove that its entropy is

Example 2.1

A triangular fuzzy variable \(\xi\) is fully determined by the triplet \((a,b,c)\) of crisp numbers with \(a < b < c\), and its membership function is given by

By the formula \({\text{Cr}}\left\{ {\xi \le x} \right\} + {\text{Cr}}\left\{ {\xi \ge x} \right\} = 1,\), we have

and

Example 2.2

The triangular fuzzy variable \(\xi = (a,b,c)\) has an expected value

Example 2.3

Let \(\xi\) be a triangular fuzzy variable \((a,b,c)\). Then its entropy is

Theorem 2.1

[11] Let \(\xi\) and \(\eta\) be independent fuzzy variables with finite expected values. Then for any numbers \(a\) and \(b\) , we have

Theorem 2.2

[11] Let \(\xi\) be an uncertain fuzzy variable, let \(c\) be a real number. Then

Theorem 2.3

[11] Let \(\xi\) and \(\eta\) be independent uncertain fuzzy variables. Then for any real numbers \(a\) and \(b\) , we have

In the portfolio selection problem, since uncertainty causes loss, we use entropy to assess the risk degree of a portfolio. In portfolio model, the smaller the entropy value is, the less uncertainty the portfolio return contains, and thus, the safer the portfolio is. So in this paper, the entropy of portfolio is regarded as the measurement of risk.

3 Fuzzy Mean-Entropy Model with Transaction Costs

Markowitz [1, 2] proposed the classical mean–variance portfolio model by maximizing investment return for a preset level of risk, or by minimizing investment risk for a preset level of investment return. In this paper, we will retain Markowitz’s selection principle: using expected value as the measure of return, but use entropy as the measure of risk. The mean-entropy fuzzy portfolio model with transaction costs will be proposed.

For convenience, we introduce the following notations. Let \(x_{i}\) be the investment proportion of the \(i{\text{th}}\) asset \((i = 1,2, \ldots ,n)\), and let \(\xi_{i}\) be the \(i{\text{th}}\) fuzzy variable representing the return rate of the \(i{\text{th}}\) asset. Suppose that an investor invests his/her wealth among \(n\) risky assets with the investment proportion vector \({\mathbf{x}} = (x_{1} ,x_{2} , \ldots ,x_{n} )^{\text{T}}\). Assume that the transaction cost is a V-shaped function of differences between a new portfolio \({\mathbf{x}} = (x_{1} ,x_{2} , \ldots ,x_{n} )^{\text{T}}\) and the original portfolio \({\mathbf{x}}^{0} = (x_{1}^{0} ,x_{2}^{0} , \ldots ,x_{n}^{0} )^{\text{T}}\). In other words, the transaction cost \(c_{i}\) of risky asset can be expressed by \(c_{i} (x_{i} ) = k_{i} \left| {x_{i} - x_{i}^{0} } \right|\), where \(k_{i}\) is the constant rate of transaction cost for the risky asset. Therefore, the total transaction cost on portfolio \({\mathbf{x}} = (x_{1} ,x_{2} , \ldots ,x_{n} )^{\text{T}}\) is given by \(c({\mathbf{x}}) = \sum\nolimits_{i = 1}^{n} {c_{i} (x_{i} )} = \sum\nolimits_{i = 1}^{n} {k_{i} \left| {x_{i} - x_{i}^{0} } \right|}\). Depending on Markowitz’s idea, the corresponding return of the portfolio after paying transaction costs is given by \(r = \sum\nolimits_{i = 1}^{n} {x_{i} \xi_{i} } - \sum\nolimits_{i = 1}^{n} {k_{i} \left| {x_{i} - x_{i}^{0} } \right|}\). Thus, we can propose the maximizing return model with transaction costs for a preset level of risk as follows:

where \(\alpha\) is the maximum entropy level the investors can tolerate, which means that the risk is not more than \(\alpha\) and \(\alpha\) is given by the investor according to his preference for risk.

The minimizing investment risk model with transaction costs for a preset level of return is:

where \(\beta\) is the lowest return level which is satisfactory to the investor, which means that the return is not less than \(\beta\) and \(\beta\) is given by the investor according to his preference for return.

Now, we consider a portfolio with \(n\) kinds of asset, suppose fuzzy asset returns are triangular fuzzy variables \(\xi_{i} = (a_{i} ,b_{i} ,c_{i} )\) with proportions \(x_{i}\) which are independent for \(i = 1,2, \ldots ,n\). Then, by formulae (11) and (13), we have

In formula (17), \(x_{i} \ge 0\) means that the portfolio is without short selling. So, when fuzzy variables are triangular, models (14) and (15) can be written as:

and

4 Numerical Examples and Sensitivity Analysis

In order to demonstrate the effectiveness of our proposed expected value and entropy, we consider a real portfolio example. In this example, ten stocks are selected from Shanghai Stock Exchange. Their returns \(\xi_{i} = (a_{i} ,b_{i} ,c_{i} )\) are regarded as triangular fuzzy numbers, and the transaction rate of risky asset \(k_{i} \equiv 0.005\) \(\, (i = 1,2, \ldots ,10)\). Based on the historical data, the future information, the experts’ opinions and the corporations’ financial reports, we obtain the following data:

4.1 Sensitivity Analysis of Maximizing Return Portfolio Model

According to the data of Table 1, we can obtain the following maximizing return of linear portfolio model with \({\mathbf{x}} = (x_{1} ,x_{2} , \ldots ,x_{10} )^{\text{T}}\), \(k_{i} = 0.005\) and \(\alpha = 1.875\):

As to model (20), when certain objective function coefficient or constraint on right-hand side changes, then we focus more on basis and optimal solution and the objective value how to change. Next, we will discuss the above questions. Namely, we will do deep sensitivity analysis of model (20).

4.1.1 Sensitivity Analysis of Objective Function Coefficient in Maximizing Return Model

Firstly, solving model (20), we can obtain the following optimal solution:

Obviously, the basic variables of model (20) are \(x_{2}\) and \(x_{8}\), and others are non-basic variables. Furthermore, we do sensitivity analysis to the objective function coefficients by LINGO software. The corresponding sensitivity analysis results show that as to coefficient \(c_{1} = 2.095\), when the basis is unchangeable, allowable increase amount is 0.1553, allowable decrease amount is infinity, so the coefficient range \(c_{1} \in [ 0 , { 2} . 2 5 0 3 ]\). At this time, the basis is unchangeable, the constraint conditions are unchangeable so optimal solution is also unchangeable. In fact, the objective function coefficient has some change, and it does affect objective function value. In general, there are the following two cases in the objective function coefficient sensitivity analysis: basic variable coefficient and non-basic variable coefficient.

- Case1 :

-

If the basic variable’s coefficient changes in the corresponding range, the optimal basis and optimal solution will be stable. But the value of objective function will change since the values of basic variable are nonzero such as \(x_{2}\) and \(x_{8}\)

- Case2 :

-

If the non-basic variable’s coefficient changes in the corresponding range, the optimal basis and optimal solution will remain unchanged. Meanwhile, the objective function value is also unchanged since the value of non-basic variables are zeros such as \(x_{1} ,x_{3} ,x_{4} ,x_{5} ,x_{6} ,x_{7} ,x_{9} ,x_{10}\) and zero multiplied by any number is still zero

According to the two cases, we can obtain the following data in Table 2:

In order to illustrate the significance of the sensitivity analysis, next we discuss concretely the different values of \(c_{1} \in [ 0 , { 2} . 2 5 0 3 ]\) and \(c_{2} \in [ 1. 4 2 5 6 , { 2} . 7 4 5 0 ]\) in models (22) and (23).

and

As to models (22) and (23), we can obtain the following data when \(c_{1} \in [ 0 , { 2} . 2 5 0 3 ]\) and \(c_{2} \in [ 1. 4 2 5 6 , { 2} . 7 4 5 0 ]\) in Tables 3 and 4.

Table 3 shows that when \(c_{1}\) changes in the closed interval of \([ 0 , { 2} . 2 5 0 3 ]\), optimal basis and optimal solution and objective function value are unchangeable.

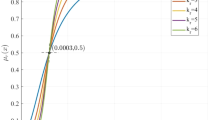

Table 4 shows that when \(c_{2}\) changes in the closed interval of \([ 1. 4 2 5 6 , { 2} . 7 4 5 0 ]\), optimal basis and optimal solution are unchangeable, but the objective function value is changeable. Furthermore, we can draw Fig. 1 about the value of \(c_{2}\) and the value of objective function:

In model (23), since \(x_{2}\) is a basic variable, when the coefficient \(c_{2}\) changes in the sensitivity analysis range, the basis and solution are unchangeable, but objective function value will change. From Fig. 1, we can see that when the coefficient \(c_{2}\) increases, the corresponding objective function value will increase too.

4.1.2 Sensitivity Analysis of Constraint on Right-Hand Sides in Maximizing Return Model

Next, we will do sensitivity analysis of constraint on right-hand sides by LINGO software in model (24):

The current right-hand side of model (24) is \(\alpha = 1.8750\). By LINGO sensitivity analysis, when the basis is unchangeable, then the allowable increase amount is 0.4250, allowable decrease amount is 0.5250, so the right-hand side range: \(\alpha \in [1.8750 - 0.5250,{ 1} . 8 7 5 0+ 0. 4 2 5 0]\) \(= [1.3500,2.300]\). Although the optimal basis is unchangeable, at this time the corresponding constraint conditions change, so the corresponding optimal solution and objective function value will change as well. In the similar way, we do sensitivity analysis of the current right-hand side in the constraint of \(x_{1} + x_{2} + \cdots + x_{n} = 1\) by LINGO. When the basis is unchanged, the allowable increase amount is 0.3889, allowable decrease amount is 0.1848, so the right-hand side range:\([1 - 0.1848,{ 1} + 0.3889] = [0.8152,1.3889]\). As to model (24), we can obtain the following data for \(\alpha \in [1.3500,2.300]\) in Table 5.

Table 5 shows that when \(\alpha\) changes in the closed interval of \([1.3500,2.300]\), optimal basis are unchangeable, but optimal solution and objective function value are changeable. If \(\alpha < 1.35\), no feasible solution can be found; if \(\alpha < 2.30\), the optimal solution is always \({\mathbf{x}}^{*} = (0,0,0,0,0,0,0,1,0,0)^{\text{T}}\). According to the data of Table 5, we can draw the effective frontier of model (24):

The effective frontier of Fig. 2 is approximately a straight line, which means that the higher risk (entropy) we bear, the higher return we obtain.

4.2 Sensitivity Analysis of Minimizing Risk Portfolio Model

According to the data of Table 1, on the other hand, by using model (19), we can obtain the following minimizing risk linear portfolio model (25) based on possibility theory with \({\mathbf{x}} = (x_{1} ,x_{2} , \ldots ,x_{10} )^{\text{T}}\) and assume \(\beta = 1.9325\):

As to the minimizing risk model (25), we can do a similar discussion work on sensitivity analyses to objective function coefficients. Thus, we still do similar research work as the one in Sect. 4.1: solving the model and working on two kinds of sensitivity analysis.

4.2.1 Sensitivity Analysis of Objective Function Coefficient in Minimizing Risk Model

First, the optimal solution of (25) by taking \(\beta = 1.9325\) is:

Obviously, we find that the basic variables still are \(x_{2}\) and \(x_{8}\), and others are non-basic variables. By LINGO software, under the condition that these basis are unchanged, we do sensitivity analysis of \(x_{1}\) coefficient of objective function: The current coefficient is 1.9000, allowable increase amount is infinity, allowable decrease amount is 0.1255, so the coefficient range is: \([ 1. 9 0 0- 0. 1 2 5 5 , { 1} . 9 0 0+ \infty ]\) \(= [ 1. 7 7 4 5 ,+ \infty ]\). In the corresponding range, the basis is unchanged, at the same time the constraint conditions are unchanged (only some objective function coefficient has some change), so unchanged optimal basis means unchanged optimal solution (since some objective function coefficient has changed, the corresponding objective value will change). There are two following cases in the objective function coefficient sensitivity analysis.

- Case 1 :

-

If the basic variable’s coefficient changes in the corresponding range, the optimal basis and optimal solution will be unchangeable. But the value of objective function will change since the values of basic variable are nonzero as to \(x_{2}\) and \(x_{8}\)

- Case 2 :

-

If the non-basic variable’s coefficient changes in the corresponding range, then the optimal basis and optimal solution will be stable. Furthermore, the objective function value is also unchanged since the values of non-basic variable are zeros such as \(x_{1} ,x_{3} ,x_{4} ,x_{5} ,x_{6} ,x_{7} ,x_{9} ,x_{10}\) and zero multiplied by any number is still zero

Depending on the ideas of cases 1 and 2, by LINGO, we can obtain the following value ranges of model (25) in which the basis is unchanged (see Table 6).

4.2.2 Sensitivity Analysis of Constraint on Right-Hand Sides in Minimizing Risk Model

Next, we will discuss the sensitivity analysis by LINGO to the first right-hand side of the following model (27):

The current right-hand side is \(\beta = 1.9325\). We do sensitivity analysis to \(\beta\) by LINGO software, under the condition that the basis is unchanged, the allowable increase amount is 0.8125, allowable decrease amount is 0.3625, then right-hand side range: \([1.9325 - 0.3625,\; 1. 9 3 2 5+ 0. 8 1 2 5]\; = \;[1.5700,2.7450]\). Although the optimal basis are unchanged, since at this time the corresponding constraint conditions change, then the corresponding optimal solution and optimal objective function value will change in model (27) (see Table 7).According to the data in Table 7, we can draw the effective frontier of model (27) as to different values of \(\beta\).

From Fig. 3, we can find that the frontier of risk (entropy) and return in the portfolio is almost a straight line, namely, when risk increases, return increases too. In the same way, we can analyze the constraint: \(x_{1} + x_{2} + \cdots + x_{n} = 1\). The current right-hand side is 1, under the condition the basis is unchanged, the allowable increase amount is 0.2309, allowable decrease amount is 0.2960, then right-hand side range: \([1 - 0.2960,{ 1} + 0.2309] = [0.7040,1.2309]\).

5 Conclusions

The fuzzy mean-entropy models with transaction costs based on credibility theory are considered in our paper. Further, we investigate in depth the sensitivity analysis about the objective coefficients and constraint right coefficients. The data and table of the numerical examples indicate that our proposed model is effective and our sensitivity analysis is useful. It is worth mentioning that the results of sensitivity analysis show that when the corresponding objective coefficients and constraint coefficients change in some value range, the corresponding basis and optimal solution and the objective function values how to change. In particular, the results of two numerical examples show that if return rate of some kind of risky asset changes in some value range and other conditions do not change, then the investor still can obtain the same optimal objective function values, namely the same expected return.

Huang [18] proposed mean-entropy models and presented a hybrid intelligent algorithm for models. Huang [19] introduced a risk curve and developed a mean-risk model. Our paper not only proposes the fuzzy mean-entropy models with transaction costs based on credibility theory, but also does deeper research work of sensitivity analysis about both maximizing return model and minimizing risk model. Compared with Huang [18, 19], our results can provide more information about optimum invest strategies, and our paper can give investors more invest choices. The sensitivity analysis results provide theory guidance with investors according to his/her preference for return and risk in the practical financial market.

6 Scope for Future Study

In the near future, several parameters of objective functions and constraint conditions change simultaneously. It attracts more and more scholars to do research on how the interaction and mutual restriction between parameters affect the optimal solution, the investment return and risk. These results will provide more choices for the investment decision-makers and have guiding significance in the practical portfolio research.

References

Markowitz, H.: Portfolio selection. J. Financ. 7, 77–91 (1952)

Markowitz, H.: Portfolio Selection: Efficient Diversification of Investment. Wiley, New York (1959)

Markowitz, H.: Mean-Variance Analysis in Portfolio Choice and Capital Markets. Basil Blackwell, Oxford (1987)

Best, M.J., Hlouskova, J.: The efficient frontier for bounded assets. Math. Methods Oper. Res. 52, 195–212 (2000)

Merton, R.C.: An analytic derivation of the efficient frontier. J. Financ. Quantit. Anal. 9, 1851–1872 (1972)

Pang, J.S.: A new efficient algorithm for a class of portfolio selection problems. Oper. Res. Int. J. 28, 754–767 (1980)

Perold, A.F.: Large-scale portfolio optimization. Manag. Sci. 30, 1143–1160 (1984)

Sharpe, W.F.: Portfolio Theory and Capital Markets. McGraw-Hill, New York (1970)

Stein, M., Branke, J., Schmeck, H.: Efficient implementation of an active set algorithm for large-scale portfolio selection. Comput. Oper. Res. 35, 3945–3961 (2008)

Anagnostopoulos, K.P., Mamanis, G.: The mean-variance cardinality constrained portfolio optimization problem: an experimental evaluation of five multiobjective evolutionary algorithms. Expert Syst. Appl. 38, 14208–14217 (2011)

Liu, B.D.: Uncertainty Theory, 3rd edn. Spring-Verlag, Berlin (2010)

Liu, B.D.: A survey of credibility theory. Fuzzy Optim. Decis. Mak. 5, 387–408 (2006)

Liu, B.D., Iwamura, K.: Chance constrained programming with fuzzy parameters. Fuzzy Sets Syst. 94, 227–237 (1998)

Amiri, M., Ekhtiari, M., Yazdani, M.: Nadir compromise programming: a model for optimization of multi-objective portfolio problem. Experts Syst. Appl. 38, 7222–7226 (2011)

Bhattacharyya, R., Kar, S., Majumder, D.D.: Fuzzy mean-variance-skewness portfolio selection models by interval analysis. Comput. Math. Appl. 61, 126–137 (2011)

Dastkhan, H., Gharneh, N.S., Golmakani, H.R.: A linguistic-based portfolio selection model using weighted max-min operator and hybrid genetic algorithm. Expert Syst. Appl. 38, 11735–11743 (2011)

Philippatos, G.C., Wilson, C.J.: Entropy, market risk, and the selection of efficient portfolios. Appl. Econ. 4, 209–220 (1972)

Huang, X.X.: Mean-Entropy models for fuzzy portfolio selection. IEEE Trans. Fuzzy Syst. 16, 1096–1101 (2008)

Huang, X.X.: Mean-risk model for uncertain portfolio selection. Fuzzy Optim Decis Mak 10, 71–89 (2011)

Mukesh, K.M.: Credibilistic mean-entropy models for multi-period portfolio selection with multi-choice aspiration levels. Inf. Sci. 345, 9–26 (2016)

Zhou, R.X., Zhan, Y., Cai, R., Tong, G.Q.: A mean-variance hybrid-entropy model for portfolio selection with fuzzy returns. Entropy 17, 3319–3331 (2015)

Zhang, W.G., Zhang, X.L., Chen, Y.X.: Portfolio adjusting optimization with added assets and transaction costs based on credibility measures. Insur. Math. Econ 49, 353–360 (2011)

Sadjadi, S.J., Seyedhosseini, S.M., Hassanlou, K.H.: Fuzzy multi period portfolio selection with different rates for borrowing and lending. Appl. Soft Comput. 11, 3821–3826 (2011)

Li, P., Liu, B.D.: Entropy of credibility distributions for fuzzy variables. IEEE Trans. Fuzzy Syst. 16, 123–129 (2007)

Liu, S.T.: The mean-absolute deviation portfolio selection problem with interval-valued returns. J. Comput. Appl. Math. 235, 4149–4157 (2011)

Liu, S.T.: A fuzzy modeling for fuzzy portfolio optimization. Experts Syst. Appl. 38, 13803–13809 (2011)

Qin, Z.F., Li, X., Li, X.Y.: Portfolio selection based on fuzzy cross-entropy. J. Comput. Appl. Math. 228, 139–149 (2009)

Zhou, R.Z., Yang, Z.B., Yu, M.: A portfolio optimization model based on information entropy and fuzzy time series. Fuzzy Optim Decis. Mak. 14, 381–397 (2015)

Yue, W., Wang, Y.P.: A new fuzzy multi-objective higher order moment portfolio selection model for diversified portfolios. Phys. A 465, 124–140 (2017)

Chen, W., Wang, Y., Mehlawat, M.K.: A hybrid FA-SA algorithm for fuzzy portfolios selection with transaction costs. Ann. Oper. Res. (1047). doi:10.1007/s9-016-2365-3

Zadeh, L.A.: Fuzzy sets. Inf. Control 8, 338–353 (1965)

Zadeh, L.A.: Fuzzy sets as a basis for a theory of possibility. Fuzzy Sets Syst. 1, 3–28 (1978)

Acknowledgements

This research was supported by “the National Natural Science Foundation of China, No. 11271140,” “the Ministry of Education, Humanities and Social Sciences Youth Fund Project of China, No. 13YJCZH030,” “the Natural Science Foundation of Guangdong Province, No. 2016A030313545” and “the Graduate Education Innovation Projects of Guangdong Province, Nos. 2015JGXM-ZD03, 2016QTLXXM-19.” The authors are highly grateful to the referees and editor-in-chief for their very helpful comments and suggestions.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Deng, X., Zhao, J. & Li, Z. Sensitivity Analysis of the Fuzzy Mean-Entropy Portfolio Model with Transaction Costs Based on Credibility Theory. Int. J. Fuzzy Syst. 20, 209–218 (2018). https://doi.org/10.1007/s40815-017-0330-1

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40815-017-0330-1