Abstract

We investigate the effects of increased transparency on prices in the Bertrand duopoly model. Market transparency is defined as the proportion of consumers that are fully informed about the market and thus not captive to one firm. We consider two main cases of strategic interaction, prices as strategic complements and as strategic substitutes. For the former class of games, conventional wisdom concerning prices is confirmed, in that they decrease with market transparency. Consumer welfare always increases with higher transparency but changes in firms’ profits are ambiguous. For the latter class of games, an increase in market transparency may lead to an increase in one of the prices, which implies ambiguous effects on both consumer welfare and firms’ profits. An example with linear demand for differentiated products is also investigated. The results of the paper shed light on the mixed evidence concerning the effects of the Internet on retail markets and may illuminate some of the ongoing related public policy debates.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In retail economics, a market is said to be transparent if a large proportion of potential consumers are aware of the different products that are available, at what price and with which characteristics. Increasing transparency is often considered as a cure for some market imperfections and associated allocative inefficiencies that might otherwise arise. From the consumers’ point of view, increased transparency is often believed to increase competition and thus consumer surplus, by generating lower prices and a reduction in price dispersion.

As a result of the emergence and the growing popularity of the Internet, which allows for instant access to relevant information in many markets, a global increase in market transparency is broadly believed to have taken place. Nevertheless, a large body of empirical research has provided mixed evidence on price comparisons between the Internet and traditional retailers. For instance, Bailey (1998) shows that Internet commerce may not reduce market friction because prices are higher when consumers buy homogeneous products on the Internet, and price dispersion for homogenous products among Internet retailers is greater than the price dispersion among physical retailers. Lee et al. (2000) found that the average product price in one of the most successful electronic commerce systems (an electronic market system for used-car transactions in Japan) is much higher than in traditional, nonelectronic markets. The second-hand cars traded there are usually of much higher quality than those sold in traditional markets, but used-car prices are slightly higher than in traditional markets even for cars of similar quality. Conversely, Brynjolfsson and Smith (2000) observed that books and CDs in the internet are cheaper than in conventional outlets. They find that prices on the Internet are 9–16% lower than prices in conventional outlets and conclude that while there is lower friction in many dimensions of Internet competition, branding, awareness, and trust remain important sources of heterogeneity among Internet retailers.

In the theoretical literature, there are studies explaining the phenomenon that prices do not always go down in case of increased transparency. The main argument, invoked in a number of recent papers, is that increasing transparency might facilitate tacit collusion for the producers (see, e.g., Møllgaard and Overgaard 2001; Nilsson 1999; Schultz 2005).

The problem of market transparency was also investigated in many different related strands of the literature. Varian (1980) showed that in case of homogenous goods and symmetric firms, the expected equilibrium profits decrease in the level of market transparency. This idea was developed in the search literature, for instance, Burdett and Judd (1983) or Stahl (1989). If the cost of searching goes down, the consumers search more and inter-firm competition becomes tougher. Another approach to explaining market transparency issues can be found in the literature on advertising, with increased advertising typically leading to lower prices, as for instance in Bester and Petrakis (1995) where transparency is considered as a firm’s decision variable. A special case of this literature is Ireland’s (1993) model on information provision in price competition with homogenous goods, for which there are only asymmetric pure-strategy Nash equilibria and the firm with higher information provision charges on average a larger price.

Another strand of the literature studies the demand side of the market under less than full transparency. For the Hotelling model with product differentiation and a fraction of uninformed consumers, Schultz (2004) shows that increasing transparency (measured by the proportion of informed consumers) leads to less product differentiation and lower prices and profits. Moreover, welfare improves for all consumers and total surplus increases. Boone and Potters (2006) analyzed a symmetric Cournot–Nash model, where goods are imperfect substitutes and consumers value variety. They found that more transparency may lead to an increase in total demand and also to higher prices. The level of substitutability is exogenous in their model and, when goods are perfect substitutes, the effect of increasing demand disappears.

The model presented in this paper is closely related to this last strand of the literature. We deal with effects of market transparency on prices in the standard Bertrand duopoly model with heterogeneous goods, modified to allow for transparency effects. In contrast to Bester and Petrakis (1995), transparency is viewed in the present paper as a characteristic of the industry under consideration, thus as an exogenous parameter. The analysis is intuitive and simple when we consider two types of strategic interaction between firms’ prices in the industry—strategic complementarity and strategic substitutability.

We derive our results in the form of equilibrium comparative statics analysis, using the methodology of supermodular games (see Vives 1999 and Amir 2005 for general surveys of this methodology as applied to oligopoly theory).Footnote 1 This framework is very natural for the issues under consideration in the present paper. It allows for a resolution of the main questions of interest under minimal sufficient conditions. This parsimony in the required assumptions allows for easy and insightful interpretations of our findings.

In the first case, with prices being strategic complements, the results conform closely with conventional wisdom, especially, if in addition products are assumed to be gross substitutes. Namely, equilibrium prices are always decreasing in the transparency level. This is the intuitive conclusion, one that is often advanced in policy circles as reflecting the natural effects of the Internet and other advances in information technology.

Considering price competition with strategic substitutes, an ambiguity in the direction of change of prices appears. This is due to the fact that the Bertrand game is then a game of strategic substitutes, for which it is well known that downward shifts in reaction curves need not always translate into lower equilibrium prices. Therefore, the lack of a definite result is easily predictable in light of the general results in the theory of supermodular games. Nevertheless from a purely intuitive standpoint, this is less of a natural conclusion. This indetermination in price changes subsequently leads to ambiguity concerning equilibrium profits and surplus changes a result of increasing transparency as well.

When the demand function is specialized to the standard linear demand for differentiated products, a complete characterization of the properties of the duopoly with uninformed consumers becomes possible. In particular, the equilibrium statics properties of market performance with respect to changes in the transparency level are fully derived, including the effects on equilibrium prices, profits, and social welfare.

The remainder of this paper is organized as follows. In Sect. 2, we present the general setup of the model of price competition with incomplete transparency. In Sect. 3, we study the reaction of Bertrand equilibrium prices to increased market transparency, distinguishing the two cases of strategic complementarity and substitutability. In Sect. 4, we complement the results of other sections for the special case of linear demand for differentiated products, which enables a full characterization. A brief conclusion follows.

2 Setup and definitions

In this section, we lay out the general model of price competition modified in a way that integrates the transparency issue in a natural way. Our model is a generalization of Schultz (2004) and Boone and Potters (2006). We also provide a microeconomic foundation for the unusual demand system under consideration in the usual representative consumer framework.

2.1 The model

We consider a Bertrand price competition game \(\varGamma \) with the following characteristics. Two firms, producing differentiated products, respectively, 1 and 2, compete in prices. Firms 1 and 2 have constant marginal costs \(c_{1}\) and \(c_{2}\), respectively.

Following Schultz (2004) and Boone and Potters (2006), we consider two different types of consumers. A fraction \(\phi \) of the consumers are informed about both products (both in terms of characteristics and prices) and the rest, the fraction \(1-\phi \), are completely uninformed about one of the products. The parameter \(\phi \in [0,1]\) is thus a natural measure of the level of transparency of the market.

Schultz considered the Hotelling model with a continuum of consumers uniformly distributed along the interval [0, 1] and the demand for firm 1 ’s product is given by \(\phi x+(1-\phi )\frac{1}{2}\), where \(x\in [0,1]\) denotes the location of the consumer who is fully informed and indifferent between buying product 1 and 2. The demand for firm 2’s product is \(1-\left( \phi x+(1-\phi )\frac{1}{2}\right) \).

We generalize this approach by allowing for other forms of demand functions, but retain the same way of modeling the behavior of informed versus uninformed consumers. We consider a one-shot model with exogenous heterogeneity of the products and firms deciding only on prices.

The full-information demands for goods 1 and 2 are denoted, respectively, \( D^{1}(p_{1},p_{2})\) and \(D^{2}(p_{2},p_{1})\). The uninformed consumers know only about one of the products and are not even aware of the existence or the presence of the other product. Hence, these uninformed consumers’ demands depend only on the price of the one good they know about, say good i, or \(d_{i}(p_{i})\), \(i=1,2\). We assume that half of the uninformed consumers know about each of the two goods, so we posit that these consumers end up allocating themselves equally across the two firms. Thus, the total demand for good i isFootnote 2

We assume throughout that \(D^{i}(p_{i},p_{j})\) and \(d_{i}(p_{i})\) are twice continuously differentiable. The two goods are gross substitutes if the demand for either one of them is globally strictly increasing in the other’s price, i.e., when \(D_{j}^{i}>0\).Footnote 3 The two goods are gross complements if the demand for either one of them is globally strictly decreasing in the other’s price, i.e., when \(D_{j}^{i}<0\). Finally, the two goods are independent if the demand for either one of them is independent of the other good’s price.

We shall also consider goods with a general relationship, i.e., demand systems where the two goods are neither substitutes nor complements in a global sense, i.e., goods for which \(D_{j}^{i}\) changes signs as the cross-price \(p_{j}\) varies.

Finally, the four demand functions \(D^{i}(p_{i},p_{j})\) and \(d_{i}(p_{i})\) can be characterized by their price elasticities, respectively, defined in the usual way by

Consider the situation where the level of market transparency is zero (i.e., \(\phi =0)\). Then every firm would face half of the consumers, and there would be no relation between firms’ pricing decisions, so firm i’s profit would be given by

If we assume strict quasi-concavity of \(\widehat{\pi }^{i}\), the unique solution of the profit maximization problem in this case, \(\mathring{p}_{i}\), is given by the first-order condition:

At the other extreme, when the market is perfectly transparent, i.e., all consumers are informed about prices and characteristics of both goods, the profit of firm i can be expressed in the standard way as:

In case of imperfect market transparency, which is the situation of particular interest for the present paper, the profit of firm i is given by

This reflects the tacit assumption that firms are not allowed to price discriminate across the two types of consumers.

We restrict our consideration to prices in \([c_{i},\infty ),i=1,2\), since lower prices are dominated by pricing at marginal cost. Moreover we assume an upper bound on price, \(\overline{p}_{i}\), such that \(p_{i}\in P_{i}=[c_{i},\overline{p}_{i}]\).

The next subsection discusses possible theoretical foundations for the demand system at hand.

2.2 Microeconomic foundations for the demand system

It is customary in industrial organization to think of demand as being derived from a representative consumer maximizing a quasi-linear utility function of the two goods under consideration and a numeraire good, subject to a standard budget constraint. In the next subsection, we shall explore two possibilities for such a foundation for the demand system at hand.

2.2.1 Option 1

The first option adapts the approach followed by Boone and Potters (2006) to our general demand setup. For the informed sector, i.e., Type I consumers, consider a representative consumer with utility function \(U(x_{1},x_{2})+y\), where \(x_{i}\) is the demand for good i and y is a composite commodity for all goods other than 1 and 2, whose price is normalized to 1.

We shall assume that U satisfies the following standard assumption:

-

(A1)

-

(i)

\(U(x_{1},x_{2})\) is twice continuously differentiable,

-

(ii)

\(U(x_{1},x_{2})\) is differentiable strictly increasing, i.e., \(U_{1}>0\) and \(U_{2}>0.\)

-

(iii)

\(U(x_{1},x_{2})\) is differentiable strictly concave, i.e.,

$$\begin{aligned} U_{11}<0,U_{22}<0,\text { and }U_{11}U_{22}-U_{12}^{2}>0. \end{aligned}$$

-

(i)

The representative consumer’s problem is

subject to

where I is the exogenously given income level of the consumer.

This yields the inverse demand system \((D^{1},D^{2})\) through the solution of the first-order conditions

The direct demand system \((D^{1},D^{2})\) is then obtained as the inverse of \( (P^{1},P^{2})\).

Then for those consumers in the uninformed sector who are aware only of good 1 (say), i.e., Type 1 consumers, being unaware of the presence of good 2, their problem may be stated as

subject to

The resulting demand \(d_{1}(p_{1})\) is then derived as the inverse of \( P_{1}(x_{1},0)\), the solution to (3), which satisfies the first-order condition

Likewise, Type 2 consumers solve \(\max U(0,x_{2})+y\) subject to the budget constraint \(p_{2}x_{2}+y\le I\), thereby giving rise to the other demand \( d_{2}(p_{2})\), via inversion of the solution to the first-order condition

Clearly, the two demand functions \(d_{2}(p_{2})\) and \(d_{1}(p_{1})\) are independent, but they are related via their origin from the same utility function U. In particular, the demands \(d_{1}(\cdot )\) and \(d_{2}(\cdot )\) will be identical if U is a symmetric function of \(x_{1}\) and \(x_{2}\).

The advantage of this formulation is that all the demand functions at hand may be regarded as originating from the same representative consumer, depending only on his level of informativeness or awareness of the product space. In other words, the demands \((D^{1},D^{2})\) and \((d_{1},d_{2})\) may be seen as being consistent with each other. This is a meaningful property, which also makes a welfare analysis possible, as we shall see below.

A specific formulation along these lines appears in Boone and Potters (2006) with a quadratic utility function and thus linear demands (for differentiated products). The present treatment may be viewed as an extension of their formulation.

Yet, one may well argue that this construction is unnecessarily restrictive in that it fails to capture some economically meaningful situations to which the model at hand might apply, which takes us to the second option.

2.2.2 Option 2

Identify Type I consumers as those with access to the duopoly market, and Type i as those without access to the duopoly market, but with access only to a local market served by firm i only, \(i=1,2.\) A prime example would be Internet shoppers as Type I and traditional buyers who patronize only actual physical shops as Type i, for instance, due to lack of access to the Internet or to credit cards. (These buyers’ behavior can then either be justified on informational grounds as before, or on other grounds, such as prohibitive geographical distance from the shop offering the other product.) Other meaningful distinctions between the two classes of consumers might be urban vs rural consumers, market insiders vs outsiders, rich and poor, domestic vs international in a border market, etc. In light of the many possible sources of heterogeneity between these two classes of consumers, there is less compelling reason to presume that one representative consumer, i.e., one utility function, could approximate the behavior of the overall pool of buyers. One option then is to have one representative consumer for each of the three types of consumers: Type I, Type 1 and Type 2. Let the Type I consumer have the same optimization problem as before, thus yielding the demand system \((D_{1},D_{2})\). Define type i’s problem, for \( i=1,2\), as \(\max \widetilde{U}_{i}(x_{i})+m\) subject to the budget constraint \(p_{i}x_{i}+m\le I\), for some valid utility function \(\widetilde{ U}_{i}(\cdot )\) and assume that this yields the demand \(d_{i}(p_{i})\), which is then unrelated to the demand \(D_{i}\) of the informed sector.

Nonetheless, one may still bring this setting within the spirit of a representative consumer, but in a framework of uncertainty. The underlying random representative consumer shall have utility U with probability \(\phi \), and utilities \(\widetilde{U}_{1}\) and \(\widetilde{U}_{2}\) with probability \((1-\phi )/2\) each. It is easily verified that the objective functions given in (1) represent the firms’ expected profit functions when they face this randomly drawn representative consumer.

This second formulation is clearly more general than the first and allows for a wider scope of economic situations that fit the model. At the same time, being so broad, it is also consistent with uninteresting situations, such as when the uninformed sector is simply too small to matter.

The approach tacitly followed in this paper will be to treat the four demand functions as basic primitives, so that both of the above formulations can be accommodated, but specific references shall be made below mostly to the first approach since the consistency of the resulting demand functions allows for a welfare analysis and some comparisons of interest.

3 Effect of transparency on prices

In this section, we consider the impact of increasing market transparency on equilibrium prices in the model formulated in (1). We distinguish two natural cases of analysis, depending on the character of the strategic interactions between firms.

3.1 Prices as strategic complements

Consider a Bertrand game with perfect transparency and payoffs given by

A sufficient condition on the market primitives that makes Bertrand competition a strictly supermodular game follows from setting the cross-partial derivative of the profit function (with respect to the two prices) nonnegative. This condition is (see Vives 1990):

This condition is more easily satisfied when the products are substitutes (i.e., \(D_{j}^{i}>0\)) and when demand is supermodular (i.e., \(D_{ij}^{i}>0)\), but inspection of the terms involved easily reveals that neither of these is a necessary condition (although at least one of them must hold for each price pair).Footnote 4 For the widely used case of linear demands, it is well known that prices are strategic complements (substitutes) in the standard Bertrand game if and only if products are substitutes (complements); see, e.g., Singh and Vives (1984). However, with general demand functions, strategic complementarity of the game may hold even when the goods are complements. In the latter case, it is necessary that demand be strongly supermodular in prices, i.e., that \(D_{ij}^{i}\) be strongly \(>0\) (more on this point below). Furthermore, while most studies in industrial organization posit that goods are either substitutes or complements, we know from standard microeconomic theory that this need not be the case, in other words that goods need not have any such relationship in a global sense (i.e., for all feasible price pairs). As a consequence, when working with general demand functions, it is important to separate the relationship between the two goods in demand from the strategic complements/substitutes property of the resulting Bertrand game. The present paper shall adopt this line of thinking.

We now note that condition (5) guarantees the supermodularity of the game with imperfect transparency as well. This is clearly due to the separability of the overall profit function and the fact that the profit from the uninformed consumers depends only on one of the prices. Define the firms’ price reaction correspondences as usual by

Lemma 1

\(\varPi ^{i}\) defined in (1) has strictly increasing differences in \((p_{i},p_{j})\in P_{i}\times P_{j}\) if \( D^{i}\) satisfies

Hence, every selection of \(r_{i}(p_{j})\) is strictly increasing in \(p_{j}\), when interior.

Proof

The cross-partial derivative of overall the profit function \(\varPi ^{i}(p_{i},p_{j})\) is given by

Setting \(\varPi _{ij}^{i} >0\) yields the result.

Since \(\varPi _{ij}^{i} >0\) implies that \(\partial \varPi _{i}^{i}(p_{i},p_{j})/\partial p_{i}\) is strictly increasing in \(p_{j}\), we conclude that every selection of \(r_{i}(p_{j})\) is strictly increasing in \( p_{j}\), when interior, by a strengthening of Topkis’s theorem due to Amir (1996b) or Edlin and Shannon (1998).

The supermodularity of the profit functions, or the strategic complementarity of the pricing game, is sufficient to guarantee the existence of a pure-strategy Bertrand equilibrium, even when profit functions are not quasi-concave in own price (i.e., when reaction curves are not necessarily continuous functions). Furthermore, it is also a key property in order to establish monotone comparative statics of equilibrium prices in reaction to a change in the level of market transparency.Footnote 5

Before stating the main result on the price effects of increased transparency, we note that, at an intuitive level, there are two conflicting effects. The first is that for each firm, higher transparency reduces its monopoly power since it shifts consumers from the uninformed to the informed (duopoly) sector, thus putting downward pressure on its price. At the same time, the same effect also takes place for its competitor, thus resulting in more consumers in the duopoly sector that the firm might newly serve. The latter effect favors a higher price. In light of these conflicting effects, it is not surprising that the result is that either effect can dominate, depending on the relative demand elasticities in the two sectors. We state the result for the intuitive direction, but then discuss both possibilities below.

Proposition 1

Assume that

-

(i)

\(D_{j}^{i}+(p_{i}-c_{i})D_{ij}^{i}>0\),\(i,j=1,2,i\ne j\) and

-

(ii)

\(\left| \varepsilon _{D^{i}}\right| \ge \left| \varepsilon _{d_{i}}\right| \) for all \((p_{i},p_{j})\in P_{i}\times P_{j},i=1,2\).

Then

-

(a)

a Bertrand equilibrium exists for all values of \(\phi \), and

-

(b)

an increase in market transparency \(\phi \) causes the extremal equilibrium prices of both goods to decrease.

Proof

-

(a)

From Lemma 2, we know that \(\varPi ^{i}\) has strictly increasing differences in \((p_{i},p_{j})\), so we have a strictly supermodular game for each value of the transparency parameter \(\phi \). Therefore, the existence of a pure-strategy Bertrand equilibrium follows directly from Tarski’s fixed-point theorem.

-

(b)

For the comparative statics result, it turns out to be more insightful to consider when \(\varPi ^{i}(p_{i},p_{j},\phi )\) is log-submodular, rather than simply submodular, in \((p_{i},\phi )\). To this end, observe that

$$\begin{aligned} \log \varPi ^{i}(p_{i},p_{j},\phi )=\log \left( p_{i}-c_{i}\right) +\log \left\{ \phi D^{i}(p_{i},p_{j})+\frac{1-\phi }{2}d_{i}(p_{i})\right\} . \end{aligned}$$To see when \(\log \varPi ^{i}(p_{i},p_{j},\phi )\) is submodular in \((p_{i},\phi )\), we use Topkis’s differential characterization. To do so, first consider

$$\begin{aligned} \frac{\partial \log \varPi ^{i}(p_{i},p_{j},\phi )}{\partial \phi }=\frac{ D^{i}(p_{i},p_{j})-\frac{1}{2}d_{i}(p_{i})}{\phi D^{i}(p_{i},p_{j})+\frac{ 1-\phi }{2}d_{i}(p_{i})}. \end{aligned}$$Differentiating next w.r.t. \(p_{i}\), we have, upon simplification

$$\begin{aligned} \frac{\partial ^{2}\log \varPi ^{i}(p_{i},p_{j},\phi )}{\partial p_{i}\partial \phi }=\frac{1}{2}\frac{ D_{i}^{i}(p_{i},p_{j})d_{i}(p_{i})-D^{i}(p_{i},p_{j})d_{i}^{\prime }(p_{i})}{ \left[ \phi D^{i}(p_{i},p_{j})+\frac{1-\phi }{2}d_{i}(p_{i})\right] ^{2}} \text {.} \end{aligned}$$(7)Hence, \(\partial ^{2}\log \varPi ^{i}(p_{i},p_{j},\phi )/\partial p_{i}\partial \phi \le 0\) whenever

$$\begin{aligned} D_{i}^{i}(p_{i},p_{j})d_{i}(p_{i})-D^{i}(p_{i},p_{j})d_{i}^{\prime }(p_{i})\le 0. \end{aligned}$$(8)Dividing (8) by \(D^{i}(p_{i},p_{j})d_{i}(p_{i})\) and multiplying by \(p_{i}\) yields \(\varepsilon _{D^{i}}-\varepsilon _{d_{i}}\le 0\). Since both these elasticities are negative, the condition \(\varepsilon _{D^{i}}-\varepsilon _{d_{i}}\le 0\) is the same as \(\left| \varepsilon _{D^{i}}\right| \ge \left| \varepsilon _{d_{i}}\right| \). We have just shown that the latter condition implies that \(\log \varPi ^{i}(p_{i},p_{j},\phi )\) is submodular in \((p_{i},\phi ).\)

We conclude via [Milgrom and Roberts 1990, Theorem 5] that, when \(\phi \) goes up, both prices go down for the maximal and the minimal equilibria of the pricing game at hand.

We now provide a discussion of the scope of the Proposition. Recall that the condition \(D_{j}^{i}+(p_{i}-c_{i})D_{ij}^{i}>0\) is much easier to satisfy when the two goods at hand are substitutes since \(D_{j}^{i}\) is then \(>0\). All that is needed then is for the cross-partial \(D_{ij}^{i}\) not to be too negative, a property satisfied by most commonly used demand functions (see Vives 1999 for further discussion). It turns out that the elasticity condition \(\left| \varepsilon _{D^{i}}\right| \ge \left| \varepsilon _{d_{i}}\right| \) is also more compatible with substitute products than with complementary products. In fact, as seen in the analysis of the special case of linear demand below, \(\left| \varepsilon _{D^{i}}\right| \ge \left| \varepsilon _{d_{i}}\right| \) always holds for substitutes while the reverse condition holds for complements (under linear demand).

At a more intuitive level, the condition \(\left| \varepsilon _{D^{i}}\right| >\left| \varepsilon _{d_{i}}\right| \) is quite natural for the model at hand, irrespective of which of the two representative consumer frameworks one takes. Indeed, the condition simply says that the demand for good i is more sensitive to changes in price for those consumers who are aware of the presence of both goods in the market. These consumers have the option of reacting to the price increase by switching to the other good, whereas those that are uninformed are not aware of this possibility.

In Schultz’s (2004) Hotelling model with full market coverage, the uninformed buyers are posited to always buy exactly one unit of the good, so that their demand is perfectly inelastic and the elasticity condition, \( \left| \varepsilon _{D^{i}}\right| \ge \left| \varepsilon _{d_{i}}\right| \) for all \((p_{i},p_{j}),\) then trivially holds. It is easily verified that the latter elasticity condition also holds for the standard linear demand for substitute products of Boone and Potters (2006).Footnote 6

3.2 Prices as strategic substitutes

This subsection explores the extent to which a similar result is possible when the price game at hand displays strategic substitutes. It is well known that in such a case, there are no general comparative statics result for Nash equilibria for asymmetric games (see Milgrom and Roberts 1990 or Amir 2005).

Analogously to Lemma 1, we can formulate a condition on \(D^{i}\) to make the price game \(\varGamma \) a submodular game.

Lemma 2

\(\varPi ^{i}\) defined like in (1) has strictly decreasing differences in \((p_{i},p_{j})\in P_{i}\times P_{j}\) if \(D^{i}\) satisfies

Hence, every selection of \(r_{i}(p_{j})\) is strictly decreasing in \(p_{j}\), when interior.

Proof

The cross-partial derivative of overall the profit function \(\varPi ^{i}(p_{i},p_{j})\) is given by

Setting \(\varPi _{ij}^{i} <0\) yields the result.

The second statement follows as in the proof of Lemma 1

The effect of a change in transparency on prices is captured in the next result.

Proposition 2

Assume that

-

(i)

\(D_{j}^{i}+(p_{i}-c_{i})D_{ij}^{i}<0\),\(i,j=1,2,i\ne j\) and

-

(ii)

\(\left| \varepsilon _{D^{i}}\right| \le \left| \varepsilon _{d_{i}}\right| \) for all \((p_{i},p_{j})\in P_{i}\times P_{j},i=1,2\).

Then

-

(a)

a Bertrand equilibrium exists for all values of \(\phi \), and

-

(b)

an increase in market transparency \(\phi \) causes the extremal equilibrium price of at least one good to increase.

Proof

-

(a)

From the previous Lemma, we know that \(\varPi ^{i}\) has strictly decreasing differences in \((p_{i},p_{j})\), so we have a strictly submodular game for each value of the transparency parameter \(\phi \). Therefore, the existence of a pure-strategy Bertrand equilibrium follows directly from Tarski’s fixed-point theorem applied to the composition of the two reaction correspondences (see Vives 1990).

-

(b)

For the comparative statics result, it is easy to see from the proof of Proposition 1 that \(\partial ^{2}\log \varPi ^{i}(p_{i},p_{j},\phi )/\partial p_{i}\partial \phi \ge 0\) if and only if \( D_{i}^{i}(p_{i},p_{j})d_{i}(p_{i})-D^{i}(p_{i},p_{j})d_{i}^{\prime }(p_{i})\ge 0\), and that the latter condition is the same as our elasticity assumption here, namely \(\left| \varepsilon _{D^{i}}\right| \le \left| \varepsilon _{d_{i}}\right| \).

Therefore, when \(\phi \) goes up, both reaction correspondences shift upwards. However, since the game is now submodular, all we can conclude is that one of the two equilibrium prices must increase (see Amir 2005).

Recall from the previous subsection that the elasticity condition \( \left| \varepsilon _{D^{i}}\right| \le \left| \varepsilon _{d_{i}}\right| \) is more compatible with complementary products. As will be seen for the special case of linear demand below, \(\left| \varepsilon _{D^{i}}\right| \le \left| \varepsilon _{d_{i}}\right| \) always holds for complementary, while the reverse condition holds for substitutes (under linear demand).

If condition (9) is satisfied, we can conclude that the price competition is of strategic substitutes and hence the best replies are nonincreasing.Footnote 7 In this case, we cannot determine unambiguously how the equilibrium prices will react to increased market transparency. From the fact that, as before, (7) is negative, whenever \(\left| \varepsilon _{D^{i}}\right| >\left| \varepsilon _{d_{i}}\right| \), it follows that both reaction curves shift down, but the latter fact does not imply that both equilibrium prices will necessarily decrease. It is possible that one of them increases if the shifts of the two reaction curves are of unequal magnitudes. Intuitively, this can be explained by the fact that the two effects mentioned before are conflicting now. The direct effect of the downward shift in a firm’s reaction curve makes own price go down for each fixed price of the rival, but the indirect effect of adjusting to rival’s price moves in the opposite direction, in view of the strategic substitutes property. Thus, the total effect depends on which of these two effects dominates.Footnote 8 An explicit closed-form example is provided at the end of the paper to illustrate the failure of a general result for submodular Bertrand games. Nonetheless, for the special case of symmetric submodular games, we next show that we recover the proposition that both equilibrium prices are decreasing in \(\phi \) for symmetric Bertrand equilibria.

3.3 Symmetric games

In the special case of a symmetric duopoly, a definite result on the effects of transparency on price is possible, irrespective of whether prices are strategic substitutes, complements or neither. This subsection deals with this important special case. The only significant restriction is that the result pertains to symmetric (pure-strategy) equilibria, when other (asymmetric) equilibria may exist.

Recall that a Bertrand duopoly is symmetric if \(P_{i}=P_{j}\equiv P\) and \( \varPi ^{i}(p_{i},p_{j}) = \varPi ^{j}(p_{j},p_{i})\). In the following result, the comparative statics result pertains to the symmetric Bertrand equilibrium only, the existence of which requires a quasi-concavity assumption (as the reaction curves may simply have a downward jump that skips over the diagonal). There may exist other, asymmetric equilibria here, and these may well have comparative statics with respect to changes in transparency that do not satisfy the following result.Footnote 9

Proposition 3

Consider a symmetric Bertrand duopoly such that

-

(i)

\(\varPi ^{i}(p_{i},p_{j})\) is strictly quasi-concave in own action, and

-

(ii)

\(\left| \varepsilon _{D^{i}}\right| \ge (\le )\left| \varepsilon _{d_{i}}\right| ,\) for all \((p_{i},p_{j})\in P_{i}\times P_{j}\).

Then

-

(a)

a symmetric Bertrand equilibrium exists for all values of \(\phi \), and

-

(b)

an increase in market transparency \(\phi \) causes the extremal common equilibrium prices of both goods to decrease (increase).

Proof

The strict quasi-concavity of \(\varPi ^{i}\) in \(p_{i}\) guarantees that the reaction curve of player i,

is a continuous single-valued function. It follows that there must exist a symmetric equilibrium, which is not necessarily unique. Consider the extremal symmetric equilibria of the game.

We consider the case \(\left| \varepsilon _{D^{i}}\right| \ge \left| \varepsilon _{d_{i}}\right| .\) Let \(\varPi ^{i}(p_{i},p_{j},\phi )\) be as defined in the proof of Proposition 1. Since \(\frac{ \partial ^{2}\log \varPi ^{i}(p_{i},p_{j},\phi )}{\partial p_{i}\partial \phi }\) given by (7) is negative, we know that \(\varPi ^{i}(p_{i},p_{j},\phi )\) is log-supermodular in \((p_{i},\phi ).\) It follows from Topkis’s monotonicity theorem (Topkis 1978) that the reaction curve \( r^{i}(p_{j})\) shifts down when \(\phi \) goes up. Invoking the main result in Milgrom and Roberts (1994), we conclude that the extremal symmetric equilibrium prices of the game decrease.

The case \(\left| \varepsilon _{D^{i}}\right| \le \left| \varepsilon _{d_{i}}\right| \) is handled similarly.

3.4 Assumptions on the utility function

We now provide respective equivalent assumptions in terms of the underlying utility function for the elasticity conditions (in both directions) to hold.

Proposition 4

Assume demand is derived from a representative consumer according to Option 1. Then

if and only if U satisfies

Proof

Since \((D^{1},D^{2})\) is the inverse of \((P_{1}^{1},P_{2}^{2})\) in \(R^{2}\), we can use the inversion relationship to relate the partials of one map to those of the other. Doing so, direct differentiation reveals (upon some computation) that

Further differentiating (2) w.r.t. \(p_{j}\) yields

Using (11) and (12), we have, say for \(D^{1}\),

Similarly, starting from (4), one arrives at

Taking into account the standard assumptions on U (see Sect. 2), and keeping in mind that \(\varepsilon _{D^{1}}\) and \(\varepsilon _{d_{i}}\) are both \(<0\), the conclusion follows from a direct comparison of \(\left| \varepsilon _{D^{1}}\right| \) and \(\left| \varepsilon _{d_{1}}\right| .\)

A similar argument applies to \(D^{2}\).

We now provide a general discussion of the scope for condition (10) to hold, under both inequalities. We first note that several commonly used utility functions in micro-economics are excluded because the consumption of nonzero amounts of both goods is essential, i.e., these utility functions naturally satisfy the condition that \(U(x_{1},0)=U(0,x_{2})=0\). In this case, the uninformed consumers’ problem is simply not well defined (and hence neither are the demands \(d_{1}\) and \(d_{2}).\) A central example of such utility functions is the Cobb–Douglas family \(U(x_{1},x_{2})=x_{1}^{ \alpha }x_{2}^{\beta }\), with \(\alpha>0,\beta >0\) and \(\alpha +\beta <1\). This discussion makes it clear that the condition \(U(x_{1},0)\ne 0\) and \( U(0,x_{2})\ne 0\) are necessary for our representative consumer approach to work.

For the standard linear demand for differentiated products (see, e.g., Singh and Vives 1984), it will be seen in the next section that condition (10 ) holds with a “<” inequality for substitute goods, and with a “>” inequality for complementary goods. This association of the two conditions in (10) with the nature of inter-product relationship (i.e., substitutes or complements) appears to be somewhat more general.

As reflected in the results of the last three subsections, the elasticity condition is essentially the critical determinant of the comparative statics of price w.r.t transparency.

Overall, the clear-cut nature of the conclusion of Proposition 1 is quite remarkable, given the level of generality of the model, particularly under the broad nature of the interpretation of the model in Option 2. In other words, even when the demands \((D^{1},D^{2})\) and \((d_{1},d_{2})\) are totally independent, Proposition 1 holds as long as the given elasticity comparison is satisfied.

Next, we discuss the fact that equilibrium selection arguments are needed for the result. As is well known with supermodular games, in case of multiple equilibria, the comparative statics conclusion would be reversed for those equilibria that are unstable in the sense of best-reply Cournot dynamics. Since the maximal equilibrium (i.e., the one with the highest prices, out of all equilibrium prices) is Pareto dominant for the firms as well as coalition-proof (Milgrom and Roberts 1996), it is quite a compelling equilibrium for the model at hand. Lastly, the minimal equilibrium is Pareto dominant for consumers, so that it also enjoys a distinguishing property.

The decrease of equilibrium prices can also be interpreted as consisting of two separate effects that push in the same direction. There is a direct effect reflected in the downward shift of the reaction curve as a unilateral reaction of the player to the parameter increase, and an indirect or strategic effect of decreasing own price in response to the decrease in opponent’s price, as a consequence of strategic complementarity (see Amir 2005).

4 A linear example

This section contains a numerical example, based on linear demand functions, illustrating some of the main findings of the paper.

Consider a representative informed consumer, as in Option 1, with a standard quadratic utility function given by

Standard assumptions on the utility function are \( U_{i}(x_{i},x_{j})=a_{i}-2b_{i}x_{i}-\gamma x_{j}>0,U_{ii}(x_{i},x_{j})=-2b_{i}<0,i=1,2\) and \( U_{ii}(x_{i},x_{j})U_{jj}(x_{i},x_{j})-U_{ij}(x_{i},x_{j})^{2}=4b_{i}b_{j}- \gamma ^{2}>0\). Maximization of the respective utility functions for the informed and uninformed consumers subject to the budget constraints leads to the following demand systems, for \(i=1,2\):

We assume \(2a_{i}b_{j}-\gamma a_{j}>0\) (so the demand function \(D^{i}\) is positive). Moreover, to ensure that each demand reacts more to changes of own price than to changes of the opponent’s price, we assume that \( \left| \gamma \right| <2b_{i},i=1,2\). The two goods are substitutes if \(\gamma >0\) and complements if \(\gamma <0\).

Firm’s i profit is given by:

Solving for equilibrium prices leads to

where \(A_{1}=4b_{i}b_{j}\left( 1+\phi \right) -\gamma ^{2}\left( 1-\phi \right) \). We left to the reader checking that if \(\gamma <0\) then \( p_{i}^{*}-c_{i}\) is always positive. This is not necessarily true if \( \gamma >0\). To guarantee that we need to impose additional conditions on parameters. In fact, \(D^{i}(p_{i}^{*},p_{j}^{*})\ge 0\) if and only if

In other words, condition (15) says that both firms are active in equilibrium.

Given the linearity of demand, the sign of \(\gamma \) also determines the nature of the strategic interaction between firms. Analyzing the profit function we observe that its cross-partial derivative with respect to \( (p_{i},p_{j})\) is \(\varPi _{ij}^{i}(p_{i},p_{j})=\frac{\gamma \phi }{ 4b_{i}b_{j}-\gamma ^{2}},\) which has the same sign as \(\gamma \). Hence, the reaction curves are increasing if goods are gross substitutes and decreasing if they are gross complements. In other words, just as in the standard Bertrand model, prices are strategic complements when goods are substitutes and strategic substitutes when goods are complements. We now show that the sign of \(\gamma \) is also crucial for the elasticity comparison. The proof of the proposition, together with all the other proofs of this section, is presented in the Appendix.

Proposition 5

Consider the demand system for informed and uninformed consumers (13).

-

(i)

If goods are substitutes, the condition \(\left| \varepsilon _{D^{i}}\right| \ge \left| \varepsilon _{d_{i}}\right| \) is satisfied.

-

(ii)

If goods are complements, the condition \(\left| \varepsilon _{D^{i}}\right| \le \left| \varepsilon _{d_{i}}\right| \) is satisfied.

This result implies that if goods are gross substitutes, the Bertrand game has strategic complementarities and the elasticity condition \(\left| \varepsilon _{D^{i}}\right| >\left| \varepsilon _{d_{i}}\right| \) is satisfied. Hence both equilibrium prices decrease in the transparency level.

In case the goods are gross complements, the game has strategic substitutes and the elasticity condition is satisfied in the opposite direction. Hence, for negative \(\gamma ,\) the reaction curves shift up with the level of transparency.

As seen earlier, for the case of strategic substitutes with asymmetric firms, the two prices may move in opposite directions as \(\phi \) changes. This is formalized next.

Proposition 6

If \(\gamma <0\) (goods are complements), then either

-

both equilibrium prices increase in \(\phi \), or

-

\(p_{i}^{*}\) decreases in \(\phi \,\ \)while \(p_{j}^{*}\) increases in \(\phi \) if the following condition is satisfied

$$\begin{aligned} -4\gamma \phi A_{1}b_{j}\left( a_{i}-c_{i}\right) <\left( a_{j}-c_{j}\right) \left( A_{1}^{2}+4\gamma ^{2}\phi ^{2}b_{i}b_{j}\right) . \end{aligned}$$(16)

Below we provide a numerical example of the situation when one equilibrium price increases and the other one decreases in \(\phi \).

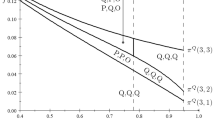

Example 1

Let \(P_{1}=P_{2}=[0,3]\). Consider the parameter values: \(a_{1}=1,a_{2}=2, b_{1}=0.5, b_{2}=1,\gamma =-0.99, c_{1}=0.4, c_{2}=0.01, \phi =0.5\). All our assumptions are satisfied. The equilibrium prices are then \( p_{1}^{*}=0.93\), \(p_{2}^{*}=1.03\), and the corresponding profits are, respectively, \(\varPi ^{1}(p_{1}^{*},p_{2}^{*})=0.34\) and \(\varPi ^{2}(p_{1}^{*},p_{2}^{*})=0.77.\)When the transparency level \(\phi \) increases to 0.8, the best responses of both firms shift upward. They cross at the new equilibrium prices \(\hat{p}_{1}^{*}=0.89\), \(\hat{p} _{2}^{*}=1.04\). Clearly, \(p_{2}\) has increased, but \(p_{1}\) has decreased as \(\phi \) went from 0.5 to 0.8.

With the assumed linear form of the demand we can study, how the transparency level influences firms’ outputs, profits, and social welfare in equilibrium.

First let us study the impact of increase in transparency on equilibrium output of a single firm, say i. To do this, we note that this impact can be expressed as a sum of two effects: the demand effect \(D^{i}(p_{i},p_{j})- \frac{1}{2}d_{i}(p_{i})\) and the indirect effect \(p_{i}^{*\prime }\left( \phi D_{i}^{i}(p_{i}^{*},p_{j}^{*})+\frac{1-\phi }{2}d_{i}^{\prime }(p_{i}^{*})\right) +\phi D_{j}^{i}(p_{i}^{*},p_{j}^{*})p_{j}^{*\prime }.\) We have to check if these effects are positive or negative.

In case of complements (\(\gamma <0\)), the demand effect is always positive. Also for substitutes (or \(\gamma >0)\), for the symmetric case (\(a_{1}=a_{2}\) and \(b_{1}=b_{2}\)), it can be shown that the demand effect is positive (this is the case in Boone and Potters 2006).

The example below illustrates that the demand effect can be negative for one firm in the asymmetric case with substitutes.

Example 2

Consider the following parameter values: \(a_{1}=1, b_{1}=1, \gamma =0.9, c_{1}=0.1, a_{2}=1.9, b_{2}=1, c_{2}=0.01, \phi =0.5\) and let \(P_{1}=P_{2}=[0,1]\). The equilibrium prices are \( p_{1}^{*}=0.38,p_{2}^{*}=0.86\). The demand effects are given by

For firm 1, this is \(-0.09\), but for firm 2 this effect is positive and equal to 0.23.

Nevertheless, the sum of the demand effects is always positive. This result is formulated as a lemma, since it is useful in the proofs of further results.

Lemma 3

The sum of the demand effects is always positive.

Apart from the demand effect, the equilibrium output derivative with respect to \(\phi \) contains also the already mentioned second part, which can be called an indirect effect since it measures an influence of changes in equilibrium prices on the total output of firm i.

Proposition 7

The indirect effect of transparency on a firm’s equilibrium output is positive if and only if \(\gamma >0\) and negative if and only if \(\gamma <0\).

This result is not enough to establish the effect on equilibrium output of an increase in \(\phi \), since in case of substitute goods we are not sure about the demand effect sign, and in case of complements the two effects, demand and indirect, work in opposite directions. However the following holds.

Proposition 8

If \(\gamma <0\) the equilibrium output of firm i is increasing in \(\phi \).

If \(\gamma >0\), the equilibrium output of firm i does not necessarily increase with \(\phi \). In this case the indirect effect is always positive but the demand effect can be negative and outweigh the positive one. This is the case in Example 2, where for firm 1 the equilibrium output derivative with respect to \(\phi \), is \(-0.00378\). However, the effect on the sum of outputs of both firms is clear.

Proposition 9

The total equilibrium output (the sum of the equilibrium outputs of the two firms) is increasing in \(\phi \).

In case of firms’ profits, the impact of the transparency increase can be ambiguous. If the goods are complements, the effect on profit is always positive, even though one of the prices may decrease. In case of substitutes, we know that both prices go down, so one could expect that this is not beneficial for firms. But larger transparency may lead to an output expansion which can outweigh the profit loss connected with the price decrease. This intuition is formalized next.

Proposition 10

\(\gamma <0\) implies the equilibrium profit \(\varPi ^{i}(p_{1}^{*}(\phi ),p_{2}^{*}(\phi ))\) is increasing in \(\phi \). If the demand effect of firm i is negative, the equilibrium profit \(\varPi ^{i}(p_{1}^{*}(\phi ),p_{2}^{*}(\phi ))\) is decreasing in \(\phi \).

Finally, we can show the following result on the effects on welfare.

Proposition 11

Social welfare is increasing in \(\phi .\)

5 Conclusion

This paper has analyzed the effects of market transparency in the context of a general formulation of a differentiated-goods Bertrand price competition model. In the more standard case of strategic complementarity of prices, we directly generalize the results of Schultz (2004) for the Hotelling model in terms of equilibrium prices and consumer surplus. While prices are decreasing in the transparency level and consumers are better off, firms are necessarily worse off only in the case of substitute goods. Otherwise, one of them may gain, and even, in some cases of complementary goods, both profits may increase.

In case of strategic substitutability of prices, the results are ambiguous even for equilibrium prices. Indeed, one of the prices may well increase with the level of transparency, as established via an example. This is in line with well-known results on the comparative statics properties of submodular games. The lack of a clear-cut result on price changes precludes general conclusions about profits and consumer surplus. However, when both prices decrease with transparency, consumers gain and in case of complementary goods, both firms gain as well.

We provide a thorough investigation of the properties of the model for the important special case where the demand function is the standard linear demand for differentiated products (e.g., Singh and Vives 1984). This characterization includes clear-cut results on the effects of transparency on prices, outputs, profits, and social welfare. This provides the Bertrand counterpart to the Cournot case (with linear demand) analyzed by Boone and Potters (2006).

Notes

For multivariate functions, subscripts denote partial derivative taken with respect to the indicated variable, here, e.g., \(D_{j}^{i}=\frac{\partial D^{i} }{\partial p_{j}}\).

There is another condition making Bertrand duopoly with linear cost into a game of strategic complementarities. It was given by Milgrom and Roberts (1990) and is equivalent to the cross-partial derivative of the log-profit function being nonnegative. In our case it is less useful, since it requires imposing additional conditions on the game with imperfect transparency to secure its log-supermodularity.

It is worthwhile to note here that other, more general complementarity conditions such as the single-crossing property (Milgrom and Shannon 1994) or the interval dominance order (Quah and Strulovici 2009) do not appear to be applicable in the present setting, due to the fact the profit function is a sum of different terms.

In their model with Cournot competition, the fact that equilibrium prices may increase in the level of transparency is due entirely to their assumption of strongly decreasing returns to scale in production (or quadratic cost function).

Here, condition (9) is much easier to satisfy for goods that are complements, since \(D_{j}^{i}\) is then \(<0.\)

About these asymmetric equilibria, nothing more can be said at this level of generality, beyond what is given in this paper for equilibria of asymmetric games.

References

Amir, R.: Cournot oligopoly and the theory of supermodular games. Games Econ. Behav. 15, 132–148 (1996a)

Amir, R.: Sensitivity analysis of multisector optimal economic dynamics. J. Math. Econ. 25, 123–141 (1996b)

Amir, R.: Supermodularity and complementarity in economics: an elementary survey. South. Econ. J. 71, 636–660 (2005)

Amir, R., Lambson, V.: On the effects of entry in Cournot markets. Rev. Econ. Stud. 67, 235–254 (2000)

Bailey, J. P.: Intermediation and electronic markets: aggregation and pricing in Internet commerce. Ph.D. Thesis, Technology, Management and Policy, M. I. T. (1998)

Bester, H., Petrakis, E.: Price competition and advertising in oligopoly. Eur. Econ. Rev. 39, 1075–1088 (1995)

Boone, J., Potters, J.: Transparency, prices and welfare with imperfect substitutes. Econ. Lett. 93, 398–404 (2006)

Burdett, K., Judd, K.L.: Equilibrium price dispersion. Econometrica 51, 955–969 (1983)

Brynjolfsson, E., Smith, M.D.: Frictionless commerce? A comparison of Internet and conventional retailers. Manag. Sci. 46, 563–585 (2000)

Echenique, F.: Comparative statics by adaptive dynamics and the correspondence principle. Econometrica 70, 833–844 (2002)

Edlin, A., Shannon, C.: Strict monotonicity in comparative statics. J. Econ. Theory 81, 201–219 (1998)

Hoernig, S.: Existence of equilibrium and comparative statics in differentiated goods Cournot oligopolies. Int. J. Ind. Organ. 21, 989–1020 (2003)

Ireland, J.N.: The provision of information in a Bertrand oligopoly. J. Ind. Econ. 41, 61–76 (1993)

Lee, H.G., Westland, C., Hong, S.: Impacts of electronic marketplaces on product prices: an empirical study of AUCNET case. Int. J. Electron. Commer. 4, 45–60 (2000)

Milgrom, P., Roberts, J.: Rationalizability, learning, and equilibrium in games with strategic complementarities. Econometrica 58, 1255–1278 (1990)

Milgrom, P., Roberts, J.: Comparing equilibria. Am. Econ. Rev. 84, 441–459 (1994)

Milgrom, P., Shannon, C.: Monotone comparative statics. Econometrica 62, 157–180 (1994)

Milgrom, P., Roberts, J.: Coalition-proofness and correlation with arbitrary communication possibilities. Games Econ. Behav. 17, 113–128 (1996)

Møllgaard, H.P., Overgaard, P.B.: Market transparency in competition policy. Rivista Di Politica Economica, Selected Papers (2001)

Monaco, A., Sabarwal, T.: Games with strategic complements and substitutes. Econ. Theory 62, 65–91 (2016)

Nilsson, A.: Transparency and competition. SSE/EFI Working Paper Series in Economics and Finance, Stockholm School of Economics, No 298. http://EconPapers.repec.org/RePEc:hhs:hastef:0298. Accessed 15 Dec 2015 (1999)

Prokopovych, P., Yannelis, N.: On strategic complementarities in discontinuous games with totally ordered strategies. J. Math. Econ. 70, 147–153 (2017)

Quah, J.K.-H., Strulovici, B.: Comparative statics, informativeness, and the interval dominance order. Econometrica 77, 1949–1992 (2009)

Roy, S., Sabarwal, T.: Characterizing stability properties in games with strategic substitutes. Games Econ. Behav. 75, 337–353 (2012)

Schultz, C.: Market transparency and product differentiation. Econ. Lett. 83, 173–178 (2004)

Schultz, C.: Transparency on the consumer side and tacit collusion. Eur. Econ. Rev. 49, 279–297 (2005)

Singh, N., Vives, X.: Price and quantity competition in a differentiated duopoly. RAND J. Econ. 15, 546–554 (1984)

Stahl, D.O.: Oligopolistic pricing with sequential consumer search. Am. Econ. Rev. 79, 700–712 (1989)

Topkis, D.: Minimizing a submodular function on a lattice. Oper. Res. 26, 305–321 (1978)

Topkis, D.M.: Supermodularity and Complementarity. Princeton University Press, Princeton, NJ (1998)

Varian, H.: A model of sales. Am. Econ. Rev. 70, 651–659 (1980)

Vives, X.: Nash equilibrium with strategic complementarities. J. Math. Econ. 19, 305–321 (1990)

Vives, X.: Oligopoly Pricing: Old Ideas and New Tools. MIT Press, Cambridge (1999)

Acknowledgements

The authors are grateful to Rabah Amir for numerous conversations and fruitful suggestions on the topic of this paper. The final version of the paper has also benefited from an anonymous reviewer’s comments. Filomena Garcia acknowledges the financial support from national funds by FCT (Fundação para a Ciência e a Tecnologia). This article is part of the project PTDC/IIM-ECO/4546/2014. The authors also thank conference participants at the 27th International Conference on Game Theory in Stony Brook University and at the VII Workshop on Institutions, Individual Behavior and Economic Outcomes in the University of Sassari.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

This section contains all the proofs of Sect. 4.

Proof of Proposition 5

The demand elasticity (in absolute value) of informed consumers is

The absolute value of the elasticity of the uniformed consumers is given by

Setting \(\left| \varepsilon _{D^{i}}\right| \ge \left| \varepsilon _{d_{i}}\right| \) leads (after computations) to the condition \(0\le \gamma \left( a_{j}-p_{j}\right) \), or \(\gamma \ge 0\) .\(\square \)

Proof of Proposition 6

When \(\gamma <0\,\) the imperfect transparency game is of strategic substitutes. Propositions 1 and 5 follow that an increase in the transparency level makes both reaction curves shift up; hence, the equilibrium prices cannot both decrease.

A necessary condition for one of the equilibrium prices, say i, to decrease, is

Reordering yields after simplification \(-\left[ a_{i}-2p_{i}^{*}+c_{i} \right] A_{1}>2b_{i}\phi \gamma [a_{j}-2p_{j}^{*}+c_{j}\quad ].\) Using the equilibrium prices (14), we obtain condition (16) after some computations.\(\square \)

Proof of Lemma 3

The sum of the demand effects \(\sum \nolimits _{i=1}^{2}\big ( D^{i}-\frac{1}{2} d_{i}\big ) \) is \(\frac{K}{8b_{i}b_{j}\big ( 4b_{i}b_{j}-\gamma ^{2}\big ) }\times \big [ \big ( a_{i}-c_{i}\big ) b_{j}\big ( A_{2}-2b_{i}\gamma (A_{1}+\big ( 4b_{i}b_{j}-\gamma ^{2}\big ) )\big ) -\big ( a_{j}-c_{j}\big ) b_{i}\big ( 2b_{j}\gamma (A_{1}+\big ( 4b_{i}b_{j}-\gamma ^{2}\big ) )-A_{2}\big ) \big ] ,\) where \(A_{1}\) is as defined in Sect. 4, \(A_{2}=\left( 4b_{i}b_{j}-z^{2}\right) \left( 4b_{i}b_{j}+z^{2}\right) +\phi \left( z^{4}+16b_{i}^{2}b_{j}^{2}\right) >0\), and

We wish to show that

There are four possible cases to be considered:

-

1.

\(A_{2}-2b_{i}\gamma (A_{1}+\left( 4b_{i}b_{j}-\gamma ^{2}\right) )>0\) and \(\left( 2b_{j}\gamma (A_{1}+\left( 4b_{i}b_{j}-\gamma ^{2}\right) )-A_{2}\right) >0\)

-

2.

\(A_{2}-2b_{i}\gamma (A_{1}+\left( 4b_{i}b_{j}-\gamma ^{2}\right) )<0\) and \(\left( 2b_{j}\gamma (A_{1}+\left( 4b_{i}b_{j}-\gamma ^{2}\right) )-A_{2}\right) >0\)

-

3.

\(A_{2}-2b_{i}\gamma (A_{1}+\left( 4b_{i}b_{j}-\gamma ^{2}\right) )>0\) and \(\left( 2b_{j}\gamma (A_{1}+\left( 4b_{i}b_{j}-\gamma ^{2}\right) )-A_{2}\right) <0\)

-

4.

\(A_{2}-2b_{i}\gamma (A_{1}+\left( 4b_{i}b_{j}-\gamma ^{2}\right) )<0\) and \(\left( 2b_{j}\gamma (A_{1}+\left( 4b_{i}b_{j}-\gamma ^{2}\right) )-A_{2}\right) <0\)

Note that in case of \(\gamma <0\) the only possibility is case 3, and in this case (17) is naturally satisfied. Hence, we consider \( \gamma >0\) and we would like to show that (17) is satisfied also in cases 1 and 4 and case 2 is not possible, given our assumptions.

-

Case 1

Using (15) for firm i we can replace \( \left( a_{j}-c_{j}\right) \) in the left-hand side (henceforth LHS) of (17) to obtain a smaller expression. After rearranging this expression, we obtain \(\left( 4b_{i}b_{j}-\gamma ^{2}\right) ^{2}+2\left( 4b_{i}b_{j}-\gamma ^{2}\right) \left( 4b_{i}b_{j}+\gamma ^{2}\right) \phi +\left( \left( 4b_{i}b_{j}+\gamma ^{2}\right) ^{2}-4\gamma ^{2}b_{i}b_{j}\right) \phi ^{2}\) which is positive, given our initial assumptions. Hence, we conclude that (17) holds.

-

Case 4

As before we use (15), but this time for firm j and we can replace \(\left( a_{i}-c_{i}\right) \) in the LHS of (17) to obtain a smaller expression. After rearranging this expression we obtain, the same as in case 1, \(\left( 4b_{i}b_{j}-\gamma ^{2}\right) ^{2}+2\left( 4b_{i}b_{j}-\gamma ^{2}\right) \left( 4b_{i}b_{j}+\gamma ^{2}\right) \phi +\left( \left( 4b_{i}b_{j}+\gamma ^{2}\right) ^{2}-4\gamma ^{2}b_{i}b_{j}\right) \phi ^{2}\) which is positive, given our initial assumptions. Hence, we conclude that ( 17) holds.

-

Case 2

Suppose \(A_{2}-2b_{i}\gamma (A_{1}+\left( 4b_{i}b_{j}-\gamma ^{2}\right) )<0\) and \(\big ( 2b_{j}\gamma (A_{1}+\big ( 4b_{i}b_{j}-\gamma ^{2}\big ) )-A_{2}\big ) >0,\) then \( \gamma \left( b_{i}+b_{j}\right) \left( A_{1}+4b_{i}b_{j}-\gamma ^{2}\right) >A_{2}.\) Using definitions of \(A_{1}\) and \(A_{2}\), this can be rewritten as

$$\begin{aligned}&\gamma ^{4}-\gamma ^{3}\left( b_{i}+b_{j}\right) -4\gamma b_{i}b_{j}\left( b_{i}+b\right) +16b_{i}^{2}b_{j}^{2}\nonumber \\&\quad <-\frac{1}{\phi }\left( 2b_{j}-\gamma \right) \left( 2b_{i}-\gamma \right) \left( 4b_{i}b_{j}-\gamma ^{2}\right) . \end{aligned}$$(18)The right-hand side (henceforth RHS) is negative. We want to show that the LHS is positive; hence, there is a contradiction.

Assume w.l.o.g that \(b_{j}<b_{i}\) and replace in the LHS \(\gamma \) by \( 2b_{j}.\) This way we obtain \((2b_{j})^{4}-\left( b_{i}+b_{j}\right) (2b_{j})^{3}-4b_{i}b_{j}\left( b_{i}+b_{j}\right) 2b_{j}+16b_{j}^{2}b_{i}^{2}=8b_{j}^{2}\left( b_{i}-b_{j}\right) ^{2}>0\). Now we show that

$$\begin{aligned}&\gamma ^{4}-\gamma ^{3}\left( b_{i}+b_{j}\right) -4\gamma b_{i}b_{j}\left( b_{i}+b\right) +16b_{i}^{2}b_{j}^{2}\nonumber \\&\quad >(2b_{j})^{4}-\left( b_{i}+b_{j}\right) (2b_{j})^{3}-4b_{i}b_{j}\left( b_{i}+b_{j}\right) 2b_{j}+16b_{j}^{2}b_{i}^{2} \end{aligned}$$(19)since this means that the LHS of (18) is positive.

To do this, we compute the difference of the left- and the right-hand side of (19). This is positive if and only if \(\left( b_{i}-b_{j}\right) \gamma ^{2}-\gamma ^{3}+2b_{j}\left( b_{i}-b_{j}\right) \gamma +4b_{j}\left( b_{i}^{2}-b_{j}^{2}+2b_{i}b_{j}\right) >0.\) To show this, we add and subtract an additional term \(4b_{i}b_{j}\gamma \) and obtain \(\left( b_{i}-b_{j}\right) \gamma ^{2}+4b_{i}b_{j}\gamma -\gamma ^{3}+2b_{j}\left( b_{i}-b_{j}\right) \gamma +4b_{j}\left( b_{i}^{2}-b_{j}^{2}+2b_{i}b_{j}\right) -4b_{i}b_{j}\gamma =\left( b_{i}-b_{j}\right) \gamma ^{2}+\left( 4b_{i}b_{j}-\gamma ^{2}\right) \gamma +2b_{j}\left( b_{i}-b_{j}\right) \gamma +\) \(4b_{j}\left( b_{i}\left( 2b_{j}-\gamma \right) +b_{i}^{2}-b_{j}^{2}\right) \). This is positive since all the components are positive.

Summarizing, we have shown that the LHS of (18) is positive; hence, it cannot be less than the RHS, which is negative. That is why \( A_{2}-2b_{i}\gamma (A_{1}+\left( 4b_{i}b_{j}-\gamma ^{2}\right) )<0\ \)and\(\ 2b_{j}\gamma (A_{1}+\left( 4b_{i}b_{j}-\gamma ^{2}\right) )-A_{2}>0\) is a contradiction.\(\square \)

Proof of Proposition 7

The indirect effect on firm i’s equilibrium output is given by \( [A_{1}A_{3}\left( a_{j}-c_{j}\right) -16b_{j}^{2}b_{i}\phi ^{3}\gamma ^{3}\left( a_{i}-c_{i}\right) ]\gamma /4A_{4}^{2}\), where \(A_{1}\) is as defined in Sect. 4,

\(A_{3}=\phi ^{2}\left( \gamma ^{4}+4b_{i}b_{j}\left( 4b_{i}b_{j}-\gamma ^{2}\right) \right) +2\phi \left( 4b_{i}b_{j}-\gamma ^{2}\right) \left( 4b_{i}b_{j}{+}\gamma ^{2}\right) +\left( 4b_{i}b_{j}{-}\gamma ^{2}\right) ^{2}>0,\) and

\(A_{4}=\phi ^{2}\left( \left( 4b_{i}b_{j}+\gamma ^{2}\right) ^{2}\!-4\gamma ^{2}b_{i}b_{j}\right) +2\phi \left( 4b_{i}b_{j}{-}\gamma ^{2}\right) \left( 4b_{i}b_{j}{+}\gamma ^{2}\right) +\left( 4b_{i}b_{j}{-}\gamma ^{2}\right) ^{2}>0.\)

If \(\gamma <0,\) the indirect effect is negative. For the case \(\gamma >0\), observe that the sign of the indirect effect is the same as the sign of the numerator. Assume it is negative, then

Conditions (20) and (15) are in contradiction since \(\frac{A_{1}A_{3}}{8b_{j}b_{i}\phi ^{3}\gamma ^{3}}> \frac{\gamma \left( 4b_{i}b_{j}-\gamma ^{2}\left( 1-\phi \right) \right) }{ \left( 4b_{i}b_{j}\left( 1+\phi \right) -\gamma ^{2}\right) }\). Therefore, the indirect effect of a \(\phi \) increase on total equilibrium output of a firm is positive if \(\gamma >0\).\(\square \)

Proof of Proposition 8

This is based on the same idea as above, namely one can check (after some computations) that the demand effect outweighs the indirect effect when both firms are active in the market in equilibrium (computational details available upon request).\(\square \)

Proof of Proposition 9

Let \(\gamma >0\). From Lemma 3 the sum of the demand effects is positive and from Proposition 7, the indirect effects are positive as well. If \(\gamma <0\) we conclude by Proposition 8 that the sum of both firms’ outputs increases when \(\phi \) increases.\(\square \)

Proof of Proposition 10

The derivative of equilibrium profit with respect to \(\phi \) is given by

where

\(\frac{\partial }{\partial \phi }\varPi ^{i}(p_{1}^{*},p_{2}^{*})\) is positive if \(\gamma <0\), or when the goods are complements. If \(\gamma >0,\) \(D_{j}^{i}>0\) and \(p_{j}^{*\prime }(\phi )<0\), hence a negative demand effect is enough for \(\frac{\partial }{\partial \phi }\varPi ^{i}(p_{i}^{*},p_{j}^{*})<0.\) \(\square \)

Proof of Proposition 11

We have \(\frac{d}{d\phi }W(p_{1}^{*}(\phi ),p_{2}^{*}(\phi ),\phi )=T_{1}+T_{2},\) where

and

\(T_{1}\) consists of the indirect effects of \(\phi \) on total equilibrium outputs of the firms, weighted by their margins. Hence, when \(\gamma >0,\) it is positive and when \(\gamma <0,\) it is negative.

\(T_{2}\) is always positive (all necessary computations can be provided upon request), and to show this we need to use the fact that (15) must hold for both firms.

Hence, if \(\gamma>0\,,\ T_{1}+T_{2}>0\). If \(\gamma <0\), \(T_{1}+T_{2}>0\) as well, but showing this requires direct computation and condition (15) for both firms (computational details upon request).\(\square \)

Rights and permissions

About this article

Cite this article

Cosandier, C., Garcia, F. & Knauff, M. Price competition with differentiated goods and incomplete product awareness. Econ Theory 66, 681–705 (2018). https://doi.org/10.1007/s00199-017-1050-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00199-017-1050-3

Keywords

- Bertrand duopoly

- Market transparency

- Consumers awareness

- Supermodular games

- Strategic complements/substitutes