Abstract

In a duopoly model of horizontal and vertical differentiation, where consumers are ex-ante unaware of product qualities, we study the firms’ incentives to signal quality via prices. Consumers, after they observe prices, can evaluate a firm’s product quality before purchase if they incur a search cost. We show that a complete information (undistorted) separating equilibrium and a unique pooling equilibrium (in pure strategies) exist. A lower search cost moves the market equilibrium from pooling to separating and induces a mean-preserving spread in the distribution of the equilibrium prices.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In markets where consumers are ex-ante unaware of product qualities, we examine rival firms’ incentives to signal quality through prices. Consumers form beliefs about product qualities after they observe prices and can learn a firm’s product quality before purchase if they incur a search cost. For example, consumers can physically visit a firm’s store and learn the quality of the product. The search cost involves the time spent and the effort exerted by a consumer to ‘visit’ another store in order to assess the quality of the product for sale in that store. Alternatively, a consumer may be shopping online and the search cost is the time and effort associated with ordering online a second product from a different online retailer if the first product is of lower than expected quality. For some products a careful inspection may be enough to assess quality, e.g., clothes, furniture. Many other products offer free trials to entice consumers to make a purchase. Free trials are costly for consumers, in terms of opportunity cost, but can facilitate quality discovery before a final purchase is made.Footnote 1

Our main departure from the literature is the assumption that consumers can assess a firm’s product quality before purchase, provided they incur a search cost. Most of the existing literature has assumed that consumers may discover the quality of the product only after purchase (see Sect. 2 for a literature review). This assumption is certainly appropriate for credence or experience goods, for example, but there are many markets where quality can be evaluated before purchase. Our paper fills this gap.

We develop a model of horizontal and vertical differentiation with two rival firms. The product quality of each firm is a random variable whose realization, independent across firms, can be either high or low. Hence, both firms can be of low quality, or of high quality, or one firm of high and the other of low quality. The product quality realizations are common knowledge between firms, but consumers are only aware of the distribution. Consumers observe prices, form beliefs about the product qualities and decide which firm to ‘visit’ first. After a visit, a consumer discovers the firm’s product quality, updates his beliefs about the product quality of the rival firm and decides whether to visit the other firm or not. A visit to the other firm entails a fixed (search) cost.

Our model best fits markets where product innovations are frequent, not deterministic, and so it is not easy for a firm to communicate to consumers its realized product quality at any given time. Moreover, prices are easily observable by consumers and quality can be assessed before consumers make a final purchase if they exert a reasonable effort.Footnote 2

We show that firms can signal product quality with the complete information prices. Hence, no price distortions arise in a separating equilibrium. This observation is a well–known implication of the unprejudiced beliefs refinement (see (Bagwell and Ramey 1991)). Given the multi-sender nature of the game in an oligopoly market, consumers anchor their beliefs about product qualities on the price of the non-deviating firm. Hence, it becomes much more difficult to sustain an equilibrium that does not involve the complete information prices. Our main focus in this paper is on the conditions that guarantee the existence of a separating and a pooling equilibrium, in pure strategies, and on how an equilibrium is affected by consumer search costs. Existence is more likely when: (i) the difference between high and low quality is higher, (ii) the market is more competitive (lower transportation cost), (iii) the search cost is lower and (iv) the probability of high quality is higher.

We also show that a unique pooling equilibrium exists, provided that search cost is high, relative to the quality differential. The prices in the pooling equilibrium are the expected prices in the separating equilibrium. A lower search cost moves the market equilibrium from pooling to separating and induces a mean-preserving spread of the equilibrium prices. It also enhances efficiency because aggregate surplus is higher in a separating than in a pooling equilibrium.

The rest of the paper is organized as follows. In Sect. 2 we offer a literature review. The model is introduced in Sect. 3 and in Sect. 4 we offer some preliminaries. The separating equilibrium is examined in Sect. 5 and the pooling equilibrium in Sect. 6. In Sect. 7, we examine how the search cost affects price dispersion and welfare. We conclude in Sect. 8. All proofs are relegated to the Appendix.

2 Literature review

Signaling product quality or cost through prices is an important issue in industrial organization. The fundamental question is what kind of prices can credibly signal that a firm has a high quality product or a low cost. The first classification is whether there is a single signal sender (monopoly) of multiple possible types or many signal senders (oligopoly), each of multiple possible types.Footnote 3

In an oligopoly market, separating prices may or may not be distorted, if distorted they can be upward or downward distorted, depending on the information firms have about the types of the rival firms, on the beliefs refinement and whether advertising is used to signal quality or not. A difference with monopoly is that the receivers of the signal can utilize the signals of the non-deviating players to draw credible inferences.

Wolinsky (1983) considers a model where competing firms can signal quality through prices, and consumers can observe the quality of a firm before purchase at a cost. Unlike our findings, he shows that, in a separating equilibrium, firms distort their prices upwards to signal quality. He assumes that each firm can observe only its own quality, whereas we consider common private information, and low search costs, whereas our search cost ranges from zero to very high values. Finally, he does not search for a pooling equilibrium.

Bagwell and Ramey (1991) introduce a limit pricing model, with common private information among (incumbent) firms, and the unprejudiced beliefs refinement and find that only non-distorted separating equilibria exist. Further, under additional assumptions, the intuitive criterion of Cho and Kreps (1987) eliminates all equilibria with pooling. Schultz (1999) considers a variation of Bagwell and Ramey (1991), where one incumbent prefers the entrant to stay out of the market, while its competitor prefers entry, and, again, separating equilibrium prices are not distorted. Bester and Demuth (2015) in a common private information setting, with horizontal and vertical differentiation, assumes that some consumers are informed about an entrant’s product quality (the rest learn the quality after purchase) and shows that a separating equilibrium exists when the fraction of informed consumers is high. The equilibrium must entail the complete information prices, a result of unprejudiced beliefs. They do not analyze pooling equilibria. In our paper, private information is common knowledge among firms and we use the unprejudiced beliefs refinement. As in the above papers, in our model a separating equilibrium, if it exists, must entail the complete information prices. But also a unique pooling equilibrium exists.

Harrington (1987) and Orzach and Tauman (1996) consider a homogeneous good market with multiple incumbents and one (or more) potential entrant. In the first paper it is the high-cost firm who tries to prove its “weakness”, while in the second, the signal sent by the low cost contestants, though costly, is also quite rewarding: it increases their payoff level. The difference with Bagwell and Ramey (1991) is that in Harrington (1987) and Orzach and Tauman (1996) the entrant does not observe individual behavior. In our model individual behavior is observable, since products are differentiated and consumers observe prices, which results in an undistorted separating equilibrium.

Hertzendorf and Overgaard (2001) study a duopoly model of vertical differentiation where consumers learn a firm’s product quality after purchase, with perfectly negative correlated product qualities and common private information among firms. Advertising can also be used to signal product quality. They use a restricted unprejudiced beliefs refinement and show that a distorted (upward or downward) separating equilibrium exists. Complete information prices cannot be an equilibrium. In a similar to the Hertzendorf and Overgaard (2001) model, Hertzendorf and Overgaard (2000), show that fully revealing separating equilibria satisfying the unprejudiced beliefs refinement do not exist. Yehezkel (2008) extends the Hertzendorf and Overgaard (2001) model by allowing some consumers to be informed. When the fraction of informed consumers exceeds a threshold the separating equilibrium entails the complete information prices. Pooling prices are distorted upwards. Mirman and Santugini (2019) analyze a monopoly model with a competitive fringe and a fraction of uninformed buyers about the monopolist’s product quality. The fringe is necessary for the existence of a unique, fully revealing equilibrium. In our model a low search cost is needed for the existence of a separating equilibrium. A low search cost increases the lost market share of a firm that tries to wrongly signal high quality, much like a high fraction of informed consumers does in Yehezkel (2008) and Bester and Demuth (2015) or a sizeable competitive fringe in Mirman and Santugini (2019). Moreover, our pooling prices are not distorted, they are actually the expectation of the separating equilibrium prices.

In Fluet and Garella (2002), consumers cannot observe quality before purchase and the ex ante distribution of the firms’ qualities is such that either both firms offer low quality or one firm offers low and the other high quality. Private information is common knowledge among firms. The authors avoid the use of selection criteria and find multiple separating and pooling equilibria. For small quality differences separation can only be achieved with a combination of upward distorted prices and advertisement.

Daughety and Reinganum (2008) study a model of horizontal and vertical differentiation where quality is each firm’s private information and consumers discover product quality after purchase. Firms signal high quality via higher prices, so a separating equilibrium entails a distortion. Janssen and Roy (2010), in a duopoly model where each firm’s product quality can be high or low and information about it is private, show that even when there is no horizontal differentiation, there exist symmetric fully revealing equilibria, where the low quality firm randomizes over an interval of prices, while the high quality firm sets a high price. Both types of firms may exhibit considerable market power.

In sum, all relevant papers assume that consumers learn the product quality after purchase, except for Yehezkel (2008) and Bester and Demuth (2015) who assume that a fraction of consumers is informed about product quality even before observing any prices. Our assumption about product quality discovery before purchase if a cost is incurred makes the model, the markets to which our model applies, the comparative statics, the empirical and policy/managerial implications different (see our discussion in Sect. 8).

3 The model

There is a continuum of consumers uniformly distributed on the [0, 1] Hotelling line and two firms, \(i=a,b\), located at the two endpoints of the interval (a at 0 and b at 1). We denote the rival firm by j. Consumers incur a linear transportation cost and buy at most one unit of the good from one firm. The maximum each consumer is willing to pay depends on the quality of the product and is denoted by \(V_a\) and \(V_b\). Hence, the indirect utility of the consumer located at x is \(V_i-td_x-p_i\), where \(t>0\) is the per-unit of distance transportation cost, \(p_i\) is the price and \(d_x\) is consumer x’s linear distance to the firm. We assume consumers know the products’ prices, but are unaware of firms’ product qualities. Following the literature, we assume that qualities are random variables whose realizations are only observed by the firms. Consumers form expectations about a firm’s product quality upon observing the products’ prices and they learn a firm’s product quality once they visit a firm (store) and inspect the product. As is commonly assumed in consumer search models, and without loss of generality, a first visit to a firm’s store is costless, but a visit to the second firm entails a cost \(\kappa >0\). The horizontal locations of the two firms on the Hotelling line are common knowledge. We assume that \(V_a\), \(V_b\) are independently drawn from a two point distribution, \(V_H\) and \(V_L\), where \(\Pr (V_i=V_H)=q\). We assume that \(V_L\) is sufficiently high to ensure a covered market and unit costs are the same across qualities, which are normalized to zero. We make the following assumption regarding the model parameters.

Assumption 1

\(V_H-V_L<3t\).

The assumption ensures that in a separating equilibrium, when product qualities are asymmetric, both firms have strictly positive market shares. The timing of the game is as follows:

-

1.

Nature draws, independently, the product qualities of both firms. Consumers do not observe the quality realizations, but these become common knowledge to the firms.

-

2.

Firms choose their prices and consumers observe them.

-

3.

Each consumer visits costlessly one store and decides whether to make a purchase or to incur search cost \(\kappa \) and visit the second store. If a consumer visits the second store, he can costlessly return and buy from the first. We assume that a consumer cannot make a purchase without incurring the search cost, unless he buys from the first store he visits.

We will search for a perfect Bayesian Nash equilibrium in pure strategies. In particular, we are interested in each firm’s pricing decision and whether prices can serve as signals of product qualities.

4 Preliminaries

It can be easily shown that the complete information (CI) prices are given by

We now return to asymmetric information. Since consumers are ex-ante unaware of product qualities, consumer beliefs play a key role. There are three different kind of beliefs: ex-ante, that is before consumers visit any firm, but after they have observed the prices, interim, that is after a consumer visits one firm, in which case he learns the product quality of the firm he visited and updates his beliefs about the product quality of the rival firm and final, that is after a consumer has visited both firms, in which case the consumer knows the true product qualities of both firms. In a separating equilibrium, the ex-ante beliefs are correct and so all three beliefs coincide, but in a pooling equilibrium, or out-of-equilibrium, this need not be true.

Let \(\mu ^e_a(p_a,p_b)\) be the consumers’ ex-ante beliefs that firm a has a high quality product and \(\mu ^e_b(p_a,p_b)\) be the beliefs that firm b has a high quality product, as a function of the observed prices. Also, let \(\mu ^{in}_{ai}(p_a,p_b)\) be the interim (in) beliefs of the consumers, who have visited firm i, that firm a has a high quality product and \(\mu ^{in}_{bi}(p_a,p_b)\) be the interim beliefs of the consumers, who have visited firm i, that firm b has a high quality product, where \(i=a,b\), as a function of the observed prices. The interim beliefs can differ between two consumers depending on which firm a consumer visited first. Clearly, since consumers learn perfectly a firm’s product quality after they visit the firm, \(\mu ^{in}_{ii}(p_a,p_b)=1\) if \(V_i=V_H\) and \(\mu ^{in}_{ii}(p_a,p_b)=0\) if \(V_i=V_L\). Also, let \(m^e(p_a, p_b)\) be the ex-ante probability that both firms are of high quality. Given the strategic interaction between the two firms, beliefs can be correlated, that is \(m^e(p_a, p_b)\ne \mu _a^e(p_a, p_b) \mu _b^e(p_a, p_b)\).

When consumers observe an out-of-equilibrium price pair, which is the case when a firm unilaterally deviates, we assume that they correctly believe that a firm has unilaterally deviated. These are the unprejudiced beliefs, which is a natural assumption in this multi-sender environment. The price of the non-deviating firm can, in many cases, provide useful information about the qualities of both firms. For example, suppose that when one firm has a high and the other a low quality product the equilibrium is separating \(({\hat{p}}_H,{\hat{p}}_L)\) and suppose consumers instead observe \((p^{\prime },{\hat{p}}_L)\) with \(p^{\prime }\ne {\hat{p}}_H,{\hat{p}}_L\). Consumers assign probability one that one firm has deviated and will use \({\hat{p}}_L\) to eliminate product quality profiles that are inconsistent with this price and unilateral deviations. This line of reasoning will be used in the derivations of the equilibria.

The consumer search process is described as follows. Each consumer, after observing a pair of prices and forms his ex-ante beliefs, visits first the firm with the higher net expected utility. Then, he inspects the product quality of the firm he visited, updates his beliefs about the product quality of the other firm and decides whether make a purchase or to incur the search cost to visit the other firm. After visiting the other firm, both product qualities are known and the consumer makes his final purchase decision based on which product yields the higher net utility.

Let \(\overline{V}\equiv qV_H+(1-q)V_L\) be the expected quality of a firm’s product before any prices are observed, \(\Delta V\equiv V_a-V_b\) be the true difference between the firms’ product qualities and \(DV\equiv V_H-V_L\) the difference between high and low quality. Note that there are three possibilities in our model: i) firms have the same product qualities, \(\Delta V=0\), ii) firm a is the high and firm b the low quality firm, \(\Delta V=DV\) and iii) firm b is the high and firm a the low quality firm, \(\Delta V=-DV\). Also let \(\Delta V^{e}(p_a,p_b)\equiv EV_a-EV_b=(\mu ^e_aV_H+(1-\mu ^e_a)V_L)-(\mu ^e_bV_H+(1-\mu ^e_b)V_L)\) be the ex-ante beliefs of consumers about the difference in the product qualities.Footnote 4 The ex-ante marginal consumer is given by

Let \(\Delta V^{in}_a(p_a,p_b)\equiv V_a-EV^{in}_b=V_a-(\mu ^{in}_{ba}V_H+(1-\mu ^{in}_{ba})V_L)\) and \(\Delta V^{in}_b(p_a,p_b)\equiv (\mu ^{in}_{ab}V_H+(1-\mu ^{in}_{ab}))-V_b\) be the two different interim beliefs about the expected quality difference, where the subscript in \(\Delta V^{in}_i\) indicates the firm a consumer visited first. Note that the initial beliefs about the firm’s expected quality, \(EV_i\), is not necessarily the same as the interim \(EV^{in}_i\), \(i=a,b\). Consumers can incur the search cost \(\kappa \) and visit the other firm, if they believe their indirect utility will increase.

The (interim) marginal consumers, after prices have been observed and consumers have visited one firm, are

Note that one difference between the two marginal consumers is the different sign in front of \(\kappa \). This is because \(x_a^{in}\) excludes the consumers who switch from a to b and so a high search cost increases a’s market share by making switching harder. For firm b higher \(\kappa \) makes switching from b to a harder, and so \(x_b^{in}\) decreases, implying higher market share for b.

There are three different possibilities, depending on the locations of the interim and the ex-ante marginal consumers.

-

Two-sided switching. If, \(\Delta V^{in}_a+\kappa<\Delta V^{e}<\Delta V^{in}_b-\kappa \), then \(x^{in}_a<x^{e}<x^{in}_b\), in which case the consumers who initially visited firm a and are in \([x^{in}_a, x^{e}]\) also visit b and the consumers who initially visited b and are in \([x^{e}, x^{in}_b]\) also visit a. For this we need \(\kappa <\Delta V^e-\Delta V_a^{in}\) and \(\kappa <\Delta V_b^{in}-\Delta V^e\). Note that \(\Delta V^e-\Delta V_a^{in}\) captures the change in the expected quality differential in favor of firm b, from the ex-ante to the interim stage, among the consumers who first visit a. Similarly, \(\Delta V_b^{in}-\Delta V^e\) captures the same change, in favor of a, among those who first visit b.

-

One-sided switching from ato b. If \(\kappa <\Delta V^e-\Delta V_a^{in}\) and \(\kappa >\Delta V_b^{in}-\Delta V^e\), then only consumers in \([x_a^{in}, x^e]\) switch to b.

-

One-sided switching from bto a. If \(\kappa >\Delta V^e-\Delta V_a^{in}\) and \(\kappa <\Delta V_b^{in}-\Delta V^e\), then only consumers in \([x^e, x_b^{in}]\) switch to a.

-

No switching. If \(\kappa >\Delta V^e-\Delta V_a^{in}\) and \(\kappa >\Delta V_b^{in}-\Delta V^e\), then no consumer switches firms at the interim stage. The marginal consumer in this case is given by (2).

To better understand the switching behavior, suppose \(\Delta V^e>0\). This means that consumers, after they have observed firms’ prices, believe that firm a has a higher quality product. Then assume that \(\Delta V_a^{in}<0\), which means that consumers who visit a update their ex-ante beliefs and think that it is firm b that has a higher quality product. This can be because, in out-of-equilibrium, consumers believed b is the low and a the high quality firm but it was actually the other way around. Consumers who visit a realize it is a low quality firm. In this case \(\Delta V^e-\Delta V_a^{in}>0\) and so some consumers will also visit b if the search cost is low.

Since consumers can costlessly return and buy from the first firm they visited, the final market share, if some consumers switched firms at the interim stage, is given by

where \(\Delta V\) is the true product quality difference, since those who have switched firms know both product qualities. There are the following possibilities regarding the location of the final marginal consumer when there is switching at the interim stage.

-

Suppose there is one-sided switching from b to a (\(\kappa <\Delta V_b^{in}-\Delta V^e\)). Then, the final marginal consumer is \(x^f\in (x^e, x_b^{in})\) if \(\Delta V_b^{in}-\kappa>\Delta V>\Delta V^e\). If one of the inequalities is not satisfied, the final marginal consumer is either \(x^e\) or \(x_b^{in}\).

-

Suppose there is one-sided switching from a to b (\(\kappa <\Delta V^e-\Delta V_a^{in}\)). Then, the final marginal consumer is \(x^f\in (x^{in}_a, x^e)\) if \(\Delta V_a^{in}+\kappa<\Delta V<\Delta V^e\). If one of the inequalities is not satisfied, the final marginal consumer is either \(x^e\) or \(x_a^{in}\).

-

Suppose there is two-sided switching case (\(\kappa <\Delta V^e-\Delta V_a^{in}\) and \(\kappa <\Delta V_b^{in}-\Delta V^e\)). Then, the final marginal consumer is \(x^f\in (x_a^{in}, x_b^{in})\) if \(\Delta V_b^{in}-\kappa>\Delta V>\Delta V_a^{in}+\kappa \). If one of the inequalities is not satisfied, the final marginal consumer is either \(x^{in}_b\) or \(x_a^{in}\).

Let \(\pi _i(p_i,p_j,V_i,V_j,\mu ^e_i(p_i,p_j), \mu ^e_j(p_i,p_j), \mu ^{in}_{ij}(p_i,p_j),\mu ^{in}_{ji}(p_i,p_j))\), \(i=a,b\) and \(j=a,b\), be firm i’s expected profit as a function of prices, product qualities and consumer beliefs, both ex-ante and interim.

5 Informative prices (separating equilibrium)

We search for an equilibrium where consumers can infer, from the advertised prices, whether the firms have the same quality (either high H or low L) or one firm has high and the other low quality. There are four possible quality configurations: (H, L), (L, H), (H, H) and (L, L), where the first letter in each case refers to the product quality of firm a located at 0 and the second to the product quality of firm b located at 1.

Let \(p^{*}_H(HL)\) and \(p^{*}_L(HL)\) be the candidate equilibrium prices in the (H, L) case and \(p^{*}(HH)\) and \(p^{*}(LL)\) the candidate symmetric equilibrium prices in the (H, H) and (L, L) cases respectively. Clearly, \(p^{*}_L(LH)\) and \(p^{*}_H(LH)\) are symmetric to \(p^{*}_H(HL)\) and \(p^{*}_L(HL)\). Moreover, given the covered market assumption, we look for an equilibrium where \(p^{*}(HH)=p^{*}(LL)=p^{*}\). Also, \(p^{*}_H(HL)\ne p^{*}_L(HL)\ne p^{*}\). Consumer ex-ante beliefs \(\mu _{a}^{e}(p_{a},p_{b})\) and \(\mu _{b}^{e}(p_{a},p_{b})\) are presented in the table in Appendix A.1.

The beliefs are defined over the equilibrium price pairs and over price pairs in which one price is an equilibrium price for a given product quality configuration, while the other may be an equilibrium price for a different quality configuration, or a non-equilibrium price. However, they are not defined over price pairs where both prices are non-equilibrium prices, as we solve the game by only considering unilateral deviations.

The beliefs are reasonable given the multi-sender nature of the game and satisfy the unprejudiced beliefs criterion where the receiver of the signals must take into account the number of price deviations that would be needed to generate a deviant price pair. In particular, unprejudiced beliefs satisfy a minimality rule, whereby the receiver (i.e., a consumer) infers a particular product quality pair if under that type the deviant price pair can be rationalized with the fewest number of deviations from the equilibrium strategies. In other words, multiple deviations are infinitely less likely than single deviations, e.g., Bagwell and Ramey (1991) and Vida and Honryo (2021). Essentially, consumers can rely on the price of the non-deviating firm, whenever possible, to infer the qualities of both firms.

To see how the beliefs are derived, consider as an example the case where consumers observe \(p_a=p_H^{*}(HL)\) and \(p_b=p^{*}\) (this is line 3 in the table in Appendix A.1). Given that beliefs are unprejudiced, consumers know that it is either (H, L) and firm b has deviated, or (L, L), or (H, H) and firm a has deviated. They can safely rule out (L, H), because if it was (L, H) the observed prices would be consistent with multiple deviations. Hence, the ex-ante probability of firm a being of high quality is \(\frac{q^2+q(1-q)}{q^2+(1-q)^2+q(1-q)}\). Similarly, the ex-ante probability of firm b being of high quality is \(\frac{q^2}{q^2+(1-q)^2+q(1-q)}\).

The following lemma is a direct consequence of the unprejudiced beliefs.

Lemma 1

We assume that consumer beliefs are unprejudiced as given in Appendix A.1. Then, if a separating equilibrium exists it must entail the complete information prices (1).

The question that arises next is under what conditions a separating equilibrium exists. First, we analyze each one of the three cases, i.e., (H, L), (H, H) and (L, L), separately and then we combine them.

5.1 Firm a has a high and firm b has a low quality product, (H, L)

Lemma 2

Suppose firm a has a high and firm b has a low quality product and \(q>\frac{2}{3}\). Then, if \(\kappa \le \frac{DV(DV-9t(1-q))}{9t}\) the equilibrium prices are

Consumers upon observing the equilibrium prices can infer the product quality of each firm.

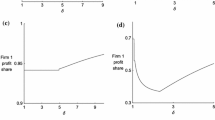

The high quality firm has no incentive to deviate. The low quality firm may have an incentive to raise its price to make consumers think that its quality is high and it is the other firm that has deviated. If the search cost is high, few consumers who first visit the deviating firm, and realize that its quality is low, switch to the other one. In this case it pays for the low quality firm to deviate. Therefore, such a deviation is unprofitable for relatively low search costs.

5.2 Both firms have high quality products, (H, H)

Lemma 3

Suppose both firms have high product quality products, \(t\le \frac{(1-2q)^2 DV}{9q(1-q)}\) and \(q<\frac{1}{2}-\frac{\sqrt{21}}{14}\), or \(q>\frac{1}{2}+\frac{\sqrt{21}}{14}\). Then the equilibrium prices are

Consumers upon observing the equilibrium prices can infer that firms have the same quality products.

A firm may have an incentive to raise its price to \(p^{*}_H(HL)\) to make consumers believe that they are in the (H, L) case and so the rival has a low quality. No consumer visits a second firm and that is why the search cost \(\kappa \) does not feature in the conditions of this case. This is because the consumers who visit the firm that deviated confirm their ex-ante beliefs about its high quality and the consumers who visit the non-deviating firm find out that it is high quality. A high t makes this deviation profitable because the deviating firm loses very little market share when it raises its price and t is high. That is why we need a low t to ensure no deviation.

5.3 Both firms have low quality products, (L, L)

Lemma 4

Suppose both firms have low product quality products. Then if

-

\(\kappa <\min \left\{ \frac{(DV)^2}{3(DV+3t)}, \frac{q(1-q)DV}{1-q+q^2}\right\} \)

-

or, \(\kappa > \frac{q(1-q)DV}{1-q+q^2}\), \(t\le \frac{(1-2q)^2DV}{9q(1-q)}\) and \(q<\frac{1}{2}-\frac{\sqrt{21}}{14}\), or \(q>\frac{1}{2}+\frac{\sqrt{21}}{14}\)

the equilibrium prices are

Consumers upon observing the equilibrium prices can infer that firms have product of the same quality.

A firm can increase its price to make consumers believe it is high quality. If the search cost is low this strategy is not profitable as consumers upon realizing that the firm’s quality is actually low switch to the other firm. If the search cost is high, the firm that deviates can keep the consumers who first visit it. For this deviation to be unprofitable we need a low t so that a higher price implies significant loss of market share (as was the case in (H, H)).

5.4 Existence of a separating equilibrium

We now combine Lemmas 2, 3 and 4 to present the main result of this section.

Theorem 1

Suppose \(DV\in \left[ \frac{9q(1-q)t}{(1-2q)^2}, 3t\right) \), \(\kappa \le \frac{DV(DV-9t(1-q))}{9t}\), \(q>\frac{1}{2}+\frac{\sqrt{21}}{14}\approx 0.8273\) and the unprejudiced beliefs are given in Appendix A.1. Then, a separating equilibrium exists and it coincides with the complete information prices given by (1).

For a separating equilibrium to exist, we need a high quality differential DV relative to the competitiveness of the market captured by the transportation cost t (but lower than 3t so that the high quality firm does not drive the low quality out of the market), or a competitive market (low transportation cost) relative to DV, a relatively low search cost (low \(\kappa \)) and a relatively high probability of a high product quality (high q).

Example 1

Suppose \(t=1\) and \(q=85\%\). Then, the permissible interval for DV is [2.34, 3). The search cost \(\kappa \) must be lower than \(\frac{DV(DV-1.35)}{9}\). If firms have the same quality, which occurs with probability \(1-2q(1-q)=74.5\%\), the prices are (1, 1), while if firm a has high and firm b has low quality the prices are \(\left( \frac{DV}{3}+1, -\frac{DV}{3}+1\right) \) (the case where a is low quality and b high is symmetric).

6 Uninformative prices (pooling equilibrium)

We search for an equilibrium where prices convey no information about the product qualities. Both firms choose the same price \(p^{*}\). Ex-ante equilibrium beliefs are \(\mu ^e_i(p^{*},p^{*})=q\), for \(i=a,b\). To find the set of \(p^{*}\) that can be supported by beliefs as a pooling equilibrium we need to ensure that both firms (regardless of their type) prefer to set \(p^{*}\). If firm i prefers to set some price \(p\ne p^{*}\), even if by doing so is perceived by consumers as a low quality firm, then it is not possible to find out-of-equilibrium beliefs that make such a deviation unprofitable.

Suppose firm i is of low quality and firm j of high quality, that is (H, L) or (L, H). Furthermore, let’s assume that \(\mu ^e_i(p,p^{*})=0\) and \(\mu ^e_j(p,p^{*})=q\), for \(p\ne p^{*}\), that is the firm that deviates is perceived as a low quality, while the ex-ante beliefs about the firm that did not deviate that is of high quality is still q. Then the candidate pooling equilibrium must satisfy the following inequalities

When both firms set \(p^{*}\), ex-ante and interim consumer beliefs are the same and equal to q. Inequality (5) says that a low quality firm would not want to deviate to \(p\ne p^{*}\) if it is perceived as a low quality firm, while the ex-ante and interim beliefs for the rival firm, who is of high quality, are not affected by such a deviation. Inequality (6) ensures that a similar deviation on part of the high quality firm is unprofitable. We will have similar inequalities in the (H, H) and (L, L) cases.

6.1 Pooling equilibria with unrefined beliefs

6.1.1 High search cost, \(\kappa \ge qDV\)

We summarize in the lemma below.

Lemma 5

Suppose \(\kappa \ge qDV\). Then any price

can be supported as a pooling equilibrium with out-of-equilibrium beliefs \(\mu ^e_i(p,p^{*})=0\), \(i=a,b\), for any \(p\ne p^{*}\).

The search cost is higher than \(qDV=\overline{V}-V_L\), which is the expected product quality gain for a consumer who has visited a low quality firm and contemplates visiting the other firm. Moreover, the firm that deviates from \((p^{*}, p^{*})\) is viewed as of low quality. Then, there is a continuum of pooling equilibria.

6.1.2 Low search cost, \(\kappa <qDV\)

Let \(\Omega \) be a set of prices such that if \(p^{*}\in \Omega \) a firm would not find a unilateral deviation from the pooling equilibrium \((p^{*},p^{*})\) profitable, if it was perceived as low quality (the set \(\Omega \) is defined precisely in the proof of Lemma 6 in the Appendix). We summarize in the Lemma below.

Lemma 6

Suppose \(\kappa <qDV\). For \(\kappa \)’s close to qDV, \(\Omega \ne \varnothing \), so a pooling equilibrium exists, while for low \(\kappa \)’s, \(\Omega =\varnothing \), implying that there is no pooling equilibrium.

The search cost is lower than the expected product quality gain for a consumer who has visited a low quality firm and contemplates visiting the other firm. As in the high search cost case, the deviating firm is perceived as low quality. For relatively high search costs, within that range, a continuum of pooling equilibria exist. For low search costs a pooling equilibrium does not exist. In particular, for low search costs, there are price intervals that prevent profitable deviations for each quality configuration, i.e., (H, L), (H, H) and (L, L). But the intersection of these intervals is empty.

6.2 Pooling equilibria with refined beliefs

To support a pooling equilibrium in Sect. 6.1, we assumed that a firm that sets an out-of-equilibrium price is perceived as low quality. These beliefs gave rise to a continuum of pooling equilibria for relatively high search costs. In this section, we refine the pooling equilibria. More specifically, we use two belief refinements: (i) intuitive beliefs and (ii) impartial beliefs. In a nutshell, intuitive beliefs are concerned with which firm, i.e., high or low quality, has stronger incentives to deviate from a pooling equilibrium. If it is the high quality firm, then beliefs assign probability one that the deviator is the high quality firm. Impartial beliefs, on the other hand, assume that the consumer is agnostic about the quality of a deviating firm, if both types of firms are equally likely to deviate. The intuitive beliefs refinement has a bite when the search cost is relatively low (in which case it is indeed the high quality firm the one with stronger incentives to deviate), while the impartial beliefs refinement is applicable when the search cost is relatively high (in which case both firms have the same incentives to deviate).

6.2.1 Intuitive beliefs

Suppose a high quality firm can profitably deviate to a price if it is perceived by consumers as high quality, while the low quality firm is worse off, relative to the pooling equilibrium, if it deviates to that price, even if it is viewed as high quality. Then, reasonable beliefs should attach probability one that such a deviation is associated with a high quality firm.Footnote 5 More precisely (see also (Yehezkel 2008)):

Definition 1

A pooling equilibrium \(p^{*}\in \Omega \) is intuitive if \(\mu _i^e(p,p^{*})=1\) for all p satisfying

and

A pooling equilibrium survives Definition 1 if there exists no price p other than \(p^{*}\) such that a high quality firm benefits from deviating (first inequality), while the low quality firm does not (second inequality), when a deviator is perceived as a high quality firm. Next, we examine the firms’ incentives to unilaterally deviate from \((p^{*}, p^{*})\), if a deviator is perceived as high quality.

Proposition 1

Suppose \(\kappa <DV\). There does not exist a pooling equilibrium with intuitive beliefs.

All pooling equilibria identified in Lemma 6 and most of the ones in Lemma 5 do not survive the intuitive beliefs refinement. A high quality firm can profitably deviate to a price range when such a deviation is unprofitable for the low quality firm even if it is perceived as high quality. The low search cost is key for this result. A low quality firm that mimics the high quality, loses significant market share when consumers discover the true quality and search cost is low.

6.2.2 Impartial beliefs

When, on the other hand, the search cost is high, \(\kappa \ge DV\), the profit function of the low quality firm is the same as the profit function of the high quality firm, because consumers learn a firm’s quality after they visit the firm but given the high search cost they are captive. In particular, the profit function of firm a is \(p_ax^e=\frac{p_a(p_b-p_a+\Delta V^e+t)}{2t}\), where \(x^e\) is given by (2), which shows that the profit function is independent of whether this firm has a high or a low quality product. The profit function is affected by product quality only through the term \(\Delta V^e\), which depends on ex-ante consumer beliefs and not on the actual product quality of a firm. This implies that the high quality firm cannot charge a high price to credibly signal its superior product quality. Hence, either type of a firm is equally likely to deviate and the intuitive refinement has no bite. We then turn to impartial beliefs.

Definition 2

(Hertzendorf and Overgaard (2001)) Out-of-equilibrium beliefs are impartial at a pooling equilibrium \(p^{*}\) if identical payoffs are associated with out-of-equilibrium ex-ante beliefs \(\mu _i^e(p,p^{*})=q\), \(i=a,b\).

If firms have the same payoff functions, then they must have the same incentives to deviate. Consumers, in this case, revert to their ex-ante beliefs following a unilateral deviation from the pooling equilibrium.

6.2.3 Main result

We can now state the main result of this section.

Theorem 2

Suppose search cost is high, \(\kappa \ge DV\). The only pooling equilibrium that is sustained by impartial out-of-equilibrium beliefs is \((p^{*},p^{*})=(t,t)\). If \(\kappa <DV\), there does not exist a pooling equilibrium that satisfies the intuitive beliefs.

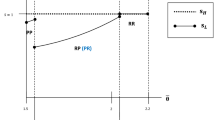

Figure 1 depicts the range of parameter values, in the \((\kappa , DV)\) space, where the equilibria presented in Theorems 1 and 2 arise.

7 Effect of search cost on price dispersion and welfare

We first examine the effect of search cost on price dispersion and then on social welfare. A caveat in performing these comparative statics is that the beliefs are also changing.

Given that there exists a parameter space where a pure strategy equilibrium does not exist, in what follows we consider drastic reductions of consumer search cost, i.e., from \(\kappa >DV\) to \(\kappa <\frac{DV(DV-9t(1-q))}{9t}\), see Fig. 1. A drastic decrease of \(\kappa \) moves the market equilibrium from pooling to separating (provided \(DV\ge \frac{9q(1-q)t}{(1-2q)^2}\)). It can be easily deduced from the equilibrium prices given by (1) that this generates a mean-preserving spread in the price distribution.

Corollary 1

A drastic reduction in search cost \(\kappa \) induces a mean-preserving spread in the distribution of the equilibrium prices.

Thus, in our model a technological improvement that results in a drastic reduction of search costs, has the potential to affect positively the dispersion of prices and leave the average price unaffected.

Social welfare is \(W=\int _0^x (V_a-tz)dz+\int _x^1(V_b-t(1-z))dz)\), i.e., the difference between total consumer benefit and total transportation cost. A social planner would maximize W with respect to x. It is straightforward to verify that the efficient marginal consumer is located at \(x^{fb}=\frac{\Delta V}{2t}+\frac{1}{2}\), where fb stands for first-best. In a separating equilibrium, using the equilibrium prices, the marginal consumer is located at \(\frac{5\Delta V}{6t}+\frac{1}{2}\), while in a pooling equilibrium, where prices are equal, the marginal consumer is located at \(\frac{1}{2}\).

When firms have the same product qualities only the transportation cost matters, so an outcome is efficient, i.e., consumers buy from the closest firm. This is no longer true when qualities are asymmetric. As is clear from above, the separating equilibrium is inefficient when the firms have different qualities, which happens with a strictly positive probability. More specifically, more consumers buy the high quality product than what a social planner would prefer, i.e., \(\frac{5\Delta V}{6t}+\frac{1}{2}>\frac{\Delta V}{2t}+\frac{1}{2}\). In a pooling equilibrium, on the other hand, firms have equal market shares, which is also inefficient, but now too few consumers purchase the high quality product, i.e., \(\frac{1}{2}<\frac{\Delta V}{2t}+\frac{1}{2}\).Footnote 6

We can also compare the social welfare between a separating and a pooling equilibrium. We show (details are straightforward and thus are omitted) that the welfare under the separating equilibrium is higher. So, we can conclude that a lower search cost, and an associated move from a pooling to a separating equilibrium, increases efficiency.

Proposition 2

A drastic reduction in search cost \(\kappa \) enhances social surplus.

Note that consumers do not search in equilibrium, so the above result is not driven by a reduction in the total search cost consumers incur.

8 Conclusion

We study a duopoly model of horizontal and vertical differentiation where private information about firm quality is common knowledge among firms and each firm can have a high or a low quality product. Consumers are ex-ante unaware of firms’ product qualities, they observe prices and decide which firm to ‘visit’ first. A visit to a firm allows consumers to assess product quality before purchase. After a visit to the first firm consumers decide whether to purchase the firm’s product, or to incur the search cost and visit the second firm. A separating equilibrium with unprejudiced beliefs entails the complete information prices. Existence of a separating equilibrium requires a low search cost, a relatively competitive market (low transportation cost) and a high probability of a high product quality. If the search cost is high, a unique reasonable pooling equilibrium exists. A drastic decrease of the search cost, moves the market equilibrium from pooling to separating and the equilibrium prices exhibit a mean-preserving spread. It also increases social surplus. Hence, an empirical implication of our analysis is a negative relationship between search costs and price dispersion, but no effect of search costs on average price. Our focus in this paper was to determine parameter constellations under which separating and pooling equilibria in pure strategies exist. Future research can examine the type of equilibria in the parameter space where pure strategy equilibria do not exist.

It would be useful to compare the negative relationship between search cost and price dispersion with traditional search models, where consumers are mainly searching for the lowest price. The relationship between search costs and price dispersion in these models can be positive, negative or even non-monotonic (see (Baye et al. 2006) for a review of the literature). In Rob (1985), for example, lower search cost, in the form of a bigger mass of consumers with low search costs, decreases price dispersion. Chandra and Tappata (2011) present a theoretical search model where price dispersion can increase or decrease with search costs, but the empirical evidence from gasoline markets suggests that it is decreasing as search costs decrease. Consistent with this finding, Dahlby and West (1986) show that car insurance premiums are less dispersed for the class of drivers who are associated with lower search costs. In these models price dispersion is entirely due to search costs related to price discovery, while in our model consumers observe prices but not product qualities and price dispersion is due to both quality differences and search costs. When search costs are high, firms pool their prices together, quality differences are ‘masked’, and hence there is no price dispersion, but when search costs are low quality differences dominate and drive price dispersion. For many products, consumer search costs, and the decision to search, are partially affected by managerial decisions, e.g., free trials, higher transparency regarding product characteristics. Managers of high quality firms should make these types of investments to ease consumer search.

Recent developments in search theory, e.g., Doval (2018) and Petrikait (2021), allow for a purchase without inspection/search. Our assumptions preclude this possibility. In our model, if a consumer, after inspecting the first product, wishes to inspect/purchase the other product he must incur the search cost. But if an option of a purchase without inspection was available, then for consumers close to the center of the market it could be optimal to buy the other product without inspection, especially if the two prices were close enough to each other and the first inspection revealed a low quality product. Allowing for a purchase-without-inspection option would introduce additional dynamics regarding consumer behavior and would likely affect firm behavior and equilibrium prices. We leave this interesting extension for possible future research.

Notes

Software and premium network TV channels routinely offer free trials. More recently, Carvana, an online used car retailer, known for its multi-story Car Vending Machines, offers a “seven day test to own”, giving buyers the option to return a vehicle within seven days if they are not satisfied with it.

As an example, consider the market for cellular phones. Innovations are frequent, e.g., chips (CPU), cameras, screens, fingerprint, 5G, battery. The realization of the innovations is not deterministic as there are many new technologies that may not work as well as expected (for example, new chips may be faster, but also hotter and reduce the length of battery). It is not easy for a firm to communicate to consumers its realized product quality, because sometimes the innovation is not easy to be felt by consumers, for example, the CPU may be faster by 20%, but for an average consumer, he/she cannot feel that the cellphone is significantly faster. Moreover, quality can be assessed by consumers before they make a final purchase if they exert a reasonable effort. Usually, producers of cellphone have a preview before introducing a new product (for example, Apple always has a preview before a new iPhone is introduced), and many professionals may write “test reports” sharing their feeling in using the new cellphone. So for consumers, if they make an effort to look at the preview or “test reports”, they can assess the quality of the new good before buying it. In addition, consumers can spend time at a store inspecting a new cellphone.

In a monopoly market a separating equilibrium entails price (or advertising) distortions (high price signals high quality and low price signals low cost), e.g., Wilson (1980), Milgrom and Roberts (1982), Milgrom and Roberts (1986), Bagwell and Riordan (1991), Linnemer (2002), Orzach et al. (2002) and Pires and Catalão-Lopes (2011).

To save on space, when needed, we will be suppressing the dependence of beliefs and expected qualities on prices.

Note that the unprejudiced beliefs refinement we employed in the previous section has no bite in refining the pooling equilibria, because no firm can free-ride on the equilibrium signal sent by the competing firm. See also the discussion related to this point in Yehezkel (2008) on page 955.

The intuition is as follows, e.g., Spence (1976). Firms compete for the marginal consumer, whereas a social planner cares about the average consumer. For the marginal consumer, who is located close to the center of the Hotelling line, competition is intense. The high quality firm has an incentive to lower its price below the level that would lead to a price differential equal to the quality differential, an outcome a social planner would choose. As a result more consumers buy the high quality product, in a separating equilibrium, even though this leads to a reduction of the average surplus. In a pooling equilibrium, prices are equal and so the low quality product is relatively inexpensive and hence too few consumers buy the high quality product.

Also, \(\kappa _1<\kappa _2\) if and only if \(t>\frac{(1-q+q^2)DV}{9(1-2q+2q^2)}\).

When \(\kappa \) is low and some consumers switch firms, \(\kappa +t>qDV\) ensures that in a pooling equilibrium both firms have strictly positive market shares.

The market share of the deviating firm cannot exceed 1. This is guaranteed if and only if \(p^{dev}\ge p^{*}+DV-\kappa -t\). Therefore, the lower bound in the interval below must be higher than \(p^{*}+DV-\kappa -t\).

References

Bagwell K, Ramey G (1991) Oligopoly limit pricing. Rand J Econ 155–172

Bagwell K, Riordan MH (1991) High and declining prices signal product quality. Am Econ Rev 224–239

Baye MR, Morgan J, Scholten P et al (2006) Information, search, and price dispersion. Handb Econ Inf Syst 1:323–375

Bester H, Demuth J (2015) Signalling rivalry and quality uncertainty in a duopoly. J Ind Compet Trade 15(2):135–154

Chandra A, Tappata M (2011) Consumer search and dynamic price dispersion: an application to gasoline markets. RAND J Econ 42(4):681–704

Cho I-K, Kreps DM (1987) Signaling games and stable equilibria. Q J Econ 102(2):179–221

Dahlby B, West DS (1986) Price dispersion in an automobile insurance market. J Polit Econ 94(2):418–438

Daughety AF, Reinganum JF (2008) Imperfect competition and quality signalling. RAND J Econ 39(1):163–183

Doval L (2018) Whether or not to open pandora’s box. J Econ Theory 175:127–158

Fluet C, Garella PG (2002) Advertising and prices as signals of quality in a regime of price rivalry. Int J Ind Organ 20(7):907–930

Harrington JE (1987) Oligopolistic entry deterrence under incomplete information. RAND J Econ 211–231

Hertzendorf MN, Overgaard PB (2000) Will the high-quality producer please stand up? A model of duopoly signaling. Department of Economics, University of Aarhus, draft

Hertzendorf MN, Overgaard PB (2001) Price competition and advertising signals: signaling by competing senders. J Econ Manag Strat 10(4):621–662

Janssen MC, Roy S (2010) Signaling quality through prices in an oligopoly. Games Econ Behav 68(1):192–207

Linnemer L (2002) Price and advertising as signals of quality when some consumers are informed. Int J Ind Organ 20(7):931–947

Milgrom P, Roberts J (1982) Limit pricing and entry under incomplete information: an equilibrium analysis. Econometrica 443–459

Milgrom P, Roberts J (1986) Price and advertising signals of product quality. J Polit Econ 94(4):796–821

Mirman LJ, Santugini M (2019) The informational role of prices. Scand J Econ 121(2):606–629

Orzach R, Overgaard PB, Tauman Y (2002) Modest advertising signals strength. RAND J Econ 340–358

Orzach R, Tauman Y (1996) Signalling reversal. Int Econ Rev 453–464

Petrikait V (2021) Escaping search when buying. Working paper

Pires CP, Catalão-Lopes M (2011) Signaling advertising by multiproduct firms. Int J Game Theory 40(2):403–425

Rob R (1985) Equilibrium price distributions. Rev Econ Stud 52(3):487–504

Schultz C (1999) Limit pricing when incumbents have conflicting interests. Int J Ind Organ 17(6):801–825

Spence M (1976) Product selection, fixed costs, and monopolistic competition. Rev Econ Stud 43(2):217–235

Vida P, Honryo T (2021) Strategic stability of equilibria in multi-sender signaling games. Games Econ Behav 127:102–112

Wilson CA (1980) The nature of equilibrium in markets with asymmetric information. Bell J Econ 11:108–130

Wolinsky A (1983) Prices as signals of product quality. Rev Econ Stud 50(4):647–658

Yehezkel Y (2008) Signaling quality in an oligopoly when some consumers are informed. J Econ Manag Strat 17(4):937–972

Acknowledgements

We would like to thank an Associate Editor, two Referees, Kaniska Dam, Ricardo Serrano-Padial and seminar participants at 2021 IIOC and 2021 ASSET for very helpful comments. Minghua Chen thanks the support by the Guanghua Talent Project of Southwestern University of Finance and Economics.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

A Appendix: Beliefs and proofs of Lemmas and Propositions

A Appendix: Beliefs and proofs of Lemmas and Propositions

1.1 A.1 Unprejudiced beliefs

In the table below we use \(p_H^{*}(HL)=p_H^{*}(LH)\equiv p_H^{*}\) and \(p_L^{*}(HL)=p_L^{*}(LH)\equiv p_L^{*}\). The ex-ante beliefs \(\mu _{a}^{e}(p_{a},p_{b})\) and \(\mu _{b}^{e}(p_{a},p_{b})\) of a firm having a high quality product are defined over the equilibrium price pairs and over price pairs in which one price is an equilibrium price for a given product quality configuration, while the other may be an equilibrium price for a different quality configuration, or a non-equilibrium price. However, they are not defined over price pairs where both prices are non-equilibrium prices, as we solve the game by only considering unilateral deviations and consumer beliefs are consistent with this. (We do not present the cases that are symmetric to the ones that are already in the table).

\(p_{a}=\) | \(p_{b}=\) | possible quality configurations | \(\mu _{a}^{e}(p_{a},p_{b})\) | \(\mu _{b}^{e}(p_{a},p_{b})\) |

|---|---|---|---|---|

\(p_{H}^{*}\) | \(p_{H}^{*}\) | (H, L)(L, H) | \(\frac{1}{2}\) | \(\frac{1}{2}\) |

\(p_{H}^{*}\) | \(p_{L}^{*}\) | (H, L) | 1 | 0 |

\(p_{H}^{*}\) | \(p^{*}\) | (H, H)(H, L)(L, L) | \(\frac{q^{2}+q(1-q)}{q^{2}+q(1-q)+(1-q)^{2}}\) | \(\frac{q^{2}}{q^{2}+q(1-q)+(1-q)^{2}}\) |

\(p_{H}^{*}\) | \(\ne \{p_{H}^{*},p_{L}^{*},p^{*}\}\) | (H, L) | 1 | 0 |

\(p_{L}^{*}\) | \(p_{L}^{*}\) | (H, L)(L, H) | \(\frac{1}{2}\) | \(\frac{1}{2}\) |

\(p_{L}^{*}\) | \(p^{*}\) | (H, H)(L, H)(L, L) | \(\frac{q^{2}}{q^{2}+q(1-q)+(1-q)^{2}}\) | \(\frac{q^{2}+q(1-q)}{q^{2}+q(1-q)+(1-q)^{2}}\) |

\(p_{L}^{*}\) | \(\ne \{p_{H}^{*},p_{L}^{*},p^{*}\}\) | (L, H) | 0 | 1 |

\(p^{*}\) | \(p^{*}\) | (H, H)(L, L) | \(\frac{q^{2}}{q^{2}+(1-q)^{2}}\) | \(\frac{q^{2}}{q^{2}+(1-q)^{2}}\) |

\(p^{*}\) | \(\ne \{p_{H}^{*},p_{L}^{*},p^{*}\}\) | (H, H)(L, L) | \(\frac{q^{2}}{q^{2}+(1-q)^{2}}\) | \(\frac{q^{2}}{q^{2}+(1-q)^{2}}\) |

1.2 A.2 Proof of Lemma 1

A candidate symmetric equilibrium when firms have the same quality, (H, H) or (L, L), is (t, t). Any other symmetric pair of prices when firms have the same product quality cannot be an equilibrium. To see this suppose \((p^{*},p^{*})\ne (t,t)\) is a candidate equilibrium in the (H, H) and (L, L) cases. Consumers, upon observing \((p^{*},p^{*})\) in equilibrium, know that firms have the same quality products. If a firm can unilaterally deviate to \(p^{dev}\) without affecting consumer beliefs, then it is clearly better off, since \(p^{*}\) is not a best response to \(p^{*}\). Any \(p^{dev}\ne p_H^{*}(HL)\) or \(p^{dev}\ne p_L^{*}(HL)\), leaves consumer beliefs unchanged because consumers observe \((p^{dev},p^{*})\) and realize from the price of the non-deviating firm \(p^{*}\) that product qualities are the same. If it happens that the best deviating price is equal to \(p_H^{*}(HL)\) or \(p_L^{*}(HL)\), in which case consumers may not know for sure who is the deviating firm and what the product qualities are, the deviating firm can set a price \(\varepsilon \) away from \(p_H^{*}(HL)\) or \(p_L^{*}(HL)\), so that consumer beliefs are unchanged, and still be better off.

Next, assume that \((p^{*}_H(HL), p^{*}_L(HL))\) is not equal to the complete information prices given by (1). Then, given the beliefs in Appendix A.1, firm a can deviate to its best response \(BR_a(p^{*}_L(HL))\ne p^{*}_H(HL)\) and become better off. Consumers believe that the deviating firm is high quality, based on the price of the non-deviating firm. The unique equilibrium under the unprejudiced beliefs is the complete information equilibrium.

1.3 A.3 Proof of Lemma 2

Firm a has high and firm b has low product qualities, (H, L). The equilibrium prices are \((p^{*}_H(HL),p^{*}_L(HL))\). We begin with firm b’s deviation, from \(p_b=p_L^{*}(HL)\) to \(p_b^{dev}\). Firm b can deviate to \(p_H^{*}(HL)\), to \(p^{*}=t\) or to any other price.

First, we assume that \(p_b^{dev}=p^{*}_H(HL)\). Consumers observe \((p^{*}_H(HL), p^{*}_H(HL))\) and do not know which firm is the low quality firm, although they know that one firm must be of low quality (given the unprejudiced beliefs consumers know that it cannot be (H, H) or (L, L), because if that was the case one price must have been t). Therefore, from the beliefs in Appendix A.1 we have \(\mu _a^e=\mu _b^e=\frac{1}{2}\) and hence \(\Delta V^{e}=0\) and the marginal consumer \(x^{e}\), given by (2), is at \(\frac{1}{2}\). Consumers then who visit either firm realize that firm a is the high quality firm and firm b has a low quality product and is the one that deviated, that is \(\Delta V_a^{in}=\Delta V_b^{in}=DV\). Some may switch from b to a, if \(\kappa <DV\), but no consumer from a will switch to b. The interim marginal consumer is \(x_b^{in}\) given by (3). Since \(\Delta V=DV>\Delta _b^{in}-\kappa =DV-\kappa \) the final marginal consumer is \(x_b^{in}\). This deviation is unprofitable if and only if

Second, we assume that \(p_b^{dev}=p^{*}=t\). Consumers observe \((p^{*}_H(HL),t)\) and know that it cannot be (L, H), because the candidate equilibrium prices in this case are \((p^{*}_L(LH),p^{*}_H(LH))\) and both firms would have to have deviated, for which unprejudiced beliefs assign probability zero. But consumers do not know whether it is (H, H) or (L, L) and one firm raised its price, or (H, L) and the low quality firm deviated. From the ex-ante beliefs presented in Appendix A.1 we have \(\mu _a^e=\frac{q^2+q(1-q)}{q^2+(1-q)^2+q(1-q)}\) and \(\mu _b^e=\frac{q^2}{q^2+(1-q)^2+q(1-q)}\). So, the expected values for the two firms’ products are

with \(EV_a>EV_b\). Consumers initially sort out according to (2) using the above expected qualities for each firm. The marginal consumer is given by

The consumers who visit firm b they realize that its quality is low and update their beliefs about the quality of firm a by ruling out (H, H). The interim beliefs of the consumers who visited b about the quality of a being high is \(\mu ^{in}_{ab}=\frac{q(1-q)}{(1-q)^2+q(1-q)}\). Using these beliefs, the expected quality of firm a for consumers who first visit b is \(EV^{in}_a=\frac{q(1-q)V_H+(1-q)^2V_L}{(1-q)^2+q(1-q)}\). The interim marginal consumer, using (3), is given by

Some consumers will switch from b to a if and only if \(x^{in}_b>x^{e}\Leftrightarrow \kappa <\kappa _2\equiv \frac{q^3}{1-q+q^2}DV. \)

Also it is clear that no consumer will switch from a to b, since a is high quality.

To summarize, when \(p_b^{dev}=t\), if \(\kappa <\kappa _2\), then \(x_b^{in}\) is the relevant marginal consumer, while if \(\kappa \ge \kappa _2\) the relevant marginal consumer is \(x^{e}\).

We first assume that \(\kappa <\kappa _2\). Firm b will not find a deviation from \(p^{*}_L(HL)\) to t profitable if and only if

The RHS of (9) is higher than the RHS of (7) if and only if \(\kappa <\frac{DV(p^{*}_H(HL)-qt)}{p^{*}_H(HL)-t}\), which holds in the case we are in, since \(\kappa _2<\frac{DV(p^{*}_H(HL)-qt)}{p^{*}_H(HL)-t}\). So, the relevant constraint is only (9).

Firm b can also deviate to \(p_b^{dev}\ne t\) and \(p_b^{dev}\ne p^{*}_H(HL)\). In this case consumers observe \((p^{*}_H(HL), p_b^{dev})\) and immediately realize from \(p^{*}_H(HL)\) that firm a has high quality and firm b has low quality. Therefore, only the complete information prices given by (1) ensure that such a deviation is unprofitable.

Using (1), the no deviation constraint (9) is satisfied if and only if \(\kappa \le \kappa _1\equiv \frac{DV(DV-9t(1-q))}{9t}\).Footnote 7 Therefore, the low quality firm does not find a deviation profitable if \(\kappa \le \min \left\{ \frac{DV(DV-9t(1-q))}{9t}, \frac{q^3}{1-q+q^2}DV \right\} \).

Note that \(\frac{DV(DV-9t(1-q))}{9t}<\frac{q^3}{1-q+q^2}DV\), because even when \(\frac{(DV-9t(1-q))}{9t}\) attains its maximum, which happens for \(DV=3t\) and \(q=1\) and \(\frac{q^3}{1-q+q^2}\) attains its minimum which happens for \(q=\frac{1}{2}+\frac{\sqrt{21}}{14}\), it is still the case that \(\frac{DV(DV-9t(1-q))}{9t}<\frac{q^3}{1-q+q^2}DV\). Therefore, \(\frac{q^3}{1-q+q^2}DV\) never binds and the constraint is \(\kappa \le \frac{DV(DV-9t(1-q))}{9t}\).

In what follows, we show that there is a profitable deviation when \(\kappa \ge \kappa _2\). Let assume that \(\kappa \ge \kappa _2\). Firm b will not find a deviation from \(p^{*}_L(HL)\) to t profitable if and only if

The RHS of (10) is higher than the RHS of (7) if and only if

After we substitute \(p^{*}_H(HL)\) from (1) the above inequality becomes

We have that \(\kappa _3>\kappa _2\). As a result, for \(\kappa \in \left[ \kappa _2,\kappa _3\right] \) the relevant constraint is (10), whereas for \(\kappa >\kappa _3\) the relevant constraint is (7).

When the relevant constraint is (10), using (1), the no deviation constraint is satisfied for \(t<\frac{(1-q+q^2)DV}{9(1-2q+2q^2)}\). However, this contradicts assumption 1.

When the relevant constraint is (7), using (1), the no deviation constraint is satisfied for \(\kappa <\kappa _4\equiv \frac{4DV^2}{3(3t+DV)}\). Also, \(\kappa _4>\kappa _3\) if and only if \(t<\frac{(1-q+q^2)DV}{9(1-2q+2q^2)}\). However, this contradicts assumption 1.

We need \(q>\frac{2}{3}\) to ensure that \(\frac{DV(DV-9t(1-q))}{9t}>0\) and Assumption 1 is satisfied.

Now let’s turn to firm a’s incentive to deviate. Equilibrium profits for the high quality firm are increasing in the quality difference \(V_a-V_b\), which is the highest in equilibrium: any deviation on part of firm a, as we have demonstrated above, will decrease the expected quality of a and will increase that of b. Consumers will attach some probability that firm a is of low quality and firm b is of high quality. Thus, firm a who has high quality has no incentive to deviate.

1.4 A.4 Proof of Lemma 3

Both firms have high quality products, (H, H). The candidate equilibrium prices are \((p^{*}, p^{*})=(t,t)\) and the equilibrium profits \(\pi _a=\pi _b=\left( \frac{t}{2},\frac{t}{2}\right) \).

First, let’s consider firm a’s deviation to \(p_a^{dev}=\frac{DV}{3}+t\). Consumers, upon observing \(\left( \frac{DV}{3}+t, t\right) \), realize that one firm has deviated. So, it can be (H, H), or (L, L) and one firm raised its price to \(\frac{DV}{3}+t\), or (H, L) and the low quality firm raised its price to t (they can, however, rule out (L, H), given the unprejudiced beliefs). The ex-ante consumer beliefs about expected product qualities are given by (8). Consumers initially sort out according to (2), using (8)

After consumers visit firm a they realize that its product is of high quality and they update their beliefs about firm b being high quality, by eliminating (L, L), to \(\mu _{ba}^{in}=\frac{q^2}{q^2+q(1-q)}\). Hence, firm b’s expected product quality, for the consumers who visited a first, is \(EV^{in}_b=\frac{q^2V_H+q(1-q)V_L}{q^2+q(1-q)}\). The interim marginal consumer for a, using (3), must satisfy

Some consumers will switch from a to b if and only if \(x^{in}_a<x^{e}\Leftrightarrow \kappa <-\frac{(1-q)^3DV}{1-q+q^2}\). So, no such switching takes place. Also, no consumer will switch from b to a. This is because those who visited b first had a belief that a had a higher expected quality than b and after their visit to b they realize that both have the same quality. Therefore, the relevant marginal consumer for firm a is \(x^{e}\).

Hence, a deviation is unprofitable if and only if

which holds if and only if

Recall that we need \(3t>DV\), assumption 1. From above we have \(t\le \frac{(1-2q)^2DV}{9q(1-q)}\). The two conditions hold simultaneously if and only if \(q<\frac{1}{2}-\frac{\sqrt{21}}{14}\), or \(q>\frac{1}{2}+\frac{\sqrt{21}}{14}\).

Second, firm a can deviate to \(p_a^{dev}\ne \frac{DV}{3}+t\). Consumers do not know whether it is (H, H) or (L, L), but they know that firms have the same quality and one firm has deviated. Therefore, such a deviation will not be profitable.

Finally, it is easy to see that if a firm does not want to deviate to \(\frac{DV}{3}+t\), then it would not want to deviate to \(-\frac{DV}{3}+t\). This is because in this case the initial consumer beliefs about the expected quality difference is tilted in favor of firm b and a firm’s profit is increasing in the quality differential.

1.5 A.5 Proof of Lemma 4

Both firms have low quality products, (L, L). The candidate equilibrium prices are \((p^{*}, p^{*})=(t,t)\) and the equilibrium profits \(\pi _a=\pi _b=\left( \frac{t}{2},\frac{t}{2}\right) \).

First, let’s consider firm a’s deviation to \(p_a^{dev}=\frac{DV}{3}+t\). Consumers, upon observing \(\left( \frac{DV}{3}+t, t\right) \), realize that one firm has deviated. So, it can be (H, H), or (L, L) and one firm raised its price to \(\frac{DV}{3}+t\), or (H, L) and the low quality firm raised its price to t (it cannot be (L, H), since we assume unprejudiced beliefs). The initial consumer beliefs about expected product qualities are given by (8), where \(EV_a\ge EV_b\). Consumers initially sort out according to (2), using (8), which yields the same \(x^{e}\) as in (11).

After consumers visit firm a they realize that its product is of low quality and they update their beliefs, by eliminating (H, H), and (H, L), so they also learn the quality of firm b, that is \(EV_b^{in}=V_L\). The interim marginal consumer for a, using (3), must satisfy

Some consumers will switch from a to b if and only if \(x^{in}_a<x^{e}\Leftrightarrow \kappa <\frac{q(1-q)DV}{1-q+q^2}\) (where \(x^{e}\) is given by (11)). Consumers who visit firm b first, eliminate (H, H), but do not know whether it is (L, L) or (H, L). So their updated beliefs about firm a being high quality is \(\mu _{ab}^{in}=\frac{q(1-q)}{q(1-q)+(1-q)^2}\). The expected product quality of firm a becomes \(EV_a^{in}=\frac{q(1-q)V_H+(1-q)^2V_L}{q(1-q)+(1-q)^2}>V_L\). The interim marginal consumer for a, using (3), must satisfy

Some consumers will switch from b to a if and only if \(x^{in}_b>x^{e}\Leftrightarrow \kappa <\frac{q^3DV}{1-q+q^2}\) (where \(x^{e}\) is given by (11)). But if consumers who visited b first switch to a, they realize that a’s product is of low quality. Given that they initially visited b with the expectation that a has higher quality, \(EV_a\ge EV_b\), and now, after they have sunk the cost \(\kappa \), they realize that both firms have low quality, they, as we have assumed, costlesly return to b. Therefore, no consumer will switch from b to a.

Thus, there are the following two different cases that we should examine.

Case 1: If \(\kappa \le \frac{q(1-q)DV}{1-q+q^2}\), then the market share of the deviating firm a is \(x^{in}_a\).

Case 2: If \(\kappa \ge \frac{q(1-q)DV}{1-q+q^2}\), then the market share of the deviating firm a is \(x^{e}\).

We analyze each one of these two cases below.

When \(\kappa \le \frac{q(1-q)DV}{1-q+q^2}\), a deviation on part of firm a is unprofitable if and only if

which holds if and only if

When \(\kappa \ge \frac{q(1-q)DV}{1-q+q^2}\), a deviation on part of firm a is unprofitable if and only if

which holds if and only if

Notice that we need \(3t>DV\), assumption 1. From above we have \(t\le \frac{(1-2q)^2DV}{9q(1-q)}\). The two conditions hold simultaneously if and only if \(q<\frac{1}{2}-\frac{\sqrt{21}}{14}\), or \(q>\frac{1}{2}+\frac{\sqrt{21}}{14}\).

The next two cases are the same as in the (H, H) case.

Firm a can deviate to \(p_a^{dev}\ne \frac{DV}{3}+t\). Consumers do not know whether it is (H, H) or (L, L), but they know that firms have the same quality and one firm has deviated. Therefore, such a deviation will not be profitable.

Finally, it is easy to see that if a firm does not want to deviate to \(\frac{DV}{3}+t\), then it would not want to deviate to \(-\frac{DV}{3}+t\). This is because in this case the initial consumer beliefs about the expected quality difference is tilted in favor of firm b and a firm’s profit is increasing in the quality differential.

1.6 A.6 Proof of Theorem 1

First, from Lemma 3, we need \(t\le \frac{(1-2q)^2 DV}{9q(1-q)}\). Also, \(q>\frac{1}{2}+\frac{\sqrt{21}}{14}\approx 0.8273\) (recall from Lemma 2 that \(q>\frac{2}{3}\), so \(q<\frac{1}{2}-\frac{\sqrt{21}}{14}\) is eliminated). Combined with assumption 1, \(DV\in \left[ \frac{9q(1-q)t}{(1-2q)^2}, 3t\right) \). When we combine the conditions from Lemmas 2, 3 and 4 , we arrive at the following conditions that must be satisfied

-

\(\kappa \le \min \left\{ \frac{DV(DV-9t(1-q))}{9t}, \frac{(DV)^2}{3(DV+3t)}, \frac{q(1-q)DV}{1-q+q^2}\right\} \)

-

or, \(\frac{DV(DV-9t(1-q))}{9t}\ge \kappa \ge \frac{q(1-q)DV}{1-q+q^2}\).

Next, note that \(\frac{(DV)^2}{3(DV+3t)}\ge \frac{q(1-q)DV}{1-q+q^2}\) if and only if \(t\le \frac{(1-2q)^2 DV}{9q(1-q)}\). Therefore, \(\frac{(DV)^2}{3(DV+3t)}\) is redundant. Hence, the constraints become

-

\(\kappa \le \min \left\{ \frac{DV(DV-9t(1-q))}{9t}, \frac{q(1-q)DV}{1-q+q^2}\right\} \)

-

or, \(\frac{DV(DV-9t(1-q))}{9t}\ge \kappa \ge \frac{q(1-q)DV}{1-q+q^2}\),

which suggests that the only relevant constraint is \(\kappa \le \frac{DV(DV-9t(1-q))}{9t}\).

1.7 A.7 Proof of Lemma 5

We assume that firm \(j=a\) (located at 0) sets the pooling equilibrium price \(p^{*}\), while firm \(i=b\) (located at 1) deviates by setting its best response, \(BR_i(p^{*})\), and the deviator is perceived as low quality.

We are in the (H, L) case and the low quality firm deviates. Consumers who visit b first confirm their beliefs and do not switch, while consumers who visit a first realize that its quality is higher than the average quality and do not switch either. The deviation profit is given by \(p^{dev}(1-x^e)\), where \(x^e\) is given by (2) with \(\Delta V^e=\overline{V}-V_L=qDV\). The maximum deviation profit is \(\frac{(p^{*}+t-qDV)^2}{8t}\). On the equilibrium, consumers who visit the low quality firm, firm b, realize that its quality is lower than the average. So, \(\Delta V^{in}_b-\Delta V^{e}=\overline{V}-V_L-0=qDV\), but since \(\kappa \ge qDV\) no consumer switches from b to a. Furthermore, those who visit a realize its quality is high and they stay. Hence, the pooling equilibrium profits is \(\frac{p^{*}}{2}\), which is higher than the deviation profit if and only if

Now we are in the (L, H) state and we assume that the high quality firm deviates. No consumer switches from b to a, since b is actually high quality. Those who visit a realize its quality is low but they believe b is also low, so \(\Delta V^{in}_a=0\). Given that \(\Delta V^e=\overline{V}-V_L=qDV\), we have \(\Delta V^{e}-\Delta V^{in}_a=qDV\) and since \(\kappa \ge qDV\) no consumer switches from a to b. This implies that the maximum deviation profit is the same as when the low quality firm deviated. Hence, the no deviation pooling price range (12) does not change.

Now we assume that we are in the (L, L) case. For the consumers who first visit a we have \(\Delta V^e-\Delta V_a^{in}=qDV+0=qDV\). For the consumers who first visit b we have \(\Delta V_b^{in}-\Delta V^e=qDV-qDV=0\). Since \(\kappa \ge qDV\), no consumer switches firms. The profit of the deviating firm is the same as in the (H, L) case above. The same is true in the (H, H) case. Therefore, the no deviation price range is given by (12).

So, it is possible to support any \(p^{*}\) in (12) as a pooling equilibrium with beliefs \(\mu _i(p,p^{*})=0\) for any \(p\ne p^{*}\) and \(i=a,b\).

1.8 A.8 Proof of Lemma 6

We assume that firm \(j=a\) (located at 0) sets the pooling equilibrium price \(p^{*}\), while firm \(i=b\) (located at 1) deviates by setting its best response, \(BR_i(p^{*})\), and the deviator is perceived as low quality. This is in the ex-ante sense, as consumers will update their ex-ante beliefs after visiting a firm.Footnote 8

Let’s start with the (L, H) case. We assume that the high quality firm deviates. Since the high quality firm is perceived as low the consumers who first visit b stay. For the consumers who visit a first we have \(\Delta V^e-\Delta V_a^{in}=qDV\) and since \(\kappa <qDV\) some switch to b. These consumers discover that the quality of b is higher than expected and purchase from b. Hence, the relevant marginal consumer is \(x_a^{in}\), given in (3), with \(\Delta V^{in}_a=0\). The deviation profit is given by \(p^{dev}(1-x_a^{in})\). The maximum deviation profit for the high quality firm is \(\frac{(p^{*}+t-\kappa )^2}{8t}\). The equilibrium profit of the high quality firm is given by \(p^{*}(1-x_a^{in})=\frac{p^{*}(t-\kappa +qDV)}{2t}\), where \(x_a^{in}\) is given in (3) with prices equal to \(p^{*}\) and \(\Delta V^{in}_a=V_L-\overline{V}=-qDV\), since some consumers who visit firm a, who is low quality, will also visit firm b, on the expectation of average quality, and since b is of high quality they buy from it. Such a deviation is not profitable if and only if

where the subscript of \(\Omega \) indicates the state and the superscript the firm that deviates.

Now assume we are in the (H, L) state and the low quality firm deviates from \(p^{*}\). The consumers who visit the high quality firm a realize that it has a higher quality than what they expected and those who visit b confirm their ex-ante beliefs. The search cost \(\kappa \) has no effect on the deviation profits, so the ex-ante and interim marginal consumers coincide. The deviation profit is \(p^{dev}(1-x^e)\), where \(x^e\) is given by (2) with \(\Delta V^e=\overline{V}-V_L=qDV\). The maximum deviation profit of the low quality firm is \(\frac{(p^{*}+t-qDV)^2}{8t}\). The equilibrium profit of the low quality firm is \(p^{*}(1-x_b^{in})=\frac{p^{*}(t+\kappa -qDV)}{2t}\), where \(x_b^{in}\) is the relevant marginal consumer, given by (3), with prices equal to \(p^{*}\) and \(\Delta V^{in}_b=\overline{V}-V_L=qDV\). Some consumers on the equilibrium path who visit firm b realize that its quality is low and switch to a and stay (since its quality is high). Such a deviation is not profitable if and only if

Now we assume that we are in the (L, L) case. We have \(\Delta V^e=\overline{V}-V_L=qDV\). For the consumers who first visit a we have \(\Delta V^e-\Delta V_a^{in}=qDV-0=qDV\). For the consumers who first visit b we have \(\Delta V_b^{in}-\Delta V^e=qDV-qDV=0\). If \(\kappa < q\Delta V\), only some consumers who visit a switch to b. Since \(\kappa >\Delta V-\Delta V_a^{in}=0-0=0\) it must be that \(x^f=x_a^{in}\). The deviation profit is \(p^{dev}(1-x_a^{in})\). The maximum deviation profit is \(\frac{(p^{*}+t-\kappa )^2}{8t}\). The equilibrium profit is \(\frac{p^{*}}{2}\). Such a deviation is not profitable if and only if

Finally, we assume that we are in the (H, H) case. The high quality firm deviates and is perceived as low quality. No consumer switches firms, since both firms are of high quality. The deviation profit is \(p^{dev}(1-x^e)\), where \(x^e\) is given by (2) with \(\Delta V^e=\overline{V}-V_L=qDV\). The maximum profit of the deviating firm is \(\frac{(p^{*}+t-qDV)^2}{8t}\). The equilibrium profit is \(\frac{p^{*}}{2}\). Such a deviation is not profitable if and only if

Let \(\Omega \equiv \Omega _{LH}^H\cap \Omega _{HL}^L\cap \Omega _{LL}\cap \Omega _{HH}\) be the intersection of the four sets, (13)–(16). If \(p^{*}\in \Omega \), then no firm finds a deviation from \((p^{*}, p^{*})\) profitable if it is perceived as low quality, regardless of the quality of the rival. The set \(\Omega \) is non-empty for high values of \(\kappa \). When \(\kappa =qDV\), \(\Omega =\left[ t+qDV-2\sqrt{tqDV}, t+qDV+2\sqrt{tqDV}\right] \). Note that in this case \(\Omega \) coincides with the price range when \(\kappa \ge qDV\), see Lemma 5. The higher the tqDV the higher the price range. By continuity, \(\Omega \) is non-empty for \(\kappa \)’s less than (but close to) qDV. But when \(\kappa =0\), the \(\Omega _{LL}\) collapses to t, while the \(\Omega _{HL}^L\) collapses to \(t-qDV\). Therefore, \(\Omega \) is empty, implying that for \(\kappa \)’s close to 0 there does not exist a pooling equilibrium.

1.9 A.9 Proof of Proposition 1