Abstract

Technological evolution is widely thought to be the primary process that brings about economic growth. It is one of the main targets of evolutionary economics, but how technological change induces economic growth has remained unexplained. Based on the new theory of value, this paper explains how technological change leads to long-run improvement in real wage rates and income per capita. Section 2 gives a brief overview of the new theory and presents two theorems (minimal price and the convergence theorem) that afford the basis of analyses in Sections 4 and 5. Before these, Section 3 compares two price systems, traditional and new, and compares efficiency from two points of view. Traditionally economics with equilibrium has been concerned with those conditions that provide allocative efficiency. However, technological evolution comprises a series of half-blind selections of ‘better’ production techniques and exhibits another kind of efficiency that can be named dynamic efficiency. The latter is more important than the former. Allocative efficiency is self-destructive, while dynamic efficiency is cumulative in its effects. Section 4 shows how technological change works cumulatively and how it leads to real wage increases and income per capita. Section 5 shows that the new theory can explain the emergence and growth of global value supply chains as a part of technology choice arising through international trade. This paper is mainly focused on supply-side theory, while problems concerning the demand side are considered in Section 6. Section 7 concludes.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction*

* This paper is based on the paper read at the 17th International Joseph Schumpeter Society conference 2018, which took place 2 July-4 July 2018 at Seoul. The original title was “Microfoundations of Evolutionary Economics”. As this is the same as that of a book (Shiozawa, Morioka and Taniguchi 2019) on which we base our new theory, we have changed the title to a more suitable one.

Technological evolution is normally thought to be the primary force that brings about economic growth (Freeman 1988). After a detailed survey of three major growth theories (classical, new or endogenous, and evolutionary growth theory), Sredojević et al. (2016) show that all three theories assert this as fact. But growth theories exhibit a strange phenomenon. None give a detailed mechanism showing how technological change induces economic growth. The fact that it does is assumed as self-evident or trivial. Evolutionary economics is no exception in this regard.

Technological change is one of the main foci of evolutionary economics, as is confirmed by Nelson and Winter (2002), the originators of evolutionary theorizing. Their 40 page survey covers 120 sources. In the section on technology and economic growth, the authors identify an important strand in evolutionary economics that “has been concerned with understanding technological advance and economic growth largely driven by advances in technology”. Undoubtedly technological progress is a major source of economic growth (Nelson and Winter 2002 p.38, Nelson et al. 2018 pp.36, 145, 149), but no theory on how technological change induces economic growth is mentioned.

In a more recent book, Nelson et al. (2018), two chapters (Chapters 2 and 4) are devoted to technological change and its effects, but no research is reported except for two groups that connect technological change and economic growth (Sections 5.3 and 5.5). One of these works with one sector economy models. In such models, technological change is treated as something that is directly connected to economic growth. If it is not purely tautological, there is at least no detailed examination of how technological change brings about economic growth. The connection is simply assumed. The second group, works with multisector evolutionary growth models, and is represented by works of Pasinetti (1993), Saviotti (2001) and Saviotti and Pyka (2013, 2017), to cite only the most recent. However, Pasinetti’s structural dynamics is defined on a “pure labour economy”, while inter-industrial complexity is abstracted. Saviotti and Pyka focuses on the effects of introducing product variety rather than the improvement of production processes.Footnote 2 Therefore, in spite of the fact that it is widely admitted, the mechanism by which changes in production techniques induce economic growth is not theoretically explored. This paper tries to fill this curious lacuna in the theory of economic growth by using what we call here the new theory of value.

The new theory of value is a modern version of classical theory of value, in sharp opposition with neoclassical theory of value. Traditionally, the neoclassical theory of prices, or ‘economics with equilibrium’, has been concerned with identifying the set of conditions that provides allocative efficiency. However, technological progress is a different thing from allocative efficiency, or it exhibits a much more dynamic and distinctly cumulative process. As Nelson and Winter (1974), Freeman (1988) and Dosi (1988) have argued, the Walrasian framework as represented by Arrow and Debreu (1954) is not a truly suitable framework for analyzing technological change. A more radical approach is required. Technological evolution comprises a series of half-blind selections of ‘better’ production techniques. Each successive change may be small, but their effects are cumulative. The final effect becomes very big and can be seen to be evolutionary. This paper explains how dynamic efficiency arises and how it is sustained, in the course of which the roots of capitalism’s dynamism are revealed.

This theory of value is relatively new and we give a brief overview in Section 2. In Section 3 we compare the new theory of value with traditional price theory. Since the time of Ricardo, two completely different price theories have existed. One, based on “demand and supply law”, became mainstream after the neoclassical revolution in economics. The other is the classical theory of value. We contend that the latter alone is able to provide a good framework for investigating technological change and its effect on the economy as a whole. This does not mean, however, that the new framework is in contradiction with what evolutionary economics has so far accumulated. On the contrary, the new framework provides a connecting principle (Loasby 1991) for the diverse body of knowledge on technological change. It is a framework that is history-friendly, as is remarked in Subsection 4.6.

Section 4 describes how firms choose among newly discovered production techniques. These choices are in a sense almost blind ones, but this section shows that they can bring about the durable, cumulative result of increasing the real wage rate. Section 5 shows that international specialization is the simple consequence of exercising choice between possible production techniques. It also explains how the new theory can explain the emergence and rapid growth of global value chains. The new framework is supply-side theory, it needs to be supplemented by demand-side theories. Section 6 briefly considers an unsolved question on demand growth in relation to technological evolution. Section 7 then concludes.

2 A modern version of classical value theory

Although many economists do not realize it, since the birth of Classical Political Economy there have been two contrasting price theories: one relies upon the law of demand and supply, the other upon the cost of production. The idea that the relation between demand and supply determines price goes back to well before Adam Smith.Footnote 3 It remains a core idea of the neoclassical economics represented by Arrow and Debreu’s (1954) General Equilibrium Model. The central idea is that it is the prices that bring demand and supply equal (or nearly equal).

On the other hand, the cost of production theory of value has been misunderstood by most economists. Ricardo had the comparatively radical idea that values are determined by production costs and not by the proportionality of demand and supply (Ricardo 1951[1821] Ch. 30). Although he was explicitly opposed to the latter idea, except for giving rise to effects of temporary duration, he was not well understood by his contemporaries. Thus his influence was only temporary and restricted to a few. There is a reason for this. Ricardo’s theory of value had a crucial defect and its correction was only possible in the twentieth century (Shiozawa 2017b). In this section, we provide a modern form of classical value theory, which we call the new theory of value. As the theory is already explained in Shiozawa (2019b), this overview must be concise. Readers are requested to read Shiozawa (2019b) for the details.

2.1 The fundamental premises of the new theory

The new theory is composed of three pillars:

-

(1)

basic independence between prices and quantities.

-

(2)

price theory as a modern extension of Ricardian cost-of-production theory of value.

-

(3)

theory of quantity adjustment process.

Item (1) is posed to reject demand and supply theory. Equilibrium theory from Marshall to Walras assumes that prices and quantities (i.e. demand and supply) are simultaneously determined. The new theory rejects this “common sense” and claims that price and quantities for a product are normally determined independent of the other. Item (2) will be explained in Section 2.2 to 2.7. Item (3) will be explained in Section 2.8.

Another basic premise is the concept of production techniques. We do not use the concept of the production function, which is scarcely more than a notion that production techniques experience common output effects from the variously arising constraints experienced by their inputs.Footnote 4 In reality, a production technique is a set of routines related to the selection of inputs, order of processing, work method, machine operations, team work, actions for tasks and other work routines. If the combination of inputs is changed, the production unit needs to search for and employ a new set of routines. Such a case should be interpreted as creating a different production technique, so a production technique must be defined as the set of routines that permits the output of a specific product using a fixed combination of inputs. The only possible variance is the change of production volume per unit time period (for example, a day or a week).

Thus a production technique is expressed by the combination of an input vector (u, a) and an output vector b, where u is an amount of labor, a is a vector of input coefficients a1, a2, …, aN and b a vector of output coefficients b1, b2, …, bN.. It is assumed here that work force is uniform and labor input is measured by a single number. N denotes the number of all products known to the economy.

In the case of single-product production (i.e. production without joint products), the output vector b can be expressed by the vector that possesses a unique positive component at an entry (single product hypothesis). In the standard form, the unique positive entry is assumed to be 1, i.e. the unit of the product. In this case, a production technique h is specified by the product name g(h) and an input coefficient vector (u, a). We use this expression and expressions such as (u(h), a(h)) when it is necessary to indicate which production technique is concerned. Input coefficients of a production technique are expressed as ui, aij when we speak of a production technique that produces product j and if there is no fear of confusion. The changing of production techniques occupies the main topic of study for the new theory of value and is considered in detail in Sections 4 and 5.

2.2 Pricing of products by firms

The new theory of value postulates that firms set the prices of their products. Merchants who trade these products are also assumed to set their sales prices based on their procurement costs. This fundamental assumption excludes what is often called commodities, i.e. the product that is homogeneous and undifferentiated between producers. This kind of product includes important products such as oil, iron ore, and rare metals. However, in the following, we do not use the word “commodity” in this sense. In the international trade situation (Subsection 2.9 and Section 5), where this term is used, it has a special meaning (See footnotes 18 and 19). Otherwise, it is used interchangeably with the word “product” and describes both goods and services. When we are talking of a firm or production technique, product means the commodity that is produced as output. Commodity is used as goods and services (in an abstract way) that are traded between countries. We assume prices of products remain invariable unless we explicitly state how they move. As all products are differentiated and should be treated as different, the number of all products N should be assumed to be extremely large, for example, tens or hundreds of millions.

The custom of sellers setting product prices is quite old. I have cited in Shiozawa (2019b) the copy of a publicity flyer that Mitsui Takatoshi, the founder of the House of Mitsui, used to proclaim a one-price policy in 1683 (Shiozawa 2019b, p.56, footnote 4). In nineteenth century Europe and North America, cases of public announcements of a one-price policy were still unusual but became widespread in the twentieth century. This policy was long understood as evidence of oligopoly and an imperfect market, but we see such customs firmly and widely established even among small retailers and cafes. Thus, price setting is not evidence of oligopoly and imperfect markets. The widespread custom of price setting simply implies the inadequacy of concepts such as perfect and imperfect markets.

In fact, the price setting custom was observed and reported, under different names by many different economists. Frederic S. Lee (1998) depicts three major names: administered prices, normal-cost prices and mark up prices. Although their names are different, all these report the same feature. It is the producers or sellers who, in general, set product prices.

The principle of price setting is quite simple. Prices are set by the cost-plus principle. If c is the unit cost, the price is set at (1 + m) c, where m is the markup rate. How ‘m’ is determined, and the factors influencing this, is discussed in the next subsection. There are many methods used for this in cost accounting. The new theory of value assumes normal cost accounting practices. In these, depreciation and other indirect fixed costs per unit product are calculated assuming a normal production volume for a period.Footnote 5 The merit of this cost accounting is that the total unit cost remains invariant even if sales and production volume are different from the assumed normal ones.Footnote 6

The counterpart of this price setting is that consumers (or, more generally, procurers) determine how much they buy at the given price. The Marshallian cross, with demand and supply curves, is inapplicable because the supply of product is not immediately determined by the price level of the product.Footnote 7

The merits of markup pricing are three:

-

(1)

The theory gives (at least theoretically) the actual prices that are used in the exchanges. Thus, we are freed from a dual system of natural and market prices.

-

(2)

The new theory provides constancy and stability of prices. It can also specify when prices change.

-

(3)

The minimal price theorem holds for any technology set that is producible. If the set of production techniques changes, the prices move to the new minimal prices (See Subsection 2.7).

Thus, the effects of technological progress in a product or in its production technology are reflected by a change in prices. This is the reason why the new theory of value can be a good framework for the analysis of technological change.

If we understand that what Ricardo simply called “profit”, in his note to the third edition of his Principles (Ricardo 1951[1821] p.47), is a markup component, then it follows that Ricardo was vaguely imagining markup pricing when he insisted that “the cost and value of a thing should be the same” as he meant by cost “‘cost of production‘ including profits” .

One important implication of price setting by producers and sellers is that it is consumers and procurers who decide how many or how much of a product they buy at the set price. Thus, in the economy that the new theory assumes, decision making concerning transactions is divided between two parties: producers (or sellers), who decide the price at which they sell, and consumers (or procurers), who decide the quantities they wish to buy. By this separation of decision variables, transactions become quasi-autonomic (Beer 1972; Whitehead cited by Hayek 1945 p.528). In this economy, there is no haggling. Thanks to this, the cost or price side can be separated from the demand side. Of course, this does not mean that producers and merchants do not consider the demand side. Quantity or demand matters for producers and merchants, because profit from a product is calculated by the formulaFootnote 8:

Even if the markup rate is constant, the profit increases when the sales volume increases. To calculate the profit rate, it is necessary to divide this profit by the total capital, the concept of which is in fact ambiguous. For a firm making accounting projections of its growth potential, rather than taking into account historic capital cost, it is better to take the total amount of capital needed to renew and expand the present production capacity.Footnote 9

2.3 How the markup rates are determined

If we admit that the unit cost of a product is determined by its production technique (and prices of inputs), the markup rate is the unique thing that the management can choose at will in the price setting. However, it does not mean the management can choose it freely. Any product, even if it is differentiated to some extent, is in competition with other differentiated products. If a firm sets a high price on its products, the procurers (consumers and industrial buyers) will choose the relatively cheaper, functionally equivalent product, considering the relative, overall ‘total cost of procurement’ implications of each combination of price and quality of the different but equivalent products of other firms. When abstraction is made of fixed cost, the above cited formula indicates that the profit that a firm can earn in a period is proportional to the product of markup rate and the sold quantity. It is thus necessary that management choose a markup rate or product price at a reasonable level, given all of the elements in its marketing environment. The trouble in this price setting is that it is very difficult to know in advance how much their product will sell at a given price. Ordinary economic calculation that maximizes the expected profit is in reality useless because the sales volume is not a simple function of the product price.Footnote 10 The sales volume depends on many factors, including design of the product, sales network, promotion activities, products of competitors, competitors’ price policy, the mood of purchasers as influenced by the overall economic climate, income level and lifestyles of consumers. Simple formulae cannot be applied. The management learns from experience a ‘good level’ of the markup rate and does not change it easily. This feature is often expressed by saying that markup rates are ‘conventionally determined’.

One question that is seldom posed is to ask the reason why the multiplicative form (1 + m) c is preferred to the adding-up form c + M in price setting (M is the fixed amount of cost plus margin independent of unit cost c). When Harold Hotelling (1929) posed the ‘best price’ setting problem, he used an illustration of a transcontinental railroad.Footnote 11 In this classic case, the best price policy was to set the price in form c + M, where M is determined independent of cost.Footnote 12 In spite of this, we widely observe that prices are set by the multiplicative form and use of the adding-up form is rarely found. This fact may imply that managers think that the sales volume depends on the price proportions rather than price differences. If we assume that the share of the product is simply a function of ratios of prices, then profit maximization implies the multiplicative form with m determined appropriately (Shiozawa 2016b Section 6).

I added this remark in order to point out that the market share function changes as price ratios change when the state of market competition changes. For example, if the share function that producer 1 expects is expressed by p2σ/(p1σ + p2σ) = 1/(1 + p1/p2)σ, we get the multiplication formula and the optimal markup rate m is an decreasing function of σ. This means that the markup rate should be reduced when the price responsiveness of clients increases. I do not enter into the details of the argument, but it is important to note that (1) markup rate is determined or adopted in no arbitrary way but depends on past experience over a long time and (2) it may be reduced when market competition for the product increases. We use this observation in Section 4.

2.4 Price system for the economy as a whole

If we introduce a markup rate for each product, the prices for an N-product economy are determined by the system of equations:

where mj is the markup rate for product j, w the wage rate, uj and ajj the labor and material input coefficients of product i to produce product j and pj the product price. Here it is assumed that there is only one production technique for each product and the workforce is uniform.

This system of equations can be concisely expressed in matrix form:

where I is the identity matrix, M the matrix the diagonal elements of which are mj and off diagonal elements are all 0, u the vector composed of labor input coefficient uj, A the square matrix composed of aji and the vector p is composed of prices pj. The matrices I, M, A are N times N square matrix, and vectors u and p are N-dimensional column vectors. The matrix A is said to be productive in the extended sense if there exists an N-dimensional nonnegative row vector x that satisfies the inequality

or more generally, if (2–5) in the next subsection is satisfied. In the first case, the matrix I − (I + M) A is invertible and its inverse is nonnegative (nonnegative invertibility theorem). It is clear that the price vector p is uniquely determined by the eq. (2-2), because we can express it as

The couple of wage rate w and price system p is called value and denoted as (w, p).

2.5 Choice of production techniques

In the previous subsection, we assumed that there is only one kind of production technique for each product. To analyze the evolution of production techniques, it is necessary to assume there are several, even an infinite number of, production techniques that produce a given product. As we have assumed that all products are differentiated by firms, a product is produced by a firm. Therefore, all production techniques that produce the same product must be known to the same firm. This does not inhibit a firm from producing several different products (multi-product firm).

Suppose there are a finite number of production techniques for each product.Footnote 13 Then, there are in total H = H(1) + … + H(N) production techniques in the economy, where H(i) is the number of production techniques known to the product j (and consequently by the firm that produces the product), and H is the total number of production techniques for all products. Let T be the set of all production techniques. Each production technique h is expressed by input coefficients uh, ah1, ..., ahN. The whole set of production techniques is expressed by

where u(T) is a H-dimensional column vector and A(T) is H × N matrix. We assume that an appropriate order for indices h is chosen and it is fixed once and for all. For the convenience of later expressions, we denote the similar vectors and matrices for any subset S of T, u(S) and A(S) the vector and matrix composed of production techniques belonging to S (set theoretical expression).

The set that contains at least one production technique for all products is called the spanning set, and the minimal spanning set if it only contains N elements. In this case, J(S) and M(S) are N × N diagonal matrices the diagonal element of which at (g(h), g(h)) is 1 and m(h), respectively, and 0 at other places. Note that there are H(1)・ … ・H(N) minimal spanning sets.Footnote 14 This number will be astonishingly big even if H(j) is small. For example, for a small economy with 20 producers and H(j) = 2 for all products, the product is 220, which is of the order of one million. Naturally a question arises. Which price system associated to which minimal spanning set will prevail in the economy when a set of production techniques T is given?. A solution is given in the next subsection.

2.6 Minimal price theorem

If we take a minimal spanning set S randomly, and if it is productive in the extended sense, it defines a value (w, p) and satisfies the equation

However, if we take a production technique k out of S, the unit full cost of production may not be equal to pg(k). It can be smaller or greater than pg(k). In the first case, the firm would replace production technique h that produces product g(k) by k (or another that has smaller unit cost than k). Then the problem arises whether there is a value (w, p) associated with a minimal spanning set S that satisfies the inequality for all production techniques i.e.

Fortunately, we have the following remarkable theorem (Shiozawa 2019b Th. 4.4).

Theorem 2.1 (Minimal price theorem)

For any set of production techniques T that is productive in the extended sense, i.e. when there exists a nonnegative scale vector s = {s(h)} such that

there exists a minimal spanning set S of T such that

and satisfies the following inequality

The price vector p is unique for given T (and M) and is called the minimal price vector for a given wage rate w.

It is important to understand correctly the meaning of the minimal price theorem. The theorem claims a property for an economy as a whole. The existence of a production technique that gives the minimal unit cost for a given value (w, p) is trivial. However, theorem 2.1 assures the existence of a minimal spanning set S that gives a value (w, p), which satisfies (2–6) and (2–7). If we want to choose such a system among the enormous number of minimal spanning sets, the process becomes a quite complicated one. See Subsection 4.3. Minimal prices are always defined with respect to a wage rate w. It is often convenient to call the vector (w, p) minimal value instead of saying that p is the minimal price vector with respect of w.

The second important remark is the range of validity of the minimal price theorem. It holds in a closed economy with uniform work force, but in an international trade situation, one crucial condition, namely the uniformity of wage rates, does not hold. Therefore, the theorem can only be applied for a closed economy. To apply the theorem to an open economy requires that it be practically closed. The open economy case must be treated as a part of an international trade economy and is formulated briefly in Subsection 2.9. The theorem corresponding to Theorem 2.1 for an international economy is Theorem 2.6 but the uniqueness of regular values does not hold in this case. Real wage movement in an international economy is much more complicated than for a closed economy. For this reason, we cannot get similar results to Subsection 4.4 in the international trade situation.

The minimal price theorem has a second but equivalent version.

Corollary 2.2 (Minimal price theorem, 2nd version)

Let T be a set of production techniques that is productive in the extended sense. Let us denote p(S, w) for a minimal spanning set S when they have a price vector defined by (2-6) for the wage rate w. Then there exists a minimal spanning set S* such that

If we recollect the enormity of the number of minimal spanning sets, we see how strong is the theorem. This version also helps in seeing why we call Theorem 2–1 the minimal price theorem. The proof of the corollary is easy if we admit Theorem 2–1. Let p ∗ = p(S∗, w) and take any production technique h in S that produces product j and satisfies inequality (2–7). Then, using the convention that <a(h), p > is a scalar product ah1 p1 + … + ahn pn of one row vector a(h) and one column vector p of the same dimension, we have, for all h in S,

Combining these for all elements h in S in matrix form and by replacing J(S) by I, we get

If S has a positive value associated with it, then matrix {I − (I + M(S))A(S)} is nonnegatively invertible. Multiplying {I − (I + M(S))A(S)}−1 from the left to the inequality above, we get

The left hand side is equal to p from (2–9) for all h in S. QED.

A value (w, p) that satisfies (2–6) and (2–7) is called admissible. For any admissible vector (w, p), the production technique h that satisfies equation

is called competitive. Other production techniques are not competitive.

We have as an important corollary to Theorem 2–1 (Shiozawa 2019b Th. 4.9):

Theorem 2.3 (Covering property)

For any set of production techniques T that is productive in the extended sense, let p be the minimal price vector with respect to wage rate w and S be a minimal spanning set that satisfies the eq. ( 2-6 ). Then, as long as labor and input goods or services are provided, any nonnegative final demand d can be produced competitively as a net product by production techniques in S, i.e. there exists a production scale vector s that satisfies the equality:

The existence of S means that a system of input-output can produce competitively any final demand of the economy as long as sufficient labor power is provided. Let S# be the set of all competitive production techniques. A shift to other production techniques outside of S# is not preferred by firms, because, with such a production technique, the firm will incur a “loss” because the full cost becomes greater than the product price. We have distinguished S and S# because two different production techniques that produce the same product can have the same full cost. But this occurs only by chance. In the following, we assume S = S# for brevity of explanation.

The minimal price theorem was first discovered by Paul A. Samuelson (1951). A more rigorous proof was given by Kenneth J. Arrow (1951) and others. It is known that this theorem holds when two conditions are satisfied: (1) no joint production exists (single product hypothesis), and (2) there is only one homogeneous primary factor. In the above, we have implicitly assumed these two conditions when we defined production technique and when we defined wage cost as w uih. It was argued by Ian Steedman (1977) and others that it is necessary to deal with joint production in a general form in order to incorporate fixed capital correctly. However, this is too strong a claim, because the minimal price theorem can be generalized for the case of fixed capitals that have a prefixed life limit and keep its efficiency within that limit.Footnote 15 Homogeneity condition concerns two situations: (1) rents for land and mining concessions, and (2) homogeneity of labor powers. Even in these cases, it is possible to generalize the minimal price theorem provided that the rent of land use and the wage rate of different labor powers vary proportionally. For extensions to cases such as non-homogenous labor, land rent and exhaustive resources, see Shiozawa (2019b, Section 2.5).

2.7 Asymptotic behavior of prices

Existence of a minimal price system does not imply that the economy is near to such a system. Is there a mechanism that assures that prices out of a minimal price system converge to the minimal price system? Yes, there is, if the set of production techniques remains invariant for a certain length of time.

When prices are not near to the minimal price system, some firms are in a situation that they are producing a product by a production technique the cost of which is not the minimum. In such a case, it is natural that firms change their production technique to that of minimal cost. Thus, we can assume a price revision process:

Here, p(t) is a price system at a time point t, T(j) the set of production techniques that produce product j. Wage rate is assumed to be constant. It is possible to trace a revision process where wage rates change and such a process is useful when we examine cost-push inflation. As we are concerned here with change in the real wage rate, we keep w constant.

If all firms revise their product prices at the same time, for example at an integer t, the price revision price can be written as

This is a simultaneous revision process. However, it is implausible that all firms revise their product prices at the same time, except in a hyperinflation situation. A revision process is non-simultaneous when some firms revise their product prices and other firms leave their product prices unchanged. The non-simultaneous process may be more realistic, but examination of such a revision process becomes much more complicated. However, it seems there are no big differences between simultaneous and non-simultaneous price revision processes. We have indeed the next theorem (Shiozawa 2019b Th. 4.10):

Theorem 2.4 (Convergence to Minimal prices)

If the economy is productive in the extended sense, the price revision process, either simultaneous or non-simultaneous, converges to the minimal price system, provided that

-

(1)

the wage rate w and markup rates m j remain constant,

-

(2)

the set of production techniques remains invariant,

-

(3)

a sufficient number of revisions is made for each product.

The proof for the simultaneous process is given in Section 2.4.4 in Shiozawa (2019b). The non-simultaneous process is treated in Shiozawa (1978). In the simultaneous revision process, we can estimate the convergence speed of (2–11) to its limits in view of the estimation given in the proof.

Frequency of price revision may depend on the rapidity of the cost changes and the ratio of cost to price. It is not easy to give a firm estimate but we can suppose that, in competitive and otherwise stable conditions, a price system is not very far from the minimal price system if we admit the lapse of 2 to 3 years.

2.8 Quantity adjustment process as a whole

Note that the new theory of value provides only half of the core theory. As we premise basic separation between prices and quantities, price theory requires as its counter part a theory of quantity adjustment. Without this half, we cannot say that the classical theory is complete.

The difficulty of treating quantity adjustment lies in the fact that consumers’ demand and capital investment have no solid law-like regularity. Mainstream economics assumes that consumers maximize their utility function, but in view of the bounded capabilities of consumers it is almost impossible to assume that they are behaving as utility maximizers (Shiozawa 2019a). Even if we admit that they can maximize their utility, the famous Sonnenschein-Mantel-Debreu theorem proved that the aggregate demand function is not necessarily a well behaved one. Although many efforts to study consumers’ demand are ongoing, we have no good theory that can be combined with the new theory of value. Capital investment also depends on management’s taking of difficult decisions and there is no simple investment function. Even in this state of economics, it is possible to guess what is happening in the economy, thanks to the results of Taniguchi and Morioka (Chapters 3 to 6 in Shiozawa et al. 2019). The only hypothesis we must assume is that the average demand of each product moves sufficiently slowly.Footnote 16

Even when the price of a product is fixed, the sales volume changes everyday. The firm deals with this situation by keeping a certain amount of product in stock, called inventory. It is also called safety stock. Every firm sells its product as much as demand is expressed. There is no problem if the demand of a day or a week remains within the level of prepared stock. When the demand exceeds the prepared stock, the firm cannot satisfy all the demand and customers may move to buy a similar product at another firm or shop. The firm may lose the present and future sales profit, something no firm wants to face. On the other hand, to keep a large amount of product stock invites an increase of inventory costs (working capital committed, interest cost for the running capital, stock depletion, quality degradation, extra holding cost for cooling, etc.). If the demand fluctuation for a product obeys a constant statistical distribution rule, it is possible to determine an optimal quantity of product stock. Herbert Scarf was one of the first researchers who studied mathematical inventory control theory (Scarf 2002). However, to know the probability distribution of the demand of a product is not easy and so firms are obliged to fix their stock levels by more simple procedures, such as taking a moving average.

Scarf’s inventory control theory and those of others’ stayed at the level of the firm. As economists, we cannot stop there, because we should know how the inventory control practices of firms produce fluctuations in the economy as a whole. Indeed, what does happen when the input demand of one firm is communicated to other producer firms? If I tell my personal history, in rhe 1980s I was interested in how the economy as a whole responds to a change in demand. To my astonishment, the adjustment process of the economy as a whole was divergent when firms adjusted their demand expectations prospectively (Shiozawa 1983). First, the works of Taniguchi (1997) and then of Morioka (2005) substituted my strange result. Taniguchi showed by numerical experiments that the total process of inventory adjustment converges to a stationary state when demand remains constant after the first shock in the case when firms employ retrospective expectations by simply taking a suitable moving average. Morioka proved further that the dominant eigenvalue (the eigen- or characteristic value that has the largest absolute value) of the matrix that describes the demand movement is smaller than one if the moving average spans several production periods. This result was really amazing, because it estimates the dominant eigenvalue of a square matrix the dimension of which is bigger than N times the number of averaging periods (more exactly N (τ + 1) where τ is the averaging period).Footnote 17 Even where we estimate N to be very small, it exceeds 10 thousand. If τ is of order five or six, this means we have to estimate the eigenvalues of a matrix of more than 50 to 60 thousand dimensions. Morioka’s result was really astonishing.

The meaning of Morioka’s result is expressed in the following theorem.

Theorem 2.5 (Dynamic stability of quantity adjustment process)

Let the demand for each final product fluctuate everyday and its moving average be also moving. If the movement of the moving average is sufficiently slow for all products, the inventory control process of firms as a whole can follow demand when the average period and buffer stock coefficients satisfy certain sufficient conditions.

For details, see Morioka (2019b). Preparatory introduction to the inventory control process is given in Shiozawa (2019b Section 2.7) and Morioka (2019a). Exact meaning of “sufficiently slow” is given in Shiozawa (2019b Sec. 2.7.4).

For simplicity, if the final demand vector d = (d1, …, dN) is nearly constant, we can safely assume that production comes to produce d as net product using a competitive production technique in a minimal spanning set S in such a way that the production scale vector s = (s1, …, sN) satisfies the equation

where A is the material input coefficient matrix corresponding to S. If the set of production techniques T remains invariant, then, by Theorem 2.4, the price system approaches to the minimal price system when price adjustment proceeds sufficiently. Then, by Theorem 2.1, firms must operate using production techniques in S. Of course, when the set of production techniques is rapidly changing, there occurs a kind of mutual chasing between price system and the spanning set of production techniques in operation. Note also that Eq. (2-12) has no matrices related to markup rates. As we include the fixed capital formation in the final demand, investment for capacity increase is already counted in the final demand. Total employment L measured by working hours is given by the formula:

We can calculate from this the level of employment if we can assume that people work a fixed number of hours a day or per week.Footnote 18

All Keynesian macroeconomic models suppose that production can follow the change in aggregate demand but no detailed mechanism is explained and it is simply assumed that, on the whole, the adjustment process must work. This unwarranted assumption was first proved by Taniguchi and Morioka. Their result is one of paramount significance, one that can indeed outdo the Arrow and Debreu (1954) theory (Shiozawa 2019b Subsection 2.7.5). A simple consequence of this theorem is the principle of effective demand, as was just explained above. The demand as a whole determines the levels of production for all products and by consequence the total working hours.

It is necessary to note that, even with this splendid result, the truly difficult problem is not yet solved, this being the long term movement of the aggregate demand and its composition between products. Even if we know by the principle of effective demand that employment depends on the gross amount of final demand, we know little about how the latter moves in the long run. The new theory of value, with its quantity adjustment process, and the theory of demand form complementary halves of the economics that should be built upon in the near future (Pasinetti 1993 p.107; Nelson et al. 2018 p.215). We will come back to this point later in Section 6.

2.9 International values

One thing is worthy of special mention. The new theory can be generalized to the international trade situation. Here we skip the formal formulation of such theory.Footnote 19 Details are given in Shiozawa (2017a, 2019b). and Shiozawa and Fujimoto (2018). If I cite only one result of the theory, we have the following theorem:

Theorem 2.6 (Regular international value)

Let (E, T) be a Ricardo-Sraffa economy with M-countries and N-commodities.Footnote 20If the set of production techniques T is in a general position, there exists at least one spanning tree S and an associated international value v = (w, p) that satisfies the following conditions:

-

(1)

For any production technique h in S, the value eq.

holds,

-

(2)

For any production technique h in T, inequality

holds.

-

(3)

Such an international value is unique up to scalar multiplication.

An international value is a couple of vectors w = (w1, ..., wM) and p = (p1, ..., pN), where wi signifies the wage rate of country i and pj price of product j, which is the same for all countries. The new vector u(h) is M-row vector whose c(h) element is the labor input coefficient in country c(h) and the other entries are all 0. It is supposed that a production technique is specific for each country.Footnote 21 The bracket <u(h), w> means the sum of products u1 w1 + ... + uM wM.

The key concept in the above theorem is the spanning tree. To define spanning tree, we need the basic notion of graph and bipartite graph. A graph G is a couple of a set of vertices V and a set of edges E. An edge is a couple of two elements of V. A special kind of graph is called a bipartite graph when V is composed of two disjoint sets V1 and V2 (i.e. V1∩V2 = Φ, V1⋃V2 = V) and edges are couples of an element of V1 and an element of V2. A tree S of a graph G is a connected subset of E that has no cycle, a chain of edges with the same vertex at the beginning and at the end of the chain without paasing the same edge twice. Spanning tree S is a tree such that each vertex in V is included in an edge of S (as a couple of vertices.) Knowledge about graphs that is necessary to international trade theory is minimal and given in Shiozawa (2019b Section 6) or Shiozawa and Fujimoto (2018 Section 4). For more details, please see any introductory book on theory of graphs, for example, Wilson (2010).

Each production technique of an international trade economy with M-countries and N-commodities can be interpreted as an element of a bipartite graph the sets of vertices of which are composed of countries and commodities, because a production technique belongs to a country and produces a product. When we have only one production technique for each pair of a country and a commodity, the associated bipartite graph is a complete bipartite graph KM,N. A closed economy can be interpreted as an international trade ecoomy, that has only one country. A spanning tree of a closed economy was called spanning set in Subsections 2.5 and 2.6. A spanning tree of a bipartite graph that has M-coutnries and N-commodities and is a superset of KM,N has exactly M+N–1 edges. For example, in the complete graph K3, 3, there are 12 spanning trees and generally three admissible spanning trees. In the case of a closed economy, we have only one admissible spanning tree. This explains partly why, in the international trade situation, the minimal price theorem does not hold.

In the international trade economy case, uniqueness of the value is not guaranteed, but we obtain the two inequalities (2–14) and (2–15). This is simply the international version of inequalities (2–6) and (2–7). Therefore, once a regular international value obtains, as long as the final demand d is produced as the net products of productions within the production techniques in S#, the set of all production techniques that satisfy equality (2–14), the value cannot change because no other production technique outside of S# can be competitive with regard to v = (w, p). The sole difference between the closed economy of a country and the international trade economy lies in the fact that there is no covering property. Thus, although we should admit path dependency on the selection of competitive production techniques, the uniqueness, constancy and local stability of the prices at a given point of time are confirmed.

As we have affirmed above, the prices are determined basically independent of demand and production volume. The separation of prices and quantities is the most important premise of the new theory. The adverb “basically” means that quantity relations can rarely intervene in prices. But in some cases, for example, when labor is in short supply, or in the case in which demand exceeds the production capacity of some industries, prices may be influenced by the shortage. The latter case must be rare, because managers normally invest to increase capacity before the demand actually exceeds it. So, except for a case of suddenly increased demand, the second case is rare.

3 Comparison of two value systems

This section compares the traditional neoclassical price theory and the new theory of value. As the neoclassical theory remains the mainstream price theory and is taught in colleges, a detailed account of the traditional theory is not necessary. In order to make this section as short as possible, comments are reduced to a minimum.

3.1 Some misconceptions on equilibrium prices

In the last quarter of the nineteenth century, the law of demand and supply had taken a roughly mathematical formulation through the work of the founding fathers of the neoclassical school, such as Jevons and Walras. Around the turn of the century, Marshall’s Principles of Economics (1920) became a standard textbook of economics for all economics students in the English speaking world. In the middle of the twentieth century, the law of demand and supply was rigorously formulated within general equilibrium models by Arrow and Debreu and others (Arrow and Debreu 1954; Arrow and Hahn 1971). The Arrow and Debreu theory has no problem as an axiomatic system, which is logically perfect. However, as almost all economists know, the premises it assumes are extremely unrealistic.

Standard models assume that firms and households maximize, respectively, their profit and their utility in a perfectly competitive economy. To make this premise theoretically possible, it was necessary to assume that (1) firms face decreasing returns to scale at the point of operation (convexity of production possibility set), which is in contradiction to widely observed facts, and (2) households have a consistent utility function for all possible consumption combinations and can calculate the maximal solution to the budget constraint problem, which is in fact impossible in view of getting necessary information and the complexity of problem solving (See Shiozawa 2016a, 2019a). The new theory of value assumes no such unrealistic capabilities, neither for firms nor for households.Footnote 22 But the key points we must observe here are not the questions raised by the use of unrealistic assumptions. Rather we must consider the consequences of each of the two value theories as alternative frameworks for the basic structure of economics.

In order to avoid confusion, before addressing the problem, it is better to define two concepts that are often confused: rigidity and stability. Rigidity (or stickiness or constancy) of prices means that prices remain unchanged for a certain interval of time. Stability means that prices tend to the equilibrium or any stationary state when they are out of it.

Rigidity or stickiness of a price means that the price stays invariable between two market times. We are accustomed with the idea that prices become stationary when equilibrium of demand and supply is satisfied. But this is a misconception, because, as we see everyday in stock markets, the price at each market changes from one “equilibrium” to another. Existence of an equilibrium at a specific point of time does not imply the stickiness of the price. As for the stability, many economists have already argued that Arrow-Debreu equilibrium theory and related models have not succeeded in proving the stability of prices (Kirman 1989; Keen 2011). The famous theorem named after Sonnenschein, Mantel and Debreu asserts that the excess demand function can take any functional form if it satisfies Walras’ law. If we do not assume extra hypothesis such as gross substitutability, equilibrium is not necessarily stable even in the virtual world of a Walrasian economy. There is no theory that shows how an actual price out of equilibrium converges to an equilibrium. The new theory of value includes the mechanism for stability as a part of the theory as we saw in Subsection 2.7.

The rigidity of prices is one of the major arguments of New Keynesian economics. Mankiw and Romer (1991) treated this question at the top of seven topics. Although a variety of reasons for price rigidity are identified, most of them consider the presence of price adjustment costs (e.g. menu cost) as its cause. The new theory of value provides a totally different reason for price rigidity, as is explained in the next subsection.

Neoclassical price theory can explain neither price rigidity nor price stability, in the sense defined above, without adding some significant supplementary reasons.

3.2 Stickiness and stability: Alternative explanations

In contrast to neoclassical price theory providing New Keynesian theory with reasons for price stickiness by the presence of price adjustment costs, the new theory of value affords an alternative explanation. The new theory of value claims that prices remain constant even if no price adjustment costs exist.

Suppose the minimal price theorem (Theorem 2.1) applies and that firms are operating by production techniques in S. Production technique h in S satisfies (2–10) and is competitive. Let another production technique k in T but out of S# satisfy the inequality (2–9) when k is replaced by h. Then, as long as the economy as a whole can produce the final demand d, firms have no reason to change their production technique from h to k. Neoclassical theory fears that prices change when the final demand d changes, but it is unnecessary to worry because we have the covering theorem (Theorem 2.3) and quantity adjustment process (Theorem 2.5). In a national economy, any final demand is producible as long as the speed of demand change is sufficiently slow, as was explained in Subsection 2.8.

Of course, Theorem 2.1 and Theorem 2.3 do not mean that prices do not change at all. The merit of the new theory is that it tells us in what conditions prices will change and in what others they will not change. Let p* be the minimal price vector corresponding to spanning set S that satisfies the equality (2–10) for h∈S and inequalities (2–9) for all h ∈T/S. Then the price system p* remains constant as long as the following three conditions are satisfied:

(1) wage rate w stays constant,

(2) prices of primary resources remain constant, and.

(3) markup rate remains invariable.

If one of these conditions is violated, the price of a product may change. If the change of total costs per unit is small, it is possible that the price remains invariant when price change requires an extra cost.Footnote 23 On the other hand, when the labor market becomes tight, it is likely that the wage will be raised in firms where the labor shortage is severe. If conditions (1) and (3) remain satisfied for all products, prices of input goods or services stay constant unless some prices of primary resources change substantially, because prices of input goods and services also remain constant by the same reason as for the product itself.Footnote 24

One consequence of these circumstances is the negation of the quantity theory of money. Even when the total quantity of money (for example, M2) changes, there is no direct influence on prices.

As pure theory, the stability of prices is more important than price rigidity. As stated above, neoclassical general equilibrium theory has no stability theorem. In contrast, stability of the price system is easily obtained in the new theory of value. In fact, as we have a convergence theorem (Theorem 2.4) that states that any price system p(t) converges to the minimal price system when the set of production techniques remains unchanged. Thanks to the convergence theorem, when the set of production techniques remains invariant, we can safely assume that prices will be near to the minimal prices system after a sufficient number of price revisions. This fact is crucial to the explanation of how technological progress induces the rise of real wages and economic growth. There is no need to explain that the majority of the earning population of a nation is composed of wage workers (except for a few exceptional, small countries that feed on finance or on rents on primary resources) and a real wage rate hike signifies an increase in per capita income, provided that the economy is near to full employment,.

3.3 Allocative versus dynamic efficiency

The above observations reveal paradigmatic differences between the neoclassical price theory and the new theory of value. However, the greatest differences lie in even deeper layers of theory. What is at stake is the understanding of how the market economy works and what kind of efficiency the market economy brings about.

Arrow and Hahn (1971, p.1) boasted that the contribution of general equilibrium theory is “the most important intellectual contribution that economic thought has made to general understanding of social processes.” It is, however, doubtful if this now continues to be true. As we have observed, the Taniguchi-Morioka results are as important as general equilibrium theory. But there is a much more important objection. What is claimed to be proven by general equilibrium theory, in combination with two fundamental theorems of welfare economics, is the allocative efficiency of the market mechanism. Does this really reveal the fundamental efficiency of the market economy? We are doubtful.

In Nelson and Winter (2002) they cite three guiding questions that were central to Adam Smith:

-

(1)

Without any central authority guiding and commanding actions, how is economic activity coordinated? Or, how can order emerge from the interactions of people who all have different values and objectives?

-

(2)

How can we explain the prevailing constellation of prices, inputs and outputs?

-

(3)

How can we explain the processes of economic progress or development?

It is true that Arrow and Debreu (1954) attacked questions (1) and (2) and solved them in their own way. When Hayek (1945) previously asked how the dispersed knowledge is used in society, he must have asked the same questions (1) and (2). Hayek asked a very important question, probably a key question on the market economy. How, and why, is the market economy more efficient than a centrally organized economy? But what Hayek saw concerned only allocative efficiency. He spoked of many things and referred to technology, but his main concern was the efficient allocation of resources. He emphasized the importance of “knowledge of the particular circumstances of time and place”. Some examples that Hayek illustrated are “a machine not fully employed”, “a surplus stock which can be drawn upon”, and “a shipper who earns his living from otherwise empty or half-filled journeys of tramp-steamers” (Hayek 1945 p.522). For Hayek, what makes people behave in this way is in a final account prices. “Fundamentally, in a system where the knowledge of the relevant facts is dispersed among many people, prices can act to coordinate the separate actions of different people in the same way as subjective values help the individual to coordinate the parts of his plan” (p.526). Hayek wholly draws on the price system.

The new theory of value also answers the questions (1) and (2) cited above (Shiozawa et al. 2019). However, it is certain that Arrow and Debreu type general equilibrium theory does not answer question (3) (Krüger 2008 p.331). Solow’s (1957) seminal paper may have showed that the motive power of economic growth is technical change, but he did not explain how technical change brings about economic growth. Endogenous growth theory assumed that the production possibility set expands for some unexplained reasons such as, for example, R&D investment, but it could not explain how individual firm’s efforts bring about economic growth. Neoclassical economics could only explain allocative efficiency but not the dynamic efficiency that is the main feature of technological progress (Freeman 1988, p.2). There is a clear distinction between the neoclassical theory of prices and the new theory of value. The new theory can explain the dynamical and cumulative mechanism of technological change, as we shall see in the following sections. In other words, the new theory of value is a theory that also answers question (3).

The distinction made between allocative and dynamic efficiency appears to bear a close relationship with Schumpeter’s opposition between the theories of circular flow and of development (Schumpeter 1926 Ch. 2, pp.82–83), although it is necessary not to confuse these with two types of economic behaviors: static, or hedonistic, and dynamic, or energetic, behaviors (Schumpeter 1912). Schumpeter perceptively identified dynamic behavior of entrepreneurs as the prime mover of economic development, but did not elucidate as to how these behaviors bring about economic development. The present paper fills this gap.Footnote 25

4 Economic growth by technological change

There is now a huge literature on how production techniques change (Dosi et al. 1988; Ziman 2000; Antonelli 2011). There are many papers that have studied learning-by-doing and organizational learning effects on unit costs (Thompson 2012). At a more aggregate level, the Kaldor-Verdoorn law relates the increase of productivity to the increase of industry- and economy-wide output (Deleidi et al. 2018 Section 3).Footnote 26 However, in this paper, we offer no hypothesis on how production techniques change and evolve. Rather, we are interested in how technological change induces the growth of real wage rates and hence economic growth.Footnote 27 Our questions are: What guides the choice of production techniques? If it is prices, will the selection of production techniques produce a good effect for the economy as a whole? These are the questions that we seek to elucidate in this section.

The starting point is the separation of prices and quantities. For a given set of production techniques, it is proved that the production system can follow the slowly changing demand flows. When repeated technological choice continues we can observe how the real wage level moves by only selecting the lowest cost production technique. To realize economic development through the increase of real wage rates, demand side consideration is necessary. In this section, we assume that effective demand increases in such a way that the rate of unemployment remains low. Whether this assumption is justified or not will be examined briefly in Section 6.

4.1 Features of technological change

Technological change must be examined according to two main categories. One category is the invention and commercialization of new products. The new theory of values has few things to say on this technological change, because a theory of demand is vacant in it. Another category is the change in methods of the production processes. According to our definition, this is a change of production techniques.

Remember that a production technique is defined as set of input and output coefficients (Subsection 2.1). When it is a single-product production, we can take a standard expression taking output coefficients vector b as a unit vector. In such a case, a production technique h is expressed by a couple (u(h), a(h)) and the name of the product by g(h). It is noteworthy that, by the above definition, any change in productivity is a result of changed production techniques. Even if the process or method of production remains the same, any change of proportion between inputs and outputs is a change of production techniques. All the improvements of a production process or of a method are a change of production techniques that has the possibility of reducing its cost. Many acts of learning-by-doing (or learning-by-making) induce changes of this kind. Another possibility is the introduction of small enhancements such as a limit switch that eliminates the labor of watch-guard time, a guide-rail that eliminates misplacing the work, and of various other fool-proofing devices. A re-arrangement of machines and infrastructure installations will also often substantially improve the labor productivity of a process.

Transportation can be treated as an independent production process. A good is an input at the start of its journey and is an output at the end point. But transportation is also necessary for any inputs. It is therefore most straight-forward to treat it as another kind of input, as this convention is adopted in input-output table compilation. Consequently, any changes in transportation costs should be reflected as changes in input coefficients. Investment in social infrastructures such as road, railway, and ports reduce input coefficients in this sense and contribute to the reduction of production costs.

Innovation normally accompanies changes in product and production techniques. Schumpeter (1926 Ch.2, II) identified five types of innovation: (1) new product, (2) new production method, (3) new market, (4) new source of supply, and (5) new organization. It should be noted all of these types, except (3), are reflected by some changes of product and production techniques. Introduction of a new product necessarily accompanies a new production technique. Improvement of production methods or process introduces a new (improved) production technique. Acquisition of a new source of supply normally means change of procurement route. Change of transportation (in cost, in method and in route) is expressed as change of input coefficients, as transportation of an input good itself must be counted as an input to the production. Thus an investment in infrastructure may reduce the input coefficients and contribute to the reduction of production costs. Organizational and managerial reorganization are reflected by new production techniques. The type of innovation that is not incorporated in the change of production techniques is the discovery of new markets. Even in this case, if the new market is an industrial one (in contrast to the consumer market), it necessitates a change of the user’s production technique (the introduction of a new positive coefficient accompanied by reductions in those of various other input goods), although the discovery may not change the producer’s production techniques. The task of marketing engineers (business developers) is to induce this change of users’ production techniques.

4.2 The criterion for choosing a new production technique

Let (u∗, a∗) ⇒ e(j) be a new production technique that produces product j and (w, p) be the value vector of the economy. If we suppose by definition the product is the same as produced by the old production technique,Footnote 28 then the sole condition for choosing between the existing and the new production technique is the cost, i.e. whether the following condition is satisfied or not:

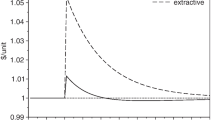

This condition is illustrated by Fig. 1.

Coordinates of the figure illustrate a placing of the input vector. The horizontal axis represents the labor input coefficient u and the vertical axis the material input vectors a. As the input vector is in general multi-dimensional, Fig. 1 is in fact a projection from a high dimensional space onto a two dimensional plane. When the wage rate is w and prices are p, a production technique h that has the full cost equal to pj occupies a point on the line (more correctly, the hyperplane):

Suppose the actual production technique is at position P somewhere on (4–2). Then the nonnegative orthant can be divided in four domains, excluding boundary points. The domain A includes all points the full cost of which exceeds pj. (In the following, we simply say “cost” instead of full cost.) B1 and B2 are the domains where the cost is less than the product price and the abscissa or the ordinate exceeds that of point P. In the general case of N commodities, the domains B1 and B2 are the set of points where the cost is smaller than the product price and one of the coordinates exceeds that of point P. When the number of products is more than one, these domains are connected and we can simply name them domain B. The third domain C is the set of points where all coordinates are less than those of point P.

When the new production technique is situated in the domain C, it is better than the actual production technique irrespective of values. However, in other places, whether a new production technique is better or not than the actual production technique (in terms of costs) depends on the value vector v = (w, p) or the set of the wage rate and the prices of goods and services. The domain A is the place where the production technique has a larger cost than the actual production technique. Thus no point in domain A can be adopted as a new production technique. A point in B (or either in B1 or B2) has a better cost than the actual one. So the production technique in B and C can be adopted as a new production technique if it does not violate any legal stipulations (such as pollution prevention and noise regulation) or moral codes.

4.3 Complexity of technological change

If we have two or more new production techniques for a product, it is normal to choose the lowest cost one, but this may not be a definite choice, because by the introduction of a new production technique of another product, the superiority of production techniques of the product may change the ordering. These circumstances are illustrated in Fig. 2.

A point of Fig. 2 also shows a production technique as in the case of Fig. 1 but, in this case, the method of representation of a production technique is different. For simplicity, we explain the case of two products. If A is a production technique that produces product 1, let the production technique A be expressed as (1, a1, a2) ⇒ (b1, 0). In other words, we normalize the production technique by requiring labor input to be always 1.Footnote 29 The coordinates of the plane in Fig. 2 represents the production technique that has the coordinates (b1−a1, −a2). In the case of a production technique that produces product 2, it has coordinates of the form (−a1, b2−a2). This coordinate expression is convenient when we want to know (in the two product case) which pair of production techniques gives the minimum prices. Suppose at the beginning there are five production techniques comprising A10, A11 that produce product 1 and B10, B11, and B12 that produce product 2. Consider combinations of two production techniques that produce product 1 and 2. There are six combinations (2 × 3 = 6). (Recall the argument in Subsection 2.5) Among these six combinations, the combination {A10, B10} gives the minimal prices, because all the points A11, B11 and B12 are placed lower and left of the line that connects A10 and B10 (These are conditions equivalent to (2–7) or (2–9)).

Now, imagine new production techniques come to be known. First, assume production techniques A2 and A3 that produce product 1 have been introduced. If there are no newly known production techniques that produce product 2, the best combination (i.e. the combination that gives the minimal prices) is {A3, B10}. In the price system associated with combination {A3, B10}, the production technique A2 is inferior in the sense that it incurs higher cost. Then, suppose a new production technique B2 comes to be known. The best combination becomes {A2, B2} and A3 is inferior than A2. In this way, an inferior production technique at one time may later become a superior one if the total set of production techniques changes. This example illustrates the complexity of choosing production techniques and the subtlety of Theorem 2–1 (the minimal price theorem).Footnote 30

The choice of production techniques depends on prices at the time of the choice. Prices depend on the set of production techniques, in particular, the set of competitive production techniques. Thus, there occurs a co-evolution between production techniques and prices. This is one of the causes of the path dependency of technological development. Note also that the following of a particular path necessarily includes time as a variable.

4.4 Cumulative effects of technological selection

Although there is co-evolution and path dependency for prices and production techniques, the cumulative effect leading to economic progress is clear and simple in the case of a closed economy. Costs of production techniques are in fact an amazingly good guide. These ‘almost half blind’ criteria (4–1) lead the economic system to display steady technological progress and a continuous improvement in the real wage level. If demand is induced in an appropriate way, the consumption level of workers rises and the economy of a nation grows.

To see this, let us assume a time path of, for example, 20 years, in which the production techniques change and new products are added to the economy. Changes may happen as a result of pursuing higher productivity, of unanticipated successes, or as a natural event along a technological path.Footnote 31 We can suppose, however, that the set of production techniques and the set of commodities (i.e. goods and services) increase through time, if we are not forgetful. Let us denote the set of commodities and of production techniques at time t by C(t) and T(t), respectively. Then, almost certainly, we can assume that C(t) and T(t) will increase through time. Thus, we have

for any two points of time t0 and t1.

It is true that, in some cases, knowledge of old production and product techniques are lost. For example, coal chemistry was important industrial technology before the arrival of low cost oil. Because the reign of low cost oil continued more than a half century, many product and production techniques have been lost. Nobody now has experiential knowledge of the products and production methods based on coal chemistry. We only know them through papers and textbooks from before World War 2. In this case, we can say that many product and production techniques are forgotten and it is possible that C(t) and T(t) have shrunk. But over a period of 20 years, we can safely assume (4–3). Even if some parts of C(t) and T(t) have been lost, there is no problem as long as those products are not used and production techniques remain non-competitive. However, in a case in which oil prices become extremely high and products based in coal chemistry become competitive, it is necessary to re-discover product and production techniques that were once commonly practiced.

Now return to the situation in which (4–3) holds. Let us assume that firms reset their product prices each time a new competitive production technique is obtained. Consequently, price structure changes as T(t) changes. Let w(t) and p(t) = (p1(t), …, pN(t)) be the wage rate and the minimal price vector with respect to the wage rate w(t) at time t. It may evolve in a quite random and unexpected way. (See Fig. 3 as a hint of price changes.) Even with such a historical change, the minimal price theory (Theorem 2.1 or 2.2) is applicable. In fact, from this we have the next theorem:

Theorem 4.1 (Increase of real wage level)

Suppose the condition (4-3), in which the sets of commodities and production techniques are increasing over time for an economy where the minimal price theorem holds. Suppose also that markup rates of all products remain constant or decrease from time t0 to t1. If p(t) is the minimal price vector of T(t) for wage rate w(t), then

Remark 1

The real wage rate is normally expressed as w/p, but in the case of multiple commodities, the price vector cannot be put as the denominator. Instead, we take the inverse p/w. If (4–4) holds, the real wage rate generally increases when we take any price index. The inequality (4–4) cannot be replaced by < or ≤ .Footnote 32 However, if T(t1) contains a production technique h such that.

where j = g(h) and (w, p) is the minimal value for the set of techniques T(t0), then (4–4) holds with strong inequality for some products and the real wage rate truly increases.

Remark 2

When C(t) increases, the number of commodities N increases. In such a case, Theorem 4.1 requires a particular interpretation. For a product k that is in T(t1) but not in T(t0), we assume that pk(t0) = ∞ . With this convention, (4–4) holds for any commodities that are newly introduced after t0. With this convention, we can talk as if N(t) is a constant. There is no need to worry about the change in the number of commodities when C(t) increases and we do not mention when this convention applies.

Remark 3

Results of this subsection do not hold for the international trade situation. See the second remark after Theorem 2.1.

If we add some specific assumptions about the change of input coefficients, we obtain more powerful results than Theorem 4.1.

Theorem 4.2 (Effect of the increase of labor productivity)

Assume an economy in which (4–3) and the minimal price theorem hold. For a given positive number η (η≦1), let us assume that the following three conditions are satisfied:

-

(1)

For any competitive production technique h in T(t0), there exists a production technique h’ in T(t1) that has the labor input coefficient u(h’) that is equal to or less than η u(h).

-

(2)

For any competitive production technique h in T(t0), the production technique h’ assumed in (1) satisfies the inequality ak(h’) ≦ ak(h) for all material inputs k.

-

(3)

The markup rate for commodity j remains constant or decreases, i.e. m(t1, j) ≦ m (t0, j).

Then, minimal prices vector p(t) for wage rate w(t) satisfies the following relations:

The meanings of these three conditions are clear. (1) means that labor productivity (in physical terms) increases at least by the factor 1/η when time passes from t0 to t1, while condition (2) means that material input coefficients did not increase. Strictly speaking, conditions (1) and (2) are often contradictory, because in order to increase labor productivity it is often necessary to add small gadgets such as limit switches and fool-proof devices. However, we can assume these increases are small in comparison to the cost reducing effects of labor productivity increase. Condition (2) is a simplifying substitute to express this situation. We can normally assume condition (3), because the markup rate of a product increases only when market competition decreases substantially. The latter case is difficult to imagine when a market economy remains competitive. But it is often observed when the conditions for a competitive market economy have been violated.

To prove Theorem 4.2 is not difficult. Let S be the spanning set that gives the minimal p(t0) for T(t0). For any production technique h in T(t0) with j = g(h), we have

By conditions (1), (2) and (3), if we take h’ in T(t1) that corresponds to competitive h, we have

Let S′ be the set of production techniques in T(t1) that correspond to competitive production techniques in S. These inequalities can be written in vector form as

where u, A, M are the labor input coefficient vector, the material input coefficient matrix for S″ and the diagonal matrix that is composed of markup rates at time t1. As S′ is productive in the extended sense, (I−(I + M))A is nonnegatively invertible. Multiplying the inverse {(I−(I + M))A}−1 from the left to vector inequality (4–7), we get

On the other hand, take the minimal value (w(t1), p(t1)) for T(t1). As each h’ in S″ is a production technique in T(t2), by the Theorem 2.1, we have

In the same way as we have (4–8) from (4–7), we get

Combining (4–8) and (4–9), we get the inequality (4–4). Theorem 4.1 is obtained as a corollary to Theorem 4.2, because it is only the special case when η = 1.