Abstract

Technological change is a central concern for evolutionary economics, which combines detailed empirical studies and conceptual frameworks with mathematical modeling, among them the NK model from evolutionary biology. Technological change is also a central concern for classical and Marxian economics, where it is studied under the rubric of “cost share-induced technological change.” Among the contributions from classical economists is a classical-evolutionary model first introduced by Duménil and Lévy. This paper strengthens the classical-evolutionary model’s microeconomic foundations by deriving it from an underlying NK model. The result is an aggregate model suitable for macroeconomic analysis that is grounded in evolutionary microeconomic theory. This explicit micro-to-macro link opens avenues for further research. The paper presents new results for the classical-evolutionary model, including a “generating function” method for creating candidate functional forms, and provides three illustrative applications.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The nature of innovation and technological change is a fundamental concern of evolutionary economics (Winter 2014; Nelson 2018). Most contributions have focused on the complexities of overlapping processes of technological discovery, innovation, and diffusion as an explanation for the unavoidably evolutionary nature of economic activity (Dosi and Nelson 2013, 2018). Inventors, entrepreneurs, workers, and R&D departments continually gain tacit and explicit knowledge of the technologies and processes they are using and developing. Whether learning-by-doing on the shop floor or experimenting at the lab bench, they have some knowledge of what might work, but their knowledge is very imperfect, so only a few innovations persist and spread. Within the broad program of evolutionary economics, one strand of work has theorized technological change using the NK model from evolutionary biology (Kauffman and Levin 1987; Altenberg 1997), so-named because it features N “genes” and K interactions between genes. The NK model has been applied extensively within evolutionary economics (Dosi and Nelson 2018, p. 75ff).

Classical and Marxian theorists have also long been interested in technological change (Kurz 2010), which they endogenize through cost share-induced mechanisms (Dutt 2013). Among the classically-inspired models is one that explicitly acknowledges evolutionary concepts, the “classical-Marxian evolutionary” model of Duménil and Lévy (1992, 2010). It starts at a micro level, with the presumed behavior of firms, and analytically traces the implications to the level of a sector or of the whole economy. In this sense, the model may be said to be “microfounded”, but the term “micro-to-macro” is used in this paper. In practice, “microfounded” now means a model that assumes economic actors behave as though they have solved an intertemporal optimization problem, a counterfactual behavioral assumption that is rejected by both evolutionary and classical economists. What is more, as discussed later, a complete model must include macro-to-micro processes, so it does not sit entirely on microfoundations (King 2012). Adopting Cantner’s terminology (Cantner 2017), the micro unit in this paper is a firm acting in the role of homo agens, rather than homo œconomicus.

This paper takes Duménil and Lévy’s model as a starting point, while acknowledging the substantial work on cost-induced technological change that preceded it. Some of the earlier literature is referenced below, while other sources can be found in (Kemp-Benedict 2019). Duménil and Lévy’s model is evolutionary in the sense that firms search uncertainly within the neighborhood of their current technology in an attempt to increase their profitability at prevailing prices and wages (a condition introduced by Okishio 1961 in the proof of his celebrated theorem) in order to gain temporary monopoly rents. Duménil and Lévy used this profitability criterion to derive what they termed a “selection frontier”. While the strategy of comparing the profitability of alternative techniques dates back to the early classical authors, the specific expression for the selection frontier was apparently new with Duménil and Lévy, and will feature prominently in the theoretical development in this paper.

As first presented, the Duménil and Lévy model was somewhat limited. The link to evolutionary theory was informal. Moreover, the selection frontier depended only on capital and labor inputs, while making restrictive assumptions about the search space for new technologies. The latter two limitations were addressed by Kemp-Benedict (2019), who expanded the selection frontier to an arbitrary number of inputs and dropped any explicit reference to the search space. Kemp-Benedict (2019) showed that the functional form of the aggregate model is meaningfully constrained by the underlying microeconomic theory, independent of the details of the search space. The result is a very general macroeconomic family of models that is ultimately grounded in an evolutionary microeconomic behavioral assumption.

Starting with an NK model, the paper shows how Duménil and Lévy’s selection frontier can be combined with other fitness measures to determine the selection of potential innovations. The result can be seen as a generalization to multiple inputs of the labor productivity criterion assumed in Auerswald et al. (2000) and Kauffman et al. (2000). Moreover, the selection frontier is expressed in terms of a quantity – cost share-weighted average productivity growth – that has been shown to equal the growth rate of total factory productivity (TFP) from a growth accounting exercise (Rada and Taylor 2006). This relationship allows the classical-evolutionary model to be compared to models based on TFP growth.

It is perhaps worth stating explicitly the approach to economic theory and modeling that this paper adopts. That approach is broadly in line with Shaikh’s (2016, p. 102) “methodology for economic analysis.” It starts with a theory of relevant factors at the micro level, while allowing for the possibility that only a few of the factors may remain relevant at the macro level. It keeps in mind that equilibration is a hypothesis that requires investigation. It accepts that the functional form applicable at the macro level may diverge from the one that applies at the micro level and embraces the idea that different microeconomic models can generate the same, empirically indistinguishable, macroeconomic model. A further influence is Lee (1994), who argued that the accounting, costing, and pricing procedures of firms should be included among the relevant micro-level factors for macroeconomic theory.

This paper explicitly aggregates a microeconomic NK model to obtain a model that can be applied at the level of a sector or the whole economy. One result from the aggregation procedure is a demonstration that candidate functional forms for cost share-induced technological change can be derived from a “generating function.” The generating function is a scalar function of cost shares, and its partial derivatives provide a vector-valued function of productivity growth rates. The generating function is the link between the microeconomic and macroeconomic analysis, so it provides an explicit route for bridging evolutionary microeconomic theory to aggregate analytical macroeconomic models.

After firms innovate, they engage in competitive price and wage setting. The resulting economy-wide prices and wages, when combined with firm-level productivities, then determine firms’ cost shares and therefore influence their next-period innovation. This sort of innovative treadmill is the basis for Marx’s theory of the declining rate of profit. It is also in line with evolutionary economics, in which prices form part of the environment within which innovation and selection take place. As (Nelson and Winter 1982, p. 160) note, “The environment (price vector) in turn depends...on the genotypes (routines) of all the individual organisms (firms) existing at a time – a dependency discussed in the subdiscipline called ecology (market theory).” The price- and wage-setting aspects of competition create a macro-to-micro link from prices to firm-level cost shares that complements the micro-to-macro link from cost share-induced firm-level innovation to aggregate productivity change.

Specific price and wage-setting strategies, when combined with cost share-induced technological change, can result in different trajectories for growth and distribution. One strategy is of particular interest; as shown by Julius (2005) and Kemp-Benedict (2019), and also in this paper, target-return pricing, in which firms set their markups to secure competitive profit rates, tends toward an equilibrium characterized by constant cost shares and constant capital productivity. Thus, unlike in Kauffman et al. (2000, p. 144), Harrod-neutral technological change is a result rather than an assumption, and it only emerges with a specific price-setting strategy.Footnote 1

Section 2 places the model developed in this paper in the context of the existing literature. Section 3 presents the core model. Section 4 proposes a general candidate functional form for cost share-induced technological change that is suitable for practical macroeconomic modeling. Section 5 offers applications of the model. The final two sections discuss the results and conclude.

2 Relation to existing literature

Duménil and Lévy’s (1992, 2010) model features cost share-induced technological change. Models of cost share-induced technological change employ a “distributive closure”, in the classification of Tavani and Zamparelli (2017, p. 1282). They have been well-explored in Marxian theory (Dutt 2013), as well as by Hicks (1932). More recently, (Foley 2003) developed a one-sector cost share-induced technological change model and argued that it can represent Duménil and Lévy’s model in its aggregate form.

Tavani and Zamparelli (2017) claim that models with a distributive closure are necessarily tied to theories of abundant labor, and therefore to a specific wage-setting regime. Because there is no pressure on wages in such models, distribution is exogenous, leading those authors to conclude that “endogenous technical change adds very little to the analysis.” To address this and other perceived limitations of prevailing theories of technological change, in a separate paper, Tavani and Zamparelli (2021) propose a model in which firms trade off two costly options: investing in capital or, through R&D expenditure, in labor-augmenting technological change. Their model assumes the direction of technological change, but makes the pace of change subject to an optimizing decision. However, there is no reason to limit models with distributive closures to the abundant labor case. In a dynamic process in which technological change is succeeded by price and wage setting, cost shares and technologies co-evolve, creating what Shiozawa et al. (2019, p. 87) term “a loop of causal change between the price system and technical change.” The model presented in this paper, when combined with a price and wage setting mechanism, generates such loops of causal change. (Kemp-Benedict 2020) provides an example; further examples can be found in Section 5 of this paper.

In addition to having a distributive closure, the model of Duménil and Lévy is evolutionary in that it assumes all firms incrementally modify or extend their current technology. This is in line with the model introduced by Nelson and Winter (1982, chap. 9), in which the search for innovations is a stochastic process. An alternative and widely accepted assumption is that firms can choose from an existing set of available techniques.Footnote 2 The counter-claim from evolutionary economics is that the range of options open to a firm depends on its dynamic and evolving capabilities (Helfat 2018).

To make this idea concrete: In real economies, many techniques and technologies coexist. Electricity can be generated from natural gas turbines or coal-fired power plants; web applications can be developed in a PHP or Python environment; passengers can be transported in narrow-bodied or jumbo airplanes. Switching from one to the other of these options is costly and time-consuming. It may require entirely new staff with different skills and entail substantial learning. These are strategic shifts that require high-level decisions. More accessible changes include upgrading a gas turbine, refactoring a web application to use a different Python library, or changing the seat spacing in an aircraft. Such changes are not routine and their potential cost may mean that multiple parties have to sign off on the change. However, they make use of existing skills and knowledge. Even more accessible options include modifying staffing levels and schedules at the power plant, modifying a single Python class to improve website responsiveness, or switching hand soap in airplane lavatories from installed dispensers to pumped bottles. Such changes are minor, almost routine.

While these different types of modification are extremely different, they are all examples of innovations. They also illustrate that capital investment and productivity growth can be complements, rather than substitutes as (Tavani and Zamparelli 2021) assumed. Other innovation can occur through purposeful R&D, for example at a lab bench. Companies that rely on such innovations nearly always have their own permanent research staff, whose work may span the range from routine modifications of established products to exploratory research for entirely new ones.

This paper assumes that most innovations are unspectacular and comparatively easily implemented, in what Murmann and Frenken (2006) call the “periphery” of a technology, rather than its “core”. In contrast, a number of different technological change models assume that while discovery may be difficult, firms can readily access any existing innovation. This is true, for example, of those models that assume an innovation possibility frontier as introduced by Kennedy (1964). (Duménil and Lévy’s “selection frontier” is an entirely different concept.) Technological change in innovation frontier models is reflected in the expansion of the frontier, but the choice of technique is a matter of relative cost of operation, rather than cost of adoption. A prominent example in this category includes the well-known model of Samuelson (1965). A less clear-cut example is the recent one-sector representative-firm model of Zamparelli (2015). He followed Kennedy by assuming that firms are constrained by an innovation possibility frontier, but incorporated adoption costs by assuming that any given firm’s frontier depends on its R&D expenditure. An alternative to the innovation possibility frontier that still assumes a fixed set of available techniques is offered by Shiozawa et al. (2019). Those authors build a theory around what they term the “minimal price theorem,” which explains how the microeconomic process in which firms choose from among a set of alternative existing techniques generates price stability as a macroeconomic outcome.

The present paper continues the work begun in (Kemp-Benedict 2019) by deepening the microeconomic foundation for the classical-evolutionary model. In contrast to Zamparelli, the model in this paper, like that of Duménil and Lévy, follows evolutionary economics by assuming that discovery has a stochastic element (Nelson and Winter 1982). However, unlike (Duménil and Lévy 1992; 2010), the path from microeconomic behavior to macroeconomic outcomes is made explicit. This feature – explicitly aggregating across heterogeneous firms rather than assuming a representative firm – distinguishes the present work from nearly all of the above-cited papers. The exceptions are (Okishio 1961) and (Shiozawa et al. 2019), who started with a disaggregated input-output model to derive macroeconomic results, but unlike this paper, those papers assumed a fixed set of available techniques. Finally, this paper allows for any number of inputs to production, whereas nearly all of the papers reviewed here treat labor and capital as inputs. The exceptions, again, are (Okishio 1961) and (Shiozawa et al. 2019).

In summary, the model presented in this paper is unique because it explicitly aggregates a microeconomic evolutionary model, in which firms make use of an arbitrary number of inputs, to derive macroeconomic results. Moreover, contra (Tavani and Zamparelli 2017), when combined with a pricing mechanism, the result is a distributive-closure model in which distribution and productivity growth are determined endogenously.

3 Development of the model

This section derives the core classical-evolutionary model. After introducing some essential concepts, the first step in the derivation is to construct a classical-evolutionary model for a single firm (or, in this paper, a single “unit”, which might be a division within a firm).Footnote 3 To be clear, this is for expository purposes only; the model makes sense only in the context of inter-firm competition, and the single unit does not constitute an independent “Robinson Crusoe” economy. This is made explicit in the following step, in which the model is aggregated across multiple units.

3.1 Production systems, fitness, and profitability

In the “production recipes” approach of (Auerswald et al. 2000), a recipe is a set of engineering instructions for producing outputs given inputs. As the evolutionary economics literature makes clear, this is a strong simplification; technologies are not “blueprints” or “recipes” executed in the same way by every firm (Dosi and Nelson 2013, p. 28ff). However, it is a useful heuristic device for thinking through the nature of technological change. The present paper follows this line of reasoning by assuming that production systems, incorporating both technologies and procedures, can be reasonably represented by a (possibly very large) set of production elements, each with (possibly very many) variants, with an arbitrary number of interactions between elements, yielding an NK model (Altenberg 1997). This paper follows the bulk of the literature by assuming a discrete set of variants for each elements, but the model could be adapted to a continuum of variants as proposed by (Valente 2014).

A specific choice of variant for each production element can be represented by a “string” s, which represents the production system (Frenken 2001). In the evolutionary analogy, s is the genotype for the production system. The production system then exhibits certain features – its phenotype – as a result of its genotype. The phenotype, in turn, determines how “fit” the system is for its purpose, which can be represented by a fitness function ϕ(s), which has that property that if a system \(s^{\prime }\) is more fit then the incumbent system s, then \(\phi (s^{\prime }) > \phi (s)\). The NK model represents complexity through interactions, so that changing one element in the string alters the fitness response to changes in other elements.

While some authors identify fitness with profitability (e.g., Kauffman et al. 2000; Nelson and Winter 1982, p. 160), in this paper they are kept separate. Profitability certainly matters, and is indeed central to the decision-making process proposed in this paper. However, fitness is influenced also by how well a process works with existing procedures, the skills of the people who will implement it, desirability of product features, and so on. Some aspects of fitness are elusive, but some may be captured analytically, as in the study of the German compact car market by Cantner et al. (2012).

Among the features that make up a production system’s phenotype are factor productivities. Certain of these are likely to feature in a fitness evaluation, and not always for reasons of cost. For example, Dosi and Nelson (2018, p. 49) noted that an important motivation for mechanization in the 19th century was to reduce the risk of strikes. Otherwise, broad cost considerations, such as persistently high labor costs, can drive innovation in particular directions. To take a 20th century example, during the oil crises of the 1970s and 1980s, considerable effort was directed to saving on products from crude oil and natural gas. In this way, a general apprehension of costliness can drive innovation in some directions more than others.

Costs enter more directly in a step after R&D has been carried out – capital budgeting (Graham and Harvey 2001). A capital budgeting assessment looks at costs and potential revenues as an input to a decision whether to invest. For novel technologies being developed within protected niches, current profitability may be ignored in hopes that future development will make an invention profitable (Geels and Schot 2007; Perez 2010). However, for the bulk of investment decisions, a case must be made that the investment can be profitable, whether in a business plan submitted to a bank or investor, or in an analysis carried out by a firm’s accountants. Following (Okishio 1961), this assessment is presumed to be carried out at constant prices and wages, and following (Duménil and Lévy 1992; 2010), the criterion is the average profit rate. As discussed in the next subsection, imposing this criterion leads to Duménil and Lévy’s “selection frontier.”

3.1.1 The selection frontier

In Duménil and Lévy’s (1992, 2010) model, as well as the model presented in this paper, innovating units search in the vicinity of their existing production system. Search may be directed, but has an irreducible random element. The fruits of the search are candidate innovations characterized by factor productivities. As in (Zamparelli 2015 p. 246), the potential profits from candidate innovations are initially private to the unit, or the firm in which it is located, but if adopted, competing units will rapidly close the gap. Seeking short-term monopoly rents, firms assess profitability at fixed prices and wages, and reject any candidate innovations that will not raise the profit rate. Imposing this criterion results in an expression for the selection frontier, which depends on cost shares and productivity growth rates.

The selection frontier is derived by comparing a unit’s prevailing technology to alternatives. This is a technique familiar from early classical authors, and it underpins the well-known construction of the wage-profit frontier in capital theory (e.g., see Scazzieri 1990). However, unlike the wage-profit frontier, which is an upper bound on production possibilities based on prevailing (and presumably known) techniques, the selection frontier is calculated with reference to the firm’s extant technology, which will normally be far from a global optimum. Rather than an external limit set by the state of technological development, the selection frontier is an internal limit set by the firm’s capital budgeting criteria. As noted below, the most profitable technologies are located off of the frontier, rather than on it.

Productivities of non-capital inputs, such as labor, fuels and other intermediate goods, and raw materials, are denoted by νi, where i ∈{1,…,n} is the list of inputs. The corresponding prices (for labor, the wage), are denoted by pi. Output of the decision-making unit – for example, a firm, or a division within a firm – is denoted Y, which is sold at a price P. Following the advice of Lee (1994), the value of the unit’s capital stock, K, is that determined by its accounting department. The unit’s profit rate, net of indirect costs per unit of the capital stock c, is then

For the final expression, the ratio PY/K, which is the capital productivity, has been introduced into the vector of productivities as the zeroth element, ν0.

This paper makes several simplifying assumptions. First, the contribution of total indirect cost per unit of capital, c, which appears in Eq. 1, is assumed not to change over time. The composition of that term can differ from one firm to the next (Lee 1994). It may include depreciation, capitalized up-front expenditure, including that incurred during R&D, or administrative costs. Further, while the profit rate is evaluated with respect to the value of the total capital stock in the equation above, that need not be the case. Shaikh (2016, p. 66ff.) has shown that competitive processes tend towards equal marginal profit rates rather than average profit rates. Moreover, while the procedure below assumes that firms compare an estimated post-innovation profit rate for the entire firm to the prevailing profit rate, firms apply capital budgeting procedures on a project-by-project basis. An alternative approach would be to require that the incremental profit rate pass a hurdle rate (one of the dominant procedures found by Graham and Harvey 2001, p. 197). As discussed briefly below, incorporating these changes would make the model slightly more complex, but it would not essentially change.

In the NK model approach to production systems, productivities are phenotypic expressions of the genotype s, so that νi = νi(s), where now i ∈{0,…,n} to include capital productivity. Note that the mapping from s to ν will typically be many-to-one; several designs can yield essentially identical productivities. Thus, catching up with a competitor need not entail copying that unit’s exact techniques. It is possible to close the gap opened by a unit’s innovation without reducing the heterogeneity that characterizes evolutionary innovation (Cantner 2017).

Different designs may be further distinguished through the fitness function, so that \(\boldsymbol {\nu }(s^{\prime }) \simeq \boldsymbol {\nu }(s)\), while \(\phi (s^{\prime }) \neq \phi (s)\), but it is possible that the fitness mapping is also many-to-one, allowing for a great deal of variety. Reduction of variety emerges from standardization, a process that provides external benefits to a group of interrelated firms (e.g., those sharing a dominant design: see Murmann and Frenken 2006).

The model assumes that, through a capital budgeting exercise, the unit’s management evaluates whether, while holding prices fixed, a candidate production system \(s^{\prime }\) would be more profitable than the incumbent, s. If it is, then the firm can enjoy at least temporary monopoly rents. Introducing the notation \({\Delta }\nu _{i} = \nu _{i}(s^{\prime }) - \nu _{i}(s)\) as the change in productivity of the i th input, Δr as the change in the profit rate, and suppressing the dependence on s to keep the notation compact, the condition that the estimated post-innovation profit rate must be greater than the prevailing profit rate while holding wages and prices fixed reads

In the final term, the ratio \(\hat {\nu }_{i} = {\Delta }\nu _{i}/\nu _{i}\) is the productivity growth rate. This “hat” notation for growth rates is used throughout the paper.

To put Eq. 2 into a more convenient form, note that the cost shares of different inputs, σi, evaluated using the productivities of the proposed new process and prevailing prices, are

The profit share σ0 is equal to one minus the sum of the cost shares of non-capital inputs. Dividing Eq. Eq. 2 by ν0 and using this expression for the cost shares then gives

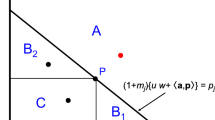

This result, also derived in Kemp-Benedict (2019) is a generalized form of Duménil and Lévy’s (1992, 2010) selection frontier, covering an arbitrary number of inputs. In vector notation, it can be written compactly as

The expression on the left-hand side of this inequality will be called, in this paper, the “selection index”. The selection frontier consists of production systems for which the selection index is zero, while the index is positive for profitable innovations.

To return to the simplifying assumptions, if indirect costs per unit capital, c, were to change, or if the capital budgeting rule included a hurdle rate, the right-hand-side of inequality Eq. 5 would be nonzero. As noted above, the resulting model would be more complicated, but not essentially different. It could, however, be interesting. It would introduce possible dependence on changing cost of capital, level of R&D expenditure, or capital budgeting policy. The avenues opened by this observation are left to future work.

3.1.2 The selection frontier and “total factor productivity”

There is a direct link between the selection frontier and the growth rate of total factor productivity (TFP).Footnote 4 TFP growth, denoted by \(\hat {A}\), is calculated empirically as the difference between real output growth and growth in inputs, weighted by cost shares:

Here, Qi = Y/νi is the quantity of input i. As (Rada and Taylor 2006) showed, because \(\hat {Q}_{i} = \hat {Y} - \hat {\nu _{i}}\), this is equal to

This result demonstrates that \(\hat {A}\) is equal to the expression for the selection index.

Candidate innovations are selected if the selection index \(\boldsymbol {\sigma }\cdot \hat {\boldsymbol {\nu }}\) is positive. On its face, this rule suggests that total factor productivity must always be seen to grow. However, empirically that is not the case; measured TFP growth can both rise and fall. The reason this is not a contradiction is that the selection frontier is calculated at fixed prices and wages. After a period of innovation, prices and wages will change, e.g., through price competition and wage bargaining, altering the values of the cost shares. Observed values of \(\boldsymbol {\sigma }\cdot \hat {\boldsymbol {\nu }}\) will reflect both innovation and the subsequent price and wage adjustment, and can be either positive or negative.

3.1.3 Improved and profitable production systems

The model presented in this paper follows (Kauffman et al. 2000) in treating the “distance” d between production recipes as the number of changes in production elements required to move from one to the other. In Shaikh’s (2016, p. 102)) methodology, this is a micro-level factor that will not appear in the macro model, but it provides an explicit link to existing work using the NK model.

The set of production systems that can be reached through altering d different production elements with respect to the incumbent system s is denoted \(\mathcal {N}_{d}(s)\). Of those systems, only some will be an improvement on the incumbent system. In terms of the fitness function ϕ(s), the set of improved production systems \(\mathcal {N}_{d}^{ {\mathrm {impr}}}(s)\) is given by

Of the improved systems, only some will be profitable; that is, only some will have a positive selection index.

Expressing the selection frontier in terms of the NK model, cost shares are evaluated using prevailing prices but (as shown previously) for the proposed substitute production system \(s^{\prime }\), rather than the prevailing system s,

The productivity growth rate is given by the difference between the productivity of the new system and the prevailing system, divided by the prevailing system productivity,

The set of profitable production systems within a distance d of the incumbent system s, \(\mathcal {N}_{d}^{ {\mathrm {prof}}}(s)\) then consists of those alternative systems \(s^{\prime }\) in \(\mathcal {N}_{d}(s)\) with a positive selection index,

Combining the criteria of fitness and profitability, the set of profitable production systems within distance d of the incumbent system s with improved fit are located within the intersection \(\mathcal {N}_{d}^{ {\mathrm {impr}}}(s) \cap \mathcal {N}_{d}^{ {\mathrm {prof}}}(s)\).

3.2 The classical-evolutionary model for a single unit

This subsection treats the case of a single unit, with index k, as one of a set of numerous such units, all working along similar lines and more or less clearly observing what the others are doing. Each unit k is presumed to choose a distance d within which to search. (However, to avoid cascading subscripts, the k subscript on d is suppressed.) Depending on its R&D strategy, a unit may execute no search at all (d = 0), or look within a distance d = 1,2,…,D, where D is a maximum distance determined by time, capacity, and cost constraints on search. Each unit looks in what it believes to be a promising direction, searching within a subset of possibilities \(\mathcal {N}_{d}^{k}(s_{k})\subset \mathcal {N}_{d}(s_{k})\) near its incumbent technology. The sets of improved and profitable production systems \(\mathcal {N}_{d}^{k {,{\mathrm {impr}}}}(s_{k})\) and \(\mathcal {N}_{d}^{k {,{\mathrm {prof}}}}(s_{k})\) are determined as in Eqs. 8 and 11.

To connect the NK model with the classical-evolutionary model of Duménil and Lévy (2010) and Kemp-Benedict (2019), it will prove useful to introduce a function \({{\Phi }_{d}^{k}}(s_{k})\) that is equal to the expected value of the selection index for profitable process that improve upon the incumbent process, relative to the size of the search space.

Mathematically, \({{\Phi }_{d}^{k}}(s_{k})\) can be calculated by first summing \(\boldsymbol {\sigma }(s^{\prime })\cdot \hat {\boldsymbol {\nu }}(s^{\prime }\rvert s_{k})\) across all alternative production systems \(s^{\prime }\) that are both improved and profitable – that is, they lie within the intersection \(\mathcal {N}_{d}^{k {,{\mathrm {impr}}}}(s_{k}) \cap \mathcal {N}_{d}^{k {,{\mathrm {prof}}}}(s_{k})\) – and then dividing by the cardinality of firm k’s search space \(\rvert \mathcal {N}_{d}^{k}(s_{k})\rvert\). However, it turns out to be more useful to sum over all of the improved production systems \(\mathcal {N}_{d}^{k {,{\mathrm {impr}}}}(s_{k})\) and multiply each term in the sum by a factor that is equal to one when the selection index is positive, and equal to zero otherwise. Being equal to one when its argument is positive and zero otherwise is the defining property of the Heaviside (or step) function, h(⋅),Footnote 5 so the terms in the sum can be written \(\boldsymbol {\sigma }(s^{\prime })\cdot \hat {\boldsymbol {\nu }}(s^{\prime }\rvert s_{k}) h(\boldsymbol {\sigma }(s^{\prime })\cdot \hat {\boldsymbol {\nu }}(s^{\prime }\rvert s_{k}))\).Footnote 6

The normalizing factor is the cardinality of the firm’s search space, \(\rvert \mathcal {N}_{d}^{k}(s_{k})\rvert\). However, here again it is useful to express this factor indirectly, through an “efficiency of search” \({\epsilon _{d}^{k}}(s_{k})\) that is equal to the quantity of improved production systems as a fraction of the size of the search space,

In terms of the above definitions and expressions, \({{\Phi }_{d}^{k}}(s_{k})\) can be written

3.2.1 Moving to a continuum model

The development so far has remained faithful to the discrete nature of production systems and decision-making units. However, at this point it is useful to transition to a continuum representation, on two assumptions: that there is an extremely large search space;Footnote 7 and search is focused mainly on incremental changes. The second assumption is consistent with a comparatively mature sector. For example, in the model of (Kauffman et al. 2000), the optimal search distance tends to decline with rising labor productivity, while in the model of (Saviotti and Pyka 2004), sectors become saturated, with gradually slowing opportunities for growth. The assumption of incremental change is also consistent with a production technology characterized by a dominant design, in which most innovation takes place in the “periphery” rather than the “core” (Murmann and Frenken 2006).

The assumption of incremental change means that terms on the order of \(\hat {\nu }_{i}\hat {\nu }_{j}\) can be neglected. It is possible to show that with this assumption

Thus, \(\boldsymbol {\sigma }(s^{\prime })\) can be replaced by σ(sk). Moreover, the continuum approximation allows for the introduction of a probability measure \(d\hat {\boldsymbol {\nu }}{f_{d}^{k}}(\hat {\boldsymbol {\nu }})\) that gives the density of the discoverable and improved production systems within a neighborhood of distance d of a particular productivity growth rate vector \(\hat {\nu }\).Footnote 8

In the continuum approximation, \({{\Phi }_{d}^{k}}(s_{k})\) is a function of the cost shares σk = σ(sk), and can be written

This function will do a great deal of work in subsequent expressions.

3.2.2 The generating function

Taking the first derivative of Eq. 15 with respect to σk,i gives

The second term appears because the derivative of the Heaviside function is the Dirac delta function. But, because xδ(x) = 0 for any x, the second term vanishes.

The first term in Eq. 16 is the important one. It is the expected value of \(\hat {\nu }_{i}\) over alternative production systems that lie beyond the selection frontier. Because firms are assumed to adopt candidate production systems only if they satisfy the selection criterion, the first term is the expected value of the productivity growth rate. Indicating the expected value with angle brackets,

Comparing to Eq. 15, it can be seen that \({{\Phi }_{d}^{k}}(\boldsymbol {\sigma }_{k}) = \boldsymbol {\sigma }_{k}\cdot \langle \hat {\boldsymbol {\nu }}{\rangle _{d}^{k}}\).

From this point forward, the scalar function \({{\Phi }_{d}^{k}}(\boldsymbol {\sigma }_{k})\) will be referred to as the “generating function”, because its derivatives generate expressions for productivity growth rates.

It might be objected that it is not legitimate to take a derivative with respect to a single cost share in isolation, because cost shares must add up to one. Varying one cost share implies variation in at least one other cost share. However, while that condition must be imposed eventually, it is not formally necessary at this stage in the derivation. It turns out to be more convenient to introduce it at a later stage because the second derivatives of \({{\Phi }_{d}^{k}}(\boldsymbol {\sigma }_{k})\) exhibit some nice properties that can be used to restrict the possible functional forms for a cost share-induced technological change model. Imposing the condition that cost shares sum to one at this point would hide the underlying properties, creating unnecessary analytical difficulties.

3.2.3 Conditions a generating function must satisfy

As written, Eq. 17 is not operational, because the probability density \({f_{d}^{k}}(\hat {\boldsymbol {\nu }})\) is not known. One could be specified – that is the procedure followed by (Duménil and Lévy 2010), who proposed a uniform probability density on a disc. However, as shown by (Kemp-Benedict 2019), it is not necessary to specify the probability density, because Eq. 17 places analytically useful conditions on the possible forms for the generating function.

To derive the conditions, take the derivative of \(\langle \hat {\nu }_{i}\rangle\) with respect to σj,

Even without knowing the probability density \(f(\hat {\boldsymbol {\nu }})\), it is possible to say a great deal about the matrix M = [Mij]. This is the Jacobian matrix of the productivity growth rates with respect to the cost shares, and will sometimes be referred to as the Jacobian in this paper. It has the following features:

-

M1.

Because \(\hat {\nu }_{i}\hat {\nu }_{j} = \hat {\nu }_{j}\hat {\nu }_{i}\), M is symmetric;Footnote 9

-

M2.

Because \(({\sum }_{i}x_{i}\hat {\nu }_{i})({\sum }_{i}x_{j}\hat {\nu }_{j}) = (\boldsymbol {x}\cdot \hat {\boldsymbol {\nu }})^{2}\) for an arbitrary vector x, and the probability density is non-negative and strictly positive within part of its domain, M is non-negative;

-

M3.

From M2 and because \(({\sum }_{i}\sigma _{k,i}\hat {\nu }_{i})\delta (\boldsymbol {\sigma }_{k}\cdot \hat {\boldsymbol {\nu }}) = (\boldsymbol {\sigma }_{k}\cdot \hat {\boldsymbol {\nu }})\delta (\boldsymbol {\sigma }_{k}\cdot \hat {\boldsymbol {\nu }}) = 0\), M is positive semi-definite, with a null vector equal to the cost shares σk;

-

M4.

Because \(\hat {\nu }_{i}\hat {\nu }_{j} \delta (\boldsymbol {\sigma }_{k}\cdot \hat {\boldsymbol {\nu }}) = 0\) when σk,i = 1 (and therefore all other σk,j = 0), Mi⋅ = M⋅i = 0 when σk,i = 1.

Furthermore, condition M3 implies that

so \(\langle \hat {\nu }_{i}{\rangle _{d}^{k}}\) is homogeneous of order zero in the cost shares. Because \(\langle \hat {\nu }_{i}{\rangle _{d}^{k}}\) is itself a derivative of \({{\Phi }_{d}^{k}}(\boldsymbol {\sigma }_{k})\) from Eq. 17, condition M3 implies that the generating function \({{\Phi }_{d}^{k}}(\boldsymbol {\sigma }_{k})\) is homogeneous of order one in the cost shares.

Importantly, the conditions M1-M4 hold regardless of the details of the specific search distance d undertaken by unit k or the probability density functions \({f_{d}^{k}}(\hat {\boldsymbol {\nu }})\). Instead, they follow from the selection frontier and the fact that probability densities are non-negative. These results provide guidelines for suggesting candidate aggregate models for cost share-induced technological change, which is the procedure followed in this paper.

This approach – proposing candidate aggregate functional forms that meet criteria derived from a microeconomic analysis – can be distinguished from the more conventional approach to NK models, in which aggregate results are derived from candidate firm-level functional forms. The motivation for following this approach is twofold. First, either choice entails model-specific assumptions. Second, as Shaikh (2016, p. 101ff.) notes, there are good reasons to specify functions at the aggregate level for macroeconomic analysis, because a variety of microeconomic specifications can give rise to the same aggregate model.

The strategy pursued in this paper, of constraining an aggregate model through the construction of a microeconomic model of which some features remain unspecified (e.g., search efficiency or the density function), opens the possibility for analytical or simulation exercises to further constrain the aggregate functional form. Conditions M1-M4 can be seen as a minimal set.

3.3 Aggregating across multiple units

To aggregate across multiple units, the model assumes that the different units produce a comparable output and, for the output and all inputs, there are well-defined anchor prices. Different units might pay prices somewhat higher or lower than the anchor – for example, a large firm might buy at a discount due to high volume and a stable customer relationship, and one firm might sell into a high-end market while another sells into a mid-level market – but the set of prices is assumed to move together with the anchor, with price differentials absorbed in productivities.Footnote 10 Every unit therefore sells into a market with anchor price P and input prices pi, i ∈{1,…,n}, and produces an output Yk that is comparable to the output of other units.

Aggregate output from all units is

while the share of output is αk = Yk/Y. Total demand Qi for the i th input across all units is

where νk,i = νi(sk). The share of demand across units is denoted βk,i = (Yk/νk,i)/Qi.

The growth rate of total output can be calculated from the above. Using standard results for growth rates, and working to first order in the growth rate, the result is

The growth rate of the quantity of input is similarly given by

The growth rate of the average productivity of input i, νi, across all units can be calculated to first order from these expressions,

The result is a sum of two terms. As indicated, the first term captures compositional changes with no technological change within units. The second term is the average productivity change across units, weighted by the unit’s share of total demand for the input.

3.3.1 The aggregate generating function

The cost share of input i for unit k can be written in terms of the average cost share σi = piQi/PY as

The aggregate function Φ(σ) can then be defined as the production-weighted share of the unit-level \({{\Phi }_{d}^{k}}(\boldsymbol {\sigma }_{k})\),

Taking the partial derivative of this expression with respect to σi and applying Eq. 17 gives the result

The final expression is the second term in Eq. 24: average productivity growth across units. Thus, the key feature of the unit-level \({{\Phi }_{d}^{k}}(\boldsymbol {\sigma }_{k})\) – that their first partial derivatives are productivity growth rates – carries over to the aggregate expression. The difference between the unit-level and aggregate expressions is an additional term in Eq. 24 arising from compositional changes.

3.3.2 Conditions for the aggregate generating function

Multiplying Eq. 27 by σi and summing gives

From Eq. 25, the product σiβk,i is equal to αkσk,i, so this is

This result shows that Φ(σ), like the unit-level \({{\Phi }_{d}^{k}}(\boldsymbol {\sigma }_{k})\), is homogeneous of order one, so its partial derivatives are homogeneous of order zero; this is equivalent to condition M3 from above. What is more, the matrix of second partial derivatives of any smooth continuous function is symmetric, including those of Φ(σ), so condition M1 is also satisfied. Because shares must always be less than or equal to one, if the average σi = 1 for any input i, then it must be true for every unit, so that condition M4 is satisfied as well.

For condition M2 it is necessary to take the second partial derivative of Eq. 27 with respect to σj, which is

Multiplying on the left and right by an arbitrary vector x, the result is

But the quantity in parenthesis is the product on the left and right by a vector with elements xiβk,i of the unit-level matrix elements Mij. These are all non-negative from condition M2, as are the αk, so the sum is non-negative as well. This means that the left-hand side is non-negative, so the aggregate Φ(σk) satisfies condition M2.

3.4 Applying the model in practice

The conclusion from the derivation above is that the aggregate generating function Φ(σ) satisfies all of the conditions M1-M4 that are satisfied by the unit-level functions. Moreover, the first partial derivatives of the function with respect to cost shares gives the contribution to aggregate productivity growth rates arising from unit-level productivity changes in Eq. 24. This gives a way to construct candidate functional forms for a cost share-induced model of productivity change:

-

1.

Propose a scalar function Φ(σ) that is homogeneous of order one in the cost shares, to ensure that condition M3 is satisfied;

-

2.

Take partial derivatives with respect to cost shares to find productivity growth rates, thereby ensuring condition M1;

-

3.

Constrain parameters such that the Jacobian matrix ∂Φ/∂σi∂σj satisfies conditions M2 and M4.

4 A candidate functional form

This section presents a reasonably flexible candidate functional form for Φ that can generate a model of cost share-induced technological change satisfying the conditions M1-M4. As shown below, the probability density can be a linear combination of probability densities, so a functional form can be a linear combination of any viable functional form. Thus, the ones considered below can be combined with suitable weights. This is done in the final subsection in this section.

4.1 Linear generating function

The simplest candidate function of order one in the cost shares is the linear function

Taking first partial derivatives, productivity growth is found to be

This is the standard form in post-Keynesian models, with \(\langle \hat {\kappa }\rangle = 0\) and \(\langle \hat {\lambda }\rangle\) taking the Kaldor-Verdoorn form. As shown in Kemp-Benedict (2019), an expanded version of the Kaldor-Verdoorn law is consistent with the classical-evolutionary model.

4.2 CES-type generating function

For an arbitrary number of inputs, a CES-type function provides a candidate generating function:

However, it is important to recognize that while this is a model of technological change and the functional form resembles that of a CES function, this expression does not have the same interpretation of a constant elasticity of substitution. Rather, it is a convenient functional form of order one in the cost shares.

The requirement that the bi sum to one in Eq. 34 is a convention, so that A is the dimensioned quantity (with dimensions of 1/time). Assuming the generating function given in Eq. 34, the expected productivity growth rates are given by

Taking a further derivative with respect to the same cost share,

If A and the bi are all positive, then this expression is non-negative – and therefore satisfies condition M2 – only if k ≥ 1. Taking the derivative with respect to a different cost share σj, where j≠i, gives

If k > 1, then this expression is negative or zero. This means that unless k = 0, all inputs act as substitutes, at least to first order: a rise in the cost share of one input leads to both a rise in the productivity of that input and a fall (or no change) in the productivity of all other inputs, other things remaining the same. If that is not the case, then another functional form might be more suitable. However, it may often be the case, even when casual observation suggests otherwise. For example, rising labor productivity is often accompanied by falling capital and energy intensity in the first instance, suggesting that perhaps energy and capital must always rise and fall together. But a rise in the energy cost share would most likely be addressed by investment in energy-saving capital goods. The relevant question is, what is the first-order impact of a rise in the cost share of an input? For many inputs, the answer will be, “No change,” while others will be increased in order to compensate for reduced use of the costly input. Complementarity is a second-order phenomenon arising from the imposition of the selection frontier and the requirement that cost shares sum to one.

The CES-type functional form satisfies the criterion that the Jacobian matrix elements should go to zero when the corresponding cost share goes to one, as long as k ≥ 1. If σi = 1 while all others are zero, then

and Eq. 36 is equal to zero. For the off-diagonal elements, the fact that σj = 0 for j≠i means that Eq. 37 is equal to zero, as long as k ≥ 1.

These results imply that a CES-type function satisfies all of the conditions M1-M4 for the Jacobian matrix as long as k ≥ 1. The interesting case is when k is strictly greater than one; while k = 1 is acceptable, it reduces to the constant productivity growth function.

4.3 Linear combinations of probabilities and R&D expenditure

In some cases, the probability distribution might be best expressed as a linear combination of probability distributions,

In that case, the expected values of the productivity growth rates can be written as a weighted sum, using the same weights,

where 〈⋅〉k is the expectation with respect to density fk.

This rule is particularly useful for the functional form assumed by Dosi et al. (2010) and Caiani et al. (2019).Footnote 11 In those models,

where 𝜃 is the probability of acquiring a candidate innovation, and fA is the probability density of achieving a particular set of productivity growth rates given that an innovation has been acquired. Because \(\langle \hat {\boldsymbol {\nu }}\rangle = 0\) if the probability density is \(\delta (\hat {\boldsymbol {\nu }})\), the corresponding expectation is

(Dosi et al. 2010) and (Caiani et al. 2019) assume that the probability of acquiring a candidate innovation is zero if R&D expenditure D is zero and increases to 100% probability asymptotically as D rises. Specifically, they assume

While this assumption is prima facie plausible, some incidental expenditure of time and financial resources occurs continually in most settings. That expenditure will not be reflected in reported R&D costs. An alternative assumption might be

4.4 Changing variables

Suppose that the probability density function can be written in the following form,

where S is a rotational and scaling matrix. A rotation might be called for if it is more likely to find technologies with combinations of productivity growth rates; for example, if there are ample opportunities for reducing labor input by increasing capital expenditure, but very few where both labor and capital productivities rise simultaneously. A scaling is called for if the possibilities for productivity improvement in one particular input shrink over time. This second possibility is true for physically constrained processes, in which the conversion efficiencies from raw material to processed goods cannot be raised above a certain level – waste can be reduced, but 1 kg of flour will always require at least 1 kg of wheat.

In such cases, a change of variables from \(\hat {\boldsymbol {\nu }}\) to \(\boldsymbol {x} = \boldsymbol {S}^{-1}\cdot \hat {\boldsymbol {\nu }}\) leads to the following changes. First, because the probability distribution is a density,

Second, because the rest of the integrand consists of ordinary functions,

A generating function for the distribution g can be defined with respect to a set of “pseudo-shares” τ, which need not sum to one,

The generating function in terms of the proper shares, which do sum to one, is then

In this way, a generating function that takes certain types of constraints into account can be expressed in terms of a possibly simpler functional form.

To take the example from above of physically restricted productivities, a scaling matrix might have the form

With such a scaling matrix, as productivities approach their maximum levels \(\nu _{i}^{\max \limits }\), productivity growth slows asymptotically.

4.5 A flexible functional form

In this section different elements are combined to create a unified model. First, construct a linear combination of the constant productivity growth and CES-type functions,

Second, introduce R&D expenditure using the parameter 𝜃 from Eq. 44,

Finally, place physical limits on selected productivities using the (diagonal) scaling matrix S from Eq. 50. This gives the final expression for the generating function,

The model of cost share-induced technological change is found by taking partial derivatives of the generating function with respect to cost shares,

As a further step, embodied technological change and increasing returns to scale can be captured by making the ai depend on the sectoral growth rate g (Metcalfe and Foster 2010). Indeed, as shown in Kemp-Benedict (2019, pp. 10-12), the coefficient on growth can be a fully independent cost share-dependent function. Maintaining the simpler assumption that there are no cross-terms between cost shares and sector growth rates,

The result is a flexible functional form for an aggregate model of cost share-induced technological change that satisfies conditions (the conditions M1-M4) derived from an evolutionary microeconomic model.

5 Applications

Cost share-induced technological change is only part of the technological change dynamic. Following the introduction of an innovation, the innovating firms enjoy temporary monopoly rents. However, as other firms emulate them, competition through innovation gives way to price competition, while workers bargain, more or less successfully, for a share of the increased revenues.

The combination of new factor productivities, through innovation, and factor costs, through competitive price and wage setting, results in new cost shares. The outcome depends on how prices and wages are set. For example, (Okishio 1961) assumed that the wage was fixed, while competition for capitals drove profit rates to a common level. The Okishio theorem states that under these conditions the profit rate must rise, contradicting Marx, but as (Okishio 2001) later noted, the result is ambiguous if the wage can adjust.

While a fixed wage rate was a standard assumption of the classical economists of the 18th and 19th centuries, contemporary classical economists often impose a fixed wage share (Foley et al. 2019). If capital and labor are the only two inputs to production, this is equivalent to a common post-Keynesian assumption of a fixed markup. However, numerous variants are observed within firms (Lee 1994), some of which have been incorporated into post-Keynesian models (Lavoie 2014, p. 165ff.). Among the variants is target-return pricing, in which firms set their markups in order to achieve a particular profit rate.

In this section, three different applications are presented. The first combines cost share-induced technological change with target-return pricing in a two-factor, one-sector model in order to show how this particular combination generates Harrod-neutral technological change as a long-run tendency. The second shows how cost share-induced technological change stabilizes prices in a two-sector model. The third is an empirical analysis that applies the flexible functional form of the previous section to the US economy from 1970-2019. In each example, the focus is on the contribution to average productivity change from unit-level productivity changes – the second term in Eq. 24 – and ignores productivity growth due to compositional changes.

5.1 Labor and capital inputs with target-return pricing

The first example takes the simplest case for the cost share-induced technological change model, in which capital and labor are the only inputs to production, and combines it with target-return pricing. The example illustrates several points: that the theory elaborated in this paper can substantially reduce the number of free parameters in macroeconomic models; that the price-productivity cycle survives aggregation; and that this particular pricing strategy produces Harrod-neutral technological change as a long-run tendency.

5.1.1 Applying the conditions

The demonstration starts with the expected values of the productivity growth rates rather than the generating function. Notation for cost shares is conventional: π, for the profit share, and ω, for the wage share. The corresponding productivities are κ and λ.

Condition M1, that the Jacobian of productivity growth rates with respect to cost shares is symmetric, implies

Condition M3, that the cost shares are a null vector of the Jacobian, implies both

and

This is three equations for four entries in the Jacobian matrix, which means that there is a single independent entry, say \(M = \partial \langle \hat {\kappa }\rangle /\partial \pi\). Because the Jacobian matrix is positive semi-definite (condition M3), the independent entry must be non-negative: M ≥ 0. Moreover, from condition M4, it must be zero, M = 0, when π = 1 and ω = 0. Together, these conditions imply that M is either identically zero, or is nonzero at some cost shares but is zero at at least one point, showing that M cannot be a nonzero constant.

The full Jacobian matrix can now be found by substituting M for \(\partial \langle \hat {\kappa }\rangle /\partial \pi\) in Eq. 57 and using Eqs. 56 and 58. The result is

5.1.2 Total change in productivity growth rate

The Jacobian matrix gives the partial derivatives of the productivity growth rates with respect to cost shares. The total change in one of the productivity growth rates is given by summing over all of the partial derivatives multiplied by the changes in individual cost shares.

It is at this point that the condition that cost shares sum to one becomes useful. Prior to this point, it would have obscured the properties of the Jacobian matrix summarized in conditions M1-M4, but now it ensures that if the profit share were to change by Δπ, then the wage share must, of necessity, change by −Δπ.

The total first-order change in the productivity growth rate under such a change would be

5.1.3 Introducing target-return pricing at the unit level

Equation 60 is as far as the conditions M1-M4 take us, but that is pretty far: the number of potentially independent functions in the Jacobian matrix is reduced from four to one, and the remaining function must satisfy additional criteria. However, as an economic model it is not complete, because prices will subsequently change in light of changing productivities and possibly other conditions, leading to a new set of cost shares.

This recursive dynamic is an essential feature of cost share-induced technological change models. In some of those models the pricing formula is very simple: a constant wage or wage share. However, other pricing formulae are possible. This is a positive feature of cost share-induced technological change models, because the separation between innovation and pricing allows for a variety of different assumptions about how prices and wages are set.

To take a concrete and important example, suppose that each unit k applies target-return pricing, in which it adjusts prices to reach a (possibly unit-specific) target profit rate rk. Then,

Rearranging this equation shows that prices are adjusted such that

5.1.4 Finding an aggregate expression

Equation 62 is a unit-level expression, including for the productivity growth rate. What is more, the unit-level productivity growth rate is the realized value rather than the expectation. However, because \(\hat {\kappa }_{k}\) does not appear on the left-hand side Eq. 62, and the right-hand side is linear in \(\hat {\kappa }_{k}\), taking the expectation with Eq. 17 is straightforward:

The aggregate expression is found by averaging both sides of this equation across units, weighted by production shares αk,

Because αkπk = βk,ππ from Eq. 25, and \({\sum }_{k}\beta _{k,\pi } = 1\), this becomes

Substituting this expression into Eq. 60 gives

This is a macroeconomic expression, derived through explicit aggregation from a micro level model.

5.1.5 Harrod-neutral technological change

It is possible that M is identically zero. In that case, Eq. 66 says simply that the capital productivity growth rate is a constant. The more interesting case is one in which M is nonzero away from π = 1. Because M is positive, Eq. 66 exhibits a stable dynamic, tending towards \(\langle \hat {\kappa }\rangle = 0\). That is, it tends towards Kaldor’s stylized fact of constant capital productivity.

What is more, from Eq. 65, when \(\langle \hat {\kappa }\rangle = 0\), the profit share is not changing, which is another of Kaldor’s stylized facts. Thus, for a generic two-factor model, target-return pricing produces an equilibrium position that features Kaldor’s stylized facts of constant capital productivity and profit share.

Labor productivity growth is unconstrained. At the equilibrium, cost shares are not changing, so the labor productivity growth rate is a constant as well. This model therefore yields Harrod-neutral technological change as a long-run tendency, a result that was noted in Kemp-Benedict (2019).

Other pricing and wage-setting strategies would give different results. For example, a classical assumption of constant (conventional) wage share would imply Δπ = 0 and thus \({\Delta }\langle \hat {\kappa }\rangle = 0\) from Eq. 60. If \(\langle \hat {\kappa }\rangle\) is negative at the outset, then it will remain negative, and the pursuit of profitability will result in the Marxian result of a continually declining profit rate.

As this example makes clear, in theories of cost share-induced technological change, price and wage-setting decisions are separate from innovation decisions. Just as in post-Keynesian theory the analytical separation of saving decisions from investment decisions leads to such surprising results as the paradox of thrift, the separation of innovation from pricing in classical theory results in unintended macroeconomic outcomes, which are reflected in a perpetually renewed, and perpetually frustrated, pursuit of profit.

5.2 Price stability in a two-sector model

Shiozawa et al. (2019), through their minimal price theorem, demonstrated that in an interlinked economy with many products and sectors, prices will fall more or less rapidly to a stable minimal level if all producers seek to minimize their costs. The theorem assumes an existing and stable set of techniques. Noting that technological change will alter the set of techniques, Shiozawa et al. (2019, pp. 86-87) argued that one cause of price change is technological change.

This example will show that cost share-induced technological change can in fact stabilize prices in a multi-sector setting. The reason for this is that the technical coefficients in an input-output matrix are both (inverse) productivities and, when adjusted for price, cost shares. While all cost shares can be represented as a price ratio divided by a productivity, the relevant prices for the intermediate cost shares are determined within a price system that is itself determined by the technical coefficients. Cost share-induced technological change tends to yield steady cost shares and productivity growth rates as long-run tendencies, so models with intermediate demand tend to generate stable relative prices and trendless technical coefficients.Footnote 12

This claim will be illustrated with a concrete example – a “toy model” that captures some key features of a multi-sector economy. It has two sectors: an “extractive sector” that takes a natural resource and provides only intermediate goods; and a “final goods sector” that provides all final goods but also intermediate goods.

5.2.1 The price system

The price equations for the economy are

In these equations, a subscript f refers to the final goods sector and an e to the extractive sector. The price pR is the resource price, and ν is the resource productivity in the extractive sector. Sector wages are given by wf, we and labor productivities by λf, λe. The technical coefficients are denoted aij so that, for example, aff is purchases of final goods by the final goods sector and aef purchases of extractive sector goods by the final goods sector.

The μi in Eqns. (67a, b) are profit margins, which are related to the profit shares via πi = 1 − 1/μi. Wage shares are given by ωi = wi/piλi, and the resource cost share in the extractive sector by ρ = pR/peν. The intermediate cost shares αij are equal to

5.2.2 Dynamics

The cost share-induced technological change sub-model is specified through sector-specific generating functions,

From Eq. 67, prices are set by fixed markups μf and μe, with full and immediate pass-through of costs. As a result, the profit shares do not change. A further assumption is that nominal wages track productivity, so the ratios wi/λi do not change.

5.2.3 Specifying parameters and initial values

The model above was run with a specific set of parameter values.Footnote 13 They are not meant to represent any particular economy, so while a dollar sign $ is used to represent a currency unit, it does not represent the US dollar.

Sector prices are initialized to pf = pe = $1/unit output. The resource price is $30/resource unit. Markups are (μf,μe) = (1.32,1.29). Labor productivities are initialized to (λf,λe) = (1000,1500) units/worker-day, which, when combined with labor productivities and the initial price levels, gives initial wage rates of $360 and $338/worker-day. Capital productivities in both sectors are initialized to κ = 0.4/year, and resource productivity to 100 extractive sector units/resource unit. Technical coefficients are initialized to

Taken together, these initial values determine the initial cost shares.

The generating functions were assumed to be as in Eq. 54, with 𝜃 = 1, no transformation (Sii = 1), and constant coefficients. The k parameter was set to 1.5 for both sectors and A to 1/year. In the final goods sector, the weights b were set to (0.2, 0.6, 0.1, 0.1) for the cost shares (πf,ωf,αff,αef). In the extractive sector, they were set to (0.2, 0.5, 0.1, 0.1, 0.1) for the cost shares (πe,ωe,αee,αfe,ρ). The constant a terms were determined by initializing labor productivity growth rates \(\hat {\lambda }_{f,e}\) to 1.5%/year and all other productivity growth rates to zero.

5.2.4 Running the simulation

The model simulation was run for 100 years. At year 20, there is a one-time and permanent shock to the resource price, which rises by 10%, from $30/resource unit to $33/resource unit. As can be seen in Eq. 67, after an initial period in which the rising resource cost is immediately passed through by the extractive sector to the final goods sector, and then passed along by the final goods sector, prices begin to return to their original values. This occurs because of technological change driven by rising cost shares (Fig. 1).

The impact of the changing cost shares on technological change can be seen in Fig. 2. The 10% rise in resource price is permanent, and it translates into a corresponding 10% rise in resource productivity that is approached asymptotically over time. As the extractive sector price rises, it initially drives the final goods sector to save on the output of the extractive sector. However, as extractive sector prices return to their prior levels, the final goods sector makes greater use of the extractive sector’s output, returning the technical coefficient to its original level. Note that this does not mean that it returns to the same technique. For example, the resource might be used to produce both fuel (e.g., woodfuel or petroleum) and materials (e.g., wood beams or plastics). The initial price rise might drive greater efficiency in fuel use, but subsequent resource productivity improvements lower costs, inviting expanded use of materials.

The long-run impact of the jump in resource price is more efficient use of resources in the economy as a whole through an increase in resource productivity ν. Otherwise, the economy returns to its original state. The nominal resource price remains at its new, higher, level (an exogenous assumption), but other prices return to their original levels.

The responsiveness of the productivity-price system to a shock depends on the availability of productivity-enhancing technology and the speed with which it can be brought into production. That can only be understood through additional analysis, such as technical assessments or empirical testing. To illustrate how such a question might be answered, the next example looks at capital, labor, and energy inputs into the US economy.

5.3 Energy costs and technological change in the US

The final example is an application of the functional form given in Eq. 54 to an actual economy: the US from 1970 to 2019. For this purpose, a one-sector model is constructed with capital, labor, and fossil energy inputs (where “fossil” includes oil and natural gas, but excludes coal). The model is meant to be illustrative, rather than diagnostic, in keeping with the goals of this paper. Nevertheless, some of the results are interesting and will be discussed below.

5.3.1 Data

The data needed to fit the model are shares of GDP and productivities for capital, labor, and fossil energy. Time series for the capital stock and GDP are given by the corresponding “national accounts” variables in Penn World Tables 10.0 (PWT10: see Feenstra et al. 2015): real GDP (rgdpna) and capital stock (rnna) at constant 2017 prices. Employment is given by the the PWT10 variable “empl” and the labor share by the variable “labsh”. Energy rents for crude oil and natural gas are given by World Bank World Development Indicators (WDI).Footnote 14

Consumption of petroleum and natural gas for industrial purposes is taken from data collected by the US Energy Information Adminstration (EIA) April 2022 Monthly Energy Review. The heat content of petroleum consumption for the commercial sectors is taken from Table 3.8a, for industry from Table 3.8b, and for electricity generation from table 3.8c. Natural gas consumption in volumetric terms for the commercial, industrial, power generation, and pipeline transport sectors is taken from Table 4.3 and converted using EIA factors for the heat content of natural gas.Footnote 15

Labor productivity is computed as GDP divided by employment, capital productivity as GDP divided by the capital stock, and energy productivity as GDP divided by the total heat content of petroleum and natural gas by economically productive sectors. The labor cost share is given by the PWT10 value, fossil energy by the sum of the WDI crude oil and natural gas rent shares, and the profit share as the balance. The profit rate is estimated as the profit share multiplied by the capital productivity.

5.3.2 Historical trends

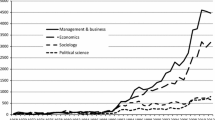

Some trends are of interest. The first, which has been widely observed, is a general downward trend in the wage share (Fig. 3). The trend paused in the mid-1980s, and reversed during the 1990s boom, but then resumed after 2001.

The second notable trend is that energy productivity began rising after the 1972 oil crisis, and accelerated after the 1979 oil crisis, as shown in Fig. 4. After that it grew more slowly, and recently it has appeared to stabilize at around 0.7 2017$/PJ. That apparent stabilization could be due to physical constraints, which could be reflected in a maximum energy productivity, as in Eq. 50. Alternatively, it could be due to a falling energy cost share (see Fig. 5), and therefore little pressure to raise energy productivity.

The third and final trend is that the profit rate has been rising since the early 1980s, as shown in Fig. 6. It could be rising for technical reasons or because of an upwardly-rising target rate. In either case, because the profit rate is changing, then from the first example the expectation is that there will be departures from Kaldor’s stylized facts. Such departures have, in fact, been seen: capital productivity and the profit share have generally been rising, while labor productivity growth has slowed.

5.3.3 Fitting the model

The data are fit to a model of cost share-induced technological change along the lines of Eq. 54. R&D expenditure is not considered, so 𝜃 = 1. Also, the Kaldor-Verdoorn term is not included, so the ai are constants. Capital productivity is denoted by κ, labor productivity by λ, and energy productivity by ν. Angle brackets 〈⋅〉 are suppressed. The corresponding shares are π, ω, and ε.

Given the possible saturation of energy productivity in Fig. 4, a maximum energy productivity \(\nu ^{\max \limits }\) is proposed. The scaling matrix is therefore

With these assumptions, the sum that appears in parentheses in Eq. 54 is given by

In terms of this factor, the expressions for the productivity growth rates are

The model defined by Eqs. 72 and was first fitted using R’s built-in optim function using data from 1970-2000 and then compared to the entire dataset, which covers the time period 1970-2019. The sample size was therefore 90 (that is, annual observations of 3 parameters over 30 years), while there are 8 independent parameters (the bi’s sum to one, removing one degree of freedom), so there are 11 observations for each parameter. Historical and fitted values are plotted in Fig. 7 and the fitted parameters in Table 1.

Regarding the comparison between simulated and historical data shown in Fig. 7, one immediate observation is that the simulated values, particularly for capital and labor productivity growth rates, are much less volatile than the historical values. This is because, as implemented, the model simulates potential rather than realized output. While capacity utilization could have been endogenized in an expanded model (e.g., as in Kemp-Benedict 2020), for this example it is assumed to be steady, so sharp drops in utilization during recessions or abrupt rises during booms are not reflected in the model estimates. Once this difference is acknowledged, a further observation is that the model performs reasonably well out of sample; that is, over the period 2000-2019. Energy productivity growth is reproduced particularly well, but so are the relatively elevated capital productivity growth rate in the 2000s and lower labor productivity growth. The trends are explained by historically low wage and energy cost shares and a high profit share.

Regarding the parameter estimates, the maximum energy productivity, \(\nu _{\max \limits }\), is of particular interest. Historically, energy productivity roughly doubled in 15 years, from around 0.2 2017$/PJ in 1970 to around 0.4 2017$/PJ in 1985, as shown in Fig. 4. It then underwent a second, slower rise, to 0.7 2017$/PJ, over the 20-year period from 1985 to 2005. The estimated maximum is around 1.0 2017$/PJ, suggesting that further attempts to raise fossil energy productivity will face diminishing returns.

5.3.4 Reflections on the model results

While the cost share-induced technological change model presented in Eqs. 72 and may appear complex, it is in fact structurally simple, with cost shares as explanatory variables and productivity growth rates as dependent variables. Still, the model is rich enough to offer some interesting results. First, historical productivity growth trends are broadly explained by the model, including the recent productivity slowdown. Some argue that the persistent slowdown is evidence of “secular stagnation” (e.g., see Teulings and Baldwin 2014). In this paper, slow labor productivity growth is the result of a declining wage share, a feature of the US economy that is indeed likely to persist (Taylor and Omer 2020). The causal chain in the model is from the supply side – a low wage share means less pressure to raise labor productivity. It complements demand-side arguments linking distribution to slower GDP growth (e.g., Cynamon and Fazzari 2015). Taylor and Omer (2020) combine both supply-side and demand-side drivers in a unified analysis, albeit with a different microeconomic behavioral assumption than the one adopted in this paper.

Also of interest is the estimated upper bound on fossil energy productivity. If it reflects a real constraint, then it is one more reason to curtail fossil energy use. But no further reasons are needed, as climate change requires immediate action (IPCC 2022). Severe impacts and risks are unavoidable, but to avoid yet worse impacts, fossil fuels must be kept in the ground (SEI 2021). This model could be used to assess the impact of fossil fuel prices on resource use efficiency and decarbonization, but prices cannot stand alone. As argued in (Kemp-Benedict 2018 p. 212), a paper that applied the model of cost share-induced technological change as presented in (Kemp-Benedict 2019) to a renewables transition, a strategy of raising fossil fuel prices should be accompanied by constraints on exploration and extraction, as well as policies to stimulate investment in renewables.

6 Discussion