Abstract

Both exogenous and endogenous growth theories in neoclassicaleconomics ignore the resource constraints and wavelike patterns in technology development. The logistic growth and species competition model in population dynamics provides an evolutionary framework of economic growth driven by technology wavelets in market-share competition. Learning by doing and knowledge accumulation ignores the interruptive nature of technology advancement. Creative destruction can be understood by using knowledge metabolism. Policies and institutions co-evolve during different stages of technology life cycles. Division of labor is limited by the market extent, numbers of resources, and environment fluctuations. There is a trade-off between the stability and complexity of an ecological-industrial system. Diversified patterns in development strategy are shaped by culture and environment when facing learning uncertainty. The Western mode of division of labor is characterized by labor-saving and resource-intensive technology, while the Asian and Chinese modes feature resource-saving and labor-intensive technology. Nonlinear population dynamics provides a unified evolutionary theory from Smith, Malthus, to Schumpeter in economic growth and technology development.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

1 Introduction

There are two conflicting views of technology development. Neoclassical growth theories consider technology progress as a smooth trajectory with perfect foresight, which can be described by log-linear models in the form of Cobb-Douglas function (Solow 1957; Romer 1986; Aghion and Howitt 1998; Dasgupta 2010; Kurz 2012). Economic historians recognize wavelike patterns and revolutionary changes in industrial economies (Schumpeter 1939; Toffler 1980; Ayres 1989; Rostow 1990; Piketty 2014). We will develop the second approach in this article by introducing nonlinear population dynamics into market-share competition.

The equilibrium perspective prescribes a uni-directional causality to convergence (exogenous growth theory in capital accumulation) or divergence (endogenous growth theory in knowledge accumulation) in economic growth. However, biological evolution and industrial revolution reveals a clear pattern of dynamic metabolism and complex patterns in a two-way evolution towards convergence and/or divergence in different periods and regions.

Historically, it was Malthus, an economist, whose theory of resource constrain for population growth inspired Darwin’s theory of biological evolution (Malthus 1798, 2008; Darwin 1859). The logistic model and the prey–predator model were introduced in modeling business cycles (Goodwin 1967; Samuelson 1971; Day 1982). We will consider a new factor of culture strategy when facing learning uncertainty, which is useful in understanding different modes of division of labor in historical development (Chen 1987).

In this article, we will raise two basic issues in growth theory.

First, what is the nature of knowledge? Endogenous growth theory offers a static picture of knowledge accumulation through learning by doing (Arrow 1962). This theory implies an increasing polarization between rich (early-movers) and poor (late-comers). This picture is not compatible with world history, with the rise and fall of nations and civilizations.

Second, how can one understand the roots of global warming and the ecological crisis? The neoclassical Cobb-Douglas production function in AK model implies unlimited resources. This framework cannot address the contemporary issues of the ecological crisis and global warming.

It is known that industrial economies are driven by sequences of new technologies, such as coal, petroleum, electricity and nuclear energy, which exploit new resources. Wavelike technology development can be described by population dynamics with resource constraints, notably the S-shaped logistic curve and the Lotka-Volterra model for species competition (Pianka 1983; Nicolis and Prigogine 1977). Schumpeter’s long waves and creative destruction can be described by metabolic movements of logistic wavelets. Culture plays a strategic role when facing learning uncertainty. The Western mode of the division of labor is characterized by labor-saving and resource-intensive technology, while the Chinese mode is mainly driven by resource-saving but labor-intensive technology.

This article is organized by the following: Section 2 discusses some basic facts on resource disparity and uneven growth in world history that raises challenges to growth theory. Section 3 develops the logistic model of growth and technology competition under resource constraints (Chen 1987). The implications of nonlinear solutions, including the S-shaped curve and the logistic wavelet, are discussed from the perspective of evolutionary dynamics. Section 4 introduces the cultural factor in learning strategy when facing a new but uncertain resource or market. The division of labor is limited by the market extent, number of resources, and environmental fluctuations. There is a trade-off between stability and diversity. Section 4.2 discusses historical puzzles in civilization bifurcation that can be explained by our approach (Chen 2008, 2010). Section 5 addresses basic issues in economic methodology. Section 6 concludes with a comparison between the equilibrium and evolutionary perspectives in growth theory.

2 Uneven Economic Growth and Limits of Neoclassical Growth Theories

The Solow model of exogenous growth predicted a convergence trend in economic growth based on the assumption of constant returns to scale (1957) while the Romer model of endogenous growth claimed a divergence trend based on increasing returns to scale in knowledge accumulation (Romer 1986; Arrow 1962; Lucas 1988). However, observed patterns in the world economy are more complex than the predictions of neoclassical growth models (see Tables 1 and 2).

We can see that the U.S. had the highest growth rate between 1913 and 1950, Japan from 1950 to 1970, and China from 1970 to 2010. We did not see a rigid convergent or divergent trend for each region or from a cross-country comparison. Instead, we see changing trends with the rise and fall of nations.

It is known that the rise of the West was driven by resource expansion under colonialism (Pomeranz 2000). In terms of per capita arable land, East Asia including Japan and China has much less arable land compared to Western countries (Table 3).

There is a striking difference between Asia’s small grain farms and large western farms in corn and cattle agri-business. Obviously, an individualist culture is deeply rooted in a resource-intensive and labor-saving technology, while a collectivist culture is associated with resource-scarce and a population-dense environment. The role of culture and resource in the modernization catch-up game will be discussed in Sect. 4.2. Our observation on patterns in resource and population started from a cross-country comparison, which can be extended to any industrial analysis if relevant data are available.

3 Logistic Model of Limited Growth and Species Competition

The Cobb-Douglas production function in neoclassical economics can be transformed into a log-linear function, which means unlimited growth without resource limits or market extents. The studies of resource limits need the development of nonlinear dynamics.

3.1 Limited and Unlimited Growth in Economic Dynamics

Adam Smith clearly stated in his third chapter of the Wealth of Nations that the division of labor is limited by the market extent (Smith 1776). This statement was called the Smith Theorem by George Stigler (1951). Malthus further pointed out that population growth is limited by natural resources (Malthus 1798, 2008).

The Smith concept of “market extent” and the Malthus idea of “resource constraint” can be described by carrying capacity N* in the nonlinear logistic model of population growth. When applying the ecological model to economic growth, we need to change the name of corresponding variables. In the following discussion, we will put the original name in theoretical ecology into brackets after the economic variable, so that readers can clearly understand the original meaning and its economic meaning.

From the demand-side perspective, n is the number of buyers (population) and N* the market extent (population size), which is a function of income distribution. Here, the market extent is associated to population size with affordable income.

From the supply-side perspective, n is the output and N* the resource constraint, which is a function of existing technology and cost structure. For example, grain yield can be increased by the application of irrigation and fertilizer or new products like corn and potatoes historically.

The simplest model of limited growth is the logistic model with a quadratic function in evolutionary ecology (Pianka 1983):

Here n is output (population), \( N^* \) is the resource limit (population size), k is output (population) growth rate.

The logistic model has a varying dynamic economy of scale:

The logistic model is the simplest form of nonlinear dynamics. The reflection point may shift from the middle point, when f(n) is not a quadratic function.

In comparison, the AK model in neoclassical growth theory has fixed returns to scale without resource limits. Therefore, neoclassical firm theory is not capable of understanding changing economies of scale (Daly and Farley 2010).

The logistic model is also called the Verhulst equation in theoretical ecology (Pianka 1983). Its discrete-time version may produce the simplest chaos regime with only one variable. Deterministic chaos in discrete-time can be called “white chaos”, since its frequency spectrum looks like white noise (May 1974; Day 1982; Chen 2010). Its continuous-time solution is a S-curve. The graphic patterns of unlimited (exponential) growth and limited (logistic) growth are shown in Fig. 1.

When we adopt the logistic model in economic theory, our analytic unit is technology or industry. If the resource limit is arable land, our analytic unit can be a region or a state. In empirical analysis, the meaning of market extent or resource capacity depends on available data.

The logistic growth pattern can be clearly observed from sector industrial data, such as the output percentage ratio to GDP in the U.S. automobile industry in Fig. 2 (Chen 2010).

We can see that the U.S. auto industry took off between the 1900s and the 1920s, and reached the saturation stage before the 1930s. The S-shaped growth curve can be observed in firm and industrial growth in sector analysis.

3.2 Market-Share Competition Model in Open Economy

Now, we move from one technology to more technologies in a market-share competition. The simplest resource competition model is a two-species competition model or the Lotka-Volterra equation in theoretical biology (Pianka 1983).

Where n 1 , n 2 are output (population) of technology or product (species) 1 and technology (species) 2; N 1 and N 2 their resource limit (carrying capacity); k 1 and k 2 their learning (population growth) rate; R 1 and R 2 their exit (death) rate; β is the competition (overlapping) coefficient in market-share (resource) competition \( \left(0\le \beta \ \le 1\right) \).

The equations can be simplified by introducing effective resource limits (carrying capacities)

Here, we should emphasize the different perspective of technology development between neoclassical economics and evolutionary economics. General equilibrium models only consider features in a closed economy, such as the static model having fixed number of products with infinite life (Arrow and Debreu 1954), or dynamic model with random innovations (Aghion and Howitt 1992). In contrast, population dynamics mainly concerns an open economy, where new technology introduces new resource and new market. Therefore, nonlinear population dynamics is more realistic for industrial economy with interruptive technologies.

Our population dynamics describes a learning competition in facing a new (uncertain) resource. Here, population indicates the number of users of a specific technology. The entry and exit speed of the new technology is described by the learning and exit rates in the learning process. For mathematical simplicity, we put the learning rate at the quadratic term and the exit rate at the linear term. Therefore, the learning mechanism has a stronger impact than the exit mechanism in technology competition.

The meaning of the exit rate can be seen in Eq. (3c). Consider a case of agricultural development. If grain is the only food available for a population, then the exit rate for grain is R1 = 0, and C1 = N1. However, if a new food, say, potatoes, are introduced, some portion of the population would switch from grain to potatoes, so that the exit rate R1 > 0, and C1 < N1. The effective resource limit may be lower than the original land without competition.

The competition coefficient β measures the degree of competition. When \( \beta =0 \), there is no competition between the two species. Both technologies may fully grow to reach their resource limits independently.

In neoclassical economics, relative price plays a central role in resource allocation. In an industrial economy, market-share plays a major role in shaping industrial structure. The competition coefficient can be estimated if market-share data is available in marketing research and industrial analysis.

Technology metabolism means the birth of new technology and the death of old technology. Technology competition may have two consequences: (1) old technology is replaced by new technology under condition (4a); or (2) old and new technologies co-exists under condition (4b).

Therefore, the new technology will wipe out the old technology if its resource limit is much higher than the old technology.

When two technologies co-exist, both the new and old technologies cannot fully utilize their resource potentials, since their equilibrium output is smaller than their resource limits (5a, 5b, 5c). The cost of creative destruction is the unrealized (excess) capacity.

For example, technology n1 would reach full capacity of C1 in absence of technology 2. After technology n2 entered the market share competition, there are two possible outcomes for technology n1: (1) Technology 1 is wiped out by technology 2, so that n1 = 0 and n2 = C2. The cost of “creative destruction” is the total loss of old capacity C1. This was the case when the handcraft textile industry was destroyed by machine industry in the early development stage. (2) Old and new technology coexist, so that both technologies have excess capacity: (C1−n1*) >0 and (C2−n2*) >0.

Here, species competition model sheds light on market-share competition. For example, if we have market-share data for major firms in computer industry, we may apply our model to marketing competition. If we have relevant data, we may also study arm race among nations.

Frank Knight made the distinction between predictable risk and unpredictable uncertainty (Knight 1921). Risk is often measured by variance in neoclassical econometrics. Here, we have two types of uncertainty: the arrival time of a new technology and the initial condition of a new technology. Therefore, there is no possibility for optimization or rational expectations in technology competition because of unpredictable uncertainty. Path dependence is the essential feature of technology development (David 1985; Arthur 1994).

Keynesian economics has no structural theory for “insufficient aggregate demand”. Micro-foundations theory attributes macro fluctuations to household fluctuations in working hours, which is rejected by the Principle of Large Numbers (Lucas 1981; Chen 2002). Now we have a meso-foundation for macro growth cycles: the existence of excess capacity at the industrial level under technology metabolism. The observed costs in terms of excess capacity and related large unemployment are typical forms of dissipative energy or economic entropy (Georgescu-Roegen 1971).

3.3 Technology Life Cycle, Logistic Wavelets and Metabolic Growth

The concept of a product life cycle is widely used in economics and management literature (Vernon 1966; Modigliani 1976). We apply this concept to a technology life cycle. Traditionally, the life-cycle phenomenon can be described by a multi-period model in econometrics. Linear dynamical models, such as a harmonic wave with infinite life and a white noise model with a short life (Kydland 1995), are not proper for a life-cycle model, since a life cycle is a nonlinear phenomenon. The logistic wavelet with a finite life is a simple nonlinear representation for technology life cycles. Schumpeter’s long waves and creative destruction can be described by a sequence of logistic wavelets in a technology competition model (Schumpeter 1934, 1939, 1950).

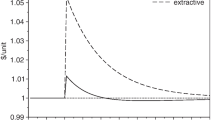

A numerical solution of Eq. (3) is shown in Fig. 3. Without competition, the growth path of technology (species) 1 would be a S-shaped logistic curve. However, the realized output of technology 1 resulting from competition with technology (species) 2 looks like an asymmetric bell curve. We call it the logistic wavelet, which is a result from the competition of new technology. The envelope of the aggregate output shows an uneven growth path that mimics the observed pattern of a time series from macroeconomic indexes. This scenario was first proposed by Peter Allen in Prigogine et al. (1977).

Metabolic growth characterized by technology competition in Eq. (3). The old technology (blue dashed line) declines when new technology (green dot and dash line) emerges. The output envelope (red solid line) is the sum of their output of all technologies. Here, \( \beta =0.4 \), \( {C}_2/{C}_1=2 \). The units here are arbitrary in computational simulation (colour figure online)

The wavelet representation can be applied in analyzing the lifecycle of products, firms, technologies, and nations (Eliasson 2005). The traditional life-cycle model in econometrics takes the form of discrete-time with linear dynamics (Browning and Crossley 2001), while the wavelet model is a continuous-time model in nonlinear dynamics. The time scale of the logistic wavelet varies between product life cycles from several months to Kondratieff long waves over several decades.

The wavelet model of metabolic growth provides clear answer why capital accumulation has no infinite trend, since recurrent capital destruction along with obsolete industries (Piketty 2014).

In the real world, rise and fall of great nations not entirely depends on technology competition. For example, German took the lead in the second industrial revolution led by electric and chemical industry. However, British-American allies won the two world wars because of their dominance in navy power and resource share. This observation further supports our theory of market-share competition not only for economic competition, but also for military competition. In contrast, optimization approach in neoclassical economics produces a utopian market of self-centered optimization without competitors.

3.4 Capital and Institution Co-evolution During the Four Stages of Logistic Wavelet in Mixed Economies

The metabolic growth model provides a theoretical framework for capital movement and institutional co-evolution with the rise and fall of technology wavelets. We may divide the logistic wavelet into four stages: I. Infancy, II. Growth, III. Maturation, IV. Decline.

Neo-classical theory treats capital as a smooth growing stock that fails to explain the endogenous causes of business cycles and recurrent crisis.

The wavelet model of technology provides an endogenous mechanism of capital movement and policy changes.

At the first stage of infant technology, some survival threshold may exist. Before reaching this threshold, it is hard for an infant technology to survive. Some protection in intellectual property and foreign trade may be helpful for infant industries. Private investors are reluctant to invest in a new technology due to great uncertainty. R&D of new technology is mainly sponsored by the public sector and non-profit universities. For example, the Internet and GPS systems were first developed in universities and national labs for military research, and then transferred to commercial businesses.

At the second growth stage, the new technology shows its market potential, private capital jumps in; market-share expands rapidly, newly issued stock prices soars. At this stage, market competition is the driving force of market expansion. However, safety and environmental standards, as well as financial regulations, are necessary for constructive competition. Herd behavior may appear in generating market instability, such as the case of the dot-com bubble in 2000.

At the third stage of market saturation, corporate profits fall and industrial concentration increases. Monopolistic competition may stiffen new innovations. Anti-trust laws are useful for preventing market concentration and market manipulation. We saw the industry concentration trends in the 2000s after liberalization in the 1980s in the U.S., including telecommunication, computer, software, airline, banking, and retail markets. The 2008 financial crisis was rooted in the American disease where financial oligarchs crowded out the real economy (Johnson 2009; Chen 2010).

The big challenge occurs at the fourth decline stage. Some sunset industries struggle for survival or end up in bankruptcy. Past investment turns into big loss. Stock prices drop and financing costs goes up. Decisions on a life-saving investment or a cut-loss strategy are life-or-death issues for old industries. Large-scale unemployment demands government assistance. Transition from a sunset industry to a sunrise industry needs coordinated efforts between the private and public sector. A typical example is the coal industry in Britain, which was the driving force of industrial revolution in the eighteenth century but declined in the 1980s. Industrial policy for encouraging new radical technology (still in an infant stage) and retraining displaced workers from obsolete technology may be useful. Conventional monetary policy and Keynesian fiscal policy are not enough for structural adjustment at this stage. Conflicts or wars between sunset and sunrise industry groups more likely occur at this stage.

Similarly, institutional arrangements must adapt to different stages of technology life cycles. Clearly, the market force alone cannot insure a healthy economy since technology metabolism may generate substantial social instability and a strong impact to biodiversity. The transaction cost argument against regulation is misleading, since sustainability of an ecological system cannot be solely judged by minimizing entropy (waste heat or transaction costs) during industrialization (Chen 2007). The issue is not big vs. small government, but effective vs. incompetent government in dealing with complexity and stability of mixed economies. A selection mechanism in market regulation plays a central role in institutional evolution (Chen 2007).

3.5 Non-equilibrium Pricing Mechanism Evolving with Technology Wavelets

Here, non-equilibrium mechanism implies multiple pricing strategies evolving with changing technology wavelets. There is no unique optimal pricing in open competition that is prescribed by neoclassic price theory. Our perspective provides a sector foundation of uneven growth cycles (Rostow 1990).

At the first infancy stage, great uncertainty rules out equilibrium pricing in R&D. The competition among rival universities and institutes mainly about research conditions and research reputation. Researcher salaries are paid according to their rank and time that is common practice for public and non-profit organizations. It is hard to estimate the expected rate of return to capital in this stage. That is why that science and industrial policy is essential for national progress in higher education and research.

At the second growth stage, investors could see the light of potential application with considerable uncertainty. There is an intensive race to be the technology leader or market leader. However, equilibrium pricing mechanism rarely exists in a rapidly growing market, such as the Internet market. Many Internet products and services are offered for free usage in order to expand market share. Asset bubble may develop in stock market when investors seek high growth rate rather than stable dividends. In this stage, profit opportunity was associated with unpredictable uncertainty (Knight 1921). The role of capital is decisive in the battle for market-share. It is capital, not labor that dominates the distribution of wealth in a capitalist society (Piketty 2014). Extremely high income for top managers and dealmakers comes from percentage gain rather than timely pay in the market-share competition. Therefore, equal opportunity before the law cannot assure fair distribution of wealth.

In the third saturation stage, market slowing-down is visible in industry growth. Diminishing returns to capital are associated with industrial concentration. For small and medium firms, their surviving strategy is cost plus pricing. The profit margin varies with different entry barrier and cost structure. Market leaders would use strategic pricing to drive out competitors, or deter potential challengers from entering the market. Neoclassical asset pricing theory seems relevant mainly at this stage. However, there is little empirical evidence of marginal cost pricing in marketing practice.

In the fourth decline stage, the strategic issue for corporate management is staying-business or taking timely exit for minimizing potential loss. Again, unpredictable uncertainty rules the asset market. Stock price could be volatile and sensitive to any information even rumors. Government help is needed when the decline industry involves large unemployment and national interest.

In short, the pricing mechanism in an open competition market is dominated by strategic pricing in market-share competition. There is little room for “invisible hand”, or equilibrium pricing in an open economy with rapidly changing technology. A fully developed complex price theory is needed in future studies.

4 Risk Attitude and Culture Diversity in Learning Strategy

From Table 3, the resource-population ratio varies greatly between Asian and Western countries. We may characterize Western civilization as a labor-saving but a resource-consuming culture, while Asian and Chinese civilizations are resource-saving but labor-consuming cultures (Chen 1990, 2010). Technologically speaking, China had the capability to discover America before Columbus (Menzies 2002). Needham asked the question why did science and capitalism originate in the West, not in China (Needham 1954). The answer can be traced from the interaction between environment and culture in history (Chen 1990).

There is an intensive debate on altruism in economics (Simon 1993). It is difficult to distinguish altruistic from selfish behavior from empirical observation. However, we can easily measure the risk attitude between different cultures, such as risk aversion versus risk taking in facing an unknown market or opportunity.

In neoclassical economics, economic risk is characterized by a static probability such as in the case of gambling; there is no uncertainty associated with a new market and a new technology in a strategic decision. In our dynamic competition model, we introduce a new kind of risk attitude in open economies: the risk of facing an unknown market or technology uncertainty. Both Knight (1921) and Keynes (1936) emphasized the role of uncertainty, which is different from risk in the sense of static statistics. Schumpeter’s concept of the entrepreneurial spirit is critical in facing evolutionary uncertainty rather than static risk.

4.1 Learning by Imitating and Learning by Trying: Risk-Aversion and Risk-Taking Culture

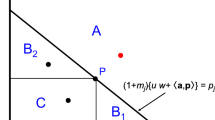

The cultural factor plays an important role in decision-making and corporate strategy. There is a great variety in the degree of “individualism” between western and oriental cultures. Risk-aversion and risk-taking strategies differ when facing an emerging market or new technology. Clearly, the strategy of learning by doing is not applicable for an open economy, since the accumulation process is only relevant for existing technology (Arrow 1962). In a new market, knowledge comes from learning by trying, which is a trial and error process from an evolutionary perspective (Chen 1987). The alternative strategy is learning by imitating or following the crowd. The risk-taking and risk-aversion attitudes in facing a new market or technology can be visualized in Fig. 4.

From Fig. 4, different cultures have different rationales behind their risk attitudes. When facing an unknown market or unproved technology, risk-taking investors often take the lead and venture to maximize their opportunities, while risk-averting investors prefer to wait and follow the crowd to minimize their risk. A critical question is: Which corporate culture or market strategy can win or survive in a rapidly changing market? To answer this question, we need to integrate the culture factor into competition dynamics in Eq. (3).

In industrial economies, resource competition essentially is a learning competition in adopting new technology. For understanding the link between cultural diversity and resource variability, we may introduce a culture factor into species competition. The original logistic equation describes a risk-neutral behavior by assuming a constant exit rate. We introduce the behavioral parameter a by introducing a nonlinear exit rate as a function of the learner’s population ratio (Chen 1987):

Here, n is the number of users of this new technology.

We may consider the constant r as a measure of the learning difficulty when adopting a new technology, which means that the harder to learn, the faster the exit. We put the behavioral factor at the exit rate for mathematical simplicity, since the original exit rate is a linear term. The modified exit rate becomes a quadratic term, so that we still have an analytic solution for this nonlinear dynamical model. Otherwise, we can only do numerical simulations using mathematical modeling.

The factor a is a measure of risk orientation. If \( a>0\), it is a measure of risk-aversion or collectivism. If \( a<0 \), it is a measure of risk-taking or individualism. At the initial stage, few people dare to try a new market; the exit rate is the same for all people. However, when more and more people accept the new technology, business strategy becomes increasingly diversified. For risk aversion investors, their exit rate declines, since they feel deceasing risk. But risk-taking entrepreneurs are more likely to exit, since they feel decreasing opportunity. When varying a from minus one to plus one, we have a full spectrum of varying behavior, from the extreme risk-aversion conservatism to the extreme risk-taking adventurism. There are different meanings of conservatism between the West and the East. To avoid a conceptual misunderstanding, we will define risk-aversion behavior as a collectivist culture while risk-taking behavior as an individualist culture in learning strategy. Our inspiration comes from the perspective of cultural anthropology. Many observers attribute high innovation in the U.S. to American individualism, while rapid copying technology in Japan may relate to their collectivist culture (Kikuchi 1981).

4.2 Resource-Saving and Resource-Consuming Culture

The equilibrium rate of resource utilization is:

From Eq. (7b), the resource utilization rate of the collectivist species (\( {n}_{a>0}^{*}\)) is higher than that of the individualist species (\( {n}_{a<0}^{*} \)). The individualist species needs a larger subsistence space than a collectivist one in order to maintain the same equilibrium size n *. Therefore, individualism is a resource-consuming culture while collectivism is a resource-saving culture (Chen 1990). This difference is visible between Western individualism and Eastern collectivism. Cultural differences are rooted in economic structures and ecological constraints. Resource expansion is a key to understanding the origin of a capitalist economy and the industrial revolution (Pomeranz 2000).

Wallerstein once observed a historical puzzle that history looked to be irrational (1974): In the Middle Ages, China’s population was near twice that of Western Europe while China’s arable land was much less than Western Europe. According to the rational choice theory, China should have expanded its space while Europe should have increased in population. But the historical behavior was opposite!

The European wastes space. Even at the demographic low-point of the beginning of the 15th century, Europe lacked space. . . . But if Europe lacks space, China lacks men. . .

This historical puzzle can be solved when we consider the link between a culture strategy and an agriculture structure. China’s staple food is rice, which is a labor-intensive but land-saving technology. Diary food plays an important role in European culture. Dairy agriculture is a land-intensive and labor-saving technology. In response to increasing population pressures, China is used to increasing labor input for increasing grain yield, while Europeans are used to seeking new land for improving their living standard. That is why Chinese philosophy used to emphasize the harmony between men and nature, while Western strategy used to conquer nature. This is a cultural perspective to Needham’s question. By the same reason, we can understand why Asian country’s saving rates are much higher than in the West. Preparing for an uncertain future rather than seeking current happiness is deeply rooted in Chinese culture and history.

In this regard, the former Soviet Union was close to western individualism, since they had a strong motivation in expansionism.

When we study civilization history, we find that famers are more collectivist than nomads and sailors. Japanese culture is highly collectivism even it’s city residents. However, Japanese foreign policy is more closely compared to the British Empire because it is an island country with a strong naval tradition. New technology in shipbuilding and navigation opened new resources in foreign trade and colonialism in addition to limited arable land.

4.3 Market Extent, Resource Variety, and Economy of Scale and Scope

We can easily extend our model from two technologies (species) to many technologies (species). In an ecological system with L technology (species), their resource limits (carrying capacities) are N 1, N 2, …, N L . The economy of scope and scale can be integrated into a complex system of coupling logistic-type competition equations. A scale economy is related to the market extent or resource limit N i , while a scope economy can be described by the number of technologies (species) L. The degree of the division of labor can be characterized by the biodiversity, i.e. the coexistence of competing technologies.

Let’s start with the simplest case of only two species with competing technologies and cultures (Chen 1987):

Here n 1, n 2 is the number of adopters in technology (species) one and two respectively. For simplicity, we only discuss the simplest case when \( \beta =1 \) under complete competition.

We may solve Eq. (8) in the similar way in solving Eq. (2). The replacement condition and the co-existence condition are (9a) and (9b) respectively:

4.4 The Impact of Environmental Fluctuations

The next task is studying the impact of environmental fluctuations to system stability. The problem of a nonlinear dynamical system under random shocks can be solved by the Langevin equation and Fokker-Planck equation (May 1974; Chen 1987, 2010). Here, we only consider a simple case where a stream of random shocks adds to the resource limit of one technology N. The realized equilibrium size X m would be reduced by a fluctuating environment with the variance of σ2:

If there exists some survival threshold in population size, then the collectivism has a better chance of surviving under external shocks because it has a larger population size.

Environmental fluctuations will reduce the resource limit of the equilibrium state, as seen from Eq. (10a). When fluctuations are larger than the threshold, the technology would die as in Eq. (10b). That is why some ancient civilizations disappeared due to a natural disaster or war. Economic development needs social stability.

When we consider environmental fluctuations to many species, we may realize the importance of biodiversity. Regional specialization effectively increases concentration of risk. Mass production in agriculture also intensifies the application of chemical fertilizer and pesticide. In another words, economy of scope is helpful for maintaining biodiversity.

4.5 Trade-Off Between Stability and Diversity and the Generalized Smith Theorem

For a more general case with many technologies, increasing the number of technologies will reduce system stability (May 1974). There is a trade-off between diversity and stability. Smith did not realize the importance of science and technology that introduces new resources and new markets, since the Industrial Revolution was still in its infancy during his time. We propose a generalized Smith Theorem (Chen 2005, 2010) as the following:

The division of labor is limited by the market extent (resource limit), bio-diversity (number of resources), and environmental fluctuations (social stability).

Neoclassical growth models have an one-way evolution to convergence or divergence under linear stochastic dynamics. There may be a two-way evolution (or co-evolution) process towards complexity or simplicity in division of labor under nonlinear evolutionary dynamics. When social stability is high and new resources keep coming, the system may develop into a complex system, like the Industrial Revolution in the past. However, when social turmoil is high or resources are used up due to over population, a complex system may break down into a simple system, such as the collapse of the Roman Empire in the Middle Ages. Even in the modern era, industrial society coexists with traditional society and even primitive tribes. The basic mechanism is the interactions among population, environment, and technology.

4.6 Competition Scenario Between Individualism and Collectivism and Dynamical Picture of Schumpeter’s Creative Destruction

There is a popular belief that individualism would beat collectivism, since individualism is more innovative in technology competition. However, there are three possibilities under different competition scenarios:

-

(i)

Both species are individualists. From Eq. (9b), two individualist species may coexist. Competition between individualists would increase system diversity. The city-states in ancient Greece and Renaissance Italy are examples.

-

(ii)

Both species are collectivists. Based on Eq. (9b), two collectivist species cannot coexist, the only result is one replaces the other. This is the story of peasant wars and dynastic cycles in Chinese history. Therefore, division of labor is hard to emerge in a purely collectivist society.

-

(iii)

One individualist and one collectivist. This is the general case when competition is a game of uncertainty. This is a mixed economy with one collectivist and one individualist species. One interesting feature is that the stability of a mixed system is higher than the liberal system with two individualists. We may extend this result to a case with more than two species. This scenario is perceivable when we compare the two-party political system in the Anglo-Saxon countries and the multi-party political system in continental Europe.

What would happen in case (iii) when an individualist species competes with a collectivist one? They may coexist, or one replaces another, depending on their resource limits, learning ability, and cultural factors. We may add a few discussions to this case.

If two species have equal resources (\( {N}_1={N}_2 \)), then, the collectivist species will replace the individualist one. If we compare (8a) with (3a), the late-comer in a collectivist culture may beat the individualistic leader even if \( {C}_2\le {C}_1 \) when \( \beta \approx 1 \) and \( 0<{a}_2\approx 1 \). This is the story of how Japan and China caught up with the West in the 1970s and 2010s respectively. A collectivist culture can concentrate its resources on a “catching-up” game. The success or failure of the industrial policy depends on the government’s ability for mobilizing strategic resources on emerging technologies, a typical feature of learning by imitating in the catching-up game.

The survival strategy for an individualist is to explore a larger resource, or learn faster. If we consider entrepreneurship as a risk-taking culture, then we may reach a similar conclusion to Schumpeter’s (1939) that creative destruction is vital for capitalism in the competition between socialism (collectivism) and capitalism (individualism). Once innovations fail to discover new and larger resources, the individualist species will lose the game to the collectivist in the existing markets. This picture of changing economic powers is different from the permanent division between early-movers and late-comers in endogenous growth theory. Our model of learning strategy can be applied to an arm race or corporate strategy if the relevant data are available.

5 Issues in Methodology and Philosophy

There are several issues in methodology and philosophy. Keynes once remarked (1936):

The classical theorists resemble Euclidean geometers in a non-Euclidean world who, discovering that in experience straight lines apparently parallel often meet, rebuke the lines for not keeping straight—as the only remedy for the unfortunate collisions which are occurring. Yet, in truth, there is no remedy except to throw over the axiom of parallels and to work a non-Euclidean geometry. Something similar is required today in economics.

Our population dynamics is an alternative framework to an optimization approach in neoclassical economics. This paradigm change induces fundamental shifts in the following issues.

5.1 Real Versus Monetary Economy

Neoclassical growth theory is a monetary system, where capital and population are driving forces in economic growth. Our population dynamics is a real system, where resource and population play key roles in economic growth. The theoretical issue is the relation between the real and virtual (monetary) economies. We are different with RBC school on the nature of technology changes. RBC school treats technology advances as random shocks without resource limit (Kydland and Prescott 1982), while we characterize technology advancement as logistic wavelets under resource constraints.

Historically, the core concepts in classical economics started from land, population, and capital. In neoclassical economics, there is an increasing trend of virtualization in economic theory. One important lesson from the 2008 financial crisis is the danger of over-expansion of the virtual economy in developed countries (Johnson 2009; Chen 2010).

According to BIS (Bank of International Settlement) data, the size of the global derivative market in Dec. 2012 was 632.6 trillion U.S. dollars, which is nearly 9 times the world total production or 40 times the U.S. GDP. There may be a dangerous link between virtualization in economic theory and virtualization in the U.S. economy.

5.2 Equilibrium Versus Non-equilibrium Mechanism

The optimization approach can only apply to an equilibrium system in a closed economy. There is a fundamental problem for general equilibrium models in the endogenous growth theory. In neoclassical economics, price plays a central role in creating equilibrium in the market exchange. The profit for a representative firm should be zero in the general equilibrium model. It means that capital cannot grow in a closed economy under general equilibrium. Clearly, microfoundations theory of endogenous growth fails to provide a consistent theory in capital accumulation and technology progress (Chen 2002).

In our metabolic growth theory, we did not introduce price factors into population dynamics, since there is no unique (linear) price in a non-equilibrium system in a market-share competition. In Sect. 3.4, profit opportunity mainly exists at the second growth stage. However, there is a trade-off between short-term profit and long-term market-share. You cannot calculate its optimal value when future market shares and competitor’s strategies are unknown. That is why vision and strategy matters in technology competition. Capital loss mainly occurs at the fourth decline stage. The cost of the 2008 financial crisis was about 13 trillion U.S. dollars. The smooth picture of capital growth in neoclassical theory abstracts out the uncertainty in technology advancement from the linear-equilibrium perspective. Our scenario is more realistic than the neoclassical model in understanding firm behavior. In another words, there is no empirical evidence of marginal cost pricing. But there are abundant cases of strategic pricing in marketing practice (Shaw 2012).

Another example is the equilibrium trap of the so-called rebalancing policy promoted by Federal Reserve Chairman Ben Bernanke. China was more successful in dealing with the 2008 financial crisis in a non-equilibrium approach, which was characterized by large investments in infrastructure, such as high-speed trains, and new technology, including new energy and new materials. The U.S. Congress refused any structural reform and single-mindedly relied on the Federal Reserve policy of QE, another form of printing money. The European Union and Japan are dealing with the debt crisis by implementing limited fiscal and monetary policies.

Both neoclassical economics and Keynesian economics pay little attention to economic structure. The down-sloped IS curve theory is wrong in an open economy under non-equilibrium conditions. If you lower the interest rate, there are three, not just one, possibilities in the globalization era; In a healthy economy with growth prospects, lower interest rates will increase investment and production; In an uncertain economy, investors prefer to hold cash or reduce existing debts; In a sick economy, lower interest rates may cause large capital flight to foreign economies promising better returns. We found solid evidence of color chaos from macro and financial indexes (Chen 1996, 2005, 2008). The linear causality in the IS-LM scheme is simply an equilibrium illusion in a non-equilibrium world with economic complexity (Chen 2010).

5.3 Linear Versus Nonlinear Thinking

Linear thinking is the common feature of neoclassical growth models. Robert Solow was clearly aware of not only the symptom, but also the cause in neoclassical growth theory (Solow 1994). For example, increasing returns to scale would lead to an explosive economy, while diminishing returns to scale would generate a convergence trend that is not shown in historical data. Each innovation kills its predecessors in the Aghion and Howitt model of “creative destruction” (1992). In reality, many innovations are complementary with predecessors. The model of learning by doing simply ignores the important role of R&D for exploring new resources.

From our perspective, the shortcoming of neoclassical economics is linear thinking. Once we adopt the nonlinear perspective, even with the simplest logistic model, all troubles in neoclassical growth theory can be easily solved. For example, Schumpeter’s creative destruction does not mean non-coexistence between old and new technology. Complementary technologies can emerge if their competition coefficients are small.

Any technology or industry has a life cycle, or more precisely, a wavelet. Let us consider the textile industry at a mature stage in developed countries. Certainly you have diminishing returns in capital if you continue to invest in the U.S., but you may still have increasing returns if you invest in Asia. There was a convergence trend when low technology moved from advanced to backward economies in the 1970s and 1980s. However, when the computer and Internet industries emerged in the West, foreign investment moved back to developed countries in order to catch the new opportunity of increasing returns to capital for new technology at the growth stage. You may have seen a temporary diverging trend between rich and poor countries in the 1990s. Why did China rapidly catch up to Asian tigers in the manufacturing industry in the 1990s and 2000s? Simply because China’s economic scale and market extent was much larger than in Asian tigers and East European countries.

The policy implications of neoclassical growth theory for economic growth are dubious. The exogenous growth theory emphasizes the roles of population growth and capital accumulation. A recent study of increasing inequality since 1970s shows little evidence of “balanced growth path” (Solow 1957; Piketty 2014). The endogenous growth theory further enhances the accumulation role of knowledge capital. They do not understand that these factors can be double-edged swords.

During a visit to Egypt last summer, it was observed that the current turmoil in the Mid-East is deeply rooted in high population growth, limited food supply, and high unemployment rate among young educated people. Egypt’s population growth rate is four times that of China, but the GDP growth rate is about one fourth that of China. Historically, Egypt was a main exporter of grain to Europe and now is a big importer of grain from the U.S. Egypt did not make major investments in family planning and farmland reconstruction like China in the past. Both the military regime and elected governments have little means to solve the resource-population problem on a short-term. The U.S. economy faces another problem. According to CIA data, the school life expectancy is 17 years in the U.S., UK, and Spain, 16 years in Germany, and 12 years in China and Egypt. According to endogenous growth theory, you may expect U.S. manufacturing should better compete with Germany and China. However, Steven Jobs, the late CEO of Apple Inc., bluntly told President Obama in 2012 that the U.S. stopped to train middle-level engineers on a large scale (Barboza et al. 2012). China once faced the shortage of skilled workers and industrial technicians. They solved the problem by introducing the German system of technical schools, not just the American system of higher education. Again, knowledge structure matters more than aggregate stock in economics. By introducing nonlinear interaction into growth theory, we have a more proper policy for economic growth and development.

5.4 Theory Versus Simulation

There is a big difference between theoretical models and computational simulations. Theory is aimed to catch general features from a wide range of observations at the cost of abstracting out many details, while simulation seeks to describe many details from a specific object at the cost of generalizing to other objects. In this regard, our market-share competition model is a theory, while system dynamics, as well as econometrics, are different approaches in economic simulation (Forrester 1961; Meadows et al. 2004). Competing simulation models are tested by empirical data. Competing theories in science are tested by controlled experiments. In economics, controlled experiments are limited in scale and scope. Economic schools of thought are mainly tested by historical trends and events. For example, the Great Depression shook the faith in the self-stabilizing market, so that Keynesian economics rose to replace classical economics in mainstream economics in the UK and the U.S. The Lucas theory of microfoundations and rational expectations became popular in the West during the stagnation era in the 1970s, and are now facing serious challenges from the 2008 financial crisis.

The exogenous theory of growth won a great deal of attention in the 1950s, which was the golden era for the U.S. after the WWII. The endogenous growth theory attracted a lot of attention during the hype of the dot.com boom and the so-called knowledge economy. After the failure of the Iraq war and the 2008 financial crisis, people started to doubt the convergence theory when so many countries were still in a poverty trap, and the sustainability of a developed economy. Our theory of metabolic growth is a mathematical way of new thinking in economics and world history. We share a similar view of anthropologists and historians that changes in climate and environment shaped by the history of civilizations (Morris 2010).

6 Conclusions

Technology advancement and resource exploitation is the driving force of an industrial economy. How to understand the dynamic interaction between technology, resources, and population is a fundamental issue in economics and history. Both exogenous and endogenous growth theory puts abstract capital as the driving force of economic growth but takes out the critical role of resources. In this regard, neoclassical growth theory is a big retreat from classical economists such as Smith and Malthus. Therefore, using neoclassical growth theory, it is hard to understand development mechanisms, environmental crisis, and recurrent cycles.

During the 2008 Financial Crisis, both monetary policy and fiscal policy had limited effects in developed countries without structural changes. The rise of China and emerging economies is mainly driven by technology advancement and structural reform (Chen 2010). The primary cause of business cycles and changing world order is technology wavelets. Market psychology and monetary movements only play secondary role in feedback dynamics. This is our lesson from the Great Recession in 2008, which is greatly different from the Great Depression in 1930s. The common limits among Keynes, Hayek, and Friedman were their ignorance of global competition and shifting power balance under technology revolution.

Our work based on population dynamics brings back the central idea of Adam Smith and Thomas Malthus that the division of labor is limited by the market extent and resource capacity. Nonlinear population dynamics is an alternative framework for economic dynamics. We made several contributions that are beyond the scope of neoclassical growth theory.

First, industrialization is characterized by a sequence of discoveries of new resources and new markets (Pomeranz 2000). Material wealth is associated with both scale (resource capacity) and scope (number of resources) economy. Therefore, material wealth in human society is closely linked to biodiversity. Division of labor may increase efficiency in utilizing existing resources, but not necessarily create new resources. Exchange economy is mainly about distribution of existing resources, not creating new resources. The nature of modernization is driven by advancement of science that opening new resources by new technology, not driven by accumulation of capital, knowledge or population if their growth has no link with proper development of science and technology.

Second, Schumpeter’s “long waves” and “creative destruction” can be described by the rise and fall of technology wavelets that are derived from population dynamics (Schumpeter 1934, 1939, 1950). The observed growth cycles with nonlinear trends and irregular cycles from macro indexes can be interpreted as the envelopment of aggregated logistic wavelets (Prigogine et al. 1977), which build a link between technology wavelets at the industry level and business cycles at the macro level. Disaggregate approach by sector analysis is more useful than aggregate approach in understanding growth dynamics and industrial policy (Rostow 1990), since capital investment in obsolete technology or monetary game generate more harm than gain in economic growth.

Third, the sources of insufficient demand and job crisis in Keynesian economics can be understood from life cycles of technology wavelets. Structural unemployment is rooted from excess-capacity under technology competition. Unlike the microfoundations model in business cycle theory, this is the meso foundation of macro unemployment and recurrent cycles, since industrial economy is not consisted from free individual atoms at the household level, but organized into large clusters as technology organizations and industrial groups (Lucas 1981; Chen 1996, 2002).

Fourth, we have a better understanding of the nature of knowledge and the nonlinear patterns in economic growth. Exogenous growth theory treats technology advancement as a series of random shocks. Endogenous growth theory asserts that knowledge is an accumulation process. We uncover the metabolic nature in knowledge development. Modern technologies are shaped by scientific revolution. Paradigm changes and interruptive technologies indicate wavelike movements in science and technology development, which is radically different from the random walk in neoclassical models (Kuhn 1962). From the nonlinear perspective, we can see changing dynamic returns and co-evolution of organization and institution during the technology life cycle. Mixed economy is the very foundation for science and education. Invisible hand may play some role in technology diffusion. However, science research is highly organized activities guided by theory, institution and policy (Bernal 1969). Random events only have minor impact in history of science.

Fifth, culture plays a critical role in “great divergence” of civilization bifurcation (Clark 2007). The culture factor is introduced into learning competition. Risk-taking individualism and risk-aversion collectivism are different strategies for survival under a market-share competition. Different modes of division of labor are shaped by resource constraints and culture in history.

Sixth, we developed the generalized Smith Theorem that the division of labor is limited by the market extent, number of resources, and environmental fluctuations. There is a trade-off between system stability and system complexity. Economic evolution is a nonlinear two-way dynamic towards diversity and non-equilibrium. From ecological perspective, biodiversity imposes fundamental constraints to technology development and human evolution (Georgescu-Roegen 1971). Not all products of modern technology are compatible with eco-system. Destruction of biodiversity will lead to destruction of national and global wealth, since any accumulation of material wealth on earth is rooted in transformed energy flows from the solar system. Ecological constraints require regulated economy to protect biodiversity. Laissez fair policy is harmful to our earth village.

Seventh, our analytical unit is species or technologies. Microeconomics should pay more attention to competing sectors and industries, rather than representative agent model of households and firms. This implies that competition among technologies is more important than competition among individuals in economic growth. From biological perspective, human nature is a social animal, which cannot be unbounded greedy. Animal evolution is subjects to ecological constraints. Living organism only exists in finite time and space. Nonlinear demand and supply mechanism is closely linked to existence threshold and saturation limit in biology. Therefore, human behaviour must be competitive and cooperative at the same time for existence struggle. Neoclassical models with unbounded utility and production function simply violate basic laws in physics and biology. That is why econometrics based on linear regression can only be considered as “alchemy” but not science (Hendry 2001). We have solid evidence that real economies are living systems, that are nonlinear, non-stationary, and non-integrable systems (Chen 1996, 2010). We need a new economic framework, which is compatible with ecological constraints.

Finally, we pave the way for a unified theory in economics including micro, macro, finance, and institutional economics based on evolutionary complex dynamics. We pointed out that a neoclassical framework is not proper for an industrial economy, since the Hamiltonian system is a closed system in nature. Neoclassical concepts such as perfect information, rational expectations, noise-driven cycles, zero-transaction costs, infinite life, IS curves, long-run equilibrium, and unlimited growth, are utopian ideas that go against basic laws in physics and are non-observable in reality (Chen 2005, 2007, 2008, 2010). People are social individuals with life cycles and interactions. We developed a nonlinear oscillator model for color chaos (Chen 1996), the birth-death process for macro and financial fluctuations (Chen 2002), and a logistic competition model for metabolic growth (Chen 1987, 2008). We show that population dynamics is a useful model for a dissipative economic system in an open economy. The wavelets representation and these nonlinear models are building blocks for a unified theory of complex evolutionary dynamics in micro, meso, macro and institutional economics (Chen 2010). The new science of complexity develops new tools in nonlinear dynamics and non-equilibrium mechanisms (Nicolis and Prigogine 1977; Prigogine 1980, 1984), which are essential for understanding economic development and social evolution. In this sense, Keynes was quite right that we need a non-Euclidean geometry to develop a general theory of economics, since we live in a non-Euclidean world (Keynes 1936; Chen 2010).

Economists used to think that economic evolution is hard to formulate by mathematical language (Mirowski 1989). This is not true in the era of complexity science. Historical development can be well described by nonlinear and non-equilibrium dynamics. The key is finding the proper link between theory and observations.

References

Aghion P, Howitt P (1992) A model of growth through creative destruction. Econometrica 60(2):323–351

Aghion P, Howitt P (1998) Endogenous growth theory. MIT Press, Cambridge

Arthur WB (1994) Increasing returns and path dependence in the economy. University of Michigan Press, Ann Arbor, MI

Arrow KJ (1962) The economic implications of learning by doing. Rev Econ Stud 39:155

Arrow KJ, Debreu G (1954) Existence of an equilibrium for a competitive economy. Econometrica 22(3):265–290

Ayres RU (1989) Technological transformations and long waves. International Institute for Applied Systems Analysis, Laxenburg

Barboza D, Lattman P, Rampell C (2012) How the U.S. lost out on iphone work. New York Times. Jan 21, 24

Bernal JD (1969) Science in history, 3rd edn. Penguin, Harmondsworth

Browning M, Crossley TF (2001) The life-cycle model of consumption and saving. J Econ Perspect 15(3):3–22

Chen P (1987) Origin of the division of labor and a stochastic mechanism of differentiation. Eur J Oper Res 30:246–250

Chen P (1990) Needham’s question and China’s evolution—cases of non-equilibrium social transition. In: Scott G (ed) Time, rhythms and chaos in the new dialogue with nature, chapter 11. Iowa State University Press, Ames, IA, pp 177–198

Chen P (1996) A random walk or color chaos on the stock market?—time-frequency analysis of S&P indexes. Stud Nonlinear Dyn Econ 1(2):87–103

Chen P (2002) Microfoundations of macroeconomic fluctuations and the laws of probability theory: the principle of large numbers vs. rational expectations arbitrage. J Econ Behav Organ 49:327–344

Chen P (2005) Evolutionary economic dynamics: persistent business cycles, disruptive technology, and the trade-off between stability and complexity. In: Dopfer K (ed) The evolutionary foundations of economics, chapter 15. Cambridge University Press, Cambridge, pp 472–505

Chen P (2007) Complexity of transaction costs and evolution of corporate governance. Kyoto Econ Rev 76(2):139–153

Chen P (2008) Equilibrium illusion, economic complexity, and evolutionary foundation of economic analysis. Evol Inst Econ Rev 5(1):81–127

Chen P (2010) Economic complexity and equilibrium illusion: essays on market instability and macro vitality. Routledge, London

Clark G (2007) A farewell to alms: a brief economic history of the world. Princeton University Press, Princeton, NJ

Darwin C (1859) On the origin of species, by means of natural selection, or the preservation of favoured races in the struggle for life, vol 1. John Murray, London

Dasgupta D (2010) Modern growth theory. Oxford University Press, Oxford

Daly H, Farley J (2010) Ecological economics: principles and applications. Island Press, Washington, DC

David PA (1985) Clio and the economics of qwerty. Am Econ Rev Pap Proc 75:332–337

Day RH (1982) Irregular growth cycles. Am Econ Rev 72:404–414

Eliasson G (2005) The birth, the life and the death of firms. The Ratio Institute, Stockholm

Forrester JW (1961) Industrial dynamics. MIT Press, Cambridge, MA

Georgescu-Roegen N (1971) The entropy law and economic process. Harvard University Press, Cambridge, MA

Goodwin RM (1967) A growth cycle. In: Feinstein CH (ed) Socialism, capitalism and economic growth. Cambridge University Press, Cambridge, MA

Hendry DF (2001) Econometrics: alchemy or science? Essays in econometric methodology. Oxford University Press, Oxford

Johnson S (2009) The quiet coup. Atlantic 303(4):46–56

Keynes JM (1936) The general theory of employment, investment, and money. Macmillan, London

Kikuchi M (1981) Creativity and ways of thinking: the Japanese style. Phys Today 34:42–51

Knight FH (1921) Risk, uncertainty and profit. Sentry Press, New York

Kurz HD (2012) Innovation, knowledge, and growth: Adam Smith, Schumpeter, and moderns. Routledge, London

Kuhn T (1962) The structure of scientific revolutions. University of Chicago Press, Chicago

Kydland FE (1995) Business cycle theory. E. Edgar, Brookfield, VT

Kydland FE, Prescott EC (1982) Time to build and aggregate fluctuations. Econometrica 50(6):1345–1370

Lucas RE Jr (1981) Studies in business-cycle theory. MIT Press, Cambridge

Lucas RE Jr (1988) On the mechanics of economic development. J Monet Econ 22:3–42

Maddison A (1998) Chinese economic performance in the long run. OECD, Paris

Maddison A (2007) The world economy: a millennial perspective/historical statistics. OECD Development Center Studies, Paris

Malthus TR (1798, 2008) An essay on the principle of population. Oxford University Press, Oxford

May RM (1974) Stability and complexity in model ecosystems. Princeton University Press, Princeton, NJ

Meadows DH, Randers J, Meadows DL (2004) Limits to growth: the 30-year update. Chelsea Green, White River Junction, VT

Menzies G (2002/1421) The year China discovered the world. Morrow, New York

Mirowski P (1989) More heat than light. Cambridge University Press, Cambridge

Modigliani F (1976) Life-cycle, individual thrift, and the wealth of nations. Am Econ Rev 76(3):297–313

Morris I (2010) Why the west rules—for now. Farrar, New York

Needham J (1954) Science and civilization in China, vol I. Cambridge University Press, Cambridge

Nicolis G, Prigogine I (1977) Self-organization in nonequilibrium systems. Wiley, New York

Pianka ER (1983) Evolutionary ecology, 6th edn. Benjamin Cummings, San Francisco, CA

Piketty T (2014) Capital in the twenty-first century. Harvard University Press, Cambridge, MA

Pomeranz K (2000) The great divergence: China, Europe, and the making of the modern world economy. Princeton University Press, Princeton, NJ

Prigogine I (1980) From being to becoming: time and complexity in the physical sciences. Freeman, San Francisco, CA

Prigogine I (1984) Order out of Chaos. Bantam, New York

Prigogine I, Peter MA, Herman R (1977) Long term trends and the evolution of complexity. In: Laszlo E (ed) Goals in a global community: a report to the club of Rome. Pergamon Press, Oxford

Romer PM (1986) Increasing returns and long-run growth. J Polit Econ 94:1002–1038

Rostow WW (1990) The stages of economic growth, 3rd edn. Cambridge University Press, Cambridge

Samuelson PA (1971) Generalized predator–prey oscillations in ecological and economic equilibrium. Proc Natl Acad Sci USA 68(5):980–983

Schumpeter JA (1934) The theory of economic development. Harvard University Press, Cambridge

Schumpeter JA (1939) Business cycles, a theoretical, historical, and statistical analysis of the capitalist process. McGraw-Hill, New York

Schumpeter JA (1950) Capitalism, socialism and democracy, 3rd edn. Harper, New York

Shaw E (2012) Marketing strategy: from the origin of the concept to the development of a conceptual framework. J Hist Res Mark 4(1):30–55

Simon HA (1993) Altruism and economics. Am Econ Rev 83(2):156–161

Smith A (1776) The wealth of nations. Liberty Classics, Indianapolis

Solow RM (1957) Technical change and the aggregate production function. Rev Econ Stat 39(3):312–320

Solow RM (1994) Perspectives on growth theory. J Econ Perspect 8(1):45–54

Stigler GJ (1951) The division of labor is limited by the extent of the market. J Polit Econ59:185–193

Toffler A (1980) The third wave. William Morrow, New York

Vernon R (1966) International investment and international trade in the product cycle. Q J Econ 80(2):190–207

Wallerstein I (1974) The modern world system I, capitalist agriculture and the origin of the European world-economy in the sixteenth century. Academic, New York

Acknowledgements

The author thanks Peter Allen, Wolfgang Weidlich, Edmond Phelps, Joseph Stiglitz, James Galbraith, Ulrich Witt, Justin Lin, Wolfram Elsner, Andreas Pyka, Laura Tyson, Zhengfu Shi, Weisen Li, Yinan Tang, Huajun Li, and Vivian Chen for their stimulating discussions. We also thank two anonymous reviewers for their stimulating comments.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2015 Springer International Publishing Switzerland

About this chapter

Cite this chapter

Chen, P. (2015). Metabolic Growth Theory: Market-Share Competition, Learning Uncertainty, and Technology Wavelets. In: Pyka, A., Foster, J. (eds) The Evolution of Economic and Innovation Systems. Economic Complexity and Evolution. Springer, Cham. https://doi.org/10.1007/978-3-319-13299-0_3

Download citation

DOI: https://doi.org/10.1007/978-3-319-13299-0_3

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-13298-3

Online ISBN: 978-3-319-13299-0

eBook Packages: Business and EconomicsEconomics and Finance (R0)