Abstract

In this paper, we provide an alternative hedging method based on a popular risk indicator relating to value at risk (VaR) for shipowners to hedge spot freight rate volatility in the tanker market. To achieve this, we use a univariate generalized autoregressive conditional heteroskedasticity model to capture the volatility characteristics of freight derivative returns and apply time-varying copula models to describe the nonlinear dependence between returns of spot and freight derivatives. Using quotes of spot freight rate and forward freight agreement (FFA) in the tanker market from January 3, 2006 to December 23, 2011, we derive the minimum VaR hedge ratios. Our main findings are as follows: First, we found significant evidence for the presence of volatility persistence in freight rate returns. Second, for dependence, we suggested that a time-varying t-copula performs best in describing how returns of spot freight rates relate to 1-month FFA returns, whereas a time-varying Gumbel copula performs much better for the description of nonlinear dependence between returns of spot freight rates and 2 and 3-month FFA returns. Third, the derived hedge ratios are associated with shipowners’ risk preferences and freight rate dynamics, which have important implications for shipowners in determining the optimal number of FFA contracts. The results provide some insights into the modeling of freight derivatives for risk management.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In the shipping market, the freight rate is the main income source for shipowners. Nevertheless, frequent and fierce freight rate volatility makes shipowners’ incomes unpredictable and brings great difficulties to their operational decisions. Extremely low freight rates might bring a shipowner to bankruptcy. To hedge against such freight rate risks, shipowners have adopted a variety of methods. For example, split operation of the fleet, the floating-index method, and long-term charter contracts have traditionally been used to mitigate freight rate risks. These methods, however, are not flexible enough to meet participants’ requirements. Referring to financial derivatives markets, some shipping derivatives, such as forward freight agreement (FFA), freight futures and freight options, were developed to hedge freight rate risks (Kavussanos and Visvikis 2006).

Among the existing shipping derivatives, FFA is widely used. According to Batchelor et al. (2007), FFAs are principal-to-principal contracts between a seller and a buyer to settle a freight or hire rate for a specified quantity of cargo or type of vessel, on one (usually) or more major trade routes. For example, a shipowner is generally concerned that the spot price of a standard freight in some future month could be lower than his or her expectation and sells FFA contracts to a charter with the help of a specialist broker. When trading FFA contracts, a core issue is to determine the optimal number needed to hedge a given level of exposure, which is the determination of the optimal hedge ratio (Kavussanos et al. 2010). An appropriate hedge ratio not only achieves a shipowner’s purpose of risk aversion but also decreases the hedging costs, which is the fundamental guarantee of the FFA hedging function.

Consequently, our goal in this paper is to provide an alternative hedging method based on a popular risk indicator relating value at risk (VaR) for shipowners to hedge freight rate risks in the tanker market using FFA. From a shipowner’s perspective, our study can enrich the existing literature in at least two important ways. Hedging strategies based on minimum VaR have not received great attention in the shipping derivatives market, although it is popular in the financial derivatives market. We also describe the dependence structure between spot and FFA returns using copula functions, which allow for the presence of nonlinear dependence.

The remainder of this paper is constructed as follows. Section 2 reviews the previous studies of hedge ratio determination. Section 3 introduces the minimum VaR hedge ratio model under a copula framework. We report data and summary statistics in Sect. 4. We analyze and discuss our empirical results in Sect. 5 and provide conclusions in Sect. 6.

2 Review of the existing literature

The concept of an optimal hedge ratio, as borrowed from financial markets and applied in shipping derivatives markets, indicates the proper size of the position to be held in the futures market to hedge an opposite position in the spot market (Barbi and Romagnoli 2014). Great efforts have been made to derive the optimal hedge ratio. Traditional hedging theory suggested that spot positions could be hedged by taking an equal but opposite position in the futures market (Pennings and Meulenberg 1997). Also, taking into account expected profit maximization, Working (1953, 1962) suggested a complete hedging or un-hedging strategy. However, the performance of the traditional hedging approach was relatively low because its assumption regarding the presence of co-movements between spot and future prices generally failed when compared to real world results.

Second, with the popularity of portfolio theory, modern hedging theory has drawn great attention through its consideration of risk avoidance and hedging cost savings (Johnson 1960; Stein 1961). Theoretically speaking, in a hedged portfolio, the optimal hedge ratio is determined by a particular objective function and estimation technique. In terms of objective functions, a common application is the maximization of utility functions. For instance, using a logarithmic utility function, Rolfo (1980) derived hedge ratios for cocoa futures. Cecchetti et al. (1988) combined investors’ expected utility and time-varying joint distribution to estimate hedge ratios. Other studies, such as Lence (1995, 1996), also contributed to this subject. But utility-maximizing hedge ratios require a specific utility function and return distribution, which is often unknown or quite different from one person to another.

Third, compared with the utility-maximizing hedge ratios, the risk-minimizing approach received a more widespread application following Ederington (1979). Different risk measurements produced a variety of hedge ratios, such as the minimum-variance hedge ratio (Myers and Thompson 1989), the hedge ratio incorporating both variance and return (Hsin et al. 1994), the sharp hedge ratio (Howard and D’Antonio 1984), the hedge ratio found by minimizing the mean-Gini coefficient (Cheung et al. 1990; Shalit 1995), the hedge ratio based on generalized semi-variance (Lien and Tse 2000; Chen et al. 2003), and the minimum VaR hedge ratio (Harris and Shen 2006; Hung et al. 2006; Chang 2011). Among all those risk measurements, VaR has become popular since it was adopted by the governors of the Central Banks gathered in Basle (Switzerland) as a mandatory risk measure. Moreover, Harris and Shen (2006) proved that hedging strategies based on minimum-VaR and minimum-conditional VaR yield small but consistent improvements over minimum-variance hedging. Therefore, we explore the minimum VaR hedge ratio in this paper.

Fourth, researchers have proposed several estimation techniques: the naive one-to-one or zero hedging in traditional hedging theory (Working 1962), the constant hedge ratio based on the regression model (Ederington 1979), and the vector autoregressive model and vector error correction model (Kavussanos and Nomikos 2000a, b; Pok et al. 2009). With the development of econometrics, a time-varying hedge ratio was developed by using moving average, exponentially weighted moving average, autoregressive conditional heteroskedasticity (ARCH) and generalized-ARCH (GARCH) models (Angelidis and Skiadopoulos 2008). Furthermore, to capture spillover effects that exist between the spot and derivatives markets, multivariate GARCH models such as the BEKK model (Engle and Kroner 1995; Chang et al. 2011), constant conditional correlation (CCC) model (Bollerslev 1990), and dynamic conditional correlation (DCC) model (Engle 2002; Toyoshima et al. 2013) were adopted. Although those multivariate GARCH models had superiority in capturing spillover effects, they were criticized for their assumption of linear dependence, which was contradictory to the well-known stylized fact that most financial returns are skewed and non-linearly dependent (Patton 2006a, b). To overcome this shortcoming, researchers have used copula models, which allow the presence of nonlinear dependence as an alternative approach (Hsu et al. 2008; Lai et al. 2009).

Nevertheless, copula models have not been widely used in shipping derivatives markets, and relatively few empirical studies have been conducted. Considering the advantages of VaR and copula methods in measuring risk and describing dependence structure, we propose an alternative hedging model for shipowners to hedge against freight rate volatility.

3 Methodology

In the shipping derivatives markets, finding the optimal hedge ratio requires a shipowner to calculate the optimal number of FFAs to hedge a given level of exposure. To this end, we here demonstrate a minimum VaR hedge strategy under a copula framework.

3.1 The optimal VaR hedging strategy

Following Chen et al. (2003), consider a portfolio consisting of \(C_{s}\) units of a long spot position and \(C_{f}\) units of a short futures position. Then the portfolio return and its variance are:

where \(S_t\) and \(F_t\) denote spot and futures prices at time t. \(r_\mathrm{h}, r_s =(S_{t+1} -S_t)/S_t \), and \(r_f =(F_{t+1} -F_t)/F_t\) are the so-called one-period returns of the portfolio, spot and futures positions, respectively. h is the hedge ratio that needs to be estimated. \(\sigma _\mathrm{s}^2\) and \(\sigma _\mathrm{f}^2\) represent the conditional variances of spot and futures returns, with conditional covariance \(\hbox {Cov}(r_s ,r_f)\).

VaR is generally defined as the largest loss on a portfolio that could be expected with a particular probability over a certain horizon (Hung et al. 2006; Cao et al. 2010). The VaR over one day at the confidence level \(\alpha \) for the above portfolio is:

where \(E(r_h)\) is the expected return of the portfolio and \(Z_\alpha \) denotes the left percentile at the confidence level \(\alpha \) for a standard normal distribution. By combining (2) and (3), VaR is rewritten as:

Accordingly, the minimum-VaR hedge ratio can be derived when VaR reaches its minimum (Hung et al. 2006) and is expressed as:

where \(\rho \) describes the dependence structure between spot and futures returns, which is estimated using copula methods. However, in Eq. (5), \(r_s\) and \(r_f\) are assumed to be jointly normally distributed, which might be inappropriate in many circumstances. To solve this problem, we use the Cornish–Fisher expansion to adjust the percentile \(Z_\alpha \) using the skewness \((s_h)\) and kurtosis \((k_h)\) of the portfolio return distribution (Hill and Davis 1968; Cao et al. 2010).

3.2 Copula method

The copula method is an efficient way to describe the dependence of variables by allowing for the presence of nonlinear dependence, indicating that any multivariate joint distribution function can be decomposed into the marginal distributions of each variable and a copula function (Sklar 1959). Patton (2001) extended Sklar’s theorem to conditional copulas and proposed a time-varying copula model:

where \(G_t (r_{st} ,r_{ft} | {I_{t-1}})\) is the conditional distribution of \(r_{st} ,r_{ft}\) at time t. Two marginal distributions \(u_t =F_{st} (r_{st} | {I_{t-1}} )\) and \(v_t =F_{ft} (r_{ft} | {I_{t-1}})\) are combined by a time-varying conditional copula \(C_t (u_t ,v_t | {I_{t-1}})\), and \(I_{t-1}\) denotes the information set available at \((t-1)\).

Given the assumption of differentiable cumulative distribution functions, the conditional density function of \(r_{st} ,r_{ft}\) can be expressed as:

In the above setting, \(c_t (u_t ,v_t | {I_{t-1}})=\partial ^{2}C_t (u_t ,v_t | {I_{t-1}})/\partial u_t \partial v_t\) is the corresponding density function to describe the dependence structure between the marginal density functions \(f_{st} (r_{st} | {I_{t-1}} ),f_{ft} (r_{ft} | {I_{t-1}})\). The parameters in \(g_t ,c_t ,f_{st}\) and \(f_{ft}\) are denoted \(\theta ,\theta _c ,\theta _s \), and \(\theta _f \), respectively. Taking the logarithm of (8), a logarithmic likelihood function can be derived as:

Using a two-step maximum likelihood estimation procedure, we can estimate the parameters (Shih and Louis 1995; Joe and Xu 1996). Specifically, the first step is to estimate the parameters that pertain to the marginal distributions and obtain standard residuals from some filtration method, and the second step is to estimate parameters pertaining to the copula function given the estimated marginal distributions and obtain dependence coefficients. The two-step estimation procedure produces asymptotically efficient and normal parameter estimates (Patton 2006a).

Turning to marginal distributions, it is now widely accepted that volatilities of freight rate returns show some characteristics of volatility clustering, leptokurtosis and skewness, which can be captured by GARCH models (Kavussanos et al. 2004; Chen and Wang 2004; Lu et al. 2008). Based on the work of Bollerslev (1986), we apply a GARCH (1, 1) model to describe the marginal distributions of spot and FFA returns.

where \(\mu _t\) and \(\sigma _t^2\) denote the conditional mean and variance, respectively, given \(\omega>0,\alpha>0,\beta >0\) and \(\alpha +\beta <1\). Here, \(z_t\) is often assumed to follow a normal, student-t, or generalized error distribution (GED). Parameters and standardized residuals can be obtained after estimating Eq. (11) using the maximum likelihood estimation.

For the dependence structure, we use several copulas: Gaussian, student-t, Clayton, Gumbel, and Symmetrized Joe-Clayton (SJC copula; Patton 2006a; Wei et al. 2011; Chollete et al. 2011; Yang and Hamori 2014). Among them, the first two are elliptical copulas whose probability density functions are given in Table 1 (Cherubini et al. 2004; Lai et al. 2009; Lu et al. 2014). As shown in Table 1, a linear correlation coefficient \(\rho \) is based on the association of the entire distribution of variables and neglects the association difference between extreme values and mid-range values. That is to say, it cannot capture the asymmetric fat tail phenomenon that exists in a multivariate setting, which means the weight of the joint density in one or both tails is larger than that in a multivariate normal density (Lai et al. 2009). Therefore, it makes sense to further consider some alternative copulas that allow asymmetric tail dependence.

Second, as discussed in Patton (2006b), the family of Archimedean copulas, such as Clayton, Gumbel, and SJC, allows a variety of tail dependencies. Their probability density functions are also reported in Table 1. Following Nelson (1999), tail dependence, by measuring the concordance between extreme values, can be expressed as:

where \(F_1 (X_1)\) and \(F_2 (X_2)\) are marginal distributions, u is a given threshold value, and \(\tau ^{U},\tau ^{L}\) are the upper and lower tail dependence coefficients, respectively. In addition, \(C(\cdot )\) is a copula function.

Third, for time-varying copulas, \(\rho \) in elliptical copulas is specified as (Patton 2006b):

where \({\tilde{\Lambda }}(x)=(1-e^{-x})/(1+e^{-x})\) is the modified logistic transformation aiming to keep \(\rho _t\) in the range of (\(-1, 1\)) at all times. Given that an Archimedean copula has no linear dependence parameter, Kendall’s \(\tau \) was proposed to solve this issue (Nelson 1999). Kendall’s \(\tau \) measures the difference between the probability of concordance and the probability of discordance for two independent random vectors. As discussed in Nelson (1999), the relationship between copula parameters and Kendall’s \(\tau \) can be represented as: \(\delta ^{\mathrm{C}}=2\tau /(1-\tau )\) for the Clayton copula, \(\delta ^{\mathrm{G}}=1/(1-\tau )\) for the Gumbel copula, and \(\tau _t =(2/\pi )\sin ^{-1}(\rho _t)\) for the Gaussian and student’s-t copulas. Patton (2006b) defines the evolution of \(\tau \) as:

Next, we will use those copulas to examine the dependence structures between spot and FFA returns in the tanker market.

4 Data

To use the alternative hedging method presented in the previous section, we took daily tanker spot, 1-month FFA, 2-month FFA, and 3-month FFA prices quoted in Worldscale points from the Baltic Exchange. We chose a popular route, TD3 (Dirty Tanker) from Middle East Gulf to Japan for very large crude carriers (VLCC) vessel sizes of 250,000 deadweight tons. Such an individual route index is relevant for the risk exposures of smaller companies employing vessels in the investigated route (Kavussanos and Dimitrakopoulos 2011). Sample period runs from January 3, 2006, to December 23, 2011, including 1489 pairs of observations (excluding holidays).

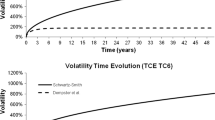

We calculated the returns of spot and FFA prices by taking the first difference of the logarithmic series, denoted as \(r_s\) and \(r_{fi} (i=1,2,3)\), respectively. Table 2 illustrates the descriptive statistics of the returns series. As shown in Table 2, the unconditional means are close to zero for all returns series. In terms of standard deviations, 1-month FFA returns show the greatest volatility over the target period. With the exception of spot returns, all FFA returns are skewed to the left, implying a greater chance that returns will go down rather than up. In addition, each return series has excess kurtosis, indicating that it has a thicker tail and a higher peak than a normal distribution, which is confirmed by the Jarque–Bera test. Ljung–Box tests imply the existence of serial autocorrelation in the returns series. Augmented Dickey–Fuller unit root tests suggest that all returns series are stationary, and we can thus avoid a spurious regression problem in this paper. Figures 1, 2, 3 and 4 present the evolution of squared returns and reveal some evidence of volatility clustering.

5 Empirical results and discussion

As discussed above, the minimum VaR hedge ratio depends not only on the volatility in individual return series, but also on the dependence structure between different return series. Before calculating the optimum hedge ratios, Eqs. (5) and (6) provide the expected return and standard deviation by estimating the marginal distributions, as well as the dependence measurement by estimating their joint distribution.

First, we apply a univariate GARCH model with GED residuals to capture the volatility characteristics of the returns series and report the estimation result (Table 3). Here, our attention is restricted to a GARCH (1,1) process because it has been empirically proved to adequately fit the typical features (like a fat tail and spiked peak) of freight rate returns (Kavussanos et al. 2004; Lu et al. 2008). In the conditional mean equations, all parameters of the AR(1) term are clearly significant at the 5 % level, implying that the effects of one-period lagged returns on current returns are significantly different from zero. As for the conditional variance equations, the estimated coefficients of the ARCH and GARCH terms are significantly positive at the 5 % level, and their sum in the individual equation is less than one (0.9001, 0.9925, 0.9735 and 0.9045, respectively), satisfying the estimation conditions. Moreover, the magnitude of each sum is close to 1, indicating the greater persistence of shocks to volatility. The diagnostics on the standardized residuals from the GARCH models presented in Table 2 suggest that the models are well-specified. In addition, the Q and F statistics show no evidence to suggest the presence of serial correlation or heteroskedasticity in the standardized residuals.

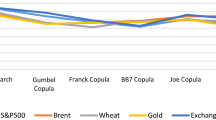

Second, before estimating copula parameters, we have to transform the standardized residuals from the filtration into uniform inputs for the copula models, which is achieved using the empirical cumulative distribution functions (Patton 2006b; Filho et al. 2014). The K−S statistics presented in Table 3 show that the transformed standardized residuals \((u_{st}, v_{1t}, v_{2t}\) and \(v_{3t})\) follow uniform distributions. Nevertheless, the lower tail dependence in the Clayton copula and the asymmetric upper and lower tail dependence in the SJC copula are empirically insignificant. Referring to Patton (2004) and Huang et al. (2009), a rotated Gumbel copula is considered to examine the lower tail dependence between different returns series. The estimation results of the time-varying copulas (excluding insignificant copulas) are reported in Table 4, and it is obvious that the best fitting copula function is the time-varying student-t copula when hedging spot freight rate risk with 1-month FFA contracts and the time-varying Gumbel copula when hedging with 2 or 3-month FFA contracts. For the model selection, we apply the negative log-likelihood function value. From a practical perspective, spot and 1-month FFA return series exhibit symmetric tail dependence when extremely high and extremely low returns are observed, which is captured by a time-varying t-copula. On the other side, spot and 2-month (or 3-month) FFA return series present tail-dependence only when extremely high returns are observed, which is described by a time-varying Gumbel copula.

Third, we derive Kendall’s \(\tau \), used as a quantitative measurement of nonlinear dependence, based on the relationship between it and the copula parameters, and its evolution is depicted in Figs. 5, 6, and 7. Compared to constant linear correlations, Kendall’s \(\tau \) displays obvious time-varying characteristics. Moreover, the dependence between spot and FFA return series are generally overestimated by constant linear correlations. More precisely, the constant linear correlations are 0.4039, 0.3122, and 0.2527, whereas the mean values of Kendall’s \(\tau \) are 0.2648, 0.2204, and 0.1897 between spot returns and 1-month FFA, 2-month FFA, and 3-month FFA returns, respectively. Broadly speaking, a relatively low dependence can be seen between spot and FFA returns, which restricts the hedging function of FFA markets. Furthermore, as the expiration date of FFA contracts becomes longer, the dependence between spot and FFA returns becomes lower. That low dependence might be partially explained by the following reasons. The empirical results in this study are based on exchange traded data and do not consider over-the-counter (OTC) trade information because detailed trade data by OTC are unavailable. On the other hand, many terms in FFA contracts, such as the underlying shipping routes, vessel age, and traded volume, are standard and might be inconsistent with shipowners’ realistic situations, which would also decrease the dependence between spot and FFA returns.

Finally, after estimating the parameters of marginal and joint distributions, we calculate the optimal hedge ratios. Figures 8, 9, and 10 illustrate the evolution of the minimum VaR hedge ratios when hedging the spot freight rate risk with 1-month FFA, 2-month FFA and 3-month FFA contracts, respectively. As shown in those figures, the minimum VaR hedge ratios present obvious dynamic characteristics. Moreover, they became higher after the 2008 financial crisis (the corresponding t is about 750), implying that participants’ hedging costs are higher. To further examine the hedging costs with different FFA contracts, we present the descriptive statistics of the minimum VaR hedge ratios in Table 5. With a longer expiration date for the contract, the mean and standard deviation of time-varying hedge ratios rise. That is to say, shipowners suffer higher costs and risks. Therefore, shipowners need to use appropriate hedging strategies based on their risk preferences and the dynamic market environment and then determine the optimal number of FFA contracts.

6 Conclusion

Knowledge of hedge ratios is essential to shipowners’ strategies when hedging spot freight rate risk with shipping derivatives. The optimal hedge ratio depends not only on the particular objective function but also on the estimation technique. In this paper, we have provided an alternative hedging method based on the concept of VaR for shipowners. Moreover, we adopted a univariate GARCH model to capture the volatility characteristics of freight rate returns and applied time-varying copula models to describe the nonlinear dependence between the spot and FFA returns. Our data are quotes of the tanker spot freight rate and FFA during the period from January 3, 2006, to December 23, 2011.

Our main results are as follows. First, we found empirical evidence to suggest the presence of significant volatility persistence in freight rate returns. Second, regarding the nonlinear dependence structure, the time-varying t-copula performs best when hedging with 1-month FFA contracts and the time-varying Gumbel performs best when hedging with 2 and 3-month FFA contracts. Finally, the minimum VaR hedge ratios present obvious dynamic characteristics, and they were relatively higher after the financial crisis. That is to say, shipowners had to pay higher hedging costs after the crisis. Therefore, with a better understanding of hedge ratios, shipowners can make improved investment decisions and receive stable cash flows.

A potential limitation of the current paper is related to hedging effectiveness. We have not considered the hedging effectiveness of the minimum VaR method because the traditional measure of hedging effectiveness is based on the minimum-variance approach, which we deemed unsuitable. That limitation points to avenues for future research.

References

Angelidis T, Skiadopoulos G (2008) Measuring the market risk of freight rates: a value-at-risk approach. Int J Theor Appl Finance 11(5):447–469

Barbi M, Romagnoli S (2014) A copula-based quantile risk measure approach to estimate the optimal hedge ratio. J Futures Mark 34(7):658–675

Batchelor R, Alizadeh A, Visvikis I (2007) Forecasting spot and forward prices in the international freight market. Int J Forecast 23(1):101–114

Bollerslev T (1986) Generalized autoregressive conditional heteroskedasticity. J Econ 31(3):307–327

Bollerslev T (1990) Modelling the coherence in short-run nominal exchange rates: a multivariate generalized ARCH model. Rev Econ Stat 72(3):498–505

Cao ZG, Harris RDF, Shen J (2010) Hedging and value at risk: a semi-parametric approach. J Futures Mark 30(8):780–794

Cecchetti SG, Cumby RE, Figlewski S (1988) Estimation of the optimal futures hedge. Rev Econ Stat 70(4):623–630

Chang KL (2011) The optimal value-at-risk hedging strategy under bivariate regime switching ARCH framework. Appl Econ 43(21):2627–2640

Chang CL, McAleer M, Tanshuchat R (2011) Crude oil hedging strategies using dynamic multivariate GARCH. Energy Econ 33:912–923

Chen SS, Lee CF, Shrestha K (2003) Futures hedge ratios: a review. Q Rev Econ Finance 43(3):433–465

Chen YS, Wang ST (2004) The empirical evidence of the leverage effect on volatility in international bulk shipping market. Marit Policy Manag 32(2):109–124

Cherubini U, Luciano E, Vecchiato W (2004) Copula methods in finance. Wiley, Hoboken, pp 95–128

Cheung CS, Kwan CCY, Yip PCY (1990) The hedging effectiveness of options and futures: a mean-gini approach. J Futures Mark 10(1):61–73

Chollete L, De la Pena V, Lu CC (2011) International diversification: a copula approach. J Bank Finance 35(2):403–417

Ederington LH (1979) The hedging performance of the new futures markets. J Finance 34(1):157–170

Engle RF, Kroner KF (1995) Multivariate simultaneous generalized ARCH. Econ Theory 11(1):122–150

Engle RF (2002) Dynamic conditional correlation—a simple class of multivariate GARCH models. J Bus Econ Stat 20(3):339–350

Filho OCS, Ziegelmann FA, Dueker MJ (2014) Assessing dependence between financial market indexes using conditional time-varying copulas: applications to Value at Risk (VaR). Quant Finance 14(12):2155–2170

Harris RDF, Shen J (2006) Hedging and value at risk. J Futures Mark 26(4):369–390

Hill GW, Davis AW (1968) Generalized asymptotic expansions of Cornish–Fisher type. Ann Math Stat 39(4):1264–1273

Howard CT, D’Antonio LJ (1984) A risk-return measure of hedging effectiveness. J Financ Quant Anal 19(1):101–112

Hsin CW, Kuo J, Lee CF (1994) A new measure to compare the hedging effectiveness of foreign currency futures versus options. J Futures Mark 14(6):685–707

Hsu CC, Tseng CP, Wang YH (2008) Dynamic hedging with futures: a copula-based GARCH model. J Futures Mark 28(11):1095–1116

Huang JJ, Lee KJ, Liang H, Lin WF (2009) Estimating value at risk of portfolio by conditional copula-GARCH model. Insur Math Econ 45(3):315–324

Hung JC, Chiu CL, Lee MC (2006) Hedging with zero-value at risk hedge ratio. Appl Financ Econ 16(3):259–269

Joe H, Xu JJ (1996) The estimation method of inference functions for margins for multivariate models. Technical Report 166, Department of Statistics, University of British Columbia

Johnson LL (1960) The theory of hedging and speculation in commodity futures. Rev Econ Stud 27(3):139–151

Kavussanos MG, Nomikos NK (2000a) Hedging in the freight futures market. J Deriv 8(1):41–58

Kavussanos MG, Nomikos NK (2000b) Constant vs. time-varying hedge ratios and hedging efficiency in the BIFFEX market. Transp Res Part E Logist Transp Rev 36(4):229–248

Kavussanos MG, Visvikis ID, Batchelor RA (2004) Over-the-counter forward contracts and spot price volatility in shipping. Transp Res Part E 40(4):273–296

Kavussanos MG, Visvikis ID (2006) Shipping freight derivatives: a survey of recent evidence. Marit Policy Manag 33(3):233–255

Kavussanos MG, Visvikis ID, Dimitrakopoulos DN (2010) Information linkages between Panamax freight derivatives and commodity derivatives markets. Marit Econ Logist 12:91–110

Kavussanos MG, Dimitrakopoulos DN (2011) Market risk model selection and medium-term risk with limited data: application to ocean tanker freight markets. Int Rev Financ Anal 20(5):258–268

Lai YH, Chen CWS, Gerlach R (2009) Optimal dynamic hedging via copula-threshold-GARCH models. Math Comput Simul 79(8):2609–2624

Lence SH (1995) The economic value of minimum variance hedges. Am J Agric Econ 72(2):353–364

Lence SH (1996) Relaxing the assumptions of minimum variance hedging. J Agric Resour Econ 21(1):39–55

Lien D, Tse YK (2000) Hedging downside risk with futures contracts. Appl Financ Econ 10(2):163–170

Lu J, Marlow PB, Wang H (2008) An analysis of freight rate volatility in dry bulk shipping markets. Marit Policy Manag 35(3):237–251

Lu XF, Lai KK, Liang L (2014) Portfolio value-at-risk estimation in energy futures markets with time-varying copula-GARCH model. Ann Oper Res 219(1):333–357

Myers RJ, Thompson SR (1989) Generalized optimal hedge ratio estimation. Am J Agric Econ 71(4):858–868

Nelson RB (1999) An introduction to copulas. Springer, New York

Patton AJ (2001) Modelling time-varying exchange rate dependence using the conditional copula. Working paper, University of California, San Diego

Patton AJ (2004) On the out-of-sample importance of skewness and asymmetric dependence for asset allocation. J Financ Econ 2(1):130–168

Patton AJ (2006a) Estimation of copula models for time series of possibly different lengths. J Appl Econ 21(2):147–173

Patton AJ (2006b) Modelling asymmetric exchange rate dependence. Int Econ Rev 47(2):527–556

Pennings JME, Meulenberg MMT (1997) Hedging efficiency: a futures exchange management approach. J Futures Mark 17(5):599–615

Pok WC, Poshakwale SS, Ford JL (2009) Stock index futures hedging in the emerging Malaysian market. Glob Finance J 20(3):273–288

Rolfo J (1980) Optimal hedging under price and quantity uncertainty: the case of a cocoa producer. J Polit Econ 88(1):100–116

Sklar A (1959) Fonctions de répartition à n dimensions et leurs marges. Publ Inst Stat Univ Paris 8:229–231

Stein JL (1961) The simultaneous determination of spot and futures prices. Am Econ Rev 51(5):1012–1025

Shalit H (1995) Mean-gini hedging in futures markets. J Futures Mark 15(6):617–635

Shih JH, Louis TA (1995) Inferences on the association parameter in copula models for bivariate survival data. Biometrics 51(4):1384–1399

Toyoshima Y, Nakajima T, Hamori S (2013) Crude oil hedging strategy: new evidence from the data of the financial crisis. Appl Financ Econ 23(12):1033–1041

Wei Y, Wang YD, Huang DS (2011) A copula-multifractal volatility hedging model for CSI 300 index futures. Phys A 390(23–24):4260–4272

Working H (1953) Futures trading and hedging. Am Econ Rev 43(3):314–343

Working H (1962) New concepts concerning futures markets and prices. Am Econ Rev 52(3):431–459

Yang L, Hamori S (2014) Dependence structure between CEEC-3 and German government securities markets. J Int Financ Mark Inst Money 29:109–125

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Shi, W., Li, K.X., Yang, Z. et al. Time-varying copula models in the shipping derivatives market. Empir Econ 53, 1039–1058 (2017). https://doi.org/10.1007/s00181-016-1146-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-016-1146-9