Abstract

In this paper, we study the risk management implications of different assumptions about the stationarity of freight rates. Specifically, we compare freight rate volatility estimations derived from two different two-factor models; a stationary and a non-stationary one. Based on these volatility estimations, we provide a simple method for estimating the value at risk, VaR, for a single route. The results indicate that when using the non-stationary model, risk managers may overestimate risk, since VaR estimations grow monotonically over time, whereas when using the stationary model, they may underestimate the risk, because VaR estimations are bounded. We also provide estimations of the freight rates option prices based on these two models. Option prices tend to be higher when using the non-stationary model. Finally, we provide a Monte-Carlo simulation method for jointly estimating the VaRs for two routes based on a two-factor model with a common long-term trend, which allows risk managers to take advantage of the benefits of diversification.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Recent events have shown that risk management, which is key to avoiding financial distress, is not as effective as many people believed. The main reason for the failure of risk management during the 2008 financial crisis was that risk was not properly measured, since many calculations were carried out using an incorrect model for price dynamics. In fact, the Basel III agreement recognized that after the 2008 financial crisis it was necessary to make some changes in the calculation of regulatory capital for market risk, introducing what has been known as “stressed VaR” (see for example Hull 2015).Footnote 1

In recent times, freight markets have shown great development in terms of spot and derivatives contracts, and the risks associated with those markets have substantially increased. This increase in the level of risk calls for a more detailed investigation into suitable risk management models.

Comprehensive reviews on risk measurement and management in the shipping sector can be found in Poblacion (2015), (2017) and Poblacion and Serna (2018). A crucial choice in terms of risk management models is that between the use of a stationary or a non-stationary data generating process. In order not to repeat previous findings, here we quote only those related to the topic of our paper.

Based on pre-existing unit root test analyses (Alizadeh and Kavussanos 2002; Tvedt 2003) and on his own analysis, Poblacion (2017) confirms that, in most cases, a non-stationary model outperforms a stationary one in terms of the in-sample fit to the observed futures rates. The analysis in Poblacion (2017) is based on stochastic factor models jointly accounting for spot and future prices, as in Schwartz and Smith (2000) and Dempster et al. (2008).

In Poblacion and Serna (2018), the empirical evidence that was previously presented is extended by showing that freight rates are cointegrated, and furthermore they exhibit common long-term dynamics, which implies that their differences reflect only short-term effects. In doing so, they use different factor models to jointly explain the dynamics of freight rates, as in Mirantes et al. (2012a). They find that the most suitable model in terms of its simplicity and fit is the one that assumes a common long-term trend for freight rates.

Concerning VaR estimations in freight markets, Kavussanos and Visvikis (2006) provide an overview of freight rate derivatives and their use in risk management, as well as an introduction to VaR estimations in freight markets. Angelidis and Skiadopoulos (2008) test several parametric and non-parametric VaR methods in various freight markets. They find that the simplest non-parametric method should be used. Kavussanos and Dimitrakopoulos (2011) find that parametric methods are more suitable in the tanker sector. Abouarghoub et al. (2014) employ a regime switching conditional variance model to improve VaR forecasts for tanker freight returns.

More recently, Argyropoulos and Panopoulou (2018) investigate the performance of several methods (parametric, non-parametric, hybrid and a variety of combined methods) to estimate the VaR of the most important Baltic Exchange indices. They find that combined methods are superior to individual ones.

A key factor in parametric VaR estimation is the assumption of a correctly specified model for the price dynamics. Therefore, in this paper, we address the problem of VaR estimation in freight markets using a theoretical model of the stochastic behaviour of freight rates that is able to properly capture the main dynamics of freight rates and to avoid the problems of model misspecification, which lead to wrong VaR estimations. Specifically, we will see that a non-stationary model is more suitable for risk measuring in freight rate markets, because with a stationary model we incorporate the risk of underestimating the risks that a company is facing, which can have serious consequences, as occurred in the past financial crisis. In fact, according to Poblacion (2017), there is significant evidence that freight rates are non-stationary. Therefore, choosing a mis-specified stationary model comes at the cost of underestimating risk.

To this end, the most suitable models for the stochastic behaviour of freight rates are the stationary and non-stationary models for freight rates that were described above (see Poblacion 2017, and Poblacion and Serna 2018). These factor models account for the main characteristics of freight rates. Long-term factors account for the long-term dynamics of freight rates, which are assumed to follow a random walk (Poblacion 2017), whereas short-term factors account for the mean-reverting components in freight rates (Tvedt 2003). Moreover, the seasonal factor accounts for the seasonal effect commonly observed in freight rates (Alizadeh and Kavussanos 2002).

Specifically, we investigate the differences arising in measuring risk according to the different models presented in Poblacion (2017) and in Poblacion and Serna (2018), i.e., a stationary and a non-stationary model for freight rates for a single route, and a model with a common long-term trend for pairs of routes, as well as their implications in terms of risk management.

Our results indicate that with the non-stationary model, risk managers may overestimate risk, given that VaR estimations grow monotonically with time, whereas with the stationary model, they may underestimate risk because VaR estimations are bounded. Specifically, with the stationary model we obtain VaR estimates with a confidence level of 99% and a time horizon of 1 month between 18 and 35% lower than those obtained with the non-stationary model (between 20 and 41% with a confidence level of 95%).

Estimations of freight rates option values based on these two models are also provided, and the results show that the non-stationary model tends to produce higher option prices. However, since the non-stationary model is more suitable in many cases for modelling the stochastic behaviour of freight rates (Poblacion 2017), with the stationary model, we take the risk of underestimating the risks that the company is facing, which can have serious consequences. Finally, we conduct an extensive Monte-Carlo simulation exercise for estimating the VaRs of two routes jointly, based on a two-factor model with a common long-term trend, which allows risk managers to take advantage of the benefits of diversification. This Monte Carlo simulation exercise for estimating the VaR of two routes jointly constitutes the main contribution of the paper. It is important to note that in the case of two routes, no analytic formula is available because, based on model assumptions, we are able to specify the distribution of the price of a single route, which is log-normal. However, the price of a portfolio consisting of positions in different routes is a linear combination of log-normal distributions that does not have a closed formula. Therefore, one must rely on Monte Carlo simulations to estimate the future portfolio value.

The remainder of the paper is organized as follows. The next section presents the data. In Sect. 3 we measure the risk for a single route. Section 4 discusses the joint risk measurement for a couple of routes and some risk management implications of the proposed models. Finally, we offer some conclusions and direction of future work.

2 Data

The data set used in this paper is the same as in Poblacion (2015) and (2017), Poblacion and Serna (2018) and Mirantes et al. (forthcoming), and consists of weekly observations of voyage charter contracts. Specifically, we have data for the spot and forward rates of the TCE (Time Charter Equivalent) during the period from 05/06/2010 to 02/25/2014 (200 weekly observationsFootnote 2) for two routes that are defined by the Baltic Exchange (www.balticexchange.com): TC2 and TC6.

As is well known, the Time Charter Equivalent, TCE, is the daily revenue performance of a vessel. The TCE is calculated by taking voyage revenues, subtracting voyage expenses, and then dividing the entire total by the round-trip voyage duration in days; therefore, this revenue is measured in $/day.

For these routes, we have the spot and forward prices with maturities from the current month up to 5 months ahead (FCM, F1, F2, F3, F4 and F5, where FCM is the current month, F1 is the forward contract for the first month after the closest maturity, F2 is the contract for the second month, and so on) and from three to five quarters (Q3, Q4 and Q5). Table 1 in Poblacion (2015) contains the details, such as loading and unloading ports and type of ship for these routes. The main descriptive statistics, including the mean and volatility, of these variables are presented in Table 1 (obtained from Poblacion 2015).

3 The risk of a single route

The VaR estimations that we present are based on two different factor models of freight rates. The first model is the stationary model of Dempster et al. (2008), and the second is an adaptation of the non-stationary model of Schwartz and Smith (2000).

Using the reformulation in Poblacion (2017), the model by Dempster et al. (2008) can be expressed as follows. It is assumed that the log-spot price (Xt) is the sum of two short-term stochastic factors (χt1 and χt2) plus a deterministic seasonal component (αt), as in Sorensen (2002). Thus, Xt is the log freight spot price, which evolves according to the following equation:

The stochastic differential equations (SDEs) for factors, under the risk-neutral measure, are stated as follows:

In model (2), μ represents the trend; κ1 and κ2 and σχ1 and σχ2 are the speeds of adjustment and volatility, respectively, of the factors; and λχ1 and λχ2 represent the market prices of the risks that are associated with the factors. dWχ1t and dWχ2t are standard Brownian motions than can be correlated (dWχ1tdWχ2t = ρχ1χ2dt). α *t is the other seasonal factor that complements αt and φ is the seasonal period.

In the Schwartz and Smith (2000) model, the log-spot price (Xt) is assumed to be the sum of two stochastic factors: a short-term deviation (χt) and a long-term equilibrium price level (ξt), plus a deterministic seasonal component (αt).Thus, if Xt is the log-spot price, then we obtain the following:

The stochastic differential equations (SDEs) for these factors, under the risk-neutral measure, are stated as follows:

In model (4), μξ and σξ represent the trend and volatility, respectively, of the long-term factor, and κ and σχ are the speeds of adjustment and volatility, respectively, of the short-term factor. λχ and λξ represent the market prices of the risks that are associated with the short- and long-term factors. As before, dWξt and dWχt are standard Brownian motions that can be correlated (dWξtdWχt = ρξχdt), α *t is the other seasonal factor that complements αt and φ is the seasonal period.

It is worth noting that in the Dempster et al. (2008) model, both stochastic factors, χt1 and χt2, are mean-reverting. On the other hand, in the Schwartz and Smith (2000) model, χt is a mean-reverting factor, and ξt is a random walk. Therefore, the Dempster et al. (2008) model is stationary and the Schwartz and Smith (2000) is non-stationary.

The estimation results of these models are presented in Table 2 (obtained from Poblacion 2017, Tables 2 and 3). Based on these results, it is interesting to investigate the way in which the theoretical variance of futures pricesFootnote 3 varies with time, as well as its implications in terms of risk management, option valuation and hedging.

Using the databases described above, Poblacion (2017) found that, in many cases, the stationary model by Dempster et al. (2008) does not adequately model changes in freight rates, thus suggesting that a non-stationary long-term factor is needed to accurately model freight rates. However, in some routes, the Dempster et al. (2008) model is a suitable model for freight rates.Footnote 4

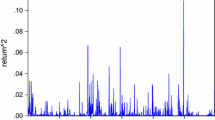

Based on these results, Fig. 1 shows the time evolution of futures price volatilities that are obtained with both the Schwartz and Smith (2000) and Dempster et al. (2008) models, for the TCEs of routes TC2 and TC6.Footnote 5 The theoretical volatilities of futures prices obtained with both models depend on the model’s parameters as well as on the futures’ time to maturity. Logically, as time to maturity increases, volatility also increases. In Fig. 1 we have computed the theoretical futures price volatility for maturities up to 50 years. As expected, the volatility that is forecasted from the non-stationary model, i.e., the Schwartz and Smith (2000) model, monotonically grows with time, whereas the volatility that is derived from the stationary model, i.e., the Dempster et al. (2008) model, is bounded.

Therefore, the two models have very different implications in terms of risk management and also in terms of derivative valuation and hedging. Specifically, as we will see in the following sub-sections, the bounded-variance model produces lower estimates of the risk, associated with the futures contracts in the long run, resulting in lower option prices compared to those that are obtained with the non-bounded variance model.

3.1 Measuring the risk: value at risk (VaR)

In this sub-section, based on the concept of the “value at risk” (VaR), we present the results of the risk measurements for a single route. Recall that VaRq is defined as the 1 − q quantile of the asset price distribution, i.e.,\(\Pr \left( {X \le X^{*} } \right) = 1 - q\), where X is the asset price and VaRq = E[X] – X*.

In both models, Schwartz and Smith (2000) and Dempster et al. (2008), it is assumed that the future log-spot price, ln(St), is normally distributed with mean μ and standard deviation σ, were σ has been calculated using the analytic formulae in Schwartz and Smith (2000) and Dempster et al. (2008) (Fig. 1). Therefore, the future spot price, St, is log-normally distributed with mean \(\exp \left( {\mu + \sigma^{2} /2} \right)\). This is to say, \(E[S_{t} ] = \exp \left( {\mu + \sigma^{2} /2} \right)\), and so \(\mu = \ln \left( {E[S_{t} ]} \right) - {{\sigma^{2} } \mathord{\left/ {\vphantom {{\sigma^{2} } 2}} \right. \kern-0pt} 2}\). In the last expression, E[St] can be easily computed as \(E[S_{t} ] = S_{0} \cdot\exp (rt)\), where r is the risk-free interest rate. Thus, once we have obtained the estimations for the parameters μ and σ, the critical value X* can be estimated as the inverse of the log-normal distribution with parameters μ and σ at the point 1 − q. Finally, the VaRq can be computed as E[St] − X*.

The results of the estimation of the VaR with probability levels 99% and 95%, i.e., 1 − q = 1% and 5%, for the TCEs of routes TC2 and TC6, are shown in Table 3. In all cases, the results are shown for different time horizons from the current date (the final date in the historical data set employed in the estimation of the models is February 25, 2014). In order to check the robustness of our findings, we have performed an empirical analysis assuming that log-prices follow a non-standard Student’s t distribution with mean μ and standard deviation σ, were σ has been empirically calculated using the values reported in Table 1, and μ is defined so that, as before, \(E[S_{t} ] = S_{0} \cdot\exp (rt)\), and 192 and 18 degrees of freedom for routes TC2 and TC6, respectively.Footnote 6

As expected, given that the Schwartz and Smith (2000) model produces unbounded estimates of the volatility (Fig. 1), the critical values (X*), i.e., the minimum spot price expected with the probability level q = 99% or 95%, are lower in the case of the Schwartz and Smith (2000) model, and therefore the maximum expected loss is always higher with the Schwartz and Smith (2000) model than with the Dempster et al. (2008) model. In fact, with the Schwartz and Smith (2000) model, the value of X* converges quickly towards zero. It is interesting to observe how the reported values calculated assuming a Student’s t distribution are closer to the values obtained assuming the Schwartz and Smith (2000) model than to the values obtained assuming the Dempster et al. (2008) model, suggesting that the Schwartz and Smith (2000) model provides better estimations of the observed volatility than the Dempster et al. (2008) model. These results confirm that with the non-stationary model, risk managers may overestimate the risk, given that the maximum estimated losses are much higher than with the stationary model, whereas with the stationary model, they may underestimate the risk.

In order to quantify the difference in the VaR estimations obtained with both models, Table 4 shows the percentage of undervaluation of the Dempster et al. (2008) model with respect to the Schwartz and Smith (2000) model. The largest differences between both models are found for short time horizons (shorter than 1 year). With the stationary model we obtain VaR estimates with a confidence level of 99% and a time horizon of one month between 18 and 35% lower than those obtained with the non-stationary model (between 20 and 41% with a confidence level of 95%). The differences decrease as the time horizon increases because the value of X* converges towards zero as we move forward in time, and therefore E[St] − X* converges to E[St].

However, as stated in Poblacion (2017), given that the non-stationary model is more suitable in many cases for modelling the stochastic behaviour of freight rates, with the stationary model, we incorporate the risk of underestimating the risks that the company is facing, which can have drastic consequences, as occurred in the past financial crisis.

3.2 Option valuation

In this subsection, we value a set of European call and put options on the TCEs of TC2 and TC6 with several maturities, ranging from one month up to 10 years. As in the previous subsection, the current date is assumed to be the last day in the historical data base, i.e., February 20th, 2014. On that date, the spot TCE of TC2 was 6118 (dollars per day) and the TCE of TC6 was 12,969. Therefore, several strike prices have been considered around the current spot price. In the case of the TCE of TC2, the strikes are 5000, 5500, 6000 and 6500. In the case of the TCE of TC6, the strikes are 8000, 10,000, 12,000 and 14,000.

Given that we are dealing with European options, theoretical values can be computed by means of the well-known Black–Scholes formula. The estimations of the volatility that are needed in the Black–Scholes formula are calculated using the analytic formulae given in Schwartz and Smith (2000) and Dempster et al. (2008) for the variance of futures contracts (see Fig. 1). The results are shown in Tables 5 and 6 for the TCE of TC2 and the TCE of TC6, respectively. The results show relatively high values for the options, taking into account that the initial spot price is 6118 (dollars per day) in the case of the TCE of TC2 and 12,969 in the case of the TCE of TC6. This result is due to the relatively high values that are calculated for the volatility estimations in the case of freight rates (see Fig. 1). Moreover, as expected, in all cases, option values are higher with the non-stationary model of Schwartz and Smith (2000) than with the stationary model of Dempster et al. (2008). The difference is due to the higher estimates of the volatility that are produced by the non-stationary model relative to the stationary model (see again Fig. 1). Furthermore, the difference is higher (in relative terms) for long-term options because the difference between the volatility estimates with both models tends to be higher whenever the time to maturity increases.

These results show again the importance of appropriately modelling the stochastic behaviour of the underlying asset (freight rates in this case) to accurately estimate option values. As stated above, given that the non-stationary model is more suitable in the case of freight rates (Poblacion 2017), with the stationary model, we run the risk of underestimating option prices.

4 The risk of more than one route

In the previous section, we have analysed the risk of one particular route with applications to risk measurement (VaR) and to option valuation. In this section, we will analyse the risk that is associated with the dynamics of two routes jointly. To characterize the stochastic behaviour of two routes jointly, we will rely on the models discussed in Poblacion and Serna (2018).

Poblacion and Serna (2018) present different factor models to characterize freight rate dynamics, based on the models proposed by Cortazar et al. (2008) and Mirantes et al. (2012b), with or without assuming a common long-term trend for pairs of freight rates. They find that the freight rate series that are considered exhibit a common long-term dynamics and conclude that the most suitable model in terms of simplicity and fit is the one that assumes a common long-term trend for pairs of freight rates.

The model with a common long-term trend for pairs of freight rates considered in Poblacion and Serna (2018) is the non-stationary model by Schwartz and Smith (2000) with three stochastic factors. In this model, the log-spot price (Xit) is assumed to be the sum of two stochastic factors, a short-term deviation (χit), which is different for each freight rate, a common long-term equilibrium price level (ξt), and a deterministic seasonal component, αt. Therefore, the log-spot price (Xit) will be \(X_{it} = \xi_{t} + \chi_{it} + \alpha_{t}\), i = 1, 2. The (risk-neutral) SDEs of the factors for this joint model with a common long-term trend are:

As before, dWξt and dWχit are standard Brownian motions that can show any correlation structures resulting in 3 correlation parameters.

It is important to note that in the case of two routes, we cannot apply the analytic method that is employed above to calculate the VaR for a single route because, based on the model assumptions, we are able to specify the distribution of the price of a single route, which is log-normal. However, the price of a portfolio consisting of positions in different routes is a linear combination of log-normal distributions that does not have a closed formula. Therefore, we must rely on Monte Carlo simulations to estimate the future portfolio value. As stated in the Introduction, this Monte Carlo simulation method for estimating the VaR of two routes jointly constitutes the main contribution of the paper.

Let us consider a portfolio consisting of a long position in the TCE of TC2 and a short position in the TCE of TC6 (equal weights). Once we have jointly estimated the common long-term trend model for these two routes (Poblacion and Serna, 2018, Table 2), we can simulate 10,000 values for the portfolio at the end of the next year, assuming that the current date is the final date in our historical dataset, i.e., February 20th, 2014. To do so, we need to generate three correlated series of 10,000 values for the three stochastic factors in the model (the common long-term factor and the two route-specific short-term factors). Using the estimated parameters from the common long-term trend model for the TCEs of the TC2 and TC6 freight rate series (Poblacion and Serna 2018, Table 2), and the three simulated series for the three stochastic factors,Footnote 7 we can simulate two series of 10,000 values for each freight rate. Finally, we can obtain a series of 10,000 simulated values for the portfolio at the end of the next year by subtracting the simulated series for TC6 from the simulated series for TC2. Finally, the VaR can be derived from the distribution of the simulated portfolio value at the end of the next year. Specifically, the VaR for the portfolio under study with probability q is calculated as the expected portfolio value at the end of the next year (the mean of the simulated distribution) minus the (1 − q)th percentile of the simulated distribution.

The simulated distribution for the value of the portfolio at the end of the next year is depicted in Fig. 2. As in the previous section, in order to check the robustness of our findings, we have performed an empirical analysis assuming that log-prices follow a non-standard Student’s t distribution with mean μ and standard deviation σ, were σ has been empirically calculated using the values reported in Table 1, and μ is defined so that, as before, \(E[S_{t} ] = S_{0} \cdot\exp (rt)\). The simulated distribution obtained with this empirical exercise is depicted in Fig. 3. As expected, the simulated distribution assuming a Student’s t distribution shows greater dispersion than the distribution obtained assuming Gaussian shocks (Fig. 2).

Simulated distribution for the portfolio value at the end of the next year. The figure shows the simulated distribution for the value of a portfolio consisting of a long position in the TCE of TC2 and a short position in the TCE of TC6 at the end of the next year. The simulation is based on the common joint long-term trend model for these two routes (Poblacion and Serna 2018, Table 2), assuming that the current date is February 20th, 2014

Simulated distribution for the portfolio value at the end of the next year assuming a non-standard Student’s t distribution. The figure shows the simulated distribution for the value of a portfolio consisting of a long position in the TCE of TC2 and a short position in the TCE of TC6 at the end of the next year. The simulation is based on the assumption that log-prices follow a non-standard Student’s t distribution with mean μ and standard deviation σ, were σ has been empirically calculated using the values reported in Table 1, and μ is defined so that \(E[S_{t} ] = S_{0} \cdot\exp (rt)\)

Table 7 shows the results of the VaR estimations (E[St] − X*) with different time horizons. We report the results assuming the common long-term trend model and also assuming a non-standard Student’s t distribution for log-spot prices. As expected, the VaR estimations monotonically grow as we move forward in time. However, it is interesting to observe how the Student’s t distribution, in spite of allowing for higher dispersion, does not seem to capture properly the trends in the freight rate series, given that the VaR estimations obtained with the Student’s t assumption do not increase with time as those obtained with the common long-term trend assumption. It is not surprising because the common long-term trend model is a theoretical model that is aimed to capture the joint dynamics of the data. However, the empirical exercise based on the Student’s t distribution simulates paths for the future evolution of the freight rates based on the current situation, without estimating the trend in the freight rate series. We must keep in mind that in the case of a single route analyzed in the previous section, the lowest possible value is zero, given that we had long positions. However, in the case of the portfolio of two routes analyzed in this section, we have a short position and therefore, the lowest possible value for the portfolio is minus infinity.Footnote 8

Therefore, we have presented a relatively simple way of estimating the VaR of a portfolio of routes based on a common long-term trend model for these routes, which is the most suitable model in terms of simplicity and fit for pairs of freight rates (Poblacion and Serna 2018). Furthermore, this procedure is quite flexible, as it can easily accommodate different portfolio weights, including short positions.

5 Risk management implications

As stated in the introduction, one of the main reasons why risk management failed during the past financial crisis is that many calculations were carried out using incorrect models for the price dynamics. For this reason, a key factor in risk management is to adopt a correct model for price dynamics.

Therefore, in this paper we address the problem of VaR estimation in freight markets using a theoretical model of the stochastic behaviour of freight rates that is able to properly capture the main dynamics of freight rates and to avoid the problems of model misspecification, which leads to wrong VaR estimations. Specifically, we have shown that with the assumption of stationarity in the freight rate series we incorporate the risk of underestimating the risks that the company is facing, which can have drastic consequences, as occurred in the past financial crisis. Thus, it is more conservative to assume a non-stationary model, because this model produces higher VaR estimations. Specifically, with the stationary model we obtain VaR estimates with a confidence level of 99% and a time horizon of 1 month between 18 and 35% lower than those obtained with the non-stationary model (between 20 and 41% with a confidence level of 95%). Moreover, the non-stationary model is the most suitable model in many cases for modelling the stochastic behaviour of freight rates (Poblacion 2017).

Concerning risk measurement in the case of pairs of freight rates, Poblacion and Serna (2018) show that the most suitable model in terms of simplicity and fit is the one that assumes a common long-term trend for pairs of freight rates. Therefore, we propose a model with a common long-term trend for estimating the VaR of two routes jointly, which allows risk managers to take advantage of the benefits of diversification.

6 Conclusions

In this paper, we address the problem of risk measurement in freight markets using the most suitable models for the stochastic behaviour of freight rates according to the existing literature.

In this way, the most suitable models for the stochastic behaviour of freight rates are the stationary and non-stationary models, proposed by Schwartz and Smith (2000) and Dempster et al. (2008), respectively. Therefore, based on these two models, we obtain volatility estimations of freight rates that can be used for estimating the VaR of a single route. However, given that the non-stationary model is more suitable in many cases for modelling the stochastic behaviour of freight rates (Poblacion 2017), with the stationary model, we take the risk of underestimating the risks that the company is facing, which can have serious consequences. We also provide estimations of the freight rates option values based on these two models. As stated above, given that the non-stationary model is the most suitable one, when using the stationary model, we can underestimate the option values.

Finally, we investigate via Monte-Carlo simulation the case of two routes assuming a common long-term trend model for pairs of freight rates and also a non-standard Student’s t distribution for log-spot prices. We find that the common long-term trend model produces more realistic results, since the Student’s t distribution exercise does not properly estimate the trend in the freight rate series.

Notes

There have also been many papers showing that the standard VaR measures needed to be improved to properly capture market risk after the 2008 financial crisis (see for example Halbleid and Pohlmeier 2012).

There are five missing data for the spot prices in both series, TC2 and TC6. Linear interpolation has been used to replace the missing values.

Under the assumptions of the models by Schwartz and Smith (2000) and Dempster et al. (2008), it can be proved that the log-price of a futures contract traded at time t with maturity at time T + t is normally distributed. Schwartz and Smith (2000) and Dempster et al. (2008) provide formulas for the theoretical variance of futures prices (see Appendix).

Poblacion (2017) analyses the stationarity of several freight rate series (five routes for the World Scale, WS, and four routes for the TCE). He found that, except for the route WS TD16, in all cases a likelihood ratio test shows that it is not possible to reject the null hypothesis that the true model is the non-stationary model by Schwartz and Smith (2000).

These theoretical volatilities are calculated using the analytic formulae that were given in Schwartz and Smith (2000) and Dempster et al. (2008) for the variance of futures contracts (see Appendix). It is worth noting that the models’ parameters in these formulae have been estimated in sample. As a consequence, we are implicitly assuming that the factors’ volatilities are constant over time.

The degrees of freedom have been estimated by maximum likelihood. The most important characteristic of the freight rate series under study, however, is not their leptokurtosis (heavy tails), but their extremely high volatility, as can be seen in Table 1.

As shown in model (5), these three stochastic factors are assumed to be Gaussian.

References

Abouarghoub, W., I. Biefang-Frisancho Mariscal, and P. Howells. 2014. A two-state Markov switching distinctive conditional variance application for tanker freight returns. International Journal of Financial Engineering and Risk Management 1 (3): 239–263.

Alizadeh, A., and N. Kavussanos. 2002. Seasonality patterns in tanker spot freight markets. Economic Modelling 19 (5): 747–782.

Angelidis, T., and G. Skiadopoulos. 2008. Measuring the market risk of freight rates: A Value-at-Risk approach. International Journal of Theoretical and Applied Finance 11 (5): 447–469.

Argyropoulos, C., and E. Panopoulou. 2018. Measuring the market risk of freight rates: A forecast combination approach. Journal of Forecasting 37 (2): 201–224.

Cortazar, G., C. Milla, and F. Severino. 2008. A multicommodity model of futures prices: Using futures prices of one commodity to estimate the stochastic process of another. The Journal of Futures Markets 28 (6): 537–560.

Dempster, M.E., E. Medova, and K. Tang. 2008. Long term spread option valuation and hedging. Journal of Banking & Finance 32: 2530–2540.

Halbleid, R., and W. Pohlmeier. 2012. Improving the value at risk forecasts: Theory and evidence from the financial crisis. Journal of Economic Dynamics and Control 36: 1212–1228.

Hull, J.C. 2015. Risk management and financial institutions. New Jersey: Wiley.

Kavussanos, M., and D. Dimitrakopoulos. 2011. Market risk model selection and medium term risk with limited data: Application to ocean tanker freight markets. International Review of Financial Analysis 20: 258–268.

Kavussanos, M.G., and I.D. Visvikis. 2006. Derivatives and risk management in shipping. London: Witherbys Publishing Limited & Seamanship International.

Mirantes, A.G., J. Población, and G. Serna. 2012a. The stochastic seasonal behavior of natural gas prices. European Financial Management 18 (3): 410–443.

Mirantes, A.G., J. Población, and G. Serna. 2012b. Analyzing the dynamics of the refining margin: Implications for valuation and hedging. Quantitative Finance 12 (12): 1839–1855.

Mirantes, A.G., J. Poblacion, and G. Serna. forthcoming Hedging Voyage Charter Rates on Illiquid Routes. International Journal of Shipping and Transport Logistics, in press.

Poblacion, J. 2015. The stochastic seasonal behavior of freight rate dynamics. Maritime Economics & Logistics 17 (2): 142–162.

Poblacion, J. 2017. Are recent tanker freight rates stationary? Maritime Economics & Logistics 19 (4): 650–666.

Poblacion, J., and G. Serna. 2018. A common long-term trend for bulk shipping prices. Maritime Economics & Logistics 20 (3): 421–432.

Schwartz, E.S., and J.E. Smith. 2000. Short-term variations and long-term dynamics in commodity prices. Management Science 46 (7): 893–911.

Sorensen, C. 2002. Modeling seasonality in agricultural commodity futures. The Journal of Futures Markets 22 (5): 393–426.

Tvedt, J. 2003. A new perspective on price dynamics of the dry bulk market. Maritime Policy & Management 30 (3): 221–230.

Acknowledgements

We acknowledge the financial support of the Spanish Ministerio de Economía, Industria y Competitividad Grant Number ECO2017-89715-P. The paper is the sole responsibility of its authors. Views expressed here do not necessarily reflect those of the Banco de España.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Here we report analytic formulae for the variances of futures prices obtained with the Schwartz and Smith (2000) and the Dempster et al. (2008) models.

In the case of the Schwartz and Smith model (2000) the theoretical variance of the futures price with maturity T is given by (see Schwartz and Smith 2000, expression (4b)):

In the case of the Dempster et al. (2008) the theoretical variance of the futures price with maturity T has been calculated as follows:

Rights and permissions

About this article

Cite this article

Población, J., Serna, G. Measuring bulk shipping prices risk. Marit Econ Logist 23, 291–309 (2021). https://doi.org/10.1057/s41278-019-00129-3

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41278-019-00129-3