Abstract

In the inventory system, usually demand and deterioration rate consider as in deterministic form. But, in the practical situation, these rates are uncertain in nature. In this case, demand increases as the number of customer increases. Furthermore, there is some limitation with the storage space. So, for keeping the inventory, retailer has to need extra space or rent warehouse (RW) with unlimited capacity. RW has better preserving facilities for keeping products for long time without any deterioration. So, RW has higher holding cost as compared with OW holding cost. In this paper, demand considered as a Weibull and deterioration in fuzzy sense; here, the supplier give some time period to pay the amount to the customer which is known as one level permissible delay in payments. The main objective is to find the optimum solution by using triangular fuzzy number. Numerical example provides the optimal solution of crisp and fuzzy model and sensitivity analysis also carried on different parameters.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

1 Introduction

The inventory models maintain inventory level. In the last few years, researchers attracted toward inventory systems. It is well known that the first model of inventory was developed by Harris (1913). Harris introduced EOQ model in which demand is assumed to be known and constant. After that, lots of research works have been done in this field. Many works have been done by extending the Harris (1913) model. There are considered lots of assumption in this model to come close to real-life situation.

In the basic EOQ model, rate of demand was assumed to be constant. But in reality, demand can not be deterministic, it should vary with time. Sometimes, it depends upon situation. So, there is always some uncertainty in demand. Silver and Moon (1969) were the first researchers to modify the EOQ formula for the case of varying demand.

Usually, it is assumed that lifetime of an item is infinite when it is in storage. Goyal (1985)‘s inventory model assumed that the lifetime of the product is infinite within the storage time. In reality, the effect of deterioration cannot be ignored in inventory models. Deterioration is outlined as decay, alternate, harm, spoilage, or obsolescence in the effect of decreasing usefulness from its usual rationale. It is assumed that items are start deteriorating as soon as they arrive in the warehouse. Generally, it is assumed as known and constant. But, it cannot be predefined. There must be an uncertainty in rate of deterioration of the products. Hence, it is preferably taken as in fuzzy.

Nowadays, the seller wants to attract the buyer to purchase products in large quantities; for this, seller always uses new techniques. Credit financing is the most common technique used by seller to attract buyer. In this, the seller offers some time period to buyer to pay the amount of the purchase. But if the customer do not pay the amount in this time, then the customer have to pay the interest on that amount. The credit financing policy seems to be a beneficial option for buyer with limited payment at one time. Possibly, Haley and Higgins (1973) were the first researchers in proposing credit policy in inventory models.

Furthermore, everyone wants to increase their customers. The availability of products in the system is common factor to attract customers. But due to limited storage capacity in own warehouse, the seller has require large space for store the inventory. To deal such type of situations, seller uses OW and RW. Also, deterioration of items in both the warehouse is not same as RW has better preserving facility to keep products from deterioration for some time.

In this paper, deterioration is taken as fuzzy value which is solved by triangular fuzzy number and defuzzify by graded mean integration method. Demand follows the pattern of Weibull distribution. This model is solved in two-warehouse environment and investigated under credit period policy.

2 Literature Study

A replenishment policy for items had been developed by Wee (1997) where demand depends upon price. Chen et al. (2003) established an inventory model having demand depends upon time and deterioration in the form of Weibull. After that, Ghosh et al. (2006) developed an inventory model by taking demand as in Weibull form. Also, he considered shortages in his model. By taking demand depends upon stock, a model was developed by Shah et al. (2011) with advance payment policy. Later on, Shah et al. Shah et al. (2012b) developed an integrated inventory model with advance payment policy and quadratic demand. Bhunia et al. (2018) developed a model for deteriorating items where demand was taken as variable. A two-warehouse inventory model was developed by Chandra (2020) in which stock-dependent demand was taken under credit financing policy.

Furthermore, the deterioration in items had been extremely considered by Nahmias (1982), Raafat (1991), Bakker et al. (2012), Pareek and Dhaka (2015) in inventory models. After these models, deterioration of items depend upon time with partial backlogging in exponential had been considered by Dye et al. (2007). An inventory model had been developed by Sarkar and Sarkar (2013a) on considering deterioration of items varies with time and demand depends upon stock. Also, deterioration as a fuzzy number was considered by few researchers. A model was established by De et al. (2003) by assuming demand and deterioration both in fuzzy sense. Roy et al. (2007) presented a model with fuzzy deterioration over a random planning horizon in two storage facility. Fuzzy EOQ model was developed by Halim et al. (2008). In this model, fuzzy deterioration was considered with stochastic demand. Mishra and Mishra (2011) proposed a model where deterioration of items was taken as in fuzzy sense and credit policy was also considered in this model. After that, an inventory model was developed in which deterioration rate can be controlled using some techniques. In this model, stock and price-dependent demand was considered. This model was developed by Mishra et al. (2017). Also, not all the items deteriorated instantaneously when they stored in warehouse. This is non-instantaneous deterioration situation. So, based on this phenomena, some models was developed. A model was developed by Shaikh et al. (2017) based on this phenomena with demand depends upon stock and price. Again, a model was generated on non-instantaneous deteriorating items under two-warehouse environment by Shaikh et al. (2019). Impact of deterioration showed in an integrated inventory model by Lin et al. (2019) where credit policy was also considered.

Nowadays, the effect of trade credit also attracts researcher. An EOQ model first developed by Goyal (1985) under credit financing policy and then this model had been extended with a constant deterioration rate by Shah (1993), Aggarwal and Jaggi (1995), and Hwang and Shinn (1997). After that, a probabilistic inventory model had been described by Shah and Shah (1998) where advance payment policy was considered. A model for deterioration in items with credit financing developed by yang (2004) under two-warehouse environment. Mahata and Goswami (2006) had been described a fuzzy EPQ model under advance payment policy. Also, they considered that items start deterioration when they arrive in inventory. Liang and Zhou (2011) presented a inventory model with permissible delay in payments and deterioration of items under two-warehouse environment. Shah et al. (2012a) described a fuzzy EOQ model with trade credit. Liao et al. (2012), Guchhait et al. (2013) generated inventory models in two-warehouse environment under advance payment policy by assuming that the rate of deterioration of items is same for both the warehouse. Bhunia et al. (2014) proposed a model for deteriorating items under credit financing. This model was generated in two-warehouse environment and backlogging. There was a model developed by Maihami et al. (2017). In this model, researcher showed the trade credit effect on inventory model. Also, demand and deterioration were considered as probabilistic in nature. A model was developed under credit financing policy when demand depends upon stock by Dhaka et al. (2019).

However, storing of items are an essential crisis in inventory models, the basic inventory models are commonly proposed with limited space in single warehouse, but due to high demand of items, the retailer may buy more items that can be stored in own warehouse (OW). But due to limited space in own warehouse, another warehouse such as RW with unlimited capacity is also required to store the goods. To know more in this field, see the models of Sarma (1987), Goswami and Chaudhuri (1992), Pakkala and Archary (1992), Benkherouf (1997), Bhunia and Matti (1998), Yang (2004), Yang (2006), Lee (2006), Banerjee and Agrawal (2008), Jaggi et al. (2013), Sett et al. (2016), Sarkar and Sharmila (2017). Jaggi et al. (2014) described a model in two-warehouse environment by considering deterioration in items. Also, they assumed backlogging and credit financing in this model. Shabani et al. (2016) developed an inventory model under advance payment policy in two storage environment. Here, both demand and deterioration rate considered in fuzzy sense. A model was developed with demand as ramp type and deterioration in Weibull distribution under two storage environment by Chakraborty et al. (2018). A sustainable inventory model was developed for two storage system by Mashud et al. (2020). In this model, demand was based on price whereas deterioration was taken as non instantaneous. Also, another model was developed for two warehouses with non-instantaneous concept by Khan et al. (2020) but this model was developed under credit policy by considering shortages (Table 1).

In this model, demand follows Weibull distribution where deterioration is used in fuzzy sense. The fuzzy solution used in the model is more simplified which provides more generalized results.

3 Prelimineries

Before start the fuzzy model, here is the description of fuzzy number.

A graded mean integration method based on the integral value of graded mean h-level of the generaliZed fuzzy number was developed by Chen and Hsieh (1999) for defuzzifying fuzzy numbers.

A fuzzy number \( \tilde{A} = ( a, b, c) \) where \( a< b < c \) and defined on R is called a triangular fuzzy number if its membership function is:

When a = b = c, we have fuzzy point \( (c,c,c) = \tilde{c} \).

The family of all triangular fuzzy numbers on R is denoted as

The \( \alpha \)-cut of \( \tilde{A} = ( a, b, c) \in F_{N}, 0 \le \alpha \le 1 \) is

where, \( A_{L}(\alpha ) = a + (b - a)\alpha \) and \( A_{R}(\alpha ) = c - (c - b)\alpha \) are the left and right endpoints of \( A(\alpha ) \).

If \( A = (a, b, c) \) is a triangular fuzzy number then the graded mean integration representation of \( \tilde{A} \) is defined as:

with \( 0 < h \le W_{A} \) and \( 0 < W_{A} \le 1 \)

4 Assumptions and Notation

The following assumptions and notation have been carried out in the paper.

4.1 Assumptions

The inventory model is based on the following assumptions:

-

There is limited capacity W in OW and unlimited capacity in RW. The items of RW are consumed first and than from OW for the profitable reasons.

-

The seller can accumulate revenue and earn interest from the very beginning that his/her customer pays for the amount of purchasing cost to the seller until the end of the credit period offered by the supplier.

-

There is an infinite replenishment rate and the lead time is zero.

-

\(\theta _{1}\) is the deterioration rate in OW and \(\theta _{2}\) is in RW. \( \theta _{1} \ne \theta _{2} \). The rate of deterioration in RW is smaller than the rate of deterioration in OW as the RW has better storing facilities than OW.

-

The inventory system considered a single item.

-

Demand \( D(t)=\alpha \beta t^{ \beta -1} \) is assumed to be a function of time i.e. where \( \alpha \) and \( \beta \) are positive constants and \( \alpha \ge 0 \), \( 0 \le \beta \le 1 \)

-

There is no shortages in the model.

4.2 Notation

The following notation are used in the model:

-

T is time period of each cycle (unit of time).

-

\( t_{w} \) is time where level of inventory reaches to W (unit of time).

-

W is stored units in OW (units).

-

A is ordering cost ($/order).

-

M is trade credit period of retailer offered by the supplier (unit of time).

-

P is sales price per unit ($/unit).

-

\( I_{e} \) is interest earn (/$/unit/unit of time).

-

c is purchasing price (rupee/unit).

-

\( h_{o} \) is holding cost in OW ($/unit/unit of time).

-

\( I_{p} \) is interest charges by the supplier (/$/unit/unit of time).

-

\( h_{r} \) is holding cost in RW ($/unit/unit of time).

-

\( I_{r}(t) \) is the inventory level at time \( t \in [0, t_{w}] \) in RW (units).

-

\( I_{o}(t) \) is the inventory level at time \( t \in [0, T] \) in OW.(units)

-

\( \textit{D} = \alpha \beta t^{\beta - 1} \) is total demand \( 0< \alpha<< 1 \), \( \beta > 1 \) (unit/unit of time).

-

\( \theta _{1}\) is rate of deterioration in OW \( 0\le \theta _{1}\le 1 \).

-

\( \tilde{ \theta _{1}} \) is the fuzzy deterioration rate in OW \( 0\le \tilde{ \theta _{1}} \le 1 \).

-

\( \theta _{2} \) is deterioration rate in RW \( 0 \le \theta _{2} \le 1 \).

-

\( \tilde{ \theta _{2}} \) is the fuzzy deterioration rate in RW \( 0 \le \tilde{ \theta _{2}} \le 1 \).

-

\( TC_{1} \) is the total inventory cost per unit time ($).

-

\( \tilde{TC_{1}} \) is the total fuzzy inventory cost per unit time ($).

5 Mathematical Model

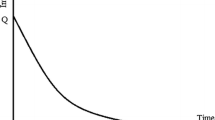

Let \( I_{o}(t) \) be the level of inventory in OW at [0, T] and \( I_{r}(t) \) be the level of inventory in RW at \( [0, t_{w}] \) with initial OW kept W units and rest stored in RW. The inventory of OW is used only after use of the stock kept in RW. The stock kept in RW exhausts due to demand and deterioration during the interval \( [0, t_{w}] \). In OW, the inventory W gradually decreases due to deterioration only during \( [0, t_{w}] \) and due to demand and deterioration during \( [t_{w}, T] \). At the time T, both RW and OW becomes empty (Fig. 1).

5.1 Crisp Model

The level of inventory in RW and OW at time \( t \in [0, t_{w}] \) has these differential equations:

with the boundary conditions \( I_{r}(t_{w})=0 \) and

with the initial conditions \( I_{o}(0)=W \),

during the interval \( [t_{w}, T] \), the level of inventory in OW, has this differential equation:

The solution from Eqs. (1) to (3 is:

Using the continuity of \( I_{o}(t)\) at time \( t=t_{w} \)

which implies that

Annual ordering cost is

Annual holding cost of RW is

Annual holding cost of OW is

Annual cost of deterioration in RW and OW is

Now there are three cases arises:

Case 1: \( M \le t_{w} \le T \)

Case 2: \( t_{w} < M \le T \)

Case 3: \( M > T \)

5.1.1 Case 1: \( M \le t_{w} \le T \)

In this case, buyer has to pay an interest charges. Also at the same time he earns interest on the income till M:

Further, Interest payable is:

Now, the total cost is:

5.1.2 Case 2: \( t_{w} < M \le T \)

Interest will be paid:

The interest will be earn as follows:

Now, the total cost is:

5.1.3 Case 3: \( M > T \)

In this case, the buyer gets a larger credit period M which is after T. Then, the buyer earns interest, no need to pay interest charges:

Now, the total cost is:

6 Fuzzy Model

In reality, it is not easy to define all the parameter accurately as there is always an uncertainty in the environment. So, in this model \( \tilde{\theta _{1}}, \tilde{\theta _{2}} \) assumes to be in fuzzy sense.

Let \( \tilde{\theta _{1}} = (\theta _{11}, \theta _{12}, \theta _{13}) \) and \( \tilde{\theta _{2}} = (\theta _{21}, \theta _{22}, \theta _{23}) \) are consider in the form of triangular fuzzy numbers.

6.1 Case 1: \( M \le t_{w} \le T \)

Total cost per unit time in fuzzy sense

Using graded mean integration method for defuzzification of \( TC_{1} \)

For the values of \( A_{1}, A_{2}, A_{3},\tilde{TC_{a}}, \tilde{TC_{b}}, \tilde{TC_{c}} \) see the appendix.

6.2 Case 2: \( t_{w} < M \le T \)

Total cost per unit time in fuzzy sense

Using graded mean integration method for defuzzification of \( TC_{2} \)

In case 2, we do the same process as in case 1.

6.3 Case 3: \( M > T \)

Total cost unit time in fuzzy sense

Using graded mean integration method for defuzzification of \( TC_{3} \)

In case 3, we do the same process as in case 1. To find the optimal cost, the given conditions should be satisfied. \( \dfrac{\partial (TC)}{\partial (T)} = 0 \) and \( \dfrac{\partial (TC)}{\partial (t_{w})} = 0 \)

Further, for total cost \( \tilde{TC}(T, t_{w}) \) to be convex, \( \left( \dfrac{\partial ^{2} (TC)}{\partial (t_{w}^{2})} \right) \left( \dfrac{\partial ^{2} (TC)}{\partial (T^{2})} \right) - \left( \dfrac{\partial ^{2} (TC)}{\partial (t_{w}) \partial (T)} \right) ^{2} > 0 \) must be satisfied.

7 Numerical Examples

An example is taken for this model to validate the results:

For crisp model A = 200 $/order, \( \alpha \) = 0.5 units/year, \( \beta \) = 4 units/year, e = 2.5, c = 10 $/unit, \( I_{p} \) = 0.15/$/unit/year, \( h_{r} \) = 1 $/unit/year, p = 12 $/unit, \( h_{o} \) = 0.5 units/year, W = 50 units, \( \theta _{1} \) = 0.9, \( I_{e} \) = 0.12/$/unit/year, \( \theta _{2} \) = 0.02, M = \( \frac{25}{365} \) year and for fuzzy model A = 200 $/order, \( \alpha \) = 0.5 units/year, \( \beta \) = 4 units/year, e = 2.5, c = 10 $/unit, \( h_{o} \) = 0.5 $/unit/year, \( I_{e} \) = 0.12/$/unit/year, \( h_{r} \) = 1 $/unit/year, p = 12 $/unit, \( I_{p} \) = 0.15/$/unit/year, W = 50 units, \( \theta _{1} \) = 0.9, \( \theta _{2} \) = 0.02, M = \( \frac{25}{365} \) year. Here parameteric values are opted from Shabani et al. (2016)

7.1 Crisp Model Versus Fuzzy Model

As, we see that from the numerical example, the fuzzy solution gives maximum optimal value in comparison to the crisp solution.

8 Sensitivity Analysis

Here is the study of the effects of changes in parameter \( \beta \), \( \theta _{1}, \theta _{2} \) and M in all the cases. Rest of the parameters are same as in example.

From Table 2, the value of total cost (Z) is increasing with the increment in the value of \( (T, t_{w}) \). But, from Table 3, the value of total cost is decreasing having the decreasing effect on the value of \( (T, t_{w}) \), except the first value of \( \beta \). So, fuzzy model is more optimal with respect to crisp model (Figs. 2, 3,4, 5, 6 and 7).

In Table 4, with the increment in the value of \( (T, t_{w}) \), the value of total cost (Z) is going to increasing. But, in Table 5, the value of total cost having decreasing effect on the value of \( (T, t_{w}) \), except the first value of \( \beta \). So, fuzzy model is more optimal with respect to crisp model.

From Table 6, the value of total cost (Z) is increasing with the increasing value of \( (T, t_{w}) \). But, from table 7, the total cost is decreasing with the value of \( (T, t_{w}) \), except the first value of \( \beta \). So, fuzzy model is more optimal with respect to crisp model.

9 Conclusion

In this paper, we have proposed the effect of fuzzy deterioration as well as Weibull demand under credit financing in two-warehouse environment. The study associated with some types of inventory such as seasonal food items inventory, newly launch fashion items, etc. The model is motivated by the fact that there is always an uncertainty in demand and the deterioration rate such as for physical goods. So, it is worthwhile to take the deterioration rate in fuzzy number as well as demand in Weibull distribution. The rate of deterioration is represented by triangular fuzzy number. Nowadays, the credit financing policy has become a advertisement tool to attract customers. Customer has to purchase items in a very large quantity without immediately payment. In trade credit policy, seller offers some credit period to pay. But beyond this time, buyer has to pay an interest. Here, graded mean integration method is used for defuzzification to calculate the total cycle time as well as total cost of the model. From the numerical study and sensitivity analysis with respect to different key parameters, it is observed that fuzzy model is more optimal than crisp model.

10 Managerial Insights

Here, fuzzy model is more optimal with respect to crisp model. The above results show the significance of the model. This model can be extended in several forms. It can be more realistic if this model can be extended with types of demand such as advertisement-dependent demand, ramp type demand or two level and three level trade credit policy or if one may assume variable lead time also, one can take nonlinear holding cost. Further, this model can be extended under carbon emission constraints with international supply chain.

References

Aggarwal, S., & Jaggi, C. (1995). Ordering policies of deteriorating items under permissible delay in payments. Journal of the operational Research Society, 46(5), 658–662.

Bakker, M., Riezebos, J., & Teunter, R. H. (2012). Review of inventory systems with deterioration since 2001. European Journal of Operational Research, 221(2), 275–284.

Banerjee, S., & Agrawal, S. (2008). A two-warehouse inventory model for items with three-parameter weibull distribution deterioration, shortages and linear trend in demand. International Transactions in Operational Research, 15(6), 755–775.

Benkherouf, L. (1997). A deterministic order level inventory model for deteriorating items with two storage facilities. International Journal of Production Economics, 48(2), 167–175.

Bhunia, A., & Maiti, M. (1998). A two warehouse inventory model for deteriorating items with a linear trend in demand and shortages. Journal of the Operational Research Society, 49(3), 287–292.

Bhunia, A. K., Jaggi, C. K., Sharma, A., & Sharma, R. (2014). A two-warehouse inventory model for deteriorating items under permissible delay in payment with partial backlogging. Applied Mathematics and Computation, 232, 1125–1137.

Bhunia, A. K., Shaikh, A. A., Dhaka, V., Pareek, S., & Cárdenas-Barrón, L. E. (2018). An application of genetic algorithm and pso in an inventory model for single deteriorating item with variable demand dependent on marketing strategy and displayed stock level. Scientia Iranica, 25(3), 1641–1655.

Bhunia, A. K., Shaikh, A. A., & Sahoo, L. (2016). A two-warehouse inventory model for deteriorating item under permissible delay in payment via particle swarm optimisation. International Journal of Logistics Systems and Management, 24(1), 45–69.

Chakraborty, D., Jana, D. K., & Roy, T. K. (2018). Two-warehouse partial backlogging inventory model with ramp type demand rate, three-parameter weibull distribution deterioration under inflation and permissible delay in payments. Computers & Industrial Engineering, 123, 157–179.

Chandra, S. (2020). Two warehouse inventory model for deteriorating items with stock dependent demand under permissible delay in payment. Journal of Mathematical and Computational Science (JMCS), 10(4), 1131–1149.

Chen, S.-H., & Hsieh, C. H. (1999). Graded mean integration representation of generalized fuzzy number.

De Kumar, S., Kundu, P., & Goswami, A. (2003). An economic production quantity inventory model involving fuzzy demand rate and fuzzy deterioration rate. Journal of Applied Mathematics and Computing, 12(1–2), 251.

Dhaka, V., Pareek, S., & Mittal, M. (2019). Stock-dependent inventory model for imperfect items under permissible. Optimization and Inventory Management, 181.

Dye, C.-Y., Hsieh, T.-P., & Ouyang, L.-Y. (2007). Determining optimal selling price and lot size with a varying rate of deterioration and exponential partial backlogging. European Journal of Operational Research, 181(2), 668–678.

Ghoreishi, M., Mirzazadeh, A., & Kamalabadi, I. N. (2014). Optimal pricing and lot-sizing policies for an economic production quantity model with non-instantaneous deteriorating items, permissible delay in payments, customer returns, and inflation. Proceedings of the Institution of Mechanical Engineers, Part B: Journal of Engineering Manufacture, 228(12), 1653–1663.

Ghosh, S., Goyal, S., & Chaudhuri, K. (2006). An inventory model with weibull demand rate, finite rate of production and shortages. International Journal of Systems Science, 37(14), 1003–1009.

Goswami, A., & Chaudhuri, K. (1992). An economic order quantity model for items with two levels of storage for a linear trend in demand. Journal of the Operational Research Society, 43(2), 157–167.

Goyal, S. K. (1985). Economic order quantity under conditions of permissible delay in payments. Journal of the Operational Research Society, 36(4), 335–338.

Guchhait, P., Maiti, M. K., & Maiti, M. (2013). Two storage inventory model of a deteriorating item with variable demand under partial credit period. Applied Soft Computing, 13(1), 428–448.

Haley, C. W. & Higgins, R. C. (1973). Inventory policy and trade credit financing. Management Science, 20(4-part-i), 464–471.

Halim, K., Giri, B., & Chaudhuri, K. (2008). Fuzzy economic order quantity model for perishable items with stochastic demand, partial backlogging and fuzzy deterioration rate. International Journal of Operational Research, 3(1–2), 77–96.

Harris, F. W. (1913). How many parts to make at once.

Hwang, H., & Shinn, S. W. (1997). Retailer’s pricing and lot sizing policy for exponentially deteriorating products under the condition of permissible delay in payments. Computers & Operations Research, 24(6), 539–547.

Jaggi, C. K., Gupta, M., & Tiwari, S. (2019). Credit financing in economic ordering policies for deteriorating items with stochastic demand and promotional efforts in two-warehouse environment. International Journal of Operational Research, 35(4), 529–550.

Jaggi, C. K., Pareek, S., Khanna, A., & Sharma, R. (2014). Credit financing in a two-warehouse environment for deteriorating items with price-sensitive demand and fully backlogged shortages. Applied Mathematical Modelling, 38(21–22), 5315–5333.

Jaggi, C. K., Pareek, S., Verma, P., & Sharma, R. (2013). Ordering policy for deteriorating items in a two-warehouse environment with partial backlogging. International Journal of Logistics Systems and Management, 16(1), 16–40.

Khan, M. A.-A., Shaikh, A. A., Panda, G. C., Bhunia, A. K., & Konstantaras, I. (2020). Non-instantaneous deterioration effect in ordering decisions for a two-warehouse inventory system under advance payment and backlogging. Annals of Operations Research, 1–33.

Kumar Sett, B., Sarkar, S., Sarkar, B., & Young Yun, W. (2016). Optimal replenishment policy with variable deterioration for fixed lifetime products. Scientia Iranica, 23(5), 2318–2329.

Lee, C. C. (2006). Two-warehouse inventory model with deterioration under FIFO dispatching policy. European Journal of Operational Research, 174(2), 861–873.

Liang, Y., & Zhou, F. (2011). A two-warehouse inventory model for deteriorating items under conditionally permissible delay in payment. Applied Mathematical Modelling, 35(5), 2221–2231.

Liao, J.-J., Huang, K.-N., & Chung, K.-J. (2012). Lot-sizing decisions for deteriorating items with two warehouses under an order-size-dependent trade credit. International Journal of Production Economics, 137(1), 102–115.

Lin, F., Jia, T., Wu, F., & Yang, Z. (2019). Impacts of two-stage deterioration on an integrated inventory model under trade credit and variable capacity utilization. European Journal of Operational Research, 272(1), 219–234.

Mahata, G., & Goswami, A. (2006). Production lot-size model with fuzzy production rate and fuzzy demand rate for deteriorating item under permissible delay in payments. Opsearch, 43(4), 358–375.

Maihami, R., Karimi, B., & Ghomi, S. M. T. F. (2017). Effect of two-echelon trade credit on pricing-inventory policy of non-instantaneous deteriorating products with probabilistic demand and deterioration functions. Annals of Operations Research, 257(1–2), 237–273.

Mashud, A. H. M., Wee, H.-M., Sarkar, B., & Li, Y.-H. C. (2020). A sustainable inventory system with the advanced payment policy and trade-credit strategy for a two-warehouse inventory system. Kybernetes.

Ming Chen, J., & Shun Lin, C. (2003). Optimal replenishment scheduling for inventory items with weibull distributed deterioration and time-varying demand. Journal of Information and Optimization Sciences, 24(1), 1–21.

Mishra, S. S., & Mishra, P. (2011). A (q, r) model for fuzzified deterioration under cobweb phenomenon and permissible delay in payment. Computers & Mathematics with Applications, 61(4), 921–932.

Mishra, U., Cárdenas-Barrón, L. E., Tiwari, S., Shaikh, A. A., & Treviño-Garza, G. (2017). An inventory model under price and stock dependent demand for controllable deterioration rate with shortages and preservation technology investment. Annals of Operations Research, 254(1–2), 165–190.

Nahmias, S. (1982). Perishable inventory theory: A review. Operations research, 30(4), 680–708.

Pakkala, T., & Achary, K. (1992). A deterministic inventory model for deteriorating items with two warehouses and finite replenishment rate. European Journal of Operational Research, 57(1), 71–76.

Pareek, S., & Dhaka, V. (2015). Fuzzy eoq models for deterioration items under discounted cash flow approach when supplier credits are linked to order quantity. International Journal of Logistics Systems and Management, 20(1), 24–41.

Raafat, F. (1991). Survey of literature on continuously deteriorating inventory models. Journal of the Operational Research society, 42(1), 27–37.

Roy, A., Maiti, M. K., Kar, S., & Maiti, M. (2007). Two storage inventory model with fuzzy deterioration over a random planning horizon. Mathematical and Computer Modelling, 46(11–12), 1419–1433.

Sarkar, B. (2012). An eoq model with delay in payments and time varying deterioration rate. Mathematical and Computer Modelling, 55(3–4), 367–377.

Sarkar, B., & Saren, S. (2017). Ordering and transfer policy and variable deterioration for a warehouse model. Hacettepe Journal of Mathematics and Statistics, 46(5), 985–1014.

Sarkar, B., Saren, S., & Cárdenas-Barrón, L. E. (2015). An inventory model with trade-credit policy and variable deterioration for fixed lifetime products. Annals of Operations Research, 229(1), 677–702.

Sarkar, B., & Sarkar, S. (2013a). An improved inventory model with partial backlogging, time varying deterioration and stock-dependent demand. Economic Modelling, 30, 924–932.

Sarkar, B., Ullah, M., & Kim, N. (2017). Environmental and economic assessment of closed-loop supply chain with remanufacturing and returnable transport items. Computers & Industrial Engineering, 111, 148–163.

Sarkar, M., & Sarkar, B. (2013b). An economic manufacturing quantity model with probabilistic deterioration in a production system. Economic Modelling, 31, 245–252.

Sarma, K. (1987). A deterministic order level inventory model for deteriorating items with two storage facilities. European Journal of Operational Research, 29(1), 70–73.

Sett, B. K., Sarkar, B., & Goswami, A. (2012). A two-warehouse inventory model with increasing demand and time varying deterioration. Scientia Iranica, 19(6), 1969–1977.

Shabani, S., Mirzazadeh, A., & Sharifi, E. (2016). A two-warehouse inventory model with fuzzy deterioration rate and fuzzy demand rate under conditionally permissible delay in payment. Journal of Industrial and Production Engineering, 33(2), 134–142.

Shah, N., Pareek, S., & Sangal, I. (2012a). Eoq in fuzzy environment and trade credit. International Journal of Industrial Engineering Computations, 3(2), 133–144.

Shah, N. H. (1993). A lot-size model for exponentially decaying inventory when delay in payments is permissible. Cahiers du Centre d’études de recherche opérationnelle, 35(1–2), 115–123.

Shah, N. H., Gor, A. S., & Jhaveri, C. A. (2012b). Optimal pricing and ordering policy for an integrated inventory model with quadratic demand when trade credit linked to order quantity. Journal of Modelling in Management.

Shah, N. H., Patel, A., & Lou, K. (2011). Optimal ordering and pricing policy for price sensitive stock-dependent demand under progressive payment scheme. International Journal of Industrial Engineering Computations, 2(3), 523–532.

Shah, N. H., & Shah, Y. (1998). A discrete-in-time probabilistic inventory model for deteriorating items under conditions of permissible delay in payments. International Journal of Systems Science, 29(2), 121–125.

Shaikh, A. A., Cárdenas-Barrón, L. E., & Tiwari, S. (2019). A two-warehouse inventory model for non-instantaneous deteriorating items with interval-valued inventory costs and stock-dependent demand under inflationary conditions. Neural Computing and Applications, 31(6), 1931–1948.

Shaikh, A. A., Mashud, A. H. M., Uddin, M. S., & Khan, M. A.-A. (2017). Non-instantaneous deterioration inventory model with price and stock dependent demand for fully backlogged shortages under inflation. International Journal of Business Forecasting and Marketing Intelligence, 3(2), 152–164.

Silver, E. A., & Meal, H. C. (1969). A simple modification of the eoq for the case of a varying demand rate. Production and inventory management, 10(4), 52–65.

Tiwari, S., Ahmed, W., & Sarkar, B. (2019). Sustainable ordering policies for non-instantaneous deteriorating items under carbon emission and multi-trade-credit-policies. Journal of Cleaner Production, 240, 118183.

Tiwari, S., Jaggi, C. K., Bhunia, A. K., Shaikh, A. A., & Goh, M. (2017). Two-warehouse inventory model for non-instantaneous deteriorating items with stock-dependent demand and inflation using particle swarm optimization. Annals of Operations Research, 254(1–2), 401–423.

Tripathy, P., & Pradhan, S. (2011). An integrated partial backlogging inventory model having weibull demand and variable deterioration rate with the effect of trade credit. International Journal of Scientific & Engineering Research, 2(4), 1–4.

Wee, H.-M. (1997). A replenishment policy for items with a price-dependent demand and a varying rate of deterioration. Production Planning & Control, 8(5), 494–499.

Yang, H.-L. (2004). Two-warehouse inventory models for deteriorating items with shortages under inflation. European Journal of Operational Research, 157(2), 344–356.

Yang, H.-L. (2006). Two-warehouse partial backlogging inventory models for deteriorating items under inflation. International Journal of Production Economics, 103(1), 362–370.

Author information

Authors and Affiliations

Editor information

Editors and Affiliations

Appendix

Appendix

Rights and permissions

Copyright information

© 2021 The Author(s), under exclusive license to Springer Nature Singapore Pte Ltd.

About this chapter

Cite this chapter

Aastha, Pareek, S., Dhaka, V. (2021). Credit Financing in a Two-Warehouse Inventory Model with Fuzzy Deterioration and Weibull Demand. In: Shah, N.H., Mittal, M. (eds) Soft Computing in Inventory Management. Inventory Optimization. Springer, Singapore. https://doi.org/10.1007/978-981-16-2156-7_5

Download citation

DOI: https://doi.org/10.1007/978-981-16-2156-7_5

Published:

Publisher Name: Springer, Singapore

Print ISBN: 978-981-16-2155-0

Online ISBN: 978-981-16-2156-7

eBook Packages: Business and ManagementBusiness and Management (R0)