Abstract

In frictionless markets there typically exists a portfolio whose long-term growth rate of wealth almost surely dominates that of any other portfolio. In this note we show that this continues to hold in a Black-Scholes-type market with proportional transaction costs.We heavily rely on results from Gerhold et al. (Financ Stochast 17:325–354 2013 [7]), who determine a portfolio maximizing the expected long-term growth rate of wealth in the same setup.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

MSC subject classification (2010):

1 Introduction

Portfolio optimization is one of the oldest problems in Mathematical Finance and it has been considered in manifold contexts and variations. A striking classical result states that in generic frictionless markets there exists a self-financing dynamic portfolio \(\varphi \) whose long-term growth rate of wealth

almost surely dominates that of any competing investment strategy, cf. e.g. [17, Theorem 3.10.1] or [8, Lemma 5.3] for markets with jumps. Here, \(V_t(\varphi )=v_0+\int _0^t\varphi _sdS_s\) represents the value at time t of a portfolio \(\varphi \) which has initial value \(v_0\) and trades assets \(S=(S^0,\dots ,S^d)\). This optimal portfolio can be obtained by solving the Merton problem for logarithmic utility or, more specifically, by computing the portfolio maximizing the expected logarithmic utility of terminal wealth. This numeraire portfolio is known not to depend on the time horizon and it shares a number of other interesting properties, cf. e.g. [15, 18] and the references therein.

In the presence of proportional transaction costs the solution to the Merton problem with logarithmic utility does depend on the time horizon T. It may therefore be less obvious whether there exists a portfolio dominating any other in the long run. Nevertheless, a natural candidate is provided by the portfolio maximizing the expected long-term growth rate of wealth. The latter has been determined by [7, 21] for a Black-Scholes type market with two assets. Based on the results in [7] we show that this portfolio dominates any other’s long-term growth rate almost surely and not just in expectation. It turns out that the optimal growth rate is deterministic and can be computed explicitly, again based on the results of [7].

The proof of almost-sure optimality relies on the concept of shadow prices, introduced by [4, 11] and applied in many papers involving proportional transaction costs. It relates the market with transaction costs to a fictitious frictionless market with the same optimal portfolio. For our purposes, this concept turns out to be particularly powerful. Indeed, it allows to reduce the present problem of almost-sure optimality to the classical statement for frictionless markets.

The paper is organized as follows. In Sect. 2 we summarize main results of [7]. Subsequently, we prove the almost sure optimality of the strategy put forward in [7]. In Sect. 4 we verify that the almost surely optimal growth rate coincides with the optimal expected growth rate of [7], in parallel to the frictionless case.

2 Trading with Proportional Transaction Costs

We consider a market consisting of a bond with constant interest rate and a stock S following geometric Brownian motion. By switching to discounted prices we may assume the bond price to be constant and equal to 1. The ask price of the stock is modelled as

with constants \(S_0,\mu ,\sigma >0\) and standard Brownian motion W. The bid price, on the other hand, is assumed to equal \((1-\lambda )S\) for some constant \(\lambda \in (0,1)\) representing transaction costs. We set \(\theta :=\mu /\sigma ^2\).

The investor is assumed to enter the market with an initial endowment of \(v_0\) bonds and no shares of stock. Dynamic trading is represented by \(\mathbb {R}^2\)-valued predictable processes \((\varphi ^0,\varphi )\) of finite variation. Here \(\varphi ^0_t,\varphi _t\) denote the number of bonds resp. shares of stock at time t. A trading strategy \((\varphi ^0,\varphi )\) is naturally called self-financing if

where we write \(\varphi = \varphi ^{\uparrow }- \varphi ^{\downarrow }\) with increasing predictable processes \(\varphi ^{\uparrow },\varphi ^{\downarrow }\) which do not grow at the same time. A self-financing strategy \((\varphi ^0,\varphi )\) is admissible if its liquidation wealth process

is almost surely nonnegative. By setting \(\varphi ^0\) as in (2) we can and will identify any predictable process \(\varphi \) of finite variation with the corresponding self-financing strategy \((\varphi ^0,\varphi )\). Accordingly, we call \(\varphi \) admissible if \(V_t(\varphi ):=V_t(\varphi ^0,\varphi )\), \(t\in \mathbb {R}_+\) is nonnegative.

An admissible strategy \(\varphi \) is called log-optimal for time horizon \(T\in \mathbb {R}_+\) if it maximizes

over all admissible strategies \(\psi \). As a natural counterpart for \(T\rightarrow \infty \), an admissible strategy \(\varphi \) is expected growth-optimal if it maximizes

over all admissible \(\psi \). The factor 1 / T is motivated by the fact that wealth typically grows exponentially in time.

In the following, the corresponding concepts for frictionless markets with some semimartingale price process \(\tilde{S}\) will play a role as well. We call a predictable \(\tilde{S}\)-integrable process \(\varphi \) \(\tilde{S}\)-admissible if its wealth process

stays nonnegative. An \(\tilde{S}\) -admissible strategy is log-optimal for the frictionless market \(\tilde{S}\) if, for any time horizon \(T\in \mathbb {R}_+\), it maximizes

over all \(\tilde{S}\)-admissible strategies \(\psi \). It is well known that such a strategy typically exists for frictionless markets, i.e. the optimizer of (3) does not depend on the time horizon T. If \(\tilde{S}\) coincides with the above geometric Brownian motion S, the optimal fraction of wealth to be invested in the stock equals the Merton ratio \(\theta \).

Let us turn back to the market S with transaction costs. As in related studies [2, 5,6,7, 9, 10, 12,13,14, 19], a key role in the analysis will be played by shadow prices. For the present problem the following version from [7] is needed.

Definition 2.1

(Shadow price) A shadow price for the bid-ask processes \((1-\lambda )S,S\) is a continuous semimartingale \(\tilde{S}\) with \((1-\lambda )S\le \tilde{S}\le S\) such that the log-optimal portfolio \(\varphi \) for the frictionless market with price process \(\tilde{S}\) exists, is of finite variation and the number of shares \(\varphi \) increases (resp. decreases) only on the set \(\{\tilde{S} = S\}\) (resp. \(\{\tilde{S} = (1- \lambda )S\}\)). Put differently, the corresponding bond investment \(\tilde{\varphi }^{0}:=\tilde{V}(\varphi )-\varphi \tilde{S}\) satisfies (2).

We summarize a few results from [7]. In that paper, a shadow price process is constructed explicitly. The log-optimal portfolio corresponding to this shadow asset turns out to be expected growth-optimal for the original market with bid-ask processes \((1-\lambda )S,S\).

Proposition 2.2

There exists a shadow price \(\tilde{S}\).

Proof

[7, Corollary 5.2]\(\square \)

Corollary 2.3

Let \(\tilde{S}\) be a shadow price such that both the corresponding log-optimal portfolio \(\varphi \) and its bond investment \(\varphi ^0:=\tilde{V}(\varphi )-\varphi \tilde{S}\) are nonnegative. Then

for any admissible strategy \(\psi \). Moreover, \(\varphi \) is expected growth-optimal for the bid-ask processes \((1-\lambda )S,S\).

Proof

[7, Corollary 1.9]\(\square \)

Corollary 2.4

Let \(\tilde{S}\) be a shadow price with corresponding log-optimal portfolio \(\varphi \).

-

1.

If \(\theta \in (0,1]\), then \(\varphi \) is expected growth-optimal for the bid-ask processes \((1-\lambda )S,S\).

-

2.

If \(\theta \in (1,\infty )\), there exists \(\lambda _0>0\) such that for all \(\lambda \in (0,\lambda _0)\) strategy \(\varphi \) is expected growth-optimal for the bid-ask processes \((1-\lambda )S,S\).

Proof

-

1.

By [7, Theorem 5.1] (resp. the proof of [7, Corollary 5.2] for \(\theta =1\)) we have \(\varphi ,\varphi ^0 \ge 0\). Now we can apply Corollary 2.3.

-

2.

[7, Lemma 5.3]

\(\square \)

As is known from related maximization problems under proportional transaction costs, the optimal portfolio remains untouched most of the time and is adjusted infinitesimally whenever it deviates too strongly from the frictionless target. In the present setup, this can be expressed in terms of the fraction of wealth invested in the stock. More specifically, let

denote the fraction of book wealth held in the risky asset, where \(\varphi ^0_t\) denotes the riskless investment from (2). According to [7, Section 5], the optimal strategy from Corollary 2.4 is to keep this fraction in the interval

where c denotes the unique root of the function

in the interval \(({1-\theta \over \theta },\infty )\) if \(\theta \in (0,{1\over 2}]\), in the interval \(({1-\theta \over \theta },{1-\theta \over \theta -1/2})\) if \(\theta \in ({1\over 2},1)\), resp. in the interval \(({1-\theta \over \theta },0)\) if \(\theta >1\), and \(\bar{s}\) is defined as

One could also consider the fraction of liquidation wealth held in the risky asset, i.e.

for positive \(\varphi (t)\). A straightforward computation yields that (4) turns into the corresponding interval

for \(\pi ^L\).

In [7] we can find a statement on the optimal expected growth rate as well:

Proposition 2.5

(Optimal expected growth rate) The optimal expected long-term growth rate equals

Proof

[7, Proposition 5.4 and Remark 5.5] \(\square \)

In the limit of small transaction costs, the bounds (4) and the expected growth rate \(\delta \) simplify considerably:

Proposition 2.6

(Asymptotics) Let \(\theta \in (0,\infty )\setminus \{1\}\). In the limit \(\lambda \rightarrow 0\) we have

for the bounds in (4) and

for the optimal expected long-term growth rate.

Proof

[7, Corollary 6.2 and Proposition 6.3] \(\square \)

Remark 2.7

For later use we remark that, unless \(\theta =1\), the shadow price in Proposition 2.2 is of the form

where

-

1.

Y is a positively recurrent one-dimensional diffusion with state space \(I:=[1\wedge \bar{s},1\vee \bar{s}]\),

-

2.

\(\tilde{\mu }\) and \(\tilde{\sigma }\) are positive continuous functions on I,

-

3.

\(\delta =\int \frac{\tilde{\mu }(s)^2}{2\tilde{\sigma }(s)^2} d\nu (s)\), where \(\nu \) denotes the stationary distribution of Y.

For \(\theta =1\) the process \(\tilde{S}=S\) is a shadow price.

Proof

[7, Section 5] \(\square \)

3 Almost Sure Growth Optimality

Our first main result concerns almost sure growth optimality in the following sense.

Definition 3.1

An admissible strategy \(\varphi \) is called almost surely growth-optimal if

almost surely for any admissible \(\psi \).

Similarly to [7, Corollary 1.9] we have the following results, which do not use the specific model (1) for the stock S.

Proposition 3.2

Let \(\tilde{S}\) be a shadow price with corresponding log-optimal portfolio \(\varphi \). If \(V(\varphi )\) is nonnegative and

then \(\varphi \) is almost surely growth-optimal.

Proof

Due to \((1-\lambda )S\le \tilde{S}\le S\) we have \(\tilde{V}(\varphi )\ge V(\varphi )\). This yields

and hence

Let \(\psi \) be an admissible strategy. Since \(\tilde{V}(\psi )\ge V(\psi )\), we have that \(\psi \) is \(\tilde{S}\)-admissible as well (cf. the proof of [7, Proposition 1.8]). From the log-optimality of \(\varphi \) in the frictionless market \(\tilde{S}\) we obtain with [17, Theorem 3.10.1] resp. [8, Lemma 5.3]

Together with (8) the assertion follows. \(\square \)

Corollary 3.7

Let \(\tilde{S}\) be a shadow price with corresponding log-optimal portfolio \(\varphi \). If \(\varphi \) and \(\varphi ^0\) from (2) are nonnegative, then \(\varphi \) is almost surely growth-optimal.

Proof

Since

(cf. the proof of [7, Corollary 1.9]), the statement follows from Proposition 3.2 \(\square \)

Coming back to the Black-Scholes price processes and using the shadow price from Proposition 2.2 we obtain the following corollaries.

Corollary 3.8

Assume \(\lambda <\lambda _0\) if \(\theta >1\), with \(\lambda _0\) as in the proof of [7, Lemma 5.3]. Let \(\tilde{S}\) be the shadow price from Proposition 2.2 with corresponding log-optimal portfolio \(\varphi \). Then \(\varphi \) is almost surely growth-optimal.

Proof

Case \(\theta \le 1\): By [7, Theorem 5.1] (resp. the proof of [7, Corollary 5.2] for \(\theta =1\)) we have \(\varphi ^0,\varphi \ge 0\). The assertion follows from Corollary 3.7.

Case \(\theta >1\): From the proof of [7, Lemma 5.3] it follows that

for some \(K>0\), which yields the claim by Proposition 3.2.\(\square \)

4 Optimal Growth Rate

As our second main result we want to show that the long-term growth rate of wealth is actually deterministic and hence coincides with the expected long-term growth rate \(\delta \) of Proposition 2.5. As may be expected, ergodicity plays a key role in this context. For a related statement in the frictionless case, cf. [17, Corollary 3.10.2].

Theorem 4.1

Suppose that \(\lambda <\lambda _0\) if \(\theta >1\). The optimal growth rate in Corollary 3.8 coincides with the optimal expected growth rate in Proposition 2.5, i.e.

Proof

Suppose that \(\theta \not =1\). As a first step, we show the assertion for the shadow wealth process \(\tilde{V}(\varphi )\). Since the shadow price is of the form (6), the log-optimal fraction of wealth equals

by [16, Example 6.4], i.e. the corresponding log-optimal portfolio satisfies \(\varphi _t=\tilde{\pi }_t\tilde{V}_t(\varphi )/\tilde{S}_t\). This implies

and hence

Since the function \(f:=\tilde{\mu }^2/(2\tilde{\sigma }^2)\) is bounded on I, the ergodic theorem [1, II.35] and Remark 2.7 yield

The process

is a continuous local martingale with quadratic variation \([M]_t=\int _{0}^t 2f(Y_s)^2 ds\), \(t\ge 0\). Since f is bounded away from zero, we have \(aT\le [M]_T\le bT\), \(T\ge 0\) for some \(a,b\in (0,\infty )\). From the law of large numbers for continuous local martingales [20, Exercise V.1.16] we obtain \(M_T/[M]_T\rightarrow 0\) and hence \(M_T/T\rightarrow 0\) almost surely for \(T\rightarrow \infty \). Together with (11, 12) we conclude that

The assertion follows now from the fact that \(V_T(\varphi )\) and \(\tilde{V}_T(\varphi )\) differ at most by a constant factor, cf. (9) resp. (10).

The case \(\theta =1\) is of course similar to [7, Remark 5.5]. Since the entire wealth is invested in stock, we have

which yields the long-term growth rate \(\sigma ^2/2\) by the strong law of large numbers for standard Brownian motion. \(\square \)

From Theorem 4.1 and Proposition 2.6 we immediately obtain an asymptotic expansion of the almost sure long-term growth rate for small transaction costs.

The existence of an explicitly computable portfolio which surely dominates any other in the long run may be viewed as a both beautiful and extremely useful mathematical result. But as is well known, it faces severe obstacles in practice. Firstly, the excess drift rate \(\mu \) is typically small compared to the standard deviation \(\sigma \). This means that it may take a long time even to beat the bond-only investment strategy with, say, 95 % probability. Put differently, long term should rather be interpreted as centuries rather than years. In addition, the frictionless target \(\theta \) depends linearly on \(\mu \) which, again since it is small compared to \(\sigma \), is very hard to estimate in any reliable way. In the presence of limited past data or instationary parameters, it may even be debatable whether the stock’s excess drift rate \(\mu \) is positive at all.

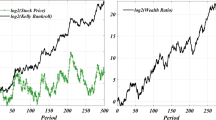

Leaving these disenchanting facts aside, let us finish with a simple numerical example in order to illustrate the results in this paper. We consider a stock with yearly volatility \(\sigma =20\,\%\) and excess drift rate \(\mu =2\,\%\). The frictionless optimal excess growth rate \(\mu ^2/(2\sigma ^2)=0.5\,\%\) seems surprisingly small but should be contrasted with the fact that the stock’s long-term growth rate (namely \(\mu -{\sigma ^2/2}\)) vanishes—in spite of its positive drift rate \(\mu =2\,\%\). The optimal fraction of wealth invested in the stock equals \(\theta =1/2\), which, due to the factor \(\theta ^2(1-\theta )^2\) in (5), seems to be a rather unpleasant parameter value if we introduce transaction costs or taxes.

If we consider transaction costs of \(\lambda =1\,\%\), the asymptotic no-trade region from Proposition 2.6 equals [0.42, 0.58], i.e. the investor tries to keep the fraction of wealth invested in stock between 42 % and 58 %. According to the asymptotic formula (5), the frictionless optimal excess growth rate of \(0.5\,\%\) is lowered by the presence of transaction costs to approximately \(0.49\,\%\). In other words, even in the unfavourable case \(\mu =2\,\%, \theta =1/2\) the effect of transaction costs on the optimal long-term growth rate appears to be rather small. For an early reference to related observations cf. [3].

References

Borodin, A., Salminen, P.: Handbook of Brownian motion: Facts and Formulae. Springer (2002)

Choi, J., Sirbu, M., Zitkovic, G.: Shadow prices and well-posedness in the problem of optimal investment and consumption with transaction costs. SIAM J. Control Optim. 51, 4414–4449 (2013)

Constantinides, G.: Capital market equilibrium with transaction costs. J. Political Econ. 842–862 (1986)

Cvitanić, J., Karatzas, I.: Hedging and portfolio optimization under transaction costs: a martingale approach. Math. Financ. 6, 133–165 (1996)

Gerhold, S., Guasoni, P., Muhle-Karbe, J., Schachermayer, W.: Transaction costs, trading volume, and the liquidity premium. Financ. Stochast. 18, 1–37 (2014)

Gerhold, S., Muhle-Karbe, J., Schachermayer, W.: Asymptotics and duality for the Davis and Norman problem. Stochastics 84, 625–641 (2012)

Gerhold, S., Muhle-Karbe, J., Schachermayer, W.: The dual optimizer for the growth-optimal portfolio under transaction costs. Financ. Stochast. 17, 325–354 (2013)

Goll, T., Kallsen, J.: A complete explicit solution to the log-optimal portfolio problem. Ann. Appl. Probab. 13, 774–799 (2003)

Guasoni, P., Muhle-Karbe, J.: Long horizons, high risk aversion, and endogenous spreads. Math. Financ. 25, 724–753 (2015)

Herczegh, A., Prokaj, V.: Shadow price in the power utility case. Ann. Appl. Probab. 25, 2671–2707 (2015)

Jouini, E., Kallal, H.: Martingales and arbitrage in securities markets with transaction costs. J. Econ. Theory 66, 178–197 (1995)

Kallsen, J., Muhle-Karbe, J.: On using shadow prices in portfolio optimization with transaction costs. Ann. Appl. Probab. 20, 1341–1358 (2010)

Kallsen, J., Muhle-Karbe, J.: The General structure of optimal investment and consumption with small transaction costs. Math. Financ. (2013)

Kallsen, J., Muhle-Karbe, J.: Option pricing and hedging with small transaction costs. Math. Financ. 25, 702–723 (2015)

Karatzas, I., Kardaras, C.: The numéraire portfolio in semimartingale financial models. Financ. Stochast. 11, 447–493 (2007)

Karatzas, I., Lehoczky, J., Shreve, S., Xu, G.: Martingale and duality methods for utility maximization in an incomplete market. SIAM J. Control Optim. 29, 702–730 (1991)

Karatzas, I., Shreve, S.: Methods of Mathematical Finance. Springer, Berlin (1998)

Korn, R., Schäl, M.: On value preserving and growth optimal portfolios. Math. Methods Oper. Res. 50, 189–218 (1999)

Kühn, C., Stroh, M.: Optimal portfolios of a small investor in a limit order market: a shadow price approach. Math. Financ. Econ. 3, 45–72 (2010)

Revuz, D., Yor, M.: Continuous Martingales and Brownian Motion. Springer, Berlin, third edition (1999)

Taksar, M., Klass, M., Assaf, D.: A diffusion model for optimal portfolio selection in the presence of brokerage fees. Math. Oper. Res. 13, 277–294 (1988)

Acknowledgements

The authors thank Johannes Muhle-Karbe for fruitful comments and discussions. Moreover, they acknowledge financial support through DFG-Sachbeihilfe KA 1682/4-1.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2016 Springer International Publishing Switzerland

About this paper

Cite this paper

Feodoria, MR., Kallsen, J. (2016). Almost Surely Optimal Portfolios Under Proportional Transaction Costs. In: Kallsen, J., Papapantoleon, A. (eds) Advanced Modelling in Mathematical Finance. Springer Proceedings in Mathematics & Statistics, vol 189. Springer, Cham. https://doi.org/10.1007/978-3-319-45875-5_14

Download citation

DOI: https://doi.org/10.1007/978-3-319-45875-5_14

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-45873-1

Online ISBN: 978-3-319-45875-5

eBook Packages: Mathematics and StatisticsMathematics and Statistics (R0)