Abstract

Climate change became the most significant challenge as the world shifted towards environmental sustainability. Under this premise, the primary aim of this study is to investigate the impact of real GDP per capita, electricity consumption, trade openness, population, and financial development on the pollutant emissions within the Stochastic Impacts by regression on population, affluence and technology (STIRPAT) framework for Southeastern European (SEE) countries. The objective of this study is to cover not only the carbon dioxide emissions but also the overall estimates of greenhouse gas emissions by incorporating both the carbon dioxide and total greenhouse gas emissions as proxies of environmental degradation. Empirical results from fully modified ordinary least squares regression show that from 1997 to 2020, real GDP per capita, population and electricity consumption exhibited unfavourable effects on pollutant emissions. In contrast, trade openness revealed a favourable effect on pollutant emissions.The evidence concerning the impact of financial development on pollutant emissions is mixed. The pooled mean group estimation also supports this. Moreover, the results of causality analysis disclose bidirectional causality between electricity consumption and pollutant emissions and between trade openness and pollutant emissions. However, a unidirectional causality from real GDP per capita to pollutant emissions is also revealed. The present study suggests that in the long-run, real GDP per capita, population and electricity consumption may adversely affect the environment in these SEE countries. Thus, the transformation toward renewable energy and energy-efficient technology is needed to sustain long-term economic growth.

Article Highlights

-

The paper examines the determinants of pollutant emissions within the STIRPAT framework.

-

A panel dataset of the Southeastern European (SEE) countries is used for the period 1997–2020.

-

Both the carbon dioxide emissions and total greenhouse gas emissions are incorporated as proxies of pollutant emissions.

-

Real GDP per capita and electricity consumption exhibited unfavourable impacts on pollutant emissions.

-

Trade openness, population, and financial development are additional relevant determinants.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Global warming is the most significant challenge that can wipe the human race from the face of the earth. It is believed that an increase in the atmospheric concentrations of greenhouse gases caused global warming (Arnab et al. 2013; Kamruzzaman et al. 2015; Gozgor 2017; Bese et al. 2020; Mehmood and Tariq 2020; Udi et al. 2020; Mujtaba and Jena 2021; Yildiz 2022). Herein, it is critical to investigate the driving mechanisms of pollutant emissions caused by anthropogenic activity. The stochastic impacts by regression on population, affluence, and technology (STIRPAT) model created by Dietz and Rosa (1997) is now the most widely used method for determining the causes of pollution emissions (Morales-Lage et al. 2016; Wang et al. 2017; Yan et al. 2017; Majeed and Tauqir 2020; Nosheen et al. 2021). Therefore, this study also used the STIRPAT model to investigate the drivers of pollutant emissions. In addition, various studies have included several other possible pollution emission drivers, such as financial development, free trade, transportation industry, population, and foreign direct investment (Lean and Smyth 2010; Sharma 2011; Bekhet et al. 2017; Incekara 2019; Khan et al. 2019, 2022; Sun et al. 2019; Rehman et al. 2019; Satrovic and Dağ 2019; Muslija et al. 2019; Mujtaba et al. 2020, 2021; Shaari et al. 2020; Adebayo et al. 2020; Verbič et al. 2021; Satrovic et al. 2021, 2022; Coban and Ozkan 2022; Jena et al. 2022; Damrah et al. 2022).

Among these, human-related determinants like energy (electricity) consumption, population, financial development and trade openness are recognised as the most important contributors to pollutant emissions (Salahuddin et al. 2018; Adedoyin et al. 2022; Khan et al. 2022). Energy (electricity) consumption is witnessed to bust economic growth since it contributes to economic activities (Dogan and Seker 2016; Majeed and Tauqir 2020; Khan et al. 2021). The combustion of fossil fuels to meet the energy demand has generated a surge in greenhouse gas emissions into the atmosphere (Sun et al. 2019; Adebayo et al. 2020). Despite the positive impact of energy consumption on economic growth, special attention should be paid to the environmental effects of fossil and non-fossil energy sources. In particular, non-renewable energy is hypothesised to boost pollutant emissions, while renewable energy is hypothesised to curb pollutant emissions (Dogan and Seker 2016).

Indeed, international trade fosters economic growth since it translates into productivity increases. In addition, international trade is beneficial for capital accumulation and knowledge spillovers (Magazzino and Cerulli 2019; Adebayo et al. 2020). However, the environmental impact of trade openness and its role in mitigating climate change has been critical. On the one hand, trade policies are powerful tools to accelerate climate-friendly innovation to support climate action. On the other hand, trade can have a negative environmental impact by increasing pollution or exploiting natural resources (Gozgor 2017). Furthermore, the increasing population is a significant determinant of pollutant emissions. Population growth increases energy consumption and increases the use of fossil fuels to generate electricity. There is little knowledge about the relationship between financial development and pollutant emissions and the role that financial development plays in this. Financial development may benefit foreign direct investments and, as a result, economic growth. Hence, financial development indirectly augments pollutant emissions through higher energy consumption (Shahbaz et al. 2020). In opposition to this thought, financial development may help listed companies to improve energy efficiency and technological innovation (Khan et al. 2019).

Based on the above arguments, this study explores the following research hypotheses: H1: Real GDP per capita is positively associated with pollutant emissions; H2: Electricity consumption is positively linked with pollutant emissions; H3: Openness to trade is positively associated with pollutant emissions; H4: Population is positively connected with pollutant emissions; H5: Financial development is positively associated with pollutant emissions. If the hypotheses are rejected, the selected macroeconomic variables can deliver pollutant emissions reductions. Otherwise, the selected determinants of pollutant emissions achieve an adverse environmental effect.

The current study incorporates carbon dioxide emissions per capita and total greenhouse gas emissions from fuel combustion as proxies of pollutant emissions, affluence (real GDP per capita), technology (electric power consumption), population, trade openness, and financial development. The Southeastern European (SEE) countries are considered in this study. This is motivated by several aspects. First, even though the determinants of pollutant emissions have been the subject of intense research during the last three decades, only a few studies have been documented for SEE countries. Second, pollutant emissions in these countries rose dramatically during the past two decades, influencing air quality (EEA 2010). Moreover, coastal areas face challenges, such as illegal solid waste dumping from urban areas, population density and the use of fossil fuels (EEA 2008).

The primary goal of this study is to use the STIRPAT model to investigate the determinants of pollutant emissions and the impact of these factors on the environment in SEE countries. In addition, this study will assist in determining whether the selected macroeconomic variables have positive or adverse environmental effects. Finally, this study also attempts to investigate the causal relationship between the variables and the series’ causal relationship will reveal whether the selected variables cause pollutant emissions.

On the methodological front, the study starts by testing for unit roots and cointegration relationships in the selected variables. Furthermore, the panel cointegration regression will be estimated using the fully modified ordinary least squares (FMOLS) estimator, whereas the panel autoregressive distributed lag (ARDL) model will be estimated using the pooled mean group (PMG) method to examine the dynamic causal relationships between pollutant emissions, electricity consumption, real GDP per capita, the openness of trade, financial development and population for a panel of ten SEE countries for the period 1997–2020 within the STIRPAT framework. Finally, the panel vector error-correction model (VECM) is estimated to examine short-term and long-term Granger causality.

This study contributes to the literature in several dimensions: (i) in addition to the carbon dioxide emissions, the current model also uses the newly introduced indicator of pollutant emissions, i.e., the total greenhouse gas emissions from fuel combustion, to cover not only the carbon dioxide emissions but also the overall estimates of greenhouse gases emissions; (ii) this study uses the STIRPAT model to explore the determinants driving pollutant emissions in ten Southeastern European (SEE) countries using the most recent available data; (iii) introduction of openness to trade and financial development into the STIRPAT model; and (iv) selection of electric power consumption to indicate the technological factor within the STIRPAT model. The study is the first to explore the nexus among the series through the STIRPAT model in the SEE countries. In addition, this study fills the gap in the literature by examining the dynamic relationship between pollutant emissions, electricity consumption, real GDP per capita, population, openness to trade, and financial development for a panel of ten SEE countries.

The remainder of the study is organised as follows. Section 2 briefly overviews the literature survey on pollutant emission and its main drivers. Sections 3 and 4 explain the data, empirical model, and econometric methods for panel data. Section 5 reports and analyses the empirical results, whereas Sect. 6 summarises empirical findings and renders some policy implications.

Literature Review

The environmental impact of macroeconomic variables has been studied in various countries and regions through the STIRPAT model, including but not limited to the European countries, using multiple econometric approaches. For instance, Morales-Lage et al. (2016) explored the determinants of carbon dioxide emissions in the 28 European Union countries during 1971–2012 through the STRIPAT model. They found the unitary elasticity of carbon dioxide emissions concerning energy consumption, affluence and population. Similarly, Majeed and Tauqir (2020) analysed an extended STIRPAT model during 1990–2014 for a panel of 156 countries. All income groups report a significantly positive impact of technology and population on pollutant emissions. González-Sánchez and Martín-Ortega (2020) used the case of Eurozone countries during the period 1990–2017 and identified energy consumption and affluence as the most significant determinants of greenhouse gases.

More recently, Nosheen et al. (2021) used the STIRPAT model to explore the impact of climate change technologies on green growth in the European Union during 2000–2017. The findings suggest that technologies and energy consumption harm green growth. Neves et al. (2020) found that renewable energy consumption reduces emissions in the seventeen European Union countries from 1995 to 2017. Dogan and Seker (2016) explored the linkage between renewable energy, non-renewable energy, affluence, pollutant emissions and free trade. The results showed a negative impact of trade openness and renewable energy on pollutant emissions in the European Union, whereas non-renewable energy positively affects pollutant emissions. Similarly, Tian and Da Costa (2014) pointed out that income inequality is in parallel with per capita carbon dioxide emissions in European Union. Finally, Montero et al. (2021) suggested the significant impacts of population, affluence and technology on pollutant emissions in the Autonomous Community of Madrid, Spain, at the municipal level.

Sun et al. (2019) conducted a study on a panel of East Asia and Europe and found a negative relationship between openness to trade and pollutant emissions. The determinants of carbon emissions for countries in the Belt and Road Initiative (BRI) were examined by Zhu and Gao (2019) during 2005–2015. The results displayed a positive and significant impact of affluence, energy use and population on carbon emissions. The scenarios based on the STIRPAT model suggested that GDP is the main factor of carbon reduction in China (Wang et al., 2017). According to Yan et al. (2017), technological progress significantly reduces carbon emissions in China, which has been explored through the STIRPAT model. Salahuddin et al. (2018) revealed that affluence, electricity consumption and foreign direct investment positively impacted pollutant emissions in Kuwait during 1980–2013. Arouri et al. (2012) examined the linkage between pollutant emissions, affluence, and energy consumption for 12 MENA countries from 1981 to 2015. They found that energy consumption and affluence exhibited positive and negative impacts on pollutant emissions. Magazzino and Cerulli (2019) have adopted a responsiveness scores approach to evaluate the association between affluence, energy and pollutant emissions in the Middle East and North Africa (MENA) countries. They revealed that affluence and energy consumption positively impact pollutant emissions, while trade openness and urban population negatively affect them. Lean and Smyth (2010) use a panel VECM to evaluate the nexus amid pollutant emissions, affluence and electricity consumption for the Association of Southeast Asian Nations (ASEAN) countries. They revealed a positive impact of electricity consumption and affluence on pollutant emissions during 1980–2006.

Furthermore, using a panel of MINT (Mexico, Indonesia, Nigeria, and Turkey) economies, Adebayo et al. (2020) investigated the dynamic connections between pollutant emissions, wealth, energy consumption, trade openness, and population. The study’s findings revealed a positive relationship between energy use and pollution emissions, while population and trade openness negatively affected pollutant emissions. Ibrahim et al. (2017) analysed the impact of energy consumption and economic growth in Turkey during 1960–2015 within the STIRPAT framework and found a positive association between energy consumption and pollutant emissions.

Mujtaba et al. (2020) investigated the relationship between economic output, energy consumption, free trade, population and pollutant emissions in 25 upper-middle-income group countries. The results revealed that energy consumption and population are positively related to pollutant emissions, while economic output and trade openness negatively impact pollutant emissions. Coskuner et al. (2020) investigated the determinants of pollutant emissions in the Organization of Petroleum Exporting Countries (OPEC) during the period 1995–2016 and found a positive association of energy consumption with population, which signifies that these macroeconomic variables are essential drivers of pollutant emissions. Considering the sample of twenty Organization of Islamic Cooperation (OIC) countries, Shaari et al. (2020) examined pollutant emissions determinants and exhibited a negative environmental impact on national output in the long run. Moreover, the principal results reveal no environmental effect of affluence in the short run.

Shafiei and Salim (2014) analysed the association between non-renewable energy consumption and pollutant emissions using the STIRPAT model for OECD countries during 1980–2011 and found a positive association. Singh and Mukherjee (2019) revisited the STIRPAT model in the United States, spanning data from 1990 to 2014 and identified affluence as the primary determinant of pollutant emissions. Liddle and Lung (2010) explored the data during 1960–2005 and found that the impact of the population on the environment in developed countries varies greatly by age group. On the other hand, Adedoyin et al. (2022) found that the economic complexity index and economic policy uncertainty moderate the contribution of energy consumption to emissions for the four World Bank Income clusters. Moreover, a study conducted by Sharma (2011) for a panel of 69 countries during the period 1985–2005 witnessed a positive impact of affluence, trade openness and electricity consumption on pollutant emissions.

Considering the studies on causal relationships, Adebayo et al. (2020) established one-way causation from affluence to carbon dioxide emissions. Khan et al. (2019) reported bidirectional causality between trade openness and pollutant emissions, while the analysis does not reveal evidence of a statistically significant causal impact of financial development. Bekhet et al. (2017) suggested a one-way causal relationship from financial development to pollutant emissions in Oman during the period 1980–2011. In the same vein, Omri et al. (2015) examined the nexus between pollutant emissions, financial development, free trade, and economic growth for a sample of MENA countries, and they revealed no causal relationship between financial development and pollutant emissions. Bento and Paulo (2014) exhibited that energy consumption and affluence drive pollutant emissions in Italy. Similar findings are presented by Li et al. (2021) for 30 provinces of China. Akpan and Akpan (2012) analyse the relationship between electricity consumption, affluence and pollutant emissions. The results confirm unidirectional causality from affluence to pollutant emissions. Abul and Satrovic (2022) found a two-way causal link between ecological depletion and affluence. Similarly, Odugbesan and Rjoub (2020) used the panel of MINT economies and found one-way causality from energy consumption to pollution emissions for Indonesia and Nigeria, while bidirectional causality was found for Turkey and Mexico.

Conclusively, controversial findings are observed from the literature regarding the impact of macroeconomic variables on pollutant emissions. Therefore, the current study considered the SEE countries to analyse the environmental impact of various macroeconomic variables on pollutant emissions. Although these countries signed the Kyoto protocol as well as the Paris agreement, pollutant emissions are still a major concern in these countries. Therefore, it is warranted to explore the real determinants of pollutant emissions for SEE countries. Previous studies that evaluate SEE countries within the European Union (Nosheen et al. 2021; Neves et al. 2020; Majeed and Tauqir 2020; Dogan and Seker 2016; Tian and Da Costa 2014; Liddle and Lung 2010), concluded with controversial findings. Therefore, the current study intends to fill this gap in the literature by establishing an augmented list of pollutant emissions factors within the STIRPAT framework specifically for SEE countries alone by incorporating both the carbon dioxide and total greenhouse gas emissions as proxies of pollutant emissions.

Empirical Model and Methodology

This study investigates the dynamic interactions between pollutant emissions, real GDP per capita, electricity consumption, openness to trade, population, and financial development in ten SEE countries within the stochastic version of the IPAT model (STIRPAT). The STIRPAT model is derived from the traditional IPAT (Impact, Population, Affluence and Technology) model (Ehrlich and Holdren 1971), specifying that environmental impact \((I)\) is determined by the size of population \((P)\), affluence \((A)\), and technology \((T)\). A stochastic version of IPAT, proposed by Dietz and Rosa (1997), can be formalised as:

where countries are denoted by \(i\) and time periods by \(t\); \(b, c,\) and \(d\) are the parameters to be estimated, \(a\) is the constant term, and \(\varepsilon\) denotes an IID disturbance term. Following the propositions of Wang et al. (2017), Yan et al. (2017), Majeed and Tauqir (2020), Satrovic et al. (2021), and Nosheen et al. (2021), all series are transformed into logarithms:

To incorporate some other potential driving forces of pollutant emissions into the STIRPAT framework, the model proposed in this study is formulated as:

In Eq. 3, \(\mathrm{PEM}\) refers to the pollutant emissions variable measured in this study by carbon dioxide emissions per capita \((\mathrm{CO})\) and total greenhouse gas emissions from fuel combustion \((\mathrm{GHG})\), \(AFL\) is the proxy for affluence (real GDP per capita), \(\mathrm{POW}\) is the proxy for technology (electric power consumption), \(\mathrm{POP}\) captures population (total), \(FTR\) is the proxy for trade openness, and \(\mathrm{DCP}\) represents the proxy for financial development. The dependant and explanatory variables are again logarithms (L). The indices \(i=1,\dots ,N\) and \(t=1,\dots ,T\) represent SEE countries and time, respectively. The coefficients \({\alpha }_{1}-{\alpha }_{5}\) thus capture the long-run elasticity estimates of pollutant emissions concerning real GDP per capita, electric power consumption, openness to trade, population, and financial development, respectively.

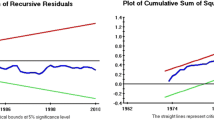

Prior to applying the proposed econometric models, a cross-sectional dependence (CD) test proposed by Pesaran (2004) is used to examine the cross-correlation in the series. After confirming CD, the second-generation unit root test (i.e., CIPS) developed by Pesaran (2007) is applied. Westerlund’s (2007) cointegration tests are further performed to determine whether pollutant emissions and selected macroeconomic variables have a stable, long-term relationship. The Westerlund cointegration technique is suitable for a situation where there is cross-correlation in the series. To further check the robustness of the Westerlund cointegration, the Kao (1999) cointegration test is also applied. The null hypothesis assumes no cointegration, whereas the alternative assumes that the variables move together in time (Kao 1999).

Evaluation of long-term associations between the variables requires the estimation of the long-run models. Accordingly, the panel autoregressive distributed lag (ARDL) model is used as the primary approach and the pooled mean group (PMG) estimation method to estimate the regression coefficients. Following Pedroni (2000), the fully modified ordinary least squares is employed to conduct the long-term model estimation. The estimation of panel regression based on the fully modified ordinary least squares can be shown as Eq. 5 (Pedroni 2000):

In Eq. 4, cointegrated variables are represented by \({X}_{it}\) and \({y}_{it}\). The modified version of the outcome variable is denoted by \({\overline{y} }_{it}^{+}\) with the corrected serial correlation terms, i.e. \({\overline{y} }_{it}^{+}=\left({y}_{it}-{\overline{y} }_{i}\right)-{\widehat{w}}_{12}{\omega }_{22}^{-1}{\nabla }_{22}\), where \(\omega\) and \(\nabla\) are the estimates of long-run covariances, \({\widehat{w}}_{12}\) stands for the long-run standard errors of conditional process, and \(\gamma_{12}^{ + ^{\prime}} = r_{12} - \hat{w}_{12} \omega_{22}^{ - 1} \Delta_{22}\).

The PMG panel data estimator is used as a robustness check and derives the long-run regression coefficients from the ARDL model. It is considered due to its advantage over other panel error-correction estimators by employing both pooling and averaging (Kim et al. 2010). The long-run coefficients are restricted to be the same, while the short-run coefficients vary across groups (Rehman et al. 2020). Pesaran et al. (1999) propose the available specification for the ARDL model as formalised in Eq. (5):

Here, \({x}_{it}\) captures regressors \(L\left(\mathrm{AFL}\right), L\left(\mathrm{POW}\right), L\left(\mathrm{FTR}\right), L(\mathrm{POP})\) and \(L(\mathrm{DCP})\), \({\rho }_{ij}\) represents regression coefficients of lagged explanatory variables, \(p\) (regressand’s lag order) and \(q\) (predictor variables’ lag order) vary across SEE countries, \({\theta }_{ij}\) are the regression coefficients of the lagged dependent variables, \({\mu }_{i}\) represents fixed effects, and uit is the general disturbance term.

The panel vector error-correction model (VECM) framework is used to test for causality between selected macroeconomic variables. The VECM framework can be formalised to test both short and long-term causality, as shown in Eqs. (6)-(11):

where \(\Delta\) captures the first difference, \(m\) is the lag length, and \(\mathrm{ECT}\) stands for the error-correction term. The VECM residual serial correlation test is used for the residual diagnostics.

Data

According to the country classification of Jelavich (1983), thirteen countries are in the SEE group. Data is not available for Serbia, Montenegro, and Kosovo. Thus Albania, Bulgaria, Bosnia and Herzegovina, Greece, Croatia, Moldova, North Macedonia, Romania, Slovenia, and Türkiye are included. Balanced annual panel data on carbon dioxide emissions (CO2) are retrieved from the Global Carbon Project (2021). Real GDP per capita, openness to trade and population data are collected from the World Bank Development Indicators Database 2021 release (World Bank 2021). The data on electric power consumption are obtained from the World Bank (2021) and IEA Energy Data Centre (International Energy Agency 2021a). The data on financial development are obtained from the World Bank (2021) and The Global Economy (2020). The data on the new proxy of pollutant emissions (greenhouse gas–GHG emissions) are retrieved from IEA Energy Data Centre (International Energy Agency 2021b). The specific timeframe was dictated by data availability. The major limitation of this study was the unavailability of financial development data before 1997 and after 2020. Table 1 gives a summary of the selected macroeconomic variables.

Table 2 shows the correlation matrix and summary statistics for the selected macroeconomic determinants of pollutant emissions in the levels within the STIRPAT model.

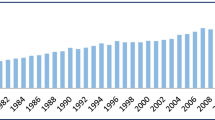

Table 2 shows a positive correlation between carbon dioxide emissions and real GDP per capita, electricity consumption, and financial development. The correlations between carbon dioxide emissions and trade openness, and carbon dioxide emissions and population were not statistically significant. The findings suggest a positive correlation between GHG and real GDP per capita, GHG and population. Moreover, the negative correlation between GHG, electricity consumption, and trade is reported. The correlation between GHG and financial development was not statistically significant. Table 2 also shows maximum carbon dioxide emissions for Greece in 2007 (10.30) and minimum carbon dioxide emissions for Albania in 1997 (0.49).

In contrast, maximum greenhouse gas emissions from fuel combustion (382.80) is reported for Türkiye in 2017 and minimum value (1.6) for Albania in 1997. Real GDP per capita reports a maximum value for Greece in 2007 (24,081.70) and a minimum value for Moldova in 1999 (1307.98). The following variable of interest is electric power consumption claiming maximum value for Slovenia in 2017 (7218.92) and minimum value for Albania in 1997 (694.67). The maximum reported value of openness to trade (% GDP) is attributed to Slovenia in 2018 (161.19) and the minimum value for Türkiye in 1999 (37.66); the maximum total population for Türkiye and minimum for North Macedonia and Slovenia; the maximum value of financial development for Greece in 2013 (118.11) and minimum value for Albania in 1998 (3.97).

Empirical Results and Discussion

The study proceeds with the empirical results and discussion in a stylised manner. The study begins with the Pesaran (2004) cross-section dependence (CD) test. Prior to performing the panel analysis, this diagnostic should be investigated, as failure to consider CD may cause forecast errors. Results from the Pesaran (2004) CD tests are depicted in Table 3. All variables are used in logarithms.

The relevant p values from Pesaran (2004) CD tests are smaller than 5%, giving strong evidence for rejecting the null hypothesis that claims cross-sectional independence. Hence, the null hypothesis of cross-sectional independence is rejected in favour of an alternative ascertaining a cross-sectional dependence of the variables under investigation. The CD refers to the interdependency of determinants of pollutant emissions between SEE countries, which may be attributed to spatial effects.

Subsequently, the cross-sectional Im–Pesaran–Shin (CIPS) test, developed by Pesaran (2007) and robust to CD, is applied to confirm that none of the variables is I(2), as shown in Table 4. The CIPS test findings give enough evidence to claim that the selected variables are stationary at first differences in both cases (intercept, intercept and trend), and none of the variables is I(2).

Panel cointegration tests are applied to see whether the determinants of pollutant emissions move together in the long term within the STIRPAT framework. The results of Kao (1999) residual cointegration test and Westerlund (2007) cointegration test are presented in Table 5. The reported p-value of the Kao (1999) test is far smaller than 5%, suggesting the rejection of the null hypothesis of no cointegration relationship between variables \(\mathrm{PEM},\mathrm{ AFL},\mathrm{ POW},\mathrm{ FTR},\mathrm{ POP}\) and \(\mathrm{DCP}.\)

Before proceeding to the long-run associations, the Westerlund (2007) cointegration test is used to check the robustness of cointegration relationships. The rejection of the null is taken as evidence of long-run equilibrium among the variables, as shown in Table 5. Hence, the existence of long-run relationships among pollutant emissions, real GDP per capita, electricity consumption, international trade, population and financial development is verified in this study. The affirmation of the long-run cointegration fulfils the pre-requisite to predict the long-run elasticities of two indicators of environmental degradation, including carbon dioxide emissions per capita \((\mathrm{CO})\) and total greenhouse gas emissions from fuel combustion \((\mathrm{GHG})\).

Long-run elasticities are estimated using the FMOLS and the PMG estimators on Eqs. 5 and 6, respectively. Table 6 shows the associated long-run cointegration parameters between the determinants of pollutant emissions.

The results for affluence (GDP per capita) show a positive and statistically significant impact on carbon dioxide emissions and total greenhouse gas emissions from fuel combustion in the long run. In other words, the evidence from Table 6 via FMOLS implies that pollutant emissions in the SEE countries increase with affluence, ceteris paribus, and support H1. These findings are consistent with Shaari et al. (2020), Arouri et al. (2012), Magazzino and Cerulli (2019), Singh and Mukherjee (2019), Wang et al. (2017), Yan et al. (2017), Ibrahim et al. (2017), Akpan and Akpan (2012), González-Sánchez and Martín-Ortega (2020), and Zhu and Gao (2019). The practical implication of this finding is explained in this section. Furthermore, the corresponding long-run coefficients associated with real GDP per capita are positive. Thus, it can be said that economic growth has a positive impact on pollutant emissions in SEE countries. The primary cause of such an effect is the extensive use of non-renewable energy sources, which has increased greenhouse gas emissions into the atmosphere (Sun et al. 2019; Adebayo et al. 2020).

The empirical findings in Table 6 also reveal that a 1% increase in electric power consumption statistically and significantly increases the carbon dioxide and total greenhouse gas emissions from fuel combustion by 0.749% (FMOLS) and 0.654% (FMOLS), respectively, supporting H2. An exponential increase in electricity consumption has driven a significant growth performance of SEE countries. However, most of the electricity was sourced from fossil fuels (88%) in 2005. Coal provides almost 40% of the total energy (EEA 2008). These results can be explained by the fact that electricity consumption is an essential and irreplaceable source in the production process that is also recognised as the primary contributor to environmental damage. Herein, electricity consumption is an unfriendly energy source for the environment and is predicted to increase the adverse environmental impacts of real GDP per capita. Considering that electricity consumption positively impacts pollutant emissions, SEE countries should reveal environmental improvement by upgrading their renewable electricity generation capacities.

Based on the regression coefficients, it can be seen from Table 6 that electricity consumption is the most vital driver of pollutant emissions. There is no doubt about the causal effect of human activity on pollutant emissions, mainly due to fossil energy combustion for purposes such as transportation or heating. Although electricity consumption per capita varies among countries, more humans emit anthropogenic gases, ceteris paribus. Energy and environmental issues are strongly interrelated since it is nearly impossible to produce or consume energy without significant environmental and economic outcomes ranging from air pollution, deforestation, climate change, waste products, and water pollution. The anthropogenic emissions from fossil fuel combustion are the primary cause of water and air pollution in urban areas. This positive coefficient of electricity consumption is supported by Salahuddin et al. (2018), Yan et al. (2017), and Akpan and Akpan (2012).

Regarding the impact of population, it is noticed that a 1% increase in the total population increases the carbon dioxide emissions and total greenhouse gas emissions from fuel combustion by 0.414% (FMOLS) and 0.309% (FMOLS), respectively. The main implication of this finding is that the total population is likely to impose a positive impact on pollutant emissions, a result which is consistent with Zhu and Gao (2019), Coskuner et al. (2020), Mujtaba et al. (2020), Hernández-Pérez et al. (2022), Satrovic and Adedoyin (2022), and Ahmad and Wu (2022). The linkage between population and environmental outcomes is often considered straightforward: more humans should have a more prominent environmental effect, ceteris paribus, supporting H4. Most notably, population growth interacts with affluence and energy consumption and could result in environmental degradation. Herein, population growth is a strong driver of climate policy. Furthermore, Table 6 suggests that a larger population entails more pollutant emissions, ceteris paribus. Thus, it can be said that more future people will be vulnerable to climate-related impacts.

The coefficient estimates are significant and negative concerning the effects of trade openness on pollutant emissions. This exhibits that the countries more included in international trade reveal lower carbon dioxide emissions and total greenhouse gas emissions from fuel combustion. Herein, trade openness can help to reduce the adverse environmental impacts of economic growth, meaning that trade policies are powerful tools to accelerate climate-friendly innovation to support climate action. Studies such as Dogan and Seker 2016, Sun et al. 2019, Adebayo et al. 2020, and Mujtaba et al. 2020 reported the negative impact of trade openness on pollutant emissions. This result, which shows that trade openness has a negative effect on pollutant emissions, rejects the H3.

In contrast, the coefficients with domestic credit to the private sector showed mixed evidence of the impact of financial development on pollutant emissions, providing no support to H5. The long-run coefficients associated with financial development are found to be negative but statistically insignificant (Khan et al. 2019). Finally, the coefficient value of the error-correction term is significant and negative, which shows the speed of adjustment, suggesting that the equilibrium restores in the long run. Table 6 shows that the effect of all independent variables on carbon dioxide emissions is entirely consistent with the estimated total greenhouse gas emissions from fuel combustion. Hence, the similarities of the magnitudes verify the robustness of the regression outcomes across the two indicators of pollutant emissions.

ENVSEC (2012) suggests that SEE countries are under a severe threat related to climate change. However, these countries’ contribution to global emissions is much lower than the European Union (EU) average. Yet, some of the SEE countries are EU member states, but do not recognise the association with the EU as a primary strategic objective. In this light, future development has been grounded in the EU Sustainable Development Strategy.

Finally, the panel VECM is employed to investigate the direction of causality. Tables 7 and 8 show the panel causality test results based on the panel VECM (the voluminous output of VECM estimation is available upon request).

Tables 7 and 8 report a bidirectional causal relationship between electricity consumption and \(PEM\), certifying the interdependence of energy and environmental sustainability objectives. These findings are supported by Dritsaki and Dritsaki (2014). The feedback hypothesis between free trade and pollutant emissions is consistent with Khan et al. (2019). As a result, it is ideal for the SEE countries to expand the intensification of foreign trade to hold on to their environmental sustainability objectives. Affluence is reported as a one-way causal relationship with pollutant emissions in the short run. There exists an extent of literature supporting the findings of the current study, such as Akpan and Akpan (2012), Dogan and Seker (2016), and Adebayo et al. (2020). This causal relationship is justified from the perspective that enhancing economic output can deteriorate environmental quality. Moreover, this finding establishes income as the decisive causal factor for pollutant emissions in SEE countries.

According to the causality results in Tables 7 and 8, there is significant causality running from population to pollutant emissions, which was also revealed by Khan et al. (2019). As for the pollutant emissions and financial development relationship, no causal relationship was found, which is consistent with the arguments made by Omri et al. (2015) and Khan et al. (2019). The presence of long-run causality running from affluence to pollutant emissions is validated in Tables 7 and 8. The significant negative coefficient of ECT with environmental depletion as the dependent variable shows that pollutant emissions converge to long-run equilibrium claiming a long-run causality. Long-run causality is also supported when real GDP per capita, electricity consumption and openness to trade are the dependent variables.

Concluding Remarks

The Stochastic Impacts by Regression on Population, Affluence and Technology framework is used to examine the relationships between pollutant emissions, affluence, electric power consumption, population, openness to trade, and financial development in ten Southeastern European (SEE) economies from 1997 to 2020. The cross-sectional dependence tests, panel data unit root tests, cointegration tests, panel pooled mean group (PMG) and fully modified ordinary least square (FMOLS) estimators, and Granger causality tests based on the vector error-correction mechanism (VECM) are used to obtain the empirical results.

The findings suggest that the selected macroeconomic determinants of pollutant emissions have long-run consequences. Empirical results suggest a positive association between affluence, population, and pollutant emissions. Similarly, electricity consumption has an upward-sloping and statistically significant effect on pollutant emissions. These findings imply that affluence, population and electric power consumption impose unfavourable impacts on pollutant emissions in the panel of ten Southeastern European countries. The results also reveal a favourable association between openness to trade and pollutant emissions. Conversely, the evidence concerning the impact of financial development on pollutant emissions is mixed. Causality tests suggest a two-way causal relationship between electricity consumption and pollutant emissions and openness to trade and pollutant emissions. However, a one-way causality from affluence to pollutant emissions and population to pollutant emissions is also revealed. Long-run causality is supported when pollutant emissions, affluence, electric power consumption, and openness to trade are the dependent variables. Overall, these results show that the volume of selected macroeconomic variables can predict the behaviour of pollutant emissions.

Based on these findings, the study suggests some essential policy measures. In particular, policies should be delivered to mitigate several significant concerns for pollution and promote sustainable development. This includes urban air quality as one of the crucial environmental challenges affecting human health, the economy (hampering tourism development), and natural resources for the future. Addressing these problems requires dedicating sufficient institutional capacity and legal and policy measures, including economic instruments such as environmental taxes discouraging polluting consumption and incentivising investments into environmentally friendly technologies.

The findings of this study proved that balancing financial development and pollution prevention policies is relevant if attempting to mitigate the adverse environmental impacts in Southeastern Europe. Thus, enforcing strict guidelines and regulations to ensure compliance with environmental requirements could reduce investments in the most polluting industries of the region, which can be anticipated to neutralise the unfavourable environmental effect of financial development. The positive coefficient with electricity consumption suggests that additional investments are needed to enable the countries to build an energy system that is substantially less reliant on non-renewable energy sources. Herein, Southeastern European countries must mobilise the required investments in renewable energy to enable the region to deliver energy at competitive costs when undergoing a renewable energy transition. The region can stimulate sustainable development and job creation by placing energy transition investments, environmental regulations, and policies at the heart of Southeastern European’s economic progress.

The current study is restricted to the ten Southeastern European countries due to the unavailability of data for other countries. The unavailability of relevant data has also limited the period of the study. In addition, data limitations also restricted the study from including other key macroeconomic determinants of carbon dioxide and total greenhouse gas emissions in the models. It is also limited to estimating linear relationships. With time, it shall be possible to examine more Southeastern European countries and assess the nonlinear impacts of the variables. Additional explanatory variables, such as agriculture, renewable energy, foreign direct investments, secondary industry factors, and energy consumption categories, could also be relevant determinants of pollutant emissions. In the future, this study can be extended to evaluate the role of different components of globalisation and natural resources abundance on regional carbon dioxide and total greenhouse gas emissions figures and other environmental sustainability indicators. Finally, it would be helpful to develop an environmental emissions index for the Southeastern European countries and employ it within the Stochastic Impacts by Regression on Population, Affluence and Technology framework.

Data Availability

The dataset generated and analysed during the current study was compiled from the World Bank DataBank, https://databank.worldbank.org/source/world-development-indicators; IEA Energy Data Centre, https://www.iea.org/data-and-statistics/data-browser?country=WORLD, the Global Carbon Budget; https://ourworldindata.org/co2-emissions; and the Global Economy Indicators, https://www.theglobaleconomy.com/indicators_list.php.

References

Abul SJ, Satrovic E (2022) Revisiting the environmental impacts of railway transport: does EKC exist in South-Eastern Europe? Pol J Environ Stud 31(1):539–549

Adebayo TS, Awosusi AA, Adeshola I (2020) Determinants of CO2 emissions in emerging markets: an empirical evidence from MINT economies. Int J Renew Energy Dev 9(3):411–422

Adedoyin FF, Satrovic E, Kehinde MN (2022) The anthropogenic consequences of energy consumption in the presence of uncertainties and complexities: evidence from World Bank income clusters. Environ Sci Pollut Res 29:23264–23279

Ahmad M, Wu Y (2022) Natural resources, technological progress, and ecological efficiency: does financial deepening matter for G-20 economies? Resour Policy 77:102770

Akpan GE, Akpan UF (2012) Electricity consumption, carbon emissions and economic growth in Nigeria. Int J Energy Econ Policy 2(4):292–306

Arnab IZ, Ali T, Shidujaman M, Hossain Md (2013) Consideration of environmental effect of power generation: Bangladesh perspective. Energy Power Eng 5(4):1521–1525

Arouri MEH, Ben Youssef A, M’henni H, Rault C (2012) Energy consumption, economic growth and CO2 emissions in Middle East and North African countries. Energy Policy 45:342–349

Bekhet HA, Matar A, Yasmin T (2017) CO2 emissions, energy consumption, economic growth, and financial development in GCC countries: dynamic simultaneous equation models. Renew Sustain Energy Rev 70:117–132

Bento C, Paulo J (2014) The determinants of CO2 emissions: Empirical evidence from Italy. MPRA Paper No. 59166. Munich: MPRA

Bese E, Friday H, Ozden C (2020) Coal consumption environmental Kuznets curve (EKC) in China and Australia: evidence from ARDL model. J Appl Business Econ 22(11):25–36

Coban MN, Ozkan O (2022) Çevresel Kuznets eğrisi: Türkiye’de küreselleşme ve ekonomik büyümenin çevre üzerindeki etkisinin yeni dinamik ARDL simülasyon modeli ile incelenmesi. Akademik Hassasiyetler 9(19):207–228

Coskuner C, Paskeh MK, Olasehinde-Williams G, Akadiri SS (2020) Economic and social determinants of carbon emissions: Evidence from organization of petroleum exporting countries. J Public Aff 20(3):e2092

Damrah S, Satrovic E, Shawtari FA (2022) How does financial inclusion affect environmental degradation in the six oil exporting countries? The moderating role of information and communication technology. Front Environ Sci 10:1013326. https://doi.org/10.3389/fenvs.2022.1013326

Dietz T, Rosa EA (1997) Effects of population and affluence on CO2 emissions. Proc Natl Acad Sci 94(1):175–179

Dogan E, Seker F (2016) Determinants of CO2 emissions in the European Union: the role of renewable and non-renewable energy. Renew Energy 94:429–439

Dritsaki C, Dritsaki M (2014) Causal relationship between energy consumption, economic growth and CO2 emissions: a dynamic panel data approach. Int J Energy Econ Policy 4(2):125–136

EEA (2008) Environmental trends and perspectives in the Western Balkans. EEA Technical Report No. 8/2008

EEA (2010) Environmental trends and perspectives in the Western Balkans: future production and consumption patterns. EEA Report No. 1/2010

Ehrlich PR, Holdren JP (1971) Impact of population growth. Science 171:1212–1217

ENVSEC (2012) Climate change in the West Balkans. Châtelaine: Zoï Environment Network

Global Carbon Project (2021) Supplemental data of Global Carbon Project 2021 (1.0). Global Carbon Project. https://doi.org/10.18160/gcp-2021

González-Sánchez M, Martín-Ortega JL (2020) Greenhouse gas emissions growth in Europe: a comparative analysis of determinants. Sustainability 12(3):1012

Gozgor G (2017) Does trade matter for carbon emissions in OECD countries? Evidence from a new trade openness measure. Environ Sci Pollut Res 24(36):27813–27821

Hernández-Pérez LG, Sánchez-Zarco XG, Ponce-Ortega JM (2022) Multi-objective optimization method based on deterministic and metaheuristic approaches in water–energy–food nexus under uncertainty. Int J Environ Res 16:33

Ibrahim SS, Celebi A, Ozdeser H, Sancar N (2017) Modelling the impact of energy consumption and environmental sanity in Turkey: a STIRPAT framework. Procedia Comput Sci 120:229–236

International Energy Agency (2021a) IEA Energy Data Centre. Retrieved on 14 Dec 2021a, from IEA Energy Data Centre

International Energy Agency (2021b) GHG emissions from Energy. Retrieved on 22 Dec 2021b, from IEA Energy Data Centre

Incekara CO (2019) Use of an optimization model for optimization of Turkey’s energy management by inclusion of renewable energy sources. Int J Environ Sci Technol 16:6617–6628

Jelavich B (1983) History of the Balkans: Eighteenth and nineteenth centuries. Cambridge University Press, Cambridge

Jena PK, Mujtaba A, Joshi DPP, Satrovic E, Adeleye BN (2022) Exploring the nature of EKC hypothesis in Asia’s top emitters: role of human capital, renewable and non-renewable energy consumption. Environ Sci Pollut Res Forthcoming. https://doi.org/10.1007/s11356-022-21551-w

Kamruzzaman M, Hine J, Yigitcanlar T (2015) Investigating the link between carbon dioxide emissions and transport-related social exclusion in rural Northern Ireland. Int J Environ Sci Technol 12:3463–3478

Kao C (1999) Spurious regression and residual-based tests for cointegration in panel data. J Econom 90(1):1–44

Khan I, Khan N, Yaqub A, Sabir M (2019) An empirical investigation of the determinants of CO2 emissions: evidence from Pakistan. Environ Sci Pollut Res 26:9099–9112

Khan I, Zakari A, Ahmad M, Irfan M, Hou F (2021) Linking energy transitions, energy consumption, and environmental sustainability in OECD countries. Gondwana Res 103:445–457

Khan H, Weili L, Khan I (2022) The role of institutional quality in FDI inflows and carbon emission reduction: evidence from the global developing and belt road initiative countries. Environ Sci Pollut Res 29:30594–30621

Kim DH, Lin SC, Suen YB (2010) Dynamic effects of trade openness on financial development. Econ Model 27(1):254–261

Lean HH, Smyth R (2010) CO2 emissions, electricity consumption and output in ASEAN. Appl Energy 87(6):1858–1864

Li ZZ, Li RY, Malik MY, Murshed M, Khan Z, Umar M (2021) Determinants of carbon emission in China: how good is green investment? Sustain Prod Consum 27:392–401

Liddle B, Lung S (2010) Age-structure, urbanization, and climate change in developed countries: revisiting STIRPAT for disaggregated population and consumption-related environmental impacts. Popul Environ 31(5):317–343

Magazzino C, Cerulli G (2019) The determinants of CO2 emissions in MENA countries: a responsiveness scores approach. Int J Sust Dev World 26(6):522–534

Majeed MT, Tauqir A (2020) Effects of urbanization, industrialization, economic growth, energy consumption, financial development on carbon emissions: an extended STIRPAT model for heterogeneous income groups. Pak J Commer Soc Sci 14(3):652–681

Mehmood U, Tariq S (2020) Globalization and CO2 emissions nexus: evidence from the EKC hypothesis in South Asian countries. Environ Sci Pollut Res 27:37044–37056

Montero JM, Fernández-Avilés G, Laureti T (2021) A local spatial STIRPAT model for outdoor NOx concentrations in the Community of Madrid, Spain. Mathematics 9(6):677

Morales-Lage R, Bengochea-Morancho A, Martinez-Zarzoso I (2016) The determinants of CO2 emissions: Evidence from European Countries. Working Paper No. 2016/04. Castelló: Universitat Jaume

Mujtaba A, Jena PK (2021) Analyzing asymmetric impact of economic growth, energy use, FDI inflows, and oil prices on CO2 emissions through NARDL approach. Environ Sci Pollut Res 28:30873–30886

Mujtaba A, Jena PK, Mukhopadhyay D (2020) Determinants of CO2 emissions in upper middle-income group countries: an empirical investigation. Environ Sci Pollut Res 27:37745–37759

Mujtaba A, Jena PK, Joshi DPP (2021) Growth and determinants of CO2 emissions: evidence from selected Asian emerging economies. Environ Sci Pollut Res 28:39357–39369

Muslija A, Satrovic E, Colakovic N (2019) Dynamic panel data analysis of the relationship between economic freedom and tourism. Çankırı Karatekin Üniversitesi İktisadi Ve İdari Bilimler Fakültesi Dergisi 9(2):327–343

Neves SA, Marques AC, Patrício M (2020) Determinants of CO2 emissions in European Union countries: does environmental regulation reduce environmental pollution? Econ Anal Policy 68:114–125

Nosheen M, Iqbal J, Abbasi MA (2021) Do technological innovations promote green growth in the European Union? Environ Sci Pollut Res 28:21717–21729

Odugbesan JA, Rjoub H (2020) Relationship among economic growth, energy consumption, CO2 emission, and urbanization: evidence from MINT countries. SAGE Open 10(2):1–15

Omri A, Daly S, Rault C, Chaibi A (2015) Financial development, environmental quality, trade and economic growth: what causes what in MENA countries. Energy Econ 48:242–252

Pedroni P (2000) Fully modified OLS for heterogeneous cointegrated panels. In: Baltagi BH (ed) Nonstationary panels, panel cointegration and dynamic panels. JAI Press, Amsterdam, pp 93–103

Pesaran MH (2004) General diagnostic test for cross section dependence in panels. IZA working paper No. 1240. Bonn: IZA

Pesaran MH (2007) A simple panel unit root test in the presence of cross-section dependence. J Appl Economet 22:265–312

Pesaran MH, Shin Y, Smith RP (1999) Pooled mean group estimation of dynamic heterogeneous panels. J Am Stat Assoc 94(446):621–634

Rehman A, Rauf A, Ahmad M, Chandio AA, Deyuan Z (2019) The effect of carbon dioxide emission and the consumption of electrical energy, fossil fuel energy, and renewable energy, on economic performance: evidence from Pakistan. Environ Sci Pollut Res 26:21760–21773

Rehman FU, Noman AA, Ding Y (2020) Does infrastructure increase exports and reduce trade deficit? Evidence from selected South Asian countries using a new Global Infrastructure Index. Econ Struct 9:10

Salahuddin M, Alam K, Ozturk I, Sohag K (2018) The effects of electricity consumption, economic growth, financial development and foreign direct investment on CO2 emissions in Kuwait. Renew Sustain Energy Rev 81(2):2002–2010

Satrovic E, Adedoyin FF (2022) An empirical assessment of electricity consumption and environmental degradation in the presence of economic complexities. Environ Sci Pollut Res Forthcoming. https://doi.org/10.1007/s11356-022-21099-9

Satrovic E, Dağ M (2019) Energy consumption, urbanizatıon and economic growth relationship: an examination on OECD countries. Dicle Üniversitesi Sosyal Bilimler Enstitüsü Dergisi 11(22):315–324

Satrovic E, Ahmad M, Muslija A (2021) Does democracy improve environmental quality of GCC region? Analysis robust to cross-section dependence and slope heterogeneity. Environ Sci Pollut Res 28:62927–62942

Satrovic E, Abul SJ, Al-Kandari A (2022) Modeling the dynamic linkages between agriculture, electricity consumption, income and pollutant emissions for Southeastern Europe. Pol J Environ Stud 31(5):1–9

Shaari MS, Abdul Karim Z, Zainol Abidin N (2020) The effects of energy consumption and national output on CO2 Emissions: new evidence from OIC countries using a panel ARDL analysis. Sustainability 12(8):3312

Shafiei S, Salim RA (2014) Non-renewable and renewable energy consumption and CO2 emissions in OECD countries: a comparative analysis. Energy Policy 66:547–556

Shahbaz M, Haouas I, Sohag K, Ozturk I (2020) The financial development-environmental degradation nexus in the United Arab Emirates: the importance of growth, globalization and structural breaks. Environ Sci Pollut Res 27:10685–10699

Sharma SS (2011) Determinants of carbon dioxide emissions: empirical evidence from 69 countries. Appl Energy 88(1):376–382

Singh MK, Mukherjee D (2019) Drivers of greenhouse gas emissions in the United States: revisiting STIRPAT model. Environ Dev Sustain 21:3015–3031

Sun H, Clottey SA, Geng Y, Fang K, Amissah JCK (2019) Trade openness and carbon emissions: evidence from Belt and Road countries. Sustainability 11(9):2682

The Global Economy, (2020) The Global Economy List of Available Indicators 2020. Retrieved on 21 Mar 2021, from The Global Economy

Tian W, and Da Costa P (2014) Inequalities in per capita CO2 emissions in European Union, 1990–2020. EEM14: 11th International Conference on the European Energy Market, Krakow, Poland

Udi J, Bekun FV, Adedoyin FF (2020) Modeling the nexus between coal consumption, FDI inflow and economic expansion: does industrialization matter in South Africa? Environ Sci Pollut Res 27:10553–10564

Verbič M, Satrovic E, Muslija A (2021) Environmental Kuznets curve in Southeastern Europe: the role of urbanization and energy consumption. Environ Sci Pollut Res 28:57807–57817

Wang S, Zhao T, Zheng H, Hu J (2017) The STIRPAT analysis on carbon emission in Chinese cities: an asymmetric Laplace distribution mixture model. Sustainability 9:2237

Westerlund J (2007) Testing for error correction in panel data. Oxford Bull Econ Stat 69(6):709–748

World Bank (2021) World development indicators. World Bank database. Accessed 16 Dec 2021

Yan D, Lei Y, Li L (2017) Driving factor analysis of carbon emissions in China’s power sector for low-carbon economy. Math Probl Eng 2017:4954217

Yildiz TD (2022) Are the compensations given to mining enterprises due to the overlapping with other investments in Turkey enough? Expectations of compensation for profit deprivation. Resour Policy 74:102507

Zhu C, Gao D (2019) A research on the factors influencing carbon emission of transportation industry in “the Belt and Road Initiative” countries based on panel data. Energies 12(12):2405

Acknowledgements

Not applicable.

Funding

Not applicable.

Author information

Authors and Affiliations

Contributions

MV: methodology, data analysis, writing, review and editing. ES: conceptualisation, data gathering, data analysis, writing, review and editing. AM: conceptualisation, data gathering, data analysis, writing, review and editing.

Corresponding author

Ethics declarations

Conflict of Interest

The authors declare that they have no competing interests.

Ethical Approval

Not applicable.

Consent for Publication

Not applicable.

Rights and permissions

Springer Nature or its licensor holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Verbič, M., Satrovic, E. & Mujtaba, A. Assessing the Driving Factors of Carbon Dioxide and Total Greenhouse Gas Emissions to Maintain Environmental Sustainability in Southeastern Europe. Int J Environ Res 16, 105 (2022). https://doi.org/10.1007/s41742-022-00486-7

Received:

Revised:

Accepted:

Published:

DOI: https://doi.org/10.1007/s41742-022-00486-7

Keywords

- Electricity consumption

- Financial development

- Openness to trade

- Pollutant emissions

- Population

- Southeastern Europe

- STIRPAT framework