Abstract

Economic expansion gives rise to modern and energy-efficient technologies and, thus, contributes to a decline in energy usage. Developing countries, including Pakistan, require tremendous efforts to sustain economic growth. However, to attain economic growth, these countries have to cope with greenhouse gas (GHG) emissions and other environmental problems. This research focuses primarily on the asymmetric impacts of energy consumption and economic growth on Pakistan’s environmental quality. Accordingly, secondary data spanning from 1971 to 2018 was used, and carbon dioxide emission (CO2) was considered a target variable (a proxy for environmental quality), whereas energy consumption (E) and gross domestic product (GDP) as a proxy for economic growth, and trade accessibility (TR) and foreign direct investment (FDI) as control variables. The nonlinear autoregressive distributed lag (NARDL) approach is used to verify the asymmetric co-integration between the variables selected. Moreover, to examine data stationarity and nonlinearity, we used the Zivot–Andrews structural break unit root and BDS tests, respectively. The findings confirmed the asymmetric and symmetric co-integrations among the considered variables. In addition, the causality analysis reveals that only negative shocks to TR have an effect on CO2 emissions. Similarly, negative shocks to FDI asymmetrically cause CO2 emissions. Meanwhile, GDP symmetrically affects CO2 emissions. Finally, a neutral causal response was observed between E and CO2 emissions. These findings have policy implications in terms of environmental management and carbon neutrality, and they serve as a baseline for future research.

Graphical Abstract

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

In the last few decades, demand for energy resources and other associated services to meet global societal and economic development needs has resulted in dramatic growth in greenhouse gas (GHG) emissions (Ahmad et al. 2011, 2019; Ajmi et al. 2015; IPCC 2011; Vasichenko et al. 2020). Carbon dioxide (CO2) is the most well-known contributor that considerably boosts greenhouse effects and contributes to climate change and global warming, accounting for nearly 75% of global GHG emissions (Crippa et al. 2019; Khan et al. 2019; Khan et al. 2021). Several studies have pointed out that the growth in CO2 emissions has been mainly driven by the combustion of fossil energy (two-thirds of global CO2 emissions) in support of human activities associated with economic growth and development (IPCC 2007; OECD 2011; Pao et al. 2012; Wang et al. 2018). Particularly, trade liberalization and the greater openness of trade have heterogeneous effects on CO2 emissions and may considerably cause environmental degradation (Afridi et al. 2019; Ansari et al. 2020; Jamel and Maktouf 2017; Khan and Zhao 2019; Lv and Xu 2019).

As a result, since the 1990s, both scholars and policymakers have been paying close attention to the growing interconnections between economic expansion and environmental degradation (Javid and Sharif 2016). The development of the environmental Kuznets curve by Grossman and Krueger (1991) prompted a large body of work on the environmental consequences of economic growth in various countries and regions around the world (Akbostancı et al. 2009; Bradford et al. 2000; Coondoo and Dinda 2008; Friedl and Getzner 2003). By and large, this literature mostly uses energy usage, economic progression and trade availability as explanatory and control variables to eliminate any specification bias (Shahbaz et al. 2013b). From a policy perspective, the Agenda 2030 and the sustainable development goals (SDGs) recognize the links between energy demands (SDG7), economic progress (SDG8), and the mitigation and adaptation to GHG emissions and climate change (SDG13). That is, achieving the SDGs in developing countries especially the ability of these countries to sustainably produce and consume energy resources achieves economic growth and protects the natural environment (Cui 2016; Saidi and Hammami 2015).

A rigorous examination of the present literature on energy consumption, economic growth, and environmental efficiency reveals three flaws. First, when it comes to emerging countries, there are few studies that focus solely on Latin America and the major Asian countries (e.g. India and China). Other developing countries in Asia and Africa, on the other hand, have received less attention (Arouri et al. 2012; Oh and Bhuyan 2018). Second, the research is characterized by regional-level assessments that employ higher aggregated levels of data, which ignores disparities in energy consumption patterns, income levels and economic growth rates across the countries analyzed. According to Shahbaz et al. (2013a), this explains the disparate outcomes and findings from these studies and supports the argument that the relationship between energy consumption, economic growth and CO2 emissions is country-specific. Third, according to the prior research, asymmetric and nonlinear econometric methodologies for environmental quality, economic development and energy consumption have not been examined in Pakistan to our knowledge.

Taking Pakistan as a case study, this paper aims to fill these gaps in the existing literature by examining empirically the causal links between endogenous and exogenous variables. Specifically, we employ the NARDL model proposed by Shin et al. (2014) and the causality test of Hatemi-j(2012) and Kim and Perron (2009) to analyze the relationships between energy consumption, economic growth, foreign investments, trade openness and CO2 emissions in Pakistan during 1971 and 2018. The logic behind our use of asymmetry and nonlinearity approaches is that the changes of one exogenous variable have no influence on another variable in the same way (Baz et al. 2019; Ozturk 2010; Shahbaz et al. 2017; Tugcu and Topcu 2018). The existence of nonlinear relationships among variables is affected by social, economic, political, financial and technological progress. These factors may cause positive or negative changes in exogenous variables, which may have a heterogeneous effect on the environment. Furthermore, using the unit root test, and Brock, Dechert and Scheinkman (or BDS) test allows us to (i) account for the integration order and unknown structural breaks, and (ii) capture prospective deviations from independence in data such as linear dependency, nonlinear dependency, or chaos (Kim and Perron 2009). The findings of this study are envisaged to help policymakers in Pakistan to upkeep modern and pollution-free technologies like renewable energy and green portfolio investment. Moreover, in order to maintain economic progress without worsening the environment, the government should focus and incorporate environmental quality matters thoroughly into their agendas for policy and fiscal reform.

Despite significant realistic economic growth in Pakistan, previous investigations have reported that energy consumption and carbon dioxide emissions have increased faster than economic growth. One key issue is determining how to manage the genuine relationship between energy consumption, economic growth and CO2 emissions. Researchers have previously used the ARDL model to assess the causal relationship between environmental degradation, energy consumption, economic growth and global trade growth (Javid and Sharif 2016; Nasir and Rehman 2011; Ozturk and Acaravci 2010, 2013; Shahbaz et al. 2012), but they have ignored the environmental impact of FDI. Therefore, this study contributes to the prevailing literature by employing the NARDL model to link FDI and other variables to environmental degradation in Pakistan. The current research also checked the existence of a threshold between per capita income and carbon dioxide emissions for the national economy over 1971–2018.

Methodology

Data

The secondary data obtained from BP Statistical Review of World Energy (2019) and World Development Indicators (WDI, 2019) was used for the current research to examine the nexus among carbon dioxide emission (kg per capita), per capita energy consumption, real GDP (Y) per capita (current US $), FDI (percent of GDP) and trade accessibility (percent of GDP) for time series annual data set spanning from 1971 to 2018 for Pakistan’s economy. The primary purpose of this study is to examine the significant impact of energy consumption, real GDP (Y), FDI and TR on environmental quality (CO2 emission). In addition, all parameters are transformed into appropriate logarithms to achieve accurate and reliable results (Shahbaz et al. 2017).

Model specification

The NARDL co-integration

Unforeseen and unpredictable incidents, such as financial and economic crises, political instability and revolutions, may lead to a lack of linear methods to consider the economic association between time series data. Accordingly, a multivariate NARDL model was employed in the present study to account for nonlinear asymmetric co-integration between the variables. NARDL methodology encompasses a dynamic model and permits us to differentiate between short and long-run asymmetries. The NARDL approach is more robust and advantageous over the Vector Error Correction Model (VECM) and other methods due to its nature of being free from integration order restriction (Apergis and Ozturk 2015). The other co-integration approaches can support only the integration order of 1 for variables, while the NARDL method is more reliable and common because of its versatility, it can be used irrespective of the nature of variables (Baz et al. 2019; Vasichenko et al. 2020). Empirically,

where αi and θi symbolize short-run and long-run coefficients, respectively. The long-run parameters here evaluate the adjustment toward the equilibrium, while the short-run asymmetries take the instantaneous effect into account. The Wald test was employed to analyze the null hypothesis for asymmetries in short-run (α = α+ = α−) and long-run asymmetries (θ = θ+ = θ−) for the given variables, i.e. Ct, Et, Yt, FDIt and TRt, which represents CO2 emission, energy consumption, per capita GDP, foreign direct investment and trade openness respectively. Where Dt is the dummy variable representing the structural break date (t). The Akaike information criterion (AIC) was applied to choose the optimal lag order for all considered variables. The exogenous variables are decomposed into a partial sum of positive and negative components as follows.

where xt represent the independent variables, i.e. Et, Yt, FDIt and TRt.

According to Shin et al. (2014), the bound test was applied to determine the long-term asymmetric co-integration which considers all the lagged levels of variables. The alternative hypothesis θ+ ≠ θ− ≠ 0 was tested against the null hypothesis θ+ = θ− = θ = 0. Rejecting the null hypothesis confirms the long-term association among the variables. The shocks, i.e. Lmi+ = θ+/ρ and Lmi− = θ−/ρ, were determined using the long-run asymmetries. The dynamic multiplier effects can be expressed as follows:

If h → ∞,\( {m}_h^{+}\to L{m}^{+}\mathrm{and}\ {m}_h^{-}\to L{m}^{-} \). It illustrates the asymmetric response of independent variables to positive and negative changes in the dependent variable.

Tests of asymmetric causalities

Hatemi-J (2012)’s causality test was employed regarding the direction of asymmetric causality. Furthermore, the Toda and Yamamoto (1995) test was used to assess nonlinear impacts and distinguish between positive shocks from negative shocks. According to Hatemi-j(2012), variables have a spontaneous walking cycle as shown below:

where t= 1, 2….T, Y0 and X0 denote the initial values, whereas e1t and e2t exemplify the residual terms. Moreover, \( {e}_{1i}^{+}=\operatorname{Max}\left({e}_{1i},0\right) \) and\( {e}_{2i}^{+}=\operatorname{Max}\left({e}_{2i},0\right) \) and \( {e}_{1i}^{-}=\operatorname{Min}\left({e}_{1i},0\right) \) and\( {e}_{2i}^{-}=\operatorname{Min}\left({e}_{2i},0\right) \) respectively symbolize the positive and negative shocks of parameters.

In an asymmetric context, the positive and negative shocks are given as follow:

In the present study, the accumulative form of both shocks is used as given below:

\( {C}_t^{+}=\sum \limits_{t=1}^t{e}_{1i}^{+},\kern0.5em {C}_t^{-}=\sum \limits_{t=1}^t{e}_{1i}^{-},\kern0.5em {\displaystyle \begin{array}{ccc}{E}_t^{+}=\sum \limits_{t=1}^t{e}_{2i}^{+},& {E}_t^{-}=\sum \limits_{t=1}^t{e}_{2i}^{-},& \begin{array}{cc}{Y}_t^{+}=\sum \limits_{t=1}^t{e}_{3i}^{+},& {Y}_t^{-}=\sum \limits_{t=1}^t{e}_{3i}^{-}\end{array}\end{array}} \)

The Hatemi-j(2003, 2008) criteria were used to choose the optimum lag order for the VAR model. For optimum lag selection, the HJC model was used as given below:

where ln denotes the natural log, |Aj| represents the variance-covariance matrix determinant of the residuals in the VAR model, while n denotes the number of variables, and ‘T’ represents the sample size.

Following the selection of the optimal lag order, we defined the null hypothesis of the kth dimension of y2, which does not cause the wthelement y1 in causality testing. The hypothesis will be tested under the Wald test (Hatemi-j 2012). H0: wth row, kth column in Ar is equal to zero for r= 1… p.

The null hypothesis can be expressed as \( {H}_0=C\hat{\beta}=0 \):

where β = vec(D) signifies column-stacking operator, while C represents p × n(1 + np) display matrix. ⨂ signifies the Kronecker product, and SU specifies the projected var-covariance matrix of the unobstructed VAR model as\( {S}_U=\frac{\overset{\acute{\mkern6mu}}{\delta_U}{\delta}_U}{T-q} \), in each equation of the VAR model, while q symbolizes the parameter numbers. The hypothesis may be dismissed if no causality has been established which is only reasonable if the estimated Wald statistic values fall beyond the relevant bootstrap values.

Results and discussion

Descriptive statistics

Table 1 demonstrates the descriptive statistics, while Fig. 1 illustrates the correlation among variables. These outcomes demonstrate that the mean values, median and standard deviations are uniform. Based on the Jarque–Bera normality test, all the selected variables are normally distributed and none of them is an outlier.

Unit root tests of stationary

In order to estimate and conduct the NARDL model, it is imperative to confirm that none of the variables is I(2). In this regard, the stationary tests of Dickey and Fuller (1979) and Phillips and Perron (1988) tests must be executed (Apergis and Ozturk 2015; Khan et al. 2021). In the NARDL model, the variables need to be of order I(0), I(1) or both (Shin et al. 2014). As shown in Table 2, the selected variables are non-stationary at I(0) linked with the trend and intercept, excepting trade openness, and became stationary at I(1) (ADF and PP tests). The previous study revealed that the traditional unit root tests may result in biased outcomes (Perron 1989). Since all unit root tests support stationary’s null hypothesis while structural break may exist in the series. Kim and Perron (Kim and Perron 2009) solved that problem by managing the structural break dates as illustrated in Table 2. In the proximity of systemic break date, the variables are noted as non-stationary during 2008, 2007, 2008, 2014 and 2009 for carbon dioxide emission, energy usage, economic expansion, trade openness and foreign investment, respectively. The inclusion of unit root in the variables allows for the application of the NARDL model to explore asymmetrical co-integration between environmental quality and exogenous variables (Jebli et al. 2016; Vasichenko et al. 2020).

The previous studies reported that the conventional PP and ADF unit root tests do not take it into consideration and have a low tendency to reject the null hypothesis in the presence of systemic break; hence, it provides biased outcomes (Baz et al. 2020; Vasichenko et al. 2020). The Zivot and Andrews approach (Zivot and Andrews 2002) is suggested in the proximity of unidentified structural breakpoint in data, which is based on three models, i.e. A, B and C, where model A, B and C allow one-time spontaneous variation in a variable at intercept, at trend, and both, respectively. Table 3 highlights the outcomes of the Zivot–Andrews test. The finding reveals that the considered variables are stationary at intercept. Moreover, all of the selected variables are also stationary at both trend and intercept except for carbon dioxide and trade openness.

Asymmetric co-integration and diagnostic tests

Table 4 displays the results obtained from the NARDL model. In order to select the best NARDL model, a general to specific approach was followed. The specific lag order selection helps to drop all the insignificant regressors, as the insignificance coefficient may lead to inaccuracies in the dynamic multiplier and provide incorrect estimation results (Baz et al. 2020; Baz et al. 2019). Table 4 illustrates the asymmetric co-integration among the variables. The null hypothesis for long and short-run discrepancies is rejected on the basis of the Wald test, representing that different shocks to independent variables will trigger a disparate influence on the dependent variable. The literature also revealed that positive and negative shocks in independent variables have heterogeneous impacts on dependent variables in short and long run (Ozturk et al. 2010; Shahbaz et al. 2012; Vasichenko et al. 2020). Overall results demonstrated in Table 4 are in favor of the NARDL model to express the dynamic association among variables. In any dynamic modeling, ignorance of asymmetries can lead to model misspecification.

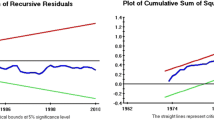

Table 4 also demonstrates the diagnostic tests of our study variables. Based on the results, all the diagnostic tests revealed that the null hypothesis regarding the presence of serial correlation, heteroscedasticity and inappropriate functional form (Ramsay Reset test) was rejected. The coefficient of R2 (0.9013) of the NARDL points out that energy consumption, per capita income, trade openness and foreign direct investment describe the speed of change to the environmental quality model equilibrium in a single equation, both in the long and short run. Moreover, Figs. 2 and 3 depict that the CUSUMSQ and CUSUM recursive residual statistics are within critical values at 5% significance, suggesting that the graphical plots of the sequence in the error correction model are stable. The Durbin Watson test (DW) statistics also indicate that the estimated model lacks autocorrelation.

On the basis of the BDS test, the null hypothesis of linearity is rejected, suggesting that all specified parameters are nonlinear, reflecting chaotic behavior in the regression results (Table 5). These results show the reliability and consistency of the variables and also confirm that the model is well designed. Notably, it is revealed that the proposed model of environmental quality is appropriate for policymaking.

Co-integration results

Table 6 gives an overview of both the long- and the short-term NARDL co-integration test. As demonstrated in Table 6, the results reported that both positive and negative shocks in energy have no significant effect on CO2 emission in the long run. In the context of the short run, a rise in the consumption of energy in the current period impacts negatively and substantially on CO2 emission (lag 0 with coefficient −0.833), while in the short run, a rise in the consumption of energy in the preceding year has a positive impact on CO2 emission (Coefficient 1.9924 at lag 1). In contrast, a decrease in energy consumption in the current year, as well as the previous 2 years of short run, is positively related to CO2 emissions, with coefficients of 1.7913, 3.6595 and 3.8487 at lags 0, 1 and 2, respectively. The increase in CO2 emissions as a result of any reduction in energy consumption suggests that energy may not be the sole factor responsible for CO2 emissions in Pakistan. For instance, the literature revealed that agricultural ecosystems pollute the environment through CO2 emission (Hongdou et al. 2018; Khan et al. 2018; Ullah et al. 2018); additionally, forest and renewable energy have a negative and significant effect on CO2 emissions (Waheed et al. 2018). Our results are in line with Luqman et al. (2019), Farhani and Ozturk (2015) and Nasir and Rehman (2011), who also reported that energy and CO2 emissions are positively associated with each other. From a policy point of view, the Pakistani government should minimize the consumption of energy or replace it with renewable energy to enhance the environment in the short run, which may have a significant impact on environmental quality in the long run.

The long-run connection of CO2 emissions and GDP discloses that a positive shock to GDP is non-significant, whereas a negative shock to GDP is significant with a negative coefficient. The significant coefficients of GDP− (−2.1536) demonstrate that a 1% decrease in GDP per capita will cause a reduction of 2.15% in CO2 emissions in the long run. Similarly, the short-run connection between GDP and CO2 emissions displays that any positive shock in GDP both in the present year and the last 2 years has a significant but negative effect on CO2 emissions with coefficients of −0.3009, −0.2165 and −0.1397 at lag 0, 1 and 2, respectively. Whereas negative shocks in per capita GDP in the present year are positively correlated, while that of the previous year is negatively associated with the emission of CO2 in the short run. The negative shocks to energy consumption decrease the long-term increase in economic activities, which would ultimately reduce the long-term CO2 emissions, which could have a positive environmental effect. Zafar et al. (2019) also revealed that economic expansion has long-term environmental stewardship consequences.

Moreover, the coefficient of trade openness, in the long run, is statistically non-significant for positive shock, while for negative shock, it is positively significant. The positive and significant coefficients (negative shocks) of trade openness reveal that a 1% fall in trade, in the long run, leads to a 0.26% increase in CO2 emissions. In the short-run context, a positive shock to trade openness in the present period is positive and significantly related to carbon dioxide emission in the very short run (coefficient 5.7164 at lag 0). Besides, we discovered that trade openness (a negative shock) in the previous year is positively related (coefficient 3.9130 at lag 1), whereas that shock of the previous 2 years is negatively associated with CO2 emission in the current period (−2.8414, Lag 2).

The long-run coefficients of foreign direct investment reveal that both shocks (positive and negative) to FDI are significant and positively related to carbon dioxide emission in Pakistan. The positive and significant coefficients of FDI show that a 1% fall (rise) in FDI leads to a 0.14% (0.09%) decrease (increase) in CO2 emission in the long run, suggesting that negative shocks in FDI transmitted to CO2 emission with higher intensity compared to positive shocks. Notably, the contribution of negative shocks to FDI in CO2 emission is 4.58 percentage points higher than that of a positive one. Meanwhile, the short-run relationship between carbon dioxide emission and foreign direct investment, as shown in Table 6, shows that a positive shock to FDI in the current period is positively associated with carbon dioxide emission, while a negative shock is negatively associated, implying that a 1% increase (decrease) in FDI will result in a 0.13% (0.04%) increase (decrease) in CO2 emission. Furthermore, the short-run coefficients of positive shocks in FDI during the previous period were −0.0637, −0.0532 and −0.1177 at lags 1, 2 and 3, respectively, whereas the coefficients of negative shocks to FDI are −0.0648, 0.1324 and 0.0904 at lags 1, 2 and 3, respectively.

Finally, we retrieved the selected variables from dynamic multiplier adjustments. Figure 4 displays the accumulated energy consumption multiplier, which supports the presence of a positive correlation between energy consumption and environmental degradation. Initially, negative energy shocks are more prevalent than positive shocks, while in lateral cases the positive shocks become dominant over the negative shocks. Moreover, as illustrated in Fig. 5, the negative shocks in economic progression (per capita GDP) are more dominant and have a negative relationship with carbon dioxide emissions, which suggests that a decrease in per capita GDP will have a positive impact on environmental quality. Similarly, Fig. 6 illustrates the dynamic multiplier effect of trade openness on the environment (CO2 emission). As depicted in Fig. 6, the positive shocks in trade openness show an adverse effect on the environment (positive impact on carbon dioxide emission). Nevertheless, negative shocks in trade openness have a distinctive illustration and do not exhibit a positive or negative influence on environmental quality. Finally, Fig. 7 demonstrates that a positive association exists between FDI and ecological degradation in terms of carbon dioxide emission.

Granger causality analysis

Table 7 displays the results of the symmetric and asymmetric bootstrap causalities test of Hatemi-j(2012). As demonstrated, a unidirectional and significant symmetric causality occurs running from CO2 to energy use. The asymmetric connection between CO2 emission and energy consumption demonstrates that a positive shock in CO2 emission may cause a positive shock in energy consumption. In contrast, there was a neutral causal effect from energy toward CO2 emission, both in symmetric and asymmetric cases. The findings of Ajmi et al. (2015) and Javid and Sharif (2016) illustrated that a synchronous causality (bidirectional) exists between emissions of CO2 and energy use, whereas the study of Saboori and Sulaiman (2013) reported that energy consumption increases the emission of CO2 over time.

The symmetric and asymmetric connections concerning CO2 emission and economic growth were not significant at any level of significance. Both symmetric and asymmetric links were found to be neutral in CO2 emission and economic progression. The previous studies also publicized no causal connection between environmental quality and economic expansion (Kasman and Duman 2015; Wang et al. 2016). Meanwhile, regarding the symmetric and asymmetric association between economic expansion and CO2 emission, a significant symmetric causal relationship exists moving from economic progression toward CO2 emission. However, a neutral asymmetric causal association was found between economic growth and CO2 emissions. The literature publicized that economic growth increases the emission of CO2(Shahbaz et al. 2013a).

Moreover, in CO2 and trade openness, the symmetric and asymmetric causal relationship confirms a significant symmetric causal relationship (Wald test 8.289 at 5%) running from CO2 emission toward trade openness. The findings of Afridi et al. (2019), Lv and Xu (2019) and Mai et al. (2019) also confirm a causal association of CO2 emission and trade openness. The results illustrated in Table 7 further report that there is no evidence of an association between positive and negative shocks. In contrast, the symmetric causal relationships and asymmetric causal relationships of positive shocks in trade openness and carbon dioxide were not significant. Whereas the asymmetric causal effect between negative shock in trade openness and carbon dioxide is significant (Wald test 5.303 at 10%). Our results are consistent with Shahbaz et al. (2013a, b).

Finally, a neutral symmetric and asymmetric effect was found amid CO2 emission and FDI. Based on our findings, the null hypothesis about no causality is accepted, which means that CO2 emission has no effect on foreign direct investment. Meanwhile, the findings reveal that a unidirectional symmetric causal effect running from FDI toward CO2 emission is significant (Wald test 5.847 at 5%), while the asymmetric relationship of both shocks between FDI and CO2 emission is non-significant.

Conclusion and policy implication

Emerging economies, including Pakistan, must make significant efforts to enhance the environment and save resources and energy in order to achieve sustainable economic growth. Despite a significant improvement in economic growth, Pakistan’s energy consumption and carbon dioxide emissions have increased at a faster rate than the country’s economic growth. How to rightfully hold the relationship between the selected endogenous and exogenous variables is a considerable challenge. Accordingly, the key purpose of this study is to explore the correlation between carbon dioxide emissions, energy usage, economic expansion, trade openness and foreign direct investment in Pakistan by employing data sets from 1971 to 2018. In this research paper, the asymmetric connection among the designated parameters was investigated through the NARDL co-integration technique formulated by Shin et al. (2014), while the asymmetric causal association was examined by Hatemi-j(2012). The outcomes confirm the existence of asymmetric co-integrations among the variables.

The symmetric and asymmetric causalities demonstrate that CO2 emissions and energy consumption have a very significant symmetric causation. However, their asymmetric causality demonstrates that any positive shock in CO2 emissions may have a positive influence on energy consumption. In contrast, there was a neutral causal effect between energy usage and CO2 emissions, both in symmetric and asymmetric cases. Furthermore, both symmetric and asymmetric relationships between CO2 emissions and economic growth were determined to be neutral. Meanwhile, economic expansion and CO2 have a large symmetric causal relationship, implying that a one-point rise in per capita economic growth will increase emissions in the country. Furthermore, a symmetric causal link between CO2 and trade openness was observed (Wald test 8.289 at 5%). In contrast, an asymmetric causal effect was detected between the negative shock in trade openness and CO2 emissions (Wald test 5.303 at 10%). Finally, a neutral effect was found between CO2 emissions and FDI. Based on the findings, the null hypothesis of no causality running from CO2 emissions to foreign direct investment is accepted, which means that CO2 emissions have no effect on foreign direct investment. In contrast, there is a strong unidirectional symmetric causal effect (Wald test 5.847 at 5%) running from foreign direct investment to CO2 emissions, implying that increasing foreign direct investment in Pakistan may result in increased CO2 emissions.

Some key policy implications have developed as a result of the research. In particular, Pakistan’s government should encourage foreign direct investment, notably in renewable energy and low-carbon technologies, as well as the adoption of green technology in agriculture, which would not only assist to lower the country’s trade deficit but also enhance the environment. The current study’s conclusions could help policymakers formulate ecologically friendly monetary and fiscal strategies.

Availability of data and materials

N/A

References

Afridi MA, Kehelwalatenna S, Naseem I, Tahir M (2019) Per capita income, trade openness, urbanization, energy consumption, and CO2 emissions: an empirical study on the SAARC Region. Environ Sci Pollut Res 26:29978–29990

Ahmad A, Yasin NM, Derek C, Lim J (2011) Microalgae as a sustainable energy source for biodiesel production: a review. Renew Sust Energ Rev 15:584–593

Ahmad N, Du L, Tian X-L, Wang J (2019) Chinese growth and dilemmas: modelling energy consumption, CO 2 emissions and growth in China. Qual Quant 53:315–338

Ajmi AN, Hammoudeh S, Nguyen DK, Sato JR (2015) On the relationships between CO2 emissions, energy consumption and income: the importance of time variation. Energy Econ 49:629–638

Akbostancı E, Türüt-Aşık S, Tunç Gİ (2009) The relationship between income and environment in Turkey: is there an environmental Kuznets curve? Energy Policy 37:861–867

Ansari MA, Haider S, Khan NA (2020) Does trade openness affects global carbon dioxide emissions: evidence from the top CO2 emitters. Manag Environ Qual 31:32–53

Apergis N, Ozturk I (2015) Testing environmental Kuznets curve hypothesis in Asian countries. Ecol Indic 52:16–22

Arouri MEH, Youssef AB, M'henni H, Rault C (2012) Energy consumption, economic growth and CO2 emissions in Middle East and North African countries. Energy Policy 45:342–349

Baz K, Xu D, Ampofo GMK, Ali I, Khan I, Cheng J, Ali H (2019) Energy consumption and economic growth nexus: new evidence from Pakistan using asymmetric analysis. Energy 189:116254

Baz K, Xu D, Ali H, Ali I, Khan I, Khan MM, Cheng J (2020) Asymmetric impact of energy consumption and economic growth on ecological footprint: using asymmetric and nonlinear approach. Sci Total Environ 718:137364

BP plc (2019) BP Statistical Review of World Energy 2019.https://www.bp.com/en/global/corporate/energy-economics/statistical-review-of-world-energy.html

Bradford DF, Schlieckert R, Shore S (2000) The environmental Kuznets curve: exploring a fresh specification

Coondoo D, Dinda S (2008) Carbon dioxide emission and income: a temporal analysis of cross-country distributional patterns. Ecol Econ 65:375–385

Crippa M, Oreggioni G, Guizzardi D, Muntean M, Schaaf E, Lo Vullo E, Solazzo E, Monforti-Ferrario F, Olivier J, Vignati E (2019) Fossil CO2 and GHG emissions of all world countries. Publication Office of the European Union, Luxemburg

Cui H (2016) China’s economic growth and energy consumption. Int J Energy Econ Policy 6:349–355

Dickey DA, Fuller WA (1979) Distribution of the estimators for autoregressive time series with a unit root. J Am Stat Assoc 74:427–431

Farhani S, Ozturk I (2015) Causal relationship between CO 2 emissions, real GDP, energy consumption, financial development, trade openness, and urbanization in Tunisia. Environ Sci Pollut Res 22:15663–15676

Friedl B, Getzner M (2003) Determinants of CO2 emissions in a small open economy. Ecol Econ 45:133–148

Grossman GM, Krueger AB (1993) Environmental impacts of a North American Free Trade Agreement1. Garber P. (éd.), The US-Mexico Free Trade Agreement, MIT Press, Cambridge, MA, 1655177

Hatemi-j A (2003) A new method to choose optimal lag order in stable and unstable VAR models. Appl Econ Lett 10:135–137

Hatemi-J A (2008) Forecasting properties of a new method to determine optimal lag order in stable and unstable VAR models. Appl Econ Lett 15:239–243

Hatemi-j A (2012) Asymmetric causality tests with an application. Empir Econ 43:447–456

Hongdou L, Shiping L, Hao L (2018) Existing agricultural ecosystem in China leads to environmental pollution: an econometric approach. Environ Sci Pollut Res 25:24488–24499

IPCC CC (2007) Impacts, adaptation and vulnerability. contribution of working group II to the fourth assessment report of the intergovernmental panel on climate change. In: Intergovernmental Panel on Climate Change (IPCC). Cambridge University Press, New York

IPCC CC (2011) IPCC special report on renewable energy sources and climate change mitigation

Jamel L, Maktouf S (2017) The nexus between economic growth, financial development, trade openness, and CO2 emissions in European countries. Cogent Econ Finance 5

Javid M, Sharif F (2016) Environmental Kuznets curve and financial development in Pakistan. Renew Sust Energ Rev 54:406–414

Jebli MB, Youssef SB, Ozturk I (2016) Testing environmental Kuznets curve hypothesis: the role of renewable and non-renewable energy consumption and trade in OECD countries. Ecol Indic 60:824–831

Kasman A, Duman YS (2015) CO2 emissions, economic growth, energy consumption, trade and urbanization in new EU member and candidate countries: a panel data analysis. Econ Model 44:97–103

Khan I, Zhao M (2019) Water resource management and public preferences for water ecosystem services: a choice experiment approach for inland river basin management. Sci Total Environ 646:821–831

Khan I, Zhao M, Khan SU (2018) Ecological degradation of an inland river basin and an evaluation of the spatial and distance effect on willingness to pay for its improvement. Environ Sci Pollut Res 25:31474–31485

Khan I, Javed T, Khan A, Lei H, Muhammad I, Ali I, Huo X (2019) Impact assessment of land use change on surface temperature and agricultural productivity in Peshawar-Pakistan. Environ Sci Pollut Res 26:33076–33085

Khan I, Rehman FU, Pypłacz P, Khan MA, Wiśniewska A, Liczmańska-Kopcewicz K (2021) A dynamic linkage between financial development, energy consumption and economic growth: evidence from an asymmetric and nonlinear ARDL model. Energies 14:5006

Kim D, Perron P (2009) Unit root tests allowing for a break in the trend function at an unknown time under both the null and alternative hypotheses. J Econ 148:1–13

Luqman M, Ahmad N, Bakhsh K (2019) Nuclear energy, renewable energy and economic growth in Pakistan: Evidence from non-linear autoregressive distributed lag model. Renew Energy 139:1299–1309

Lv Z, Xu T (2019) Trade openness, urbanization and CO2 emissions: dynamic panel data analysis of middle-income countries. J Int Trade Econ Dev 28:317–330

Mai LTT, Kimtaegi, Anh LH (2019) The effects of trade openness on CO2 emissions in Vietnam. J Int Trade Commer 15:153–163

Nasir M, Rehman FU (2011) Environmental Kuznets curve for carbon emissions in Pakistan: an empirical investigation. Energy Policy 39:1857–1864

OECD (2011) OECD MRL calculator: spreadsheet for single data set and spreadsheet for multiple data set, 2 March 2011

Oh K-Y, Bhuyan MI (2018) Trade openness and CO 2 emissions: evidence of Bangladesh. Asian J Atmos Environ (AJAE) 12:30–36

Ozturk I (2010) A literature survey on energy–growth nexus. Energy Policy 38:340–349

Ozturk I, Acaravci A (2010) CO2 emissions, energy consumption and economic growth in Turkey. Renew Sust Energ Rev 14:3220–3225

Ozturk I, Acaravci A (2013) The long-run and causal analysis of energy, growth, openness and financial development on carbon emissions in Turkey. Energy Econ 36:262–267

Ozturk I, Aslan A, Kalyoncu H (2010) Energy consumption and economic growth relationship: evidence from panel data for low and middle income countries. Energy Policy 38:4422–4428

Pao H-T, Fu H-C, Tseng C-L(2012) Forecasting of CO2 emissions, energy consumption and economic growth in China using an improved grey model. Energy 40:400–409

Perron P (1989) The great crash, the oil price shock, and the unit root hypothesis. Econometrica: Journal of the Econometric Society 57:1361–1401

Phillips PC, Perron P (1988) Testing for a unit root in time series regression. Biometrika 75:335–346

Saboori B, Sulaiman J (2013) CO2 emissions, energy consumption and economic growth in Association of Southeast Asian Nations (ASEAN) countries: a cointegration approach. Energy 55:813–822

Saidi K, Hammami S (2015) The impact of CO2 emissions and economic growth on energy consumption in 58 countries. Energy Rep 1:62–70

Shahbaz M, Lean HH, Shabbir MS (2012) Environmental Kuznets curve hypothesis in Pakistan: cointegration and Granger causality. Renew Sust Energ Rev 16:2947–2953

Shahbaz M, Hye QMA, Tiwari AK, Leitão NC (2013a) Economic growth, energy consumption, financial development, international trade and CO2 emissions in Indonesia. Renew Sust Energ Rev 25:109–121

Shahbaz M, Tiwari AK, Nasir M (2013b) The effects of financial development, economic growth, coal consumption and trade openness on CO2 emissions in South Africa. Energy Policy 61:1452–1459

Shahbaz M, Hoang THV, Mahalik MK, Roubaud D (2017) Energy consumption, financial development and economic growth in India: new evidence from a nonlinear and asymmetric analysis ☆. Energy Econ 66:199–212

Shin Y, Yu B, Greenwood-Nimmo M (2014) Modelling asymmetric cointegration and dynamic multipliers in an ARDL framework. In: Festschrift in Honor of Peter Schmidt. Springer Science and Business Media, New York

Toda HY, Yamamoto T (1995) Statistical inference in vector autoregressions with possibly integrated processes. J Econ 66(1–2):225–250. https://doi.org/10.1016/0304-4076(94)01616-8

Tugcu CT, Topcu M (2018) Total, renewable and non-renewable energy consumption and economic growth: revisiting the issue with an asymmetric point of view. Energy 152:64–74

Ullah A, Khan D, Khan I, Zheng S (2018) Does agricultural ecosystem cause environmental pollution in Pakistan? Promise and menace. Environ Sci Pollut Res 25:13938–13955

Vasichenko K, Khan I, Wang Z (2020) Symmetric and asymmetric effect of energy consumption and CO2 intensity on environmental quality: using nonlinear and asymmetric approach. Environ Sci Pollut Res Int 27:32809–32819

Waheed R, Chang D, Sarwar S, Chen W (2018) Forest, agriculture, renewable energy, and CO2 emission. J Clean Prod 172:4231–4238

Wang S, Li Q, Fang C, Zhou C (2016) The relationship between economic growth, energy consumption, and CO 2 emissions: empirical evidence from China. Sci Total Environ 542:360–371

Wang S, Li G, Fang C (2018) Urbanization, economic growth, energy consumption, and CO2 emissions: empirical evidence from countries with different income levels. Renew Sust Energ Rev 81:2144–2159

World Bank (2019) World development indicators 2019. Accessed at https://data.worldbank.org/indicator?tab=all

Zafar MW, Zaidi SAH, Khan NR, Mirza FM, Hou F, Kirmani SAA (2019) The impact of natural resources, human capital, and foreign direct investment on the ecological footprint: the case of the United States. Res Policy 63:101428

Zivot E, Andrews DWK (2002) Further evidence on the great crash, the oil-price shock, and the unit-root hypothesis. J Bus Econ Stat 20:25–44

Author information

Authors and Affiliations

Contributions

IK and HL conceived and designed the research. IK, HL and AAS analyzed the data and wrote the paper. IK, MAK, KB and AAH proofread, edited and revised the paper.

Corresponding author

Ethics declarations

Ethics approval and consent of participate

N/A

Consent for publication

N/A

Competing interest

The authors declare no competing interests.

Additional information

Responsible Editor: Ilhan Ozturk

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Khan, I., Lei, H., Shah, A.A. et al. Environmental quality and the asymmetrical nonlinear consequences of energy consumption, trade openness and economic development: prospects for environmental management and carbon neutrality. Environ Sci Pollut Res 29, 14654–14664 (2022). https://doi.org/10.1007/s11356-021-16612-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-021-16612-5