Abstract

The present study uses both carbon dioxide emission and ecological footprints as proxies for environmental degradation to examine the environmental Kuznets curve hypothesis for the top three emitters from Asia, i.e., China, India, and Japan. To this end, the autoregressive distributed lag model for time series and panel estimation is used for a period spanning over 1980–2016. For carbon dioxide emission, China presents an inverted-U shape of the environmental Kuznets curve, while a U-shape relationship is found for India and Japan. Similarly, when the hypothesis is tested with the ecological footprint, Japan offers an inverted U-shape and U-shaped association is detected for China and India. The panel analysis indicates the existence of the environmental Kuznets curve with both proxies of environmental degradation. Besides, human capital and renewable energy promote environmental sustainability, while non-renewable energy use hinders environmental quality. The findings of this study suggest that in order to meet the combined goals of economic growth and environmental protection, the three economies, i.e., China, India, and Japan, should employ renewable energy–enabled technology.

Graphical abstract

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

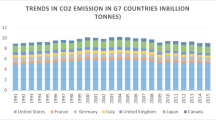

Studies to date have aspired to ascertain the association between economic growth and environmental quality (Razzaq et al. 2021a, 2021b; Murshed 2020; Mehmood and Tariq 2020; Ahmad et al. 2021; Adeel-Farooq et al. 2020; Mujtaba et al. (2022b); Verbič et al. 2021; Adeleye et al. 2021a; An et al. 2021; Usama et al. 2015; Zhuang et al. 2021; Eregha et al. 2021; Abul and Satrovic 2022; Li et al. 2022). The graphical illustration of such a relationship usually takes an inverted U-shape, popularly known as the environmental Kuznets curve (EKC). There have been considerable economic growth and improvement in the quality of life in the last few decades, which has boosted energy consumption (fossil fuels especially). Efforts of governments worldwide thrive on energy efficiency, energy conservation, and capacity building in renewable energy. Still, fossil fuels stand as the supreme energy source constituting 79.68% of the total energy use in 2015 (World Bank 2020).

The United Nations Framework Convention on Climate Change (UNFCCC) directed a protocol in Kyoto, Japan, in 1992 where 160 countries advised the developed countries to reduce emissions by 5.2% below the 1990 levels by 2008–2012. The primary goal of the convention was to stabilize greenhouse gas concentrations in the atmosphere through technological advancements in the energy sector, regular energy audits, incentives for solar energy, and the use of compressed natural gas (CNG) in vehicles. The developed countries launched the Clean Development Mechanism (CDM), in which they invest in technologies that reduce GHG emissions in developing countries. However, the Kyoto Protocol was a failure because the USA, the most industrialized country and a major contributor of releasing emissions, did not approve the Kyoto Protocol’s agreements. Furthermore, large developing nations such as China and India were not bound by the protocol, which did not reduce emissions by 1990 levels. Despite signing the Kyoto Protocol in August 2002, India’s share of global energy–related CO2 emissions was only 2% from 1990 to 2005 (IEA 2007). India believes that the developed world bears a greater responsibility to reduce emissions. However, Western nations exerted pressure on India and China to reduce greenhouse gas (GHG) emissions as industrialization, urbanization, and economic growth increased.

Accordingly, the world has also experienced enormous environmental challenges. Regardless of the extensive empirical studies, prevailing literature has concentrated on adopting carbon dioxide emissions to substitute for environmental deterioration. As opposed to carbon dioxide emissions that represent only air pollution, the ecological footprint that measures human pressure on the environment is recognized as a universal indicator of environmental depletion (Wang et al. 2013; Al-Mulali et al. 2015; Gormus and Aydin 2020; Ahmad et al. 2020). In a recent study, Razzaq et al. (2021c) implemented consumption-based material footprint which accurately represents the domestic material footprint. This study found that economic growth, globalization, and population increase the material-footprint in the top eleven material-consuming countries. Thus, the ecological footprint presents a positive indicator of environmental degradation. Subsequently, our study uses two proxies of environmental degradation, carbon dioxide emissions and ecological footprint, to give a more comprehensive exploration of the legitimacy of the EKC theory.

The environmental Kuznets curve (1955) theory’s legitimacy exclusively for the top three emitters from Asia was not investigated intensively in recent decades. This study’s primary motivation is that China, India, and Japan represent the top three emitters and the three largest economies in Asia. Besides, China and India are two booming economies today, but both are undergoing severe environmental challenges. The dramatic rise of fossil fuel energy consumption currently has a profound influence on the energy market. On the other hand, Japan is a developed country with full access to electrical energy and notably mediocre provision of fossil fuels. Growing energy intake causes some discouraging challenges related to the security of the fossil fuel supply. Fossil fuel supply and energy security are the most critical issues in all three countries (Sovacool and Vivoda, 2015). With a rapid increase of industrialization in large cities and modernization, air pollution and environmental depletion have been intensified in the last few decades in the inspected countries. Given the critical pollution level in cities like Beijing and New Delhi and the Japanese push to decarbonize its economy, the study examines EKC theory’s legitimacy by using carbon dioxide emissions and ecological footprint as indicators of environmental damage. The study also manifests the imprints of different types of energy on the environment more distinctly.

With the above background, this study investigates the dynamic impacts of economic growth, human capital, renewable and non-renewable energy use on environmental degradation based on the EKC hypothesis. The objectives of this study are twofold. First, contrary to the existing studies, our research introduces ecological footprint as a representative of the environmental deterioration to examine the robustness of the inverted U-shaped relationship between economic growth and environmental pollution. Second, to determine whether empirical findings are homogeneous across all countries in the study. We also hypothesized the validity of the EKC theory for both ecological footprint and carbon dioxide emissions. The evidence on the inverted U-shaped relationship between economic output and environmental quality decline support our hypothesis, implicating that environmental degradation declines after attaining a certain threshold level of income. The time series autoregressive distributed lag (ARDL) cointegration approach is applied to probe the hypothesis empirically. Addressing that panel data are more informative, the empirical part also uses the panel ARDL model to scrutinize the EKC hypothesis’s legitimacy for both indicators of environmental degradation.

This study is one of the few existing papers investigating the validity of EKC theory for both ecological footprint and carbon dioxide emissions exclusively for the top three emitters from Asia. Secondly, as far as we know, no earlier paper has examined the validity of EKC theory controlling for different types of energy and human capital in the context of inspected countries. Just as importantly, quite a few of the existing papers utilize both panel and individual country-specific examinations to support the inverted U-shaped relationship between economic output and environmental degradation. Exclusively, this study adopted the second-generational panel estimation techniques, which give more robust results compared to the first-generational panel estimation techniques. Traditional cointegration techniques produce misleading results when there is cross-sectional dependence in the series, which is common in first-generational panel studies. In the presence of cross-sectional dependence, however, the Westerlund panel cointegration technique is appropriate (Westerlund 2007). Furthermore, existing studies ignore the significance of structural breaks in time series data, which makes the results misleading; however, this study takes structural breaks into account by employing the structural breaks unit root tests. Therefore, these innovations differentiate this study from the prevailing studies.

The rest of the study is as follows: the “Review of literature” section presents a review of the existing literature; the “Research model, materials, and methods” section describes the data and methodology and the “Results and discussions” section presents the empirical findings and discussions. Finally, the “Conclusions and policy implications” section provides concluding remarks, policy implications, and scope for further inquiry.

Review of literature

Innumerable literature is available to validate the EKC hypothesis for developed as well as developing economies. As discussed in the introduction, the EKC hypothesis is tested using either CO2 emission or environmental footprint (EFP) as a proxy for environmental degradation. Similarly, existing studies do not differentiate between energy sources, whether renewable or non-renewable. Besides, human capital as one of the determinants of environmental degradation is less explored in the literature. Therefore, we broadly categorize the existing literature on two sub-heads; one is related to validating the EKC hypothesis; second, it relates to finding the determinants of environmental degradation.

Literature related to testing of the EKC hypothesis

Many studies tested for the existence of an inverted U-shaped environmental Kuznets curve and arrived at different results. Ang (2007) and Gozgor (2017) validated the hypothesized shape of the environmental Kuznets curve for France and 35 OECD countries, respectively. However, several studies concluded the U-shape of the environmental Kuznets curve. Dogan and Turkekul (2016) used the ARDL bound tests to analyze the association between CO2, real output, energy consumption, trade, and financial development in USA. In addition, the study tries to address the omitted-variable bias problem. Sapkota and Bastola (2017) have used the dynamic panel model to test the pollution haven hypothesis and the EKC hypothesis for 14 Latin American countries. They included many macroeconomic variables to avoid omitted variable bias as well as the paper examines the endogeneity problem. Studies also used methane emission as proxy for environmental pollution and tested the EKC hypothesis for the ASEAN countries using mean group and pooled mean group estimators (Adeel-Farooq et al. 2020).

Some existing literature found an ever-increasing slope of the environmental Kuznets curve. Tutulmaz (2015) tested the EKC hypothesis for Turkey and concluded only a first-phase of EKC curve. Importantly, the author tried to address the difference in results on EKC validity, and prescribes a non-restrictive estimation to avoid sensitivity bias in cointegration estimates. Another study emphasizes the fact that EKC growth requires large resource and it includes both environmental and human cost. For the poor nations, it becomes almost impossible to govern the environment; and thus EKC will be ever-increasing (Gill et al. 2018). Shahbaz et al. (2015) validate the inverted U-shaped EKC for the panel of 12 African countries in the long run. However, the energy intensity of growth demands optimal use of alternative energy for the African nations. Similar inverted U-shaped EKC is reported for Indonesia using ARDL bound tests (Sugiawan and Managi 2016). The research reiterates the importance of efficient energy policy and renewable energy sources. Dong et al. (2016) used the multi-regional input–output model and dynamic panel models to conclude a linearly increasing consumption-based EKC. One important implication of the study is to recognize the embedded emission in exports and internationally traded goods and services.

It is also understood that human activity in nature is not limited to air pollution instead, they are multi-dimensional (Wackernagel et al. 2002). Thus, adopting a diverse path, many studies used ecological footprint instead of CO2 emission as a proxy for environmental degradation (Charfeddine 2017; Dogan et al. 2019; Ahmed and Wang 2019; Acar and Asici 2017; Adeleye et al. 2021b). Danish et al. (2019) used the Bayer-Hanck cointegration tests and VECM Granger causality to examine the association between ecological footprints and GDP growth, human capital growth, and urbanization in Pakistan. The study reports an adverse effect of GDP growth on ecological footprints. However, other studies reported the existence of EKC in Pakistan as the ecological footprints first increased and later it decreased (Hassan et al. 2019a). Nathaniel et al. (2019) studied the energy-environment nexus for South Africa, one of the largest economies in Africa, using the Bayer-Hanck cointegration technique. The authors reported the detrimental effect of economic growth, energy consumption, urbanization, and financial development on ecological footprints. In another study, energy consumption, GDP growth, and urbanization in Indonesia had a negative impact on the environment in both short run and long run, while trade became harmless in long run for Indonesia (Nathaniel 2020).

Al-Mulali et al. (2014) tested the EKC for a panel of 93 economies classified into four groups based on income using fixed effect and GMM. The EKC relationship is reported only for the high- and upper-middle-income countries. Similarly, the inverted U-shaped relationship was validated for the MENA countries and oil-exporting MENA countries from 1975 to 2007 (Charfeddine and Mrabet 2017). Moreover, they found a U-shaped relationship between ecological footprints and economic growth in the non-oil-exporting MENA countries. York et al. (2004) also arrived at similar results where they found the validity of EKC for developed countries only out of the 141 countries included in the study. Another study on the BRICS countries confirmed inverted U-shaped EKC and also a negative effect on natural resources, renewable energy consumption, and urbanization of ecological footprints (Danish et al. 2020).

Many studies concluded the non-existence of EKC for their respective sample country. Mrabet et al. (2017) reported no EKC for the Qatar economy. Even in the studies including country panels, researchers nullified the validity of EKC (Wang et al. 2013; Dogan et al. 2020). Besides, many studies found a positive monotonically increasing EKC curve for different economies (Uddin et al. 2016; Ahmed and Wang 2019). Thus, from this brief review of existing literature, it can be inferred that the validity of EKC depends on the sample countries of the study. Significant evidence is that for the developed countries, the EKC hypothesis was valid irrespective of the choice of variables representing environmental degradation and methods; however, the theory was falsified in poor and low-middle-income countries.

Literature related to determinants of environmental degradation

The second part of the survey is related to the identification of determinants of environmental degradation and the channel of their operations. From the study of existing literature, we found energy consumption as the primary cause of environmental degradation. A positive association was estimated between energy consumption and CO2 emission (Apergis and Payne 2009; Halicioglu 2009; Zhang and Cheng 2009; Huskic and Satrovic 2020). Can and Gozgor (2017) examined the effects of energy consumption and economic complexity on CO2 emission in France, and validated the EKC hypothesis. Studies reported that economic growth has inverted U-shaped EKC association with environmental degradation in India. Furthermore, positive energy consumption and asymmetric shocks on oil prices also influence CO2 emission (Mujtaba and Jena 2021).

For the panel of 25 upper-middle-income countries, Mujtaba et al. (2020) reported the validity of EKC hypothesis and technique effect of trade openness on the environment. The study also reported energy consumption and population contributed positively to environmental degradation. Similarly, results were reported for the seven Asian economies (Mujtaba et al. 2021). In contrast, an adverse but insignificant impact of energy consumption was detected for 36 OECD countries (Chen et al. 2020). Renewable energy consumption contributed less to CO2 emission than fossil energy consumption, and thus, shifting to alternative energy sources helps prevent GHG emissions in European countries (Boluk and Mert 2014). The authors found results supporting the use of renewable energy sources in Turkey (Boluk and Mert 2015). Several studies concluded that non-renewable energy sources were detrimental to environmental quality when proxied by CO2 emissions (Ahmed et al. 2019; Bekun et al. 2019). Dogan et al. (2019) found that fossil fuel, trade, financial development, and urbanization are detrimental to ecological footprints in MINT nations.

Many other studies reported the deteriorating effect of non-renewable energy use on ecological footprints (Destek and Sarkodie 2019; Ma et al. 2019; Ghazali and Ali 2019; Nathaniel and Bekun 2019). Nathaniel et al. (2020a) studied the differentiated effect of renewable and non-renewable energy consumption on the ecological footprints using an augmented mean group algorithm and Westerlund cointegration for 13 MENA countries. A similar study was also published for the CIVETS countries (Nathaniel et al. 2020b). However, the conclusions from both studies are different. For the MENA countries, renewable energy consumption had not contributed to ecological footprints, while it reduced environmental degradation in CIVETS countries. Furthermore, urbanization and non-renewable energy consumption deteriorate the environment in both MENA and CIVETS countries. Nathaniel and Adeleye (2021) applied the panel-corrected standard errors (PCSE), spatial correlation consistent standard errors (PSCC), and system GMM to 44 African nations. The study reported growth in urban population, energy consumption, per capita income, and financial development were the main significant determinants of ecological footprints and CO2 emission. To summarize, a consensus on the detrimental effects of non-renewable energy consumption on the environment is reached.

Besides, several other factors like human capital, urbanization, population, labor force, trade openness, and foreign direct investments cause environmental degradation. Increase in population has resulted in higher energy demand, loss of green land, and increased demand for transportation and infrastructure development (Shi 2003; Dietz and Rosa 1997; Satrovic et al. 2020). The relationship between FDI and environmental pollution is popularly known as Porter’s hypothesis (Porter 1991; Porter and Van-Der Linde 1995; Esty and Porter 1998). Similarly, the transfer of pollution-intensive industries to a weak environment regime from strict control is known as the pollution haven hypothesis (Aliyu 2005). Studies related to trade openness and environmental pollution arrived at contrasting results by virtue of the explanation given by Antweiler et al. (2001). The authors pointed at three effects: scale, technique, and composition effect. Some studies found trade openness to improve environmental quality through the technique effect (Shahbaz et al. 2012, 2013; Fang et al. 2019). However, the combined effect had a detrimental impact on the environment (Lopez 1994; Cole and Rayner 2000). Human capital may reduce environmental pollution. Many studies were directed to examine this relationship. Hassan et al. (2019b) found the influence of human capital on EFP to be insignificant in Pakistan. Danish et al. (2019), using an ARDL model, found human capital had a negligible impact on Pakistan’s ecological footprints. However, human capital’s negative contribution to environmental pollution was detected for India with a uni-directional causality (Ahmed and Wang 2019).

Similarly, using the AMG and CCEMG methods, Nathaniel et al. (2021) reported the favorable result of human capital on the environment in LAC countries. Human capital’s positive impact on reducing environmental degradation is transmitted through skilled labor, environmentally friendly practices, environmental awareness, and a sustainable lifestyle (Satrovic 2019; Rahman and Ahmad 2019; Ahmed et al. 2020a, b). However, studies also revealed a negative effect of human capital on environmental sustainability as educational attainment increases manufacturing activities and the use of energy-intensive techniques in the Latin American and Caribbean regions (Balaguer and Cantavella 2018; Ahmed et al. 2020c). Several researchers have undertaken studies to find the association between urbanization and environmental degradation. The majority of the studies arrived at the deteriorating effect of urbanization on the environment (Hassan et al. 2019a; Al Mulali et al. 2014; Al-Mulali and Ozturk 2015; Dogan et al. 2019; Satrovic et al. 2021).

From the above survey of the literature, we can observe that the use and comparison of CO2 emission and ecological footprints as a proxy for environmental degradation remain unexplored except for Nathaniel and Adeleye (2021). We acknowledge that past studies have justified the use of econometric methodology and the selection of sample countries. However, the different conclusions reached by these studies on the effect of several determinants of environmental quality. Thus, more research is required to track the causal effects of renewable and non-renewable energy sources’ on environmental quality. From the above review, we firmly believe that policy implications for SDGs will be different for different nations/pool of nations. The panel of selected countries is not attempted by any researchers to the best of our knowledge and is thus the novelty of the study.

Research model, materials, and methods

Rising environmental degradation has gained the attention of policymakers across the world and the drive towards economic growth and development seems to be putting the planet at risk in severe ways. One of the key contributors to environmental degradation is human activities which are geared towards enhancing the standard of living comes an increase in consumption and demand for energy (Adedoyin et al. 2022; Adeleye et al. 2021a, b). Moreso, since environmental challenges are rising as a result of increasing carbon emissions from the conventional energy source, more attention is being given to renewable energy. Adams and Nsiah (2019) and Nathaniel and Adeleye (2021) noted that renewable energy resource availability makes it a preferred source of energy consumption as proposed by the United Nations in SDG 7 mainly as it emits less carbon compared to the traditional source of energy. Therefore, to situate this current study within the extant literature, we hypothesize that economic growth, human capital, renewable and nonrenewable directly influence carbon emissions and ecological footprint which are the proxies for environmental degradation. For instance, economic growth requires human capital which is an important factor of production. Moreso, growth thrives via the usage of both renewable and nonrenewable energy. Thus, it is expected that each of these variables will directly and indirectly affect the environment. The study’s hypothetical research model is shown in the following research model (Fig. 1).

We proceed to test these hypotheses using annual data from 1980 to 2016 for the three major Asian energy consumers and emitters economies, i.e., China, India, and Japan. Data related to carbon dioxide (CO2) emissions, ecological footprint (EF), economic growth (EG), human capital (HC), renewable (RE) and non-renewable (NRE) energy consumption are collected from the sources as in Table 1.

All the series are transformed into natural logarithms to overcome the variances. The study model CO2 emissions as an output variable in a multiplicative production function of the given variables:

Furthermore, EF can be modeled similarly as below:

The logarithmic transformation of Eqs. (1) and (2) can be written as:

where \({\alpha }_{t}\) is the intercept of the dependent variable, \({\beta }_{s}\) are the coefficients of the variables, and ln denotes natural logarithm.

The Augmented Dickey Fuller (ADF) test (Dickey and Fuller 1979), and Philips and Perron (P-P) test (Phillips and Perron 1988) are performed to diagnose the stationarity before the time series analysis. To detect structural breaks, unit root tests with structural breaks are used (Bai and Perron 1998). Similarly, before the panel estimation, the cross-correlation (LM) test formulated by Breusch and Pagan (1980) is applied as the number of cross-sections is less than the time point (N < T). The CIPS and CADF second-generation unit root tests, put forth by Pesaran (2007), are applied to nullify the effect of cross-correlation among the series. Moreover, the Westerlund panel cointegration technique is more appropriate than other methods to tackle cross-sectional dependency. Finally, the panel autoregressive distributed lag (PARDL) is employed to examine the EKC hypothesis on the three largest Asian emitters.

The autoregressive distributed lag (\(p, {q}_{1,}{q}_{2\dots }{q}_{n})\) model approach to cointegration test is as follows:

where \(p\) is the lag order chosen based on the AIC suggestion.

The autoregressive distributed lag (ARDL) models’ specification of Eq. (3) can be written as:

Similarly, for Eq. (4), the specification of the ARDL model can be as follows:

where \({Y}_{t}\) denotes the dependent variable (i.e., CO2 in Eq. (3), and EF in Eq. (4)) and (\({X}_{1t}, {X}_{2t}, {X}_{3t},\dots {X}_{nt}\)) are the explanatory variables; \(p\) is the number of optimum lag order. The short-run estimation with error correction model for the Eqs. (3) and (4) can be as:

where \({EC}_{t}\) is the error correction mechanism defined as:

The ECM is the feedback effect derived as the error term from the cointegration models (5) and (6). The ECM shows how much of the disequilibrium is being corrected.

For panel estimation, first of all, the study uses the cross-section dependence (LM) test as N < T. Equations (10) and (11) represent the LM test statistic:

The LM test statistic can be estimated through the following specification:

where \(\widehat{{\rho }_{ij}}\) presents the pair-wise correlation of the residuals.

CIPS and CADF tests are applied for unit root test for a panel data with cross-sectional dependency as below:

The \({t}_{i}(N,T)\) denotes the cross-section ADF statistic for the ith cross-section unit.

The other cointegration techniques (i.e., Pedroni and Kao) may be misleading as they do not consider the cross-sectional dependency. However, in the presence of C-D, the Westerlund panel cointegration technique is more appropriate (Westerlund 2007). There are four types of tests in the error correction panel cointegration test. Out of four, two are panel statistics and two are group statistics. Panel statistics allow an option to create a deduction for the panel itself, while group statistics make the deduction for individual forming panels possible. The Westerlund technique for panel cointegration can be calculated by utilizing the following equation:

where \({\partial }_{i}\) denotes error correction coefficient for the ith country.

For panel estimation, we can write Eqs. (1) and (2) respectively as:

where \({\beta }_{i}\) is the intercept of the dependent variable and \({\beta }_{is}\) are the coefficients of the variables; \({\varepsilon }_{t}\) is the error term with time t and ln is the natural logarithm.

The panel specification of the ARDL model can be written as:

where \({Y}_{it}\) denotes the regressand and X is the vector of independent variables.

From the results, conclusions about the functional form of EKC can be derived, as categorized by Dinda (2004); Sinha and Shahbaz (2018). The functional forms of specifications are presented below:

-

1)

\({\beta }_{1}={\beta }_{2}=0;\) No growth-CO2 emissions association.

-

2)

\({\beta }_{1}>0, {\beta }_{2}=0;\) Linear increasing growth-CO2 emissions association.

-

3)

\({\beta }_{1}<0, {\beta }_{2}=0;\) Linear decreasing growth-CO2 emissions association.

-

4)

\({\beta }_{2}<0;\) Inverted U-shaped growth-CO2 emissions association.

-

5)

\({\beta }_{2}>0;\) U-shape of association between economic growth and CO2 emissions.

This study uses both time series and a panel autoregressive distributed lag model for selected countries to examine the EKC hypothesis.

Results and discussions

This study’s empirical findings and discussion are categorized in two sub-sections, concerning time series and panel analysis.

Time-series estimation

We begin with the time series traditional unit root testing for the specific country. The results confirmed that variables are either stationary at the level or the first difference, as reported in Table 2. Thus, the ARDL model can be applied.

After the confirmation, none of the variables is I(2); the ARDL model is applied and the results are reported in Table 3. The results of the long- and short-run models show the estimated elasticity values of EG, HC, RE, and NRE on CO2 in Model I. However, Model II demonstrates the long- and short-run elasticities of the mentioned variables on the ecological footprint. Furthermore, the ARDL bound testing approach has confirmed cointegration among the variables because the F-statistic values are greater than the values of upper bounds and it is significant at 1% level.

An inverted U-shaped EKC is detected in China as the elasticities of EG and EG2 are 2.41 and − 0.17, respectively, in Model I. These elasticities, significant at 1% level, suggest that a percentage change in EG will raise CO2 emissions by 2.41% in China. Together, these values imply a rise in emission at the initial level of growth up to a threshold and then decline at a rate of 0.17%. This result supports the fourth specification of EKC (i.e., \({\beta }_{2}<0)\). This result is in line with previous studies (Adeleye et al. 2021b; Apergis 2016; Apergis and Ozturk 2015; Baek and Kim 2013; Shahbaz et al. 2012). However, India and Japan display simple U-shaped EKC. The elasticities of EG and EG2 for India and Japan are (− 1.11, 0.09) and (− 0.78, 0.03), respectively. These findings support the fifth specification of the EKC hypothesis (i.e., \({\beta }_{2}>0)\), implying a U-shaped EKC in India and Japan. Our results resemble earlier findings by Dogan and Turkekul (2016) and Sapkota and Bastola (2017).

The results of human capital for China and Japan show a negative association towards CO2 emissions. The elasticities of HC for China and Japan are − 4.61 and − 0.79, respectively.

The results are significant at a 1% level, signifying a percentage change in HC is projected to cut down CO2 by 4.61% and 0.79%, respectively. These results find support from previous studies (Ahmed et al. 2020a, b, c), which detected a negative association between HC and CO2 emissions in G7 countries in their research. Furthermore, Mahmood et al. (2019) also found the same results for Pakistan. However, for India, the results show an insignificant relation with CO2 emissions.

Moreover, non-renewable energy consumption contributes to increasing CO2 emissions in India and Japan. The elasticities of NRE are 0.79 and 0.98 at 1% level of significance on CO2 emissions in India and Japan, respectively. The result is similar to the findings supporting the positive nexus between energy and pollution (Okoye et al. 2022; Mujtaba et al. 2022a, 2020; Okoro et al. 2021; Okoye et al. 2021; Can and Gozgor 2017; Lean and Smyth 2010). However, China shows an insignificant relation to CO2 emissions. Renewable energy consumption shows an insignificant association with CO2 emissions in India and Japan. For China, it offers a negative and significant connection with CO2 emissions. The elasticity is − 1.49, which implies that a 1% change in RE consumption in China is expected to decline 1.49% in CO2 emissions. This result is similar to the Kingdom of Saudi Arabia’s results by Toumi and Toumi (2019). The structural break dummy for 1999 positively affects CO2 emissions in China. It may be due to the introduction of tax incentives and state financing during that period of rapid industrialization by China’s administration. The results show that this break increases CO2 emission by 0.12%. However, the effect of the dummy for the other break year, i.e., 2012, is found to be insignificant. For India, the structural breaks are located in 1996 and 2007. Both breaks generate positive effects on CO2 emissions in India. The year 1996 represents the early stage of reforms and its recovery from the balance of payment (BoP) crises in the late 1980s and early 1990s. Similarly, India adhered to the Kyoto protocol in 2005–2006 and committed herself to reduce emissions by shifting energy resources by 2030, subsequently causing a break in 2007. The structural break dummies for 1988 and 1997 are reported to cut CO2 in Japan. In 1997, Japan hosted the third conference of the parties for the United Nations Framework Convention on Climate Change in Kyoto.

In the short run, the results show that there is a U-shaped link between EG and CO2 emissions in China and Japan. However, in India, there is an inverted U-shaped link between EG and environmental degradation. The other variables also significantly affect CO2 emissions. The HC affects CO2 emissions insignificantly in China, positively in India, and adversely in Japan. NRE consumption positively affects CO2 emissions in the three sampled countries. However, the RE negatively affects CO2 emissions in China and India and positively in Japan, as reported in the results. The dummies show adverse effects on CO2 emissions in China and India and a positive impact in Japan. The error correction coefficients are negative and significant in China, India, and Japan; the respective correction speed estimates are 87%, 79%, and 92% of the time interval. The overall fitting of the model is found to be significant.

The long-run findings from Model II report a simple U-shaped association between EG and ecological footprint in China and India. The elasticities of EG and EG2 in China and India are (− 0.79, 0.06) and (− 0.62, 0.05), respectively. These elasticities are significant at a 1% level, signifying that the ecological footprint starts to decline with the rising EG in the initial stage. However, after a threshold level, the ecological footprint starts to increase and outline a U-shaped relationship. This association supports the fifth specification of EKC (i.e., \({\beta }_{2}>0)\). These findings are supported by the previous study conducted by Destek and Sinha (2020) for OECD countries. On the contrary, an inverted U-shaped link between EF and EG is detected in Japan. The elasticities of EG and EG2 are 2.53 and − 0.10, respectively, supporting the fourth specification of EKC (i.e., \({\beta }_{2}<0)\). This result is in line with previous studies (Ahmed and Wang 2019) for India and (Mrabet et al. 2017) for the MENA region.

The results of human capital for China and India show an insignificant relation towards ecological footprint. However, for Japan, the results show a negative and statistically significant association with EF. The coefficient value implies 1% increase in HC is expected to decline EF by 3.26% in Japan. This result aligns with earlier studies (Ahmed and Wang 2019; Rahman and Ahmad 2019). Consumption of non-renewable energy contributes to increasing EF both in India and Japan. The statistically significant coefficients of NRE signify 1% change in NRE will result in a rise of 0.12% and 1.38% in EF in India and Japan, respectively. These results are supported by previous studies (Sharif et al. 2020; Ahmed and Wang 2019; Ahmed et al. 2020b). However, for China, it shows an insignificant relation. Renewable energy consumption shows an insignificant association with EF in Japan. China and India show a positive and significant connection with EF. The elasticities of RE for China and India are 0.64 and 0.02, respectively, which implies that 1% change in RE consumption will improve EF by 0.64% in China and by 0.02% in India. Baz et al. (2020) arrived at similar results in their study.

The dummies D1 and D2 show the structural breaks in 2002 and 2012, and they positively affect EF in China. However, the D2, representing a structural break in 2010, has adverse and significant effects on EF in India. The results show that this break had decreased EF by 10% in India.

Short-run estimation iterates a U-shaped link between EG and EF in India and China. The HC positively and significantly affects EF in China and India and adversely in Japan. The NRE consumption positively affects EF in India and Japan and insignificantly affects China. However, the RE insignificantly affects EF in China and Japan. In India, RE shows positive effects on EF; even the result is significant at 10% level. The impact of the structural breaks is negative on EF in China in the short run. In India, only the break in 2010 shows adverse and significant effects on EF. At the same time, the structural breaks in Japan show insignificant effects on EF. The coefficients of the error correction mechanism (ECM) are negative and significant in China, India, and Japan; EG, EG2, HC, NRE, and RE are corrected to their equilibrium at 82%, 80%, and 84% of a year in the respective economies. The values of R and adjusted R squared signifies that the model is quite good (Table 4).

Diagnostic tests

The results of the diagnostic tests, as presented in Table 5, confirm no serial correlation, no heteroscedasticity, and all the variables are found to be normally distributed.

Structural stability tests

The structural stability test, developed by Brown et al. (1975), is presented in Fig. 2. The cumulative sum (CUSUM) test and cumulative sum of the squares (CUSUMSQ) test confirm the model is structurally stable.

Panel estimation

Cross-sectional dependence test

The panel estimation begins with the cross-sectional dependency LM test. From the results reported in Table 6, cross-sectional dependency is confirmed at a 1% level of significance. Thus, we use the second-generation unit root tests.

The results of S-G unit root tests of Pesaran’s CIPS and CADF are shown in Table 7. The CIPS exhibit that variables like EF, EG, and EG2 have a unit root at the level I(0) and become stationary after the first difference I(1). However, the CADF exhibits that only RE is stationary at I(0) and all others become stationary at I(1). Therefore, the variables are I(0) and I(1), and thus, the Johansen cointegration tests and the VAR/VEC models cannot be used.

Panel cointegration estimation

As cross-sectional dependency is confirmed, the Westerlund panel cointegration is applied to verify the relationship between the long-run variables. Table 8 reports a statistically significant cointegration between CO2 in Model I and EF in Model II with the independent variables.

The panel ARDL results for both Model I and Model II for both the long run and the short run are reported in Table 9.

The long-run findings from Model I present an inverted U-shaped link between EG and CO2 emissions. The elasticities of EG and EG2 are 0.11 and − 0.00, which are significant at a 1% level, signifying that the carbon emissions rise to a threshold level initially with the increasing economic growth, then the emissions start to decline. A statistically significant but negative relation is reported for human capital with CO2. A percentage change in HC is expected to decrease CO2 emissions by 0.63%. Non-renewable energy consumption shows a positive and significant association with CO2 emissions. The elasticity of NRE is 1.14, and the results are significant at a 1% level, signifying a percentage change in NRE consumption is projected to increase CO2 by 1.14%. The result is supported by Mujtaba et al. (2022a) who also found a positive association between NRE consumption and CO2 emissions in OECD countries in their research.

As expected, a unit percentage change in RE causes a decrease in CO2 by 0.03% in these sampled countries. The adverse effects of RE on CO2 emissions indicate adopting sustainable technology (Bilgili et al. 2016; Charfeddine and Kahia 2019). In essence, non-renewable energy consumption contributes to increasing CO2 emissions. The positive association of NRE with CO2 is consistent with past research (Chen et al. 2020 and Mujtaba et al. 2020). The NRE consists of fossil fuels; when the fossil fuels burn, it emits carbon. Therefore, the rising consumption of non-renewable is only a major reason behind the CO2 emissions as per the reported results. The policymakers should frame such policies that help attain sustainable economic growth.

Model II shows an inverted U-shaped relationship between EG and EF in the long run. The coefficients, signifying elasticities of EG and EG2 are 2.21 and − 0.11, respectively. These findings demonstrated an inverted U-shaped relationship between economic growth and ecological footprint. Human capital, as with CO2, presents a negative relation with EF at 1% level of significance and the coefficient implies an even greater elasticity value of − 5.23 on EF. The elasticities of NRE and RE on EF are 0.67 and 0.19, which are significant at 1% and 10% levels, respectively. Similar conclusions are reached by Ansari et al. (2020), Sharma et al. (2020), Destek and Sinha (2020). As we already discussed in the introduction section, EF presents positive side environmental quality, as the results show that the rise in NRE increases the EF. It indicates that these countries are opting for those sources of growth and development which are environmentally unfriendly. The results also revealed that RE affects EF positively. The elasticity is 0.19, suggesting that 1% change in RE increases EF by 0.19%. The error correction coefficients (ECM) are negative and statistically significant in both models. The speed of adjustment of the independent variables to the equilibrium is 86% and 82% of 1-year time intervals in Model I and Model II, respectively.

Implications for sustainability

The United Nations Sustainable Development Goals (SDGs) constitute a befitting framework to answer the developmental challenges to achieve a sustainable future, free from social, economic, and environmental inequalities and thereby ensuring a greener and healthy planet for future generations. The positive stride towards achieving the target is largely driven by commendable country-wide performance in the five goals—Clean Water and Sanitation, Affordable and Clean Energy, Industry, Innovation and Infrastructure, Life on Land and Peace, Justice and Social Institutions. The findings of this study are highly linked with the seventh goal of the United Nations (Affordable and Clean Energy); to achieve this goal, the findings urge the policymakers and stakeholders of the sampled countries mainly focus on clean energy production through potential financial instruments like Green Bonds. The “Green” investment banks or GIBs are government-funded entities that “crowd in” private investment in low-carbon assets and provide debt for projects with existing capital reserves and raise funds through the issuance of bonds and creation of asset-backed securities.The government can issue bonds through private or public banks, the World Bank, or Regional Development Bank. This bond taps both domestic and international investors, which expands the investor base.

Moreover, the U-shaped relationship between economic growth and ecological footprint in China reveals that anthropogenic activities negatively affect the environment. According to a report,Footnote 1 China’s Belt and Road Initiative (BRI) will touch the lives of 60% of the world’s population. With a focus on “win–win partnerships” and “connectivity,” the project has received mixed reviews from those who have looked at its potential broader impacts. It has been found by Ng et al. (2020) that the BRI could have a significant impact on ecosystems and terrestrial and marine biodiversity in Southeast Asia, affecting plant and animal habitats resulting in a violation of the United Nations rules in achieving the Sustainable Development Goals (SDGs 8, 11, 13, and 15). For this reason, the Chinese government should establish biodiversity monitoring stations and invest in the construction of ecological corridors for the movement of species when building roads and railways. The findings and policy implications of this study are not limited to these sampled countries. However, the stockholders and policymakers of the other countries having similar backgrounds and income group levels are suggested to follow the rules framed by the United Nations to achieve sustainability.

Although the SDGs are referred to as the peoples’ goals, a survey reportFootnote 2 found that the majority of the population is not yet familiar with the sustainable development goals; only between 28 to 45% of the people have heard about the goals. Furthermore, a 2016 studyFootnote 3 found that only about one among hundred people across 24 countries is well aware of the goals while 25% only know the name of the goals. Thus, awareness centers must be established in the sampled countries as well as in other similar income group countries and geographical regions of similar backgrounds in order to educate the general public.

Conclusions and policy implications

This paper aligns with the 2030 United Nations Sustainable Development Goals (SDGs) 7, 8, and 13 to exclusively investigate the environmental Kuznets curve (EKC) in China, India, and Japan as the three largest economies and top emitters in Asia. This novel study uses annual data from 1980 to 2016 and two main proxies of environmental degradation—carbon dioxide emissions and ecological footprint. We summarize findings from both time series and panel ARDL techniques.

Using each proxy of environmental degradation and considering only the long-run impacts, country-level results are mixed. Outcomes show that with carbon dioxide emissions, (1) the EKC holds in China but not in India and Japan; (2) human capital reduces degradation in China and Japan; (3) non-renewable energy exacerbates degradation in India and Japan; and (4) renewable energy promotes environmental sustainability in China. For ecological footprint, (1) an inverted U-shaped EKC exists in Japan but not in China and India; (2) human capital significantly reduces degradation in Japan; (3) non-renewable energy exacerbates degradation in India and Japan; and (4) renewable energy aggravates the environment in China and India. The panel data results reveal that (1) the EKC hypothesis holds; (2) human capital and renewable energy promote environmental sustainability; while (3) non-renewable energy exerts devastating environmental impact. A cursory examination of the country-level results shows that the inverted U-shaped EKC in India does not operate.

Policy recommendations are not far-fetched. Since China, India, and Japan are undisputable the three largest Asian economies producing high pollutant emissions, it becomes imperative for the three economies to adopt renewable energy–enabled technologies to achieve the dual purpose of economic growth and clean environment. For instance, investments in hydro-power, wind, and solar energy may drive the needed innovations in the manufacturing, construction, tourism, and transportation sectors, to mention a few. Also, since human capital is found to enable a sustainable and friendly environment, the stakeholders and policymakers in these countries should channel resources to make education open and accessible to everyone. Lastly, combating climate change and ensuring a sustainable environment (SDG13) require that de-carbonization measures be pursued to enable a healthy environment that will reduce health impacts due to energy-related air pollution (SDG3) by 2030. Given the available data, researchers may take up further investigation in the future.

Data availability

The present study’s data sources are the World Development Indicators (https://data.worldbank.org/, GFN database 2019, PWT database, version 10.0 and OWID database, 2020). The data specific to the study can be made available upon request. However, they are available and downloadable at the earlier mentioned database and weblink.

Notes

Glocalities: Towards 2030 Without Poverty (2016); 56,000 respondents in 24 countries. (Fieldwork: 12/2015–2/2016.

References

Abul SJ, Satrovic E (2022) Revisiting the environmental impacts of railway transport: does EKC exist in South-Eastern Europe? Pol J Environ Stud 31(1):539–549

Acar S, Asici AA (2017) Nature and economic growth in Turkey: what does ecological footprints imply? Middle East Development Journal 9(1):101–115. https://doi.org/10.1080/17938120.2017.1288475

Adams S, Nsiah C (2019) Reducing carbon dioxide emissions; does renewable energy matter? Sci Total Environ 693:133288–133288. https://doi.org/10.1016/j.scitotenv.2019.07.094

Adedoyin FF, Satrovic E, Kehinde MN (2022) The anthropogenic consequences of energy consumption in the presence of uncertainties and complexities: evidence from World Bank income clusters. Environ Sci Pollut Res 29:23264–23279

Adeel-Farooq RM, Raji O, Adeleye BN (2020) Economic growth and methane emission: testing the EKC hypotheses in ASEAN economies. Manag Environ Qual 32(2):1–13. https://doi.org/10.1108/MEQ-07-2020-0149

Adeleye BN, Akam D, Inuwa N, Olarinde M, Okafor V (2021a) Investigating growth-energy-emissions trilemma in South Asia. Int J Energy Econ Policy 11(5):112–120

Adeleye BN, Nketiah E, Adjei M (2021b) Causal examination of carbon emissions and economic growth for sustainable environment: evidence from Ghana. Estudios de Economia Aplicada 39(8):1–18. https://doi.org/10.25115/eea.v39i8.4347

Ahmad M, Jiang P, Majeed A, Umar M, Khan Z, Muhammad S (2020) The dynamic impact of natural resources, technological innovations and economic growth on ecological footprint: an advanced panel data estimation. Resour Policy 69:101817, 1–10. https://doi.org/10.1016/j.resourpol.2020.101817

Ahmad M, Muslija A, Satrovic E (2021) Does economic prosperity lead to environmental sustainability in developing economies? Environmental Kuznets curve theory. Environ Sci Pollut Res 28(18):22588–22601

Ahmed Z, Wang Z (2019) Investigating the impact of human capital on the ecological footprint in India: an empirical analysis. Environ Sci Pollut Res 26:26782–26796. https://doi.org/10.1007/s11356-019-05911-7

Ahmed Z, Wang Z, Mahmood F, Hafeez M, Ali N (2019) Does globalization increase the ecological footprint? Empirical evidence from Malaysia. Environ Sci Pollut Res 26(18):18565–18582. https://doi.org/10.1007/s11356-019-05224-9

Ahmed Z, Zafar MW, Ali S (2020a) Linking urbanization, human capital, and the ecological footprint in G7 countries: an empirical analysis. Sustain Cities Soc 55:102064. https://doi.org/10.1016/j.scs.2020.102064

Ahmed Z, Ashgar MM, Malik MN, Nawaz K (2020b) Moving towards a sustainable environment: the dynamic linkage between natural resources, human capital, urbanization, economic growth, and ecological footprint in China. Resour Policy 67:101677. https://doi.org/10.1016/j.resourpol.2020.101677

Ahmed Z, Nathaniel SP, Shahbaz M (2020c) The criticality of information and communication technology and human capital in environmental sustainability: evidence from Latin American and Caribbean countries. J Clean Prod 286:1–44. https://doi.org/10.1016/j.jclepro.2020.125529

Aliyu MA (2005) Foreign direct investment and the environment: pollution haven hypothesis revisited. In: Eight Annual Conference on Global Economic Analysis, Lübeck, Germany, pp 9–11. https://www.gtap.agecon.purdue.edu/resources/download/2131.pdf. Accessed 4 Jan 2020

Al-Mulali U, Ozturk I (2015) The effect of energy consumption, urbanization, trade openness, industrial output, and the political stabilityon the environmental degradation in the MENA (Middle East and North African) region. Energy 84:382–389. https://doi.org/10.1016/j.energy.2015.03.004

Al-Mulali U, Weng-Wai C, Sheau-Ting L, Mohammed AH (2014) Investigating the environmental Kuznets curve (EKC) hypothesis by utilizing the ecological footprint as an indicator of environmental degradation. Ecol Indic 48:315–323. https://doi.org/10.1016/j.ecolind.2014.08.029

Al-Mulali U, Tang CF, Ozturk I (2015) Does financial development reduce environmental degradation? Evidence from a panel study of 129 countries. Environ Sci Pollut Res 22:14891–14900

An H, Razzaq A, Haseeb M, Mihardjo LW (2021) The role of technology innovation and people’s connectivity in testing environmental Kuznets curve and pollution heaven hypotheses across the Belt and Road host countries: new evidence from Method of Moments Quantile Regression. Environ Sci Pollut Res 28(5):5254–5270

Ang JB (2007) CO2 emissions, energy consumption, and output in France. Energy Policy 35(10):4772–4778

Ansari MA, Haider S, Khan NA (2020) Environmental Kuznets curve revisited: an analysis using ecological and material footprint. Ecol Indic 115:106416

Antweiler W, Copeland BR, Taylor MS (2001) Is free trade good for the environment? Am Econ Rev 91(4):877–908

Apergis N (2016) Environmental Kuznets curves: new evidence on both panel and country-level CO2 emissions. Energy Econ 54:263–271

Apergis N, Ozturk I (2015) Testing environmental Kuznets curve hypothesis in Asian countries. Ecol Ind 52:16–22

Apergis N, Payne JE (2009) CO2 emissions, energy usage, and output in Central America. Energy Policy 37(8):3282–3286

Baek J, Kim HS (2013) Is economic growth good or bad for the environment? Empirical evidence from Korea. Energy Econ 36:744–749

Bai J, Perron P (1998) Estimating and testing linear models with multiple structural changes. Econometrica 66(1):47–78

Balaguer J, Cantavella M (2018) The role of education in the environmental Kuznets curve: evidence from Australian data. Energy Economics 70:289–296. https://doi.org/10.1016/j.eneco.2018.01.021

Baz K, Xu D, Ali H, Ali I, Khan I, Khan MM, Cheng J (2020) Asymmetric impact of energy consumption and economic growth on ecological footprint: using asymmetric and nonlinear approach. Sci Total Environ 718:137364

Bekun FV, Alola AA, Sarkodie SA (2019) Towards a sustainable environment: nexus between CO2 emissions, resource rent, renewable and non-renewable energy in 16-EU countries. Sci Total Environ 657:1023–1029. https://doi.org/10.1016/j.scitotenv.2018.12.104

Bilgili F, Koçak E, Bulut Ü (2016) The dynamic impact of renewable energy consumption on CO2 emissions: a revisited Environmental Kuznets Curve approach. Renew Sustain Energy Rev 54:838–845

Boluk G, Mert M (2014) Fossil and renewable energy consumption, GHGs (greenhouse gases) and economic growth: evidence from a panel of EU (European Union) countries. Energy 74:439–446

Boluk G, Mert M (2015) The renewable energy, growth and environmental Kuznets curve in Turkey: an ARDL approach. Renew Sustain Energy Rev 52:587–595

Breusch TS, Pagan AR (1980) The Lagrange multiplier test and its applications to model specification in econometrics. Rev Econ Stud 47(1):239–253

Brown RL, Durbin J, Evans JM (1975) Techniques for testing the constancy of regression relationships over time. J R Stat Soc Ser B Methodol 37(2):149–163

Can M, Gozgor G (2017) The impact of economic complexity on carbon emissions: evidence from France. Environ Sci Pollut Res 24(19):16364–16370

Charfeddine L (2017) The impact of energy consumption and economic development on ecological footprint and CO2 emissions: evidence from a Markov switching equilibrium correction model. Energy Economics 65:355–374. https://doi.org/10.1016/j.eneco.2017.05.009

Charfeddine L, Mrabet Z (2017) The impact of economic development and social-political factors on ecological footprint: a panel data analysis for 15 MENA countries. Renew Sustain Energy Rev 76:138–154. https://doi.org/10.1016/j.rser.2017.03.031

Charfeddine L, Kahia M (2019) Impact of renewable energy consumption and financial development on CO2 emissions and economic growth in the MENA region: a panel vector autoregressive (PVAR) analysis. Renew Energy 139:198–213

Chen T, Gozgor G, Koo CK, Lau CKM (2020) Does international cooperation affect CO 2 emissions? Evidence from OECD countries. Environ Sci Pollut Res 27:8548–8556. https://doi.org/10.1007/s11356-019-07324-y

Cole MA, Rayner AJ (2000) The Uruguay round and air pollution: estimating the composition, scale and technique effects of trade liberalization. J Int Trade Econ Dev 9(3):339–354

Danish, Hassan ST, Baloch MA, Mahmood N, Zhang JW (2019) Linking economic growth and ecological footprint through human capital and biocapacity. Sustain Cities Soc 47:101516. https://doi.org/10.1016/j.scs.2019.101516

Danish, Ulucak R, Khan SU (2020) Determinants of the ecological footprint: role of renewable energy, natural resources, and urbanization. Sustain Cities Soc 54:1–34. https://doi.org/10.1016/j.scs.2019.101996

Destek MA, Sarkodie SA (2019) Investigation of environmental Kuznets curve for ecological footprint: the role of energy and financial development. Sci Total Environ 650(2):2483–2489. https://doi.org/10.1016/j.scitotenv.2018.10.017

Destek MA, Sinha A (2020) Renewable, non-renewable energy consumption, economic growth, trade openness and ecological footprint: evidence from organisation for economic co-operation and development countries. J Clean Prod 242:118537

Dickey DA, Fuller WA (1979) Distribution of the estimators for autoregressive time series with a unit root. J Am Stat Assoc 74(366a):427–431

Dietz T, Rosa EA (1997) Effects of population and affluence on CO2 emissions. Proc Natl Acad Sci 94(1):175–179

Dinda S (2004) Environmental Kuznets curve hypothesis: a survey. Ecol Econ 49(4):431–455

Dogan E, Turkekul B (2016) CO2 emissions, real output, energy consumption, trade, urbanization and financial development: testing the EKC hypothesis for the USA. Environ Sci Pollut Res 23(2):1203–1213

Dogan E, Taspinar N, Gokmenoglu KK (2019) Determinants of ecological footprint in MINT countries. Energy Environ. 30(6):1065–1086. https://doi.org/10.1177/2F0958305X19834279

Dogan E, Ulucak R, Kocak E, Isik C (2020) The use of ecological footprint in estimating the environmental Kuznets curve hypothesis for BRICST by considering cross-section dependence and heterogeneity. Sci Total Environ 723:138063. https://doi.org/10.1016/j.scitotenv.2020.138063

Dong B, Wang F, Guo Y (2016) The global EKCs. Int Rev Econ Financ 43:210–221

Eregha PB, Adeleye BN, Ogunrinola I (2021) Pollutant emissions, energy use and real output in Sub-Saharan Africa (SSA) countries. J Policy Model. https://doi.org/10.1016/j.jpolmod.2021.10.002

Esty DC, Porter ME (1998) Industrial ecology and competitiveness: strategic implications for the firm. J Ind Ecol 2(1):35–43

Fang J, Gozgor G, Lu Z, Wu W (2019) Effects of the export product quality on carbon dioxide emissions: evidence from developing economies. Environ Sci Pollut Res 26(12):12181–12193

Ghazali A, Ali G (2019) Investigation of key contributors of CO2 emissions in extended STIRPAT model for newly industrialized countries: a dynamic common correlated estimator (DCCE) approach. Energy Rep 5:242–252. https://doi.org/10.1016/j.egyr.2019.02.006

Gill AR, Viswanathan KK, Hassan S (2018) The environmental Kuznets curve (EKC) and the environmental problem of the day. Renew Sustain Energy Rev 81:1636–1642

Gormus S, Aydin M (2020) Revisiting the environmental Kuznets curve hypothesis using innovation: new evidence from the top 10 innovative economies. Environ Sci Pollut Res 27:27904–27913. https://doi.org/10.1007/s11356-020-09110-7

Gozgor G (2017) Does trade matter for carbon emissions in OECD countries? Evidence from a new trade openness measure. Environ Sci Pollut Res 24(36):27813–27821

Halicioglu F (2009) An econometric study of CO2 emissions, energy consumption, income and foreign trade in Turkey. Energy Policy 37(3):1156–1164

Hassan ST, Baloch MA, Mahmood N, Zhang JW (2019a) Linking economic growth and ecological footprint through human capital and biocapacity. Sustain Cities Soc 47:101516. https://doi.org/10.1016/j.scs.2019.101516

Hassan ST, Xia E, Khan NH, Shah SMA (2019b) Economic growth, natural resources, and ecological footprints: evidence from Pakistan. Environ Sci Pollut Res 26(3):2929–2938. https://doi.org/10.1007/s11356-018-3803-3

Huskic M, Satrovic E (2020) Human development-renewable energy-growth nexus in the top 10 energy gluttons. Administration 22:25–42

IEA (2007) World energy outlook: China and India insights. https://www.iea.org/reports/world-energy-outlook-2007. Accessed 12 June 2020

Kuznets S (1955) Economic growth and income inequality. Am Econ Rev 45(1):1–28

Lean HH, Smyth R (2010) CO2 emissions, electricity consumption and output in ASEAN. Appl Energy 87(6):1858–1864

Li M, Yao-Ping Peng M, Nazar R, Ngozi Adeleye B, Shang M, Waqas M (2022) How does energy efficiency mitigate carbon emissions without reducing economic growth in post COVID-19 era. Front Energy Res 10:832189. https://doi.org/10.3389/fenrg.2022.832189

Lopez R (1994) The environment as a factor of production: the effects of economic growth and trade liberalization. J Environ Econ Manag 27(2):163–184

Ma X, Wang C, Dong B, Gu G, Chen R, Li Y, Zou H, Zhang W, Li Q (2019) Carbon emissions from energy consumption in China: its measurement and driving factors. Sci Total Environ 648:1411–1420. https://doi.org/10.1016/j.scitotenv.2018.08.183

Mahmood N, Wang Z, Hassan ST (2019) Renewable energy, economic growth, human capital, and CO2 emission: an empirical analysis. Environ Sci Pollut Res 26(20):20619–20630

Mehmood U, Tariq S (2020) Globalization and CO2 emissions nexus: evidence from the EKC hypothesis in South Asian countries. Environ Sci Pollut Res 27:37044–37056. https://doi.org/10.1007/s11356-020-09774-1

Mrabet Z, Al-Samara M, Hezam JS (2017) The impact of economic development on environmental degradation in Qatar. Environ Ecol Stat 24:7–38. https://doi.org/10.1007/s10651-016-0359-6

Mujtaba A, Jena PK (2021) Analyzing asymmetric impact of economic growth, energy use, FDI inflows, and oil prices on CO2 emissions through NARDL approach. Environ Sci Pollut Res 28(24):30873–30886

Mujtaba A, Jena PK, Mukhopadhyay D (2020) Determinants of CO2 emissions in upper middle-income group countries: an empirical investigation. Environ Sci Pollut Res 27(30):37745–37759

Mujtaba A, Jena PK, Joshi DPP (2021) Growth and determinants of CO2 emissions: evidence from selected Asian emerging economies. Environ Sci Pollut Res 28(29):39357–39369

Mujtaba A, Jena PK, Bekun FV, Sahu PK (2022a) Symmetric and asymmetric impact of economic growth, capital formation, renewable and non-renewable energy consumption on environment in OECD countries. Renew Sustain Energy Rev 160:112300. https://doi.org/10.1016/J.RSER.2022.112300

Mujtaba A, Jena PK, Mishra BR, Hammoudeh S, Roubaud D, Dehury T (2022b) Do economic growth, energy consumption and population degrade the environmental quality? Evidence from five regions using the nonlinear ARDL approach. Environmental Challenges 8:100554

Murshed M (2020) Revisiting the deforestation-induced EKC hypothesis: the role of democracy in Bangladesh. GeoJournal. https://doi.org/10.1007/s10708-020-10234-z

Nathaniel SP (2020) Ecological footprint, energy use, trade, and urbanization linkage in Indonesia. Geo J 86(5):2057–2070

Nathaniel S, Adeleye N (2021) Environmental preservation amidst carbon emissions, energy consumption and urbanization in selected African countries: implications for sustainability. J Clean Prod 285:125409

Nathaniel SP, Bekun FV (2019) Environmental management amidst energy use, urbanization, trade openness, and deforestation: the Nigerian experience. J Public Aff 20(2):e2037. https://doi.org/10.10202/pa.2037

Nathaniel S, Nwodo O, Adediran A, Sharma G, Shah M, Adeleye N (2019) Ecological footprint, urbanization, and energy consumption in South Africa: including the excluded. Environ Sci Pollut Res 26(26):27168–27179

Nathaniel S, Anyanwu O, Shah M (2020a) Renewable energy, urbanization, and ecological footprint in the Middle East and North Africa region. Environ Sci Pollut Res 27(13):14601–14613

Nathaniel S, Nwodo O, Sharma G, Shah M (2020b) Renewable energy, urbanization, and ecological footprint linkage in CIVETS. Environ Sci Pollut Res 27(16):19616–19629

Nathaniel SP, Nwulu N, Bekun F (2021) Natural resource, globalization, urbanization, human capital, and environmental degradation in Latin American and Caribbean countries. Environ Sci Pollut Res 28:6207–6221. https://doi.org/10.1007/s11356-020-10850-9

Ng LS, Campos-Arceiz A, Sloan S, Hughes AC, Tiang DCF, Li BV, Lechner AM (2020) The scale of biodiversity impacts of the Belt and Road Initiative in Southeast Asia. Biol Conserv 248:108691

Okoro EE, Adeleye BN, Okoye LU, Maxwell O (2021) Gas flaring, ineffective utilization of energy resource and associated economic impact in Nigeria: evidence from ARDL and Bayer-Hanck cointegration techniques. Energy Policy 153:1–8. https://doi.org/10.1016/j.enpol.2021.112260

Okoye LU, Adeleye BN, Okoro EE, Okoh JI, Ezu GK, Anyanwu FA (2022) Effect of gas flaring, oil rent and fossil fuel on economic performance: the case of Nigeria. Resour Policy 77:102677. https://doi.org/10.1016/j.resourpol.2022.102677

Okoye LU, Omankhanlen AE, Okoh JI, Adeleye NB, N., E. F., K., E. G., et al. (2021). Analyzing the energy consumption and economic growth nexus in Nigeria. Int J Energy Econ Policy, 11 1:378–387. https://doi.org/10.32479/ijeep.10768

Pesaran MH (2007) A simple panel unit root test in the presence of cross-section dependence. J Appl Economet 22(2):265–312

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J Appl Econ 16(3):289–326

Phillips PC, Perron P (1988) Testing for a unit root in time series regression. Biometrika 75(2):335–346

Porter ME (1991) America’s green strategy. Sci Am 264(4):168–179

Porter ME, Van der Linde C (1995) Toward a new conception of the environment-competitiveness relationship. J Econ Perspect 9(4):97–118

Rahman ZU, Ahmad M (2019) Modeling the relationship between gross capital formation and CO 2 (a) symmetrically in the case of Pakistan: an empirical analysis through NARDL approach. Environ Sci Pollut Res 26(8):8111–8124

Razzaq A, Sharif A, Ahmad P, Jermsittiparsert K (2021) Asymmetric role of tourism development and technology innovation on carbon dioxide emission reduction in the Chinese economy: fresh insights from QARDL approach. Sustain Dev 29(1):176–193

Razzaq A, Sharif A, Najmi A, Tseng ML, Lim MK (2021) Dynamic and causality interrelationships from municipal solid waste recycling to economic growth, carbon emissions and energy efficiency using a novel bootstrapping autoregressive distributed lag. Resour Conserv Recycl 166:105372

Razzaq A, Ajaz T, Li JC, Irfan M, Suksatan W (2021) Investigating the asymmetric linkages between infrastructure development, green innovation, and consumption-based material footprint: novel empirical estimations from highly resource-consuming economies. Resour Policy 74:102302

Sapkota P, Bastola U (2017) Foreign direct investment, income, and environmental pollution in developing countries: panel data analysis of Latin America. Energy Economics 64:206–212

Satrovic E (2019) Moderating effect of economic freedom on the relationship between human capital and shadow economy. Trakya Üniversitesi Sosyal Bilimler Dergisi 21(1):295–306

Satrovic E, Muslija A, Abul SJ (2020) The relationship between CO2 emissions and gross capital formation in Turkey and Kuwait. South East Eur J Econ Bus 15(2):28–42

Satrovic E, Ahmad M, Muslija A (2021) Does democracy improve environmental quality of GCC region? Analysis robust to cross-section dependence and slope heterogeneity. Environ Sci Pollut Res 28(44):62927–62942

Shahbaz M, Lean HH, Shabbir MS (2012) Environmental Kuznets curve hypothesis in Pakistan: cointegration and Granger causality. Renew Sustain Energy Rev 16(5):2947–2953

Shahbaz M, Hye QMA, Tiwari AK, Leitão NC (2013) Economic growth, energy consumption, financial development, international trade and CO2 emissions in Indonesia. Renew Sustain Energy Rev 25:109–121

Shahbaz M, Solarin SA, Sbia R, Bibi S (2015) Does energy intensity contribute to CO2 emissions? A trivariate analysis in selected African countries. Ecol Ind 50:215–224

Sharif A, Baris-Tuzemen O, Uzuner G, Ozturk I, Sinha A (2020) Revisiting the role of renewable and non-renewable energy consumption on Turkey’s ecological footprint: Evidence from Quantile ARDL approach. Sustain Cities Soc 57:102138

Sharma R, Sinha A, Kautish P (2020) Examining the impacts of economic and demographic aspects on the ecological footprint in South and Southeast Asian countries. Environ Sci Pollut Res 27(29):36970–36982

Shi A (2003) The impact of population pressure on global carbon dioxide emissions, 1975–1996: evidence from pooled cross-country data. Ecol Econ 44(1):29–42

Sinha A, Shahbaz M (2018) Estimation of environmental Kuznets curve for CO2 emission: role of renewable energy generation in India. Renew Energy 119:703–711

Sovacool BK, Vivoda V (2015) A comparison of Chinese, Indian, and Japanese perceptions of energy security. Asian Surv 52(5):949–969

Sugiawan Y, Managi S (2016) The environmental Kuznets curve in Indonesia: exploring the potential of renewable energy. Energy Policy 98:187–198

Toumi S, Toumi H (2019) Asymmetric causality among renewable energy consumption, CO 2 emissions, and economic growth in KSA: evidence from a non-linear ARDL model. Environ Sci Pollut Res 26(16):16145–16156

Tutulmaz O (2015) Environmental Kuznets Curve time-series application for Turkey: why controversial results exist for similar models? Renew Sustain Energy Rev 50:73–81

Uddin GA, Alam K, Gow J (2016) Does ecological footprint impede economic growth? An empirical analysis based on the environmental Kuznets curve hypothesis. Aust Econ Pap 55(3):301–316. https://doi.org/10.1111/1467-8454.12061

Usama A-M, Weng-Wai C, Sheau-Ting L, Mohammed AH (2015) Investigating the environmental Kuznets curve (EKC) hypothesis by utilizing the ecological footprint as an indicator of environmental degradation. Ecol Ind 48:315–323. https://doi.org/10.1016/j.ecolind.2014.08.029

Verbič M, Satrovic E, Muslija A (2021) Environmental Kuznets curve in Southeastern Europe: the role of urbanization and energy consumption. Environ Sci Pollut Res 28(41):57807–57817

Wackernagel M, Schulz B, Deumling D, Linares AC, Jenkins M, Kapos V, Monfreda C, Loh J, Myers N, Norgaard R, Randers J (2002) Tracking the ecological overshoot of the human economy. Proc Natl Acad Sci usa 99:9266–9271

Wang Y, Kang L, Wu X, Xiao Y (2013) Estimating the environmental Kuznets curve for ecological footprint at the global level: a spatial econometric approach. Ecol Ind 34:15–21. https://doi.org/10.1016/j.ecolind.2013.03.021

Westerlund J (2007) Testing for error correction in panel data. Oxf Bull Econ Stat 69(6):709–748

World Bank (2020) World Development Indicators 10/15/2020. https://databank.worldbank.org/source/world-development-indicators. Retrieved on Dec. 28, 2020, from World Bank database

York R, Rosa EA, Dietz T (2004) The ecological footprint intensity of national economies. J Ind Ecol 8(4):139–154

Zhang XP, Cheng XM (2009) Energy consumption, carbon emissions, and economic growth in China. Ecol Econ 68(10):2706–2712

Zhuang Y, Yang S, Razzaq A, and Khan Z (2021). Environmental impact of infrastructure-led Chinese outward FDI, tourism development and technology innovation: a regional country analysis. J Environ Plan Manag 1-33. https://doi.org/10.1080/09640568.2021.1989672

Author information

Authors and Affiliations

Contributions

PKJ has done empirical analysis and supervises the work. AM is responsible for the conceptualization, data collection and analysis. DPPJ is responsible for the literature survey and initial stage proofreading. ES contributed to the introduction part; BNA is accountable for the conclusion and policy recommendations.

Corresponding author

Ethics declarations

Ethics approval and consent to participate

The authors declare the provided manuscript with the title “Exploring the Nature of EKC Hypothesis in Asia’s Top Emitters: Role of Human Capital, Renewable and Non-Renewable Energy Consumption” has not been published before nor submitted to another journal for the consideration of publication.

Consent for publication

The authors declare that the manuscript does not contain any person’s data in any form (including any individual details, images, or videos).

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Arshian Sharif

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Highlights

1. The study amalgamates both CO2 emission (negative indicator) and ecological footprint (positive indicator) of environmental degradation to investigate the validity of the environmental Kuznets curve hypothesis for the top three Asian emitting economies, namely Japan, China, and India.

2.The environmental Kuznets curve holds for China when CO2 emission represents environmental degradation. Japan confirms the validity of the environmental Kuznets curve hypothesis when ecological footprint depicts environmental degradation. However, the inverted U-shaped environmental Kuznets curve does not operate in India.

3. The panel analysis detects an inverted U-shaped environmental Kuznets curve for both the proxies of the environment for the panel of selected economies.

4. Human capital and renewable energy use promote environmental sustainability, while non-renewable energy is detrimental to the environment.

5.This study suggests China, India, and Japan are undisputable the three largest Asian economies producing high pollutant emissions; it becomes imperative for the three economies to adopt renewable energy–enabled technologies to achieve the dual purpose of economic growth and a clean environment.

6.Finally, this study recommends that combating climate change and ensuring a sustainable environment (SDG13) require de-carbonization measures be pursued to enable a healthy environment that will reduce health impacts due to energy-related air pollution (SDG3) by 2030.

Rights and permissions

About this article

Cite this article

Jena, P.K., Mujtaba, A., Joshi, D.P.P. et al. Exploring the nature of EKC hypothesis in Asia’s top emitters: role of human capital, renewable and non-renewable energy consumption. Environ Sci Pollut Res 29, 88557–88576 (2022). https://doi.org/10.1007/s11356-022-21551-w

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-022-21551-w