Abstract

The paper analyses the relationship between environmental regulation and eco-innovation. The relationship is tested using a German firm-based panel and a dynamic count data model estimating the propensity of firms to innovate in response to five initiating factors, namely the fulfillment of existing legal requirements, expectations towards future legal requirements, financial incentives, demand for eco-innovations and self-commitment. The heterogeneity of firms is controlled for using R&D intensity, the size, the sector and the region of the company. The results answer the central question concerning the design of environmental policies in order to foster eco-innovation. Comparing a static model to a dynamic one shows that only long term objectives and market incentives are positively associated with eco-innovation. Conventional regulatory tools, namely legally binding instruments, are not effective for triggering innovative behavior at the firm level. The results do not allow to confirm the Porter hypothesis but rather offer a refined version, emphasizing the nuances that apply to the concept of “regulation”. The claim is that what matters is not the type of the policy instrument but rather the perception of the instrument by firms.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Since its publication, Porter's (1991) paper explaining how stricter environmental regulation could, actually, improve business competitiveness through eco-innovation created a turmoil among scholars, managers and politicians alike. This claim would later be known as the “Porter hypothesis”. Following this line of thought, the research in this paper is centered around the Porter hypothesis. However, the investigation in this paper is limited to the relationship between environmental regulation and eco-innovation, also known as the “weak” Porter hypothesis (Jaffe and Palmer 1997). To do so, the relationship between environmental regulation and eco-innovation is tested using a German firm-based panel data collected by the Centre for European Economic Research in Mannheim (ZEWFootnote 1). As noted by Jaffe and Palmer (1997) and more recently by Lanoie et al. (2008), the lack of dynamics is one of the recurrent shortcomings in testing the Porter hypothesis. Accordingly, a dynamic count data model is used in order to estimate the propensity of firms to innovate in response to a set of initiating factors for eco-innovation, namely the fulfilment of legal requirements, expectations towards legal requirements, public funding, demand for environmental innovations and self-commitment. This refinement is one of the novelties of the paper answering another shortcoming in the existing literature as noted by Cohen and Tubb (2015). In fact, the authors stated that the majority of the studies they reviewed could not distinguish between “command and control” and “flexible” regulatory approaches. The authors consider this as one of the reasons for the inconclusiveness of the empirical studies covering the Porter hypothesis. In order to address this shortcoming, instead of using the usual dichotomy of “command and control” vs “market-based” regulation, an alternative approach is proposed based on the perception of regulation where the key distinction lies between penalizing polluters, enabling eco-innovators and negotiated self-commitment. Accordingly, three policy alternatives, namely legally binding instruments, financial and market incentives, and self-regulation are compared in order to answer the following research question: which policy is more inclined to foster eco-innovation? The claim being that what matters for eco-innovation is not the type of the policy instrument in itself but rather the perception of the policy by firms.

The remainder of this paper is divided into five sections, a review of the relevant literature on the relationship between environmental regulation and eco-innovation, followed by a formulation of the hypotheses to be tested, the methodology used for the empirical model, the results and a discussion of these results.

2 Literature review

Measuring eco-innovation is still subject to a debate in academia with different measures such as research and development expenditures, patents or eco-efficiency performance (Arundel and Kemp 2009). The paper relies on the definition of eco-innovation given by Beise and Rennings (2005). The authors pointed to the fact that an innovation that has been developed without the specific goal of either reducing or avoiding environmental harm is still considered as eco-innovation if it effectively does so. In fact, in many cases the decision to eco-innovate is motivated by economic objectives rather than environmental considerations. Accordingly, limiting the dependent variable to innovations with the explicit aim of reducing the environmental impact might exclude a number of projects that do reduce environmental harm but were not necessarily designed with the aim of doing so (OECD 2009). In fact, Calleja et al. (2004) found very few distinctions between “normal” innovation and eco-innovation when it comes to the factors affecting its adoption. The most notable one is the distinction between end-of-pipe and process or product eco-innovation. More specifically, Rothenberg and Zyglidopoulos (2003) explain that when it comes to policy: “in order to encourage the adoption of eco-innovations, one can also focus on enhancing industries? overall ability to adopt new technologies in general ...therefore, it might be less important to focus on environmental technologies than to increase regulatory flexibility so as not to impede technology adoption” (Rothenberg and Zyglidopoulos 2003, p. 15). Thus, suggesting that the normal innovation drivers are just as important for the adoption of eco-innovation and that innovative businesses, in general, are more likely to eco-innovate, as well. Moreover, Del Río (2009) explained that environmental technological change occurs at three different stages: invention, innovation and diffusion. Limiting the dependent variable to patents for instance could exclude innovation projects at earlier stages. Given all these arguments, the total number of innovation projects is used as a measure of eco-innovation in this paper.

According to Murphy and Gouldson (2000), in order to address the environmental urgency regulators need to respond with instruments that could result in both environmental and economic benefits. They argued that in order to do so regulators would have to resort to “innovative policy instruments and approaches to replace the traditional understanding of the regulation of industry, particularly through the incentivization of environmental improvement” (Murphy and Gouldson 2000, p. 35). When studying the case of the Integrated Pollution Control (IPC) of the Environmental Protection Act (1990) in England and Wales, Murphy and Gouldson (2000) noticed that businesses would rather consider end-of-pipe solutions, instead of radical change in their process, to comply with existing regulations. By contrast, businesses would favour process eco-innovations in order to meet environmental objectives that are expected to be increasingly more stringent in the long-term. In addition, businesses saw tangible benefits for eco-innovation in the form of cost savings, productivity improvements and customer satisfaction. However, this option entails higher costs and lower flexibility and required more time to implement. In the same line of thought, Fisher and Freudenburg (2001) described ecological modernization as being twofold. They explain that in order to successfully transition to a more sustainable economy, policies need to be both economically and politically feasible with businesses committed to ecological change and politics ensuring environmental protection and supporting eco-innovation. Thus, in order to meet both expectations, new forms of political interventions need to be used. More recently, Huber (2008) explained that environmental regulation is a necessary condition for eco-innovation. On the one hand, the author stated that “it is stringent regulatory innovation which paves the way for technological environmental innovations” (Huber 2008, p. 362). Johnstone (2005) stressed the importance of favoring performance-based regulation instead of technology based regulation. Indeed, with standard-based regulation, the author stressed the absence of incentives to go beyond the standard once it is met, while performance-based regulation lead the way for the emergence of new technologies. Similarly, Nordhaus (2011) distinguished between standard-based and performance-based regulation. According to the author, both are considered as command and control since they set the objective to achieve, however standard-based regulation specifies the technology to use, while performance-based regulation gives businesses the freedom to choose the technology to use in order to meet the regulatory objective. The authors illustrated his claim using CO\(_2\) emissions as an example. The regulator could decide to impose a specific technology, carbon capture and sequestration (CCS) for instance, in order to reduce the level of pollution. Under such circumstances, businesses would have to show both capture and ultimate storage of CO\(_2\) emissions and risk penalties if the legal requirements are not satisfied (Nordhaus 2011). This is the case of standard-based regulation. Alternatively, the regulator could establish a performance standard that would limit the emissions allowed per unit of production. Under such circumstances, businesses would only have to show that they have met the legal requirements either by using CCS or any other technology and risk penalties if they do not comply with the legal boundary.

By contrast, incentives represent another driver for eco-innovation. Rennings (2000) refers to market incentives as the “technology-push factors” and the “market-pull factors”. In fact, a new technology will be diffused if it is found to be more efficient and cost effective, thus creating a market. In the same manner, if there is a demand for green products then a market for eco-innovations will be created, thus fostering eco-innovation. In that sense, policies should be designed in a way that they stimulate such market forces. In this paper, the long standing debate on the relative importance of the technology-push hypothesis (Rosenberg 1976; Dosi 1988) versus the demand-pull hypothesis (Schmookler 1966; Freeman 1982) will not be emphasized [see Godin and Lane (2013) for a historical review of the models]. That is because as far as the drivers of eco-innovation are concerned, both have been shown to be important (Horbach et al. 2012; Costantini et al. 2015). Moreover, Del Río et al. (2010) suggest to apply technology-push and demand-pull incentives simultaneously due to the potential synergies in driving eco-innovation. This complementarity is further explained by Di Stefano et al. (2012). The authors came to the conclusion that while the technology-pull factors provide the “trajectories” of innovation (i.e. generate innovations), it is the demand-push factors that guide the “trajectories” to the adequate economic channel (i.e. select innovation).

Alternatively, eco-innovation may be driven by the self-commitment of businesses, voluntary codes or sectoral agreements. The regulator may resort to such policy due to the uncertainty and the complexity of environmental issues (Aggeri 2000). In fact, according to Aggeri (2000), because of the information asymmetry existing among the several stakeholders, regulators no longer have the means nor the necessary knowledge to build a regulatory framework unilaterally. Therefore, by negotiating with industries regulators can setup a dynamic cooperation in order to mobilize the different actors around a revisable contract where they play the role of the coordinator. However, this can only be possible in the absence of regulatory “capture” (Aggeri and Hatchuel 1999).

In an empirical study using a cross-section of the Irish counterpart of the CIS data used in this paper, Doran and Ryan (2012) found a positive impact of self-regulation on the probability of firms to eco-innovate. They provided two possible explanations for the results: either firms engaged in a voluntary agreement are likely to follow through on the negotiated objectives, or that firms commit to a voluntary agreement only if they know that they have the ability to achieve the negotiated objectives. Similarly, Kesidou and Demirel (2012) found that the extent of the commitment of firms under such pressure is limited in term of resources. Therefore, the strong positive impact of self-regulation may be due to the fact that the objectives are less ambitious and thus require a less radical eco-innovation (Doran and Ryan 2012).

3 Hypotheses development

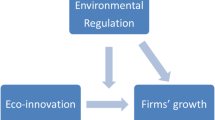

Based on the literature review, five hypotheses are formulated to be later tested by the model empirically with the objective of studying the marginal effect of legally binding instruments compared to incentive-based instruments and self-regulation in fostering eco-innovation (see Fig. 1).

3.1 Legally binding instruments

In order to study the marginal effect of legally binding instruments a distinction is made between existing environmental regulation and the expectations towards future environmental regulation.

Evidence from the literature show that technology-based regulation is not as effective as market-based regulation if the aim is to foster eco-innovation dynamically (Johnstone 2005; Huber 2008). In reality, a standard has to be both ambitious enough to foster eco-innovation while remaining realistically feasible by businesses. The balance between these two objectives is no easy task. Another limitation is the fact that however ambitious a standard is, if not revised dynamically, once it is met by businesses there is no incentive to go beyond the regulatory requirement, thus limiting the prospect of future technological innovation. In addition, such instruments limit the technological choices to achieve the regulatory objective, and therefore remove the incentive to develop new ways of reducing environmental harm (Jaffe and Stavins 1995). Moreover, Jaffe and Stavins (1995) warn against a counter-effect of such regulation. The authors argue that innovative businesses might even refrain from developing new technologies fearing more rigorous performance standards in the future.

Taxes are another type of legally binding instruments. Regulators design eco-taxes such that their value reflects the cost of the environmental harm caused by business, thus internalizing the value of the negative environmental externality originated by firms subject to these taxes (Andersen and Sprenger 2000). In line with the previous arguments, Frondel et al. (2007) found that although positively associated with the adoption of new technologies, legally binding regulatory measures tend to favor end-of-pipe solutions rather than process innovation. Nevertheless, the authors noted that taxes, for instance, are necessary when targeting environmental harm that cannot be reduced by process innovation (such as diesel emissions). Otherwise, policies should be designed to stimulate investments in cleaner process and product eco-innovation. Accordingly, regulations should appropriately alleviate the obstacles faced by eco-innovators rather than impose technology standards that can only be met through end-of-pipe measures (Frondel et al. 2007). Similarly, Krysiak (2011) showed that standard-based regulation and taxes do not foster eco-innovation but rather encourage the adoption of the least-costly available technology thus leading to a lock-in into a “possibly inferior technology” (Del Río 2014).

Based on these theoretical arguments, the hypothesize that legally binding instruments, alone, are ineffective in fostering eco-innovation is to be tested. That being said, with increasing public concern, regulators, often, resort to command and control regulation in order to have a convergence towards a level of pollution deemed more acceptable than the current level.

Hypothesis 1

Existing regulation does not foster eco-innovation.

Unlike technology-specific regulation, performance-based regulation sets long-term objectives, thus creating a dynamic effect with clear objectives over a known time-horizon. Performance-based regulation is defined as a type of regulation which sets the objectives to reach with minimal technical details on the means to achieve them (Queensland Government 2006; Coglianese et al. 2003; Guerin et al. 2003; Lowry 2002). Such regulation is, often, featured with multiyear plans and long-term objectives that are systematically updated (Sappington et al. 2001). The main departure from standards-based regulation in such regulation is the presence of a “beyond compliance” incentive for businesses (Zarker and Kerr 2008). In effect, Calleja and Delgado (2008) explain that in order for such “performance targets” to set a clear signal they should be based on a long-term and progressive guiding vision of the economy. Another difference between technology-based regulation and performance-based lies in the fact that businesses are free to choose the technology to adopt in order to achieve the objective, and are encouraged to discover new, more efficient and effective, technologies to achieve the regulatory objectives.

In addition, Del Río et al. (2010) explain that a long-term vision grants firms more flexibility to comply with stringent objectives. However, while too much certainty would not be enough of a stimulus, too much uncertainty would inhibit investment in eco-innovation (Ashford 1993). Accordingly, a right balance between the clarity in the policy vision and the consistency in the signal of increasingly stringent environmental targets need to be achieved in order to meet the intended goal of fostering eco-innovation.

Therefore, the theoretical arguments seem to agree with the hypothesis that expectations toward future regulation do foster eco-innovation.

Hypothesis 2

Signal of future regulation does foster eco-innovation.

3.2 Incentives for eco-innovation

In order to study the marginal effect of incentives for eco-innovation a distinction is made between public financial incentives, such as subsidies, and the market incentives, such as demand for green products.

In contrast to command and control regulation, which is considered direct regulation, financial policy incentives are considered indirect regulation. Economic policy instruments include, but are not limited to, subsidies, taxes, property rights, tradable permits and aim to reinstate the full-cost of an activity and align it with the social cost (Opschoor 1995). Financial incentives are limited to the different forms of subsidies such as loans, guarantees or interest rate subsidies (European Commission 2014). The objective of such policy instruments is to internalize the value of the environmental externality (Andersen and Sprenger 2000). In the case of a subsidy for instance, the value should reflect the positive spillover of eco-innovation. Alternatively, the regulator could decide to encourage eco-innovation in the form of a tax credits for avoided emission as a financial incentive (Nordhaus 2011). According to the European Environment Agency (2006), financial policy instruments give businesses the freedom to choose, or develop, the best technology to achieve the established regulatory level of environmental protection. Thus, the objective of such a tool is to lift the barriers faced by eco-innovators rather than to penalize polluters. Accordingly, these measures are more in line with the objective of a sustainable transition (Del Río et al. 2010). However, Andersen and Sprenger (2000) warn against the perverse effect of such instruments. In the case of subsidies, the authors noted that the lack of an incentive and reward system may lead to reduced levels of investment in pollution reduction technologies and favored end-of-pipe solutions.Footnote 2

The theoretical arguments do not seem to provide a clear-cut to whether such instruments foster or hinder eco-innovation. Thus, the hypothesis of neither a positive nor a negative association between public financial incentives and eco-innovation is to be tested.

Hypothesis 3

Public financial incentives foster eco-innovation.

Popp et al. (2010) define market-based instruments as “mechanisms that encourage behaviour through market signals rather than through explicit directives regarding pollution-control levels or methods”. In that sense, market-based policies are considered indirect regulation. In other words, businesses are free to choose the way to achieve the regulatory objectives. The main characteristic of market-based incentives is the fact that they “harness the market forces” (Stavins 1995) rather than influence the price or quantities of the market (Ecorys 2011). A typology of market-based policy instruments is given in Fig. 2.

In a report for the European Commission, Ecorys (2011) refers to these market-based incentives as “market friction instruments” that ameliorate the market conditions by improving information flows. Whitten et al. (2003) provided a comprehensive list of such instruments. They listed, among other tools, the reduction of market barriers for eco-innovative products, education programs for consumers, research programs with market applications, eco-labelling and information disclosure. However, the authors commented that such instruments have a less certain output and take longer than other market-based instruments to show results.

In their paper, Fontana and Guerzoni (2008) showed the positive effect of demand on innovation. The authors explain that demand not only provides an economic incentive for innovation, but also reduces the level of uncertainty inherent to novelty. On the one hand, demand will act as a multiplier favoring innovation in the Schmooklerian tradition (Schmookler 1962). On the other hand, by “channeling” information to the firms, demand will provide knowledge on the expected pay-offs, stimulating innovation as explained by Griliches (1957)

Based on these theoretical arguments, it is quite clear that such incentives will foster eco-innovation dynamically and allow businesses to go well beyond compliance objectives.

Hypothesis 4

Market-based incentives do foster eco-innovation.

Source: Adapted from Whitten et al. (2003)

Typology of market-based policy instruments

3.3 Self-regulation

In order to study the marginal effect of self-commitment for eco-innovation, instruments with no legally binding force such as sectoral voluntary agreements or Environmental Management Systems are considered. Many researchers have observed that unregulated businesses would rarely decide to invest in green technologies (Hahn and Stavins 1991). This is explained by the fact that with no regulation businesses would not have to bear the cost of their negative environmental externalities. At the same time, if a business makes the decision to eco-innovate the “double-externality problem” (Rennings 2000) will reduce its incentive to take such a decision. In fact, the peculiarity of eco-innovation resides in the fact that the environment is a non-excludable and non-rivalrous public good (Marginson 2007). As such, while the benefits of eco-innovation are shared by all the society, the sole bearer of the costs is the innovator (Beise and Rennings 2005). Another reason businesses would not invest in eco-innovation, if left to decide for themselves, is simply because other investment options are, often, more financially rewarding (Fiorino 2006). Taking all these points into account, regulators are summoned to intervene in order to achieve socially efficient levels of environmental protection. In that sense, policies should tackle the problem of market failures in terms of positive and negative externalities as well as financial attractiveness of environmentally friendly technologies.

These theoretical arguments allow to formulate the hypothesis that self-regulation will not suffice to foster eco-innovation.

Hypothesis 5

Regulatory intervention is necessary to foster innovation.

4 Methods

4.1 Methodology

Many studies concerning the Porter hypothesis have come to the conclusion that there is no such thing as a win-win solution when it comes to environmental regulation, eco-innovation and business competitiveness (Ambec and Lanoie 2008). Those studies claimed that there are no “low-hanging fruits” to be picked, and if they did exist, businesses would not need any governmental intervention, in the form of regulation for instance, to seize such opportunities (Ambec and Barla 2006). However, Ambec and Lanoie (2008) commented on those results by pointing out that the methodologies used have been lacking dynamics, among other things such as controlling for R&D intensity or the size and the sector of the business (McWilliams and Siegel 2000; Wagner 2010). Indeed, the original claim of the Porter hypothesis is that stricter environmental regulation would foster eco-innovation, which will in turn either, or both, reduce the costs and/or increase the revenues of businesses subject to stringent environmental regulation, and thus enhance their competitiveness. Ambec and Lanoie (2008) noted that such a process requires time, while many researchers who have rejected the Porter hypothesis studied the effect of regulation on innovation and productivity, or business performances, on the same period. The authors added that when Lanoie et al. (2008) allowed for a lag in time, they found that stringent regulation had a greater impact on productivity gains compared to a static model. Following those arguments, a static count data model is compared to a dynamic one in order to test the relationship between environmental regulation and eco-innovation. This choice is due to the nature of the dependent variable (total number of innovation projects). In effect, the total number of innovation projects is a variable that takes non-negative integer values. In addition, the period of study is relatively short and the number of observation is large. Under these conditions, Cameron and Trivedi (2013) explain that the negative binomial model is necessary, especially if the count variable is incomplete due to truncation for instance, which is the case for the total number of innovation projects in the ZEW survey. Another motive for choosing the Negative Binomial over the Poisson distribution is the over-dispersed nature of the dependent variable. In order to allow for time dependency, the lagged values of the dependent variable are added to the model as a regressor. The formal specification of the model is given by the following equations (Bai 2013; Moral-Benito 2013):

with:

where \(y_{it-1}\) is a vector of the lagged values of the dependent variable, \(x_{it}\) is a vector of time-varying variables, \(w_i\) is a vector of time-invariant variables, \(\nu _{it}\) is the time-varying error term, \(\alpha _i\) is the unobserved time-invariant firm heterogeneity, \(\epsilon _{it}\) is the time-varying idiosyncratic error.

In order to avoid the problem of the initial condition inherent to dynamic nonlinear models, Wooldridge (2005) simple solution is adopted with correlated random effects (Wooldridge 2009) allowing to estimate the average partial effects. In addition, the initial period of time-varying variables is added as well in order to avoid a biased estimation in short panels, as suggested by Rabe-Hesketh and Skrondal (2013). Finally, Arulampalam and Stewart (2009) show that even for short panels, the Wooldridge’s estimators have the smallest relative bias when compared to Heckman (1981) and Orme (2001) estimators, and that the bias is almost nonexistent with a large number of observations (N \(=1000\)) even for a small number of periods (T \(=3\)). One drawback of this method is the necessity of balanced panels resulting in the loss of many observations. The size of the resulting net balanced panel is still satisfactory for the purpose of this study, nonetheless. The formal specification of the model is given by the following equations (Rabe-Hesketh and Skrondal 2013):

where \(y_{it_0}\) is the initial values of the dependent variable, \(\bar{x_{i}}\) is the mean of the time-varying explanatory variables, \(x^{'}_{it_0}\) is the initial values of the time-varying explanatory variables.

In addition, a number of control variables is added in order to avoid model misspecifications. The objective being the assessment of the effect of different policy options on the eco-innovative behavior of businesses. Accordingly, the following simplified version of the model is specified:

where TotInno is the dependent variable measuring the total number of innovation projects during the last 3 years, IFs are the five different variables representing the initiating factors of eco-innovation.

Control variables:

\(R \& D\) is the R&D intensity of the company measured by the total R&D expenditures as a share of the turnover (values over 15% are truncated).

EMS is a dummy variable that filters companies that account for their environmental impact (0=Yes,1=No).

Size is the natural logarithm of the number of full-time employees.

Region is a dummy variable controlling for the region of the company (0=western, 1=eastern Germany).

Sector is a categorical variable accounting for the sector of the company (energy sector is the base category).

The theoretical model tested is represented in Fig. 1. Environmental regulation is linked to eco-innovation through the different policy alternatives. The marginal effect of each policy instrument in fostering innovation is estimated. Practically, three alternatives are compared: legally binding instruments, incentives for eco-innovation and self-regulation. A distinction between existing and expected future regulation is made. Both forms of incentives for eco-innovation: public funding and market demand are expected to be more effective than legally binding instruments since they create continuous and dynamic incentives. Finally, if left unregulated, businesses are not expected to eco-innovation. In other words, while strategic self-commitment and voluntary agreements have led to encouraging results when adopted, if the number of participants is too few then the expected effect will not be significant (Nordhaus and Danish 2005; Gardiner and Jacobson 2002).

4.2 Data set

In order to test the hypotheses listed in Sect. 3 a firm-based panel data collected by the Centre for European Economic Research in Mannheim is used. The ZEW is responsible for annual surveys on the innovative behavior of the German economy (ZEW 2014). The gross sample is stratified by sector, size and region (Peters and Rammer 2013). The sectors surveyed range from mining, manufacturing, energy and water supply, construction, trade, financial intermediation, transport to business-oriented services. The complete list is given in Table 1. The only sectors excluded from the MIP survey are: agriculture, forestry and fishing, public administration, health, education, and personal and cultural services. The aim of the survey being the study of the innovative behavior of businesses with five employees or more, it explains way the listed sectors are excluded. As noted by Rexhäuser and Rammer (2014), German data are ideal for studying the relationship between regulation and innovation since Germany is one of the pioneers in strict environmental policies which make the data particularity adapted to test the hypotheses formulated in Sect. 3. As a matter of fact, the first environmental legislation dates back to 1969 in West Germany followed by increasingly ambitious environmental policies such as the Emission Control Act, the German Energy Conservation Act (Energieeinsparungsgesetz), and more recently the Renewable Energies Act (Erneuerbare Energie-Wärmegesetz) (Richter and Johnke 2004; Lah 2009; Iwulska 2012; Bauermann 2016).

The main data set was collected in 2008 and includes a set of questions on eco-innovations and initiating factors of eco-innovation necessary for the hypotheses tested in this paper. In order to allow for dynamics, three non-consecutive waves were merged in order to constitute the panel. The dependent variable used is the total number of innovation projects. To collect the data on this variable, businesses had to answer the following question: What was the total number of innovation projects (including R&D projects) carried out in your enterprise during the last 3 years? (newly started, ended or still ongoing projects). The dependent variable is truncated in order to prevent recognition of firms on the basis of large values of innovation projects. The upper limit as shown in the descriptive statistics Table 2 is 200 projects during the last 3 years. The size of the firm in measured using the natural logarithm of the number of full-time employees (see Table 3).

In addition to the lagged values of the dependent variable (total number of innovation projects from 2008 to 2010), the main explanatory variables used are the five eco-innovation initiating factors, namely the fulfilment of existing legal requirements, expectations towards future legal requirements, public funding, demand for eco-innovations and self-commitment. To collect the data on these variables, businesses had to answer the following question: From 2006 to 2008, did your enterprise introduce an environmental innovation in response to:

-

Existing environmental regulations (including taxes on pollution).

-

Environmental regulations that you expected to be introduced in the future (including taxes on pollution).

-

Availability of government grants, subsidies or other financial incentives for environmental innovations.

-

Current or expected market demand from your customers for environmental innovations.

-

Voluntary codes or agreements for environmental good practice within your sector.

The lagged values for all policy-oriented variables are used in order to avoid endogeneity that would arise from the reverse causality problem. In other words, taking into account the impact of regulation on innovation, the fact that innovation can in turn influence regulation is not excluded. However, by using lagged values for the explanatory variables such interference is avoided since current innovation can not influence past regulation while the opposite is possible. Therefore, only the marginal effect of past regulation on innovation is accounted for. Concerning the particular case of public funding and the potential endogeneity arising from self-selection, several solution have been proposed in the literature: Heckmans selection model (Kesidou and Demirel 2012), propensity score matching (Bérubé and Mohnen 2009), instrumental variable (Clausen 2009) and difference-in-difference (Hujer and Radić 2005) and switching models (Catozzella and Vivarelli 2016) (see Aerts and Czarnitzki (2006) for an extensive review). In fact, there are two potential sources of endogeneity in the case of public funding: “picking the winners” or “saving the losers”, that is either backing the firms most likely to succeed or helping the ones most in need of support. Similarly, Catozzella and Vivarelli (2016) noted that the “better” firms may be more inclined to receive public funding because of their ability to identify subsidies programs while the “worse” firms may be intentionally targeted by such program to improve their innovative performance. These self-selection mechanisms make the randomness questionable. However, the presence of panel data allows for the use of lagged values for the initiating factor, thus limiting the potential bias. In addition, the variable used concerns the availability of public funding as an initiating factor for eco-innovation and not the amount nor the fact that the firm has indeed received the public funds.

Finally, in his empirical review of the determinants for eco-innovation, Del Río (2009) summarized the relevant factors for businesses to engage in eco-innovation in three categories: internal (such as financial resources), external (such as regulation) and technical (such as the cost reduction of technology).

5 Results

The results support the hypotheses formulated in Sect. 3. Understandingly, the number of observation drops when in the dynamic model and more so for the balanced panel. The estimation results are summarized in Tables 5 and 6.

The results of the static model show that: Firstly, the coefficients of the fulfilment of legal requirements (legally binding instruments) and the public funding (financial incentives) are statistically insignificant suggesting no association with innovation. Secondly, the coefficient of the expectation towards future requirements (future regulation) and the demand for green products (market incentives) are as expected positive and statistically significant. Lastly, self-commitment (self regulation) was correlated with innovation.

The dynamic model does not wield substantially different results. In fact, the only difference is Self-Regulation which is not significant anymore. As expected, innovation is indeed past dependent.

Lastly, the results of the dynamic model with initial condition and correlated random effects are consistent with the two previous outputs. The main notable difference concerns the coefficient of financial incentives which is negative and highly significant. This could be explained by the potential perverse effect of subsidies resulting in a lock-in effect that has been explained in Hypothesis 3 (see Table 4).

6 Discussion

The empirical results agree with the hypotheses formulated and the findings of previous research (Bitat 2016). Furthermore, they allow to shed some light on an important question. If environmental regulation is indeed necessary in order to trigger eco-innovation, how should it be designed?

6.1 Legally binding instruments

The first hypothesis tested dealt with existing and expected environmental regulation. Both theoretical and empirical evidence point to the relative ineffectiveness of existing regulation obligations compared to long term performance-based regulation when the aim is to foster eco-innovation. That is to say, businesses may refrain from innovating in apprehension of a rise of the regulatory standard. In contrast, performance-based regulation set long-term objectives that are systematically reviewed over a known time-horizon, thus it creates a market for eco-innovation and encourages businesses to find better ways to meet the regulatory objective. Nevertheless, for elected policy-makers, the choice of standard-based environmental regulation over performance-based regulation is motivated by two arguments. The outcome of the latter is less certain and requires longer periods than the former, in addition to difficulty of setting the long-term objectives with the right balance between environmental protection and economic growth. In fact, the objectives should be both ambitious and realistic, otherwise they will either fall short of environmental protection, or will hamper economic growth. Another argument in favor of legally binding instruments is intrinsically linked to the nature of eco-innovation with a distinction between end-of-pipe innovation and other forms of innovation. In fact, the use of end-of-pipe solution might be necessary awaiting a more radical solution.

6.2 Incentives

The second policy alternative is financial and market incentives. When studying this alternative, two initiating factors were analyzed: public funding and demand for green products. The theoretical arguments could not provide a clear-cut on the effectiveness of financial incentives to foster eco-innovation. Neither did the empirical results. In fact, the results show that these instruments are positively associated with eco-innovation only when they are forward looking such as the expectation towards a market demand for green innovation. That being said, it is important to distinguish between price and quantity-based instruments on the one hand, and information-based instruments on the other hand. Although it is necessary to correct market failures inherent to eco-innovation, such as the spillover effect, the former alternative may delay eco-innovation if the design of a subsidy is flawed, due to regulatory capture where special interests affect regulatory intervention in setting R&D subsidies for instance (Dal Bó 2006). Another limit of such policy is the uncertainty around the outcome and the time necessary to reach the intended results. It is also important to note that environmental and technology policy are more effective when the regulator should enable ecological modernization rather than controlling the process of transition.

6.3 Self-regulation

While the short-term results of self-regulation may be encouraging, clearly, regulators cannot rely on self-regulation alone to face the environmental urgency and foster eco-innovation in a consistent and dynamic fashion. The results suggest that self-regulation can be the first step toward a more inclusive regulation. However, in the medium to long run the effect of such instrument fades out. An explanation for such results lies in the nature of eco-innovation and the environment as a public good. Indeed, businesses that would voluntarily engage in self-regulation would have to bear the cost of their negative externalities. In addition, while the cost of the investment in eco-innovation is borne by the businesses, the benefits are share but the society as whole. These reasons make the eco-innovation less attractive from a financial stand point. As a result, regulators need to couple self-regulation with other instruments that would constitute a consistent policy mix in order to foster eco-innovation dynamically.

7 Conclusion

The objective of this paper is to determine which policy is more inclined to foster eco-innovation? To do so, three policy alternatives are compared: legally binding instruments, financial and market incentives, and self-regulation. The claim being that what matters for eco-innovation is not the design of the policy instrument (command and control vs. market-based) but rather the perception of the policy instruments by firms subject to the regulation. The results allow to draw the following policy recommendations: conventional regulatory tools, namely legally binding instruments are not effective for triggering innovative behavior at the firm level while market incentives have a positive effect on eco-innovation. Moreover, there is a market inertia justifying regulatory intervention in order to break path dependency with innovative policy instruments that create a sound and dynamic environment for eco-innovation.

However, these results offer only a partial view, in the sense that they are specific to Germany. In fact, the German context is structurally different from other European countries participating in the Community Innovation Survey. Thus it would be more informative to conduct a similar study allowing for heterogeneity across countries. Similarly, several approaches for studying the effect of regulation on eco-innovation have been used in literature such as the evolutionary (Rennings 2000), induced innovation (Andersen 2010; Wagner and Llerena 2011), actor-networks theory (Braun 2008; Truffer and Coenen 2012), the systemic approach (Edquist 1999) or the practice-based approach (Mele and Russo-Spena 2015). These approaches explore different aspects of eco-innovation such as the interactions between different policies, path dependencies, the role of the position in the network, the role of national innovation systems and institutional factors as well as the non-linear and dynamic nature of innovation.

Nonetheless, although the results do not allow to confirm the Porter hypothesis, they offer a refined version, emphasizing the nuances that apply to the concept of “regulation”. In addition to the fact that not all types of regulation trigger eco-innovation, the results show that although necessary, environmental regulation is certainly not a sufficient condition for eco-innovation. Indeed, as stressed by Palmer (1992), environmental policy should not be “slow, cumbersome, expensive, uncoordinated and uncertain” (p. 259). On the contrary, it should rather be “proactive, ambitious, open, flexible and knowledge oriented” (Del Río et al. 2010, p. 547) arising from dialogue and consensus. Accordingly, the empirical analysis in this paper provides further evidence to Del Río et al. (2010) recommendations: the objective of environmental policy should not focus on penalizing polluting businesses but rather on lifting the barriers to eco-innovation allowing the passage to a more sustainable economy.

Notes

ZEW stands for Zentrum für Europäische Wirtschaftsforschung.

The authors illustrate with the case of the Spanish agricultural sector

References

Aerts, K., & Czarnitzki, D. (2006). The impact of public R&D—funding in Flanders. Brussels: IWT.

Aggeri, F. (2000). Les politiques d’environnement comme politiques de l’innovation. In Gérer et Comprendre. Annales des Mines 60 (pp. 31–43).

Aggeri, F., & Hatchuel, A. (1999). A dynamic model of environmental policies. The case of innovation oriented voluntary agreements. In Voluntary approaches in environmental policy (pp. 151–185). Springer.

Ambec, S., & Barla, P. (2006). Can environmental regulations be good for business ? An assessment of the porter hypothesis. Energy Studies Review, 14, 42–62.

Ambec, S., & Lanoie, P. (2008). Does it pay to be green? A systematic overview. Academy of Management Perspectives, 22, 45–62. doi:10.5465/AMP.2008.35590353.

Andersen, M. M. (2010). On the faces and phases of eco-innovation-on the dynamics of the greening of the economy. In Druid Summer Conference 2010. London, United Kingdom.

Andersen, M. S., & Sprenger, R.-U. (2000). Market-based instruments for environmental management: politics and institutions. Cheltenham: Edward Elgar Publishing.

Arulampalam, W., & Stewart, M. B. (2009). Simplified implementation of the heckman estimator of the dynamic probit model and a comparison with alternative estimators. Oxford Bulletin of Economics and Statistics, 71, 659–681.

Arundel, A., & Kemp, R. (2009). Measuring eco-innovation. UNU-MERIT Working Paper Series-017.

Ashford, N. A. (1993). Understanding technological responses of industrial firms to environmental problems: implications for government policy. In Environmental strategies for industry: international perspectives in research needs and policy implications (pp. 277–307). Washington, DC: Island Press.

Bai, J. (2013). Fixed-effects dynamic panel models, a factor analytical method. Econometrica, 81, 285–314.

Bauermann, K. (2016). German energiewende and the heating market-impact and limits of policy. Energy Policy, 94, 235–246.

Beise, M., & Rennings, K. (2005). Lead markets and regulation: A framework for analyzing the international diffusion of environmental innovations. Ecological Economics, 52, 5–17.

Bérubé, C., & Mohnen, P. (2009). Are firms that receive r&d subsidies more innovative? Canadian Journal of Economics/Revue canadienne d’économique, 42, 206–225.

Bitat, A. (2016). Environmental regulation and eco-innovation: insights from diffusion of innovations theory. Maghreb Review of Economics and Management, 3, 112–129.

Braun, B. (2008). Environmental issues: inventive life. Progress in Human Geography, 32, 667–679.

Calleja, I., & Delgado, L. (2008). European environmental technologies action plan (etap). Journal of Cleaner Production, 16, S181–S183.

Calleja, I., Delgado, L., Eder, P., Kroll, A., Lindblom, J., Van Wunnik, C., Wolf, O., Gouarderes, F., & Langendorff, J. (2004). Promoting environmental technologies: sectoral analysis, barriers and measures. IPTS report EUR, 21002. Institute for Prospective Technological Studies, Seville.

Cameron, C., & Trivedi, P. K. (2013). Count panel data. In B. H. Baltagi (Ed.), Oxford handbook of panel data econometrics. New York: Oxford University Press.

Catozzella, A., & Vivarelli, M. (2016). The possible adverse impact of innovation subsidies: some evidence from italy. International Entrepreneurship and Management Journal, 12, 351–368.

Clausen, T. H. (2009). Do subsidies have positive impacts on r&d and innovation activities at the firm level? Structural Change and Economic Dynamics, 20, 239–253.

Coglianese, C., Nash, J., & Olmstead, T. (2003). Performance-based regulation: prospects and limitations in health, safety, and environmental protection. Administrative Law Review, 705–729.

Cohen, M. A., & Tubb, A. (2015). The impact of environmental regulation on firm and country competitiveness: a meta-analysis of the porter hypothesis. Available at SSRN. http://ssrn.com/abstract=2692919. Accessed 31 May 2017.

Costantini, V., Crespi, F., Martini, C., & Pennacchio, L. (2015). Demand-pull and technology-push public support for eco-innovation: The case of the biofuels sector. Research Policy, 44, 577–595.

Dal Bó, E. (2006). Regulatory capture: A review. Oxford Review of Economic Policy, 22, 203–225.

Del Río, G. P. (2009). The empirical analysis of the determinants for environmental technological change: A research agenda. Ecological Economics, 68, 861–878.

Del Río, P. (2014). On evaluating success in complex policy mixes: the case of renewable energy support schemes. Policy Sciences, 47, 267–287.

Del Río, P., Carrillo-Hermosilla, J., & Könnölä, T. (2010). Policy strategies to promote eco-innovation. Journal of Industrial Ecology, 14, 541–557.

Di Stefano, G., Gambardella, A., & Verona, G. (2012). Technology push and demand pull perspectives in innovation studies: Current findings and future research directions. Research Policy, 41, 1283–1295.

Doran, J., & Ryan, G. (2012). Regulation and firm perception, eco-innovation and firm performance. European Journal of Innovation Management, 15, 421–441.

Dosi, G. (1988). Sources, procedures, and microeconomic effects of innovation. Journal of Economic Literature, 26(3), 1120–1171.

Ecorys,. (2011). The role of market-based instruments in achieving a resource efficient economy. Technical Report European Commission: DG Environment.

Edquist, C. (1999). Innovation policy: A systemic approach. Tema: Univ.

Environmental Protection Act (1990). Environmental protection act 1990. London: Her Majesty's Stationary Office.

European Commission (2014). Factsheet: financial instruments in cohesion policy 2014–2020. Brussels: DG REGIOnal Policy. http://ec.europa.eu/regional_policy/sources/docgener/informat/2014/financial_instruments_en.pdf. Accessed 30 May 2007.

European Environment Agency (2006). EEA report. In Using the market for cost-effective environmental policy: market-based instruments in Europe. Luxembourg: Office for Official Publications of the European Communities.

Fiorino, D. J. (2006). The new environmental regulation. Cambridge, MA: MIT Press.

Fisher, D. R., & Freudenburg, W. R. (2001). Ecological modernization and its critics: Assessing the past and looking toward the future. Society & Natural Resources, 14, 701–709.

Fontana, R., & Guerzoni, M. (2008). Incentives and uncertainty: An empirical analysis of the impact of demand on innovation. Cambridge Journal of Economics, 32, 927–946.

Freeman, C. (1982). The economics of industrial innovation. Cambridge, MA: MIT Press.

Frondel, M., Horbach, J., & Rennings, K. (2007). End‐of‐pipe or cleaner production? An empirical comparison of environmental innovation decisions across OECD countries. Business Strategy and the Environment, 16(8), 571–584.

Gardiner, D., & Jacobson, L. (2002). Will voluntary programs be sufficient to reduce U.S. greenhouse gas emissions? An analysis of the Bush administration’s global climate change initiative. Environment, 44(8), 27–33.

Godin, B., & Lane, J. P. (2013). Pushes and pulls hi (s) tory of the demand pull model of innovation. Science, Technology & Human Values, 38, 621–654.

Griliches, Z. (1957). Hybrid corn: an exploration in the economics of technological change. Econometrica, Journal of the Econometric Society, 25, 501–522.

Guerin, K. et al. (2003). Encouraging quality regulation: Theories and tools. Technical Report New Zealand Treasury.

Hahn, R. W., & Stavins, R. N. (1991). Incentive-based environmental regulation: A new era from an old idea. Ecology LQ, 18, 1.

Heckman, J. J. (1981). The incidental parameters problem and the problem of initial conditions in estimating a discrete time-discrete data stochastic process. In C. F. Manski & D. L. McFadden (Eds.), Structural analysis of discrete data with econometric applications. Cambridge, MA: The MIT Press.

Horbach, J., Rammer, C., & Rennings, K. (2012). Determinants of eco-innovations by type of environmental impactthe role of regulatory push/pull, technology push and market pull. Ecological Economics, 78, 112–122.

Huber, J. (2008). Pioneer countries and the global diffusion of environmental innovations: Theses from the viewpoint of ecological modernisation theory. Global Environmental Change, 18, 360–367.

Hujer, R., & Radić, D. (2005). Evaluating the impacts of subsidies on innovation activities in germany. Scottish Journal of Political Economy, 52, 565–586.

Iwulska, A. (2012). Country benchmarks. In I. S. Gill & M. Raiser (Eds.), Golden growth: restoring the lustre of the European economic model. Washington, DC: World Bank Publications.

Jaffe, A. B., & Palmer, K. (1997). Environmental regulation and innovation: A panel data study. Review of Economics and Statistics, 79, 610–619.

Jaffe, A. B., & Stavins, R. N. (1995). Dynamic Incentives of Environmental Regulations: The Effects of Alternative Policy Instruments on Technology Diffusion. doi:10.1006/jeem.1995.1060.

Johnstone, N. (2005). The innovation effects of environmental policy instruments. In J. Horbach (Ed.), Indicator systems for sustainable innovation (pp. 21–41). Heidelberg: Physica-Verlag HD.

Kesidou, E., & Demirel, P. (2012). On the drivers of eco-innovations: Empirical evidence from the uk. Research Policy, 41, 862–870.

Krysiak, F. C. (2011). Environmental regulation, technological diversity, and the dynamics of technological change. Journal of Economic Dynamics and Control, 35, 528–544.

Lah, O. (2009). The climate for change: the conditions for effective climate change policies: a case study on residential home insulation policies in New Zealand and Germany. Wellington: School of Geography, Environment and Earth Sciences.

Lanoie, P., Patry, M., & Lajeunesse, R. (2008). Environmental regulation and productivity: Testing the porter hypothesis. Journal of Productivity Analysis, 30, 121–128. doi:10.1007/s11123-008-0108-4.

Lowry, M. N. (2002). Performance-based regulation of utilities. Energy LJ, 23, 399.

Marginson, S. (2007). The public/private divide in higher education: A global revision. Higher Education, 53, 307–333.

McWilliams, A., & Siegel, D. (2000). Corporate social responsibility and financial performance: correlation or misspecification? Strategic Management Journal, 21, 603–609. doi:10.1002/(SICI)1097-0266(200005)21:5<603::AID-SMJ101>3.0.CO;2-3

Mele, C., & Russo-Spena, T. (2015). Eco-innovation practices. Journal of Organizational Change Management, 28, 4–25.

Moral-Benito, E. (2013). Likelihood-based estimation of dynamic panels with predetermined regressors. Journal of Business & Economic Statistics, 31, 451–472.

Murphy, J., & Gouldson, A. (2000). Environmental policy and industrial innovation: Integrating environment and economy through ecological modernisation. Geoforum, 31, 33–44.

Nordhaus, R. R. (2011). Treatment of ccs under ghg regulatory programmes. In I. Havercroft, R. Macrory, & R. Stewart (Eds.), Carbon Capture and Storage: Emerging Legal and Regulatory Issues chapter 5. (pp. 81–91). Oxford: Bloomsbury Publishing. https://books.google.be/books?id=Dol6BAAAQBAJ. Accessed 30 Sept 2016

Nordhaus, R. R., & Danish, K. W. (2005). Assessing the Options for Designing a Mandatory U.S. Greenhouse Gas Reduction Program. Boston College Environmental Affairs Law Review, 32, 97–163. http://search.proquest.com/docview/743475172?accountid=26636$delimiter”026E30F.

OECD (2009). Eco-innovation in industry: enabling green growth. Paris: OECD.

Opschoor, J. B. (1995). Managing the environment: the role of economic instruments. Fuel and Energy Abstracts, 5(36), 373.

Orme, C. (2001). Two-step inference in dynamic non-linear panel data models. Manuscript, School of Economic Studies, University of Manchester.

Palmer, G. (1992). New ways to make international environmental law. The American Journal of International Law, 86(2), 259–283.

Peters, B., & Rammer, C. (2013). Innovation panel surveys in Germany. In Handbook of innovation indicators and measurement (p. 135) Cheltenham and Northhampton: Edward Elgar.

Popp, D., Newell, R. G., & Jaffe, A. B. (2010). Energy, the Environment, and Technological Change. Handbook of the Economics of Innovation, 2, 873–937

Porter, M. (1991). America’s green strategy. Scientific American Magazine, 264, 168.

Queensland Government (2006). Guidelines on alternative to prescriptive regulation. Technical Report.

Rabe-Hesketh, S., & Skrondal, A. (2013). Avoiding biased versions of wooldridges simple solution to the initial conditions problem. Economics Letters, 120, 346–349.

Rennings, K. (2000). Redefining innovationeco-innovation research and the contribution from ecological economics. Ecological Economics, 32, 319–332.

Rexhäuser, S., & Rammer, C. (2014). Environmental Innovations and Firm Profitability: Unmasking the Porter Hypothesis. Environmental and Resource Economics, 57, 145–167. doi:10.1007/s10640-013-9671-x.

Richter, S., & Johnke, B. (2004). Status of pcdd/f-emission control in germany on the basis of the current legislation and strategies for further action. Chemosphere, 54, 1299–1302.

Rosenberg, N. (1976). Perspectives on technology. Cambridge: Cambridge University Press.

Rothenberg, S., & Zyglidopoulos, S. (2003). Determinants of environmental innovation adoption in the printing industry. Rochester Institute of Technology, Rochester, USA. http://scholarworks.rit.edu/books/13

Sappington, D. E., Pfeifenberger, J. P., Hanser, P., & Basheda, G. N. (2001). The state of performance-based regulation in the us electric utility industry. The Electricity Journal, 14, 71–79.

Schmookler, J. (1962). Economic sources of inventive activity. The Journal of Economic History, 22, 1–20.

Schmookler, J. (1966). Invention and economic growth. Cambridge, MA: Harvard University Press.

Stavins, R. N. (1995). Harnessing market forces to protect the environment. In K. Schwab (Ed.), Overcoming Indifference: Ten Key Challenges in Today’s Changing World: A Survey of Ideas and Proposals for Action on the Threshold of the Twenty-First Century. New York: New York University Press. C-5.

Truffer, B., & Coenen, L. (2012). Environmental innovation and sustainability transitions in regional studies. Regional Studies, 46, 1–21.

Wagner, M. (2010). The role of corporate sustainability performance for economic performance: A firm-level analysis of moderation effects. Ecological Economics, 69, 1553–1560. doi:10.1016/j.ecolecon.2010.02.017.

Wagner, M., & Llerena, P. (2011). Eco-innovation through integration, regulation and cooperation: Comparative insights from case studies in three manufacturing sectors. Industry and Innovation, 18, 747–764.

Whitten, S., Van Bueren, M., & Collins, D. (2003). An overview of market-based instruments and environmental policy in australia. In AARES Symposium.

Wooldridge, J. M. (2005). Simple solutions to the initial conditions problem in dynamic, nonlinear panel data models with unobserved heterogeneity. Journal of Applied Econometrics, 20, 39–54.

Wooldridge, J. M. (2009). Correlated random effects models with unbalanced panels. Manuscript (version July 2009) Michigan State University.

Zarker, K. A., & Kerr, R. L. (2008). Pollution prevention through performance-based initiatives and regulation in the united states. Journal of Cleaner Production, 16, 673–685.

ZEW (2014). The Scientific-Use of the Mannheim Innovation Panel. Technical Report Zentrum für Europäische Wirtschaftsforschung.

Acknowledgements

The author would like to show his gratitude to Dr. Abdelghafour Ayadi, Dr. Wim Laurier, Dr. Pierre Mohnen, Dr. Juan Antonio Duro Moreno, Dr. Delphine Misonne, Dr. Christian Rammer and Dr. Mercedes Teruel Carrizosa, in addition to two anonymous referees for comments and suggestions that greatly improved earlier versions of the paper.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Bitat, A. Environmental regulation and eco-innovation: the Porter hypothesis refined. Eurasian Bus Rev 8, 299–321 (2018). https://doi.org/10.1007/s40821-017-0084-6

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40821-017-0084-6