Abstract

Innovation is an imperative way of harmonizing the relationship between environmental protection and economic growth. Reasonably creating institutional pressure to stimulate the innovation vitality of enterprises is a crucial issue in promoting the modernization of ecological environment governance systems and governance capacity. This paper considered China’s new environmental protection law (NEPL) as a quasi-natural experiment to evaluate the impact of environmental regulation on enterprise eco-innovation in a difference-in-difference (DID) framework. It also identifies the conditions of the NEPL that encourage enterprise eco-innovation. We found that the NEPL significantly hinders the level of enterprise eco-innovation. This inhibition is mainly associated with invention patents with high degrees of innovation rather than utility model patents, resulting from tightening financing constraints. Further, when considering enterprise heterogeneity in terms of ownership, size, and cost transfer ability, private and small-sized enterprises and enterprises with higher cost transfer ability are more affected by the implementation of the NEPL. Furthermore, enterprises with a better business environment are more likely to perform innovation activities. Our findings have valuable implications for evaluating the effects of policy implementation more scientifically and comprehensively, and consequently, promoting the “innovation compensation effect” of environmental regulation.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

The theoretical system of ecological civilization has been developing continuously, and it has been deeply rooted in the hearts of the people since the 18th National Congress of the Communist Party of China in 2012. Therefore, managing the relationship between environmental protection and economic growth has become a vital issue. However, China scored 50.74 points and ranked 120th among 180 countries, according to the 2018 report on the global environmental performance index (EPI) that was jointly released by the Yale University environmental law and policy center. It reflects China’s high environmental pollution pressure due to economic development. Data from “The Bulletin of the Second National Pollution Source Survey” issued by the Ministry of Ecological Environment of China on June 9, 2020 shows that industrial emissions of sulfur dioxide, nitrogen oxides, and particulate matter accounted for 75.98%, 36.18%, and 75.44%, respectively, of total national emissions. This indicates that industrial pollution is still the primary source of environmental pollution in China. Thus, it is necessary to encourage enterprises to make full use of raw materials and reduce pollution emissions. As commonly recognized, enterprise eco-innovation is the fundamental way to solve environmental problems. Although it has the characteristics of double-positive externalities of R&D and environmental protection (Rennings 2000), it entails high investment and risk, resulting in the lack of motivation for enterprise eco-innovation. Therefore, designing scientific and reasonable environmental regulations to encourage enterprise eco-innovation is of great significance.

The Environmental Protection Law of the People’s Republic of China (referred to as “the New Environmental Protection Law,” NEPL), officially implemented on January 1, 2015, is the first revision since the promulgation of the Environmental Protection Law of the People’s Republic of China (referred to as “the Old Environmental Protection Law,” OEPL) in 1989. It is the strictest basic law in the field of environmental protection in history, which reflects the government’s determination to pursue ecological governance and environmental protection. Therefore, identifying the effects and mechanism of the NEPL on enterprise eco-innovation and the conditions for the NEPL to stimulate enterprise eco-innovation is crucial.

The impact assessment of the NEPL implementation belongs to the category of environmental regulation effect evaluation. Measuring environmental regulation strictness is the biggest hurdle in empirical research (Fu and Zhao 2014). Presently, the academic community has no consensus regarding a scientific authoritative method to measure this strictness. Some scholars use a single indicator to measure environmental regulation strictness, namely, per capita income level (Antweiler et al. 2001; Lu 2009), the pollution intensity, pollution emission or unit emission intensity (Zhang and Zhao 2012), pollution control cost, investment in environmental pollution control or pollution control investment per unit output value (Zhang et al. 2011; Shen and Liu 2012; Zheng and Bai 2019), the number of pollution control laws enforced (Brunnermeier and Cohen 2003), and sewage charge (Cai and Li 2019). On this basis, Fu and Zhao (2014) and Li and Tao (2012) used the comprehensive index method to measure the intensity of environmental regulation. However, both the single and comprehensive index methods have distinct endogenous problems. Accordingly, recent studies have paid more attention to the impact of individual environmental policies, such as cleaner production regulation (Zhang and Lv 2018; Gao and Yuan 2020), emission trading pilot (Tu and Chen 2015; Li and Wen 2016; Qi et al. 2018; Ren et al. 2019), environmental tax (Bi and Yu 2019), carbon emission trading system (Hu et al. 2020a, b), low carbon city pilot (Zhang 2020), and Two Control Zone (Tang et al. 2020). At present, literature regarding the effect of the NEPL implementation is relatively sparse. Li and Wang (2019) empirically found that the implementation of the NEPL can improve the technological innovation investment of enterprises, but the results were not significant. While Zhang et al. (2018) hold the viewpoint that the NEPL has a negative effect on the innovation of having polluting enterprises, Cui and Jiang (2019) believed that the implementation of the NEPL impairs the enthusiasm of enterprises to invest in environmental protection and leads to the reduction of production scale.

Although the literature on environmental regulation measurement and related policy assessment has carried on the corresponding research, there is room for further expansion. Thus, owing to insufficient research and practical significance, we employed the NEPL as a quasi-natural experiment. We used a Chinese panel dataset of A-share listed companies from 2010 to 2018 to investigate the multi-dimensional impact of the NEPL on the eco-innovation of enterprises with a difference-in-difference (DID) framework and exhibited the internal effect mechanism of how the NEPL influences enterprise eco-innovation. Accordingly, the heterogeneity of enterprises and policy environment was fully considered. Our research provides relevant suggestions for further optimizing environmental protection policies and promoting environmental governance.

This study contributes in the following ways. First, it fills the gap in the literature on the impact of environmental regulation on enterprise eco-innovation. While extant literature has mainly focused on the effect of a single type of environmental regulation, we used the NEPL as an exogenous policy shock. It comprehensively uses three types of environmental regulation, such as command-and-control, market-oriented, and public participation, to clarify the relationship between the NEPL and enterprise eco-innovation, thus making our research closer to the actual situation and leading to greater practical significance.

Second, this study analyzes the impact mechanism of the NEPL implementation regarding enterprise eco-innovation from the perspective of corporate governance and financing constraints. Further, it tests this analysis with an empirical method, which reveals the effects of environmental regulations on enterprise eco-innovation and enriches the theory of environmental governance.

Third, the enterprises’ own endowment and policy environment influence the effect of the NEPL on enterprise eco-innovation from a micro- as well as macro- perspective. Accordingly, we not only analyzed the differences of policy implementation effects while considering the enterprises’ heterogeneity, such as enterprise ownership, size, and cost transfer ability, but also tested these differences based on the business environment. Thus, our findings can help enterprises improve their own endowment conditions and urge the government to optimize the business environment such that enterprises realize the “innovation compensation effect” of the NEPL.

The rest of the study is structured as follows. “Policy background and research hypotheses” presents the policy background and research hypotheses. “Empirical strategy” describes the empirical strategy, including the DID basic model setting, DID dynamic model setting, description of variables, and data sources. “Estimation results and robustness test” reports the empirical results and robustness test. “Mechanism analysis” analyzes the mechanism of the NEPL’s effect. “Heterogeneity analysis” elaborates the difference of effects by considering enterprise heterogeneity and policy environment. Finally, “Conclusions and policy implications” concludes the study.

Policy background and research hypotheses

Policy characteristics

Compared with the OEPL, the NEPL has the following characteristics. First, the legislative goal has changed. The OEPL paid more attention to economic development, whereas the NEPL focuses on the system construction of ecological civilization, striving to achieve a win-win situation of economic development and environmental protection. Second, the NEPL encourages the public to participate in environmental governance, as reflected in the fifth chapter. This chapter stipulates that the public has the right to obtain environmental information, participate in and supervise environmental protection according to relevant law, and encourages the public to report all kinds of environmental violations. Third, the NEPL reinforces enterprises’ environmental protection responsibility. It not only expands the implementation scope of the environmental impact assessment system, but also formally writes the total emission control system of key pollutants into the law, which means it clearly establishes the “emission permit management system.” Lastly, under the NEPL, more efforts have been made to punish environmental violations. The NEPL has established the strictest environmental damage compensation system and implemented the strictest environmental responsibility investigation system of the government. It establishes the rules of sealing up, detaining, continuous penalty on a daily basis, limiting production, stopping production, among others, to standardize the enterprise behavior. Regarding the government, NEPL has strengthened its responsibility from many aspects, stipulated the target responsibility system and assessment system of environmental protection, and improved the accountability mechanism. Based on the above characteristics, it is a typical policy to promote environmental governance and environmental protection.

NEPL and enterprise eco-innovation output

Despite environmental regulations improving the environmental quality to a certain extent, scholars have different opinions regarding its impact on enterprise eco-innovation, which is mainly reflected in the “innovation compensation effect” and the “compliance cost effect.”

According to the “compliance cost theory” of the traditional economics, the implementation of the NEPL increases enterprises’ environmental expenditure and management expenses, which reduces the capital investment of technological innovation. Specifically, the NEPL stipulates that enterprises and other production and business operators that discharge pollutants shall operate to prevent and control the wastewater, waste gas, and other pollutants generated through production and construction activities. Additionally, they shall pay the pollutant discharge fee in accordance with the relevant national regulations. Thus, this will directly increase enterprises’ environmental expenditure and comparatively reduce their funds for R&D investment, which will hinder the development of enterprise innovation activities.

Instead, Porter and Linde (1995) believes that environmental regulations with scientific design can encourage enterprises to promote innovation activities and improve existing products or develop new products, conducive to improving production efficiency regarding reducing production costs and increasing production income. Specifically, the NEPL implementation encourages enterprises to perform innovation activities. On the one hand, it makes enterprises meet the green needs of consumers, which helps to expand their market share and enjoy innovation advantages. On the other hand, enterprises can make profits by selling advanced equipment after making innovation achievements and carry out deep-seated R&D activities. Compared with other enterprises that have not carried out innovation activities, they have less technical resistance to carrying out independent innovation activities. Thus, the revenue earned from innovation can partly or completely offset the compliance cost and bring a greater competitive advantage for such enterprises.

Therefore, we formulated hypotheses 1a and 1b as follows:

-

H1a. The implementation of the NEPL restrains enterprises’ eco-innovation output.

-

H1b. The implementation of the NEPL stimulates enterprises’ eco-innovation output.

NEPL mechanism and enterprise eco-innovation output

How the NEPL affects the enterprise eco-innovation is a vital issue of this paper. Therefore, we take the “Pressure-State-Response (PSR)” model proposed by the Organisation for Economic Co-operation and Development (OECD) and the United Nations Environment Programme (UNEP) as a reference to make an in-depth analysis. There is no doubt that the implementation of the NEPL puts pressure on enterprises’ environmental governance (P), which may change the enterprises’ internal and external environment (S), and then affect the enterprises’ innovation decision-making and innovation behavior (R). According to the principal-agent theory and the information asymmetry, we assumed that corporate governance and financing constraints are important internal and external factors affecting enterprise innovation activities.

Corporate governance

Corporate governance includes ownership structure, board of directors, and board of supervisors (Jiang and Xu 2015). The equity balance mechanism is the basis of corporate governance. It can alleviate the centralized control behavior of the controlling shareholders, and thus facilitate effective supervision and restriction regarding the shareholders and operators to improve the decision-making level of the board of directors and encourage enterprises to carry out more innovation activities. Moreover, it is helpful to solve the moral hazard and adverse selection problems in the principal-agent process. Therefore, it is crucial to set up a reasonable ownership structure. Two kinds of costs should be considered when an enterprise chooses its ownership structure, namely, risk cost and governance cost.

Undoubtedly, an enterprise’s ownership structure is correlated with its development stage, type of service, and development theory. The NEPL requires enterprises to actively promote sustainable development by stipulating penalties such as daily penalties and production restrictions. These measures encourage enterprises to reduce resource waste by transforming the energy type from non-clean energy to green energy, or by establishing a green procurement system to achieve sustainable development. Thus, the green means of production suppliers, green production technicians, and other stakeholders play a vital role in the healthy development of enterprises. Accordingly, they are afforded a certain amount of equity to help enterprises meet the requirements of the NEPL and avoid negative environmental events that affect the social image of enterprises, which may decrease the enterprise’s risk cost. From the analysis above, the implementation of the NEPL is conducive to decentralizing an enterprise’s equity to carry out more innovation activities.

However, the equity dispersion causes the separation of ownership and management, which may aggravate the principal-agent problem. Specifically, the goal of the owners is to achieve the enterprise’s value maximization from the perspective of managerial economics. The operators prefer to buy advanced equipment from other enterprises to make full use of resources, aiming to reduce pollution emissions and increase profits in the short run. Nevertheless, this approach is unsustainable for the enterprise’s development in the long run, because it does not improve the competitive advantage of the enterprise, which should be realized through innovation. Thus, it is not conducive to realizing the enterprise’s long-term goals. Hence, the implementation of the NEPL will reduce an enterprise’s innovation investment due to equity dispersion.

Financing constraint

Schumpeter’s “innovation theory” proposes that the availability of capital plays an important role in the technological innovation process. R&D capital is composed of internal capital and external financing, wherein there are great constraints to acquiring external financing support. In particular, the higher the degree of information asymmetry between the operators and investors, the larger the financing constraint is. Further, if an enterprise strengthens information disclosure, the degree of information asymmetry will decrease. The NEPL not only asks enterprises to disclose information about pollutant discharge levels, investment in pollution control, among others, but also requires the government to expose the list of environmental violations of enterprises and institutions. This helps investors to receive more information about the enterprises, and consequently, the degree of information asymmetry between the operators and investors will lessen. Subsequently, the investors will prefer to invest more, and the enterprise may obtain more R&D capital to do innovation research.

However, the implementation of NEPL may increase enterprises’ management costs due to the requirements concerning reducing pollutant discharge, which will drain the internal capital that could be used in R&D activities. Moreover, R&D activities are characterized by a long cycle, high input cost, and high investment risk. Therefore, the investors will increase the rate of invested capital return, and this may further increase the cost of innovation research for enterprises.

Therefore, we postulate the following hypotheses:

-

H2a. The implementation of the NEPL impacts the level of eco-innovation by affecting corporate governance.

-

H2b. The implementation of the NEPL impacts the level of eco-innovation by affecting financing constraints.

Empirical strategy

Empirical model

The baseline model

We employed the NEPL as a quasi-natural experiment setting for studying environmental regulation effects. Empirically, we treated heavy polluting enterprises as the experimental group, while other companies, which are in the same industry as heavy polluting enterprises, were the control group (Cui and Jiang 2019). Based on the above-mentioned theoretical analysis, we first used the DID method to construct the following basic model:

where the subscripts i and t represent enterprise and year, respectively. lnInnovationi, t is the dependent variable, representing the innovation output level of enterprise i in year t (measured by the number of green patents authorized). Treati is a dummy variable that represents whether the enterprise is a part of the experimental group. If the enterprise is a heavy polluting enterprise, Treati=1; otherwise, Treati=0. Postt is a dummy variable of the experiment year. When the time considered is in the year of the NEPL implementation (2015) or later, Postt=1; otherwise, Postt=0. The most important variable is the interactive term Postt × Treati, which defines whether the enterprise is affected by the NEPL in year t. Its coefficient α1, the key coefficient of concern, is the DID estimator. This coefficient measures the effect of the NEPL in 2015 on the enterprise eco-innovation of heavy polluting enterprises. If α1 > 0, it means that the NEPL had a positive impact on enterprise eco-innovation; if α1 < 0, it means that the NEPL had a negative impact on enterprise eco-innovation. Xi, t is a set of control variables that affect enterprise eco-innovation. The descriptions are provided in Table 1. γt is the time effect variable; μi is the individual effect variable; and εi, t is the random error term.

The dynamic model

The baseline model only estimates the average effect of the NEPL after the policy’s implementation from 2015 to 2018, but it does not show the dynamic effect of the NEPL on enterprise eco-innovation over time and whether there is a time lag on the effects. To test this dynamic effect, we used the event study method proposed by Jacobson et al. (1993) to construct Model (2) to estimate the impact of the NEPL by year.

We considered 2015, the year when the NEPL was formally implemented, as the base year. αt represents a series of estimated values from 2010 to 2018, and the definitions of other variables are consistent with Model (1).

The mechanism test model

The implementation of environmental regulation affects the level of innovation output through influencing corporate governance and financing constraints (Lv 2020; Fan and Zhou 2020). Based on the methods of Wen and Ye (2014), we constructed the following Models (3)–(5) to test the mediating effect:

where Mi, t represents a mediating variable of corporate governance and financing constraints, respectively, and the other variables are consistent with Model (1).

Data source and variable description

We used a panel data set of enterprises listed on the Shenzhen and Shanghai stock exchanges from 2010 to 2018 and collected data from China Stock Market and Accounting Research Database (CSMAR database), the Wind database, and companies’ annual reports.

To identify a listed company as a heavy polluting enterprise, we used “The Guidelines for Environmental Information Disclosure of Listed Companies (Draft for Comments)” issued by the Ministry of Environmental Protection in 2010, “The Industry Classification Management Directory of Environmental Protection Verification of Listed Companies” enacted by the Ministry of Environmental Protection in 2008, and “The Industry Classification Standards” promulgated by China Securities Regulatory Commission in 2012. Other companies, which were in the same industry as the heavy polluting enterprises, were considered non-heavy polluting enterprises. The list of heavy polluting industry and non-heavy polluting industry is shown in Table 1.

Furthermore, we performed data cleaning to ensure the stability and validity of the sample. We excluded the enterprises that were listed in AB/AH shares, listed as ST or *ST, delisted or listed from 2010 to 2018, or missing key variables from the research sample. Finally, 861 enterprises were included in the sample. To improve the comparability of the obtained data, we used the industrial producer price index to adjust the net profit and the fixed assets investment price index to adjust other financial data.

Table 2 presents the descriptive statistics of the main variables in this study. The average value of lnInnovation is 0.395, while the maximum value is 5.829, and the minimum value is 0, which indicates that the average number of green patents authorized to the sample enterprises was small and the heterogeneity among enterprises was high. As for Post, the average value is 0.444, which shows that the proportion of the sample enterprises after the NEPL implementation is 44.4%. The average value of Treat is 0.528, which means heavy polluting enterprises accounted for 52.8% of all sample enterprises, and the number of heavy polluting enterprises was slightly more than that of non-heavy polluting enterprises.

Estimation results and robustness test

Parallel trend test

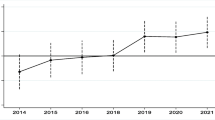

The key premise of the DID test is that the treatment group and the control group must have the same trend before the implementation of the policy. That is, the time trend of the treatment group and the control group must be the same before the implementation of the policy, and there are obvious changes after the implementation of the policy. Specifically, the time trends of green patents authorized to heavy polluting enterprises and non-heavy polluting enterprises were extremely close before the NEPL implementation. However, there were differences between the two trends after the NEPL implementation. Figure 1 shows the time trends of green patents authorized to heavy polluting enterprises and non-heavy polluting enterprises. In the figure, the horizontal axis represents the year, and the vertical axis represents the logarithm of the average number of green patents authorized to enterprises. It shows that before the NEPL implementation, the trend of green patents authorized to heavy polluting enterprises and non-heavy polluting enterprises was relatively similar. However, the number of green patents authorized to heavy polluting enterprises initially increased and then gradually decreased after the NEPL implementation, while that of non-heavy polluting enterprises continued to rise. Therefore, we assumed that the trend of average green patents authorized to heavy polluting enterprises and non-heavy polluting enterprises meets the parallel trend hypothesis before the implementation of the NEPL. Thus, it was reasonable to use the DID method to test the impact of the NEPL implementation on enterprise eco-innovation.

Baseline estimation result

Table 3 presents the baseline estimation results of the NEPL affecting enterprise eco-innovation. The empirical results are divided into four columns.

Columns (1)–(2) and (3)–(4) present the results of the polled regression model (OLS) and two-way fixed effect model (FE), respectively. The coefficients of the interaction term Post × Treat exhibit strong significance statistically in both models. Specifically, the results in column (4) suggest that, with key variables controlled, there is a clear reduction in the level of innovation output after the NEPL implementation, which is significant at the 10% level. Furthermore, in terms of economic significance, the level of innovation output of heavy polluting enterprises declined by an average of 6.0%. From this perspective, the “innovation compensation effect” of the NEPL was not realized from 2015 to 2018, which supports H1a.

Dynamic estimation effects

Although Figure 1 indicates that the green patents authorized of heavy polluting enterprises and non-heavy polluting enterprises meet the parallel trend hypothesis before the NEPL implementation, we needed to adopt more rigorous empirical methods to prove it. Moreover, the baseline estimations show the average effects of the NEPL on enterprise eco-innovation, but do not further explore the effects of the NEPL in the years after the implementation of the policy and test the time lag effect. Thus, we examined the dynamic effects of the NEPL on the enterprise eco-innovation in each year according to Model (2). Figure 2 reports the results of dynamic estimation effects.

The coefficients are not significant until 2017, which is the third year after the implementation of the NEPL. We further tested the joint significance of the pre-treatment and post-treatment indicators, respectively. The results showed that the post-treatment indicators are jointly significant, while the pre-treatment indicators are not. This suggests that the number of green patents authorized to heavy polluting enterprises and non-heavy polluting enterprises followed similar growth trends before the NEPL implementation, and these growth trends began to diverge after the NEPL.

The coefficients of Treat2017 are negative and statistically significant, indicating that the growth of the number of green patents authorized to heavy polluting enterprises became slower than that of non-heavy polluting enterprises from 2017. Moreover, the impact of the implementation of the NEPL on enterprise eco-innovation has a lag of 2 years. This may be because innovation activities often require a long time for research. In addition, a patent often takes 1 to 2 years from application to authorization. All these factors may lead to a time lag.

Robustness test

Placebo test

First, the period before the implementation of the policy was selected as a new sample for the placebo test (Topalova 2010). In our case, the interval was limited from 2010 to 2014, and the implementation years of the NEPL were assumed to be 2012 and 2013, respectively. Table 4 displays the regression results. As shown, the coefficients in columns (1)–(4) are not significant, which indicates that there are no other factors that decrease the level of enterprise eco-innovation except for the NEPL implementation.

Furthermore, we conducted the placebo test by randomly selecting heavy polluting enterprises (Cai et al. 2016). Accordingly, random samples were selected 1000 times and then estimated according to Model (1). Figure 3 shows the kernel density distribution of the regression estimation coefficient and the scatter plot of coefficients’ P values. The graph shows that most of the estimated coefficients are not statistically significant at conventional levels. In addition, we added the true estimate coefficient of Post × Treat (Table 3, column (4)) to compare with the estimated coefficient of the randomly selected heavy polluting enterprises and found that the true estimate coefficient was a significant outlier. Thus, the placebo tests further enhanced the credibility of the research and the conclusion of our study.

Instrumental variable (IV)

Random grouping is one of the conditions for the effectiveness of the DID method. In this study, we selected the heavy polluting enterprises in strict accordance with the series of documents mentioned above. However, some potential factors may have affected the distribution of samples in the treatment group, resulting in endogenous policy problems.

Thus, to ensure the robustness of the results, we introduced the instrumental variable (IV) for the robustness test (Cai et al. 2016). The lag of the explanatory variable was selected as an IV to decide whether to include an enterprise in the treatment group (Qi and Zhang 2021). Columns (5)–(6) of Table 4 present the regression results. We found that the impact of the NEPL implementation on enterprise eco-innovation was still significantly negative, which means that our research results were not influenced by sample selection bias. Furthermore, we carried out weak instruments test, and the Kleibergen-Paap rk Wald F statistic is 1.4e+06 in column (5) and 8.4e + 04 in column (6), which is much larger than the 10% maximum IV size (16.38). The results mean that it is reasonable to use the lag of the explanatory variable as the instrumental variable.

PSM-DID test

To further test the robustness of the estimation results, we combined DID with the PSM method. First, the PSM was used to match heavy polluting enterprises and non-heavy polluting enterprises based on their individual characteristics. A Logit regression was performed on the matching variables by using the dummy variable Treat, and we then obtained the propensity score value. Following extant studies (Cui and Jiang 2019), we selected individual characteristics, including enterprise size lnSize, enterprise age lnAge, enterprise liabilities lnDebt, TobinQ TobinQ, enterprise profitability Roa, cash flow from operating activities Clowf, and enterprise ownership Soe as matching variables. The Logit regression results indicated that most matching variables have a significant impact on Treat.

Second, based on the matching variables and propensity scores above, heavy polluting enterprises and non-heavy polluting enterprises were matched. We adopted the radius matching method to match the experiment group and control group with a radius of 0.05. Figure 4 shows the common range of propensity scores for the two groups after PSM. Notably, most of the observations used throughout this study are on the same support, and only a small number of samples were lost after the radius matching. Then, we performed a balance test to identify whether this dataset was applicable to PSM-DID. Table 5 presents the test results. There was no significant difference between the experimental group and control group regarding the mean value of all variables, and all t-test results did not reject the original hypothesis that there was no systematic difference between the experimental group and control group. This implies that the distribution of the variables between the two groups was balanced. Thus, the experimental group and control group met the homogeneity assumption, and the validity of the PSM-DID method was guaranteed in this dataset. Columns (7) and (8) in Table 4 present the results of the PSM-DID method. It is notable that the NEPL still has a significant inhibitory effect on the enterprise eco-innovation. This further validated the empirical results and analysis of the previous models.

Other robustness tests

First, we balanced out the years before and after the implementation of the NEPL by limiting the sample interval to 2011–2018. Columns (9) and (10) of Table 4 present the test results. Second, the two-way influence of the control variable and the explained variable is possible, so we did a lag treatment for continuous control variables and then reconducted the regression. Column (11) of Table 4 shows these results. Supporting the previous conclusion, the coefficients of the interaction term Post × Treat are all significantly negative, indicating that the NEPL implementation had an inhibitory effect on enterprise eco-innovation.

Mechanism analysis

Our research revealed that the implementation of the NEPL had an obvious inhibitory effect on the level of enterprise eco-innovation. According to the above theoretical analysis, the NEPL implementation may affect enterprises’ eco-innovation by changing their internal and external environment. Therefore, we tested this mechanism via the mediating effect test on models (3)–(5). For this purpose, the shareholding ratio of the largest shareholder and long-term loan was selected to measure corporate governance and financing constraints, respectively. Table 6 reports the results.

Columns (1)–(3) of Table 6 report the empirical results of financing constraints as intermediary variables. According to the mediating effect test process, the coefficient of the interaction term Post × Treatin in column (1) is significantly negative, which should be considered as an intermediary effect. However, the coefficient of the interaction term Post × Treat in column (2) is significant, and the coefficient of M in column (3) is not significant. Thus, it was necessary to conduct a bootstrap test. The bootstrap test results showed that the confidence interval does not contain zero, which means that α2α4 is significant and that further testing could be done. In column (3), it is notable that the interaction term Post × Treat is significant, and α2α4 as well as α3 are both negative, so financing constraints can be considered to play an intermediary role in the NEPL decreasing the level of enterprise eco-innovation output, which supports H2b. Specifically, the implementation of the NEPL increases the pressure of enterprises’ financing constraints, which may lead to a reduction in R&D investment, and consequently, decrease the innovation output. This may be because the NEPL, which is the most stringent “basic law” in the history of environmental laws, has increased the punishment of enterprises’ environmental violations by establishing a series of measures such as continuous punishment on a daily basis and detention, among others. Faced with a severe punishment mechanism and high-intensity financing pressure, enterprises do not have enough funds to invest in R&D and innovation. Instead, they use funds to purchase new equipment that can help improve the utilization rate of raw materials and reduce pollution in the short term.

Columns (4)–(6) of Table 6 show the results of using corporate governance as an intermediary variable. The coefficient of the interaction term Post × Treatin column (4) is significantly negative. Although the coefficient of the interaction term Post × Treat in column (5) is significant, the coefficient of M is not significant. Moreover, the results of the bootstrap test illustrated that α2α4 is not significant, which means that the mediating effect of corporate governance is not significant.

Heterogeneity analysis

According to the analysis above, the implementation of the NEPL negatively affects eco-innovation, which is mainly caused by the increase of financing constraints. However, it is still unclear why the NEPL does not urge enterprises to do more innovation research. Thus, we analyzed heterogeneity from the perspective of innovation diversity, enterprise heterogeneity, and policy environment to clarify this issue.

Innovation diversity

The green patent is a kind of R&D innovation, and we have previously discussed the impact of the NEPL on R&D innovation. However, it is unclear whether the NEPL has a negative impact on all types of innovation. Therefore, we first selected total fixed assets and net fixed assets to measure the enterprise process innovation, to analyze the impact of the NEPL implementation on different types of innovation (Zhang and Lv 2018). The regression results are reported in columns (1) and (2) of Table 7. It is notable that regardless of whether the total fixed assets or the net fixed assets were considered the explanatory variables, the coefficient of Post × Treat was positive but not significant, which indicates that the implementation of the NEPL can promote the process innovation of enterprises. Accordingly, we can assume that the implementation of the NEPL does not inhibit all types of innovation, and it only inhibits the input and output of R&D innovation to a certain extent.

According to the degree of invention, there are three types of patents: invention, utility model, and design. Since there is no design aspect for green patents, we divided them into the invention and utility models to analyze the different impacts of the NEPL implementation. Columns (3) and (4) of Table 7 report the results. The coefficient of Post × Treat in column (3) is significantly negative, whereas in column (4), it is negative, but not significant. This shows that the negative impact of the NEPL implementation on R&D innovation is mainly caused by the inhibition of invention patents, and it has no impact on utility models.

Through the analysis above, we found that although the implementation of the NEPL negatively impacts R&D innovation, this impact is primarily caused by the inhibition of invention. Moreover, the NEPL only has a negative effect on R&D innovation, but has an incentivizing effect on other types of innovation, such as process innovation. This shows that the enterprises reduce pollution emissions under the pressure of NEPL by purchasing new equipment to meet the requirements of environmental protection. Therefore, the NEPL is likely to realize the “Porter hypothesis,” which requires the joint efforts of enterprises, government departments, and the public.

Enterprise heterogeneity

Enterprise ownership

Different kinds of ownership of enterprises lead to various government-enterprise relations and diverse anti-risk capability. These factors cause differences in the impact of the NEPL on enterprise eco-innovation. Based on the major shareholders or actual controllers, the enterprises are divided into state-owned enterprises, foreign enterprises, and other enterprises. Generally, state-owned enterprises have a lot of government support, abundant funds, and strong anti-risk capability, and thus, they have more advantages in R&D and innovation. Additionally, foreign enterprises enjoy more preferential policies, such as reduced tax rates for limited areas and industrial projects, regular tax reduction and tax exemption for restricted industries and projects, and a tax rebate for reinvestment, among others. Compared with other enterprises such as private enterprises, the NEPL implementation has less impact on state-owned enterprises and foreign enterprises. Table 8 reports the empirical test results. The coefficients of the interaction term Post × Treat in columns (1) and (2) are not significant, while it is significantly negative in column (3). The estimation results above imply that the NEPL implementation has no significant impact on the eco-innovation of state-owned enterprises and foreign enterprises, but significantly inhibits the eco-innovation of other enterprises such as private enterprises. This is in line with our expectations.

Enterprise size

Different enterprise sizes imply differences in R&D investment capacity, management capability, and innovation ability. Therefore, the impact of the implementation of the NEPL on enterprises of different sizes will be different. In this paper, the samples are divided into large enterprises and small enterprises according to the net assets of the enterprises. The regression results are reported in Table 9. The coefficient of cross-term Post × Treat is not significant in column (1) and significantly negative in column (2), which indicates that the implementation of the NEPL has little impact on large enterprises, but significantly inhibited the level of eco-innovation output of small enterprises. One possible reason is that large enterprises have a strong ability to carry out R&D activities, which help the enterprises to formulate a “positive cumulative effect,” so the implementation of the NEPL has little impact on the level of innovation output. However, the innovation ability of small enterprises is weak, and the implementation of the NEPL also increases the management cost of enterprises in the short term, resulting in less investment in R&D.

Cost transfer ability

Different cost transfer ability leads to different countermeasures under the pressure of environmental regulation. We used the individual stock Lener index to measure the enterprises’ cost transfer ability and divided the sample into a high-cost transfer ability group and a low-cost transfer ability group, respectively. Table 10 presents the empirical results. Interestingly, the enterprises with high-cost transfer ability are more likely to transfer the environmental regulation costs to consumers, which may decrease the enterprises’ eco-innovation motivation. The NEPL implementation greatly hinders enterprises’ R&D innovation. However, reasonable environmental regulation can promote innovation and engender a “win-win” situation regarding economic benefits and environmental benefits for the enterprises with a low-cost transfer ability. Therefore, the NEPL implementation encourages enterprises with a low-cost transfer ability to improve their innovation awareness and increase innovation investment.

Policy environment

Regarding the external environment faced by enterprises, the business environment has a great effect on enterprises’ innovation. We used the relationship index between government and market from “Marketization Index of China’s Provinces” to measure regions’ business environment and divided the sample into two groups, namely, enterprises with the better business environment and enterprises with the general business environment. Table 11 shows the empirical results. Although the coefficients of Post × Treat for the two groups are negative and not significant, the hindering effect of the NEPL for the group of enterprises with better business environments is relatively smaller. This signifies that creating a good business environment promotes enterprises to carry out more innovative activities.

Conclusions and policy implications

The purpose of this study is to explore the impact of environmental regulations on enterprise eco-innovation by using a difference-in-difference model and mediating effect model based on the micro data of Shanghai and Shenzhen A-share listed companies from 2010 to 2018. The main conclusions are as follows: first, the NEPL implementation has an obvious inhibitory effect on the level of enterprise eco-innovation (Zhang et al. 2018), and the negative effect is lagging and continuous. Second, this negative effect is mainly caused by the increase in enterprises’ financing constraints. Third, the negative impact of the NEPL is mainly associated with R&D innovation, especially concerning the invention patents with a high degree of innovation compared to utility model patents. However, NEPL can promote process innovation and other types of innovation to help enterprises reduce pollution and meet the environmental protection standards. Lastly, when considering the heterogeneity of enterprises and policy environment in terms of ownership, size and cost transfer ability, private and small-sized enterprises, and enterprises with higher cost transfer ability are more affected by the implementation of the NEPL. Moreover, enterprises with a better business environment are more likely to carry out innovative activities.

This study demonstrates that the NEPL is a reasonable environmental regulation policy, but the “innovation compensation effect” has not yet been realized. Thus, our findings have important implications for governments and enterprises.

First, multi-channel financing must be provided to reduce the financing constraints of enterprises’ R&D innovation. For example, relevant departments could reduce the threshold of enterprises’ capital loan applications and simplify the approval process to ease the pressure of enterprises’ financing constraints. As for the government and financial institutions, they can help enterprises broaden the sources of funds by conducting activities such as policy propaganda and financing roadshows.

Second, the government should formulate differentiated emission reduction standards to encourage all types of enterprises to participate in innovation research. State-owned enterprises and large-scale enterprises have strong anti-risk ability and innovation ability, and thus, they can undertake more social responsibility by increasing the environmental protection and emission reduction standards. This may encourage the enterprises with higher innovative ability to realize clean production through independent innovation. As for small-scale enterprises, the government should formulate step-by-step emission reduction standards to guide enterprises to carry out independent innovation and cooperative innovation activities. Moreover, tax relief and subsidies should be afforded to enterprises carrying out innovation activities, which will help to reduce the loss caused by innovation failure. Since the enterprises with high-cost transfer ability can easily transfer the cost of pollution prevention and control onto consumers, these types of enterprises lack innovation consciousness and motivation. Accordingly, the government can raise the environmental protection standards for these enterprises to reduce the proportion of pollution costs that can be transferred to impel enterprises to carry out innovation activities.

Third, the government must formulate reforms to optimize business environments. The government should sort out relevant administrative approval items punctually to reduce unnecessary administrative approval procedures required to provide a good business environment for enterprises. This will in turn reduce the cumbersome procedures in the process of R&D innovation and patent protection application, and indirectly improve the innovation enthusiasm of enterprises.

This study has some limitations that deserve to be mentioned. Future studies could, if data are available, study not only the impact of the NEPL on green innovation output, but also the impact on green innovation input and deeply analyze the impact mechanism. It could be a meaningful topic for further exploration to examine the realization of the Porter hypothesis in developing countries.

Data availability

The datasets used and analyzed during the current study are available from the corresponding author on reasonable request.

References

Antweiler W, Copeland BR, Taylor MS (2001) Is free trade good for the environment. Am Econ Rev 91(4):877–908. https://doi.org/10.1257/aer.91.4.877

Bi Q, Yu L (2019) Environmental tax and enterprise technological innovation: promotion or suppression? Sci Res Manag 40(12):116–125 (in Chinese). https://doi.org/10.19571/j.cnki.1000-2995.2019.12.012

Brunnermeier SB, Cohen MA (2003) Determinants of environmental innovation in US manufacturing industries. J Environ Econ Manag 45(2):278–293. https://doi.org/10.1016/S0095-0696(02)00058-X

Cai W, Li Q (2019) Dual effect of environmental regulation on enterprise’s eco-technology innovation. Sci Res Manag 40(10):87–95 (in Chinese). https://doi.org/10.19571/j.cnki.1000-2995.2019.10.008

Cai X, Lu Y, Wu M, Yu L (2016) Does environmental regulation drive away inbound foreign direct investment? Evidence from a quasi-natural experiment in China. J Dev Econ 123(1):73–85. https://doi.org/10.1016/j.jdeveco.2016.08.003

Cui G, Jiang Y (2019) The influence of environmental regulation on the behavior of enterprise environmental governance: based on a quasi-natural experiment of new environmental protection law. Bus Manag J 41(10):54–72 (in Chinese). https://doi.org/10.19616/j.cnki.bmj.2019.10.004

Fan H, Zhou X (2020) A research on the effect mechanism of managerial ownership on innovation performance——the mediating role based on financial constraints. Sci Res Manag 41(03):52–60 (in Chinese). https://doi.org/10.19571/j.cnki.1000-2995.2020.03.006

Fu J, Zhao C (2014) Will environmental regulation affect export trade of pollution intensive industries: analysis based on China’s panel data and Trade Gravity Model (in Chinese). Economist (02):47–58. https://doi.org/10.16158/j.cnki.51-1312/f.2014.02.001

Gao X, Yuan K (2020) Cleaner production environment regulation and technology complexity of enterprise export——micro evidence and influencing mechanisms. J Int Trade (02):93–109 (in Chinese). https://doi.org/10.13510/j.cnki.jit.2020.02.007

Hu J, Huang Q, Pan X (2020a) Carbon emission trading system and firms’ innovation quality: suppression or promotion. China Popul Resour Environ 30(02):49–59 (in Chinese)

Hu J, Huang N, Shen H (2020b) Can market-incentive environmental regulation promote corporate innovation? A natural experiment based on China’s carbon emissions trading mechanism. J Financ Res (01):171–189 (in Chinese). https://doi.org/CNKI:SUN:JRYJ.0.2020-01-010

Jacobson LS, LaLonde RJ, Sullivan DG (1993) Earnings losses of displaced workers. Am Econ Rev 83(4):685–709.

Jiang X, Xu C (2015) Environmental regulation, corporate governance and environmental protection investment. Financ Account Mon (27):9–13 (in Chinese). https://doi.org/10.19641/j.cnki.42-1290/f.2015.27.002

Li L, Tao F (2012) Selection of optimal environmental regulation intensity for Chinese manufacturing industry——based on the green TFP perspective. China Ind Econ (05):70–82 (in Chinese). https://doi.org/10.19581/j.cnki.ciejournal.2012.05.006

Li B, Wang B (2019) Has the implementation of the New Environmental Protection Law increased the company's technological innovation investment? Research Based on PSM-DID Method. J Audit Econ 34(01):87–96 (in Chinese). https://doi.org/10.3969/j.issn.1004-4833.2019.01.009

Li Y, Wen Y (2016) A study on the efficiency of emission trading policy in China--empirical analysis based on natural experiment. Economist (05):19–28 (in Chinese). https://doi.org/10.16158/j.cnki.51-1312/f.2016.05.004

Lu Y (2009) Do Environmental regulations influence the competitiveness of pollution-intensive products? Econ Res J 44(04):28–40 (in Chinese) . https://doi.org/CNKI:SUN:JJYJ.0.2009-04-005

Lv X (2020) Financing constraints, equity structure and innovation investment—data from China’s gem listed companies. Dissertation, Zhejiang Gongshang University.https://doi.org/10.27462/d.cnki.ghzhc.2020.000090

Porter ME, Linde C (1995) Green and comparative: ending the stalemate. Harv Bus Rev 73(5):120–134.

Qi J, Zhang Z (2021) Profit-driven or innovation-driven? The emission trading mechanism and Chinese enterprises' OFDI. Ind Econ Res (02):15–29 (in Chinese). https://doi.org/10.13269/j.cnki.ier.2021.02.002

Qi S, Lin S, Cui J (2018) Do environmental rights trading schemes induce green innovation? Evidence from listed firms in China. Econ Res J 53(12):129–143 (in Chinese). https://doi.org/CNKI:SUN:JJYJ.0.2018-12-010

Ren S, Zheng J, Liu D, Chen X (2019) Does emissions trading system improve firm's total factor productivity——evidence from Chinese listed companies. China Ind Econ (05):5–23 (in Chinese) . https://doi.org/10.19581/j.cnki.ciejournal.2019.05.001

Rennings K (2000) Redefining innovation—eco-innovation research and the contribution from ecological economics. Ecol Econ 32(2):319–332. https://doi.org/10.1016/S0921-8009(99)00112-3

Shen N, Liu F (2012) Can intensive environmental regulation promote technological innovation?: porter hypothesis reexamined. China Soft Sci (04):49–59 (in Chinese). https://doi.org/CNKI:SUN:ZGRK.0.2012-04-007

Tang H, Liu J, Wu J (2020) The impact of command-and-control environmental regulation on enterprise total factor productivity: a quasi-natural experiment based on China’s “Two Control Zone” policy. J Clean Prod 254:1–14. https://doi.org/10.1016/j.jclepro.2020.120011

Topalova P (2010) Factor immobility and regional impacts of trade liberalization: evidence on poverty from India. Am Econ J Appl Econ 2(4):1–41. https://doi.org/10.1257/app.2.4.1

Tu Z, Chen R (2015) Can emissions trading scheme achieve the Porter effect in China?. Econ Res J 50(07):160–173 (in Chinese). https://doi.org/CNKI:SUN:JJYJ.0.2015-07-013

Wen Z, Ye B (2014) Analyses of mediating effects: the development of methods and models. Adv Psychol Sci 22(05):731–745 (in Chinese). https://doi.org/10.3724/SP.J.1042.2014.00731

Zhang H (2020) Can low-carbon city construction reduce carbon emissions? Evidence from a quasi-natural experiment. Bus Manag J 42(06):25–41 (in Chinese). https://doi.org/10.19616/j.cnki.bmj.2020.06.002

Zhang C, Lv Y (2018) Green production regulation and enterprise R&D innovation: impact and mechanism research. Bus Manag J 40(01):71–91 (in Chinese). https://doi.org/10.19616/j.cnki.bmj.2018.01.005

Zhang Z, Zhao G (2012) FDI, environmental regulation and technological progress. J Quant Tech Econ 29(04):19–32 (in Chinese). https://doi.org/10.13653/j.cnki.jqte.2012.04.006

Zhang C, Lu Y, Guo L, Yu T (2011) The intensity of environmental regulation and technological progress of production. Econ Res J 46(02):113–124 (in Chinese). https://doi.org/CNKI:SUN:JJYJ.0.2011-02-010

Zhang G, Qiu S, Zhang W (2018) Does strengthening environmental regulations affect corporate R&D innovation: an empirical analysis based on the implementation of the New Environmental Protection Law of PRC. J Guangdong Univ Financ Econ 33(06):80–88+101 (in Chinese).

Zheng T, Bai X (2019) Re-examination of environmental regulation and industrial international competitiveness from the perspective of dynamic evolutionary game. Ind Econ Rev 10(06):70–86 (in Chinese). https://doi.org/10.14007/j.cnki.cjpl.2019.06.006

Acknowledgements

We thank the anonymous referees for their insightful comments that improved the paper.

Funding

This work was supported by the National Natural Science Foundation of China (71974032).

Author information

Authors and Affiliations

Contributions

Wugan Cai contributed to the conceptualization, methodology, funding acquisition, investigation, supervision, validation, project administration, and writing (review and editing). Fengru Xu contributed to data curation, formal analysis, software, methodology, investigation, writing (original draft), and visualization. All the authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Ethics approval and consent to participate

Not applicable.

Consent for publication

Not applicable.

Competing interests

The authors declare no competing interests.

Additional information

Responsible editor: Eyup Dogan

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Cai, W., Xu, F. The impact of the new environmental protection law on eco-innovation: evidence from green patent data of Chinese listed companies. Environ Sci Pollut Res 29, 10047–10062 (2022). https://doi.org/10.1007/s11356-021-16365-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-021-16365-1