Abstract

The demand for a service is the amount of it that a consumer will purchase or will be ready to purchase at different prices at a given moment of time. An EOQ model for spoilage commodities and power demand under trade credits is established. Mathematical model is established to obtain optimal ordering policies for policies for retailer under two different cases. In this model buyer who purchases the commodities enjoy a fixed period offered by his/her vendor. We show that total profit function is concave with respect to time. We then provide for finding maximum profit. Numerical examples are provided of the optimal solution to find order quantity and total profit. Sensitivity analysis of the key parameters is presented to validate the model.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

In high tech business transaction industries found that they can get more advantages by establishing steady and long term relationship between retailer and supplier. Thus, it is a powerful and incremental tool to get more profit. Therefore inventory model is an excellent model for both seller and buyer. In traditional Economic Order Quantity (EOQ) models, it is assumed that the demand rates of commodities be either constant or time induced.But in actual practice it may be stock-sensitive. In recent days, changeable demand is attracting the researchers due to maintaining inventory very crucial.

Every item in the universe deteriorates over time. While the rate of deterioration of some items may be small. Therefore, the effect of deterioration cannot ignore in the study of inventory policy, otherwise it will cause inaccurate results. Jaggi and Aggarwal [1] established the economic ordering policies considering discounted cash flow approach. Jaggi et al. [2] established an EOQ of deteriorating items under inflation. Ghare and Schrader [3] first proposed an inventory model with constant deterioration rate over a finite planning horizon. Covert and Philip [4] generalized a model considering variable deterioration rate. Researchers like: Holler and Mak [5], Datta and Pal [6], Dye et al. [7], Philip [8], Chakrabarty and Chaudhuri [9], Giri and Chaudhuri [10], Deb and Chaudhuri [11], Chung and Ting [12], Hariga [13], Hariga and Benkherouf [14], Jalan and Chaudhuri [15], Roy [16].

At present in high tech business transaction, supplier offers their buyers a fixed period with interest in between the credit period. Two benefits are produced in case of permissible delay in payment: (1) it motivates more buyers that consider it a price discount and (2) it is applicable an alternative discount price. Shinn et al. [17] provided an EOQ model considering quantity discount for freight charges. Teng et al. [18] developed an EOQ model with progressive demand. Khanra et al. [19] focused an EOQ model for deteriorating items with time-sensitive demand under permissible delay in payments. Tripathi [20] established “EOQ model for optimal payment time for a retailer with exponential demand under permitted credit period by the whole seller”. Tripathi and Mishra [21] presented an inventory model for deteriorating items with inventory sensitive demand. Shah [22] considered a stochastic EOQ model under trade credits. Several related papers can be seen in Chung [23], Jamal et al. [24], Hwang and Shinn [25], Chung and Teng [26], Chung and Liao [27], Ouyang et al. [28] etc.

In the classical EOQ model demand is always constant. In actual practice, it is in dynamic stage and may not always constant. Demand expresses the functional relational ship between price and quantity demanded. Price of an item is the most important factor affecting the demand for a commodity. Generally, demand for an item increases, when its price falls. In the same way, if the price increases the demand will fall. Variation in the price of a commodity may result in the change of demand for that commodity. Demand may occur due to factors other than price. Silver and Meal [29] first considered a generalization of the inventory model for the case of a varying demand. Jalan and Chaudhuri [30] established inventory model considering exponentially time varying demand pattern. Ghosh and Chaudhuri [31] presented EOQ models considering time- quadratic demand rate. Soni and Shah [32] presented an EOQ model retailer when customer demand is stock-induced and when supplier offers two progressive credit periods. Tripathi and Singh [33] developed EOQ model for inventory-induced demand rate. Soni [34] established inventory model for optimal replenishment policies for spoilage products with stock-sensitive demand. Hou [35] derived a model for deteriorating items with stock-dependent consumption rate and shortages under inflation and time discounting. Padmanabhan and Vrat [36] pointed out inventory models for perishable commodities for stock-dependent selling rate. The notable researchs were addressed by Kim et al. [37], Noh [38], Cheikhrouhou et al. [39]. Sarkar [40, 41], Kang [42] Sarkar and Saren [43], Sarkar et al. [44,45,46], Shin et al [47], Tayyab and Sarkar [48], Sett et al. [49], Datta and Pal [50], Dye and Ouyang [51], Taleizadeh et al. [52], Tripathi [53] and others (Table 1).

The problem of determining the total profit with stock- dependent demand (power demand pattern) is addressed in this paper in a manner that reflects realistic situation. Thus this model has a new managerial insight that helps a manufacturing system to generate maximum profit. The rest of the paper is designed as follows: in “Notation and Assumptions” section fundamental notations and assumption are provided. In “Mathematical Formulation” section, Mathematical model is shown. Optimal solution is discussed in “Determination of Optimal Solution” section followed by solution algorithm. Numerical examples and sensitivity analysis are given in “Solution Algorithm and Numerical Examples” sections respectively. Conclusions are made in the last section.

Notation and Assumptions

Notations

- \(c, p,\,\mathrm{and}\,h\) :

-

Unit purchase, selling and holding cost (Rs./unit/year)

- \(\theta \) :

-

Constant deterioration rate of an item (0 \(\le \) \(\theta \) \(\le \) 1)

- A :

-

Replenishment cost of item (Rs./order)

- \(D\{I(t)\}=\alpha \{I(t)\}^{\beta }\) :

-

Demand rate which is inventory dependent \(\alpha \) > 0, 0 \(\le \) \(\beta \) \(\le \) 1, where \(\alpha \) is initial demand (for \(\beta \) = 0)

- M :

-

Permissible delay period (in years)

- T :

-

Time interval between (in years)

- \(I_{c}\) :

-

Interest charges/unit/year (in Rs.)

- \(I_{d}\) :

-

Interest earned unit/year (in Rs.) (\(I_{c}>I_{d})\)

- I(t) :

-

Inventory level at instant t

- Q :

-

Lot-size (in units)

- RC :

-

Replenishment cost/unit time (in Rs.)

- DC :

-

Deterioration cost (in Rs.)

- SR :

-

Sales revenue (Rs./year)

- \({IP}_{1 }\,\mathrm{and}\,{IP}_{2}\) :

-

Interest payable (Rs./unit/year for case I and II respectively

- \({IE}_{1}\,\mathrm{and}\,{IE}_{2 }\) :

-

Interest earned (Rs./unit/year for case I and II respectively

- \(Z_{1}{(T)},\,\mathrm{and}\,Z_{2}(T)\) :

-

Total variable profit (in Rs.) for case I and II respectively

- \(T_{1}^{*}\,\mathrm{and}\,T_{2}^{*}\) :

-

Optimal T for case I and II

- \(Z_{1}^{*}(T_{1}^{*})\,\mathrm{and}\,Z_{2}^{*}(T_{2}^{*})\) :

-

Optimal \(Z_{1}(T)\,\mathrm{and}\, Z_{2}(T) \) respectively

Assumptions

-

(i)

Deterioration rate is constant and 0 \(\le \) \(\theta \) \(\le \) 1 per unit time.

-

(ii)

Demand rate is inventory dependent of the item.

-

(iii)

Selling price is greater than purchase cost (\(p>c)\).

-

(iv)

Inventory is considered for single item.

Mathematical Formulation

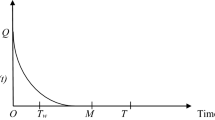

The rate of decrease of inventory I(t) at time t is:

The solution of (1) with the condition I(T) = 0, is

The order quantity Q is

The following two cases may arise depending on credit period

Case I: T \({\varvec{>}}\) M

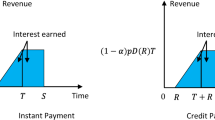

In this case, the cycle time is greater than credit period (M), the interest is payable during (T–M), the interest payable in [0, T] is:

The interest earned (IE\(_{1})\) in between [0, T] is:

The total variable profit/ unit time is:

Case II: T \({\varvec{\le }}\) M

In this, case, the cycle time (T) is less than credit period (M) customer earns interest on the sales revenue and no interest is payable (i.e. IP\(_{2}\) = 0). Therefore, interest earned in [0, M] is:

Therefore, the interest earned IE\(_{2}\) is:

The total variable profit/cycle is:

Case III: Let \({\varvec{T}}~{\varvec{=}~{\varvec{M}}}\)

At \(T~=~M\), \(Z_{1}(T)\) and \(Z_{2}(T)\) are equal i .e. \(Z_{1}(T)~=~Z_{2}(T)\). Substituting \(T~=~M \) in Eqs. (12) or (16), we get

Or

Determination of Optimal Solution

Differentiating \(Z_{1}(T)\) and \(Z_{2}(T)\) from Eqs. (12) and (15) with respect to T, we get

The main aim is to find the maximum value of profit. The maximum value of \(Z_{i}(T)\) for given \(T~=~T_{i}^{*}, i~=~1,2\), are obtained by solving \(\frac{dZ_i (T)}{dT}=0\) for T, provided \(\frac{d^{2}Z_i (T)}{dT^{2}}<0\), (see “Appendix”).

Putting \(\frac{dZ_i (T)}{dT}=0\), i = 1,2, from Eqs. (18) and (19), we obtain

The following algorithm is established to obtain the \(Q^{*}\) and \(Z^{*}(T^{*})\).

Solution Algorithm

- Step 1 :

-

: Initialize the parameters

- Step 2 :

-

: Find \(T_{1}^{*}\) from Eq. (21), if \(T_{1}^{*}~>~M\), calculate \(Z_{1}^{*}(T_{1}^{*})\) from Eq. (12)

- Step 3 :

-

: Find \(T_{2}^{*}\) from Eq. (21), if \(T_{2}^{*}~\le ~M\), calculate \(Z_{2}^{*}(T_{2}^{*})\) from Eq. (15)

- Step 4 :

-

: If \(T_{1}^{*}~>~M\), and \(T_{2}^{*}~\le ~M\) is satisfied, compare \(Z_{1}^{*}(T_{1}^{*})\), \(Z_{2}^{*}(T_{2}^{*})\) and obtain the maximum profit.

- Step 5 :

-

: If \(\hbox {T}_{1}^{*}\) > M is satisfied and \(T_{2}^{*}~>~M\) is not satisfied, then \(Z_{1}^{*}(T_{1}^{*})\) is the maximum profit

- Step 6 :

-

: If \(\hbox {T}_{1}^{*}<M\) is not satisfied and \(T_{2}^{*}~\le ~M\) is satisfied, then \(Z_{2}^{*}(T_{2}^{*})\) is the maximum profit

- Step 7 :

-

: Compare \(Q (T_{1}^{*})\) and \(Q (T_{2}^{*})\) for corresponding maximum profit

The following examples are given to validate the above algorithm:

Numerical Examples

Following three examples discussed below cover all three cases. The numerical data is taken from the previous literature survey:

Example 1

In this inventory system, let us take \(\alpha \) = 1000 units/ year, \(\beta \) = 0.5, c = 40 units/year, A = Rs. 200/ order, \(I_{c}\) = 0.15/ year, \(I_{d}\) = 0.13/year, h = Rs. 150/year, p = Rs.50/units, \(\theta \) = 0.20 and M = 0.35 year.

Putting these values in (20) and solving for T, we get \(T_{1}^{*}\) = 0.483832 year, corresponding \(Z_{1}(T_{1}^{*})\) = Rs. \(3.08245\,\times \,10^{6}\) and \(Q(T_{1}^{*})\) = 61381.1 units.

Also, substituting these above parameter values is (21), and solving for T, we obtain \(T_{2}^{*}\) = 0.42826 year, corresponding \(Z_{2}(T_{2}^{*})\) = Rs. \(2.97985\,\times \,10^{6}\) and \(Q(T_{2}^{*})\) = 46156.4 units.

Here \(T_{2}^{*}~>~M\), which contradicts the assumption of case II, thus only case I holds as \(T_{1}^{*}~>~M\). Therefore, \(Z_{1}(T_{1}^{*})\) = Rs. \(3.08245\,\times \,10^{6}\), in which \(T_{1}^{*}\) = 0.483832 year and \(Q(T_{1}^{*})\) = 61381.1 units.

Example 2

Let us consider \(\alpha \) = 1000 units, \(\beta \) = 0.5, c = 40, A = 200, \(I_{c}\) = 0.15, \(I_{d}~\)= 0.13, h = . 230, p = 50, \(\theta \) = 0.20 and M = 0.30 year in appropriate units.

Putting these values in (20) and solving for T, we get, \(T_{1}^{*}\) = 0.31971 year, \(Z_{1}(T_{1}^{*})\) = Rs. \(2.01991\,\times \,10^{6}\) and \(Q(T_{1}^{*})\) = 26377.1 units.

Also, substituting these above parameter values is Eq. (21), and solving for T, we obtain \(T_{2}^{*}~\)= 0.296152 year, corresponding \(Z_{2}(T_{2}^{*})\) = Rs. \(2.01066\,\times \,10^{6}\) and \(Q(T_{2}^{*})\) = 22580.7 units.

Here \(T_{1}^{*}~>~M\), and \(T_{2}^{*}~\le ~M\), both cases are satisfied. Since \(Z_{1}(T_{1}^{*})~>~Z_{2}(T_{2}^{*}), \)therefore, the \(Z_{1}(T_{1}^{*})\) = Rs. \(2.01991\,\times \,10^{6}\), in which the maximum, cycle time is \( T_{1}^{*}\) = 0.31971 year and optimal \(Q(T_{1}^{*})\) = 26377.1 units.

Example 3

Let us consider \(\alpha \) = 1000, \(\beta \) = 0.5, c = 40, A = 200, \(I_{c}\) = 0.15, \(I_{d}\) = 0.13, h = 250, p = 50, \(\theta \) = 0.20 and M = 0.30 year, in appropriate units.

Substituting these values in Eq. (20) and solving for T, we get, \(T_{1}^{*}\) = 0.294609 year, corresponding \(Z_{1}(T_{1}^{*})\) = Rs. \(1.85942\,\times \,10^{6}\) and \(Q(T_{1}^{*})\) = 22342.6 units.

Also, substituting these above parameter values is Eq. (21), and solving for T, we obtain \(T_{2}^{*}~\)= 0.276562 year, corresponding \(Z_{2}(T_{2}^{*})\) = Rs. \(1.86301\,\times \,10^{6}\) and \(Q(T_{2}^{*})\) = 19654.1 units.

Here \(T_{1}^{*}<M\), which contradicts the assumption of case I, thus only case II holds as \(T_{2}^{*}<M\). Therefore, the \(Z_{2}(T_{2}^{*})\) = Rs. \(1.86301\,\times \,10^{6}\), in which the maximum, cycle time is \(T_{2}^{*}\) = 0.276562 year and the optimal \(Q(T_{2}^{*})\) = 19654.1 units.

Example 4

Let us consider \(\alpha \) = 1000, \(\beta \) = 0.5, c = 40, A = 200, \(I_{c}\) = 0.15, \(I_{d}\) = 0.13, h = 150, p = 50, \(\theta \) = 0.20 and \(T~=~M\) in appropriate units.

Substituting these values in Eqs. (20) or (21) and solving for Tor M, we get \(T_{1}^{*} = T_{2}^{*}= M^{*}\) = 0.48572 year, which is the case III. Thus the maximum average profit is \(Z(M^{*})\) = Rs. 3.08497 x10\(^{6}\), in which optimal cycle time is \(T^{*}\) = 0.48572 year and optimal \(Q(T^{*})\) = 61880.6 units.

The following Figs. 1 and 2 are given for case I and II respectively

Sensitivity Analysis

Sensitivity analysis is established for case I, considering the rest parameters at their original values as in Example 1.

Sensitivity analysis for case II: Sensitivity analysis is established considering the numerical data as in Example 2.

Based on Tables 2 and 3, following inferences can be made:

-

(i)

We see that if initial demand \(\upalpha \), unit selling price (p) and credit period (M), will increase, total profit will also increase. It means that \(Z_{1}(T_{1}^{*})\) and \(Z_{2}(T_{2}^{*})\) are quite sensitive to change in \(\upalpha \), and \(T_{1}^{*}\), \(T_{2}^{*}\) are moderately sensitive with \(\alpha \), p, and M.

-

(ii)

We observe that if, unit holding cost (h), unit purchase cost (c), replenishment cost (A) will increase, total profit \(Z_{1}(T_{1}^{*})\) and \(Z_{2}(T_{2}^{*})\) will decrease. It means that \(Z_{1}(T_{1}^{*})\) and \(Z_{2}(T_{2}^{*})\) are sensitive with h, c and A, and \(T_{1}^{*}\) is approximately insensitive to change in h and A.

Conclusion

This model is based on inventory dependent demand. Most of the EOQ models are considered that demand rate remain constant. If \(\beta \) = 0, the demand becomes constant. However, at present, the demand rate of items increases during growth of production process. In this paper, we have provided an EOQ model for spoilage commodities trade credits. An algorithm is discussed to obtain the order quantity and total profit. Numerical examples are given to illustrate the applicability solution algorithm. Sensitivity analysis has been discussed with variation of several key parameters. Several managerial phenomena have also pointed out:

-

Increase in, initial demand, unit selling price, and credit period, will lead increase in total profit.

-

Increase in unit holding cost, unit purchase cost and replenishment cost will cause decrease in total profit.

References

Jaggi, C.K., Aggarwal, S.P.: Credit financing in economic ordering policies of deteriorating items. Int. J. Prod. Econ. 34, 151–155 (1994)

Jaggi, C.K., Aggarwal, K.K., Goel, S.K.: Optimal order policy for deteriorating items with inflation induced demand. Int. J. Prod. Econ. 103, 707–714 (2006)

Ghare, P.M., Schrader, S.K.: A model for exponentially decaying inventory. J. Ind. Eng. 14(5), 238–243 (1963)

Covert, R.P., Philip, G.C.: An EOQ model with Weibull distribution deterioration. IIE Trans. 5, 323–326 (1973)

Holler, R.H., Mak, K.L.: Inventory replenishment policies for deteriorating items in a decline market. Int. J. Prod. Res. 21(6), 813–826 (1983)

Datta, T.K., Pal, A.K.: A note on inventory model with inventory level dependent demand rate. J. Oper. Res. Soc. 41, 971–975 (1990)

Dye, C.Y., Ouyang, L.Y., Hsieh, T.P.: Inventory and pricing strategies for deteriorating items with shortages: a discounted cash flow approach. Comput. Ind. Eng. 52, 29–40 (2007)

Philip, G.C.: A generalized EOQ model for items with Weibull distribution deterioration. AIIE Trans. 6, 159–162 (1974)

Chakrabarti, T., Chaudhuri, K.S.: An EOQ model for deteriorating items with a linear trend in demand and shortages in all cycles. Int. J. Prod. Econ. 49, 205–213 (1997)

Giri, B.C., Chaudhuri, K.S.: Heuristic models for deteriorating items with shortages and time varying demand and costs. Int. J. Syst. Sci. 28, 153–159 (1997)

Deb, M., Chaudhuri, K.S.: An EOQ model for deteriorating items with finite rate of production and variable rate of deterioration. Opsearch 23, 175–181 (1986)

Chung, K., Ting, P.: An heuristic for replenishment of deteriorating items with a linear trend in demand. J. Oper. Res. Soc. 44, 1235–1241 (1973)

Hariga, M.A.: Optimal EOQ models for deteriorating items with time varying demand. J. Oper. Res. Soc. 47, 1228–1246 (1996)

Hariga, M.A., Benkherouf, L.: Optimal and heuristic inventory replenishment models for deteriorating items with exponential time varying demand. Eur. J. Oper. Res. 79, 123–137 (1994)

Jalan, A.K., Chaudhuri, K.S.: Structural properties of an inventory system with deterioration and trended demand. Int. J. Syst. Sci. 30, 627–633 (1999)

Roy, A.: An inventory model for deteriorating items with price dependent demand rate and time-varying holding cost. Adv. Model. Optim. 10(1), 25–37 (2008)

Shinn, H.P., Hwang, H.P., Sung, S.: Joint price and lot size deterioration under condition of permissible delay in payments and quantity for freight cost. Eur. J. Oper. Res. 91, 528–542 (1996)

Teng, J.T., Min, J., Pan, Q.: Economic order quantity model with trade credit financing for non-decreaing demand. Omega 40, 328–335 (2012)

Khanra, S., Ghosh, S.K., Chaudhuri, K.S.: An EOQ model for a deteriorating items with time dependent quadratic demand under permissible delay in payments. Appl. Math. Comput. 218, 1–9 (2011)

Tripathi, R.P.: Optimal payment time for a retailer with exponential demand under permitted credit period by the wholesaler. Appl. Math. Inf. Sci. Lett. 2(3), 91–101 (2014)

Tripathi, R.P., Mishra, S.M.: Inventory model for deteriorating items with inventory dependent demand rate under trade credits. J. Appl. Probab. Stat. 9(2), 25–32 (2014)

Shah, N.H.: Probabilistic time scheduling model for an exponentially decaying inventory when delay in payment is permissible. Int. J. Prod. Econ. 32, 77–82 (1993)

Chung, K.J.: Comments on the EPQ model under retailer partial trade credit policy in the supply chain. Int. J. Prod. Econ. 114, 308–312 (2008)

Jamal, A.M.M., Sarker, B.R., Wang, S.: An ordering policy for deteriorating items with allowable shortages and permissible delay in payments. J. Oper. Res. Soc. 48, 826–833 (1997)

Hwang, H., Shinn, S.W.: Retailer’s pricing and lot sizing policy for exponentially deteriorating products under the conditions of permissible delay in payments. Comput. Oper. Res. 24, 539–547 (1997)

Chang, C.T., Teng, J.T.: Retailer’s optimal ordering policy under supplier credits. Math. Method Oper. Res. 60, 471–483 (2004)

Chung, K.J., Liao, J.J.: Lot sizing decisions under trade credit depending on the order quantity. Comput. Oper. Res. 31, 909–928 (2004)

Ouyang, L.Y., Chang, C.T., Teng, J.T.: Optimal ordering policy for items with partial backlogging under permissible delay in payments. J. Global Optim. 34, 245–271 (2006)

Silver, E.A., Meal, H.C.: A simple modification of the EOQ for the case of a varying demand rate. Prod. Inventory Manag. 10(4), 52–65 (1969)

Jalan, A.K., Chaudhuri, K.S.: EOQ model for deteriorating items in a declining Market with SFI policy. Korean J. Comput. Appl. Math. 6(2), 437–449 (1999)

Ghosh, S.K., Chaudhuri, K.S.: An EOQ model with a quadratic demand, time proportional deterioration and shortages in all cycles. Int. J. Syst. Sci. 37(10), 663–672 (2006)

Soni, H., Shah, N.H.: Optimal ordering policy for stock- dependent demand under progressive payment scheme. Eur. J. Oper. Res. 184, 91–100 (2008)

Tripathi, R.P., Singh, D.: Inventory model with stock-dependent demand and different holding cost function. Int. J. Ind. Syst. Eng. 21(1), 68–72 (2015)

Soni, H.N.: Optimal replenishment policies for deteriorating items with stock-sensitive demand under two level trade credit and limited capacity. Appl. Math. Model. 37, 5887–5895 (2013)

Hou, K.L.: An inventory model for deteriorating with stock dependent consumption rate and shortages under inflation and time discounting. Eur. J. Oper. Res. 168, 463–474 (2006)

Padmanabhan, G., Vrat, P.: EOQ models for perishable items under stock dependent selling rate. Eur. J. Oper. Res. 86, 281–292 (1995)

Kim, M.S., Sarkar, B.: Multi-stage cleaner production process with quality improvement and lead time dependent ordering cost. J. Clean. Prod. 144, 572–590 (2017)

Noh, J.S., Kin, J.S., Sarkar, B.: Stochastic joint replenishment problem with quantity discounts and minimum order constraints. Res. Oper. https://doi.org/10.1007/s12351-016-0281-6 (2016)

Cheikhrouhou, N., Sarkar, B., Ganguly, B., Malik, A.I., Balisten, R., Lee, Y.H.: Optimization of sample size and order size in an inventory model with quality inspection and return of defective items. Ann. Oper. Res. 1–23 (2017). https://doi.org/10.1007/s10479-017-2511-6

Sarkar, B.: An EOQ model with delay-in-payments and time-varying deterioration rate. Math. Comput. Model. 55, 367–377 (2012)

Sarkar, B.: Supply chain coordination with variable backorder, inspections, and discount policy for fixed lifetime products. Math. Probl. Eng. 2016(6318737), 14 (2016)

Kang, C.W., Ullah, M., Sarkar, B., Hussain, I., Akhatar, R.: Impact of random defective rate on lot size focusing work-in-process inventory in manufacturing system. Int. J. Prod. Res. 55(6), 1748–1766 (2017). https://doi.org/10.1080/00207543.2016.1235295

Sarkar, B., Saren, S.: Product inspection policy for an imperfect production system with inspection errors and warranty cost. Eur. J. Oper. Res. 248(1), 263–271 (2016)

Sarkar, B., Majumder, A., Sarkar, M., dey, B.K., Roy, G.: Two-echelon supply chain model with manufacturing quality improvement and setup cost reduction. J. Ind. Manag. Optim. 13(2), 1085–1104 (2017)

Sarkar, B., Ganguly, B., Sarkar, M., Pareek, S.: Effect of variable transportation and carbon emission in a three-echelon supply chain model. Transp. Res. Part E Logist. Transp. Rev. 91, 112–128 (2016)

Sarkar, B., Mondal, B., Sarkar, S.: Preservation of deteriorating seasonal products with stock-dependent consumption rate and shortages. J. Ind. Manag. Optim. 13, 187–206 (2017)

Shin, D., Guchhait, R., Sarkar, B., Mittal, M.: Controllable lead time, service level constraint, and transportation discount in a continuous review inventory model. RAIRO Oper. Res. 50(4–5), 921–934 (2016)

Tayyab, M., Sarkar, B.: Optimal batch quantity in a cleaner multi-stage lean production system with random defective rate. J. Clean. Prod. 139, 922–934 (2016)

Sett, B.K., Sarkar, S., Sarkar, B., Yun, W.Y.: Optimal replenishment policy with variable deterioration for fixed lifetime products. Sci. Iran. SCIE 23(5), 2318–2329 (2016)

Datta, T.K., Pal, A.K.: A note on an inventory model with inventory dependent demand rate. Oper. Res. Soc. 41(10), 971–975 (1990)

Dye, C.Y., Ouyang, L.Y.: An EOQ model for perishable items under stock-dependent selling rate and time-dependent partial backlogging. Eur. J. Oper. Res. 163(3), 776–783 (2005)

Taleizadeh, A.A., Mohammadi, B.C., Barron, L.E., Sammi, H.: An EOQ model for perishable products with special sale and shortages. Intern. J. Prod. Econ. 145(1), 318–338 (2013)

Tripathi, R.P.: Inventory model with different demand rate and different holding cost. Int. J. Ind. Eng. Comput. 4(3), 437–446 (2013)

Acknowledgements

Author would like to acknowledge the Editor-in Chief of the journal and referees for their encouragement and constructive comments in revising the paper.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix A\(_{1}\)

We first to prove the Appendix \(A_{1}\) for following Lemma 1.

Lemma 1

Let \(H(T)=\frac{\phi (T)}{T}\), where \(\phi (T)\)is continuous and twice differentiable function of T, then the maximum value of H(T) exists at \(T~=~T^{*}\), if \(\frac{1}{T}\frac{d^{2}\phi (T)}{dT^{2}}<0\), at \(T~=~T^{*}.\)

Proof

Differentiating (i) w.r.t. T, we have

The necessary condition for extremum is \(\frac{dH(T)}{dT}=0\), from (ii) we get

Let Eq. (iii) is satisfied at \(T~=~T^{*}\).

Again differentiating (ii) we get

But at \(T~=~T^{*}\), \(T\frac{d\phi (T)}{dT}-\phi (T)=0\)

From (iv), we get \(\frac{dH(T)}{dT}=\frac{1}{T}\frac{d^{2}\phi (T)}{dT^{2}}\)

The sufficient condition for maximum value of H(T) is \(\frac{d^{2}H(T)}{dT^{2}}<0\).

Hence we have proved the Lemma. \(\square \)

We have

Appendix A\(_{2}\)

We have \(Z_2 (T)=\frac{1}{T}\left( {SR-RC-DC-HC+IE_2 } \right) \)

For maximum or minimum of \(Z_{2}(T), \frac{dZ_2 (T)}{dT}=0\), if \(T~=~T_{2}^{*}\) be maximum value of \(Z_{2}(T),\) then at \(T~=\) \(T_{2}^{*}\), we have

Appendix A \(_{3}\)

It is very difficult to handle the total profit function and its elements for finding closed form optimal solution. Truncated Taylor’s series expansions are considered for exponential terms to find closed form optimal solution. For low deterioration rate \(e^{\theta t}\approx 1+\theta t+\frac{(\theta t)^{2}}{2}\)etc. Note that this approximation is valid only for \(\theta t<1\).

Using the above approximation in (3), we get

Similarly we can calculate the remaining elements of the total profit.

Rights and permissions

About this article

Cite this article

Tripathi, R.P. Establishment of EOQ (Economic Order Quantity) Model for Spoilage Products and Power Demand Under Permissible Delay in Payments. Int. J. Appl. Comput. Math 4, 55 (2018). https://doi.org/10.1007/s40819-018-0485-y

Published:

DOI: https://doi.org/10.1007/s40819-018-0485-y